The Little Book That Builds Wealth by Pat Dorsey

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

“The Little Book That Builds Wealth” by Pat Dorsey is a modern classic in the world of value investing. Pat Dorsey, the former Director of Equity Research at Morningstar, is highly respected for his rigorous analytical approach and deep understanding of competitive advantages. With decades of experience dissecting thousands of businesses and building the Morningstar moat rating system, Dorsey brings unparalleled authority to the subject of economic moats. His insights are grounded in both academic research and real-world investing, making his guidance both credible and practical for investors at all levels.

The central theme of the book is the concept of economic moats—structural advantages that allow companies to fend off competition and maintain superior profitability over the long term. Dorsey’s main purpose is to teach investors how to systematically identify, evaluate, and invest in companies with these durable competitive advantages. He demystifies the process of finding moats, explains why they matter for compounding wealth, and provides actionable steps for integrating moat analysis into a disciplined investment process. The book is written in an accessible, conversational style, making complex ideas digestible without sacrificing depth.

This book is a must-read for anyone serious about long-term investing, from individual retail investors to professional portfolio managers. Beginners will appreciate the clear explanations and practical frameworks, while seasoned investors will find the in-depth analysis and nuanced case studies invaluable. Dorsey’s approach is especially relevant for those who want to move beyond superficial metrics and understand the underlying drivers of business quality. If you’re interested in building a portfolio of stocks that can compound wealth over years or decades, this book provides a powerful toolkit.

What sets “The Little Book That Builds Wealth” apart is its relentless focus on actionable, real-world investing. Unlike many investment books that dwell on theory or market timing, Dorsey’s work is grounded in the realities of business analysis and market behavior. He provides concrete examples from well-known companies like Coca-Cola, Microsoft, and Visa, showing how moats lead to enduring outperformance. The book’s structure is logical and practical, moving from foundational concepts to advanced valuation techniques, and culminating in guidance on when to sell. Its unique blend of strategic insight, practical tools, and timeless wisdom makes it a valuable addition to any investor’s library.

Key Concepts and Ideas

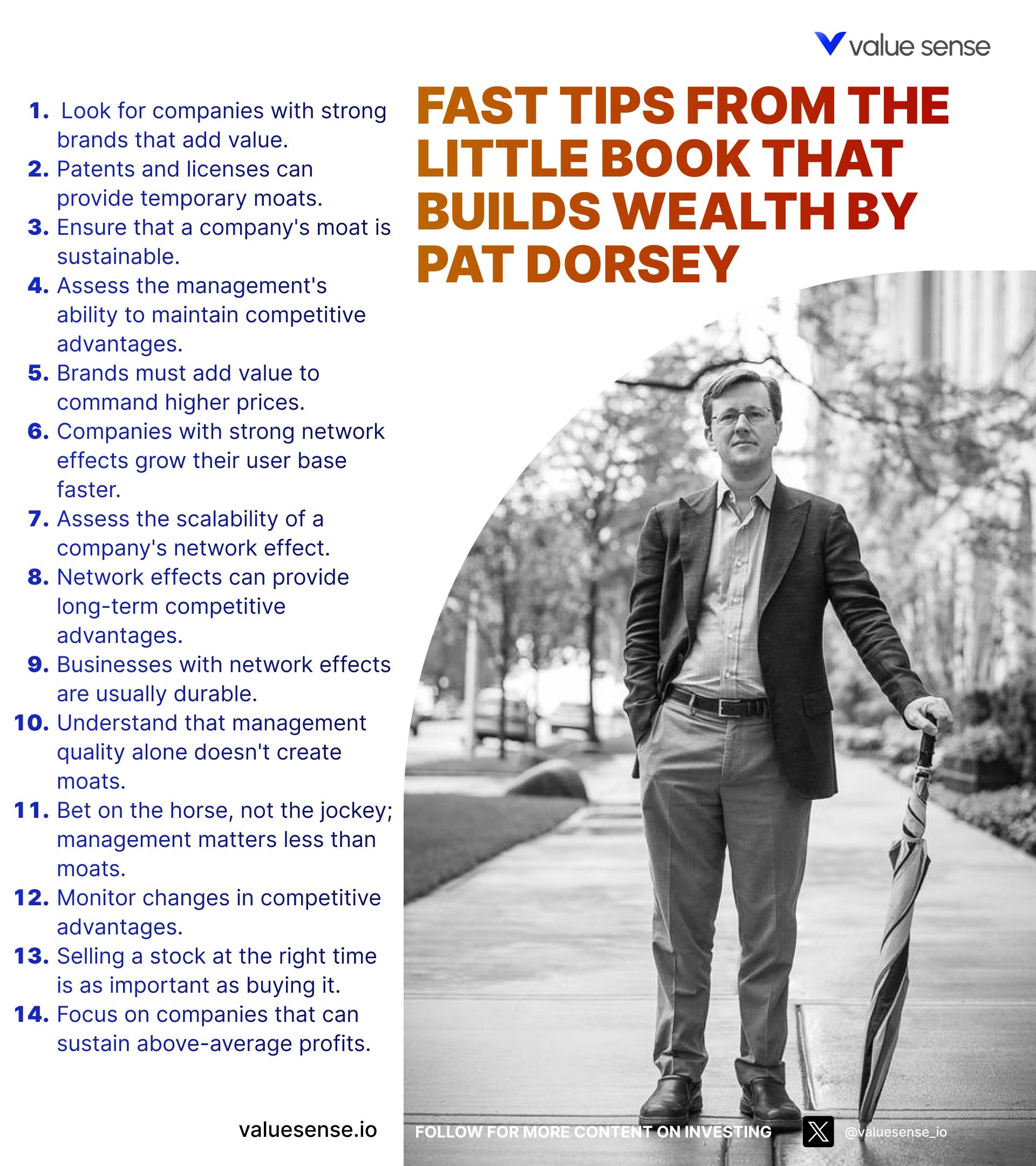

At the heart of “The Little Book That Builds Wealth” is the investment philosophy that long-term outperformance is achieved by owning businesses with durable economic moats. Dorsey argues that while markets are efficient in the short run, over the long run, companies with sustainable competitive advantages consistently generate excess returns on capital. These moats—whether stemming from intangible assets, switching costs, network effects, or cost advantages—shield profits from competitive erosion and allow for compounding wealth.

