The Little Book that Saves Your Assets by David M. Darst

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

David M. Darst’s “The Little Book that Saves Your Assets” is a practical and accessible guide to the world of asset allocation, written by one of Wall Street’s most respected strategists. Darst, a former Managing Director and Chief Investment Strategist at Morgan Stanley Wealth Management, brings decades of real-world investing experience to this concise yet comprehensive book. His career, spanning senior roles at Goldman Sachs and Morgan Stanley, as well as teaching at Yale and Wharton, establishes his credibility as a leading authority on portfolio construction, risk management, and the psychology of investing. Darst’s ability to distill complex financial concepts into actionable advice has made him a trusted voice among both institutional and individual investors.

The book’s central theme revolves around the critical importance of asset allocation in building and preserving wealth. Darst argues that while stock selection and market timing often dominate the conversation, it is the strategic distribution of assets across different classes—stocks, bonds, real estate, commodities, and alternatives—that truly determines long-term investment success. He demystifies asset allocation by likening it to building and maintaining a sturdy house, where each asset class serves a unique purpose and helps weather financial storms. The book’s purpose is to empower readers to take control of their financial future by implementing a disciplined, diversified investment strategy, regardless of market conditions or economic cycles.

This book is a must-read for a broad spectrum of investors: from beginners seeking a foundational understanding of portfolio design, to experienced investors looking to refine their approach and avoid common pitfalls. It is especially valuable for those who have been overwhelmed by the noise of financial media, or who have suffered from emotional decision-making during periods of market volatility. Darst’s engaging writing style, enriched by anecdotes, analogies, and practical checklists, makes complex ideas accessible without sacrificing depth. Readers will appreciate the book’s structure, which walks them step-by-step from basic principles through advanced strategies, always with a focus on real-world application.

What sets “The Little Book that Saves Your Assets” apart is its blend of behavioral finance insights, timeless investing wisdom, and actionable frameworks. Darst not only explains the mechanics of asset allocation, but also addresses the psychological traps—like overconfidence, loss aversion, and herd behavior—that can derail even the best-laid plans. He draws on historical data, case studies, and memorable metaphors (such as “Uncle Frank” as your trusted advisor) to illustrate his points. The book’s compact format belies its depth, offering a toolkit that investors can return to repeatedly as their financial lives evolve. Ultimately, Darst’s message is one of empowerment: with the right knowledge and discipline, anyone can build a resilient portfolio that stands the test of time.

Key Concepts and Ideas

At the heart of “The Little Book that Saves Your Assets” lies the philosophy that asset allocation, not stock picking or market timing, is the primary driver of investment returns and risk management. Darst makes a compelling case that the way you distribute your investments across different asset classes has a greater impact on your long-term wealth than any single investment decision. He emphasizes that a disciplined, diversified approach—grounded in self-awareness and regular review—offers the best defense against market uncertainty, emotional pitfalls, and the ever-present temptation to chase trends.

Darst’s investment philosophy is rooted in the belief that every investor, knowingly or unknowingly, practices some form of asset allocation. The difference between success and failure often comes down to whether this allocation is intentional, balanced, and aligned with personal goals. He advocates for a holistic, goals-based framework, where each financial objective (retirement, education, emergency funds) is integrated into an overall plan. The book also highlights the importance of understanding your own psychology—recognizing cognitive biases and emotional triggers that can sabotage rational decision-making. By combining timeless principles with practical tools, Darst equips readers to build portfolios that are both resilient and adaptable.

- Asset Allocation as the Foundation: Darst explains that asset allocation is the process of dividing your investments among different asset classes (stocks, bonds, real estate, commodities, alternatives) to achieve a balance between risk and return. He cites studies showing that over 90% of long-term portfolio performance is determined by asset allocation, not individual security selection or market timing.

- Diversification and Non-Correlation: The book stresses the importance of holding assets that do not move in sync. By blending low-correlation investments, such as equities and bonds, or adding alternatives like real estate and commodities, investors can reduce portfolio volatility and protect against sharp downturns in any one sector.

- Disciplined Rebalancing: Regularly adjusting your portfolio back to its target allocation is critical. Darst provides practical guidance on when and how to rebalance, noting that this discipline forces investors to “sell high and buy low,” countering emotional impulses during bull and bear markets.

- Goal-Based Planning: Rather than treating all money the same, Darst advocates assigning different asset mixes to different goals (e.g., short-term savings vs. long-term retirement). This approach ensures that risk levels match time horizons and objectives.

- Behavioral Finance and Biases: The book explores common psychological traps—overconfidence, loss aversion, herd mentality—that lead investors astray. Darst offers strategies to recognize and counteract these biases, such as using checklists and seeking outside perspective.

- The Role of Trusted Advisors: Introducing the concept of “Uncle Frank,” Darst shows the value of having an experienced, objective mentor or financial advisor. He outlines the traits to look for and the questions to ask when selecting someone to guide your investment journey.

- Risk Management: Darst emphasizes that risk cannot be eliminated, only managed. He provides frameworks for assessing your personal risk tolerance and adjusting your asset allocation accordingly, helping investors avoid catastrophic losses during market shocks.

- Long-Term Perspective and Patience: The book repeatedly stresses the importance of staying focused on long-term goals, resisting the urge to react to short-term market noise. Historical examples, such as the 2008 financial crisis and subsequent recovery, illustrate the rewards of patience and discipline.

- Regular Portfolio Maintenance: Like a well-built house, a portfolio requires ongoing care—monitoring, rebalancing, and adjusting as life circumstances and markets change. Darst provides checklists and routines for keeping your plan on track.

- Avoiding Common Pitfalls: The book identifies seven major mistakes that can destroy wealth—chasing performance, overconcentration, neglecting reviews, ignoring risk, and more. Each is paired with actionable advice to help readers steer clear of these traps.

