The Little Book of Value Investing by Christopher H. Browne, Roger Lowenstein

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

The Little Book of Value Investing by Christopher H. Browne, with a foreword by Roger Lowenstein, is a concise yet powerful guide to the time-tested principles of value investing. Browne was a managing director at Tweedy, Browne Company, a legendary investment firm with roots dating back to Benjamin Graham, the father of value investing himself. Browne’s career spanned decades, and he was known for his disciplined, rational approach to markets, as well as for managing billions in client assets. Roger Lowenstein, author of the classic biography "Buffett: The Making of an American Capitalist," lends additional credibility to the book with his endorsement and introduction.

The main theme of the book is straightforward: value investing is about buying stocks for less than their intrinsic value, ensuring a margin of safety, and patiently waiting for the market to recognize that value. Browne demystifies the process by drawing analogies to everyday shopping—buying stocks the way you’d buy steaks, only when they’re on sale. He systematically breaks down the core concepts of value investing, including how to assess intrinsic value, the importance of financial health, diversification, and the psychological discipline required to succeed. The book is replete with practical examples, historical case studies, and actionable checklists that empower readers to implement value investing strategies in their own portfolios.

This book is ideal for a wide range of investors. Beginners will appreciate the accessible language and clear explanations, while experienced investors will find value in Browne’s distilled wisdom and real-world insights. Professional money managers, financial advisors, and even seasoned value investors will benefit from the reminders and nuances Browne provides—especially his focus on discipline, margin of safety, and the avoidance of value traps. The book is particularly valuable for those who want to avoid the pitfalls of market hype and speculation, and instead build wealth through a methodical, evidence-based approach.

What makes "The Little Book of Value Investing" unique is its blend of simplicity and depth. Browne’s writing is approachable, yet he never oversimplifies the complexities of investing. The book stands out for its practical, step-by-step guidance, including how to perform a "physical exam" on companies, monitor insider activity, and avoid common traps. It also addresses international investing, the importance of ongoing education, and the psychological resilience needed to stick to a value strategy through thick and thin. In just over 200 pages, Browne distills decades of market experience into a manual that is both timeless and highly relevant for today’s investors.

Key Concepts and Ideas

The investment philosophy at the heart of "The Little Book of Value Investing" is rooted in the teachings of Benjamin Graham and Warren Buffett: buy businesses, not tickers, and always demand a margin of safety. Browne emphasizes that the stock market is often irrational in the short-term, creating opportunities for disciplined investors to buy quality companies at a discount. He warns against the dangers of speculation and herd mentality, highlighting that true value investing requires independent thinking and patience.

Browne’s approach is deeply practical. He believes that anyone can learn to invest successfully by focusing on a few key principles: understanding intrinsic value, buying at a discount, diversifying wisely, and maintaining emotional discipline. The book walks readers through the process of evaluating companies, managing risk, and avoiding the most common mistakes that derail investors. Browne’s guidance is grounded in decades of experience and supported by empirical studies that demonstrate the long-term outperformance of value strategies.

- Intrinsic Value: The cornerstone of value investing, intrinsic value is the true worth of a business based on its assets, earnings, and growth potential. Browne explains how to estimate intrinsic value using financial statements and why buying below this value is critical for success.

- Margin of Safety: This concept, popularized by Graham, is about buying with a buffer between the purchase price and the intrinsic value. It protects investors from errors in judgment or unforeseen events. For example, paying $66 for $1 of value means even if your estimate is off, you’re less likely to lose money.

- Low Price-to-Earnings (P/E) Ratios: Browne advocates for buying stocks with low P/E ratios, as they tend to outperform over the long term. He provides historical data showing that value stocks, defined by low P/E, consistently beat growth stocks in various market cycles.

- Diversification: While focus is important, Browne stresses the need to spread investments across industries and geographies to mitigate risk. He discusses global diversification, using examples of undervalued stocks found in Europe, Asia, and emerging markets.

- Financial Health: Before investing, Browne insists on a "physical exam" for companies—analyzing debt levels, profit margins, cash flow, and return on equity. He provides checklists and case studies to help readers avoid financially unstable firms.

- Insider Activity: Monitoring insider buying and selling can provide valuable signals. Browne cites examples where CEOs and CFOs bought large amounts of their own stock before price increases, and warns to be wary of persistent insider selling.

- Avoiding Value Traps: Not all cheap stocks are good investments. Browne teaches readers how to distinguish between true bargains and companies that are cheap for a reason, such as deteriorating fundamentals or poor management.

- Global Investing: Value isn’t confined to domestic markets. Browne explores how to find opportunities abroad, but also warns about currency risks, political instability, and the need for due diligence in unfamiliar markets.

- Emotional Discipline: The ability to remain calm during market volatility is essential. Browne references historical crashes and corrections, showing that patient value investors who buy during panics often achieve superior results.

- Continuous Learning: Browne encourages ongoing education, urging investors to study financial statements, read widely, and consult experts when venturing into complex industries like healthcare or technology.

Practical Strategies for Investors

Applying the lessons from "The Little Book of Value Investing" requires both discipline and a willingness to do the hard work of research. Browne provides a clear blueprint for how investors can implement value strategies in their own portfolios, regardless of experience level. His advice is actionable, emphasizing the importance of process over prediction and fundamentals over fads. He encourages investors to build habits—such as regular portfolio reviews and ongoing learning—that increase the odds of long-term success.

Browne also stresses that value investing is not about finding the next hot stock, but about consistently applying a rational framework to every investment decision. He advocates for a systematic approach: screen for undervalued stocks, perform rigorous financial analysis, and set clear buy and sell criteria. The practical strategies below are drawn directly from the book’s guidance and are designed for implementation in real-world portfolios.

- Screen for Low P/E Stocks: Use stock screeners to identify companies with P/E ratios below the market average. Focus on sectors or regions that are temporarily out of favor and compare earnings yields to bond yields for context.

- Estimate Intrinsic Value: Analyze a company’s balance sheet, income statement, and cash flow to estimate its true worth. Use conservative assumptions for growth and profitability to avoid overestimating value.

- Demand a Margin of Safety: Only buy when a stock trades at least 25-35% below your estimate of intrinsic value. Set strict entry points and be patient; do not compromise on this principle, even if opportunities seem scarce.

- Monitor Insider Transactions: Regularly review SEC filings for significant insider buying or selling. Give extra weight to purchases by CEOs, CFOs, and board chairs, and investigate the context behind any large sales.

- Perform a Financial Health Check: Before buying, assess debt/equity ratios, profit margins, return on equity, and free cash flow. Avoid companies with deteriorating fundamentals or excessive leverage, especially in volatile industries.

- Diversify Across Sectors and Geographies: Build a portfolio of 15-30 stocks across different industries and at least two or three geographic regions. This reduces the risk of catastrophic loss from sector-specific or country-specific events.

- Set Clear Sell Criteria: Plan to sell when a stock reaches or exceeds its intrinsic value, or if the company’s fundamentals deteriorate. Regularly review your holdings and avoid holding out of inertia or hope.

