The Little Book of Emerging Markets by Mark Mobius

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Mark Mobius is a legendary figure in the world of international investing, renowned for his pioneering work in emerging markets. With a career spanning over four decades, Mobius has managed billions in assets, primarily through his tenure at Franklin Templeton Investments, where he was Executive Chairman of Templeton Emerging Markets Group. His hands-on experience traveling to more than 100 countries and meeting with thousands of company executives gives him unparalleled insight into the unique dynamics of developing economies. In "The Little Book of Emerging Markets," Mobius distills his decades of experience into a practical guide for investors seeking to capitalize on the vast potential of these fast-growing regions.

The main theme of the book is the extraordinary opportunity that emerging and frontier markets present for investors willing to look beyond the developed world. Mobius demystifies the risks and rewards of investing in these markets, offering a balanced view that highlights both the explosive growth potential and the volatility inherent in less mature economies. The book systematically covers the evolution of emerging markets, the practicalities of investing, the psychological challenges, and the advanced strategies required to navigate these complex environments. Mobius’s writing is accessible, peppered with real-world examples, case studies, and actionable advice, making it a valuable resource for both novice and seasoned investors.

This book is essential reading for anyone serious about portfolio diversification, global investing, or seeking higher returns in a low-yield world. It is particularly relevant for investors who wish to move beyond the traditional confines of U.S. and Western European equities and tap into the growth stories of Asia, Latin America, Africa, and Eastern Europe. Financial advisors, institutional investors, and even retail investors with an appetite for risk will find Mobius’s insights invaluable. The book’s structured approach, from defining emerging markets to exploring advanced tactics for crisis investing, ensures readers gain both foundational knowledge and practical tools for immediate application.

What sets "The Little Book of Emerging Markets" apart is Mobius’s ability to blend macroeconomic analysis with on-the-ground anecdotes, providing a holistic view of what it takes to succeed in these markets. He doesn’t just offer theory; he shares the lessons learned from decades of successes and failures, including navigating currency crises, political upheavals, and market panics. The book’s value lies in its honesty about the risks, its emphasis on research and discipline, and its encouragement to adopt a contrarian, optimistic mindset. By the end of the book, readers are equipped not only with strategies but with the psychological resilience needed to thrive in volatile environments.

Key Concepts and Ideas

At the heart of "The Little Book of Emerging Markets" is Mobius’s investment philosophy: embrace volatility, seek outgrowth, and manage risk through rigorous research and diversification. Mobius believes that emerging and frontier markets offer the highest potential for long-term capital appreciation, but only for those who are willing to do the work—digging beneath headlines, understanding local dynamics, and maintaining emotional discipline. He advocates for a contrarian approach, one that capitalizes on market inefficiencies and panics rather than fleeing from them.

The book’s core ideas revolve around understanding the unique drivers of emerging markets, the importance of timing and currency risk, and the psychological fortitude required to withstand dramatic market swings. Mobius stresses that while the risks are real—ranging from political instability to illiquidity—the rewards can be extraordinary for those who prepare properly. He provides a toolbox of concepts, from the FELT criteria for market selection to advanced crisis investing tactics, all grounded in real-world experience.

- FELT Criteria (Fair, Efficient, Liquid, Transparent): Mobius introduces the FELT framework as a lens for evaluating the investability of emerging markets. Markets that are fair (rule of law), efficient (low transaction costs), liquid (easy to buy/sell), and transparent (reliable information) are more attractive. For example, South Korea’s improvement in market transparency and liquidity over the past two decades made it a top destination for foreign investors.

- Growth and Diversification: Emerging markets offer faster GDP growth and lower correlations with developed markets, providing both return potential and portfolio diversification. Mobius cites China’s double-digit growth in the 2000s and Brazil’s commodities boom as prime examples of these dynamics.

- Frontier Market Investing: The book distinguishes between emerging and frontier markets, emphasizing that the latter—such as Vietnam, Nigeria, and Bangladesh—are even earlier in their development cycle and often overlooked. Mobius details how early entrants can achieve outsized returns, as seen in Mongolia’s mining sector in the early 2010s.

- Investment Vehicles: Mobius discusses mutual funds, ETFs, closed-end funds, and direct stock purchases. He explains how American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs) enable investors to access foreign stocks without dealing with local exchanges, reducing complexity and risk.

- Investment Styles—Value, Growth, Contrarian: The book compares value investing (finding undervalued companies), growth investing (targeting high-growth firms), and contrarian investing (buying out-of-favor assets). Mobius often combines these, seeking undervalued growth in unpopular markets—such as buying Russian oil majors during periods of political instability.

- Deep Research and Local Insight: Mobius stresses the need for independent, on-the-ground research. He describes how site visits, interviews with management, and gathering local intelligence can uncover truths not found in analyst reports—such as uncovering corruption or hidden assets.

- Risk Management and Diversification: A key concept is that risk in emerging markets can be mitigated by diversifying across countries, sectors, and currencies. Mobius gives the example of balancing exposure between fast-growing Asian tech stocks and Latin American consumer companies to smooth out volatility.

- Currency and Market Timing: The book explains why currency fluctuations are both a risk and an opportunity. Mobius recounts how the 1997 Asian financial crisis created bargains for those who understood the underlying fundamentals and could stomach short-term losses.

- Emotional Discipline and Contrarian Mindset: Mobius argues that emotional control is essential. He describes how panic selling during the 2008 financial crisis allowed disciplined investors to buy assets at deep discounts, leading to substantial gains in the recovery.

- Crisis Investing and Long-Term Optimism: The book’s final concept is that crises and panics often lay the groundwork for future booms. Mobius’s optimistic outlook is rooted in decades of witnessing countries recover from disaster—such as Thailand post-Asian crisis or Brazil after hyperinflation—rewarding investors who stay the course.

Practical Strategies for Investors

Mobius’s book is packed with actionable strategies for investors seeking to profit from emerging and frontier markets. He understands that the theoretical appeal of these markets—high growth, diversification, and inefficiency—must be matched with practical steps to manage risk and maximize returns. The book guides readers through the process of selecting markets, choosing investment vehicles, conducting research, and maintaining emotional discipline, all tailored for the unique challenges of less developed economies.