Practical Strategies for Investors

Translating the lessons of “The Little Book that Saves Your Assets” into action requires more than just understanding theory—it demands a commitment to disciplined execution. Darst provides a roadmap for investors to implement robust asset allocation strategies, manage emotions, and adapt to changing circumstances. His approach is grounded in practicality, offering step-by-step tactics that can be applied by investors at any stage, from novice to seasoned professional.

The book’s actionable strategies are designed to help investors avoid common mistakes and build portfolios that withstand volatility. Darst’s emphasis on regular review, behavioral awareness, and the importance of trusted advice ensures that readers are equipped to navigate both bull and bear markets. By following these strategies, investors can increase their odds of achieving long-term financial goals while minimizing costly errors.

- Establish Your Target Asset Allocation: Begin by assessing your financial goals, risk tolerance, and investment horizon. Use Darst’s frameworks to determine the optimal mix of stocks, bonds, real estate, and alternatives for your unique situation. Action step: Complete a risk questionnaire and set target percentages for each asset class.

- Systematic Diversification: Build your portfolio with exposure to multiple asset classes and sectors. Don’t just hold different stocks—include bonds, real estate investment trusts (REITs), commodities, and possibly alternatives like private equity. Action step: Use low-cost index funds or ETFs to achieve broad diversification across geographies and industries.

- Regular Rebalancing Routine: Set a schedule (e.g., quarterly or annually) to review your portfolio and rebalance back to your target allocation. Action step: If stocks have grown from 60% to 68% of your portfolio, sell some equities and buy underweight assets like bonds to restore balance.

- Goal-Based Buckets: Divide your investments into separate “buckets” for each financial goal (e.g., emergency fund, college savings, retirement). Assign a different asset mix to each based on its time horizon and importance. Action step: Use a spreadsheet or financial planning app to track each bucket’s progress and allocation.

- Behavioral Checklists: Before making any investment decision, pause and consult a checklist to guard against emotional reactions and cognitive biases. Action step: Include questions like “Am I acting out of fear or greed?” and “Does this decision align with my long-term plan?”

- Engage a Trusted Advisor or Mentor: Seek out an “Uncle Frank”—an experienced, objective advisor who can challenge your assumptions and provide perspective during turbulent times. Action step: Interview potential advisors, focusing on experience, transparency, and alignment with your goals.

- Stress-Test Your Portfolio: Use historical data and scenario analysis to evaluate how your portfolio would have performed during past market crises (e.g., 2008, COVID-19). Action step: Adjust your allocation if you discover unacceptable risks or vulnerabilities.

- Implement Automatic Investing and Rebalancing: Automate contributions and, where possible, rebalancing to remove emotion from the process. Action step: Set up automatic monthly transfers and use robo-advisors or brokerage tools to maintain your target allocation.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