- Keep a Value Watchlist: Maintain a running list of companies that meet your value criteria but are not yet cheap enough to buy. Update your research quarterly and be ready to act when prices drop.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

"The Little Book of Value Investing" is structured as a series of concise, focused chapters, each addressing a core principle or practical aspect of value investing. Browne’s approach is to break down the process into digestible steps, using real-world examples and analogies to illustrate each point. The book follows a logical progression: starting with foundational concepts like intrinsic value and margin of safety, then moving into specifics such as financial analysis, diversification, and the psychological discipline required for long-term success.

Each chapter is self-contained, allowing readers to revisit key ideas as needed. Browne weaves in anecdotes from legendary investors, empirical studies, and his own experience managing billions in assets. The structure makes it easy for readers to apply the lessons incrementally, building a toolkit for value investing that can be adapted to any market environment. Below, we provide detailed analyses of all major chapters, highlighting the actionable insights and real-world relevance of each.

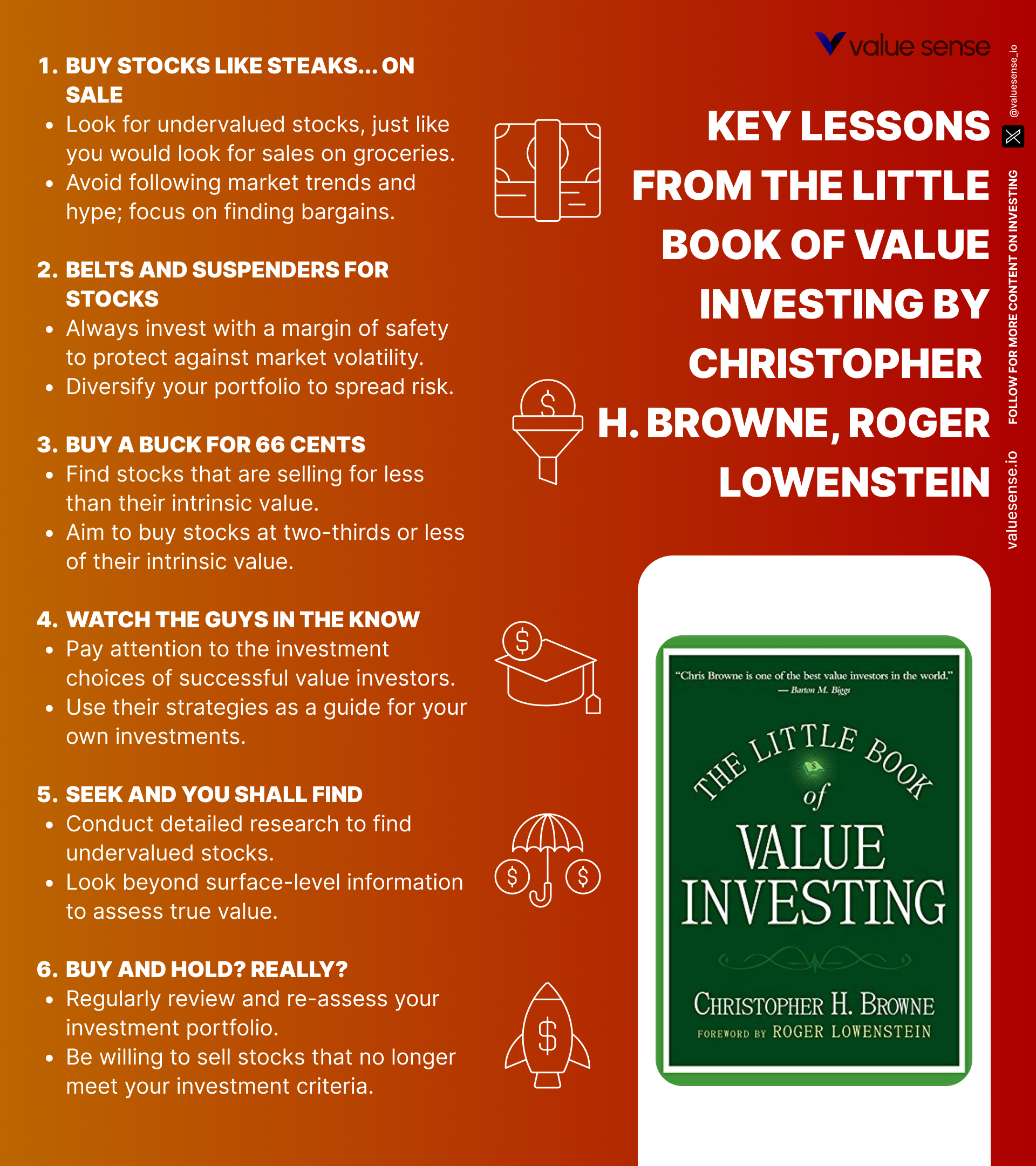

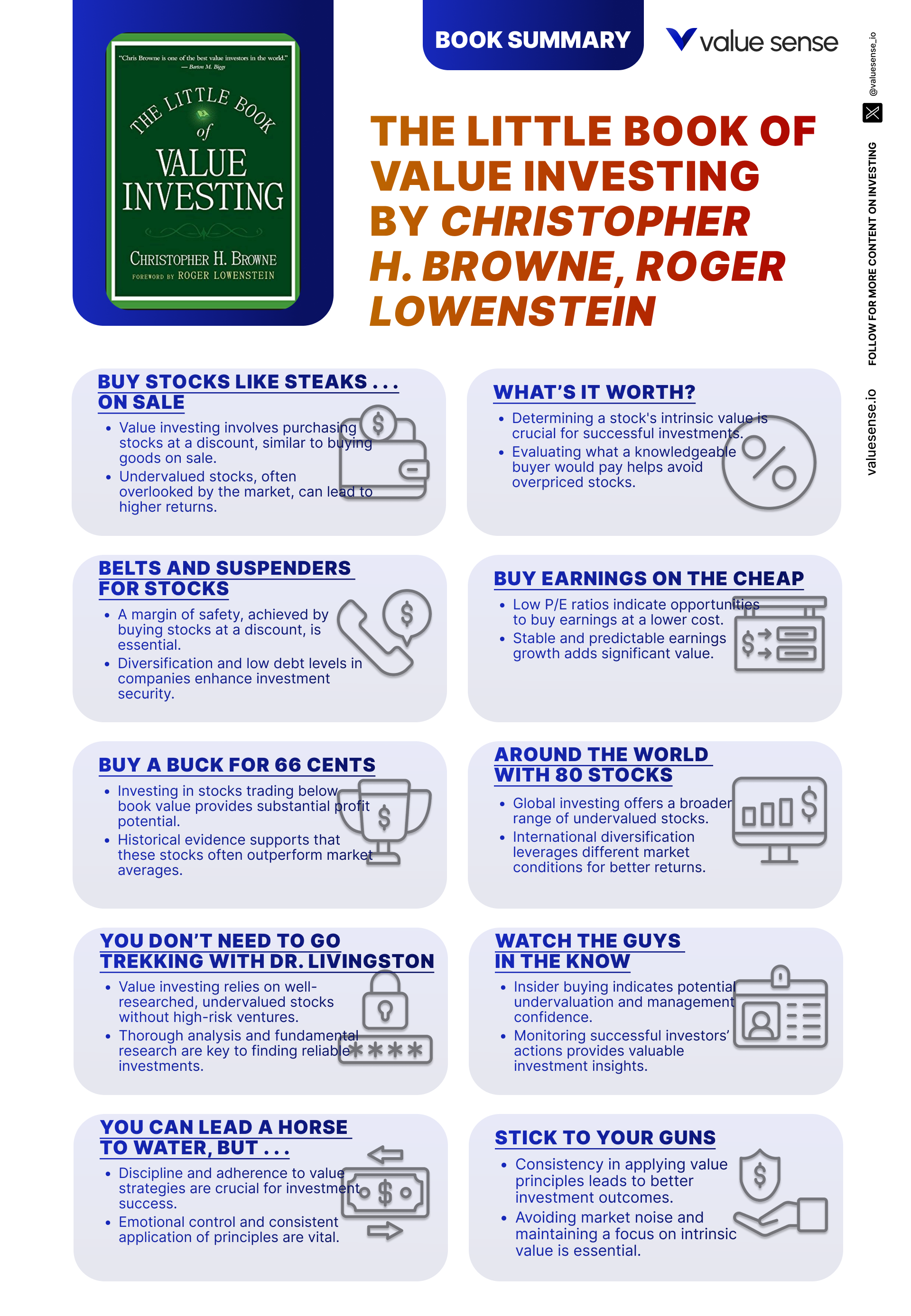

Chapter 1: Buy Stocks like Steaks... On Sale

The opening chapter sets the tone for the entire book, introducing the central metaphor that investing should be approached like shopping for groceries or steaks—buy only when there’s a sale. Browne draws a vivid parallel between the consumer’s instinct to seek bargains and the investor’s need to buy stocks below their intrinsic value. He points out that most people would never overpay for everyday items, yet the same discipline is often abandoned in the stock market. This disconnect, Browne argues, is where opportunity lies for the value investor. He cautions against the herd mentality, noting that following the crowd usually leads to buying at inflated prices, especially during market manias.

Browne supports his argument with historical data, referencing studies that show value investing has outperformed growth investing over the long term. He cites the work of Benjamin Graham and Warren Buffett, explaining how their disciplined approach led to market-beating returns. Browne also references the dot-com bubble of the late 1990s as a cautionary tale, where investors who chased hot tech stocks suffered significant losses, while value investors who waited for bargains were rewarded in the subsequent recovery. He introduces the concept of "margin of safety," explaining that buying at a discount provides a buffer against mistakes or unforeseen events.

For investors, the key takeaway is to develop a habit of patience and selectivity. Browne suggests building a watchlist of quality companies and waiting for their prices to fall below intrinsic value before buying. He emphasizes the importance of ignoring market hype and focusing on fundamentals. Investors can apply this lesson by setting strict buy criteria and resisting the urge to chase trends. Browne recommends reviewing financial statements and using valuation metrics like P/E ratios to assess whether a stock is truly "on sale."

The chapter’s real-world relevance is underscored by examples like the 2008 financial crisis, when many high-quality companies traded at steep discounts due to panic selling. Browne notes that investors who maintained discipline and bought during the downturn enjoyed substantial gains as markets recovered. He quotes Buffett: "Be fearful when others are greedy and greedy when others are fearful." This chapter establishes the psychological foundation for value investing and sets the stage for the analytical tools introduced in later chapters.

Chapter 2: What’s It Worth?

This chapter delves into the core concept of intrinsic value—the true, underlying worth of a business independent of its current market price. Browne explains that intrinsic value is determined by analyzing a company’s assets, earnings, and growth prospects. He stresses that the market price often deviates from intrinsic value due to fear, greed, or short-term news, creating opportunities for disciplined investors. Browne provides a step-by-step guide to estimating intrinsic value, advocating for conservative assumptions and a focus on tangible metrics such as book value, cash flow, and sustainable earnings.

