The Most Important Thing by Howard Marks

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

Howard Marks, the author of The Most Important Thing, is widely regarded as one of the most insightful and influential investors of our time. As the co-founder and co-chairman of Oaktree Capital Management, Marks has spent decades navigating the complexities of global markets, specializing in distressed debt, value investing, and risk management. His memos to Oaktree clients have become legendary for their clarity, wisdom, and practical guidance, often cited by leading investors including Warren Buffett, who praised Marks’s writing as “a rarity.”

Published in 2011, The Most Important Thing emerged in the wake of the global financial crisis—a period that tested the mettle and philosophies of even the most seasoned investors. The book distills decades of Marks’s experience into a series of essential principles for successful investing, emphasizing the need for deep thinking, rigorous risk assessment, and a disciplined approach to markets that are often irrational and unpredictable. Its timing was crucial: investors worldwide were seeking frameworks to avoid the mistakes of the past and build resilience amid ongoing volatility.

The main theme of the book is the pursuit of superior investment results through a blend of second-level thinking, risk awareness, and an unwavering focus on intrinsic value. Marks doesn’t offer a formula or a checklist; instead, he provides a nuanced philosophy that recognizes the complexity of markets and the necessity of judgment, patience, and humility. The book is structured as a series of essays, each tackling a “most important thing”—from market cycles and contrarianism to defensive investing and the psychology of risk—resulting in a holistic guide for thoughtful investors.

What sets The Most Important Thing apart is its emphasis on the subtleties and paradoxes of investing. Unlike many investment books that promise easy answers or quick profits, Marks’s work challenges readers to embrace uncertainty, think independently, and accept that there are no shortcuts to lasting success. The book is considered a modern classic because it synthesizes timeless principles with the hard-earned lessons of market history, making it relevant for both novices and professionals. It is frequently recommended by investment legends, business schools, and financial advisors as a must-read for anyone serious about building wealth in the markets.

This book is ideal for investors who want to move beyond basic strategies and develop a deeper, more resilient approach to investing. Whether you’re a value investor, a portfolio manager, or a self-directed individual investor, Marks’s insights offer a roadmap for navigating cycles, managing risk, and capitalizing on market inefficiencies. Its unique value lies in its blend of practical wisdom, psychological insight, and real-world examples—making it an indispensable resource for those seeking to outperform over the long term.

Key Themes and Concepts

At its core, The Most Important Thing is a meditation on the fundamental principles that underpin successful investing. Rather than advocating a rigid system, Howard Marks urges readers to embrace a flexible, multi-dimensional approach grounded in deep understanding, rigorous analysis, and humility. The book’s themes are interwoven, each reinforcing the others to create a comprehensive philosophy that stands the test of time and turbulence.

