The Little Book of Trading by Michael W. Covel

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Michael W. Covel’s “The Little Book of Trading” stands out as a practical and motivational guide for investors seeking to master the art of trend following. Covel, a renowned author, educator, and trend-following advocate, brings decades of research and interviews with legendary traders into this compact volume. He is best known for his seminal works, including “Trend Following” and “The Complete TurtleTrader,” which have become standard references for those interested in systematic trading. Covel’s credibility is further established by his extensive interviews with top traders and his ability to distill complex trading philosophies into actionable advice for everyday investors.

The central theme of “The Little Book of Trading” is the power and simplicity of trend following—a rules-based trading strategy that capitalizes on sustained market movements. Unlike many investment books that focus on predicting market outcomes or dissecting fundamental data, Covel’s book emphasizes reacting to price trends, managing risk, and maintaining psychological discipline. The book is structured around the real-life experiences of successful traders, such as Gary Davis, Jack Forrest, and David Druz, whose stories illustrate the highs and lows of trend following across different market environments.

This book is particularly valuable for individual investors, aspiring traders, and even seasoned professionals who want to refine their approach or break free from the noise of Wall Street. Readers who are frustrated by the unpredictability of short-term trading, overwhelmed by information overload, or disillusioned with traditional fundamental analysis will find Covel’s message refreshing and empowering. The book’s accessible language and practical examples make it suitable for both beginners and experienced traders looking to reinforce their discipline and risk management skills.

What sets “The Little Book of Trading” apart is its relentless focus on process over prediction, its celebration of independent thinking, and its clear, actionable strategies. Covel demystifies trend following by showing that it does not require complex algorithms or insider information; rather, it thrives on simplicity, discipline, and consistency. The book’s unique blend of psychological insights, technical guidance, and motivational anecdotes makes it an enduring resource for anyone aiming to achieve long-term trading success. By drawing on the collective wisdom of top traders and presenting it in a concise, engaging format, Covel provides readers with a blueprint for navigating the uncertainties of financial markets with confidence.

Key Concepts and Ideas

At the heart of “The Little Book of Trading” lies the philosophy of trend following—a systematic approach that prioritizes reacting to price movements over forecasting market directions. Covel argues that the most successful traders are those who maintain unwavering discipline, manage risk meticulously, and focus on process rather than outcome. He dispels the myth that successful investing requires predicting the future or having access to privileged information. Instead, Covel demonstrates that anyone can achieve consistent results by following a simple, robust set of trading rules.

The book’s investment philosophy is rooted in the belief that markets are inherently unpredictable in the short term but exhibit persistent trends that can be exploited with the right mindset and strategy. Covel draws parallels between trading and games of probability, such as poker, to illustrate that long-term success comes from playing the odds, not seeking certainty. He also emphasizes the importance of psychological resilience, continuous learning, and independence from mainstream financial thinking.

- Trend Following Discipline: The core concept is sticking to a well-defined, rules-based trading system regardless of market noise or emotional swings. Successful trend followers like Gary Davis and Jack Forrest achieved long-term profits by refusing to deviate from their strategies, even during drawdowns or periods of underperformance.

- Process Over Prediction: Covel advocates for a reactive approach—traders do not try to predict market movements but instead respond to trends as they develop. This minimizes emotional decision-making and leverages observable price action rather than unreliable forecasts.

- Risk Management: Managing risk is paramount. Covel stresses the use of predefined stop-losses and position sizing to protect capital. He shares examples of traders who survived market downturns by cutting losses quickly and letting winners run.

- Diversification Across Markets: Trend followers typically operate in multiple asset classes—stocks, commodities, currencies—to spread risk and increase the likelihood of capturing trends. This approach reduces reliance on any single market and smooths portfolio returns.

- Psychological Resilience: Trading is emotionally demanding. Covel highlights the need for mental toughness, perseverance, and the ability to learn from setbacks. He shares stories of traders who bounced back from significant losses by maintaining confidence in their process.

- Technical Analysis Over Fundamentals: The book challenges traditional reliance on fundamental analysis. Covel argues that price action and technical signals provide a clearer, more actionable picture of market sentiment and direction.

- Probability-Based Decision Making: Covel draws analogies to poker, emphasizing that traders should focus on probabilities and the long-term edge instead of seeking certainty. Each trade is a bet with uncertain outcomes, and success is measured over many trades.

- Continuous Learning and Adaptation: The best traders are lifelong learners who adapt their strategies to evolving market conditions. Covel encourages readers to invest in their education and remain open to change.

- Simplicity and Consistency: Simple, rule-based systems outperform complex, discretionary approaches. Covel demonstrates that straightforward methods like channel breakouts can be effective across different markets.

- Embracing Whipsaws and Small Losses: Whipsaws—periods of small, frequent losses—are inevitable in trend following. Covel teaches that accepting these setbacks is crucial for capturing the occasional big trend that drives overall profitability.

Practical Strategies for Investors

Applying the lessons from “The Little Book of Trading” requires a shift in mindset and a commitment to systematic execution. Covel provides a roadmap for investors who want to move beyond guesswork and emotional trading. His strategies are designed to be accessible, actionable, and adaptable to different market conditions and personal risk tolerances.

