The Little Book of Common Sense Investing by John C. Bogle

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

John C. Bogle’s “The Little Book of Common Sense Investing” is widely considered a cornerstone of modern investment literature. As the founder of The Vanguard Group and the creator of the first index mutual fund in 1976, Bogle’s credibility is unparalleled. His decades of experience managing billions in assets and leading the charge for investor-friendly, low-cost solutions make him one of the most respected figures in finance. Bogle’s philosophy has shaped the investment landscape, influencing not only individual investors but also institutional giants and the entire mutual fund industry.

The central theme of this book is elegantly simple: the best strategy for long-term investment success is to buy and hold a diversified portfolio of the entire stock market through low-cost index funds. Bogle meticulously dismantles the myths of active management, market timing, and stock picking, demonstrating with data and real-world examples how costs, fees, and taxes erode returns. He advocates for a disciplined, patient, and cost-efficient approach that allows investors to capture the full growth of the market while avoiding the pitfalls of speculation and high fees. The book is a rallying cry for rational, evidence-based investing.

This book is essential reading for anyone interested in building wealth through the stock market, regardless of experience level. Beginners will find Bogle’s clear explanations and practical advice invaluable for avoiding common mistakes, while seasoned investors will appreciate the depth of research and the challenge to conventional wisdom. Financial advisors, portfolio managers, and even skeptics of passive investing will benefit from Bogle’s rigorous analysis and the compelling case he makes for indexing. If you’re seeking a guide that cuts through the noise and hype of Wall Street, this book is for you.

What sets “The Little Book of Common Sense Investing” apart is its relentless focus on investor outcomes. Bogle supports every argument with historical data, academic studies, and vivid parables—most notably, the “Gotrocks Family” story that opens the book. He demystifies complex financial concepts, making them accessible without sacrificing nuance. The book’s practical lessons are timeless, applying equally well in bull and bear markets, and its advocacy for low-cost, tax-efficient investing has only grown more relevant as index funds and ETFs now dominate global markets. Bogle’s writing is both authoritative and humble, emphasizing investor empowerment and financial independence over industry profits.

Ultimately, this book is a manifesto for the everyday investor. Its unique value lies in its combination of simplicity and depth, providing a clear roadmap for anyone who wants to take control of their financial future. By championing the power of compounding, the dangers of costs, and the wisdom of patience, Bogle offers readers a proven path to investment success—one that has stood the test of time and market cycles.

Key Concepts and Ideas

At the heart of “The Little Book of Common Sense Investing” lies a philosophy grounded in simplicity, discipline, and evidence. Bogle’s investment approach is built on the premise that most investors are best served by minimizing costs, avoiding unnecessary complexity, and focusing on long-term market returns. He challenges the allure of stock picking and active management, demonstrating that the pursuit of outperformance often leads to underperformance after accounting for fees, taxes, and mistakes. Instead, Bogle advocates for capturing the full return of the market through broad-based index funds.

The book’s core ideas revolve around the power of compounding, the corrosive impact of costs, and the importance of investor behavior. Bogle meticulously shows that while the stock market is a “winner’s game” in aggregate, it becomes a “loser’s game” for most individuals due to avoidable errors and expenses. His message is both empowering and cautionary: by embracing common sense and resisting the temptations of speculation, investors can significantly improve their chances of long-term success.

- The Power of Indexing: Bogle’s central thesis is that owning the entire market through a low-cost index fund is the most reliable way to achieve investment success. Index funds provide instant diversification, minimize the risk of poor stock selection, and ensure that investors receive the market’s average return—less only a minimal fee. For example, the Vanguard 500 Index Fund, which Bogle launched in 1976, has outperformed the vast majority of actively managed funds over decades.

- Cost Matters Most: One of the book’s most powerful lessons is the destructive effect of investment costs. Bogle demonstrates that even seemingly small fees—like a 1% annual expense ratio—can reduce an investor’s final wealth by 20% or more over 30 years due to compounding. He urges investors to seek out no-load funds and ETFs with the lowest possible expense ratios, citing data that low-cost funds consistently outperform their higher-cost peers.

- The Gotrocks Parable: The opening parable of the Gotrocks family illustrates how wealth is eroded by intermediaries—brokers, advisors, and fund managers—each taking a cut. Bogle uses this story to emphasize that the more investors pay in fees, the less they keep. The lesson is clear: “Don’t let others eat your lunch.”

- Long-Term Focus: Bogle repeatedly stresses the importance of patience and a long-term perspective. He shows that while markets are volatile in the short run, over decades, returns are driven by the earnings and dividends of real businesses. Investors who stay the course and avoid knee-jerk reactions to market swings are rewarded with compounding growth.

- The Illusion of Outperformance: The book dismantles the myth that most investors or fund managers can consistently beat the market. Bogle cites studies showing that after costs, more than 80% of active funds underperform their benchmarks over 10- and 20-year periods. Chasing past winners or relying on manager “skill” is a losing strategy.

- Tax Efficiency: Taxes, like fees, can quietly erode investment returns. Bogle explains how index funds, with their low turnover and buy-and-hold structure, are inherently tax-efficient. He contrasts this with actively managed funds, which generate frequent taxable events through trading, often resulting in higher short-term capital gains taxes for investors.

- Reversion to the Mean: Bogle explores the tendency for performance to regress to the average. Funds that are top performers one year are rarely leaders the next. This phenomenon, known as “reversion to the mean,” warns investors against chasing hot funds or stocks based on recent results.

- Behavioral Pitfalls: The book highlights the dangers of emotional investing—panic selling during downturns and exuberant buying at market peaks. Bogle provides examples of how investor behavior often leads to buying high and selling low, locking in losses and missing out on recoveries.

