The Little Book of Valuation by Aswath Damodaran

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Aswath Damodaran, a professor of finance at New York University’s Stern School of Business, is widely regarded as one of the world’s leading authorities on valuation. With decades of teaching, research, and consulting experience, Damodaran has authored several foundational texts on valuation, including “Damodaran on Valuation” and “Investment Valuation.” “The Little Book of Valuation” distills his vast expertise into a concise, accessible guide aimed at demystifying the art and science of valuing companies. Damodaran’s background lends immense credibility to the book; his blend of academic rigor and practical market insight makes this work an indispensable resource for investors, analysts, and finance professionals alike.

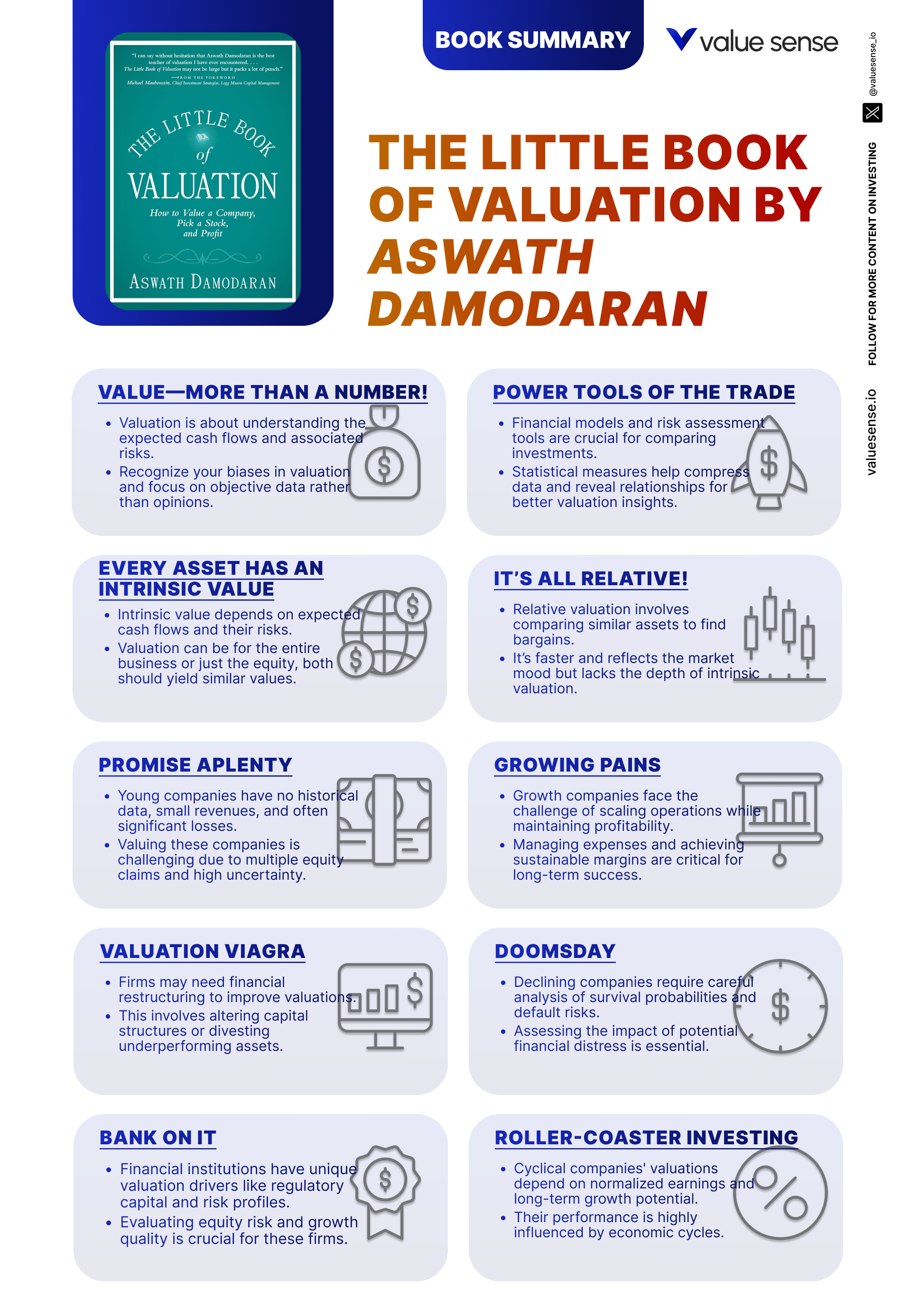

The central theme of “The Little Book of Valuation” is that sound investing is rooted in understanding the intrinsic value of assets and not simply chasing price trends or market fads. Damodaran asserts that every asset has an underlying value determined by its expected cash flows and the risks associated with them. He guides readers through both intrinsic valuation (focusing on discounted cash flow models) and relative valuation (comparing companies using multiples like P/E and EV/EBITDA), emphasizing that mastering both approaches is essential for making informed investment decisions. The book’s purpose is to empower readers to independently assess the worth of any business, whether it’s a high-growth tech startup, a mature industrial giant, or a distressed company on the brink of bankruptcy.