Investors can implement these teachings by developing a clear, rule-based trading plan, focusing on risk management, and maintaining discipline through market ups and downs. Covel’s approach is not about chasing the latest hot stock or reacting to news headlines; it’s about building a robust process that can withstand the inevitable volatility and uncertainty of financial markets. By following these strategies, investors can increase their chances of long-term success while minimizing the impact of short-term setbacks.

- Develop a Simple Trend-Following System: Start by defining clear entry and exit rules based on price trends—such as moving average crossovers or channel breakouts. Test your system on historical data before committing real capital.

- Set Predefined Stop-Loss Levels: For every trade, establish a stop-loss point to limit potential losses. This enforces discipline and prevents emotional decision-making during market downturns.

- Diversify Across Multiple Markets: Trade a mix of asset classes—equities, commodities, currencies—to reduce risk and increase the likelihood of finding profitable trends.

- Size Positions Appropriately: Use position sizing formulas (like the 1-2% rule) to ensure no single trade can significantly damage your portfolio. Adjust position sizes based on volatility and risk tolerance.

- Keep a Trading Journal: Document every trade, including entry and exit points, rationale, and outcomes. Review your journal regularly to identify patterns and areas for improvement.

- Ignore Market Noise and Financial Media: Focus on your trading system and market data, not sensational news or analyst opinions. Avoid making impulsive decisions based on headlines.

- Embrace Small Losses and Whipsaws: Accept that frequent small losses are part of the process. Stay disciplined and avoid abandoning your strategy after a losing streak.

- Invest in Continuous Learning: Dedicate time to studying market history, trading psychology, and new strategies. Attend seminars, read books, and seek mentorship from experienced traders.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book of Trading” is organized into twelve concise yet powerful chapters, each building on the previous to provide a comprehensive framework for trend following. Covel structures the book to move from foundational concepts—such as discipline and risk management—to more advanced topics like diversification, psychological resilience, and adapting strategies across different markets. Each chapter features real-world stories, practical advice, and actionable takeaways that readers can implement immediately.

Every chapter stands on its own, focusing on a specific aspect of trend following, but together they form a cohesive guide to systematic trading. Covel’s use of trader interviews, historical examples, and direct quotes adds credibility and relevance to each lesson. The following detailed analysis explores each chapter, highlighting its main ideas, practical applications, and historical context.

