The Little Book of Main Street Money by Jonathan Clements

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Jonathan Clements, the author of The Little Book of Main Street Money, is a highly respected figure in personal finance journalism. With decades of experience writing for The Wall Street Journal and a background as the director of financial education for Citi Personal Wealth Management, Clements brings both credibility and a practical, down-to-earth perspective to the world of money management. His writing style is known for being accessible, honest, and focused on the real-world challenges faced by everyday investors, not just financial professionals. This book represents the culmination of his core beliefs about money, investing, and personal fulfillment.

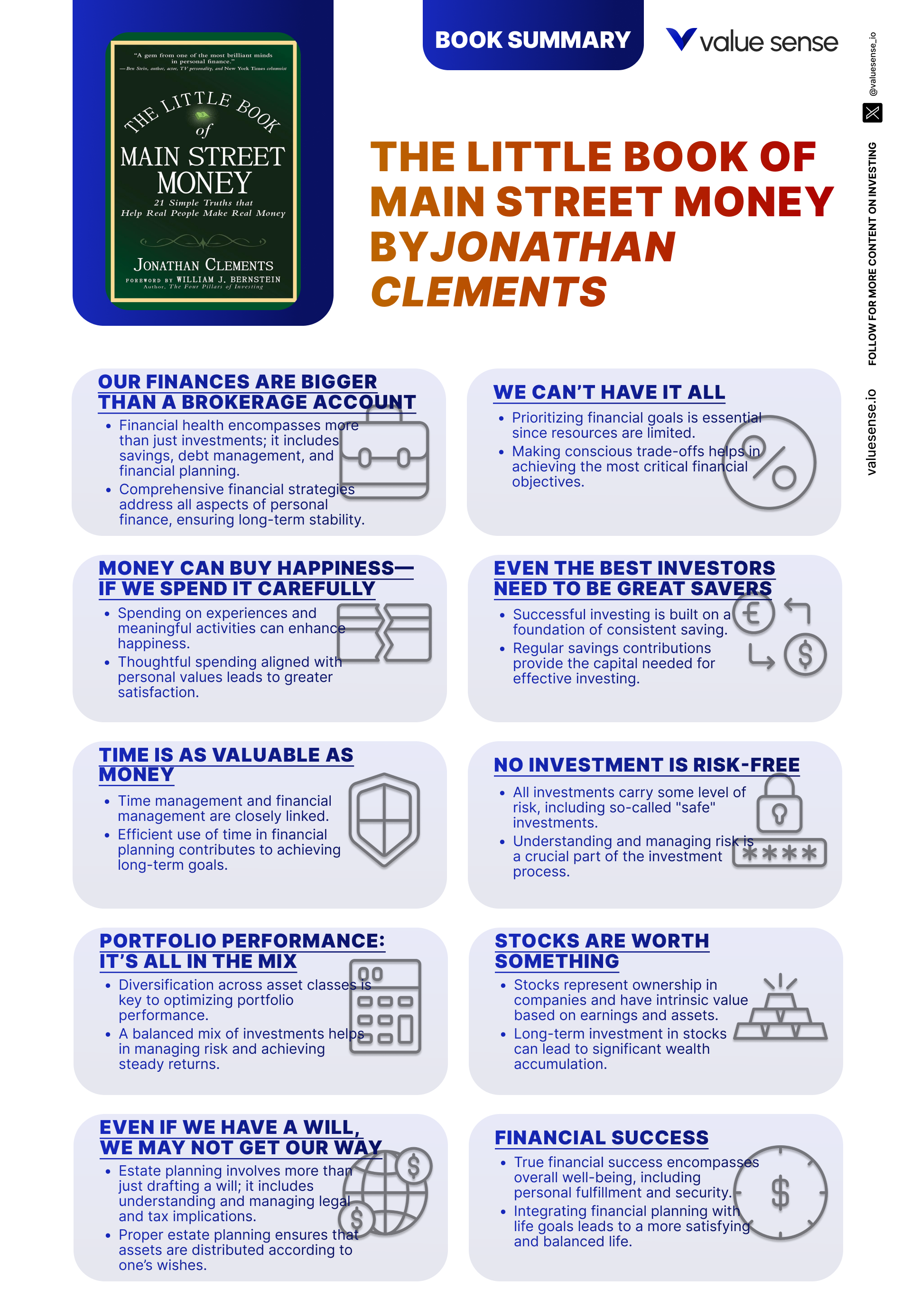

The main theme of the book is that financial success is not just about picking the right stocks or timing the market; it’s about adopting a holistic, values-based approach to money. Clements believes that wealth should serve your life, not the other way around. The book is structured around 21 concise, principle-driven chapters, each tackling a common misconception or challenge in personal finance—from the importance of saving early, to the psychological traps that derail investors, to the realities of home ownership and estate planning. Clements combines behavioral finance insights with actionable advice, making the book both intellectually rigorous and immediately practical.

This book is ideal for a wide audience: young professionals starting their financial journeys, mid-career savers looking to optimize their portfolios, retirees concerned about outliving their assets, and even seasoned investors who want to revisit the fundamentals. Its accessible language and relatable anecdotes make it especially valuable for those who feel overwhelmed by the jargon and complexity of Wall Street. Clements’ focus on behavioral pitfalls, risk management, and aligning money with personal values resonates with anyone seeking both financial security and life satisfaction.

What sets The Little Book of Main Street Money apart is its integration of behavioral psychology, practical investing wisdom, and life philosophy. Clements doesn’t just tell you what to do—he explains why most people struggle to do it, and how to set up systems and habits to overcome those obstacles. The book’s unique value lies in its ability to distill complex financial concepts into simple, memorable rules. It is packed with real-world examples, research findings, and timeless advice that remains relevant regardless of market cycles or economic trends. Whether you’re looking to build wealth, avoid costly mistakes, or simply find more meaning in your financial life, this book offers a comprehensive roadmap.

Throughout the book, Clements challenges conventional wisdom—such as the idea that homes are always great investments, or that beating the market is a realistic goal for most people. He advocates for passive investing, prudent risk-taking, and the importance of controlling what you can: your savings rate, spending habits, and asset allocation. By the end, readers are left with a clear framework for making smarter financial decisions, reducing stress, and using money as a tool for a happier, more fulfilling life.

