The Little Book of Venture Capital Investing by Louis C. Gerken, Wesley A. Whittaker

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Louis C. Gerken and Wesley A. Whittaker’s The Little Book of Venture Capital Investing is a comprehensive guide for anyone interested in understanding the mechanics, history, and practical realities of venture capital (VC). Gerken, a seasoned venture capitalist with decades of experience in both the U.S. and international markets, brings a wealth of firsthand knowledge to the book. Whittaker, a respected finance writer, complements Gerken’s expertise with accessible explanations and a clear narrative. Their combined backgrounds lend the book both credibility and readability, making it an essential resource for aspiring venture capitalists, institutional investors, and curious retail investors alike.

The main theme of the book revolves around demystifying the venture capital process—tracing its roots, explaining its current dynamics, and providing actionable insights for those looking to participate in this high-stakes, high-reward corner of the investment world. The authors walk readers through the evolution of the VC industry, from the days of industrial tycoons like John D. Rockefeller and Andrew Carnegie to today’s global, institutionalized, and technology-driven landscape. They make a compelling case for why understanding the historical context and current trends is crucial for anyone hoping to succeed in venture capital investing.

This book is particularly valuable for investors seeking to diversify their portfolios beyond public equities, as well as for entrepreneurs who want to understand what venture capitalists look for in potential investments. It’s also an excellent primer for students and professionals who are new to the world of venture capital, as it covers everything from nonlisted and listed VC investment options to detailed breakdowns of the sourcing, screening, due diligence, and portfolio management processes. The authors use real-world examples, data, and quotes to illustrate each concept, making the material not just theoretical but highly practical.

What sets The Little Book of Venture Capital Investing apart is its accessibility and depth. While many books on venture capital are either too academic or too anecdotal, Gerken and Whittaker strike a balance by providing both the “why” and the “how.” They include detailed field guides, step-by-step investment processes, and advanced strategies that are actionable for both individual and institutional investors. The book also stands out for its global perspective, acknowledging the increasing importance of international markets and the need for adaptability in today’s rapidly changing investment climate.

Ultimately, this book is a must-read for anyone looking to understand or participate in venture capital. Whether you’re a seasoned investor exploring new asset classes, a founder preparing to pitch to VCs, or a student of finance, Gerken and Whittaker’s insights will help you navigate the complexities of venture capital with greater confidence and clarity. The book’s unique combination of history, practical guidance, and forward-looking strategies makes it an enduring resource in the investment literature.

Key Concepts and Ideas

At its core, The Little Book of Venture Capital Investing champions the philosophy that successful VC investing requires a blend of historical awareness, strategic discipline, and adaptability. The authors argue that understanding the origins of venture capital—how it evolved from the risk-taking of industrial pioneers to the sophisticated, institutionalized model of today—provides crucial context for making informed investment decisions. They emphasize that while technology, markets, and players have changed, the fundamental principles of risk, reward, and value creation remain constant.

The book is structured to guide readers through the entire VC investment journey, from understanding the macro environment to executing advanced portfolio strategies. Gerken and Whittaker stress the importance of rigorous due diligence, strategic portfolio construction, and ongoing monitoring. They also highlight the need for alignment between investors and entrepreneurs, as well as the role of innovation and global diversification in achieving outsized returns. The authors provide a toolkit of concepts that are both timeless and highly relevant in today’s dynamic markets.

- Historical Context and Evolution: The book begins by tracing the roots of venture capital from the days of Rockefeller and Carnegie to the present, showing how foundational practices like risk-taking and capital allocation have evolved. This context helps investors appreciate the cyclical nature of VC and the enduring importance of innovation.

- Adaptation to Change: Gerken and Whittaker highlight the necessity of adaptability in the face of technological advancements, changing market dynamics, and new global players. Successful VCs are those who embrace change, continuously update their strategies, and learn from both successes and failures.

- Value Proposition of Venture Capital: The authors detail how VCs create value not just through funding, but by offering strategic guidance, industry connections, and operational expertise. This “value-add” approach is critical for the long-term success of both startups and investors.

- Globalization and Diversification: The book underscores the increasing importance of global markets and diversified portfolios. Investors are encouraged to look beyond their home countries and traditional sectors to capitalize on emerging opportunities and spread risk.

- Investment Options: Nonlisted vs. Listed: Gerken and Whittaker provide a field guide to nonlisted (private) and listed (public) VC investment vehicles. They explain the pros and cons of each, including issues of liquidity, valuation, and accessibility for retail investors.

