The Little Book of Market Wizards by Jack D. Schwager

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

"The Little Book of Market Wizards" by Jack D. Schwager is a compact yet profound guide to the mindsets, habits, and strategies that define the world’s most successful traders. Schwager, a renowned financial author, market historian, and industry veteran, is best known for his "Market Wizards" series, which features in-depth interviews with legendary traders such as Paul Tudor Jones, Michael Marcus, and Marty Schwartz. Drawing on decades of experience and direct conversations with top performers, Schwager distills the essence of trading success into a series of concise, actionable lessons suitable for investors at any stage.

Schwager’s credibility is rooted in his extensive career as a futures and hedge fund manager, as well as his role as a chronicler of trading psychology and market behavior. His work bridges the gap between academic finance and real-world application, making complex concepts accessible without sacrificing depth. In "The Little Book of Market Wizards," he synthesizes insights from interviews with dozens of trading legends, weaving their stories into a tapestry of timeless principles. The book’s core theme is that there is no single path to market success—rather, it is the combination of discipline, self-awareness, risk management, and relentless learning that separates the elite from the average.

This book is ideal for both aspiring traders and seasoned investors seeking to refine their approach. Beginners will appreciate the clear, jargon-free explanations and the encouragement to view setbacks as learning opportunities. Experienced professionals will find value in the nuanced discussions of trading psychology, position sizing, and the importance of adapting to ever-changing markets. Its compact format makes it a perfect reference for busy investors who want to revisit fundamental truths without wading through dense academic tomes.

What makes "The Little Book of Market Wizards" unique is its blend of storytelling and practical wisdom. Schwager’s use of real-life anecdotes—ranging from the early failures of Michael Marcus to the contrasting styles of Jim Rogers and Marty Schwartz—brings abstract principles to life. The book’s structure, with each chapter focusing on a key lesson, allows readers to quickly internalize actionable insights. Its value lies not just in the strategies discussed, but in the emphasis on psychological resilience, adaptability, and the willingness to learn from mistakes—traits that are as relevant in today’s volatile markets as they were decades ago.

Key Concepts and Ideas

At its heart, "The Little Book of Market Wizards" is a study in the psychology of trading and investing. Schwager’s philosophy is that success in markets is less about finding a magical formula and more about cultivating the right habits, mindset, and approach to risk. He emphasizes that while methodologies differ—some traders are technical, others fundamental—the common denominators among the best are discipline, adaptability, and a relentless commitment to self-improvement. The book highlights that there is no single path to success, but rather a set of principles that can be tailored to fit an individual’s personality and goals.

Schwager’s investment philosophy is grounded in the belief that markets are unpredictable, and the only way to survive and thrive is through rigorous risk management and emotional control. He draws on the experiences of legendary traders to illustrate that setbacks are inevitable, but resilience and the willingness to learn from mistakes are what ultimately lead to long-term profitability. The book also stresses the importance of having a trading edge, the value of hard work, and the necessity of independence in thinking and decision-making.

