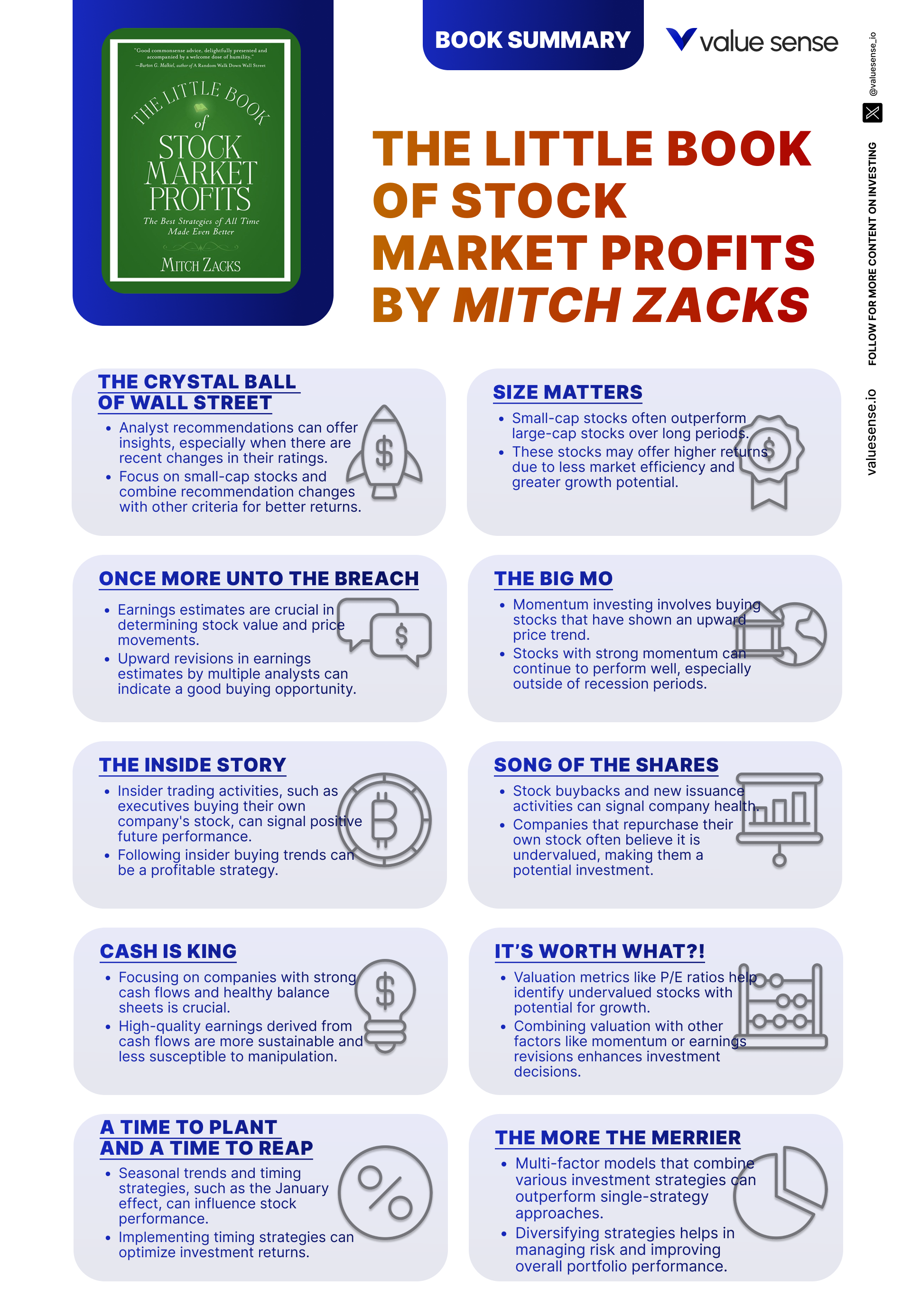

The Little Book of Stock Market Profits by Mitch Zacks

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

"The Little Book of Stock Market Profits" by Mitch Zacks is a concise yet comprehensive guide tailored for investors seeking practical, evidence-based strategies to outperform the market. Mitch Zacks, a seasoned investment manager and the CEO of Zacks Investment Management, brings a wealth of experience to the table. He is the son of Len Zacks, the founder of Zacks Investment Research, a firm renowned for its quantitative research and pioneering work in earnings estimate revisions. Mitch’s investment philosophy is grounded in academic research and decades of real-world market experience, making his guidance both credible and actionable for a wide range of investors.

The core purpose of this book is to distill complex academic research and institutional investing techniques into simple, actionable strategies that everyday investors can use. Zacks demystifies the factors that drive stock returns—such as earnings estimate revisions, price momentum, insider trading, and valuation—showing readers how to systematically exploit these anomalies for profit. The book is structured to walk readers through each key concept, providing historical context, empirical evidence, and practical steps for implementation. Zacks’s writing style is approachable, making advanced financial concepts accessible without sacrificing depth or rigor.

This book is ideally suited for both novice and experienced investors who want to enhance their stock selection process using proven, data-driven methods. Whether you are a DIY investor managing your own portfolio, a finance professional looking to sharpen your quantitative edge, or someone interested in understanding the mechanics behind institutional investment success, this book offers valuable insights. Zacks’s focus on multi-factor models, risk management, and long-term discipline makes it particularly relevant for investors who want to avoid fads and base their decisions on sound research rather than speculation or market hype.