Dorsey’s framework is built on the idea that investors should focus their research not just on financial metrics, but on the structural features of a business that make its profits resilient. He stresses that identifying a moat is only the first step; investors must also be vigilant for signs of erosion and know how to value these businesses appropriately. The book provides a roadmap for integrating qualitative analysis (understanding the business) with quantitative analysis (assessing financial strength and valuation).

- Economic Moats: Dorsey defines economic moats as structural characteristics that give companies a lasting edge over competitors. Examples include Coca-Cola’s brand, Microsoft’s dominance in operating systems, and Visa’s network effect. The book details four primary sources of moats: intangible assets, switching costs, network effects, and cost advantages.

- Intangible Assets: These include brands, patents, and regulatory licenses. For instance, Coca-Cola’s global brand allows it to charge premium prices, while Pfizer’s patents protect its drug profits. Dorsey explains how to assess whether these assets are truly durable or at risk of obsolescence.

- Switching Costs: When customers face high costs (financial, time, or operational) to switch providers, companies enjoy pricing power. Examples include enterprise software like SAP or Oracle, where integration and retraining costs deter switching.

- Network Effects: The value of a product or service increases as more people use it. Visa’s payment network or Facebook’s social platform are classic examples. Dorsey shows how network effects create self-reinforcing barriers to entry and long-term profitability.

- Cost Advantages: Some firms can produce at lower costs due to scale, proprietary technology, or access to cheap resources. Walmart’s supply chain and Intel’s chip manufacturing are cited as examples. Cost advantages allow firms to undercut rivals or maintain superior margins.

- Mistaken Moats: The book warns against confusing temporary advantages (like market share or low prices) with true moats. Dorsey provides checklists for distinguishing between real and illusory competitive advantages, helping investors avoid common traps.

- Eroding Moats: Even the strongest moats can be undermined by technological disruption, changing consumer preferences, or regulatory shifts. The book teaches investors how to spot early warning signs—such as declining margins or market share—and act accordingly.

- Valuation of Moats: Dorsey emphasizes that even great businesses can be poor investments if bought at the wrong price. He introduces valuation tools like discounted cash flow (DCF), price-to-earnings, and EV/EBITDA multiples, with a focus on applying them to moated businesses.

- Management Quality: Leadership can make or break a moat. Visionary CEOs like Steve Jobs or Warren Buffett are highlighted as examples of managers who built or protected moats. The book provides criteria for assessing management’s capital allocation and strategic vision.

- Practical Application: Throughout, Dorsey offers step-by-step processes for researching industries, screening for moats, analyzing financials, and monitoring investments. The emphasis is on building a repeatable, disciplined process rather than chasing trends or market timing.

Practical Strategies for Investors

Applying the teachings of “The Little Book That Builds Wealth” requires a systematic approach to business analysis, valuation, and portfolio management. Dorsey’s strategies are designed to help investors not only identify moated businesses, but also to buy them at attractive prices and manage them for long-term compounding. The book emphasizes patience, discipline, and continuous learning—qualities that separate successful investors from the rest.

Investors should integrate Dorsey’s moat framework into their stock selection process, focusing on companies that can sustain high returns on capital while protecting profits from competitive threats. The strategies outlined below are actionable, repeatable, and suitable for investors of all experience levels. By following these steps, investors can build a portfolio designed to weather market cycles and deliver superior returns over time.

- Screen for Moats: Use stock screeners and financial databases to identify companies with high return on invested capital (ROIC), consistent profit margins, and strong free cash flow. Focus on sectors where moats are common, such as consumer staples, software, and payment networks.

- Analyze Industry Structure: Research industry dynamics to assess barriers to entry, customer loyalty, and competitive intensity. Look for industries with few competitors, high switching costs, or regulatory protection—such as pharmaceuticals or utilities.

- Assess Intangible Assets: Evaluate the strength and durability of brands, patents, and licenses. For example, check the length and enforceability of pharmaceutical patents, or the global reach of a brand like Nike or Apple.

- Examine Switching Costs: Investigate whether customers are locked in by contracts, integration, or training. Look for high customer retention rates and recurring revenue models, such as those found in enterprise software or telecoms.

- Identify Network Effects: Analyze user growth, engagement metrics, and competitive positioning in businesses like social media, payments, or marketplaces. Companies like Visa, Mastercard, or eBay benefit from powerful network effects.

- Evaluate Cost Advantages: Compare cost structures across competitors. Investigate scale economies, proprietary processes, or long-term supplier contracts that allow for lower costs. Walmart and Costco are classic examples.

- Monitor for Eroding Moats: Set up regular reviews of key performance indicators—margins, market share, customer churn—to detect signs of weakening competitive advantage. Be prepared to exit positions if the moat shows signs of deterioration.

- Value with a Margin of Safety: Apply Dorsey’s valuation tools (DCF, P/E, EV/EBITDA) and only buy when the stock trades at a significant discount to intrinsic value. This reduces risk and increases upside potential.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book That Builds Wealth” is structured to guide readers from foundational principles to advanced applications of moat-based investing. Each chapter builds on the last, beginning with the core concept of economic moats, moving through their identification and valuation, and concluding with practical advice on portfolio management and selling discipline. The book is organized into fifteen chapters, each focusing on a specific aspect of competitive advantage and investment process.

Below, we provide a comprehensive, chapter-by-chapter analysis, with each section offering detailed explanations, real-world examples, and actionable lessons. This in-depth approach ensures that readers not only understand the theory, but also know how to apply it in their own investing. Whether you are new to the concept of moats or seeking to refine your process, these summaries will equip you with the knowledge to make better investment decisions.