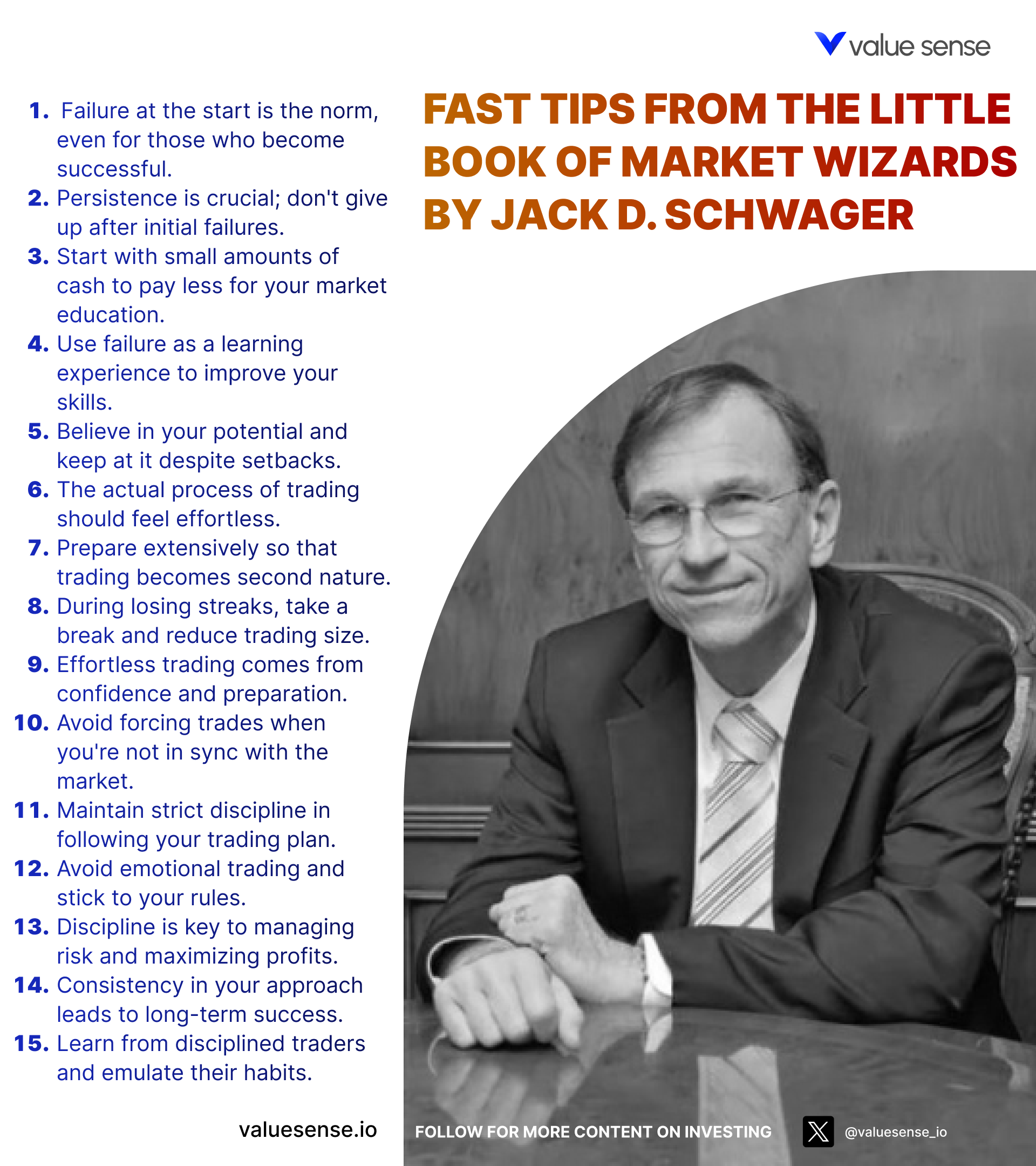

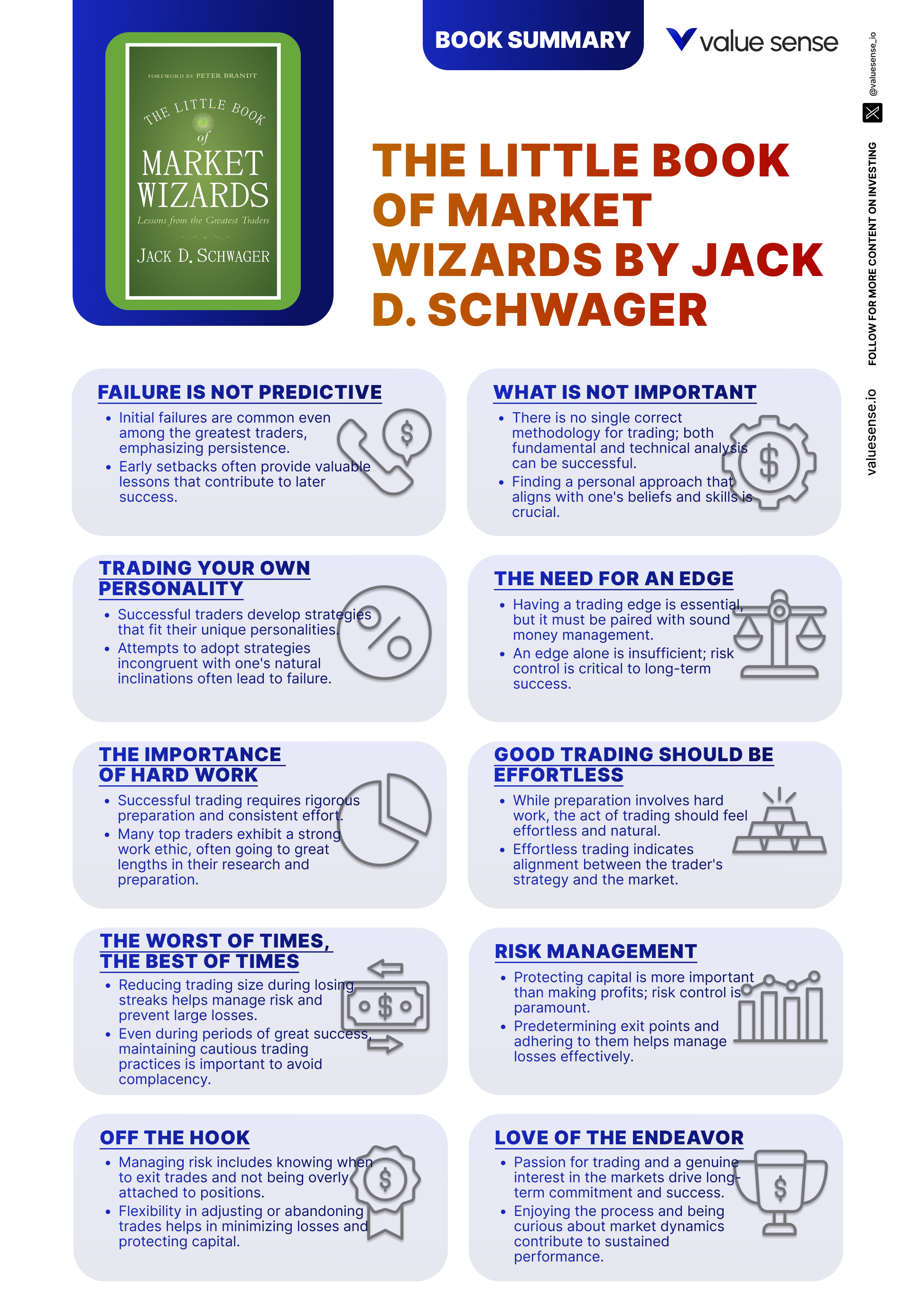

- Failure as a Stepping Stone: Early setbacks do not predict future failure. Schwager shares stories of traders like Michael Marcus, who suffered significant losses before achieving market success. The key is to treat losses as learning experiences and to persist through adversity.

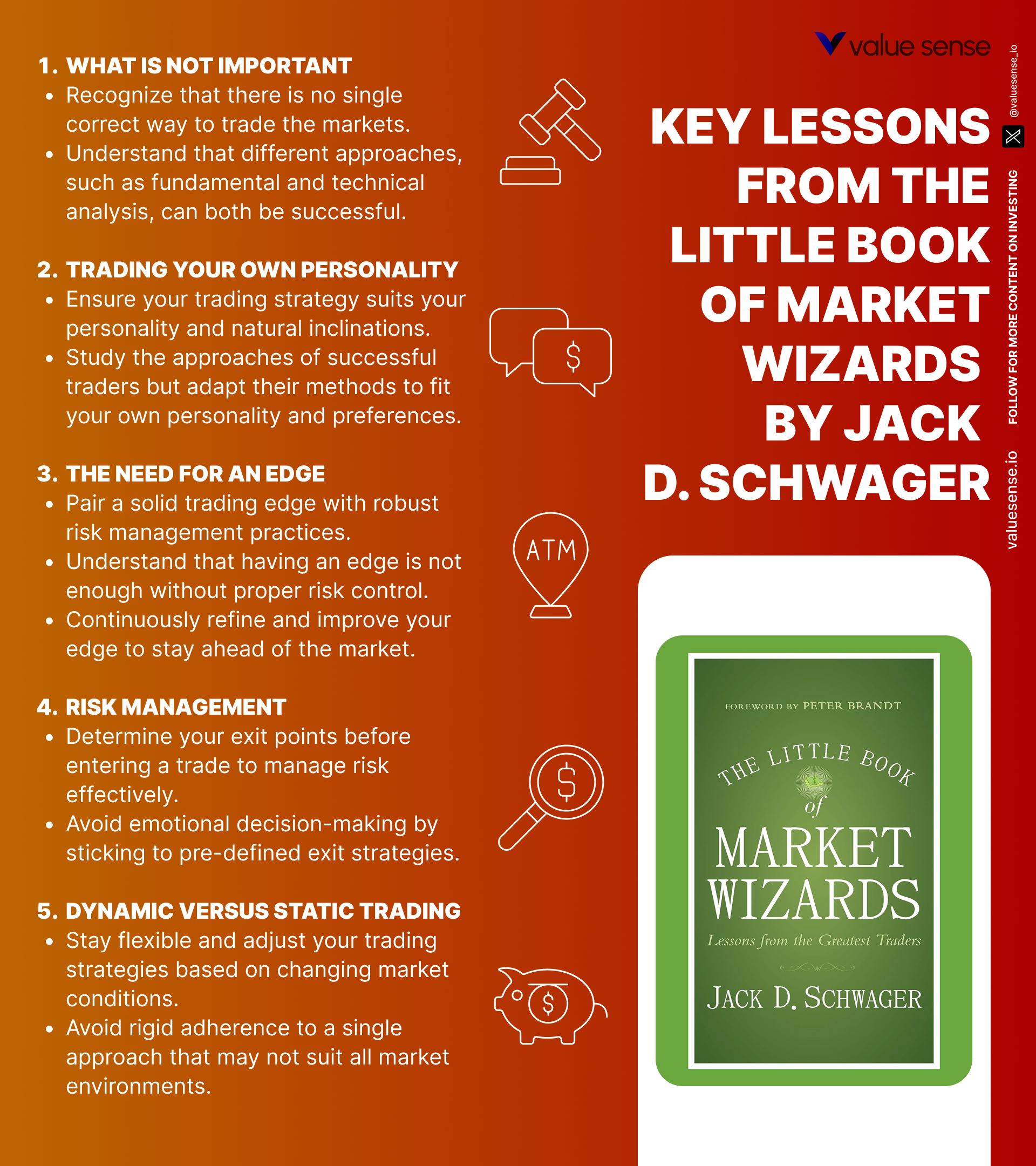

- No Single Right Way to Trade: There is no universal trading system. Schwager contrasts the approaches of Jim Rogers (a fundamentalist) and Marty Schwartz (a technician) to show that diverse methods can all lead to success if aligned with one’s personality.

