The Little Book of Market Myths by Kenneth L. Fisher

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

“The Little Book of Market Myths” by Kenneth L. Fisher is a compelling and accessible guide that debunks many of the most persistent misconceptions in investing. Fisher, a billionaire investor, founder of Fisher Investments, and long-time Forbes columnist, brings decades of real-world experience and market analysis to the table. His reputation as one of the world’s most successful money managers lends immense credibility to his writing. Fisher’s approach is grounded in both historical data and behavioral finance, making his insights both practical and evidence-based.

The book’s central theme is the importance of critical thinking in investing. Fisher systematically dismantles seventeen widely held market myths, ranging from the supposed safety of bonds over stocks to the belief that political or economic turmoil always spells disaster for investors. Each chapter tackles a separate myth, providing data, historical context, and actionable advice. The book’s purpose is not just to correct misinformation but to empower investors to make more rational, evidence-driven decisions. Fisher’s tone is conversational, often witty, and always direct, making complex concepts digestible for readers at all levels.

This book is ideal for both novice and experienced investors. Beginners will find it demystifies much of the jargon and fear that often surround the stock market, while seasoned professionals will appreciate Fisher’s nuanced take on risk, asset allocation, and market psychology. Financial advisors, portfolio managers, and anyone responsible for investment decisions will find the book’s myth-busting approach invaluable for client communication and portfolio construction. The lessons are universally applicable, regardless of portfolio size or investment style.

What sets “The Little Book of Market Myths” apart is its blend of rigorous analysis and behavioral finance. Fisher doesn’t just present facts—he explains why certain myths persist and how human psychology contributes to poor investment decisions. The book’s structure, with each chapter focused on a single myth, allows readers to dip in and out or read straight through. Fisher’s use of specific historical examples, data, and memorable quotes makes the lessons stick. Ultimately, the book is a toolkit for developing a skeptical, rational, and resilient investment mindset, which is essential in today’s ever-evolving financial markets.

Key Concepts and Ideas

At the heart of “The Little Book of Market Myths” is a philosophy of skepticism and evidence-based investing. Kenneth L. Fisher challenges readers to question conventional wisdom, scrutinize popular narratives, and make investment decisions based on facts rather than emotion or herd mentality. Fisher’s approach is rooted in the belief that many widely held investment beliefs are not only wrong but actively harmful to long-term performance. By dissecting these myths, he aims to help investors avoid common pitfalls and adopt a more rational, disciplined approach to wealth building.

Fisher’s investment philosophy is a blend of behavioral finance, historical analysis, and practical portfolio management. He emphasizes that markets are complex, forward-looking systems, and that investors must be aware of their own biases as well as the limitations of simplistic rules. The book repeatedly highlights the dangers of overreacting to news, relying on shortcuts, and chasing “sure things.” Instead, Fisher advocates for a holistic view of risk, diversification, and a focus on fundamentals over fads or fear-driven strategies.

- The Myth of Bonds as the Safest Investment: Fisher demonstrates that bonds, often seen as “safe,” carry significant risks such as interest rate risk and inflation risk. He uses long-term data to show that stocks can be less volatile than bonds over extended periods, challenging the traditional “stocks are risky, bonds are safe” narrative.

- Personalized Asset Allocation: The book debunks one-size-fits-all asset allocation rules like “subtract your age from 100.” Fisher stresses the need for individualized strategies based on goals, risk tolerance, and market conditions, rather than arbitrary formulas.

- Broader Perspective on Risk: Fisher expands the definition of risk beyond mere volatility. He highlights the importance of considering opportunity cost, inflation, and interest rate risk, arguing that an exclusive focus on volatility can lead to suboptimal portfolios.

- Market Volatility is Cyclical: Contrary to the belief that markets are more volatile than ever, Fisher shows that volatility is cyclical and often exaggerated by the media. He encourages investors to maintain discipline and avoid being swayed by short-term noise.

- No Holy Grail for Capital Preservation and Growth: The book dispels the myth that investors can have both guaranteed capital preservation and high growth. Fisher explains that all investments involve trade-offs, and a balanced, diversified approach is essential.

- GDP Growth Does Not Predict Stock Returns: Fisher provides evidence that stock market performance is not directly tied to GDP growth. He urges investors to focus on company fundamentals and broader market dynamics rather than macroeconomic headlines.

- Realistic Return Expectations: The notion that stocks will always deliver 10% annual returns is debunked. Fisher advocates for more conservative, realistic expectations and warns against planning based on historical averages alone.

- Dividend Yield is Not a Guarantee: High dividend yields can signal underlying company distress. Fisher teaches readers to assess dividend sustainability through financial health and earnings stability, not just yield percentages.

- Diversification Over Single-Category Superiority: The book warns against relying solely on small-cap value stocks or any single asset class, emphasizing the cyclical nature of outperformance and the importance of diversification.

- Action Over Paralysis: Fisher argues that waiting for certainty leads to missed opportunities. He encourages investors to make informed decisions amid uncertainty, rather than attempting to time the market perfectly.