Key Concepts and Ideas

At the heart of The Little Book of Main Street Money is a philosophy that blends rational investing with behavioral awareness and life satisfaction. Jonathan Clements urges readers to look beyond the narrow focus of maximizing investment returns and instead build a financial life that is resilient, meaningful, and aligned with personal values. He emphasizes that wealth is not just about money in the bank, but about making choices that support long-term happiness and security.

Clements’ approach is grounded in the realities of Main Street, not Wall Street. He recognizes that most people are not professional investors and that the biggest financial gains often come from getting the basics right—saving diligently, managing risk, and avoiding costly mistakes. The book’s key concepts are designed to help readers sidestep the common traps that derail financial progress, such as emotional investing, overconfidence, and the allure of “get rich quick” schemes.

- Holistic Financial Planning: Clements argues that your financial health is bigger than your brokerage account. He encourages readers to consider all assets (including human capital, Social Security, and future income) and liabilities (such as debt) when making decisions. This comprehensive view helps investors make smarter choices about risk, savings, and spending.

- The Power of Compounding and Early Action: One of the book’s central tenets is the exponential effect of compound interest. Clements illustrates how starting to save early—even small amounts—leads to significant wealth over time, thanks to compounding. He uses examples showing that a 25-year-old who saves $200 a month can accumulate far more by retirement than someone who starts at 40 and saves twice as much.

- Behavioral Finance and Emotional Pitfalls: Clements devotes multiple chapters to the psychological traps that sabotage investors, such as loss aversion, herd mentality, and overconfidence. He provides strategies to counteract these biases, like automation, diversification, and sticking to a written plan.

- Asset Allocation and Diversification: Rather than chasing hot stocks or sectors, Clements emphasizes that the mix of asset classes (stocks, bonds, cash, alternatives) determines most of your long-term returns. He advocates for a diversified portfolio tailored to your risk tolerance and life stage, rebalanced periodically to maintain discipline.

- Passive Investing and the “Average” Advantage: The book makes a strong case for passive investing—using low-cost index funds to capture market returns—rather than trying to beat the market. Clements explains that most active investors underperform after fees and that aiming for “average” is the surest way to win in the long run.

- Minimizing Fees, Taxes, and “Subtractions”: Clements shows how seemingly small costs—investment fees, taxes, inflation—can erode wealth over decades. He provides actionable advice on using tax-advantaged accounts, minimizing investment costs, and avoiding high-fee products.

- Debt Management and the Value of Paying Off Debt: The book reframes debt repayment as an investment, especially for high-interest debts. Clements explains that paying off a 15% credit card is like earning a risk-free 15% return, often better than any bond.

- Realistic Expectations for Real Estate: Clements challenges the myth that homes are always great investments. He presents data showing that real estate appreciation often barely outpaces inflation and argues that the main benefit of homeownership is stability, not outsized returns.

- Insurance and Risk Protection: Rather than viewing insurance as an investment, Clements stresses its role as a safety net. He advises readers to insure against catastrophic losses, avoid over-insuring, and regularly review coverage as life circumstances change.

- Aligning Money with Life Goals: Ultimately, Clements believes that money should serve your life, not the other way around. He encourages readers to spend on experiences, nurture relationships, and pursue purpose—using financial resources to support a happy, meaningful life.

Practical Strategies for Investors

Translating Clements’ philosophy into action requires more than just understanding the concepts—it’s about implementing concrete strategies that fit your life. The book is filled with practical steps that investors at any stage can take to improve their financial security, reduce stress, and build wealth over time. Clements recognizes that the best financial plan is one you can stick to, so he emphasizes automation, simplicity, and behavioral safeguards.

Whether you’re just starting out or looking to optimize your existing portfolio, the following strategies from the book provide a blueprint for financial success. Each is backed by research, real-world data, and examples from Clements’ decades of experience. These strategies are designed to be accessible, actionable, and effective regardless of market conditions or economic cycles.

- Automate Savings and Investing: Set up automatic transfers to savings and retirement accounts each month. This “pay yourself first” approach removes willpower from the equation and ensures consistent progress. Action step: Schedule a recurring transfer of 10-20% of your income to a 401(k), IRA, or brokerage account.

- Start Early, Even with Small Amounts: Don’t wait for a big windfall to begin investing. The earlier you start, the more you benefit from compounding. Action step: Begin investing as soon as possible, even if it’s just $50 or $100 a month—time is your greatest ally.

- Use Low-Cost Index Funds: Avoid high-fee mutual funds and active managers. Instead, invest in broad-market index funds or ETFs with expense ratios below 0.20%. Action step: Allocate the majority of your equity investments to S&P 500 or total market index funds from providers like Vanguard or Fidelity.

- Rebalance Regularly: Over time, market movements will shift your asset allocation away from your targets. Rebalance annually or semiannually to maintain your desired risk profile. Action step: Set a calendar reminder each year to review and adjust your portfolio back to your original allocation.

- Prioritize High-Interest Debt Repayment: Before investing aggressively, pay off high-interest debts like credit cards. Action step: List all debts by interest rate and focus extra payments on the highest-rate debt first (“avalanche method”).

- Maximize Tax-Advantaged Accounts: Contribute the maximum allowed to tax-deferred accounts like 401(k)s and IRAs. Action step: Increase your 401(k) contribution rate by 1% each year until you reach the annual maximum or at least capture any employer match.

- Insure Against Catastrophic Risks: Purchase insurance to protect against events that could devastate your finances—such as disability, health crises, or liability lawsuits. Action step: Review your insurance coverage annually and adjust deductibles or benefits as your situation changes.

- Align Spending with Values and Life Goals: Make conscious choices about where your money goes, prioritizing experiences, relationships, and purpose over material goods. Action step: Create a “values-based budget” that allocates money to the things that matter most to you, and review it quarterly.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

The Little Book of Main Street Money is structured as a series of 21 concise chapters, each focused on a single principle or financial myth. Clements’ approach is to tackle one big idea at a time, using stories, research, and practical advice to drive home the lesson. Each chapter builds on the last, creating a comprehensive framework for financial success that covers everything from saving and investing to insurance and estate planning. The book’s structure makes it easy to dip into specific topics or read cover to cover for a complete education.

What makes the chapter format especially powerful is Clements’ ability to blend technical concepts with relatable examples and actionable steps. He draws on real-world data, historical context, and behavioral research to explain why certain strategies work—and why most people fail to follow them. Each chapter concludes with key lessons and practical takeaways, making it easy for readers to implement the advice in their own lives.

