The Little Book of Hedge Funds by Anthony Scaramucci

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Anthony Scaramucci’s The Little Book of Hedge Funds is a definitive guide for understanding the enigmatic world of hedge funds. Scaramucci, a seasoned Wall Street veteran and founder of SkyBridge Capital, draws on decades of experience managing billions in assets and interacting with some of the most influential figures in finance. His credibility is rooted not only in his professional success but also in his candid, accessible writing style, which demystifies complex financial concepts for a broad audience. Scaramucci’s background as a hedge fund manager, entrepreneur, and commentator gives him unique insights into the industry’s inner workings, making this book a must-read for both aspiring professionals and curious investors.

The main theme of the book is to break down the barriers that have long surrounded hedge funds, making their strategies, structures, and value propositions understandable to investors at all levels. Scaramucci’s purpose is clear: to provide readers with the foundational knowledge needed to evaluate hedge funds as an asset class, understand their role in the financial markets, and make informed decisions about whether and how to invest in them. He does this by exploring the history, strategies, fee structures, and operational intricacies of hedge funds, using real-world examples and anecdotes to illustrate key points.

This book is particularly valuable for individual investors, finance students, and professionals seeking to deepen their understanding of alternative investments. While hedge funds are often perceived as exclusive vehicles for the ultra-wealthy, Scaramucci demonstrates that their core principles—risk management, absolute returns, and strategic flexibility—can benefit a wide range of investors. Even those who may never invest directly in a hedge fund will gain a richer perspective on how these funds influence markets, drive innovation, and offer lessons applicable to personal portfolio management.

What sets The Little Book of Hedge Funds apart is its ability to translate the sophisticated, jargon-laden world of hedge funds into practical, actionable insights. Scaramucci’s writing is peppered with memorable analogies, clear explanations, and direct advice. He covers not just the “how” but also the “why” behind hedge fund strategies, revealing both their strengths and limitations. The book’s unique value lies in its balanced approach: it celebrates the successes of hedge funds while also addressing their controversies, risks, and the ongoing debates about fees and transparency. Readers come away with a toolkit for evaluating hedge funds and applying their core lessons to any investment approach.

Ultimately, this book is more than a primer on hedge funds—it’s a roadmap for thinking differently about risk, opportunity, and the pursuit of alpha. Whether you’re an institutional allocator, a retail investor, or simply fascinated by the evolution of modern finance, Scaramucci’s insights offer both depth and clarity. His blend of history, strategy, and practical guidance ensures that readers finish the book not only better informed, but also equipped to act with greater confidence in today’s dynamic markets.