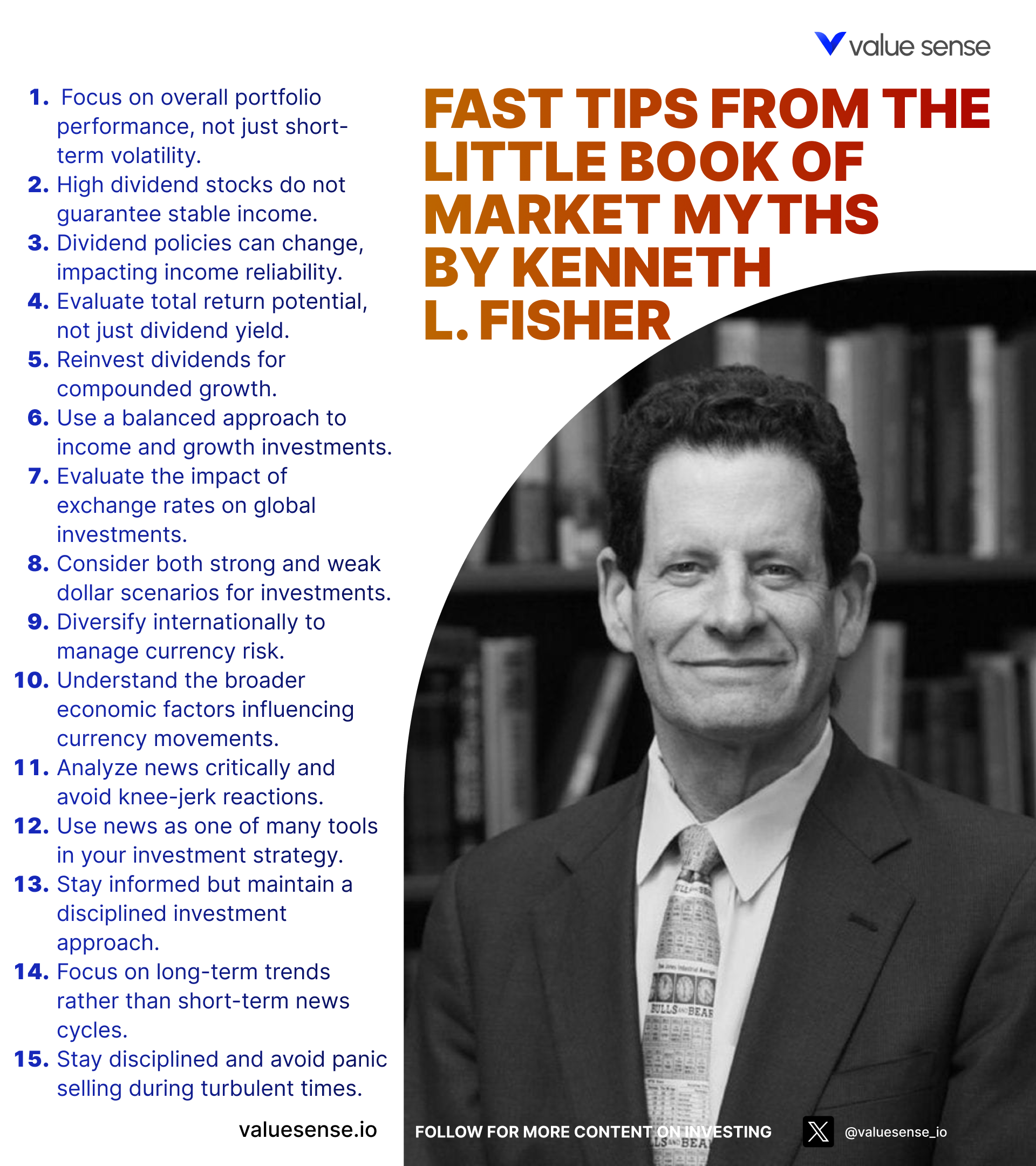

Practical Strategies for Investors

Applying the teachings from “The Little Book of Market Myths” requires more than just understanding the myths—it demands a shift in mindset and the adoption of robust, evidence-based strategies. Fisher’s insights encourage investors to move beyond simplistic rules and emotional reactions, replacing them with disciplined, long-term approaches. The book’s practical value lies in its actionable steps for constructing and managing portfolios that can withstand market noise and capitalize on real opportunities.

Fisher’s strategies are designed to help investors avoid common traps, such as chasing high yields, overreacting to news, or relying on mechanical trading triggers. Instead, he advocates for a focus on fundamentals, regular portfolio review, and a willingness to accept uncertainty as part of the investment journey. By implementing these strategies, investors can build portfolios that are resilient, adaptable, and aligned with their unique financial goals.

- Conduct Holistic Risk Assessments: Go beyond volatility by evaluating interest rate risk, inflation risk, and opportunity cost. Regularly review your portfolio for exposure to these risks, especially during changing economic environments.

- Customize Asset Allocation: Develop an asset allocation strategy tailored to your age, goals, risk tolerance, and market outlook. Rebalance annually or after significant life events to ensure alignment with your objectives.

- Focus on Fundamentals Over Headlines: Before making buy or sell decisions, analyze company earnings, cash flow, and management quality rather than reacting to news events or market rumors.

- Set Realistic Return Expectations: Base your financial planning on conservative return assumptions (e.g., 6-7% for equities), and stress-test your portfolio for periods of underperformance.

- Evaluate Dividend Sustainability: Instead of chasing high yields, assess payout ratios, cash flow coverage, and earnings consistency. Use tools like Value Sense to screen for financially healthy dividend payers.

- Diversify Across Asset Classes and Sectors: Avoid concentration in any one asset class or market segment. Include a mix of equities, bonds, and alternative assets to reduce portfolio volatility and enhance risk-adjusted returns.

- Act Amid Uncertainty: Don’t wait for perfect clarity before investing. Make decisions based on informed probabilities, and be prepared to adjust as new information emerges.

- Review Investment Rationale Regularly: Instead of relying on stop-loss orders, periodically reassess the fundamentals of your holdings. Sell only if the original investment thesis no longer holds, not due to short-term price movements.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book of Market Myths” is structured as a series of concise, focused chapters, each dedicated to debunking a specific investment myth. Fisher’s approach allows readers to tackle one misconception at a time, building a cumulative understanding of how market narratives can mislead investors. Each chapter combines historical data, psychological analysis, and practical advice, making the book both educational and actionable.

The chapters are designed to be read in sequence or individually, depending on the reader’s interests and experience. Fisher uses real-world examples, market statistics, and memorable anecdotes to illustrate his points. From the perceived safety of bonds to the dangers of chasing “too good to be true” investments, each chapter provides a deep dive into a common belief that can derail even the most experienced investor.

Below, we provide a detailed, chapter-by-chapter analysis, highlighting the main ideas, supporting data, and actionable lessons for investors. Each chapter is explored in depth, with specific examples, quotes, and guidance for applying Fisher’s insights to your own investment strategy.