To illustrate the dangers of overpaying, Browne references the tech bubble of 2000, when companies with little or no earnings traded at astronomical valuations. He points out that investors who bought into the hype suffered permanent capital losses when reality set in. By contrast, those who insisted on buying below intrinsic value were protected by a margin of safety. Browne quotes Graham: "Price is what you pay, value is what you get." He also discusses the use of discounted cash flow (DCF) analysis and asset-based valuation as tools for estimating intrinsic value, cautioning that all estimates involve some degree of uncertainty.

Investors should use intrinsic value as a rational benchmark for decision-making. Browne recommends creating a checklist of key metrics—such as price-to-book, price-to-earnings, and free cash flow yield—to compare a stock’s market price to its estimated value. He advises against relying on analyst forecasts or market sentiment, urging readers to do their own homework. Investors can apply this lesson by regularly updating their intrinsic value estimates and only buying when there is a significant gap between price and value.

Historically, the discipline of focusing on intrinsic value has helped investors avoid the worst excesses of market bubbles and crashes. Browne cites examples such as Buffett’s purchase of American Express during the Salad Oil Scandal of the 1960s, when the stock traded well below its intrinsic value due to temporary fears. The chapter reinforces the importance of independent thinking and rational analysis, which are the hallmarks of successful value investing.

Chapter 3: Belts and Suspenders for Stocks

In this chapter, Browne introduces the concept of "margin of safety" as a financial equivalent of wearing both a belt and suspenders—an extra layer of protection against unforeseen risks. He explains that the margin of safety is the difference between a stock’s intrinsic value and its purchase price. By insisting on this buffer, investors reduce the risk of permanent capital loss, even if their valuation estimates are slightly off. Browne emphasizes that the margin of safety is not just a mathematical concept but a mindset that prioritizes caution and prudence over speculation.

Browne provides specific examples of how a margin of safety can protect investors. He references companies like Johnson & Johnson and Procter & Gamble, which have strong balance sheets and stable earnings, making them less risky even during downturns. He warns against investing in highly leveraged companies, noting that excessive debt can quickly erode value in a crisis. Browne also discusses the importance of diversification as another form of safety net, spreading risk across industries and geographies.

To implement this principle, investors should set strict purchase criteria—such as only buying stocks that trade at least 30% below their estimated intrinsic value. Browne suggests using screening tools to identify candidates and then conducting a thorough financial analysis to confirm the margin of safety. He advises against stretching for returns by buying marginal companies or compromising on quality. Diversification should be achieved by holding 15-30 stocks across different sectors, avoiding over-concentration in any single area.

The margin of safety concept has proven its worth through multiple market cycles. Browne cites the example of the 2008 financial crisis, when value investors who insisted on a margin of safety suffered smaller losses and recovered more quickly than those who chased hot stocks. He also references the bankruptcy of companies like Lehman Brothers as a cautionary tale about the dangers of ignoring balance sheet risks. The chapter’s lessons are timeless, providing a framework for managing risk in any market environment.

Chapter 4: Buy Earnings on the Cheap

Here, Browne focuses on the importance of buying stocks with low price-to-earnings (P/E) ratios—a hallmark of value investing. He explains that earnings are the primary driver of stock prices over the long term, and paying a lower price for each dollar of earnings increases the potential for future gains. Browne presents historical data showing that portfolios of low P/E stocks have consistently outperformed high P/E growth stocks, citing studies that span several decades and multiple market cycles.

