The Little Book of Economics by Greg Ip

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Greg Ip’s “The Little Book of Economics: How the Economy Works in the Real World” is a masterfully written guide that demystifies the complexities of economics for investors, students, and curious minds alike. Greg Ip, a highly respected journalist and economics commentator, brings a wealth of experience to the table. As the chief economics commentator for The Wall Street Journal and a former U.S. economics editor at The Economist, Ip’s career has been defined by his ability to explain economic concepts in clear, actionable terms. His writing style is approachable yet deeply insightful, making him a trusted voice for both novice and seasoned investors seeking to understand the forces shaping markets and economies.

The central theme of the book is to provide readers with a foundational understanding of how economies function, why business cycles occur, and what drives prosperity or crisis in nations. Rather than focusing solely on abstract theory, Ip grounds his lessons in real-world examples, historical episodes, and contemporary challenges. He covers everything from the role of innovation and capital in national wealth, to the dangers of inflation and deflation, to the interconnectedness of global financial markets. The book’s purpose is to arm readers with the knowledge needed to interpret economic news, anticipate market shifts, and make more informed investment decisions.

This book is essential reading for anyone who wants to become a more intelligent investor or a more informed citizen. Whether you’re a retail investor trying to time the market, a business leader making strategic decisions, or a student preparing for a career in finance, “The Little Book of Economics” provides the context and clarity needed to understand economic cycles, policy responses, and the underlying mechanisms that drive financial markets. Ip’s explanations are particularly valuable for investors who want to distinguish signal from noise in economic data and news headlines.

What truly sets this book apart is its accessibility and breadth. Ip distills decades of economic research and policy experience into concise, engaging chapters, each packed with actionable insights and practical examples. He doesn’t shy away from the messy realities of government intervention, market psychology, or the unpredictable nature of crises. Instead, he provides a toolkit for readers to analyze economic indicators, interpret central bank actions, and understand the ripple effects of globalization and financial innovation. “The Little Book of Economics” stands out as a uniquely practical and readable introduction to macroeconomics, with direct relevance for investors seeking to navigate today’s volatile markets.

Key Concepts and Ideas

At the heart of “The Little Book of Economics” is a pragmatic approach to understanding how economies grow, contract, and recover. Greg Ip emphasizes that economic prosperity is not the result of luck or isolated decisions, but rather the outcome of a dynamic interplay among people, capital, and ideas. He argues that investors who grasp these fundamentals are far better equipped to interpret economic signals, anticipate turning points, and position their portfolios for long-term success.

Ip’s investment philosophy is rooted in the belief that economic cycles are inevitable, but their impact can be managed and even leveraged by those who understand their causes and consequences. He stresses the importance of tracking key indicators, understanding the policy levers available to governments and central banks, and appreciating the role of globalization in shaping market opportunities and risks. Throughout the book, Ip provides a framework for analyzing how macroeconomic forces—from labor markets to monetary policy—directly affect investment outcomes.

- Economic Growth Engines: Prosperity is driven by a combination of a productive workforce, effective capital investment, and a culture of innovation. Ip illustrates how countries like the United States and Germany have achieved sustained growth by investing in education, infrastructure, and research, while others struggle due to demographic decline or poor governance.

- Business Cycles and Market Timing: Economic activity naturally fluctuates between expansion and contraction. Ip explains the stages of the business cycle, the role of consumer confidence, and how investors can use leading indicators—such as GDP growth rates and unemployment claims—to anticipate recessions or recoveries.

- The Role of Central Banks: Central banks, especially the Federal Reserve, have immense power to influence economic conditions through interest rate policy, open market operations, and quantitative easing. Understanding Fed signals and policy moves is critical for investors seeking to navigate market volatility.

- Inflation and Deflation Dynamics: Both inflation and deflation can erode wealth and destabilize markets. Ip discusses the causes, dangers, and policy responses to these phenomena, providing historical examples such as the hyperinflation of the 1970s and Japan’s deflationary spiral in the 1990s.

- Globalization and Interconnected Markets: The increasing integration of global trade and financial systems means that shocks in one region can rapidly spread worldwide. Ip details how capital flows, multinational corporations, and institutions like the IMF shape economic outcomes and investment risks.

- Fiscal Policy and Government Intervention: Government spending, taxation, and borrowing can stimulate or restrain economic activity. Ip analyzes the impact of stimulus measures, infrastructure investment, and the dangers of excessive debt, using real-world examples from the U.S. and Europe.

- Financial System Risks and Regulation: The financial system is essential for growth but prone to instability. Ip examines the causes of banking crises, the importance of regulation, and the lessons learned from events like the 2008 global financial crisis.

- Labor Market Dynamics: Employment levels, wage growth, and the types of unemployment (frictional, structural, cyclical) all affect economic health and consumer demand. Understanding these dynamics helps investors anticipate shifts in spending and growth.

- Market Psychology and Human Behavior: Herd mentality, overconfidence, and fear play significant roles in the development of asset bubbles and financial crises. Ip encourages readers to recognize these biases in both markets and policy responses.

- Learning from Crises: Every financial crisis leaves behind valuable lessons. Ip stresses the importance of vigilance, early intervention, and continuous adaptation in risk management for both policymakers and investors.

Practical Strategies for Investors

Translating the lessons of “The Little Book of Economics” into actionable strategies is a core value for investors seeking to outperform the market. Greg Ip provides a roadmap for applying macroeconomic insights to portfolio management, risk assessment, and opportunity identification. By understanding the drivers of economic cycles and the tools used by policymakers, investors can anticipate market shifts and adjust their strategies proactively.

Ip’s approach encourages investors to move beyond short-term news headlines and focus on the underlying economic trends that shape asset prices. He advocates for a systematic process of monitoring indicators, interpreting policy signals, and maintaining a disciplined investment framework. The following strategies, inspired by the book, offer concrete steps for investors to implement these principles in their own portfolios.