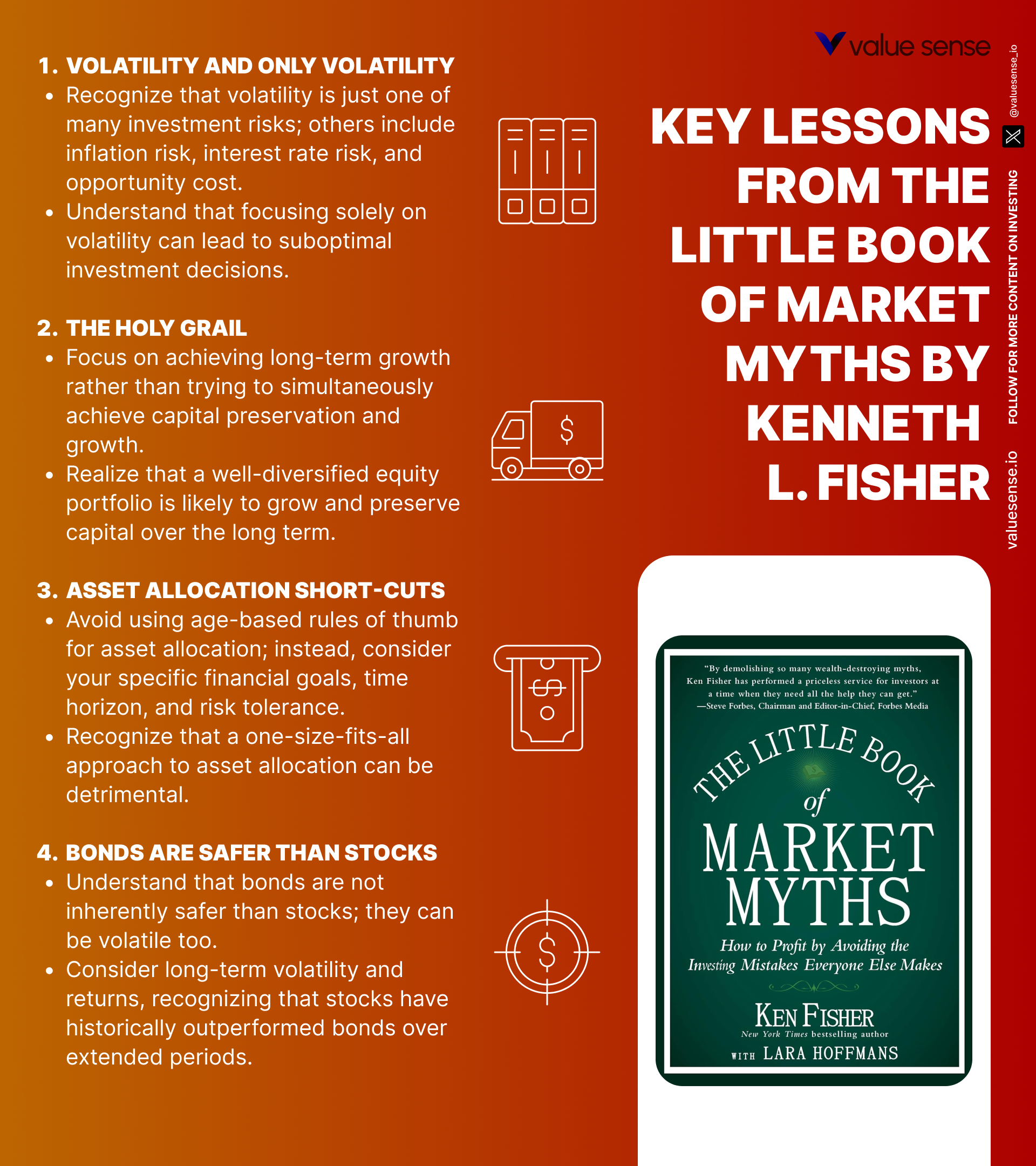

Chapter 1: Bonds Are Safer Than Stocks

The opening chapter of Fisher’s book takes direct aim at one of the most persistent beliefs in finance: that bonds are inherently safer than stocks. Fisher acknowledges that bonds are typically viewed as less volatile, but he quickly points out that this perception is rooted in short-term thinking. He introduces the concept of interest rate risk—the danger that rising rates can erode bond prices—and inflation risk, which can destroy the real value of fixed income returns. Fisher uses historical data to support his argument, noting that over periods of 20 years or more, stocks have not only outperformed bonds in terms of total return but have also demonstrated comparable or even lower volatility. For example, he references the U.S. market’s performance from 1926 to 2012, where stocks delivered higher inflation-adjusted returns than bonds, with the volatility gap narrowing over time.

Fisher explains that the “safety” attributed to bonds is often an illusion. He cites periods such as the 1970s, when high inflation devastated bondholders, resulting in negative real returns for what were presumed to be safe assets. The author also highlights the risk of reinvestment—the challenge of finding new bonds at similar yields when existing ones mature, especially in a low-rate environment. Fisher quotes, “Bonds are not riskless; they’re just differently risky.” He uses charts and tables to illustrate how bond portfolios can experience significant drawdowns and underperformance, particularly when interest rates rise unexpectedly.

For investors, the lesson is clear: don’t assume that bonds are a safe haven, especially for long-term goals like retirement. Instead, Fisher advises evaluating your investment horizon and considering how inflation and interest rate cycles can impact both stocks and bonds. He suggests that younger investors, or those with long time horizons, should not overweight bonds simply out of fear of volatility. Instead, a diversified portfolio with a meaningful equity allocation can provide better long-term protection against inflation and purchasing power erosion.

Historically, the belief in bond safety has led to costly mistakes. During the 2008 financial crisis, many investors fled to bonds, only to see their real returns eroded by subsequent inflation and ultra-low interest rates. In the post-pandemic era, with central banks raising rates to combat inflation, bondholders have experienced sharp declines in value, proving Fisher’s point. The chapter’s core message is timeless: understand the specific risks of every asset class and avoid making decisions based on outdated or oversimplified notions of safety.

Chapter 2: Asset Allocation Short-Cuts

In this chapter, Fisher dismantles the popular “rule of thumb” for asset allocation, such as “subtract your age from 100 and put that percentage in stocks.” He argues that these shortcuts are dangerously simplistic and ignore the complexity of individual financial situations. Fisher points out that such rules fail to account for factors like investment goals, risk tolerance, income needs, and life expectancy. He notes that two investors of the same age could have vastly different financial profiles and thus require different asset allocations. Fisher writes, “Asset allocation is not a math problem; it’s a life problem.”

Fisher supports his argument with examples of investors who suffered from rigid application of allocation rules. For instance, a 65-year-old with a large pension and minimal living expenses might be able to take on more equity risk than a 40-year-old with significant financial obligations and a low risk tolerance. The author references studies showing that asset allocation decisions account for the majority of long-term portfolio returns, far more than market timing or security selection. He provides charts comparing the outcomes of various allocation strategies across different market environments, demonstrating that personalized approaches consistently outperform generic formulas.

Practically, Fisher encourages investors to build customized asset allocation plans based on a thorough assessment of their own circumstances. He recommends starting with a detailed inventory of assets, liabilities, income sources, and future goals. Investors should then consider their ability and willingness to take risk, as well as any constraints (such as liquidity needs or tax considerations). Fisher advises annual reviews and adjustments to ensure the allocation remains aligned with life changes and market conditions.

The historical context for this chapter is the widespread adoption of age-based allocation models by financial advisors and robo-advisors. While these tools are convenient, they often ignore the nuances that drive real-world outcomes. Fisher’s message is particularly relevant in today’s environment, where people are living longer, retiring later, and facing more complex financial landscapes. By rejecting shortcuts and embracing a personalized approach, investors can better navigate the uncertainties of the market and achieve their unique financial objectives.

Chapter 3: Volatility and Only Volatility

Fisher’s third chapter tackles the misconception that volatility is the only risk that matters in investing. He explains that while volatility—the tendency for prices to fluctuate—is an important consideration, it is far from the only risk that can harm a portfolio. Fisher introduces readers to other risks, such as interest rate risk, inflation risk, and the often-overlooked opportunity cost. He argues that an excessive focus on volatility can lead investors to avoid equities altogether, missing out on long-term growth and compounding.