What sets this book apart is its practical orientation and clarity. Damodaran avoids excessive jargon and complex mathematics, making the material accessible to both beginners and experienced investors. He uses real-world examples, case studies, and step-by-step explanations to illustrate key concepts. Each chapter addresses a different stage in a company’s life cycle—from early-stage growth to maturity, distress, and even the unique challenges of valuing financial service firms. The book is particularly valuable for those who want actionable frameworks and tools for valuation, rather than abstract theory. Damodaran’s candid discussions about the limitations, biases, and uncertainties inherent in valuation further distinguish this book from more formulaic texts.

This book is ideal for investors seeking to sharpen their valuation skills, equity analysts looking for a practical reference, business students preparing for careers in finance, and even entrepreneurs who want to understand what drives the value of their own companies. Anyone interested in making smarter investment decisions—whether in public equities, private markets, or even venture capital—will find Damodaran’s approach both enlightening and empowering. The book’s unique blend of theory, application, and critical thinking makes it a must-read for anyone serious about value investing or financial analysis.

Ultimately, “The Little Book of Valuation” stands out for its ability to make a complex subject approachable and actionable. Damodaran’s teaching style, grounded in real-world experience and academic insight, ensures that readers not only learn the mechanics of valuation but also develop the judgment and skepticism necessary to apply these tools effectively in the ever-changing world of investing.

Key Concepts and Ideas

At the heart of “The Little Book of Valuation” is a philosophy that stresses rationality, discipline, and a deep understanding of what drives value. Damodaran’s investment philosophy is rooted in the belief that every asset has an intrinsic value, and that the key to successful investing is not to pay more than this value. He argues that valuation is both an art and a science, requiring a blend of quantitative analysis and qualitative judgment. The book encourages investors to look beyond market noise, fads, and superficial metrics, focusing instead on the underlying fundamentals—cash flows, growth prospects, risk, and competitive positioning.

Damodaran also emphasizes the importance of recognizing and managing uncertainty. He acknowledges that all valuations are, by nature, imprecise and subject to bias, but insists that a disciplined approach—grounded in sound methodology and realistic assumptions—can significantly improve investment outcomes. The book provides readers with a toolkit for analyzing companies at every stage of their life cycle, from high-growth startups to mature cash cows, distressed firms, and financial service companies. By mastering both intrinsic and relative valuation techniques, investors can develop a more nuanced and comprehensive view of value.

- Intrinsic Valuation: This method estimates the true worth of a company based on its expected future cash flows, discounted back to present value using an appropriate risk-adjusted rate. Damodaran walks readers through discounted cash flow (DCF) models, explaining how to forecast revenues, assess profit margins, and estimate terminal value. He stresses that intrinsic value is independent of market price and requires careful scrutiny of assumptions about growth, risk, and reinvestment needs.

- Relative Valuation: Rather than building detailed forecasts, this approach values a company by comparing it to similar peers using multiples such as price-to-earnings (P/E), price-to-book (P/B), or enterprise value to EBITDA (EV/EBITDA). Damodaran explains how to choose the right comparables, adjust for differences, and interpret multiples in context. He cautions against blindly following market multiples and urges investors to understand the limitations and potential distortions in relative valuation.

- Time Value of Money: A foundational concept, the time value of money recognizes that a dollar today is worth more than a dollar in the future due to inflation, opportunity cost, and risk. Damodaran explains present value calculations, discounting techniques, and why these are crucial for comparing investment opportunities with different cash flow patterns.

- Risk Assessment and Discount Rates: Accurately measuring risk is central to valuation. Damodaran introduces the Capital Asset Pricing Model (CAPM) and the use of beta to estimate the cost of equity. He discusses how company-specific risk, industry factors, and macroeconomic conditions should influence discount rate selection, and how higher risk warrants higher required returns.

- Growth Estimation: Projecting future growth in revenues and cash flows is both critical and challenging. Damodaran offers frameworks for estimating growth rates, distinguishing between sustainable and unsustainable growth, and adjusting projections as companies mature. He shows how reinvestment rates and return on capital drive long-term growth potential.

- Valuing Special Situations: The book provides specialized guidance for valuing high-growth startups, mature companies, distressed firms, cyclical businesses, and financial institutions. Damodaran explains the unique challenges and adjustments required for each, such as handling negative cash flows in startups, normalizing earnings for cyclical firms, and accounting for regulatory capital in banks.

- Intangible Assets Valuation: Recognizing the growing importance of intangible assets—like intellectual property, brand value, and customer loyalty—Damodaran discusses methods for identifying and valuing these assets, including the relief-from-royalty method and analyzing economic benefits from intangibles.

- Scenario and Sensitivity Analysis: Given the inherent uncertainty in forecasting, Damodaran advocates using scenario analysis to model different outcomes and sensitivity analysis to test how changes in key assumptions impact valuation results. This approach helps investors understand the range of possible values and make more informed decisions.

- Recognizing Bias and Uncertainty: Damodaran candidly addresses the biases that analysts and investors bring to valuation, from optimistic forecasts to selective use of data. He urges readers to be honest about their assumptions, document their reasoning, and recognize the limits of precision in valuation work.

- Practical Application and Continuous Learning: The book is filled with practical tips for applying valuation techniques to real-world investment decisions. Damodaran encourages readers to practice valuing a range of companies, learn from mistakes, and adapt their approach as markets and business models evolve.

Practical Strategies for Investors

Applying the lessons from “The Little Book of Valuation” requires more than just understanding formulas—it’s about building a disciplined, repeatable process for analyzing companies and making investment decisions. Damodaran’s frameworks are designed for real-world use, enabling investors to navigate market volatility, identify undervalued opportunities, and avoid common valuation traps. Whether you’re a seasoned analyst or a retail investor, these strategies can help you make more confident, evidence-based choices.