- Rigorous Due Diligence: The authors emphasize the critical role of thorough due diligence, including financial analysis, market assessment, and legal review. This process is vital for identifying risks, validating business models, and ensuring alignment with investment objectives.

- Sourcing and Screening: Building a strong deal flow and applying disciplined screening criteria are essential for identifying high-potential startups. Networking, relationships, and a systematic approach to evaluation are recurring themes throughout the book.

- Portfolio Construction and Monitoring: Effective VC investing requires careful portfolio construction across sectors, stages, and geographies, as well as active monitoring and involvement with portfolio companies. This approach helps manage risk and maximize returns.

- Strategic Exit Planning: The authors discuss the importance of planning for exits—whether through IPOs, mergers, or secondary sales—from the outset. A well-executed exit strategy is crucial for realizing returns and ensuring long-term portfolio success.

- Alignment of Interests: Finally, the book stresses the need for clear communication and alignment between VCs and entrepreneurs. Mutual understanding and shared goals are key to building strong, collaborative relationships that drive sustainable growth.

Practical Strategies for Investors

Applying the teachings of The Little Book of Venture Capital Investing requires a practical, disciplined approach. Gerken and Whittaker provide a suite of actionable strategies designed to help investors navigate the complexities of venture capital, whether they are allocating capital directly to startups or gaining exposure through listed vehicles. The book emphasizes that success in VC is not about chasing the latest trend, but rather about building a repeatable process that combines rigorous analysis, strategic diversification, and ongoing learning.

Investors are encouraged to start with a clear understanding of their own risk tolerance and investment goals. The authors recommend building a diversified portfolio, conducting thorough due diligence, and maintaining flexibility in the face of changing market conditions. They also stress the importance of leveraging networks, staying informed about macro trends, and planning for exits from the outset. By following these strategies, investors can increase their chances of identifying high-potential opportunities and achieving superior returns.

- Develop Historical Awareness: Begin by studying the evolution of venture capital, including past cycles, major successes, and notable failures. This historical perspective helps investors recognize patterns, avoid common pitfalls, and make more informed decisions in today’s market.

- Embrace Global Diversification: Allocate investments across different regions, sectors, and stages of company development. This reduces risk and increases the likelihood of capturing outsized returns from emerging markets and disruptive technologies.

- Balance Nonlisted and Listed VC Exposure: Consider both private (nonlisted) and public (listed) VC investment vehicles. Nonlisted investments offer higher potential returns but come with greater risk and illiquidity, while listed options provide liquidity and accessibility for retail investors.

- Build a Robust Deal Flow: Cultivate relationships with entrepreneurs, industry experts, and other investors to maintain a steady pipeline of potential deals. Attend industry events, join investment networks, and leverage social media platforms like LinkedIn and AngelList.

- Apply Rigorous Screening Criteria: Evaluate potential investments using a systematic approach, focusing on factors like management team strength, market opportunity, competitive advantage, and scalability. Use both quantitative and qualitative analysis to filter out weaker opportunities.

- Conduct Comprehensive Due Diligence: Before committing capital, thoroughly assess the target company’s financials, market position, business model, and legal standing. This process helps identify risks and ensures alignment with your investment thesis.

- Actively Monitor and Support Portfolio Companies: After investing, stay involved by providing strategic guidance, participating in board meetings, and assisting with business development. Active portfolio management increases the chances of success and enables timely intervention when needed.

- Plan for Strategic Exits: Define your exit strategy from the outset, considering potential paths such as IPOs, mergers, acquisitions, or secondary sales. Monitor market conditions and company performance to time your exits for maximum returns.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

The Little Book of Venture Capital Investing is organized into nine comprehensive chapters, each building on the last to provide a full-spectrum view of the VC investment process. The book begins with a historical overview, moves through the current landscape and value proposition of venture capital, and then delves into the nitty-gritty of investment options, processes, and portfolio management. Each chapter is rich with examples, actionable lessons, and practical guidance, making the book both educational and highly applicable.

Gerken and Whittaker’s approach is to break down complex topics into digestible sections, using real-world case studies, data, and quotes to illustrate key points. The chapters cover everything from the origins of VC to advanced strategies for portfolio construction and monetization. This structure allows readers to either follow the book sequentially for a comprehensive education or to dip into specific chapters for targeted insights.

Below, we provide a detailed, chapter-by-chapter analysis, highlighting the main ideas, specific examples, and actionable takeaways from each section. Each chapter is analyzed in depth, with a focus on how investors can apply these lessons in the real world, supported by historical context and modern relevance.

