The Little Book of Currency Trading by Kathy Lien

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Written by renowned currency strategist Kathy Lien, The Little Book of Currency Trading serves as a comprehensive guide for both aspiring and experienced forex traders. Kathy Lien is a globally recognized expert in foreign exchange markets, with a career spanning over two decades. She began her journey at JPMorgan Chase and later became the Director of Currency Research at GFT and BK Asset Management. Lien is a frequent guest on CNBC, Bloomberg, and Reuters, and her books are widely regarded as essential reading for anyone interested in understanding the complexities of the global currency markets. Her credibility is further cemented by her hands-on experience and her ability to distill complex concepts into actionable advice.

The main theme of the book revolves around demystifying the world of currency trading. Lien’s central message is that while the forex market can seem intimidating, it is accessible to anyone willing to learn and practice sound risk management. She emphasizes that successful currency trading is not about chasing quick profits or relying on luck, but rather about preparation, discipline, and a solid understanding of market dynamics. The book is structured to take readers from the basics of forex terminology to advanced trading strategies, all while highlighting the psychological aspects that often determine success or failure in the market.

This book is particularly valuable for retail investors, aspiring traders, and even seasoned professionals who want to refine their approach to forex. Beginners will appreciate Lien’s clear explanations of concepts like pips, leverage, and risk management, while experienced traders will find her insights into market psychology and advanced strategies highly relevant. Small-business owners and investors with international exposure will also benefit from understanding how currency movements can impact their bottom line. The book’s practical focus makes it a useful reference for anyone looking to navigate the volatile world of forex trading with confidence.

What sets The Little Book of Currency Trading apart is its blend of real-world examples, actionable strategies, and psychological guidance. Lien draws on legendary figures like George Soros and John Templeton to illustrate how crises can create trading opportunities. She also shares cautionary tales about common pitfalls, including scams and emotional trading, ensuring readers are prepared for the realities of the market. The book’s unique value lies in its holistic approach—covering not just the mechanics of trading, but also the mindset and discipline required for long-term success. Whether you are a novice or a veteran, Lien’s book offers a roadmap to mastering currency trading in a rapidly evolving global economy.

Key Concepts and Ideas

Kathy Lien’s investment philosophy centers on the idea that opportunity in currency trading arises from understanding global economic forces, market psychology, and disciplined risk management. She believes that anyone can participate in the forex market, provided they are willing to learn its mechanics and respect its risks. The book emphasizes that both investors and traders must tailor their strategies to their personal strengths, time commitments, and risk tolerances. Lien’s approach is pragmatic: she advocates for a balance between technical analysis, fundamental research, and emotional discipline, all while maintaining a focus on long-term sustainability over short-term gains.

At its core, the book teaches that the forex market is not reserved for financial professionals. Instead, it is an integral part of everyday life—impacting everything from travel to international business transactions. Lien demystifies the jargon and mechanics of forex, making it accessible to anyone willing to invest the time to learn. Her key concepts include the importance of preparation, the value of trend-following, and the necessity of learning from both successes and failures. Each concept is supported by real-world examples and practical advice, ensuring that readers can translate theory into action.

- Opportunity in Crisis: Lien illustrates how financial crises, though unpredictable and potentially devastating, can create unique trading opportunities. She references George Soros’ famous bet against the British pound in 1992, which netted him over $1 billion, as a prime example of profiting from market turmoil.

- Forex in Everyday Life: The book stresses that currency trading is not just for professionals. Anyone who travels, shops internationally, or runs a business with overseas exposure is already interacting with the forex market. Understanding exchange rates and their impact is valuable for everyone.

- Mastering Forex Terminology: Lien emphasizes the importance of understanding key terms like base currency, counter currency, and pips. Mastery of these basics is essential before advancing to more complex strategies.

- Preparation and Discipline: Success in forex trading requires thorough preparation and a clear strategy. Lien likens entering the market unprepared to riding a rollercoaster blindfolded—exciting, but likely to end in disaster.

- Market Movers: Major news events, economic data releases, and political changes are key drivers of currency movements. Lien teaches readers to stay informed and anticipate how such events can affect currency pairs.

- Investor vs. Trader Mindset: The book differentiates between long-term investors and short-term traders. Investors focus on gradual wealth accumulation and fundamentals, while traders seek to capitalize on short-term price movements.

- Trend Following and Risk Management: Lien advocates for following market trends and managing risk diligently. She notes that many traders fail because they ignore clear trends or take on excessive risk without proper safeguards.

- Diversification and Hedging: The importance of spreading risk across different currencies and using tools like ETFs and mutual funds to gain exposure to forex markets is emphasized for investors seeking steady growth.

- Psychological Resilience: Emotional discipline is highlighted as a critical factor in trading success. Lien discusses the dangers of emotional trading and the need to learn from mistakes without losing confidence.

- Protection Against Scams: The book warns readers about common forex scams, urging due diligence, skepticism, and reliance on reputable sources to avoid falling victim to fraud.

