The Little Book of Investing Like the Pros by Joshua Pearl, Joshua Rosenbaum

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

"The Little Book of Investing Like the Pros" by Joshua Pearl and Joshua Rosenbaum stands out as a practical, accessible guide for investors seeking to adopt professional-grade stock-picking strategies. Both authors bring exceptional credibility: Joshua Pearl is a renowned investment banker and founder of Hickory Lane Capital Management, while Joshua Rosenbaum is a managing director at RBC Capital Markets and co-author of the acclaimed "Investment Banking: Valuation, Leveraged Buyouts, and Mergers & Acquisitions." Their combined expertise bridges the gap between Wall Street insiders and individual investors, making complex concepts understandable and actionable for a broad audience.

The core theme of the book is to demystify the stock-picking process by offering a clear, step-by-step framework that mirrors the methods used by top institutional investors. The authors emphasize that successful investing is not about speculation or luck, but about disciplined analysis, structured processes, and a keen understanding of business fundamentals. By breaking down the investment process into five manageable steps—idea generation, identifying the best ideas, business and financial due diligence, valuation and catalysts, and investment decision and portfolio management—they empower readers to move beyond guesswork and adopt a more systematic, evidence-based approach.

This book is particularly valuable for individual investors at all levels, from beginners eager to learn the ropes to experienced market participants looking to refine their process. Pearl and Rosenbaum recognize the lack of accessible resources for non-professional investors and aim to democratize the tools and techniques typically reserved for hedge funds and institutional players. The book’s practical orientation, with real-world examples and templates, ensures that readers can immediately apply what they learn to their own portfolios.

What sets "The Little Book of Investing Like the Pros" apart is its focus on actionable skills over abstract theory. The authors provide not just the “what” but the “how”—from using screening tools to generate ideas, to building financial models, to identifying critical catalysts that drive stock prices. Their approach is rooted in the realities of the market, addressing common pitfalls and emphasizing risk management at every stage. The book is concise yet comprehensive, making it an essential read for anyone serious about building long-term wealth through disciplined investing.

Key Concepts and Ideas

At its heart, "The Little Book of Investing Like the Pros" advocates for a structured, repeatable investment process grounded in rigorous analysis and sound judgment. The authors believe that anyone can achieve above-average investment results by following the disciplined steps used by professional investors. Rather than chasing hot tips or speculative trades, Pearl and Rosenbaum urge readers to focus on understanding businesses, evaluating financials, and identifying clear catalysts for value realization.

The book’s investment philosophy is rooted in the belief that markets are not always efficient, and that careful research can uncover mispriced stocks. The authors stress the importance of both qualitative and quantitative analysis, highlighting that a successful investor must be part detective, part analyst, and part risk manager. Through real-world examples and practical tools, the book equips readers to navigate the complexities of the stock market with confidence.