Browne provides practical guidance on how to use the P/E ratio and earnings yield (the inverse of P/E) to compare investment opportunities. He warns against relying on analyst forecasts, which are often overly optimistic or inaccurate, and instead recommends focusing on trailing earnings—actual results from the past year or two. Browne also suggests comparing a stock’s earnings yield to prevailing bond yields to assess relative value, a technique famously used by Buffett in the 1980s and 1990s.

Investors can apply this strategy by screening for stocks with P/E ratios below the market average, then conducting further analysis to ensure the company’s earnings are sustainable. Browne cautions that a low P/E ratio alone is not enough—investors must also assess the quality of earnings, the stability of the business, and the strength of the balance sheet. He recommends avoiding companies with erratic or declining earnings, as these may be value traps rather than true bargains.

The chapter’s lessons are supported by real-world examples, such as the strong performance of value stocks during the 1970s and 1980s, when high inflation and rising interest rates punished overpriced growth stocks. Browne also references the resurgence of value investing after the dot-com bust, when many low P/E stocks delivered outsized returns. The message is clear: buying earnings on the cheap is a reliable path to long-term wealth creation, provided investors remain disciplined in their analysis.

Chapter 5: Buy a Buck for 66 Cents

This chapter distills one of the most famous value investing maxims: aim to buy $1 of value for just 66 cents. Browne explains that the essence of value investing is purchasing assets at a substantial discount to their true worth, maximizing potential upside while minimizing downside risk. He provides concrete examples, such as buying companies with strong tangible assets, cash-rich balance sheets, or undervalued real estate, all of which can trade at significant discounts during periods of market pessimism.

Browne emphasizes that finding these opportunities requires patience and discipline. He recounts stories from his own career, including situations where he waited months or even years for a stock to fall to his target price. Browne warns against the temptation to compromise on price or quality, noting that overpaying—even for a good company—can lead to subpar returns or losses. He also discusses the psychological challenges of waiting for bargains, especially when markets are rising and others seem to be making easy money.

To implement this strategy, investors should maintain a watchlist of companies that meet their value criteria and set strict buy limits based on conservative estimates of intrinsic value. Browne recommends using a checklist to ensure that all key factors—financial health, management quality, industry outlook—are considered before making a purchase. He also suggests reviewing historical price-to-book and price-to-earnings ratios to gauge whether a stock is truly cheap relative to its own history and peers.

The principle of "buying a buck for 66 cents" has stood the test of time, as evidenced by the success of investors like Buffett, who famously bought shares of The Washington Post and GEICO at deep discounts in the 1970s. Browne notes that these opportunities are rare and often require the courage to act when others are fearful. The chapter reinforces the importance of patience, discipline, and a willingness to go against the crowd in pursuit of long-term value.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Around the World with 80 Stocks

In this chapter, Browne broadens the value investing lens to include global markets. He argues that value opportunities are not limited to domestic stocks and that international diversification can enhance returns while reducing risk. Browne provides examples of undervalued companies in Europe, Asia, and emerging markets, noting that different regions often experience cycles of popularity and neglect, creating opportunities for patient investors.

Browne discusses the benefits of global diversification, such as exposure to different economic conditions, currencies, and industries. He explains that investing abroad can help balance the risks associated with any one country or sector, especially during periods of domestic market stress. Browne also highlights the challenges of international investing, including currency fluctuations, political instability, and differing regulatory environments. He advises investors to conduct thorough research and consider using international funds or ETFs to gain exposure to unfamiliar markets.

To apply this lesson, investors should look beyond their home country for value opportunities, using screeners and research tools to identify undervalued stocks globally. Browne suggests starting with developed markets, where accounting standards and corporate governance are more transparent, before venturing into emerging markets. He also recommends hedging currency risk when appropriate and partnering with local experts or fund managers to navigate complex environments.

The chapter’s real-world context includes examples such as the European debt crisis, when many high-quality companies traded at steep discounts due to macroeconomic fears. Browne notes that global value investors who bought during these periods often enjoyed significant gains as conditions normalized. The lesson is clear: value can be found anywhere, but successful global investing requires diligence, adaptability, and a willingness to embrace complexity.

Chapter 7: You Don’t Need to Go Trekking with Dr. Livingston

Browne reassures investors that they do not need to venture into obscure or high-risk markets to find value. He argues that many attractive opportunities exist in familiar industries and regions, where investors have a better understanding of the business environment. Browne draws on the example of legendary investor Peter Lynch, who famously advocated for "investing in what you know." He warns against the allure of exotic or speculative investments, noting that these often carry higher risks and greater uncertainty.

The chapter emphasizes the importance of focusing on clear, understandable business models. Browne provides examples of companies like Coca-Cola, Walmart, and McDonald’s—firms with straightforward operations and long track records of profitability. He contrasts these with complex or opaque businesses, where even experienced analysts can struggle to assess value. Browne also discusses the trade-off between concentration and diversification, suggesting that a focused portfolio of well-understood, undervalued stocks can outperform a broadly diversified portfolio of unfamiliar names.

For investors, the practical takeaway is to prioritize depth over breadth. Browne recommends building expertise in a handful of industries or sectors and concentrating investments where you have the greatest confidence. He suggests using watchlists, regular research updates, and ongoing education to deepen understanding. Investors should avoid chasing returns in areas where they lack knowledge or conviction, as these bets are more likely to result in losses.

Historically, the strategy of focusing on familiar markets has produced strong results for investors like Buffett and Lynch, who built fortunes by sticking to their "circle of competence." Browne’s advice is especially relevant in today’s complex, fast-moving markets, where the temptation to chase the next big thing is ever-present. The chapter encourages discipline, humility, and a commitment to continuous learning.

Chapter 8: Watch the Guys in the Know

This chapter introduces the valuable practice of monitoring insider activity—buying and selling by company executives and directors. Browne explains that insiders often have superior knowledge of their company’s prospects, and significant insider buying can signal undervaluation. He provides examples where CEOs and CFOs purchased large quantities of stock before price increases, citing studies that show stocks with heavy insider buying tend to outperform over time.

Browne cautions, however, that not all insider transactions are equally informative. He notes that insiders may sell shares for reasons unrelated to the company’s prospects—such as diversification, taxes, or personal expenses. By contrast, large, coordinated purchases by multiple insiders are more likely to indicate genuine confidence in the company’s future. Browne recommends using public filings (such as SEC Form 4 in the US) to track insider activity and paying special attention to purchases by top executives and board chairs.

Investors can incorporate this strategy by adding insider activity to their research checklist. Browne suggests looking for patterns of sustained buying, particularly during periods of market weakness or company-specific challenges. He advises against making investment decisions based solely on insider activity, instead using it as a supplementary signal alongside fundamental analysis. Investors should also be wary of companies with persistent insider selling or where management has a history of poor capital allocation.