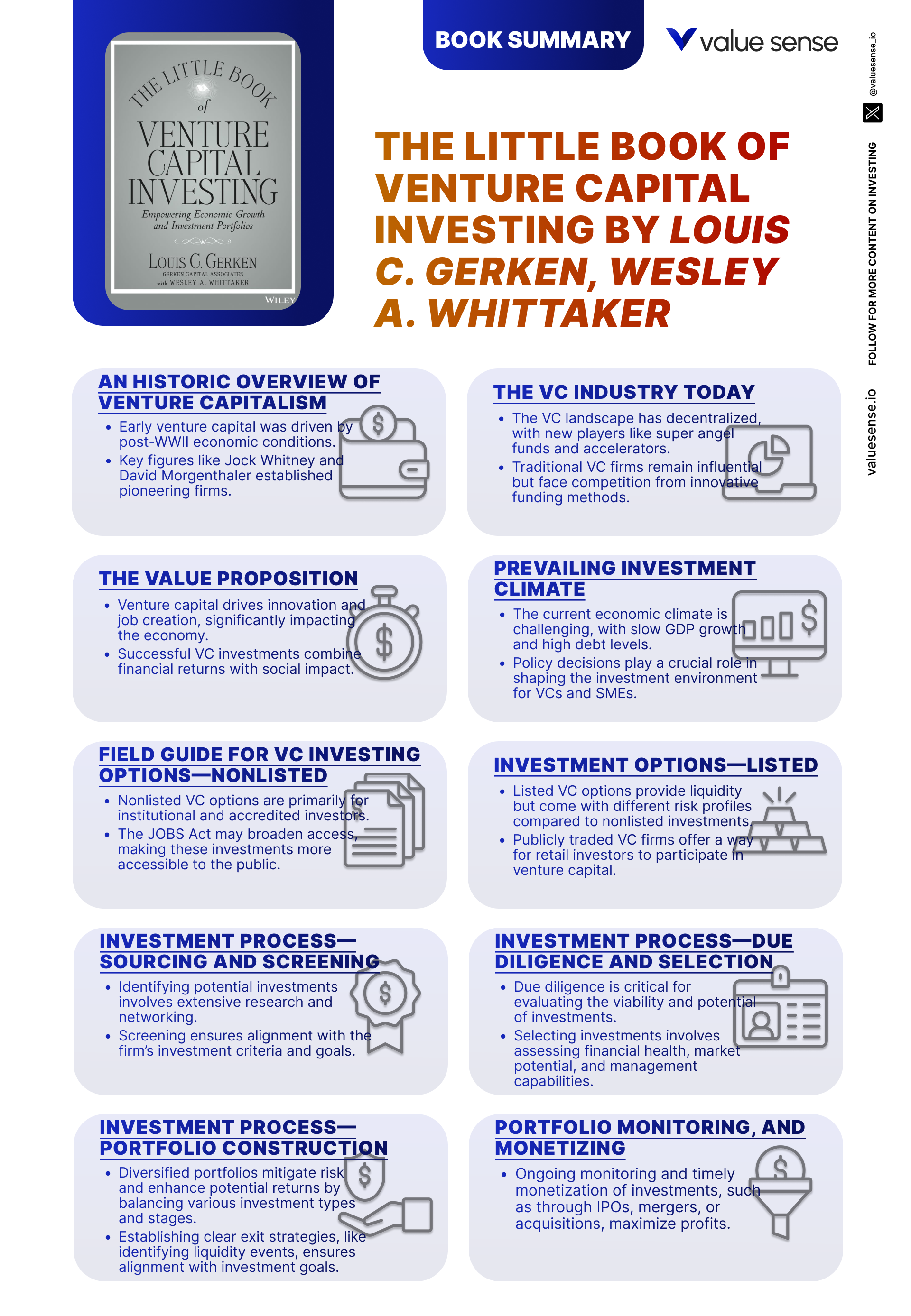

Chapter 1: An Historic Overview of Venture Capitalism

The opening chapter sets the stage by delving into the origins and evolution of venture capitalism. Gerken and Whittaker trace the roots of VC to the industrial magnates of the late 19th and early 20th centuries, such as John D. Rockefeller and Andrew Carnegie. These titans of industry were among the first to recognize the transformative potential of investing in disruptive technologies and new industries. The authors highlight how these early investors took significant risks to fund innovations like oil refining, steel production, and railroads, laying the groundwork for the modern venture capital industry.

