The Little Book of Stock Market Cycles by Jeffrey A. Hirsch

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

"The Little Book of Stock Market Cycles" by Jeffrey A. Hirsch is a comprehensive guide to understanding and capitalizing on the recurring patterns that shape stock market behavior. Hirsch, the editor-in-chief of the Stock Trader’s Almanac and a well-respected market historian, brings decades of experience and a unique perspective to the subject. He is renowned for his deep research into market seasonality, cycles, and historical trends, making him a trusted authority for both professional and retail investors seeking an edge in timing the markets.

The book’s central theme revolves around the predictability of market cycles—long-term secular trends, short-term cyclical swings, and the seasonality that recurs year after year. Hirsch’s purpose is to demystify the stock market’s seemingly erratic movements by showing how history, politics, economics, and even the calendar itself influence market performance. He argues that by studying and understanding these cycles, investors can enhance returns, avoid costly mistakes, and bring discipline to their investment strategies.

This book is particularly valuable for investors who are frustrated by market volatility and are seeking a systematic approach to portfolio management. Both beginners and seasoned investors will find actionable insights, as Hirsch combines historical analysis with practical strategies. The book is also highly relevant for those interested in macroeconomic trends, political cycles, and behavioral finance, as it connects market performance to broader social and economic forces.

What sets "The Little Book of Stock Market Cycles" apart is its ability to translate dense historical data into clear, actionable advice. Hirsch’s writing is accessible, yet packed with specific examples—from the impact of wars on markets to the notorious “summer doldrums” and the “Best Six Months” strategy. The book’s unique blend of quantitative research, historical storytelling, and practical application makes it a must-read for anyone serious about improving their investment outcomes. Readers will walk away with a toolkit for recognizing cycles, timing trades, and building resilient portfolios that can weather both booms and busts.

Key Concepts and Ideas

At its core, "The Little Book of Stock Market Cycles" is built on the philosophy that markets are not random, but instead are governed by observable, recurring cycles. Hirsch emphasizes that by understanding these cycles—whether they’re based on economic trends, political events, or even the time of year—investors can gain a significant advantage. The book’s approach is grounded in historical analysis, demonstrating that while no two cycles are identical, they often rhyme, offering predictive power for those who pay attention.

Hirsch also stresses the importance of flexibility and discipline. He warns against the dangers of relying solely on past successes or static strategies, arguing instead for adaptive approaches that respond to the current market environment. By combining historical patterns with modern data and behavioral insights, investors can anticipate market shifts, avoid pitfalls, and capitalize on emerging opportunities.

- Secular and Cyclical Market Trends: Hirsch distinguishes between long-term secular trends (lasting 10-20 years) and shorter cyclical swings (2-5 years). Recognizing whether the market is in a secular bull or bear phase helps investors set realistic expectations and allocate assets appropriately. For example, the secular bull market of the 1980s-1990s saw the S&P 500 compound at 17% annually, while secular bears like 2000-2010 delivered flat returns.

- Impact of Geopolitical Events: Wars, treaties, and periods of peace have profound effects on markets. Hirsch shows that wars typically lead to stagnation or declines due to uncertainty and inflation, while post-war recoveries often spark powerful bull markets—such as the post-WWII boom.

- Government Policy and Political Cycles: Election cycles, fiscal and monetary policy changes, and regulatory shifts can create predictable market patterns. Hirsch highlights the “presidential cycle,” where pre-election years tend to be strong for stocks, and how policy changes can benefit or hurt specific sectors.

- Market Seasonality: Certain months and seasons consistently outperform others. The “Best Six Months” (November-April) have historically delivered the majority of annual returns, while the summer months often underperform—a phenomenon known as the “summer doldrums.”

- Triple Witching and Market Volatility: The expiration of stock options, index futures, and index options on the same day (Triple Witching) leads to heightened volatility and trading volumes. Understanding these events helps investors manage risk and spot short-term opportunities.

- Autumn Planting and Value Opportunities: September and October are prone to corrections, which can create buying opportunities for patient investors. Hirsch encourages “autumn planting”—buying high-quality stocks during these dips for long-term gains.

- Tax-Loss Selling and the January Effect: Year-end tax strategies often depress prices in December, setting the stage for rebounds in January, especially among small-cap stocks. The “January Effect” is a recurring pattern savvy investors can exploit.

- Day-of-the-Week Effects: Fridays tend to be strong for stocks due to positive sentiment and low trading volumes, while Mondays are weaker. Incorporating this knowledge can fine-tune trade execution.

- Combining Historical Patterns with Modern Analysis: Hirsch advocates integrating seasonal, cyclical, and technical indicators to create robust, adaptive strategies. This multi-pronged approach helps investors avoid overreliance on any single signal.

- Discipline and Continuous Learning: The most successful investors are those who combine patience, discipline, and a willingness to adapt as new information arises. Hirsch emphasizes sticking to well-defined strategies and continually updating one’s knowledge base.

Practical Strategies for Investors

Hirsch’s book is not just theoretical; it’s packed with actionable strategies that investors can implement to harness the power of cycles and seasonality. By following these time-tested approaches, investors can tilt the odds in their favor, reduce risk, and enhance long-term returns. The key is to blend historical insights with a disciplined, rules-based process that avoids emotional decision-making.

Applying these strategies requires both awareness of the calendar and a willingness to act when opportunities arise. Hirsch provides detailed guidance on when to buy, when to sell, and how to position portfolios around recurring events—such as elections, holidays, and quarterly expirations. He also emphasizes the importance of diversification, risk management, and ongoing portfolio review to ensure that strategies remain effective as market conditions evolve.