- Monitor Leading Economic Indicators: Regularly track metrics such as GDP growth, unemployment rates, consumer confidence, and manufacturing activity. Use these indicators to gauge the current phase of the business cycle and adjust asset allocations accordingly.

- Anticipate Central Bank Actions: Analyze Federal Reserve statements, meeting minutes, and interest rate trends. Position portfolios to benefit from anticipated rate hikes or cuts—such as favoring financials during tightening cycles or growth stocks during easing.

- Hedge Against Inflation and Deflation: Allocate a portion of the portfolio to assets that perform well in inflationary environments (e.g., commodities, real estate, TIPS) and maintain liquidity to seize opportunities during deflationary downturns.

- Diversify Globally: Invest across regions and asset classes to mitigate the risk of localized shocks. Consider exposure to emerging markets, developed market equities, and global bonds to capture growth and manage volatility.

- Assess Fiscal Policy and Government Spending: Evaluate the impact of government stimulus or austerity measures on sectors such as infrastructure, healthcare, and technology. Adjust sector weights based on expected policy trends.

- Focus on Quality and Resilience: Prioritize companies with strong balance sheets, consistent cash flows, and a history of navigating downturns. These firms are more likely to survive recessions and benefit from recoveries.

- Stay Informed on Globalization Trends: Monitor trade agreements, supply chain developments, and capital flow data. Identify companies and sectors poised to benefit from increased globalization or those vulnerable to protectionism.

- Incorporate Behavioral Insights: Recognize the impact of market psychology on asset prices. Use contrarian strategies during periods of excessive optimism or fear, and avoid herd-driven bubbles.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book of Economics” is structured as a series of concise, focused chapters, each tackling a major theme in macroeconomics and its implications for investors. Greg Ip’s approach is to build understanding step-by-step, starting from the core drivers of prosperity and moving through the mechanics of business cycles, the role of central banks, the impact of globalization, and the recurring nature of financial crises. Each chapter blends historical context, real-world examples, and practical advice, making the book a valuable reference for both new and experienced investors.

Below, we provide an in-depth, chapter-by-chapter analysis, highlighting the main ideas, illustrative examples, direct quotes, and actionable lessons for investors. Each section is designed to help readers translate economic theory into practical investment strategies, with a focus on real-world application and historical relevance.

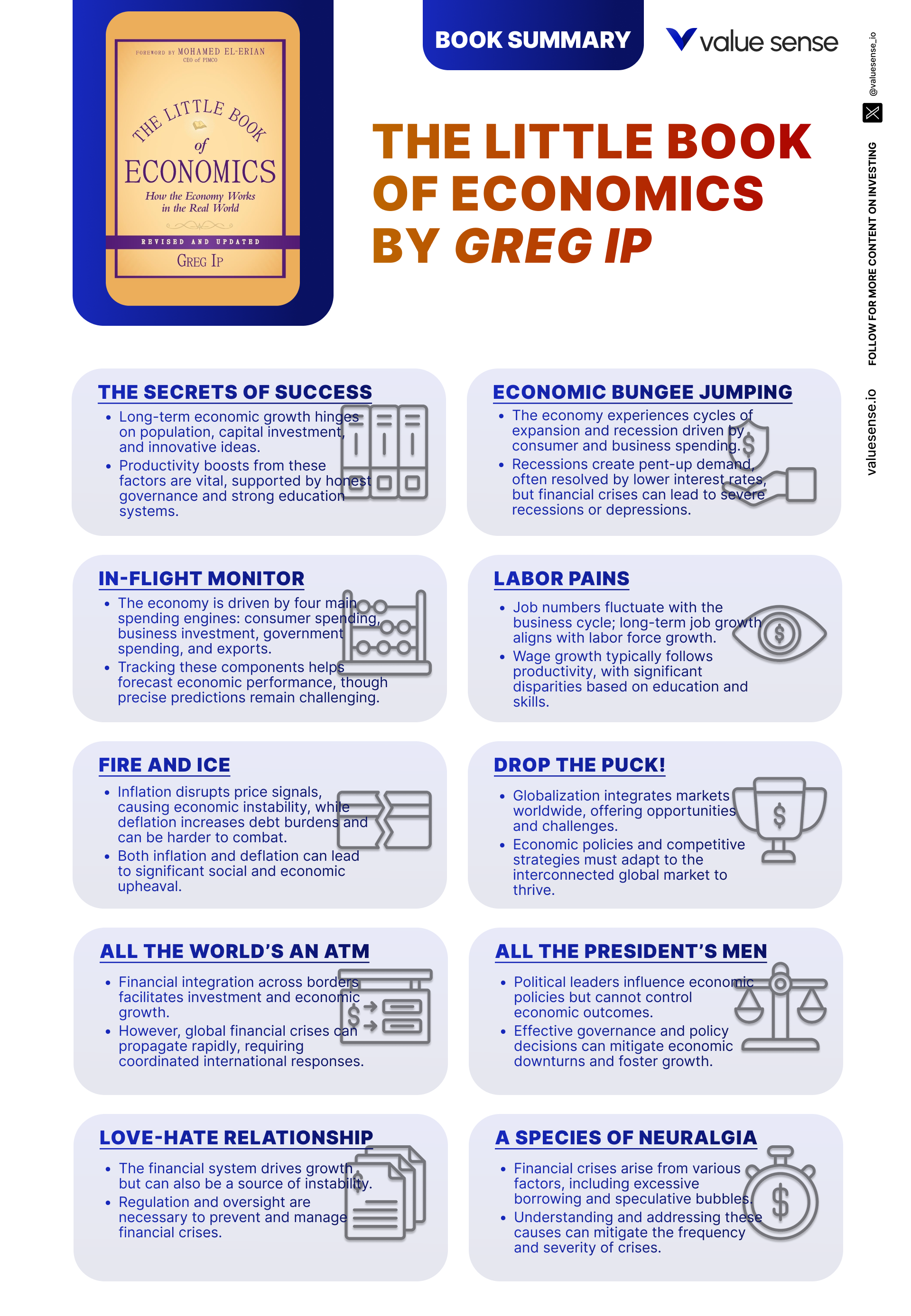

Chapter 1: The Secrets of Success: How People, Capital, and Ideas Make Countries Rich

This opening chapter lays the foundation for understanding what makes some countries wealthy while others remain poor. Greg Ip identifies three primary engines of economic growth: people, capital, and ideas. He explains that a productive and growing workforce is essential for sustained prosperity, using examples such as the U.S. post-World War II baby boom, which fueled decades of expansion. Ip notes that demographic challenges, like Japan’s aging population and shrinking labor force, can act as a brake on growth, leading to stagnant economies and increased fiscal burdens.

