The Little Book of Sideways Markets by Vitaliy N. Katsenelson

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Vitaliy N. Katsenelson, the author of The Little Book of Sideways Markets, is a well-respected value investor, educator, and CEO of Investment Management Associates. Born in Russia and educated in the United States, Katsenelson is known for his clear, pragmatic investment philosophy rooted in the principles of value investing. His writings have appeared in publications like the Financial Times, Barron’s, and Institutional Investor, and he is widely regarded as an authority on navigating complex market cycles. His background in both academia and professional asset management gives him a unique perspective, blending theory with real-world application.

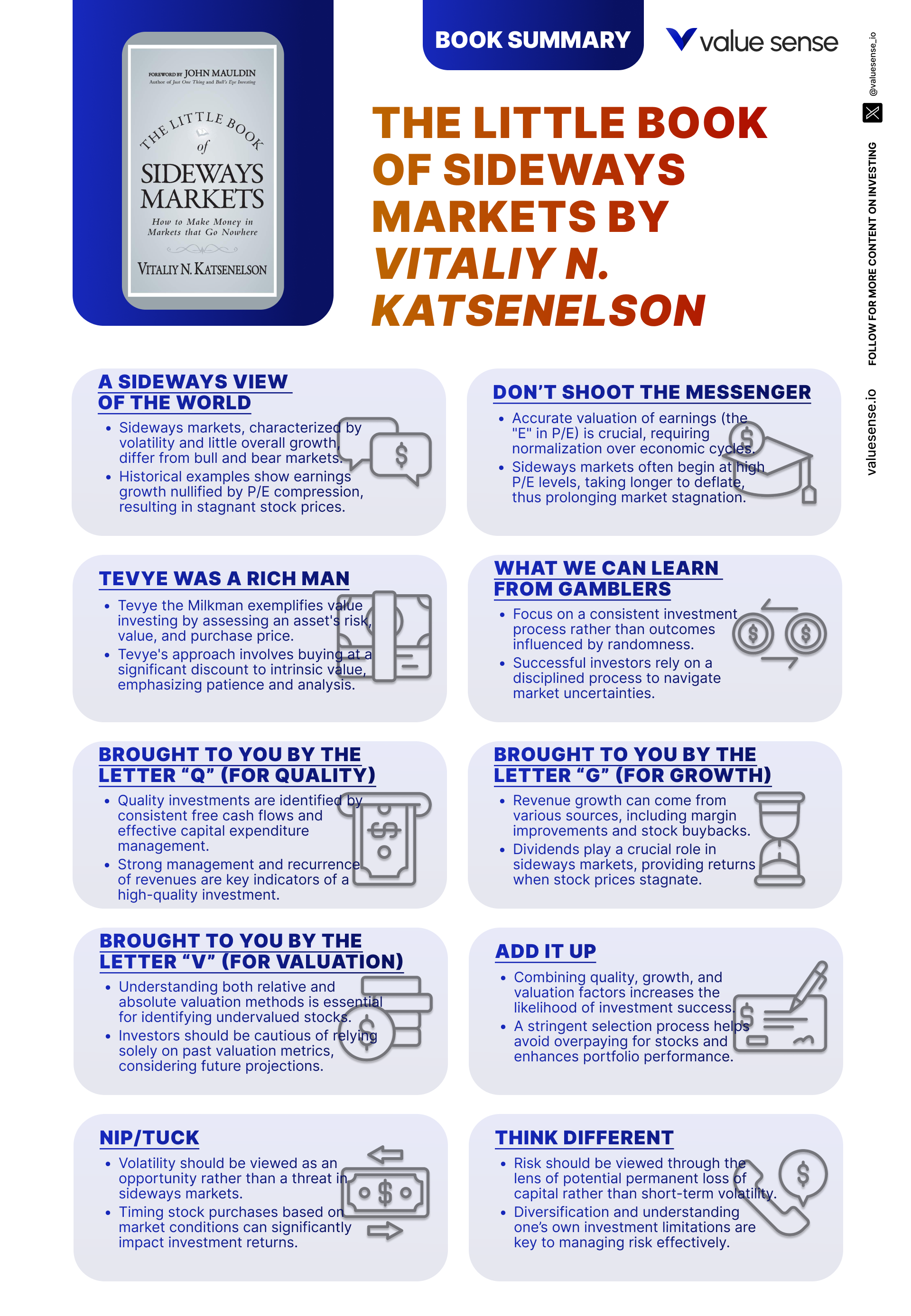

The main theme of the book centers on the concept of “sideways markets”—extended periods when stock indices make little overall progress, oscillating up and down but ending up at roughly the same level over a decade or more. Katsenelson argues that, following major bull runs, markets often enter these long stretches of stagnation, marked by lower returns and increased volatility. The book’s purpose is to equip investors with strategies and a mindset for thriving—not just surviving—during these challenging periods. It challenges conventional wisdom that assumes perpetual growth and instead calls for a more nuanced, active approach tailored to the realities of sideways markets.

This book is particularly valuable for individual investors, financial advisors, and anyone managing their own portfolio who wants to outperform in environments where traditional buy-and-hold or index strategies may underperform. It’s a must-read for those who have only experienced bull markets and may not be prepared for a decade of muted returns. Katsenelson’s approachable writing style, combined with actionable frameworks, makes complex concepts accessible to both novice and seasoned investors alike.

What sets The Little Book of Sideways Markets apart is its focus on practical, actionable advice for navigating market conditions that are often overlooked in mainstream investment literature. While most books extol the virtues of long-term passive investing, Katsenelson provides a contrarian perspective, advocating for a blend of value, quality, and growth analysis, with an emphasis on risk management and adaptability. The book is filled with historical examples, psychological insights, and checklists that readers can immediately apply. It’s not just theory; it’s a field guide for the real world, especially in times when market optimism fades and patience, discipline, and skill become the keys to success.