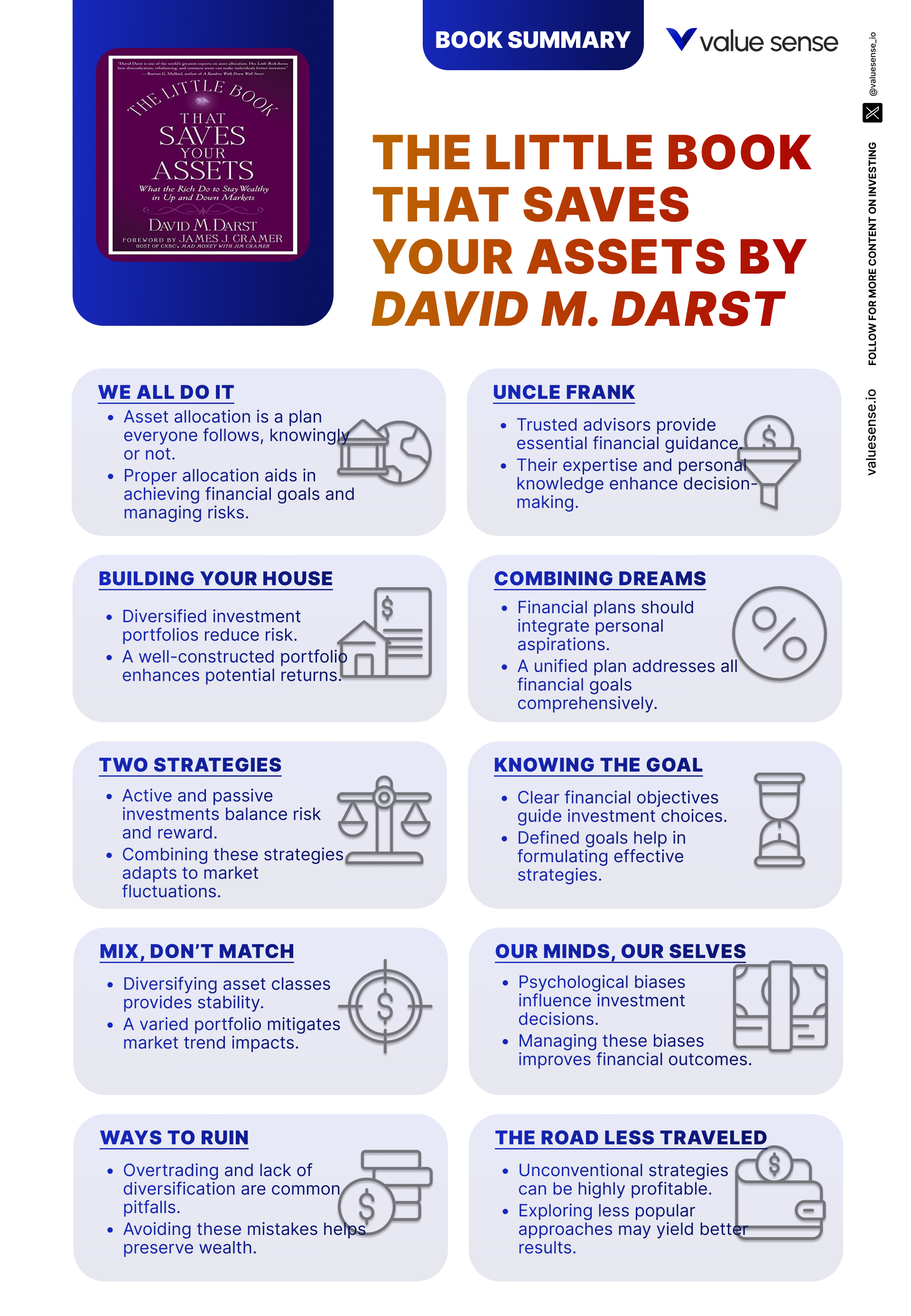

“The Little Book that Saves Your Assets” is structured as a step-by-step guide, with each chapter building on the last to create a comprehensive framework for asset allocation and long-term investing success. The book begins by laying the groundwork—explaining the what, why, and how of asset allocation—before moving into more nuanced topics like behavioral finance, the role of advisors, and advanced risk management techniques. Each chapter is rich with practical examples, anecdotes, and checklists, making the material accessible and actionable.

The chapters are organized to mirror the logical progression an investor should follow: from understanding the basics of diversification, through integrating various financial goals, to managing emotions and avoiding costly mistakes. Darst uses memorable metaphors and real-world stories to illustrate his points, ensuring that readers not only grasp the concepts but also understand how to apply them in their own lives. Below, we provide an in-depth, chapter-by-chapter analysis, highlighting the key lessons, examples, and practical steps from each section of the book.

Chapter 1: We All Do It (Even if We Don’t Realize It)

In the opening chapter, Darst introduces the foundational concept of asset allocation, asserting that every investor—whether consciously or not—engages in some form of it. He explains that asset allocation is the process of distributing investments across various asset classes, such as stocks, bonds, real estate, and alternatives, to manage risk and pursue financial goals. Darst uses relatable analogies, comparing asset allocation to the way people naturally divide their resources in everyday life, like balancing time between work, family, and hobbies. He highlights that even those who keep all their money in a savings account have made an implicit allocation decision, albeit a potentially suboptimal one.

The chapter delves into the evolution of asset allocation strategies, tracing the shift from simple diversification within stocks and bonds to more sophisticated approaches that include commodities, real estate, and alternative investments. Darst references studies showing that over 90% of long-term portfolio returns are attributable to asset allocation, not stock picking or market timing. He emphasizes the concept of non-correlation—choosing assets that don’t move in tandem—to reduce overall volatility. For example, during the 2008 financial crisis, portfolios with a mix of stocks, government bonds, and commodities fared significantly better than those concentrated in equities alone.

Darst provides actionable advice on how to begin constructing a balanced portfolio. He recommends starting with an honest assessment of your current financial situation, risk tolerance, and investment horizon. The chapter includes a simple worksheet for readers to list their assets and categorize them by class. Darst also stresses the importance of setting clear, measurable goals (e.g., “retire with $1 million by age 65”) to guide allocation decisions. He suggests reviewing your portfolio at least annually to ensure it remains aligned with your objectives and adjusting as life circumstances change.

Historically, the principles outlined in this chapter have proven resilient across market cycles. During periods of economic expansion, equities tend to outperform, while in recessions, bonds and defensive assets provide stability. Darst references the performance of the “Yale Model,” which incorporates a broad mix of asset classes, as evidence of the benefits of diversification. In today’s environment—characterized by low interest rates and increased volatility—the need for intentional, well-balanced asset allocation is more critical than ever. This chapter sets the stage for the rest of the book, emphasizing that asset allocation is not just a technical exercise, but a fundamental life skill for financial security.

Chapter 2: Everyone Needs an Uncle Frank

Darst’s second chapter introduces the concept of the trusted advisor, affectionately dubbed “Uncle Frank.” He argues that, much like having a wise family member to consult on big life decisions, investors benefit immensely from having a mentor or advisor who can provide objective, experienced guidance. Darst recounts stories of clients who avoided costly mistakes thanks to a steady hand during turbulent markets. He notes that even the most knowledgeable investors are susceptible to emotional impulses and blind spots, making outside perspective invaluable.

The chapter outlines the qualities that make a good advisor: deep experience, a track record of sound judgment, and, most importantly, an alignment of interests. Darst warns against advisors who are motivated by commissions or short-term gains, instead advocating for those who prioritize the client’s long-term success. He provides a checklist of questions to ask potential advisors, such as “How do you get paid?” and “Can you provide references from clients with similar goals?” Darst also emphasizes the importance of emotional intelligence—advisors should be able to offer support during market downturns, helping clients stay the course when fear and uncertainty are at their peak.

For investors applying these lessons, the key is to seek out mentors who challenge your assumptions and help you avoid common pitfalls. Darst encourages readers to build relationships with advisors who not only possess technical expertise but also understand their unique goals and circumstances. He suggests regular check-ins—at least quarterly—to review progress, discuss concerns, and recalibrate strategies as needed. For those unable to hire a professional, Darst recommends forming an informal “investment committee” with trusted friends or family members who can provide honest feedback.

Real-world examples abound of investors who have benefited from trusted guidance. During the dot-com bubble of the late 1990s, many who lacked experienced advisors chased tech stocks to unsustainable heights, only to suffer devastating losses when the bubble burst. In contrast, those with seasoned mentors were more likely to diversify and rebalance, preserving capital through the downturn. Darst’s “Uncle Frank” metaphor underscores the timeless value of wisdom, objectivity, and emotional support in achieving long-term financial success.