What sets "The Little Book of Stock Market Profits" apart is its relentless focus on evidence-based investing. Unlike many books that rely on anecdotes or vague principles, Zacks backs up his recommendations with decades of market data, academic studies, and practical examples. He doesn’t just tell readers what works—he shows them why it works, under what conditions, and how to avoid common pitfalls. The book’s emphasis on integrating multiple strategies—such as combining earnings estimate revisions with momentum and valuation—reflects the sophisticated, multi-dimensional approach used by top institutional investors. This makes the book uniquely valuable for anyone seeking to build a robust, adaptable investment framework that can withstand market volatility and deliver consistent results over time.

Key Concepts and Ideas

At the heart of "The Little Book of Stock Market Profits" is a philosophy rooted in systematic, evidence-driven investing. Zacks advocates for strategies that exploit persistent market inefficiencies—anomalies that academic research has shown to deliver excess returns over time. Rather than relying on gut instinct or market timing, Zacks urges investors to focus on quantifiable factors such as earnings estimate revisions, price momentum, insider trading activity, and valuation metrics. He draws on decades of empirical research, including studies from Zacks Investment Research, to demonstrate how these factors can be harnessed in a disciplined, repeatable way.

The book’s main investment philosophy can be summarized as follows: successful investing is not about predicting the future with a crystal ball, but about systematically exploiting behavioral and structural inefficiencies in the market. Zacks shows that by following data-backed signals—such as upward revisions in analyst earnings estimates or insider buying—investors can tilt the odds in their favor. He emphasizes that no single factor is a silver bullet; instead, the most robust results come from combining multiple strategies into a cohesive, multi-factor model. This approach reduces risk, smooths returns, and helps investors avoid the pitfalls of chasing the latest trend or overreacting to market noise.

- Analyst Recommendation Changes: Zacks explains that changes in analyst recommendations (not just the level) are powerful predictors of future stock performance. For example, when multiple analysts upgrade a stock from "hold" to "buy," it often signals improving fundamentals that the market has yet to fully price in. However, he cautions that high turnover and transaction costs can erode returns, especially in illiquid small-cap stocks.

- The Small-Cap Premium: The book explores the well-documented phenomenon that small-cap stocks tend to outperform large-caps over long periods. Zacks discusses the "January Effect," where tax-loss selling depresses small-cap prices in December, followed by a rebound in January. He highlights the need for patience and risk management due to higher volatility and liquidity challenges in small-caps.

- Earnings Estimate Revisions: Central to the Zacks philosophy, upward revisions in consensus earnings estimates by analysts are strong predictors of stock outperformance. The market often underreacts to these revisions, creating opportunities for investors who track them systematically. Zacks provides data showing that stocks with positive earnings revisions deliver higher returns, especially when combined with other factors.

- Momentum Investing: Zacks demonstrates that price momentum—buying stocks that have recently performed well—can be a winning strategy, particularly outside of recessions. He notes the risks of trend reversals and recommends combining momentum with valuation and earnings signals to reduce downside risk.

- Insider Trading Signals: The book details how following the buying and selling activities of corporate insiders (like CEOs and CFOs) can provide valuable insights. Insider buying is often a sign of confidence in a company’s prospects. However, Zacks warns against relying solely on insider activity, as insiders may buy or sell for reasons unrelated to future performance.

- Stock Issuance and Buybacks: Zacks discusses how companies’ decisions to issue new shares or repurchase stock can signal management’s outlook. Buybacks often indicate undervaluation and confidence, while frequent stock issuance may signal underlying problems or dilution risk. He advises investors to analyze the context and combine these signals with other factors.

- Cash Flow Analysis: The book underscores that cash flow is a more reliable indicator of a company’s health than reported earnings, which can be manipulated. Consistent positive cash flow signals financial strength and reduces investment risk. Zacks encourages investors to prioritize free cash flow metrics in their analysis.

- Valuation Metrics: Zacks emphasizes the importance of valuation tools like the price-to-earnings (P/E) ratio to identify overvalued or undervalued stocks. He warns against chasing high-multiple stocks and advocates for a disciplined approach to uncovering bargains, especially when combined with positive earnings revisions or momentum.

- Earnings Surprises: The book shows that companies consistently beating analysts’ earnings expectations (positive earnings surprises) tend to outperform over time. Zacks provides a framework for identifying such stocks and managing the risks associated with earnings volatility.

- Multi-Factor Models: The capstone concept is that combining multiple proven strategies—such as earnings revisions, momentum, and valuation—creates a more robust investment approach. Zacks explains how to customize and adapt these models to individual goals and market conditions, emphasizing continuous improvement and long-term discipline.

Practical Strategies for Investors

Applying the teachings from "The Little Book of Stock Market Profits" requires a methodical, disciplined approach. Zacks’s strategies are not about making quick bets or chasing fads; rather, they focus on systematically exploiting persistent market anomalies. By following these principles, investors can build portfolios that are more resilient, less prone to emotional decision-making, and better positioned for long-term outperformance. Each strategy outlined in the book is backed by empirical data and can be implemented with widely available tools and resources.

To maximize the practical value of Zacks’s insights, investors should focus on integrating multiple strategies, monitoring key metrics regularly, and maintaining a long-term perspective. The following bullet points distill the book’s most actionable strategies, each accompanied by concrete steps for implementation. These approaches can be adapted to suit different investment styles, risk tolerances, and portfolio sizes, making them accessible to both individual investors and professionals.