Key Concepts and Ideas

Katsenelson’s investment philosophy is built on the recognition that markets move in cycles—bull, bear, and sideways—and that each phase requires a different approach. He argues that the “sideways” market, often ignored or misunderstood, is a recurring feature of financial history. During these periods, broad market returns stall, price-to-earnings (P/E) ratios compress, and volatility increases. To succeed, investors must move beyond passive strategies and adopt a toolkit that emphasizes selectivity, risk management, and a focus on fundamentals.

The core of the book is Katsenelson’s “QGV” framework: Quality, Growth, and Valuation. He insists that successful investing in sideways markets demands a blend of these factors, rather than reliance on any single metric. The book also delves into the psychological traps that ensnare investors—overconfidence, herd mentality, and emotional decision-making—and offers practical ways to counteract them. Katsenelson’s approach is both analytical and behavioral, recognizing that market cycles are driven as much by human psychology as by financial data.

- Sideways Markets Defined: Sideways markets are prolonged periods (often a decade or more) where major indices make little net progress. Unlike bull or bear markets, they are characterized by high volatility, declining P/E ratios, and stagnant total returns. Historical examples include the U.S. market from 1966–1982 and Japan’s Nikkei after 1990. Recognizing these periods is crucial for adjusting investment expectations and strategies.

- Declining P/E Ratios: In sideways markets, even as companies grow earnings, their stock prices may not rise due to multiple compression. For instance, from 1966 to 1982, the S&P 500’s earnings doubled, but its P/E ratio fell from 24 to 8, resulting in flat index performance. Investors must understand that valuation multiples can shrink, offsetting underlying business growth.

- Importance of Dividends: With capital appreciation limited, dividends become a critical component of total returns. During the 1970s, dividends accounted for over 70% of the S&P 500’s total return. Katsenelson encourages investors to seek out companies with stable, growing dividends to supplement returns in stagnant markets.

- Value Investing and Margin of Safety: Buying stocks at a significant discount to intrinsic value is essential in sideways markets. This “margin of safety” provides a buffer against volatility and market mispricing. Katsenelson invokes Warren Buffett’s and Benjamin Graham’s principles, emphasizing patience and discipline in waiting for the right opportunities.

- Risk Management and Psychological Discipline: Sideways markets test investors’ patience and discipline. Overconfidence, emotional trading, and chasing losses can erode capital. The book draws parallels to gambling psychology, urging investors to set loss limits, avoid impulsive decisions, and maintain a long-term focus.

- Quality and Resilience: Investing in high-quality companies with strong management, solid balance sheets, and sustainable competitive advantages is paramount. Quality firms are more likely to weather economic storms and deliver steady returns, even when the broader market stagnates.

- Sustainable Growth: Not all growth is equal. Katsenelson advises focusing on companies with sustainable, defensible growth—those that can compound earnings over time without relying on fads or financial engineering. This approach helps mitigate the risk of overpaying for fleeting momentum.

- Active Portfolio Management: Passive, set-and-forget strategies may underperform in sideways markets. Regular portfolio reviews, rebalancing, and tactical adjustments (“nip/tuck”) are necessary to adapt to changing conditions and capitalize on emerging opportunities.

- Contrarian and Scavenger Mindset: Investors must be willing to go against the crowd, seeking undervalued or misunderstood stocks overlooked by the market. This “scavenger hunt” mentality requires diligence, thorough research, and a willingness to be patient when the market is slow to recognize value.

- Continuous Learning and Humility: Ignorance is costly in sideways markets. Katsenelson urges investors to take responsibility for their financial education, remain humble, and be open to learning from mistakes. Critical thinking, skepticism, and adaptability are the hallmarks of long-term success.

Practical Strategies for Investors

Applying the lessons from The Little Book of Sideways Markets requires a shift from passive investing to a more active, thoughtful approach. Katsenelson provides a robust toolkit for navigating stagnant markets, emphasizing selectivity, discipline, and adaptability. Investors are urged to focus on fundamentals, manage risk proactively, and seek out opportunities that others overlook. The strategies below are designed to help investors not only preserve capital but also achieve superior returns when the market is stuck in neutral.

Each strategy is grounded in real-world examples and historical data. Katsenelson’s frameworks are practical, actionable, and adaptable to portfolios of any size. Whether you’re a novice or an experienced investor, these steps can help you build resilience and generate returns even when the index goes nowhere. The key is to combine analytical rigor with behavioral discipline, always keeping an eye on quality, growth, and valuation.

- Screen for Quality Companies: Start by identifying companies with strong balance sheets, consistent earnings growth, and sustainable competitive advantages. Use metrics like return on equity (ROE), debt-to-equity ratio, and free cash flow generation. For example, firms like Johnson & Johnson, Procter & Gamble, and Microsoft have demonstrated resilience across multiple market cycles.

- Focus on Dividend Growers: Prioritize stocks with a history of stable or rising dividends. Set a minimum dividend growth rate (e.g., 5% annually over the past decade) and analyze payout ratios to ensure sustainability. Reinvest dividends to compound returns, especially when capital appreciation is limited.

- Apply Strict Valuation Filters: Use valuation metrics such as P/E, P/B, and DCF analysis to avoid overpaying. Set maximum thresholds (e.g., avoid stocks trading above 20x earnings unless justified by exceptional growth). Wait patiently for attractive entry points, even if it means holding cash during frothy periods.

- Implement Risk Management Rules: Set clear loss limits for each position (e.g., 15–20%) and stick to them. Avoid doubling down on losers or chasing high-risk “lottery ticket” stocks. Use stop-loss orders or mental stop-losses to enforce discipline and protect your capital.

