The Little Book That Still Beats the Market by Joel Greenblatt

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Book Overview

Joel Greenblatt’s The Little Book That Still Beats the Market stands as one of the most influential investing guides of the 21st century. Greenblatt, a Columbia Business School adjunct professor and managing partner at Gotham Asset Management, has a legendary track record. His hedge fund, Gotham Capital, returned over 40% annually for two decades, solidifying his reputation as a master of value investing. Greenblatt’s academic background, coupled with his practical success, gives him unique credibility. He’s also the author of several other acclaimed books, including You Can Be a Stock Market Genius, making him a respected authority among both retail and institutional investors.

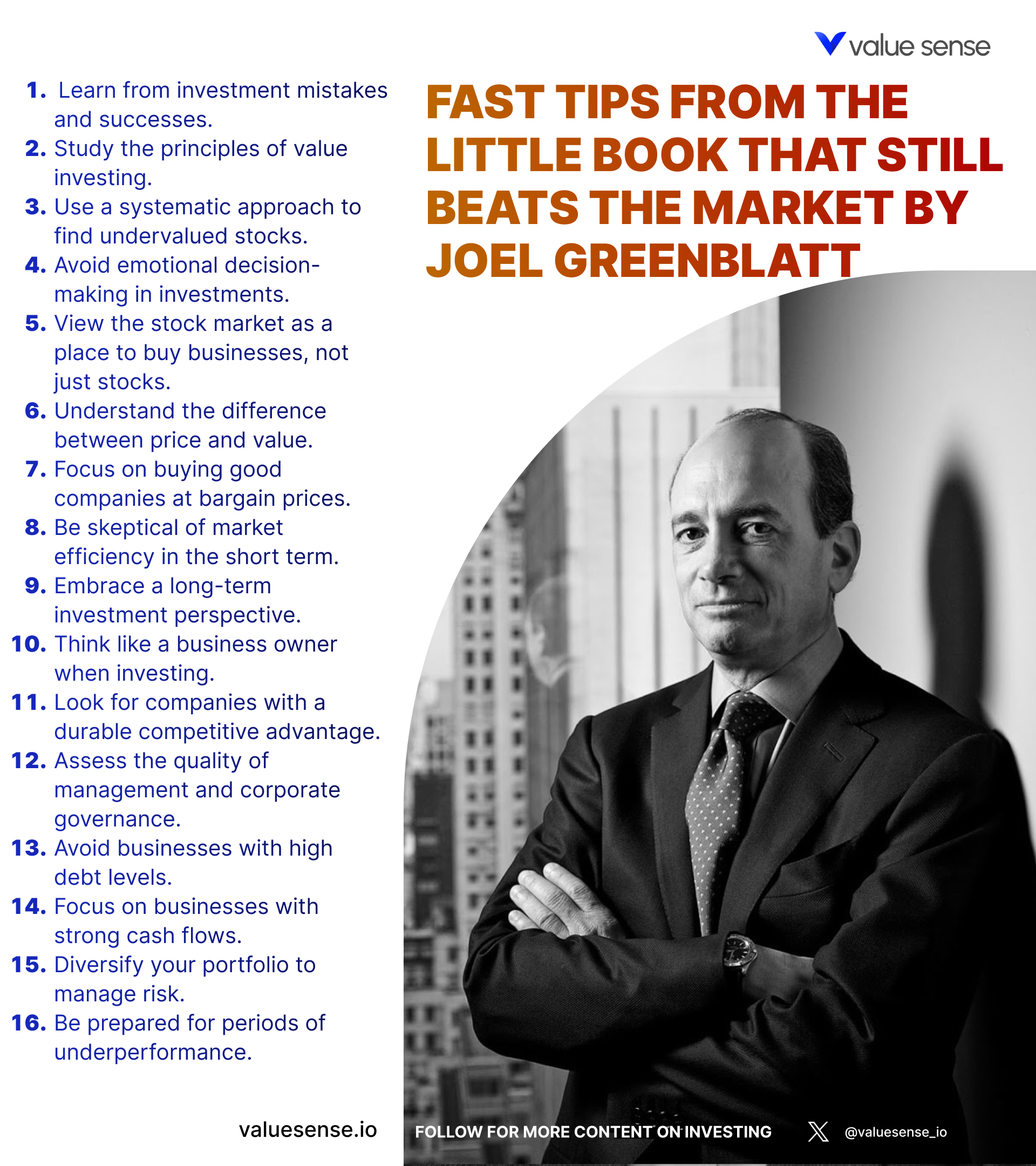

At its core, the book introduces and explains the “magic formula” investing strategy—a systematic, rules-based approach designed to help ordinary investors outperform the market. Greenblatt’s main thesis is that by focusing on two key metrics—earnings yield and return on capital—investors can reliably identify and buy good companies at bargain prices. The book’s purpose is to democratize sophisticated value investing by making it accessible, actionable, and easy to follow. Greenblatt’s writing is clear, engaging, and peppered with anecdotes, which makes complex financial concepts approachable for readers of all backgrounds.

This book is essential reading for anyone who wants to take control of their investments, whether you’re a beginner looking for a step-by-step system or a seasoned investor seeking to refine your stock selection process. It’s especially valuable for those disillusioned with mutual funds or professional managers who consistently underperform the market. Greenblatt’s approach is ideal for investors who prefer evidence-based strategies over speculation and want a method that removes emotion from the investing process.

What sets The Little Book That Still Beats the Market apart is its blend of simplicity and rigor. Unlike many investing books that drown readers in jargon or vague advice, Greenblatt provides a specific, repeatable process. The “magic formula” is not just a theoretical idea—it’s backed by decades of data, real-world case studies, and a track record of outperformance. The book’s unique value lies in its ability to bridge the gap between academic finance and practical investing, empowering readers to implement a proven strategy without needing advanced degrees or expensive software. Greenblatt’s emphasis on discipline, patience, and long-term thinking makes this book a timeless resource for investors who want to build lasting wealth.