Key Concepts and Ideas

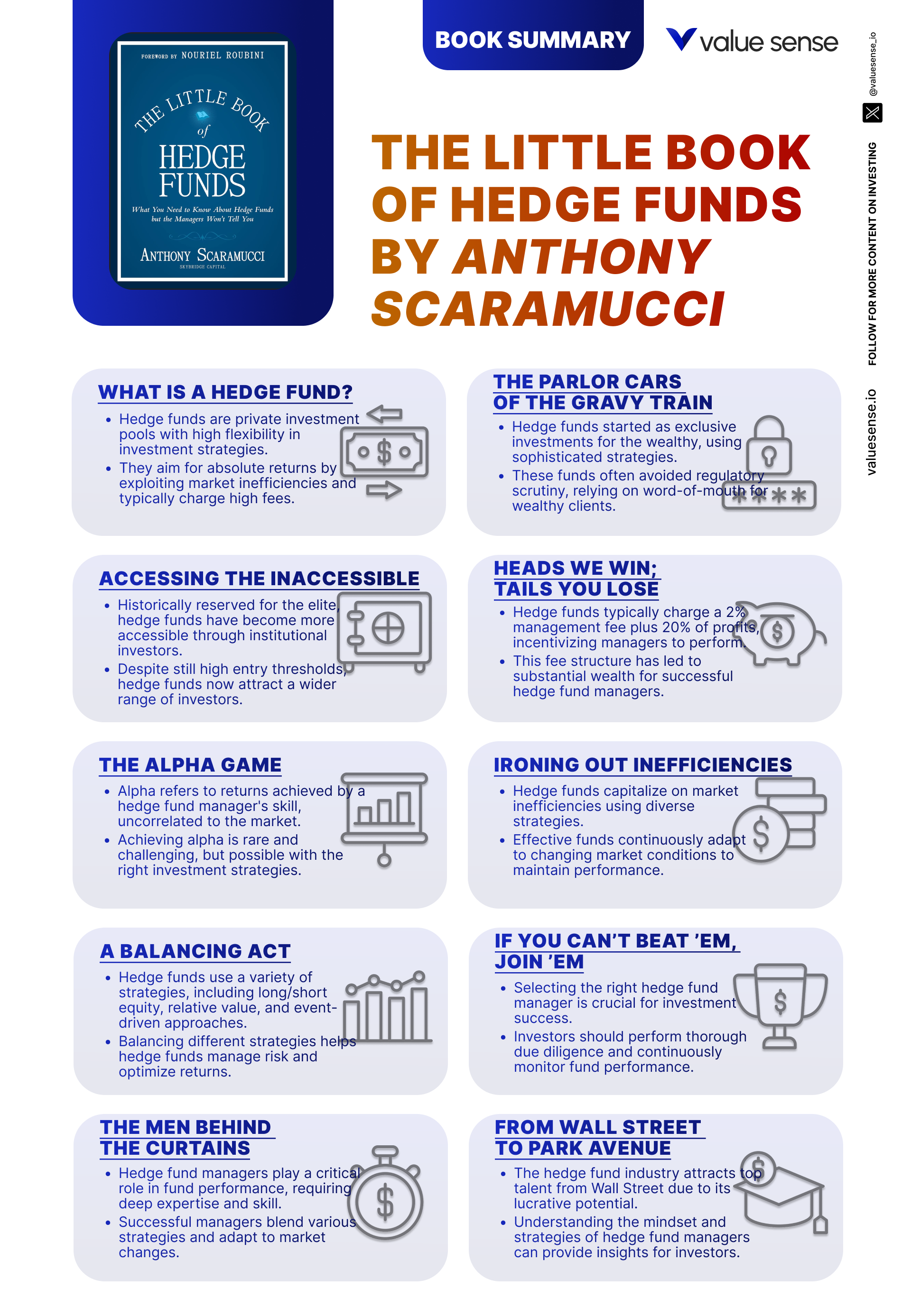

At its core, The Little Book of Hedge Funds is built around the investment philosophy that markets are not always efficient and that skilled managers can exploit inefficiencies to generate superior, risk-adjusted returns. Scaramucci emphasizes the pursuit of absolute returns—profits that are independent of market direction—by employing a wide variety of strategies, from long/short equity to event-driven investing. The book argues that while hedge funds are often shrouded in mystery, their underlying principles are accessible and, when understood, can be applied to improve any investor’s toolkit.

Scaramucci’s approach is rooted in the belief that diversification, flexibility, and rigorous risk management are essential to successful investing. He demystifies the industry’s structures and strategies, showing that hedge funds’ real value lies in their ability to adapt, innovate, and manage risk in ways that traditional investment vehicles cannot. The following key concepts form the foundation of the book’s teachings and offer practical takeaways for investors of all backgrounds.

- Absolute Return Investing: Hedge funds aim for positive returns regardless of market conditions. Unlike mutual funds, which benchmark against indices, hedge funds use strategies like long/short equity, derivatives, and leverage to generate “absolute” profits. For example, during the 2008 financial crisis, many hedge funds that employed market-neutral or global macro strategies posted gains even as the S&P 500 fell by over 37%.

- Fee Structures (“Two-and-Twenty”): The standard hedge fund fee model is 2% of assets under management plus 20% of profits. This aligns manager and investor interests but can also incentivize excessive risk-taking. Scaramucci explains how understanding fee structures is critical: a fund earning 10% gross returns would leave just 6% for investors after fees, meaning careful due diligence is essential.

- Alpha vs. Beta: Alpha is the excess return generated by manager skill, while beta is return due to market movement. Hedge funds seek to maximize alpha through active management, exploiting inefficiencies, and taking contrarian positions. For example, Renaissance Technologies’ Medallion Fund, famous for its high alpha, has posted annualized returns above 30% for decades—far outpacing the market.

- Market Inefficiencies: Scaramucci details how hedge funds thrive by identifying and capitalizing on mispricings, overreactions, or regulatory changes. This requires deep research and the courage to go against consensus. The book cites examples like Paulson & Co.’s bet against subprime mortgages, which netted billions by exploiting market blind spots in 2007-2008.

- Diversification and Strategy Mix: Hedge funds often blend multiple strategies—long/short, relative value, event-driven—to balance risk and return. This approach allows them to profit in various environments. For instance, Bridgewater Associates combines macroeconomic analysis with diversified asset allocation, reducing volatility and drawdowns.

- Operational Excellence: Behind every successful hedge fund is a robust operational team handling compliance, risk management, and logistics. Scaramucci highlights that operational failures, not just poor investment decisions, have sunk many funds. Investors should assess not only the portfolio manager but also the fund’s infrastructure.

- Accessibility and Regulation: Traditionally, hedge funds were only open to accredited investors, but regulatory changes and new products have broadened access. Still, high minimums and complexity remain barriers. The book discusses how funds-of-funds and replication strategies have made hedge fund-like returns more accessible to a wider audience.

- Risk Management: Hedge funds use tools like stop-loss orders, portfolio insurance, and dynamic hedging to control downside risk. Scaramucci stresses that successful funds are as focused on protecting capital as they are on generating returns—a lesson that retail investors can apply by diversifying and setting clear risk limits.

- Replication Strategies: Investors can now mimic hedge fund strategies using quantitative models and ETFs, often at lower cost and with greater transparency. Products like the IQ Hedge Multi-Strategy Tracker ETF allow investors to access hedge fund-like returns without the high fees or lockups.

- Talent and Culture: The migration of top talent from Wall Street to hedge funds has fueled innovation and competition. Success requires not just analytical skill but also independent thinking and adaptability. Scaramucci offers advice for those seeking a career in the industry, emphasizing the importance of network-building and continuous learning.

Practical Strategies for Investors

While hedge funds may seem out of reach for most individual investors, The Little Book of Hedge Funds provides a wealth of practical strategies that can be adapted to any portfolio. Scaramucci emphasizes that the core principles behind hedge fund success—rigorous research, risk management, and strategic flexibility—are universal. By understanding and applying these lessons, investors can enhance returns, reduce risk, and better navigate volatile markets.

Applying the book’s teachings begins with a shift in mindset: instead of simply tracking the market, investors should focus on absolute returns and protecting capital in all environments. This means adopting a more active, research-driven approach to portfolio construction, seeking out inefficiencies, and not being afraid to take contrarian positions when warranted. The following strategies, inspired by Scaramucci’s insights, offer actionable steps for investors at all levels.