- Track Analyst Recommendation Changes: Monitor not just the current analyst ratings, but changes in recommendations (e.g., from "hold" to "buy"). Action steps: Use financial news services or platforms like Zacks.com to get real-time alerts on upgrades and downgrades. Focus on stocks with multiple positive recommendation changes, especially in small-cap space, but be mindful of liquidity and transaction costs.

- Exploit the Small-Cap Premium: Allocate a portion of your portfolio to small-cap stocks, especially during periods of tax-loss selling and the "January Effect." Action steps: Screen for small-cap stocks with strong fundamentals and recent price weakness in December, then consider buying ahead of the typical January rebound. Diversify across sectors to manage risk.

- Follow Earnings Estimate Revisions: Build a watchlist of stocks experiencing upward consensus earnings estimate revisions. Action steps: Use research tools to track consensus estimate changes weekly. Prioritize stocks with multiple analysts raising estimates, and consider holding for several quarters to capture the full effect.

- Implement Momentum Screens: Identify stocks with strong recent price momentum (e.g., top 20% performers over the past 6-12 months). Action steps: Regularly rebalance your momentum portfolio, but avoid chasing momentum during recessionary periods. Combine with valuation filters to avoid overpaying.

- Monitor Insider Buying Activity: Track insider purchase filings (e.g., Form 4 in the U.S.). Action steps: Use free sites like OpenInsider or paid tools to spot significant insider buying, especially by top executives. Look for clusters of insider buys and confirm with other indicators before acting.

- Analyze Stock Issuance and Buyback Announcements: Pay attention to company press releases and SEC filings about share issuance or repurchase programs. Action steps: Favor companies announcing large buybacks (indicating confidence and undervaluation) and be cautious of serial stock issuers, especially if fundamentals are weak.

- Prioritize Cash Flow Over Earnings: Screen for companies with consistently positive free cash flow, even if reported earnings fluctuate. Action steps: Use financial statements to compare net income with operating and free cash flow. Avoid companies with weak or negative cash flow, regardless of apparent earnings strength.

- Combine Factors for Robust Portfolios: Integrate multiple signals (e.g., earnings revisions, momentum, valuation, insider activity) into your stock selection process. Action steps: Build or use multi-factor screens and periodically review your portfolio for adherence to these criteria. Adjust weights and thresholds as market conditions change.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

"The Little Book of Stock Market Profits" is structured to guide readers through a logical progression of investment concepts, starting with the basics of analyst recommendations and culminating in the construction of sophisticated multi-factor models. Each chapter focuses on a specific market anomaly or strategy, providing historical context, empirical evidence, and practical advice. Zacks’s approach is to build understanding layer by layer, ensuring that readers not only grasp each concept in isolation but also see how they interconnect to form a comprehensive investment framework.

The book is divided into eleven major chapters, each addressing a key element of the Zacks investment philosophy. From the nuanced analysis of analyst recommendation changes to the integration of cash flow, valuation, and insider trading signals, every chapter offers actionable insights grounded in real-world data. Below, we provide a detailed, chapter-by-chapter analysis, highlighting the main ideas, supporting examples, and practical applications for investors. Each section is designed to give you a deep understanding of the material, as well as concrete steps for implementation and historical context to illustrate the enduring relevance of these strategies.

Chapter 1: The Crystal Ball of Wall Street

The opening chapter delves into the influential role of sell-side analysts in shaping market sentiment and stock prices. Zacks clarifies that while many investors obsess over the absolute level of analyst recommendations (e.g., "buy," "hold," "sell"), it is actually the changes in these recommendations that drive meaningful price movements. For example, when a stock is upgraded from "hold" to "buy" by multiple analysts, it often signals improved fundamentals or the emergence of new growth catalysts. Zacks supports this with data showing that stocks experiencing positive recommendation changes tend to outperform over the subsequent months, particularly in less efficient segments like small-cap stocks.

To illustrate, Zacks points to the behavior of small-cap stocks following analyst upgrades. He notes that these stocks are less covered by Wall Street and more prone to mispricing, making them fertile ground for recommendation-based strategies. However, he also warns that such strategies are not without pitfalls. High turnover, bid/ask spreads, and liquidity issues can significantly erode returns, especially in thinly traded names. Zacks provides examples from the late 1990s and early 2000s, when analyst upgrades in small-cap technology stocks led to rapid price surges, only for many to reverse when liquidity dried up or sentiment shifted.

Investors can apply these lessons by focusing on the direction and frequency of recommendation changes rather than the consensus rating itself. Zacks recommends using screening tools to track upgrades and downgrades, and to cross-reference these signals with liquidity and transaction cost considerations. For example, prioritizing stocks with multiple upgrades and sufficient trading volume can help mitigate the risks associated with illiquid names. He also suggests combining this approach with other factors, such as earnings estimate revisions or valuation screens, to further enhance returns and reduce risk.

Historically, the predictive power of analyst recommendation changes has been strongest in less efficient markets, such as small- and mid-cap stocks, where information is slower to disseminate. Zacks references academic studies showing that the excess returns from following recommendation changes have diminished somewhat in large-cap stocks, where the market is more efficient and transaction costs are lower. In today’s market, with the proliferation of real-time data and algorithmic trading, investors must be even more selective and cost-conscious when implementing these strategies. Nonetheless, the core insight remains valid: monitoring changes in analyst sentiment can provide a valuable edge, especially when combined with other quantitative signals and a disciplined approach to risk management.

