The Little Book of Zen Money by Seven Dollar Millionaire

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

“The Little Book of Zen Money” by Seven Dollar Millionaire offers a refreshing blend of Eastern philosophy and practical personal finance. The author, writing under the pseudonym Seven Dollar Millionaire, is a notable financial educator and advocate for financial literacy, particularly among younger and first-time investors. With a background in both investment management and personal finance education, the author has built a reputation for demystifying complex financial topics and making them accessible to a broad audience. His previous works and educational projects have been used in schools and by financial institutions globally, emphasizing his credibility and commitment to empowering everyday people with financial knowledge.

The main theme of “The Little Book of Zen Money” is the integration of Zen mindfulness with the fundamentals of money management. The book aims to help readers achieve financial peace and security by fostering a mindful, non-judgmental approach to their finances. It challenges the stress and anxiety that often accompany money matters, replacing them with a sense of calm, clarity, and purpose. Through a structured framework and practical exercises, the book guides readers to develop healthy financial habits, overcome emotional barriers, and make decisions that align with their values and long-term goals.

Ideal for beginners, young professionals, and anyone seeking a healthier relationship with money, the book stands out for its compassionate tone and actionable advice. It is particularly valuable for those who have struggled with financial mistakes or feel overwhelmed by the complexity of personal finance. By breaking down intimidating concepts into manageable steps and infusing them with Zen principles, the author makes financial planning approachable and even enjoyable. The book’s emphasis on self-acceptance, patience, and continuous learning resonates with readers who want to improve their finances without self-blame or unrealistic expectations.

What sets “The Little Book of Zen Money” apart is its unique synthesis of Eastern philosophy and Western financial wisdom. The author’s use of the MISSION framework offers a clear, step-by-step pathway to financial security, while the Zen-inspired mindset encourages readers to find contentment and balance. The book’s practical focus, combined with its philosophical depth, makes it a valuable resource for anyone looking to transform their financial life from a source of stress to a foundation for well-being. With relatable anecdotes, real-world examples, and easy-to-follow strategies, this book is a must-read for those seeking a holistic approach to money management.