- Conduct Rigorous Due Diligence: Before investing in any fund or strategy, analyze the manager’s track record, fee structure, and risk management approach. Review audited performance data, ask about drawdowns, and ensure alignment of interests. For individual stock selection, apply the same scrutiny—study financial statements, management incentives, and industry trends.

- Embrace Diversification Across Strategies: Don’t rely solely on one approach. Blend long/short equity, event-driven, and relative value strategies within your portfolio. For example, allocate 40% to core equities, 30% to alternatives (REITs, commodities), and 30% to tactical or hedge-fund-like strategies using ETFs or funds.

- Focus on Absolute Returns, Not Just Benchmarks: Set portfolio goals based on achieving positive returns in all market conditions. Use hedging tools like options, inverse ETFs, or market-neutral funds to reduce downside risk. Track your performance against cash or inflation, not just the S&P 500.

- Utilize Replication Products: If direct hedge fund investment is not feasible, consider hedge fund replication ETFs or mutual funds. Products like the HFRX Global Hedge Fund Index ETF or the AlphaClone Alternative Alpha ETF provide exposure to hedge fund strategies with lower fees and greater liquidity.

- Implement Robust Risk Controls: Set stop-loss limits, diversify across asset classes, and monitor position sizes. Use risk metrics like Value at Risk (VaR) or maximum drawdown to quantify and manage exposure. Regularly stress-test your portfolio for adverse scenarios.

- Stay Informed and Adaptable: Markets change rapidly. Continuously update your research, monitor macroeconomic trends, and be willing to pivot strategies as conditions evolve. Hedge funds thrive on adaptability; individual investors should cultivate the same mindset.

- Learn from Hedge Fund Disclosures: Study 13F filings and public letters from top funds like Pershing Square, Greenlight Capital, and Third Point. Analyze their holdings and rationale to gain insight into current market opportunities and risks.

- Invest in Your Own Education: Read widely on alternative investments, risk management, and behavioral finance. Attend webinars, follow industry news, and consider simulation trading to practice new strategies before committing real capital.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

The Little Book of Hedge Funds is structured to take readers on a comprehensive journey through the hedge fund landscape, from its origins and foundational concepts to its modern strategies and operational intricacies. Each chapter is crafted to build on the previous, gradually layering key insights and practical lessons. Scaramucci’s approach is both chronological and thematic, allowing readers to understand not just how hedge funds work, but why they have become such influential players in global finance.

The book’s ten chapters cover a wide range of topics, each focusing on a critical aspect of the hedge fund world. Scaramucci begins with the basics—defining what a hedge fund is and how it differs from other investment vehicles—before moving on to the history, accessibility, fee structures, and the elusive pursuit of alpha. Later chapters delve into the nuts and bolts of strategy, operational excellence, and the ongoing evolution of the industry. Each chapter is rich with examples, data, and actionable advice, making the book both informative and immediately useful.

Below, we provide an in-depth, chapter-by-chapter analysis, highlighting the main ideas, specific examples, and practical applications for investors. Each chapter summary is designed to capture the essence of Scaramucci’s teachings and offer concrete steps for putting these lessons into practice.

Chapter 1: What is a Hedge Fund?

The opening chapter serves as a foundational primer on hedge funds, aiming to dispel the aura of mystery that often surrounds them. Scaramucci begins by acknowledging the popular perception of hedge funds as high-risk, exclusive vehicles reserved for the ultra-wealthy. He breaks down the core elements that define a hedge fund: flexible investment mandates, performance-based fee structures (notably the “two-and-twenty” model), and the use of advanced strategies such as leverage, derivatives, and short selling. The chapter contrasts hedge funds with mutual funds, emphasizing that while mutual funds are typically constrained by regulatory requirements and benchmarked against indices, hedge funds are designed to pursue absolute returns regardless of market direction. This flexibility is both a strength and a source of risk, as it allows for innovative approaches but also requires rigorous oversight.

Scaramucci provides specific details about the regulatory environment that enables hedge funds to operate with fewer restrictions than traditional investment vehicles. He explains that hedge funds are usually structured as private partnerships, exempt from many of the disclosure and diversification rules that govern mutual funds. This allows them to act swiftly and exploit market inefficiencies, but it also means that investors must be more diligent in their due diligence. He highlights the standard fee arrangement—2% of assets under management plus 20% of profits—which incentivizes managers to outperform but can also lead to higher costs for investors. The chapter uses real-world examples to illustrate how hedge funds can profit in both bull and bear markets, citing strategies like long/short equity and global macro as evidence of their adaptability.

For investors, the key takeaway from this chapter is the importance of understanding not just the potential rewards but also the risks and complexities involved in hedge fund investing. Scaramucci advises readers to look beyond the allure of high returns and focus on the fund’s structure, strategy, and risk management practices. He suggests that individual investors can apply hedge fund principles—such as seeking absolute returns and employing hedging techniques—even within their own portfolios. For example, using options or inverse ETFs can help mitigate downside risk, a lesson drawn directly from the hedge fund playbook.

Historically, hedge funds have played a pivotal role in financial markets despite their relatively small size compared to mutual funds. Scaramucci notes that while hedge funds manage a fraction of the assets controlled by mutual funds, their ability to move quickly and employ sophisticated strategies makes them influential market participants. The chapter references the 2008 financial crisis, during which certain hedge funds posted gains by shorting mortgage-backed securities, demonstrating their capacity to profit in adverse conditions. This historical context underscores the value—and the potential pitfalls—of the hedge fund model, setting the stage for deeper exploration in subsequent chapters.