- Trading Your Own Personality: The best traders develop methods that fit their psychological makeup. For example, Paul Tudor Jones thrives on fast-paced trading, while Gil Blake favors a methodical style. Self-awareness is crucial for aligning strategy with temperament.

- The Need for an Edge: Profitable trading requires a genuine edge—an identifiable advantage that increases the probability of success. Money management is important but cannot compensate for a lack of edge.

- Hard Work and Preparation: Trading is not a shortcut to wealth. Schwager highlights the dedication of traders like David Shaw, who invest countless hours in research and preparation to stay ahead of the market.

- Effortless Execution: While preparation is demanding, actual trading should feel natural and fluid when done right. Schwager draws parallels to peak athletic performance, where effortless execution follows intense practice.

- Risk Management: Preserving capital is paramount. Proper position sizing, stop-loss orders, and continuous monitoring are essential to avoid catastrophic losses and ensure longevity in the markets.

- Discipline and Emotional Control: Discipline is the backbone of successful trading. Schwager emphasizes the need for emotional control, consistency in execution, and adherence to risk management rules.

- Independence and Confidence: Successful traders think independently and have confidence in their analysis. They avoid herd mentality and are willing to act contrary to popular opinion when warranted.

- Learning from Mistakes: Mistakes are inevitable, but they are valuable opportunities for growth. Schwager encourages traders to reflect on errors, adapt strategies, and embrace failure as a necessary part of the journey.

Practical Strategies for Investors

Schwager’s teachings are not just theoretical; they are deeply practical and can be applied by investors at any level. The book’s structure, with each chapter focused on a core principle, allows readers to translate insights into concrete strategies for their own portfolios. Whether you are a full-time trader or a long-term investor, the lessons about risk, discipline, and adaptability are universally relevant. Schwager’s emphasis on preparation, self-awareness, and continuous learning provides a framework for building a robust investment process.

Applying the book’s teachings requires a willingness to look inward, assess one’s strengths and weaknesses, and develop a trading or investing approach that fits your personality. Schwager repeatedly stresses that there is no shortcut to success—hard work, discipline, and a commitment to learning are essential. By focusing on risk management, developing a clear edge, and maintaining emotional control, investors can improve their odds of long-term profitability and avoid many of the pitfalls that derail others.

- Start Small and Learn from Early Mistakes: Begin with small position sizes to minimize the financial impact of initial errors. Track your trades and analyze what went wrong to build a foundation of experience without risking large amounts of capital.

- Develop a Personalized Trading Plan: Assess your personality and risk tolerance. Choose a trading strategy—whether technical, fundamental, or a hybrid—that aligns with your natural inclinations and stick to it consistently.

- Define and Hone Your Trading Edge: Identify what gives you an advantage—unique research, pattern recognition, or superior risk management. Continuously refine your edge through backtesting and real-world application.

- Emphasize Rigorous Preparation: Dedicate time to researching markets, analyzing data, and preparing for different scenarios. Create checklists for trade setups and risk controls to ensure you are ready for any market condition.

- Implement Strict Risk Management Rules: Set maximum loss limits per trade and for your overall portfolio. Use stop-loss orders and position sizing formulas (such as risking no more than 1-2% of capital per trade) to protect yourself from catastrophic losses.

- Maintain Emotional Discipline: Establish routines for decision-making that minimize emotional interference. Take breaks after a string of losses or wins to reset your mindset and avoid impulsive actions.

- Review and Learn from Every Trade: Keep a trading journal to document your decisions, outcomes, and emotional states. Regularly review your journal to identify recurring mistakes and areas for improvement.

- Stay Flexible and Open to Change: Markets evolve, and so should your strategies. Be willing to adapt your approach when conditions shift, but avoid overreacting to short-term noise.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

"The Little Book of Market Wizards" is structured as a series of concise chapters, each dedicated to a core principle or lesson distilled from Schwager’s interviews with elite traders. The book’s organization makes it easy to digest, with each chapter functioning as a self-contained module that builds on the previous ones. This structure allows readers to focus on specific areas of interest, revisit key concepts, and apply actionable takeaways to their own investing journey.

Each chapter opens with a vivid anecdote or example, followed by a detailed exploration of the underlying principle. Schwager uses real-world stories to illustrate abstract concepts, making the lessons memorable and relatable. The chapters cover a range of topics—from the inevitability of failure and the importance of risk management to the nuances of trading psychology and the value of independence. Below, we provide a comprehensive, chapter-by-chapter analysis, unpacking the book’s most important lessons and offering practical guidance for investors seeking to emulate the habits of market wizards.

Chapter 1: Failure Is Not Predictive

The opening chapter sets the tone for the book by challenging the common misconception that early failures in trading are indicative of one’s long-term potential. Schwager recounts the stories of Michael Marcus and Tony Saliba, both of whom suffered significant losses at the outset of their careers. Marcus, for example, lost his initial stake multiple times before eventually becoming one of the most successful traders in the commodities markets. Schwager uses these stories to illustrate that setbacks are not only common but can serve as crucial learning experiences for those willing to persist.

Schwager emphasizes the importance of psychological resilience. He notes that what separates successful traders from the rest is not an absence of failure, but rather the ability to bounce back, analyze mistakes, and adapt. The chapter includes direct quotes from Marcus, who attributed his eventual success to the lessons he learned from his early losses. Schwager also points out the role of persistence, arguing that many of the world’s top traders achieved greatness precisely because they refused to give up after repeated setbacks.

For investors, this chapter offers a powerful lesson: do not let early losses define your trajectory. Instead, treat them as tuition paid to the markets—a necessary investment in your education as a trader. Start with small stakes to minimize the financial impact of mistakes, and keep detailed records of your trades to facilitate learning. Schwager suggests that the willingness to learn from failure is a hallmark of future success.

Historically, many legendary investors—Warren Buffett included—have experienced periods of underperformance or outright loss early in their careers. The key, as Schwager illustrates, is to view these setbacks as part of the process rather than as a verdict on one’s abilities. In today’s fast-moving markets, where volatility can quickly erode confidence, this lesson is more relevant than ever. By fostering resilience and a growth mindset, investors can turn setbacks into stepping stones toward long-term profitability.

Chapter 2: What Is Not Important

In the second chapter, Schwager debunks the myth that there is a single, universally correct way to trade the markets. He contrasts the approaches of Jim Rogers, a fundamentally driven investor, and Marty Schwartz, a technical trader, to demonstrate that both achieved remarkable success despite employing vastly different methodologies. Rogers is known for his deep macroeconomic analysis and long-term bets, while Schwartz found his edge in short-term technical signals and momentum trading. Schwager’s point is clear: the method itself is less important than the trader’s commitment and consistency in applying it.