Practical Strategies for Investors

Applying the teachings of The Little Book of Currency Trading requires a blend of strategic planning, continuous learning, and disciplined execution. Lien provides readers with concrete steps to translate her philosophy into action, emphasizing that preparation and adaptability are crucial in the fast-moving world of forex. Whether you are an investor seeking long-term growth or a trader looking for short-term gains, the book’s strategies are designed to help you navigate the complexities of currency markets with confidence and control.

To maximize the value of Lien’s insights, investors should focus on developing a robust trading plan, understanding the drivers of currency movements, and managing risk effectively. The book encourages readers to treat trading as a business, not a hobby, and to regularly review and adjust their strategies based on performance and changing market conditions. By adopting a methodical approach and leveraging the tools and techniques outlined in the book, investors can improve their chances of achieving consistent results.

- Develop a Comprehensive Trading Plan: Define your goals, risk tolerance, and criteria for entering and exiting trades. Write down your plan and review it regularly to ensure you remain disciplined and focused.

- Start with Demo Trading: Before risking real money, practice on a demo account to familiarize yourself with trading platforms, order types, and market dynamics. This helps build confidence and reduces costly beginner mistakes.

- Follow Major News and Economic Releases: Set up news alerts for key economic indicators, central bank announcements, and political events. Use economic calendars to anticipate market-moving events and adjust your positions accordingly.

- Use Stop-Loss and Take-Profit Orders: Protect your capital by setting stop-loss levels to limit potential losses and take-profit orders to lock in gains. Adjust these orders as market conditions change.

- Diversify Across Currencies and Asset Classes: Spread your investments across multiple currency pairs and consider using ETFs or mutual funds for broader exposure and reduced risk.

- Keep a Trading Journal: Record every trade, including the rationale, entry and exit points, and outcomes. Review your journal regularly to identify patterns, mistakes, and areas for improvement.

- Stay Emotionally Disciplined: Develop routines to manage stress and avoid emotional trading. Take breaks after losses, stick to your plan, and resist the urge to chase quick profits.

- Conduct Regular Performance Reviews: At the end of each week or month, analyze your trading results, review your plan, and make adjustments based on what’s working and what isn’t.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

The Little Book of Currency Trading is structured to guide readers through the entire journey of becoming a successful forex trader or investor. Each chapter builds on the previous one, starting with foundational concepts and progressing to advanced strategies and psychological insights. Lien uses real-world examples, practical advice, and cautionary tales to ensure that readers not only understand the mechanics of currency trading but also the mindset required for long-term success.

The book is divided into fifteen chapters, each focusing on a specific aspect of forex trading. From understanding how crises create opportunities to learning how to avoid costly mistakes and scams, Lien covers the full spectrum of skills and knowledge needed to thrive in the forex market. The following section provides an in-depth, chapter-by-chapter analysis, highlighting key lessons, examples, and practical applications for investors at every stage of their journey.