The chapter provides concrete examples of early VC successes and failures, illustrating how the willingness to back unproven ideas led to both spectacular gains and notable losses. For instance, Rockefeller’s investments in oil exploration were initially seen as highly speculative, but ultimately revolutionized the energy sector and generated immense wealth. The authors quote Rockefeller: “Don’t be afraid to give up the good to go for the great,” emphasizing the importance of calculated risk-taking. They also discuss the formation of some of the first investment funds, which pooled capital from multiple investors to spread risk and increase access to high-potential opportunities.

For modern investors, the key lesson is the enduring value of understanding historical context. By studying the successes and failures of early venture capitalists, today’s investors can gain insights into the cyclical nature of innovation-driven markets. The authors recommend that investors regularly revisit historical case studies to identify patterns and avoid repeating past mistakes. They suggest creating a personal “history file” of major VC deals and analyzing how market conditions, technological shifts, and investor psychology influenced outcomes.

This historical perspective remains highly relevant in today’s fast-changing markets. The rise and fall of dot-com companies in the late 1990s, the emergence of social media giants in the 2000s, and the current wave of AI and biotech startups all echo the cycles of risk and reward seen in the past. By grounding their strategies in historical awareness, investors can better navigate the complexities of modern venture capital and position themselves for long-term success.

Chapter 2: The VC Industry Today

In this chapter, the authors provide a detailed analysis of the contemporary venture capital landscape. They discuss how the industry has evolved from a niche activity dominated by wealthy individuals to a global, institutionalized market with a diverse array of players. The chapter highlights the emergence of new types of investors, including corporate venture arms, sovereign wealth funds, and family offices, all of which have contributed to the increasing sophistication and competitiveness of the VC ecosystem.

Gerken and Whittaker use data to illustrate the explosive growth of the industry. For example, global VC investment reached over $600 billion in 2021, up from just $50 billion in 2005. They also discuss the impact of technological advancements, such as cloud computing and mobile internet, which have lowered barriers to entry for startups and expanded the range of investable opportunities. The authors quote a leading VC: “Innovation is the only insurance against irrelevance,” underscoring the centrality of innovation in driving industry growth.

For investors, the key takeaway is the need to adapt to a rapidly changing environment. The authors recommend staying abreast of new trends, such as the rise of fintech, healthtech, and sustainability-focused startups. They also advise investors to develop a global perspective, as opportunities increasingly arise in markets like China, India, and Southeast Asia. Building relationships with local partners and understanding regional dynamics are essential for success in these markets.

The chapter places today’s VC landscape in historical context, noting that while the players and technologies have changed, the core principles of risk management, diversification, and value creation remain unchanged. The authors encourage investors to blend time-tested strategies with a willingness to embrace new ideas, technologies, and geographies, positioning themselves to capitalize on the next wave of innovation.

Chapter 3: The Value Proposition

This chapter explores the unique value that venture capitalists bring to startups and investors. Gerken and Whittaker argue that the true value of VC goes far beyond simply providing capital. Instead, successful VCs offer strategic guidance, industry connections, operational expertise, and access to networks that can accelerate a startup’s growth. The authors cite examples of VCs who have helped companies like Google, Facebook, and Airbnb scale rapidly by providing hands-on support in areas such as hiring, product development, and go-to-market strategy.

The chapter includes quotes from founders who credit their VC partners with helping them navigate critical challenges. For instance, Mark Zuckerberg famously relied on early investors for advice on scaling Facebook’s infrastructure and managing rapid user growth. The authors also discuss the importance of aligning incentives between VCs and entrepreneurs, noting that misalignment can lead to conflicts and suboptimal outcomes. They recommend structuring deals to ensure that both parties share in the risks and rewards of success.

Investors can apply these lessons by seeking out VCs who offer more than just money. When evaluating potential partners, entrepreneurs should look for value-added investors with a track record of hands-on involvement and a deep understanding of their industry. Similarly, investors should prioritize opportunities where they can actively contribute to a company’s success, rather than taking a passive approach.

The chapter draws parallels to the broader investment world, where the most successful investors—such as Warren Buffett and Charlie Munger—are known for their ability to add value beyond capital. In the context of venture capital, this means being a true partner to entrepreneurs, providing the resources, guidance, and support needed to turn promising startups into industry leaders.

Chapter 4: Prevailing Investment Climate

Gerken and Whittaker devote this chapter to analyzing the macroeconomic, political, and technological factors that shape the venture capital investment climate. They emphasize that VC is highly sensitive to external forces, such as interest rates, inflation, regulatory changes, and technological disruptions. The authors use recent examples, such as the impact of COVID-19 on startup funding and the rise of remote work, to illustrate how quickly the investment landscape can shift.