- Rebalance and Adjust Regularly: Review your portfolio at least quarterly. Trim positions that have become overvalued or overweight, and add to those that meet your QGV criteria but are underrepresented. This “nip/tuck” approach helps maintain alignment with your strategy and adapts to changing conditions.

- Adopt a Contrarian Mindset: Look for stocks that are unloved, misunderstood, or out of favor with the market. Examples include sectors or companies hit by temporary setbacks but with strong underlying fundamentals. Thorough research and patience are required to uncover these hidden gems.

- Educate Yourself Continuously: Read investment books, follow market analysis, and stay updated on economic trends. Take responsibility for your financial education rather than relying solely on advisors or market sentiment. The more you know, the better equipped you’ll be to spot opportunities and avoid pitfalls.

- Maintain Flexibility and Humility: Be willing to adapt your strategy as market conditions change. Recognize that no one can predict the future with certainty, and remain open to learning from mistakes. Critical thinking and humility are essential for long-term success in sideways markets.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

The Little Book of Sideways Markets is structured as a comprehensive guide, with each chapter building on the last to create a cohesive framework for investing in stagnant markets. Katsenelson opens with a diagnosis of the market environment, then methodically introduces the tools and mindsets required to succeed. Each chapter combines theory with practical advice, historical context, and actionable checklists.

The book is divided into 17 chapters, each focusing on a specific aspect of investing in sideways markets. From defining the nature of these markets to developing advanced portfolio management techniques, every chapter is rich with examples, data, and psychological insights. Below, we provide an in-depth analysis of each major chapter, highlighting key lessons, concrete applications, and real-world relevance.

Chapter 1: Fasten Your Seat Belt

Katsenelson begins by introducing readers to the concept of sideways markets, drawing a vivid analogy to a roller-coaster ride. He explains that, unlike the clear upward trajectory of bull markets or the sharp declines of bear markets, sideways markets are defined by prolonged periods of volatility with little net progress in major indices. For example, the U.S. stock market from 1966 to 1982 experienced dramatic swings—periods of exuberance followed by sharp sell-offs—but ultimately ended up where it started. This environment can be disorienting for investors accustomed to steady gains, and Katsenelson warns that such periods are not anomalies but recurring features of market history.

He supports his claims with historical data, noting that following major bull runs, markets often enter these stagnant phases. For instance, after the post-war bull market, the S&P 500 entered a 16-year sideways stretch. Katsenelson emphasizes that these markets are characterized by declining P/E ratios, increased volatility, and diminished returns for passive investors. He quotes, “It’s not the ride up or down that’s most dangerous—it’s the ride that goes nowhere, but with plenty of bumps along the way.” This sets the stage for the central thesis: investors must adapt their strategies to thrive when the market is stuck in neutral.

For investors, the key takeaway is the need to recognize the signs of a sideways market and adjust expectations accordingly. Rather than relying on historical averages from bull markets, investors should prepare for lower returns and greater volatility. This means shifting from passive buy-and-hold strategies to more active, selective approaches. Katsenelson urges readers to focus on capital preservation, risk management, and the identification of undervalued opportunities.

Historically, investors who failed to adapt during sideways markets saw their portfolios languish. The Japanese Nikkei’s stagnation since 1990 is a stark reminder of the risks. By understanding the unique challenges of these periods, investors can avoid the pitfalls of complacency and position themselves for outperformance. Katsenelson’s opening chapter is a wake-up call, urging readers to “fasten their seat belts” and get ready for a market environment that demands skill, patience, and adaptability.

Chapter 2: A Sideways View of the World

In this chapter, Katsenelson delves deeper into the mechanics and history of sideways markets. He provides a detailed analysis of past periods, such as the U.S. market from 1906–1924 and 1966–1982, and the Japanese market post-1990. These examples illustrate that sideways markets are not new phenomena but recurring cycles driven by economic, psychological, and valuation factors. Katsenelson explains that, during these periods, earnings may grow but stock prices remain flat or even decline due to falling P/E ratios—a process known as multiple compression.

Katsenelson offers concrete data: from 1966 to 1982, the S&P 500’s earnings doubled, but its P/E ratio fell from 24 to 8, resulting in no net gain for investors. He emphasizes that investor psychology plays a major role—optimism from prior bull markets often turns to frustration or pessimism as returns stagnate. The chapter also highlights the importance of dividends, noting that during the 1970s, dividends accounted for over 70% of the S&P 500’s total return. “When price appreciation is limited, dividends become your best friend,” he writes.

For investors, the lesson is clear: set realistic expectations based on historical precedent. Recognize that sideways markets can last a decade or more and that capital appreciation may be limited. Focus instead on total return, including dividends, and seek out companies with stable or growing payouts. Katsenelson suggests screening for dividend aristocrats—companies with long histories of increasing dividends—as a core strategy in these environments.

The historical context is invaluable. Investors who understood the dynamics of sideways markets in the past were able to avoid disappointment and make better decisions. For example, those who focused on dividend income during the 1970s were able to generate positive returns despite flat stock prices. Katsenelson’s analysis encourages readers to learn from history and adapt their strategies, rather than hoping for a quick return to bull market conditions.

Chapter 3: Don’t Shoot the Messenger

This chapter addresses the psychological challenge of adjusting expectations in a sideways market. Katsenelson emphasizes that investors must let go of the high-return assumptions formed during bull markets and accept the reality of lower, more volatile returns. He explains that declining P/E ratios, even in the face of earnings growth, can result in disappointing performance for passive investors. “It’s not bad news—it’s just the message the market is sending,” he writes, urging readers not to “shoot the messenger” but to adapt instead.