- Implement the “Best Six Months” Strategy: Focus equity exposure from November through April, when historical data shows the S&P 500 delivers the bulk of its annual gains. Action steps: Review portfolio allocations in late October, shift overweight to equities, and consider trimming exposure at the end of April or early May.

- Harvest Gains in Spring: Take profits on positions that have appreciated during the winter and spring rally. Action steps: Monitor earnings reports and economic indicators in March-April, set trailing stop orders, and rebalance into defensive assets as summer approaches.

- “Autumn Planting” During Market Corrections: Use the volatility and corrections often seen in September and October to buy high-quality stocks at discounted prices. Action steps: Screen for fundamentally strong companies experiencing temporary declines, build watchlists in late August, and stagger purchases as volatility peaks.

- Capitalize on the January Effect: Target small-cap stocks in late December and early January, as tax-loss selling often depresses prices, creating rebound potential. Action steps: Identify small-cap laggards in December, allocate a portion of the portfolio to these names, and plan to take profits by late January or February.

- Defensive Positioning in the Summer: Shift allocations to defensive sectors—such as utilities, healthcare, and consumer staples—during the “summer doldrums” (May-August) when market returns historically weaken. Action steps: Rebalance sector weights in May, use stop-losses, and avoid aggressive new positions until autumn.

- Monitor Triple Witching Dates: Prepare for heightened volatility on the third Friday of March, June, September, and December. Action steps: Reduce leverage, avoid short-term trades near expiration, and use limit orders to manage execution risk.

- Align Trades with Day-of-the-Week Effects: Favor entering new positions on Mondays (when prices tend to be lower) and taking profits on Fridays (when sentiment is stronger). Action steps: Review weekly trading volume and sentiment data, and adjust trade timing accordingly.

- Integrate Political and Economic Cycles: Adjust sector exposure based on the stage of the election cycle and major policy changes. Action steps: Increase exposure to infrastructure or defense stocks in pre-election years, monitor tax and regulatory proposals, and stay nimble around geopolitical events.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

Hirsch structures the book in a logical, thematic progression, moving from foundational market concepts to increasingly nuanced strategies that incorporate seasonality, politics, and behavioral finance. Each chapter builds on the last, offering historical context, data-driven insights, and practical applications. The book’s organization makes it easy for readers to follow along, whether they are new to investing or seasoned professionals seeking to refine their approach.

Below, we provide a comprehensive, chapter-by-chapter analysis, distilling the key lessons, examples, and actionable takeaways from each section. Each chapter is explored in detail, with specific references to historical events, market data, and concrete steps investors can use to apply these principles in their own portfolios. This deep dive ensures that readers gain not only a conceptual understanding but also the practical know-how to implement Hirsch’s cyclical investing framework.