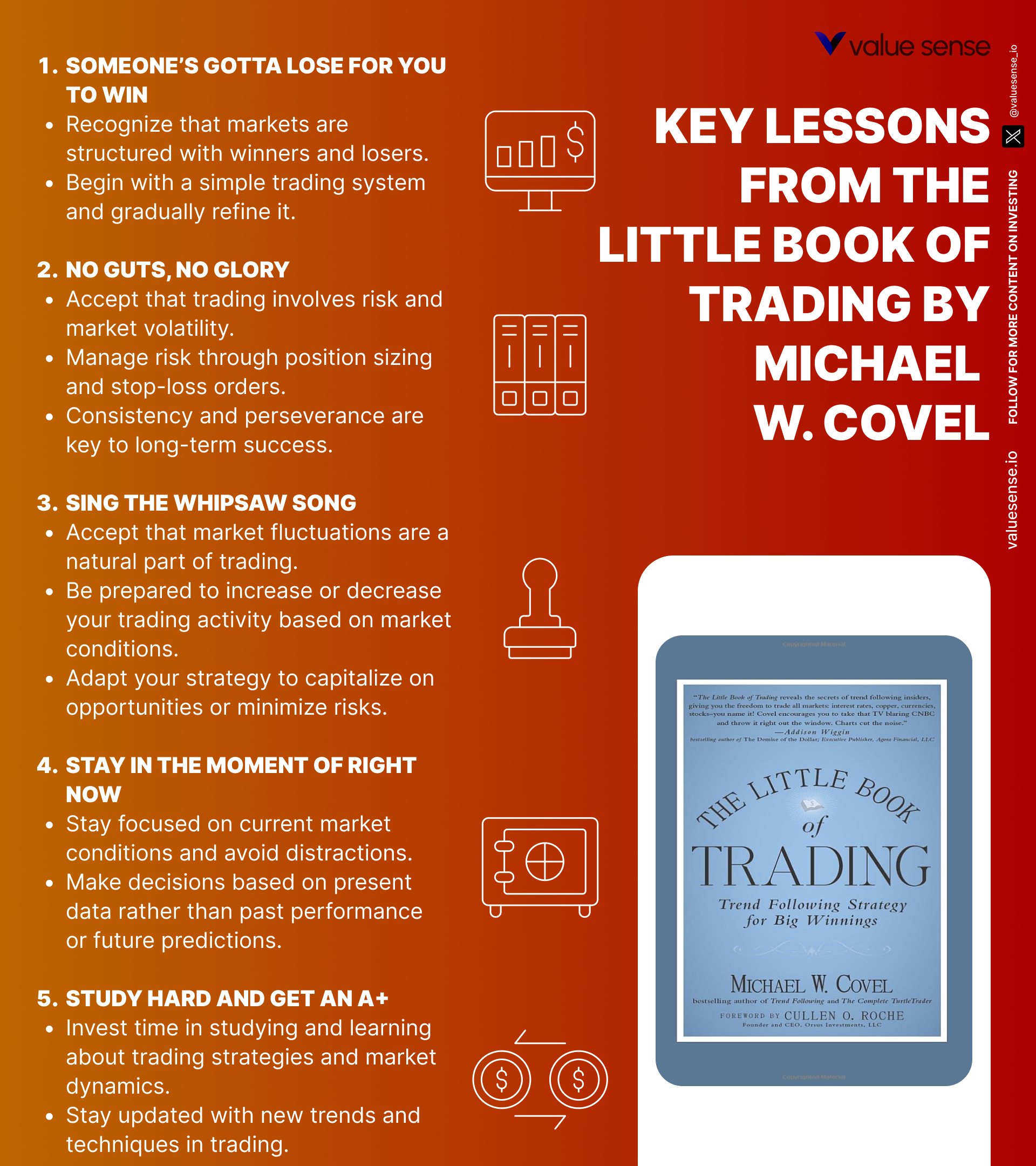

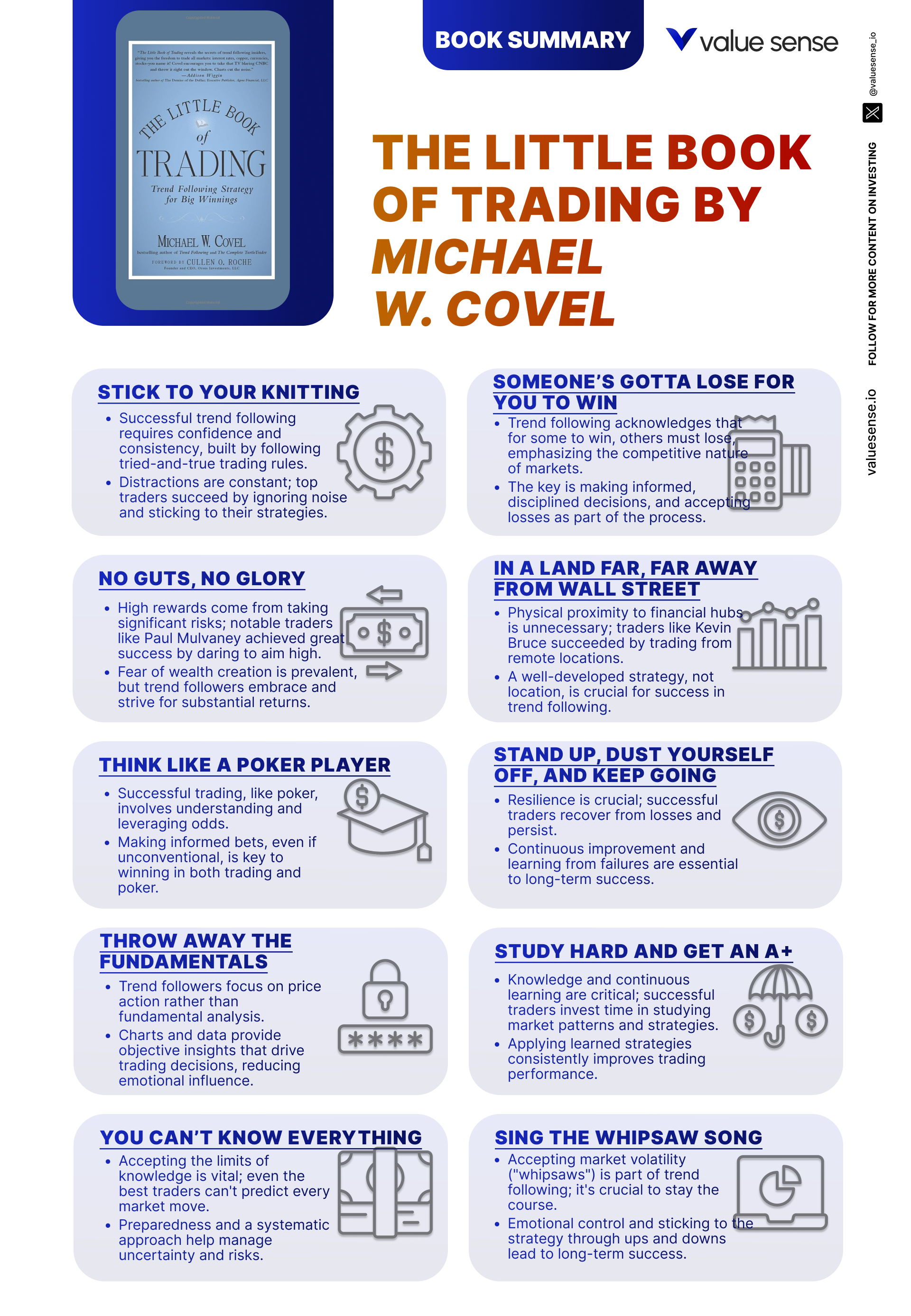

Chapter 1: Stick to Your Knitting

The opening chapter introduces the foundational principle of trend following—maintaining unwavering discipline and adherence to a well-defined trading strategy. Covel emphasizes that success in trading is not about predicting market movements but about following a consistent process regardless of external noise or short-term fluctuations. He shares the stories of traders like Gary Davis, Jack Forrest, and Rick Slaughter, who achieved substantial long-term success by refusing to deviate from their systematic approaches. These traders illustrate that sticking to one’s “knitting”—the core trading strategy—prevents emotional decision-making and the temptation to chase market fads.