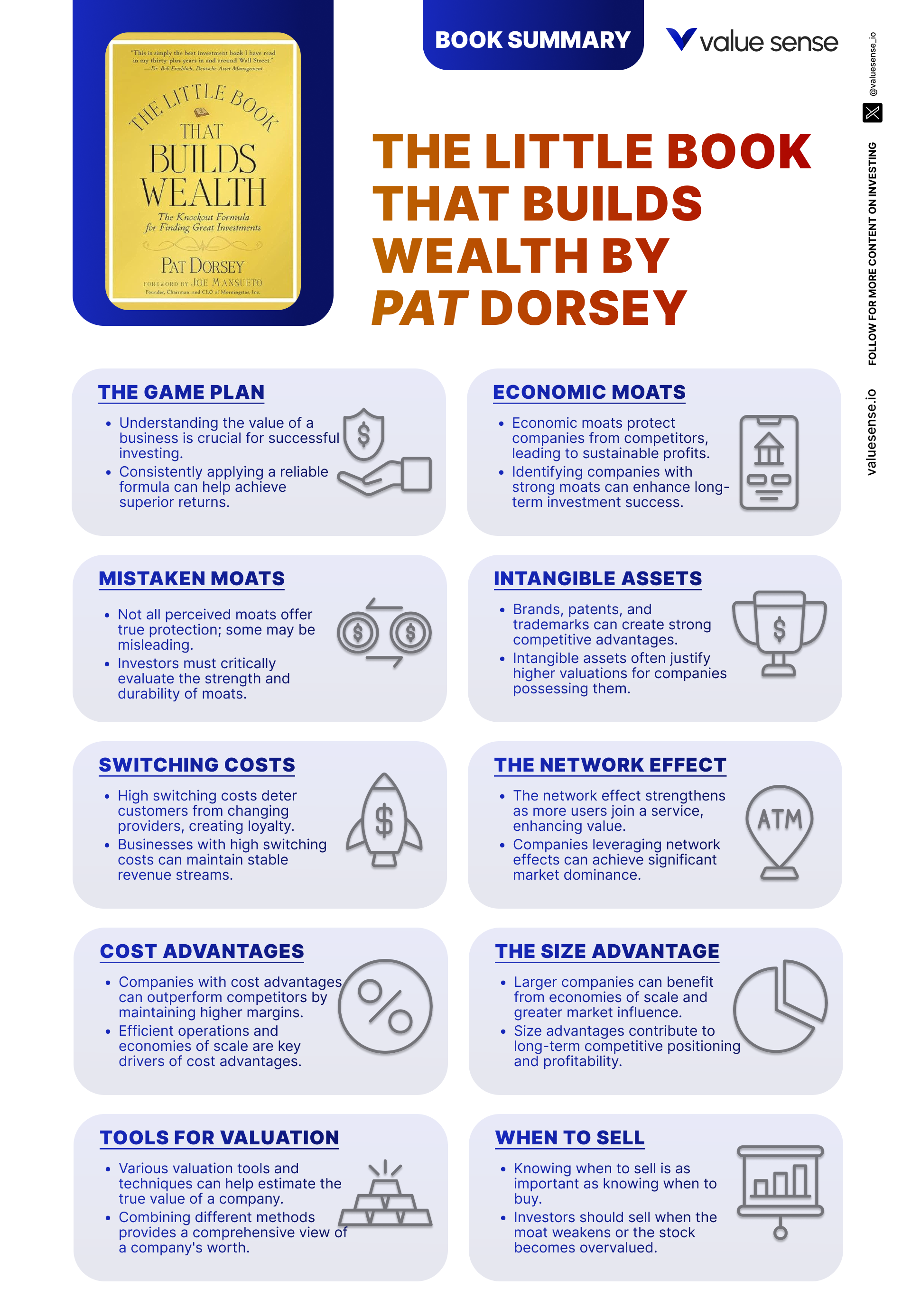

Chapter 1: The Game Plan

The opening chapter of “The Little Book That Builds Wealth” lays out Dorsey’s core investment philosophy: the pursuit of companies with sustainable competitive advantages, or “economic moats.” He introduces the idea that the best way to achieve superior long-term returns is to own businesses that can protect their profits from competition over many years. Dorsey explains that these moats are not just theoretical constructs, but real, observable characteristics that can be systematically identified and analyzed. He uses examples like Coca-Cola and Microsoft to illustrate how moats manifest in the real world, citing their ability to maintain pricing power and profitability for decades as evidence of their enduring advantages.

Dorsey emphasizes the importance of patience and discipline in this strategy. He warns against the temptation to chase hot stocks or time the market, instead advocating for a focus on business quality and intrinsic value. The chapter includes quotes such as, “The best returns come from holding high-quality companies for many years,” underscoring the compounding effect of long-term ownership. Dorsey also introduces the concept of intrinsic value, explaining that investors should seek to buy moated companies only when they are trading below their true worth. He provides a simple framework: identify moats, wait for the right price, buy, and hold.

For practical application, investors are encouraged to build a repeatable process for finding and evaluating moats. This involves regular screening for high-return businesses, conducting deep research into their sources of advantage, and maintaining a watchlist of potential buys. Dorsey stresses that the process is ongoing—investors must continually reassess their holdings to ensure that the competitive advantages remain intact. He suggests setting up a checklist to evaluate each company’s moat, financial health, and valuation before making a purchase.

Historically, this approach has been validated by the success of legendary investors like Warren Buffett, who famously described moats as the key to his investment strategy. Buffett’s investments in companies like See’s Candies and American Express were based on their ability to fend off competition and generate high returns on capital. In today’s market, where technological disruption is constant, the need for a disciplined, moat-focused strategy is more important than ever. Dorsey’s framework provides a timeless blueprint for building wealth through quality businesses.