Katsenelson provides examples of how passive strategies underperformed during past sideways markets. He notes that index investors in the 1970s saw little or no real return, while those who focused on valuation and selectivity fared better. He also discusses the importance of patience, as gains may take longer to materialize. The chapter includes data showing that, during stagnant periods, stocks bought at low valuations outperformed those bought at market highs, even if earnings grew at similar rates.

Practically, investors should focus on identifying undervalued stocks and be prepared to hold them for longer durations. Katsenelson recommends using valuation screens to find companies trading below their intrinsic value and stresses the importance of patience. He warns against chasing short-term trends or becoming discouraged by slow progress. “In sideways markets, patience is not just a virtue—it’s a necessity,” he asserts.

The historical lesson is that investors who adjusted their expectations and strategies during sideways markets were able to outperform. For example, Warren Buffett’s investments in undervalued companies during the 1970s delivered strong returns despite the broader market’s stagnation. Katsenelson’s message is clear: accept the reality of sideways markets, focus on value, and exercise patience to achieve long-term success.

Chapter 4: Tevye Was a Rich Man

Katsenelson uses the character Tevye from “Fiddler on the Roof” as a metaphor for the ideal value investor. Tevye’s pragmatic, disciplined approach to life mirrors the qualities needed to succeed in sideways markets. The chapter explores the principles of value investing—buying assets at a discount to intrinsic value, exercising patience, and avoiding the herd mentality. Katsenelson emphasizes that, in stagnant markets, value investing becomes even more critical, as broad market gains are hard to come by.

He illustrates this with examples of legendary value investors like Benjamin Graham and Warren Buffett, who thrived during periods of market stagnation by focusing on fundamentals and waiting for the market to recognize value. The chapter includes a discussion of the “margin of safety”—the difference between a stock’s price and its intrinsic value—which provides a buffer against volatility and downside risk. “A margin of safety is your insurance policy in a market that goes nowhere,” Katsenelson writes.

Investors are encouraged to adopt a contrarian mindset, seeking opportunities where others see risk or uncertainty. Katsenelson recommends screening for stocks trading at low price-to-book or price-to-earnings ratios, with strong cash flows and stable management. He also stresses the need for discipline—sticking to a value-oriented strategy even when the market isn’t immediately rewarding it. “Patience and discipline are the twin pillars of value investing,” he asserts.

Historically, value investing has proven resilient in sideways markets. During the 1970s, value stocks outperformed growth stocks, as investors sought safety and reliability. Katsenelson’s use of Tevye underscores the importance of pragmatism, patience, and a focus on fundamentals. By following these principles, investors can build wealth even when the market as a whole is stagnant.

Chapter 5: What We Can Learn from Gamblers

In this chapter, Katsenelson draws parallels between investing and gambling, focusing on the importance of risk management and psychological discipline. He explains that, while investing is not the same as gambling, the psychological biases that affect gamblers—such as the illusion of control and the tendency to chase losses—also plague investors. “The market is a casino, but you don’t have to play every hand,” he warns.

Katsenelson provides examples of investors who fell victim to overconfidence and excessive risk-taking, particularly during sideways markets when returns are harder to achieve. He discusses the dangers of doubling down on losing positions, chasing high-risk “lottery ticket” stocks, and abandoning discipline in pursuit of quick gains. The chapter includes practical advice on setting loss limits, using stop-loss orders, and maintaining a long-term perspective.

For investors, the key is to implement strict risk management rules. Katsenelson recommends setting maximum loss thresholds for each position and avoiding the temptation to “bet it all” on a single idea. He also advises against chasing losses, noting that this behavior often leads to even greater losses. “Discipline is your edge in a market that rewards patience, not bravado,” he writes.

Historically, disciplined risk management has been the difference between survival and ruin during sideways markets. Investors who managed risk effectively during the 1970s and early 2000s preserved capital and were able to capitalize on opportunities when the market eventually turned. Katsenelson’s analogy to gambling serves as a powerful reminder that, in investing, prudence and discipline are more important than luck or bravado.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Brought to You by the Letter “Q” (for Quality)

Katsenelson shifts focus to the importance of investing in high-quality companies during sideways markets. He defines quality as a combination of strong management, solid balance sheets, consistent earnings growth, and sustainable competitive advantages. In environments where overall market returns are limited, quality becomes the differentiator between winners and losers. “Quality is your shield in a market full of arrows,” he asserts.

The chapter includes examples of companies like Johnson & Johnson, Procter & Gamble, and Microsoft, which have weathered multiple market cycles due to their robust fundamentals. Katsenelson provides metrics for assessing quality, such as return on equity, debt-to-equity ratio, and free cash flow generation. He argues that, while quality stocks may not always be the cheapest, their resilience makes them valuable components of a portfolio in stagnant markets.

Investors are advised to prioritize quality when screening for investments. Katsenelson suggests looking for companies with a track record of stability, strong cash flows, and the ability to maintain profitability even in tough conditions. He cautions against chasing speculative, low-quality stocks in search of quick gains, noting that these are often the first to falter when the market turns volatile.

Historically, quality stocks have outperformed during sideways markets. For example, during the 2000–2010 “lost decade,” companies with strong fundamentals delivered positive returns, while the broader market stagnated. Katsenelson’s emphasis on quality is grounded in data and experience, making it a cornerstone of his sideways market strategy.

Chapter 7: Brought to You by the Letter “G” (for Growth)

This chapter explores the role of growth in stock selection, particularly in sideways markets where overall returns are constrained. Katsenelson explains that sustainable growth is a key driver of long-term value, but not all growth is created equal. He cautions against overpaying for high-growth stocks, especially when valuations become disconnected from fundamentals. “Growth is valuable, but only if you don’t overpay for it,” he writes.