Key Concepts and Ideas

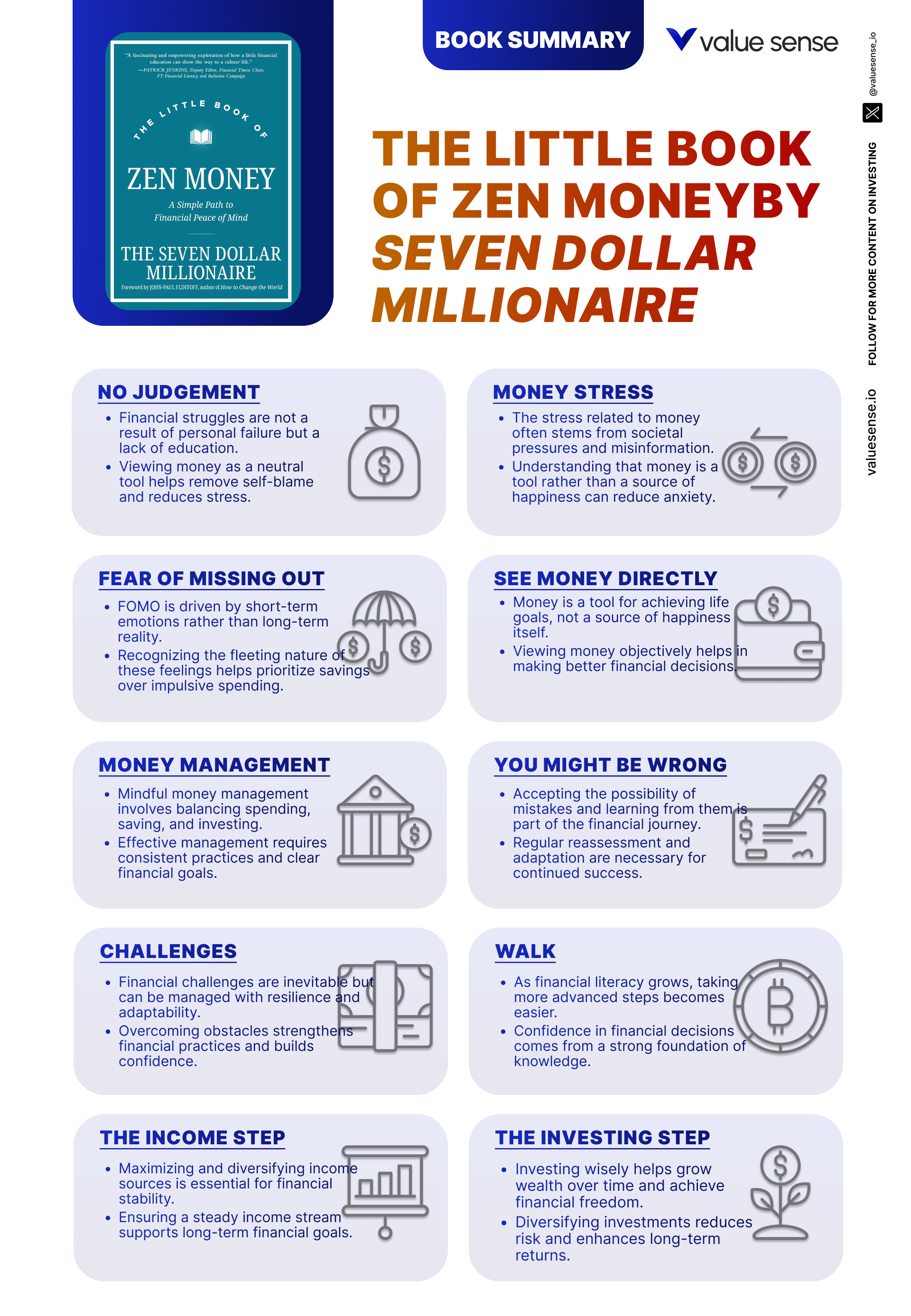

At the heart of “The Little Book of Zen Money” lies a philosophy that blends mindfulness with practical financial management. The author advocates for seeing money as a tool, not a source of stress or self-worth. By adopting a Zen approach—marked by simplicity, acceptance, and presence—readers are encouraged to let go of guilt and anxiety around money, replacing them with clarity and a sense of control. This philosophy is not about denial or frugality for its own sake, but about conscious decision-making and aligning financial actions with personal values.

The book’s investment philosophy centers on the idea that financial well-being is a journey, not a destination. It’s about building habits, practicing patience, and staying grounded even during market volatility or personal setbacks. The author’s MISSION framework provides a structured path—starting with money basics and culminating in mindful living—while consistently emphasizing the importance of self-compassion and adaptability. This holistic approach is designed to empower readers, regardless of their starting point, to take control of their financial future.

- Mindful Money Management: The core concept is approaching money without judgment. Instead of blaming oneself for past mistakes, the book urges readers to observe their financial habits objectively and use them as a foundation for growth. This mindset, inspired by Zen, fosters continuous learning and improvement.

- The MISSION Framework: The book introduces a step-by-step system: Money, Income, Saving, Spending, Investing, Owning, and Now. Each step addresses a fundamental aspect of personal finance, from budgeting and income maximization to investing and living in the present. The framework is designed to be both comprehensive and accessible.

- Emotional Detachment from Money: Readers are taught to separate emotional reactions from financial decisions. Recognizing that money is a neutral tool allows for more rational, objective choices, reducing stress and impulsive behavior.

- Intentional Spending: The book distinguishes between needs and wants, promoting spending that aligns with personal values and long-term goals. Mindful consumption helps readers avoid the pitfalls of FOMO (fear of missing out) and societal pressures.

- Consistency and Practice: Mastery of money management comes from small, consistent actions. The author emphasizes that perfection is not required; rather, steady progress and the willingness to learn from mistakes are key to building financial security.

- Compound Interest and Long-Term Investing: The power of compounding is highlighted as a critical factor in wealth building. The book encourages starting early and maintaining a long-term perspective to maximize investment growth.

