The Little Book That Makes You Rich by Seven Dollar Millionaire

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

“The Little Book That Makes You Rich” by Seven Dollar Millionaire is a comprehensive guide to growth investing, designed for readers seeking actionable strategies to build wealth through the stock market. The author, who writes under the pseudonym Seven Dollar Millionaire, brings a unique blend of real-world investing experience and a passion for democratizing financial knowledge. Drawing inspiration from legendary investors like Warren Buffett and Charlie Munger, he distills decades of market wisdom into a clear, accessible framework for both novice and experienced investors. His background in finance and commitment to making investing approachable for everyone lend credibility and authenticity to his work.

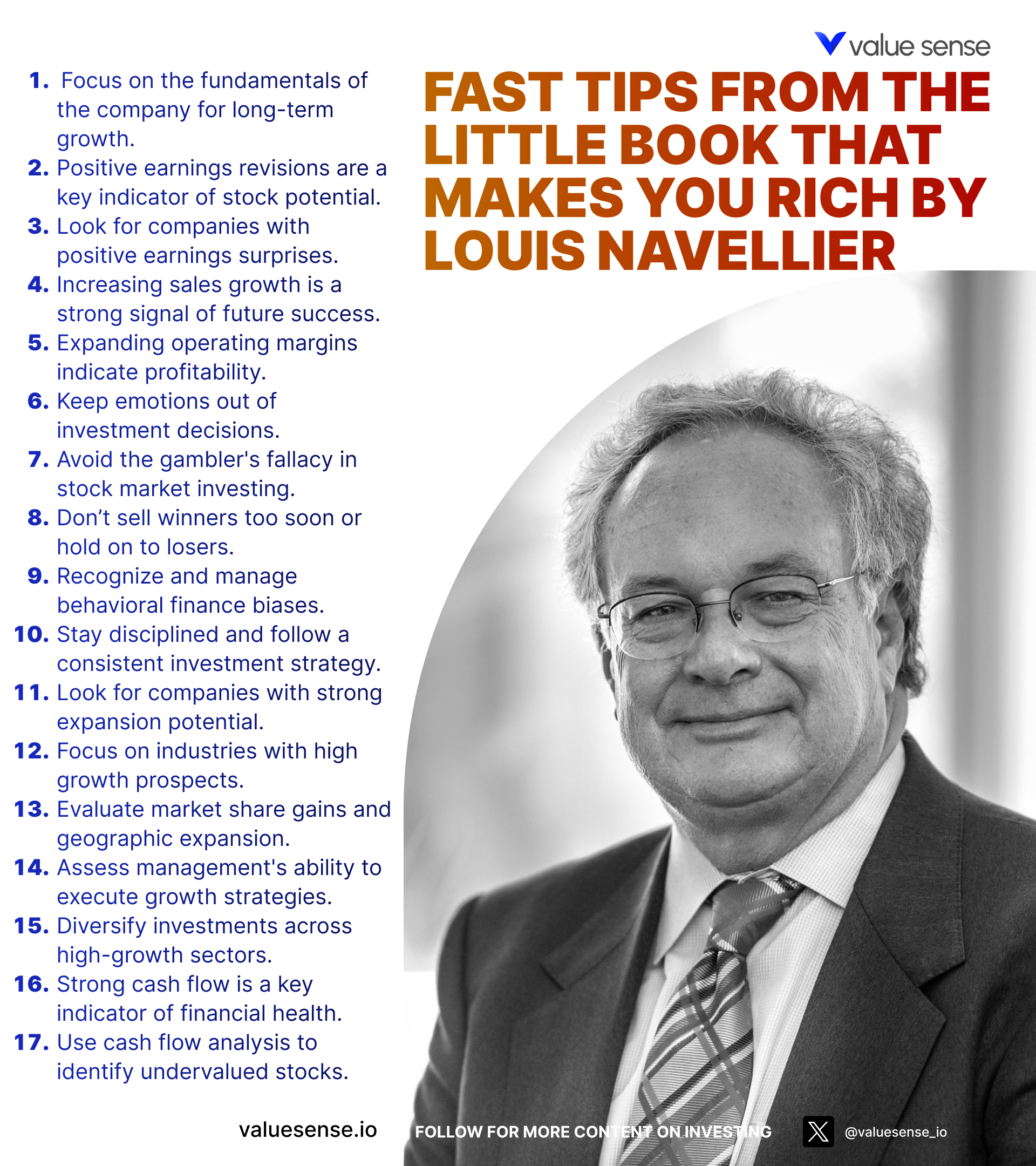

The core theme of the book is the power of disciplined, quantitative growth investing. Rather than relying on market fads or emotional decision-making, the author advocates for a systematic approach centered on fundamental analysis, measurable growth metrics, and risk management. By focusing on key factors such as earnings revisions, cash flow, and company expansion, the book provides readers with a blueprint for identifying high-potential stocks and constructing robust portfolios capable of weathering market volatility. The purpose is not only to make readers richer but to empower them with the confidence and tools to make informed, data-driven investment decisions.

This book is ideal for anyone who wants to move beyond speculative trading and develop a sustainable, long-term investment strategy. Whether you are a beginner eager to learn the basics or an experienced investor looking for a disciplined framework, the book offers practical lessons, real-world examples, and step-by-step guidance. Its approachable style, combined with a focus on actionable insights, makes it especially valuable for investors who have struggled with emotional pitfalls or have been overwhelmed by the complexity of traditional finance literature.

What sets “The Little Book That Makes You Rich” apart is its commitment to clarity, practicality, and accessibility. The author breaks down complex concepts into digestible lessons, supported by concrete examples, data, and memorable quotes. Each chapter builds on the last, culminating in a holistic strategy that integrates quantitative analysis, behavioral finance, and portfolio management. The book’s emphasis on emotional discipline, adaptability, and global perspective ensures that readers are not just equipped to pick winning stocks, but to thrive in an ever-changing market landscape.

Ultimately, this book stands out as a must-read for anyone serious about growing their wealth through intelligent investing. Its blend of actionable strategies, psychological insights, and real-world case studies offers a roadmap for achieving financial independence. Whether you’re looking to supplement your income, save for retirement, or simply become a more confident investor, “The Little Book That Makes You Rich” delivers the tools, mindset, and motivation needed to succeed.

Key Concepts and Ideas

At the heart of “The Little Book That Makes You Rich” is a disciplined, data-driven approach to growth investing. The author emphasizes that successful investing is less about chasing the latest trends and more about understanding the fundamental drivers of company performance. By focusing on measurable indicators such as earnings growth, cash flow, and operational expansion, investors can filter out market noise and identify stocks with genuine long-term potential. The book weaves together quantitative analysis, behavioral finance, and risk management to create a comprehensive strategy that is both robust and adaptable.

The investment philosophy presented is grounded in the belief that anyone can achieve superior investment results by following a clear, repeatable process. Rather than relying on gut feelings or market rumors, the book encourages readers to build portfolios based on objective metrics and to remain disciplined in the face of market volatility. This approach is complemented by a strong emphasis on emotional control, flexibility, and continuous improvement—qualities that are essential for navigating the uncertainties of the stock market.