- Simplicity and Parsimony: Bogle champions simple, frugal strategies over complex, expensive ones. He argues that complexity breeds confusion, higher costs, and greater risk of underperformance. A straightforward investment plan, such as owning a total market index fund, is both effective and easy to maintain.

- Investor Empowerment: Finally, Bogle encourages investors to educate themselves and take responsibility for their financial decisions. He warns against blindly following advice from conflicted intermediaries and stresses that common sense, discipline, and self-reliance are the keys to lasting wealth.

Practical Strategies for Investors

Applying the principles from “The Little Book of Common Sense Investing” is straightforward yet profoundly effective. Bogle’s strategies are designed for real people with real goals, focusing on maximizing returns through discipline, cost control, and simplicity. Whether you’re just starting out or managing a sizable portfolio, these strategies can help you avoid costly mistakes and build lasting wealth.

To implement Bogle’s teachings, investors should prioritize minimizing fees, maximizing diversification, and maintaining a long-term perspective. The book provides actionable steps that can be tailored to individual circumstances, from selecting the right funds to managing emotional reactions during market turbulence. By following these strategies, investors can align their portfolios with their personal goals and risk tolerance, all while keeping more of their hard-earned returns.

- Invest in Broad Market Index Funds: Choose low-cost index funds or ETFs that track the entire U.S. stock market or the S&P 500. Set up automatic monthly contributions to take advantage of dollar-cost averaging. For example, start with the Vanguard Total Stock Market Index Fund (VTSAX) or a similar ETF, and let your investments grow over time.

- Minimize Fees and Expenses: Always check the expense ratio before investing in any fund. Avoid funds with loads (sales charges), 12b-1 fees, or high management costs. Use online calculators to compare the long-term impact of different fee levels. Even a 0.5% difference in annual costs can mean tens of thousands of dollars over 30 years.

- Hold for the Long Term: Resist the urge to trade in and out of funds or stocks based on short-term news or market movements. Commit to a buy-and-hold strategy, reviewing your allocation annually or after major life events rather than reacting to daily market noise.

- Rebalance Periodically: Maintain your desired asset allocation by rebalancing once or twice a year. For example, if your plan is 70% stocks and 30% bonds and stocks have grown to 80%, sell some stocks and buy bonds to restore balance. This disciplined approach enforces buying low and selling high.

- Maximize Tax Efficiency: Use tax-advantaged accounts like IRAs and 401(k)s for your index fund investments. In taxable accounts, prefer index funds with low turnover to minimize capital gains distributions. Consider tax-loss harvesting strategies to offset gains with losses.

- Ignore Market Predictions: Don’t base your investment decisions on forecasts, hot tips, or media hype. Bogle’s research shows that market timing rarely works and usually reduces returns. Stick to your plan and tune out the noise.

- Educate Yourself: Read the prospectus and annual reports for any fund you consider. Understand the basics of how index funds work, and don’t hesitate to ask questions or seek out reputable educational resources. Knowledge is your best defense against costly mistakes.

- Stay the Course During Volatility: When markets drop, avoid panic selling. Historical data shows that investors who remain invested during downturns recover faster and earn higher long-term returns. Develop an investment policy statement outlining your goals and risk tolerance to help you stay disciplined during turbulent times.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

The structure of “The Little Book of Common Sense Investing” is methodical, with each chapter building on the last to create a comprehensive guide to rational investing. Bogle begins with foundational concepts—why most investors underperform and how costs destroy wealth—before moving into specific strategies and the evidence supporting them. Each chapter is packed with data, historical context, and actionable lessons, making the book both accessible and deeply informative.

In the following section, we provide a detailed, chapter-by-chapter analysis. Each chapter summary explores the main ideas, provides concrete examples and quotes from Bogle, and explains how investors can apply these lessons today. Real-world context and historical references are included to show the enduring relevance of Bogle’s advice, even as markets evolve. Whether you’re new to indexing or a seasoned pro, these insights will help reinforce the habits and mindsets that lead to investment success.

Chapter 1: A Parable

In the opening chapter, Bogle introduces the “Gotrocks Family” parable to illustrate the fundamental problem facing most investors: the erosion of wealth by intermediaries and unnecessary activity. The Gotrocks family owns all of the companies in America and thus receives all profits. However, as different family members seek to outperform each other, they begin hiring helpers—brokers, managers, consultants—each of whom takes a fee. Over time, these costs compound, and the family’s collective wealth diminishes, even as the underlying companies continue to prosper. Bogle’s storytelling makes the abstract concept of compounding costs tangible and memorable.

Bogle uses the Gotrocks parable to expose the “industry of helpers” that profits at the expense of investors. He points out that every dollar paid in fees, commissions, or taxes is a dollar less for the investor’s future. “In investing, you get what you don’t pay for,” Bogle famously writes, emphasizing that minimizing costs is the surest way to maximize returns. He provides data showing that the average actively managed mutual fund charges expense ratios of 1% or higher, while index funds often charge less than 0.10%. Over a 30-year period, this difference can reduce the final value of a $100,000 investment by more than $60,000.

The lesson for investors is clear: avoid unnecessary helpers and keep your investment strategy as simple and cost-effective as possible. Bogle advises buying a single, broad-market index fund and holding it for decades, allowing the power of compounding to work in your favor. He warns against the temptation to chase hot tips, time the market, or hire expensive advisors whose interests may not align with your own. By eliminating intermediaries and minimizing activity, investors can capture the full growth of the market.