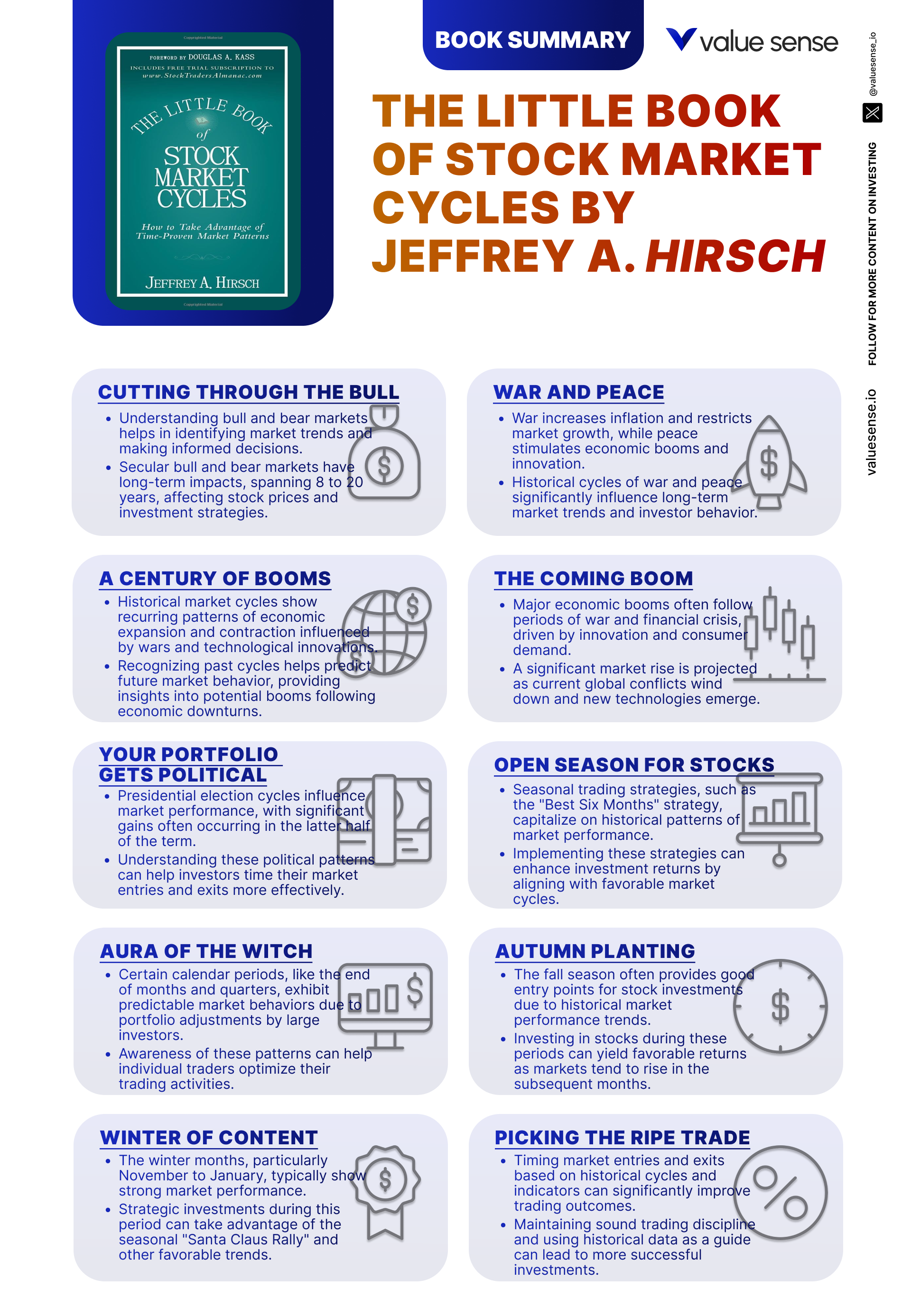

Chapter 1: Cutting through the Bull

The opening chapter lays the groundwork for understanding the market’s cyclical nature, focusing on the distinction between secular and cyclical trends. Hirsch explains that secular bull markets, such as those from 1982-2000, are characterized by sustained, multi-year advances in stock prices, while secular bear markets (like 2000-2010) feature prolonged stagnation or decline. He provides historical data showing that the S&P 500 compounded at over 17% annually during the 1980s-1990s, while the following decade saw nearly flat returns. This distinction is crucial for setting realistic expectations—investors who fail to recognize the prevailing market regime risk overestimating future gains or underestimating risks.

Hirsch uses vivid examples from history, such as the 1920s bull market followed by the Great Depression, and the 1970s bear market that gave way to the tech-driven boom of the 1980s. He quotes, “Understanding whether you’re in a secular or cyclical trend is the single most important factor in portfolio strategy.” The chapter is rich with charts and tables mapping out these long-term cycles, highlighting how even within secular trends, shorter cyclical swings can provide opportunities or pitfalls. Hirsch notes that cyclical bull markets can occur within broader secular bears, and vice versa, emphasizing the need for nuanced analysis.

For practical application, Hirsch advises investors to regularly assess the current market environment by tracking valuation metrics (like the Shiller P/E), macroeconomic indicators, and technical trends. He suggests adjusting equity allocations based on the secular trend—overweight equities in secular bulls, underweight in secular bears, and using cyclical swings to rebalance. He also recommends maintaining flexibility, warning that “the greatest danger is assuming the future will look exactly like the past.” This means staying alert to signs of regime change, such as shifts in interest rates or major policy moves.

Historically, investors who aligned their strategies with the prevailing secular trend have outperformed those who ignored these cycles. For example, those who reduced equity exposure in the early 2000s avoided the brunt of the dot-com bust, while those who loaded up on stocks in the early 1980s participated in one of the greatest bull markets in history. Hirsch’s emphasis on flexibility and adaptation is particularly relevant in today’s rapidly changing market environment, where new technologies and global dynamics can accelerate or disrupt traditional cycles.

Chapter 2: War and Peace

This chapter explores the profound impact of geopolitical events—especially wars and periods of peace—on market performance. Hirsch demonstrates that wars typically lead to stagnation or declines in the stock market, primarily due to uncertainty, resource diversion, and inflation. He cites examples such as World War I, which saw the Dow Jones Industrial Average (DJIA) close for months and deliver minimal gains, and the Vietnam War era, which was marked by elevated inflation and volatile markets. The chapter is filled with historical data showing how markets struggled to make headway during major conflicts.

Conversely, Hirsch shows that the aftermath of wars often marks the beginning of powerful bull markets. The post-World War II period, for instance, saw the DJIA surge from around 150 in 1945 to over 1,000 by the early 1970s, fueled by economic recovery, innovation, and renewed consumer confidence. He writes, “Markets thrive on stability, and nothing restores confidence like the end of a major conflict.” The chapter includes detailed case studies, such as the post-Vietnam boom and the Gulf War rally, illustrating how peace can act as a catalyst for economic expansion and market gains.

Investors can apply these lessons by monitoring global geopolitical developments and adjusting their portfolios accordingly. Hirsch suggests reducing risk exposure during periods of escalating conflict and looking for buying opportunities as conflicts resolve and stability returns. He also advises tracking inflation trends, as wartime spending often leads to price pressures that can erode real returns. “Inflation is the silent killer during war,” Hirsch warns, recommending inflation-protected securities or commodity exposure as hedges.

Real-world examples abound: those who invested in U.S. equities after World War II or the end of the Cold War enjoyed decades of prosperity, while those who remained fully invested during prolonged conflicts often saw muted returns. The lessons of this chapter are especially pertinent given the ongoing geopolitical tensions in today’s world, reminding investors to stay vigilant and flexible in response to global events.

Chapter 3: A Century of Booms and Busts

In this sweeping historical overview, Hirsch chronicles the major booms and busts of the 20th century, drawing out the recurring patterns that define market cycles. He begins with the Roaring Twenties, a period of technological innovation and cultural change that drove stock prices to unprecedented heights, only to be followed by the devastating crash of 1929 and the Great Depression. The chapter details how government policies—such as the New Deal and post-war fiscal stimulus—played a crucial role in shaping recovery and subsequent market behavior.