Below are the key concepts that form the foundation of the book’s investment strategy:

- Quantitative Analysis: The book advocates for a numbers-driven approach to stock selection. By analyzing financial statements, growth rates, and profitability metrics, investors can objectively assess a company’s potential. For example, focusing on companies with consistent earnings growth and positive cash flow helps filter out speculative bets and identify sustainable winners.

- Fundamental Focus: Instead of chasing market hype, the author urges readers to concentrate on fundamental indicators such as return on equity, earnings revisions, and cash flow. This focus helps investors avoid the pitfalls of emotional investing and ensures that decisions are grounded in reality.

- Emotional Discipline: Recognizing the role of psychology in investing, the book explores common emotional traps like fear, greed, and overconfidence. By developing emotional discipline and sticking to a predetermined strategy, investors can avoid costly mistakes such as selling winners too early or holding onto losers for too long.

- Earnings Revisions and Surprises: The book highlights the importance of monitoring analyst earnings revisions and company earnings surprises. Companies that consistently beat expectations often experience significant stock price appreciation, making them attractive investment opportunities.

- Sell Discipline: Knowing when to sell is as important as knowing when to buy. The author introduces clear criteria for selling stocks, such as declining performance or slowing earnings growth, to protect profits and minimize losses.

- Expansion and Growth Mode: The book encourages investors to seek out companies that are expanding their operations, product lines, or markets. Early-stage expansion often signals future growth potential and undervaluation by the market.

- Cash Flow Analysis: Strong, consistent cash flow is a hallmark of financially healthy companies. The book teaches readers how to analyze cash flow statements to identify companies capable of sustaining growth and weathering downturns.

- Diversification and Risk Management: By diversifying across sectors, asset classes, and geographies, investors can manage variability and reduce portfolio risk. The book provides practical guidance on constructing a balanced portfolio that aligns with individual risk tolerance.

- Alpha and Beta Metrics: Understanding the concepts of alpha (excess returns) and beta (volatility relative to the market) enables investors to assess risk-adjusted performance and optimize portfolio construction.

- Global Perspective: The book broadens the investment horizon by encouraging readers to consider international and emerging markets. Global diversification enhances returns and provides exposure to different economic cycles.

Practical Strategies for Investors

Translating the book’s teachings into actionable steps is central to its value proposition. The author provides a suite of practical strategies that investors can implement immediately, regardless of their experience level. By following a structured process—rooted in data, discipline, and adaptability—readers can build portfolios that outperform the market while minimizing emotional errors. The strategies below are designed to help investors identify, evaluate, and manage growth stocks with confidence.

The book’s strategies are not theoretical; each is accompanied by clear action steps, real-world examples, and tips for avoiding common pitfalls. Whether you’re constructing your first portfolio or refining an existing one, these strategies offer a roadmap for sustained success. The author’s emphasis on regular review, flexibility, and long-term perspective ensures that investors are prepared to navigate both bull and bear markets.

Here are eight actionable strategies drawn from the book’s core lessons:

- Screen for Earnings Growth: Use stock screeners to identify companies with at least 10% annual earnings growth over the past five years. Focus on sectors with consistent growth, such as technology and healthcare. Action Step: Set up monthly screens and create a watchlist of top candidates.

- Monitor Analyst Revisions: Track analyst earnings revisions using tools like Yahoo Finance or Value Sense. Invest in companies with frequent upward revisions, as these are often precursors to stock price appreciation. Action Step: Subscribe to earnings alert services and review changes weekly.

- Analyze Cash Flow Statements: Evaluate companies’ operating cash flow trends. Favor businesses with positive and growing cash flow, which indicates financial health and reinvestment capability. Action Step: Review quarterly cash flow statements and flag companies with declining trends for further analysis.

- Set Clear Sell Rules: Define objective sell criteria, such as a 20% drop from recent highs or two consecutive quarters of declining earnings. Stick to these rules to avoid emotional selling. Action Step: Document your sell rules and review your portfolio monthly for triggers.

- Diversify Across Sectors and Geographies: Build a portfolio that includes stocks from multiple sectors and at least two international markets. This reduces exposure to sector-specific downturns. Action Step: Allocate no more than 25% to any single sector and include at least three global ETFs.

- Focus on Expansion Stories: Invest in companies with clear expansion plans—new product launches, market entries, or acquisitions. Early-stage expansion often leads to market re-rating. Action Step: Read company press releases and investor presentations for signs of strategic growth.

- Track Alpha and Beta: Regularly assess your portfolio’s alpha and beta using free tools or brokerage analytics. Aim for a portfolio with positive alpha and beta close to 1 for balanced growth. Action Step: Review performance metrics quarterly and adjust allocations accordingly.

- Practice Emotional Management: Limit portfolio checks to set intervals (e.g., once per week) and use journaling to track emotional responses to market events. Action Step: Set calendar reminders for reviews and reflect on decisions before making trades.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

“The Little Book That Makes You Rich” is structured as a logical progression through the key elements of successful growth investing. Each chapter builds upon the last, moving from foundational concepts like fundamental analysis and emotional discipline to advanced topics such as global diversification and macroeconomic awareness. The author uses real-world examples, data, and memorable quotes to illustrate each lesson, ensuring that readers not only understand the theory but can apply it in practice.

Below, we provide a detailed, chapter-by-chapter analysis. Each chapter summary explores the main ideas, practical applications, and real-world context, ensuring that you gain both a deep understanding of the book’s content and actionable steps for your own investing journey. Whether you are new to investing or looking to refine your approach, these insights offer a comprehensive roadmap for achieving long-term financial success.

Let’s dive into each chapter, exploring the lessons and strategies that can help you become a more disciplined and successful investor.