To drive home his point, Fisher provides examples of investors who, fearing volatility, shifted entirely into cash or bonds during market downturns. He shows how these decisions, while reducing short-term fluctuations, often resulted in lower long-term wealth due to inflation and missed opportunities for market recovery. Fisher references data from periods like the 1970s and 1980s, when inflation eroded the real value of “safe” assets. He also discusses the concept of opportunity cost—the potential gains lost by avoiding riskier assets—which can be just as damaging as actual losses.

For practical application, Fisher encourages investors to adopt a broader perspective on risk management. He recommends diversifying across asset classes to mitigate different types of risk and regularly reviewing the portfolio’s exposure to inflation and interest rate changes. Rather than obsessing over short-term volatility, investors should focus on their long-term objectives and the real, inflation-adjusted growth of their assets. Fisher suggests using tools like rolling return analyses to understand how different risks impact portfolios over time.

This chapter is especially relevant during periods of market turmoil, such as the 2008 financial crisis or the COVID-19 pandemic, when volatility spikes and fear dominates headlines. Fisher’s advice to consider the full spectrum of risks, rather than just price swings, provides a more holistic framework for building resilient portfolios. The key takeaway is that avoiding volatility at all costs can be more dangerous than embracing it within a thoughtful, diversified strategy.

Chapter 4: More Volatile Than Ever

In Chapter 4, Fisher confronts the narrative that markets are more volatile today than ever before. He explains that while periods of high volatility do occur, they are typically followed by calmer periods, making volatility itself a cyclical phenomenon rather than a permanent trend. Fisher uses historical market data to illustrate that episodes of extreme volatility—such as the 1987 crash, the dot-com bubble burst, and the 2008 financial crisis—were followed by extended periods of relative stability. He writes, “Volatility is not a constant; it’s a variable.”

The author also addresses the role of the media in amplifying perceptions of volatility. He cites studies showing that media coverage tends to focus disproportionately on market declines and dramatic swings, fueling investor anxiety and short-term thinking. Fisher provides examples from recent years, such as the 2020 pandemic-induced market crash, where headlines predicted ongoing chaos, yet markets rebounded rapidly. He emphasizes that past volatility does not reliably predict future volatility or market performance, and that long-term investors should not be swayed by short-term turbulence.

For investors, the practical lesson is to maintain discipline and perspective during volatile periods. Fisher recommends setting clear investment goals, sticking to a predetermined asset allocation, and avoiding impulsive decisions based on media-driven fear. He suggests using volatility as an opportunity to rebalance portfolios or add to positions at attractive valuations, rather than as a reason to exit the market. Fisher’s analysis demonstrates that those who remain invested during turbulent times are often rewarded with strong subsequent returns.

Looking at history, the myth of ever-increasing volatility has led many investors to reduce equity exposure unnecessarily, missing out on long-term growth. The rapid recovery of markets after crises like 2008 and 2020 underscores Fisher’s point that volatility is temporary, but the rewards of staying invested are enduring. The chapter’s message is clear: volatility is a normal, cyclical part of investing, and reacting emotionally to it can undermine long-term success.

Chapter 5: The Holy Grail—Capital Preservation and Growth

This chapter addresses a deep-seated investor desire: the search for a strategy that guarantees both capital preservation and high growth. Fisher labels this the “Holy Grail” of investing, and he explains why it is fundamentally unattainable. He argues that all investments involve trade-offs between risk and return, and that seeking both absolute safety and high returns is unrealistic. Fisher uses historical returns from various asset classes to show that low-risk assets like bonds or savings accounts may preserve capital but offer limited growth, while equities provide higher returns at the price of greater volatility.

Fisher illustrates this trade-off with examples from different market cycles. During the 2000-2002 bear market, investors who fled to cash or government bonds avoided short-term losses but missed the subsequent equity market recovery. Conversely, those who stayed fully invested in stocks may have endured painful drawdowns but ultimately benefited from long-term compounding. Fisher writes, “There is no free lunch in investing. Every choice involves giving something up.” He also discusses the dangers of products that claim to offer both safety and high returns, cautioning that these often rely on complex derivatives or hidden risks.

Practically, Fisher advises investors to embrace a balanced approach tailored to their own risk tolerance, time horizon, and financial goals. He suggests constructing diversified portfolios that include a mix of assets—equities for growth, bonds for stability, and cash for liquidity. Regular rebalancing ensures that the portfolio remains aligned with the investor’s objectives as market conditions change. Fisher also recommends setting realistic expectations and avoiding the temptation to chase “guaranteed” strategies or products.

The historical context for this chapter includes the proliferation of structured products and “guaranteed” investment schemes in the 2000s and 2010s, many of which failed to deliver on their promises during market stress. Fisher’s warning is particularly relevant in today’s low-interest-rate environment, where the allure of high-yield, “safe” products remains strong. The key takeaway is that investors must accept the inherent trade-offs in investing and build portfolios that balance their need for safety with their desire for growth.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: The GDP–Stock Mismatch Crash

Chapter 6 explores the common misconception that stock market performance is directly tied to GDP growth. Fisher argues that while GDP measures the overall economic activity of a country, it does not have a straightforward relationship with stock market returns. He points out that markets are forward-looking and often anticipate changes in economic conditions before they are reflected in GDP data. Fisher provides examples from the 1990s and early 2000s, when U.S. stocks soared despite modest GDP growth, and from 2008-2009, when markets began recovering even as GDP continued to contract.

Fisher explains that investor sentiment, speculation, and global economic influences can drive stock prices independently of domestic GDP trends. He cites the example of multinational companies like Apple and Microsoft, whose performance depends as much on global demand and currency fluctuations as on U.S. economic growth. Fisher writes, “Stocks don’t wait for GDP to catch up; they look ahead.” He supports his argument with charts showing the lack of correlation between GDP growth rates and stock market returns across multiple countries and time periods.

For investors, the lesson is to focus on company fundamentals and broader market dynamics rather than relying on macroeconomic indicators like GDP. Fisher suggests analyzing earnings growth, management quality, and competitive positioning when selecting stocks. He also recommends considering global economic conditions, especially for companies with significant international exposure. By looking beyond headline GDP figures, investors can identify opportunities that others may overlook.

The chapter’s historical examples highlight the dangers of making investment decisions based on macro headlines. During the European debt crisis, many investors avoided European equities due to weak GDP data, missing out on strong subsequent rallies. Fisher’s message is especially relevant in today’s interconnected world, where companies operate across borders and are influenced by a wide range of factors. The key takeaway is that stock markets and GDP are related but not directly linked, and investors should base decisions on a comprehensive analysis of fundamentals and global trends.

Chapter 7: 10% Forever!

In this chapter, Fisher addresses the widespread belief that the stock market will deliver an average return of 10% per year indefinitely. He explains that this expectation, often rooted in historical data from the 20th century, is misleading because it oversimplifies the variability of market returns. Fisher points out that while the U.S. stock market has delivered an average annual return of around 10% over long periods, there have been extended stretches—such as the 1970s or 2000s—where returns were significantly lower or even negative.