Hirsch emphasizes that technological and cultural shifts often underpin major bull markets. He points to the rise of automobiles, radio, and consumer appliances in the 1920s, and later, the post-WWII boom driven by suburbanization, the baby boom, and advances in manufacturing. The chapter is rich with data, showing how the DJIA rose from 41 in 1932 to over 1,000 by 1972, despite numerous recessions and shocks along the way. Hirsch quotes, “Innovation is the engine of every great bull market.”

For investors, the key takeaway is to look for the underlying drivers of each cycle—be it technology, demographics, or policy. Hirsch suggests that by identifying emerging trends (such as the rise of the internet in the 1990s or renewable energy today), investors can position themselves ahead of the next boom. He also warns that busts are inevitable, and that diversification, risk management, and a long-term perspective are essential for weathering downturns.

Historical context is central to this chapter. Hirsch shows that while no two cycles are identical, they often follow similar trajectories—rapid ascent, speculative excess, sharp correction, and eventual recovery. Investors who understand these rhythms can avoid the common pitfalls of buying at the top or selling at the bottom. The lessons of the 20th century remain highly relevant, as today’s markets continue to be shaped by innovation, policy, and the ever-present possibility of a new boom or bust.

Chapter 4: The Coming Boom

Building on the historical analysis, this chapter looks forward, arguing that the conditions are ripe for a new market super boom. Hirsch draws parallels to past periods of post-crisis recovery, such as the 1950s and the 1980s, and identifies key ingredients for the next major advance: economic recovery, technological innovation, and geopolitical stability. He writes, “Every great boom is born out of crisis,” pointing to the aftermath of the 2008 financial crisis and the COVID-19 pandemic as potential catalysts for the next leg higher.

The chapter is filled with data on recent technological advances—cloud computing, artificial intelligence, green energy—that are poised to drive productivity and growth in the coming decade. Hirsch cites government policies, such as infrastructure spending and innovation incentives, as additional tailwinds. He recommends focusing on sectors at the forefront of these trends, such as technology, healthcare, and clean energy, and diversifying across industries to capture broad-based growth.

Investors are advised to maintain a long-term perspective, resisting the temptation to trade in and out of the market based on short-term noise. Hirsch suggests dollar-cost averaging into leading sectors, using corrections as buying opportunities, and periodically rebalancing to lock in gains. He warns that “patience is the investor’s greatest ally” during the early stages of a new boom, as volatility and skepticism can create attractive entry points.

Real-world examples include the explosive growth of tech stocks after the dot-com bust and the resurgence of industrials following the 2008 crisis. Hirsch’s analysis is especially timely in the context of the current market, where rapid innovation and policy support are setting the stage for potentially historic gains. The chapter serves as both a roadmap and a source of optimism for investors willing to look beyond the headlines and focus on long-term drivers.

Chapter 5: Your Portfolio Gets Political

This chapter delves into the intersection of politics and markets, showing how government actions, election cycles, and geopolitical events create both risks and opportunities for investors. Hirsch introduces the “presidential cycle,” a well-documented pattern where U.S. stocks tend to perform best in the third year of a presidential term—pre-election years—due to pro-growth policies and fiscal stimulus. He provides data showing that since 1949, the S&P 500 has averaged double-digit returns in pre-election years, compared to lower returns in post-election years.

Hirsch also examines the impact of legislative changes, tax policies, and regulatory shifts on specific sectors. For example, he notes that defense stocks often outperform during periods of rising military spending, while healthcare and renewable energy stocks benefit from supportive legislation. The chapter includes case studies of market reactions to major events—such as the passage of the Affordable Care Act or the 2017 tax reform—demonstrating how political developments can drive sector rotation and volatility.

For practical application, Hirsch advises investors to stay informed about the political landscape and to adjust sector exposure based on anticipated policy changes. He recommends increasing allocations to sectors likely to benefit from upcoming legislation or election outcomes, while reducing exposure to those facing headwinds. Diversification across sectors and regions is also emphasized as a way to mitigate political risk.

Historical context is provided through examples like the post-election rallies of the 1980s and the market turbulence surrounding the 2000 and 2016 elections. Hirsch’s analysis is particularly relevant in today’s polarized environment, where policy shifts can have immediate and significant effects on market performance. Investors who incorporate political cycles into their strategy can gain an edge over those who ignore these powerful forces.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Open Season for Stocks

In this chapter, Hirsch introduces the concept of market seasonality—the idea that certain times of the year are consistently more favorable for stock investing. He presents the “Best Six Months” strategy, which involves concentrating equity exposure from November through April, when historical data shows the S&P 500 delivers the majority of its annual returns. Charts in the chapter reveal that, since 1950, the S&P 500 has averaged over 7% returns during these months, compared to just 1.5% from May through October.

Hirsch explains the underlying reasons for this pattern, including year-end bonuses, holiday spending, and favorable economic data releases. He cautions, however, that seasonality is not a guarantee—there are exceptions, and market timing is inherently challenging. Still, he argues that incorporating seasonality into a broader investment strategy can provide a valuable framework for decision-making.

For implementation, Hirsch suggests reviewing portfolio allocations in late October, increasing equity exposure ahead of the November-April window, and considering defensive shifts as spring turns to summer. He also recommends using stop-losses and trailing stops to protect gains, and monitoring macroeconomic indicators for signs of changing conditions. “Seasonality is a tool, not a crystal ball,” he writes, encouraging investors to use it as one component of a diversified approach.

Real-world examples include the consistent outperformance of the S&P 500 during the “Best Six Months” and the relative underperformance during the summer. Hirsch’s strategy has been widely adopted by professional traders and is supported by decades of empirical research. In today’s volatile markets, seasonality offers a simple, data-driven way to tilt the odds in favor of investors who are willing to follow the calendar.