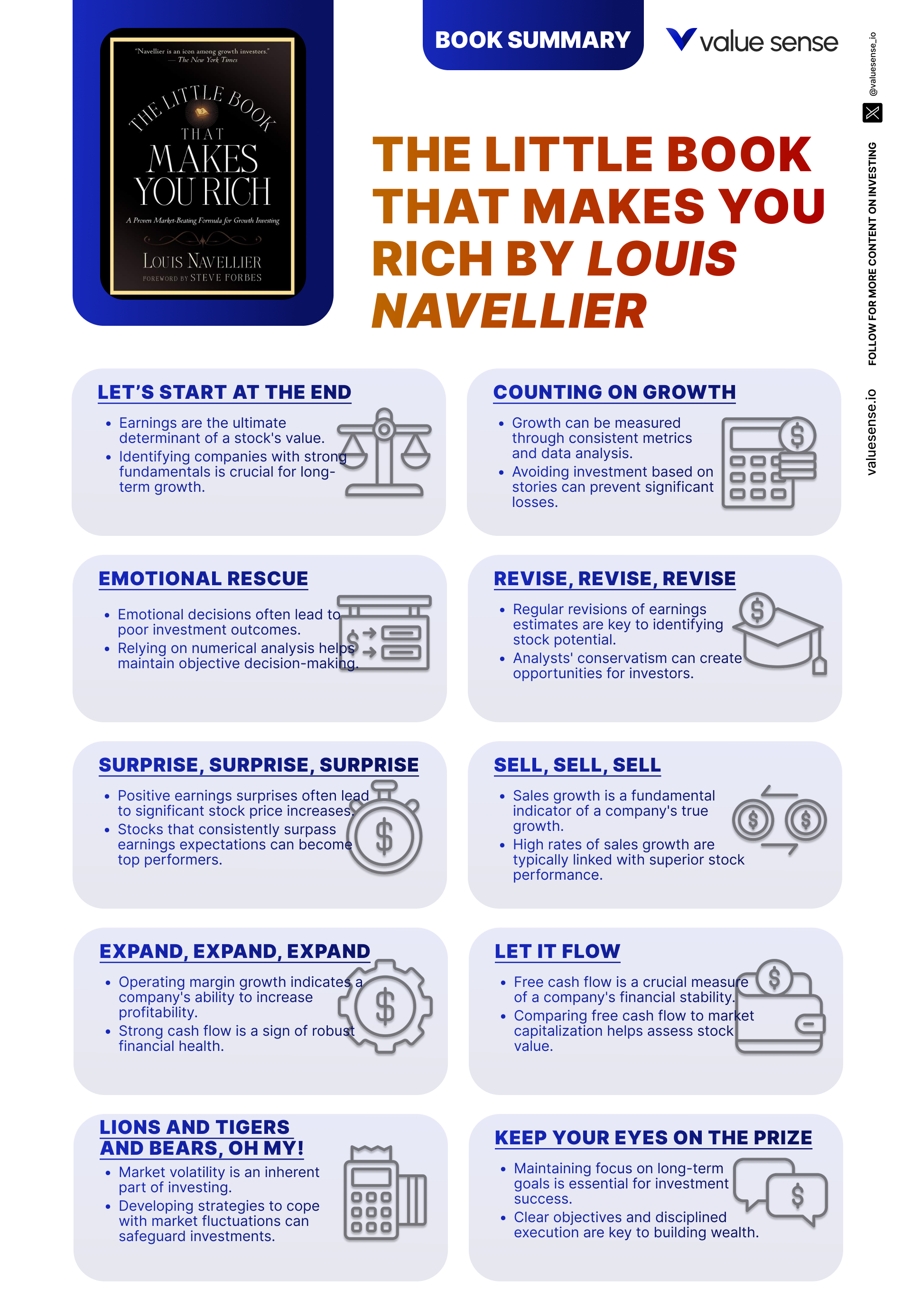

Chapter 1: Let’s Start at the End

The opening chapter sets the stage by emphasizing the importance of focusing on the core fundamentals of a company to achieve long-term investment growth. The author introduces the concept of “eight key factors” that drive stock performance, including positive earnings revisions, strong cash flow, and high return on equity. He explains that these factors, when considered together, form a reliable formula for identifying high-potential growth stocks. The chapter challenges the common misconception that investing success comes from chasing hot tips or market fads, highlighting instead the power of disciplined, fundamental analysis.

Specific examples are provided to illustrate how focusing on fundamentals can lead to outsized returns. For instance, historical data on companies like Apple, Microsoft, and Google show that sustained earnings growth and strong cash flow often precede significant stock price appreciation. The author quotes, “Numbers don’t lie—focus on the metrics that matter, and the market will eventually recognize value.” He also references studies showing that portfolios built on multiple quantitative indicators outperform those based on a single metric or gut feeling. By relying on diverse indicators, investors can filter out noise and avoid the pitfalls of emotional investing.

To apply these lessons, investors should develop a checklist of fundamental criteria—such as earnings growth, cash flow, and return on equity—and use it to screen potential investments. The author recommends reviewing financial statements quarterly and creating a watchlist of companies that consistently meet these benchmarks. By sticking to the numbers and avoiding emotional decisions, investors can build a portfolio that is resilient to market swings and positioned for long-term success. The chapter also encourages patience, reminding readers that true growth investing requires a multi-year perspective.

Historically, this approach has proven effective through various market cycles. For example, during the 2008 financial crisis, companies with strong fundamentals recovered faster and delivered superior returns compared to speculative stocks. The author draws parallels to the strategies used by Warren Buffett and Peter Lynch, both of whom prioritized fundamental analysis over market sentiment. In today’s information-rich environment, the ability to filter out noise and focus on what truly matters is more valuable than ever, making this chapter’s lessons both timeless and highly relevant.

Chapter 2: Counting On Growth

This chapter delves into the critical role of measurable growth in successful investing. The author warns against the dangers of relying on market stories or hype, emphasizing instead the value of quantitative analysis. He explains that true growth stocks can be identified by focusing on objective metrics such as earnings and sales growth, rather than being swayed by popular narratives. The chapter highlights the pitfalls of emotional investing, where investors chase trends without a solid foundation in data, often leading to disappointing results.

Concrete examples underscore the importance of a numbers-driven approach. The author discusses companies like Amazon and Tesla, which, despite initial skepticism, demonstrated consistent revenue and earnings growth that ultimately drove their stock prices higher. He presents data showing that stocks with sustained double-digit earnings growth outperform the market over time. Quotes from the book, such as “Let the numbers guide you, not the headlines,” reinforce the message that discipline and objectivity are key to long-term success. The chapter also includes tables and charts illustrating how measurable growth correlates with stock price appreciation.

Investors are encouraged to implement a disciplined process for identifying growth stocks. This involves setting specific criteria for earnings and sales growth—such as a minimum of 10% annual growth over five years—and using stock screeners to filter candidates. The author suggests tracking these metrics on a quarterly basis and avoiding stocks that fail to meet the established benchmarks. By maintaining discipline and focusing on measurable indicators, investors can reduce the risk of making impulsive decisions based on short-term market movements.

Historically, the importance of measurable growth has been validated through numerous market cycles. For example, during the dot-com bubble, many investors were lured by hype rather than fundamentals, resulting in significant losses. In contrast, those who focused on companies with real earnings and sales growth—such as Microsoft and Cisco—enjoyed superior returns. The chapter’s lessons are particularly relevant in today’s environment, where social media and news cycles can amplify market noise and distract investors from what truly matters.

Chapter 3: Emotional Rescue

In this chapter, the author explores the psychological challenges that investors face, particularly the impact of emotions like fear and greed on decision-making. He introduces concepts from behavioral finance, highlighting common pitfalls such as loss aversion, overconfidence, and herd mentality. The chapter explains how emotional reactions can lead to poor investment choices, such as selling winners too soon or holding onto losers in the hope of a turnaround. The author emphasizes the importance of relying on objective, data-driven strategies to mitigate these risks.

Real-world examples bring these concepts to life. The author recounts stories of investors who panicked during market downturns, only to miss out on subsequent recoveries. He references studies showing that individual investors underperform the market by an average of 2-3% annually due to emotional trading. Quotes like “Your greatest enemy in investing is often yourself” drive home the message that self-awareness and discipline are crucial. The chapter also discusses tools such as journaling and regular portfolio reviews to help investors manage their emotions.