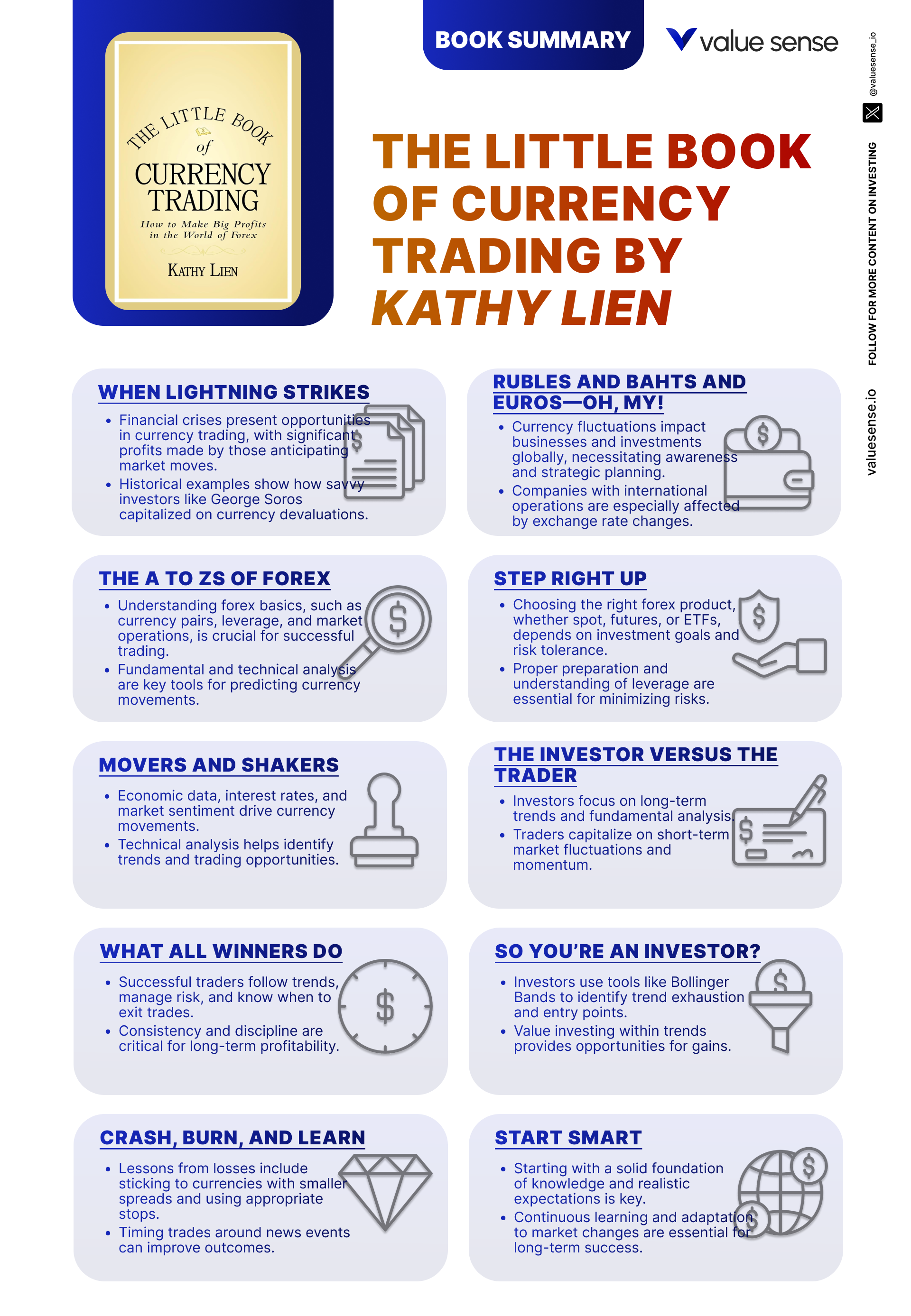

Chapter 1: When Lightning Strikes

The opening chapter sets the tone by comparing financial crises to lightning strikes—sudden, unpredictable, and potentially devastating, but also rich with opportunity for those who are prepared. Lien recounts the story of George Soros, who famously “broke the Bank of England” in 1992 by betting against the British pound, earning over $1 billion in a single day. She also references Sir John Templeton, who bought distressed assets during market panics and later reaped substantial rewards. These examples illustrate that while crises can induce panic, they also create unique trading opportunities, especially in the forex market where currency values can swing dramatically within hours or days.

Throughout the chapter, Lien emphasizes that market “lightning strikes” are often triggered by investor panic, political upheaval, or unexpected economic news. She points out that in 2008, as the global financial crisis unfolded, the U.S. dollar surged against most major currencies, creating windfalls for those who anticipated the move. Lien argues that understanding the dynamics behind these events—such as central bank interventions or sudden shifts in market sentiment—is crucial for capitalizing on volatility. She quotes, “Preparation and awareness are your best allies when the storm hits.”

For investors, the lesson is clear: don’t fear volatility—prepare for it. Lien recommends developing a well-thought-out strategy that includes identifying potential catalysts for currency movements, such as upcoming elections, economic reports, or central bank meetings. She suggests using stop-loss orders and position sizing to manage risk during turbulent periods. By staying informed and maintaining discipline, traders can turn crises into profitable events rather than costly mistakes.

Historically, those who have thrived during market crises did so by combining foresight, preparation, and decisive action. The 1997 Asian financial crisis, the 2008 global meltdown, and the 2015 Swiss franc shock all provided opportunities for traders who understood the underlying forces. Today, with geopolitical tensions and rapid information dissemination, these “lightning strikes” are more frequent and impactful than ever, underscoring the need for vigilance and adaptability in currency trading.

Chapter 2: Rubles and Bahts and Euros—Oh, My!

In the second chapter, Lien demystifies the forex market by relating it to everyday experiences. She explains that anyone who has traveled internationally, purchased goods online from another country, or run a business with overseas clients has already participated in currency trading, albeit indirectly. By drawing parallels between exchanging dollars for euros at an airport and executing a forex trade, Lien makes the market accessible and relatable. She emphasizes that understanding exchange rates is not just for traders—it’s essential for business owners, investors, and even casual travelers.

The chapter provides specific examples, such as how a small business importing electronics from Japan can see its profit margins erode if the yen strengthens against the dollar. Lien also discusses how multinational corporations like Apple and Toyota hedge their currency exposures to protect profits. She quotes, “Currency movements don’t just affect Wall Street—they touch Main Street, too.” This perspective broadens the book’s appeal, showing that forex knowledge benefits a wide audience.

For practical application, Lien suggests that individuals and businesses pay attention to exchange rates when making international transactions or investments. She recommends using simple hedging strategies, such as forward contracts or currency ETFs, to mitigate risk. Even for non-traders, understanding the basics of forex can lead to smarter financial decisions, such as timing large purchases or negotiating contracts in favorable currencies.

Historically, currency fluctuations have had significant impacts on global trade and investment. The 2014-2015 surge in the U.S. dollar hurt American exporters but benefited travelers heading abroad. Similarly, emerging market crises often lead to sharp currency depreciations, affecting everything from commodity prices to tourism. By framing forex as a universal concern, Lien ensures that readers from all backgrounds see the relevance of her teachings.

Chapter 3: The A to Zs of Forex

This foundational chapter serves as a crash course in forex terminology and mechanics. Lien introduces key concepts such as base currency, counter currency, pips (the smallest price movement in a currency pair), and lots (standardized trade sizes). She explains that understanding these terms is essential for navigating trading platforms and interpreting market data. The chapter includes practical examples, like how a one-pip move in the EUR/USD pair translates to a specific dollar amount depending on trade size.