Chapter 7: Aura of the Witch

This chapter explores the phenomenon of “Triple Witching”—the simultaneous expiration of stock options, index futures, and index options on the third Friday of March, June, September, and December. Hirsch explains that these events lead to surges in trading volume and volatility, as traders unwind positions and roll contracts forward. He provides data showing that market volatility often spikes during Triple Witching weeks, with the S&P 500 experiencing larger-than-average price swings.

Hirsch delves into the psychological aspects of Triple Witching, noting that heightened uncertainty can lead to both panic selling and speculative buying. He quotes, “Triple Witching is a test of nerves—those who remain disciplined can profit from the chaos.” The chapter includes examples of major market moves during Triple Witching, such as the sharp reversals seen in September 2008 and December 2018, when contract expirations coincided with broader market stress.

For investors, the key takeaway is risk management. Hirsch advises reducing leverage and avoiding large, short-term trades in the days leading up to Triple Witching. He also suggests using limit orders to manage execution risk and maintaining a diversified portfolio to buffer against sudden volatility. For more advanced investors, there may be opportunities to profit from mispricings or temporary dislocations, but caution is paramount.

Historically, Triple Witching has been both a source of opportunity and risk. Those who are aware of the calendar and adjust their strategies accordingly can avoid being caught off guard by sudden price swings. Hirsch’s guidance is particularly relevant for active traders and options investors, but even long-term investors should be mindful of these recurring events and the volatility they can introduce.

Chapter 8: Autumn Planting

Hirsch introduces the concept of “autumn planting,” a strategy that takes advantage of the seasonal volatility and corrections often seen in September and October. He provides data showing that these months have historically been the most volatile for U.S. stocks, with the S&P 500 experiencing more corrections and bear market bottoms during this period than any other time of year. The chapter is filled with charts illustrating the frequency and magnitude of autumn declines, from the 1987 crash to the 2008 financial crisis.

The strategy involves buying high-quality stocks during these dips, when fear and uncertainty are at their peak. Hirsch emphasizes patience and timing, recommending that investors build watchlists of fundamentally strong companies and stagger purchases as volatility peaks. He also suggests using technical indicators, such as the Relative Strength Index (RSI) and moving averages, to identify oversold conditions and potential reversal points.

For practical application, Hirsch advises investors to maintain a long-term perspective, recognizing that the benefits of autumn planting may take months or even years to materialize. He recommends focusing on companies with strong balance sheets, consistent earnings, and attractive valuations—traits that tend to outperform in subsequent recoveries. “Autumn is the season of opportunity for value investors,” he writes, urging readers to embrace volatility as a friend rather than a foe.

Historical examples abound: those who bought during the panic of October 1987 or the lows of September 2008 enjoyed outsized gains in the years that followed. Hirsch’s strategy is particularly relevant in today’s fast-moving markets, where algorithmic trading and global news can amplify volatility. By preparing for autumn corrections and having a disciplined buying plan, investors can turn seasonal weakness into long-term strength.

Chapter 9: Winter of Content

This chapter focuses on the positive seasonal trends that typically occur during the winter months, especially from November through January. Hirsch highlights the “winter rally,” driven by factors such as holiday spending, year-end bonuses, and portfolio rebalancing. He presents data showing that the S&P 500 has historically delivered some of its best monthly returns during this period, with December and January consistently ranking among the top-performing months.

Hirsch also discusses the “January Effect,” a well-known phenomenon where small-cap stocks tend to outperform in January due to increased buying pressure following year-end tax-loss selling. He provides examples of years when the Russell 2000 outpaced the S&P 500 by 2-4% in January, and offers guidance on identifying small-cap stocks that are likely to benefit from this trend. The chapter includes practical tips for timing purchases and setting profit targets.

For investors, the key strategy is to increase exposure to equities—particularly small-caps—in late December and early January, then monitor performance closely as the rally unfolds. Hirsch advises setting stop-losses and taking profits as gains accumulate, while remaining alert to signs of exhaustion or reversal. He also recommends using tax-loss selling in December to harvest losses and reset cost bases for the new year.

Historical context is provided through examples of winter rallies following bear markets, such as the powerful rebound in January 2009 after the financial crisis. Hirsch’s analysis is especially relevant for those seeking to optimize returns around the calendar, as the winter months offer both statistical and psychological tailwinds. By aligning portfolio moves with these seasonal trends, investors can capture gains that might otherwise be missed.

Chapter 10: Spring Harvest

As the winter rally fades, Hirsch turns his attention to the spring months—another period of positive market performance, often driven by improving economic indicators and corporate earnings reports. He provides data showing that GDP growth, employment figures, and earnings surprises tend to peak in the spring, fueling investor optimism and stock market gains. The chapter explores the idea of “harvesting” gains during this period, locking in profits before the traditional summer slowdown.

Hirsch also introduces the “sell in May and go away” strategy, a time-honored approach based on the observation that market returns often weaken after the spring months. He presents charts showing that, since 1950, the S&P 500’s average return from May through October is just 1.5%, compared to over 7% from November through April. The chapter discusses the psychological and economic drivers behind this pattern, including vacations, reduced trading volumes, and fewer corporate catalysts.

For practical application, Hirsch advises investors to review portfolios in late April, take profits on positions that have appreciated during the winter and spring, and rebalance into defensive sectors or cash. He suggests monitoring economic indicators and earnings releases for signs of slowing momentum, and using stop-losses to protect gains. “Spring is the season for harvesting—not planting,” he writes, emphasizing the importance of discipline and timing.