Capital investment is the second pillar, with Ip highlighting the transformative power of infrastructure, technology, and education. He points to the rapid industrialization of China since the 1980s, where massive investment in factories, roads, and schools turned a rural economy into the world’s manufacturing powerhouse. However, he cautions that capital must be allocated efficiently to maximize returns; wasteful spending or corruption can undermine growth, as seen in some resource-rich but poorly managed countries.

The third driver, innovation, is described as the ultimate source of long-term prosperity. Ip uses the example of Silicon Valley’s ecosystem, where research and development spending, venture capital, and a culture of risk-taking have produced global leaders like Apple, Google, and Tesla. Countries that foster innovation through strong intellectual property protection, access to funding, and open markets tend to outperform those that stifle creativity or restrict competition.

For investors, the lesson is clear: focus on economies and companies that invest in their people, allocate capital wisely, and prioritize innovation. Ip suggests monitoring trends in education, R&D spending, and demographic shifts to identify regions and sectors with the greatest growth potential. He also emphasizes the role of government in creating a stable environment for investment, noting that “good governance, the rule of law, and investment in public goods are key to economic prosperity.” The historical success of the U.S., Germany, and Singapore illustrates how the right mix of people, capital, and ideas can generate sustained wealth creation.

Chapter 2: Economic Bungee Jumping: Business Cycles, Recessions, and Depressions... Oh My!

In this chapter, Greg Ip delves into the natural ebb and flow of economic activity, known as the business cycle. He explains that economies are inherently cyclical, alternating between periods of expansion and contraction. Using the analogy of a bungee jump, Ip describes how booms are followed by busts, and recoveries eventually give way to new downturns. He cites the U.S. economic expansions of the 1990s and 2000s, both of which ended in recessions triggered by technology and housing bubbles, respectively.

Ip discusses the role of monetary policy in managing these cycles, particularly the Federal Reserve’s use of interest rates to cool overheated economies or stimulate growth during downturns. He references the Fed’s aggressive rate cuts during the 2008 financial crisis, which helped prevent a deeper depression. However, he cautions that predicting the timing and severity of recessions is notoriously difficult, as economic indicators often send mixed signals. He highlights the inverted yield curve as a reliable recession predictor, but notes that it is not foolproof.

For investors, understanding the business cycle is crucial for asset allocation and risk management. Ip recommends monitoring key indicators such as unemployment claims, manufacturing activity, and consumer sentiment to gauge where the economy stands in the cycle. He also advises caution during late-stage expansions, when asset prices may become overvalued and the risk of correction increases. “While exact predictions are challenging, certain economic indicators can signal an upcoming recession,” he writes, urging investors to remain vigilant and flexible.

The chapter draws on historical examples, including the Great Depression of the 1930s and the more recent 2008 global financial crisis, to illustrate the devastating impact of prolonged downturns. Ip emphasizes that depressions are rare but severe, often requiring extraordinary policy responses. The key takeaway is that while cycles are inevitable, informed investors can mitigate losses and capitalize on recoveries by staying attuned to economic signals and adjusting their strategies accordingly.

Chapter 3: In-Flight Monitor: Tracking and Forecasting the Business Cycle from Takeoff to Landing

Greg Ip likens the economy to an airplane, emphasizing the importance of monitoring key indicators to ensure a smooth flight. He outlines the primary metrics used to assess economic health, including GDP growth, employment rates, consumer spending, and business investment. Ip explains that these indicators provide a real-time dashboard for investors and policymakers, enabling them to anticipate shifts in the business cycle and adjust their actions proactively.

Consumer spending is identified as a particularly powerful engine of economic activity, accounting for roughly 70% of GDP in the United States. Ip cites the resilience of U.S. consumer spending during the early 2010s recovery, which helped offset weakness in business investment. He also discusses the role of consumer confidence, noting that sharp declines in sentiment often precede recessions, as households cut back on discretionary purchases.

Business investment is another critical driver, with Ip pointing to the surge in capital spending during the tech boom of the late 1990s and the subsequent collapse that triggered the 2001 recession. He explains that investment tends to rise during expansions, fueling productivity and innovation, but falls sharply during downturns, exacerbating contractions. Government spending and international trade are described as additional engines, with fiscal stimulus and export growth providing important boosts during weak periods.

For investors, the practical application is to develop a habit of “economic monitoring.” Ip recommends tracking monthly and quarterly data releases, such as the Bureau of Labor Statistics’ employment report and the Institute for Supply Management’s manufacturing index. By staying informed, investors can adjust their portfolios to reflect changing economic conditions—shifting toward defensive sectors during slowdowns and cyclical sectors during recoveries. Historical examples, such as the post-2008 rebound fueled by government stimulus and export growth, underscore the value of this disciplined approach.

Chapter 4: Labor Pains: Employment, Unemployment, and Wages

This chapter explores the dynamics of the labor market and its profound impact on economic health. Greg Ip begins by highlighting the importance of high employment levels for stability and growth, using the U.S. recovery from the Great Recession as an example. He notes that declining unemployment rates from 10% in 2009 to below 4% by 2019 contributed to robust consumer spending and a record-long expansion. Conversely, spikes in unemployment, such as during the COVID-19 pandemic, can trigger sharp declines in economic output and confidence.