The following section provides a detailed, chapter-by-chapter analysis, highlighting the main ideas, supporting evidence, and practical applications for investors. Each chapter is explored in depth, with specific examples, quotes, and historical context to illustrate how the lessons can be applied in today’s market environment.

Chapter 1: Our Finances Are Bigger than a Brokerage Account

Jonathan Clements opens the book by challenging the narrow view that financial health is defined solely by the size of your brokerage account. He urges readers to adopt a holistic perspective, considering not only their savings and investments but also less tangible assets such as future Social Security benefits, human capital (the ability to earn income), and even the value of employer pensions. Clements argues that a true assessment of financial well-being must account for all assets and liabilities, including debts like mortgages and student loans, which can significantly impact one’s net worth and risk exposure.

This chapter is rich with examples. Clements explains how a young professional with modest investment accounts but high earning potential (human capital) is often in a stronger financial position than a retiree with substantial savings but no future income stream. He uses the analogy of a household balance sheet, where future Social Security payments and pension benefits can be thought of as “invisible assets” that provide security in retirement. Clements also discusses the dangers of excessive leverage, noting that while debt can help you acquire valuable assets (like a home), it also magnifies risk if not managed carefully.

For investors, the practical takeaway is to broaden your definition of wealth and base decisions on your entire financial picture. This means factoring in job stability, insurance coverage, and the value of future income when determining how much to save, invest, or borrow. Clements recommends young investors take more risk in stocks, given their long investment horizon and the ability to recover from setbacks, while those nearing retirement should gradually shift toward more conservative allocations to protect accumulated wealth.

Historically, this comprehensive approach has protected investors during market downturns. For example, during the 2008 financial crisis, those who relied solely on their portfolios often panicked, while those with a diversified asset base—including stable jobs, pensions, and insurance—weathered the storm more effectively. Clements’ framework encourages readers to think like chief financial officers of their own lives, managing both assets and liabilities strategically for long-term stability.

Chapter 2: We Can’t Have It All

In the second chapter, Clements addresses the reality of financial trade-offs, emphasizing that every spending decision comes at the expense of another potential use for your money. He challenges the cultural narrative that we can have it all—big houses, luxury cars, lavish vacations—without sacrificing long-term goals like retirement security. Clements uses the concept of opportunity cost to illustrate that every dollar spent today is a dollar not available for future needs, such as building an emergency fund or investing for retirement.

He provides concrete examples, such as the choice between buying a larger home versus maximizing retirement contributions. Clements points out that while banks may approve you for a large mortgage, it’s up to you to decide whether the monthly payments will crowd out other priorities. He also discusses the importance of right-sizing insurance and emergency funds based on your risk tolerance and financial situation, noting that over-insuring can waste resources that could be better used elsewhere.

For investors, the key lesson is to prioritize long-term goals and make conscious spending decisions. Clements recommends starting with a clear list of financial priorities—such as retirement, children’s education, and debt repayment—and allocating resources accordingly. He suggests automating retirement savings to ensure they happen before discretionary spending, and periodically reviewing insurance coverage to avoid overpaying for unnecessary protection.

Historically, those who have succeeded financially are not the ones who earned the most, but those who consistently aligned their spending with their values and goals. The FIRE (Financial Independence, Retire Early) movement is a modern example of this principle, with adherents choosing to live below their means in order to retire decades early. Clements’ advice is timeless: you can have anything you want, but not everything—so choose wisely.

Chapter 3: Money Can Buy Happiness—If We Spend It Carefully

Clements challenges the old adage that “money can’t buy happiness,” arguing instead that it can—but only if spent in ways that truly enhance your life. He draws on research from behavioral economics showing that experiences, not material goods, are more likely to produce lasting happiness. For example, spending money on travel, learning new skills, or enjoying time with friends and family creates memories and satisfaction that endure, while the pleasure from buying a new gadget or car quickly fades due to hedonic adaptation.

The chapter is filled with actionable advice. Clements recommends regularly reflecting on your purchases to ensure they align with your values and bring genuine joy. He discusses the importance of combating hedonic adaptation—the tendency to quickly get used to new levels of comfort or luxury—by practicing gratitude and savoring achievements. He also highlights the role of relationships, noting that investing time and money in nurturing connections with loved ones is a key driver of happiness.

Investors can apply these lessons by creating a “values-based budget” that allocates funds to experiences and relationships rather than accumulating more stuff. Clements suggests setting aside a portion of your discretionary spending for activities that foster connection, learning, or personal growth. He also advises using financial resources to support a sense of purpose, whether through charitable giving, volunteering, or pursuing meaningful work.

Historically, studies have shown that above a certain income threshold (around $75,000 according to some research), additional money has diminishing returns on happiness. However, spending intentionally—on experiences, relationships, and purpose—consistently correlates with higher life satisfaction. Clements’ approach is a modern antidote to consumerism, encouraging readers to use money as a tool for fulfillment rather than a scorecard.

Chapter 4: Even the Best Investors Need to Be Great Savers

This chapter reinforces the foundational role of saving in building wealth. Clements argues that no matter how skilled an investor you are, consistent saving is the single most important driver of financial success. He dispels the myth that high investment returns alone can make you rich, showing with simple math that even modest returns can lead to significant wealth if paired with disciplined saving over decades.

Clements provides practical advice for becoming a diligent saver. He recommends automating savings by setting up recurring transfers to retirement and brokerage accounts, making saving the default rather than a choice. He also addresses psychological barriers to saving, such as the temptation to spend windfalls or the illusion of saving created by simply moving money between accounts without actually reducing spending. The chapter includes examples of individuals who achieved financial independence by saving 20-30% of their income over many years, often starting with small amounts and increasing contributions as their earnings grew.

For investors, the key takeaway is to prioritize saving over chasing high returns. Clements advises tracking your savings rate and setting incremental goals to boost it over time. He suggests reviewing your expenses quarterly to identify areas where you can cut back and redirect funds to savings. He also warns against carrying high-interest debt, which can quickly negate the benefits of even the most diligent saving.

Historically, the power of compounding has rewarded those who start saving early and consistently. Clements cites examples from the FIRE movement and traditional retirement planning, where individuals who began saving in their 20s or 30s were able to retire comfortably, while late starters struggled to catch up. The lesson is clear: saving is the bedrock of financial security, and it’s never too early—or too late—to start.