- Diversification and Ownership: To reduce risk and build wealth, readers are advised to diversify their investments and seek ownership of appreciating assets, such as stocks, real estate, or businesses. Ownership is presented as a path to financial independence and passive income.

- Financial Resilience and Adaptability: Challenges are inevitable on the financial journey. The book stresses the importance of resilience, humility, and the ability to adapt strategies in response to new information or setbacks.

- Defining “Enough”: Instead of chasing endless accumulation, the book encourages readers to define what “enough” means for them personally. This leads to greater contentment, reduced anxiety, and more meaningful financial decisions.

- Zen Mindset for Financial Decisions: Ultimately, the book advocates for a calm, balanced, and purposeful approach to money. By applying Zen principles—simplicity, mindfulness, contentment—readers can transform their financial life into a source of peace and fulfillment.

Practical Strategies for Investors

Applying the teachings of “The Little Book of Zen Money” requires more than just understanding the concepts—it demands action. The author provides a toolkit of practical strategies that can be implemented immediately, regardless of your financial starting point. These strategies are designed to build momentum, reinforce positive habits, and support both short-term stability and long-term growth. By focusing on small, manageable steps, readers can overcome inertia and steadily improve their financial well-being.

Each strategy is grounded in the book’s Zen-inspired philosophy, emphasizing mindfulness, consistency, and adaptability. Whether you are just beginning your financial journey or looking to refine your approach, these techniques can help you identify opportunities, avoid common pitfalls, and make decisions that serve your unique goals. The strategies below are actionable, realistic, and proven to work in real-world scenarios.

- Create a Judgment-Free Financial Review: Set aside time each month to review your finances without self-criticism. List your income, expenses, savings, and debts. Observe patterns and identify areas for improvement, but avoid blaming yourself for past mistakes. This reflective practice builds self-awareness and sets the stage for positive change.

- Build and Automate a Budget: Use the MISSION framework to create a simple budget. Allocate income to essentials, savings, and discretionary spending. Automate transfers to savings and investment accounts to ensure consistency. Tools like online banking, budgeting apps, or spreadsheets can streamline this process.

- Maximize and Diversify Income Streams: Regularly assess your income sources. Explore opportunities for side gigs, freelance work, or passive income (such as dividends or rental properties). Treat every dollar earned as valuable, directing additional income toward savings and investments.

- Set Specific Savings Goals and Automate Contributions: Define clear, achievable savings targets for emergencies, major purchases, and long-term objectives. Automate contributions to savings accounts or investment funds to make saving effortless and reduce the temptation to spend.

- Practice Mindful Spending: Before making non-essential purchases, apply the 24-hour rule—wait a day before buying to curb impulsive spending. Regularly review your expenses to distinguish between needs and wants, and adjust your spending to align with your values and goals.

- Start Investing Early and Consistently: Open a brokerage or retirement account and begin investing, even with small amounts. Focus on diversified, low-cost index funds or ETFs to reduce risk. Leverage the power of compound interest by contributing regularly and reinvesting returns.

- Focus on Ownership and Asset Accumulation: Seek opportunities to own appreciating assets, such as stocks, real estate, or intellectual property. Evaluate potential investments based on their ability to generate passive income and long-term value.

- Balance Present Enjoyment with Future Planning: Allocate resources for both current pleasures and future security. Practice gratitude for what you have today, while making strategic plans to achieve your long-term financial goals. This balance fosters contentment and reduces financial anxiety.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book of Zen Money” is structured into three major chapters, each containing several subchapters that build upon one another. The book begins with foundational principles, moves through a comprehensive framework for financial management, and culminates in the practice and mastery of these concepts. Each chapter is designed to be accessible, actionable, and deeply rooted in both practical finance and Zen philosophy. This structure allows readers to progress from understanding their financial mindset to implementing concrete strategies and, finally, to refining their approach through ongoing practice.