Ip examines the factors that influence wage growth, including productivity, labor demand, and bargaining power. He discusses the stagnation of real wages in the U.S. during the early 2000s, despite rising productivity, and attributes this to globalization, automation, and weakened labor unions. The chapter also distinguishes between different types of unemployment—frictional (short-term, job-switching), structural (mismatch of skills), and cyclical (resulting from downturns). Each requires different policy responses, from job training to macroeconomic stimulus.

For investors, understanding labor market trends is essential for anticipating shifts in consumer demand, inflation, and corporate earnings. Ip suggests monitoring wage growth, labor force participation, and job creation data to identify inflection points in the economy. He also highlights the role of government interventions, such as unemployment benefits and minimum wage laws, in cushioning downturns and supporting recovery. “Sustainable wage growth is necessary to maintain consumer spending and economic expansion,” he writes, emphasizing the importance of balanced labor policies.

Historical context is provided through examples like Germany’s successful vocational training programs, which have kept youth unemployment low, and the U.S. experience with jobless recoveries in the 1990s and 2000s. Ip argues that flexible labor markets, combined with targeted protections, are best suited to navigating the challenges of globalization and technological change. Investors can use these insights to assess sector exposure—favoring industries with strong wage growth and employment prospects during expansions, and defensive sectors during downturns.

Chapter 5: Fire and Ice: Warning: Inflation and Deflation Are Toxic to Your Economic Health

In this pivotal chapter, Greg Ip addresses the dual threats of inflation and deflation, both of which can destabilize economies and erode investor wealth. He explains that inflation—rising prices across the economy—reduces purchasing power and can undermine confidence if left unchecked. Ip references the U.S. experience in the 1970s, when double-digit inflation led to soaring interest rates, stagnant growth, and a prolonged bear market. He also points to more recent episodes, such as Venezuela’s hyperinflation in the 2010s, as cautionary tales.

Deflation, or falling prices, is described as equally dangerous. Ip uses Japan’s “Lost Decade” of the 1990s as a case study, where persistent deflation led to weak consumer spending, declining business investment, and a stagnant economy. He explains that deflation can create a vicious cycle: as prices fall, consumers delay purchases, businesses cut back, and unemployment rises, further depressing demand. Central banks struggle to combat deflation, as traditional tools like rate cuts become less effective near zero interest rates.

For investors, the key lesson is to hedge against both inflation and deflation risks. Ip recommends diversifying into assets that perform well in different environments—such as commodities, real estate, and inflation-protected securities during inflationary periods, and high-quality bonds or cash during deflationary downturns. He also emphasizes the importance of monitoring central bank actions, as policy responses can dramatically shift market dynamics. “Policymakers must carefully balance efforts to control inflation with the need to avoid deflationary pressures,” Ip warns, highlighting the delicate trade-offs faced by the Federal Reserve and other central banks.

Historical examples, including the U.S. Federal Reserve’s aggressive monetary easing during the 2008 crisis and the European Central Bank’s struggle with low inflation in the 2010s, illustrate the real-world challenges of managing price stability. Ip’s analysis provides investors with a framework for interpreting inflation data, anticipating policy moves, and adjusting portfolios to protect against the corrosive effects of both rising and falling prices.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Drop the Puck!: The Globalization Game Is Here Whether We’re Ready or Not

Greg Ip turns his attention to the transformative impact of globalization on modern economies. He explains that globalization—defined by the increasing interconnectedness of trade, investment, and technology—has created unprecedented opportunities for growth, but also significant challenges. Ip highlights the rapid expansion of international trade since the 1980s, driven by the rise of China, the spread of multinational corporations, and the liberalization of markets in Eastern Europe and Asia.

While globalization has lifted millions out of poverty and fueled growth in emerging markets, Ip notes that it has also contributed to rising income inequality and job displacement in developed economies. He cites the decline of U.S. manufacturing jobs as a direct result of offshoring and competition from lower-wage countries. The chapter discusses the role of trade agreements, such as NAFTA and the European Union, in facilitating economic integration, as well as the backlash against globalization seen in recent years through Brexit and U.S.-China trade tensions.

For investors, the lesson is to stay informed about global economic trends and to diversify portfolios across regions and sectors. Ip suggests monitoring developments in trade policy, technological innovation, and supply chain management to identify winners and losers from globalization. He also emphasizes the importance of adaptability, as technological change accelerates the pace of global integration and disruption. “Staying competitive in the global economy requires continuous innovation and adaptation,” Ip writes, urging investors to seek out companies and countries that embrace change.

Historical context is provided through examples such as the rise of South Korea as a global manufacturing hub, and the transformation of Ireland into a technology powerhouse. Ip argues that the benefits of globalization can be maximized—and the risks mitigated—through sound policy, targeted investment, and a willingness to adapt to shifting economic realities. Investors who understand these dynamics are better positioned to capture growth opportunities and manage volatility in an increasingly interconnected world.

Chapter 7: All the World’s an ATM: Knitting Global Markets Together

In this chapter, Greg Ip explores the integration of global financial markets and the implications for investors. He likens the modern financial system to a vast ATM network, where capital can flow instantly across borders, providing opportunities for investment and risk diversification. Ip discusses the surge in cross-border capital flows since the 1990s, driven by foreign direct investment, portfolio flows, and the rise of multinational banks and asset managers.

While financial globalization has facilitated economic development and access to capital, Ip warns that it has also increased the risk of contagion. He references the Asian Financial Crisis of 1997 and the 2008 global financial crisis as examples of how shocks in one region can rapidly spread worldwide. The interconnectedness of markets means that investors must be attuned to developments not only in their home country, but also in major economies like China, the Eurozone, and emerging markets.