Chapter 2: Size Matters

This chapter explores the enduring phenomenon known as the "small-cap premium," wherein smaller companies consistently outperform their larger counterparts over long periods. Zacks provides a historical overview, citing research from Eugene Fama and Kenneth French that documents the superior long-term returns of small-cap stocks. He explains that this premium is not without its challenges—small-caps are more volatile, face higher transaction costs, and can underperform for extended periods. Zacks cautions that investors need a long-term horizon and the psychological fortitude to withstand inevitable drawdowns.

Zacks highlights the "January Effect" as a key driver of small-cap outperformance. This seasonal pattern occurs when tax-loss selling depresses small-cap prices in December, only for them to rebound sharply in January as selling pressure abates. He provides data showing that small-cap indices have historically outperformed large-caps in the first quarter, a trend that savvy investors can exploit. However, he also notes that this effect has become less pronounced in recent years as more investors have become aware of it, and as trading costs have declined.

To implement this strategy, Zacks suggests allocating a portion of your portfolio to small-cap stocks, particularly during periods of tax-related selling. He recommends screening for small-caps with strong fundamentals and recent price weakness in late December, then initiating positions ahead of the typical January rebound. Diversification is crucial, as individual small-caps can be highly volatile. Zacks also advises monitoring liquidity and transaction costs, as these can erode the small-cap premium if not managed carefully.

The small-cap premium has persisted across decades and market cycles, though its magnitude has varied. Zacks references the 1970s and 1980s, when small-caps dramatically outperformed during periods of economic recovery. In the aftermath of the 2008 financial crisis, small-cap stocks again led the market higher, fueled by renewed risk appetite and improving fundamentals. While the premium has narrowed in recent years, particularly as more institutional capital has flowed into small-cap ETFs, Zacks maintains that disciplined, value-oriented investors can still benefit from this anomaly—especially when combining it with other factors like momentum and earnings revisions.

Chapter 3: Once More Unto the Breach

Chapter three centers on the critical role of earnings estimates in stock valuation and price discovery. Zacks explains that institutional investors pay close attention to consensus earnings estimates, as these forecasts often set the baseline for market expectations. When analysts revise their earnings estimates upward, it typically signals improving business prospects, which the market is slow to fully price in. Zacks presents empirical data showing that stocks experiencing positive earnings estimate revisions consistently outperform those with downward revisions or static estimates.

He emphasizes the importance of focusing on consensus estimates—aggregated forecasts from multiple analysts—rather than relying on individual opinions. This approach reduces the noise and idiosyncratic biases that can skew single-analyst predictions. Zacks provides examples from the technology sector in the early 2000s, where companies like Apple and Microsoft saw their stock prices surge following a series of upward earnings revisions, even before headline earnings beats were reported. He notes that the market often underreacts to these revisions, creating a window of opportunity for disciplined investors.

Investors can operationalize this strategy by regularly tracking consensus earnings estimate changes for stocks in their watchlist. Zacks recommends using research platforms that aggregate analyst forecasts, such as Zacks.com or Bloomberg, to identify stocks with a trend of upward revisions. He suggests holding these positions for several quarters, as the market’s adjustment to new information can be gradual. Combining this approach with valuation and momentum screens can further enhance returns and reduce the risk of false positives.

The predictive power of earnings estimate revisions has been validated by decades of academic research and real-world investing results. Zacks references studies from the 1980s and 1990s showing that portfolios constructed around positive estimate revisions outperformed the market by 2-4% annually. This effect has persisted into the 21st century, particularly in sectors with rapid innovation and frequent analyst coverage changes. In today’s fast-moving markets, the ability to systematically track and act on consensus estimate revisions remains a valuable edge for both individual and institutional investors.

Chapter 4: The Big Mo

This chapter is devoted to the concept of price momentum—the tendency for stocks that have performed well in the recent past to continue outperforming in the near future. Zacks draws on extensive academic research, including studies by Jegadeesh and Titman, which found that momentum strategies delivered excess returns across multiple decades and markets. He explains that momentum works because investors tend to underreact to new information, causing trends to persist longer than expected. However, he also cautions that momentum can be a double-edged sword, as trends can reverse abruptly, leading to sharp losses.

Zacks provides concrete examples from bull markets, such as the post-2009 recovery, when momentum strategies thrived as capital poured into winning stocks. He also discusses the pitfalls of momentum investing during bear markets or recessions, when previously strong performers can quickly fall out of favor. To manage these risks, Zacks recommends combining momentum signals with other factors, such as valuation and earnings revisions, to filter out overvalued or fundamentally weak stocks.

For practical implementation, Zacks suggests screening for stocks in the top decile of price performance over the past 6-12 months, then applying additional filters to weed out names with excessive valuations or deteriorating fundamentals. He advises regular portfolio rebalancing—typically monthly or quarterly—to capture new momentum leaders and avoid laggards. Investors should also be mindful of trading costs and tax implications, as high turnover can erode returns if not managed carefully.

Momentum investing has a long history of delivering strong risk-adjusted returns, particularly in non-recessionary periods. Zacks references the 1990s technology boom and the 2013-2017 bull market as periods when momentum strategies outperformed. However, he also notes the challenges of momentum crashes, such as the sharp reversals in Q4 2008 and March 2020, when market leadership shifted abruptly. By combining momentum with other factors and maintaining a disciplined approach to rebalancing and risk management, investors can harness the power of momentum while mitigating its inherent volatility.