Below, we provide a detailed, in-depth analysis of each major chapter and its key sections. For each chapter, we explore the main ideas, provide specific examples and quotes, and discuss how investors can apply these lessons in their own lives. We also contextualize the material with real-world scenarios and historical examples, ensuring that readers gain both practical and philosophical insights. Use these chapter-by-chapter breakdowns as a guide to deepen your understanding and application of the book’s teachings.

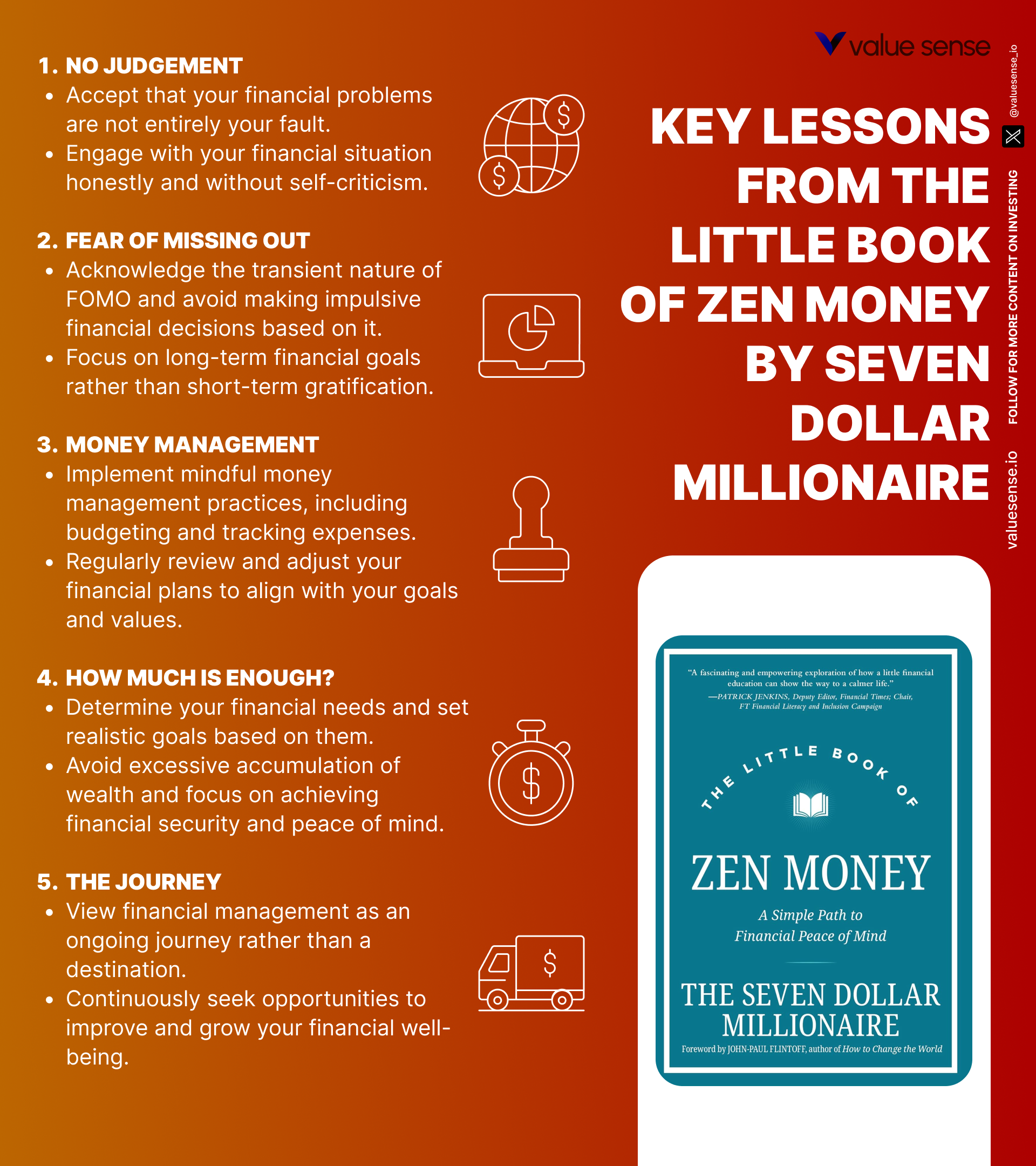

Chapter 1: Zen and the Art of Money Management

The opening chapter of “The Little Book of Zen Money” introduces readers to the concept of applying Zen principles to personal finance. The author begins by addressing the common experience of self-judgment and guilt around money. Many people, he notes, have never received proper financial education, making it unfair to blame themselves for past mistakes. By replacing self-criticism with understanding and growth, readers can begin to heal their relationship with money. The chapter emphasizes that financial problems are not entirely your fault, and that self-judgment often hinders progress. This compassionate perspective sets the tone for the rest of the book, encouraging readers to approach their finances with empathy and a willingness to learn.

Throughout the chapter, the author uses relatable examples and direct quotes to illustrate his points. For instance, he likens the stress of money management to a playground where competition and aggression are normalized, and highlights how societal pressures and relentless marketing can lead to poor financial decisions. The book states, “Be aware of how marketing influences your spending decisions. Practice mindful consumption to reduce unnecessary financial stress.” By recognizing these external influences, readers can begin to take control of their financial choices. The chapter also addresses the fear of missing out (FOMO) as a significant driver of impulsive spending, urging readers to make decisions based on true needs and long-term benefits.

In practical terms, investors are encouraged to adopt a non-judgmental approach to their financial situations and focus on improving their knowledge. This means detaching emotionally from past mistakes and approaching financial decisions with clarity rather than guilt. The author recommends regular, judgment-free financial reviews—setting aside time each month to observe income, expenses, and savings without self-blame. This process builds self-awareness and creates a foundation for positive change. By replacing judgment with empathy, readers can also extend this understanding to others, fostering healthier financial conversations and relationships.