Key Concepts and Ideas

Greenblatt’s investment philosophy is built on two pillars: buying good companies at bargain prices and following a disciplined, systematic process. He argues that most investors, both amateur and professional, underperform the market due to emotional decision-making and a lack of a repeatable strategy. The “magic formula” is Greenblatt’s answer—a method that strips out emotion, focuses on measurable business fundamentals, and leverages the power of compounding over the long term.

The book’s main ideas revolve around the importance of value and quality in stock selection. Greenblatt demonstrates that by consistently applying a rules-based approach—selecting companies with high earnings yields and high returns on capital—investors can sidestep common pitfalls like chasing hot stocks or reacting to market noise. The formula is designed to be simple enough for anyone to use, yet robust enough to outperform even the best professional managers when applied with patience and discipline.

- The Magic Formula: Greenblatt’s core concept is a two-factor model that ranks stocks based on earnings yield (a measure of value) and return on capital (a measure of quality). By buying the top-ranked companies, investors can capture the benefits of both undervaluation and operational excellence. For example, a company like Apple in the early 2000s, with high returns on capital and a modest valuation, would score highly on the magic formula.

- Earnings Yield: This metric is calculated as EBIT (Earnings Before Interest and Taxes) divided by enterprise value. It shows how much a company earns relative to its price, helping investors identify undervalued stocks. Greenblatt emphasizes that a high earnings yield signals a bargain—much like buying a $1 for 60 cents.

- Return on Capital: Calculated as EBIT divided by (Net Working Capital + Net Fixed Assets), this measures how efficiently a company turns capital into profits. Companies with high returns on capital, such as Microsoft or Visa, are typically well-managed and have durable competitive advantages.

- Systematic, Rule-Based Investing: The magic formula requires investors to follow a strict set of rules—selecting and rebalancing a portfolio of 20-30 top-ranked stocks annually. This removes emotion, bias, and guesswork, which are the primary reasons most investors underperform.

- Long-Term Focus and Patience: Greenblatt stresses that the magic formula does not guarantee immediate success. There will be periods of underperformance. However, over 3-5 years or more, the strategy has consistently beaten the market. Patience is critical.

- Diversification: The formula recommends holding a portfolio of 20-30 stocks to reduce the impact of individual company risk. This ensures that the law of averages works in the investor’s favor, smoothing out the inevitable losers with more frequent winners.

- Behavioral Discipline: One of the book’s key lessons is that investors must resist the urge to tinker with the formula during tough periods. Emotional reactions—like selling during downturns or abandoning the strategy after a bad year—undermine long-term results.

- Real-World Application: Greenblatt provides practical guidance on implementing the formula, including how to screen for stocks, when to rebalance, and how to handle market downturns. He addresses common concerns, such as what to do when the formula picks unpopular or “boring” companies.

- Flexibility and Adaptation: While the formula is systematic, Greenblatt acknowledges that investors can adapt it to their needs—focusing on different sectors, adjusting for risk tolerance, or customizing portfolio size—while still adhering to the core principles.

- Continuous Learning: The book encourages investors to stay curious, keep learning, and remain open to new ideas. The market evolves, and successful investors update their approach while staying true to fundamental principles.

Practical Strategies for Investors

Applying the teachings from The Little Book That Still Beats the Market requires more than just understanding the magic formula—it demands discipline, consistency, and a willingness to stick with the process even when results are disappointing in the short term. Greenblatt provides a step-by-step approach that investors can follow to build a market-beating portfolio, regardless of experience level. The strategies below are designed to help you implement the formula effectively and avoid common pitfalls.

To maximize the benefits of the magic formula, investors should focus on building a diversified portfolio, rebalancing regularly, and maintaining a long-term perspective. Greenblatt emphasizes that the formula works best when applied systematically and unemotionally. By following these practical strategies, you can increase your chances of achieving superior returns while minimizing risk and emotional stress.

- Screen for High Earnings Yield and Return on Capital: Use a stock screener to identify companies with top quartile earnings yields and returns on capital. Action Step: Filter out financials and utilities, then rank remaining stocks by the two metrics. Select the top 20-30 for your portfolio.

- Build a Diversified Portfolio: Don’t concentrate your bets. Action Step: Hold 20-30 magic formula stocks across different industries to reduce company-specific risk and smooth out performance volatility.

- Annual Rebalancing: Each year, sell stocks that have been held for 12 months and replace them with new top-ranked companies. Action Step: Set a calendar reminder to review and rebalance your portfolio annually, ensuring you always hold the current best candidates.

- Ignore Short-Term Performance: Expect periods of underperformance. Action Step: Commit to a 3-5 year holding period, and avoid checking your portfolio too frequently to minimize emotional reactions.

- Resist the Urge to Tinker: Don’t override the formula by picking favorites or skipping “boring” stocks. Action Step: Trust the process, even when the formula selects companies that seem unexciting or are out of favor with Wall Street.

- Stay Invested During Market Downturns: The formula may underperform in bear markets, but these periods often offer the best buying opportunities. Action Step: Continue following the strategy through downturns, and consider adding capital if possible.

- Customize for Personal Goals: Adjust your portfolio size, sector focus, or risk profile to fit your needs. Action Step: For example, retirees might focus on lower volatility stocks, while younger investors can accept more risk for higher growth potential.