Chapter 5: The Inside Story

In this chapter, Zacks explores the strategy of "piggybacking" on insider trades—tracking the buying and selling activity of corporate executives and directors. He explains that insiders, such as CEOs and CFOs, often have superior knowledge of their company’s prospects and tend to buy shares when they believe the stock is undervalued. Zacks cites studies showing that stocks with significant insider buying outperform the market over subsequent months, particularly when multiple insiders are buying in close proximity ("cluster buying").

He provides examples from the financial crisis of 2008-2009, when insider buying surged in battered bank stocks like Bank of America and Citigroup. These purchases often preceded strong rebounds as market sentiment improved and fundamentals stabilized. However, Zacks cautions that insider trading signals are not foolproof. Insiders may buy for reasons unrelated to future performance, such as fulfilling stock option requirements or signaling confidence during periods of corporate stress. Conversely, insider selling is not always a negative sign, as executives may sell for diversification or personal liquidity needs.

To use insider trading data effectively, Zacks recommends tracking Form 4 filings (required for U.S. insiders) and focusing on large, open-market purchases by top executives. He suggests looking for patterns of multiple insiders buying within a short timeframe, as this often signals genuine conviction. However, he warns against making investment decisions based solely on insider activity; instead, use it as a confirming signal alongside earnings revisions, momentum, and valuation screens.

Insider trading strategies have a long track record of adding value, particularly in less-followed small- and mid-cap stocks. Zacks references research from the 1980s and 1990s showing that portfolios based on insider buying outperformed by 2-3% annually. In the modern era, with the proliferation of online databases and real-time filings, individual investors can access this information as easily as professionals. However, the effectiveness of insider signals has diminished somewhat as more market participants track these filings, making it essential to combine insider data with other robust factors for the best results.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Song of the Shares

This chapter examines the impact of stock issuance and buybacks on shareholder value and investment returns. Zacks explains that when companies issue new shares, it can dilute existing shareholders and signal potential weaknesses or funding needs. Conversely, stock buybacks often indicate that management believes the shares are undervalued and that the company is generating excess cash. Zacks provides numerous examples of companies announcing large buybacks ahead of share price rallies, such as Apple’s ongoing repurchase programs in the 2010s.

He cautions, however, that not all buybacks are created equal. Some companies repurchase shares simply to offset dilution from employee stock options, while others may be attempting to mask deteriorating fundamentals. Similarly, stock issuance is not always negative; companies may issue shares to fund value-accretive acquisitions or strengthen their balance sheets. Zacks emphasizes the importance of analyzing the context and motivations behind these corporate actions, rather than relying on them as standalone signals.

For practical application, Zacks recommends monitoring company press releases and SEC filings for announcements of buybacks or new share offerings. He suggests favoring companies with a track record of value-enhancing buybacks—those that reduce share count and boost earnings per share—while being cautious of serial issuers or companies raising capital to cover operating losses. Combining these signals with other factors, such as insider buying and earnings estimate revisions, can help investors separate genuine value creators from potential value destroyers.

The impact of stock issuance and buybacks on investment returns has been well documented in both academic literature and real-world market cycles. Zacks references the 1990s, when aggressive buyback programs by blue-chip companies like IBM and ExxonMobil supported share prices during volatile periods. Conversely, the tech bubble of 2000 saw a surge in secondary offerings by unprofitable startups, many of which underperformed after diluting existing shareholders. In today’s market, with buybacks at record levels, Zacks’s nuanced approach—analyzing the context and combining multiple signals—remains a critical tool for discerning investors.

Chapter 7: Cash Is King

Chapter seven underscores the paramount importance of cash flow as a measure of a company’s financial health and investment quality. Zacks argues that while reported earnings can be manipulated through accounting practices, cash flow provides a more accurate and reliable indicator of underlying business performance. He points to numerous high-profile accounting scandals—such as Enron and WorldCom—where companies reported strong earnings while their cash flow deteriorated, ultimately leading to collapse.

Zacks provides a framework for analyzing cash flow, focusing on metrics such as operating cash flow and free cash flow. He explains that companies with consistent, positive cash flow are better positioned to weather economic downturns, invest in growth opportunities, and return capital to shareholders through dividends and buybacks. Conversely, companies with negative or erratic cash flow are at higher risk of financial distress, even if their reported earnings appear strong.

Investors can apply this strategy by screening for companies with a multi-year track record of positive free cash flow, stable or growing cash balances, and prudent capital allocation. Zacks recommends cross-referencing cash flow data with earnings trends to identify discrepancies that may signal accounting manipulation or deteriorating fundamentals. He also suggests monitoring cash flow margins and comparing them to industry peers for additional context.

The emphasis on cash flow has only grown in importance in the wake of high-profile corporate failures and increased scrutiny of accounting practices. Zacks references the 2008-2009 financial crisis, when companies with strong cash flow outperformed during the downturn and recovered more quickly. In the current environment, with heightened volatility and economic uncertainty, prioritizing cash flow over earnings remains a cornerstone of sound investment analysis and risk management.

Chapter 8: It’s Worth What?!

This chapter focuses on the critical role of valuation in stock investing. Zacks explains that valuation metrics—such as the price-to-earnings (P/E) ratio, price-to-book, and enterprise value-to-EBITDA—are essential tools for determining whether a stock is overvalued or undervalued. He cautions that investing in overvalued stocks can lead to significant losses if the market corrects, while undervalued stocks offer the potential for outsized gains as the market recognizes their true worth.