Historical examples include the repeated underperformance of the market during the summer months, and the success of investors who rotated out of equities in May and re-entered in the fall. Hirsch’s strategy is particularly valuable for those seeking to minimize risk and maximize returns by aligning trades with the natural rhythms of the market. By harvesting gains in the spring, investors can avoid the summer doldrums and position themselves for the next cycle.

Chapter 11: Summer Doldrums

Hirsch describes the “summer doldrums” as a period marked by lower trading volumes, reduced volatility, and weaker market performance. He provides data showing that, from May through August, the S&P 500’s average return is significantly lower than in other months, with many years seeing outright declines. The chapter explores the reasons for this pattern, including vacations, reduced corporate activity, and a lack of major economic events to drive momentum.

To navigate this challenging period, Hirsch recommends shifting allocations to defensive sectors—such as utilities, consumer staples, and healthcare—which tend to be less affected by seasonal slowdowns. He also advises maintaining a long-term perspective, avoiding impulsive decisions based on short-term market movements, and using the summer months to review and adjust portfolios in preparation for the more active autumn season.

For practical application, Hirsch suggests setting tighter stop-losses, reducing leverage, and focusing on income-generating assets during the summer. He also encourages investors to stay informed about upcoming catalysts, such as economic data releases or earnings reports, that could spark renewed activity. “The summer is a time for patience, not aggression,” he writes, urging readers to resist the temptation to chase returns during a naturally subdued period.

Historical context is provided through examples of summer slumps, such as the 2011 debt ceiling crisis and the 2015 China devaluation, which caught many investors off guard. Hirsch’s advice is especially relevant for those who struggle with the urge to overtrade during quiet markets. By maintaining discipline and focusing on defense, investors can weather the summer doldrums and be ready to capitalize on opportunities as the market reawakens in the fall.

Chapter 12: Celebrate Good Times

This chapter examines the impact of holidays and special events on market performance. Hirsch presents data showing that the stock market often rallies around major holidays—such as Christmas and Thanksgiving—due to increased consumer spending and positive investor sentiment. He also explores the effects of major events, such as presidential elections and significant anniversaries, which can drive volatility and create short-term trading opportunities.

Hirsch explains that holiday-driven optimism often leads to short-term rallies, particularly in sectors that benefit from increased consumer activity, such as retail, travel, and hospitality. He provides examples of the “Santa Claus Rally”—the tendency for stocks to rise in the last week of December and the first two trading days of January—and the strong performance of the market in the days leading up to Thanksgiving. The chapter includes practical tips for adjusting portfolios to capitalize on these trends.

For investors, the key strategy is to anticipate periods of heightened activity and adjust sector exposure accordingly. Hirsch advises increasing allocations to consumer-facing sectors ahead of major holidays, and being prepared for increased volatility around special events. He also recommends monitoring news flows and sentiment indicators to gauge the likelihood of a rally or correction.

Historical examples include the consistent outperformance of stocks during holiday weeks and the volatility seen around major elections. Hirsch’s analysis is particularly relevant in today’s fast-paced markets, where algorithmic trading and social media can amplify the effects of news and sentiment. By staying alert to the calendar and adjusting strategies in advance, investors can turn seasonal optimism into tangible gains.

Chapter 13: Don’t Sell on Friday

Here, Hirsch explores the “day-of-the-week” effect—a pattern where stocks tend to perform better on certain days, with Fridays historically being stronger and Mondays weaker. He presents data showing that, over several decades, the S&P 500 has averaged higher returns on Fridays, often due to positive sentiment and lighter trading volumes. Conversely, Mondays have seen more frequent declines, possibly due to the digestion of weekend news and cautious sentiment at the start of the week.

Hirsch delves into the psychological factors behind these patterns, noting that traders often close short positions ahead of the weekend, and that positive news is more likely to be released on Fridays. He also discusses the impact of earnings announcements and economic data releases, which can skew returns on specific days. The chapter includes tables of average daily returns by day of the week, supporting the argument for timing trades to exploit these effects.

For practical application, Hirsch advises investors to consider entering new positions on Mondays (when prices may be lower) and taking profits on Fridays (when sentiment is stronger). He cautions, however, against relying too heavily on this pattern, as it is not foolproof and can be overshadowed by broader market trends or unexpected news. “Day-of-the-week effects are a subtle edge, not a primary strategy,” he writes, encouraging investors to use them as a supplement to other signals.

Historical context is provided through examples of Friday rallies following major news events, and the tendency for markets to open lower on Mondays after negative weekend developments. Hirsch’s analysis is especially useful for active traders and those seeking to optimize trade execution. By incorporating day-of-the-week effects into a broader strategy, investors can fine-tune their timing and potentially improve outcomes.

Chapter 14: Picking the Ripe Trade

In the final chapter, Hirsch brings together all the concepts and strategies discussed throughout the book, emphasizing the importance of timing, patience, and discipline in successful investing. He explains that the best trades are those made at the “ripe” moment—when historical cycles, seasonal trends, and technical indicators align to create high-probability opportunities. Hirsch writes, “Success in the market is about waiting for the right pitch, not swinging at every ball.”

The chapter provides a framework for integrating multiple signals, including secular and cyclical trends, seasonality, political cycles, and technical analysis. Hirsch encourages investors to develop a rules-based process for identifying and executing trades, and to avoid impulsive decisions driven by emotion or noise. He also stresses the importance of continuous learning, urging readers to review past trades, study new patterns, and adapt strategies as markets evolve.

For practical application, Hirsch recommends setting clear entry and exit rules, maintaining watchlists of target stocks, and using checklists to ensure that all criteria are met before executing trades. He also suggests keeping a trading journal to document decisions and outcomes, facilitating ongoing improvement. “Discipline is the bridge between goals and accomplishment,” he quotes, highlighting the value of structure and process.