- Track and Learn from Results: Keep a log of your portfolio’s performance, including winners and losers. Action Step: Review your results annually to reinforce discipline and identify any areas for improvement—but don’t abandon the formula based on a single bad year.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Chapter-by-Chapter Insights

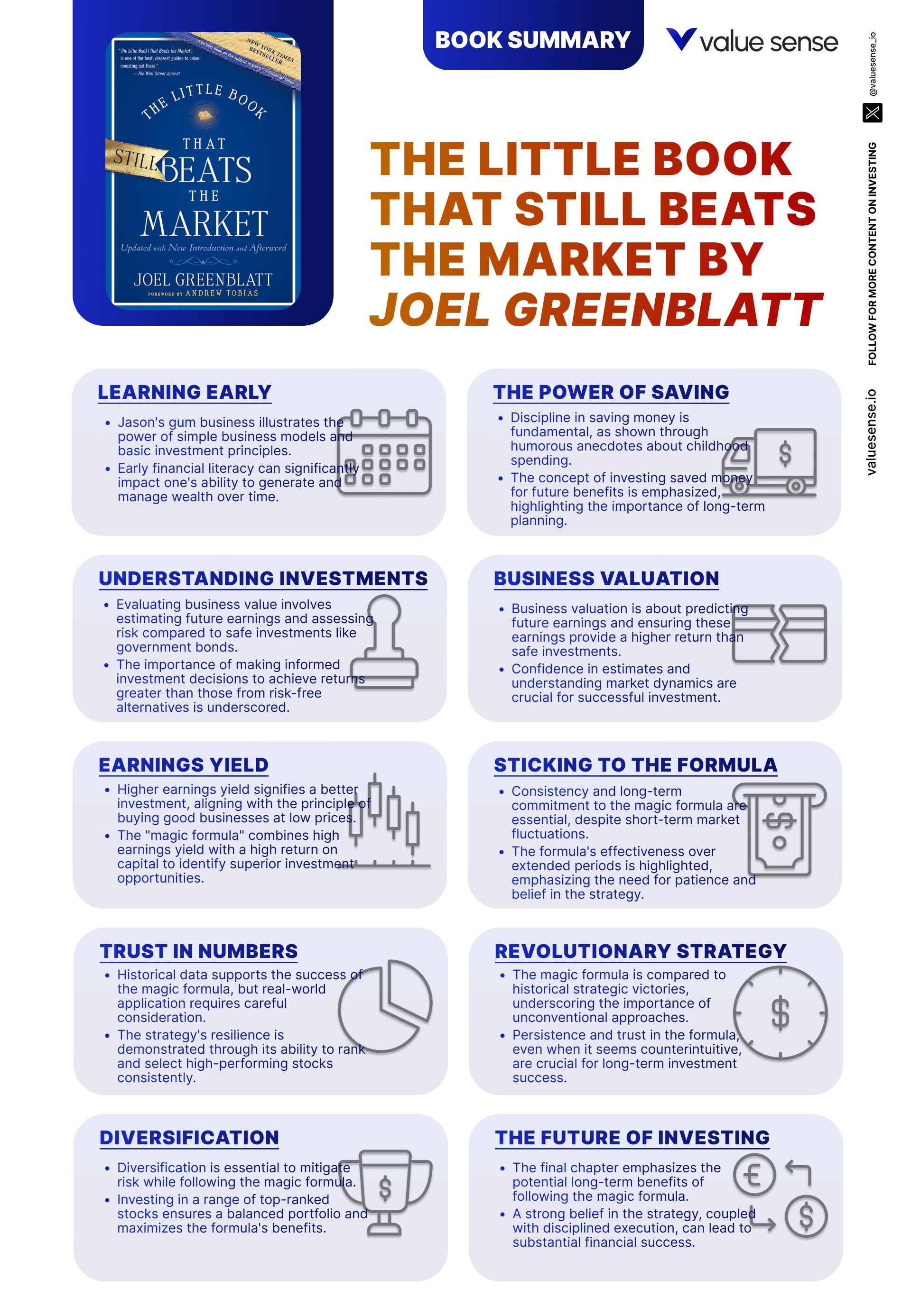

Greenblatt structures The Little Book That Still Beats the Market in a logical progression, starting with the problems most investors face and culminating in actionable steps to implement the magic formula. Each chapter builds on the last, moving from the “why” to the “how” and finally to the “what ifs” and “what next.” This structure makes the book both educational and practical, ensuring that readers not only understand the theory but also have the tools to put it into practice.

The chapters are concise yet packed with insights, anecdotes, and case studies. Greenblatt uses real-world examples, historical data, and plain language to explain complex concepts. He addresses common objections and challenges, providing readers with strategies to overcome them. The chapter-by-chapter breakdown below delves deeply into each section, highlighting key lessons, examples, and actionable takeaways for investors.

Chapter 1: The Basics of Beating the Market

In the opening chapter, Greenblatt introduces readers to the perennial challenge facing investors: consistently beating the market. He explains that despite the best efforts of professional fund managers, the vast majority fail to outperform benchmarks like the S&P 500 over the long term. Greenblatt attributes this underperformance to emotional decision-making, high fees, and a lack of discipline. He sets the stage by questioning why, if professionals struggle to win, individual investors should even try. This honest assessment resonates with readers who may have experienced similar frustrations with mutual funds or stock picking.

Greenblatt then presents the concept of the “magic formula,” a systematic approach that aims to solve these problems. He argues that by removing emotion and following a rules-based process, individual investors can actually beat the pros. The magic formula is built on two simple criteria: buying good companies (those with high returns on capital) at bargain prices (high earnings yields). Greenblatt uses relatable analogies—like buying $1 for 60 cents—to illustrate the power of value investing. He references historical studies and his own hedge fund’s success to support the formula’s effectiveness.

The chapter emphasizes that the magic formula is designed to be simple enough for anyone to use, regardless of experience. Greenblatt assures readers that they don’t need advanced degrees or insider information—just discipline and patience. He introduces the idea that the formula is not about predicting the future or finding the next hot stock, but about systematically buying quality businesses at attractive prices. This approach, he argues, can lead to superior long-term returns if followed consistently.