Lien also discusses why businesses and investors participate in the forex market, highlighting the pursuit of “alpha”—returns that exceed traditional benchmarks. She notes that while some participants trade for speculation, others use forex as a tool for risk management, such as hedging future cash flows or protecting investment returns. The chapter is peppered with real-world scenarios, such as a U.S. company locking in exchange rates to stabilize overseas revenues.

For investors, Lien advises mastering the basics before venturing into live trading. She suggests starting with small positions, practicing on demo accounts, and gradually building confidence. She writes, “A solid grasp of the basics is your first line of defense against costly mistakes.” This approach ensures that readers develop a strong foundation before tackling more advanced strategies.

In the broader context, the rise of online trading platforms and mobile apps has made forex more accessible than ever. However, this accessibility also increases the risk of uninformed trading. Lien’s emphasis on education and terminology is especially relevant in today’s market, where retail participation is at an all-time high and the potential for misunderstanding is significant.

Chapter 4: Step Right Up

In this chapter, Lien likens entering the forex market to stepping into an amusement park—exciting, but potentially overwhelming for the unprepared. She highlights common beginner mistakes, such as jumping into trades without a plan, chasing quick profits, or ignoring risk management. Lien stresses the importance of choosing the right forex products based on individual goals, whether it’s spot trading, futures, or options. Each product has its own characteristics, advantages, and risks, and understanding these differences is crucial for success.

She provides examples of traders who lost money by trading exotic currency pairs without understanding their volatility or liquidity risks. Lien also discusses the importance of selecting reputable brokers and platforms, noting that a poor choice can lead to technical issues, high fees, or even fraud. She quotes, “Preparation is your ticket to a smoother ride in the forex amusement park.”

To apply these lessons, Lien recommends that new traders spend significant time researching brokers, trading products, and market conditions before committing real capital. She suggests starting with major currency pairs like EUR/USD or USD/JPY, which are more liquid and less volatile than exotics. Developing a clear strategy—complete with entry and exit criteria, risk limits, and performance metrics—is essential to avoid common pitfalls.

The chapter’s advice is especially relevant in today’s market, where low barriers to entry have led to a surge in retail forex trading. Many beginners are lured by promises of easy money, only to suffer losses due to lack of preparation. Lien’s focus on discipline, product selection, and risk management provides a roadmap for avoiding the traps that ensnare many newcomers.

Chapter 5: Movers and Shakers

This chapter explores the forces that drive currency movements, drawing an analogy to the unpredictable swings of a Pirate Ship ride at an amusement park. Lien identifies major news events, economic data releases, and interest rate decisions as primary catalysts for currency volatility. She provides detailed examples, such as how the 2016 Brexit vote caused the British pound to plummet by over 10% in a single day, or how U.S. nonfarm payroll reports regularly trigger sharp moves in the dollar.

Lien emphasizes the importance of staying informed about global news and understanding its potential impact on currencies. She discusses the role of central banks, such as the Federal Reserve and the European Central Bank, in setting interest rates and signaling policy changes. Political events, like elections or government instability, are also highlighted as significant drivers of market sentiment and currency values.

For practical application, Lien advises traders to use economic calendars to track upcoming data releases and central bank meetings. She suggests developing strategies that account for increased volatility during these events, such as reducing position sizes or using tighter stop-loss orders. She writes, “Anticipating market-moving events is half the battle in forex trading.”

Historically, major currency moves have often coincided with unexpected news. The 2015 Swiss National Bank’s decision to remove the franc’s peg to the euro caused a 30% surge in the franc within minutes, wiping out many traders. Lien’s focus on news-driven strategies is particularly relevant in today’s interconnected world, where information travels instantly and markets react swiftly.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: The Investor versus the Trader

In this pivotal chapter, Lien contrasts the mindsets and strategies of investors and traders, using the example of two fictional brothers—one patient and methodical, the other fast-paced and opportunistic. She explains that investors typically take a long-term approach, focusing on gradual wealth accumulation through steady growth and fundamentals. Traders, on the other hand, seek to profit from short-term price movements, often requiring quick decision-making and close market monitoring.

Lien discusses the importance of aligning one’s trading style with personal temperament and lifestyle. She notes that investors generally require less daily time commitment and are better suited for those who prefer a hands-off approach. Traders, conversely, must be comfortable with higher risk, rapid decision-making, and the psychological pressures of frequent market swings. She quotes, “Success in forex is not just about strategy—it’s about knowing yourself.”

For readers, the takeaway is to assess their own risk tolerance, time availability, and emotional resilience before choosing a path. Lien suggests starting with a hybrid approach—investing for the long term while experimenting with small, short-term trades to gauge comfort levels. She also emphasizes the importance of consistency, regardless of the chosen strategy, to mitigate emotional challenges and maintain discipline.

This distinction remains highly relevant in today’s market, where both passive investing and active trading have their proponents. The rise of algorithmic trading and robo-advisors has blurred the lines, but Lien’s message endures: success comes from self-awareness and matching strategy to personality, not simply following the latest trend.