The book emphasizes the importance of adapting your approach to the specific company and context. Valuing a fast-growing tech startup requires different assumptions and techniques than assessing a mature utility or a bank. Damodaran’s practical advice includes not only how to crunch the numbers but also how to think critically about the drivers of value, risk, and competitive advantage. By following these strategies, investors can reduce the influence of emotion and market hype, focusing instead on long-term value creation.

- Start with a Clear Investment Thesis: Before diving into numbers, articulate why you believe a company is undervalued or overvalued. This thesis should be grounded in business fundamentals, not just price movements or news headlines. Write down your assumptions about growth, profitability, and risks.

- Use Both Intrinsic and Relative Valuation: Don’t rely exclusively on one method. Begin with a discounted cash flow (DCF) analysis to estimate intrinsic value, then compare your results to market multiples using relative valuation. If both methods point to undervaluation, your thesis is stronger.

- Focus on Cash Flows, Not Accounting Profits: Damodaran stresses that free cash flow to equity (FCFE) and free cash flow to the firm (FCFF) are more meaningful than reported net income. Adjust for non-cash items, working capital changes, and capital expenditures to get a true sense of value creation.

- Adjust Discount Rates for Risk: Use higher discount rates for riskier companies (e.g., startups, distressed firms) and lower rates for stable, mature businesses. Damodaran recommends using CAPM as a starting point but adjusting for company-specific risks that may not be captured by beta alone.

- Normalize Earnings for Cyclical and Distressed Companies: For companies with volatile or negative earnings, use average or normalized earnings over a full business cycle. This helps avoid overreacting to temporary downturns or unsustainable booms.

- Incorporate Scenario Analysis: Model at least three scenarios—base case, optimistic, and pessimistic—to capture the range of possible outcomes. Assign probabilities to each and calculate a weighted average valuation. This approach helps manage uncertainty and avoid overconfidence in any single projection.

- Value Intangibles Explicitly: For companies with significant intangible assets (e.g., tech firms, consumer brands), use methods like relief-from-royalty or excess earnings to estimate their value. Don’t ignore the impact of patents, trademarks, or customer relationships on long-term cash flows.

- Document and Review Your Assumptions: Keep a record of your key assumptions, sources, and rationale for each valuation. Regularly review and update your models as new information emerges. This discipline helps you learn from past mistakes and improve over time.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book of Valuation” is structured to guide readers through the full spectrum of valuation challenges, from foundational principles to specialized techniques for different types of companies. Each chapter tackles a distinct scenario, providing detailed frameworks, examples, and practical tips. Damodaran’s approach is both systematic and flexible, equipping investors to handle the real-world complexities of modern markets.

The book begins by laying the groundwork—defining value, explaining why it matters, and introducing the essential tools of the trade. It then progresses through the company life cycle, offering tailored valuation strategies for high-growth startups, mature firms, distressed businesses, financial institutions, and companies with significant intangible assets. Each chapter is packed with real-world case studies, data, and actionable advice, making it easy for readers to apply the lessons to their own investment process.

Below, you’ll find a comprehensive, chapter-by-chapter analysis, with each section delving deeply into the key ideas, examples, and practical takeaways. Whether you’re new to valuation or looking to refine your skills, this breakdown will help you extract maximum value from Damodaran’s teachings.

Chapter 1: Value—More Than a Number!

The opening chapter establishes the fundamental premise that underpins all sound investing: never pay more for an asset than its intrinsic value. Damodaran begins by distinguishing between price and value, highlighting that while market prices fluctuate with sentiment, true value is rooted in the underlying business fundamentals—specifically, the cash flows an asset is expected to generate and the risks associated with those cash flows. He introduces the two primary approaches to valuation: intrinsic valuation, which is based on discounted cash flows, and relative valuation, which involves comparing an asset to similar ones using market multiples. Damodaran’s clear explanation demystifies the process, making it accessible even for those without a finance background.

This chapter also addresses why valuation is critical at every stage of a company’s life cycle, from venture capital investments to public offerings and ongoing financial management. Damodaran points out that valuation is not just an academic exercise; it’s a practical tool for making informed investment decisions and avoiding the costly mistake of overpaying. He candidly discusses the realities of valuation work, noting that all valuations are inherently biased and imprecise. Analysts’ assumptions, choice of comparables, and even their optimism or pessimism can influence outcomes. Damodaran’s honesty about these challenges is refreshing and sets the tone for the rest of the book.

For investors, the key takeaway is the importance of discipline and objectivity. Damodaran urges readers to focus on fundamentals, document their assumptions, and be wary of market hype. He suggests that simpler models, grounded in reality, are often more effective and less error-prone than complex, over-engineered ones. By recognizing the limitations and biases inherent in valuation, investors can make more rational, evidence-based decisions. Damodaran’s advice to “keep it simple” is especially relevant in today’s data-rich yet often confusing market environment.

Historically, the distinction between price and value has been at the core of value investing, a philosophy championed by legends like Benjamin Graham and Warren Buffett. Damodaran’s approach builds on this tradition while integrating modern tools and techniques. In an era of meme stocks, speculative bubbles, and rapid technological change, his insistence on grounding investment decisions in intrinsic value is more important than ever. This chapter lays the foundation for a disciplined, repeatable process that can help investors navigate both bull and bear markets with confidence.