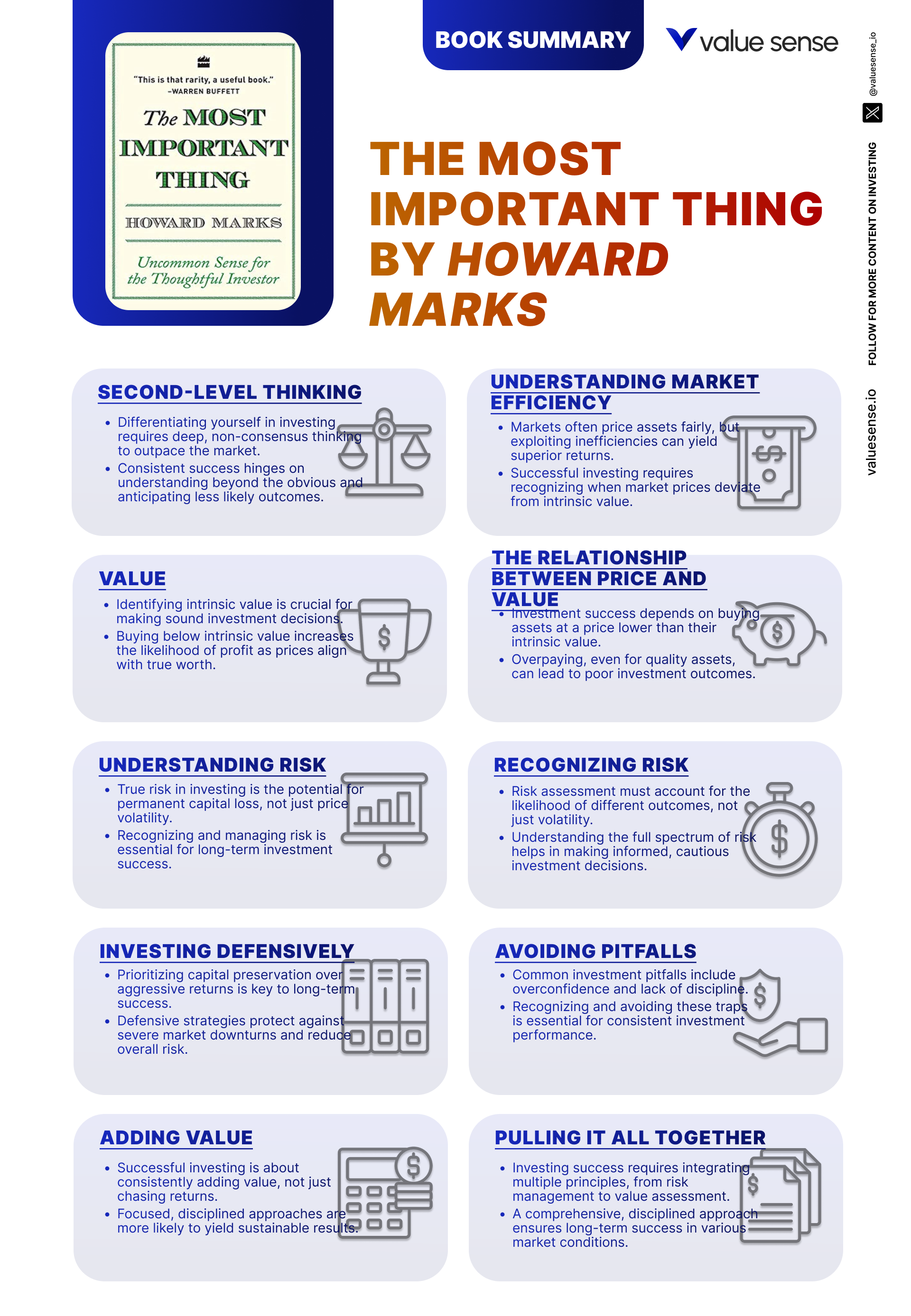

Several key themes run throughout the book, shaping its message and providing actionable guidance for investors. These include the necessity of second-level thinking, the limitations and opportunities presented by market efficiency, the critical relationship between price and intrinsic value, the centrality of risk management, the power of contrarianism, the role of defensive investing, and the importance of synthesizing these elements into a holistic investment philosophy. Each theme is explored through real-world examples, practical advice, and Marks’s distinctive perspective on the psychology of markets.

- Second-Level Thinking: Marks opens the book with the concept of second-level thinking—a hallmark of great investors. While first-level thinkers focus on obvious conclusions (e.g., “Company X is growing, so its stock will go up”), second-level thinkers probe deeper, asking what is already reflected in the price, how the consensus might be wrong, and what unique insights can be gleaned from the data. Throughout the book, Marks illustrates how second-level thinking leads to differentiated results, citing examples from market panics, bubbles, and periods of extreme pessimism. For investors, developing this mindset is about questioning assumptions, seeking alternative viewpoints, and being willing to act when the crowd is headed in the opposite direction.

- Market Efficiency and Inefficiency: The efficient market hypothesis (EMH) posits that all available information is already priced into securities, leaving little room for outperformance. Marks acknowledges that markets are often efficient, but he argues that inefficiencies do arise—especially during times of emotional excess or distress. He provides numerous examples of mispricings, from distressed debt in the early 1990s to the aftermath of the dot-com bust, showing that patient, insightful investors can exploit these anomalies. The key is to recognize when the consensus is wrong and to have the conviction to act when opportunities present themselves.

- Intrinsic Value and Price: Central to Marks’s philosophy is the distinction between price and intrinsic value. While markets may temporarily drive prices away from fundamental value, the long-term investor’s task is to identify these gaps and act accordingly. Marks stresses the importance of rigorous analysis to estimate intrinsic value, warning against the dangers of chasing momentum or following the crowd. He uses case studies of undervalued and overvalued assets to demonstrate how a disciplined focus on value can protect capital and generate superior returns over time.

- Risk Assessment and Management: Contrary to the conventional wisdom that equates risk with volatility, Marks defines risk as the potential for permanent loss of capital. He emphasizes that true risk management involves understanding the full spectrum of possible outcomes, assessing the adequacy of compensation for bearing risk, and focusing on downside protection. The book is replete with examples of investors who ignored risk—often to their detriment—and those who survived by being vigilant, skeptical, and disciplined. Marks provides practical frameworks for recognizing, measuring, and controlling risk in various market environments.

- Contrarian Investing: One of the most actionable themes in the book is the value of contrarianism. Marks argues that superior results are rarely achieved by following the crowd. Instead, investors must be willing to buy when others are fearful and sell when others are greedy. He analyzes episodes such as the 2008 financial crisis and the bursting of speculative bubbles to illustrate how contrarian thinking—grounded in value and risk assessment—can lead to outsized gains. This approach requires patience, discipline, and a willingness to be wrong in the short term in pursuit of long-term success.