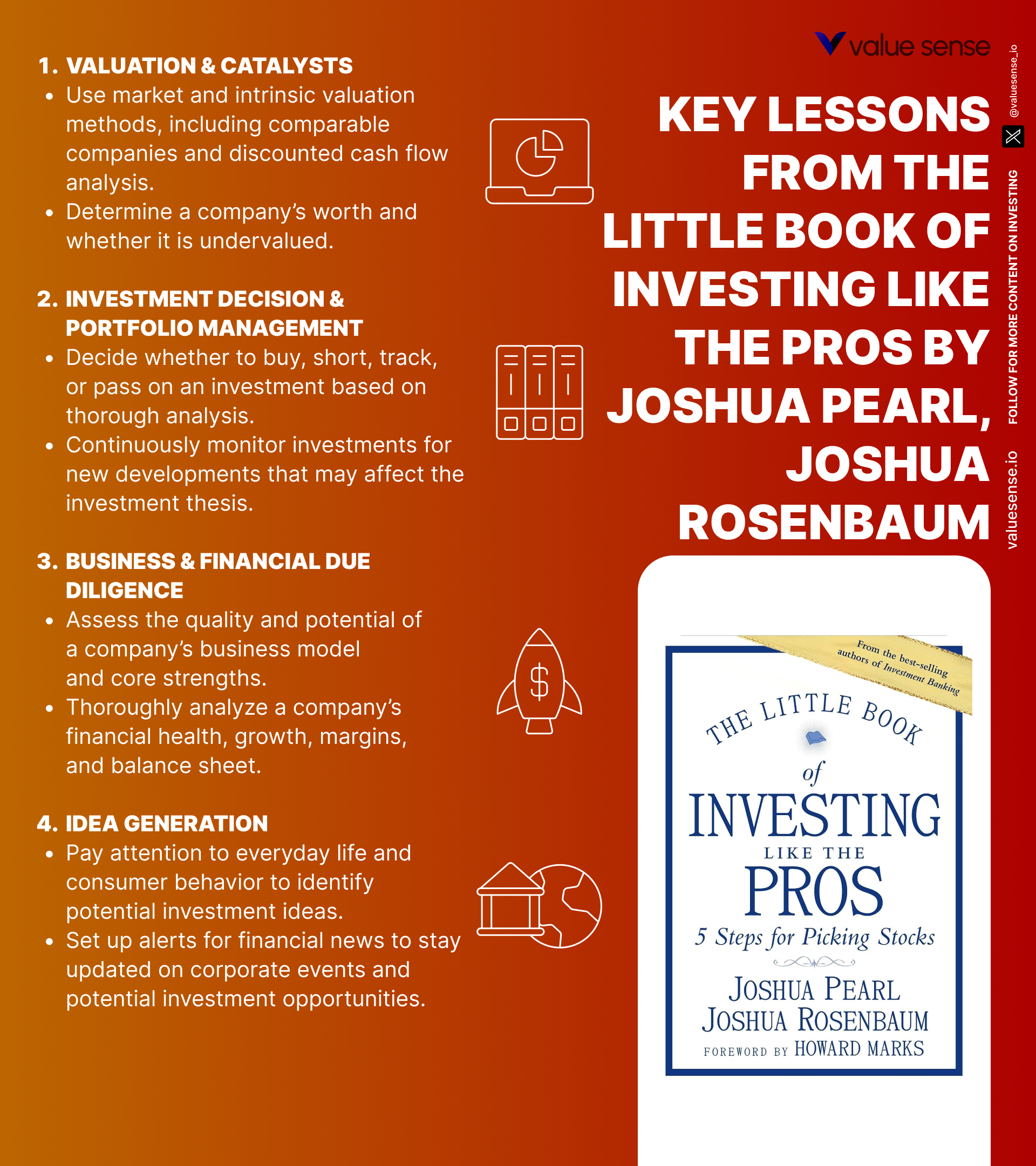

- Structured Five-Step Framework: The central concept is a five-step process—idea generation, filtering for the best ideas, due diligence, valuation and catalysts, and investment decision/portfolio management. This framework mirrors how top institutional investors approach stock picking and ensures nothing critical is overlooked.

- Bottom-Up and Top-Down Analysis: The book explains the difference between bottom-up (company-specific) and top-down (macro/industry) approaches to idea generation. It argues that combining both gives investors a fuller picture and helps identify high-potential opportunities.

- Use of Screening Tools: Pearl and Rosenbaum emphasize the power of screening tools to efficiently narrow down thousands of stocks to a manageable list based on criteria like valuation, growth, and financial health. This saves time and increases the odds of finding winners.

- Investment Thesis Development: Every investment should start with a clear, well-articulated thesis. The authors stress that a strong thesis—based on business drivers, competitive advantages, and catalysts—guides the entire research process and helps avoid emotional decisions.

- Comprehensive Due Diligence: The book details the importance of both qualitative (business model, management, industry) and quantitative (financial statements, projections) due diligence. This dual approach helps investors understand what makes a company tick and spot potential red flags.

- Valuation Techniques: Pearl and Rosenbaum teach readers how to use market-based (comparable companies, precedent transactions) and intrinsic (discounted cash flow) valuation methods. These tools help determine if a stock is truly undervalued or overvalued relative to its fundamentals.

- Catalyst Identification: A unique aspect of the framework is the focus on catalysts—specific events or developments that can drive a stock’s price toward its intrinsic value. Examples include earnings surprises, M&A activity, or regulatory changes.