For investors, the key takeaway is that success does not require brilliance or complexity. By focusing on measurable fundamentals and following a repeatable process, anyone can outperform the market. Greenblatt’s message is empowering: “The secret to investing is to figure out the value of something—and then pay a lot less.” He provides historical context, noting that value investing legends like Benjamin Graham and Warren Buffett have used similar principles for decades. The magic formula, Greenblatt suggests, is a modern, accessible version of this timeless approach.

Chapter 2: Why We Need the Magic Formula

This chapter delves into the pitfalls of traditional investing and why most people, including professionals, struggle to achieve consistent success. Greenblatt highlights the challenges of stock picking, noting that even experts are prone to emotional biases, overconfidence, and herd mentality. He references studies showing that the majority of actively managed funds underperform their benchmarks, often due to high fees, frequent trading, and poor timing decisions. Greenblatt’s candid assessment helps readers understand that the odds are stacked against those who rely on intuition or market timing.

Greenblatt argues that the solution lies in adopting a disciplined, rule-based approach. He introduces the idea that a structured system, like the magic formula, eliminates emotional decision-making and helps investors avoid common mistakes. By focusing on objective criteria—rather than gut feelings or market hype—investors can make more rational, consistent choices. Greenblatt uses anecdotes of investors who chased hot stocks or panicked during downturns, only to regret their decisions later. He emphasizes that discipline is the key to long-term success.

The chapter also discusses the dangers of chasing trends, reacting to short-term market movements, and abandoning strategies during periods of underperformance. Greenblatt explains that such behaviors are not only counterproductive but also common among both amateurs and professionals. He encourages readers to resist the temptation to follow the crowd or make impulsive decisions. The magic formula, he argues, provides a framework that keeps investors focused on fundamentals and long-term goals.

For practical application, Greenblatt recommends that investors commit to a systematic process and avoid making exceptions. He suggests writing down investment rules and sticking to them, even when emotions run high. The historical context is clear: most legendary investors, from Graham to Buffett, have succeeded by following disciplined systems. In today’s fast-paced, information-saturated market, Greenblatt’s message is more relevant than ever—structure and discipline are essential for beating the odds.

Chapter 3: Understanding the Magic Formula

In this pivotal chapter, Greenblatt breaks down the mechanics of the magic formula, providing detailed explanations of its two core components: earnings yield and return on capital. He defines earnings yield as EBIT (Earnings Before Interest and Taxes) divided by enterprise value, a metric that measures how much a company earns relative to its price. Greenblatt explains that a high earnings yield signals undervaluation—akin to buying a profitable business at a discount. He uses examples like Dell and IBM in the early 2000s, which had high earnings yields and subsequently delivered strong returns.

Return on capital, the second component, is calculated as EBIT divided by (Net Working Capital + Net Fixed Assets). This metric gauges how efficiently a company turns capital into profits, highlighting operational excellence. Greenblatt cites companies like Coca-Cola and Johnson & Johnson, which have maintained high returns on capital for decades, as examples of quality businesses. He provides data showing that stocks with high returns on capital tend to outperform over time, regardless of industry or market conditions.

The magic formula combines these two metrics by ranking all eligible stocks and selecting those that score highest on both. Greenblatt emphasizes that this approach captures both value (cheap stocks) and quality (profitable, well-managed companies). He demonstrates the formula’s effectiveness with back-tested results, showing that a portfolio of top-ranked stocks has outperformed the market by several percentage points annually over multiple decades. The formula’s simplicity is its strength—it can be implemented with basic spreadsheets or free online tools.

For investors, the lesson is clear: focus on companies that are both cheap and good. Greenblatt encourages readers to use the formula consistently, avoiding the temptation to tweak or override it. He provides step-by-step instructions for screening stocks and building a portfolio. The historical context reinforces the formula’s validity—studies show that combining value and quality metrics leads to superior returns across market cycles. In an era of complex financial products, Greenblatt’s approach stands out for its clarity and effectiveness.

Chapter 4: The Importance of Patience

This chapter emphasizes that patience is the linchpin of successful investing with the magic formula. Greenblatt warns that the formula will not always deliver immediate results—there will be periods when it underperforms the market or produces disappointing returns. He shares anecdotes of investors who abandoned the strategy after a bad year, only to miss out on subsequent recoveries. Greenblatt’s message is straightforward: short-term pain is the price of long-term gain.

Greenblatt provides data showing that the magic formula has outperformed the market over 3-, 5-, and 10-year periods, but often lags behind in any given year. He cites specific examples from the 2000-2002 bear market, when the formula underperformed, only to rebound strongly in the following years. Greenblatt explains that market cycles are unpredictable, and even the best strategies experience rough patches. He quotes Warren Buffett: “The stock market is a device for transferring money from the impatient to the patient.”

The practical takeaway for investors is to set realistic expectations and commit to a multi-year holding period. Greenblatt suggests that investors should mentally prepare for stretches of underperformance and resist the urge to abandon the formula. He recommends reviewing performance annually, rather than obsessing over short-term fluctuations. By focusing on the long-term, investors can weather volatility and benefit from the formula’s compounding effect.

Historically, patience has been the hallmark of great investors. Greenblatt references studies showing that most mutual fund investors underperform the funds they invest in—simply because they buy high and sell low, driven by emotion. The magic formula, he argues, is a test of discipline as much as intelligence. In today’s fast-moving markets, the ability to stay the course is more valuable than ever. Greenblatt’s advice: “Patience is not passive; it’s concentrated strength.”