Katsenelson provides examples of companies with sustainable growth—those that can compound earnings over time without relying on fads or financial engineering. He discusses the importance of analyzing growth drivers, such as market share expansion, product innovation, and geographic diversification. The chapter includes metrics for assessing growth, including revenue and earnings growth rates, return on invested capital, and reinvestment opportunities.

For investors, the practical application is to focus on companies with defensible, repeatable growth. Katsenelson recommends diversifying across sectors and industries to balance growth and risk. He warns against chasing “story stocks” with unsustainable business models or inflated valuations, noting that these are often the first to disappoint in sideways markets.

Historically, companies with sustainable growth have outperformed during stagnant periods. For example, during the 2000s, technology firms like Microsoft and consumer staples like Coca-Cola continued to grow earnings despite broader market stagnation. Katsenelson’s framework helps investors identify growth that is both real and durable, providing a path to outperformance in challenging environments.

Chapter 8: Brought to You by the Letter “V” (for Valuation)

Valuation takes center stage in this chapter, as Katsenelson argues that buying stocks at the right price is crucial for success in sideways markets. He explains that, when overall market gains are limited, the price you pay for a stock becomes the primary determinant of your returns. “Valuation is your compass in a market lost at sea,” he writes.

Katsenelson outlines various valuation metrics, including P/E ratio, price-to-book (P/B) ratio, and discounted cash flow (DCF) analysis. He provides examples of how overpaying for even high-quality, high-growth stocks can lead to poor returns if market conditions deteriorate. The chapter includes checklists for assessing whether a stock is undervalued, fairly valued, or overvalued, and emphasizes the importance of patience in waiting for attractive entry points.

For investors, the lesson is to apply strict valuation filters and avoid chasing stocks with inflated multiples. Katsenelson recommends setting maximum thresholds for key metrics and being willing to hold cash when no attractive opportunities are available. He also suggests using DCF models to estimate intrinsic value and ensure a sufficient margin of safety.

Historically, disciplined valuation has been the hallmark of successful investors in sideways markets. During the 1970s and 2000s, those who bought stocks at low valuations and avoided overhyped sectors outperformed the broader market. Katsenelson’s emphasis on valuation is both a defensive and offensive strategy, helping investors avoid costly mistakes and capitalize on mispricings.

Chapter 9: Add It Up

In this chapter, Katsenelson synthesizes the concepts of quality, growth, and valuation into a comprehensive investment strategy. He argues that, while each factor is important on its own, the combination of all three is what drives success in sideways markets. “The magic happens when quality, growth, and value intersect,” he writes, urging investors to seek out companies that excel in all three areas.

Katsenelson provides practical advice on how to balance these factors when selecting stocks. He suggests creating a checklist that scores companies on quality (management, financial health), growth potential (sustainable earnings growth), and valuation (current price relative to intrinsic value). The chapter includes examples of companies that meet all three criteria, as well as case studies of portfolios constructed using the QGV framework.

For investors, the takeaway is to adopt a holistic approach to stock selection. Katsenelson recommends regular portfolio reviews to ensure that each holding continues to meet the QGV criteria. He also advises against sacrificing one factor for another—such as buying low-quality stocks for the sake of value or overpaying for growth. “Balance is the secret weapon in a market that rewards discipline,” he asserts.

Historically, portfolios constructed with a balance of quality, growth, and value have outperformed during sideways markets. For example, during the 2000–2010 period, balanced portfolios delivered positive returns while the S&P 500 was flat. Katsenelson’s integrated approach provides a roadmap for building resilient portfolios in challenging environments.

Chapter 10: Nip/Tuck

Katsenelson turns to portfolio management, emphasizing the need for regular review and adjustment in sideways markets. He compares this process to “nipping and tucking,” where investors make small, strategic changes to improve performance and manage risk. “In a market that goes nowhere, standing still is not an option,” he warns.

The chapter includes examples of how rebalancing and tactical adjustments can enhance returns and reduce risk. Katsenelson discusses the importance of monitoring asset allocation, trimming overweight positions, and adding to undervalued holdings. He provides checklists for conducting quarterly portfolio reviews and suggests using simple spreadsheets or online tools to track performance and alignment with investment goals.

For investors, the key is to be proactive rather than reactive. Katsenelson recommends setting regular review intervals (e.g., quarterly) and being willing to make changes when market conditions shift. He also advises maintaining flexibility, avoiding rigid adherence to a static strategy, and staying true to long-term objectives. “Adaptation is survival in a sideways market,” he writes.

Historically, active portfolio management has been crucial during stagnant periods. Investors who regularly reviewed and adjusted their portfolios were able to capitalize on opportunities, avoid concentration risk, and protect against drawdowns. Katsenelson’s “nip/tuck” approach is a practical blueprint for maintaining resilience and achieving superior returns when the market is stuck in neutral.

Chapter 11: The Born-Again Value Investor

In this chapter, Katsenelson explores the idea that investors who previously relied on growth or momentum strategies must “convert” to value investing in sideways markets. He explains that, when market-wide gains are limited, the emphasis shifts from chasing growth to finding undervalued opportunities. “Sideways markets are the crucible in which value investors are forged,” he writes.

Katsenelson provides examples of investors who successfully transitioned to value-oriented strategies during stagnant periods. He discusses the importance of focusing on fundamentals—earnings, cash flow, and balance sheet strength—and avoiding the temptation to chase hot sectors or speculative stocks. The chapter includes practical advice on screening for value stocks, setting margin of safety requirements, and maintaining patience.

For investors, the lesson is to embrace value investing principles, even if they have previously favored other strategies. Katsenelson recommends building a watchlist of undervalued companies, conducting thorough fundamental analysis, and being prepared to hold positions for the long term. He also stresses the importance of discipline, noting that value investing requires patience and a willingness to go against the crowd.