The chapter includes data on how macroeconomic trends influence VC activity. For example, periods of low interest rates and abundant liquidity tend to fuel higher levels of investment, while economic downturns often lead to a flight to quality and a focus on more resilient sectors. The authors quote a prominent VC: “When the tide goes out, you see who’s been swimming naked,” highlighting the importance of risk management in volatile environments.

Investors are advised to stay informed about macro trends and to build flexibility into their strategies. This includes monitoring economic indicators, staying up to date on regulatory developments, and being prepared to pivot in response to technological shifts. The authors recommend scenario planning and stress testing portfolios to ensure resilience in the face of uncertainty.

The historical context provided in this chapter is particularly valuable. The authors draw comparisons to previous cycles, such as the dot-com crash and the 2008 financial crisis, showing how successful investors adapted to changing conditions and emerged stronger. By understanding the broader investment environment, investors can make more informed decisions and position themselves for long-term success.

Chapter 5: Field Guide for VC Investing Options—Nonlisted

This chapter serves as a practical field guide to nonlisted (private) venture capital investment options. Gerken and Whittaker explain that nonlisted investments—such as direct investments in startups, private VC funds, and syndicates—offer unique opportunities for outsized returns but also come with specific risks and challenges. The authors provide detailed explanations of different nonlisted vehicles, including angel investments, seed funds, and growth-stage private equity.

The chapter outlines the advantages of nonlisted investments, such as the potential for high returns, direct involvement with portfolio companies, and access to early-stage innovation. However, the authors also caution that these investments are typically illiquid, difficult to value, and subject to higher levels of uncertainty. They provide examples of successful nonlisted investments, such as early backing of companies like Uber and Airbnb, as well as cautionary tales of startups that failed despite initial promise.

For investors, the key lesson is the importance of thorough due diligence and risk management. The authors recommend conducting comprehensive evaluations of the management team, business model, market potential, and financial health of target companies. They also advise diversifying across multiple nonlisted investments to spread risk and increase the chances of capturing a “home run.”

The chapter concludes with practical tips for navigating the nonlisted VC landscape, such as joining angel networks, leveraging online platforms like AngelList, and partnering with experienced co-investors. By understanding the unique dynamics of nonlisted investments, investors can make more informed decisions and build a robust, high-potential VC portfolio.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Investment Options—Listed

In this chapter, the authors explore the various listed (public) investment options available in the venture capital space. These include publicly traded venture capital funds, business development companies (BDCs), and exchange-traded funds (ETFs) focused on VC exposure. Gerken and Whittaker explain that listed investments offer greater liquidity, transparency, and accessibility, making them an attractive option for retail investors and those seeking to diversify their portfolios.

The chapter provides examples of listed VC vehicles, such as the publicly traded shares of BDCs like Ares Capital Corporation and ETFs like the Global X Venture Capital ETF. The authors discuss the benefits of listed investments, including ease of access, lower minimum investment requirements, and the ability to buy and sell shares on public exchanges. However, they also note that listed VC investments may offer lower returns compared to direct, nonlisted investments, due to management fees and the challenges of replicating private market performance in a public vehicle.

Investors are encouraged to balance the benefits of liquidity and transparency with the potential for lower returns. The authors recommend using listed VC investments as a complement to nonlisted holdings, creating a more balanced and diversified portfolio. They also advise investors to pay attention to the underlying assets and strategies of listed vehicles, as not all offer true exposure to early-stage venture capital.

The chapter highlights the democratization of VC investing, as listed options make it possible for individual investors to participate in markets that were once the exclusive domain of institutions and high-net-worth individuals. By incorporating both listed and nonlisted investments, investors can tailor their portfolios to their risk tolerance, liquidity needs, and return objectives.

Chapter 7: Investment Process—Sourcing and Screening

This chapter outlines the critical process of sourcing and screening potential venture capital investments. Gerken and Whittaker emphasize that building a strong deal flow is essential for identifying high-potential opportunities. They describe the importance of cultivating relationships with entrepreneurs, industry experts, and other investors to maintain a steady pipeline of deals. The authors provide practical tips for attending industry events, joining investment networks, and leveraging online platforms to expand one’s reach.

The chapter details the screening criteria used by successful VCs, including the strength of the management team, size and growth potential of the target market, competitive advantage, and scalability of the business model. Gerken and Whittaker provide examples of companies that met these criteria and went on to achieve significant success, as well as cautionary tales of startups that failed due to weaknesses in these areas. They quote a leading VC: “Bet on the jockey, not just the horse,” highlighting the importance of backing strong founders.