Chapter 3: Building Your House

This chapter uses the metaphor of constructing a house to explain portfolio design. Darst likens each asset class to a different room in a house, each serving a distinct function—stocks as the living room for growth, bonds as the foundation for stability, real estate as the kitchen for steady income, and alternatives as the home office for unique opportunities. He stresses that a well-built house requires careful planning, quality materials, and ongoing maintenance, just like a robust investment portfolio.

Darst provides specific guidance on selecting the right mix of assets based on individual goals, risk tolerance, and time horizon. He offers sample asset allocation models for different investor profiles: a conservative retiree might hold 30% stocks, 60% bonds, and 10% alternatives, while a young professional could allocate 70% to equities, 20% to bonds, and 10% to real estate. The chapter includes real-life case studies, such as a family who diversified into REITs and commodities in 2007, cushioning their portfolio during the 2008 crash. Darst also discusses the importance of liquidity—ensuring that a portion of assets can be accessed quickly for emergencies or opportunities.

Investors are encouraged to periodically review their “house” to ensure it remains structurally sound. Darst recommends annual checkups to assess whether each asset class is fulfilling its intended role and to make adjustments as life circumstances or market conditions evolve. He provides a checklist for portfolio maintenance, including rebalancing, tax-loss harvesting, and updating beneficiary designations. Darst also suggests using financial planning software or working with an advisor to monitor progress toward goals.

The analogy of building and maintaining a house resonates in all market environments. During the 2008 financial crisis, portfolios with diversified “rooms” weathered the storm far better than those concentrated in a single asset class. In recent years, the rise of alternative investments and global diversification has provided new “building materials” for investors. Darst’s approach ensures that, regardless of economic conditions, investors have a sturdy foundation and flexible design to adapt over time.

Chapter 4: Parts of the Whole—Combining Dreams into a Plan

Here, Darst addresses the challenge of integrating multiple financial goals into a cohesive investment strategy. He argues that, just as a house is more than the sum of its rooms, a financial plan must harmonize retirement savings, education funding, emergency reserves, and other objectives. The chapter introduces the concept of “goal-based buckets,” where each goal is assigned a distinct asset allocation tailored to its time horizon and risk profile.

Darst provides practical frameworks for prioritizing goals. He suggests categorizing them by urgency (e.g., emergency fund vs. vacation home) and importance, then allocating resources accordingly. For example, short-term goals like a down payment on a house should be funded with low-risk, liquid assets, while long-term goals like retirement can tolerate more volatility. Darst shares stories of clients who successfully balanced competing objectives by segmenting their portfolios, such as a couple who simultaneously saved for college and retirement by using separate investment accounts with different allocations.

The chapter includes worksheets for mapping out goals, estimating required funding, and assigning appropriate asset mixes. Darst emphasizes the need for regular review, as life events (marriage, childbirth, job changes) may shift priorities or necessitate reallocation. He also discusses the importance of avoiding conflicting strategies—such as taking excessive risk in a college fund needed in five years—by maintaining an integrated, holistic plan.

Historically, goal-based planning has helped investors stay disciplined during market turbulence. During the 2020 COVID-19 crisis, those with segmented portfolios were less likely to raid long-term retirement accounts for short-term needs, preserving their future security. Darst’s approach ensures that all parts of your financial life work in concert, reducing stress and increasing the likelihood of achieving multiple dreams simultaneously.

Chapter 5: Two Strategies to Win the Battle for Investment Survival

This pivotal chapter introduces two cornerstone strategies: diversification and rebalancing. Darst explains that diversification—spreading investments across multiple asset classes—reduces the impact of any single asset’s poor performance. He cites data from the 2000-2002 and 2008-2009 bear markets, where diversified portfolios experienced smaller drawdowns and faster recoveries than concentrated ones. Darst also discusses the mathematical benefits of combining assets with low or negative correlations, which can smooth returns and lower overall risk.

The second strategy, rebalancing, involves periodically adjusting your portfolio back to its target allocation. Darst provides a step-by-step guide: set target percentages for each asset class, monitor performance, and rebalance by selling overweight assets and buying underweight ones. He notes that this discipline forces investors to “sell high and buy low,” countering the natural tendency to chase winners and abandon losers. The chapter includes real-world examples, such as investors who rebalanced during the 2009 market bottom and subsequently benefited from the recovery.

For practical implementation, Darst recommends establishing a rebalancing schedule—quarterly, semi-annually, or annually—and setting thresholds (e.g., if any asset class drifts more than 5% from its target). He suggests using automated tools or working with an advisor to streamline the process. Darst also warns against letting emotions dictate timing, as research shows that investors who rebalance systematically outperform those who try to time the market.

The lessons of this chapter have been validated across decades of market history. During the tech bubble burst and the global financial crisis, diversified, regularly rebalanced portfolios suffered less and recovered faster. In today’s volatile environment, these strategies remain essential for long-term survival and success. Darst’s clear, actionable guidance empowers investors to stay disciplined and avoid the costly pitfalls of emotional investing.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Do You Know Where You Are Going?

In this chapter, Darst emphasizes the necessity of having clear, well-defined financial goals as the foundation for any investment strategy. He argues that, without a destination in mind, investors are prone to drift, react to market noise, and make impulsive decisions. Darst draws parallels to planning a road trip—before setting out, you need to know where you’re going, how long the journey will take, and what resources you’ll need along the way.