Zacks provides examples of valuation-driven investing from the tech bubble of 2000, when high-multiple stocks like Cisco and Yahoo! suffered massive declines as valuations reverted to more reasonable levels. Conversely, he highlights the post-crisis recovery in 2009-2012, when undervalued sectors such as financials and industrials delivered strong returns as investor sentiment improved. Zacks emphasizes that valuation should never be used in isolation; combining valuation screens with earnings revisions and momentum signals leads to more robust stock selection and reduces the risk of value traps.

For practical implementation, Zacks recommends screening for stocks trading at below-average valuation multiples relative to their industry peers and historical norms. He advises investors to look for companies with improving fundamentals—such as rising earnings estimates or strong cash flow—that are temporarily out of favor with the market. He also warns against chasing "cheap" stocks with deteriorating business prospects, as these are often value traps that underperform over time.

The importance of valuation has been borne out through multiple market cycles. Zacks references the "Nifty Fifty" era of the 1970s, when blue-chip growth stocks became massively overvalued and subsequently underperformed for years. In today’s market, with pockets of frothy valuations in technology and growth stocks, Zacks’s disciplined, multi-factor approach to valuation remains highly relevant for investors seeking to avoid costly mistakes and uncover hidden gems.

Chapter 9: Earnings Surprises: The Gift that Keeps on Giving

In this chapter, Zacks delves into the phenomenon of earnings surprises—when a company’s reported earnings significantly exceed or fall short of analysts’ expectations. He explains that positive earnings surprises often lead to sustained stock price gains, as the market adjusts to the new information and analysts revise their forecasts upward. Conversely, negative surprises can trigger sharp declines, particularly for high-expectation stocks with elevated valuations.

Zacks presents data showing that stocks with a history of positive earnings surprises are more likely to continue exceeding expectations in the future, as strong management teams and robust business models tend to deliver consistent results. He provides examples from the consumer technology sector, where companies like Apple and Amazon have repeatedly beaten earnings estimates, fueling long-term outperformance. Zacks also notes that the market tends to underreact to earnings surprises initially, creating a window of opportunity for investors to capitalize on post-earnings drift.

To implement this strategy, Zacks recommends tracking companies with a track record of beating earnings estimates and monitoring analyst revisions following earnings releases. He suggests buying stocks that deliver positive surprises and holding them for several quarters, as the full impact of the news often takes time to be reflected in the share price. Diversification is key, as not all surprises lead to sustained gains and some may reverse if the company fails to maintain momentum.

The predictive power of earnings surprises has been well documented in academic research, with studies showing that post-earnings announcement drift can persist for months. Zacks references the 1990s and 2000s as periods when this strategy delivered strong returns, particularly in sectors with frequent analyst coverage changes. In the current environment, with heightened earnings volatility and increased analyst scrutiny, tracking and acting on earnings surprises remains a valuable edge for disciplined investors.

Chapter 10: A Time to Plant and a Time to Reap

This chapter explores the concept of market timing and seasonal investing, focusing on how certain times of the year or economic cycles can present better opportunities for investment. Zacks reviews various seasonal strategies, such as the "Sell in May and Go Away" approach, which is based on the historical tendency for stocks to underperform during the summer months and rally in the fall and winter. He provides data showing that these patterns, while not foolproof, have persisted over decades and can be exploited by disciplined investors.

Zacks cautions, however, that market timing is inherently risky, as it requires accurately predicting market movements—a challenge even for experienced professionals. He notes that poorly timed exits or entries can lead to missed opportunities or significant losses, particularly during periods of heightened volatility. To mitigate these risks, Zacks recommends balancing timing strategies with a core, long-term portfolio focused on fundamental strength and diversification.

For practical application, Zacks suggests using seasonal patterns as a supplementary tool rather than a primary investment strategy. He advises maintaining a diversified core portfolio and using timing strategies to adjust tactical allocations around the margins—for example, reducing exposure to high-beta sectors during traditionally weak periods and increasing allocations to defensive sectors. He also emphasizes the importance of monitoring transaction costs and tax implications, as excessive trading can erode returns.

Seasonal investing has a long history, dating back to studies in the 1970s and 1980s that documented recurring patterns in stock returns. Zacks references the persistence of the "January Effect" and the "Sell in May" phenomenon, while acknowledging that these patterns have become less pronounced as more investors have adopted them. In today’s market, with increased competition and algorithmic trading, Zacks’s balanced approach—using seasonal signals as a supplement to a robust, long-term strategy—remains a prudent way to enhance returns without taking on undue risk.

Chapter 11: The More the Merrier

The final chapter brings together the book’s key concepts by advocating for the use of multi-factor models in investment decision-making. Zacks explains that relying on a single strategy—whether it be earnings revisions, momentum, or valuation—can lead to inconsistent results and heightened risk. By combining multiple proven factors into a cohesive framework, investors can smooth out the bumps and achieve more reliable, long-term outperformance.

Zacks provides a blueprint for constructing multi-factor models, suggesting weights and thresholds for each factor based on historical data and individual risk tolerance. He emphasizes the importance of customization, urging investors to tailor their models to their own goals, time horizons, and market outlook. Zacks also highlights the need for continuous improvement, recommending regular reviews and updates to incorporate new data and evolving market conditions.