Chapter 2: Power Tools of the Trade

In the second chapter, Damodaran introduces the essential tools required for effective valuation. He begins with the time value of money, explaining why future cash flows must be discounted to present value to facilitate meaningful comparisons across investment opportunities. Damodaran provides practical examples, such as comparing a $1,000 payment received today versus in five years, and walks readers through present value calculations. He then delves into risk assessment, highlighting the importance of incorporating risk into every investment decision. The Capital Asset Pricing Model (CAPM) is introduced as a common method for estimating the cost of equity, with beta used to measure a company’s market risk relative to the broader market.

This chapter also covers the interpretation of financial statements—the balance sheet, income statement, and cash flow statement—which provide crucial insights into a company’s financial health. Damodaran explains key accounting principles, such as accrual accounting and the categorization of expenses, and discusses how to extract meaningful data for valuation purposes. He emphasizes the need to look beyond headline numbers and understand the drivers of profitability, liquidity, and solvency. The chapter concludes with an overview of basic statistical tools, including averages, standard deviations, correlation, and regression analysis, which help investors make sense of large data sets and identify patterns.

For practical application, Damodaran advises investors to build a solid foundation in financial statement analysis and statistical reasoning. He recommends regularly reviewing company filings, adjusting for non-cash items, and using summary statistics to identify trends and outliers. Investors should also familiarize themselves with risk measurement techniques, starting with CAPM but remaining open to alternative models as their skills develop. By mastering these tools, investors can approach valuation with greater confidence and precision.

Many of these concepts have stood the test of time. The importance of the time value of money, for example, is as relevant today as it was in the early days of modern finance. Damodaran’s emphasis on understanding financial statements echoes the teachings of Graham and Dodd, while his use of statistical tools reflects the increasing data-driven nature of modern investing. In a world awash with information, the ability to sift through data and focus on what matters is a critical edge for any investor.

Chapter 3: Yes, Virginia, Every Asset Has an Intrinsic Value

This chapter reinforces Damodaran’s core belief that every asset—regardless of its stage in the business life cycle—has an intrinsic value that can be estimated using discounted cash flow (DCF) analysis. He distinguishes between valuing the entire business (enterprise value) and valuing just the equity, explaining when each approach is appropriate. For instance, enterprise value is relevant when assessing mergers and acquisitions, while equity value is more pertinent for shareholders. Damodaran walks readers through the process of forecasting cash flows, selecting appropriate discount rates, and estimating terminal value—the value of cash flows beyond the explicit forecast period.

Damodaran provides concrete examples of different types of cash flows, including dividends, augmented dividends (factoring in stock buybacks), and free cash flow to equity (FCFE). He explains how to adjust for capital expenditures, working capital changes, and debt repayments to arrive at a realistic estimate of cash available to shareholders. The chapter includes step-by-step calculations, tables, and illustrative case studies, such as valuing a hypothetical consumer products company with varying growth assumptions. Damodaran also discusses the importance of matching the risk profile of the discount rate to the riskiness of the projected cash flows.

For investors, the practical lesson is the importance of building robust, transparent DCF models. Damodaran recommends starting with historical financials, then making reasonable projections based on industry trends, company strategy, and macroeconomic conditions. He cautions against over-optimistic growth assumptions and urges readers to be conservative in their estimates of terminal value. Regularly updating models as new data becomes available is essential for maintaining accuracy and relevance.

DCF analysis has long been the gold standard for valuation among professional investors, but it is often misunderstood or misapplied by retail investors. Damodaran’s clear, methodical approach helps demystify the process, making it accessible to a broader audience. In an era of rapid technological change and shifting business models, the ability to estimate intrinsic value is a powerful tool for identifying mispriced opportunities and avoiding overhyped stocks. This chapter equips readers with the skills needed to perform rigorous, independent analysis in any market environment.

Chapter 4: It’s All Relative!

Chapter four shifts focus to relative valuation, a method that determines value by comparing a company to similar peers using market multiples. Damodaran explains that while intrinsic valuation provides a theoretically sound estimate of value, relative valuation is often more practical in fast-moving markets where detailed forecasts are difficult. He introduces common multiples such as price-to-earnings (P/E), price-to-book (P/B), and enterprise value to EBITDA (EV/EBITDA), discussing their pros and cons in different industries. Damodaran emphasizes that the choice of comparable companies is critical—differences in industry, size, growth, and profitability can significantly distort results.

The chapter provides detailed guidance on selecting and adjusting comparables. Damodaran uses real-world examples, such as comparing technology firms with varying growth rates or adjusting for differences in accounting practices between U.S. GAAP and IFRS. He also discusses the limitations of relative valuation, including market inefficiencies and the risk of “herding” behavior, where investors blindly follow prevailing multiples without questioning their validity. Damodaran encourages readers to use relative valuation as a complement to intrinsic valuation, not a substitute.

For practical application, investors should start by identifying a peer group of companies with similar business models, growth prospects, and risk profiles. Damodaran recommends using multiple valuation metrics to triangulate a fair value estimate, rather than relying on a single multiple. Adjustments may be necessary to account for differences in capital structure, accounting policies, or business mix. Documenting the rationale for each adjustment enhances transparency and helps avoid common pitfalls.