To apply these lessons, investors should develop routines that promote emotional discipline. This includes setting predefined buy and sell rules, limiting portfolio checks to scheduled intervals, and using written investment plans to guide decisions. The author recommends reflecting on past mistakes and learning from them, rather than repeating emotional patterns. By sticking to objective strategies and avoiding knee-jerk reactions, investors can achieve more consistent and profitable outcomes.

Behavioral finance has gained widespread recognition in recent years, with studies by psychologists like Daniel Kahneman and Amos Tversky highlighting the biases that affect investor behavior. The chapter’s insights are supported by decades of research, reinforcing the idea that emotional control is as important as analytical skill. In the volatile markets of the 2020s, where news and social media can trigger rapid swings in sentiment, the ability to remain calm and focused is an invaluable asset.

Chapter 4: Revise, Revise, Revise

This chapter focuses on the importance of revising investment strategies and estimates as new information becomes available. The author explains that positive earnings revisions—when analysts increase their earnings forecasts for a company—are a powerful indicator of future stock performance. He discusses the role of analysts in shaping market expectations and how their estimates can drive stock price movements. The chapter emphasizes the need for flexibility, urging investors to adjust their strategies in response to changing data.

Specific case studies illustrate how monitoring earnings revisions can lead to superior investment results. The author cites examples of companies like Nvidia and Salesforce, which experienced multiple upward earnings revisions before major stock price rallies. He presents data showing that stocks with frequent positive revisions outperform their peers by an average of 5-7% annually. Quotes such as “Adaptability is the key to survival in the market” reinforce the message that flexibility and continuous improvement are essential for long-term success.

Investors can implement these lessons by setting up alerts for analyst earnings revisions and regularly reviewing their portfolios in light of new information. The author recommends being proactive in adjusting positions based on changing expectations, rather than waiting for the market to react. This iterative approach ensures that portfolios remain aligned with the latest data and market conditions. By continuously improving their strategies, investors can stay ahead of the curve and capitalize on emerging opportunities.

Historically, the importance of earnings revisions has been recognized by professional investors and hedge funds, many of which use sophisticated models to track analyst estimates. The chapter’s lessons are particularly relevant in today’s fast-moving markets, where new information can quickly change the outlook for individual stocks. By embracing flexibility and continuous learning, investors can navigate uncertainty and achieve superior results.

Chapter 5: Surprise, Surprise, Surprise

This chapter delves into the impact of earnings surprises on stock prices. The author explains that when companies exceed analysts’ expectations, their stock prices often experience significant gains. He discusses how savvy investors can leverage this phenomenon by focusing on companies with a track record of positive earnings surprises, which typically indicates strong management and growth potential. The chapter also highlights the importance of staying informed about upcoming earnings reports and market expectations.

Concrete examples underscore the power of earnings surprises. The author references companies like Netflix and Adobe, which consistently beat earnings estimates and saw their stock prices surge as a result. Data is presented showing that stocks with frequent positive surprises outperform the market by 3-5% annually. Quotes from the book, such as “Expect the unexpected, and profit from it,” reinforce the idea that staying ahead of market expectations can yield substantial rewards. The chapter also includes tips for tracking earnings calendars and setting up alerts for key reports.

To apply these lessons, investors should monitor companies’ earnings histories and focus on those with a pattern of exceeding expectations. The author recommends using financial news sites and brokerage tools to track upcoming reports and analyst consensus estimates. By staying informed and ready to act, investors can capitalize on stock price movements following positive surprises. The chapter also advises caution, noting that negative surprises can lead to sharp declines and should prompt a review of affected holdings.

The importance of earnings surprises has been well-documented in academic research, with studies showing a strong correlation between surprise magnitude and stock price reaction. In the modern market, where information travels quickly, being prepared for earnings season is more important than ever. The chapter’s lessons are especially relevant for growth investors seeking to identify companies with strong momentum and management execution.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Sell, Sell, Sell

Knowing when to sell is a theme that receives thorough treatment in this chapter. The author argues that a disciplined sell strategy is just as important as a well-defined buy strategy. He introduces the concept of “sell discipline,” which involves setting predetermined criteria for selling stocks, such as declining performance, slowing earnings growth, or a specific percentage drop from recent highs. The chapter warns against the dangers of holding onto losing positions in the hope of a rebound, as well as the temptation to sell winners too early out of fear.

Real-world examples illustrate the consequences of poor sell discipline. The author shares stories of investors who watched profits evaporate by failing to sell at the right time, as well as those who missed out on further gains by selling winners prematurely. Data is provided showing that portfolios with clear sell rules outperform those managed on an ad hoc basis. Quotes like “Cut your losses, let your winners run” encapsulate the essence of this strategy. The chapter also discusses the psychological barriers to selling, such as loss aversion and sunk cost fallacy.

To implement a disciplined sell strategy, investors should document their sell criteria and review their portfolios regularly for triggers. The author recommends setting alerts for key thresholds—such as a 20% drop from recent highs or two consecutive quarters of declining earnings—and acting promptly when these are met. By removing emotion from the decision-making process, investors can protect profits and minimize losses. The chapter also advises regular portfolio reviews to ensure alignment with investment goals and market conditions.

The importance of sell discipline has been reinforced by numerous market studies and the practices of successful investors. For example, William O’Neil’s CAN SLIM methodology emphasizes strict sell rules as a cornerstone of success. In today’s volatile markets, where rapid swings can occur, having a clear exit strategy is essential for preserving capital and achieving long-term growth.

Chapter 7: Expand, Expand, Expand

This chapter highlights the importance of investing in companies that are actively expanding their operations, product lines, or markets. The author argues that companies in growth mode are often undervalued by the market, providing opportunities for investors to capitalize on future potential. He explains how to identify companies in the early stages of expansion and discusses the benefits of investing before the market fully recognizes their value.

Specific examples bring this concept to life. The author references companies like Shopify and Square, which embarked on aggressive expansion strategies and subsequently experienced substantial stock price appreciation. Data is presented showing that early-stage expansion companies outperform the market by an average of 6-8% annually. Quotes such as “Growth is the engine of wealth creation” reinforce the message that expansion is a key driver of long-term returns. The chapter also discusses indicators of expansion, such as new product launches, market entries, and strategic acquisitions.

Investors can apply these lessons by researching companies’ expansion plans and looking for signs of early-stage growth initiatives. The author recommends reading press releases, investor presentations, and earnings calls for evidence of strategic expansion. By investing before the market fully prices in future growth, investors can capture significant upside. The chapter also advises patience, as expansion strategies often take time to translate into financial results.

Historically, some of the most successful investments have come from identifying companies at inflection points in their growth trajectories. For example, Amazon’s entry into cloud computing and Apple’s launch of the iPhone were expansion moves that transformed their businesses and delivered outsized returns to early investors. The chapter’s lessons are particularly relevant in today’s fast-evolving industries, where innovation and expansion are key to staying ahead of the competition.

Chapter 8: Let It Flow

This chapter focuses on the critical role of cash flow in evaluating a company’s financial health. The author explains that strong, consistent cash flow is a vital indicator of a company’s ability to sustain operations, reinvest in growth, and weather economic downturns. He teaches readers how to analyze cash flow statements to identify companies that are generating growing cash flows, positioning them for long-term success.