Chapter 2: The Parlor Cars of the Gravy Train

In this chapter, Scaramucci delves into the rich history and evolution of hedge funds, tracing their origins back to Alfred Winslow Jones, who is widely credited with creating the first hedge fund in 1949. Jones pioneered the concept of hedging risk by combining long and short positions, using leverage to amplify returns while protecting against market downturns. The chapter explores how Jones’s innovative approach laid the groundwork for the modern hedge fund industry, which has since grown into a multi-trillion-dollar powerhouse attracting top talent and delivering outsized returns through creative strategies.

Scaramucci provides a detailed account of the industry’s growth, noting that hedge funds were initially viewed as niche, secretive vehicles for the financial elite. Over time, however, their success in navigating volatile markets and generating absolute returns drew increasing attention from institutional investors and high-net-worth individuals. The chapter highlights key milestones, such as the rise of global macro funds in the 1980s and the proliferation of diverse strategies like event-driven and relative value investing. Scaramucci also addresses the criticisms that have dogged the industry—high fees, lack of transparency, and questions about true value—while arguing that hedge funds’ adaptability and innovation have allowed them to thrive.

For investors, this chapter underscores the importance of understanding the historical context and foundational principles of hedge funds. Scaramucci encourages readers to study the evolution of strategies and the lessons learned from past successes and failures. He suggests that by adopting a mindset of continuous learning and adaptability, investors can better navigate the complexities of modern markets. The chapter also highlights the value of seeking out managers who demonstrate both innovation and discipline, rather than simply chasing past performance.

Historically, the hedge fund industry has weathered numerous market cycles, adapting to changing conditions and regulatory landscapes. Scaramucci points to the resilience of hedge funds during periods of crisis, such as the 1998 Long-Term Capital Management collapse and the 2008 financial meltdown. In both cases, while some funds suffered heavy losses, others capitalized on market dislocations, reinforcing the idea that flexibility and strategic diversity are key to long-term success. The chapter’s historical perspective provides valuable lessons for today’s investors, emphasizing the need for both caution and creativity in pursuing superior returns.

Chapter 3: Accessing the Inaccessible

This chapter explores the gradual democratization of hedge fund investing, charting the journey from an exclusive club for the ultra-wealthy to a more accessible asset class for institutional and accredited investors. Scaramucci explains that, historically, hedge funds operated as private partnerships with high minimum investments—often $1 million or more—and limited transparency. Regulatory exemptions allowed them to avoid many disclosure requirements, making them attractive but largely off-limits to the general public. The chapter details how the allure of high returns and innovative strategies fueled demand among pension funds, endowments, and family offices, prompting gradual changes in accessibility.

Scaramucci provides specific examples of how regulatory shifts and the creation of new investment vehicles, such as funds-of-funds and registered alternative products, have broadened access to hedge fund strategies. He notes that while minimum investments remain high, the rise of replication products and alternative mutual funds has enabled smaller investors to participate indirectly. The chapter also discusses the persistent exclusivity of hedge funds, with many top managers still favoring a select clientele to maintain performance and manage risk. Scaramucci highlights the trade-offs: while broader access increases opportunity, it also brings greater scrutiny and regulatory oversight.

For investors, the key lesson is to be aware of both the opportunities and the complexities involved in hedge fund investing. Scaramucci advises readers to carefully assess the suitability of hedge funds for their own portfolios, considering factors such as liquidity, fees, and transparency. He suggests that those unable to meet traditional minimums can still benefit from hedge fund strategies by investing in replication products, alternative mutual funds, or ETFs that mimic hedge fund returns. The chapter encourages investors to stay informed about regulatory developments and to approach new products with a critical eye.

Historically, the gradual opening of the hedge fund world has transformed the investment landscape. Scaramucci references the influx of institutional capital in the early 2000s, which fueled industry growth but also led to increased competition and lower returns. He notes that the proliferation of alternative products has made hedge fund-like returns available to a broader audience, but warns that complexity and risk remain. The chapter’s real-world examples, such as the rise of liquid alternatives post-2008, illustrate the ongoing evolution of access and the need for careful due diligence in navigating this space.

Chapter 4: Heads We Win; Tails You Lose

This chapter tackles one of the most controversial aspects of hedge funds: their fee structures. Scaramucci explains the “two-and-twenty” model, in which managers charge a 2% management fee on assets under management plus a 20% performance fee on profits. He discusses how this structure is designed to align the interests of managers and investors, incentivizing managers to deliver strong returns. However, the chapter also highlights the potential for conflicts of interest, as the lure of performance fees can encourage excessive risk-taking in pursuit of outsized gains.

Scaramucci uses detailed examples to illustrate the impact of fees on investor returns. He shows that a fund earning 15% gross returns would deliver only 11% to investors after fees, and even less when accounting for high-water marks and hurdle rates. The chapter explains that while the performance fee component rewards skill, it can also lead to situations where managers benefit disproportionately from short-term gains while investors bear the brunt of losses. Scaramucci cites industry data showing that, over time, high fees can erode the benefits of active management, particularly in periods of mediocre performance.

For investors, the practical takeaway is the necessity of understanding and negotiating fee structures before committing capital. Scaramucci advises readers to ask detailed questions about how fees are calculated, whether there are clawbacks or high-water marks, and how performance is measured. He suggests comparing net-of-fee returns across funds and considering whether the potential for higher returns justifies the higher costs. The chapter also encourages investors to seek out managers who demonstrate transparency and a willingness to align interests through co-investment or fee concessions.