This chapter includes anecdotes illustrating how traders who chase the “holy grail” of trading systems—believing there is a perfect formula for market success—often end up frustrated and unsuccessful. Schwager shares that many of the traders he interviewed had tried multiple systems before settling on one that resonated with their personality and strengths. He quotes Schwartz as saying, “There are a million ways to make money in the markets. The irony is that they are all very difficult to find.”

For investors, the takeaway is to focus on finding an approach that aligns with your own temperament and beliefs. Rather than endlessly searching for the perfect system, dedicate yourself to mastering a strategy that feels natural and makes sense to you. This could be value investing, technical analysis, quantitative strategies, or a hybrid approach. The key is to avoid being swayed by the latest fads or by the successes of others—what works for one person may not work for another.

Historically, the diversity of successful trading styles is evident in the careers of investors like George Soros, who combines macroeconomic analysis with bold risk-taking, and Peter Lynch, who favored bottom-up stock picking. The lesson for modern investors is to embrace this diversity and focus on self-awareness. In an era of algorithmic trading and social media-driven hype, the temptation to copy others is strong—but true success comes from finding and refining your own edge.

Chapter 3: Trading Your Own Personality

Building on the previous chapter, Schwager delves deeper into the importance of aligning your trading strategy with your personality. He uses the contrasting examples of Paul Tudor Jones, an aggressive, fast-paced trader, and Gil Blake, a more methodical, systematic investor. Both achieved extraordinary results, but through approaches that suited their psychological makeup. Schwager argues that self-awareness is critical—traders who stray from their natural inclinations often struggle with consistency and discipline.

This chapter is rich with anecdotes about traders who failed when they tried to emulate someone else’s style, only to succeed when they returned to a method that felt comfortable and intuitive. Schwager notes that the most successful traders are those who have spent significant time experimenting, reflecting, and ultimately settling on a strategy that matches their strengths and risk tolerance. He quotes Jones as saying, “You always want to be in control, never wishing, always trading, and always, first and foremost, protecting your butt.”

For investors, the lesson is to conduct an honest self-assessment before committing to a trading style. Are you comfortable with volatility, or do you prefer a more measured approach? Do you thrive on fast decision-making, or do you excel in research and analysis? Schwager suggests that consistency in applying a method that feels natural is more important than chasing the latest market trend.

In the broader context, this principle is evident in the careers of investors like Warren Buffett, whose temperament is suited to patient, long-term value investing, and Stanley Druckenmiller, who excels at dynamic macro trading. The modern market offers a wide array of tools and data, but the challenge remains the same: align your strategy with your personality to maximize your chances of success.

Chapter 4: The Need for an Edge

This chapter focuses on the necessity of having a genuine trading edge—an identifiable advantage that increases the probability of success. Schwager asserts that while money management is essential, it cannot compensate for the absence of an edge. He defines an edge as a methodology, pattern, or process that, over time, yields positive expectancy. Whether it’s superior research, unique data analysis, or a proprietary trading system, the edge is what separates winners from losers in the long run.

Schwager shares examples of traders who initially experienced success due to luck but ultimately failed because they lacked a sustainable edge. He emphasizes that traders must be able to articulate what their edge is and how it provides a statistical advantage. The chapter includes a quote from one trader: “If you don’t know what your edge is, you don’t have one.” Schwager also discusses the importance of continuously refining and testing your edge to ensure it remains effective in changing market conditions.

For investors, the practical takeaway is to clearly define and validate your trading edge before risking significant capital. This might involve backtesting strategies, analyzing historical performance, or developing unique insights that others overlook. Schwager advises against relying on luck or copying others blindly—instead, focus on building a repeatable process that gives you a measurable advantage.

Historically, the concept of edge is central to the success of quantitative firms like Renaissance Technologies, which rely on sophisticated algorithms and data analysis to maintain a statistical advantage. In today’s markets, where information is widely available, developing and protecting your edge is more important than ever. Schwager’s advice is timeless: without an edge, even the best risk management cannot save you from eventual losses.

Chapter 5: The Importance of Hard Work

Schwager dispels the romantic notion that trading is an easy path to wealth. He highlights the intense dedication and work ethic exhibited by top traders like David Shaw and John Bender. Shaw, for instance, was known for his relentless research and willingness to invest countless hours in developing and testing trading models. The chapter emphasizes that success in trading, as in any profession, is built on a foundation of hard work, preparation, and continuous learning.

Through anecdotes and direct quotes, Schwager illustrates that the most successful traders are those who treat trading as a craft, not a hobby. They meticulously analyze markets, prepare for different scenarios, and stay ahead of the curve through constant study. Schwager notes that many traders who fail do so because they underestimate the amount of effort required to succeed. He quotes one trader as saying, “Trading is the hardest way to make easy money.”

For investors, the lesson is to approach trading with the same seriousness and discipline as any other demanding career. This means dedicating time to research, developing checklists and routines, and committing to lifelong learning. Schwager suggests that preparation is what enables traders to act decisively and confidently when opportunities arise.

In historical context, legendary investors like Benjamin Graham and Peter Lynch were renowned for their exhaustive research and attention to detail. In the modern era, where information is abundant but time is limited, the willingness to outwork the competition remains a key differentiator. Schwager’s message is clear: there are no shortcuts—consistent effort and preparation are prerequisites for long-term success.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Good Trading Should Be Effortless

In contrast to the hard work required for preparation, Schwager argues that the actual process of trading should feel effortless when executed correctly. He draws an analogy to peak athletic performance, where the best results come when actions are fluid, natural, and free of strain. The chapter suggests that if trading feels forced or difficult, it may be a sign that something is off—either with the market or with the trader’s mindset.

Schwager shares stories of traders who describe their best periods as times when trading seemed almost automatic. This state of “flow” is only possible after rigorous preparation and practice. The chapter includes a quote from one trader: “When I’m trading well, it feels like I’m in a groove. I’m not thinking—I’m just reacting.” Schwager cautions that when trading becomes a struggle, it’s important to step back, reassess, and potentially take a break.

For investors, the practical takeaway is to strive for a balance between intense preparation and relaxed execution. Develop routines and checklists that allow you to act confidently and without hesitation when the right conditions present themselves. If you find yourself second-guessing or feeling anxious, it may be time to review your process or take a pause.

Historically, this principle is echoed in the experiences of athletes and performers across disciplines. In trading, the ability to enter a state of effortless execution is a hallmark of expertise. In today’s high-stress, fast-paced markets, cultivating this balance is essential for maintaining both performance and mental well-being.

Chapter 7: The Worst of Times, the Best of Times

This chapter explores the emotional and strategic challenges traders face during both losing and winning streaks. Schwager discusses the psychological pitfalls of overconfidence during periods of success and the dangers of despair during drawdowns. He advises traders to reduce position sizes during losing streaks to limit potential losses and to remain disciplined during winning streaks to avoid the temptation of overleveraging.