Fisher supports his argument with detailed charts showing rolling 10- and 20-year returns for the S&P 500, highlighting periods of both outperformance and underperformance relative to the 10% average. He cautions against using this figure as a planning assumption, noting that market cycles, valuation levels, and economic conditions can all impact returns. Fisher writes, “Averages are comforting, but they rarely describe reality.” He also discusses the psychological impact of expecting consistent double-digit gains, which can lead to disappointment and poor decision-making during inevitable downturns.

For practical application, Fisher advises investors to set more conservative return expectations when planning for retirement or other long-term goals. He suggests using a range of 6-7% for equities and stress-testing portfolios to ensure they can withstand periods of low or negative returns. This approach helps investors avoid overestimating future wealth and making unsustainable withdrawal plans. Fisher also recommends focusing on factors within your control—such as saving rate, asset allocation, and cost management—rather than relying on historical averages to deliver results.

Historically, the myth of “10% forever” has led to overconfidence and excessive risk-taking, particularly during bull markets. The tech bubble of the late 1990s and the housing boom of the 2000s both saw investors assume that past returns would continue indefinitely, resulting in painful corrections. Fisher’s message is a timely reminder that markets are unpredictable, and prudent planning requires humility and flexibility. The chapter’s core lesson is to base your financial strategy on realistic, evidence-based assumptions rather than comforting myths.

Chapter 8: High Dividends for Sure Income

Chapter 8 challenges the belief that high-dividend stocks are a guaranteed source of safe and steady income. Fisher explains that while dividends can provide valuable cash flow, chasing high yields can expose investors to significant risks. He notes that companies offering unusually high dividends may be doing so because their stock price has declined, often due to underlying business problems. Fisher provides examples of well-known companies that cut or eliminated dividends during financial distress, leaving yield-chasing investors with both income loss and capital losses.

The author emphasizes the importance of assessing a company’s ability to sustain its dividend payments. He recommends analyzing payout ratios, cash flow coverage, and earnings stability to determine whether a dividend is likely to continue. Fisher writes, “A high yield is only as good as the company’s ability to pay it.” He provides case studies of companies with high yields that ultimately proved unsustainable, as well as examples of firms with moderate yields but consistent dividend growth over decades.

For investors, the practical takeaway is to look beyond headline yield figures and conduct a thorough analysis of financial health and business prospects. Fisher suggests using tools like Value Sense to screen for companies with strong balance sheets, stable cash flows, and a track record of dividend growth. He advises building a diversified portfolio of dividend payers across sectors, rather than concentrating in high-yield industries like utilities or REITs. This approach balances income needs with the potential for capital appreciation.

The historical context includes the wave of dividend cuts during the 2008-2009 financial crisis and the early months of the COVID-19 pandemic, when many companies suspended payouts to preserve cash. Fisher’s message is particularly relevant in today’s low-yield environment, where investors may be tempted to reach for yield at the expense of safety. The chapter’s key lesson is that sustainable income comes from financially healthy companies, not just high yields.

Chapter 9: The Perma-Superiority of Small-Cap Value

In Chapter 9, Fisher examines the belief that small-cap value stocks are consistently superior investments. He acknowledges that small-cap value has outperformed other categories during certain periods but warns that this performance is highly cyclical and not guaranteed. Fisher provides data from the Fama-French studies, which showed strong small-cap value outperformance in the decades following World War II, but also highlights extended periods of underperformance, such as the 1990s and parts of the 2010s.

Fisher cautions against relying on past performance as a predictor of future returns, especially for cyclical asset classes. He explains that the success of small-cap value stocks often depends on specific economic and market conditions, such as periods of economic recovery or low interest rates. Fisher writes, “No asset class is permanently superior; markets are always changing.” He provides examples of investors who overallocated to small-cap value based on historical data, only to experience disappointing results when market conditions shifted.

For practical application, Fisher advises investors to diversify across different asset classes and sectors rather than betting heavily on any single category. He recommends regularly reviewing portfolio allocations to ensure they reflect current market conditions and long-term objectives. Fisher suggests using a core-satellite approach, with a diversified core of broad-market funds and smaller allocations to higher-risk segments like small-cap value.

The historical context includes the proliferation of small-cap value funds and ETFs in the 2000s, many of which underperformed during subsequent market cycles. Fisher’s message is particularly relevant for investors tempted by recent outperformance in any asset class. The chapter’s lesson is to avoid the trap of “recency bias” and to build resilient portfolios through diversification and periodic rebalancing.

Chapter 10: Wait Until You’re Sure

Chapter 10 addresses the myth that investors should wait for certainty before making investment decisions. Fisher argues that waiting for absolute clarity often leads to missed opportunities, as markets are forward-looking and tend to move ahead of widely recognized events or trends. He explains that by the time certainty is achieved—such as confirmation of an economic recovery or a new bull market—much of the potential gains have already been captured by the market.

Fisher provides examples from past market cycles, such as the early stages of the 2009 bull market, when many investors stayed on the sidelines until economic data improved, only to miss substantial returns. He writes, “Markets don’t wait for you to feel comfortable; they move on anticipation.” Fisher discusses the psychological barriers to investing amid uncertainty, including fear of loss and the desire for confirmation, and explains how these biases can lead to paralysis and underperformance.

For investors, the lesson is to make decisions based on informed analysis and reasonable probabilities, rather than waiting for perfect information. Fisher recommends developing a disciplined investment process that incorporates both quantitative and qualitative factors, and being willing to act when conditions align with your analysis. He also suggests setting clear criteria for entering and exiting positions, to avoid the trap of perpetual indecision.

The historical context includes numerous market recoveries that began amid widespread pessimism and uncertainty, such as the post-World War II expansion, the 1982 bull market, and the rebound from the 2020 pandemic sell-off. Fisher’s message is especially relevant in volatile or rapidly changing environments, where waiting for certainty can mean missing out on the best opportunities. The chapter’s key takeaway is to embrace uncertainty as an inherent part of investing and to act with conviction when your research supports it.

Chapter 11: Stop-Losses Stop Losses

In this chapter, Fisher critiques the popular use of stop-loss orders as a risk management tool. While stop-losses are intended to limit losses by automatically selling a stock when it falls to a certain price, Fisher argues that they can be counterproductive. He explains that stop-losses can trigger sales during temporary market dips, leading to missed opportunities for recovery and long-term gains. Fisher provides examples of stocks that experienced sharp but short-lived declines, only to rebound strongly, leaving stop-loss users out of the recovery.

The author emphasizes that investment decisions should be based on the underlying fundamentals of a stock rather than mechanical triggers like stop-losses. He writes, “If you don’t know why you own a stock, a stop-loss won’t save you.” Fisher recommends regular review of an investment’s fundamentals, such as earnings growth, competitive position, and management quality, to determine whether to hold or sell. He cautions that relying on stop-losses can lead to emotional decision-making and excessive trading costs.