Historically, the debate over hedge fund fees has intensified as industry growth has brought increased scrutiny. Scaramucci references the post-2008 era, when many institutional investors pushed for lower fees and greater transparency. He notes that some funds have responded by offering lower management fees or performance-only structures, while others have introduced hurdle rates to ensure that managers are only rewarded for true outperformance. The chapter’s analysis of fee dynamics provides a framework for investors to evaluate the real value of hedge fund investments in a world where cost control is increasingly important.

Chapter 5: The Alpha Game

In this chapter, Scaramucci delves into the elusive pursuit of “alpha”—the excess return generated by manager skill rather than market movement. He likens the search for alpha to the quest for El Dorado, emphasizing its rarity and the intense competition among hedge fund managers to achieve it. The chapter explains the distinction between alpha and beta, with beta representing market-driven returns and alpha reflecting the value added through active management. Scaramucci highlights that true alpha is difficult to achieve consistently, as markets are increasingly efficient and information is widely disseminated.

Scaramucci provides concrete examples of hedge funds that have succeeded in generating alpha, such as Renaissance Technologies’ Medallion Fund, which has delivered annualized returns above 30% for decades. He discusses the strategies employed by top managers, including exploiting market inefficiencies, taking contrarian positions, and leveraging advanced data analysis. The chapter also addresses the challenges of sustaining alpha, noting that as more capital flows into successful strategies, opportunities for outperformance diminish. Scaramucci cites academic studies showing that only a small percentage of managers consistently deliver alpha after fees.

For investors, the key lesson is to approach the pursuit of alpha with both ambition and realism. Scaramucci advises readers to carefully evaluate a manager’s track record, investment process, and risk controls before investing. He suggests diversifying across multiple managers or strategies to increase the odds of capturing alpha while mitigating the risk of underperformance. The chapter also encourages investors to be wary of “hot hands” and to focus on process over short-term results, recognizing that even the best managers experience periods of drawdown.

Historically, the quest for alpha has driven innovation and competition in the hedge fund industry. Scaramucci references the rise of quant funds, the use of alternative data, and the increasing sophistication of risk models as evidence of the ongoing arms race for outperformance. He notes that while the bar for generating alpha has risen, the rewards for those who succeed remain substantial. The chapter’s blend of optimism and caution provides a balanced perspective on the realities of active management in today’s markets.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Ironing Out Inefficiencies

This chapter focuses on the core principle that hedge funds exist to exploit market inefficiencies—mispricings, overreactions, and anomalies that skilled managers can turn into profits. Scaramucci explains that while the Efficient Market Hypothesis suggests that prices reflect all available information, real-world markets are rife with inefficiencies due to behavioral biases, regulatory changes, and structural factors. The chapter details how hedge funds use rigorous research, data analysis, and contrarian thinking to identify and capitalize on these opportunities.

Scaramucci provides specific examples of inefficiency exploitation, such as Paulson & Co.’s famous bet against subprime mortgages in 2007, which netted billions by recognizing the mispricing of mortgage-backed securities. He discusses the importance of deep fundamental analysis, alternative data sources, and the willingness to go against consensus when warranted. The chapter also highlights the risks involved, noting that not all inefficiencies are exploitable and that failed bets can lead to significant losses. Scaramucci stresses the need for robust risk management and the discipline to cut losses when trades go awry.

For investors, the practical application lies in adopting a research-driven approach to portfolio construction. Scaramucci advises readers to look for inefficiencies in their own markets—whether in small-cap stocks, niche sectors, or under-followed geographies—and to use tools like screening, quantitative analysis, and scenario modeling to uncover opportunities. He suggests that individual investors can benefit from contrarian thinking, such as buying undervalued assets during periods of panic or selling into euphoria. The chapter also encourages ongoing learning and adaptation as markets evolve.

Historically, the exploitation of market inefficiencies has been the engine of hedge fund outperformance. Scaramucci references the evolution of strategies from simple long/short equity to complex statistical arbitrage and high-frequency trading. He notes that as technology advances and competition intensifies, the window for exploiting inefficiencies narrows, requiring ever-greater skill and innovation. The chapter’s insights into the mechanics of alpha generation provide a roadmap for investors seeking to apply hedge fund principles in their own portfolios.

Chapter 7: A Balancing Act

In this chapter, Scaramucci explores the art and science of portfolio construction within hedge funds, emphasizing the importance of balancing risk and return through diversification and strategic mix. He explains that hedge funds rarely rely on a single strategy; instead, they blend approaches such as long/short equity, relative value, and event-driven investing to create portfolios that can withstand a variety of market environments. The chapter details how each strategy has its own risk-return profile and how their combination can reduce overall volatility while enhancing the potential for positive returns.

Scaramucci provides concrete examples of multi-strategy funds, such as Bridgewater Associates, which uses a combination of macroeconomic analysis, risk parity, and tactical asset allocation to manage risk and seek consistent returns. He discusses the mechanics of long/short equity—profiting from both rising and falling stocks—relative value trades that exploit price discrepancies between related securities, and event-driven strategies that capitalize on corporate actions like mergers or bankruptcies. The chapter highlights the importance of diversification not just across asset classes, but also across time horizons and geographic regions.

For investors, the key takeaway is the value of building a balanced portfolio that can weather market turbulence. Scaramucci advises readers to diversify across strategies, asset classes, and risk factors, rather than relying solely on traditional stocks and bonds. He suggests using tools like correlation analysis, scenario testing, and risk budgeting to optimize portfolio construction. The chapter also encourages investors to periodically rebalance their holdings to ensure alignment with their risk tolerance and investment objectives.