Applying Mobius’s teachings requires a blend of patience, flexibility, and courage. He repeatedly emphasizes that success in emerging markets is not about chasing fads or reacting to headlines, but about sticking to a disciplined process. Investors are encouraged to develop a robust framework for market selection, build diversified portfolios, and adopt a contrarian mindset—especially during periods of market panic. The strategies below are designed to help investors translate Mobius’s principles into concrete action steps.

- Screen Markets Using FELT: Begin by evaluating countries based on their fairness, efficiency, liquidity, and transparency. Create a checklist for each target market—look for recent reforms, stock market upgrades, or regulatory improvements. For instance, after India’s 2016 demonetization and subsequent financial reforms, the market became more accessible and attractive for foreign investors.

- Build Diversified Portfolios: Allocate capital across multiple countries and sectors to reduce exposure to any single risk. For example, combine exposure to Chinese technology, Brazilian agriculture, and South African mining. Use ETFs or mutual funds for broad exposure, and consider direct stock purchases for high-conviction bets.

- Utilize ADRs and GDRs: Access foreign stocks through depositary receipts listed on U.S. or European exchanges. This reduces administrative complexity and currency conversion risk. For instance, purchase Alibaba ADRs on the NYSE instead of buying shares directly in Hong Kong.

- Adopt a Contrarian Approach: Look for markets or sectors that are temporarily out of favor due to political turmoil, currency crises, or negative headlines. Mobius suggests screening for countries with recent double-digit market declines, then researching whether the fundamentals remain intact.

- Conduct On-the-Ground Research: Supplement analyst reports with site visits, meetings with company management, and conversations with local experts. Mobius describes how visiting a Vietnamese factory revealed operational strengths not visible in financial statements, leading to a successful investment.

- Hedge Currency Exposure: Use forward contracts, currency ETFs, or multi-currency portfolios to manage currency risk. For example, if investing in Turkish equities, consider hedging against the lira’s volatility through currency-hedged funds.

- Monitor Macro and Micro Trends: Regularly review both country-level economic indicators (GDP growth, inflation, political stability) and company-level fundamentals (earnings, management quality). Mobius recommends creating dashboards to track macroeconomic data and company KPIs side by side.

- Prepare for Crisis Investing: Develop a playbook for buying during market panics. Set aside liquidity or create watchlists of target assets. When a crisis hits—such as the 2020 COVID-19 selloff—be ready to act decisively, focusing on companies with strong balance sheets and recovery potential.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

"The Little Book of Emerging Markets" is meticulously structured, guiding readers from foundational concepts to advanced strategies. Each chapter builds on the last, starting with the definition of emerging markets and progressing through investment vehicles, risk management, behavioral finance, and crisis investing. Mobius uses a consistent format: he introduces a concept, supports it with real-world examples, and concludes with actionable takeaways for investors. This approach makes the book both educational and practical, with each chapter standing as a mini-guide on a specific aspect of emerging market investing.

The following chapter-by-chapter analysis dives deep into the book’s core lessons, illustrating how Mobius’s principles can be applied in the real world. For each chapter, we explore the main ideas, specific examples and data, practical application for investors, and historical or modern context. Whether you are new to emerging markets or a seasoned global investor, these insights provide a comprehensive roadmap for navigating one of the most exciting—and challenging—areas of the investment universe.