Real-world examples include legendary investors like Warren Buffett and Peter Lynch, who combined patience, discipline, and a deep understanding of cycles to achieve extraordinary results. Hirsch’s final message is one of empowerment: by applying the lessons of history, embracing seasonality, and committing to continuous improvement, any investor can enhance their returns and navigate the market’s inevitable ups and downs with confidence.

Advanced Strategies from the Book

Beyond the foundational strategies, Hirsch offers a suite of advanced techniques for investors seeking to further optimize their performance. These approaches require a deeper understanding of cycles, technical analysis, and macroeconomic indicators, but can provide significant rewards for those willing to put in the effort. The advanced strategies are particularly valuable for active traders, portfolio managers, and investors looking to fine-tune their timing and risk management.

Hirsch emphasizes that advanced strategies should be built on a solid foundation of historical data, rigorous analysis, and disciplined execution. He cautions against overcomplicating one’s approach, recommending that investors integrate these techniques selectively and in conjunction with broader portfolio management principles.

Strategy 1: Sector Rotation Based on Political and Economic Cycles

Hirsch advocates rotating sector allocations in anticipation of political and economic shifts. For example, during pre-election years, he recommends overweighting infrastructure, defense, and consumer discretionary stocks, which tend to benefit from pro-growth policies and increased government spending. In post-election years, he suggests shifting to more defensive sectors, such as healthcare and utilities, as markets digest policy changes and face potential headwinds. This approach requires tracking legislative agendas, economic indicators, and historical sector performance, then adjusting allocations quarterly or semi-annually. By aligning sector bets with the broader cycle, investors can capture relative outperformance and reduce risk.

Strategy 2: Tactical Use of Options Around Triple Witching

For experienced investors, Hirsch suggests using options strategies—such as straddles, strangles, or protective puts—around Triple Witching dates to manage volatility and exploit mispricings. He recommends reducing directional exposure in the week leading up to expiration, then using options to hedge against sudden moves or to capture premium from elevated implied volatility. Hirsch provides examples of using covered calls on core holdings or buying puts on indices as a hedge. The key is to size positions conservatively and to monitor liquidity, as bid-ask spreads can widen during periods of extreme activity. This strategy can help smooth returns and protect portfolios during turbulent weeks.

Strategy 3: Quantitative Seasonality Models

Hirsch encourages building quantitative models that integrate multiple seasonal and cyclical indicators. For instance, an investor might create a model that combines the “Best Six Months” effect, day-of-the-week returns, and Triple Witching volatility, generating buy and sell signals based on the confluence of these factors. Backtesting such models over decades of data can reveal robust patterns and help refine timing. Hirsch warns that models should be regularly updated to account for changing market dynamics and should include risk controls to prevent overfitting. By leveraging quantitative tools, investors can bring discipline and objectivity to their cyclical strategies.

Strategy 4: Tax-Efficient Rebalancing Around Year-End

Hirsch outlines a strategy for maximizing after-tax returns by harvesting losses in December and reallocating proceeds to similar, but not identical, securities—a technique known as tax-loss harvesting. He suggests reviewing portfolios in late November, identifying positions with unrealized losses, and executing sales before year-end to offset capital gains. Investors can then reinvest in related stocks or ETFs to maintain market exposure while resetting cost bases. Hirsch also recommends timing purchases of small-cap stocks in late December to benefit from the January Effect. This approach requires careful tracking of wash-sale rules and coordination with broader portfolio objectives but can significantly enhance long-term returns.

Strategy 5: Integrating Technical Analysis with Cycle Indicators

Hirsch advises combining traditional technical analysis—such as moving averages, momentum oscillators, and support/resistance levels—with cyclical and seasonal signals. For example, an investor might use the 200-day moving average to confirm the start of the “Best Six Months,” or employ RSI to identify oversold conditions during autumn corrections. By requiring multiple signals to align before executing trades, investors can improve the probability of success and avoid false positives. Hirsch provides examples of using this integrated approach to time entries and exits with greater precision, enhancing both risk-adjusted returns and confidence in decision-making.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the lessons and strategies from "The Little Book of Stock Market Cycles" requires a systematic, disciplined approach. Hirsch emphasizes that successful implementation starts with understanding one’s own investment goals, risk tolerance, and time horizon. He encourages investors to begin with the foundational strategies—such as the “Best Six Months” and autumn planting—before layering on more advanced techniques as experience grows.

It’s also critical to maintain ongoing portfolio review and adjustment. Markets are dynamic, and cycles can shift due to new technologies, policy changes, or global events. Hirsch recommends setting regular checkpoints (monthly, quarterly, or semi-annually) to reassess market conditions, sector exposures, and the effectiveness of current strategies. Keeping a trading journal and documenting decisions can facilitate continuous learning and improvement.

- First step investors should take: Assess your current portfolio for alignment with major cycles—are you overweight equities during the “Best Six Months” and defensive during the summer?

- Second step for building the strategy: Develop a calendar of key market events (Triple Witching dates, earnings seasons, election years) and plan portfolio adjustments in advance.

- Third step for long-term success: Regularly review and update your approach, incorporating new data, lessons learned, and changes in market structure. Stay disciplined, avoid emotional decisions, and commit to continuous learning.