Historically, the multi-strategy approach has helped hedge funds navigate crises and capitalize on shifting market dynamics. Scaramucci references the performance of diversified funds during the 2008 financial crisis, when some strategies faltered but others thrived, resulting in overall resilience. He notes that the ability to pivot between strategies and adjust exposures in real time is a hallmark of successful hedge fund management. The chapter’s insights into portfolio construction are directly applicable to individual investors seeking to enhance diversification and manage risk in their own portfolios.

Chapter 8: If You Can’t Beat ’Em, Join ’Em

This chapter examines the rise of hedge fund replication strategies—approaches that seek to mimic the returns of successful hedge funds using quantitative models, ETFs, or alternative mutual funds. Scaramucci explains that as demand for hedge fund-like returns has grown, so too has the market for replication products that offer similar exposures at lower cost and with greater transparency. The chapter details how replication models identify key factors driving hedge fund performance and use them to construct portfolios that approximate the risk-return profile of top funds.

Scaramucci provides specific examples of replication products, such as the IQ Hedge Multi-Strategy Tracker ETF and the AlphaClone Alternative Alpha ETF, which use public data and proprietary algorithms to emulate hedge fund strategies. He discusses the advantages of replication—lower fees, daily liquidity, and broader access—as well as the challenges, including the difficulty of accurately capturing dynamic, often opaque hedge fund positions. The chapter notes that while replication can offer attractive risk-adjusted returns, it may lag true hedge funds in periods of rapid market change or when unique insights drive outperformance.

For investors, the practical takeaway is that replication products can be a valuable addition to a diversified portfolio, particularly for those unable to meet traditional hedge fund minimums. Scaramucci advises readers to evaluate the methodology, track record, and risk controls of replication products before investing. He suggests using replication as a complement to, rather than a substitute for, direct hedge fund exposure or active management. The chapter also highlights the importance of understanding the limitations of replication and maintaining realistic expectations about potential returns.

Historically, the proliferation of replication products has democratized access to hedge fund strategies, allowing a broader range of investors to benefit from alternative approaches. Scaramucci references the post-2008 boom in liquid alternatives and the growing use of factor-based investing as evidence of this trend. He notes that while replication has its drawbacks, it represents a meaningful step toward greater transparency and cost efficiency in the alternative investment space. The chapter’s analysis offers a practical framework for investors seeking to harness the benefits of hedge fund strategies without the traditional barriers to entry.

Chapter 9: The Men Behind the Curtains

This chapter shines a light on the often-overlooked world of hedge fund operations, emphasizing that investment success depends not only on portfolio managers but also on the strength of the operational team. Scaramucci explains that risk management, compliance, accounting, and technology are critical functions that ensure the smooth running of a hedge fund. The chapter details how operational failures—such as inadequate risk controls or regulatory breaches—can lead to catastrophic losses, regardless of investment acumen.

Scaramucci provides real-world examples of operational challenges, including the collapse of funds due to fraud, poor oversight, or technology failures. He discusses the importance of building robust systems for trade execution, risk monitoring, and regulatory compliance. The chapter highlights that top funds invest heavily in talent and infrastructure, recognizing that operational excellence is a competitive advantage. Scaramucci notes that due diligence should extend beyond the investment team to include an assessment of the fund’s operational capabilities and culture.

For investors, the key lesson is to evaluate the entire organization, not just the star manager. Scaramucci advises readers to ask detailed questions about risk management processes, compliance protocols, and operational track records before investing. He suggests that individual investors can apply similar principles by establishing clear rules for trade execution, record-keeping, and risk controls in their own portfolios. The chapter also encourages ongoing monitoring and adaptation as regulatory and technological landscapes evolve.

Historically, operational excellence has been a differentiator in the hedge fund industry, separating sustainable success from costly failure. Scaramucci references high-profile cases such as the collapse of Amaranth Advisors and the Madoff scandal as cautionary tales. He notes that as regulatory scrutiny increases and technology advances, the bar for operational competence continues to rise. The chapter’s focus on the “men behind the curtains” underscores the importance of organizational strength in achieving long-term investment success.

Chapter 10: From Wall Street to Park Avenue

The final chapter explores the migration of top talent from traditional investment banking to the hedge fund industry, a trend that has transformed the landscape of modern finance. Scaramucci describes how, over the past few decades, hedge funds have become the destination of choice for ambitious professionals seeking greater autonomy, higher earnings, and the opportunity to implement sophisticated investment strategies. The chapter examines the skills and mindset required to succeed in the hedge fund world, emphasizing the importance of analytical rigor, risk tolerance, and independent thinking.

Scaramucci provides examples of successful career transitions, highlighting individuals who leveraged their experience in trading, portfolio management, or research to excel in hedge fund roles. He discusses the importance of building a strong professional network, gaining exposure to diverse strategies, and continuously upgrading one’s skills. The chapter offers practical advice for those considering a move into the industry, including the value of mentorship, ongoing education, and a willingness to embrace uncertainty and innovation.

For investors, the lesson is that talent and culture are critical drivers of hedge fund performance. Scaramucci advises readers to assess not only a fund’s strategy and track record but also the quality and stability of its team. He suggests that individual investors can benefit from adopting a growth mindset, seeking out new learning opportunities, and cultivating relationships with experienced professionals. The chapter also highlights the importance of adaptability, noting that the most successful hedge fund professionals are those who can navigate change and thrive in dynamic environments.