Chapter 2: Economic Moats

In Chapter 2, Dorsey delves deeper into the definition and importance of economic moats. He explains that a moat is a structural feature that allows a company to maintain superior returns on capital over time, despite the efforts of competitors. The chapter categorizes moats into four main types: intangible assets (brands, patents, licenses), switching costs, network effects, and cost advantages. Each type is explored in detail, with examples drawn from real companies. For instance, he cites Visa’s payment network as a classic network effect, and Walmart’s scale-driven cost advantage as another form of moat.

The chapter provides quantitative evidence for the power of moats. Dorsey references studies showing that companies with high and stable returns on capital tend to outperform the market over the long term. He also notes that not all moats are created equal—some are wide and durable, while others are narrow or at risk of erosion. The book encourages investors to look for signs of moat strength, such as consistent profit margins, high customer retention, and pricing power, while remaining vigilant for potential threats.

For investors, this chapter offers a practical checklist for moat identification. Dorsey recommends starting with industries known for structural advantages, then analyzing company financials and competitive positioning. He suggests looking for evidence of sustained profitability, low customer churn, and barriers to entry. The chapter also introduces the idea of “moat erosion,” warning that even strong advantages can be undermined by technological change or regulatory shifts.

Historically, companies like Gillette (razor blades) and Procter & Gamble (consumer brands) have demonstrated the staying power of economic moats, delivering decades of outperformance. In the digital age, new types of moats—such as platform network effects (e.g., Amazon, Google)—have emerged, but the underlying principles remain the same. Dorsey’s framework is adaptable to any era, making it a valuable tool for navigating today’s dynamic markets.

Chapter 3: Mistaken Moats

Chapter 3 addresses one of the most common pitfalls in investing: confusing temporary or superficial advantages with true economic moats. Dorsey warns that not all perceived advantages are sustainable. He provides examples of “mistaken moats,” such as government regulation, large market share, or low prices, which may offer short-term protection but rarely endure in the face of competition. The chapter includes case studies of companies that appeared invincible—like Kodak or Blockbuster—only to see their advantages eroded by new technology or shifting consumer preferences.

Dorsey offers a checklist for distinguishing real moats from false ones. He suggests looking for qualities that are difficult for competitors to replicate, such as proprietary technology, deeply embedded customer relationships, or unique intellectual property. The chapter emphasizes the importance of critical analysis, urging investors to dig beneath the surface and question whether an advantage will persist over the long term. Dorsey writes, “Short-term advantages often lead to mistaken moats, as they do not endure.”

Practical application involves rigorous industry and company analysis. Investors should study competitive dynamics, technological trends, and regulatory environments to assess the sustainability of a company’s advantage. Dorsey recommends using a “moat checklist” to evaluate each potential investment, focusing on durability, replicability, and relevance in the face of change. He also advises investors to be wary of management claims and marketing hype, which often exaggerate the strength of a company’s position.

In the real world, the collapse of companies like Nokia in mobile phones or MySpace in social media demonstrates the danger of mistaken moats. Both enjoyed temporary dominance but failed to build structural barriers to competition. Dorsey’s advice is especially relevant in today’s fast-changing industries, where yesterday’s leader can quickly become tomorrow’s casualty. By applying a disciplined, skeptical approach, investors can avoid costly mistakes and focus on businesses with genuine, lasting advantages.

Chapter 4: Intangible Assets

This chapter explores how intangible assets—such as brands, patents, and regulatory licenses—can serve as powerful economic moats. Dorsey explains that these assets allow companies to offer unique products or services that competitors cannot easily replicate. He uses Coca-Cola’s global brand as a prime example, noting that its brand equity enables premium pricing and fosters deep customer loyalty. Similarly, pharmaceutical companies like Pfizer benefit from patent protection, which grants them exclusive rights to sell blockbuster drugs for years.

Dorsey provides detailed criteria for assessing the value and durability of intangible assets. He examines the enforceability and remaining lifespan of patents, the global reach and recognition of brands, and the regulatory barriers that protect incumbents in industries like utilities or telecoms. The chapter includes data on profit margins and return on capital for companies with strong intangible assets, showing that these businesses consistently outperform peers without such advantages.

For investors, the key is to distinguish between truly valuable intangible assets and those that are easily replicated or at risk of obsolescence. Dorsey advises analyzing brand strength through customer surveys, market share trends, and pricing power. For patents, he recommends reviewing patent portfolios, expiration dates, and the likelihood of generic competition. Regulatory licenses should be evaluated based on their exclusivity and the difficulty of obtaining new licenses in the industry.

Historical examples abound: Apple’s brand has allowed it to command premium prices for its devices, while Disney’s intellectual property portfolio has generated decades of profits through movies, merchandise, and theme parks. In pharmaceuticals, companies like Merck and Johnson & Johnson have leveraged patent protection to build multi-billion-dollar franchises. Dorsey’s framework helps investors assess whether a company’s intangible assets are a fleeting advantage or a durable moat capable of compounding wealth over time.

Chapter 5: Switching Costs

Chapter 5 focuses on switching costs as a source of economic moat. Dorsey explains that when customers face significant costs—financial, time, or operational—to switch providers, companies enjoy a high degree of pricing power and customer stickiness. He provides examples from the software industry, where enterprise solutions like SAP or Oracle require extensive integration, training, and ongoing support, making it costly for customers to switch to competitors.

The chapter details how long-term contracts, complex integration, and product dependencies create high switching costs. Dorsey cites telecom providers, financial services, and industrial suppliers as sectors where switching costs are prevalent. He includes data on customer retention rates and recurring revenue models, showing that companies with high switching costs enjoy more stable cash flows and higher margins. The chapter also discusses the role of customer inertia and the psychological barriers that reinforce switching costs.

Investors are advised to analyze customer contracts, integration requirements, and the prevalence of proprietary systems. Dorsey suggests looking for evidence of high customer retention, low churn rates, and a history of successful price increases. He also recommends reviewing customer satisfaction surveys and industry benchmarks to gauge the strength of the switching cost moat. Companies that can lock in customers for years at a time—such as software-as-a-service (SaaS) providers—are particularly attractive.