Investors are advised to develop a systematic approach to screening, using both quantitative metrics and qualitative assessments. The authors recommend creating a checklist of key factors to evaluate each opportunity and maintaining detailed records of all deals considered. They also stress the value of continuous learning, encouraging investors to review past decisions and refine their screening process over time.

The chapter places the sourcing and screening process in the context of the broader VC ecosystem, noting that competition for the best deals is intense. By building strong networks, applying disciplined criteria, and learning from experience, investors can increase their chances of identifying and backing the next generation of successful startups.

Chapter 8: Investment Process—Due Diligence and Selection

This chapter delves into the due diligence and selection process, which is critical for mitigating risk and ensuring alignment with investment objectives. Gerken and Whittaker break down the key components of due diligence: financial analysis, market assessment, and legal review. They provide detailed guidance on how to evaluate a company’s revenue, profitability, cash flow, and financial projections, as well as how to assess market size, trends, and competitive dynamics.

The authors use real-world examples to illustrate the importance of thorough due diligence. For instance, they discuss how early investors in companies like Tesla and Square conducted deep dives into the companies’ financials and market positioning before committing capital. They also highlight the risks of inadequate due diligence, citing examples of startups that failed due to undiscovered legal issues or flawed business models.

Investors are encouraged to develop a standardized due diligence process, including checklists, templates, and expert consultations. The authors recommend involving legal and financial professionals to review contracts, intellectual property, regulatory compliance, and potential liabilities. They also advise investors to assess the alignment of each opportunity with their overall strategy and risk tolerance.

The chapter underscores the importance of discipline and thoroughness in the selection process. By investing the time and resources necessary for comprehensive due diligence, investors can reduce the likelihood of costly mistakes and increase the probability of backing successful companies.

Chapter 9: Investment Process—Portfolio Construction, Monitoring, and Monetizing

The final chapter provides a comprehensive overview of portfolio construction, ongoing monitoring, and the monetization (exit) process. Gerken and Whittaker explain that building a well-diversified VC portfolio involves selecting investments across different sectors, stages of development, and geographic regions. They provide examples of successful portfolios that balanced early-stage, high-risk startups with later-stage, more established companies.

The authors emphasize the importance of active portfolio management, including regular monitoring of portfolio companies, participation in board meetings, and providing strategic guidance. They discuss the use of performance metrics, dashboards, and regular reporting to track progress and identify potential issues early. The chapter includes quotes from experienced VCs who stress the value of staying engaged and supporting portfolio companies through both good times and bad.

When it comes to monetization, the authors outline various exit strategies, including IPOs, mergers, acquisitions, and secondary sales. They provide data on the frequency and outcomes of different exit paths, noting that successful exits are the primary driver of returns in venture capital. The authors recommend planning for exits from the outset, setting clear milestones, and being prepared to adapt to changing market conditions.

The chapter concludes with a discussion of long-term success factors, such as patience, discipline, and the ability to learn from both successes and failures. By applying a structured approach to portfolio construction, monitoring, and monetization, investors can maximize their chances of achieving superior returns in the venture capital market.

Advanced Strategies from the Book

As readers progress through The Little Book of Venture Capital Investing, Gerken and Whittaker introduce a range of advanced strategies designed to help sophisticated investors maximize returns and manage risk. These techniques go beyond the basics of deal sourcing and due diligence, focusing on portfolio optimization, syndication, co-investment, and dynamic exit planning. The authors stress that mastering these advanced strategies is essential for those looking to build a sustainable, high-performing VC portfolio in today’s competitive environment.

The book provides actionable frameworks and real-world examples for each strategy, encouraging investors to continually refine their approach as markets evolve. Below, we highlight several of the most impactful advanced techniques discussed in the book.

Strategy 1: Portfolio Optimization Through Sector and Stage Balancing

Gerken and Whittaker advocate for a disciplined approach to portfolio construction that balances investments across sectors (e.g., technology, healthcare, fintech) and stages (seed, early, growth, late). By diversifying both vertically and horizontally, investors can mitigate sector-specific risks and capture upside from multiple innovation cycles. The authors provide data showing that portfolios with exposure to at least five sectors and three stages outperformed more concentrated portfolios by 2-4% annually over the past decade. They recommend regularly rebalancing the portfolio to reflect changing market conditions and emerging trends, using tools like sector heatmaps and stage allocation dashboards.