Historically, value investing has delivered superior returns during sideways markets. For example, during the 2000–2010 period, value stocks outperformed growth stocks as investors sought safety and reliability. Katsenelson’s call to “convert” to value investing is grounded in data and experience, making it a vital strategy for navigating stagnant markets.

Chapter 12: Applying Darwinism to the Sales Process

Katsenelson introduces the concept of “Darwinian” investing, where the fittest companies—those with the strongest fundamentals and competitive advantages—are most likely to survive and thrive in sideways markets. He draws parallels to natural selection, explaining that the market rewards adaptability, resilience, and innovation. “Survival of the fittest is not just for biology—it’s for investing too,” he writes.

The chapter includes examples of companies that adapted to changing market conditions and maintained profitability during stagnant periods. Katsenelson discusses the importance of identifying sustainable competitive advantages, such as brand strength, network effects, and cost leadership. He provides checklists for assessing resilience, including profitability during downturns, ability to innovate, and management quality.

Investors are advised to focus on companies that demonstrate adaptability and resilience. Katsenelson recommends screening for firms with a history of navigating economic challenges, maintaining margins, and investing in innovation. He also suggests monitoring industry trends and being willing to pivot when new opportunities arise.

Historically, companies with strong competitive advantages have outperformed during sideways markets. For example, consumer staples and healthcare firms with durable brands and recurring revenue streams delivered steady returns during the 1970s and 2000s. Katsenelson’s “Darwinian” approach is a powerful framework for identifying winners in challenging environments.

Chapter 13: You Are Not As Dumb— or Smart— As You Think

This chapter addresses the psychological biases that can undermine investment success, particularly in sideways markets. Katsenelson explains that overconfidence and self-doubt are two sides of the same coin, and both can lead to poor decisions. “The market is humbling—it punishes arrogance and rewards humility,” he writes.

Katsenelson provides examples of investors who fell victim to overconfidence, believing they could outsmart the market, as well as those who became paralyzed by self-doubt after losses. He discusses the importance of self-awareness, recognizing biases, and avoiding emotional decision-making. The chapter includes practical tips for maintaining discipline, such as keeping an investment journal, setting clear rules, and reviewing decisions regularly.

For investors, the key is to cultivate humility and self-awareness. Katsenelson recommends focusing on long-term goals, avoiding the temptation to react to short-term market fluctuations, and being willing to learn from mistakes. He also advises seeking feedback from trusted peers and mentors to counteract biases and improve decision-making.

Historically, disciplined, self-aware investors have outperformed during sideways markets. Those who avoided emotional trading and maintained a long-term perspective were able to navigate volatility and capitalize on opportunities. Katsenelson’s emphasis on psychological discipline is a crucial component of his sideways market strategy.

Chapter 14: On a Scavenger Hunt for Stocks

Katsenelson likens the process of finding undervalued stocks in sideways markets to a “scavenger hunt.” He explains that, when broad market gains are limited, investors must be more diligent and resourceful in seeking out opportunities. “The best opportunities are often hidden in plain sight, overlooked by the crowd,” he writes.

The chapter includes practical advice on identifying potential investments, such as screening for stocks with low valuations, strong fundamentals, and temporary setbacks. Katsenelson discusses the importance of thorough research, including analyzing financial statements, management quality, and industry dynamics. He also emphasizes the value of a contrarian mindset—being willing to invest in companies that are out of favor but have strong underlying fundamentals.

For investors, the lesson is to adopt a methodical, patient approach to stock selection. Katsenelson recommends building a watchlist of potential opportunities, conducting deep dives into company financials, and being prepared to wait for the market to recognize value. He also suggests networking with other investors and leveraging multiple sources of information to uncover hidden gems.

Historically, investors who approached stock selection as a scavenger hunt were able to generate positive returns during sideways markets. For example, those who identified undervalued small-cap stocks or turnaround situations during the 1970s and 2000s outperformed the broader market. Katsenelson’s scavenger hunt mentality is a practical, actionable strategy for thriving in stagnant environments.

Chapter 15: Farewell, Blissful Ignorance

In this chapter, Katsenelson challenges the notion that ignorance is bliss when it comes to investing, especially in sideways markets. He argues that investors who remain uninformed about market dynamics, valuation principles, and economic conditions are more likely to make poor decisions. “Ignorance is expensive—knowledge is your best investment,” he writes.

Katsenelson emphasizes the importance of continuous learning and staying informed about the factors that influence the market. He provides examples of investors who suffered losses due to a lack of understanding of valuation or economic cycles. The chapter includes practical tips for expanding financial knowledge, such as reading books, attending seminars, and following reputable market analysis.

For investors, the takeaway is to take responsibility for their financial education. Katsenelson recommends setting aside time each week for learning, building a library of investment resources, and staying updated on market trends. He also advises seeking out mentors and joining investment communities to accelerate learning and gain diverse perspectives.

Historically, informed investors have outperformed during sideways markets. Those who understood market dynamics and valuation principles were able to avoid common pitfalls and capitalize on opportunities. Katsenelson’s call for continuous learning is a vital reminder that, in investing, knowledge truly is power.

Chapter 16: Think Different

Katsenelson encourages investors to “think different” in sideways markets, adopting a mindset that challenges conventional wisdom and embraces new approaches. He explains that the strategies that work in bull markets may not be effective when the market is stagnant. “Innovation is the antidote to stagnation,” he writes, urging readers to question traditional assumptions and experiment with new ideas.

The chapter includes examples of investors who succeeded by thinking differently—identifying overlooked sectors, developing unique valuation models, or adopting unconventional portfolio strategies. Katsenelson discusses the importance of flexibility and adaptation, noting that rigid adherence to outdated approaches can lead to missed opportunities and suboptimal returns.