Chapter 1: What Are Emerging Markets? An Investment Opportunity Not to Be Missed

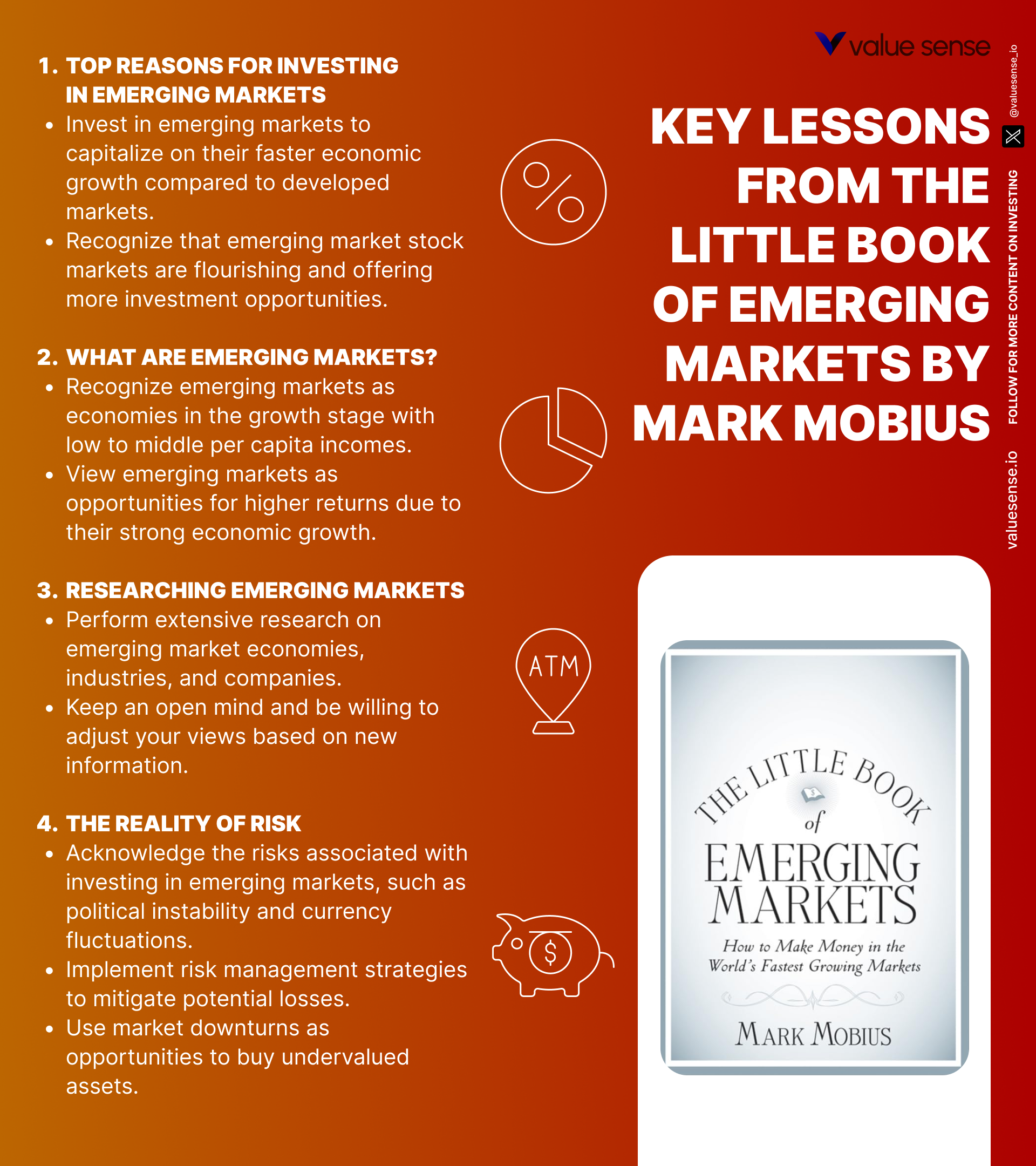

Mobius opens the book by defining emerging markets as economies in the growth stage of their development cycle, typically characterized by low to middle per capita incomes and rapidly developing financial systems. He traces the evolution of the term “emerging markets,” originally coined in the 1980s, and explains how countries like South Korea, Taiwan, and Brazil transitioned from frontier to emerging status as their economies matured. Mobius details the key criteria for identifying these markets, such as GDP growth rates, market capitalization, and improvements in legal and financial infrastructure. He introduces the FELT criteria—Fair, Efficient, Liquid, Transparent—as a framework for evaluating market attractiveness.

The chapter is rich with examples, such as China’s transformation from a closed economy in the 1970s to a global powerhouse by the 2000s. Mobius cites data showing that emerging markets have accounted for more than 50% of global GDP growth since 2000. He highlights the rise of stock exchanges in countries like India and Brazil, where improved transparency and liquidity have attracted billions in foreign investment. A quote from the book encapsulates the opportunity: “Emerging markets offer the kind of growth that developed markets can only dream about.”

For investors, the key takeaway is to use the FELT criteria as a screening tool. Mobius suggests creating a checklist for each country under consideration, looking for signs of legal reform, technological adoption, and increasing foreign participation. He warns that not all emerging markets are created equal—some may lack transparency or have illiquid markets, increasing risk. Investors should prioritize countries that are making tangible progress in market infrastructure and governance.

Historically, countries that improved their FELT scores—such as South Korea’s reforms in the 1990s or Poland’s EU accession—delivered outsized returns to early investors. In today’s environment, markets like Vietnam and Nigeria are following similar trajectories, making them prime candidates for long-term capital appreciation. Mobius’s approach encourages investors to look beyond headlines and focus on structural improvements that signal a market’s readiness for foreign capital.

Chapter 2: Top Reasons for Investing in Emerging Markets: Growth and Diversification

This chapter delves into the primary reasons for allocating capital to emerging markets: superior growth potential and diversification benefits. Mobius presents compelling data showing that emerging economies have consistently outpaced developed markets in GDP growth, with countries like China, India, and Indonesia posting annual growth rates of 6-10% over the past two decades. He explains how technological advancements, urbanization, and rising consumer demand are fueling this expansion, creating new opportunities in sectors ranging from technology to infrastructure.

Mobius provides specific examples, such as the rise of the Indian technology sector, which saw companies like Infosys and Tata Consultancy Services become global leaders. He also discusses Brazil’s commodities boom in the 2000s, which lifted millions out of poverty and created a burgeoning middle class. The chapter includes charts comparing the long-term performance of emerging market indices (like the MSCI Emerging Markets Index) to developed market benchmarks, illustrating periods where EMs outperformed by wide margins.

Investors are encouraged to view emerging markets as a means of enhancing portfolio returns while reducing overall risk through diversification. Mobius recommends allocating a portion of equity exposure to EMs, especially for those with long time horizons. He notes that the low correlation between emerging and developed markets can smooth portfolio volatility, particularly during periods when developed economies stagnate.

Historically, the inclusion of emerging markets has been shown to boost risk-adjusted returns. For example, from 2003 to 2007, the MSCI EM Index delivered annualized returns of over 30%, far outpacing the S&P 500. Even during volatile periods, such as the 2008 financial crisis, markets like China and India rebounded faster than many developed peers. Mobius’s message is clear: by positioning yourself in these high-growth regions, you can capture both upside potential and diversification benefits.

Chapter 3: Discovering Frontier Markets: Don’t Miss the First Mover Advantage

Mobius shifts focus to frontier markets—economies that are even less developed than traditional emerging markets but offer outsized growth potential. He defines frontier markets as those with rapid economic expansion, low levels of debt, and abundant natural resources. Examples include Mongolia, Bangladesh, and Nigeria, where GDP growth rates often exceed 7% and market capitalization is still in its infancy. Mobius emphasizes that these markets are typically underresearched and overlooked by mainstream investors, creating opportunities for those willing to be early movers.

The chapter features case studies such as Mongolia’s mining boom in the early 2010s, where investors who entered before the rush saw triple-digit returns as the country opened up to foreign capital. Mobius also discusses the risks—frontier markets are prone to political instability, currency volatility, and illiquidity. He shares anecdotes of visiting factories in Bangladesh and oil fields in Nigeria, highlighting the importance of on-the-ground research to uncover both opportunities and red flags.

For investors, the practical lesson is to approach frontier markets with a combination of thorough due diligence and a willingness to accept higher risk. Mobius suggests starting with small allocations—perhaps 5-10% of an emerging markets portfolio—and focusing on sectors with strong structural drivers, such as natural resources or consumer goods. He advises using closed-end funds or specialized ETFs to gain diversified exposure, reducing the impact of single-country shocks.

Historically, first movers in frontier markets have reaped substantial rewards. For instance, early investors in Vietnam’s equity market in the mid-2000s saw gains of over 200% within a few years. However, Mobius cautions that patience and resilience are required, as these markets can experience sharp drawdowns and extended periods of underperformance. The key is to focus on long-term trends and avoid being swayed by short-term volatility.