- Defensive Investing: Recognizing that not all risks can be predicted or avoided, Marks advocates for a defensive approach that prioritizes capital preservation. He discusses strategies such as diversification, margin of safety, and prudent position sizing, all aimed at surviving adverse markets. Defensive investing is not about avoiding risk altogether, but about ensuring that no single mistake or event can jeopardize long-term objectives. The book provides a toolkit for building resilient portfolios that can weather the inevitable storms of the market.

- Holistic Investment Philosophy: The final theme is the integration of these principles into a holistic investment philosophy. Marks cautions against rigid adherence to any single strategy, advocating instead for a dynamic approach that adapts to changing circumstances. He encourages investors to synthesize insights from psychology, history, and fundamental analysis, creating a balanced framework that can guide decision-making across cycles. This holistic view is what ultimately separates great investors from the merely good.

Book Structure: Major Sections

Part 1: Investment Philosophy and Market Understanding

This opening section encompasses Chapters 1 through 4 and lays the intellectual foundation for the entire book. Marks introduces the necessity of second-level thinking, explores the concept of market efficiency, and delves into the crucial distinction between price and intrinsic value. These chapters set the stage for a nuanced understanding of how markets function and how investors can develop an edge.

A key takeaway from this section is that first-level thinking—simply following the herd or surface-level logic—rarely leads to outperformance. Marks provides concrete examples of how deeper analysis, skepticism, and independent thought can reveal opportunities that are invisible to the majority. He challenges the assumption that markets are always right, illustrating with historical mispricings and periods of irrational exuberance or despair. The discussion on intrinsic value, in particular, emphasizes the need for rigorous analysis and patience, as prices often deviate from underlying worth for extended periods.

For investors, the practical application is to cultivate habits of independent research, question prevailing narratives, and focus relentlessly on the relationship between price and value. Developing second-level thinking means looking beyond headlines and consensus forecasts, seeking out contrarian insights, and building conviction through analysis rather than emotion. This mindset is foundational for anyone aiming to identify mispriced assets and achieve consistent, superior results.

In today’s information-saturated environment, the principles from this section are more relevant than ever. With data and opinions readily available, the real edge comes from interpretation, synthesis, and the ability to act decisively when the crowd is wrong. Marks’s emphasis on intellectual discipline and skepticism provides a timeless guide for navigating both bull and bear markets.

Part 2: Risk Assessment and Management

This section, covering Chapters 5 through 7, delves into the heart of risk—how to understand it, recognize it, and manage it effectively. Marks argues that risk is not simply volatility, but the potential for permanent capital loss, and that successful investors are those who can accurately assess and control risk in all environments.

Key concepts include the multifaceted nature of risk, the inadequacy of conventional risk measures such as standard deviation, and the importance of scenario analysis. Marks uses vivid anecdotes from market history to illustrate how complacency, overconfidence, and herd behavior can lead to catastrophic losses. He also discusses the psychological barriers to risk recognition, including the tendency to extrapolate recent trends and ignore warning signs. The section is rich with practical frameworks for measuring risk, such as stress testing portfolios and evaluating downside scenarios.

Investors can apply these lessons by implementing robust risk management protocols: diversifying across asset classes, maintaining a margin of safety, and being vigilant for signs of excess or complacency in the market. Marks emphasizes the need for humility and the willingness to act conservatively when conditions warrant. Risk management is not about avoiding all risk, but about ensuring that risks taken are well understood and appropriately compensated.

With markets increasingly driven by algorithmic trading and global flows, the lessons on risk from this section are indispensable. The financial crises of the past decades underscore the dangers of ignoring risk, and Marks’s frameworks remain highly relevant for both institutional and individual investors seeking to build resilient portfolios.

Part 3: Market Cycles and Investor Behavior

Chapters 8 through 10 explore the cyclical nature of markets and the profound influence of investor psychology on market dynamics. Marks asserts that understanding cycles—economic, market, and psychological—is essential for timing decisions and managing expectations.

This section details the inevitability of cycles, the patterns of boom and bust, and the recurring errors made by investors who fail to recognize where they are in the cycle. Marks provides historical examples, such as the tech bubble and the housing crisis, to illustrate how optimism and pessimism can become self-reinforcing. He also examines the role of behavioral biases, including overconfidence, herding, and loss aversion, in amplifying market swings. The section concludes with strategies for recognizing cycle phases and adjusting positioning accordingly.

Investors can use these insights by developing tools for cycle recognition, such as monitoring valuation metrics, sentiment indicators, and macroeconomic data. Being attentive to cycles allows for more informed asset allocation, timely risk reduction, and the ability to capitalize on dislocations. Marks encourages investors to maintain a contrarian stance when the consensus becomes extreme, either optimistic or pessimistic.