The chapter situates these lessons within a broader historical and social context. It notes that even high earners can face financial difficulties without proper money management, and that the relentless pursuit of more can lead to stress and dissatisfaction. By defining what is “enough” and embracing simplicity, readers can achieve greater contentment and peace of mind. The Zen approach advocated here is particularly relevant in today’s fast-paced, consumer-driven society, where financial anxiety is widespread. The author’s message—that financial peace comes from mindfulness, not just technical skill—resonates deeply in an era of economic uncertainty and information overload.

Chapter 2: The Path Is a MISSION

Chapter 2 introduces the MISSION framework, a structured, step-by-step approach to financial management. Each letter in the acronym stands for a critical aspect of personal finance: Money, Income, Saving, Spending, Investing, Owning, and Now. The chapter begins by emphasizing the importance of financial literacy and the need to build a strong foundation before pursuing more complex goals. The author writes, “Start with strong financial habits, like saving and living within your means. Focus on creating a secure financial base before pursuing more complex financial goals.” This foundational mindset is essential for long-term success.

The chapter proceeds to break down each step of the MISSION framework in detail. The Money step focuses on understanding and managing income, expenses, and savings through budgeting. The Income step encourages readers to maximize earnings by exploring additional streams and treating every dollar with respect. The Saving step stresses the importance of automating savings and prioritizing emergency funds. The Spending step advocates for aligning expenditures with personal values and differentiating between needs and wants. The Investing step introduces the basics of asset classes, compound interest, and diversification, urging a long-term perspective. The Owning step highlights the benefits of asset ownership—such as property, businesses, or intellectual property—for building wealth and financial security. Finally, the Now step encourages mindfulness and balance between present enjoyment and future planning.

For investors, the MISSION framework provides a clear roadmap for building financial security. The author recommends using budgeting tools or apps to track income and expenses, regularly reviewing income sources, and setting specific savings goals. Automation is emphasized as a way to ensure consistency, while mindful spending helps avoid lifestyle inflation and impulsive purchases. In the investing phase, readers are encouraged to start early, diversify their portfolios, and focus on long-term growth. Ownership of appreciating assets is presented as a key strategy for achieving financial independence and passive income. The Now step serves as a reminder to practice gratitude and contentment, balancing immediate enjoyment with strategic planning for the future.