For investors, the practical takeaway is to diversify globally and to monitor international financial conditions. Ip suggests paying attention to capital flow data, exchange rates, and the policies of multinational institutions such as the International Monetary Fund (IMF) and World Bank. He also emphasizes the need for strong risk management practices, as sudden shifts in global liquidity or investor sentiment can trigger sharp market movements. “Managing these risks requires international cooperation and strong financial regulation,” Ip writes, highlighting the role of coordinated policy responses in stabilizing markets.

Historical examples, including the coordinated central bank interventions during the 2008 crisis and the IMF’s role in stabilizing developing economies, illustrate the importance of global governance. Ip’s analysis provides investors with a framework for assessing international risks and opportunities, and for building resilient portfolios that can weather cross-border shocks.

Chapter 8: All the President’s Men: They Don’t Control the Economy But They Sure Do Try

This chapter examines the influence of political leaders on economic outcomes. Greg Ip argues that while presidents and other politicians often claim credit for economic success or blame for downturns, their actual power is limited by external factors such as global markets, private sector dynamics, and the independent actions of central banks. He uses the example of the U.S. presidency, where economic performance is often tied to election outcomes, despite the lag between policy implementation and real-world effects.

Ip analyzes the tools available to political leaders, including fiscal policy (government spending and taxation), regulation, and trade agreements. He discusses the impact of stimulus measures such as the American Recovery and Reinvestment Act of 2009, as well as the risks of poorly timed or targeted interventions. The chapter also explores the concept of political business cycles, where leaders may implement short-term economic boosts ahead of elections, sometimes at the expense of long-term stability.

For investors, the key lesson is to separate political rhetoric from economic reality. Ip recommends focusing on the underlying fundamentals—such as corporate earnings, productivity trends, and global demand—rather than being swayed by policy announcements or election cycles. He also suggests monitoring regulatory changes and fiscal policy for their potential impact on specific sectors, such as healthcare, energy, or technology. “Balancing regulation to protect public interests while promoting economic growth is a key challenge for policymakers,” Ip notes, highlighting the trade-offs involved.

Historical context is provided through examples like the Reagan-era tax cuts, which boosted short-term growth but contributed to rising deficits, and the Clinton-era budget surpluses, which were aided by a booming tech sector. Ip’s analysis helps investors interpret political developments with a critical eye, focusing on the factors that truly drive economic and market performance.

Chapter 9: The Buck Starts Here: The Federal Reserve’s Amazing Power to Print and Destroy Money

Greg Ip provides an in-depth look at the Federal Reserve’s role in managing the money supply and influencing economic conditions. He explains the primary tools at the Fed’s disposal: open market operations (buying and selling government securities), setting the federal funds rate, and adjusting reserve requirements for banks. These tools allow the Fed to control the availability and cost of credit, which in turn affects consumer spending, business investment, and overall economic activity.

One of the Fed’s primary objectives is to maintain price stability by controlling inflation. Ip discusses the challenges faced by the Fed in balancing its dual mandate—promoting maximum employment and stable prices. He references the Volcker era of the early 1980s, when aggressive rate hikes successfully tamed double-digit inflation but triggered a deep recession. Conversely, the Fed’s rapid rate cuts during the 2008 crisis helped stabilize markets and support recovery.

For investors, understanding the Fed’s actions is critical for anticipating shifts in asset prices and market sentiment. Ip recommends closely monitoring Fed statements, meeting minutes, and economic projections to gauge the direction of monetary policy. He also emphasizes the importance of recognizing the limits of central bank power, as the Fed must navigate complex trade-offs and cannot always prevent downturns or asset bubbles. “The Fed’s decisions have far-reaching effects on the economy, influencing everything from consumer spending to business investment,” Ip writes.

Historical examples, such as the quantitative easing programs of the 2010s and the Fed’s emergency interventions during the COVID-19 pandemic, illustrate the evolving nature of monetary policy. Ip’s analysis equips investors with the tools to interpret central bank actions, anticipate market reactions, and adjust their strategies to reflect changing economic conditions.

Chapter 10: White Smoke over the Washington Mall: The Making of Monetary Policy and the Fine Art of Fed Watching

This chapter delves into the process of making monetary policy and the importance of transparency in central banking. Greg Ip explains that the Federal Reserve’s decision-making is guided by careful analysis of economic data, trends, and forecasts. The Federal Open Market Committee (FOMC) plays a central role, meeting regularly to set policy based on a consensus view of the economy’s needs.

Ip introduces the concept of “Fed watching,” where investors, economists, and journalists scrutinize every word and gesture from Fed officials to anticipate future policy moves. He describes how markets react instantly to changes in tone, language, or projections, as seen in the “taper tantrum” of 2013 when hints of reduced bond purchases triggered a sharp selloff in global markets. Transparency is emphasized as a vital tool for maintaining market confidence and minimizing unnecessary volatility.

For investors, the practical lesson is to develop the skill of interpreting Fed communications. Ip recommends paying attention to official statements, press conferences, and economic projections, as well as speeches by key policymakers. He also suggests looking beyond the headlines to understand the underlying economic rationale for policy decisions. “Transparency in monetary policy is essential for maintaining market confidence and avoiding unnecessary volatility,” Ip writes, underscoring the importance of clear communication.

Historical context is provided through examples like the Greenspan era’s cryptic signals and the more open approach adopted by Ben Bernanke and Janet Yellen. Ip argues that improved transparency has helped stabilize expectations and guide economic decisions, but also requires investors to be more sophisticated in their analysis. By mastering the art of Fed watching, investors can better anticipate market reactions and position their portfolios for success.

Chapter 11: When the World Needs a Fireman: America’s Lender of Last Resort and the World’s Crisis Manager

Greg Ip explores the unique role of the United States as the world’s lender of last resort and crisis manager. He explains that during periods of financial turmoil, the Federal Reserve and U.S. Treasury provide critical liquidity to stabilize markets and prevent systemic collapse. Ip references the 2008 global financial crisis, when the Fed extended emergency loans to banks and foreign central banks, and the Treasury implemented massive bailout programs to restore confidence.