In the modern era, with increased market volatility and rapid information dissemination, understanding cycles is more important than ever. The ability to anticipate inflection points and avoid the pitfalls of crowd psychology remains a critical edge for those seeking to outperform over full market cycles.

Part 4: Investment Strategies and Opportunities

This section, encompassing Chapters 11 through 14, focuses on actionable strategies for finding investment opportunities, particularly through contrarianism, value investing, and patient opportunism. Marks explores how investors can achieve superior results by going against the consensus and capitalizing on market inefficiencies.

Key concepts include the power of contrarian thinking, the discipline required to buy when others are selling, and the importance of waiting for the right opportunities rather than chasing every trend. Marks provides case studies of distressed debt, post-crisis recoveries, and undervalued assets to illustrate how patience and independent analysis can yield exceptional returns. He also discusses the psychological challenges of standing apart from the crowd and the need for conviction and resilience.

Practically, investors can apply these lessons by building watchlists of potential bargains, developing criteria for contrarian entry points, and cultivating the patience to wait for favorable conditions. Marks highlights the importance of thorough due diligence and a willingness to act decisively when opportunities arise, even if it means enduring short-term discomfort or criticism.

In today’s fast-moving markets, the ability to act opportunistically and contrarily is increasingly valuable. With the proliferation of passive investing and algorithmic strategies, genuine value and inefficiency can persist for those willing to dig deeper and act independently. Marks’s emphasis on discipline and opportunism remains highly relevant for modern investors.

Part 5: Defensive Investing and Value Addition

The final section, covering Chapters 17 through 20, emphasizes the importance of defensive investing, avoiding common pitfalls, and consistently adding value to portfolios. Marks advocates for strategies that prioritize capital preservation and resilience in the face of uncertainty.

This part covers defensive tactics such as diversification, prudent position sizing, and maintaining a margin of safety. Marks discusses the psychological traps that can lead to overconfidence and excessive risk-taking, providing examples from past market downturns. He also synthesizes the book’s key lessons into a comprehensive framework for value addition, stressing the need for continuous learning and adaptation.

For investors, the practical takeaway is to build portfolios that can withstand adverse scenarios, avoid overexposure to any single asset or theme, and regularly reassess risk exposures. Marks encourages a culture of humility, skepticism, and ongoing improvement, recognizing that markets are unpredictable and that survival is the prerequisite for long-term success.

With the increasing complexity and interconnectedness of global markets, defensive investing is more crucial than ever. The principles outlined in this section provide a blueprint for building robust portfolios and avoiding the costly mistakes that have undone many investors in the past.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: Second-Level Thinking

This opening chapter is foundational to the entire book and arguably to Marks’s entire investment philosophy. “Second-level thinking” is the ability to go beyond the obvious and analyze what others miss. Marks explains that most investors engage in first-level thinking—simple, direct conclusions based on surface-level information. However, markets are competitive, and only those who think differently and more deeply can achieve superior results. He emphasizes that outperformance requires not only different information, but also a different interpretation and willingness to act on it, especially when it means standing apart from the crowd.

Marks illustrates the concept with examples such as market panics and bubbles, where the consensus view is often wrong. He writes, “To outperform the crowd, you must be different from the crowd.” The chapter is replete with practical advice, such as asking, “And then what?” and “What is already priced in?” He references historical episodes, like the dot-com bubble, where second-level thinkers avoided losses by questioning the prevailing optimism. Marks also discusses the importance of understanding how others are likely to react to news, not just the news itself.

To apply these lessons, investors should cultivate habits of skepticism, ask probing questions, and challenge consensus narratives. Marks suggests regularly considering alternative scenarios, stress-testing assumptions, and being willing to hold unpopular positions when warranted by analysis. Developing second-level thinking is a skill that improves with practice, requiring ongoing effort and intellectual humility.

Historically, second-level thinkers have been those who avoided the worst excesses of bubbles and capitalized on periods of distress. From Warren Buffett’s contrarian bets during market panics to John Paulson’s analysis during the housing crisis, the ability to think differently and act on it has consistently separated great investors from the rest. In today’s crowded and information-rich markets, second-level thinking remains as critical as ever.

Chapter 2: Understanding Market Efficiency (and Its Limitations)

This chapter is pivotal because it addresses the debate over whether markets can be beaten. Marks acknowledges the efficient market hypothesis (EMH), which argues that all information is reflected in prices, but he quickly points out its limitations. He contends that while markets are often efficient, they are not always right—especially during periods of emotional excess. This nuanced view forms the basis for value investing and the pursuit of alpha.

Marks provides examples of market inefficiencies, such as distressed debt in the early 1990s and the aftermath of the tech bust, where prices deviated significantly from intrinsic value. He writes, “Markets are not always right, just most of the time.” The chapter includes references to academic studies on EMH and real-world cases where disciplined investors outperformed by exploiting mispricings. Marks also discusses the dangers of assuming markets are always efficient, which can lead to complacency and missed opportunities.