Historically, the Gotrocks parable resonates with the experience of countless investors who have underperformed the market due to fees and poor timing. During the tech bubble of the late 1990s and the financial crisis of 2008, many investors switched funds or managers in search of better returns, only to lock in losses and miss the subsequent recovery. Bogle’s advice is as relevant today as ever: the simplest path is often the most successful. The rise of low-cost index funds and ETFs has made it easier than ever for investors to follow the Gotrocks approach and keep more of their wealth.

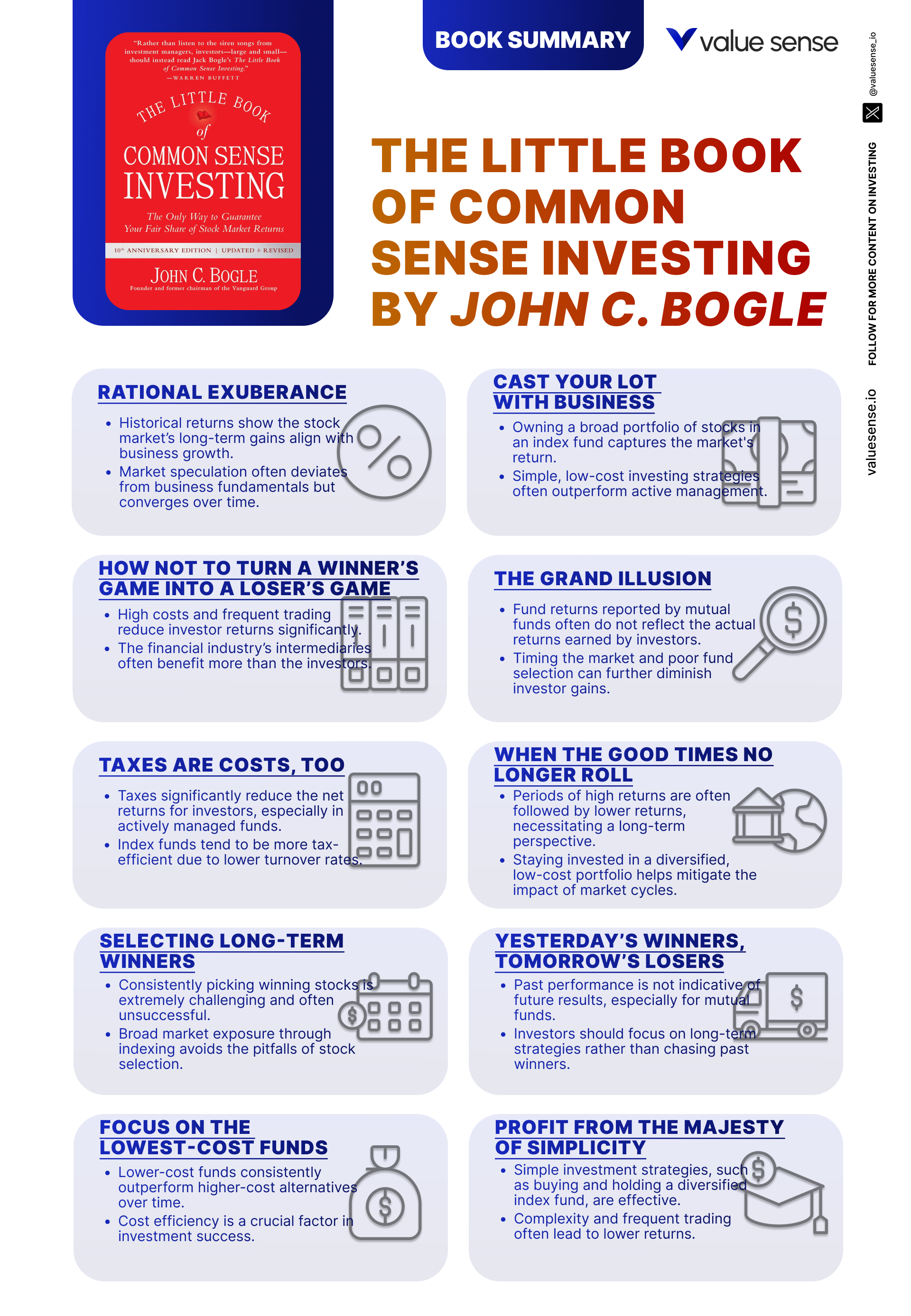

Chapter 2: Rational Exuberance

In “Rational Exuberance,” Bogle contrasts the rational, long-term growth of business fundamentals with the irrational, short-term swings of the stock market. He explains that while stock prices can fluctuate wildly due to investor sentiment, the true driver of long-term returns is the earnings and dividends generated by real companies. Bogle presents historical data showing that from 1900 to 2000, the U.S. stock market delivered an average annual return of about 9.5%, with approximately 5% coming from earnings growth and 4.5% from dividend yield. The remaining fluctuations—caused by changes in valuation multiples—tend to even out over time.

Bogle warns against confusing speculation with investment. He argues that speculation is driven by attempts to predict short-term price movements, often fueled by greed and fear. In contrast, investment is grounded in the ownership of productive businesses and the steady accumulation of wealth through reinvested profits. He cites the example of the dot-com bubble, where speculative mania drove prices far above intrinsic value, only for the market to crash and revert to the mean. Bogle quotes Warren Buffett: “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

For investors, the takeaway is to focus on business fundamentals rather than market noise. Bogle recommends analyzing the long-term growth prospects and dividend policies of the companies represented in your index fund, rather than reacting to daily headlines or trying to time the market. He provides charts showing that, despite numerous recessions, wars, and crises, the stock market’s long-term upward trajectory is remarkably consistent when viewed through the lens of earnings and dividends.