Covel provides concrete examples of how simple, rule-based systems outperform more complex approaches. He highlights channel breakouts and moving average crossovers as practical techniques that have stood the test of time. The chapter includes data showing that traders who diversified across multiple markets—such as commodities, stocks, and currencies—were better able to capture trends and manage risk. Covel quotes Jack Forrest: “It’s not about being right on every trade, it’s about being consistent over time.” This focus on process over prediction sets the stage for the rest of the book.

Investors can apply these lessons by developing a clear set of trading rules and committing to them regardless of market conditions. Covel recommends backtesting strategies on historical data to build confidence and discipline. He also advises against overcomplicating systems, noting that simplicity reduces the likelihood of errors and overtrading. By focusing on process and diversification, investors can reduce emotional stress and improve long-term performance.

Historically, traders who maintained discipline during periods of market turmoil—such as the 2008 financial crisis—were able to avoid catastrophic losses and capitalize on subsequent trends. Covel cites the example of trend-following funds that outperformed during volatile periods by sticking to their systems, while discretionary traders often suffered significant drawdowns. In today’s fast-paced markets, the principle of “sticking to your knitting” remains as relevant as ever, providing a foundation for sustainable trading success.

Chapter 2: Someone’s Gotta Lose for You to Win

This chapter explores the inherently competitive nature of trading, where profits are often made at the expense of other market participants. Covel delves into the psychological and strategic aspects of this zero-sum environment, emphasizing that not everyone can win in the markets. He features insights from David Druz, a seasoned trend follower, who highlights the importance of recognizing and exploiting market inefficiencies. Druz’s perspective reinforces the idea that markets are not always efficient, and those who can identify and ride trends have a significant edge.

Covel discusses the critical role of risk management in trend following. He explains that successful traders are those who are willing to cut losses quickly to preserve capital, using predefined stop-loss points to protect against large drawdowns. The chapter includes examples of traders who survived market downturns by adhering to strict risk controls, while others who ignored these principles suffered devastating losses. Covel quotes Druz: “Managing risk is the only thing you can control. Everything else is up to the market.”

For investors, the key takeaway is the necessity of incorporating risk management into every aspect of their trading plan. This means setting stop-loss levels for every trade, sizing positions appropriately, and avoiding emotional reactions during losing streaks. Covel also highlights the importance of effective portfolio selection and weighting, recommending that traders focus on markets with the highest potential for trending rather than simply allocating capital equally across all assets.

Historically, the concept of exploiting market inefficiencies has been central to the success of legendary traders like Richard Dennis and the Turtle Traders. By focusing on trend following and risk management, these traders were able to generate outsized returns even in challenging market environments. In today’s increasingly algorithmic and competitive markets, the principles outlined in this chapter remain essential for anyone seeking consistent trading profits.

Chapter 3: No Guts, No Glory

Chapter three delves into the mindset required for successful trend following, emphasizing the courage needed to take calculated risks and stick with a strategy through periods of uncertainty and volatility. Covel illustrates this with stories of traders who thrived by maintaining discipline even when the markets appeared chaotic. He argues that volatility should not be feared but embraced as an opportunity for profit, provided that traders adhere to their rules and manage risk effectively.

Covel provides examples of traders who endured short-term pain for long-term gain, highlighting the importance of resilience and conviction. He notes that trend followers do not attempt to predict market directions but react to emerging trends, adjusting their positions as necessary. The chapter includes data on the performance of trend-following systems during volatile periods, showing that those who stayed the course were often rewarded with significant gains. Covel writes, “It’s not about avoiding losses; it’s about capturing the big moves when they come.”

Investors can apply these lessons by developing the mental toughness to withstand drawdowns and avoid second-guessing their strategies. Covel recommends focusing on the long-term edge rather than short-term outcomes, and accepting that losses are an inevitable part of the process. By maintaining consistency and refusing to abandon their systems during tough times, traders increase their chances of capitalizing on major market trends.

Historically, the willingness to endure volatility has separated successful traders from the rest. During the 2008 financial crisis, for example, trend-following funds that maintained their strategies were able to profit from extended market moves, while many discretionary traders were whipsawed by rapid reversals. In today’s markets, where volatility is often viewed as a threat, Covel’s message is a reminder that risk and reward are inseparable, and that courage is a prerequisite for trading success.

Chapter 4: In a Land Far, Far Away from Wall Street

Covel explores the advantages of independence from Wall Street’s traditional trading mentality in chapter four. He encourages readers to think differently, develop their own strategies, and resist the influence of mainstream financial media and conventional wisdom. The chapter is filled with stories of traders who found success by rejecting the norms of Wall Street and embracing alternative approaches to trading.

Covel highlights the importance of confidence in one’s trading system, especially when it goes against popular opinion. He shares examples of self-taught traders who succeeded by relying on their own research and backtesting rather than formal financial training or consensus views. Covel quotes one trader: “I learned more from my mistakes and market experience than I ever did from textbooks.” This theme of self-education and independent thinking runs throughout the chapter.

For investors, the practical takeaway is to focus on developing and trusting their own process rather than seeking validation from external sources. Covel recommends ignoring financial media noise and concentrating on data-driven decision-making. He also advises traders to document their strategies and results, building confidence through experience rather than relying on the opinions of others.