Chapter 7: What All Winners Do

This chapter identifies the common traits and strategies shared by consistently successful forex traders. Lien places particular emphasis on trend-following, arguing that traders who align themselves with prevailing market trends increase their chances of success. She notes that while many traders understand the importance of following trends, few do so consistently, often succumbing to the temptation to “call tops and bottoms” or trade against momentum.

Lien provides examples of traders who achieved long-term profitability by sticking to trend-following strategies, using technical indicators like moving averages and trendlines to guide their decisions. She also discusses the critical role of risk management, including the use of stop-loss orders and predefined exit points. The chapter includes references to psychological studies showing that disciplined traders outperform those who act impulsively or emotionally.

For practical application, Lien recommends that traders develop rules-based systems for entering and exiting trades, focusing on trend confirmation and risk parameters. She writes, “Profitable exits are just as important as well-timed entries.” Planning exits in advance and resisting the urge to hold onto losing positions can make the difference between consistent gains and chronic losses.

The chapter’s lessons are supported by historical data, such as the long-term outperformance of trend-following strategies in both bull and bear markets. In the modern era, with increased algorithmic trading and rapid information flow, the principles of discipline, trend identification, and risk management remain as vital as ever.

Chapter 8: So You’re an Investor?

Here, Lien explores the characteristics of successful forex investors, contrasting them with short-term traders. She argues that investors should adopt a long-term perspective, focusing on steady growth rather than quick profits. The chapter highlights the importance of patience, diversification, and a strong understanding of market fundamentals, such as economic trends and interest rate differentials.

Lien provides practical examples of how investors can use exchange-traded funds (ETFs) and mutual funds to gain exposure to currency markets while diversifying risk. She discusses the benefits of spreading investments across multiple currencies and asset classes, which can protect against downturns in any single area. The chapter includes case studies of investors who weathered market volatility by maintaining diversified portfolios and resisting the urge to react to short-term fluctuations.

For implementation, Lien suggests that investors define clear financial goals, conduct thorough research on currency fundamentals, and use passive investment vehicles to gain broad exposure. She writes, “Patience is your greatest ally in the pursuit of long-term financial goals.” Regular portfolio reviews and rebalancing are recommended to ensure continued alignment with objectives and market conditions.

The approach outlined in this chapter is particularly relevant in today’s environment of low interest rates and heightened market uncertainty. Diversification and a focus on fundamentals have proven effective in navigating periods of volatility, such as the 2020 pandemic and the ongoing shifts in global trade dynamics.

Chapter 9: So You’re a Trader?

In this chapter, Lien shifts focus to short-term traders, outlining the mindset and skills required for success in the fast-paced world of forex trading. She emphasizes the need for quick, informed decision-making, effective risk management, and the ability to stay abreast of market developments. Lien discusses the use of technical analysis tools, such as candlestick patterns and momentum indicators, to identify entry and exit points.

The chapter includes examples of traders who use news-driven strategies, reacting to economic data releases or geopolitical events to capture short-term price movements. Lien highlights the psychological challenges of trading, such as dealing with losses, managing stress, and maintaining discipline in the face of rapid market swings. She quotes, “Emotional resilience is as important as technical skill in trading.”

For practical application, Lien advises traders to set strict stop-loss orders, limit leverage, and avoid overtrading. She recommends developing a daily routine that includes market analysis, journaling, and performance review. Staying informed through financial news and economic calendars is essential for making timely decisions.

The lessons in this chapter are especially pertinent in the current era of 24-hour trading and high market volatility. The proliferation of trading platforms and real-time data has increased both the opportunities and risks for short-term traders, making Lien’s advice on discipline and risk management more relevant than ever.

Chapter 10: Risky Business

This chapter delves into the critical concept of risk management, drawing a parallel between trading and climbing Mount Everest—both require preparation, discipline, and respect for the dangers involved. Lien explains that successful traders focus on high-probability trades, supported by solid fundamentals and favorable market sentiment, rather than taking unnecessary risks in pursuit of quick gains.

Lien provides examples of traders who suffered significant losses by ignoring risk management principles, such as overleveraging or failing to use stop-loss orders. She discusses the importance of assessing the risk-reward ratio of each trade and ensuring that multiple factors align before entering a position. The chapter includes practical advice on setting risk parameters, diversifying positions, and preparing for market volatility.

For investors, Lien recommends developing a risk management plan that includes position sizing, stop-loss levels, and contingency strategies for unexpected events. She writes, “Preparation is the difference between surviving and thriving in volatile markets.” By focusing on high-probability setups and avoiding trades with excessive uncertainty, traders can protect their capital and improve long-term performance.

The lessons in this chapter are underscored by numerous historical examples, such as the blow-ups of highly leveraged hedge funds and the fortunes lost during the 2008 financial crisis. In today’s market, with increased leverage and rapid information flow, risk management remains the cornerstone of sustainable trading success.

Chapter 11: The Top 10 Mistakes

In this chapter, Lien catalogs the most common mistakes made by forex traders and offers guidance on how to avoid them. She highlights errors such as over-leveraging, emotional trading, neglecting a well-defined trading plan, and failing to learn from past mistakes. Lien stresses that these pitfalls can lead to significant losses, especially for beginners who are unaware of the risks involved.