Real-world examples include Microsoft’s dominance in operating systems, where the cost of retraining employees and migrating data deters switching. In banking, account switching is often hindered by direct deposit arrangements and bill pay setups. Dorsey’s analysis is especially relevant in the digital age, where subscription models and cloud platforms have increased the prevalence and importance of switching costs. By focusing on businesses with high customer stickiness, investors can build portfolios that are resilient to competitive threats and economic cycles.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: The Network Effect

In this chapter, Dorsey introduces the network effect as one of the most powerful and scalable sources of economic moat. The network effect occurs when the value of a product or service increases as more people use it, creating a self-reinforcing cycle that attracts even more users. Dorsey uses Visa’s payment network and Facebook’s social platform as prime examples, explaining how these businesses become more entrenched as their user bases grow.

The chapter provides quantitative and qualitative evidence for the strength of network effects. Dorsey cites data on user growth, transaction volumes, and market share to show how network effects translate into superior profitability and market dominance. He also discusses the critical mass required for a network effect to become self-sustaining, warning that not all networks reach this tipping point. The chapter includes case studies of companies that failed to achieve critical mass, as well as those—like eBay and LinkedIn—that built enduring moats through network effects.

For investors, the key is to identify businesses where network effects are real and sustainable. Dorsey recommends analyzing user engagement metrics, competitive positioning, and barriers to switching. He also suggests monitoring the company’s ability to innovate and adapt, as network effects can be eroded by new entrants or technological shifts. The ability to monetize a large user base—through advertising, transaction fees, or premium services—is another sign of a strong network effect.

Historically, network effects have driven the success of companies like Google (search), Microsoft (Windows), and Alibaba (e-commerce). In today’s digital economy, the importance of network effects has only increased, with platform businesses capturing outsized returns. Dorsey’s framework equips investors to spot these opportunities early and capitalize on the compounding benefits of network-driven growth.

Chapter 7: Cost Advantages

Chapter 7 examines cost advantages as a source of economic moat. Dorsey explains that companies able to produce goods or services at lower costs than competitors can dominate their markets by undercutting rivals on price or maintaining superior margins. He highlights Walmart’s supply chain efficiency and Intel’s proprietary chip manufacturing as classic examples of cost-driven moats.

The chapter provides a detailed analysis of the drivers of cost advantage, including economies of scale, proprietary technology, and access to cheap resources. Dorsey includes data on operating margins, cost per unit, and market share to illustrate how cost leaders outperform peers. He also discusses the sustainability of cost advantages, noting that they are most durable when rooted in scale or unique processes that are difficult for competitors to replicate.

Investors are encouraged to compare cost structures across industry players, looking for evidence of scale economies, long-term supplier contracts, and proprietary manufacturing techniques. Dorsey suggests reviewing company disclosures, industry reports, and benchmarking studies to assess the depth and durability of cost advantages. He also warns that cost advantages can be eroded by technological change or shifts in input costs, so ongoing monitoring is essential.

Real-world examples include Costco’s membership model, which leverages scale to offer low prices, and Ryanair’s ultra-low-cost airline operations. In commodity industries, companies like Cargill and BHP Billiton have built moats through access to cheap resources and efficient logistics. Dorsey’s framework helps investors identify businesses with cost structures that can withstand competitive pressures and deliver consistent, above-average returns.

Chapter 8: The Size Advantage

Chapter 8 explores how sheer size can create economic moats. Dorsey explains that large companies often enjoy advantages such as brand recognition, pricing power, and the ability to dictate terms to suppliers. He cites Procter & Gamble’s dominance in consumer products and Amazon’s scale in e-commerce as examples of how size translates into competitive advantage.

The chapter analyzes the mechanisms by which size confers advantage, including supply chain control, negotiating leverage, and the ability to invest in marketing or innovation. Dorsey provides data on market share, supplier terms, and operating leverage to illustrate the benefits of scale. He also notes that size can create barriers to entry, as new competitors struggle to match the resources and reach of industry leaders.

For investors, the key is to assess whether a company’s size is being effectively leveraged to create sustainable advantages. Dorsey suggests analyzing cost structures, supplier relationships, and brand equity. He also recommends monitoring the company’s ability to reinvest in growth and defend its market position. Companies that use their scale to drive down costs, improve efficiency, and enhance customer loyalty are particularly attractive.

Historically, size advantages have underpinned the success of companies like IBM in technology, Nestlé in food, and Johnson & Johnson in healthcare. In today’s globalized economy, the ability to operate at scale is more important than ever, as companies compete across borders and channels. Dorsey’s insights help investors identify businesses that can use their size to build and sustain economic moats, delivering long-term value to shareholders.

Chapter 9: Eroding Moats

This chapter serves as a cautionary tale, warning that even the strongest moats can erode over time. Dorsey explains that technological advances, changes in consumer behavior, and increased competition can all undermine a company’s competitive advantage. He provides examples of companies like Kodak, which failed to adapt to digital photography, and Sears, whose retail dominance was eroded by new business models and shifting consumer preferences.

The chapter details the warning signs of moat erosion, including declining profit margins, loss of market share, and reduced customer loyalty. Dorsey includes data on financial performance and competitive dynamics to help investors spot early indicators of trouble. He also discusses the role of technological disruption, regulatory change, and evolving industry structures in weakening moats.

For practical application, Dorsey recommends regular monitoring of key performance indicators and competitive positioning. Investors should be alert to shifts in technology, consumer trends, and industry regulation that could threaten a company’s moat. He advises setting up a systematic process for reviewing holdings, with clear criteria for when to exit a position if the moat is weakening.

Historical examples abound: BlackBerry’s dominance in smartphones was quickly overturned by Apple and Android, while Blockbuster’s video rental moat was destroyed by Netflix’s streaming model. In today’s fast-moving markets, vigilance is essential. Dorsey’s framework equips investors to spot the early signs of moat erosion and protect their portfolios from permanent capital loss.