Historically, some of the most successful traders have operated outside the mainstream, from the Turtle Traders to modern-day quantitative funds. By thinking independently and focusing on process, these traders have consistently outperformed those who simply follow the crowd. In today’s era of information overload and consensus-driven markets, Covel’s call for independence is more relevant than ever.

Chapter 5: Think Like a Poker Player and Play the Odds

In this chapter, Covel draws insightful parallels between trading and poker, emphasizing the importance of probability-based decision-making. He explains that, like poker, trading is a game of incomplete information where success depends on playing the odds rather than seeking certainty. Covel argues that traders must learn to base their decisions on probabilities, understanding that no single trade is guaranteed to win.

Covel provides examples of traders who excelled by focusing on the long-term edge rather than short-term outcomes. He discusses the dangers of the gambler’s fallacy, where traders mistakenly believe that past outcomes influence future probabilities. The chapter includes stories of successful traders who knew when to “fold” a losing hand—cutting losses and preserving capital for future opportunities. Covel writes, “The best traders know that it’s not about being right every time; it’s about being right enough of the time to win in the long run.”

Investors can implement these lessons by adopting a probability-based mindset and focusing on the aggregate results of their trades rather than individual outcomes. Covel recommends tracking win rates, average gains, and losses to ensure that the overall strategy has a positive expectancy. He also advises against chasing losses or increasing position sizes after a losing streak, as this can lead to catastrophic drawdowns.

Historically, the analogy between trading and poker has been embraced by many top investors, including Bill Gross and Ed Thorp. By treating each trade as a bet with uncertain outcomes, these traders have been able to maintain discipline and avoid emotional pitfalls. In today’s markets, where uncertainty is the norm, Covel’s emphasis on probability and risk management remains a cornerstone of successful trading.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Stand Up, Dust Yourself Off, and Keep Going

Chapter six focuses on the resilience required to succeed in trading. Covel discusses the inevitability of setbacks and losses, emphasizing that these experiences are part of the learning process. He shares stories of traders who encountered significant challenges but continued to follow their trend-following strategies, ultimately achieving success through perseverance and mental toughness.

Covel provides examples of traders who bounced back from major drawdowns by analyzing their mistakes, adjusting their strategies, and maintaining confidence in their systems. He quotes one trader: “Every loss is a lesson. The only real failure is giving up.” The chapter includes data showing that traders who persisted through tough periods were often rewarded with substantial gains when market conditions improved.

For investors, the key takeaway is the importance of perseverance and continuous improvement. Covel recommends keeping a trading journal to document setbacks and identify areas for growth. He also advises traders to seek support from mentors and peers, as trading can be a lonely and emotionally taxing endeavor. By viewing losses as opportunities to learn rather than reasons to quit, investors can build the resilience needed for long-term success.

Historically, the ability to recover from setbacks has been a defining characteristic of top traders. During the dot-com bust and the 2008 financial crisis, many trend followers endured significant losses before capitalizing on subsequent trends. Covel’s message is clear: setbacks are inevitable, but those who persist and adapt will ultimately prevail.

Chapter 7: Throw Away the Fundamentals and Stick to Your Charts

In this provocative chapter, Covel challenges the conventional wisdom of relying on fundamental analysis for trading decisions. He advocates for a purely technical approach, where traders base their decisions on price charts and trends rather than economic data or financial statements. Covel argues that market action is the ultimate arbiter of direction, and that technical analysis provides a clearer, more actionable picture of market sentiment.

Covel presents examples of traders who achieved success by focusing exclusively on technical signals. He cites data showing that fundamental analysis often fails to predict market movements accurately, as markets are driven by investor behavior rather than underlying economic factors. The chapter includes stories of traders who avoided major losses by adhering to technical stop-losses, even when fundamentals suggested otherwise. Covel writes, “The market doesn’t care about your opinion. It only cares about price.”

Investors can implement these lessons by simplifying their trading process and relying on objective technical indicators. Covel recommends using tools like moving averages, channel breakouts, and momentum indicators to identify and follow trends. He also advises against second-guessing technical signals based on news events or analyst opinions, as this can introduce emotional bias and undermine discipline.

Historically, technical analysis has been the foundation of many successful trading systems, from the original Turtle Traders to modern quantitative funds. In today’s data-driven markets, where information is abundant but often contradictory, Covel’s emphasis on price action and technical discipline offers a practical and effective alternative to traditional fundamental analysis.

Chapter 8: Study Hard and Get an A+

Covel underscores the importance of continuous learning and self-education in trading in chapter eight. He argues that the most successful traders are lifelong learners who constantly study the markets, refine their strategies, and adapt to changing conditions. The chapter features stories of traders who invested significant time in studying market history, trading psychology, and the principles of trend following.

Covel provides practical advice on how to build a solid foundation of market knowledge. He recommends keeping a trading journal, attending seminars, reading books, and seeking mentorship from experienced traders. The chapter includes examples of traders who documented their decisions and outcomes, using this information to identify strengths and weaknesses. Covel writes, “The market is always changing. The only way to keep up is to keep learning.”