Darst provides practical tools for goal-setting, including worksheets for articulating short-, medium-, and long-term objectives. He encourages readers to quantify their goals (“accumulate $500,000 for retirement by age 65”) and to consider factors such as inflation, taxes, and unexpected expenses. The chapter also addresses the importance of aligning your investment strategy with your risk tolerance and time horizon. For example, a young professional saving for retirement can afford to take more risk than someone nearing college tuition payments for a child.

Investors are advised to review their goals annually, adjusting as life circumstances and market conditions evolve. Darst suggests creating a “financial roadmap” that outlines each goal, the required funding, and the target asset allocation. He also discusses the role of flexibility—recognizing that plans may need to change in response to job loss, health issues, or major life events. The chapter includes examples of investors who successfully navigated setbacks by revisiting and revising their goals.

Historically, clear goal-setting has helped investors maintain discipline during turbulent markets. During the 2008 crisis, those with well-defined retirement plans were less likely to panic and sell at the bottom. In recent years, the proliferation of goal-based investment platforms has made it easier for individuals to track progress and stay focused. Darst’s emphasis on clarity and intentionality provides a strong foundation for building wealth and achieving financial security.

Chapter 7: Mix, Don’t Match

This chapter delves deeper into the mechanics of diversification, emphasizing the importance of mixing different asset classes rather than matching investments within a single category. Darst explains that true diversification means holding assets with different risk and return profiles—such as stocks, bonds, real estate, and alternatives—rather than simply owning multiple stocks or funds. He illustrates this with historical data showing that portfolios diversified across asset classes experienced less volatility and higher risk-adjusted returns than those concentrated in equities or bonds alone.

Darst introduces the concept of correlation, explaining that assets with low or negative correlations do not move in the same direction at the same time. For example, during the 2000-2002 bear market, bonds and real estate provided positive returns while stocks declined. The chapter provides practical guidance on how to identify and include low-correlation assets, such as international stocks, commodities, and REITs. Darst also warns against overconcentration in any one sector or region, citing the collapse of the tech sector in 2000 and the financial sector in 2008 as cautionary tales.

Investors are encouraged to regularly rebalance their portfolios to maintain the desired level of diversification. Darst provides a step-by-step process for assessing current allocations, identifying gaps, and making adjustments. He also discusses the benefits of using low-cost index funds and ETFs to achieve broad exposure without excessive fees. The chapter includes case studies of investors who improved their risk-adjusted returns by adding new asset classes to their portfolios.

The principles outlined in this chapter have stood the test of time. During the COVID-19 crisis, portfolios with exposure to gold, bonds, and international assets experienced smaller drawdowns than those concentrated in U.S. equities. Darst’s approach ensures that investors are prepared for a wide range of market scenarios, reducing the risk of catastrophic losses and increasing the likelihood of long-term success.

Chapter 8: Our Minds, Our Selves

In this insightful chapter, Darst explores the psychological factors that influence investment decisions. He argues that our minds can often be our own worst enemies, leading us to make irrational choices driven by emotion rather than logic. Darst identifies common cognitive biases—such as overconfidence, loss aversion, and herd behavior—that can sabotage even the best-laid investment plans. He draws on behavioral finance research to illustrate how these biases manifest in real-world scenarios.

The chapter provides vivid examples of investors who fell victim to emotional decision-making, such as those who sold at the bottom of the 2008 crisis or chased tech stocks during the dot-com bubble. Darst explains the science behind these behaviors, citing studies that show how fear and greed can override rational analysis. He offers practical strategies for overcoming these biases, including using checklists, setting pre-determined rules for buying and selling, and seeking outside perspective from trusted advisors.

For investors, the key takeaway is the importance of self-awareness. Darst encourages readers to reflect on their own risk tolerance, emotional triggers, and past mistakes. He suggests keeping a “decision journal” to track the reasoning behind investment choices and to identify patterns over time. The chapter also discusses the value of automation—using systematic investing and rebalancing to reduce the impact of emotions on decision-making.

Behavioral finance has gained prominence in recent years, with studies showing that individual investors consistently underperform the market, largely due to emotional mistakes. By understanding and counteracting these biases, investors can improve their returns and reduce stress. Darst’s focus on psychology adds a crucial dimension to the book, reminding readers that successful investing is as much about managing oneself as it is about managing money.

Chapter 9: The Jockey Matters as Much as the Horse

This chapter highlights the critical role of financial advisors and managers in navigating the complexities of investing. Darst uses the metaphor of a jockey guiding a horse, arguing that even the best portfolio (the horse) needs a skilled, trustworthy advisor (the jockey) to reach its full potential. He outlines the key qualities to look for in an advisor: experience, transparency, alignment with your goals, and a commitment to ongoing education.

Darst provides a checklist of questions to ask when evaluating potential advisors, such as “What is your investment philosophy?” and “How do you ensure my portfolio remains aligned with my objectives?” He warns against advisors who promise outsized returns or rely on high-fee products, advocating instead for those who focus on risk management and long-term planning. The chapter includes stories of investors who benefited from strong advisor relationships, as well as cautionary tales of those who suffered due to poor guidance or conflicts of interest.

For practical application, Darst recommends regular communication with your advisor—at least quarterly—to review performance, discuss changes in your life or goals, and adjust strategies as needed. He also suggests periodically assessing your advisor’s performance and seeking a second opinion if necessary. Darst emphasizes that the best advisors act as partners, providing both technical expertise and emotional support during turbulent times.

In the modern era, the proliferation of robo-advisors and online platforms has made professional guidance more accessible. However, Darst’s advice remains relevant: whether working with a human advisor or a digital platform, investors should prioritize transparency, alignment, and ongoing communication. The right “jockey” can make all the difference in achieving financial success and peace of mind.