Historically, this approach has proven resilient through events like the 1970s stagflation, the 1987 crash, and the 2008 financial crisis. Investors who maintained a long-term perspective and continued to invest regularly were rewarded with strong compounding returns. Bogle’s message is that rational exuberance—confidence in the growth of businesses, not the speculation of prices—is the foundation of successful investing. In today’s era of meme stocks and social media-driven volatility, this lesson is more important than ever.

Chapter 3: Cast Your Lot with Business

This chapter is a call to align your investment strategy with the performance of the entire business sector by investing in a total market index fund. Bogle explains that by owning a piece of every publicly traded company, investors benefit from the collective success of businesses across all sectors. He provides data showing that over 20-year periods, the broad U.S. stock market has consistently outperformed the majority of actively managed funds. The diversification inherent in index funds reduces the risk of poor stock selection and avoids the pitfalls of market timing.

Bogle discusses the advantages of broad diversification, using the example of the Vanguard Total Stock Market Index Fund, which holds thousands of companies across industries. He contrasts this with the risks of concentrating in a handful of stocks or sectors, citing the collapse of Enron and the volatility of tech stocks as cautionary tales. By owning the entire market, investors are not dependent on the fortunes of any single company or manager. Bogle quotes Benjamin Graham: “The investor’s chief problem—and even his worst enemy—is likely to be himself.” Diversification helps protect against emotional decision-making and overconfidence.

For practical application, Bogle advises investors to select a total market or S&P 500 index fund with a low expense ratio and to make regular, automated contributions. He emphasizes that this strategy requires minimal maintenance and is suitable for investors of all ages and experience levels. By staying invested through market cycles, investors capture the full return of the market, including dividends and capital appreciation. Bogle warns against the temptation to deviate from this simple approach in search of higher returns, noting that complexity often leads to disappointment.

Historically, the broad market approach has weathered economic shocks, sector rotations, and technological disruptions. During the 2000-2002 bear market, diversified index investors fared better than those concentrated in tech stocks. In the recovery that followed the 2008 crisis, total market funds rebounded strongly, rewarding disciplined investors. Bogle’s advice to “cast your lot with business” is a timeless prescription for building wealth in any market environment.

Chapter 4: How Most Investors Turn a Winner’s Game into a Loser’s Game

In this chapter, Bogle addresses a paradox: while the stock market as a whole is a “winner’s game” that delivers solid long-term returns, most individual investors turn it into a “loser’s game” through self-defeating behaviors. He identifies the primary culprits as high fees, frequent trading, and the pursuit of hot trends. Bogle presents data showing that the average investor’s returns lag the market by 2-3% annually, largely due to these avoidable mistakes. He cites a DALBAR study revealing that from 1994 to 2013, the average equity fund investor earned only 3.7% per year, while the S&P 500 returned 9.2%.

Bogle explains that active management and excessive trading generate costs that compound over time, steadily eroding investor wealth. He uses the example of a $10,000 investment growing at 7% annually for 30 years: with a 2% annual cost, the final value drops from $76,123 to $43,219—a loss of nearly $33,000. Bogle also highlights the dangers of performance chasing, where investors buy funds after periods of strong returns only to experience reversion to the mean. He quotes Peter Lynch: “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

To avoid these traps, Bogle recommends a buy-and-hold approach using low-cost index funds. He advises investors to ignore short-term market noise, resist the urge to time the market, and avoid switching funds based on recent performance. Instead, focus on long-term goals and stick to a simple, diversified portfolio. Bogle provides step-by-step guidance for setting up an investment policy statement and automating contributions to reinforce discipline.

The historical evidence is clear: investors who avoid frequent trading and high-cost funds consistently outperform those who do not. During the 2008 financial crisis, many investors sold at the bottom and missed the subsequent recovery, while disciplined index investors saw their portfolios rebound. Bogle’s message is that the market’s long-term gains are available to anyone who avoids turning a winner’s game into a loser’s game. This lesson is especially relevant in today’s era of zero-commission trading and constant financial news, which can tempt investors into costly mistakes.

Chapter 5: The Grand Illusion

“The Grand Illusion” is Bogle’s exposé of the active management industry’s central claim: that skilled managers can consistently outperform the market. He marshals a wealth of evidence to show that, after accounting for fees and expenses, very few managers deliver superior returns over the long term. Bogle cites studies from S&P Dow Jones Indices showing that over 10- and 20-year periods, more than 80% of actively managed U.S. equity funds underperform their benchmarks. Even the rare winners tend to revert to the mean, with periods of outperformance followed by underperformance.

Bogle explains the arithmetic of investing: before costs, all investors collectively earn the market return; after costs, the average investor must underperform. He uses the analogy of a poker game, where the house (fund managers, brokers, advisors) always takes a cut. Over time, the compounding effect of fees and trading costs eats away at returns, turning the promise of outperformance into an illusion. Bogle quotes Nobel laureate William Sharpe: “The average actively managed dollar must underperform the average passively managed dollar, net of costs.”

For investors, the implication is clear: don’t chase the mirage of market-beating managers. Instead, embrace indexing, which guarantees you’ll earn the market return minus only a minimal fee. Bogle recommends scrutinizing the expense ratios, turnover rates, and tax efficiency of any fund before investing. He provides data showing that the lowest-cost funds, such as the Vanguard 500 Index Fund, have consistently outperformed the vast majority of their actively managed peers over decades.