Real-world examples include Buffett’s purchase of shares in his own company, Berkshire Hathaway, during periods of undervaluation, and the heavy insider buying at companies like Apple and Microsoft before major product launches. The lesson is that while insider activity is not a foolproof indicator, it can provide valuable clues about where value may be hiding. Browne’s approach is balanced, emphasizing the need for context and corroborating evidence.

Chapter 9: Things That Go Bump in the Market

Browne tackles the topic of market volatility and external shocks, arguing that these events often create the best opportunities for value investors. He explains that during periods of panic—such as recessions, geopolitical crises, or financial scandals—high-quality companies can be sold off indiscriminately, creating bargains for patient buyers. Browne references historical market crashes, including the 1987 Black Monday and the 2008 financial crisis, as times when disciplined value investors made their best purchases.

The chapter stresses the importance of emotional discipline during turbulent markets. Browne cites studies showing that investors who panic and sell during downturns often miss the subsequent recovery, while those who buy when others are fearful achieve superior returns. He advocates for a long-term perspective, reminding readers that markets are inherently cyclical and that temporary declines are a normal part of investing. Browne also discusses the psychological challenges of buying during periods of widespread pessimism, noting that it takes courage and conviction to act when sentiment is negative.

Practically, investors should prepare for volatility by maintaining a margin of safety, holding cash reserves, and keeping a watchlist of target stocks. Browne recommends reviewing historical price charts and financial statements to identify companies with a track record of resilience during past crises. He also suggests setting pre-determined buy targets and automating purchases if possible, to avoid being paralyzed by fear in the heat of the moment.

The chapter’s lessons are illustrated by examples such as the recovery of blue-chip stocks after the 2008-2009 bear market and the rebound of consumer staples and healthcare companies during the COVID-19 pandemic. Browne quotes Buffett: "Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble." The message is clear: market turbulence is not to be feared, but embraced as a source of long-term value.

Chapter 10: Seek and You Shall Find

Browne encourages investors to be proactive in their search for value, emphasizing that successful value investing requires diligent research and effort. He dispels the myth that bargains will simply fall into your lap, arguing that the best opportunities are often hidden beneath the surface, overlooked by the majority of market participants. Browne provides a roadmap for finding undervalued stocks, including screening for low valuation metrics, reading annual reports, and analyzing industry trends.

The chapter highlights the importance of going against the crowd and looking where others are not. Browne references the concept of "unloved" stocks—companies that are temporarily out of favor due to negative news, short-term setbacks, or sector-wide pessimism. He provides examples of stocks that rebounded dramatically after being abandoned by the market, such as Ford during the 2008 crisis and various European banks after the sovereign debt panic.

Investors can apply these lessons by developing a systematic research process. Browne recommends setting aside regular time each week for stock screening and analysis, maintaining a database of potential candidates, and updating research as new information becomes available. He also suggests leveraging resources like Value Sense, screening tools, and industry publications to stay informed. Persistence and diligence are key—Browne notes that many great investments require months or even years of waiting.

The chapter’s real-world context includes the resurgence of value stocks in the late 2010s after a long period of underperformance, as well as the ongoing opportunities created by sector rotations and macroeconomic shifts. Browne’s advice is to remain vigilant, curious, and willing to do the hard work that others avoid. The rewards, he argues, go to those who seek—and find—value where others see only risk.

Chapter 11: Sifting Out the Fool’s Gold

In this chapter, Browne addresses the critical issue of value traps—stocks that appear cheap but are actually poor investments due to deteriorating fundamentals or flawed business models. He explains that not all low-priced stocks are bargains, and that thorough analysis is required to separate true value from "fool’s gold." Browne provides examples of companies that traded at low multiples for years due to persistent problems, such as declining industries, poor management, or unsustainable debt loads.

Browne outlines a checklist for avoiding value traps, including analysis of financial health, earnings quality, cash flow stability, and management integrity. He emphasizes the importance of looking beyond surface-level metrics, such as P/E or price-to-book, to assess whether a company’s problems are temporary or structural. Browne also discusses the role of industry trends, noting that secular declines—such as those in print media or coal mining—can render even the cheapest stocks unattractive.

To avoid value traps, investors should focus on companies with strong balance sheets, consistent profitability, and a clear path to recovery. Browne recommends conducting regular reviews of portfolio holdings, selling quickly if new information reveals deeper problems. He also suggests using stop-loss limits or position sizing to limit exposure to risky bets. Management quality is a key factor—Browne advises looking for leaders with a track record of shareholder-friendly decisions and operational excellence.

Historical examples include the collapse of Kodak, Blockbuster, and other companies that appeared cheap but ultimately failed due to disruptive technological change. Browne’s message is that discipline, skepticism, and a willingness to walk away are essential tools for the value investor. The chapter serves as a cautionary reminder that not all that glitters is gold, and that careful sifting is required to find genuine value.

Chapter 12: Give the Company a Physical

Browne likens the process of evaluating a company to giving it a physical examination. He insists that investors must thoroughly assess a company’s financial health before committing capital. This involves analyzing key metrics such as debt levels, profit margins, return on equity (ROE), and cash flow. Browne provides a detailed checklist for conducting this analysis, including specific thresholds for acceptable levels of leverage and profitability.

The chapter offers practical guidance on how to interpret financial statements. Browne explains the importance of strong, positive cash flow as an indicator of a company’s ability to fund operations, pay dividends, and invest in growth. He warns against companies with high levels of debt, especially in cyclical industries, noting that leverage can quickly become unmanageable during downturns. Browne also discusses the significance of profit margins and ROE, suggesting that investors look for companies with consistent or improving performance in these areas.

Investors can implement this approach by creating a standardized checklist for every potential investment. Browne recommends reviewing at least five years of financial data to identify trends and spot potential red flags. He also suggests comparing companies to industry peers to assess relative strength. The goal is to avoid financially unstable firms that may be at risk of bankruptcy or severe dilution.

Real-world examples include the collapse of Enron and WorldCom, both of which masked financial problems until it was too late for most investors. Browne’s advice is to dig deep, ask tough questions, and never take management’s statements at face value. The chapter reinforces the importance of due diligence and the role of financial analysis in protecting capital.

Chapter 13: Physical Exam, Part II

This chapter continues the theme of financial health, focusing on additional metrics such as inventory management, accounts receivable, and capital expenditures. Browne explains that high inventory levels can signal overproduction or declining demand, while low inventory may indicate efficient operations. He advises investors to monitor inventory turnover ratios to assess how effectively a company is managing its stock and sales.

Browne also discusses the importance of analyzing accounts receivable, noting that a large or growing balance may signal potential cash flow problems or issues with customer payments. He provides guidance on how to evaluate the quality of receivables and the likelihood of collection. Capital expenditures are another key focus—Browne suggests that investors examine a company’s investment in future growth and maintenance of existing assets, looking for evidence of prudent capital allocation.

To apply these lessons, investors should review detailed financial disclosures, including footnotes and management discussion sections. Browne recommends comparing capital expenditure trends to industry averages and assessing whether management is investing wisely or simply chasing growth for its own sake. Effective capital allocation is a hallmark of high-quality management and a key driver of long-term shareholder value.