Chapter 10: Riding Out Storms

This chapter addresses the inevitability of market volatility and the importance of staying the course during turbulent times. Darst likens market downturns to storms, arguing that the key to survival is preparation, discipline, and emotional resilience. He cites historical examples—such as the 1987 crash, the 2008 financial crisis, and the COVID-19 panic of 2020—where investors who panicked and sold at the bottom locked in losses, while those who stayed invested ultimately recovered and prospered.

Darst provides practical strategies for weathering market storms, including maintaining a well-diversified portfolio, adhering to a pre-determined asset allocation, and avoiding impulsive decisions. He recommends revisiting your investment plan during periods of volatility to ensure it still aligns with your goals and risk tolerance. The chapter includes anecdotes of clients who resisted the urge to sell during the 2008 crisis and were rewarded when markets rebounded in 2009 and beyond.

For investors, the lesson is clear: volatility is a normal part of investing, not a signal to abandon your plan. Darst suggests creating an “emergency playbook” that outlines steps to take during market downturns, such as reviewing your allocation, consulting with your advisor, and focusing on long-term objectives. He also discusses the psychological benefits of having a plan, which can reduce anxiety and prevent rash decisions.

History shows that markets have always recovered from downturns, often reaching new highs within a few years. By maintaining discipline and perspective, investors can avoid the costly mistake of selling low and missing out on subsequent gains. Darst’s guidance is especially relevant in today’s environment, where headlines and social media amplify every market move, increasing the temptation to react emotionally.

Chapter 11: Build Your House on These Rocks

In this chapter, Darst returns to the metaphor of building a house, focusing on the foundational principles that underpin a resilient investment strategy. He identifies diversification, risk management, and a long-term perspective as the “rocks” upon which financial security is built. Darst explains that, just as a house needs a solid foundation to withstand storms, a portfolio needs these core principles to weather market volatility and economic uncertainty.

The chapter provides practical checklists for assessing your portfolio’s foundation. Darst recommends reviewing your asset allocation, ensuring adequate diversification across asset classes, sectors, and geographies. He also emphasizes the importance of understanding your risk tolerance and adjusting your portfolio accordingly. The chapter includes examples of investors who avoided catastrophic losses during the 2008 crisis by adhering to these principles, as well as those who suffered due to overconcentration or excessive risk-taking.

Regular maintenance is another key theme. Darst advises conducting annual reviews of your portfolio, updating your allocation as life circumstances change, and rebalancing as needed. He also discusses the benefits of working with an advisor or using financial planning tools to monitor progress and stay disciplined. The chapter includes a “foundation checklist” for readers to assess the strength of their own financial house.

The enduring relevance of these principles is evident in every market cycle. Whether facing inflation, recession, or geopolitical turmoil, investors who build on a foundation of diversification, risk management, and long-term perspective are better positioned to achieve their goals. Darst’s approach provides a blueprint for financial stability and growth, regardless of external conditions.

Chapter 12: Count to Zen

This chapter introduces the concept of “financial zen”—a state of calmness, balance, and discipline in investing. Darst argues that achieving financial zen involves staying composed during market volatility, sticking to your strategy, and resisting the urge to react to every market move. He draws on both behavioral finance and personal anecdotes to illustrate how patience and emotional control can lead to better investment outcomes.

Darst provides practical tips for cultivating financial zen, such as practicing patience, setting realistic expectations, and focusing on long-term goals. He suggests using techniques like meditation, journaling, or regular check-ins with an advisor to manage stress and maintain perspective. The chapter includes stories of investors who achieved peace of mind by automating their investments, avoiding media noise, and trusting their process.

For implementation, Darst recommends creating routines that reinforce discipline—such as scheduled portfolio reviews, automatic contributions, and pre-committed rebalancing dates. He also advises against checking your portfolio too frequently, as this can increase anxiety and the temptation to make impulsive changes. The chapter includes a “financial zen checklist” to help readers assess their own emotional state and identify areas for improvement.

In today’s fast-paced, information-saturated world, the ability to maintain composure and focus is more valuable than ever. Investors who cultivate financial zen are less likely to make costly mistakes and more likely to achieve their long-term objectives. Darst’s insights provide a roadmap for achieving both financial success and peace of mind.

Chapter 13: Seven Quick Ways to Ruin

In one of the book’s most practical chapters, Darst outlines seven common mistakes that can quickly derail a financial plan and ruin an investment portfolio. These include chasing returns, overconcentration in a single asset or sector, ignoring risk management, neglecting regular portfolio reviews, and making emotional decisions. Darst provides vivid examples of each pitfall, such as investors who bought into tech stocks at their peak in 2000 or who failed to rebalance before the 2008 crash.

The chapter offers actionable advice for avoiding these mistakes. Darst recommends sticking to a disciplined investment strategy, maintaining diversification, and regularly reviewing and adjusting your portfolio. He also emphasizes the importance of risk management—setting stop-loss limits, using position sizing, and avoiding leverage unless fully understood. The chapter includes checklists and self-assessment tools to help readers identify and correct potential weaknesses in their approach.

For practical application, Darst suggests creating a “mistake prevention plan” that outlines specific actions to take when tempted to chase performance or abandon discipline. He also recommends seeking feedback from trusted advisors or mentors to provide objective perspective. The chapter includes stories of investors who avoided disaster by adhering to sound principles, as well as those who suffered due to complacency or overconfidence.

The lessons of this chapter are timeless. Every market cycle produces new “hot” sectors and tempting narratives, but the fundamental risks remain the same. By understanding and avoiding these seven pitfalls, investors can protect their wealth and increase the likelihood of long-term success. Darst’s practical guidance serves as a valuable checklist for both new and experienced investors.