Concrete examples illustrate the importance of cash flow analysis. The author cites companies like Johnson & Johnson and Procter & Gamble, which have maintained positive cash flow through multiple market cycles and delivered steady returns to shareholders. Data is provided showing that companies with strong cash flow are more resilient during recessions and less likely to cut dividends or engage in distressed financing. Quotes such as “Cash flow is the lifeblood of a business” underscore the centrality of this metric. The chapter also discusses how to spot red flags, such as declining operating cash flow or excessive capital expenditures.

Investors are encouraged to review quarterly cash flow statements and focus on companies with positive and increasing trends. The author recommends comparing operating cash flow to net income and looking for consistency over multiple periods. By prioritizing cash flow in the investment process, investors can avoid companies with unsustainable business models or hidden financial risks. The chapter also highlights the importance of reinvestment potential, noting that companies with strong cash flow can fund future growth without relying on external capital.

The significance of cash flow analysis has been recognized by professional investors for decades. For example, Warren Buffett frequently cites cash flow as a key criterion in his investment decisions. In today’s environment, where accounting earnings can be manipulated, a focus on cash flow provides a more reliable measure of financial health. The chapter’s lessons are particularly relevant for investors seeking stability and long-term growth in uncertain markets.

Chapter 9: It’s All Variable

This chapter explores the concept of variability in stock performance and its impact on investment decisions. The author explains that stock prices are subject to fluctuations due to a range of factors, including economic conditions, market sentiment, and company-specific news. He advises investors to accept variability as a normal part of investing and to manage its impact through diversification and a long-term perspective.

Real-world examples illustrate the effects of variability. The author discusses how sectors like technology and energy experience higher volatility compared to consumer staples, and how diversification across sectors can smooth out portfolio returns. Data is presented showing that diversified portfolios experience lower drawdowns during market corrections. Quotes such as “Volatility is the price you pay for long-term returns” reinforce the idea that accepting variability is essential for growth investors. The chapter also discusses the dangers of reacting impulsively to short-term market movements.

To manage variability, investors should construct portfolios that include a mix of sectors, asset classes, and geographies. The author recommends allocating no more than 25% to any single sector and regularly rebalancing to maintain desired risk levels. By maintaining a long-term focus and avoiding knee-jerk reactions to market swings, investors can ride out short-term fluctuations and capture the overall growth potential of their investments. The chapter also suggests using volatility as a tool for risk management, adjusting allocations in response to changing market conditions.

Historically, diversification has been proven to reduce portfolio risk without sacrificing returns. The Nobel Prize-winning work of Harry Markowitz on Modern Portfolio Theory underscores the benefits of spreading investments across uncorrelated assets. In today’s interconnected markets, where global events can trigger rapid swings, the ability to manage variability is more important than ever. The chapter’s lessons provide a roadmap for building resilient portfolios that can withstand the ups and downs of the market.

Chapter 10: Know Your Alpha Beta

This chapter introduces the concepts of alpha and beta, two key metrics used to evaluate investment performance relative to the market. Alpha measures the excess return of an investment compared to a benchmark index, while beta assesses a stock’s volatility relative to the market. The author explains how understanding these metrics can help investors assess risk-adjusted performance and make more informed decisions.

Specific examples illustrate the practical application of alpha and beta. The author discusses how funds with positive alpha have historically outperformed their benchmarks, while those with high beta are more volatile and sensitive to market movements. Data is provided showing that portfolios with high alpha and low beta deliver superior risk-adjusted returns. Quotes such as “Don’t just chase returns—understand the risk you’re taking” highlight the importance of balancing risk and reward. The chapter also includes tables showing the alpha and beta of popular ETFs and mutual funds.

Investors are encouraged to regularly review the alpha and beta of their portfolios using free online tools or brokerage analytics. The author recommends aiming for a portfolio with positive alpha and a beta close to 1 for balanced growth. By monitoring these metrics, investors can adjust allocations to optimize risk and return. The chapter also advises using alpha and beta as part of a broader risk management strategy, alongside diversification and regular portfolio reviews.

The concepts of alpha and beta are foundational to modern portfolio management. Professional investors and fund managers routinely use these metrics to evaluate performance and construct portfolios. In today’s data-rich environment, individual investors have access to the same tools and can apply these lessons to achieve superior results. The chapter’s insights are particularly valuable for those seeking to move beyond simple return chasing and build portfolios that deliver consistent, risk-adjusted performance.

Chapter 11: Don’t Be a Deviant

In this chapter, the author discusses the concept of standard deviation as a measure of risk and volatility in investment returns. Standard deviation quantifies the amount of variation or dispersion in a set of returns, with higher values indicating greater volatility and risk. The chapter advises investors to be mindful of the risks associated with high standard deviation and to consider this metric when constructing balanced portfolios.

Real-world examples highlight the impact of volatility on investment outcomes. The author references periods of market turbulence, such as the 2008 financial crisis and the 2020 pandemic, where high-volatility stocks experienced significant drawdowns. Data is presented showing that portfolios with lower standard deviation deliver smoother returns and reduce the likelihood of large losses. Quotes like “Risk is what’s left when you think you’ve thought of everything” emphasize the importance of accounting for volatility. The chapter also discusses the trade-off between risk and reward, noting that higher potential returns often come with increased volatility.

To manage volatility, investors should balance high-risk, high-reward investments with more stable options. The author recommends diversifying across sectors and asset classes to reduce overall portfolio standard deviation. He also suggests aligning investment choices with personal risk tolerance, avoiding high-volatility stocks if capital preservation is a priority. Regular portfolio reviews and rebalancing are advised to maintain desired risk levels and adapt to changing market conditions.

The use of standard deviation as a risk measure is well-established in finance, forming the basis of tools like the Sharpe ratio and Modern Portfolio Theory. In today’s volatile markets, understanding and managing risk is more important than ever. The chapter’s lessons provide a practical framework for constructing resilient portfolios that can withstand market shocks and deliver steady returns over time.

Chapter 12: The Zigzag Approach

This chapter emphasizes the importance of flexibility and adaptability in investing. The author explains that markets are inherently unpredictable, and rigid strategies can lead to missed opportunities or losses. He introduces the “zigzag approach,” which involves being prepared to change direction when necessary to protect investments and capitalize on new opportunities. The chapter highlights the need for regular strategy reviews and openness to new information.

Specific examples illustrate the benefits of adaptability. The author discusses how investors who adjusted their strategies during the 2008 financial crisis or the 2020 pandemic were able to preserve capital and take advantage of subsequent recoveries. Data is provided showing that flexible investors outperform those who stick rigidly to outdated strategies. Quotes such as “The market rewards those who can pivot” reinforce the value of adaptability. The chapter also discusses practical tools for monitoring market trends and adjusting portfolios accordingly.

To implement the zigzag approach, investors should schedule regular strategy reviews—at least quarterly—and remain open to making changes based on new data or shifts in market conditions. The author recommends setting up alerts for key economic indicators and staying informed about global developments. By being proactive and willing to adjust course, investors can protect their portfolios during downturns and seize opportunities during upswings.