Relative valuation is widely used by Wall Street analysts, investment bankers, and private equity investors, especially in fast-moving or opaque markets where detailed forecasts are challenging. Damodaran’s nuanced approach helps investors avoid the trap of simply “following the herd,” encouraging critical thinking and skepticism. In today’s market, where high-growth sectors like technology often trade at lofty multiples, the ability to distinguish justified premiums from speculative excess is a key skill for any investor.

Chapter 5: Promise Aplenty

Chapter five tackles the unique challenges of valuing young, high-growth companies—firms that often have immense potential but limited operating history and significant uncertainty. Damodaran explains that projecting future growth rates for these companies is inherently difficult due to the lack of historical data and the unpredictability of market adoption. He recommends using scenario analysis and probability-weighted outcomes to manage this uncertainty, modeling multiple possible futures rather than relying on a single projection.

The chapter provides practical frameworks for estimating revenues and earnings, starting with an analysis of total addressable market, potential market share, and realistic profit margins. Damodaran discusses the importance of understanding the company’s competitive landscape, barriers to entry, and scalability. He also addresses the reality that many high-growth companies require substantial reinvestment in the early years, leading to negative free cash flows. Investors must assess the sustainability of the business model and the likelihood of achieving scale before profitability runs out.

For actionable steps, Damodaran suggests building DCF models that incorporate multiple scenarios—base, optimistic, and pessimistic—with assigned probabilities. He advises adjusting discount rates upward to reflect higher risk and considering the value of intangible assets such as intellectual property and brand recognition. Investors should also pay close attention to cash burn rates and funding requirements, as the ability to raise capital can be a make-or-break factor for startups.

Valuing high-growth companies has become increasingly important in the age of technology and innovation. Companies like Amazon, Tesla, and Uber all faced skepticism in their early years due to negative cash flows and uncertain paths to profitability. Damodaran’s approach provides a disciplined framework for navigating this uncertainty, allowing investors to separate genuine opportunities from speculative hype. By focusing on fundamentals and modeling a range of outcomes, investors can make more informed decisions in high-risk, high-reward segments of the market.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Growing Pains

In chapter six, Damodaran addresses the valuation of companies transitioning from high growth to maturity—a phase characterized by slowing growth rates, stabilizing margins, and evolving capital structures. He explains that accurately estimating when and how this transition will occur is critical for building realistic valuation models. Damodaran recommends using a combination of historical growth patterns, industry benchmarks, and management guidance to inform projections.

The chapter discusses the hallmarks of mature companies: more predictable and stable profit margins, greater access to capital markets, and increased financial flexibility. Damodaran explains how capital structure decisions—such as taking on more debt or returning capital to shareholders—can impact valuation. He provides examples of companies like Procter & Gamble and Coca-Cola, which have successfully navigated the transition to maturity by maintaining stable cash flows and disciplined capital allocation.

For practical application, investors should adjust their models to reflect slower, more sustainable growth rates and stable margins. Damodaran advises using lower discount rates to account for reduced risk and incorporating changes in capital structure into the cost of capital calculation. He also suggests monitoring management’s capital allocation decisions, as mature companies often face pressure to deploy excess cash through dividends, buybacks, or acquisitions.

This chapter is particularly relevant in today’s market, where many technology firms are reaching maturity after years of rapid expansion. The ability to recognize when a company is shifting from growth to value mode can help investors adjust their expectations and avoid overpaying for slowing businesses. Damodaran’s frameworks provide a roadmap for navigating this transition, ensuring that valuation models remain grounded in reality as companies evolve.

Chapter 7: Valuation Viagra

Chapter seven explores the valuation of companies with strong growth potential driven by unique products, patents, network effects, or other sustainable competitive advantages. Damodaran introduces the concept of the “competitive advantage period”—the length of time a company can sustain above-average growth and profitability before competition erodes its edge. He explains that estimating both the duration and magnitude of this advantage is crucial for accurate valuation.

The chapter provides detailed case studies of companies like Apple, Google, and pharmaceutical firms with blockbuster drugs. Damodaran shows how to incorporate higher profit margins and longer growth periods into DCF models, while adjusting for the reinvestment required to maintain competitive advantages. He also discusses the impact of market dynamics, such as regulatory changes or technological disruption, on the sustainability of growth.

For practical steps, investors should conduct deep research into the sources of a company’s competitive advantage—patents, brand strength, network effects, or cost leadership—and assess how long these advantages are likely to persist. Damodaran recommends stress-testing models by shortening or extending the competitive advantage period and analyzing the resulting impact on valuation. He also advises monitoring industry trends and potential disruptors that could erode profitability.

In the modern economy, companies with durable competitive advantages often command premium valuations. However, overestimating the duration of these advantages can lead to significant overvaluation. Damodaran’s frameworks help investors strike the right balance, identifying when high multiples are justified and when they signal excessive optimism. This chapter is essential reading for anyone investing in technology, pharmaceuticals, or other innovation-driven sectors.

Chapter 8: Doomsday

Chapter eight addresses the valuation of distressed companies—firms facing significant financial difficulties, liquidity crises, or the risk of bankruptcy. Damodaran explains that assessing the value of such companies requires a different mindset and specialized tools. He begins by outlining the key indicators of financial distress, including deteriorating liquidity ratios, falling profitability, and mounting debt obligations. Damodaran provides a framework for analyzing the likelihood of recovery versus liquidation, emphasizing the importance of scenario analysis in modeling different outcomes.