- Risk Management and Diversification: The authors highlight the necessity of managing risk through portfolio diversification, position sizing, and the use of stop-losses or hedges. They argue that protecting capital is as important as seeking returns.

- Active Portfolio Monitoring: The book stresses the importance of ongoing monitoring and periodic rebalancing to ensure each holding still fits the original thesis and risk profile. This discipline prevents small mistakes from becoming large losses.

- Documentation and Templates: Pearl and Rosenbaum provide practical templates for investment write-ups and research checklists. This structured documentation ensures consistency, thoroughness, and easier comparison between investment ideas.

Practical Strategies for Investors

The teachings from "The Little Book of Investing Like the Pros" are designed to be immediately implementable, regardless of your experience level. Pearl and Rosenbaum’s process-oriented approach encourages investors to move beyond gut instinct and speculation, instead relying on data, structured analysis, and clear decision rules. By following their strategies, investors can systematically uncover undervalued stocks, avoid common pitfalls, and build a resilient portfolio.

Applying the book’s strategies starts with developing a disciplined research routine. Investors are encouraged to use screening tools, build investment theses, and conduct thorough due diligence before making any investment decision. The authors provide step-by-step action plans for each stage, ensuring that readers can put theory into practice. The focus on actionable steps—such as setting price targets, monitoring catalysts, and managing risk—makes the book a valuable resource for anyone seeking to improve their investment outcomes.

- Develop a Repeatable Screening Process: Set up stock screeners using parameters like low price-to-earnings ratios, high return on equity, or consistent revenue growth. Review the output weekly to identify new opportunities and keep a running watchlist.

- Write a Clear Investment Thesis for Every Stock: Before investing, draft a one-page thesis outlining why the stock should outperform, what the key drivers are, and what could go wrong. Refer to this document before making buy, hold, or sell decisions.

- Conduct Layered Due Diligence: Start with a high-level review (business model, management, basic financials), then move to deeper analysis (competitive positioning, detailed financial projections, industry dynamics) for your top ideas.

- Use Multiple Valuation Methods: Apply at least two valuation techniques—such as DCF and comparable companies—to each stock. Compare your results to current market prices and set a target price based on your most conservative estimate.

- Identify and Track Catalysts: For each investment, list potential catalysts (earnings, product launches, regulatory changes) and monitor for updates. Only invest when you see a realistic path for value to be unlocked within a reasonable timeframe.

- Implement Strict Risk Controls: Limit position sizes to avoid overexposure. Use stop-loss orders or trailing stops to protect against large losses. Consider hedging with options or inverse ETFs during periods of elevated market risk.

- Diversify Across Sectors and Styles: Build a portfolio with exposure to different industries, geographies, and investment styles (value, growth, defensive) to reduce correlation and smooth returns.

- Regularly Review and Rebalance: Schedule quarterly portfolio reviews to reassess each holding’s thesis, valuation, and risk profile. Rebalance to maintain target allocations and trim positions that no longer meet your criteria.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

"The Little Book of Investing Like the Pros" is meticulously structured to guide readers through the full investment process, from the initial spark of an idea to the ongoing management of a diversified portfolio. Each chapter corresponds to a critical step in the framework and builds upon the last, creating a logical and actionable progression. The authors use real-world examples, professional templates, and detailed checklists to ensure that readers not only understand the theory but can also apply it in practice.

The book is organized into five main steps, each covered in a dedicated chapter, with an introduction and supporting sections that reinforce the core concepts. Each chapter provides both a big-picture view and granular, actionable details, making it possible for investors to follow along and implement the strategies as they read. The following chapter-by-chapter analysis unpacks the key lessons, practical applications, and real-world context from each major section of the book, offering a comprehensive roadmap for anyone seeking to invest like a pro.

Chapter 1: Introduction

The opening chapter sets the tone for the entire book by highlighting the need for a structured, step-by-step approach to investing. Pearl and Rosenbaum recognize that many individual investors are overwhelmed by the complexity of the stock market, leading to decisions driven more by emotion or speculation than by sound analysis. They argue that without a clear framework, investors are prone to making costly mistakes, such as chasing hot tips, reacting to market noise, or failing to assess risk properly. The authors introduce their mission: to democratize the professional investment process and make it accessible to everyone, regardless of background or experience.