Chapter 5: Time Is as Valuable as Money

In this chapter, Clements emphasizes the critical role of time in the wealth-building process. He explains that starting to save and invest early is the most powerful way to harness the exponential growth of compound interest. Clements uses examples showing that a 25-year-old who saves $200 per month at a 7% annual return will accumulate over $500,000 by age 65, while someone who waits until 40 and saves $400 per month will end up with far less, despite saving more each month.

The chapter introduces the concept of “critical mass”—the point at which investment gains begin to outpace your annual contributions. Clements explains that reaching this tipping point requires years of consistent saving, but once achieved, your portfolio starts to grow faster on its own. He also discusses the financial benefits of delaying retirement by even a few years, which can dramatically increase your nest egg and reduce the number of years your savings must support you. For example, working until 68 instead of 65 can boost Social Security benefits by 24% and allow for more years of compounding.

Investors are encouraged to view time as their most valuable asset. Clements suggests setting up automatic increases to retirement contributions each year, starting with small amounts and gradually ramping up. He also advises using wealth to lower costs—such as reducing insurance premiums, avoiding debt, and qualifying for discounts—once you reach a certain level of financial security.

Historically, the power of compounding has turned modest savers into millionaires over time, while late starters have struggled to catch up. Clements’ advice is echoed by legendary investors like Warren Buffett, whose fortune is largely the result of decades of compounding. The lesson: time is your greatest ally in building wealth—don’t waste it.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: No Investment Is Risk-Free

Clements dispels the myth that certain investments are completely safe, arguing that every asset class carries its own unique risks. He explains that while stocks are subject to market volatility, bonds face interest rate risk, and cash loses value to inflation over time. The chapter provides a detailed discussion of the different types of investment risk, including market risk, inflation risk, liquidity risk, and credit risk, using examples from recent financial crises and historical market downturns.

He illustrates the dangers of overconcentration by referencing investors who put all their money in tech stocks during the dot-com bubble or in real estate before the 2008 crash, only to suffer significant losses. Clements advocates for diversification—not just within asset classes, but across them—as the best defense against the unpredictable nature of markets. He provides data showing that diversified portfolios experience less volatility and recover faster from downturns than those concentrated in a single asset class.

For investors, the practical application is to build a balanced portfolio that includes a mix of stocks, bonds, cash, and possibly alternative assets, tailored to your risk tolerance and time horizon. Clements recommends reviewing your portfolio annually to ensure no single asset class dominates and adjusting allocations as your life circumstances change. He also advises maintaining a long-term perspective, resisting the urge to make drastic changes based on short-term market movements.

Historically, diversified investors have weathered crises like the 2008 financial meltdown and the COVID-19 market shock far better than those who chased hot sectors or relied on “safe” assets like cash. Clements’ chapter is a reminder that risk is a permanent feature of investing, but it can be managed through thoughtful diversification and patience.

Chapter 7: Portfolio Performance: It’s All in the Mix

This chapter explores the critical role of asset allocation in determining long-term investment success. Clements cites research showing that over 90% of a portfolio’s variability in returns is explained by its mix of asset classes, rather than the selection of individual stocks or market timing. He argues that investors should spend less time picking winners and more time designing a portfolio that balances growth, income, and risk.

Clements provides examples of different asset allocation models, such as the classic 60/40 split between stocks and bonds, and explains how to tailor your mix based on age, risk tolerance, and financial goals. He discusses the importance of rebalancing—periodically adjusting your portfolio to maintain your target allocation—as a way to buy low and sell high automatically. The chapter includes data on how diversified portfolios have historically performed across various market environments, showing that those who stuck to their allocation plans fared better than those who chased trends.

For practical implementation, Clements recommends starting with a simple target allocation (e.g., 70% stocks, 30% bonds for a mid-career investor) and using low-cost index funds to achieve broad diversification. He advises rebalancing once or twice a year, or whenever allocations drift by more than 5-10% from targets. He also suggests adjusting your mix as you approach major life milestones, such as retirement or funding a child’s education.

Historically, the discipline of asset allocation has protected investors from the worst market downturns and allowed them to participate in recoveries. Clements’ advice is supported by the experiences of endowments like Yale and Harvard, which have used diversified, rebalanced portfolios to achieve strong long-term returns. The key takeaway: focus on the mix, not the minutiae.

Chapter 8: Stocks Are Worth Something

In this chapter, Clements makes a compelling case for stocks as engines of long-term wealth creation. He explains that, despite their volatility, stocks represent ownership in real businesses that generate earnings and pay dividends. Clements uses historical data to show that stocks have outperformed bonds and cash over every 20-year period in modern history, thanks to their ability to grow with the economy and outpace inflation.

The chapter delves into the fundamentals of stock ownership, discussing how company earnings and dividend growth drive long-term returns. Clements warns against being swayed by short-term market fluctuations, arguing that the intrinsic value of stocks is rooted in the underlying business, not daily price movements. He provides examples of companies like Johnson & Johnson and Procter & Gamble, which have delivered steady returns to shareholders through decades of dividend growth and earnings expansion.

For investors, the lesson is to focus on the fundamentals—earnings, dividends, and long-term growth potential—rather than trying to time the market or chase fads. Clements recommends building a diversified portfolio of quality stocks, reinvesting dividends, and maintaining discipline through market cycles. He also advises patience, noting that successful stock investing requires the fortitude to hold through downturns and resist the urge to sell in panic.

Historically, those who invested in stocks for the long term—such as Warren Buffett, whose Berkshire Hathaway portfolio is heavily weighted toward equities—have been rewarded with substantial wealth. Clements’ chapter is a reminder that stocks are not just pieces of paper, but claims on real economic value.

Chapter 9: To Add Wealth, We Need to Overcome the Subtractions

Clements turns the spotlight on the “subtractions” that erode wealth over time: investment fees, taxes, inflation, and poor financial decisions. He argues that minimizing these costs is just as important as maximizing returns, since even small percentage drags can compound into significant losses over decades. The chapter is packed with data showing how a 1% annual fee can reduce a portfolio’s value by up to 25% over 30 years, and how inflation silently chips away at purchasing power.

He provides actionable strategies for reducing these subtractions. Clements recommends using low-cost index funds and ETFs, which often charge less than 0.10% per year, compared to actively managed funds that may charge 1% or more. He also advises maximizing the use of tax-advantaged accounts like IRAs and 401(k)s to defer or eliminate taxes on investment gains. The chapter discusses the importance of investing in assets that can outpace inflation—such as stocks and real estate—and avoiding costly mistakes like market timing or chasing hot trends.