Examples include the success of companies like Costco, which has consistently managed inventory and capital expenditures efficiently, resulting in strong free cash flow and shareholder returns. Conversely, firms with poor inventory control or reckless spending—such as Sears or General Electric in recent years—have suffered operational and financial setbacks. Browne’s message is that attention to detail and a focus on operational excellence are critical for value investors.

Chapter 14: Send Your Stocks to the Mayo Clinic

Browne extends the medical analogy by suggesting that investors periodically send their stocks for a "Mayo Clinic" level of scrutiny—a comprehensive, in-depth review that goes beyond basic financial metrics. This involves assessing qualitative factors such as management integrity, corporate governance, and industry dynamics. Browne argues that successful investing requires ongoing monitoring and a willingness to make changes when conditions deteriorate.

The chapter provides a framework for conducting these reviews, including checklists for evaluating board composition, shareholder rights, and transparency of disclosures. Browne emphasizes the importance of management integrity, citing examples where poor leadership led to disastrous outcomes for shareholders. He also discusses the role of corporate governance in protecting investor interests, highlighting best practices such as independent boards and clear succession plans.

Investors should schedule regular portfolio reviews—at least annually—to reassess each holding in light of new information. Browne suggests using both quantitative and qualitative criteria, and being willing to sell or reduce positions if a company no longer meets value standards. He also recommends engaging with management through earnings calls, investor days, and proxy voting to stay informed and influence outcomes where possible.

Real-world examples include the turnaround of Microsoft under Satya Nadella, whose focus on transparency and shareholder value transformed the company’s prospects, and the collapse of companies like Valeant Pharmaceuticals, where governance failures led to catastrophic losses. Browne’s advice is to treat investments as ongoing commitments, not set-and-forget bets, and to prioritize stewardship and accountability at all levels.

Chapter 15: We Are Not in Kansas Anymore! (When in Rome...)

This chapter explores the unique challenges and opportunities of international investing. Browne explains that value investing principles apply globally, but investors must adapt their strategies to account for differences in regulations, accounting standards, and market dynamics. He discusses the risks associated with currency fluctuations, political instability, and unfamiliar legal environments, providing examples from his own experience investing abroad.

Browne offers practical advice for mitigating these risks, such as hedging currency exposure, partnering with local experts, and focusing on developed markets with strong rule of law. He also recommends conducting thorough due diligence on local business practices and cultural norms, noting that what works in one country may not translate directly to another. Browne highlights the potential for finding undervalued opportunities in global markets, particularly during periods of crisis or neglect.

Investors can apply these lessons by starting with international funds or ETFs to gain exposure while building expertise. Browne suggests gradually expanding into individual foreign stocks as confidence and knowledge grow. He also advises monitoring geopolitical developments and adjusting portfolio allocations as needed to manage risk.

Examples include the recovery of European stocks after the sovereign debt crisis, the growth of Asian technology companies, and the challenges faced by investors in emerging markets during political upheavals. Browne’s message is that global diversification can enhance returns and reduce risk, but only for those willing to do the work of understanding and adapting to new environments.

Chapter 16: Trimming the Hedges

Browne discusses the role of hedging in value investing, explaining that while the primary focus should be on buying undervalued stocks, there are situations where hedging can protect against downside risk. He outlines common hedging strategies, including options, short selling, and inverse ETFs, but cautions that these tools can be complex and costly if not used judiciously.

The chapter emphasizes that hedging should be a strategic tool, not a default approach. Browne advises investors to focus on protecting against significant, identifiable risks rather than attempting to hedge every potential downside. He provides examples of situations where hedging was warranted, such as during periods of extreme market volatility or when holding concentrated positions in a single sector or geography.

To implement hedging effectively, investors should carefully assess the cost and potential impact on returns. Browne recommends using options to limit downside in high-volatility environments or to lock in gains on winning positions. He also suggests considering sector or market-wide hedges when macro risks are elevated, but warns against over-reliance on these tools, which can detract from the core principles of value investing.

Real-world examples include the use of put options during the 2008 financial crisis and the role of short selling in hedge fund strategies. Browne’s advice is to maintain a long-term focus and use hedging sparingly, ensuring that it complements rather than undermines the value approach. The chapter serves as a reminder that risk management is an integral part of investing, but should never replace the search for genuine value.

Chapter 17: It’s a Marathon, Not a Sprint

Browne underscores the importance of patience and a long-term perspective in value investing, likening the process to running a marathon rather than a sprint. He explains that it can take years for the market to recognize the true value of undervalued stocks, and that short-term performance is often driven by noise and sentiment rather than fundamentals. Browne cites studies showing that value strategies outperform over multi-year periods, but may lag during bull markets or speculative frenzies.

The chapter discusses the psychological challenges of staying the course during periods of underperformance. Browne references the experience of value investors during the late 1990s, when growth stocks dominated headlines and value strategies were temporarily out of favor. He notes that those who remained disciplined were ultimately rewarded when the bubble burst and fundamentals reasserted themselves.

Investors can apply this lesson by setting realistic expectations for returns and focusing on process rather than short-term outcomes. Browne recommends tracking performance over rolling three- to five-year periods and avoiding the temptation to chase hot sectors or abandon strategy after setbacks. He also suggests building a support network of like-minded investors to maintain discipline during challenging times.

Historical examples include Buffett’s patience with Berkshire Hathaway’s investments in Coca-Cola and American Express, both of which took years to realize their full potential. Browne’s message is clear: value investing requires endurance, resilience, and a willingness to wait for the market to catch up to reality. The rewards, he argues, go to those who persist.

Chapter 18: Buy and Hold? Really?

Browne addresses the merits and limitations of the buy-and-hold strategy within the context of value investing. While he acknowledges that holding quality stocks for the long term can be effective, he cautions against complacency. Browne argues that value investors should be willing to sell when a stock reaches its intrinsic value or when the underlying investment thesis changes. He provides examples of companies that became overvalued or experienced deteriorating fundamentals, noting that holding on in such cases can erode gains or result in losses.

The chapter provides a framework for regular portfolio reviews, recommending that investors reassess each holding at least annually. Browne suggests setting clear sell criteria—such as a target price based on intrinsic value, or specific financial or operational triggers. He also discusses the importance of reinvesting proceeds from sales into new value opportunities, keeping the portfolio aligned with core principles.

Investors can implement this approach by maintaining detailed records of purchase prices, intrinsic value estimates, and reasons for each investment. Browne recommends using checklists to guide sell decisions and avoiding emotional attachment to individual stocks. He also advises remaining flexible and adaptable, adjusting holdings as new information emerges or market conditions change.

Real-world examples include the decision by many value investors to sell technology stocks in the late 1990s as valuations became extreme, or to exit financials during the early stages of the 2008 crisis. Browne’s message is that buy and hold is a tool, not a dogma, and that active management—grounded in value principles—is essential for long-term success.

Chapter 19: When Only a Specialist Will Do

Browne discusses the importance of specialized knowledge in evaluating complex industries or sectors. He explains that certain areas, such as technology, healthcare, or energy, require a deeper understanding of industry dynamics, competitive advantages, and regulatory environments. Browne provides examples of costly mistakes made by investors who ventured into unfamiliar territory without the requisite expertise.