Throughout the introduction, the authors emphasize the practical nature of their approach, noting that the book is designed to bridge the gap between Wall Street professionals and everyday investors. They share anecdotes from their own careers, illustrating how even seasoned professionals rely on process and discipline to succeed. Pearl and Rosenbaum reference legendary investors like Warren Buffett and Peter Lynch, who attribute their success to a repeatable, research-driven process rather than luck. The introduction also addresses the proliferation of investing resources online, many of which lack the rigor and structure necessary for sustained success.

For investors, the key takeaway from this chapter is the importance of establishing a personal investment process. The authors recommend starting with clear goals, a defined research routine, and a commitment to continuous learning. They suggest keeping an investment journal to document decisions and reflect on outcomes, a practice that can reveal patterns and help avoid repeating mistakes. Pearl and Rosenbaum also stress that successful investing is a journey, not a one-time event, and that building expertise takes time and deliberate practice.

Historically, the lack of accessible, high-quality investing resources has disadvantaged retail investors relative to institutions. The authors cite the evolution of online brokerages and the rise of financial blogs as positive developments but caution that information overload can be just as dangerous as ignorance. By providing a concise, actionable roadmap, "The Little Book of Investing Like the Pros" aims to level the playing field and empower readers to take control of their financial futures. The introduction lays the groundwork for the detailed process that follows, setting expectations for a hands-on, skill-building experience.

Chapter 2: Step I - Idea Generation

This chapter dives into the critical first step of the investment process: generating high-quality stock ideas. Pearl and Rosenbaum explain that idea generation is both an art and a science, requiring discipline, curiosity, and a systematic approach. They introduce two primary methods: the bottom-up approach, which starts with individual companies and focuses on business drivers, financial health, and valuation; and the top-down approach, which begins with macroeconomic trends and industry themes to identify promising sectors or markets. The authors argue that both methods have merit and that experienced investors often combine them to maximize their opportunity set.

The chapter provides practical guidance on using screening tools to sift through thousands of stocks and identify candidates that meet specific criteria. For example, investors might screen for companies with low price-to-earnings ratios, high return on equity, or strong earnings growth. Pearl and Rosenbaum include case studies of how professional investors use screens to surface ideas and then apply qualitative judgment to refine their lists. They also discuss the importance of patience and discipline, noting that it can take reviewing dozens of companies to find one truly compelling opportunity.

For readers, the actionable takeaway is to establish a repeatable idea generation process. The authors recommend setting up custom screens using free or low-cost tools like Yahoo Finance, Finviz, or Value Sense’s analytics platform. They suggest maintaining a watchlist of interesting stocks and revisiting it regularly as new data becomes available. Investors are encouraged to read widely—industry reports, earnings transcripts, and news articles—to stay abreast of emerging trends and potential catalysts.

In the broader context, the authors point out that some of history’s best investments have come from diligent idea generation. They reference Peter Lynch’s practice of “investing in what you know,” as well as Buffett’s exhaustive reading of annual reports. By combining structured screening with open-minded curiosity, investors can uncover opportunities that the broader market may overlook. The chapter concludes by reiterating that consistent, high-quality idea generation is the foundation of any successful investment strategy.

Chapter 3: Step II - Identifying the Best Ideas

Once a list of potential investments has been generated, the next step is to filter and identify the best ideas. Pearl and Rosenbaum introduce a framework that focuses on five key factors: the investment thesis, business model, management team, risks, and financials. They argue that conducting a preliminary analysis on each of these aspects allows investors to quickly weed out weaker ideas and focus their efforts on the most promising opportunities. The authors provide templates and checklists to help readers organize their research and ensure consistency across different stocks.

The chapter includes detailed examples of how to construct an investment thesis, emphasizing that it should clearly articulate why a particular stock is expected to outperform. The authors suggest that a strong thesis is grounded in specific business or market factors—such as a company’s competitive advantage, a secular growth trend, or an upcoming catalyst. They also discuss the importance of evaluating management quality, industry dynamics, and potential risks, including competitive threats, regulatory changes, or financial red flags.