Historically, the influx of Wall Street talent has fueled competition and innovation in the hedge fund industry, raising the bar for performance and professionalism. Scaramucci references the ongoing evolution of the industry, with new entrants bringing fresh perspectives and driving the development of novel strategies. He notes that as the industry continues to mature, opportunities will abound for those with the right skills, mindset, and willingness to innovate. The chapter’s focus on human capital provides a fitting conclusion to the book, reinforcing the idea that investment success ultimately depends on people as much as process.

Advanced Strategies from the Book

While The Little Book of Hedge Funds is accessible to readers at all levels, Scaramucci does not shy away from exploring the advanced techniques that set top funds apart. These strategies require a deep understanding of markets, data analysis, and risk management, but even individual investors can adapt elements of these approaches to enhance their own portfolios. The following advanced strategies highlight the innovation and sophistication that define the hedge fund industry, offering practical insights for those seeking to move beyond the basics.

Scaramucci’s advanced techniques focus on exploiting inefficiencies, leveraging alternative data, and dynamically managing risk. He emphasizes that successful implementation requires not just technical skill, but also discipline, adaptability, and a willingness to learn from both successes and failures. Below, we detail several advanced strategies featured in the book, each with examples and actionable takeaways.

Strategy 1: Statistical Arbitrage

Statistical arbitrage involves using quantitative models to identify and exploit short-term mispricings between related securities. Hedge funds deploy sophisticated algorithms that analyze historical price relationships, trading volumes, and volatility patterns to detect anomalies. For example, a fund might pair trade two highly correlated stocks—buying one and shorting the other—when their price relationship diverges from historical norms, expecting convergence. Scaramucci notes that firms like D.E. Shaw and Citadel have built entire businesses around these strategies, employing teams of PhDs and leveraging vast computational resources. Individual investors can apply simplified versions by using correlation analysis and backtesting to identify potential pairs trades, though the edge is narrower as competition and technology advance.

Strategy 2: Event-Driven Investing

Event-driven strategies focus on profiting from corporate actions such as mergers, acquisitions, restructurings, or bankruptcies. Hedge funds analyze deal terms, regulatory risks, and market sentiment to assess the likelihood and timing of events, positioning their portfolios to benefit from price movements before and after announcements. For instance, in a merger arbitrage scenario, a fund might buy the target company’s shares and short the acquirer’s, capturing the spread if the deal closes. Scaramucci highlights the success of funds like Elliott Management and Paulson & Co., which have made billions exploiting event-driven opportunities. Investors can adapt this approach by monitoring corporate news, analyzing deal spreads, and using options to manage risk.

Strategy 3: Global Macro Trading

Global macro strategies involve making large, directional bets on macroeconomic trends, such as interest rates, currencies, commodities, or geopolitical events. Hedge funds like Bridgewater Associates and Soros Fund Management have famously profited from predicting shifts in economic policy, currency devaluations, or commodity cycles. These strategies require a deep understanding of global markets, economic indicators, and policy dynamics. Scaramucci suggests that individual investors can incorporate macro analysis by following economic data releases, monitoring central bank actions, and using ETFs or futures to express thematic views. However, he cautions that macro trading is high-risk and best approached with discipline and diversification.

Strategy 4: Alternative Data and Machine Learning

As traditional sources of alpha become increasingly competitive, hedge funds are turning to alternative data—such as satellite imagery, credit card transactions, and social media sentiment—to gain an edge. Scaramucci discusses how funds integrate machine learning algorithms to process and interpret vast datasets, uncovering patterns and predictive signals overlooked by conventional analysis. For example, a fund might analyze shipping traffic or retail footfall to forecast earnings surprises. While access to alternative data is more limited for individual investors, Scaramucci encourages readers to experiment with new data sources and analytics tools, emphasizing the importance of staying ahead of the curve in a rapidly evolving landscape.

Strategy 5: Dynamic Risk Parity

Dynamic risk parity is an advanced portfolio construction technique that allocates capital based on risk contribution rather than market value. Hedge funds adjust exposures dynamically in response to changing volatility, correlations, and macroeconomic conditions. For example, if equity volatility rises, the fund reduces stock exposure and increases allocations to bonds or commodities to maintain a balanced risk profile. Scaramucci highlights Bridgewater’s All Weather Fund as a pioneer in this space, demonstrating the power of risk-based allocation to deliver consistent returns across market cycles. Investors can implement basic risk parity principles by regularly rebalancing portfolios and monitoring risk metrics, though full implementation requires sophisticated modeling and data analysis.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Translating the lessons of The Little Book of Hedge Funds into actionable steps requires both discipline and adaptability. Scaramucci’s framework emphasizes the importance of research, risk management, and ongoing learning. Whether you’re an individual investor or an institutional allocator, the following guide outlines concrete steps for implementing hedge fund-inspired strategies in your own portfolio.

Begin by clarifying your investment objectives and risk tolerance. Assess your current portfolio for diversification, exposure to alternative strategies, and potential vulnerabilities. Use the insights from the book to identify areas where you can enhance returns or reduce risk—whether through new asset classes, replication products, or improved risk controls. Remember that successful implementation is an ongoing process, requiring regular review and adjustment as markets and personal circumstances evolve.

- First step investors should take: Conduct a comprehensive review of your current portfolio, identifying gaps in diversification and exposure to alternative strategies. Set clear objectives for risk, return, and liquidity.

- Second step for building the strategy: Research and select appropriate hedge fund-inspired products or strategies, such as replication ETFs, alternative mutual funds, or direct investments in funds (if eligible). Analyze fee structures, risk controls, and historical performance.