This chapter’s lessons are borne out by decades of market history. The mutual fund industry has launched thousands of funds, but only a tiny fraction have delivered sustained outperformance. The few that do often close to new investors or see their performance fade as assets grow. Bogle’s critique of the “grand illusion” remains as relevant as ever, especially as new generations of investors are tempted by hedge funds, private equity, and other high-cost vehicles. The evidence overwhelmingly favors indexing as the rational choice for long-term wealth creation.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Taxes Are Costs, Too

In this chapter, Bogle turns the spotlight on an often-overlooked drag on investment returns: taxes. He explains that just as fees and expenses erode wealth, so too do taxes—especially for investors in actively managed funds with high turnover. Bogle provides concrete examples of how frequent trading generates taxable events, leading to higher short-term capital gains taxes. He cites Morningstar data showing that the average actively managed U.S. stock fund has a turnover rate of 85%, compared to less than 5% for index funds. This difference translates into significantly higher tax bills for active fund investors.

Bogle illustrates the impact with a hypothetical scenario: two investors each earn a 7% annual return, but one’s fund generates high short-term gains taxed at 35%, while the other’s index fund produces mostly long-term gains taxed at 15%. Over 30 years, the index investor ends up with substantially more wealth. Bogle emphasizes that taxes can easily reduce net returns by 1-2% per year, compounding into a major shortfall over decades. He quotes Benjamin Franklin: “Nothing is certain except death and taxes”—but investors can control how much they pay by choosing tax-efficient vehicles.

For practical implementation, Bogle recommends holding index funds in tax-advantaged accounts like IRAs and 401(k)s whenever possible. In taxable accounts, investors should favor funds with low turnover and minimal capital gains distributions. Bogle also suggests strategies like tax-loss harvesting, where investors sell losing positions to offset gains elsewhere. He cautions against frequent trading, which not only increases costs but also triggers higher taxes, reducing after-tax returns.

The historical context is clear: tax efficiency has become increasingly important as tax laws have evolved and as more investors hold assets in taxable accounts. The rise of ETFs and index funds with “in-kind” redemption mechanisms has further enhanced tax efficiency. Bogle’s advice to minimize taxes is a critical component of maximizing real, after-tax wealth. In an era of rising tax complexity and scrutiny, this lesson is indispensable for investors seeking to keep more of what they earn.

Chapter 7: When the Good Times No Longer Roll

Bogle uses this chapter to address the inevitability of market downturns and the behavioral traps that ensnare investors during tough times. He recounts periods such as the 1973-74 bear market, the bursting of the dot-com bubble, and the 2008 financial crisis, highlighting how many investors reacted by selling at the bottom and missing the subsequent recovery. Bogle emphasizes that emotional responses—panic selling during declines and exuberant buying during rallies—are the primary reasons investors underperform the market.

He provides data showing that, historically, the U.S. stock market has experienced bear markets every 5-7 years, with average declines of 30% or more. Despite these setbacks, the market has always recovered and delivered strong long-term returns. Bogle quotes Sir John Templeton: “The four most dangerous words in investing are: ‘This time it’s different.’” He urges investors to set realistic expectations, recognizing that markets will not always deliver double-digit returns and that periods of low or negative performance are normal and even healthy for long-term growth.

For practical application, Bogle advises creating an investment policy statement that outlines your goals, risk tolerance, and rebalancing strategy. This document serves as an anchor during turbulent times, helping you stay disciplined and avoid rash decisions. He recommends maintaining a diversified portfolio, continuing to invest regularly, and viewing market downturns as opportunities to buy at lower prices. Bogle also suggests reviewing historical market data to build confidence in the resilience of equities over time.

The historical record supports Bogle’s counsel. Investors who stayed the course during the 2008-09 crisis saw their portfolios recover and reach new highs within a few years. Those who panicked and sold often locked in losses and missed the rebound. Bogle’s message is that discipline and patience are the ultimate competitive advantages in investing. In today’s volatile markets, with constant news and social media amplification, this lesson is more important than ever for achieving long-term financial success.

Chapter 8: Selecting Long-Term Winners

This chapter tackles the perennial challenge of identifying mutual funds or managers that will outperform in the future. Bogle presents extensive research showing that past performance is a poor predictor of future success. He cites studies indicating that the majority of funds that outperform over a five-year period subsequently lag their benchmarks in the next five years. Bogle uses the example of the Fidelity Magellan Fund, which was a superstar in the 1980s under Peter Lynch but struggled to maintain its edge after his departure.

Bogle explains that the primary factors correlated with long-term success are low costs, low turnover, and consistent management. He provides data showing that funds with expense ratios below 0.25% are far more likely to outperform than those with higher fees. Bogle also highlights the importance of stable management teams and clear investment strategies, warning that frequent changes in leadership or approach often lead to inconsistent results and increased risk.

For investors, the practical takeaway is to avoid chasing recent top performers and instead focus on structural advantages like low costs and simplicity. Bogle recommends selecting index funds or ETFs with long track records, transparent strategies, and minimal expenses. He cautions against relying on star managers or marketing hype, noting that the odds of picking a future winner are slim. Bogle’s advice is to “own the haystack, not just search for the needle.”

Historically, the mutual fund industry has seen thousands of funds come and go, with only a handful delivering sustained outperformance. The vast majority regress to the mean or worse. Bogle’s emphasis on indexing as the prudent choice is supported by decades of evidence. In an age where new funds, strategies, and managers are constantly promoted, his message to resist performance chasing and focus on enduring advantages is more relevant than ever.

Chapter 9: Yesterday’s Winners, Tomorrow’s Losers

In this chapter, Bogle delves into the phenomenon of reversion to the mean, showing that exceptional performance by funds or managers is almost always temporary. He provides data from Standard & Poor’s showing that of the top quartile of mutual funds in one five-year period, less than 20% remain in the top quartile in the next five years. Bogle explains that as successful strategies become widely adopted, their effectiveness diminishes due to increased competition and market efficiency.