Chapter 14: The Road Less Traveled that You Should Take Right Now

In the final chapter, Darst encourages readers to embrace the “road less traveled”—a disciplined, thoughtful approach to investing and asset allocation. He argues that, while this path may not be glamorous or exciting, it is the most reliable way to build and protect wealth over the long term. Darst contrasts this approach with the temptation to chase trends, follow the crowd, or seek quick gains, noting that such behaviors often lead to disappointment and loss.

The chapter provides a call to action, urging readers to implement a comprehensive asset allocation strategy tailored to their goals, risk tolerance, and time horizon. Darst emphasizes the importance of starting now, rather than waiting for the “perfect” moment or market conditions. He provides practical steps for getting started, including setting clear goals, establishing target allocations, and automating contributions and rebalancing.

For investors, the key takeaway is the value of discipline and patience. Darst encourages readers to tune out market noise, avoid distractions, and stay focused on their long-term plan. He also discusses the importance of regular review and adjustment, recognizing that life circumstances and markets will inevitably change over time. The chapter includes motivational stories of investors who achieved financial security by following the road less traveled, as well as cautionary tales of those who fell victim to impatience or herd mentality.

Historically, disciplined asset allocation has outperformed more speculative approaches, especially during periods of market turbulence. In today’s environment—marked by rapid technological change, geopolitical uncertainty, and increased volatility—the principles outlined in this chapter are more relevant than ever. Darst’s final message is one of empowerment: by taking action today and committing to a sound strategy, anyone can secure their financial future and achieve lasting peace of mind.

Advanced Strategies from the Book

While “The Little Book that Saves Your Assets” is accessible for beginners, it also offers advanced strategies for experienced investors seeking to optimize and future-proof their portfolios. Darst moves beyond basic diversification to explore techniques such as dynamic asset allocation, scenario analysis, alternative investments, and behavioral coaching. These strategies are designed to enhance returns, manage risk in complex environments, and address the psychological challenges of investing in a volatile world.

Darst’s advanced techniques are grounded in real-world experience and supported by historical data. He provides readers with frameworks for adapting their strategies to changing market conditions, integrating new asset classes, and leveraging technology to automate and improve decision-making. The following sections detail several of these advanced approaches, complete with examples and actionable steps.

Strategy 1: Dynamic Asset Allocation

Dynamic asset allocation involves adjusting your portfolio’s asset mix in response to changing economic and market conditions. Unlike static allocation, which maintains fixed percentages, dynamic allocation uses leading indicators—such as interest rates, inflation trends, or market valuations—to tilt the portfolio toward more attractive opportunities. For example, Darst discusses increasing bond exposure during periods of rising equity valuations or shifting toward real assets like commodities when inflation expectations rise. He provides a framework for monitoring key economic indicators and setting pre-defined rules for making allocation changes, helping investors avoid emotional, ad hoc decisions. This approach requires discipline and a willingness to act when signals indicate increased risk or opportunity, but it can enhance returns and reduce drawdowns in turbulent markets.

Strategy 2: Scenario Analysis and Stress Testing

Scenario analysis involves modeling how your portfolio would perform under different market conditions—such as a 2008-style crash, a prolonged bear market, or rapid inflation. Darst recommends regularly running stress tests using historical data and hypothetical scenarios to identify vulnerabilities and ensure your asset allocation is robust. For example, an investor might discover that their portfolio is overly sensitive to rising interest rates or a collapse in tech stocks. By identifying these risks in advance, investors can make targeted adjustments—such as adding inflation-protected bonds or diversifying into international equities—to improve resilience. Darst provides step-by-step instructions and recommends using online tools or working with an advisor to implement scenario analysis as part of regular portfolio reviews.

Strategy 3: Integration of Alternative Investments

Darst advocates for the selective inclusion of alternative investments—such as real estate, commodities, private equity, and hedge funds—to further diversify and enhance portfolio returns. He explains that alternatives often have low correlation with traditional assets, providing valuable diversification benefits during periods of market stress. For instance, during the 2008 financial crisis, certain hedge fund strategies and gold outperformed stocks. Darst cautions that alternatives come with unique risks, fees, and liquidity considerations, so investors should limit exposure to a reasonable percentage (typically 10-20% of the portfolio) and conduct thorough due diligence. He offers practical tips for accessing alternatives through liquid vehicles like REITs, commodity ETFs, and interval funds, making these strategies accessible to individual investors.

Strategy 4: Behavioral Coaching and Automation

Recognizing the powerful influence of psychology on investment outcomes, Darst recommends integrating behavioral coaching and automation into your investment process. This involves using checklists, pre-commitment contracts, and automated investing tools to reduce the impact of emotion-driven decisions. For example, investors can set up automatic monthly contributions and rebalancing, removing the temptation to time the market. Darst also suggests working with an advisor or accountability partner who can provide perspective and challenge emotional impulses during periods of stress. By combining behavioral insights with technology, investors can improve discipline, reduce mistakes, and achieve better long-term results.

Strategy 5: Tax-Efficient Asset Location

Advanced investors can further enhance returns by strategically placing different asset classes in tax-advantaged or taxable accounts. Darst explains that income-generating assets like bonds are best held in tax-deferred accounts (e.g., IRAs), while equities with long-term growth potential belong in taxable accounts to benefit from lower capital gains rates. He provides examples of how this approach can increase after-tax returns by 0.5-1% annually over time. The chapter includes checklists for reviewing account types, asset locations, and tax implications, as well as recommendations for working with a tax advisor to optimize your strategy.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Implementing the principles from “The Little Book that Saves Your Assets” requires a structured, step-by-step approach. Darst emphasizes that the key to success is not just understanding the concepts, but consistently applying them over time. He encourages readers to start with a clear assessment of their current situation, set realistic goals, and build a disciplined process for ongoing review and adjustment. By following a systematic implementation plan, investors can build resilient portfolios that adapt to changing markets and life circumstances.