Chapter 5: Real-World Application

In this chapter, Greenblatt moves from theory to practice, providing step-by-step instructions for implementing the magic formula in a real portfolio. He begins by recommending that investors build a diversified portfolio of 20-30 stocks that meet the formula’s criteria. Greenblatt explains that diversification reduces the impact of individual company risk and ensures that the law of averages works in the investor’s favor. He provides examples of portfolios constructed using the formula and shows how they have performed over time.

Greenblatt addresses practical questions, such as how often to rebalance the portfolio. He suggests selling each stock after holding it for one year, then replacing it with a new top-ranked company. This annual rebalancing ensures that the portfolio remains aligned with the formula’s criteria and allows investors to capture gains from winners while reinvesting in new opportunities. Greenblatt also discusses what to do during market downturns, emphasizing that the formula may underperform in bear markets but often rebounds strongly afterward.

The chapter tackles concerns about the formula picking unpopular or counterintuitive stocks. Greenblatt reassures readers that the process works precisely because it is unemotional and contrarian. He cites examples of companies that seemed boring or out of favor but delivered strong returns after being selected by the formula. Greenblatt’s advice is to trust the process, even when it feels uncomfortable.

For investors, the key action steps are clear: use a stock screener to identify magic formula stocks, build a diversified portfolio, and rebalance annually. Greenblatt provides checklists and sample spreadsheets to help readers get started. He emphasizes that the formula’s simplicity is its greatest asset—by removing guesswork and emotion, investors can achieve consistent, market-beating results. The historical context shows that systematic, rules-based strategies have outperformed discretionary stock picking for decades.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Case Studies and Examples

This chapter brings the magic formula to life with real-world case studies and examples of its performance in different market environments. Greenblatt presents data from back-tests and live portfolios, demonstrating that the formula has consistently outperformed the market over long periods. He includes examples from the 1990s, 2000s, and even during the 2008 financial crisis, showing that the strategy works across bull and bear markets. Greenblatt highlights specific companies—such as AutoZone, Ross Stores, and Bed Bath & Beyond—that were identified by the formula and delivered outsized returns.

Greenblatt uses these examples to illustrate how the formula selects undervalued, high-quality stocks that are often overlooked by the market. He discusses cases where the formula picked companies facing temporary challenges or negative sentiment, only to see them recover and outperform. Greenblatt argues that the formula’s contrarian nature is a key reason for its success—it capitalizes on market inefficiencies and investor overreactions.

The chapter also includes stories of investors who followed the formula and achieved superior results. Greenblatt shares anecdotes of individuals who stuck with the strategy through tough periods and were rewarded with strong returns. He contrasts these with stories of investors who abandoned the formula during downturns and missed out on recoveries. The message is clear: consistency and discipline are essential for capturing the formula’s benefits.

For practical application, Greenblatt encourages readers to study past winners and losers, learning from both successes and mistakes. He suggests keeping a journal of investment decisions and outcomes to reinforce discipline. The historical context reinforces the formula’s validity—systematic value and quality investing has worked for decades, and the magic formula is a proven way to harness these principles. Greenblatt’s case studies provide inspiration and confidence for investors considering the strategy.

Chapter 7: Common Misconceptions

In this chapter, Greenblatt addresses the most common misconceptions about the magic formula and value investing in general. He begins by debunking the myth that value investing is too complex or only suitable for professionals. Greenblatt argues that the magic formula’s simplicity is its greatest strength—it allows anyone, regardless of experience, to implement a successful strategy. He cites studies showing that simple, rules-based approaches often outperform more complex models, precisely because they are easier to follow consistently.

Greenblatt also tackles the misconception that the magic formula is too simplistic to work. He explains that the formula’s focus on value and quality captures the essential drivers of long-term returns, without getting bogged down in unnecessary complexity. Greenblatt points to academic research and real-world results as evidence that simple strategies can beat the market. He warns that adding more variables or trying to outsmart the formula often leads to worse outcomes.

The chapter discusses the belief that investing success can be achieved quickly. Greenblatt emphasizes that the magic formula requires patience and a long-term perspective. He shares stories of investors who expected immediate results and abandoned the strategy prematurely. Greenblatt’s advice is to set realistic expectations and commit to the process for at least 3-5 years. He quotes legendary investors like Buffett and Munger, who have always preached the virtues of patience and discipline.

For investors, the key takeaway is to embrace simplicity and stay the course. Greenblatt encourages readers to ignore market hype, resist the urge to tweak the formula, and focus on the proven principles of value and quality. The historical context is clear: most great investors have succeeded by following simple, repeatable strategies. In an age of information overload, the magic formula’s clarity and focus are more valuable than ever.

Chapter 8: How to Stick with the Formula

This chapter explores the psychological challenges of sticking with the magic formula over the long term. Greenblatt acknowledges that there will be times when the strategy underperforms or feels difficult to follow. He discusses the temptation to abandon the formula during market downturns or after a string of disappointing results. Greenblatt shares stories of investors who gave up too soon and missed out on subsequent recoveries, reinforcing the importance of discipline and patience.

Greenblatt provides practical strategies for maintaining commitment to the formula. He suggests setting clear investment goals, writing down the reasons for following the strategy, and regularly reviewing progress. Greenblatt recommends creating a checklist or journal to track decisions and outcomes, helping investors stay focused on the long-term plan. He emphasizes that discipline is a muscle that can be strengthened with practice and self-awareness.

The chapter also addresses the role of emotions in investing. Greenblatt explains that fear and greed are powerful forces that can derail even the best strategies. He encourages readers to recognize emotional triggers and develop routines to manage them—such as limiting portfolio checks or discussing decisions with a trusted advisor. Greenblatt’s advice is to trust the process, even when it feels uncomfortable or counterintuitive.

Historically, the ability to stick with a strategy has separated successful investors from the rest. Greenblatt references studies showing that most mutual fund investors underperform the funds they invest in, simply because they buy and sell at the wrong times. The magic formula, he argues, is a test of discipline as much as intelligence. In today’s volatile markets, the ability to stay the course is a competitive advantage. Greenblatt’s message: “The hardest part of investing is not the math—it’s the psychology.”