Bogle warns investors against the temptation to select funds based on recent high returns, noting that this approach often leads to disappointment. He cites the example of sector funds that outperform during booms—such as technology in the late 1990s or energy in the mid-2000s—only to crash when market conditions change. Bogle reinforces that indexing avoids these pitfalls by ensuring exposure to all sectors and companies, capturing the market’s average return without the risk of chasing fleeting trends.

For practical application, Bogle recommends maintaining a disciplined, long-term focus and resisting the urge to rotate into whatever fund or sector has recently performed best. He suggests reviewing your portfolio annually to ensure it remains diversified and aligned with your goals, but cautions against making changes based solely on performance. Bogle’s advice is to “stay the course,” trusting in the power of broad diversification and the inevitability of reversion to the mean.

The historical evidence is compelling: countless investors have been lured by yesterday’s winners, only to suffer losses when performance reverts. The mutual fund “graveyard” is filled with once-hot funds that failed to sustain their edge. Bogle’s message is a powerful antidote to the performance-chasing mentality promoted by much of the financial media. In an era of constant innovation and product launches, his call for patience, discipline, and indexing remains the surest path to investment success.

Chapter 10: Seeking Advice to Select Funds? Look in the Mirror

Bogle addresses the role of financial advisors and the potential conflicts of interest inherent in the advice industry. He explains that many advisors are compensated through commissions or fees tied to specific products, creating incentives that may not align with the investor’s best interests. Bogle provides examples of advisors steering clients into high-cost, actively managed funds or insurance products that generate commissions but deliver subpar returns. He urges investors to be vigilant and critical when evaluating advice, asking questions about compensation, incentives, and the rationale behind recommendations.

Bogle champions investor empowerment through education. He argues that by learning the basics of investing—how index funds work, the impact of costs, and the principles of diversification—individuals can make informed decisions without relying on conflicted intermediaries. Bogle cites studies showing that self-directed investors in low-cost index funds often outperform those who delegate decisions to advisors charging high fees. He quotes: “No one cares as much about your money as you do.”

For practical implementation, Bogle recommends that investors read fund prospectuses, understand expense ratios, and use online tools to compare options. He encourages taking personal responsibility for investment decisions, developing a simple, rules-based plan, and seeking out independent, fee-only advisors if professional guidance is needed. Bogle also suggests joining investment forums or reading reputable books to continue learning and building confidence.

Historically, the financial advice industry has been slow to embrace indexing, but the rise of fiduciary standards and fee-only advisory models is changing the landscape. Bogle’s message is that self-reliance, combined with common sense and discipline, is the most effective defense against costly mistakes. As robo-advisors and digital platforms democratize access to low-cost investing, his call for investor empowerment is more relevant than ever. By “looking in the mirror,” investors can ensure their interests come first.

Chapter 11: Focus on the Lowest Costs

This chapter is a deep dive into the critical importance of minimizing investment costs. Bogle presents data showing that over 30 years, a 1% difference in annual fees can reduce an investor’s ending wealth by more than 25%. He explains the various types of costs investors face: management fees, sales loads, 12b-1 fees, trading commissions, and hidden expenses. Bogle provides examples of funds with expense ratios ranging from as low as 0.03% (such as Vanguard’s S&P 500 ETF) to over 2% for some actively managed funds, illustrating the dramatic impact on long-term returns.

Bogle cites research from Morningstar and the Investment Company Institute showing a strong correlation between low costs and higher net returns. He explains that every dollar saved in fees is a dollar that remains invested and compounds over time. Bogle also discusses the advantages of no-load funds and ETFs, which typically have lower expenses and no sales commissions. He warns investors to be vigilant for hidden costs, such as high portfolio turnover, which can increase trading expenses and taxes.

For practical application, Bogle advises investors to always compare expense ratios before selecting a fund, favoring those with the lowest costs. He recommends using online screening tools and calculators to project the long-term impact of fees. Bogle suggests consolidating investments in a few broad index funds to further reduce administrative costs. He also encourages investors to periodically review their portfolios for opportunities to switch to lower-cost options as new products become available.

Historically, the trend toward lower fees has accelerated with the growth of index funds and ETFs. Vanguard, Fidelity, and Schwab now offer index funds with expense ratios below 0.05%, making it easier than ever for investors to keep more of their returns. Bogle’s relentless focus on costs has revolutionized the industry, saving investors billions of dollars. In an era of fee compression and increased transparency, his advice to “focus on the lowest costs” remains the single most actionable lesson for maximizing wealth.

Chapter 12: Profit from the Majesty of Simplicity and Parsimony

In the final chapter, Bogle celebrates the virtues of simplicity and frugality in investment strategy. He argues that complex products and strategies—such as hedge funds, structured notes, and tactical asset allocation—rarely deliver better results than simple, low-cost index investing. Bogle provides data showing that over long periods, the vast majority of complex funds underperform due to higher fees, greater risk, and increased potential for mistakes. He quotes Albert Einstein: “Everything should be made as simple as possible, but not simpler.”

Bogle explains that simplicity makes investing more understandable, manageable, and resilient to behavioral errors. He recommends a straightforward approach: own a total market index fund, rebalance occasionally, and avoid unnecessary trading or speculation. Bogle also highlights the benefits of frugality—being cost-conscious and avoiding unnecessary expenses. He provides examples of investors who achieved financial independence by living below their means, saving diligently, and investing in simple portfolios.

For investors, the practical steps are clear: select a few broad index funds, automate contributions, and focus on long-term goals rather than short-term market movements. Bogle advises against the temptation to chase fads, buy exotic products, or pay for complex strategies that promise outperformance. He encourages investors to periodically review their plans to ensure they remain aligned with their values and objectives, but to resist making changes for the sake of novelty.