Schwager provides examples of traders who blew up their accounts after a series of wins led to overconfidence and excessive risk-taking. Conversely, he shares stories of traders who survived difficult periods by scaling back and focusing on capital preservation. The chapter includes the advice: “When you’re hot, don’t get too cocky; when you’re cold, don’t get too discouraged.” Schwager emphasizes the importance of self-awareness and emotional balance in navigating market extremes.

For investors, the lesson is to develop routines for adjusting risk in response to changes in performance. After a string of losses, reduce your trading size or take a break to regain perspective. After a series of wins, resist the urge to increase risk or deviate from your plan. Schwager suggests that psychological resilience is as important as technical skill in surviving the ups and downs of the market.

Historically, the cyclical nature of markets means that both euphoria and despair are inevitable. The ability to manage emotions and adapt strategy during these periods is a defining trait of successful investors. In today’s environment, where social media amplifies both fear and greed, Schwager’s advice to stay grounded and disciplined is more relevant than ever.

Chapter 8: Risk Management

Risk management is the central theme of this chapter, and Schwager leaves no doubt about its importance. He argues that even the best trading strategy will fail without proper risk controls. The chapter covers key concepts such as position sizing, stop-loss orders, and the primacy of capital preservation. Schwager notes that successful traders are often more focused on managing risk than on maximizing profits, understanding that survival is the prerequisite for long-term success.

Schwager provides detailed examples of risk management techniques used by top traders. He discusses the practice of limiting the amount of capital risked on any single trade—often to no more than 1-2% of the portfolio. The chapter includes a quote: “If you manage the risk, the profits will take care of themselves.” Schwager also emphasizes the need for continuous monitoring and adjustment of risk parameters as market conditions change.

For investors, the practical application is clear: implement strict risk management rules and adhere to them without exception. Set maximum loss limits per trade, use stop-loss orders, and regularly review your portfolio for concentration risk. Schwager suggests that protecting your capital should always take precedence over chasing gains.

Historically, major blowups—such as the collapse of Long-Term Capital Management in 1998—have been caused by inadequate risk controls. In the modern era, where leverage and derivatives are widely accessible, the potential for catastrophic loss is even greater. Schwager’s message is timeless: risk management is not optional—it is the foundation of sustainable investing.

Chapter 9: Discipline

Schwager identifies discipline as the cornerstone of successful trading. He argues that having a well-defined plan is meaningless without the discipline to follow it consistently. The chapter discusses the challenges traders face in maintaining discipline, such as emotional decision-making, impatience, and the temptation to deviate from established rules during periods of market volatility.

Schwager shares anecdotes of traders who lost fortunes by abandoning their plans in moments of fear or greed. He emphasizes that discipline is not just about executing trades, but also about adhering to risk management protocols and maintaining a commitment to continuous learning. The chapter includes the advice: “Discipline is the bridge between goals and accomplishment.”

For investors, the lesson is to develop routines and checklists that reinforce discipline. This might include pre-trade checklists, daily reviews, and regular performance audits. Schwager suggests that discipline extends beyond trade execution to include preparation, risk management, and ongoing education.

In the broader context, discipline is a common trait among successful investors across eras. From Benjamin Graham’s adherence to value principles to Ray Dalio’s commitment to systematic decision-making, the ability to stay the course in the face of uncertainty is a key differentiator. In today’s environment of rapid information flow and constant distraction, cultivating discipline is more challenging—and more important—than ever.

Chapter 10: Independence

This chapter explores the importance of independent thinking in trading and investing. Schwager argues that successful traders have the confidence to trust their own analysis and convictions, even when they diverge from popular opinion or market consensus. He notes that herd mentality often leads to poor decision-making, as traders who follow the crowd tend to buy high and sell low.

Schwager provides examples of traders who made their fortunes by going against the grain—buying when others were fearful and selling when others were greedy. He quotes one trader as saying, “If you find yourself on the side of the majority, it’s time to pause and reflect.” The chapter emphasizes that independence is not about contrarianism for its own sake, but about developing a unique approach that reflects your strengths and insights.

For investors, the practical takeaway is to cultivate the confidence to make decisions based on your own analysis. This requires rigorous research, self-awareness, and a willingness to stand alone when necessary. Schwager suggests that relying too heavily on external advice or consensus can undermine your independence and lead to suboptimal results.

Historically, some of the greatest investment opportunities have arisen for those willing to act independently—think of John Paulson’s bet against the housing market in 2007 or Warren Buffett’s investments during the 2008 financial crisis. In today’s social media-driven environment, the pressure to conform is immense, making the cultivation of independence more valuable than ever.

Chapter 11: Confidence

Schwager delves into the role of confidence in trading success, emphasizing that it is essential for executing trades with conviction and maintaining discipline during challenging periods. He distinguishes between true confidence, which is built on preparation and experience, and overconfidence, which can lead to excessive risk-taking and eventual losses. The chapter highlights that genuine confidence comes from a deep understanding of the markets and one’s own strategy.

Schwager shares stories of traders who faltered due to overconfidence, ignoring warning signs and taking on too much risk after a string of successes. Conversely, he describes how thorough preparation and experience enable traders to trust their analysis and stay the course during volatility. The chapter includes the advice: “Confidence is not the absence of fear, but the willingness to act in spite of it.”

For investors, the lesson is to build confidence through preparation—study markets, backtest strategies, and keep detailed records of your decisions and outcomes. At the same time, remain humble and open to new information. Schwager suggests that confidence should always be tempered with humility and a commitment to continuous learning.

Historically, the line between confidence and arrogance has been the downfall of many investors—think of the tech bubble in 2000 or the financial crisis in 2008. In modern markets, where leverage and rapid information flow can amplify both gains and losses, maintaining balanced confidence is critical for long-term success.

Chapter 12: Losing Is Part of the Game

This chapter addresses the inevitability of losses in trading and the importance of accepting them as a natural part of the process. Schwager explains that even the most successful traders experience losses, but what sets them apart is their ability to manage and learn from setbacks. He emphasizes that traders should not take losses personally or allow them to undermine their confidence.

Schwager provides examples of traders who bounced back from significant losses by maintaining perspective and focusing on risk management. He notes that the key to long-term success is minimizing losses and learning from mistakes, rather than trying to avoid losses altogether. The chapter includes the advice: “You can’t control whether you win or lose on any given trade, but you can control how much you lose.”

For investors, the practical takeaway is to develop routines for analyzing losses and extracting lessons. Maintain a long-term perspective and avoid the temptation to “revenge trade” or double down on losing positions. Schwager suggests that every loss is an opportunity to refine your strategy and improve your decision-making process.

Historically, the acceptance of loss as part of the investment journey is a common trait among great investors. In today’s volatile markets, where losses can be swift and severe, the ability to manage setbacks and maintain focus on the long-term goal is more important than ever.

Chapter 13: Patience

Schwager discusses the critical role of patience in trading, arguing that many traders fail because they lack the discipline to wait for high-probability opportunities. He explains that successful trading often involves long periods of waiting followed by short bursts of activity. The chapter emphasizes that patience is not only about waiting for the right trade, but also about allowing trades to reach their full potential.