For practical application, Fisher advises investors to maintain a long-term perspective and to sell only when the original investment thesis no longer holds. He suggests setting up regular portfolio reviews—quarterly or semi-annually—to assess the health of each holding. Fisher also recommends documenting the reasons for each investment, so that decisions are grounded in analysis rather than short-term price movements.

The historical context includes periods of heightened volatility, such as the 2015-2016 market correction, when many investors were whipsawed out of positions by stop-loss triggers, only to see prices recover quickly. Fisher’s message is particularly relevant in today’s fast-moving, algorithm-driven markets, where price swings can be sharp and unpredictable. The chapter’s key lesson is to focus on fundamentals and discipline, rather than relying on mechanical trading rules to manage risk.

Chapter 12: High Unemployment Kills Stocks

Chapter 12 addresses the myth that high unemployment rates are a death sentence for the stock market. Fisher explains that while high unemployment is often perceived as a negative economic indicator, it does not necessarily translate into poor stock market performance. He points out that markets are forward-looking and often price in the effects of high unemployment before they become widely recognized. Fisher provides examples from the early 1980s and the aftermath of the 2008 financial crisis, when stocks began to recover even as unemployment remained elevated.

The author emphasizes that unemployment is just one of many economic indicators, and that other factors—such as corporate earnings, interest rates, and consumer confidence—can also influence stock performance. Fisher writes, “Stocks don’t wait for full employment to rise; they anticipate improvement.” He supports his argument with data showing that some of the strongest bull markets in history began during periods of high or rising unemployment, as investors looked ahead to eventual recovery.

For investors, the lesson is to analyze a broad range of economic indicators and market conditions, rather than focusing narrowly on unemployment rates. Fisher recommends monitoring trends in productivity, monetary policy, and business investment, as these can signal turning points in the market. He also suggests maintaining a diversified portfolio to capture opportunities in sectors that may benefit from changing economic conditions.

The historical context includes the post-World War II expansion, the Reagan-era recovery, and the rebound from the Great Recession, all of which saw strong stock market gains amid high unemployment. Fisher’s message is especially relevant in today’s economy, where labor market data can be volatile and subject to revision. The chapter’s key takeaway is that unemployment is just one piece of the puzzle, and investors should avoid overreacting to headline numbers.

Chapter 13: Over-Indebted America

In this chapter, Fisher tackles the pervasive myth that America’s high levels of debt, particularly government debt, spell doom for the stock market and the economy. He explains that while debt levels are often cited as a major risk, they are not as catastrophic as commonly believed. Fisher points out that markets have historically absorbed high levels of debt without disastrous consequences, and that the U.S. government’s ability to service its debt through taxation and borrowing power is often underestimated.

Fisher provides examples from the post-World War II era, when U.S. debt-to-GDP ratios were far higher than today, yet the economy and stock market experienced robust growth. He also discusses Japan’s experience with high government debt and persistent deflation, noting that markets can adapt to a wide range of debt levels. Fisher writes, “Debt is a problem, but it’s not the only problem—and it’s rarely the fatal one.” He cautions against fear-mongering and the tendency to focus on debt to the exclusion of other, more important factors.

For practical application, Fisher advises investors to maintain a balanced perspective on debt and to consider a wide range of economic indicators when making decisions. He suggests focusing on corporate earnings, productivity growth, and innovation as drivers of long-term market performance. Fisher also recommends avoiding knee-jerk reactions to debt-related headlines and instead conducting a thorough analysis of the underlying fundamentals.

The historical context includes repeated episodes of debt panic, such as the European sovereign debt crisis and the U.S. debt ceiling debates, which often led to market volatility but rarely to lasting damage. Fisher’s message is particularly relevant in today’s environment of rising government debt and fiscal stimulus. The chapter’s key lesson is that debt is a manageable risk, not an automatic disaster, and investors should avoid making decisions based on fear alone.

Chapter 14: Strong Dollar, Strong Stocks

Fisher debunks the myth that a strong U.S. dollar is inherently beneficial for the stock market. He explains that the relationship between the dollar’s strength and stock market performance is complex and sector-specific. While a strong dollar can benefit import-heavy industries by lowering the cost of goods and materials, it can hurt export-oriented companies by making their products more expensive for foreign buyers. Fisher provides examples of multinational corporations like Coca-Cola and Caterpillar, whose earnings are sensitive to currency fluctuations.

The author uses historical data to show that periods of dollar strength have not consistently coincided with strong stock market performance. He discusses the late 1990s, when a strong dollar accompanied a bull market, and the early 2000s, when the dollar weakened but stocks still performed well. Fisher writes, “Currency trends are just one piece of a very large puzzle.” He cautions investors against making decisions based solely on currency movements, as many other factors influence stock prices.

For practical application, Fisher recommends conducting a comprehensive analysis that includes global economic trends, sector performance, and company fundamentals. He suggests diversifying across sectors and geographies to mitigate the impact of currency fluctuations. Fisher also advises monitoring the exposure of portfolio companies to international markets and adjusting allocations as needed to manage risk.

The historical context includes the post-2014 period, when a strengthening dollar hurt the earnings of U.S. exporters but benefited domestic-focused companies. Fisher’s message is particularly relevant in today’s globalized economy, where currency movements can have far-reaching effects. The chapter’s key takeaway is that investors should avoid overreliance on currency trends and instead focus on building balanced, diversified portfolios.

Chapter 15: Turmoil Troubles Stocks

Chapter 15 addresses the myth that political or economic turmoil always leads to poor stock market performance. Fisher argues that while turmoil can create uncertainty and short-term volatility, it does not necessarily result in long-term declines. He provides examples from history, such as the Cuban Missile Crisis, the Watergate scandal, and the aftermath of 9/11, when markets experienced sharp but temporary drops before recovering and moving higher.

Fisher explains that markets are resilient and often recover quickly from shocks, especially when underlying economic fundamentals remain strong. He writes, “Markets climb a wall of worry.” The author discusses the psychological impact of turmoil, noting that fear and panic can lead to selling at the worst possible times. Fisher provides data showing that contrarian investors who bought during periods of crisis—such as the 2008-2009 financial meltdown—were often rewarded with outsized returns.

For investors, the lesson is to maintain a long-term perspective and avoid overreacting to news of turmoil. Fisher recommends focusing on the fundamentals of the economy and individual companies, rather than being swayed by headlines. He suggests using periods of volatility as opportunities to add to positions at attractive valuations, provided the underlying investment thesis remains intact.

The historical context includes numerous crises, from wars and political scandals to pandemics and natural disasters, all of which created short-term volatility but rarely derailed long-term market growth. Fisher’s message is especially relevant in today’s era of 24/7 news cycles and social media, where panic can spread rapidly. The chapter’s key takeaway is that turmoil is a normal part of investing, and those who remain disciplined are best positioned to benefit from the eventual recovery.