The chapter advises investors to either acquire the necessary knowledge or consult with experts when considering investments in specialized sectors. Browne suggests building expertise through ongoing education, industry conferences, and networking with professionals. He also recommends partnering with specialists or using sector-focused funds to gain exposure while mitigating risk.

For most investors, the practical takeaway is to focus on sectors and industries where they have a solid understanding and confidence in their ability to evaluate companies. Browne encourages gradual expansion into new areas, emphasizing the importance of humility and a willingness to seek help when needed. He warns against the temptation to chase returns in hot sectors without adequate preparation.

Historical examples include the rise and fall of biotech stocks, where scientific breakthroughs and regulatory changes can dramatically impact valuations. Browne’s message is that knowledge is power, and that informed investors are better equipped to identify genuine value and avoid costly errors. The chapter reinforces the importance of continuous learning and specialization in building a durable investment edge.

Chapter 20: You Can Lead a Horse to Water, But...

Browne reflects on the challenges of convincing others to adopt value investing principles, noting that the approach requires a disciplined, long-term mindset that may not appeal to everyone. He discusses the importance of investor education and the difficulty of overcoming short-term thinking and market hype. Browne shares anecdotes from his own experience trying to persuade clients and colleagues to embrace value strategies, often encountering resistance or skepticism.

The chapter emphasizes the importance of staying true to one’s investment philosophy, even when others do not understand or agree. Browne encourages readers to lead by example, demonstrating the benefits of value investing through their own success rather than trying to persuade through argument alone. He also advocates for sharing knowledge and resources, recognizing that not everyone will be receptive but that education is essential for spreading sound principles.

Investors can apply these lessons by maintaining discipline in their own portfolios and focusing on process rather than external validation. Browne suggests mentoring younger investors, participating in investment clubs, and contributing to educational initiatives. He also recommends documenting investment decisions and outcomes to build confidence and credibility over time.

Real-world examples include the gradual acceptance of value investing among institutional investors and the proliferation of value-oriented mutual funds and ETFs. Browne’s message is that while not everyone will embrace the approach, those who do are likely to achieve superior long-term results. The chapter serves as both encouragement and a call to action for value investors to share their knowledge and stay the course.

Chapter 21: Stick to Your Guns

In the final chapter, Browne reinforces the importance of adhering to value investing principles, especially during challenging market conditions or periods of underperformance. He acknowledges that value investing can be difficult at times, particularly when the market is driven by speculative behavior or when value stocks lag behind growth stocks. Browne draws on historical examples of market cycles, noting that discipline, patience, and perseverance are essential for long-term success.

The chapter discusses the psychological pressures faced by value investors, including fear of missing out, peer pressure, and the temptation to chase short-term gains. Browne provides strategies for maintaining confidence, such as reviewing past successes, tracking long-term performance, and engaging with a community of like-minded investors. He also emphasizes the importance of trusting in the process and the proven track record of value investing over decades.

Investors can implement these lessons by setting clear investment goals, documenting their strategy, and regularly reviewing their adherence to value principles. Browne recommends building routines and habits that reinforce discipline, such as scheduled portfolio reviews, ongoing education, and participation in investment forums. He also suggests celebrating milestones and successes to maintain motivation during tough periods.

Real-world context includes the resurgence of value investing after prolonged periods of underperformance, as seen in the early 2000s and again in the late 2010s. Browne’s message is that the rewards of value investing accrue to those who remain steadfast, even when the approach is out of favor. The chapter serves as a fitting conclusion, encapsulating the resilience and conviction required to succeed in the markets over the long haul.

Advanced Strategies from the Book

While "The Little Book of Value Investing" is accessible to beginners, Browne also introduces several advanced techniques for experienced investors seeking to refine their edge. These strategies build on the core principles of value investing, incorporating nuanced approaches to valuation, risk management, and portfolio construction. Browne’s advanced insights are grounded in decades of professional experience and are supported by empirical evidence and real-world case studies.

These techniques require a deeper understanding of financial analysis, behavioral finance, and market structure. Browne encourages investors to continually expand their toolkit, integrating advanced methods as their confidence and expertise grow. Below are four advanced strategies from the book, each explained with practical examples and guidance for implementation.

Strategy 1: Deep Value and Net-Net Investing

Deep value investing involves seeking out companies trading at or below their net current asset value (NCAV), a concept popularized by Benjamin Graham. Browne explains that these "net-net" stocks are typically small, neglected, or facing temporary challenges, but offer significant upside if the business stabilizes or liquidates. For example, during the aftermath of the 2008 financial crisis, several small-cap industrials and Japanese microcaps traded below net cash, providing outsized returns to patient investors. To implement this strategy, screen for companies with current assets minus all liabilities greater than the market capitalization, analyze liquidation value, and ensure adequate diversification to offset higher individual risk. Browne cautions that while net-net opportunities are rare in bull markets, they appear more frequently during periods of widespread pessimism or sector-specific distress.

Strategy 2: Special Situations and Event-Driven Value

Browne introduces the concept of investing in special situations—corporate events such as spin-offs, restructurings, or bankruptcies that can unlock hidden value. He cites examples like the 2011 split of Kraft and Mondelez, where investors who bought ahead of the event benefited from the market’s re-rating of the constituent businesses. Event-driven value investing requires careful analysis of legal documents, management intentions, and the likelihood of successful execution. Browne suggests focusing on situations where the sum of the parts is greater than the whole, or where a catalyst (such as activist involvement or regulatory approval) is likely to close the value gap. This strategy is best suited to experienced investors with the resources to conduct deep due diligence and the patience to wait for events to play out.

Strategy 3: Behavioral Arbitrage and Contrarian Investing

Behavioral finance plays a significant role in value investing, and Browne highlights the opportunities created by investor overreaction, panic selling, and herd behavior. Contrarian investing involves deliberately seeking out stocks that are out of favor due to temporary setbacks, bad news, or negative sentiment. Browne references the recovery of Ford in 2009, when the stock traded below $2 amid bankruptcy fears, only to rebound above $10 within two years as the company stabilized. To capitalize on behavioral inefficiencies, investors should track sentiment indicators, monitor short interest, and look for extreme price dislocations. Browne advises maintaining a disciplined checklist and being prepared to act when fear dominates the market, as these periods often produce the best bargains.

Strategy 4: Owner-Operator and Family-Controlled Companies

Browne points out that companies with significant insider ownership—especially those run by founders or families—often outperform due to better alignment of interests and long-term focus. He cites the example of Berkshire Hathaway under Buffett’s leadership, as well as European industrials like BMW and LVMH, which have benefited from stable, visionary ownership. Investors should look for firms where management has a substantial personal stake in the business and a track record of shareholder-friendly decisions. Browne recommends reviewing proxy statements, insider filings, and governance structures to identify owner-operator dynamics. This strategy can be especially effective in markets where agency problems and short-termism are prevalent.