Critical Analysis

"The Little Book of Stock Market Cycles" excels in translating complex historical data into clear, actionable insights. Hirsch’s experience as editor of the Stock Trader’s Almanac shines through in the depth of research, the clarity of explanations, and the practical focus of the book. The integration of seasonality, political cycles, and behavioral finance provides a comprehensive toolkit for investors seeking to improve their timing and risk management. The book’s accessibility makes it suitable for both beginners and experienced investors, and its emphasis on discipline and adaptability is a welcome antidote to the hype and noise of modern markets.

However, the book is not without limitations. While Hirsch provides ample historical evidence for his strategies, markets are constantly evolving, and past patterns may not always predict future performance. The reliance on seasonality and cycles can lead some investors to overlook fundamental analysis or to become overconfident in timing trades. Additionally, some of the more advanced strategies—such as options trading around Triple Witching—require significant expertise and may not be suitable for all readers. Hirsch acknowledges these caveats, urging readers to use cycles as one component of a broader, diversified approach.

In the current market environment, characterized by rapid technological change, geopolitical uncertainty, and the rise of algorithmic trading, Hirsch’s cyclical framework remains highly relevant. The book’s lessons on flexibility, discipline, and continuous learning are especially valuable in navigating today’s complex landscape. While no strategy is foolproof, "The Little Book of Stock Market Cycles" equips investors with the tools and mindset needed to adapt and thrive across market regimes.

Conclusion

"The Little Book of Stock Market Cycles" is a masterclass in recognizing and harnessing the rhythms that drive market performance. Jeffrey Hirsch’s blend of historical analysis, practical strategy, and behavioral insight offers investors a roadmap for navigating both booms and busts. By understanding secular and cyclical trends, leveraging seasonality, and maintaining discipline, readers can tilt the odds in their favor and build more resilient portfolios.

The book’s greatest strength lies in its actionable guidance. Whether you’re implementing the “Best Six Months” strategy, capitalizing on autumn corrections, or integrating political and economic cycles into your process, Hirsch provides clear steps and real-world examples. While no approach guarantees success, the lessons of history—and the discipline to apply them—remain among the most powerful tools in any investor’s arsenal.

For anyone seeking to move beyond guesswork and emotion, "The Little Book of Stock Market Cycles" is an essential addition to the investing library. Its lessons are timeless, its strategies robust, and its wisdom as relevant today as ever. We highly recommend it for investors of all levels looking to enhance returns and reduce risk through the power of cycles.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Stock Market Cycles

1. Who is Jeffrey A. Hirsch and why should I trust his advice?

Jeffrey A. Hirsch is the editor-in-chief of the Stock Trader’s Almanac and a respected market historian with decades of experience analyzing market cycles, seasonality, and historical trends. His research is widely used by professional traders and institutions, and he is known for translating complex data into practical, actionable strategies for investors at all levels.

2. What is the main takeaway from The Little Book of Stock Market Cycles?

The main takeaway is that markets are governed by recurring cycles—secular trends, seasonal patterns, and political/economic events—which can be studied and used to improve investment timing and returns. By understanding these cycles, investors can reduce risk, avoid common pitfalls, and capitalize on predictable opportunities throughout the year.

3. How reliable are the seasonal and cyclical patterns described in the book?

While the patterns are supported by decades of historical data, no strategy is foolproof, and past performance does not guarantee future results. Market dynamics can change due to new technologies, policy shifts, or global events. Hirsch emphasizes using cycles as one component of a diversified, disciplined investment approach rather than as a standalone strategy.

4. Can beginners use the strategies in this book, or is it only for advanced investors?

The book is accessible to both beginners and experienced investors. Foundational strategies like the “Best Six Months” and autumn planting are easy to implement, while more advanced techniques—such as options trading around Triple Witching—are clearly explained for those seeking deeper involvement. Hirsch encourages starting with the basics and layering on complexity as experience grows.

5. How do I apply the “Best Six Months” strategy in my own portfolio?

Review your portfolio in late October, increase exposure to equities (especially broad market ETFs or leading sectors), and hold through April. Consider trimming positions or shifting to defensive assets at the end of April or early May. Use stop-losses and regular reviews to manage risk and adapt to changing conditions.

6. What are the risks of relying on cycles and seasonality?

Relying solely on cycles can lead to missed opportunities if market dynamics shift, or to overtrading if signals are misinterpreted. Hirsch advises using cycles as a supplement to fundamental and technical analysis, maintaining diversification, and avoiding emotional or impulsive decisions based on calendar effects alone.

7. How can I use political and economic cycles to improve investment returns?

Monitor election cycles, policy proposals, and major legislative changes, then adjust sector allocations accordingly (e.g., overweight infrastructure in pre-election years, shift to defense or healthcare during periods of policy uncertainty). Diversify across sectors and regions to mitigate political risk and stay nimble as new information emerges.

8. Are the book’s strategies relevant for international markets or just the U.S.?

While most examples are drawn from U.S. markets, many of the cyclical and seasonal patterns—such as the impact of holidays, political cycles, and sector rotation—apply globally. Hirsch encourages adapting the strategies to local market calendars and political environments for international investors.

9. How often should I review and adjust my cyclical investment strategy?

Hirsch recommends regular portfolio reviews—at least quarterly, and ideally monthly or around major market events (earnings seasons, Triple Witching, elections). Use these checkpoints to reassess market conditions, sector exposures, and the effectiveness of your strategies, making adjustments as needed.

10. Where can I find more resources to deepen my understanding of market cycles?

In addition to "The Little Book of Stock Market Cycles," Hirsch’s Stock Trader’s Almanac is an excellent annual resource for cycle and seasonality data. Value Sense also offers in-depth research, intrinsic value tools, and stock ideas based on cyclical analysis—visit valuesense.io for more insights and tools to enhance your investing journey.