Chapter 9: Adapting the Formula to Your Needs

In this chapter, Greenblatt discusses how investors can adapt the magic formula to suit their individual preferences and goals. He explains that while the core principles of the formula—value and quality—are non-negotiable, there is flexibility in how it can be applied. For example, investors can choose to focus on specific sectors, adjust portfolio size, or modify holding periods based on their risk tolerance and objectives. Greenblatt provides examples of investors who have customized the formula to fit their unique circumstances.

Greenblatt emphasizes the importance of balancing risk and reward. He suggests that investors with lower risk tolerance might focus on stocks with lower volatility or higher dividend yields, while those seeking higher returns can accept more risk by including smaller or more cyclical companies. Greenblatt advises readers to align their portfolio with their financial goals—whether that’s income generation, capital appreciation, or a mix of both. He provides guidelines for adjusting the formula without compromising its core principles.

The chapter also discusses the dangers of deviating too far from the formula’s guidelines. Greenblatt warns that excessive customization or ignoring the formula’s criteria can undermine its effectiveness. He encourages investors to make changes thoughtfully and to monitor results carefully. Greenblatt provides checklists and decision frameworks to help readers evaluate potential adjustments.

For practical application, Greenblatt suggests starting with the standard formula and making incremental changes based on experience and comfort level. He recommends tracking performance and reviewing results annually to ensure that any adaptations are delivering the desired outcomes. The historical context reinforces the value of flexibility—successful investors adapt to changing circumstances while staying true to fundamental principles. Greenblatt’s advice: “Customize, but don’t compromise.”

Chapter 10: The Magic Formula in Practice

This chapter features real-life stories of investors who have successfully implemented the magic formula. Greenblatt shares examples of individuals and families who followed the strategy, overcame challenges, and achieved their financial goals. He discusses the experiences of investors who started with small portfolios and grew their wealth over time by sticking with the formula. Greenblatt highlights the importance of commitment, discipline, and a willingness to learn from both successes and setbacks.

Greenblatt also addresses the challenges that investors face when applying the formula in different market environments. He explains that while the formula works across bull and bear markets, it may require adjustments based on market conditions. For example, during periods of high volatility, investors may need to rebalance more frequently or adjust position sizes. Greenblatt provides tips for managing risk, staying flexible, and maintaining confidence in the strategy.

The chapter includes practical advice for implementing the formula, such as using online tools, setting up automated alerts, and seeking support from investment communities. Greenblatt encourages readers to share their experiences, learn from others, and stay engaged with the process. He emphasizes that the magic formula is not just a set-and-forget strategy—it requires ongoing attention and a willingness to adapt as needed.

For investors, the key takeaway is that success with the magic formula is achievable for anyone willing to commit to the process. Greenblatt’s real-world examples provide inspiration and confidence, showing that ordinary people can achieve extraordinary results by following a disciplined, systematic approach. The historical context reinforces the formula’s validity—decades of data and thousands of investors have demonstrated its effectiveness. Greenblatt’s message: “The best way to learn is by doing—start small, stay disciplined, and let the formula work for you.”

Chapter 11: Common Mistakes to Avoid

This chapter outlines the most frequent mistakes investors make when implementing the magic formula. Greenblatt begins by warning against over-trading, which can lead to higher transaction costs and lower returns. He explains that frequent buying and selling, often driven by impatience or the desire to time the market, undermines the benefits of the formula. Greenblatt provides data showing that investors who trade less frequently tend to achieve better results.

Another common mistake is deviating from the formula—such as picking stocks based on personal preferences, market trends, or news headlines. Greenblatt emphasizes that the formula’s success depends on strict adherence to its rules. He shares stories of investors who underperformed by second-guessing the formula or making exceptions. Greenblatt’s advice is to trust the process and avoid the temptation to override the system.

Emotional decision-making is another pitfall. Greenblatt explains that fear and greed often lead investors to sell during downturns or chase hot stocks during rallies. He provides examples of investors who panicked during the 2008 financial crisis, sold their magic formula stocks, and missed the subsequent recovery. Greenblatt encourages readers to remain disciplined and avoid making decisions based on short-term market fluctuations.

The chapter also warns against ignoring the fundamental principles of value and quality. Greenblatt explains that investors who focus on hype, momentum, or speculative stocks are likely to underperform. He provides checklists and reminders to help readers stay focused on the formula’s criteria. The historical context reinforces the importance of discipline—most great investors have succeeded by avoiding these common mistakes. Greenblatt’s message: “Success is a matter of avoiding the big mistakes as much as making the right choices.”

Chapter 12: The Future of the Magic Formula

In this forward-looking chapter, Greenblatt discusses the continued relevance of the magic formula in an evolving market landscape. He explains that while the core principles of value investing are timeless, the application of the formula may need to adapt to new challenges. Greenblatt addresses potential changes in the market—such as increased competition, technological disruption, and shifts in investor behavior—that could impact the formula’s effectiveness.

Greenblatt emphasizes the importance of continuous learning and staying informed about market trends. He encourages investors to remain open to new ideas, technologies, and strategies that can enhance the formula’s performance. Greenblatt provides examples of how the formula has adapted over time, incorporating new data sources, screening tools, and risk management techniques. He suggests that successful investors are those who combine discipline with curiosity and flexibility.

The chapter also discusses the need to stay ahead of the curve. Greenblatt explains that as more investors adopt systematic strategies, the market may become more efficient, making it harder to find bargains. He encourages readers to look for new opportunities, such as international markets, small-cap stocks, or alternative data sources. Greenblatt provides guidelines for evaluating potential enhancements to the formula without compromising its core principles.