The chapter highlights the importance of swift and decisive action in crisis management. Ip discusses the coordination between the Fed, the European Central Bank, and the IMF during the eurozone debt crisis, as well as the U.S. response to the COVID-19 pandemic. He emphasizes that global financial stability depends on cooperation among central banks, governments, and international institutions, as crises in one region can quickly spread worldwide.

For investors, the key takeaway is to recognize the potential for policy interventions to alter the course of crises and to monitor developments in real time. Ip suggests paying attention to central bank liquidity programs, fiscal stimulus measures, and international agreements, as these can have immediate and far-reaching effects on asset prices. He also advises investors to maintain flexibility and liquidity during periods of heightened uncertainty, as conditions can change rapidly.

Historical examples, such as the 1998 Russian default and the 2010 Greek debt crisis, illustrate the recurring nature of financial shocks and the critical role of U.S. leadership in managing global stability. Ip’s analysis provides investors with a framework for assessing crisis risk, anticipating policy responses, and positioning portfolios to benefit from eventual recoveries.

Chapter 12: The Elephant in the Economy: What the Government Giveth and Taketh Away

This chapter examines the government’s role in shaping economic outcomes through taxation and spending policies. Greg Ip explains that government spending on public goods, infrastructure, and social programs can stimulate growth and improve quality of life, citing the postwar expansion of highways, schools, and healthcare in the U.S. as examples. However, he warns that excessive spending can lead to budget deficits, rising debt, and long-term economic challenges.

Ip analyzes the impact of tax policy on consumer behavior, business investment, and overall economic activity. He discusses the effects of the 2017 U.S. tax cuts, which boosted corporate profits and stock prices but contributed to higher deficits. The chapter also explores the challenges of balancing tax rates to encourage growth while ensuring sufficient revenue for essential services.

For investors, the lesson is to monitor fiscal policy developments and assess their potential impact on sectors and asset classes. Ip recommends paying attention to government budgets, infrastructure plans, and entitlement reforms, as these can create opportunities or risks for specific industries. He also emphasizes the importance of long-term fiscal sustainability, warning that unchecked deficits and rising debt can undermine confidence and trigger market volatility.

Historical context is provided through examples like the European sovereign debt crisis, where excessive government borrowing led to austerity measures and prolonged recessions. Ip argues that effective fiscal policy requires careful planning, responsiveness to changing economic conditions, and a commitment to long-term stability. Investors who understand these dynamics can better anticipate policy shifts and adjust their strategies accordingly.

Chapter 13: Good Debt, Bad Debt: How Government Borrowing Can Save or Destroy an Economy

Greg Ip explores the complex role of government borrowing in economic management. He distinguishes between “good debt”—used to finance investments that generate economic returns, such as infrastructure and education—and “bad debt,” which results from borrowing for unproductive purposes. Ip uses the example of the U.S. interstate highway system, which delivered decades of economic benefits, versus unsustainable entitlement spending that contributes to rising deficits without boosting growth.

The chapter discusses the impact of government borrowing on interest rates, inflation, and long-term economic health. Ip explains that borrowing can be an effective tool for stimulating growth during downturns, as seen in the 2009 fiscal stimulus and the COVID-19 relief packages. However, he cautions that excessive borrowing can lead to higher interest costs, crowding out private investment and increasing the risk of debt crises.

For investors, the practical lesson is to evaluate the purpose and sustainability of government debt. Ip recommends assessing the quality of public investment, the trajectory of national debt, and the potential for policy changes that could affect fiscal stability. He also advises monitoring sovereign credit ratings and market signals, such as rising bond yields, for early warning signs of fiscal stress. “Responsible management of national debt involves balancing short-term economic needs with long-term fiscal sustainability,” Ip writes.

Historical examples, including the Greek debt crisis and the U.S. debt ceiling standoffs, illustrate the dangers of unchecked borrowing and the importance of prudent fiscal policy. Ip’s analysis provides investors with a framework for assessing sovereign risk and for identifying opportunities in markets where government borrowing is used productively to support growth and innovation.

Chapter 14: Love-Hate Relationship: The Bipolar Financial System — Essential for Economic Growth But Sometimes It Goes Nuts

This chapter examines the dual nature of the financial system, which is both essential for economic growth and prone to instability. Greg Ip explains that the financial system facilitates the allocation of capital, provides credit, and supports investment, making it a cornerstone of innovation and development. He cites the role of banks, capital markets, and venture capital in funding new businesses and technologies.

However, Ip warns that the financial system is inherently cyclical, with periods of excessive risk-taking followed by crises and corrections. He references the 2008 global financial crisis, where lax regulation and complex financial products led to a housing bubble and subsequent collapse. The chapter emphasizes the importance of effective regulation and oversight in preventing crises and maintaining stability.

For investors, the key lesson is to recognize the signs of financial excess and to adjust risk exposure accordingly. Ip recommends monitoring credit growth, leverage ratios, and asset price inflation as indicators of potential instability. He also suggests favoring well-regulated markets and institutions with strong risk management practices. “Effective regulation and oversight are crucial for preventing financial crises and ensuring the stability of the financial system,” Ip writes.

Historical context is provided through examples like the savings and loan crisis of the 1980s, the dot-com bubble of the late 1990s, and the subprime mortgage crisis of 2008. Ip argues that continuous adaptation of financial regulations is necessary to address emerging risks and to foster a healthy balance between innovation and stability. Investors who understand the dynamics of the financial system can better navigate booms and busts, and position their portfolios to benefit from periods of growth while protecting against downturns.