The chapter provides real-world examples of traders who wiped out their accounts by using excessive leverage or deviating from their plans during periods of market volatility. Lien discusses the dangers of emotional decision-making, such as revenge trading after a loss or chasing profits without proper analysis. She quotes, “Discipline is the antidote to most trading mistakes.”

For practical application, Lien advises traders to stick to conservative leverage levels, maintain a detailed trading journal, and regularly review their performance to identify patterns and areas for improvement. She recommends setting realistic expectations and avoiding the temptation to optimize strategies endlessly or expect outsized returns.

Historically, the majority of retail forex traders lose money due to these common mistakes. The proliferation of high-leverage offerings and aggressive marketing by brokers has only increased the risks. Lien’s focus on discipline, self-awareness, and continuous learning provides a framework for avoiding the traps that ensnare many traders.

Chapter 12: Greetings from Nigeria, Please Help!

This chapter addresses the prevalence of scams in the forex market, using the infamous “Nigerian email scam” as a starting point. Lien explains that fraudulent schemes often take the form of promises of guaranteed profits, offers of automated trading systems, or high-pressure sales tactics. She stresses the importance of skepticism and due diligence when evaluating any trading opportunity.

Lien provides examples of common red flags, such as unsolicited offers, unrealistic guarantees, and requests for upfront payments to unverified entities. She discusses the dangers of trusting unregulated brokers or signal providers, noting that many traders have lost substantial sums to scams. The chapter includes advice on researching firms, verifying credentials, and relying on reputable sources of information.

For practical application, Lien urges readers to conduct thorough research before committing funds to any trading system or investment. She recommends using established regulatory bodies, such as the Commodity Futures Trading Commission (CFTC), to check the legitimacy of brokers and platforms. She writes, “If it sounds too good to be true, it probably is.”

The chapter’s lessons are especially relevant in today’s digital age, where online scams are increasingly sophisticated and widespread. By promoting skepticism, due diligence, and reliance on trusted resources, Lien provides readers with the tools to protect themselves from financial fraud.

Chapter 13: Getting Down to Business

In this chapter, Lien emphasizes the importance of treating trading as a business rather than a hobby. She compares successful traders to well-prepared contestants on a game show, highlighting the value of having a clear strategy, discipline, and the ability to adapt to changing market conditions. The chapter outlines the key components of a solid trading plan, including goal setting, risk management, and regular performance review.

Lien provides examples of traders who achieved consistent profitability by developing comprehensive plans and sticking to them, even during periods of market volatility. She discusses the importance of defining achievable goals, aligning them with risk tolerance and financial objectives, and using these goals to guide trading decisions. The chapter includes practical advice on reviewing and adjusting plans based on market conditions and personal performance.

For investors, Lien recommends approaching trading with the same level of professionalism as any other business. This means documenting strategies, tracking results, and continuously seeking improvement. She writes, “Consistency and discipline are the hallmarks of successful traders.” By maintaining a businesslike approach, traders can increase their chances of long-term success.

The chapter’s lessons are particularly relevant in an era where trading platforms and social media have gamified investing, leading many to treat it as entertainment rather than a serious endeavor. Lien’s focus on planning, discipline, and continuous improvement provides a counterbalance to these trends.

Chapter 14: Crash, Burn, and Learn

This chapter tackles the inevitability of losses in trading and the importance of learning from mistakes. Lien compares the experience of losing trades to the setbacks faced by athletes like Michael Jordan, who famously overcame failures to achieve greatness. She emphasizes that every trader will experience losses, but those who analyze their mistakes and adjust their strategies are more likely to succeed in the long run.

Lien provides examples of traders who used detailed journals to identify patterns of mistakes and refine their approaches. She discusses the value of resilience, maintaining a positive mindset, and focusing on long-term goals despite short-term setbacks. The chapter includes practical advice on using losses as learning opportunities and embracing change as a natural part of the trading process.

For practical application, Lien suggests keeping a detailed trading journal, reviewing losing trades objectively, and seeking feedback from mentors or peers. She writes, “Every failure is a step toward mastery, if you’re willing to learn.” Developing resilience and a growth mindset is essential for surviving and thriving in the volatile world of forex trading.

The chapter’s message is timeless, echoing the experiences of legendary investors and traders who turned setbacks into stepping stones. In today’s market, where rapid information flow and social media amplify both successes and failures, the ability to learn from mistakes is more important than ever.

Chapter 15: Start Smart - Begin Your Currency Adventure the Right Way

The final chapter brings the book full circle, emphasizing the importance of starting your forex trading journey with the right mindset and preparation. Lien reflects on the interconnectedness of the global economy, noting that currencies play a pivotal role in international trade, finance, and everyday life. She discusses how the forex market has evolved, becoming more accessible to individual investors, and how this accessibility presents both opportunities and challenges.