The historical context supports Bogle’s advocacy for simplicity and parsimony. The most successful investors—Warren Buffett, Charlie Munger, and others—have consistently emphasized the importance of simplicity and discipline. Bogle’s message is that anyone can achieve investment success by following a simple, cost-effective plan. In an age of information overload and constant innovation, his call to “profit from the majesty of simplicity and parsimony” is a timeless and empowering conclusion to the book.

Advanced Strategies from the Book

While Bogle’s central message is one of simplicity, he also addresses advanced strategies for investors seeking to optimize their portfolios within the framework of common sense investing. These techniques build on the core principles of low costs, diversification, and discipline, providing additional tools for maximizing after-tax returns and managing risk. Bogle’s advanced strategies are grounded in evidence and practicality, avoiding the pitfalls of complexity and speculation.

The following advanced techniques can help investors fine-tune their approach, especially as their portfolios grow or their financial situations become more complex. Each strategy is accompanied by examples and actionable steps, ensuring that even advanced investors can benefit from Bogle’s wisdom without sacrificing the core tenets of his philosophy.

Strategy 1: Tax-Loss Harvesting

Tax-loss harvesting involves selling investments that have declined in value to realize a capital loss, which can be used to offset capital gains elsewhere in your portfolio. Bogle recommends this technique for investors with taxable accounts, as it can reduce your overall tax bill and improve after-tax returns. For example, if you own an S&P 500 ETF that has temporarily declined, you can sell it, realize the loss, and immediately buy a similar but not identical fund (such as a total market ETF) to maintain market exposure. This strategy requires careful record-keeping and adherence to IRS rules, such as the wash-sale rule, which disallows losses if you repurchase the same security within 30 days. Over time, tax-loss harvesting can add 0.5% or more to your annual after-tax return, especially in volatile markets.

Strategy 2: Asset Location Optimization

Asset location refers to placing different types of investments in accounts that are most advantageous from a tax perspective. Bogle explains that tax-inefficient assets, like bond funds and REITs, should be held in tax-advantaged accounts (IRAs, 401(k)s), while tax-efficient assets, like index funds and ETFs, can be held in taxable accounts. For example, holding a total bond market fund in your IRA and a total stock market index fund in your taxable account can reduce your overall tax burden. This strategy requires coordination and periodic rebalancing but can boost your after-tax returns by 0.2-0.5% per year. Bogle emphasizes that the benefits of asset location compound over time, making it a powerful tool for long-term investors.

Strategy 3: Glide Path Adjustments for Retirement

Bogle discusses the importance of adjusting your asset allocation as you approach retirement—a concept known as the “glide path.” He recommends gradually shifting from a higher allocation to stocks in your early years to a more balanced mix of stocks and bonds as retirement nears. For example, a typical glide path might start with 80% stocks and 20% bonds in your 30s, transitioning to 60% stocks and 40% bonds by age 65. This approach reduces portfolio volatility and sequence-of-returns risk, ensuring that you have sufficient assets to fund retirement withdrawals even during market downturns. Bogle advises reviewing your allocation every 3-5 years and making gradual adjustments rather than abrupt changes.

Strategy 4: International Diversification

While Bogle was famously skeptical of heavy international allocations, he acknowledges that adding a modest allocation (10-20%) to international index funds can enhance diversification and reduce country-specific risk. He suggests using broad-based international ETFs or mutual funds with low expense ratios. For example, pairing the Vanguard Total International Stock Index Fund (VTIAX) with a U.S. total market fund provides exposure to thousands of companies worldwide. Bogle cautions against overweighting international markets, noting that currency risk and higher fees can offset some diversification benefits, but a measured allocation can provide additional resilience to global economic shifts.

Strategy 5: Automatic Investment and Rebalancing

Bogle highlights the power of automation in enforcing discipline and reducing behavioral errors. Setting up automatic monthly investments into your chosen index funds ensures consistent dollar-cost averaging and removes the temptation to time the market. Similarly, automating portfolio rebalancing—either through your brokerage platform or by setting calendar reminders—ensures that your allocation remains aligned with your goals. For example, if your plan is 70% stocks and 30% bonds, automated rebalancing will sell stocks during rallies and buy during dips, enforcing the principle of buying low and selling high. Bogle’s research shows that automated strategies outperform manual approaches due to reduced emotional interference and consistent implementation.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Getting started with Bogle’s approach is both simple and effective. The key is to focus on the fundamentals: low costs, broad diversification, and disciplined execution. Whether you’re a new investor or looking to optimize an existing portfolio, following a step-by-step implementation plan can help you build lasting wealth and avoid common pitfalls. Bogle’s strategies are designed to be accessible to all, regardless of investment knowledge or account size.

Begin by clarifying your financial goals, risk tolerance, and time horizon. Select a handful of low-cost index funds or ETFs that provide exposure to the total stock market (and, optionally, international markets and bonds). Automate your contributions and rebalancing to enforce discipline and minimize the impact of emotions. Review your plan annually, making adjustments only as your life circumstances or goals change—not in response to market fluctuations. By following these steps, you can confidently apply Bogle’s principles and set yourself on the path to financial independence.

- First step investors should take: Open an investment account (IRA, 401(k), or taxable brokerage) and select a low-cost total market or S&P 500 index fund as your core holding.

- Second step for building the strategy: Set up automatic monthly contributions and establish a simple asset allocation (e.g., 70% stocks, 30% bonds), adjusting for your age and risk tolerance.