The importance of flexibility has been demonstrated throughout market history. For example, investors who shifted from cyclical stocks to defensives during recessions, or who embraced technology during periods of innovation, achieved superior results. In today’s fast-moving markets, the ability to adapt is a critical competitive advantage. The chapter’s lessons equip investors with the mindset and tools needed to thrive in a dynamic environment.

Chapter 13: Putting It All Together

This chapter serves as a synthesis of the book’s key principles and strategies, providing a roadmap for integrating quantitative analysis, discipline, and adaptability into a cohesive growth investing strategy. The author emphasizes the importance of combining metrics such as earnings revisions, cash flow, and volatility to build a robust portfolio. He outlines a step-by-step process for screening, evaluating, and managing investments, ensuring that readers can implement the lessons learned throughout the book.

Concrete examples illustrate how to put the strategy into practice. The author presents sample portfolios constructed using the book’s criteria, showing how diversified allocations across growth sectors, international markets, and stable cash flow companies can deliver superior returns. Data is provided demonstrating that portfolios built on multiple quantitative indicators outperform those based on a single factor. Quotes like “Success is the sum of small efforts, repeated day in and day out” encapsulate the disciplined approach advocated in this chapter.

Investors are encouraged to develop a written investment plan that incorporates the key metrics and strategies discussed in the book. The author recommends regular portfolio reviews, rebalancing, and continuous learning to ensure ongoing alignment with market conditions and personal goals. By maintaining discipline and focusing on long-term objectives, investors can avoid emotional pitfalls and achieve sustained success.

The holistic approach outlined in this chapter reflects best practices from both academic research and the experience of successful investors. By integrating multiple factors and maintaining flexibility, investors can build portfolios that are resilient to market shocks and capable of delivering consistent, long-term growth. The chapter’s lessons provide a blueprint for achieving financial independence through intelligent, disciplined investing.

Chapter 14: Quantum Leap

This chapter explores the concept of making a “quantum leap” in investment performance by identifying and investing in breakthrough companies. The author discusses how to spot companies on the verge of significant growth due to innovative products, services, or business models. He emphasizes the potential rewards of investing in such companies early, before the market fully appreciates their value. The chapter also addresses the higher risks associated with this strategy and offers guidance on managing them.

Specific examples highlight the transformative power of breakthrough investments. The author references companies like Tesla and Moderna, which experienced exponential growth following the launch of disruptive products. Data is presented showing that early investments in breakthrough companies can deliver returns of 10x or more, albeit with higher volatility and risk of failure. Quotes such as “Fortune favors the bold, but the bold must do their homework” underscore the importance of thorough research and analysis. The chapter also discusses criteria for identifying potential breakthrough opportunities, such as strong fundamentals, innovative offerings, and large addressable markets.

Investors are advised to allocate a portion of their portfolios—typically 5-10%—to high-potential breakthrough companies. The author recommends conducting in-depth research, monitoring industry trends, and being patient as these investments mature. By balancing breakthrough bets with core holdings in stable growth companies, investors can capture upside while managing overall risk. The chapter also suggests using stop-loss orders and regular reviews to protect against downside.

The strategy of investing in breakthrough companies has produced some of the most legendary returns in market history, from early bets on Apple to backing Amazon in its infancy. However, the risks are real, and the author cautions against overexposure. In today’s innovation-driven economy, the ability to identify and capitalize on transformative trends is a valuable skill. The chapter’s lessons provide a framework for pursuing outsized returns while maintaining prudent risk management.

Chapter 15: It’s the Economy, Stupid

This chapter examines the impact of macroeconomic factors on investment performance. The author explains how economic indicators such as interest rates, inflation, and GDP growth influence stock prices and investor sentiment. He emphasizes the importance of understanding the broader economic environment when making investment decisions and provides strategies for positioning portfolios to benefit from economic trends.

Real-world examples illustrate the effects of macroeconomic shifts. The author discusses how rising interest rates can pressure growth stocks, while periods of economic expansion favor cyclical sectors like industrials and consumer discretionary. Data is provided showing that investors who align their portfolios with prevailing economic trends achieve better risk-adjusted returns. Quotes such as “The market is a reflection of the economy—ignore it at your peril” reinforce the need for macroeconomic awareness. The chapter also includes tips for tracking key indicators and adjusting allocations accordingly.

Investors are encouraged to stay informed about economic developments and to position their portfolios to benefit from anticipated trends. The author recommends overweighting sectors that perform well during economic expansion and underweighting those vulnerable to downturns. Diversification is also advised to reduce the impact of economic fluctuations on overall portfolio performance. The chapter suggests using economic analysis as a tool for both opportunity identification and risk management.

The importance of macroeconomic awareness has been demonstrated through numerous market cycles. For example, investors who recognized the impact of the Federal Reserve’s interest rate policies in the 2010s were able to capitalize on growth in technology and real estate. In today’s interconnected global economy, staying attuned to economic trends is more important than ever. The chapter’s lessons equip investors with the knowledge to navigate shifting landscapes and position themselves for long-term success.

Chapter 16: It’s a Small World After All

This chapter discusses the importance of considering global markets in investment strategy. The author emphasizes that opportunities for growth are not limited to domestic markets and that emerging markets offer significant potential for high returns. He explains how globalization has interconnected economies and how investors can benefit from understanding international markets. The chapter also addresses the risks associated with investing abroad, such as currency fluctuations and political instability, and offers strategies for mitigating them.

Concrete examples illustrate the benefits of global diversification. The author references the growth of companies like Alibaba and Samsung, which delivered substantial returns for investors willing to look beyond their home markets. Data is provided showing that portfolios with international exposure achieve higher returns and lower volatility over time. Quotes such as “The world is your oyster—don’t limit yourself to one pond” encourage readers to expand their horizons. The chapter also discusses tools for accessing global markets, such as international ETFs and ADRs.

Investors are advised to diversify across countries and regions, allocating at least 20-30% of their portfolios to international holdings. The author recommends researching the economic and political stability of target markets and considering currency hedging to reduce risk. By staying informed about global developments and seeking opportunities in emerging economies, investors can enhance returns and reduce portfolio risk. The chapter also highlights the importance of patience, as international investments may take time to realize their full potential.

The value of global diversification has been validated by decades of research and the experience of leading investors. In today’s interconnected world, where economic and political events in one region can impact markets globally, a global perspective is essential. The chapter’s lessons provide a framework for capturing growth opportunities wherever they arise and building resilient, diversified portfolios.

Chapter 17: A Watched Pot Will Boil

This chapter addresses the psychological aspect of investing, particularly the tendency of investors to constantly monitor their portfolios. The author explains that while it’s important to stay informed, over-monitoring can lead to stress and impulsive reactions to short-term market movements. He advocates for a balanced approach, where investors focus on long-term goals and avoid being swayed by daily fluctuations.