For practical application, Greenblatt suggests that investors regularly review their approach, seek feedback from peers, and stay engaged with the broader investment community. The historical context reinforces the value of adaptability—great investors have thrived by evolving with the market while staying true to fundamental principles. Greenblatt’s message: “The only constant in investing is change—embrace it, but don’t lose sight of what works.”

Chapter 13: Final Thoughts

In the concluding chapter, Greenblatt reflects on the lessons learned throughout the book and reinforces the importance of sticking with the magic formula. He encourages readers to have confidence in the strategy and to commit to following it over the long term. Greenblatt shares stories of investors who achieved their financial goals by staying disciplined and avoiding common mistakes. He emphasizes that success with the formula is not about brilliance or luck, but about consistency, patience, and a willingness to learn from both successes and setbacks.

Greenblatt reiterates the importance of avoiding common mistakes, such as over-trading, emotional decision-making, and deviating from the formula. He provides reminders and checklists to help readers stay focused on the process. Greenblatt’s advice is to trust the formula, even during periods of underperformance, and to remember that the greatest rewards come to those who stay the course.

The chapter also encourages readers to take action and start implementing the magic formula in their own investing. Greenblatt provides practical tips for getting started, such as using online tools, setting up a diversified portfolio, and tracking results over time. He emphasizes that the journey to financial success begins with a single step—committing to a disciplined, systematic approach.

For investors, the final message is one of empowerment and encouragement. Greenblatt’s book is a call to action, urging readers to take control of their financial future by embracing the magic formula. The historical context reinforces the formula’s validity—decades of data and thousands of investors have demonstrated its effectiveness. Greenblatt’s closing words: “Start now, stay disciplined, and let the magic formula work for you.”

Advanced Strategies from the Book

While the magic formula is designed to be simple and accessible, Greenblatt also discusses advanced strategies for investors who want to further enhance their results. These techniques involve refining the formula, managing risk more effectively, and seeking out new opportunities beyond the standard approach. Greenblatt emphasizes that these advanced strategies are best suited for experienced investors who are comfortable with the basics and looking to take their investing to the next level.

The advanced techniques below build on the core principles of value and quality, adding layers of customization, risk management, and market adaptation. Greenblatt provides examples and guidelines for implementing these strategies, while cautioning against overcomplicating the process or deviating too far from the formula’s proven framework.

Strategy 1: Sector and Market Cap Customization

Greenblatt suggests that advanced investors can customize the magic formula by focusing on specific sectors or market capitalizations. For example, some investors may choose to apply the formula only to small-cap stocks, which tend to be less efficiently priced and offer higher potential returns. Others may focus on sectors with strong growth prospects, such as technology or healthcare. Greenblatt provides data showing that the formula works across all sectors and market caps, but certain segments may offer better risk-reward profiles depending on market conditions. The key is to maintain diversification and avoid concentrating too heavily in any one area. Action Step: Use screening tools to filter for desired sectors or market caps, then apply the magic formula to the resulting universe.

Strategy 2: Incorporating Additional Quality Metrics

For those seeking to refine the formula, Greenblatt recommends adding supplementary quality metrics, such as debt-to-equity ratio, free cash flow yield, or dividend growth. These additional filters can help identify companies with stronger balance sheets, more sustainable earnings, or better shareholder returns. For example, an investor might require that all magic formula stocks also have a debt-to-equity ratio below 0.5 or a history of increasing dividends. Greenblatt cautions that adding too many variables can reduce the formula’s simplicity and effectiveness, but a few well-chosen metrics can enhance risk-adjusted returns. Action Step: Experiment with one or two additional filters and track performance over time.

Strategy 3: International Diversification

Greenblatt notes that the magic formula can be applied to international markets, providing opportunities for diversification and exposure to faster-growing economies. By screening for high earnings yield and high return on capital stocks outside the U.S., investors can access a broader universe of opportunities and reduce reliance on any single market. Greenblatt provides examples of successful international magic formula portfolios, particularly in developed markets like Europe and Asia. Action Step: Use international stock screeners and adjust for currency risk, tax considerations, and local market regulations.

Strategy 4: Dynamic Rebalancing and Tax Optimization

Advanced investors can enhance returns by optimizing the timing of rebalancing and managing taxes more efficiently. Greenblatt suggests that instead of rebalancing all stocks on the same date, investors can stagger sales throughout the year to minimize tax liabilities and smooth out performance. For example, selling losers before year-end to harvest tax losses and deferring gains on winners can improve after-tax returns. Greenblatt also recommends monitoring transaction costs and using tax-advantaged accounts when possible. Action Step: Develop a rebalancing calendar and coordinate with a tax advisor to maximize efficiency.

Strategy 5: Behavioral Risk Management

Finally, Greenblatt emphasizes the importance of managing behavioral risks—such as overconfidence, loss aversion, and recency bias. Advanced investors can implement routines and safeguards to reduce the impact of emotions on decision-making. For example, setting strict rules for portfolio changes, using checklists, or working with an accountability partner can help maintain discipline. Greenblatt shares stories of investors who succeeded by creating systems to manage their own psychology, rather than relying solely on technical expertise. Action Step: Identify personal behavioral triggers and design routines to counteract them.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

Getting started with the magic formula requires a combination of preparation, discipline, and ongoing learning. Greenblatt encourages investors to begin with the basics—understanding the formula, setting clear goals, and building a diversified portfolio. He emphasizes the importance of tracking results, learning from experience, and making incremental improvements over time. The steps below provide a roadmap for implementing the magic formula and maximizing its benefits.

Greenblatt also advises investors to stay engaged with the broader investment community, seek feedback from peers, and remain open to new ideas. He suggests starting small, gaining confidence through experience, and scaling up as comfort and understanding grow. The key is to maintain discipline, avoid common mistakes, and stay focused on long-term goals.