The historical context of this framework is evident in its adaptability to changing economic conditions. The author references the importance of resilience during market downturns, noting that consistent habits and long-term thinking can help weather financial storms. The MISSION framework is particularly relevant in today’s volatile market environment, where uncertainty and rapid change are the norm. By following these structured steps, readers can build a resilient financial foundation that supports both current and future well-being. The chapter’s comprehensive, actionable approach makes it a valuable resource for investors at any stage of their journey.

Chapter 3: The Path Is Practice

The third chapter shifts focus from theory and planning to the importance of practice in mastering financial management. The author likens the journey to learning a new skill—progress begins with small, manageable steps, and mastery comes through consistent effort over time. The chapter opens with the concept of “first steps,” encouraging readers to begin their financial journey with basic practices like budgeting and saving. The author writes, “Every step, no matter how small, contributes to long-term financial success.” This message is both empowering and realistic, acknowledging that significant progress often starts with minor actions.

Throughout the chapter, the author provides a roadmap for gradual improvement. The “baby steps” section emphasizes setting small, achievable goals and building confidence through early successes. The “crawl” section suggests mastering foundational skills—such as budgeting, saving, and debt management—before moving on to more advanced strategies. The “walk” section marks the transition to greater independence and sophistication, including investing and wealth-building. The author stresses that consistency is more important than perfection, and that regular, small actions have a greater impact than occasional, large efforts.

Investors are encouraged to apply these lessons by starting with simple, repeatable actions. This might include setting up a basic budget, automating savings, or making a small, regular investment in a diversified fund. The author recommends celebrating small wins to build momentum and confidence. When challenges arise, readers are urged to view them as opportunities for growth, building resilience and discipline in the process. The chapter also highlights the importance of humility, recognizing that mistakes are inevitable and can be valuable learning experiences. By remaining open to new information and adapting strategies as needed, investors can continue to improve over time.

The chapter concludes by framing financial management as a lifelong journey rather than a destination. The author encourages readers to enjoy the process, find satisfaction in progress, and remain flexible as life circumstances change. This perspective is particularly relevant in a rapidly evolving financial landscape, where adaptability and continuous learning are essential. By embracing the journey and practicing mindfulness, readers can transform their approach to money from a source of stress to a foundation for growth and fulfillment. The practical, compassionate tone of this chapter makes it an invaluable guide for anyone seeking lasting financial well-being.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Advanced Strategies from the Book

While “The Little Book of Zen Money” is accessible to beginners, it also offers advanced strategies for those looking to deepen their financial expertise. These techniques build on the foundational principles outlined in earlier chapters, incorporating more sophisticated approaches to investing, wealth-building, and financial resilience. By integrating Zen principles with advanced financial tactics, the book empowers readers to navigate complex markets and achieve long-term success.

The advanced strategies below are designed for investors who have mastered the basics and are ready to take their financial journey to the next level. Each technique is explained with practical examples and action steps, ensuring that readers can implement them effectively in real-world scenarios.

Strategy 1: Strategic Asset Allocation and Diversification

Building on the book’s emphasis on diversification, this strategy involves creating a balanced portfolio across multiple asset classes—such as stocks, bonds, real estate, and alternative investments. The author recommends assessing your risk tolerance and financial goals, then allocating assets accordingly. For example, a 35-year-old investor might allocate 60% to equities, 30% to bonds, and 10% to real estate or alternative assets. The book highlights the importance of rebalancing your portfolio annually to maintain your desired allocation, especially after market fluctuations. By diversifying, investors reduce the risk of significant losses in any single asset class and improve the likelihood of steady, long-term growth. This approach is supported by historical data showing that diversified portfolios weathered the 2008 financial crisis and the 2020 pandemic downturn more effectively than concentrated ones.