Schwager shares stories of traders who missed out on gains by closing positions too early or who suffered losses by entering trades impulsively. He notes that patience is a form of discipline, requiring the ability to resist the urge to act when conditions are not optimal. The chapter includes the advice: “Sometimes the best action is inaction.”

For investors, the lesson is to develop routines for identifying high-probability setups and waiting for confirmation before acting. Use checklists and alerts to avoid impulsive trades, and trust your analysis when holding positions. Schwager suggests that patience is as important in exiting trades as it is in entering them.

Historically, patience has been rewarded in markets—think of Warren Buffett’s long-term holdings or the success of value investors who wait for mispricings to correct. In today’s environment of instant information and high-frequency trading, cultivating patience is both more challenging and more valuable than ever.

Chapter 14: No Loyalty

In this chapter, Schwager explains that successful traders should not have loyalty to any particular stock, strategy, or opinion. He argues that markets are constantly changing, and what worked yesterday might not work today. The chapter emphasizes the importance of flexibility and adaptability in trading, warning that loyalty can be a liability if it prevents traders from adjusting to new market conditions.

Schwager provides examples of traders who suffered losses by holding onto positions out of stubbornness or emotional attachment. He notes that the best traders are those who are willing to change their views when the evidence suggests it. The chapter includes the advice: “Be loyal to your money, not to your opinions.”

For investors, the practical takeaway is to regularly review positions and strategies in light of new information. Avoid becoming emotionally attached to any trade or investment, and be willing to cut losses or change direction when necessary. Schwager suggests that open-mindedness and adaptability are essential for staying ahead of market trends.

Historically, the ability to adapt has been a hallmark of successful investors—think of George Soros’s willingness to reverse positions or Peter Lynch’s flexibility in stock selection. In today’s dynamic markets, where conditions can change rapidly, Schwager’s advice to avoid loyalty is more relevant than ever.

Chapter 15: Size Matters

Schwager discusses the importance of trade size, explaining that the size of a position can significantly impact both the potential for profit and the level of risk involved. The chapter emphasizes that successful traders carefully consider position size relative to their overall portfolio and risk tolerance, warning against the dangers of over-leveraging and taking on positions that are too large.

Schwager provides examples of traders who blew up their accounts by taking on excessive risk, as well as those who managed risk effectively by scaling positions based on confidence and portfolio context. He notes that proper risk management involves considering trade size in relation to the entire portfolio, not just the individual trade. The chapter includes the advice: “Never risk more than you can afford to lose.”

For investors, the lesson is to implement position sizing formulas—such as risking no more than 1-2% of capital per trade—and to scale positions based on confidence and market conditions. Schwager suggests that managing trade size is as important as picking the right trade, as it determines the impact of both gains and losses on the overall portfolio.

Historically, the collapse of firms like Barings Bank in 1995 was due in large part to unchecked position sizing and leverage. In today’s markets, where leverage is easily accessible, Schwager’s advice to carefully manage trade size is critical for avoiding catastrophic losses and ensuring long-term survival.

Chapter 16: Doing the Uncomfortable Thing

This chapter explores the concept that successful trading often involves doing what feels uncomfortable or counterintuitive. Schwager explains that markets are driven by emotions, and the majority of traders tend to follow the crowd, leading to irrational behavior. The best opportunities often arise when traders are willing to go against the grain and act on sound analysis, even when it feels uncomfortable.

Schwager shares stories of traders who made their fortunes by taking calculated risks that others avoided, such as buying during market panics or selling into euphoria. He notes that discomfort can be a sign that a trader is on the right path, as real opportunities often lie where others are hesitant to venture. The chapter includes the advice: “If it feels easy, you’re probably not doing it right.”

For investors, the practical takeaway is to develop the ability to act on analysis rather than emotion, especially when it means going against popular sentiment. This might involve buying when others are fearful or selling when others are greedy. Schwager suggests that embracing discomfort and trusting your process is essential for capturing outsized returns.

Historically, contrarian investors like John Templeton and Howard Marks have achieved extraordinary results by acting when others were paralyzed by fear or overconfidence. In today’s markets, where crowd behavior is amplified by social media, Schwager’s advice to do the uncomfortable thing is a powerful antidote to herd mentality.

Chapter 17: Emotions and Trading

Schwager explores the significant impact that emotions have on trading performance, discussing how emotions like fear, greed, and hope can cloud judgment and lead to poor decision-making. He emphasizes that successful traders develop emotional discipline, allowing them to make objective decisions based on analysis rather than impulse.

Schwager provides examples of common emotional traps, such as panic selling during market downturns or holding onto losing positions out of hope for a rebound. He notes that techniques such as setting clear rules, taking breaks, and maintaining a long-term perspective can help manage emotional responses. The chapter includes the advice: “Master your emotions, or they will master you.”

For investors, the lesson is to implement routines and checklists that minimize emotional interference. This might include pre-defined exit strategies, regular self-assessment, and taking breaks after periods of intense activity. Schwager suggests that maintaining objectivity and emotional control is as important as technical skill in achieving long-term success.

Historically, the role of emotion in market bubbles and crashes—from the tulip mania of the 17th century to the dot-com bubble of 2000—is well documented. In today’s markets, where volatility and uncertainty are ever-present, Schwager’s advice to master your emotions is essential for avoiding costly mistakes.

Chapter 18: Dynamic versus Static Trading

In this chapter, Schwager contrasts dynamic trading—where strategies and positions are adjusted in response to changing market conditions—with static trading, which relies on a fixed approach applied consistently regardless of market shifts. He argues that dynamic trading offers greater flexibility and adaptability, allowing traders to navigate volatility and capitalize on emerging opportunities.

Schwager provides examples of traders who successfully adapted their strategies to changing conditions, as well as those who suffered losses by sticking rigidly to outdated methods. He warns that dynamic trading carries the risk of overtrading, where frequent adjustments lead to excessive transaction costs and potential losses. The chapter includes the advice: “Be flexible, but not fickle.”

For investors, the lesson is to find a balance between adaptability and consistency. Be willing to adjust strategies when warranted by market conditions, but avoid making changes based on impulse or short-term noise. Schwager suggests that having a core approach while remaining open to adaptation is the key to navigating different market environments.

Historically, the ability to adapt has been a hallmark of long-term success—think of George Soros’s dynamic macro trading or Ray Dalio’s evolution of Bridgewater’s strategies. In today’s rapidly changing markets, Schwager’s advice to balance dynamic and static approaches is essential for staying relevant and profitable.

Chapter 19: Market Response

Schwager discusses the importance of paying attention to how the market responds to news and events, rather than just the news itself. He explains that the market’s reaction can provide valuable insights into underlying sentiment and direction, often serving as a more reliable indicator of future trends than the news itself.

Schwager shares examples of contrarian traders who profit by analyzing market overreactions to news, identifying mispricings that can be exploited. He notes that not all news has the same impact on the market, and traders should focus on the news that significantly influences behavior. The chapter includes the advice: “It’s not the news, but the market’s reaction to the news, that matters.”

For investors, the practical takeaway is to develop routines for monitoring market sentiment and response, rather than simply reacting to headlines. This might involve tracking price action following major news releases or analyzing volume spikes for signs of overreaction. Schwager suggests that understanding market psychology is essential for identifying opportunities and avoiding traps.