- First step investors should take: Learn the mechanics of the magic formula—how to calculate earnings yield and return on capital, screen for eligible stocks, and rank them according to the formula. Use online resources, spreadsheets, or screening tools to practice the process.

- Second step for building the strategy: Construct a diversified portfolio of 20-30 top-ranked stocks, spread across different sectors and market caps. Set a schedule for annual rebalancing and establish clear rules for buying and selling.

- Third step for long-term success: Track portfolio performance, review decisions annually, and make incremental improvements as needed. Stay disciplined, avoid emotional reactions, and commit to the strategy for at least 3-5 years to realize its full potential.

Critical Analysis

The Little Book That Still Beats the Market excels at making sophisticated investing concepts accessible to a wide audience. Greenblatt’s writing is clear, engaging, and free of jargon, making the book suitable for both beginners and experienced investors. The magic formula’s simplicity is its greatest strength—it removes emotion, bias, and complexity, allowing investors to focus on what matters most: buying good companies at attractive prices. The book’s use of real-world examples, historical data, and practical checklists makes it a valuable resource for anyone seeking to improve their investment results.

However, the book is not without limitations. The magic formula, while powerful, is not a silver bullet. It can underperform for extended periods, especially during market bubbles or when value stocks are out of favor. The formula also excludes certain sectors, such as financials and utilities, which may limit diversification. Additionally, the simplicity of the approach may tempt some investors to over-customize or abandon the strategy during tough times. Greenblatt addresses these caveats, but readers should be aware that discipline and patience are essential for success.

In the current market environment, where information is abundant and competition is fierce, the magic formula remains relevant but may face new challenges. As more investors adopt systematic strategies, markets may become more efficient, reducing the formula’s edge. However, Greenblatt’s emphasis on discipline, value, and quality ensures that the core principles will remain effective over the long term. The book is a timely reminder that successful investing is as much about psychology and process as it is about picking stocks.

Conclusion

The Little Book That Still Beats the Market is a must-read for anyone seeking a proven, evidence-based approach to stock investing. Greenblatt’s magic formula distills decades of research and real-world experience into a simple, actionable system that anyone can follow. The book’s blend of clarity, rigor, and practical advice makes it one of the most valuable investing guides available today.

The key takeaways are clear: focus on value and quality, follow a disciplined, rules-based process, and commit to a long-term perspective. Greenblatt’s emphasis on patience, diversification, and behavioral discipline provides a roadmap for avoiding common pitfalls and achieving superior returns. Whether you’re a beginner or a seasoned investor, the magic formula offers a powerful tool for building wealth and navigating the complexities of the stock market.

In summary, Greenblatt’s book is both a call to action and a source of inspiration. By embracing the magic formula and staying disciplined, investors can take control of their financial future and achieve lasting success. The journey begins with a single step—start today, trust the process, and let the magic formula work its magic.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Little Book That Still Beats the Market

1. What is the “magic formula” described in the book?

The magic formula is a systematic investing strategy developed by Joel Greenblatt. It ranks stocks based on two key metrics: earnings yield (a measure of value) and return on capital (a measure of quality). By buying a diversified portfolio of the top-ranked stocks and rebalancing annually, investors can outperform the market over the long term.

2. How does the magic formula differ from traditional value investing?

Traditional value investing often relies on subjective judgment and a variety of metrics. The magic formula simplifies the process by focusing on two quantitative measures—earnings yield and return on capital—removing emotion and bias. It provides a repeatable, rules-based system that anyone can implement, regardless of investing experience.

3. Can the magic formula underperform the market?

Yes, the magic formula can underperform in the short term, especially during periods when value stocks are out of favor or during market bubbles. However, over 3-5 year periods or longer, the formula has historically outperformed the market. Patience and discipline are essential for realizing its full potential.

4. Do I need special software or tools to use the magic formula?

No special software is required. You can use free online stock screeners, spreadsheets, or resources like Value Sense to screen for stocks with high earnings yields and returns on capital. Greenblatt’s approach is designed to be accessible and easy to implement for individual investors.

5. Should I customize the magic formula for my own needs?

You can adapt the formula to fit your preferences, such as focusing on certain sectors or adjusting portfolio size. However, it’s important not to deviate too far from the core principles of value and quality. Excessive customization can reduce the formula’s effectiveness, so make changes thoughtfully and track results carefully.

6. What types of companies does the magic formula exclude?

The formula typically excludes financials and utilities, as their accounting structures make earnings yield and return on capital less meaningful. It focuses on operating companies where these metrics provide a clear picture of value and quality. This may limit diversification but ensures more reliable results.

7. How often should I rebalance my magic formula portfolio?

Greenblatt recommends rebalancing annually—selling each stock after one year and replacing it with a new top-ranked company. This approach captures gains, allows for tax optimization, and ensures the portfolio remains aligned with the formula’s criteria. Some advanced investors may choose to stagger rebalancing for tax efficiency.

8. What are the main risks of using the magic formula?

The primary risks include periods of underperformance, emotional decision-making, and the temptation to override the formula. Investors may also face sector concentration or liquidity issues, especially with smaller-cap stocks. Maintaining discipline, diversification, and a long-term perspective helps mitigate these risks.

9. Can the magic formula be applied to international stocks?

Yes, the magic formula can be used to screen for high-value, high-quality stocks in international markets. This provides additional diversification and access to faster-growing economies. Investors should be mindful of currency risk, tax considerations, and local regulations when investing abroad.

10. Is the magic formula still effective in today’s market?

While markets have become more competitive and efficient, the core principles of value and quality remain effective. The magic formula continues to outperform over the long term, though the edge may be smaller as more investors adopt systematic strategies. Discipline, patience, and ongoing learning are key to maintaining success with the formula.