- Third step for long-term success: Review your portfolio annually, rebalance to maintain your target allocation, and stay the course through market ups and downs—avoiding unnecessary trading or reacting to short-term news.

Critical Analysis

“The Little Book of Common Sense Investing” excels at distilling decades of market research and practical experience into actionable advice for investors. Bogle’s writing is clear, concise, and persuasive, making complex topics accessible without oversimplifying. The book’s relentless focus on costs, discipline, and evidence-based investing is both its greatest strength and its most enduring contribution to investment literature. Bogle’s use of parables, historical data, and real-world examples brings the material to life and reinforces the timeless nature of his advice.

However, the book’s emphasis on indexing and simplicity may be seen as limiting by investors seeking more advanced or tactical strategies. Bogle’s skepticism toward international diversification and alternative asset classes, while grounded in data, may not fully account for the needs of investors with unique circumstances or higher risk appetites. Additionally, the book’s focus on U.S. markets may require adaptation for readers in other countries with different tax laws or investment options. Still, these limitations are minor compared to the overwhelming evidence supporting Bogle’s core message.

In the current market environment—characterized by low fees, widespread access to index funds, and increased investor education—Bogle’s principles are more relevant than ever. The rise of robo-advisors, zero-commission trading, and global ETFs has made it easier for investors to implement Bogle’s strategies at scale. While new products and strategies continue to emerge, the fundamental truths outlined in this book remain unchanged. For anyone seeking a reliable, evidence-based approach to building wealth, “The Little Book of Common Sense Investing” is an indispensable resource.

Conclusion

John C. Bogle’s “The Little Book of Common Sense Investing” is a masterclass in rational, disciplined investing. Its core message—that low-cost, diversified index investing is the surest path to long-term wealth—has transformed the financial industry and empowered millions of investors worldwide. Bogle’s blend of data, parables, and practical advice makes the book both accessible and deeply insightful, providing readers with the tools and confidence to take control of their financial futures.

The key takeaways are clear: minimize costs, embrace simplicity, focus on the long term, and avoid the traps of speculation, high fees, and emotional decision-making. By following Bogle’s principles, investors can capture the full power of compounding and achieve their goals without unnecessary risk or complexity. The book’s lessons are timeless, equally relevant in bull and bear markets, and adaptable to investors of all backgrounds and experience levels.

For anyone serious about building wealth through the stock market, “The Little Book of Common Sense Investing” is essential reading. Its wisdom is as fresh today as when it was first published, and its impact continues to shape the investment world. Bogle’s legacy lives on in every investor who chooses common sense over hype, discipline over speculation, and long-term success over short-term excitement.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Common Sense Investing

1. What is the main message of “The Little Book of Common Sense Investing”?

The book’s central message is that the best way to achieve long-term investment success is to buy and hold a diversified portfolio of the entire stock market through low-cost index funds. Bogle argues that minimizing costs, avoiding market timing, and focusing on the long-term growth of businesses are the keys to building wealth.

2. Who is John C. Bogle, and why is he credible?

John C. Bogle is the founder of The Vanguard Group and the inventor of the first index mutual fund. With decades of experience managing billions in assets, Bogle is widely regarded as a pioneer of low-cost, investor-friendly investing. His principles have shaped the mutual fund industry and helped millions of investors achieve better outcomes.

3. How do index funds differ from actively managed funds?

Index funds passively track a market benchmark (like the S&P 500) and aim to match its performance, while actively managed funds employ managers who attempt to outperform the market through stock selection and timing. Index funds typically have much lower fees and turnover, resulting in higher net returns for most investors over time.

4. Why are investment costs so important?

Investment costs—such as expense ratios, sales loads, and trading fees—directly reduce your returns. Even small differences in annual fees can compound into large shortfalls over decades. Bogle’s research shows that low-cost funds consistently outperform higher-cost alternatives, making cost control the most reliable way to maximize wealth.

5. Is indexing suitable for international investors?

While Bogle’s focus is primarily on U.S. markets, the principles of low-cost, broad diversification, and long-term investing apply globally. Many countries now offer index funds and ETFs tailored to local markets. International investors should seek out the lowest-cost options available and consider modest allocations to global equities for additional diversification.

6. How should investors respond to market downturns?

Bogle advises maintaining discipline and sticking to your investment plan during downturns. Panic selling locks in losses and often results in missing the recovery. By staying invested, rebalancing as needed, and continuing regular contributions, investors can take advantage of lower prices and benefit from the market’s long-term growth.

7. What role do financial advisors play in Bogle’s philosophy?

Bogle encourages investors to educate themselves and be cautious when seeking advice. Many advisors are compensated through commissions or fees that may not align with the investor’s best interests. If you choose to work with an advisor, look for a fee-only fiduciary who prioritizes low costs and evidence-based strategies.

8. How can investors minimize taxes on their investments?

Investors can minimize taxes by holding index funds in tax-advantaged accounts (like IRAs and 401(k)s), favoring funds with low turnover in taxable accounts, and using techniques like tax-loss harvesting. Bogle’s approach emphasizes tax efficiency as a key component of maximizing after-tax returns.

9. Is it ever worth trying to pick individual stocks or active managers?

Bogle’s research shows that very few investors or managers consistently outperform the market, especially after fees and taxes. While some may succeed for short periods, the odds of sustained outperformance are low. Indexing offers a more reliable and less risky path to long-term wealth.

10. What are the first steps for someone new to investing who wants to follow Bogle’s advice?

Start by opening an investment account and selecting a low-cost total market or S&P 500 index fund. Set up automatic monthly contributions, establish a simple asset allocation, and commit to a buy-and-hold strategy. Educate yourself on the basics, avoid high-cost products, and review your plan annually to stay on track.