The chapter discusses turnaround strategies, such as restructuring debt, selling non-core assets, or bringing in new management. Damodaran explains how to adjust discount rates upward to reflect the heightened risk associated with distressed companies. He also covers the use of probability-weighted valuations, where investors assign probabilities to different scenarios—recovery, partial recovery, or bankruptcy—and calculate an expected value based on these weights.

For practical application, investors should start by conducting a thorough analysis of the company’s financial statements, focusing on liquidity, solvency, and operational efficiency. Damodaran recommends building models that incorporate multiple scenarios and adjusting key assumptions as new information emerges. He also advises monitoring news flow, management actions, and industry developments, as these can significantly impact the likelihood of recovery.

Valuing distressed companies is a high-risk, high-reward endeavor. Historical examples like General Motors (pre-bankruptcy) and Lehman Brothers highlight the challenges and potential pitfalls. Damodaran’s disciplined approach helps investors avoid common mistakes, such as underestimating the time required for turnaround or overestimating the company’s ability to return to profitability. By focusing on fundamentals and maintaining a healthy skepticism, investors can identify genuine opportunities amid the chaos of financial distress.

Chapter 9: Bank on It

Chapter nine focuses on the valuation of financial service companies, such as banks and insurance firms. Damodaran explains that these companies have unique characteristics—large portfolios of financial assets and liabilities, heavy regulation, and sensitivity to interest rates—that require specialized valuation techniques. He emphasizes the importance of understanding the regulatory environment, as capital adequacy requirements and compliance costs can significantly impact profitability and risk.

The chapter provides detailed guidance on analyzing the quality and risk of a financial company’s asset and liability portfolios. Damodaran discusses the significance of capital adequacy ratios, such as Tier 1 capital and leverage ratios, as key indicators of financial health. He also explains how to assess interest rate risk, credit risk, and the impact of regulatory changes on earnings and valuation. The use of dividend discount models (DDM) and excess return models is highlighted as particularly relevant for banks and insurers, given their stable dividend policies and regulated capital structures.

For practical application, investors should start by reviewing regulatory filings and stress test results, analyzing the composition and quality of loan and investment portfolios. Damodaran recommends adjusting valuation models to reflect interest rate sensitivity and potential regulatory changes. He also suggests monitoring industry trends, such as consolidation or technological disruption, which can impact long-term profitability.

Valuing financial service companies has become increasingly complex in the wake of the 2008 financial crisis and subsequent regulatory reforms. Damodaran’s frameworks provide a roadmap for navigating these challenges, ensuring that investors account for both the unique risks and opportunities in the sector. By focusing on fundamentals and maintaining a disciplined approach, investors can identify undervalued opportunities in a sector that is often misunderstood or overlooked.

Chapter 10: Roller-Coaster Investing

The tenth chapter addresses the valuation of cyclical companies—firms whose performance fluctuates significantly with economic cycles. Damodaran explains that earnings for these companies can be highly volatile, making it difficult to rely on single-year financials for valuation purposes. He recommends using normalized earnings, calculated over a full business cycle, to avoid overreacting to temporary booms or busts.

Damodaran provides practical examples from industries such as automotive, steel, and energy, where profits can swing dramatically based on macroeconomic conditions. He discusses the importance of adjusting discount rates upward to reflect the increased risk and volatility inherent in cyclical businesses. Scenario analysis is again emphasized, with Damodaran advising investors to model multiple economic scenarios—recession, recovery, expansion—and calculate a weighted average valuation.

For practical steps, investors should gather long-term financial data to calculate average margins and returns over several cycles. Damodaran suggests monitoring leading economic indicators, such as GDP growth, interest rates, and commodity prices, to inform scenario analysis. He also advises being cautious with valuation multiples during boom periods, as market optimism can lead to unsustainable valuations.

Cyclical investing has always been challenging, as illustrated by the dramatic swings in sectors like oil and gas or heavy manufacturing. Damodaran’s disciplined approach helps investors avoid the common mistake of extrapolating recent trends indefinitely. By focusing on normalized earnings and incorporating a range of scenarios, investors can make more balanced, long-term decisions in volatile sectors.

Chapter 11: Invisible Value

The final chapter delves into the valuation of intangible assets—such as intellectual property, brand value, and customer loyalty—that are often not reflected in traditional financial statements but can significantly impact a company’s true worth. Damodaran explains that identifying and valuing these assets is essential for a comprehensive valuation, particularly in industries like technology, pharmaceuticals, and consumer goods.

The chapter introduces various methods for valuing intangibles, including the relief-from-royalty method, which estimates the value of patents or trademarks based on the royalties a company would have to pay if it didn’t own the asset. Damodaran also discusses the excess earnings method, which attributes a portion of a company’s profits to intangible assets after accounting for returns on tangible assets. He provides real-world examples, such as valuing the Coca-Cola brand or Microsoft’s intellectual property portfolio, to illustrate these techniques.

For practical application, investors should start by identifying the key intangible assets that drive a company’s competitive advantage. Damodaran recommends using a combination of valuation methods and making conservative assumptions to avoid overvaluation. He also advises monitoring changes in the value of intangibles over time, as shifts in consumer preferences, technological innovation, or legal challenges can rapidly alter their worth.

In today’s knowledge-based economy, intangible assets account for a growing share of corporate value. Damodaran’s frameworks equip investors to recognize and quantify these assets, ensuring that their valuations reflect the full picture. By incorporating intangibles into their analysis, investors can gain an edge in sectors where traditional metrics fail to capture the true drivers of value.