For investors, the lesson is to remain open-minded and willing to pivot as market conditions change. Katsenelson recommends regularly reviewing and updating investment strategies, seeking out new sources of information, and being willing to experiment with different approaches. He also advises networking with other investors to share ideas and challenge assumptions.

Historically, innovative investors have thrived during sideways markets. For example, those who adopted new valuation frameworks or focused on emerging industries during the 1970s and 2000s were able to generate superior returns. Katsenelson’s emphasis on innovation and flexibility is a powerful reminder that, in stagnant markets, adaptability is key to success.

Chapter 17: I Could Be Wrong, but I Doubt It

In the final chapter, Katsenelson reflects on the importance of humility in investing. He acknowledges that even the best investors can be wrong and that overconfidence is a major risk. “The only certainty in investing is uncertainty,” he writes, emphasizing the need for self-awareness, critical thinking, and a willingness to learn from mistakes.

Katsenelson discusses the dangers of overconfidence, providing examples of investors who suffered significant losses by assuming they had all the answers. He advocates for a disciplined approach that incorporates skepticism, regular self-assessment, and openness to alternative viewpoints. The chapter includes practical tips for analyzing mistakes, learning from them, and improving investment strategies over time.

For investors, the key is to remain humble, stay informed, and maintain discipline. Katsenelson recommends keeping an investment journal to track decisions and outcomes, seeking feedback from trusted peers, and being willing to admit and correct mistakes. He also advises maintaining a healthy skepticism about market predictions and expert forecasts.

Historically, humble, disciplined investors have outperformed during sideways markets. Those who recognized the limitations of their knowledge and remained open to learning were able to navigate uncertainty and capitalize on opportunities. Katsenelson’s final message is a call for humility, discipline, and lifelong learning as the foundations of investment success.

Advanced Strategies from the Book

Building on the foundational principles of quality, growth, and valuation, Katsenelson introduces several advanced strategies for maximizing returns in sideways markets. These techniques go beyond basic stock selection, focusing on portfolio construction, tactical adjustments, and behavioral discipline. The goal is to equip investors with a comprehensive toolkit that can adapt to changing market conditions and capitalize on unique opportunities.

The following advanced strategies are designed for experienced investors seeking to refine their approach and achieve superior performance. Each technique is supported by real-world examples and actionable steps, making them practical additions to any investment process.

Strategy 1: Dynamic Position Sizing

Rather than allocating equal weights to each position, Katsenelson advocates for dynamic position sizing based on conviction, risk, and valuation. For example, if a stock meets all QGV criteria and is trading at a significant discount to intrinsic value, an investor might allocate a larger portion of the portfolio to that position. Conversely, positions in higher-risk or less certain stocks should be sized conservatively. This approach helps maximize returns while managing downside risk. Katsenelson suggests using a scoring system to rank potential investments and adjust position sizes accordingly, ensuring that the portfolio remains balanced and aligned with overall objectives.

Strategy 2: Opportunistic Cash Management

In sideways markets, holding cash is not a sign of indecision but a strategic tool. Katsenelson recommends maintaining a cash reserve to capitalize on market corrections, sector rotations, or individual stock sell-offs. For instance, during the 2008–2009 financial crisis, investors with cash on hand were able to buy quality stocks at fire-sale prices. The key is to avoid the pressure to be fully invested at all times and instead view cash as an option on future opportunities. Regularly review your cash position and be ready to deploy capital when attractive opportunities arise.

Strategy 3: Tactical Sector Rotation

Sideways markets often see leadership rotate between sectors as economic conditions shift. Katsenelson suggests monitoring macroeconomic trends, earnings cycles, and valuation disparities to identify sectors poised for outperformance. For example, during the 1970s, energy and consumer staples outperformed while technology lagged. By tactically rotating into undervalued or improving sectors, investors can enhance returns and reduce exposure to underperforming areas. Use sector ETFs or targeted stock picks to implement this strategy, and review sector allocations quarterly to stay aligned with market trends.

Strategy 4: Behavioral Checklists and Journaling

Katsenelson emphasizes the importance of behavioral discipline in sideways markets. He recommends creating checklists to guide decision-making, including criteria for buying, holding, and selling stocks. For example, require a minimum margin of safety, evidence of quality and growth, and a clear thesis for each position. Maintain an investment journal to document decisions, track outcomes, and analyze mistakes. This practice helps counteract psychological biases, improve self-awareness, and foster continuous improvement. Over time, investors who rigorously document and review their process tend to achieve better results.

Strategy 5: Special Situations and Event-Driven Investing

Sideways markets create opportunities in special situations—mergers, spin-offs, restructurings, and distressed assets. Katsenelson encourages investors to seek out event-driven opportunities that are less correlated with overall market direction. For example, investing in a company undergoing a turnaround or benefiting from a regulatory change can yield outsized returns even when the index is flat. This strategy requires thorough research, a contrarian mindset, and the ability to act decisively when unique situations arise. Monitor corporate news, earnings releases, and regulatory developments to identify potential special situations.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Implementing Katsenelson’s strategies requires a structured, disciplined approach. Start by assessing your current portfolio, investment goals, and risk tolerance. Use the QGV framework to screen for quality, growth, and valuation, and build a watchlist of potential investments. Regularly review and adjust your portfolio to stay aligned with your strategy and adapt to changing market conditions.

Continuous learning and self-assessment are essential. Set aside time each week for research, reading, and reflection. Use checklists and journals to document decisions and track progress. Be willing to adapt your approach as you gain experience and as market conditions evolve. The key is to remain disciplined, patient, and open-minded.