Chapter 15: A Species of Neuralgia: The Multiple, Recurring Causes of Financial Crises

In the concluding chapter, Greg Ip explores the recurring causes of financial crises, comparing them to a chronic illness that periodically afflicts the economy. He identifies excessive leverage, asset bubbles, and systemic risk as common factors that contribute to crises. Ip discusses the role of human behavior—herd mentality, overconfidence, and fear—in amplifying economic imbalances and triggering panics.

The chapter emphasizes the importance of vigilance, early intervention, and strong regulation in preventing crises. Ip explains that financial crises are rarely caused by a single event, but rather by a combination of factors that build up over time. He uses the 2008 global financial crisis as a case study, highlighting the interplay of loose lending standards, complex derivatives, and inadequate oversight.

For investors, the key takeaway is to maintain a healthy skepticism, to monitor risk factors, and to avoid complacency during periods of apparent stability. Ip recommends diversifying portfolios, maintaining liquidity, and paying attention to warning signs such as rapid credit growth or surging asset prices. He also stresses the importance of learning from past crises, as each episode provides valuable lessons for risk management and policy design. “Each financial crisis provides valuable lessons that can inform future policy decisions and risk management practices,” Ip writes.

Historical context is provided through examples such as the 1929 stock market crash, the Asian Financial Crisis, and the dot-com bubble. Ip argues that while crises are inevitable, their impact can be mitigated through continuous learning, adaptation, and cooperation among policymakers, financial institutions, and investors. The chapter serves as a call to action for all market participants to remain vigilant and proactive in managing risk.

Advanced Strategies from the Book

Beyond the foundational lessons, “The Little Book of Economics” offers advanced techniques for investors who want to leverage macroeconomic understanding for superior portfolio performance. Greg Ip’s insights into the interplay between policy, psychology, and global markets provide a toolkit for navigating complex environments and capitalizing on unique opportunities. These strategies require a deeper engagement with economic data, policy analysis, and behavioral finance.

Investors who master these advanced concepts can anticipate turning points, identify mispriced assets, and manage risk more effectively. Below are several high-level techniques inspired by Ip’s analysis, each illustrated with practical examples and implementation tips.

Strategy 1: Dynamic Asset Allocation Based on Business Cycle Analysis

This strategy involves adjusting portfolio weights in response to the stage of the business cycle. For example, during early-stage recoveries, investors might overweight cyclical sectors such as consumer discretionary, industrials, and small-cap stocks, which tend to outperform as growth accelerates. As the cycle matures and inflationary pressures rise, the allocation might shift toward defensive sectors like healthcare, utilities, and consumer staples, which provide stability during downturns. By systematically monitoring indicators such as GDP growth, unemployment, and manufacturing data, investors can anticipate turning points and rebalance proactively. This approach was successfully employed by many institutional investors during the 2009–2012 recovery, when shifting from defensive to cyclical assets captured significant upside.

Strategy 2: Hedging Currency and Inflation Risk in Global Portfolios

As globalization increases exposure to international markets, investors must manage currency and inflation risks. Ip recommends using hedging instruments such as currency futures, options, or ETFs to protect against adverse exchange rate movements. For inflation protection, he suggests allocating to Treasury Inflation-Protected Securities (TIPS), commodities, and real assets. For instance, during periods of dollar weakness, U.S. investors with significant European or Asian holdings might hedge their currency exposure to preserve returns. Similarly, in anticipation of rising inflation, increasing exposure to commodities or real estate can help maintain purchasing power. These techniques were particularly effective during the 2003–2008 commodity boom and the post-2020 inflation surge.

Strategy 3: Interpreting Policy Signals for Tactical Positioning

Advanced investors can gain an edge by closely analyzing central bank communications and fiscal policy announcements. By interpreting subtle shifts in language, tone, or projections, investors can anticipate changes in interest rates, quantitative easing, or government spending. For example, recognizing the Fed’s pivot toward tightening in 2015 allowed investors to reduce duration risk in bond portfolios and increase exposure to financials. Conversely, identifying signals of fiscal stimulus in 2020 enabled tactical allocations to infrastructure, technology, and consumer sectors. Mastery of policy analysis requires ongoing education, attention to detail, and a disciplined process for integrating new information into portfolio decisions.

Strategy 4: Behavioral Contrarian Investing During Market Extremes

Greg Ip’s discussion of market psychology provides a framework for contrarian strategies. During periods of excessive optimism—such as the late 1990s tech bubble or the 2021 meme stock frenzy—contrarians reduce exposure to overvalued assets and build cash reserves. Conversely, during panics or sharp selloffs, they seek out fundamentally sound companies trading at distressed prices. This approach requires emotional discipline and a willingness to go against the crowd, but has historically delivered superior risk-adjusted returns. Notable examples include Warren Buffett’s investments during the 2008 crisis and Bill Ackman’s contrarian bets during the COVID-19 selloff.

Strategy 5: Scenario Planning for Policy and Market Shocks

Advanced investors use scenario planning to prepare for a range of potential outcomes, such as sudden rate hikes, trade wars, or geopolitical crises. By modeling the impact of different scenarios on portfolio returns, investors can identify vulnerabilities and develop contingency plans. For example, in anticipation of Brexit, many global funds reduced exposure to UK equities, hedged currency risk, and increased allocations to defensive assets. Scenario planning enables rapid response to unexpected events, reducing the risk of large drawdowns and enhancing long-term resilience.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the lessons of “The Little Book of Economics” requires a structured approach, combining ongoing education, disciplined monitoring, and proactive portfolio management. Greg Ip’s framework is accessible to investors at all levels, but its full benefits are realized through consistent practice and adaptation to changing market conditions.

To get started, investors should focus on building a foundation of economic literacy, developing a process for tracking key indicators, and integrating macroeconomic analysis into portfolio decisions. Over time, these habits will enable more informed risk management, opportunity identification, and long-term wealth creation.

- Begin by reading and summarizing key chapters of “The Little Book of Economics,” focusing on the drivers of growth, business cycles, and policy tools.