Lien advises readers to invest in their education, take advantage of free resources, and approach trading with patience and a long-term perspective. She provides examples of traders who succeeded by building a strong foundation, developing clear strategies, and remaining adaptable in the face of changing market conditions. The chapter underscores the significance of preparation, discipline, and continuous learning in achieving long-term success.

For practical application, Lien recommends starting with small positions, using demo accounts, and gradually increasing exposure as confidence and skills grow. She writes, “The best journeys begin with careful planning and a willingness to learn.” By taking a measured approach and focusing on education, new traders can avoid common pitfalls and set themselves up for sustainable success.

The chapter’s lessons are especially relevant in today’s rapidly changing market environment, where new technologies, geopolitical shifts, and economic uncertainties create both risks and opportunities. Lien’s emphasis on preparation, patience, and adaptability provides a roadmap for navigating the challenges of modern currency trading.

Advanced Strategies from the Book

Building on the foundational concepts, Kathy Lien introduces several advanced strategies designed for traders who want to elevate their performance in the forex market. These techniques require a deeper understanding of market dynamics, technical analysis, and risk management. Lien stresses that while advanced strategies can enhance returns, they also come with increased complexity and risk, making discipline and preparation even more critical.

Each advanced strategy is accompanied by real-world examples and actionable steps, ensuring that traders can implement them effectively. Lien encourages readers to experiment with different techniques, track their results, and refine their approaches based on experience and market conditions. The following advanced strategies are among the most valuable insights from the book:

Strategy 1: Carry Trade Optimization

The carry trade involves borrowing in a currency with a low interest rate and investing in a currency with a higher rate, profiting from the interest rate differential. Lien explains that successful carry trades require more than just identifying rate differences—they demand careful analysis of macroeconomic trends, central bank policies, and market sentiment. For example, during the mid-2000s, many traders borrowed in Japanese yen (with near-zero rates) and invested in Australian dollars (with rates above 5%), earning both interest and capital gains as the AUD appreciated. However, carry trades can unravel quickly during periods of market stress, as seen during the 2008 financial crisis when risk aversion led to a rapid unwinding of positions. Lien advises using stop-loss orders, monitoring volatility indices, and diversifying carry trades across multiple pairs to manage risk.

Strategy 2: News-Driven Trading

News-driven trading focuses on capitalizing on market moves triggered by economic data releases, central bank announcements, or geopolitical events. Lien recommends preparing for major events by identifying key currency pairs likely to be affected and setting up alerts for data releases. For instance, U.S. nonfarm payrolls, European Central Bank meetings, and unexpected political developments can cause sharp, short-term movements. Lien advises using tight stop-loss orders and smaller position sizes during these periods to manage heightened volatility. She also suggests backtesting strategies around specific news events to identify patterns and improve execution. This approach requires discipline and the ability to react quickly, but can yield significant returns for well-prepared traders.

Strategy 3: Technical Breakout Trading

Technical breakout trading involves identifying key support and resistance levels and entering trades when prices break through these barriers. Lien recommends using tools such as moving averages, Bollinger Bands, and trendlines to confirm breakouts and avoid false signals. For example, if the EUR/USD pair has been trading in a tight range and suddenly breaks above resistance on high volume, it may signal the start of a new trend. Lien cautions against chasing every breakout, advising traders to look for confirmation from multiple indicators and to set stop-loss orders just below the breakout level to minimize losses if the move fails. She highlights the importance of backtesting and refining breakout strategies to suit individual risk profiles and market conditions.

Strategy 4: Multi-Timeframe Analysis

Multi-timeframe analysis involves examining currency pairs across different chart periods—such as daily, hourly, and 15-minute charts—to identify trends and entry points with greater accuracy. Lien explains that aligning signals across multiple timeframes increases the probability of successful trades. For example, a trader may look for a long-term uptrend on the daily chart, a pullback on the hourly chart, and a bullish reversal on the 15-minute chart before entering a position. This approach helps filter out noise and false signals, ensuring that trades are supported by broader market trends. Lien suggests practicing this technique on demo accounts and gradually incorporating it into live trading as confidence grows.

Strategy 5: Sentiment and Positioning Analysis

Sentiment and positioning analysis involves assessing market psychology and the positioning of large traders to anticipate potential reversals or trend continuations. Lien recommends monitoring indicators such as the Commitment of Traders (COT) report, which shows the positions of institutional and retail traders. Extreme positioning—such as record-long or short positions—can signal an impending reversal as the market becomes overextended. Lien advises combining sentiment analysis with technical and fundamental indicators to improve timing and reduce risk. For example, if sentiment is overwhelmingly bullish but technical indicators show signs of exhaustion, it may be prudent to scale back long positions or prepare for a correction.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the lessons from The Little Book of Currency Trading requires a structured approach, ongoing education, and disciplined execution. Lien encourages readers to start small, focus on building foundational skills, and gradually incorporate more advanced strategies as confidence and experience grow. The key is to treat trading as a continuous learning process, regularly reviewing performance and adapting to changing market conditions.

To get started, investors should prioritize education, practice on demo accounts, and develop a comprehensive trading plan. Lien recommends setting realistic goals, maintaining a trading journal, and seeking feedback from mentors or peers. By following a step-by-step approach, traders can build the skills and resilience needed to succeed in the volatile world of forex.