Historically, market reactions to news—such as the “buy the rumor, sell the news” phenomenon—have created opportunities for savvy investors. In today’s era of 24/7 news cycles and algorithmic trading, Schwager’s advice to focus on market response is critical for cutting through the noise and making informed decisions.

Chapter 20: The Value of Mistakes

This chapter emphasizes the importance of learning from mistakes in trading. Schwager explains that mistakes are inevitable, but they provide valuable learning experiences that contribute to a trader’s development. He discusses common mistakes such as overtrading, poor risk management, and emotional decision-making, encouraging traders to reflect on errors and use these insights to improve strategies.

Schwager shares stories of traders who turned setbacks into stepping stones by analyzing what went wrong and making necessary adjustments. He notes that the process of learning from mistakes should be ongoing, with traders continuously refining their strategies based on past experiences. The chapter includes the advice: “Failure is the tuition you pay for success.”

For investors, the lesson is to maintain a trading journal and regularly review both successes and failures. Analyze mistakes objectively and develop action plans to avoid repeating them. Schwager suggests that embracing failure as a natural part of the journey builds resilience and accelerates growth.

Historically, the ability to learn from mistakes has been a defining trait of great investors. In today’s competitive markets, where innovation and adaptation are essential, Schwager’s advice to view mistakes as learning opportunities is a blueprint for continuous improvement and long-term success.

Chapter 21: Implementation versus Idea

Schwager discusses the distinction between having a great trading idea and successfully implementing it. He explains that many traders have good ideas but fail to execute them effectively due to poor timing, lack of discipline, or inadequate risk management. The chapter emphasizes that successful trading is not just about generating ideas, but about implementing them with precision and discipline.

Schwager provides examples of traders who missed out on profits by hesitating or deviating from their plans, as well as those who succeeded by executing with clarity and conviction. He notes that markets are dynamic, and traders must be prepared to adapt their implementation strategy as conditions change. The chapter includes the advice: “Ideas are cheap; execution is everything.”

For investors, the practical takeaway is to develop clear, actionable plans for executing trades, including defined entry, exit, and risk management strategies. Practice disciplined execution and be willing to adapt your plan as market conditions evolve. Schwager suggests that focusing on the details of implementation is what turns good ideas into profitable trades.

Historically, the gap between idea and execution has been the downfall of many investors. In today’s fast-moving markets, where opportunities can vanish in seconds, Schwager’s advice to prioritize implementation is essential for translating insight into results.

Chapter 22: Off the Hook

Schwager discusses the concept of being “off the hook,” where traders take steps to relieve themselves of psychological pressures that can impair decision-making. He explores strategies such as reducing position sizes, taking breaks, or stepping away from the market temporarily to manage stress and maintain clarity.

Schwager shares stories of traders who avoided costly mistakes by recognizing when they were under too much pressure and taking proactive steps to reset mentally. He emphasizes that trading is as much a mental game as it is a strategic one, and managing stress effectively is crucial for maintaining focus and performance. The chapter includes the advice: “Sometimes the best trade is not to trade.”

For investors, the lesson is to develop routines for monitoring stress levels and implementing stress-relief strategies as needed. This might include regular breaks, meditation, or reducing exposure during periods of high volatility. Schwager suggests that maintaining mental resilience is essential for long-term success in the markets.

Historically, burnout and mental fatigue have been responsible for many trading failures. In today’s high-stress, always-on environment, Schwager’s advice to proactively manage stress is critical for sustaining performance and avoiding costly errors.

Chapter 23: Love of the Endeavor

In the final chapter, Schwager discusses the importance of passion and love for trading as key components of long-term success. He explains that the most successful traders are those who genuinely enjoy the process of trading, including the challenges and learning experiences it provides. This passion drives traders to continuously improve, stay disciplined, and remain committed even during difficult periods.

Schwager shares stories of traders who thrive not just on profits, but on the intellectual challenge and problem-solving aspects of trading. He notes that a love for the endeavor fosters a commitment to continuous improvement and learning, which is essential for adapting to changing market conditions. The chapter includes the advice: “If you don’t love the game, you won’t last.”

For investors, the practical takeaway is to cultivate a genuine interest in markets and trading. Focus on the process, not just the outcomes, and seek fulfillment in the pursuit of mastery. Schwager suggests that passion is the fuel that sustains long-term success and resilience in the face of setbacks.

Historically, passion has been a common trait among the greats—from Jesse Livermore to Warren Buffett. In today’s competitive, rapidly evolving markets, Schwager’s advice to love the endeavor is a reminder that lasting success comes to those who are truly invested in their craft.

Advanced Strategies from the Book

Beyond the foundational principles, "The Little Book of Market Wizards" offers a wealth of advanced strategies for those seeking to elevate their trading and investing game. Schwager distills decades of interviews and research into actionable techniques that go beyond the basics of risk management and discipline. These advanced strategies are designed to help experienced investors refine their edge, adapt to changing market environments, and achieve consistent outperformance.

Schwager emphasizes that advanced strategies require a solid foundation in the basics. He encourages traders to master the core principles before experimenting with more complex techniques. The following advanced strategies are drawn from the book’s deep well of wisdom, each accompanied by real-world examples and practical guidance for implementation.

Strategy 1: Adaptive Position Sizing

Adaptive position sizing involves adjusting the size of trades based on market conditions, confidence in the setup, and recent performance. Schwager notes that top traders often scale up positions when their edge is strongest and scale down during periods of uncertainty or after a string of losses. For example, Paul Tudor Jones is known for increasing position sizes when his conviction is high and reducing exposure after a series of losing trades. This dynamic approach helps traders maximize gains during favorable conditions while minimizing losses during drawdowns. To implement this strategy, investors should develop rules for scaling positions—such as increasing size after three consecutive wins or reducing size after two losses—and regularly review performance to ensure the approach is effective.

Strategy 2: Contrarian Market Response Analysis

Contrarian market response analysis focuses on exploiting market overreactions to news and events. Schwager highlights the importance of analyzing how the market responds to news, rather than just the news itself. For instance, if negative earnings news is met with a muted decline or a quick rebound, it may signal underlying strength and present a buying opportunity. Legendary traders like George Soros and Howard Marks have profited by taking positions contrary to prevailing sentiment when market reactions become extreme. To apply this strategy, investors should monitor price and volume action following major news releases, look for divergences between sentiment and price movement, and develop criteria for entering contrarian trades when market reactions appear overdone.

Strategy 3: Systematic Error Analysis and Continuous Improvement

Systematic error analysis involves maintaining a detailed trading journal and regularly reviewing trades to identify patterns of mistakes and areas for improvement. Schwager emphasizes that the best traders are relentless in their pursuit of self-improvement, using mistakes as opportunities to refine their strategies. For example, Gil Blake attributed much of his success to his habit of meticulously recording every trade and analyzing errors to prevent recurrence. Investors can implement this strategy by keeping a journal that tracks entry and exit points, rationale, emotional state, and outcomes for each trade. Regularly review the journal to identify recurring errors—such as premature exits or overtrading—and develop concrete action plans to address them.