For investors, the practical steps are clear: scrutinize all investment fees, prioritize tax efficiency, and focus on long-term growth assets. Clements suggests reviewing your portfolio’s expense ratios annually, using tax-loss harvesting when appropriate, and maintaining a disciplined investment plan to avoid emotional errors. He also warns against the temptation to “do something” during market volatility, noting that inactivity is often the best defense against costly mistakes.

Historically, the most successful investors have been those who controlled costs and avoided unnecessary risks. Vanguard founder John Bogle, for example, built an empire on the principle of low-cost investing. Clements’ advice is a modern echo of Bogle’s mantra: “In investing, you get what you don’t pay for.”

Chapter 10: Aiming for Average Is the Only Sure Way to Win

Clements challenges the conventional wisdom that investors should strive to beat the market, arguing instead that aiming for average—through passive investing—is the most reliable path to wealth. He cites research showing that the vast majority of active managers underperform their benchmarks after fees, and that attempts to time the market or pick winners usually result in lower returns and higher risk.

The chapter explains the mechanics of passive investing, using index funds and ETFs that track broad market benchmarks like the S&P 500. Clements provides data showing that over 80% of actively managed funds have failed to outperform their index equivalents over the past 20 years. He discusses the pitfalls of chasing performance, such as buying last year’s winners or making frequent trades, which often lead to higher costs and lower returns.

For investors, the practical application is to embrace simplicity: build a diversified portfolio of low-cost index funds, set it on autopilot, and resist the urge to tinker. Clements recommends ignoring market noise, avoiding hot tips, and focusing on long-term goals. He also suggests using dollar-cost averaging—investing a fixed amount at regular intervals—to smooth out volatility and reduce the temptation to time the market.

Historically, the passive investing approach has outperformed the vast majority of active strategies, especially after accounting for fees and taxes. The rise of index funds from providers like Vanguard and Fidelity has democratized access to market returns, making it possible for everyday investors to succeed without specialized knowledge. Clements’ advice is clear: accept the market’s average, and you’ll end up ahead of most.

Chapter 11: Wild Investments Can Tame Our Portfolios

In this chapter, Clements explores the role of alternative or “wild” investments—such as real estate, commodities, and REITs—in reducing overall portfolio risk. He explains that while these assets can be volatile on their own, they often move differently from stocks and bonds, providing valuable diversification benefits when included in a broader portfolio.

Clements provides examples of how adding a small allocation to alternatives can smooth out returns and reduce drawdowns during market downturns. For instance, real estate and commodities often perform well during periods of inflation or stock market weakness, helping to offset losses elsewhere. He cautions, however, that these investments come with unique risks, such as illiquidity (in the case of direct real estate) or high volatility (as with commodities), and should not dominate your portfolio.

For investors, the takeaway is to use alternatives strategically, allocating a modest portion (5-15%) of your portfolio to assets like REITs, commodities, or private equity, depending on your risk tolerance and investment horizon. Clements advises thorough research before venturing into these areas and suggests using publicly traded vehicles (like REIT ETFs) for liquidity and transparency. He also recommends regularly reviewing your allocation to ensure alternatives remain a complement, not a distraction, from your core investment strategy.

Historically, portfolios that included alternatives have weathered crises like the 1970s inflation spike and the 2008 real estate collapse better than those limited to stocks and bonds. Clements’ advice reflects the modern trend among institutional investors—such as endowments and pension funds—to diversify beyond traditional assets in pursuit of more stable, long-term returns.

Chapter 12: Short-Term Results Matter to Long-Term Investors

This chapter explores the paradox that, while long-term investing is the key to wealth, short-term results still matter—both psychologically and practically. Clements discusses the risk that significant short-term losses can lead to panic selling, derailing long-term plans and causing investors to miss out on recoveries. He draws on behavioral finance research showing that losses are felt more acutely than gains, leading to emotional decisions that undermine investment success.

Clements provides examples of investors who abandoned their plans during market downturns—such as the 2008 financial crisis or the 2020 COVID-19 crash—only to lock in losses and miss subsequent rebounds. He discusses strategies for managing short-term risk, such as maintaining a balanced asset allocation, holding some cash or bonds as a buffer, and setting clear rules for when (if ever) to make changes to your portfolio.

For investors, the key lesson is to anticipate short-term volatility and plan for it, rather than reacting emotionally when it occurs. Clements recommends building a portfolio that you can stick with through both bull and bear markets, using diversification and regular rebalancing to manage risk. He also suggests tracking your progress toward long-term goals, rather than obsessing over short-term performance, to maintain perspective during turbulent times.

Historically, those who stayed the course during crises—such as the Great Depression, Black Monday (1987), or the dot-com bust—were ultimately rewarded, while those who sold out often struggled to recover. Clements’ chapter is a reminder that long-term success depends on surviving the short-term storms without losing your nerve.

Chapter 13: A Long Life Is a Big Risk

Clements highlights the underappreciated financial risk of longevity—the possibility of outliving your retirement savings. He explains that as life expectancies increase, the challenge of making your money last becomes more acute, especially in the face of inflation, rising healthcare costs, and the potential need for long-term care. The chapter discusses strategies for managing this risk, such as delaying retirement, purchasing annuities, and maintaining a diversified portfolio with growth assets.

He provides examples of how working just a few extra years can dramatically improve retirement security, both by allowing more time for savings to grow and by shortening the period those savings must support you. Clements also discusses the role of annuities in providing guaranteed lifetime income, helping to mitigate the risk of running out of money. He cautions, however, to shop carefully and avoid high-fee or complex products.

For investors, the practical steps include planning for a longer-than-average retirement, considering inflation-protected assets like TIPS, and setting aside funds for potential healthcare and long-term care expenses. Clements recommends reviewing your retirement plan annually, updating assumptions about life expectancy, expenses, and investment returns as needed.

Historically, retirees who ignored longevity risk often faced difficult choices in old age, such as downsizing homes or relying on family support. Clements’ advice reflects the modern reality of longer, healthier lives—and the need for careful, flexible planning to ensure financial security throughout retirement.

Chapter 14: Markets May Be Rational, but We Aren’t

This chapter delves into the behavioral and psychological pitfalls that can sabotage even the best-laid financial plans. Clements explains that while markets tend to behave rationally over the long term, individual investors are prone to cognitive biases such as overconfidence, loss aversion, and herd behavior. He provides examples of how these biases lead to poor decisions, such as chasing hot stocks, panic selling during downturns, or holding onto losers in the hope of a rebound.