Chapter 10: Finding Moats

Chapter 10 offers a practical roadmap for identifying companies with economic moats. Dorsey outlines a step-by-step process, beginning with industry research to understand the dynamics and barriers to entry. He recommends focusing on sectors where moats are common, such as consumer staples, healthcare, and technology. The chapter provides examples of industries with high and low moat prevalence, helping investors prioritize their research efforts.

The chapter details the use of financial analysis to screen for moat indicators, such as high return on capital, consistent profit margins, and strong free cash flow. Dorsey suggests using stock screeners and financial databases to filter potential investments, then conducting deep dives into company disclosures, competitive positioning, and management quality. He includes checklists and sample screening criteria to make the process actionable and repeatable.

For investors, the key is to combine quantitative screening with qualitative analysis. Dorsey recommends evaluating management’s track record, strategic vision, and capital allocation skills. He also advises using tools like the Morningstar moat rating system, which he helped develop, to benchmark companies against peers. The chapter emphasizes the importance of patience and discipline, encouraging investors to wait for attractive entry points and avoid chasing hot stocks.

Real-world examples include the use of screening tools to identify companies like Nike (brand moat), Adobe (switching costs), and Visa (network effect). By following Dorsey’s process, investors can build a watchlist of high-quality businesses and focus their research on the most promising opportunities. The systematic approach outlined in this chapter is a cornerstone of successful moat-based investing.

Chapter 11: The Big Boss

Chapter 11 explores the critical role of leadership and management in building and maintaining economic moats. Dorsey argues that even the strongest competitive advantages can be eroded by poor management decisions, while visionary leaders can create new moats through innovation and strategic execution. He highlights CEOs like Steve Jobs (Apple) and Warren Buffett (Berkshire Hathaway) as examples of leaders who have built and protected moats over decades.

The chapter provides criteria for evaluating management quality, including track record, capital allocation, strategic vision, and corporate culture. Dorsey includes case studies of companies that have thrived under strong leadership and those that have faltered due to mismanagement. He also discusses the importance of aligning management incentives with shareholder interests, such as through stock ownership or performance-based compensation.

For investors, the practical application involves conducting due diligence on management teams, reviewing past decisions, and assessing their ability to adapt to changing market conditions. Dorsey suggests attending annual meetings, reading shareholder letters, and analyzing insider ownership to gauge management’s commitment to long-term value creation. He also advises monitoring management turnover and succession planning, as leadership changes can signal shifts in strategic direction.

Historically, companies like Microsoft saw renewed growth and innovation under Satya Nadella, while GE’s decline was accelerated by poor capital allocation decisions. In today’s environment, where disruption is constant, the ability of management to innovate, allocate capital wisely, and maintain a strong corporate culture is more important than ever. Dorsey’s framework helps investors identify leaders who can build and defend economic moats for years to come.

Chapter 12: Where the Rubber Meets the Road

Chapter 12 shifts the focus to the practical application of identifying and investing in companies with economic moats. Dorsey discusses how to put theory into practice by conducting thorough research, assessing risk, and making informed investment decisions. He emphasizes the importance of a disciplined process that combines qualitative analysis (business model, moat strength) with quantitative analysis (financial health, valuation).

The chapter provides step-by-step guidance on researching industries, analyzing competitors, and evaluating company financials. Dorsey recommends building a checklist that covers moat sources, financial metrics, management quality, and valuation. He also discusses the importance of risk assessment, advising investors to consider potential threats to the moat, such as new entrants, technological change, or regulatory shifts.

For investors, the key is to apply the principles of economic moats in stock selection and portfolio construction. Dorsey suggests focusing on companies with durable competitive advantages, avoiding those with eroding moats, and maintaining a diversified portfolio to manage risk. He also advises regularly monitoring investments to ensure that the moats remain intact, with clear criteria for when to adjust or exit positions.

Real-world application of this process can be seen in the investment strategies of successful funds like Sequoia or Berkshire Hathaway, which prioritize business quality and competitive advantage. In today’s market, where information is abundant but insight is scarce, Dorsey’s systematic approach provides a roadmap for building a resilient, high-performing portfolio.

Chapter 13: What’s a Moat Worth?

Chapter 13 tackles the crucial question of how to value companies with economic moats. Dorsey explains that while moated businesses often deserve a premium valuation due to their sustainable competitive advantages, it is essential not to overpay. The chapter covers the basics of intrinsic value, emphasizing the importance of estimating future cash flows and discounting them to present value.

Dorsey provides practical guidance on applying valuation methods such as discounted cash flow (DCF) analysis, price-to-earnings ratios, and EV/EBITDA multiples. He includes examples of companies with wide moats that traded at excessive valuations—such as Cisco during the tech bubble—only to deliver poor subsequent returns. The chapter also discusses the concept of margin of safety, urging investors to buy only when the stock trades at a significant discount to intrinsic value.

For investors, the key is to balance quality and price. Dorsey recommends building valuation models that incorporate realistic growth assumptions, conservative discount rates, and sensitivity analysis. He also advises comparing valuation multiples to industry peers and historical averages to assess relative value. The goal is to avoid the twin pitfalls of overpaying for quality or settling for mediocre businesses at cheap prices.

Historically, the discipline of valuation has protected investors from the excesses of market bubbles and panics. Warren Buffett’s refusal to buy tech stocks at the height of the dot-com boom is a classic example of this principle in action. In today’s market, where quality businesses often trade at high multiples, Dorsey’s emphasis on valuation discipline is more relevant than ever. By combining moat analysis with rigorous valuation, investors can maximize returns while minimizing risk.

Chapter 14: Tools for Valuation

Chapter 14 provides a toolkit of practical methods for valuing companies with economic moats. Dorsey walks readers through key techniques, including discounted cash flow (DCF) analysis, relative valuation using price multiples, and sensitivity analysis. He explains that DCF is particularly useful for companies with stable cash flows and strong moats, as it allows investors to estimate the present value of future profits with greater confidence.