Investors can use these insights by remaining vigilant for signs of market excess or panic, conducting independent valuation work, and being prepared to act when prices diverge from fundamentals. Marks recommends maintaining a watchlist of potential opportunities and being patient until inefficiencies arise. He cautions against overconfidence and urges humility, noting that inefficiencies are rare and require both skill and discipline to exploit.

From the 2008 financial crisis to the COVID-19 selloff, history is replete with examples of market inefficiencies. Investors like Seth Klarman and Howard Marks himself have built careers on identifying and capitalizing on these moments. In an era of passive investing and algorithmic trading, the ability to recognize and exploit inefficiency remains a key edge.

Chapter 3: Value

This chapter is essential because it establishes the bedrock of Marks’s approach: the pursuit of intrinsic value. Marks argues that successful investing is about buying assets for less than they are worth, not about predicting the future or chasing trends. He contrasts value investing with speculative approaches, emphasizing that the only reliable compass in uncertain markets is a rigorous assessment of value.

Marks provides detailed explanations of intrinsic value, using examples from corporate bonds, equities, and distressed assets. He discusses valuation methods such as discounted cash flow analysis and asset-based valuation, highlighting the importance of conservatism and skepticism. The chapter includes memorable quotes like, “The discipline to pay less than something is worth is what distinguishes investors from speculators.” Marks also warns against the dangers of overpaying, even for high-quality assets, and the temptation to follow the crowd during periods of exuberance.

For practical application, investors should develop robust valuation models, focus on margin of safety, and resist the urge to chase momentum or “hot” stocks. Marks recommends regular review of valuation assumptions and stress-testing against adverse scenarios. He emphasizes that value investing is not about avoiding risk, but about ensuring that the price paid offers sufficient compensation for the risks taken.

Value investing has a long and successful track record, from Benjamin Graham and Warren Buffett to Marks himself. The discipline of focusing on intrinsic value has protected investors during bubbles and enabled them to capitalize on distressed opportunities. In today’s markets, where narratives often drive prices, a relentless focus on value remains a powerful defense against permanent capital loss.

Chapter 5: Understanding Risk

This chapter is a cornerstone of Marks’s philosophy, highlighting the central role of risk in investing. Marks challenges the conventional view that risk is synonymous with volatility, arguing instead that true risk is the possibility of permanent loss of capital. He stresses that successful investing requires a deep understanding of risk and a disciplined approach to managing it.

Marks uses examples from financial crises and market downturns to illustrate the dangers of ignoring or underestimating risk. He discusses different types of risk, including credit risk, liquidity risk, and psychological risk, and provides frameworks for assessing whether the potential returns justify the risks taken. The chapter includes practical advice such as, “The greatest risk lies in the belief that there is no risk.” Marks also examines the relationship between risk and return, emphasizing that higher returns often come with higher risks that may not be immediately apparent.

Investors can apply these lessons by conducting thorough risk assessments, stress-testing portfolios, and maintaining a healthy skepticism toward consensus views. Marks recommends building in a margin of safety, diversifying across asset classes, and being prepared to act defensively when conditions warrant. Risk management should be an ongoing process, not a one-time exercise.

Historical episodes like the collapse of Long-Term Capital Management and the 2008 crisis demonstrate the catastrophic consequences of poor risk management. Marks’s emphasis on understanding and controlling risk is echoed by leading investors and remains highly relevant in today’s interconnected and rapidly changing markets.

Chapter 6: Recognizing Risk

This chapter builds on the previous one by focusing on the practical challenge of recognizing risk in real time. Marks argues that risk is often invisible during bull markets and only becomes apparent when it’s too late. He explores the psychological barriers to risk recognition, including overconfidence, groupthink, and the tendency to extrapolate recent trends.

Marks provides examples from periods of market euphoria, such as the late 1990s tech boom and the pre-crisis housing market, where risk was systematically underestimated. He writes, “Risk is what’s left over when you think you’ve thought of everything.” The chapter includes discussions of market signals, such as narrowing credit spreads or excessive leverage, that can indicate rising risk levels. Marks also emphasizes the importance of independent analysis and the willingness to act on warning signs, even when the consensus is dismissive.

Investors can use these insights by developing tools and processes for ongoing risk monitoring, such as tracking leverage ratios, credit spreads, and sentiment indicators. Marks recommends regular portfolio reviews and scenario analysis to identify emerging risks. He also encourages investors to cultivate a contrarian mindset, being especially cautious when others are complacent.