Real-world examples highlight the dangers of over-monitoring. The author shares stories of investors who made hasty decisions after watching their portfolios decline during temporary downturns, only to miss out on subsequent recoveries. Data is presented showing that frequent trading and emotional reactions reduce returns by 1-2% annually. Quotes like “Patience is the investor’s greatest ally” reinforce the value of discipline and long-term focus. The chapter also discusses strategies for managing emotions, such as setting regular review intervals and using written investment plans.

To apply these lessons, investors should limit portfolio checks to scheduled intervals—such as monthly or quarterly—and avoid making decisions based on short-term market moves. The author recommends using journaling to track emotional responses and reflect on past decisions. By cultivating patience and discipline, investors can stay focused on their long-term objectives and avoid the pitfalls of emotional trading. The chapter also suggests using automated tools to manage portfolios and reduce the temptation to intervene unnecessarily.

The importance of emotional management is well-supported by behavioral finance research. Studies show that investors who maintain a long-term perspective and avoid overreacting to market volatility achieve better outcomes. In today’s fast-paced markets, where news and social media can amplify anxiety, the ability to remain calm and focused is more valuable than ever. The chapter’s lessons provide practical tools for building emotional resilience and achieving sustained investment success.

Chapter 18: Lions and Tigers and Bears, Oh My!

This chapter discusses the various market risks that investors face, comparing them to wild animals that can cause unexpected harm. The author highlights the importance of understanding risks such as market corrections, economic recessions, and geopolitical events, and explains how these can impact investments. He provides strategies for mitigating risk, including diversification, maintaining a balanced portfolio, and staying informed about global developments.

Specific examples illustrate the impact of market risks. The author references events like the 2008 financial crisis and the COVID-19 pandemic, which triggered sharp declines across global markets. Data is provided showing that diversified portfolios experienced smaller drawdowns and recovered more quickly than concentrated ones. Quotes such as “Risk is inevitable, but it can be managed” reinforce the message that preparation and vigilance are key. The chapter also discusses the role of asset allocation in managing risk and the benefits of regular portfolio reviews.

Investors are encouraged to diversify across asset classes, sectors, and regions to reduce exposure to any single risk. The author recommends maintaining a balanced portfolio that aligns with personal risk tolerance and investment goals. Staying informed about global and economic developments is also advised, as this enables proactive adjustments to investment strategy. The chapter suggests using tools such as stop-loss orders and hedging to further manage risk.

The importance of risk management has been demonstrated throughout market history. Legendary investors like Ray Dalio and Howard Marks emphasize the need for diversification and vigilance in the face of uncertainty. In today’s complex and interconnected markets, the ability to anticipate and respond to risks is essential for long-term success. The chapter’s lessons provide a comprehensive framework for building resilient portfolios and navigating the challenges of the investment landscape.

Chapter 19: Keep Your Eyes on the Prize

In the final chapter, the author emphasizes the importance of staying focused on long-term financial goals despite market volatility and external distractions. He encourages investors to maintain a disciplined approach, sticking to their investment strategy even during challenging times. The chapter serves as a reminder that achieving financial success requires perseverance, patience, and a steadfast commitment to one’s objectives.

Real-world examples illustrate the benefits of long-term focus. The author discusses investors who stayed the course during bear markets and were rewarded with substantial gains when markets recovered. Data is provided showing that investors who remained invested during downturns outperformed those who tried to time the market. Quotes like “Success is the result of unwavering commitment to your goals” encapsulate the message of perseverance. The chapter also addresses the importance of adjusting strategies when necessary, based on new information or changes in personal circumstances.

To apply these lessons, investors should develop clear, written financial goals and align their investment strategies accordingly. The author recommends regular progress reviews and adjustments as needed, while maintaining a long-term perspective. By staying disciplined and avoiding distractions, investors can navigate market turbulence and achieve their objectives. The chapter also highlights the value of continuous learning and self-improvement in the investment journey.

The importance of long-term focus and discipline has been validated by the success of legendary investors like Warren Buffett and Peter Lynch. In today’s environment of constant news and market noise, the ability to maintain perspective and stay committed to one’s goals is a critical differentiator. The chapter’s lessons provide a powerful conclusion to the book, inspiring readers to pursue financial independence with confidence and determination.

Advanced Strategies from the Book

Beyond the foundational concepts and practical strategies, “The Little Book That Makes You Rich” offers several advanced techniques for investors seeking to further enhance their performance. These strategies are designed for those who are comfortable with the basics and looking to gain an edge through deeper analysis, sophisticated portfolio construction, and proactive risk management. By integrating these advanced methods, investors can optimize returns, minimize risks, and capitalize on unique market opportunities.

The advanced strategies outlined below are supported by real-world examples and actionable steps. Each technique is designed to be accessible to dedicated investors willing to invest the time in research and analysis. By mastering these approaches, readers can move beyond conventional investing and position themselves for exceptional results.

Strategy 1: Earnings Revision Momentum

Earnings revision momentum involves tracking the frequency and direction of analyst earnings estimate changes. Companies experiencing frequent upward revisions are often in the midst of positive business developments that the market has yet to fully price in. For example, in 2020 and 2021, semiconductor companies like Advanced Micro Devices (AMD) saw multiple upward revisions as demand for chips surged, leading to significant stock price gains. Investors can use tools like Value Sense or Bloomberg to set up alerts for earnings revisions and create a watchlist of companies with positive momentum. By systematically investing in these stocks, investors can capture the upside associated with improving fundamentals before the broader market catches on. This strategy requires regular monitoring and a willingness to act quickly as new data becomes available.

Strategy 2: Multi-Factor Screening

Multi-factor screening combines several quantitative criteria—such as earnings growth, return on equity, cash flow, and low volatility—to identify high-quality stocks. Instead of relying on a single metric, this approach creates a more robust filter for potential investments. For instance, screening for companies with 10%+ earnings growth, ROE above 15%, positive cash flow, and beta below 1.2 can yield a shortlist of resilient growth stocks. In practice, this method has been used by institutional investors and quant funds to outperform traditional stock-picking approaches. Investors can implement this strategy using spreadsheet models or online screening tools, updating criteria as market conditions evolve. The key is to remain disciplined and avoid overriding the model with subjective judgments.

Strategy 3: Tactical Asset Allocation

Tactical asset allocation involves adjusting portfolio weights in response to changing market conditions, economic indicators, or sector trends. For example, if economic data suggests an upcoming recession, investors might reduce exposure to cyclical sectors and increase allocations to defensives like healthcare or consumer staples. Conversely, during periods of economic expansion, shifting towards technology and industrials can enhance returns. This strategy requires regular monitoring of macroeconomic indicators and a willingness to rebalance portfolios proactively. Successful tactical asset allocation can smooth returns and reduce drawdowns, but it also demands a deep understanding of market dynamics and the discipline to avoid overtrading.

Strategy 4: Global Rotation

Global rotation involves shifting investments between regions or countries based on relative economic strength, valuation, or currency trends. For example, during the 2010s, investors who rotated into emerging markets like China and India captured higher returns as those economies outpaced developed markets. Conversely, during periods of global uncertainty, rotating back into U.S. or developed market equities can provide stability. Investors can use global ETFs or ADRs to implement this strategy, monitoring indicators such as GDP growth, inflation, and political stability. The key is to remain flexible and ready to adjust allocations as global conditions change, balancing the pursuit of higher returns with prudent risk management.