Chapter 4: Getting Down to Business: How to Invest in Emerging Markets

This chapter provides a comprehensive overview of the various vehicles available for investing in emerging markets. Mobius breaks down the pros and cons of mutual funds, ETFs, closed-end funds, and direct stock purchases. He explains that mutual funds and ETFs offer diversification and professional management, making them suitable for most investors. Closed-end funds can sometimes be purchased at a discount to net asset value, providing an extra margin of safety.

Mobius also discusses the role of depositary receipts—such as American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs)—which allow investors to buy shares of foreign companies on U.S. or European exchanges. He cites the example of Alibaba’s NYSE-listed ADRs, which provide access to the Chinese tech giant without the complexities of trading in Hong Kong. The chapter includes practical tips for evaluating fund managers, such as reviewing their track records, fees, and alignment of interests.

For investors, the main takeaway is to match the investment vehicle to their risk tolerance, expertise, and desired level of involvement. Mobius recommends starting with diversified mutual funds or ETFs for broad exposure, then gradually adding direct stock positions as confidence and knowledge grow. He warns that direct investing requires careful attention to local market conditions, currency risk, and regulatory environments.

In practice, many successful investors combine multiple vehicles—using ETFs for core exposure and direct stocks for high-conviction bets. During the 2008-2009 crisis, for example, investors who added beaten-down Russian energy ADRs to their portfolios saw significant gains as the market recovered. Mobius’s advice is to prioritize diversification, professional management, and liquidity when entering these complex markets.

Chapter 5: Is There a Right Way to Invest? Comparing Investment Styles

Here, Mobius explores different investment styles—value, growth, and contrarian—and discusses how to blend them for success in emerging markets. He defines value investing as the search for companies trading below their intrinsic worth, often due to temporary setbacks or market neglect. Growth investing, by contrast, focuses on companies with strong earnings momentum and expansion prospects. Mobius shares his preference for a hybrid approach, seeking undervalued growth companies in markets that others have overlooked.

The chapter is filled with examples, such as buying Brazilian consumer stocks during periods of political turmoil, or investing in Russian oil majors when oil prices were depressed. Mobius notes that contrarian investing—buying when others are selling—can be particularly effective in volatile markets. He references the success of investors who bought South Korean equities during the Asian financial crisis, reaping substantial gains as the country recovered.

For investors, the practical lesson is to remain flexible and adapt strategies to changing market conditions. Mobius suggests using fundamental analysis to identify undervalued companies with strong growth potential, then layering in a contrarian mindset to capitalize on market overreactions. He recommends maintaining a long-term perspective, as value and contrarian strategies often require patience to bear fruit.

Historically, combining value and growth has delivered superior returns in emerging markets. For instance, investors who bought Chinese internet stocks during the 2015 market selloff saw outsized gains as fundamentals reasserted themselves. Mobius’s approach encourages investors to avoid rigid adherence to any single style, instead blending techniques to suit the unique dynamics of each market cycle.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Researching Emerging Markets

Mobius dedicates this chapter to the critical importance of independent, thorough research in emerging markets. He explains that information in these regions is often less reliable, with data subject to political bias, misinformation, or outright manipulation. Mobius shares stories of visiting factories, interviewing local managers, and conducting site visits to verify the claims found in annual reports or analyst notes.

The chapter includes practical advice on gathering information from multiple sources—local experts, financial statements, competitor analysis, and even informal conversations with employees. Mobius warns against overreliance on third-party analysis, noting that many foreign research providers have limited on-the-ground presence. He describes how firsthand research in Turkey revealed hidden assets and management strengths that were missed by the consensus view.

For investors, the key takeaway is to develop a robust research process that goes beyond desk analysis. Mobius recommends combining quantitative screening (using financial ratios, growth rates, etc.) with qualitative assessments (management quality, corporate governance, local reputation). He suggests cross-referencing findings from different sources to ensure accuracy and uncover discrepancies.

Historically, investors who conducted deep, independent research have outperformed the crowd. Mobius cites the example of discovering undervalued Thai banks in the aftermath of the Asian crisis, where local insights revealed improving fundamentals before the market recognized them. In today’s era of information overload, Mobius’s emphasis on direct engagement and skepticism remains as relevant as ever.

Chapter 7: The Reality of Risk

This chapter tackles the perception and management of risk in emerging markets. Mobius argues that while these markets are often seen as inherently riskier than developed ones, the reality is more nuanced. He breaks down the main types of risk—political, currency, liquidity, and market—and explains how each can impact investment outcomes. Mobius provides examples of countries like Argentina, where political instability led to currency devaluation, and Russia, where liquidity dried up during the 1998 crisis.

Mobius uses data to show that volatility in emerging markets can create both risk and opportunity. He notes that while annual returns can swing dramatically, disciplined investors who diversify across countries and sectors can mitigate much of this risk. The chapter includes charts comparing the standard deviation of returns in EMs versus developed markets, illustrating that risk-adjusted returns can be similar or even superior for diversified portfolios.

For investors, the main lesson is to focus on understanding and managing risk rather than avoiding it altogether. Mobius recommends diversifying across uncorrelated markets, maintaining liquidity buffers, and staying informed about macroeconomic and political developments. He also advises against relying solely on perceptions—many developed markets have experienced crises just as severe as those in the developing world.

Historically, investors who managed risk through diversification and thorough research have been rewarded. The 2008 financial crisis, for example, saw U.S. and European markets suffer alongside EMs, but those with global diversification recovered faster. Mobius’s approach is to embrace risk as a source of opportunity, provided it is understood and managed proactively.

Chapter 8: Timing Market Factors: Currencies

Mobius explores the profound impact of currency fluctuations on emerging market investments. He explains that currency risk is often the largest single factor affecting returns, as local market gains can be wiped out by devaluation. The chapter details the challenges of predicting currency movements, noting that even professional forecasters have poor track records in this area. Mobius recounts the 1997 Asian financial crisis, when sharp currency declines created deep value opportunities for those who understood the underlying fundamentals.