- Third step for long-term success: Establish a disciplined monitoring and rebalancing process. Regularly review performance, risk metrics, and market conditions, making adjustments as needed to stay aligned with your objectives. Invest in ongoing education to stay current with industry trends and innovations.

Critical Analysis

The Little Book of Hedge Funds excels in translating the complex world of hedge funds into clear, actionable insights. Scaramucci’s writing is engaging, accessible, and grounded in real-world experience, making the book both informative and enjoyable. The chapter-by-chapter structure allows readers to build knowledge incrementally, while the use of concrete examples and practical advice ensures that concepts are immediately applicable. The book’s balanced perspective—celebrating the successes of hedge funds while acknowledging their controversies—adds credibility and depth.

However, the book does have some limitations. While Scaramucci provides a comprehensive overview of hedge fund strategies and structures, the discussion of advanced techniques may be too high-level for readers seeking detailed implementation guidance. The focus on U.S. markets and regulations may also limit applicability for international investors. Additionally, the book’s optimism about hedge fund performance may understate the challenges of consistently achieving alpha, especially in today’s highly competitive, data-driven environment.

In the current market environment—characterized by low interest rates, increased volatility, and rapid technological change—the lessons of The Little Book of Hedge Funds are particularly relevant. The emphasis on risk management, diversification, and adaptability aligns well with the needs of modern investors. While direct hedge fund investment remains out of reach for many, the book’s core principles can be applied to any portfolio, helping investors navigate uncertainty and pursue superior returns.

Conclusion

The Little Book of Hedge Funds is an indispensable resource for anyone seeking to understand or apply the principles of alternative investing. Anthony Scaramucci’s blend of history, strategy, and practical advice makes the book both a primer and a playbook for success in today’s markets. Readers come away with a clear understanding of what makes hedge funds unique—and how their core lessons can be adapted to any investment approach.

The book’s greatest strength lies in its ability to demystify hedge funds, stripping away jargon and complexity to reveal the underlying principles that drive success. By focusing on absolute returns, risk management, and strategic flexibility, Scaramucci provides a roadmap that is both timeless and timely. Whether you’re an aspiring professional, a seasoned investor, or simply curious about the evolution of modern finance, this book offers insights that will enhance your understanding and improve your results.

In a world where uncertainty and complexity are the norm, The Little Book of Hedge Funds equips readers with the tools, mindset, and confidence to navigate the markets with skill and discipline. Its lessons are as relevant for the next generation of investors as they are for today’s leaders, making it a valuable addition to any financial library.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Hedge Funds

1. Who is Anthony Scaramucci and why is he qualified to write about hedge funds?

Anthony Scaramucci is the founder and managing partner of SkyBridge Capital, a global alternative investment firm with billions under management. He has decades of experience on Wall Street, including roles at Goldman Sachs and as a hedge fund manager. His deep industry knowledge and candid writing style make him a credible and engaging guide to the world of hedge funds.

2. What makes hedge funds different from mutual funds or ETFs?

Hedge funds are private investment vehicles that use a wide range of strategies—including leverage, derivatives, and short selling—to pursue absolute returns. Unlike mutual funds or ETFs, which are typically benchmarked against indices and subject to strict regulations, hedge funds have more flexibility but are generally limited to accredited investors due to their complexity and risk.

3. Are hedge funds only for the ultra-wealthy?

Historically, hedge funds were accessible only to high-net-worth individuals and institutions due to high minimum investments and regulatory restrictions. However, the rise of replication products and alternative mutual funds has made hedge fund-like returns available to a broader range of investors, though direct investment still requires significant capital and accreditation.

4. What is the “two-and-twenty” fee structure?

The standard fee model for hedge funds is 2% of assets under management plus 20% of profits. This structure is designed to align manager and investor interests but can lead to higher costs compared to traditional funds. Investors should carefully evaluate whether the potential for higher returns justifies the higher fees.

5. Can individual investors apply hedge fund strategies in their own portfolios?

Yes, many hedge fund principles—such as diversification, risk management, and seeking absolute returns—can be adapted by individual investors. Tools like options, inverse ETFs, and replication products allow investors to hedge risk and pursue alternative strategies, even without direct access to hedge funds.

6. How do hedge funds generate “alpha”?

Alpha refers to returns generated by manager skill rather than market movement. Hedge funds seek alpha by exploiting market inefficiencies, taking contrarian positions, and leveraging advanced data analysis. However, generating consistent alpha is challenging and requires deep research, discipline, and innovation.

7. What are hedge fund replication strategies?

Replication strategies use quantitative models, ETFs, or mutual funds to mimic the returns of hedge funds. These products provide access to hedge fund-like returns with lower fees and greater liquidity, making them accessible to a wider audience. However, replication may lag true hedge funds in periods of rapid market change.

8. What risks should investors consider before investing in hedge funds?

Hedge funds carry risks such as illiquidity, leverage, complex strategies, and less regulatory oversight. Investors should conduct thorough due diligence, understand fee structures, and assess the fund’s risk management processes before investing. Diversification and regular monitoring are essential for managing these risks.

9. How important is the operational team in a hedge fund?

The operational team is critical to a hedge fund’s success, handling risk management, compliance, accounting, and logistics. Operational failures can lead to significant losses, so investors should evaluate the strength and experience of the entire organization—not just the portfolio manager.

10. Is The Little Book of Hedge Funds relevant for today’s market environment?

Absolutely. The book’s emphasis on risk management, diversification, and adaptability is especially relevant in today’s volatile, low-rate environment. Its lessons apply to both institutional and individual investors seeking to navigate uncertainty and pursue superior risk-adjusted returns.