Advanced Strategies from the Book

While “The Little Book of Valuation” provides a strong foundation in core valuation techniques, Damodaran also shares advanced strategies for investors seeking to refine their approach. These techniques are designed to address the complexities and uncertainties inherent in modern markets, enabling investors to make more nuanced and informed decisions. The advanced strategies focus on managing uncertainty, incorporating real options, valuing complex capital structures, and adjusting for macroeconomic factors.

By mastering these advanced techniques, investors can enhance the robustness of their valuations, better account for risk, and identify opportunities that may be overlooked by more simplistic models. Below are several key advanced strategies drawn from the book, each illustrated with practical examples and action steps.

Strategy 1: Scenario and Sensitivity Analysis

Damodaran advocates for the use of scenario and sensitivity analysis to manage the uncertainty inherent in forecasting future cash flows and growth rates. Scenario analysis involves modeling multiple possible futures—such as base case, optimistic, and pessimistic scenarios—and assigning probabilities to each. Sensitivity analysis tests how changes in key assumptions (e.g., discount rates, growth rates, profit margins) impact the final valuation. For example, when valuing a high-growth tech startup, an investor might model scenarios where the company captures 5%, 10%, or 20% market share, with corresponding impacts on revenue and profitability. By calculating a probability-weighted average value, investors can make more informed decisions and avoid overreliance on any single projection.

Strategy 2: Real Options Valuation

Real options analysis treats investment opportunities as options—choices that can be exercised or abandoned as new information emerges. This approach is particularly useful for companies in volatile industries or those with significant growth opportunities, such as biotech firms with drug pipelines or energy companies with untapped reserves. Damodaran explains how to use option pricing models to value the flexibility inherent in these opportunities, accounting for the value of waiting, expanding, or abandoning projects. For instance, a pharmaceutical company might have a drug candidate with a 30% chance of approval; real options analysis can quantify the value of this potential upside, even if traditional DCF models undervalue the opportunity due to risk and uncertainty.

Strategy 3: Adjusting for Capital Structure Complexity

Many companies have complex capital structures involving multiple classes of equity, convertible debt, preferred shares, or options. Damodaran provides frameworks for allocating value among different stakeholders, using techniques like the option-pricing method for convertible securities or the waterfall approach for bankruptcy scenarios. For example, when valuing a distressed company with outstanding convertible bonds, investors must model the impact of conversion on equity value and adjust their valuation accordingly. This ensures a more accurate assessment of the value available to each class of investor.

Strategy 4: Incorporating Macroeconomic and Industry Factors

Damodaran emphasizes the importance of adjusting valuation models for macroeconomic and industry-specific factors, such as changes in interest rates, inflation, or regulatory environments. He suggests using scenario analysis to model the impact of rising interest rates on bank profitability or the effect of new regulations on healthcare companies. For instance, a rise in interest rates may increase the cost of capital for leveraged firms, reducing their intrinsic value. By incorporating these factors into their models, investors can better anticipate risks and opportunities that may not be captured by company-level analysis alone.

Strategy 5: Explicit Valuation of Intangible Assets

As intangible assets become an increasingly important driver of value, Damodaran provides advanced techniques for explicitly valuing brands, patents, and customer relationships. He recommends using methods like relief-from-royalty, excess earnings, and multi-period excess earnings models, adjusting for uncertainty and potential obsolescence. For example, when valuing a consumer brand like Nike, investors can estimate the royalty rate a competitor would pay to license the brand and discount these “royalty” cash flows to present value. This approach ensures that the full economic value of intangibles is reflected in the overall company valuation.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Putting Damodaran’s valuation frameworks into practice requires a disciplined, step-by-step approach. Investors should start by building a solid foundation in financial statement analysis and core valuation techniques, then gradually incorporate advanced methods as their skills develop. The key is to focus on fundamentals, remain objective, and continuously refine your process based on real-world experience and feedback.

Below is a practical implementation guide for applying the lessons from “The Little Book of Valuation.” By following these steps, investors can build a repeatable process for analyzing companies, identifying undervalued opportunities, and making evidence-based investment decisions.

- Begin by selecting a company of interest and gathering its financial statements, investor presentations, and relevant industry data.

- Articulate a clear investment thesis, outlining your assumptions about growth, profitability, and risk factors.

- Build a discounted cash flow (DCF) model, forecasting revenues, margins, and cash flows over a 5-10 year period. Select appropriate discount rates based on company and industry risk.

- Conduct a relative valuation using market multiples, identifying a peer group of comparable companies and adjusting for differences in growth and risk.

- Incorporate scenario and sensitivity analysis to model a range of possible outcomes and assess the impact of key assumptions.

- Explicitly value any significant intangible assets, such as patents or brands, using appropriate methods.

- Document all assumptions, sources, and rationale for each step in the process. Regularly review and update your models as new information becomes available.

Critical Analysis

“The Little Book of Valuation” excels at making complex valuation concepts accessible to a broad audience. Damodaran’s clear explanations, practical frameworks, and real-world examples set this book apart from more theoretical or mathematically dense texts. The book’s structure—moving from foundational principles to specialized scenarios—ensures that readers can apply the lessons to any company, regardless of industry or stage of development. Damodaran’s candid discussions about the limitations and biases inherent in valuation work add depth and credibility to his approach.