The chapter provides practical advice on hedging currency risk, such as using forward contracts or investing in currency-hedged ETFs. Mobius also discusses the potential for currency crises to create buying opportunities, as panic selling often drives asset prices below intrinsic value. He shares the example of investing in Brazilian equities during periods of real devaluation, which led to significant gains when the currency stabilized and the market rebounded.

For investors, the takeaway is to be aware of currency risk and to incorporate it into portfolio construction. Mobius suggests diversifying across currencies, using hedging tools where appropriate, and focusing on companies with natural currency hedges (such as exporters). He warns against attempting to time currency markets, instead recommending a focus on long-term fundamentals.

Historically, currency crises have been both a source of pain and opportunity. Investors who bought during the depths of the Russian ruble crisis or the Turkish lira collapse saw substantial gains as markets normalized. Mobius’s pragmatic approach is to accept currency risk as part of the emerging markets package and to use it strategically rather than fearfully.

Chapter 9: It’s Called Volatility

This chapter addresses the roller-coaster nature of emerging markets, likening volatility to both a challenge and an opportunity. Mobius explains that volatility is a natural feature of developing economies, driven by factors such as political uncertainty, economic cycles, and market immaturity. He describes how markets can swing by 20-30% in a matter of months, citing examples from Brazil, Russia, and Indonesia.

Mobius uses data to illustrate that while volatility can be unsettling, it is also the source of outsized returns. He provides case studies of investors who stayed invested during periods of high volatility—such as the 2008-2009 global financial crisis—and were rewarded when markets rebounded. The chapter includes charts showing the cyclical nature of EM returns, emphasizing the importance of patience and a long-term perspective.

For investors, the practical advice is to embrace volatility rather than fear it. Mobius recommends setting clear investment horizons, maintaining liquidity for opportunistic buying, and avoiding the temptation to sell during market downturns. He suggests using volatility as a signal to look for undervalued assets, rather than as a reason to exit the market.

Historically, volatility has been the friend of disciplined investors. Those who bought Indonesian equities after the 1998 crisis, or Russian stocks after the 2014 sanctions, saw dramatic gains as markets recovered. Mobius’s message is that volatility is not a bug, but a feature—one that can be harnessed for superior returns by those with the right mindset and strategy.

Chapter 10: The Importance of Being Contrary

Mobius devotes this chapter to the contrarian approach, arguing that the best opportunities in emerging markets often arise when sentiment is at its lowest. He explains that following the crowd usually leads to mediocre returns, while going against prevailing sentiment—buying when others are selling—can yield significant rewards. Mobius shares personal anecdotes of investing in markets like Russia and Argentina during periods of crisis, when most investors were fleeing.

The chapter includes psychological insights into why contrarian investing is difficult. Mobius discusses the fear of missing out, the pressure to conform, and the discomfort of standing alone against the consensus. He provides practical strategies for developing conviction, such as focusing on fundamentals, setting predefined investment rules, and maintaining a long-term perspective even when short-term losses mount.

For investors, the lesson is to cultivate a contrarian mindset and to trust independent analysis over market noise. Mobius recommends screening for assets that are out of favor, then conducting deep research to determine whether the pessimism is justified. He suggests using checklists to avoid emotional decision-making and to stay disciplined during periods of market stress.

Historically, contrarian investors have outperformed by buying during panics and selling during euphoria. Mobius cites the example of those who bought Thai equities during the Asian financial crisis, benefiting from the country’s subsequent recovery. The chapter’s message is clear: the courage to be contrary, supported by rigorous analysis, is a key ingredient for success in emerging markets.

Chapter 11: The Big Picture and the Small Picture

In this chapter, Mobius emphasizes the importance of balancing macroeconomic analysis with micro-level company research. He uses Russia as a case study, illustrating how the country’s bleak macro outlook in the 1990s masked significant opportunities in specific sectors, such as energy and telecommunications. Mobius explains that while the macro view provides essential context—such as political stability, regulatory environment, and economic growth—the micro view uncovers hidden gems that may be overlooked by top-down analysis.

The chapter provides examples of how sector-specific trends can diverge from the broader economy. For instance, while Russia’s overall economy struggled during the transition from communism, oil majors like Lukoil and Gazprom benefited from privatization and global demand. Mobius also discusses the importance of on-the-ground research to verify company fundamentals, management quality, and competitive positioning.

For investors, the practical takeaway is to integrate both macro and micro perspectives into the investment process. Mobius recommends starting with a macro screen to identify promising countries, then drilling down into sectors and companies with favorable fundamentals. He suggests creating a research matrix that tracks both country-level risks and company-specific opportunities.

Historically, investors who balanced macro and micro analysis have outperformed those who relied solely on one approach. Mobius’s experience in Russia and Brazil shows that even in challenging environments, well-managed companies can deliver exceptional returns. The chapter encourages investors to look beyond headlines and to seek out opportunities where the macro and micro views diverge.

Chapter 12: Privatization: The Trend That Can Bring Huge Opportunities

This chapter explores the transformative impact of privatization in emerging markets. Mobius explains how the shift from state-owned enterprises to privately held companies unlocks value by improving efficiency, governance, and profitability. He details the stages of privatization, from government-led initiatives to the involvement of strategic investors who bring capital and expertise.

Mobius provides case studies of successful privatizations in Russia and Latin America, where early investors saw substantial gains. He describes how the Russian oil sector, once dominated by inefficient state enterprises, became a global powerhouse after privatization in the 1990s. The chapter includes data on the performance of newly privatized companies, showing that those who invested early often reaped the largest rewards.

For investors, the lesson is to monitor privatization trends and to seek early entry into newly listed companies. Mobius recommends tracking government announcements, sector reforms, and the involvement of reputable strategic partners. He warns that timing is critical—entering too late can mean missing out on the initial surge in value.

Historically, privatization waves have created some of the biggest winners in emerging markets. The Czech Republic’s voucher privatization program in the 1990s, for example, created a generation of successful companies and investors. Mobius’s advice is to stay alert to these trends and to act decisively when opportunities arise.

Chapter 13: Boom to Bust: How, When, and Why?

Mobius analyzes the cyclical nature of emerging markets, focusing on the transition from boom to bust. He outlines the warning signs of impending market crashes, such as rising inflation, excessive debt, and imbalances in trade and capital flows. Mobius explains that while booms create euphoria and overconfidence, they are often followed by sharp contractions that can wipe out gains for unprepared investors.