For investors, the key takeaway is the necessity of investing in their own education. Covel suggests dedicating time each week to studying new strategies, analyzing past trades, and staying informed about market developments. He also advises traders to remain open to new ideas and to adapt their approaches as market conditions evolve.

Historically, the most successful traders have been those who never stopped learning. From Jesse Livermore to modern-day hedge fund managers, the ability to adapt and grow has been a common trait among top performers. In today’s rapidly changing markets, Covel’s emphasis on education and self-improvement is more important than ever.

Chapter 9: You Can’t Know Everything

Chapter nine addresses the impossibility of knowing everything about the markets and the dangers of information overload. Covel argues that traders should focus on what matters most—price action and trends—rather than trying to predict every market movement or absorb every piece of data. He discusses the risks of analysis paralysis, where too much information leads to indecision and missed opportunities.

Covel provides examples of traders who simplified their approach by concentrating on key indicators and ignoring market noise. He quotes one trader: “The more I tried to know, the less I actually did.” The chapter includes data showing that traders who focused on a few critical metrics—such as trend direction and volatility—were more effective than those who attempted to analyze every variable.

For investors, the lesson is to streamline their trading process and concentrate on observable market behavior. Covel recommends identifying the most important indicators for their strategy and ignoring irrelevant information. He also advises against relying on forecasts or opinions, as predicting market movements is inherently uncertain.

Historically, the most effective traders have been those who focused on simplicity and clarity. By letting go of the need to know everything and reacting to real-time market data, they have been able to make swift, confident decisions. In today’s era of information overload, Covel’s advice to prioritize simplicity and focus is both timely and practical.

Chapter 10: Make It Work Across All Markets

In chapter ten, Covel discusses the versatility of trend following as a strategy that can be applied across different markets, including stocks, commodities, currencies, and bonds. He emphasizes that the principles of trend following are universal and can be used in any market where price data is available. The chapter features examples of traders who successfully applied their strategies in diverse markets, highlighting the importance of adaptability.

Covel provides practical guidance on how to adjust strategies for different market characteristics, such as liquidity, volatility, and trading hours. He shares stories of traders who diversified their portfolios across multiple asset classes, increasing their chances of finding profitable trends and reducing overall risk. Covel writes, “Trends exist everywhere. The key is to find them and follow them, no matter the market.”

For investors, the takeaway is to explore opportunities beyond their primary market and to apply their trend-following systems to a range of asset classes. Covel recommends researching the unique dynamics of each market and adjusting position sizes and risk parameters accordingly. He also advises maintaining consistency in applying the core principles of trend following, regardless of the market being traded.

Historically, the universality of trend following has been demonstrated by traders who achieved success in both traditional and emerging markets. From the commodities boom of the 1970s to the rise of forex trading in the 2000s, those who adapted their strategies to new environments were able to capitalize on global trends. In today’s interconnected markets, Covel’s message of adaptability and diversification is more relevant than ever.

Chapter 11: Stay in the Moment of Right Now

This chapter highlights the importance of staying present and focused on the current market situation rather than dwelling on past trades or worrying about future outcomes. Covel discusses the psychological challenges of trading, where being in the moment allows traders to react more effectively to market changes. He advocates for a mindset centered on the present, enabling traders to make decisions based on current data and trends.

Covel provides examples of traders who improved their performance by letting go of regrets about past losses and fears about future risks. He quotes one trader: “The only thing that matters is what the market is doing right now.” The chapter includes practical tips for cultivating mindfulness, such as taking breaks, reviewing current positions, and avoiding distractions during trading hours.

For investors, the lesson is to focus on process and real-time information, making decisions based on observable market behavior rather than emotional reactions. Covel recommends developing routines that reinforce present-moment awareness, such as daily reviews and checklists. He also advises against overanalyzing past trades or obsessing over potential future scenarios, as this can lead to indecision and missed opportunities.

Historically, the ability to stay present has been a hallmark of successful traders. By concentrating on the current market environment and reacting to real-time data, they have been able to adapt quickly and avoid costly mistakes. In today’s fast-moving markets, Covel’s emphasis on mindfulness and present-moment focus is a valuable tool for improving trading discipline and performance.

Chapter 12: Sing the Whipsaw Song

The final chapter celebrates the concept of “whipsaw” in trend following—a situation where traders may experience several small losses before capturing a significant trend. Covel explains that whipsaw is an inherent part of trend following, and accepting it is crucial for long-term success. He encourages traders to embrace the ups and downs of the market, knowing that persistence will eventually lead to big wins.

Covel provides examples of traders who endured multiple small losses before hitting a major trend, demonstrating that discipline and patience are essential. He quotes one trader: “You have to take the small hits to stay in the game long enough for the big win.” The chapter includes data showing that the occasional large gain from a sustained trend more than compensates for the frequent small losses that precede it.

For investors, the lesson is to maintain discipline and stick with their strategy through periods of whipsaw and drawdown. Covel recommends setting realistic expectations about the frequency of losses and focusing on the long-term rewards of trend following. He also advises celebrating the satisfaction that comes from capturing a significant trend after enduring a series of setbacks.

Historically, the phenomenon of whipsaw has been well documented in trend-following systems. Traders who accepted small, frequent losses were able to survive and thrive when major trends emerged. In today’s volatile markets, Covel’s message of persistence and resilience is a powerful reminder that success often comes to those who are willing to endure short-term pain for long-term gain.