Clements draws on research from behavioral finance pioneers like Daniel Kahneman and Richard Thaler, illustrating how emotions often drive financial decisions more than logic. He discusses strategies for counteracting these biases, such as automating investments, setting clear rules for buying and selling, and maintaining a written investment plan. The chapter includes anecdotes of investors who succeeded by sticking to their plans, as well as cautionary tales of those who let emotions take over.

For investors, the practical advice is to build systems that reduce the impact of emotion on decision-making. Clements recommends using automatic investment plans, regularly reviewing your behavior for signs of bias, and seeking accountability from a trusted advisor or peer group. He also suggests diversifying portfolios to reduce the temptation to tinker with individual holdings.

Historically, the greatest investment disasters—from the South Sea Bubble to the 2008 housing crisis—have been fueled by collective irrationality and emotional excess. Clements’ chapter is a call to self-awareness and discipline, urging readers to recognize their own weaknesses and put safeguards in place to protect their financial future.

Chapter 15: Our Homes Are a Fine Investment that Won’t Appreciate Much

Clements challenges the widely held belief that homeownership is the path to riches. He explains that, while owning a home can provide stability and forced savings (as mortgage payments build equity), the long-term appreciation of real estate often barely outpaces inflation. The chapter presents data showing that, over the past century, U.S. home prices have risen at an average rate of 3-4% per year—barely keeping up with the cost of living.

He discusses the financial realities of homeownership, including transaction costs, maintenance expenses, and the risk of market downturns. Clements argues that the primary benefit of owning a home is the stability it provides—not the prospect of outsized returns. He advises readers to view their homes as places to live, not as central components of their investment portfolios.

For investors, the lesson is to diversify beyond real estate and avoid relying solely on home equity for wealth building. Clements suggests keeping housing costs to no more than 30% of income, resisting the urge to “trade up” to larger homes, and prioritizing retirement savings over paying down low-interest mortgages. He also recommends considering the opportunity cost of tying up capital in a home versus investing in higher-return assets like stocks.

Historically, housing booms and busts—such as the 2008 crisis—have left many homeowners underwater, while those who diversified enjoyed greater financial resilience. Clements’ chapter is a reality check for anyone tempted to view their house as a ticket to wealth.

Chapter 16: Paying off Debts Could Be Our Best Bond Investment

In this chapter, Clements reframes debt repayment as an investment, arguing that paying off high-interest debt often yields better returns than traditional bonds. He explains that eliminating a 15% credit card balance is equivalent to earning a risk-free 15% return—far higher than the 2-4% typically offered by government or corporate bonds. Clements provides examples of individuals who prioritized debt repayment and achieved greater financial flexibility and lower stress as a result.

He discusses the order in which to tackle debts, recommending the “avalanche method” (paying off the highest-interest debt first) for maximum impact. Clements also addresses the psychological benefits of living debt-free, such as increased confidence, reduced anxiety, and the freedom to pursue new opportunities. He notes that in low-interest-rate environments, the relative return on paying off debt becomes even more attractive compared to investing in bonds.

For investors, the practical takeaway is to focus on eliminating high-interest debt before making large investments in low-yielding bonds. Clements suggests maintaining a modest emergency fund, then directing extra cash toward debt repayment. Once debts are paid off, investors can redirect those payments to savings and investments, accelerating wealth accumulation.

Historically, those who prioritized debt repayment weathered economic downturns more effectively and enjoyed greater financial security in retirement. Clements’ advice is especially relevant in today’s environment of rising interest rates and economic uncertainty.

Chapter 17: Saving Taxes Can Cost Us Dearly

Clements warns against the temptation to let tax considerations dictate investment decisions. He explains that strategies focused solely on minimizing taxes—such as holding onto losing investments for tax deferral or taking excessive risks in tax-advantaged accounts—can lead to suboptimal outcomes. The chapter provides examples of investors who clung to poorly performing assets to avoid realizing gains, only to see further losses erase any tax benefit.

He discusses the importance of integrating tax efficiency into a broader financial plan, rather than letting it dominate your strategy. Clements recommends using tax-loss harvesting judiciously, balancing the benefits of deferral with the risks of locking in losses. He also advises considering the impact of taxes when planning withdrawals from retirement accounts, suggesting strategies like Roth conversions or spreading out distributions to minimize the tax hit.

For investors, the key lesson is to focus on overall financial goals and sound investment principles, with tax efficiency as a complement—not the driver—of your plan. Clements suggests working with a tax advisor to identify opportunities for savings without compromising investment returns or risk management.

Historically, those who prioritized tax efficiency over sound investing often ended up with lower returns and greater risk. Clements’ chapter is a reminder that taxes are just one piece of the puzzle, and that chasing tax breaks at the expense of good strategy can be costly.

Chapter 18: A Tax Deferred Is Extra Money Made

This chapter highlights the power of tax-deferred accounts, such as 401(k)s and IRAs, in building wealth. Clements explains that deferring taxes allows investments to grow without the drag of annual tax payments, leading to larger balances over time. He provides data showing that, over 30 years, a tax-deferred account can be 25-50% larger than a taxable account with the same contributions and returns.

Clements discusses the mechanics of tax deferral, including the impact of employer matching contributions and the rules for required minimum distributions (RMDs) in retirement. He advises maximizing contributions to tax-advantaged accounts before investing in taxable accounts, and planning retirement withdrawals to minimize taxes. The chapter also addresses the importance of considering future tax rates and the potential benefits of Roth accounts for those who expect higher taxes in retirement.

For investors, the practical steps include contributing the maximum allowed to 401(k)s and IRAs, taking full advantage of employer matches, and reviewing account types annually to ensure optimal tax efficiency. Clements recommends modeling different withdrawal strategies to minimize lifetime taxes and consulting with a financial planner as needed.

Historically, tax-deferred accounts have been a cornerstone of retirement planning, enabling millions to retire comfortably. Clements’ advice is supported by decades of research and the experience of successful savers across generations.

Chapter 19: Insurance Won’t Make Us Any Money—If We’re Lucky

Clements clarifies the role of insurance in financial planning, emphasizing that it is a tool for protection—not profit. He explains that the primary purpose of insurance is to guard against catastrophic losses, such as medical emergencies, disability, or liability lawsuits. The best outcome, he notes, is never having to make a claim, meaning you “lose” the money spent on premiums but avoid financial disaster.