The chapter includes step-by-step instructions for building a DCF model, selecting appropriate discount rates, and projecting future growth. Dorsey also discusses the use of valuation multiples—such as price-to-earnings, price-to-book, and EV/EBITDA—to compare companies within the same industry. He provides examples of how to interpret these multiples, highlighting cases where moated businesses justified premium valuations due to their superior profitability and growth prospects.

For investors, the key is to use a combination of valuation methods to cross-check results and identify potential risks. Dorsey recommends conducting sensitivity analysis to understand how changes in assumptions—such as growth rates or discount rates—impact the valuation. He also advises monitoring market conditions and peer valuations to avoid overpaying in frothy markets.

Historically, valuation tools have helped investors navigate periods of market exuberance and pessimism. During the 2008 financial crisis, disciplined valuation allowed investors to buy high-quality businesses at deep discounts. In today’s environment, where interest rates and growth expectations are constantly shifting, Dorsey’s toolkit provides a robust framework for making informed investment decisions.

Chapter 15: When to Sell

The final chapter addresses one of the most challenging aspects of investing: knowing when to sell. Dorsey explains that selling decisions should be based on a combination of factors, including changes in the company’s moat, valuation, and overall market conditions. He warns against emotional decision-making and urges investors to develop clear, objective criteria for exiting positions.

The chapter outlines the key triggers for selling: moat deterioration (such as increased competition or technological disruption), overvaluation (when the stock trades significantly above intrinsic value), and portfolio rebalancing (to maintain diversification and risk alignment). Dorsey provides examples of companies whose moats eroded over time—such as Sears and Blackberry—and emphasizes the importance of acting early to avoid permanent capital loss.

For practical application, Dorsey recommends regular portfolio reviews, with a focus on monitoring key performance indicators, competitive positioning, and valuation. He advises setting up a systematic process for evaluating each holding, with clear thresholds for when to consider selling. The chapter also discusses the role of broader market conditions, suggesting that investors remain alert to bubbles, frothy valuations, or macroeconomic shifts that may warrant portfolio adjustments.

Historically, disciplined selling has protected investors from the pitfalls of holding onto losers or missing opportunities to redeploy capital. The ability to recognize when a moat is eroding or a stock is overvalued is a hallmark of successful investors. In today’s volatile markets, Dorsey’s framework provides the tools and discipline needed to make sound exit decisions and maximize long-term returns.

Advanced Strategies from the Book

Beyond the fundamentals, “The Little Book That Builds Wealth” offers several advanced strategies for investors who want to refine their moat-based approach. Dorsey’s insights go deeper into the nuances of competitive advantage, valuation, and portfolio management. These techniques are particularly valuable for experienced investors seeking to enhance returns and manage risk in more sophisticated ways.

The advanced strategies below draw on Dorsey’s experience at Morningstar and his extensive research into business economics. Each technique is illustrated with real-world examples and actionable steps, providing a roadmap for integrating advanced moat analysis into your investment process.

Strategy 1: Moat Trend Analysis

Moat trend analysis involves tracking the evolution of a company’s competitive advantage over time. Dorsey recommends monitoring key indicators such as changes in market share, profit margins, customer retention rates, and R&D spending. For example, if a company’s margins are declining while competitors are gaining ground, it may signal that the moat is weakening. Conversely, rising market share and improving profitability suggest that the moat is strengthening. Investors can use this analysis to identify early signs of erosion or expansion, enabling proactive portfolio management. Regularly updating your moat assessment—at least annually—ensures that your holdings remain high quality and that you can act quickly if trends turn negative.

Strategy 2: Scenario-Based Valuation

Dorsey advocates for scenario-based valuation, where investors build multiple models based on different assumptions about growth, margins, and competitive dynamics. This approach helps quantify the risks and opportunities associated with a moated business. For example, you might model a base case (steady moat, moderate growth), a bull case (expanding moat, high growth), and a bear case (eroding moat, declining margins). By comparing valuations across scenarios, investors can gauge the margin of safety and make more informed buy/sell decisions. This technique is especially useful in industries facing rapid change, such as technology or healthcare, where the future is highly uncertain.

Strategy 3: Peer Moat Benchmarking

Peer moat benchmarking involves comparing the strength and sustainability of moats across companies within the same industry. Dorsey suggests using quantitative metrics (ROIC, margin stability, customer retention) and qualitative factors (brand strength, network effects) to rank companies on a relative basis. For instance, in the payment processing industry, Visa and Mastercard may score higher on network effects than smaller competitors. This benchmarking helps investors allocate capital to the most advantaged businesses and avoid those with weaker or deteriorating moats. It also provides context for valuation, as companies with superior moats often deserve premium multiples.

Strategy 4: Moat-Driven Portfolio Concentration

For advanced investors, Dorsey discusses the benefits and risks of portfolio concentration in a select group of moated businesses. By focusing capital on the highest-quality companies with the widest moats, investors can potentially achieve higher returns. However, this approach requires deep conviction, thorough research, and ongoing monitoring to ensure that the moats remain intact. Dorsey advises limiting concentration to businesses with proven track records, strong management, and resilient competitive advantages. Historical examples include Buffett’s concentrated bets on Coca-Cola and American Express. This strategy can enhance returns, but it also increases risk, so diversification and risk controls remain important.

Strategy 5: Dynamic Moat Rebalancing

Dynamic moat rebalancing involves adjusting portfolio weights based on changes in moat strength, valuation, and market conditions. Dorsey suggests increasing exposure to businesses whose moats are strengthening or undervalued, while trimming or exiting positions where moats are eroding or valuations are stretched. This dynamic approach ensures that the portfolio remains focused on quality and value, while adapting to evolving market realities. Investors can use regular reviews—quarterly or semiannually—to update moat assessments and rebalance accordingly. The goal is to maximize long-term returns by staying invested in the best businesses at the right prices.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Implementing the concepts from “The Little Book That Builds Wealth” requires a disciplined, step-by-step approach. Dorsey’s framework is designed to be practical and repeatable, enabling investors to build and manage portfolios of high-quality, moated businesses. The key is to integrate qualitative analysis (business model, moat strength) with quantitative analysis (financial health, valuation), and to maintain a long-term perspective focused on compounding wealth.