The chapter provides practical advice on recognizing the signs of a bubble, including rapid credit growth, speculative investment behavior, and deteriorating fundamentals. Mobius shares examples from the 1997 Asian financial crisis and the 2013 “Taper Tantrum,” when capital outflows triggered sharp declines in EM asset prices. He emphasizes the importance of maintaining discipline and liquidity during booms, so as to avoid forced selling during busts.

For investors, the key takeaway is to monitor macroeconomic indicators and to avoid overexposure during periods of exuberance. Mobius recommends diversifying across asset classes, maintaining cash reserves, and setting stop-loss rules to protect against sudden downturns. He also suggests reviewing portfolio allocations regularly to ensure they remain aligned with risk tolerance and market conditions.

Historically, investors who recognized the signs of a bust and acted early—such as reducing leverage or shifting to defensive sectors—have preserved capital and been positioned to buy during the subsequent recovery. Mobius’s cyclical framework helps investors navigate the inevitable ups and downs of emerging markets with greater confidence and resilience.

Chapter 14: Don’t Get Emotional: How to Profit from the Panic

Mobius addresses the psychological challenges of investing, particularly the dangers of emotional decision-making. He explains how fear and greed can lead to poor choices, such as panic selling during downturns or chasing returns during booms. Mobius shares stories of investors who lost fortunes by abandoning their strategies in moments of crisis, as well as those who profited by maintaining discipline and buying when others were fearful.

The chapter includes practical strategies for managing emotions, such as setting predefined rules for buying and selling, regularly reviewing investment plans, and focusing on long-term goals. Mobius emphasizes the importance of contrarian thinking, arguing that market panics often create opportunities to buy undervalued assets at a discount. He provides the example of buying South Korean equities during the 1998 crisis, which rebounded strongly as the panic subsided.

For investors, the lesson is to develop emotional discipline and to stick to a well-defined investment process. Mobius recommends creating checklists, automating investment decisions where possible, and seeking out supportive communities or mentors to help maintain perspective during volatile periods. He also suggests keeping a journal to track emotional responses and to learn from past mistakes.

Historically, disciplined investors have outperformed by remaining calm during market turmoil. The 2008-2009 financial crisis, for instance, provided once-in-a-generation buying opportunities for those who stayed the course. Mobius’s advice is to view panic as a signal to act, not to retreat, provided the underlying fundamentals remain sound.

Chapter 15: Turning Fear into an Advantage Instead of a Disadvantage

This chapter highlights the potential to use fear as a strategic tool rather than a paralyzing force. Mobius shares a detailed case study of Thailand during the Asian financial crisis, when widespread panic led to deep undervaluation of assets. He explains how those who invested during the depths of the crisis benefited from the country’s subsequent recovery, as reforms and foreign investment fueled a robust rebound.

Mobius discusses the psychological barriers to investing during periods of extreme fear, noting that most investors are wired to avoid risk when uncertainty is highest. He provides practical tips for overcoming this bias, such as focusing on long-term fundamentals, conducting thorough research, and maintaining confidence in one’s analysis. Mobius also emphasizes the importance of decisive action—waiting too long can mean missing out on the initial surge in value as markets recover.

For investors, the key takeaway is to view fear-driven selloffs as potential entry points rather than exit signals. Mobius recommends building watchlists of target companies, maintaining liquidity for opportunistic buying, and setting predefined investment triggers based on valuation metrics. He also advises seeking out markets and sectors where fear has created the largest disconnect between price and intrinsic value.

Historically, investors who acted boldly during crises—such as buying Thai banks in 1998 or Brazilian equities in 2002—have achieved exceptional returns. Mobius’s message is that fear, when managed properly, can be a source of competitive advantage rather than a handicap.

Chapter 16: The Crisis Bargain Bin

Mobius explores the opportunities that arise in the aftermath of financial crises. He explains that while crises are painful, they often lead to significant economic and policy reforms that create a more favorable environment for future growth. Mobius provides examples of countries like South Korea and Mexico, where post-crisis reforms led to improved governance, increased foreign investment, and robust market recoveries.

The chapter includes practical advice on identifying undervalued assets in crisis-hit markets. Mobius suggests focusing on sectors or companies that are essential to the economy and likely to benefit from reforms, such as banks, infrastructure, and consumer goods. He recommends maintaining a long-term perspective, as recovery can take several years but often delivers substantial returns to patient investors.

For investors, the lesson is to look beyond the immediate panic and to focus on the potential for recovery and growth. Mobius advises against being swayed by short-term market sentiment, instead emphasizing the importance of disciplined investing based on fundamentals. He also suggests monitoring policy changes and government initiatives, as these often signal the start of a new growth cycle.

Historically, some of the best-performing investments have been made in the wake of a crisis. The Mexican peso crisis of 1994 and the Russian debt default of 1998 both created buying opportunities for those who recognized the potential for reform-driven recovery. Mobius’s approach is to treat crises as opportunities to buy quality assets at a discount, provided the underlying fundamentals remain intact.

Chapter 17: Overcoming Irrational Market Panic

Mobius addresses the phenomenon of irrational market panic, explaining how fear-driven selloffs often create buying opportunities for disciplined investors. He describes how panics are typically disconnected from fundamental economic conditions, leading to sharp declines in asset prices that are not justified by underlying realities. Mobius emphasizes the importance of maintaining objectivity and using thorough research to identify quality assets that have been unfairly punished by the market.

The chapter includes examples of global contagion, where panic in one market spreads to others, creating widespread opportunities for those prepared to act. Mobius discusses the 2008-2009 financial crisis, when panic selling in developed markets triggered declines in emerging markets, even in countries with strong fundamentals. He provides strategies for navigating these periods, such as maintaining liquidity, focusing on long-term value, and avoiding herd mentality.

For investors, the key lesson is to use market panics as opportunities to buy high-quality assets at a discount. Mobius recommends developing a clear investment strategy, conducting deep research, and setting predefined rules for buying during periods of extreme volatility. He also suggests monitoring global interconnections, as contagion can create synchronized opportunities across multiple markets.