The chapter discusses the importance of right-sizing coverage, avoiding over-insuring, and reviewing policies regularly as your life changes. Clements provides examples of common mistakes, such as maintaining expensive life insurance after children are grown or carrying low deductibles that drive up premiums. He recommends raising deductibles to lower costs and focusing on insuring only against risks you cannot afford to bear yourself.

For investors, the takeaway is to balance insurance needs with other financial goals. Clements suggests conducting an annual insurance audit, comparing policies, and shopping for better rates. He also advises integrating insurance decisions into your overall financial plan, ensuring that coverage supports—not undermines—your long-term objectives.

Historically, those who managed insurance wisely avoided the financial ruin that can accompany unexpected events, while those who neglected coverage or over-insured wasted resources that could have been invested elsewhere. Clements’ chapter is a guide to using insurance as a safety net, not a speculative tool.

Chapter 20: Even If We Have a Will, We May Not Get Our Way

Clements explores the complexities of estate planning, explaining that simply having a will is not enough to ensure your wishes are carried out. He discusses the various ways assets are transferred upon death—such as beneficiary designations, joint ownership, and trusts—and the potential pitfalls if these elements are not coordinated. The chapter provides examples of families who faced unintended consequences because beneficiary forms were outdated or joint ownership arrangements conflicted with the will.

He emphasizes the importance of regularly reviewing all aspects of your estate plan, including updating beneficiary designations on retirement accounts and insurance policies. Clements also discusses the role of trusts in managing complex estates, minimizing probate, and providing for minor children or disabled dependents. He advises consulting with an estate planning professional to ensure that all documents and asset ownership structures are aligned with your intentions.

For investors, the practical steps include creating a comprehensive estate plan, reviewing it every few years, and communicating your wishes to family members and executors. Clements recommends keeping a master list of accounts, policies, and documents, and ensuring that all elements of your plan work together seamlessly.

Historically, poor estate planning has led to family disputes, unnecessary taxes, and assets passing to unintended beneficiaries. Clements’ chapter is a reminder that thoughtful preparation can spare your loved ones stress and ensure your legacy is preserved.

Chapter 21: Financial Success: It’s About More than Money

In the final chapter, Clements broadens the definition of financial success, arguing that true well-being encompasses more than just accumulating wealth. He discusses the importance of aligning financial decisions with personal values, pursuing happiness, and nurturing emotional and relational health. Clements encourages readers to use money as a tool for achieving life satisfaction, not as an end in itself.

The chapter includes examples of individuals who found fulfillment by spending on experiences, supporting causes they care about, or investing in relationships. Clements advises regular reflection on your financial goals, ensuring they remain aligned with your evolving values and life circumstances. He also discusses the dangers of letting money become a source of stress or conflict, and the importance of balance between saving for the future and enjoying the present.

For investors, the practical application is to develop a financial plan that supports both long-term security and present happiness. Clements recommends setting aside funds for meaningful activities, practicing gratitude, and periodically reassessing your priorities. He also suggests seeking professional guidance when needed to ensure your plan reflects your true goals.

Historically, those who viewed money as a means to an end—rather than an end itself—enjoyed greater satisfaction and resilience during financial setbacks. Clements’ concluding message is that financial success is ultimately about living a life that is rich in experiences, relationships, and meaning.

Advanced Strategies from the Book

While The Little Book of Main Street Money is rooted in simple, actionable advice, Clements also offers advanced strategies for those seeking to optimize every aspect of their financial lives. These techniques go beyond the basics, integrating behavioral finance, tax planning, and risk management for investors who want to squeeze every last bit of value from their portfolios. Clements’ advanced strategies are grounded in real-world data and designed to be both effective and practical for individual investors.

The following advanced strategies draw from multiple chapters, providing sophisticated tools for maximizing returns, minimizing risk, and aligning your financial plan with your life goals. Each strategy includes examples and step-by-step guidance for implementation.

Strategy 1: Tax-Efficient Withdrawal Sequencing

One of the most powerful advanced strategies in the book is optimizing the order in which you withdraw funds from different account types in retirement. Clements explains that drawing down taxable accounts first, followed by tax-deferred (like IRAs and 401(k)s), and finally Roth accounts, can minimize your lifetime tax bill. For example, by spending from taxable accounts early, you allow tax-advantaged accounts to continue compounding. He advises tracking required minimum distributions (RMDs) and using Roth conversions in low-income years. This approach can save tens of thousands of dollars in taxes over a multi-decade retirement, as shown in case studies of retirees who coordinated withdrawals with Social Security timing and investment income.

Strategy 2: Behavioral Automation and Guardrails

Clements draws on behavioral finance to recommend systems that automate good decisions and protect against emotional mistakes. He suggests pre-committing to periodic portfolio rebalancing, setting up automatic investment plans, and using “guardrails” like written investment policies or accountability partners. For example, an investor might automate monthly contributions to a diversified set of index funds, rebalance annually on a set date, and require a waiting period before making any major changes. These behavioral guardrails help investors stick to their plans during market turbulence, reducing the risk of panic selling or performance chasing.

Strategy 3: Strategic Use of Alternatives for Risk Management

For investors seeking additional diversification, Clements advocates for the strategic inclusion of alternative assets such as REITs, commodities, and inflation-protected bonds (TIPS). He explains that these assets often have low or negative correlations with stocks and bonds, providing a buffer during market downturns or inflationary periods. For example, a portfolio with 10% allocated to REITs and 5% to commodities may experience lower volatility and smaller drawdowns during bear markets. Clements cautions that alternatives should be used judiciously, with a focus on liquid, transparent vehicles like ETFs or mutual funds.

Strategy 4: Roth Conversions During Market Downturns

Clements highlights the opportunity to convert traditional IRA or 401(k) balances to Roth accounts during market corrections, when account values are temporarily depressed. This strategy allows investors to pay taxes on a lower balance, locking in future tax-free growth. For example, during a 20% market drop, converting $100,000 instead of $125,000 can result in significant tax savings. Clements advises consulting with a tax professional to model the impact and ensure conversions do not push you into a higher tax bracket.