Chapter 16: News You Can Use

Fisher challenges the notion that investors can consistently profit by reacting to financial news. He explains the concept of efficient markets, where prices quickly adjust to new information, leaving little room for individual investors to gain an edge by trading on news events. Fisher provides examples of major announcements—such as earnings reports, economic data releases, and central bank decisions—that were already priced into the market by the time they became public.

The author discusses the dangers of news-driven investing, including the tendency to make impulsive decisions based on headlines rather than analysis. Fisher writes, “By the time you read it, it’s too late.” He cites studies showing that attempts to time the market based on news events often result in missed opportunities or losses, as markets move faster than most investors can react. Fisher also addresses the role of financial media in creating noise and distraction, which can lead to overtrading and increased transaction costs.

For practical application, Fisher advises investors to focus on long-term trends and fundamental analysis, rather than trying to capitalize on short-term news events. He recommends filtering out the noise and sticking to a disciplined investment strategy. Fisher suggests setting up regular portfolio reviews and using systematic criteria for buying and selling, rather than reacting to every headline.

The historical context includes the dot-com bubble, the 2008 financial crisis, and the COVID-19 pandemic, all of which saw wild swings in news coverage and investor sentiment. Fisher’s message is particularly relevant in today’s information-saturated environment, where social media and 24-hour news channels can amplify market volatility. The chapter’s key lesson is to resist the urge to trade on news and instead build wealth through patience and discipline.

Chapter 17: Too Good to Be True

In the final chapter, Fisher warns against the allure of investment opportunities that seem “too good to be true.” He explains that investments promising high returns with little or no risk are often deceptive and can lead to significant losses. Fisher discusses the psychology behind such schemes, including greed, overconfidence, and the desire for quick riches. He provides examples of infamous frauds and bubbles, such as the Bernie Madoff Ponzi scheme and the dot-com mania, where investors ignored warning signs in pursuit of outsized gains.

The author emphasizes the importance of skepticism and due diligence in evaluating investment opportunities. Fisher writes, “If it sounds too good to be true, it probably is.” He recommends thoroughly researching any investment, verifying the credibility of the people and companies involved, and understanding the risks before committing money. Fisher also discusses the dangers of chasing unrealistically high returns, which often leads to excessive risk-taking and eventual losses.

For practical application, Fisher advises investors to adopt a balanced approach that aligns with their risk tolerance and financial goals. He suggests avoiding complex or opaque products that promise guaranteed returns, and instead focusing on transparent, well-understood investments. Fisher recommends conducting regular reviews of portfolio holdings to ensure they remain consistent with the original investment thesis.

The historical context includes numerous episodes of financial fraud and speculative bubbles, from the South Sea Bubble to the cryptocurrency mania of the 2010s. Fisher’s message is especially relevant in today’s era of online scams and unregulated markets. The chapter’s key takeaway is that every investment carries risk, and the best protection is a healthy dose of skepticism and a commitment to due diligence.

Advanced Strategies from the Book

While “The Little Book of Market Myths” is accessible to all investors, it also offers advanced strategies for those looking to refine their approach. Fisher delves into nuanced techniques for risk management, portfolio construction, and behavioral discipline. These strategies go beyond the basics, providing tools for navigating complex markets and avoiding the subtle traps that ensnare even experienced professionals.

Fisher’s advanced techniques focus on integrating behavioral finance principles with rigorous analysis. He emphasizes the importance of understanding market psychology, managing emotions, and developing systematic processes for decision-making. The following advanced strategies are drawn from the book’s deeper lessons and can help investors enhance returns while minimizing costly mistakes.

Strategy 1: Dynamic Asset Allocation Based on Regime Shifts

Fisher encourages advanced investors to move beyond static allocation models and adopt dynamic asset allocation strategies that respond to changing market regimes. This involves monitoring macroeconomic indicators, such as interest rates, inflation, and global growth trends, and adjusting portfolio weights accordingly. For example, during periods of rising inflation and interest rates, reducing bond exposure and increasing allocations to equities or inflation-protected assets can help preserve real returns. Fisher provides historical examples, such as the 1970s stagflation era and the post-2008 recovery, where flexible allocation strategies outperformed rigid models. The key is to remain disciplined, avoid overreacting to short-term noise, and make changes only when there is clear evidence of a regime shift.

Strategy 2: Multi-Factor Stock Selection

Fisher advocates for a multi-factor approach to stock selection, combining value, quality, momentum, and size factors to build robust portfolios. He explains that relying on a single factor—such as value or small-cap bias—can lead to periods of underperformance due to cyclical market dynamics. By blending multiple factors, investors can capture diverse sources of return and reduce portfolio risk. Fisher suggests using quantitative screens to identify stocks with attractive valuations, strong balance sheets, consistent earnings growth, and positive price momentum. He provides examples of successful multi-factor strategies, such as those employed by institutional investors and smart beta ETFs, which have delivered superior risk-adjusted returns over time.

Strategy 3: Behavioral Bias Mitigation Techniques

Recognizing the impact of behavioral biases on investment decisions, Fisher outlines techniques for mitigating their effects. He recommends setting predefined rules for buying and selling, such as target allocation bands or stop-gain levels, to counteract the tendency to chase performance or panic during downturns. Fisher also suggests using checklists to ensure that decisions are based on objective criteria rather than emotions. For example, before making a trade, investors can review a checklist of fundamental and technical indicators, recent news, and alignment with long-term goals. By institutionalizing these processes, investors can reduce the influence of fear and greed and improve consistency.

Strategy 4: Scenario Analysis and Stress Testing

Fisher highlights the importance of scenario analysis and stress testing in portfolio construction. He advises investors to model how their portfolios would perform under various market conditions, such as recessions, interest rate shocks, or geopolitical crises. This involves using historical data and forward-looking simulations to estimate potential drawdowns, volatility, and recovery times. Fisher provides examples of how stress testing helped investors navigate the 2008 financial crisis and the COVID-19 pandemic, by identifying vulnerabilities and prompting timely adjustments. He recommends conducting stress tests at least annually and after major market events, to ensure that the portfolio remains resilient and aligned with risk tolerance.

Strategy 5: Systematic Rebalancing and Tax Optimization

Fisher emphasizes the value of systematic rebalancing and tax optimization in enhancing long-term returns. He suggests setting predefined thresholds for rebalancing—such as a 5% deviation from target allocations—to maintain portfolio discipline and prevent drift. Fisher also discusses tax-loss harvesting, where investors sell losing positions to offset gains and reduce tax liabilities. He provides examples of how disciplined rebalancing and tax management have added significant value for high-net-worth clients and institutional portfolios. The key is to implement these strategies consistently, using automated tools or professional advisors as needed, to maximize after-tax returns.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the lessons from “The Little Book of Market Myths” requires a structured, step-by-step approach. Fisher’s insights are most effective when integrated into a disciplined investment process that combines analysis, planning, and regular review. By following a systematic implementation guide, investors can build resilient portfolios that are well-positioned to navigate market uncertainties and capitalize on real opportunities.