For investors, the practical application is to adopt a standardized approach to preliminary analysis. Pearl and Rosenbaum recommend using a one-page write-up for each idea, summarizing the thesis, key drivers, risks, and valuation metrics. This documentation not only clarifies thinking but also facilitates comparison across different opportunities. The authors stress that it is better to spend more time upfront filtering ideas than to waste resources on deep analysis of weak candidates.

Historically, the ability to quickly distinguish between good and bad ideas has separated successful investors from the rest. The authors reference examples from hedge funds and mutual funds, where analysts are expected to present concise, well-structured pitches before deeper research is approved. By adopting these professional practices, individual investors can dramatically improve their efficiency and focus. The chapter concludes by encouraging readers to be ruthless in their filtering, as only the best ideas deserve further attention.

Chapter 4: Step III - Business & Financial Due Diligence

This chapter delves into the heart of investment research: conducting thorough business and financial due diligence. Pearl and Rosenbaum stress that understanding both the qualitative and quantitative aspects of a company is essential for evaluating its long-term potential. They outline a process that begins with analyzing the business model, competitive positioning, and industry dynamics, then moves to a detailed review of financial statements and key metrics. The authors provide step-by-step guidance on how to read income statements, balance sheets, and cash flow statements, highlighting the importance of profitability, cash generation, and balance sheet strength.

The chapter includes examples of how to build simple financial models and projections, using realistic assumptions to estimate future performance. Pearl and Rosenbaum explain how to assess growth rates, margins, and leverage, and how these factors influence a company’s valuation and risk profile. They also discuss the importance of identifying red flags, such as inconsistent earnings, high debt levels, or frequent management turnover, which can signal deeper problems. The authors share anecdotes from their own careers, where rigorous due diligence uncovered issues that less careful investors missed.

For readers, the actionable strategy is to develop a checklist-driven approach to due diligence. The authors recommend creating a standardized template for each company, covering both qualitative and quantitative factors. They suggest starting with a “quick and dirty” analysis to spot obvious red flags, then moving to a deeper dive for companies that pass the initial screen. Investors are encouraged to compare their findings to industry peers and historical performance to gain context.

In the broader investment landscape, the importance of due diligence cannot be overstated. The authors reference historical blowups—such as Enron and WorldCom—where superficial analysis led to catastrophic losses. They also highlight success stories where diligent research uncovered hidden gems, such as Apple in the early 2000s or Netflix before its streaming pivot. By prioritizing thorough due diligence, investors can avoid costly mistakes and position themselves for outsized returns.

Chapter 5: Step IV - Valuation & Catalysts

Valuation is the linchpin of the investment process, and this chapter provides a comprehensive overview of the most widely used techniques. Pearl and Rosenbaum explain the difference between market-based methods (comparable companies, precedent transactions) and intrinsic valuation (discounted cash flow analysis). They provide detailed examples of how to apply each method, including the selection of appropriate multiples, adjustment for growth rates, and sensitivity analysis. The authors emphasize that no single method is perfect and that triangulating across several approaches yields the most robust results.

The chapter also introduces the concept of catalysts—specific events or developments that can drive a stock’s price toward its intrinsic value. Examples include earnings surprises, regulatory approvals, M&A activity, or strategic initiatives like product launches or cost-cutting programs. Pearl and Rosenbaum argue that a stock can remain undervalued for years without a catalyst, and that identifying these triggers is critical for timing investments and maximizing returns. They share case studies of how professional investors monitor for upcoming catalysts and adjust their portfolios accordingly.

For investors, the practical application is to use at least two valuation methods for each stock and to set a conservative price target based on the most reliable inputs. The authors recommend documenting all assumptions and regularly revisiting them as new information emerges. Investors should also maintain a catalyst calendar for each holding, tracking key dates and events that could impact the stock’s trajectory. This proactive approach helps avoid the frustration of “value traps”—stocks that appear cheap but lack a clear path to revaluation.