The inability to recognize risk has led to some of the most spectacular investment failures in history. From the savings and loan crisis to the collapse of Enron, the warning signs were often visible to those willing to look. In today’s markets, where risk can build up in complex and opaque ways, Marks’s frameworks for risk recognition are more valuable than ever.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 8: Being Attentive to Cycles

Marks dedicates this chapter to the inevitability of market cycles and the importance of understanding them for investment success. He argues that cycles—whether in the economy, markets, or psychology—are a fundamental feature of investing, and that recognizing where you are in the cycle is crucial for timing decisions and managing risk.

Drawing on historical examples, Marks explains how cycles of boom and bust have repeated throughout market history. He discusses the drivers of cycles, including monetary policy, investor sentiment, and exogenous shocks. The chapter includes practical advice on monitoring valuation metrics, credit conditions, and macroeconomic indicators to gauge cycle phases. Marks also warns against the temptation to believe that “this time is different,” a recurring error during every bubble.

Investors can apply these lessons by maintaining a cycle-aware approach to asset allocation, reducing risk during periods of excess and increasing exposure when pessimism prevails. Marks recommends developing checklists and indicators to track cycle progression and being willing to act contrarily when the consensus is extreme. Timing cycles perfectly is impossible, but avoiding the worst excesses is achievable with discipline and awareness.

The history of investing is a history of cycles, from the tulip mania to the global financial crisis. Investors who are attentive to cycles—such as Ray Dalio and Howard Marks—have consistently avoided catastrophic losses and capitalized on recoveries. In a world of rapid change and increased volatility, cycle awareness is a critical edge.

Chapter 11: Contrarianism

This chapter explores the concept of contrarian investing, which is at the heart of Marks’s approach to finding opportunities. Contrarianism means going against the crowd, especially when the consensus is driven by emotion rather than analysis. Marks argues that superior results are rarely achieved by following the herd; instead, they come from having the courage and conviction to act differently.

Marks provides memorable examples of contrarian investing, such as buying distressed debt during financial crises or investing in out-of-favor sectors. He writes, “The consensus is often right, but superior performance requires being right when the consensus is wrong.” The chapter discusses the psychological challenges of contrarianism, including the discomfort of being alone and the risk of being early. Marks also emphasizes the importance of rigorous analysis to distinguish between genuine opportunities and value traps.

Investors can apply these lessons by developing criteria for contrarian entry points, building conviction through independent research, and being patient enough to wait for the market to recognize value. Marks recommends maintaining a watchlist of out-of-favor assets and being prepared to act decisively when conditions align. Contrarian investing is not about reflexively opposing the crowd, but about identifying situations where the market has mispriced risk and value.

Historical examples abound, from John Templeton’s purchases during the Great Depression to Warren Buffett’s investments in American Express during the salad oil scandal. Contrarianism remains a powerful strategy in today’s markets, where sentiment can swing rapidly and create opportunities for those willing to think and act differently.

Chapter 17: Investing Defensively

This chapter is critical because it addresses the necessity of protecting capital during adverse market conditions. Marks argues that the primary goal of investing should be survival—preserving capital so that you can participate in future opportunities. Defensive investing is not about avoiding risk altogether, but about managing it prudently.

Marks discusses defensive strategies such as diversification, prudent position sizing, and maintaining a margin of safety. He provides examples from market downturns where defensive investors fared much better than aggressive risk-takers. The chapter includes practical advice on building resilient portfolios, such as avoiding excessive leverage and being wary of concentrated bets. Marks also emphasizes the psychological benefits of a defensive approach, including reduced stress and the ability to act decisively during crises.

Investors can implement defensive strategies by setting strict risk limits, diversifying across sectors and asset classes, and regularly reviewing exposures. Marks recommends maintaining liquidity to take advantage of future opportunities and being willing to forgo some upside in exchange for greater security. Defensive investing is about playing the long game and ensuring that no single event can derail your financial objectives.

The importance of defensive investing has been demonstrated in every major market crisis, from the Great Depression to the COVID-19 pandemic. Investors who prioritized capital preservation were able to survive downturns and capitalize on recoveries. In today’s uncertain world, the principles of defensive investing are more relevant than ever.

Chapter 20: Pulling It All Together

The final chapter synthesizes the key concepts discussed throughout the book, providing a comprehensive overview of Marks’s investment philosophy. He emphasizes that successful investing requires integrating second-level thinking, value assessment, risk management, cycle awareness, and contrarianism into a holistic approach.

Marks revisits the main themes, illustrating how they interact and reinforce each other. He writes, “There is no single ‘most important thing’—it is the combination of many things, applied with judgment and discipline, that leads to success.” The chapter includes practical frameworks for developing an investment process, building teams, and fostering a culture of continuous improvement. Marks also discusses the importance of humility, adaptability, and lifelong learning.

For investors, the lesson is to avoid rigid adherence to any one strategy and instead focus on synthesizing insights from multiple disciplines. Marks recommends regular reflection, ongoing education, and the willingness to adapt as conditions change. Building a holistic philosophy is an ongoing journey, not a destination.