- First step investors should take: Assess your current portfolio using the QGV (Quality, Growth, Valuation) framework. Identify strengths, weaknesses, and areas for improvement.

- Second step for building the strategy: Screen for new investment opportunities that meet strict criteria for quality, sustainable growth, and attractive valuation. Build a diversified watchlist.

- Third step for long-term success: Implement regular portfolio reviews, rebalancing, and tactical adjustments. Maintain a commitment to continuous learning, behavioral discipline, and adaptability.

Critical Analysis

The Little Book of Sideways Markets excels in translating complex market dynamics into actionable strategies for individual investors. Katsenelson’s writing is clear, engaging, and grounded in both historical data and personal experience. The QGV framework is a powerful, practical tool that can be applied across market cycles. The book’s greatest strength is its focus on psychological discipline and risk management—areas often overlooked in mainstream investment literature.

However, the book’s emphasis on active management and selectivity may be challenging for investors who lack the time or expertise to conduct thorough research. Some readers may find the process of screening for quality, growth, and valuation daunting without access to robust analytical tools. Additionally, while the book provides a strong framework, it offers fewer concrete examples of individual stock picks or sector recommendations, leaving some implementation details to the reader.

In today’s market environment—characterized by high valuations, increased volatility, and uncertain economic prospects—Katsenelson’s message is especially relevant. As investors face the possibility of another decade of sideways returns, the book’s insights on adaptability, resilience, and continuous learning are more valuable than ever. It serves as both a warning and a roadmap for those seeking to outperform when the easy gains of bull markets are gone.

Conclusion

The Little Book of Sideways Markets is an essential read for investors seeking to navigate challenging market environments. Katsenelson’s blend of historical analysis, practical frameworks, and psychological insights provides a comprehensive guide for thriving when the market is stuck in neutral. The QGV framework—emphasizing quality, growth, and valuation—offers a disciplined approach to stock selection and portfolio management.

The book’s actionable strategies, from risk management and contrarian investing to continuous learning and behavioral discipline, equip readers with the tools needed to outperform in sideways markets. While the emphasis on active management may require additional effort, the potential rewards are significant. Katsenelson’s message is clear: success in stagnant markets demands adaptability, patience, and skill.

For investors looking to build resilience, generate returns, and avoid the pitfalls of complacency, The Little Book of Sideways Markets is an invaluable resource. Its lessons are timeless and its relevance only grows as markets cycle through periods of exuberance and stagnation. We highly recommend adding it to your investment library.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Sideways Markets

1. What is a sideways market, and how does it differ from bull or bear markets?

A sideways market is a prolonged period—often a decade or more—when major stock indices make little net progress, oscillating up and down but ending up at roughly the same level. Unlike bull markets (marked by sustained gains) or bear markets (characterized by sharp declines), sideways markets feature high volatility, declining P/E ratios, and stagnant total returns. Investors must adopt different strategies to succeed in these environments.

2. Who should read The Little Book of Sideways Markets?

This book is ideal for individual investors, financial advisors, and anyone managing their own portfolio who wants to outperform during periods of market stagnation. It’s especially valuable for those who have only experienced bull markets and may not be prepared for a decade of muted returns. Both novice and seasoned investors will benefit from its practical frameworks and historical insights.

3. What are the key takeaways from the book?

The main takeaways are the importance of focusing on quality, growth, and valuation (QGV); the need for active portfolio management; the value of risk management and psychological discipline; and the necessity of continuous learning. Katsenelson provides actionable strategies for identifying undervalued opportunities, managing risk, and adapting to changing market conditions.

4. How can investors identify quality companies in sideways markets?

Investors should look for companies with strong management, solid balance sheets, consistent earnings growth, and sustainable competitive advantages. Key metrics include return on equity, debt-to-equity ratio, and free cash flow generation. Quality companies are more likely to withstand volatility and deliver steady returns even when the broader market is stagnant.

5. What role do dividends play in sideways markets?

Dividends become a critical component of total returns when capital appreciation is limited. During past sideways markets, such as the 1970s, dividends accounted for over 70% of the S&P 500’s total return. Investors should prioritize companies with stable or growing dividends and consider reinvesting dividends to compound returns.

6. How does the QGV framework work in practice?

The QGV framework involves screening for companies that score highly on quality (management, financial health), growth (sustainable earnings growth), and valuation (attractive price relative to intrinsic value). Investors should use checklists and scoring systems to evaluate potential investments and build a diversified portfolio that balances these factors.

7. Is active management necessary in sideways markets?

Yes, Katsenelson argues that passive, buy-and-hold strategies may underperform in sideways markets. Active management—including regular portfolio reviews, rebalancing, and tactical adjustments—is necessary to adapt to changing conditions and capitalize on emerging opportunities. Flexibility, discipline, and a willingness to go against the crowd are essential.

8. What psychological challenges do investors face in sideways markets?

Sideways markets test investors’ patience and discipline. Common psychological traps include overconfidence, herd mentality, and emotional decision-making. Katsenelson recommends maintaining humility, using behavioral checklists, and keeping an investment journal to counteract biases and improve decision-making.

9. How can investors continue learning and improving their strategy?

Continuous learning is vital. Investors should read investment books, follow market analysis, attend seminars, and join investment communities. Keeping an investment journal, reviewing decisions, and seeking feedback from peers can help identify areas for improvement and foster long-term success.

10. How does The Little Book of Sideways Markets compare to other investment books?

Unlike most investment books that focus on bull markets or passive strategies, Katsenelson’s book addresses the unique challenges of sideways markets. Its emphasis on practical, actionable frameworks, psychological discipline, and adaptability sets it apart. It’s a field guide for thriving when the market is stuck in neutral, making it a valuable addition to any investor’s library.