Darst advises beginning with a comprehensive inventory of your assets, liabilities, income, and expenses. From there, set specific, measurable financial goals and determine your risk tolerance. Next, design a diversified asset allocation tailored to your objectives, and establish routines for regular monitoring and rebalancing. The use of checklists, automation, and trusted advisors can help maintain discipline and reduce the impact of emotional decision-making. Below are concrete steps to get started:

- First step investors should take: Conduct a thorough financial inventory and set clear, measurable goals for each major objective (retirement, education, emergency fund).

- Second step for building the strategy: Determine your risk tolerance using questionnaires or advisor consultation, then design a diversified asset allocation across stocks, bonds, real estate, and alternatives.

- Third step for long-term success: Establish a routine for regular portfolio reviews (quarterly or annually), automate contributions and rebalancing, and seek ongoing education or advice to adapt as markets and life circumstances change.

Critical Analysis

“The Little Book that Saves Your Assets” excels in distilling complex investment concepts into clear, actionable advice. Darst’s decades of experience shine through in his practical frameworks, memorable metaphors, and focus on both the technical and psychological aspects of investing. The book’s structure—progressing from foundational principles to advanced strategies—makes it accessible to readers at all levels. Its emphasis on behavioral finance and the role of trusted advisors adds depth and relevance, especially in today’s volatile markets.

However, the book’s brevity may leave some advanced readers wanting more detail on topics like alternative investments, tax optimization, or global diversification. While Darst provides a strong foundation, those seeking in-depth analysis of specific asset classes or quantitative models may need to supplement with additional resources. Additionally, the book’s focus on U.S. markets and examples may limit its direct applicability for international investors, though the core principles are universally relevant.

In the current market environment—characterized by low interest rates, high volatility, and rapid technological change—Darst’s emphasis on disciplined asset allocation, behavioral awareness, and regular review is especially timely. The book serves as both a primer for new investors and a valuable refresher for experienced ones, providing a toolkit for navigating uncertainty and building lasting wealth.

Conclusion

David M. Darst’s “The Little Book that Saves Your Assets” offers a comprehensive, practical roadmap for investors seeking to build resilient portfolios and achieve long-term financial security. By focusing on the fundamentals of asset allocation, diversification, and disciplined execution, the book empowers readers to take control of their financial future. Darst’s blend of technical expertise, behavioral insights, and actionable checklists makes this an indispensable resource for anyone serious about investing.

The key takeaways—establishing clear goals, building diversified portfolios, maintaining discipline through regular review, and seeking trusted advice—are timeless principles that have proven effective across generations of investors. Whether you are just starting out or looking to refine your strategy, this book provides the tools and confidence needed to succeed in any market environment. Darst’s final message is clear: the road less traveled may not be easy, but it is the surest path to lasting wealth and peace of mind.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book that Saves Your Assets

1. Who is David M. Darst, and why should I trust his advice?

David M. Darst is a renowned investment strategist with decades of experience at Morgan Stanley and Goldman Sachs. He has taught at Yale and Wharton, authored several investment books, and is widely respected for his expertise in asset allocation, risk management, and investor psychology. His insights are grounded in both academic research and practical, real-world experience.

2. What is the main message of the book?

The central message is that asset allocation—how you divide your investments among different asset classes—is the most important factor in achieving long-term investment success. Darst emphasizes the need for diversification, disciplined rebalancing, and a focus on individual goals, rather than chasing trends or relying on stock picking and market timing.

3. Is this book suitable for beginners?

Yes, the book is written in an accessible, engaging style that makes complex concepts easy to understand. It provides step-by-step frameworks, practical checklists, and real-world examples, making it ideal for beginners. However, it also offers valuable insights and advanced strategies for experienced investors.

4. How can I apply the lessons from the book to my own portfolio?

Start by assessing your financial goals, risk tolerance, and investment horizon. Use Darst’s frameworks to design a diversified asset allocation, set up regular portfolio reviews and rebalancing routines, and consider engaging a trusted advisor or using automation tools. The book’s checklists and worksheets can guide you through each step of the process.

5. Does the book address how to handle market downturns?

Absolutely. Darst dedicates entire chapters to staying disciplined during market volatility, avoiding panic selling, and focusing on long-term goals. He provides practical strategies for maintaining composure, revisiting your asset allocation, and using diversification to weather financial storms.

6. What are the most common mistakes investors make, according to Darst?

Darst identifies seven major pitfalls: chasing returns, overconcentration in a single asset, neglecting risk management, failing to review and rebalance portfolios, making emotional decisions, ignoring fees and taxes, and procrastinating on important changes. Each mistake is paired with actionable advice for prevention.

7. How often should I rebalance my portfolio?

Darst recommends rebalancing at least annually, or whenever any asset class drifts more than 5% from its target allocation. Regular rebalancing helps maintain your desired risk level and forces you to “sell high and buy low,” improving long-term returns and discipline.

8. Does the book cover alternative investments?

Yes, Darst discusses the role of alternatives such as real estate, commodities, and hedge funds in diversifying portfolios and reducing risk. He explains the benefits and risks of these assets, and provides guidance on how to incorporate them into your allocation strategy.

9. Can I use the book’s strategies with small amounts of money?

Definitely. The principles of asset allocation and diversification apply regardless of portfolio size. Darst provides examples and tools for building diversified portfolios using low-cost index funds and ETFs, making his strategies accessible to investors with modest starting amounts.

10. How does the book address investor psychology and emotions?

Darst dedicates significant attention to behavioral finance, explaining how cognitive biases and emotional reactions can undermine investment success. He offers checklists, journaling techniques, and the concept of “financial zen” to help investors cultivate discipline, self-awareness, and resilience in the face of market volatility.