- Set up a dashboard for tracking leading economic indicators (GDP, unemployment, inflation, consumer confidence) and schedule regular portfolio reviews.

- Develop a written investment policy statement that incorporates macroeconomic analysis, risk management guidelines, and criteria for tactical adjustments.

- Monitor central bank and government policy announcements, interpreting their potential impact on asset prices and sector performance.

- Practice scenario analysis by modeling the effects of different economic shocks (e.g., rate hikes, trade disputes) on your portfolio.

- Continuously educate yourself through books, research reports, and economic news, refining your framework as new information emerges.

- Review and adjust your strategy quarterly or annually, learning from successes and mistakes to improve future decision-making.

Critical Analysis

“The Little Book of Economics” excels at translating complex macroeconomic concepts into actionable insights for investors. Greg Ip’s journalistic background ensures that the material is both engaging and rigorously researched, with a strong emphasis on real-world application. The book’s structure—short, focused chapters—makes it easy to digest and reference, while the inclusion of historical examples and practical strategies enhances its value for readers seeking to improve their investment decision-making.

One of the book’s greatest strengths is its accessibility. Ip avoids jargon and theoretical abstraction, opting instead for clear explanations and relatable analogies. However, this simplicity can sometimes come at the expense of depth, particularly for advanced readers seeking detailed quantitative analysis or technical modeling. The book is best suited as an introduction or refresher, rather than a comprehensive textbook on macroeconomics or portfolio management.

In the context of today’s rapidly evolving market environment—characterized by heightened volatility, policy uncertainty, and global interconnectedness—Ip’s framework remains highly relevant. The book’s emphasis on adaptability, vigilance, and continuous learning aligns well with the challenges faced by modern investors. While some examples may date from earlier cycles, the underlying principles are timeless and broadly applicable across market regimes.

Conclusion

Greg Ip’s “The Little Book of Economics” is an indispensable resource for investors and anyone seeking to understand the forces that shape markets and economies. By demystifying complex concepts and providing a toolkit for practical application, Ip empowers readers to make more informed decisions, manage risk, and capitalize on opportunities across the business cycle. The book’s blend of historical context, real-world examples, and actionable strategies makes it a valuable addition to any investor’s library.

Whether you’re a seasoned professional or a newcomer to economics, this book offers a clear roadmap for interpreting economic data, anticipating policy moves, and navigating the ups and downs of global markets. Its lessons are especially pertinent in an era of rapid change, where adaptability and informed analysis are key to long-term success. We highly recommend “The Little Book of Economics” as both a primer and a reference for anyone committed to smart, value-driven investing.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Economics

1. Who is Greg Ip, and why is he qualified to write about economics?

Greg Ip is a renowned economics journalist and commentator, currently serving as the chief economics commentator for The Wall Street Journal. He previously held senior roles at The Economist and is known for his ability to explain complex economic topics in accessible language. His extensive experience covering global markets, policy, and financial crises makes him highly qualified to author a practical guide for investors and readers interested in economics.

2. What makes “The Little Book of Economics” different from other economics books?

This book stands out for its clarity, brevity, and focus on real-world application. Unlike dense academic texts, Ip’s book is structured as a series of short, engaging chapters packed with practical examples and actionable lessons. It’s designed for investors, business leaders, and students who want to quickly grasp the essentials of macroeconomics without getting lost in jargon or theory.

3. How can investors use the lessons from this book in their portfolios?

Investors can apply the book’s teachings by monitoring economic indicators, interpreting central bank and government policy moves, and adjusting asset allocations based on the business cycle. The book provides frameworks for hedging inflation and deflation risk, diversifying globally, and incorporating behavioral insights into investment strategy. Its emphasis on vigilance and adaptability helps investors manage risk and seize opportunities.

4. Does the book cover current events, such as the COVID-19 pandemic or recent inflation trends?

While the original edition predates the COVID-19 pandemic, the book’s principles are timeless and directly applicable to recent events. The frameworks for understanding business cycles, policy responses, and financial crises help readers interpret current headlines and anticipate market shifts. Readers can supplement the book with recent news and research for up-to-date context.

5. Is this book suitable for beginners, or is it better for advanced readers?

“The Little Book of Economics” is ideal for beginners and intermediate readers, offering clear explanations and practical examples without overwhelming technical detail. Advanced investors and economists may find it a useful refresher or a source of illustrative case studies, but may want to supplement it with more in-depth analysis or quantitative research.

6. What are the most important takeaways from the book?

The key takeaways include the importance of understanding economic growth drivers, monitoring business cycles, interpreting policy signals, and recognizing the role of psychology in markets. The book also stresses the need for diversification, risk management, and continuous learning to succeed as an investor in a complex, interconnected world.

7. Can the book help non-investors or people outside the finance industry?

Absolutely. The book is written for a broad audience, including students, business professionals, policymakers, and anyone interested in how the economy works. Its lessons are relevant for making personal financial decisions, understanding news headlines, and participating in informed public debate about economic policy and global challenges.

8. How does the book address the risks of financial crises?

Greg Ip dedicates several chapters to the causes, consequences, and prevention of financial crises. He explains the roles of leverage, asset bubbles, and human behavior, and provides frameworks for risk management and early intervention. The book encourages readers to learn from past crises and to remain vigilant in monitoring market and policy developments.

9. What sectors or types of investments are most discussed in the book?

The book covers a wide range of sectors, including technology, manufacturing, finance, and consumer goods, using them as examples to illustrate economic concepts. It also discusses asset classes such as equities, bonds, real estate, and commodities, providing guidance on how each is affected by macroeconomic trends and policy decisions.

10. Where can I find more resources or tools to implement the book’s lessons?

You can visit valuesense.io for stock analytics, intrinsic value tools, and research products that help investors apply the principles from “The Little Book of Economics.” Additional resources include economic news sites, government data releases, and financial education platforms for ongoing learning and portfolio management.