Below are concrete steps for putting Dorsey’s teachings into action. By following this guide, investors can systematically identify, evaluate, and invest in companies with durable competitive advantages, while managing risk and maximizing returns over time.

- Start by screening for companies with high and stable returns on invested capital, consistent profit margins, and strong free cash flow. Use stock screeners and financial databases to filter potential investments.

- Conduct deep qualitative analysis of each company’s business model, moat sources, and competitive positioning. Evaluate intangible assets, switching costs, network effects, and cost advantages.

- Build valuation models using DCF, P/E, and EV/EBITDA multiples. Incorporate conservative assumptions and conduct sensitivity analysis to assess risk and margin of safety.

- Assess management quality by reviewing track record, capital allocation decisions, and strategic vision. Look for alignment with shareholder interests and a focus on long-term value creation.

- Monitor investments regularly, tracking key performance indicators, competitive dynamics, and industry trends. Be alert to signs of moat erosion or overvaluation, and be prepared to rebalance or exit positions as needed.

- Maintain a diversified portfolio of moated businesses across sectors and geographies to manage risk and capture a range of growth opportunities.

- Commit to continuous learning and improvement, refining your process based on experience, new information, and evolving market conditions.

Critical Analysis

“The Little Book That Builds Wealth” excels at distilling complex concepts into actionable insights. Dorsey’s writing is clear, concise, and grounded in real-world experience, making the book accessible to both novice and experienced investors. The systematic framework for identifying and evaluating moats is a major strength, providing readers with practical tools that can be applied across industries and market cycles. The use of concrete examples and case studies enhances understanding and demonstrates the power of moat-based investing.

However, the book is not without limitations. While Dorsey provides a robust framework for moat analysis, some readers may desire more depth on advanced valuation techniques or industry-specific nuances. The focus on large-cap, established businesses may also limit its applicability to small-cap or emerging market stocks, where moats are harder to identify and quantify. Additionally, the book assumes a basic level of financial literacy, which may be challenging for absolute beginners.

In the current market environment—characterized by rapid technological change, evolving consumer preferences, and global competition—the principles of moat investing remain highly relevant. Dorsey’s emphasis on quality, discipline, and long-term perspective is a valuable antidote to the short-termism that often dominates financial markets. By focusing on businesses with durable competitive advantages, investors can build portfolios that are resilient to disruption and capable of compounding wealth over decades.

Conclusion

“The Little Book That Builds Wealth” is an essential guide for investors seeking to build long-term wealth through high-quality businesses. Pat Dorsey’s framework for identifying, valuing, and investing in companies with economic moats is both practical and timeless. The book’s step-by-step process, actionable checklists, and real-world examples make it a valuable resource for investors at all levels of experience.

The key takeaway is that sustainable competitive advantages—whether rooted in intangible assets, switching costs, network effects, or cost advantages—are the foundation of superior investment returns. By focusing on moated businesses, maintaining valuation discipline, and regularly monitoring for signs of erosion, investors can build resilient portfolios that outperform over the long run. Dorsey’s insights are especially relevant in today’s dynamic markets, where quality and durability are more important than ever.

For anyone serious about investing, “The Little Book That Builds Wealth” is a must-read. Its lessons will help you navigate market cycles, avoid common pitfalls, and achieve your financial goals through disciplined, moat-based investing.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book That Builds Wealth

1. What is the main concept behind “The Little Book That Builds Wealth”?

The main concept is that long-term investment success comes from owning businesses with durable economic moats—structural advantages that protect profits from competition. Dorsey teaches readers how to identify, evaluate, and invest in these moated companies to achieve superior returns over time.

2. Who is Pat Dorsey, and why is he credible?

Pat Dorsey is the former Director of Equity Research at Morningstar and the creator of the Morningstar moat rating system. With decades of experience analyzing thousands of companies, Dorsey is widely respected for his expertise in competitive advantage analysis and value investing.

3. What are the four main types of economic moats discussed in the book?

The four main types are intangible assets (brands, patents, licenses), switching costs, network effects, and cost advantages. Each type is explained in detail, with real-world examples and criteria for assessment.

4. How does the book suggest investors find companies with economic moats?

Dorsey recommends a systematic process: screen for high returns on capital and stable margins, research industry dynamics, analyze company disclosures, and assess management quality. Tools like stock screeners and the Morningstar moat rating system can help identify promising candidates.

5. What are some warning signs that a company’s moat is eroding?

Warning signs include declining profit margins, loss of market share, reduced customer loyalty, and increased competition. Dorsey advises regular monitoring of these indicators and being prepared to exit positions if the moat weakens.

6. How should investors value companies with strong moats?

Investors should use valuation methods like discounted cash flow (DCF), price-to-earnings, and EV/EBITDA multiples, with a focus on buying at a significant discount to intrinsic value. Dorsey emphasizes the importance of a margin of safety to reduce risk.

7. Does the book offer strategies for knowing when to sell a stock?

Yes, Dorsey provides clear criteria for selling, including moat deterioration, overvaluation, and portfolio rebalancing. He stresses the importance of objective decision-making and regular portfolio reviews to maximize long-term returns.

8. Is this book suitable for beginners?

While the book assumes some basic financial literacy, its clear explanations, practical frameworks, and actionable checklists make it accessible to both beginners and experienced investors. It is an excellent starting point for those new to moat-based investing.

9. How does this book differ from other investing books?

Unlike many books that focus on market timing or short-term trading, Dorsey’s work is grounded in business analysis and long-term value creation. Its unique focus on economic moats, combined with practical tools and real-world examples, sets it apart from more theoretical texts.

10. Can the strategies in this book be applied in today’s fast-changing markets?

Absolutely. The principles of moat investing are timeless and adaptable to any market environment. By focusing on quality, durability, and valuation discipline, investors can build portfolios that are resilient to disruption and capable of compounding wealth over decades.