Advanced Strategies from the Book

While “The Little Book of Trading” is accessible for beginners, it also offers a wealth of advanced strategies for experienced investors seeking to refine their approach. Covel delves into nuanced techniques that build on the fundamentals of trend following, emphasizing adaptability, risk controls, and psychological mastery. These advanced methods are designed to help traders maximize returns, minimize drawdowns, and maintain consistency across various market environments.

The key to mastering these advanced strategies lies in integrating them into a comprehensive trading plan. Covel encourages traders to continually test and adapt their systems, leveraging both quantitative and qualitative insights. The following advanced techniques, drawn directly from the book’s lessons and trader interviews, provide a blueprint for elevating your trading discipline and performance.

Strategy 1: Volatility-Based Position Sizing

Covel highlights the importance of adjusting position sizes based on market volatility. Rather than allocating the same capital to every trade, advanced trend followers use metrics like Average True Range (ATR) or standard deviation to determine position size. For example, if a market is highly volatile, a trader might reduce position size to limit risk exposure, while increasing size in less volatile environments. This approach ensures that no single loss can significantly impact the overall portfolio. By using volatility-based position sizing, traders can adapt to changing market conditions and maintain consistent risk levels across different assets. This technique was popularized by the Turtle Traders and remains a cornerstone of professional trend-following systems today.

Strategy 2: Multi-Market Diversification with Correlation Analysis

Beyond simple diversification, Covel recommends analyzing correlations between different markets to optimize portfolio construction. Advanced traders identify assets that are not highly correlated—such as gold and equities or currencies and commodities—to maximize the benefits of diversification. By monitoring rolling correlations, traders can adjust their exposure to reduce overall portfolio risk. For instance, during periods when equity and bond markets move in tandem, a trader might increase exposure to commodities or currencies to maintain diversification. This approach helps smooth returns and reduces vulnerability to market-specific shocks, a principle demonstrated by successful global macro funds.

Strategy 3: Dynamic Trailing Stops

Covel introduces dynamic trailing stops as a sophisticated risk management tool. Instead of using static stop-loss levels, traders employ trailing stops that adjust as the market moves in their favor. For example, a trader might set a trailing stop at 2 ATRs below the highest price achieved since entry, locking in profits as the trend progresses. This technique allows traders to capture larger portions of sustained trends while protecting gains and limiting losses if the market reverses. Dynamic trailing stops are especially effective in trending markets and are widely used by professional systematic traders to maximize risk-adjusted returns.

Strategy 4: Adaptive System Calibration

Markets evolve, and so should trading systems. Covel advises advanced traders to regularly review and recalibrate their strategies based on changing market conditions. This might involve adjusting parameters like moving average lengths, volatility thresholds, or breakout levels. For example, during periods of low volatility, a trader might shorten breakout channels to capture smaller trends, while expanding them during high volatility. By backtesting and forward-testing system adjustments, traders can ensure their strategies remain robust and effective over time. This adaptive approach distinguishes top performers from those who become obsolete in shifting market environments.

Strategy 5: Psychological Resilience Training

Beyond technical skills, Covel emphasizes the need for psychological resilience as an advanced edge. He recommends structured routines such as meditation, visualization, and journaling to manage stress, maintain focus, and reinforce discipline. Advanced traders develop mental frameworks to handle drawdowns, avoid revenge trading, and stay objective during emotional market swings. By integrating psychological training into their daily routines, traders can sustain high performance and avoid the pitfalls of emotional decision-making. Covel’s interviews with top traders reveal that mental strength is often the decisive factor separating consistent winners from those who falter under pressure.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Translating the lessons of “The Little Book of Trading” into actionable steps requires commitment, discipline, and a willingness to embrace systematic processes. Covel’s teachings are designed to be practical, enabling investors to start small and gradually build a robust trend-following practice. The key is to focus on execution, risk management, and continuous improvement, rather than seeking shortcuts or instant results.

Investors should begin by outlining their personal goals, risk tolerance, and available resources. From there, they can develop and test a simple trend-following system, gradually scaling up as confidence and experience grow. Covel encourages traders to regularly review their performance, learn from mistakes, and adapt their strategies to evolving market conditions. The following steps provide a concrete roadmap for implementing the book’s principles:

- Define your trading objectives and risk tolerance. Establish clear goals, such as annual return targets and maximum acceptable drawdowns.

- Develop a rule-based trend-following system. Specify entry and exit criteria, stop-loss levels, and position sizing rules. Backtest the system on historical data to ensure robustness.

- Start with a small, diversified portfolio. Trade across multiple markets—stocks, commodities, currencies—to spread risk and increase the chances of capturing trends.

- Document every trade in a journal. Record entry and exit points, rationale, outcomes, and lessons learned. Review your journal regularly to identify patterns and areas for improvement.

- Monitor performance and adjust as needed. Analyze win rates, average gains and losses, and overall portfolio volatility. Make incremental adjustments to your system based on results and changing market conditions.

- Invest in continuous learning. Dedicate time each week to studying new strategies, market history, and trading psychology. Seek mentorship and participate in trading communities for support and feedback.

- Maintain discipline and resilience. Stick to your system during drawdowns, embrace small losses, and focus on long-term results rather than short-term fluctuations.