Strategy 2: Automating Wealth-Building Systems

Automation is a recurring theme in the book, but advanced investors can take it further by setting up automated contributions not only to savings accounts but also to investment and retirement accounts. The author suggests using direct deposit to funnel a portion of each paycheck into diversified investment vehicles, such as index funds or ETFs. Additionally, automating bill payments and debt repayments ensures that financial obligations are met consistently, reducing the risk of late fees or missed payments. This systematized approach frees up mental energy, allowing investors to focus on strategic decisions rather than day-to-day management. The book cites studies showing that investors who automate contributions are more likely to achieve their savings and investment goals, thanks to the power of consistency and compounding.

Strategy 3: Leveraging Passive Income Streams

Ownership of appreciating assets is a cornerstone of the book’s philosophy. Advanced readers are encouraged to seek out and develop passive income streams, such as dividend-paying stocks, rental properties, or intellectual property (like books or online courses). For instance, investing in a diversified basket of dividend aristocrats—companies with 25+ years of increasing dividends—can provide a stable, growing income. The book also discusses the benefits of real estate investment trusts (REITs) for those seeking exposure to property markets without direct ownership. By building multiple streams of passive income, investors can achieve greater financial independence and resilience, reducing reliance on active employment income.

Strategy 4: Practicing Dynamic Risk Management

The book emphasizes the importance of adaptability and humility in financial decision-making. Advanced investors are advised to regularly review their portfolios, assess market conditions, and adjust strategies as needed. This might involve reducing exposure to overvalued assets, increasing cash reserves during periods of uncertainty, or hedging against downside risk with options or inverse ETFs. The author notes that even the most experienced investors make mistakes, and that the willingness to change course in response to new information is a hallmark of long-term success. By practicing dynamic risk management, investors can protect their wealth and capitalize on emerging opportunities.

Strategy 5: Integrating Mindfulness into High-Stakes Decisions

At the highest level, the book encourages integrating mindfulness practices—such as meditation, journaling, or reflective walks—into the process of making significant financial decisions. Before executing a major investment or rebalancing a portfolio, the author suggests taking time to clear your mind and assess your motivations. Are you acting out of fear, greed, or genuine alignment with your goals? By cultivating self-awareness and emotional detachment, investors can avoid impulsive moves and make decisions that serve their long-term interests. This Zen-inspired approach is especially valuable during periods of market volatility, when emotional reactions can lead to costly mistakes.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Translating the lessons of “The Little Book of Zen Money” into daily life requires a thoughtful, step-by-step approach. The author emphasizes that sustainable financial change is built on small, consistent actions rather than dramatic overhauls. By starting with foundational habits and gradually layering in more advanced strategies, readers can create a financial system that is both resilient and adaptable to changing circumstances.

To begin, it’s important to assess your current financial situation with honesty and without judgment. From there, you can build a personalized action plan using the MISSION framework and the advanced techniques outlined above. Remember that progress is incremental, and setbacks are natural parts of the journey. The key is to maintain momentum, celebrate small victories, and remain open to learning and adaptation.

- First step investors should take: Conduct a judgment-free financial review. List your income, expenses, debts, and savings. Identify areas for improvement without self-blame.

- Second step for building the strategy: Create and automate a budget using the MISSION framework. Set up automatic transfers to savings and investment accounts, and establish clear, achievable goals for each financial category.

- Third step for long-term success: Regularly review and adjust your financial plan. Embrace continuous learning, adapt strategies in response to new information or life changes, and practice mindfulness to stay grounded and resilient.

Critical Analysis

“The Little Book of Zen Money” excels at making personal finance approachable, compassionate, and actionable. Its greatest strength lies in its integration of Zen philosophy with practical financial strategies. The author’s emphasis on self-acceptance, mindfulness, and continuous improvement sets it apart from more rigid or technical finance books. The MISSION framework provides a clear, step-by-step roadmap, while the book’s tone is encouraging and non-judgmental—a refreshing change from the fear-based messaging common in financial media.

However, the book’s simplicity may be a double-edged sword for some readers. While it offers valuable guidance for beginners and those seeking a healthier relationship with money, experienced investors or those looking for in-depth technical analysis may find it lacking in advanced financial modeling or market-specific tactics. The book’s focus on mindset and habits means it does not delve deeply into topics like tax optimization, complex investment vehicles, or macroeconomic analysis. Nonetheless, its universal principles and adaptable framework make it relevant for a wide audience, especially in today’s uncertain market environment.