Historically, level-headed investors have profited by buying during periods of irrational panic. The recovery of global markets after the 2008 crisis, for example, delivered substantial gains to those who acted decisively. Mobius’s advice is to remain objective, focus on fundamentals, and use panic as a tool for value investing rather than as a reason to exit the market.

Chapter 18: The World Belongs to Optimists

In the final chapter, Mobius concludes by emphasizing the importance of optimism in successful investing, particularly in emerging markets. He argues that while challenges and risks are inherent, these markets also offer unparalleled opportunities for growth. Mobius encourages investors to adopt a long-term, optimistic outlook, which enables them to navigate volatility and uncertainty with confidence.

The chapter highlights key personal attributes required for success: discipline, humility, and resilience. Mobius explains that optimism is not about ignoring risks, but about recognizing the potential for positive change and being willing to act when opportunities arise. He shares examples of countries that rebounded from crisis—such as Brazil after hyperinflation or Thailand after the Asian crisis—rewarding those who maintained faith in the long-term growth story.

For investors, the practical lesson is to cultivate optimism as a core component of the investment process. Mobius recommends focusing on long-term goals, maintaining discipline during downturns, and viewing volatility as an opportunity rather than a threat. He suggests building routines and support systems that reinforce positive thinking and resilience.

Historically, optimistic investors have been the ones to capitalize on the biggest opportunities in emerging markets. The rise of China, India, and other developing economies over the past two decades has rewarded those who stayed the course despite setbacks. Mobius’s final message is that the world belongs to optimists—those who see beyond the risks to the extraordinary potential of emerging markets.

Advanced Strategies from the Book

Beyond foundational techniques, Mobius offers a suite of advanced strategies for experienced investors seeking to maximize returns in emerging and frontier markets. These approaches require deeper research, stronger risk management, and the ability to act decisively during periods of crisis or market dislocation. Mobius’s advanced methods are rooted in his decades of experience navigating volatile environments and capitalizing on inefficiencies that less nimble investors often miss.

The following advanced strategies leverage crisis investing, sector rotation, currency arbitrage, and political risk analysis. Each technique is illustrated with real-world examples and step-by-step guidance, enabling investors to apply these tools in their own portfolios.

Strategy 1: Crisis Investing Playbook

Mobius’s crisis investing approach centers on building a watchlist of high-quality assets in vulnerable markets, then acting quickly when a crisis hits. He recommends maintaining liquidity—such as cash or short-term bonds—so you can deploy capital when panic selling creates deep discounts. For example, during the 2008 financial crisis, Mobius’s team bought into South Korean and Russian blue chips at multi-year lows, achieving triple-digit returns as markets recovered. The key is to focus on companies with strong balance sheets, essential products, and the capacity to survive short-term turmoil. Mobius suggests setting predefined valuation triggers (e.g., price-to-book below 1.0) and acting decisively when they are met, while maintaining diversification to manage risk.

Strategy 2: Sector Rotation Based on Macro Trends

Mobius advocates for rotating between sectors based on macroeconomic cycles and policy changes. For instance, when commodity prices rise, he increases exposure to mining and energy stocks in resource-rich countries like Brazil and South Africa. Conversely, during periods of consumer-led growth, he shifts into retail and technology sectors in markets like India and Indonesia. Mobius uses macro indicators—such as GDP growth, inflation, and government spending—to anticipate sector winners and losers. He recommends reviewing sector allocations quarterly and using ETFs or sector-specific funds for efficient implementation. This dynamic approach allows investors to capture shifting opportunities and avoid sectors likely to underperform due to cyclical headwinds.

Strategy 3: Currency Hedging and Arbitrage

Currency movements can dramatically impact returns in emerging markets. Mobius’s advanced strategy involves actively managing currency exposure through hedging and arbitrage. He uses forward contracts, currency ETFs, and multi-currency portfolios to offset potential losses from devaluation. For example, when investing in Turkish equities, Mobius might hedge lira exposure using euro- or dollar-denominated instruments. He also looks for arbitrage opportunities when local and foreign-listed shares of the same company diverge in price due to currency fluctuations or capital controls. This approach requires close monitoring of currency markets and a willingness to adjust positions as macro conditions evolve.

Strategy 4: Political Risk Analysis and Event-Driven Investing

Emerging markets are often subject to political shocks—elections, policy changes, or geopolitical tensions—that create both risk and opportunity. Mobius’s strategy involves tracking political calendars, regulatory changes, and international relations to anticipate market-moving events. He cites the example of Brazil’s 2016 impeachment crisis, which initially triggered a selloff but ultimately led to pro-market reforms and a rally in equities. Mobius recommends building a database of upcoming political events, analyzing historical market reactions, and positioning portfolios to benefit from likely outcomes. This may involve increasing exposure ahead of anticipated reforms or reducing risk before contentious elections. Event-driven investing in EMs requires agility and deep local knowledge but can deliver outsized returns for those who get it right.

Strategy 5: Deep Dive Due Diligence and Local Partnerships

For the most sophisticated investors, Mobius recommends forming partnerships with local experts—analysts, consultants, or co-investors—to gain an edge in due diligence. He describes how collaborating with local partners in Vietnam and Nigeria revealed insights that were invisible to foreign investors, such as regulatory changes, management quality, and informal business practices. Mobius suggests conducting joint site visits, sharing research, and leveraging local networks to access information unavailable through public channels. This approach is especially valuable in frontier markets, where transparency is limited and relationships are critical. Deep due diligence, supported by local partnerships, can uncover hidden gems and avoid costly mistakes.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Putting Mobius’s strategies into practice requires a disciplined, step-by-step approach. The book emphasizes that success in emerging markets is not about making a single bold bet, but about building a robust process—screening markets, conducting research, managing risk, and maintaining emotional discipline. The following guide outlines the key steps for investors looking to implement the lessons from "The Little Book of Emerging Markets."

Start by identifying your investment objectives and risk tolerance. Decide how much of your portfolio you want to allocate to emerging and frontier markets—typically 10-30% for most diversified investors. Next, use the FELT criteria to screen potential markets, focusing on those with improving fairness, efficiency, liquidity, and transparency. Build a watchlist of target countries and sectors, and begin researching investment vehicles (ETFs, mutual funds, ADRs) that match your goals.