Start by assessing your current portfolio and identifying any areas where myths or misconceptions may have influenced past decisions. Use Fisher’s framework to challenge assumptions, evaluate risks, and set realistic expectations. Develop a written investment plan that outlines your goals, asset allocation, and decision-making criteria, and commit to regular reviews and adjustments as needed. The following steps provide a roadmap for putting Fisher’s teachings into practice:

- First step investors should take: Conduct a comprehensive portfolio review, identifying any holdings or strategies based on debunked myths (e.g., overreliance on bonds for safety, chasing high-dividend yields, or waiting for certainty before investing).

- Second step for building the strategy: Develop a personalized asset allocation plan based on your unique goals, risk tolerance, time horizon, and market outlook. Use tools like Value Sense to screen for fundamentally strong companies and diversify across asset classes and sectors.

- Third step for long-term success: Implement systematic processes for regular portfolio review, rebalancing, and risk assessment. Set realistic return expectations, monitor for behavioral biases, and adjust your strategy as life circumstances and market conditions evolve.

Critical Analysis

“The Little Book of Market Myths” excels in its clear, concise, and evidence-based approach to debunking common investment misconceptions. Fisher’s use of historical data, real-world examples, and behavioral finance insights makes the book both informative and engaging. The structure—one myth per chapter—allows readers to absorb complex ideas in manageable pieces, and Fisher’s conversational tone makes the material accessible to a wide audience. The book’s greatest strength is its focus on empowering investors to think critically and avoid costly mistakes driven by fear, greed, or herd mentality.

However, the book does have some limitations. Its brevity, while making it accessible, means that some topics are covered at a high level and may leave experienced investors wanting more depth or technical detail. Additionally, Fisher’s emphasis on skepticism and contrarian thinking, while valuable, may not provide enough specific guidance for investors seeking step-by-step portfolio construction advice. Some readers may also find the focus on U.S. markets limits the applicability of certain lessons to global portfolios.

In the context of today’s market environment—characterized by rapid technological change, geopolitical uncertainty, and evolving investor behavior—Fisher’s lessons are more relevant than ever. The book’s emphasis on evidence-based decision-making, diversification, and behavioral discipline provides a solid foundation for navigating volatile markets. While no single book can offer all the answers, “The Little Book of Market Myths” is an essential resource for investors seeking to separate fact from fiction and build resilient, long-term portfolios.

Conclusion

“The Little Book of Market Myths” by Kenneth L. Fisher is a must-read for anyone serious about investing. Its myth-busting approach, grounded in data and behavioral finance, provides a powerful toolkit for avoiding common traps and building wealth over time. Fisher’s insights are accessible yet profound, making the book suitable for both beginners and experienced investors.

The key takeaways are clear: challenge conventional wisdom, focus on fundamentals, diversify your portfolio, and maintain discipline amid uncertainty. By applying Fisher’s lessons, investors can navigate market noise, avoid costly mistakes, and achieve their financial goals. The book’s practical strategies and advanced techniques offer a roadmap for success in any market environment.

If you’re looking to enhance your investment process, avoid common pitfalls, and build a resilient portfolio, “The Little Book of Market Myths” is an invaluable addition to your financial library. Use it as a reference, a guide, and a source of inspiration as you pursue long-term investment success.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Market Myths

1. Who is Kenneth L. Fisher, and why should I trust his investment advice?

Kenneth L. Fisher is a billionaire investor, founder of Fisher Investments, and a long-time Forbes columnist. With over four decades of experience managing billions in client assets, Fisher is recognized as one of the world’s top money managers. His track record and deep understanding of market history lend significant credibility to his investment insights and myth-busting approach.

2. What are the main myths debunked in the book?

The book tackles seventeen major investment myths, including the safety of bonds over stocks, the reliability of asset allocation shortcuts, the dangers of focusing solely on volatility, the illusion of guaranteed high returns, and the misconception that political or economic turmoil always leads to market declines. Each chapter focuses on a different myth, providing data and practical advice.

3. Is this book suitable for beginners or only experienced investors?

The book is written in a clear, accessible style that makes it suitable for both beginners and experienced investors. Novices will benefit from the myth-busting explanations and practical tips, while seasoned professionals will appreciate Fisher’s nuanced analysis and behavioral finance insights. The structure allows readers to focus on topics most relevant to their experience level.

4. How can I apply the lessons from the book to my own investment strategy?

You can apply Fisher’s lessons by conducting holistic risk assessments, customizing your asset allocation, focusing on fundamentals, and setting realistic return expectations. The book emphasizes regular portfolio reviews, diversification, and disciplined decision-making. Using tools like Value Sense can help you implement these strategies effectively.

5. Does the book address global investing, or is it focused only on U.S. markets?

While many examples are drawn from U.S. market history, Fisher also discusses global economic trends, the impact of currency fluctuations, and the importance of considering international factors in portfolio construction. The core principles of skepticism, diversification, and evidence-based investing are universally applicable.

6. What is the biggest mistake investors make according to Fisher?

Fisher believes the biggest mistake is making decisions based on myths, emotions, or herd mentality rather than evidence and analysis. He warns against chasing “sure things,” overreacting to news, and relying on simplistic rules. Instead, he advocates for a disciplined, contrarian, and data-driven approach to investing.

7. Are there actionable tools or checklists provided in the book?

While the book does not include formal checklists, it offers numerous actionable strategies and decision-making frameworks. Fisher’s advice can be easily translated into checklists for risk assessment, portfolio review, and stock selection. Supplementing the book with tools like Value Sense can further enhance your investment process.

8. How does the book address behavioral biases in investing?

Fisher integrates behavioral finance throughout the book, explaining how biases like fear, greed, and overconfidence contribute to the persistence of market myths. He provides practical techniques for mitigating these biases, such as setting predefined rules, conducting regular reviews, and focusing on long-term goals.

9. What is the most important takeaway from The Little Book of Market Myths?

The most important takeaway is to question conventional wisdom and base investment decisions on evidence, not emotion or popular narratives. By debunking common myths, Fisher empowers investors to make smarter, more resilient choices and avoid costly mistakes that can derail long-term wealth building.

10. Where can I find additional resources to implement Fisher’s strategies?

You can use online platforms like Value Sense to screen for undervalued stocks, analyze company fundamentals, and track portfolio performance. Many investment firms and educational websites offer tools and courses that align with Fisher’s evidence-based approach. Regular reading of financial news, research reports, and books on behavioral finance will also reinforce these lessons.