For implementation, Zacks suggests starting with a core set of factors—such as earnings estimate revisions, price momentum, and valuation—then layering on additional signals like insider trading or buyback activity as resources and expertise allow. He advises backtesting models using historical data to validate their effectiveness and making incremental adjustments as needed. Patience and discipline are critical, as multi-factor models work best over long periods and can underperform during certain market regimes.

The use of multi-factor models has become standard practice among institutional investors and quantitative hedge funds, reflecting decades of research and real-world success. Zacks references the evolution of factor investing from the early days of value and momentum screens to today’s sophisticated, algorithm-driven portfolios. In the current environment, with increased competition and information flow, the ability to combine and adapt multiple strategies is more important than ever for investors seeking to outperform the market over the long term.

Advanced Strategies from the Book

While the core strategies outlined by Zacks are accessible to most investors, the book also delves into advanced techniques for those seeking to further enhance their edge. These approaches often require more sophisticated tools, a deeper understanding of market microstructure, and a willingness to engage in ongoing research and model refinement. Zacks emphasizes that advanced strategies should be built on the same foundation of evidence-based investing, with an unwavering commitment to risk management and continuous learning.

Below, we explore several of the most impactful advanced techniques from the book, each illustrated with practical examples and actionable guidance. These strategies are designed for investors who wish to move beyond basic screens and incorporate multi-dimensional analysis, dynamic weighting, and real-time data into their decision-making process.

Strategy 1: Dynamic Multi-Factor Weighting

Rather than assigning fixed weights to each factor in a multi-factor model, Zacks advocates for dynamic weighting based on prevailing market conditions. For example, during periods of economic expansion, momentum and earnings revisions may be more predictive, while valuation and cash flow become more important during downturns. Investors can use historical backtesting and rolling regressions to identify which factors are currently driving returns, then adjust their model weights accordingly. This approach requires regular data analysis and a willingness to adapt, but it can significantly enhance risk-adjusted performance over time. For instance, a portfolio that increased its weighting to cash flow and valuation factors in early 2020 would have weathered the COVID-19 crash better than a pure momentum strategy.

Strategy 2: Post-Earnings Announcement Drift (PEAD) Exploitation

Zacks highlights the phenomenon of post-earnings announcement drift, where stocks that surprise on earnings continue to outperform for weeks or months after the initial news. Advanced investors can build portfolios that systematically buy stocks immediately after positive earnings surprises and hold them until the drift effect dissipates—typically one to three months. This strategy works best when combined with screens for upward earnings revisions and positive price momentum, as these signals reinforce the likelihood of sustained outperformance. Automated trading tools and event-driven algorithms can help investors execute this strategy efficiently, capturing incremental alpha with manageable risk.

Strategy 3: Event-Driven Insider Trading Analysis

While basic insider trading screens focus on aggregate buying or selling, advanced investors can analyze insider activity in the context of specific corporate events—such as M&A announcements, new product launches, or industry disruptions. For example, a cluster of insider buys ahead of a major acquisition may signal management’s confidence in the deal’s accretive potential. Conversely, insider selling following a disappointing product launch could foreshadow further weakness. By integrating event-driven analysis with traditional insider screens, investors can enhance the predictive power of these signals and avoid false positives.

Strategy 4: Liquidity-Adjusted Small-Cap Investing

Zacks acknowledges that the small-cap premium comes with significant liquidity and transaction cost challenges. Advanced investors can use liquidity-adjusted screens—such as minimum average daily volume thresholds or bid/ask spread filters—to identify small-cap stocks with sufficient tradability. They can also employ algorithmic trading strategies to minimize market impact when entering or exiting positions. This approach allows investors to capture the small-cap premium while mitigating the risks associated with illiquid names, particularly during periods of market stress or heightened volatility.

Strategy 5: Adaptive Rebalancing and Risk Controls

Finally, Zacks recommends implementing adaptive rebalancing schedules and dynamic risk controls to optimize portfolio performance. Rather than rebalancing on a fixed calendar, investors can use volatility triggers, drawdown limits, or factor correlation analysis to determine when and how to adjust their holdings. For example, if momentum and value factors become highly correlated (as in late-stage bull markets), reducing exposure to one or both can help avoid concentration risk. Advanced portfolio management tools and risk analytics platforms can facilitate these adaptive processes, ensuring that portfolios remain aligned with investor objectives and market realities.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Applying the insights from "The Little Book of Stock Market Profits" requires a structured, step-by-step approach. Zacks emphasizes the importance of starting with a clear investment framework, building robust screening and monitoring processes, and maintaining discipline through market cycles. The following guide outlines the essential steps for putting these strategies into practice, whether you are a beginner or an experienced investor seeking to refine your approach.

First, investors should define their investment goals, risk tolerance, and time horizon. This will inform the selection and weighting of various factors, as well as the construction of a diversified portfolio. Next, it is crucial to set up systematic screens and tracking tools for key signals—such as earnings estimate revisions, price momentum, and insider activity. Regular portfolio reviews and performance analysis will ensure that the strategy remains effective and aligned with changing market conditions.

- First step investors should take: Establish clear investment objectives and risk parameters, then select a core set of proven factors (e.g., earnings revisions, momentum, valuation) to guide stock selection.

- Second step for building the strategy: Set up automated screens and alerts for key signals using online research platforms or portfolio management tools. Monitor these signals regularly and update your watchlist accordingly.

- Third step for long-term success: Periodically review and rebalance your portfolio, incorporating new data and insights. Maintain discipline through market cycles, and continuously refine your approach based on performance analysis and evolving market dynamics.