Critical Analysis

“The Little Book of Trading” excels at distilling the complex world of trend following into clear, actionable principles. Covel’s writing is engaging, motivational, and grounded in real-world experience. The book’s greatest strength lies in its practical focus—every chapter is packed with concrete examples, trader interviews, and step-by-step guidance. Covel’s emphasis on discipline, risk management, and psychological resilience sets it apart from more theoretical investment texts. The use of stories from successful traders adds credibility and makes the lessons relatable for readers at all levels.

However, the book’s relentless focus on trend following may be seen as a limitation for readers seeking a broader exploration of investment strategies. Covel is unapologetically critical of fundamental analysis, which may not resonate with investors who prefer a blended approach. Additionally, the book does not delve deeply into the mechanics of system development or provide detailed quantitative models, which some advanced traders might desire. While the simplicity of Covel’s message is a strength, it may leave readers wanting more technical depth or hands-on system-building tools.

In the current market environment—characterized by rapid technological change, increased competition, and heightened volatility—Covel’s principles remain highly relevant. The emphasis on adaptability, risk controls, and psychological resilience is particularly valuable for navigating today’s complex markets. While no single strategy is a panacea, “The Little Book of Trading” offers a timeless framework that can be adapted and expanded upon to suit individual needs and evolving market conditions.

Conclusion

Michael W. Covel’s “The Little Book of Trading” is an indispensable resource for investors and traders seeking to master the art of trend following. The book’s clear, actionable lessons—grounded in real-world experience and supported by trader interviews—make it accessible and practical for readers at all levels. Covel’s relentless focus on discipline, risk management, and process over prediction provides a blueprint for navigating the uncertainties of financial markets with confidence.

The key takeaways—stick to your rules, manage risk, embrace simplicity, and maintain psychological resilience—are timeless principles that have proven effective across generations of traders. While the book’s focus on trend following may not appeal to every investor, its core lessons are universally applicable. By internalizing Covel’s teachings and implementing them with discipline and adaptability, investors can increase their chances of long-term success in any market environment.

For those seeking a practical, motivational, and enduring guide to trading, “The Little Book of Trading” is a must-read. It offers not just strategies, but a mindset for thriving in the face of uncertainty—a valuable asset in today’s ever-changing markets.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Trading

1. What is the main message of “The Little Book of Trading”?

The book’s core message is that consistent long-term trading success comes from following a simple, rules-based trend-following system. Covel emphasizes discipline, risk management, and reacting to price trends rather than trying to predict market movements. The book provides practical guidance and motivational stories to help readers build and stick to a robust trading process.

2. Who should read this book—beginners or experienced traders?

Both beginners and experienced traders can benefit from the book’s clear, actionable lessons. Beginners will find the concepts accessible and easy to implement, while experienced traders can use the book to reinforce discipline, risk controls, and psychological resilience. The real-world examples and trader interviews make the content relevant for all levels.

3. Does the book provide specific trading systems or just general advice?

The book focuses on the principles and mindset of trend following rather than prescribing a single, detailed trading system. Covel discusses practical techniques like channel breakouts and moving average crossovers, but encourages readers to develop and test their own rule-based systems. The emphasis is on process, discipline, and risk management.

4. How does trend following differ from other investment strategies?

Trend following is a systematic approach that reacts to price movements rather than predicting them. Unlike value investing or fundamental analysis, trend following relies on technical signals and objective rules. The strategy is designed to capture sustained market trends and cut losses quickly, making it adaptive and resilient across different market environments.

5. Can trend following work in today’s fast-moving, algorithm-driven markets?

Yes, the principles of trend following remain effective in modern markets. Many successful hedge funds and proprietary trading firms continue to use trend-following systems, often enhanced with algorithmic execution. Covel’s emphasis on adaptability, risk controls, and psychological resilience is particularly relevant given today’s volatility and competition.

6. What are the biggest challenges trend followers face?

The main challenges include enduring frequent small losses (whipsaws), maintaining discipline during drawdowns, and resisting the urge to abandon the system after setbacks. Psychological resilience and patience are critical, as the strategy’s edge comes from capturing occasional large trends that outweigh many small losses.

7. How much capital do I need to start trend following?

You can start with a relatively small amount of capital, especially if you use liquid markets and risk controls like the 1-2% rule per trade. The key is to size positions appropriately, diversify across markets, and focus on process rather than trying to “get rich quick.” As experience grows, you can scale up your trading system.

8. Does the book discuss how to handle losing streaks?

Yes, Covel addresses the inevitability of setbacks and losing streaks, emphasizing the importance of perseverance and learning from failures. He shares stories of traders who bounced back from drawdowns by maintaining confidence in their systems and focusing on the long-term edge rather than short-term results.

9. Is fundamental analysis completely useless according to Covel?

Covel is critical of fundamental analysis for trading decisions, arguing that price action and technical signals provide a clearer, more actionable picture of market sentiment. However, he acknowledges that some investors may blend approaches, but his focus is on the simplicity and objectivity of trend following.

10. How can I implement the book’s lessons in my own trading?

Start by defining a simple, rule-based trend-following system with clear entry, exit, and risk management rules. Test your system on historical data, keep a trading journal, and commit to continuous learning. Diversify across markets, embrace small losses, and focus on process over prediction for long-term success.