Many of the world’s most successful investors, from Warren Buffett to Charlie Munger, have emphasized the importance of integrating diverse perspectives and continually updating their approach. Marks’s synthesis provides a roadmap for building a resilient, adaptable investment process that can thrive in any environment.

Practical Investment Strategies

- Develop Second-Level Thinking: Begin by cultivating a habit of questioning assumptions and seeking deeper insights. Instead of accepting consensus views, ask what is already reflected in the price, how prevailing narratives might be wrong, and what alternative scenarios could unfold. Regularly engage in scenario analysis, challenge your own biases, and practice thinking through “what if” situations. Over time, this disciplined approach will help you identify opportunities that others overlook and avoid common pitfalls.

- Focus on Intrinsic Value Over Price: Build your investment process around the rigorous estimation of intrinsic value. Use discounted cash flow analysis, asset-based valuation, and other fundamental tools to determine what an asset is truly worth. Only invest when there is a meaningful gap between price and value, ensuring a margin of safety. Maintain a watchlist of high-quality companies and be patient—wait for prices to become attractive before committing capital. This discipline helps protect against overpaying in frothy markets.

- Implement Robust Risk Management: Establish clear risk management protocols for every investment. Set maximum position sizes, diversify across sectors and asset classes, and use scenario analysis to assess downside risks. Monitor leverage, liquidity, and credit exposures regularly. Create a checklist for risk factors and review it before making major decisions. By systematically managing risk, you increase the odds of surviving downturns and achieving long-term success.

- Be Attentive to Market Cycles: Track economic indicators, valuation metrics, and sentiment data to understand where you are in the market cycle. Adjust your asset allocation and risk exposure based on cycle phases—reduce risk and take profits during periods of exuberance, and increase exposure when fear dominates. Develop a cycle checklist that includes valuation spreads, credit conditions, and macroeconomic trends. This approach helps you avoid buying at the top and selling at the bottom.

- Practice Contrarian Investing: Identify situations where the consensus is excessively optimistic or pessimistic. Use sentiment indicators, fund flows, and valuation extremes to pinpoint potential contrarian opportunities. Build conviction through independent research and be willing to act when your analysis diverges from the crowd. Keep a journal of contrarian ideas and review them regularly. Contrarian investing requires patience and resilience, but it can lead to substantial outperformance over time.

- Adopt Defensive Investing Techniques: Prioritize capital preservation by maintaining diversification, avoiding excessive leverage, and keeping a margin of safety in every investment. Set stop-loss limits and review your portfolio’s risk exposures at regular intervals. Maintain a portion of your portfolio in liquid assets or cash to take advantage of future opportunities. Defensive investing ensures you can weather market storms and remain positioned for long-term growth.

- Integrate Continuous Learning and Reflection: Schedule regular reviews of your investment process and performance. After each major decision, conduct a post-mortem analysis to identify what worked, what didn’t, and why. Read widely—books, memos, market history—and seek out diverse perspectives. Join investment communities or study groups to challenge your thinking. Continuous learning and reflection are essential for adapting to changing markets and improving your results over time.

- Build a Holistic Investment Philosophy: Synthesize lessons from psychology, history, fundamental analysis, and risk management into a cohesive framework. Document your investment beliefs, processes, and decision-making criteria. Regularly revisit and update your philosophy as you gain experience and as market conditions evolve. A holistic approach helps you stay grounded, avoid fads, and remain adaptable in the face of uncertainty.

Modern Applications and Relevance

Since its publication, The Most Important Thing has only grown in relevance as markets have become more complex, globalized, and technology-driven. The principles outlined by Howard Marks are timeless, but they also offer crucial guidance for navigating today’s unique challenges—whether it’s the proliferation of algorithmic trading, the rise of passive investing, or the volatility induced by geopolitical shocks and pandemics.

One of the most enduring lessons is the necessity of independent, second-level thinking in a world awash with information and noise. With social media, 24/7 news cycles, and the democratization of financial data, consensus views can form and shift rapidly. Investors who rely solely on surface-level analysis or crowd sentiment are at greater risk of falling into herd behavior and suffering avoidable losses. Marks’s emphasis on skepticism, deep analysis, and independent judgment is more important than ever in this environment.

Risk management, another central theme, has taken on new dimensions in the era of complex derivatives, global interconnectedness, and rapidly shifting correlations. The events of 2020 and 2022—marked by pandemic shocks, inflation surges, and sudden market reversals—underscore the importance of Marks’s advice to prioritize downside protection and maintain a margin of safety. Defensive strategies, such as diversification and liquidity management, have proven invaluable for investors seeking to survive and thrive amid uncertainty.