However, the book is not without its limitations. While Damodaran does an admirable job of simplifying complex topics, some readers may find the pace brisk or wish for more detailed case studies and worked examples. The book assumes a basic familiarity with financial statements and accounting, which may pose a hurdle for absolute beginners. Additionally, the rapidly evolving nature of modern markets—particularly in areas like technology and intangible assets—means that some frameworks may require adaptation to stay current.

In the context of today’s market environment, “The Little Book of Valuation” remains highly relevant. The proliferation of new business models, the rise of intangible assets, and the volatility of global markets make disciplined valuation more important than ever. Damodaran’s insistence on grounding investment decisions in fundamentals provides a valuable antidote to the noise and hype that often dominate financial media. While no single book can cover every nuance, “The Little Book of Valuation” provides a robust foundation for investors seeking to navigate uncertainty with confidence and skill.

Conclusion

Aswath Damodaran’s “The Little Book of Valuation” is a masterclass in the art and science of valuing businesses. By blending academic rigor with practical wisdom, Damodaran equips readers to tackle the real-world challenges of modern investing. The book’s clear explanations, actionable frameworks, and candid discussions of uncertainty and bias make it an invaluable resource for investors at every level of experience.

Key takeaways include the importance of focusing on intrinsic value, the need to adapt valuation techniques to different company types, and the value of scenario analysis and critical thinking. Damodaran’s emphasis on discipline, objectivity, and continuous learning ensures that readers are well-prepared to navigate the complexities of today’s markets. Whether you’re analyzing a high-growth tech startup, a mature industrial giant, or a distressed company in turnaround, the lessons from this book will help you make smarter, more confident investment decisions.

In summary, “The Little Book of Valuation” is essential reading for anyone serious about investing. Damodaran’s frameworks, examples, and practical advice provide a roadmap for building a repeatable, evidence-based investment process. By mastering the principles in this book, you’ll be better equipped to identify undervalued opportunities, manage risk, and achieve long-term investment success.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Valuation

1. Who is Aswath Damodaran, and why is he considered an authority on valuation?

Aswath Damodaran is a professor of finance at NYU’s Stern School of Business and a globally recognized expert in the field of valuation. He has authored several foundational books, taught thousands of students and professionals, and consults for leading investment firms. His blend of academic rigor and real-world experience makes his insights highly respected in the investment community.

2. What is the main difference between intrinsic and relative valuation?

Intrinsic valuation estimates a company’s true worth based on its expected future cash flows, discounted to present value using a risk-adjusted rate. Relative valuation, on the other hand, values a company by comparing it to similar peers using market multiples like P/E or EV/EBITDA. Both approaches have strengths and limitations and are best used together for a comprehensive view.

3. How does Damodaran suggest dealing with uncertainty in valuation?

Damodaran recommends using scenario and sensitivity analysis to model a range of possible outcomes. By assigning probabilities to different scenarios and testing how changes in key assumptions impact valuation, investors can better understand the risks and avoid overconfidence in any single projection. This approach helps manage uncertainty and improve decision-making.

4. What are the key challenges in valuing high-growth or startup companies?

Valuing high-growth startups is challenging due to limited historical data, high uncertainty, and negative cash flows in the early years. Damodaran suggests using scenario analysis, probability-weighted outcomes, and adjusting discount rates upward to reflect higher risk. Investors should focus on market potential, competitive landscape, and sustainability of the business model.

5. How does the book address the valuation of intangible assets?

Damodaran discusses methods for identifying and valuing intangible assets such as patents, brands, and customer relationships. Techniques like the relief-from-royalty method and excess earnings model are explained, with practical examples from real companies. The book emphasizes the importance of conservative assumptions and regular monitoring of intangible asset value.

6. Can the valuation techniques in the book be applied to financial service companies?

Yes, Damodaran provides specialized frameworks for valuing banks, insurance firms, and other financial service companies. He explains how to account for regulatory requirements, capital adequacy, and interest rate sensitivity, and recommends using dividend discount models and excess return models tailored to the sector’s unique characteristics.

7. What practical steps does Damodaran recommend for building a repeatable valuation process?

Damodaran advises starting with a clear investment thesis, gathering financial and industry data, building DCF and relative valuation models, and incorporating scenario analysis. He stresses the importance of documenting assumptions, regularly reviewing models, and practicing on a range of companies to build expertise and confidence.

8. How does the book help investors avoid common valuation mistakes?

The book warns against over-optimistic assumptions, blindly following market multiples, and ignoring risk. Damodaran encourages critical thinking, transparency, and the use of both intrinsic and relative valuation methods. By focusing on fundamentals and documenting assumptions, investors can avoid common pitfalls and improve their decision-making.

9. Is “The Little Book of Valuation” suitable for beginners?

While the book assumes some familiarity with financial statements and basic accounting, Damodaran’s clear explanations and practical examples make it accessible to motivated beginners. Readers willing to invest time in learning the basics will find the book an excellent introduction to valuation, as well as a valuable reference for more advanced study.

10. How does the book remain relevant in today’s rapidly changing markets?

Damodaran’s focus on fundamentals, adaptability, and critical thinking ensures that the book’s lessons remain relevant amid market volatility and technological change. His frameworks for valuing intangibles, managing uncertainty, and adjusting for macroeconomic factors help investors navigate modern challenges and identify opportunities in a dynamic investment landscape.