Strategy 4: Psychological Risk Management Techniques

Advanced psychological risk management techniques go beyond traditional stop-losses and position sizing, focusing on managing stress, maintaining emotional balance, and preventing burnout. Schwager describes how elite traders use routines such as scheduled breaks, meditation, and mental resets to maintain clarity and avoid impulsive decisions. For example, some traders reduce position sizes or step away from the market after a string of losses to regain composure. Investors can implement this strategy by developing personalized routines for stress management, setting limits on daily or weekly trading activity, and incorporating practices like mindfulness or exercise to maintain mental sharpness.

Strategy 5: Hybrid Dynamic-Static Strategy Integration

Integrating dynamic and static trading approaches allows investors to benefit from both adaptability and consistency. Schwager explains that successful traders often maintain a core strategy (static) while allowing for tactical adjustments (dynamic) in response to changing market conditions. For instance, a value investor might hold a portfolio of long-term positions but use technical analysis to time entries and exits more effectively. To implement this strategy, investors should define their core approach, establish rules for when and how to make adjustments, and regularly review performance to ensure the integration enhances results rather than introducing inconsistency.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the lessons from "The Little Book of Market Wizards" requires a deliberate, step-by-step approach. Schwager’s principles are timeless, but their effectiveness depends on disciplined implementation and ongoing refinement. Whether you are a novice or an experienced investor, the following guide will help you translate the book’s wisdom into tangible results.

Begin by conducting an honest self-assessment of your strengths, weaknesses, and risk tolerance. Develop a personalized trading or investing plan that aligns with your personality and goals. Focus on building a foundation of risk management, discipline, and continuous learning before experimenting with advanced strategies. Regularly review your performance, adapt to changing market conditions, and never stop seeking improvement.

- Start by defining your trading or investing edge—what gives you a unique advantage in the market.

- Develop a comprehensive risk management plan, including position sizing, stop-losses, and maximum loss limits.

- Establish routines for preparation, trade execution, and post-trade analysis, including maintaining a detailed trading journal.

- Implement psychological risk management techniques, such as scheduled breaks and stress-relief practices, to maintain mental clarity.

- Regularly review performance, analyze mistakes, and update your strategies to adapt to evolving market conditions.

- Stay committed to continuous learning and improvement, leveraging new tools, data, and insights as they become available.

Critical Analysis

"The Little Book of Market Wizards" excels as a concise, actionable guide to the habits and mindsets that define trading success. Schwager’s ability to distill decades of interviews with legendary traders into clear, memorable lessons is a testament to his expertise and storytelling skill. The book’s structure—short, focused chapters—makes it accessible to readers of all experience levels, and its emphasis on psychological resilience, risk management, and adaptability is both timeless and highly relevant in today’s volatile markets.

One of the book’s greatest strengths is its use of real-world anecdotes and direct quotes from top traders, which bring abstract principles to life and make the lessons memorable. Schwager’s focus on self-awareness and the importance of aligning strategy with personality sets the book apart from more formulaic trading guides. However, some readers may find the lack of detailed, step-by-step trading systems or quantitative models to be a limitation, especially those seeking a more prescriptive approach. The book is best viewed as a guide to mindset and process, rather than a manual for specific strategies.

In the current market environment—characterized by rapid technological change, increased volatility, and the democratization of trading tools—Schwager’s emphasis on discipline, risk management, and adaptability is more important than ever. The book’s lessons are universally applicable, whether you trade stocks, futures, crypto, or any other asset class. Its timeless wisdom makes it a valuable addition to any investor’s library, serving as both a reference and a source of inspiration during challenging times.

Conclusion

"The Little Book of Market Wizards" is a masterclass in the psychology and process of trading and investing. Jack D. Schwager distills the wisdom of legendary traders into a series of actionable lessons that transcend market cycles and asset classes. The book’s core message is that success is not about finding a magic formula, but about cultivating discipline, self-awareness, risk management, and a relentless commitment to learning.

Whether you are a beginner seeking to avoid common pitfalls or an experienced investor looking to refine your edge, Schwager’s book offers invaluable guidance. Its blend of storytelling, practical advice, and timeless principles makes it a must-read for anyone serious about achieving long-term success in the markets. The actionable takeaways—start small, know your edge, manage risk, and never stop learning—provide a roadmap for navigating the complexities of modern investing.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Market Wizards

1. Who is Jack D. Schwager, and why should I trust his advice?

Jack D. Schwager is a renowned financial author, market historian, and former hedge fund manager best known for his "Market Wizards" series. He has interviewed dozens of the world’s most successful traders and distilled their wisdom into accessible lessons. His credibility comes from decades of experience in both trading and chronicling the habits of elite investors, making his advice both practical and deeply informed by real-world success stories.

2. Is "The Little Book of Market Wizards" suitable for beginners?

Yes, the book is highly accessible for beginners. Schwager uses clear language, real-life stories, and concise chapters to explain complex concepts. The focus on mindset, risk management, and learning from mistakes provides a strong foundation for those new to trading and investing.

3. Does the book provide specific trading systems or strategies?

While the book covers key principles and advanced techniques, it does not provide detailed, step-by-step trading systems. Instead, Schwager emphasizes the importance of finding a strategy that fits your personality and developing a process grounded in discipline, risk management, and continuous improvement.

4. How can I apply the lessons from the book to long-term investing?

The book’s principles—such as risk management, discipline, patience, and learning from mistakes—are universally applicable to long-term investing. Investors can use these lessons to develop robust investment processes, avoid common pitfalls, and adapt strategies to changing market conditions.

5. What is meant by having a "trading edge," and how do I develop one?

A trading edge is an identifiable advantage that increases your probability of success—such as unique research, pattern recognition, or superior risk management. To develop an edge, focus on a process or methodology that consistently yields positive results, backtest your strategies, and continuously refine your approach based on performance and market feedback.

6. How does the book address the psychological challenges of trading?

Schwager dedicates several chapters to the psychological aspects of trading, including emotional control, resilience, and stress management. He provides practical routines and anecdotes to help traders recognize and manage emotions, avoid impulsive decisions, and maintain mental clarity during periods of volatility.

7. Is the book relevant for investors in markets outside of stocks, such as crypto or commodities?

Absolutely. The principles in "The Little Book of Market Wizards" are asset-agnostic and apply to any market—stocks, futures, commodities, crypto, and more. Schwager’s focus on mindset, risk management, and adaptability makes the book valuable for investors and traders across all asset classes.

8. How often should I revisit the lessons from the book?

Many experienced investors revisit Schwager’s lessons regularly—especially after periods of market volatility or personal setbacks. The book’s concise chapters make it easy to use as a reference or motivational tool whenever you need to refocus on the fundamentals of trading success.

9. What are the most common mistakes traders make, according to Schwager?

Common mistakes include overtrading, poor risk management, emotional decision-making, and lack of discipline. Schwager emphasizes that these errors are natural but must be addressed through self-awareness, journaling, and continuous improvement to achieve long-term success.

10. Can the book help me find undervalued stocks or investment opportunities?

While the book does not provide specific stock picks, its lessons on developing an edge, risk management, and independent thinking can help you spot undervalued opportunities. By applying Schwager’s principles, you can build a process for identifying and capitalizing on mispricings in any market.