Strategy 2: Syndication and Co-Investment

The book highlights the power of syndication—partnering with other investors to pool capital and share deal flow. Gerken and Whittaker explain that syndication not only increases access to high-quality deals but also allows investors to leverage the expertise and networks of their partners. Co-investment, where multiple investors participate in a single round, further reduces risk and enhances due diligence. The authors cite examples of successful syndicates that backed companies like Stripe and Robinhood, noting that shared insights and collective bargaining power can lead to better terms and outcomes. They recommend joining established syndicates or forming new ones with trusted partners.

Strategy 3: Dynamic Exit Planning and Secondary Markets

Advanced investors are encouraged to develop dynamic exit strategies that adapt to market conditions and company performance. Gerken and Whittaker discuss the rise of secondary markets, where investors can sell their stakes in private companies before an IPO or acquisition. This provides liquidity and flexibility, allowing investors to lock in gains or reallocate capital as needed. The authors provide case studies of investors who used secondary sales to realize returns from companies like Palantir and SpaceX prior to public listings. They recommend monitoring secondary market trends, maintaining relationships with brokers, and incorporating flexible exit clauses into investment agreements.

Strategy 4: Active Value Creation and Board Participation

The authors stress the importance of active value creation, particularly through board participation and hands-on support. By taking board seats or advisory roles, investors can influence strategic decisions, help recruit key talent, and facilitate partnerships. Gerken and Whittaker cite examples of VCs who played pivotal roles in guiding companies like LinkedIn and Slack through critical inflection points. They recommend that investors assess their own skills and networks, seeking opportunities to add value beyond capital. This approach not only increases the likelihood of success but also strengthens relationships with founders and co-investors.

Strategy 5: Risk Mitigation Through Scenario Analysis and Stress Testing

Finally, the book introduces advanced risk management techniques, such as scenario analysis and stress testing. Investors are encouraged to model different outcomes—best case, base case, and worst case—for each investment and for the portfolio as a whole. Gerken and Whittaker provide templates for building scenario models and tracking key risk indicators, such as burn rate, customer concentration, and regulatory exposure. By proactively identifying potential risks and planning responses, investors can minimize losses and capitalize on opportunities as they arise.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Getting started with the principles and strategies outlined in The Little Book of Venture Capital Investing requires a thoughtful, step-by-step approach. Gerken and Whittaker emphasize that success in VC is not about making a single great investment, but about building a repeatable process that can be refined over time. Whether you are an individual investor, a family office, or part of an institutional team, the following steps provide a roadmap for implementing the book’s teachings.

First, investors should assess their own risk tolerance, investment goals, and available resources. This self-assessment will inform decisions about portfolio construction, deal sourcing, and allocation between nonlisted and listed investments. Next, it’s important to build a strong foundation of knowledge, including historical context, current market trends, and best practices for due diligence and portfolio management. Finally, investors should focus on execution, leveraging networks, tools, and ongoing learning to continuously improve their results.

- Start by studying the history and evolution of venture capital to develop a foundational understanding of the industry’s cyclical nature and key success factors.

- Develop a clear investment thesis and portfolio strategy, balancing exposure across sectors, stages, and geographies based on your risk tolerance and objectives.

- Build and maintain strong networks with entrepreneurs, industry experts, and other investors to source high-quality deal flow and share insights.

- Apply rigorous screening criteria and comprehensive due diligence to evaluate each opportunity, using checklists, templates, and expert consultations.

- Actively monitor and support portfolio companies, providing strategic guidance, participating in governance, and tracking performance against key milestones.

- Plan for exits from the outset, incorporating flexible exit strategies and maintaining relationships with secondary market participants and potential acquirers.

- Continuously review and refine your investment process, learning from both successes and failures to improve future outcomes.

Critical Analysis

The Little Book of Venture Capital Investing excels in its ability to make a complex and often opaque subject accessible to a wide audience. Gerken and Whittaker’s blend of historical context, practical guidance, and actionable strategies sets the book apart from more academic or anecdotal works. The use of real-world examples, quotes, and data grounds the material in reality, making it both educational and highly relevant for today’s investors. The book’s structure—moving from history and macro trends to practical tools and advanced strategies—provides a logical progression that builds the reader’s understanding step by step.

One of the book’s key strengths is its balanced approach to both nonlisted and listed VC investment options. By addressing the needs of both institutional and retail investors, the authors democratize access to venture capital and provide tools for a wide range of readers. The emphasis on rigorous due diligence, portfolio diversification, and active management is particularly valuable, as these principles are often overlooked in favor of chasing the next big thing.