Critical Analysis

"The Little Book of Stock Market Profits" excels at translating complex academic research into practical, actionable strategies for individual investors. Zacks’s evidence-based approach, clear explanations, and wealth of real-world examples make the book a standout resource for anyone seeking to build a robust, data-driven investment process. The emphasis on multi-factor models and continuous improvement reflects the best practices of institutional investors, while the accessible writing style ensures that readers of all backgrounds can benefit from the material.

However, the book is not without its limitations. Some strategies—such as those involving small-cap stocks or momentum trading—require careful attention to transaction costs, liquidity, and tax implications, which may be challenging for smaller investors to manage. Additionally, while Zacks provides ample historical data and backtested results, market dynamics are always evolving, and past performance is not a guarantee of future results. Investors must remain vigilant, adapt their models as conditions change, and avoid overfitting strategies to historical data.

In the context of today’s market environment—characterized by rapid information flow, algorithmic trading, and increased competition—the core principles of the book remain highly relevant. The focus on systematic, evidence-based investing, risk management, and multi-factor integration provides a solid foundation for navigating volatility and uncertainty. By combining Zacks’s insights with modern tools and a commitment to ongoing learning, investors can position themselves for long-term success in an ever-changing market landscape.

Conclusion

"The Little Book of Stock Market Profits" offers a masterclass in systematic, evidence-driven investing. Mitch Zacks distills decades of academic research and professional experience into a clear, actionable framework that empowers investors to outperform the market. By focusing on persistent anomalies—such as earnings estimate revisions, price momentum, insider trading, and valuation—Zacks provides readers with a toolkit for building robust, adaptable portfolios capable of weathering market storms and capturing long-term growth.

The book’s greatest strength lies in its integration of multiple proven strategies, its emphasis on risk management, and its commitment to continuous improvement. Whether you are a novice looking to build your first portfolio or an experienced investor seeking to refine your edge, this book delivers practical guidance, real-world examples, and a roadmap for ongoing success. In a world awash with noise and speculation, Zacks’s disciplined, data-driven approach offers a beacon of clarity and confidence.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Stock Market Profits

1. Who is Mitch Zacks, and why should I trust his investment advice?

Mitch Zacks is the CEO of Zacks Investment Management and the son of Len Zacks, founder of Zacks Investment Research—a leading authority in quantitative finance. With decades of experience managing institutional and individual portfolios, Mitch’s advice is grounded in rigorous academic research and real-world results. His firm’s reputation for pioneering earnings estimate revision strategies lends significant credibility to his recommendations.

2. What makes this book different from other investing guides?

"The Little Book of Stock Market Profits" stands out for its evidence-based, actionable strategies. Unlike books that rely on anecdotes or general principles, Zacks backs up every recommendation with empirical data, historical performance, and practical implementation steps. The focus on multi-factor models and integration of institutional best practices makes it uniquely valuable for serious investors.

3. Can beginners benefit from the strategies in this book?

Absolutely. While the book covers advanced concepts, Zacks explains each strategy in clear, accessible language suitable for beginners. He provides step-by-step guidance, concrete examples, and practical tips, making it easy for new investors to start applying evidence-based approaches to their portfolios.

4. How can I track analyst recommendation changes and earnings estimate revisions?

You can use financial news platforms, brokerage research tools, or dedicated sites like Zacks.com to monitor analyst upgrades, downgrades, and consensus earnings estimate changes. Many online screeners allow you to set alerts for these events, enabling you to act quickly on new information as recommended in the book.

5. Is momentum investing still effective in today’s market?

Momentum investing remains effective, particularly in non-recessionary periods. However, Zacks cautions that trends can reverse quickly, and high turnover can lead to increased transaction costs. Combining momentum with other factors—like valuation and earnings revisions—can help mitigate risks and improve long-term performance.

6. What are the risks of following insider trading signals?

Insider trading signals can be valuable, but they are not infallible. Insiders may buy or sell for reasons unrelated to the company’s future prospects, such as diversification or compensation needs. Zacks recommends using insider activity as a confirming signal alongside other factors, rather than as the sole basis for investment decisions.

7. How do I manage the liquidity and transaction cost challenges of small-cap investing?

Zacks advises using liquidity screens—such as minimum average daily volume—and avoiding excessive turnover in illiquid names. Diversifying across multiple small-cap stocks and using limit orders can help manage execution risk. Be mindful of bid/ask spreads and factor these costs into your expected returns.

8. Should I use market timing or seasonal strategies as my main investment approach?

Zacks recommends using market timing and seasonal strategies as supplementary tools, not as your primary approach. While patterns like the "January Effect" or "Sell in May" can add value, they are not foolproof and carry significant risks. Focus on building a core portfolio around proven, long-term strategies and use timing signals to make tactical adjustments at the margins.

9. How often should I rebalance my multi-factor portfolio?

Zacks suggests rebalancing your portfolio on a regular schedule—such as quarterly—or in response to significant changes in your key signals (e.g., earnings revisions, momentum shifts). Adaptive rebalancing based on volatility or drawdown triggers can further optimize performance and manage risk, especially in dynamic market environments.

10. Can I implement these strategies using ETFs or must I pick individual stocks?

While the book primarily focuses on individual stock selection, many of the strategies can be implemented using factor-based ETFs that track earnings revisions, momentum, value, or small-cap indexes. This approach offers diversification and lower transaction costs, making it accessible for investors who prefer not to manage individual positions.