Historically, the combination of rigorous valuation and catalyst identification has been central to the success of many legendary investors. The authors reference Buffett’s use of discounted cash flow analysis, as well as the event-driven strategies employed by hedge funds like Pershing Square and Third Point. In today’s fast-moving markets, the ability to anticipate and capitalize on catalysts can make the difference between mediocre and outstanding performance. The chapter concludes by reiterating the importance of discipline and documentation in the valuation process.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Step V - Investment Decision & Portfolio Management

The final step in the process is making the investment decision and managing the portfolio over time. Pearl and Rosenbaum guide readers through the process of deciding whether to buy, hold, or sell a stock based on the analysis conducted in the previous steps. They emphasize that the decision should be grounded in a clear investment thesis, robust valuation, and the presence of identifiable catalysts. The authors also discuss the importance of portfolio construction, highlighting the need for diversification across sectors, geographies, and asset classes to manage risk.

The chapter provides practical tips on position sizing, risk management, and the use of stop-loss orders or hedging strategies. Pearl and Rosenbaum argue that protecting capital is as important as seeking returns and that no single investment should be allowed to jeopardize the entire portfolio. They also stress the importance of ongoing monitoring, recommending that investors regularly review each holding to ensure it still aligns with the original thesis. The authors provide examples of how professional investors rebalance portfolios, take profits, or cut losses as circumstances change.

For readers, the actionable takeaway is to establish clear rules for portfolio management. The authors suggest setting target allocations for each position, using diversification to reduce correlation, and implementing risk controls to limit downside. Investors are encouraged to schedule quarterly reviews, updating their thesis and valuation for each holding and making adjustments as needed. Pearl and Rosenbaum also recommend keeping a performance log to track wins and losses and identify areas for improvement.

In the broader context, the chapter draws lessons from both bull and bear markets, showing how disciplined portfolio management can help investors weather volatility and avoid catastrophic losses. The authors reference the 2008 financial crisis and the COVID-19 pandemic as examples of periods where diversification and risk management proved invaluable. By adopting professional-grade portfolio management practices, individual investors can build resilience and position themselves for long-term success.

Advanced Strategies from the Book

Beyond the foundational five-step process, "The Little Book of Investing Like the Pros" offers several advanced strategies for investors ready to take their analysis and performance to the next level. Pearl and Rosenbaum recognize that as investors gain experience, they can incorporate more sophisticated techniques—such as scenario analysis, event-driven investing, and behavioral risk management—to further refine their edge. These advanced approaches build on the core framework while allowing for greater flexibility and nuance in decision-making.

The following advanced strategies are designed for investors who have mastered the basics and are looking to enhance their process with professional-grade tools. Each technique is grounded in real-world examples and offers practical steps for implementation. By integrating these strategies, investors can better navigate complex market environments, capitalize on unique opportunities, and further protect their portfolios from unforeseen risks.

Strategy 1: Scenario Analysis and Stress Testing

Scenario analysis involves modeling different potential outcomes for a company or portfolio based on varying assumptions about key drivers—such as revenue growth, margin expansion, or macroeconomic conditions. Pearl and Rosenbaum recommend building “base case,” “bull case,” and “bear case” scenarios for each investment, quantifying the impact of different variables on valuation and expected returns. For example, an investor analyzing a cyclical industrial company might model the effects of a recession (bear case), stable growth (base case), and a strong economic rebound (bull case). This approach helps investors understand the range of possible outcomes and prepare for adverse scenarios. Stress testing the portfolio under extreme conditions—such as a market crash or interest rate spike—further ensures that risk is appropriately managed. By regularly updating scenarios as new information emerges, investors can make more informed, resilient decisions.

Strategy 2: Event-Driven Investing

Event-driven investing focuses on capitalizing on specific corporate events—such as mergers and acquisitions, restructurings, spin-offs, or regulatory approvals—that can create significant price movements. Pearl and Rosenbaum explain how to identify and analyze potential events, estimate their probability and impact, and structure trades to capture upside while managing downside risk. For example, an investor might buy shares of a company rumored to be an acquisition target, with the expectation that a deal will result in a premium. Alternatively, investors can play post-earnings drift or regulatory catalysts in biotech stocks. The key is to thoroughly research the event, understand the timeline and stakeholders, and use options or tight stop-losses to control risk. Event-driven strategies require agility and deep research but can generate outsized returns when executed well.