Modern examples abound of the book’s principles in action. During the COVID-19 crash, investors who maintained discipline, focused on intrinsic value, and avoided panic selling were able to capitalize on the subsequent recovery. The rise of meme stocks and speculative manias in cryptocurrencies further highlight the dangers of first-level thinking and the enduring need for contrarian, value-driven approaches. Marks’s insights on cycles, psychology, and risk are echoed in the strategies of leading hedge funds and institutional investors today.

To adapt these classic lessons to current conditions, investors must integrate new tools—such as data analytics, alternative data sources, and global macro analysis—while remaining grounded in the timeless principles of value, risk, and independent thought. The rise of ESG investing, the impact of artificial intelligence, and the ongoing evolution of market structure present new challenges and opportunities, but the core message of The Most Important Thing remains unchanged: lasting success requires humility, discipline, and a relentless focus on the fundamentals.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Start by Developing Second-Level Thinking: Set aside time each week to review your investment process and challenge your assumptions. For every investment idea, write down what the consensus believes and then force yourself to articulate a different, deeper insight. Use tools such as scenario analysis and “devil’s advocate” sessions to test your thinking. This should become a regular habit—aim for a weekly review and reflection session.

- Build Your Strategy Around Intrinsic Value: Over the next month, create or refine your valuation models for the assets you track. Focus on discounted cash flow, asset-based, and earnings-based approaches. Set clear criteria for what constitutes a sufficient margin of safety and document your process. Use your models to screen for opportunities and avoid investments where price exceeds intrinsic value. Review and update your valuation assumptions quarterly.

- Construct a Diversified, Defensive Portfolio: Allocate your portfolio across multiple asset classes, sectors, and geographies to reduce idiosyncratic risk. Set position size limits—no single holding should exceed 5-10% of your total portfolio. Maintain a portion (at least 10-20%) in cash or liquid assets to provide flexibility. Rebalance quarterly to maintain your desired risk profile and ensure no single exposure becomes excessive.

- Implement Ongoing Risk Management and Cycle Awareness: Establish a schedule for regular risk reviews—at least monthly. Monitor key indicators such as credit spreads, market sentiment, leverage ratios, and macroeconomic data. Use checklists to ensure you’re not overlooking emerging risks. Adjust your risk exposure in response to cycle signals, reducing leverage and increasing liquidity during periods of exuberance, and being prepared to deploy capital during periods of distress.

- Commit to Continuous Improvement and Learning: Dedicate time each month to reading investment books, memos, and market history. Join an investment group or online community to discuss ideas and challenge your thinking. After each major investment decision, conduct a post-mortem to analyze what worked, what didn’t, and how you can improve. Keep a journal of lessons learned and revisit it regularly to reinforce your development.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Most Important Thing

1. What is the main message of The Most Important Thing by Howard Marks?

The main message is that successful investing requires a combination of second-level thinking, deep understanding of risk, focus on intrinsic value, and the discipline to act independently of the crowd. Marks emphasizes that there is no single “most important thing”—rather, it’s the integration of multiple principles, applied with judgment and humility, that leads to superior results. The book serves as a guide to developing a holistic investment philosophy that can withstand market cycles and uncertainty.

2. How does Howard Marks define and manage investment risk?

Marks defines risk not as volatility, but as the potential for permanent loss of capital. He stresses the importance of recognizing, assessing, and controlling risk through diversification, margin of safety, and ongoing vigilance. Marks advocates for scenario analysis, regular portfolio reviews, and a focus on downside protection rather than just chasing returns. His approach is proactive and emphasizes the need to be prepared for adverse outcomes, not just optimistic scenarios.

3. What is “second-level thinking” and why does it matter?

Second-level thinking is the ability to go beyond obvious conclusions and analyze what others might miss. It involves questioning consensus views, considering alternative outcomes, and understanding what is already reflected in market prices. This mindset is crucial for outperforming the market, as it enables investors to identify mispricings and opportunities that are invisible to first-level thinkers. Marks argues that second-level thinking is a skill that can be developed through practice and reflection.

4. Is The Most Important Thing suitable for beginner investors?

Yes, the book is suitable for both beginners and experienced investors. While some concepts may require careful study, Marks writes in a clear and accessible style, using real-world examples to illustrate his points. Beginners will benefit from the focus on fundamentals, risk management, and the psychology of investing, while more advanced readers will appreciate the depth and nuance of Marks’s philosophy. The book is widely recommended as a foundational text for anyone serious about investing.

5. How can investors apply the lessons from The Most Important Thing in today’s markets?

Investors can apply the lessons by developing independent thinking, focusing on intrinsic value, implementing robust risk management, and being attentive to market cycles. Marks’s emphasis on discipline, patience, and humility is especially relevant in today’s volatile and information-rich environment. By integrating these principles into their investment process, investors can better navigate uncertainty, avoid common pitfalls, and position themselves for long-term success.