Strategy 5: Dynamic Portfolio Rebalancing

Advanced value investors can enhance returns by dynamically rebalancing their portfolios based on changes in valuation, risk, and opportunity set. Browne suggests using quantitative models to track portfolio weights, intrinsic value gaps, and sector exposures, adjusting positions as conditions evolve. For example, during the 2020 COVID-19 crash, rebalancing into beaten-down sectors like travel and energy provided significant upside as markets recovered. Browne cautions that rebalancing should be disciplined and rules-based, avoiding emotional reactions or excessive trading costs. The goal is to maintain a portfolio that is consistently aligned with value principles and risk tolerance.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Getting started with value investing requires a combination of education, discipline, and practical action. Browne’s book provides a clear roadmap for building a value-oriented portfolio, but success depends on consistent execution and ongoing learning. The following steps are designed to help investors apply the book’s teachings in a systematic and effective manner.

Begin by setting clear investment goals and familiarizing yourself with the core principles of value investing. Use the checklists and frameworks provided in the book to evaluate potential investments, and commit to regular portfolio reviews and research updates. Remember that value investing is a journey, not a destination, and that success comes from incremental improvement over time.

- Start by reading and understanding the foundational chapters on intrinsic value and margin of safety.

- Build a watchlist of quality companies, screening for low P/E ratios, strong financial health, and clear business models.

- Set strict buy criteria, demanding at least a 25-35% discount to your estimate of intrinsic value before purchasing.

- Diversify your portfolio across sectors and geographies, aiming for 15-30 holdings to balance risk and opportunity.

- Monitor insider activity, financial statements, and news for each holding, updating your research quarterly.

- Conduct annual "Mayo Clinic" reviews of your portfolio, reassessing each company’s fundamentals, management, and governance.

- Remain patient and disciplined, resisting the urge to chase trends or abandon strategy during periods of underperformance.

Critical Analysis

"The Little Book of Value Investing" excels at distilling complex investment principles into clear, actionable guidance. Browne’s writing is accessible without being simplistic, and his use of real-world examples, historical data, and practical checklists makes the book a valuable resource for investors at all levels. The book’s structure—short, focused chapters—allows readers to absorb key lessons quickly and revisit them as needed. Browne’s emphasis on discipline, margin of safety, and financial health is both timeless and highly relevant in today’s volatile markets.

One limitation of the book is its brevity; while the concise format is a strength for accessibility, some readers may wish for deeper dives into advanced valuation techniques, sector-specific analysis, or case studies. The book occasionally assumes a basic familiarity with financial statements and valuation models, which may require supplemental reading for absolute beginners. Additionally, while Browne addresses global investing and special situations, these topics are covered at a high level and would benefit from more detailed exploration.

In the current market environment—characterized by rapid technological change, geopolitical uncertainty, and periodic bouts of speculation—the principles outlined in the book are more relevant than ever. Value investing has experienced periods of underperformance in recent years, but historical evidence suggests that discipline and patience are ultimately rewarded. Browne’s guidance provides a steady hand for investors seeking to navigate uncertainty and build wealth over the long term.

Conclusion

"The Little Book of Value Investing" is a masterclass in the art and science of buying stocks below their true worth. Christopher Browne’s decades of experience and clear writing make the book an essential resource for anyone seeking to build wealth through rational, evidence-based investing. The book’s core principles—intrinsic value, margin of safety, financial health, and emotional discipline—are timeless and universally applicable.

Whether you’re a novice investor or a seasoned professional, Browne’s insights will help you avoid common pitfalls, identify genuine bargains, and stay the course during turbulent markets. The practical strategies, checklists, and advanced techniques provide a comprehensive toolkit for implementing value investing in any environment. The book’s enduring relevance is a testament to the power of simplicity, patience, and independent thinking in achieving long-term financial success.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Value Investing

1. Who is Christopher H. Browne, and why should I trust his advice?

Christopher H. Browne was a managing director at Tweedy, Browne Company, a legendary value investment firm with direct ties to Benjamin Graham. He managed billions in client assets over several decades and was widely respected for his disciplined, rational approach to investing. Browne’s teachings are grounded in real-world experience and the proven principles of Graham and Buffett, making his advice highly credible for investors of all backgrounds.

2. What is the main message of The Little Book of Value Investing?

The core message is that investors should buy stocks for less than their intrinsic value, demand a margin of safety, and patiently wait for the market to recognize that value. Browne emphasizes discipline, independent thinking, and a systematic approach to evaluating companies, warning against speculation and herd mentality. The book provides practical steps and checklists for implementing value investing in any portfolio.

3. Is this book suitable for beginners, or do I need prior investing experience?

The book is highly accessible for beginners, with clear explanations, analogies, and step-by-step guidance. While some familiarity with basic financial statements is helpful, Browne’s writing is approachable and avoids jargon. Experienced investors will also find value in the book’s distilled wisdom, real-world examples, and advanced strategies.

4. How does Browne define "intrinsic value," and how can I estimate it?

Intrinsic value is the true worth of a company based on its assets, earnings, and growth prospects. Browne suggests estimating it using conservative assumptions, analyzing financial statements, and comparing metrics such as price-to-book, price-to-earnings, and discounted cash flow. He recommends focusing on tangible, measurable factors and avoiding reliance on analyst projections or market sentiment.

5. What is a "margin of safety," and why is it important?

A margin of safety is the buffer between a stock’s purchase price and its intrinsic value, protecting investors from errors in judgment or unforeseen events. Browne argues that buying with a margin of safety reduces the risk of permanent capital loss and increases the likelihood of long-term gains. He recommends demanding at least a 25-35% discount to intrinsic value before buying.

6. Does the book cover international investing and global diversification?

Yes, Browne dedicates several chapters to the benefits and challenges of global investing. He discusses how value opportunities exist worldwide and provides guidance on managing risks such as currency fluctuations and political instability. The book encourages investors to diversify across sectors and geographies while emphasizing the need for thorough research and local expertise.

7. How can I avoid value traps and distinguish genuine bargains from "fool’s gold"?

Browne provides a checklist for avoiding value traps, including analysis of financial health, earnings quality, cash flow stability, and management integrity. He warns that not all cheap stocks are bargains and emphasizes the importance of thorough due diligence. The book teaches readers to look beyond surface-level metrics and focus on companies with strong fundamentals and a clear path to recovery.

8. What role does emotional discipline play in value investing?

Emotional discipline is critical to value investing success. Browne explains that markets are often irrational, and investors must remain calm during volatility and resist the urge to chase trends or panic-sell. He provides strategies for maintaining discipline, such as regular portfolio reviews, checklists, and participation in investment communities.

9. Does Browne recommend a strict buy-and-hold strategy?

Browne recognizes the merits of buy-and-hold but cautions against holding indefinitely. He advises investors to sell when a stock reaches its intrinsic value or when the investment thesis changes. The book advocates for regular portfolio reviews and adaptability, ensuring that holdings remain aligned with value principles and long-term goals.

10. How can I start applying the lessons from this book in my own investing?

Begin by reading the foundational chapters, building a watchlist of quality companies, and setting strict buy criteria based on intrinsic value and margin of safety. Diversify across sectors and geographies, monitor insider activity, and conduct regular portfolio reviews. Stay patient, disciplined, and committed to continuous learning—success in value investing is a marathon, not a sprint.