Strategy 3: Behavioral Bias Mitigation

The authors devote attention to the psychological pitfalls that can undermine even the most rigorous investment process. They discuss common biases—such as confirmation bias, anchoring, and loss aversion—and provide techniques for mitigating their impact. For instance, Pearl and Rosenbaum suggest using pre-mortems (imagining why an investment might fail before committing capital), maintaining a decision journal, and seeking out dissenting opinions as ways to challenge assumptions. They also recommend setting predefined exit criteria and sticking to them, rather than reacting emotionally to market swings. By cultivating self-awareness and systematically checking for bias, investors can make more objective, rational decisions and avoid costly mistakes.

Strategy 4: Relative Value and Pair Trading

Relative value investing involves comparing similar companies or securities to identify mispricings. Pearl and Rosenbaum explain how to use valuation multiples (such as EV/EBITDA, P/E, or price-to-book) to spot discrepancies between peers. For example, if two companies in the same industry have similar growth and risk profiles but trade at different multiples, the cheaper stock may offer a better risk/reward. Pair trading takes this concept further by simultaneously buying the undervalued stock and shorting the overvalued one, thus hedging out market risk. This strategy requires careful analysis and ongoing monitoring but can produce steady returns in both rising and falling markets. The authors provide examples from sectors like airlines and banks, where relative value opportunities frequently arise.

Strategy 5: Advanced Portfolio Construction and Risk Budgeting

Professional investors often use sophisticated portfolio construction techniques, such as risk parity, factor exposure analysis, and risk budgeting, to optimize returns while controlling volatility. Pearl and Rosenbaum introduce the concept of allocating capital based on risk contribution rather than just dollar amount, ensuring that no single position dominates the portfolio’s risk profile. They also discuss the use of factor analysis to understand exposures to value, growth, momentum, and other drivers. By regularly reviewing and adjusting allocations based on changing market conditions and risk assessments, investors can build more resilient, adaptive portfolios. This advanced approach is especially valuable for those managing larger sums or seeking to emulate institutional best practices.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Getting started with the process outlined in "The Little Book of Investing Like the Pros" requires commitment, organization, and a willingness to learn by doing. Pearl and Rosenbaum encourage readers to view investing as a craft that improves with practice, rather than a one-time event. The implementation journey begins with small, consistent steps and gradually builds toward a comprehensive, professional-grade process.

Investors should begin by setting clear goals and establishing a research routine. The authors recommend starting with a manageable universe of stocks, using screening tools to generate ideas, and documenting every step of the analysis. Over time, as confidence and skills grow, investors can expand their toolkit to include advanced strategies and more complex portfolio management techniques. Regular reflection and review are key to continuous improvement and long-term success.

- Start by defining your investment goals, risk tolerance, and time horizon.

- Set up stock screeners based on your preferred criteria (valuation, growth, quality) and generate an initial watchlist.

- For each candidate, write a one-page investment thesis covering business drivers, risks, and valuation.

- Conduct layered due diligence—first a high-level review, then deeper analysis for top ideas.

- Apply at least two valuation methods and set a target price for each stock.

- Identify and track potential catalysts for each investment.

- Build a diversified portfolio, limiting position sizes and sector concentrations.

- Schedule quarterly reviews to reassess each holding’s thesis, valuation, and risk profile.

- Document all decisions and outcomes to build a personal investing playbook.

Critical Analysis

"The Little Book of Investing Like the Pros" excels at translating institutional-grade investment processes into actionable steps for individual investors. Pearl and Rosenbaum’s clear writing, practical examples, and professional templates make the book both accessible and highly effective. The focus on process, discipline, and risk management sets it apart from more speculative or theory-heavy investing books. Readers are likely to appreciate the authors’ candor about the challenges and pitfalls of investing, as well as their emphasis on continuous learning and improvement.