- First step investors should take: Define your allocation to emerging markets and use the FELT framework to screen for attractive countries. Create a shortlist based on macro trends, policy reforms, and market accessibility.

- Second step for building the strategy: Select appropriate investment vehicles—such as diversified ETFs for core exposure and direct stocks or sector funds for tactical bets. Conduct deep research on target companies, including site visits and local expert interviews where possible.

- Third step for long-term success: Monitor portfolio performance, rebalance regularly, and maintain emotional discipline during periods of volatility. Stay informed about macroeconomic and political developments, and be prepared to act decisively during crises or market panics.

Critical Analysis

"The Little Book of Emerging Markets" excels at demystifying a complex and often intimidating asset class. Mobius’s writing is clear, concise, and packed with practical examples drawn from decades of real-world experience. The book’s greatest strength is its balance—Mobius neither overhypes the potential rewards nor glosses over the risks. He provides a nuanced view, acknowledging the volatility and uncertainty inherent in emerging markets while offering concrete strategies to manage them. The inclusion of psychological and behavioral insights sets the book apart from more technical guides, making it accessible to a wide range of readers.

However, the book is not without limitations. Some readers may find that Mobius’s focus on high-level frameworks and anecdotes leaves them wanting more detailed, step-by-step instructions for implementing strategies. The book occasionally glosses over the complexities of currency hedging, tax considerations, or regulatory barriers that can trip up less experienced investors. Additionally, the fast-evolving nature of emerging markets means that some examples—particularly those from the early 2000s—may not fully reflect today’s realities, such as the rise of digital assets or ESG investing trends.

In the current market environment, characterized by rising geopolitical tensions, inflation, and shifting global supply chains, Mobius’s emphasis on diversification, research, and emotional discipline is more relevant than ever. The book serves as both a timeless primer and a practical manual for navigating the ever-changing landscape of global investing. For investors seeking to expand beyond developed markets, Mobius provides the tools and mindset required to succeed.

Conclusion

"The Little Book of Emerging Markets" is an indispensable guide for anyone seeking to unlock the growth potential of developing economies. Mark Mobius distills decades of experience into a concise, actionable framework that balances optimism with realism. The book’s core message—that volatility and risk are not to be feared but embraced—rings especially true in today’s uncertain world. By combining macroeconomic analysis, deep research, and disciplined execution, investors can capture the extraordinary opportunities that emerging and frontier markets offer.

Key takeaways include the importance of the FELT criteria for market selection, the value of diversification across countries and sectors, the need for emotional discipline, and the power of a contrarian, optimistic mindset. Mobius’s advanced strategies—crisis investing, sector rotation, currency management, and political risk analysis—provide a roadmap for experienced investors to achieve superior returns. Whether you are a novice or a seasoned global investor, this book will expand your horizons and equip you with the tools needed to thrive in the world’s most dynamic markets.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Emerging Markets

1. Who is Mark Mobius, and why is his perspective on emerging markets valuable?

Mark Mobius is a globally recognized investor with over 40 years of experience in emerging markets. As the former Executive Chairman of Templeton Emerging Markets Group, he managed billions in assets and traveled extensively to research companies firsthand. His unique blend of macroeconomic insight and on-the-ground experience makes his advice particularly valuable for investors navigating the complexities of developing economies.

2. What are the main risks associated with investing in emerging markets?

Emerging markets are subject to several risks, including political instability, currency fluctuations, illiquidity, and less transparent regulatory environments. While these risks can lead to higher volatility, Mobius argues that they also create opportunities for disciplined, well-informed investors who diversify and conduct thorough research.

3. How can I start investing in emerging markets with limited experience?

Mobius recommends starting with diversified mutual funds or ETFs that focus on emerging markets. These vehicles offer professional management and broad exposure, reducing the risk associated with individual stocks. As you gain experience, you can explore direct investments in specific companies or sectors, always applying rigorous research and the FELT criteria.

4. What is the FELT criteria, and how should I use it?

The FELT criteria stands for Fair, Efficient, Liquid, and Transparent. Mobius suggests using this framework to evaluate the investability of a market. Focus on countries that have strong legal systems, low transaction costs, good liquidity, and reliable information. This helps reduce risk and increases the likelihood of long-term success.

5. How important is currency risk in emerging market investing, and how can I manage it?

Currency risk is a major factor in emerging market returns. Mobius advises diversifying across multiple currencies, using currency-hedged funds, or employing forward contracts to offset potential losses from devaluation. He stresses that while timing currency markets is difficult, understanding macroeconomic drivers can help mitigate risk.

6. What are frontier markets, and how do they differ from emerging markets?

Frontier markets are less developed than traditional emerging markets and often feature higher growth potential but greater risk. They are typically underresearched and less liquid, making them suitable for investors with higher risk tolerance and a willingness to conduct deep due diligence. Examples include Vietnam, Nigeria, and Bangladesh.

7. How can I maintain emotional discipline during market volatility?

Mobius recommends setting predefined rules for buying and selling, regularly reviewing your investment plan, and focusing on long-term goals. He suggests automating decisions where possible and seeking support from mentors or investment communities to stay objective during periods of panic or euphoria.

8. What role does privatization play in emerging market investing?

Privatization transforms state-owned enterprises into more efficient, profitable companies, often unlocking significant value for early investors. Mobius highlights the importance of monitoring privatization trends and acting quickly to invest in newly listed companies, as the largest gains typically occur in the early stages of the process.

9. How do I identify when a market is transitioning from boom to bust?

Mobius advises monitoring macroeconomic indicators such as inflation, credit growth, and trade balances. Warning signs of a bust include excessive debt, speculative investment behavior, and deteriorating fundamentals. Maintaining discipline and liquidity during booms can help protect your portfolio when the cycle turns.

10. Is "The Little Book of Emerging Markets" still relevant in today’s fast-changing world?

Yes, the book’s principles—diversification, deep research, emotional discipline, and a contrarian mindset—are timeless. While some examples may predate recent trends, Mobius’s frameworks and strategies remain highly applicable to the challenges and opportunities of today’s global markets, including the rise of digital assets and ESG investing.