In the current economic climate—marked by inflation, market volatility, and rapid technological change—the book’s emphasis on resilience, adaptability, and mindfulness is particularly timely. Its teachings encourage readers to focus on what they can control, build strong financial foundations, and remain calm in the face of uncertainty. As such, “The Little Book of Zen Money” is a valuable addition to any investor’s library, offering both philosophical depth and practical tools for navigating the complexities of modern finance.

Conclusion

“The Little Book of Zen Money” is more than a guide to personal finance—it’s a manual for achieving financial peace and well-being. By blending Zen philosophy with actionable strategies, the book empowers readers to transform their relationship with money from one of stress and anxiety to one of clarity, control, and contentment. Its compassionate tone, practical framework, and emphasis on continuous learning make it accessible and valuable for readers at any stage of their financial journey.

The key takeaways from the book are clear: approach money with mindfulness, build habits through small, consistent actions, and define success on your own terms. By following the MISSION framework and integrating Zen principles into daily practice, readers can create a resilient, adaptable financial system that supports both present enjoyment and future security. Whether you’re a beginner or a seasoned investor, this book offers insights and tools that can help you achieve your financial goals with greater peace of mind.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book of Zen Money

1. Who is the author of “The Little Book of Zen Money,” and what is his background?

The author, known as Seven Dollar Millionaire, is a financial educator and advocate for financial literacy. He has worked in investment management and developed educational materials used by schools and financial institutions worldwide. His mission is to make financial knowledge accessible and actionable for everyone, especially beginners and young investors.

2. What is the main message of the book?

The book’s central message is to approach money with mindfulness, self-compassion, and intentionality. By integrating Zen principles with practical financial management, readers can achieve financial peace, build healthy habits, and make decisions that align with their values and long-term goals.

3. Is this book suitable for experienced investors?

While the book is particularly valuable for beginners and those seeking a healthier relationship with money, experienced investors can benefit from its emphasis on mindset, resilience, and adaptability. However, those seeking advanced technical analysis may find it less detailed in that regard.

4. What is the MISSION framework, and how does it work?

The MISSION framework is a step-by-step system for managing money: Money, Income, Saving, Spending, Investing, Owning, and Now. Each step addresses a core aspect of personal finance, guiding readers from budgeting and income maximization to investing and mindful living.

5. How does the book address emotional challenges around money?

The book encourages readers to replace self-judgment with understanding and empathy. It provides strategies for detaching emotionally from past mistakes, managing financial stress, and making decisions based on clarity rather than guilt or fear. This approach fosters a healthier, more productive relationship with money.

6. Can the strategies in the book be applied during market downturns?

Yes, the book’s emphasis on consistency, resilience, and long-term thinking is especially relevant during periods of market volatility. The author advises sticking to your financial plan, avoiding impulsive decisions, and focusing on what you can control, which helps weather economic uncertainty.

7. What are some actionable steps recommended by the book?

Key action steps include conducting judgment-free financial reviews, automating savings and investments, maximizing income streams, practicing mindful spending, and regularly reviewing and adjusting your financial plan. These habits help build a resilient financial foundation over time.

8. How does the book define “enough” in personal finance?

The book encourages readers to define “enough” based on their own needs and values, rather than societal benchmarks. Understanding your personal threshold for sufficiency leads to greater contentment, reduced anxiety, and more meaningful financial decisions.

9. Does the book provide guidance on investing?

Yes, the book covers the basics of investing, including asset classes, compound interest, diversification, and the importance of starting early. It recommends a long-term, consistent approach to investing, with an emphasis on education and risk management.

10. Where can I learn more about applying these principles and finding undervalued stocks?

You can explore more resources, stock ideas, and intrinsic value tools at valuesense.io. The Value Sense platform offers in-depth research, analytics, and actionable insights to help you implement the strategies from “The Little Book of Zen Money” and discover undervalued investment opportunities.