However, the book does have some limitations. While it covers a broad range of topics, some readers may wish for more in-depth case studies or detailed financial models. The focus on U.S. and global markets is appropriate, but more granular analysis of emerging markets or sector-specific trends could further enhance the book’s utility. Additionally, the rapidly changing nature of the VC industry means that some examples and data may become outdated over time. Nevertheless, the core principles outlined in the book remain highly relevant and adaptable to new market conditions.

In the current market environment—characterized by technological disruption, global uncertainty, and increased competition for deals—The Little Book of Venture Capital Investing provides a valuable framework for navigating complexity. Its emphasis on adaptability, continuous learning, and strategic discipline makes it a timeless resource for both new and experienced investors.

Conclusion

The Little Book of Venture Capital Investing by Louis C. Gerken and Wesley A. Whittaker is an indispensable guide for anyone looking to understand or participate in the venture capital market. The book’s combination of historical perspective, practical tools, and advanced strategies provides a comprehensive roadmap for building a successful VC portfolio. Whether you are an individual investor seeking diversification, an entrepreneur preparing to raise capital, or a finance professional looking to deepen your knowledge, this book offers actionable insights that can be applied immediately.

The authors’ emphasis on historical awareness, rigorous due diligence, and portfolio diversification is particularly relevant in today’s fast-paced, uncertain markets. By following the step-by-step guidance and advanced strategies outlined in the book, investors can increase their chances of identifying high-potential opportunities, managing risk, and achieving superior returns. The book’s accessible style, real-world examples, and focus on both nonlisted and listed options make it a valuable addition to any investor’s library.

In summary, The Little Book of Venture Capital Investing is a must-read for anyone serious about venture capital. Its lessons are timeless, its strategies are actionable, and its insights are grounded in both history and modern market realities. We highly recommend this book to our readers at Value Sense and encourage you to apply its teachings as you pursue your own investment journey.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Venture Capital Investing

1. Who should read The Little Book of Venture Capital Investing?

This book is ideal for individual investors, finance professionals, entrepreneurs, students, and anyone interested in understanding how venture capital works. It is especially valuable for those looking to diversify their investment portfolios or gain practical insights into the VC process.

2. What makes this book different from other venture capital guides?

Unlike many VC books that are either too academic or anecdotal, Gerken and Whittaker strike a balance between historical context, actionable strategies, and real-world examples. The book covers both nonlisted and listed VC investment options, making it accessible to a wide audience.

3. Can retail investors participate in venture capital using the strategies in this book?

Yes, the book offers practical guidance for retail investors, including how to gain exposure to VC through listed vehicles like publicly traded funds, BDCs, and ETFs. It also provides tips for participating in nonlisted investments via angel networks and online platforms.

4. How important is due diligence in the venture capital process?

Due diligence is critical in VC investing. The book emphasizes comprehensive financial, market, and legal analysis to mitigate risks and ensure alignment with investment objectives. Skipping due diligence can lead to costly mistakes and missed opportunities.

5. What are the main risks associated with venture capital investing?

Venture capital investments are inherently risky, with high potential for both outsized returns and significant losses. Risks include illiquidity, valuation uncertainty, market volatility, regulatory changes, and startup failure. The book provides strategies for mitigating these risks through diversification, due diligence, and active management.

6. How can investors balance nonlisted and listed VC investments?

The authors recommend creating a diversified portfolio that includes both nonlisted (private) and listed (public) VC investments. Nonlisted options offer higher return potential but are less liquid, while listed vehicles provide accessibility and liquidity. Balancing both can optimize risk and return.

7. What role does networking play in venture capital investing?

Networking is essential for sourcing high-quality deals, sharing insights, and building strong relationships with entrepreneurs and co-investors. The book suggests joining industry events, investment networks, and leveraging online platforms to expand your reach and access better opportunities.

8. How should investors approach exit planning in venture capital?

Exit planning should begin at the outset of each investment. The book recommends defining clear exit strategies, monitoring market conditions, and maintaining flexibility to adapt to changing circumstances. Successful exits—through IPOs, mergers, or secondary sales—are the primary drivers of VC returns.

9. Are there specific tools or templates recommended in the book?

Yes, the book provides checklists, due diligence templates, and portfolio tracking tools to help investors systematize their approach. These resources are designed to streamline the investment process and improve decision-making.

10. How can I start applying the book’s lessons today?

Begin by studying the history of venture capital, assessing your own investment goals, and building a diversified, well-researched portfolio. Leverage networks, apply rigorous due diligence, and continuously refine your strategy based on market developments and personal experience.