Strategy 5: Dynamic Spending Rules in Retirement

To manage longevity risk and market volatility, Clements recommends dynamic spending strategies—such as the “4% rule with adjustments” or “guardrail” approaches that increase or decrease withdrawals based on portfolio performance. For instance, retirees might start with a 4% withdrawal rate, but reduce spending if the portfolio falls below a certain threshold, or allow for increases after strong market years. This flexibility helps retirees avoid outliving their assets while maintaining a stable standard of living. Clements provides examples of retirees who used dynamic rules to navigate the 2000-2002 and 2008-2009 bear markets without running out of money.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the lessons from The Little Book of Main Street Money begins with an honest assessment of your current financial situation and a commitment to incremental improvement. Clements emphasizes that building wealth is a marathon, not a sprint, and that the most important step is simply to start—no matter your age or financial background. The following guide provides a step-by-step roadmap for implementing the book’s principles in your own life.

Begin by taking inventory of all your assets and liabilities, including less obvious items like future Social Security benefits, pension entitlements, and human capital. Next, set clear financial goals that reflect your values, such as retirement security, home ownership, or funding education. Create a written plan that prioritizes these goals, allocates resources accordingly, and includes safeguards against common behavioral pitfalls.

- First step investors should take: Conduct a comprehensive financial inventory, listing all assets (including human capital and future income streams) and liabilities (debts, obligations). Use this to calculate your net worth and identify areas for improvement.

- Second step for building the strategy: Set up automated systems for saving and investing, such as recurring transfers to retirement accounts and automatic investment in low-cost index funds. Establish an asset allocation tailored to your age, risk tolerance, and goals, and schedule periodic reviews for rebalancing and progress tracking.

- Third step for long-term success: Regularly review and adjust your plan as life circumstances change. Integrate tax efficiency, risk management (insurance, diversification), and behavioral safeguards (written plans, accountability) to stay on track. Revisit your goals annually to ensure they remain aligned with your values and make adjustments as needed.

Critical Analysis

The Little Book of Main Street Money excels in making complex financial concepts accessible to a broad audience. Clements’ writing is clear, concise, and rooted in real-world experience, making the book both engaging and practical. Its integration of behavioral finance, investment strategy, and life philosophy sets it apart from more technical or narrowly focused finance books. The chapter format allows readers to absorb lessons in manageable chunks, and the use of anecdotes and research findings brings the material to life.

One of the book’s greatest strengths is its emphasis on behavioral pitfalls and the psychological aspects of money. Clements does not shy away from discussing the emotional challenges of investing, and he provides actionable strategies for overcoming them. The book’s focus on values-based financial planning and the pursuit of happiness—not just wealth—adds a refreshing dimension often missing from traditional investment guides.

However, the book’s simplicity may leave some advanced investors wanting more detail on specific investment products or strategies. While Clements covers a wide range of topics, the advice is sometimes more principle-driven than prescriptive, and readers seeking in-depth analysis of asset classes or tax law may need to supplement with additional resources. In the current market environment, with increased access to sophisticated investment vehicles and rapidly changing tax laws, readers should use the book as a foundation and seek professional guidance for complex decisions. Nonetheless, the timeless principles outlined by Clements remain relevant and valuable for investors of all levels.

Conclusion

The Little Book of Main Street Money is a masterclass in the fundamentals of personal finance and investing. Jonathan Clements distills decades of experience into 21 concise, actionable chapters that guide readers from the basics of saving and investing to the complexities of estate planning and behavioral finance. The book’s core message—that financial success is about more than just money—resonates in an era of economic uncertainty and information overload.

For investors seeking a clear, practical roadmap to financial security, this book offers a comprehensive framework grounded in both research and real-world experience. Its focus on automation, diversification, risk management, and aligning money with life goals makes it a valuable resource for anyone looking to build wealth, avoid common mistakes, and find greater satisfaction in their financial lives. Whether you are just starting out or looking to refine your approach, Clements’ wisdom provides the tools and mindset needed for long-term success.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Main Street Money

1. Who is Jonathan Clements, and why should I trust his advice?

Jonathan Clements is a renowned personal finance journalist with decades of experience, including a long tenure at The Wall Street Journal and as director of financial education at Citi. His advice is grounded in both research and real-world experience, making it accessible and reliable for everyday investors seeking practical guidance.

2. What is the main message of The Little Book of Main Street Money?

The book’s central message is that financial success is about more than just investment returns—it’s about holistic planning, behavioral discipline, and aligning money with your life goals. Clements emphasizes saving, diversification, risk management, and using money as a tool for happiness and fulfillment.

3. Is this book suitable for beginners or only experienced investors?

The book is designed for a wide audience, from beginners to seasoned investors. Its clear explanations, relatable examples, and actionable steps make it especially valuable for those new to personal finance, while its behavioral insights and advanced strategies provide depth for experienced readers.

4. How does the book address behavioral finance and emotional investing?

Clements dedicates several chapters to the psychological traps that derail investors, such as loss aversion, overconfidence, and herd mentality. He offers practical strategies for overcoming these biases, including automation, diversification, and written investment plans to reduce emotional decision-making.

5. What investment strategies does the book recommend?

The book advocates for passive investing using low-cost index funds, regular rebalancing, and a diversified asset allocation tailored to your risk tolerance and life stage. Clements also emphasizes the importance of minimizing fees, taxes, and avoiding high-interest debt before investing aggressively.

6. Does the book cover topics like real estate, insurance, and estate planning?

Yes, Clements covers a broad range of topics, including the realities of homeownership, the proper role of insurance, and the complexities of estate planning. Each topic is addressed with practical advice and real-world examples, making the book a comprehensive guide to all aspects of personal finance.

7. How can I apply the book’s lessons to my own financial situation?

Start by conducting a comprehensive financial inventory, setting clear goals, and automating your savings and investments. Use the book’s principles to design a diversified portfolio, manage risk, and align your spending with your values. Regularly review your plan and adjust as life changes.

8. Are the book’s strategies still relevant in today’s market environment?

Absolutely. The principles of saving, diversification, risk management, and behavioral discipline are timeless and have proven effective across market cycles. While the investment landscape evolves, Clements’ advice provides a solid foundation for navigating uncertainty and building long-term wealth.

9. What are some actionable steps I can take after reading the book?

Automate your savings, pay off high-interest debt, invest in low-cost index funds, rebalance your portfolio annually, and review your insurance and estate plans. Focus on aligning your financial decisions with your core values and long-term goals for greater satisfaction and security.

10. Where can I find more resources or tools to implement these strategies?

Visit valuesense.io for intrinsic value tools, stock ideas, and educational resources. The platform offers company quality analytics, historical valuation insights, and actionable research to help you find undervalued stocks and build a smarter investment portfolio.