Strategy 5: Event-Driven Investing

Event-driven investing focuses on capitalizing on specific corporate events—such as mergers, acquisitions, spin-offs, or regulatory changes—that can drive stock price movements. For example, investors who anticipated the impact of the 2020 U.S. stimulus packages on consumer stocks were able to benefit from rapid price appreciation. This strategy requires in-depth research, timely execution, and a keen understanding of the potential risks and rewards associated with each event. By staying informed about upcoming corporate actions and market-moving news, investors can position themselves to profit from short-term catalysts while maintaining a long-term investment perspective.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Starting to apply the concepts from “The Little Book That Makes You Rich” requires a blend of preparation, discipline, and ongoing learning. The book’s step-by-step approach ensures that even novice investors can build a robust, growth-oriented portfolio. By following a structured process—rooted in data, regular review, and adaptability—investors can steadily accumulate wealth and avoid common pitfalls.

To maximize the benefits of the book’s teachings, it’s essential to take a systematic approach. Begin by building a strong foundation in fundamental analysis, then layer on advanced techniques as your confidence and experience grow. Regular portfolio reviews and a commitment to continuous improvement will ensure long-term success.

- First step investors should take: Define clear financial goals and risk tolerance, then develop a written investment plan outlining target returns, asset allocation, and screening criteria.

- Second step for building the strategy: Use quantitative tools and stock screeners to identify potential investments based on earnings growth, cash flow, and other key metrics. Construct a diversified portfolio across sectors and geographies.

- Third step for long-term success: Schedule regular portfolio reviews (at least quarterly) to monitor performance, rebalance allocations, and incorporate new data or insights. Stay disciplined, adapt to changing market conditions, and commit to ongoing learning.

Critical Analysis

“The Little Book That Makes You Rich” excels in translating complex financial concepts into accessible, actionable strategies. Its greatest strength lies in its clarity and practicality, making it a valuable resource for both beginners and experienced investors. The book’s emphasis on quantitative analysis, emotional discipline, and adaptability ensures that readers are equipped to navigate the uncertainties of the stock market. Real-world examples, data-driven insights, and memorable quotes enhance the learning experience and reinforce key lessons.

However, the book is not without limitations. While its focus on growth investing is well-supported, some readers may find the coverage of value investing or alternative asset classes to be less comprehensive. Additionally, the reliance on historical examples may not fully account for the unique challenges of today’s market environment, such as the rise of algorithmic trading or the impact of social media on investor sentiment. The book also assumes a basic familiarity with financial statements, which may require additional study for absolute beginners.

In the context of the current market environment, the book’s lessons remain highly relevant. The principles of disciplined, data-driven investing, risk management, and global diversification are timeless and have proven effective across market cycles. As markets become increasingly complex and interconnected, the ability to filter out noise and focus on fundamentals is more valuable than ever. Overall, “The Little Book That Makes You Rich” is a highly recommended read for anyone seeking to build lasting wealth through intelligent investing.

Conclusion

“The Little Book That Makes You Rich” offers a comprehensive, step-by-step guide to growth investing, blending quantitative analysis, emotional discipline, and practical strategies. Its accessible style, real-world examples, and actionable insights make it an invaluable resource for investors at all levels. By focusing on fundamentals, monitoring key metrics, and maintaining a long-term perspective, readers can build resilient portfolios capable of delivering superior returns.

The book’s emphasis on adaptability, risk management, and global perspective ensures that investors are well-prepared to navigate the complexities of today’s markets. Whether you are just starting out or looking to refine your approach, the lessons and strategies outlined in this book provide a solid foundation for achieving financial independence. We highly recommend “The Little Book That Makes You Rich” as a must-read for anyone serious about growing their wealth through intelligent, disciplined investing.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book That Makes You Rich

1. Who is the author of “The Little Book That Makes You Rich” and what is their background?

The book is written by Seven Dollar Millionaire, a pseudonym for an experienced investor and educator dedicated to democratizing financial knowledge. Drawing inspiration from legendary investors like Warren Buffett, the author combines real-world investing experience with a passion for making complex concepts accessible to everyone. Their background in finance and commitment to investor education lend credibility and depth to the book’s teachings.

2. What is the main investment philosophy presented in the book?

The core philosophy is disciplined, quantitative growth investing. The author emphasizes focusing on fundamental metrics—such as earnings growth, cash flow, and return on equity—while maintaining emotional discipline and adaptability. This approach helps investors avoid market hype, manage risk, and achieve consistent long-term results.

3. How does the book help investors manage their emotions?

The book addresses common emotional pitfalls like fear, greed, and overconfidence by promoting objective, data-driven strategies. It offers practical tools such as setting predefined buy/sell rules, limiting portfolio checks, and journaling to track emotional responses. By following these routines, investors can reduce impulsive decisions and improve long-term performance.

4. What are some practical strategies recommended for beginners?

Beginners are encouraged to screen for companies with strong earnings growth, monitor analyst revisions, analyze cash flow statements, and diversify across sectors and geographies. The book provides step-by-step guidance on building a watchlist, setting clear sell rules, and conducting regular portfolio reviews to ensure ongoing alignment with financial goals.

5. How does the book address risk management?

Risk management is a central theme, with strategies including diversification, regular portfolio reviews, and the use of alpha/beta metrics to assess risk-adjusted performance. The author also discusses the importance of understanding macroeconomic trends and global diversification to mitigate the impact of market volatility and unforeseen events.

6. Are the strategies in the book suitable for long-term investors?

Yes, the book’s strategies are designed for investors with a long-term perspective. By focusing on measurable growth, fundamental analysis, and disciplined execution, readers can build portfolios that withstand market cycles and compound wealth over time. The emphasis on patience and perseverance aligns well with long-term financial planning.

7. Does the book cover global investing and international diversification?

Absolutely. The book encourages investors to look beyond domestic markets and explore opportunities in emerging and international markets. It discusses the benefits of global diversification, the risks associated with foreign investing, and practical steps for accessing global equities through ETFs and ADRs.

8. What advanced strategies does the book offer for experienced investors?

Advanced strategies include earnings revision momentum, multi-factor screening, tactical asset allocation, global rotation, and event-driven investing. These techniques are designed to help experienced investors optimize returns, manage risk, and capitalize on unique market opportunities through deeper analysis and proactive portfolio management.

9. How often should investors review and rebalance their portfolios according to the book?

The author recommends conducting portfolio reviews at least quarterly. During these reviews, investors should assess performance, check for alignment with goals, rebalance allocations, and incorporate new data or insights. Regular reviews help ensure that portfolios remain resilient and responsive to changing market conditions.

10. Is “The Little Book That Makes You Rich” suitable for absolute beginners?

While the book assumes some familiarity with basic financial statements, its clear explanations, practical examples, and step-by-step guidance make it accessible to motivated beginners. Those new to investing may benefit from supplementary resources on financial statement analysis, but the book provides a solid foundation for building investing skills and confidence.