- Begin by investing time in education—read books, take online courses, and follow reputable market analysts to build a strong knowledge base.

- Open a demo trading account to practice executing trades, testing strategies, and familiarizing yourself with trading platforms without risking real money.

- Develop a written trading plan that outlines your goals, risk tolerance, entry and exit criteria, and performance metrics. Review and adjust your plan regularly based on results and market conditions.

Critical Analysis

The Little Book of Currency Trading excels at making the complex world of forex accessible to a wide audience. Kathy Lien’s clear explanations, real-world examples, and actionable strategies provide a comprehensive roadmap for both beginners and experienced traders. The book’s holistic approach—covering technical, fundamental, and psychological aspects—ensures that readers are well-equipped to navigate the challenges of currency trading. Lien’s emphasis on preparation, discipline, and continuous learning is particularly valuable in today’s fast-paced, volatile markets.

However, the book is not without its limitations. While it covers a broad range of topics, some readers may desire more in-depth coverage of advanced technical analysis or algorithmic trading strategies. Additionally, the rapidly evolving nature of the forex market means that some examples or tools may become outdated over time. Readers should supplement the book’s teachings with ongoing research and stay abreast of new developments in trading technology and market regulation.

In the current market environment—characterized by heightened volatility, geopolitical uncertainty, and technological innovation—Lien’s focus on risk management and adaptability is more relevant than ever. The book’s practical advice and timeless principles make it a valuable addition to any investor’s library, providing a solid foundation for success in the dynamic world of currency trading.

Conclusion

The Little Book of Currency Trading by Kathy Lien offers a thorough, accessible, and actionable guide to mastering the forex market. The book’s blend of foundational knowledge, advanced strategies, and psychological insights equips readers with the tools needed to succeed in both calm and turbulent market conditions. Lien’s real-world examples and emphasis on discipline, risk management, and continuous learning ensure that readers are prepared for the realities of trading.

Whether you are a novice looking to build a strong foundation or an experienced trader seeking to refine your approach, Lien’s book provides a roadmap to long-term success. By applying the lessons, strategies, and mindset outlined in the book, investors can navigate the complexities of the forex market with confidence and resilience. The Little Book of Currency Trading is a must-read for anyone serious about achieving consistent results in currency trading.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Currency Trading

1. Who is Kathy Lien, and why is she a credible authority on forex trading?

Kathy Lien is a globally recognized currency strategist with over 20 years of experience in the forex market. She has held senior positions at major financial institutions like JPMorgan Chase and BK Asset Management, and is a frequent guest on CNBC and Bloomberg. Her deep expertise and practical approach make her a trusted voice in the industry.

2. Is this book suitable for beginners, or do I need prior trading experience?

The book is designed for both beginners and experienced traders. Lien explains basic concepts like pips, leverage, and currency pairs in clear language, making it accessible to newcomers. At the same time, she covers advanced strategies and market psychology, offering valuable insights for seasoned traders.

3. What are the main risks involved in currency trading, according to the book?

Currency trading carries risks such as leverage-induced losses, market volatility, and emotional decision-making. Lien emphasizes the importance of risk management, preparation, and discipline to mitigate these risks. She provides practical tools like stop-loss orders and trading journals to help traders protect their capital.

4. How does the book address the psychological aspects of trading?

Lien dedicates several chapters to the psychological challenges of trading, such as dealing with losses, managing stress, and maintaining discipline. She offers strategies for building emotional resilience, learning from mistakes, and developing a growth mindset—critical factors for long-term success.

5. Does the book provide actionable strategies for both investors and traders?

Yes, the book distinguishes between long-term investors and short-term traders, offering tailored strategies for each. Investors are advised to focus on diversification and fundamentals, while traders are guided toward trend-following, technical analysis, and news-driven trading.

6. Are there real-world examples and case studies in the book?

Absolutely. Lien uses real-world stories, such as George Soros’ bet against the British pound and actual trading scenarios, to illustrate key concepts. These examples make the lessons tangible and provide practical insights into how successful traders operate.

7. How can readers protect themselves from forex scams, as discussed in the book?

Lien warns readers about common scams, including guaranteed profit schemes and unregulated brokers. She advises conducting due diligence, verifying credentials, and relying on reputable sources like regulatory bodies. The book provides a checklist of red flags to help readers avoid falling victim to fraud.

8. What advanced strategies are covered, and how can I implement them?

The book covers advanced techniques such as carry trade optimization, news-driven trading, technical breakout strategies, multi-timeframe analysis, and sentiment analysis. Lien explains each strategy with examples and actionable steps, encouraging readers to practice on demo accounts before risking real capital.

9. Is the book still relevant in today’s rapidly changing forex market?

Yes, the book’s core principles—preparation, risk management, and adaptability—are timeless and highly relevant in today’s volatile markets. While some examples may become dated, the strategies and mindset Lien promotes remain effective regardless of market conditions.

10. How can I start applying the lessons from the book right away?

Begin by educating yourself using the book and other reputable sources, practice on demo accounts, and develop a written trading plan. Focus on risk management, keep a trading journal, and regularly review your performance to continuously improve your skills and results.