However, the book’s concise format means that some topics—such as advanced financial modeling, options strategies, or international investing—are only briefly touched upon. While this keeps the book approachable for beginners, more advanced readers may wish for deeper dives into certain areas. Additionally, the focus on U.S. equities and market structures may limit direct applicability for those investing in other geographies or asset classes. Still, the core framework is universally relevant and can be adapted to a wide range of investing styles.

In today’s rapidly changing market environment, the book’s emphasis on process, adaptability, and risk management is more valuable than ever. With increased market volatility, the rise of retail trading, and the proliferation of new asset classes, investors need a reliable framework to navigate uncertainty. "The Little Book of Investing Like the Pros" offers exactly that—a practical, proven roadmap that can help investors thrive in any market cycle. Its lessons are as relevant for 2025 as they were when first published, making it a lasting addition to any investor’s library.

Conclusion

"The Little Book of Investing Like the Pros" provides a rare combination of accessibility, practicality, and depth. Pearl and Rosenbaum succeed in distilling the methods of top institutional investors into a step-by-step process that anyone can follow. By emphasizing structured analysis, risk management, and continuous improvement, they empower readers to move beyond speculation and build lasting wealth. The book’s actionable strategies, real-world examples, and professional templates make it a must-read for anyone serious about investing.

For individual investors seeking to elevate their process, avoid common pitfalls, and achieve consistent results, this book offers a clear and effective roadmap. Whether you’re just starting out or looking to refine your approach, the lessons from "The Little Book of Investing Like the Pros" will serve you well in any market environment. We highly recommend adding it to your investing toolkit and revisiting its principles regularly as you grow as an investor.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Investing Like the Pros

1. Who are the authors and why are they credible?

Joshua Pearl is an experienced investment banker and founder of Hickory Lane Capital Management, while Joshua Rosenbaum is a managing director at RBC Capital Markets and co-author of several leading finance textbooks. Their combined backgrounds in investment banking and professional investing give them deep insight into the processes and techniques used by top institutional investors.

2. What is the main investment philosophy of the book?

The book advocates for a disciplined, step-by-step investment process based on rigorous analysis, structured research, and risk management. It emphasizes that successful investing is not about speculation or luck, but about understanding businesses, evaluating financials, and identifying clear catalysts for value realization.

3. Is this book suitable for beginners?

Yes, the book is designed to be accessible to investors at all levels, including beginners. It breaks down complex concepts into simple, actionable steps and provides templates, checklists, and real-world examples to help readers apply the lessons immediately.

4. What practical tools does the book provide?

The book includes investment write-up templates, research checklists, and step-by-step guides for each stage of the process. These tools help investors organize their research, ensure consistency, and make better, more informed decisions.

5. How does the book address risk management?

Pearl and Rosenbaum devote significant attention to risk management, including portfolio diversification, position sizing, stop-losses, and hedging strategies. They emphasize that protecting capital is as important as seeking returns, and provide concrete steps for mitigating downside risk.

6. Can the framework be applied to international stocks or other asset classes?

While the book focuses primarily on U.S. equities, the core framework—idea generation, due diligence, valuation, and risk management—can be adapted to international stocks and other asset classes. Some tools and data sources may differ, but the process remains relevant across markets.

7. How does the book help investors avoid common mistakes?

The authors highlight common pitfalls such as chasing hot tips, neglecting due diligence, and failing to manage risk. By following their structured process and using the provided templates, investors can avoid emotional decisions and focus on evidence-based investing.

8. Are advanced strategies covered in the book?

Yes, the book introduces advanced techniques such as scenario analysis, event-driven investing, behavioral bias mitigation, and relative value strategies. While these sections are concise, they provide a solid foundation for further study and implementation.

9. How often should investors review and rebalance their portfolios?

The authors recommend scheduling quarterly reviews to reassess each holding’s thesis, valuation, and risk profile. Regular rebalancing ensures that the portfolio remains aligned with the investor’s goals and risk tolerance, and helps capitalize on new opportunities.

10. Where can I find additional resources and tools mentioned in the book?

Many of the tools and templates discussed in the book are available through financial websites like Yahoo Finance, Finviz, and Value Sense’s analytics platform. Investors can also access further reading and educational materials through the authors’ other works and online resources.