The Snowball: Warren Buffett and the Business of Life by Alice Schroeder

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

Few figures in the world of investing command as much respect as Warren Buffett, and "The Snowball: Warren Buffett and the Business of Life" by Alice Schroeder stands as the definitive biography of this legendary investor. Alice Schroeder, a former managing director at Morgan Stanley and respected Wall Street analyst, was granted unprecedented access to Buffett’s personal archives, friends, family, and—most importantly—Buffett himself. Her financial acumen and investigative rigor allowed her to craft a portrait that goes far beyond the numbers, delving into the intricacies of Buffett's character, motivations, and the principles that have guided him for over eight decades.

Published in 2008, "The Snowball" arrived at a pivotal moment in financial history. The world was reeling from the global financial crisis, and investors everywhere were searching for wisdom and stability. Against this backdrop, Schroeder’s biography offered more than just a chronicle of Buffett’s career; it provided a masterclass in value investing, personal discipline, and ethical leadership. The book traces Buffett’s journey from his humble beginnings in Omaha, Nebraska, through his early entrepreneurial ventures, to his transformation of Berkshire Hathaway into one of the world’s most successful conglomerates. Throughout, it weaves together stories of triumph, failure, resilience, and the relentless compounding of knowledge and capital—what Buffett himself calls the “snowball effect.”

The central theme of the book is not merely financial success, but the philosophy of life that underpins it. Schroeder reveals how Buffett’s investment decisions are inextricably linked to his personal values: integrity, patience, humility, and a relentless pursuit of learning. The biography explores his relationships with family, friends, and business partners, providing a nuanced understanding of the man behind the public persona. It also examines his philanthropic ambitions, his response to criticism, and the challenges he faced during periods of market euphoria and despair.

"The Snowball" is considered essential reading for anyone interested in investing, business leadership, or personal development. Its appeal lies in its breadth and depth: it is as much a guide to living wisely as it is a manual for building wealth. Aspiring investors will find practical lessons in value investing, risk management, and market psychology, while readers interested in human behavior will appreciate the exploration of habits, routines, and decision-making processes that have shaped Buffett’s extraordinary life. Schroeder’s narrative is both accessible and deeply researched, making complex financial concepts understandable without sacrificing nuance or detail.

What sets "The Snowball" apart from other investment books is its holistic approach. Rather than focusing solely on technical analysis or stock-picking strategies, the book integrates Buffett’s business achievements with his personal journey. Schroeder’s access to Buffett’s inner circle allows her to present candid anecdotes, revealing both his strengths and his vulnerabilities. The book’s unique value lies in its ability to humanize a financial icon, providing readers with actionable insights into not only how Buffett invests, but why he invests—and how those reasons have shaped his enduring legacy.

Key Themes and Concepts

"The Snowball" is more than a biography; it is a compendium of timeless investing wisdom, life lessons, and the psychological underpinnings of success. Throughout the book, Alice Schroeder weaves together the strands of Buffett’s life and career to reveal recurring themes that inform both his investment philosophy and his approach to living. These themes are not only relevant to professional investors but to anyone seeking to understand the dynamics of wealth, decision-making, and personal integrity.

Buffett’s story is shaped by several foundational concepts—value investing, the “Inner Scorecard,” resilience, and the importance of family and legacy. The book explores how these themes interact, evolve, and reinforce each other, creating a framework that has allowed Buffett to thrive in the face of adversity and market volatility. Below, we examine the most significant themes that run through "The Snowball," highlighting their practical application and relevance for modern investors.

- Value Investing: At the core of Buffett’s philosophy is the principle of value investing—the discipline of buying companies whose intrinsic value exceeds their market price. Buffett’s approach, heavily influenced by Benjamin Graham, emphasizes rigorous analysis of fundamentals, a margin of safety, and the patience to hold investments for the long term. Throughout the book, Schroeder illustrates how Buffett applies these principles, from his early investments in pinball machines to his billion-dollar acquisitions at Berkshire Hathaway. Real-world examples, such as his purchase of American Express during the salad oil scandal, underscore the importance of contrarian thinking and the willingness to act when others are fearful. For investors, the lesson is clear: focus on businesses with durable competitive advantages, strong management, and consistent cash flows, and be prepared to wait for the market to recognize their true worth.

- The Inner Scorecard: One of the most profound concepts in "The Snowball" is Buffett’s idea of the “Inner Scorecard”—the practice of measuring success by one’s own standards rather than external validation. This theme is woven throughout the book, from Buffett’s refusal to chase short-term trends during the tech bubble to his emphasis on integrity in business dealings. The Inner Scorecard informs not only his investment decisions but his personal relationships and philanthropic commitments. Schroeder provides numerous anecdotes—such as Buffett’s decision to walk away from lucrative but ethically questionable deals—that illustrate the power of self-awareness and principled living. For readers, the Inner Scorecard serves as a reminder to define success on your own terms and to prioritize long-term fulfillment over fleeting approval.

- Resilience and Adaptability: Buffett’s journey is marked by periods of challenge, criticism, and uncertainty. "The Snowball" chronicles his ability to remain steadfast in his principles while adapting to changing market conditions. Whether facing the skepticism of peers during the dot-com boom or navigating the financial crises of the 1970s and 2000s, Buffett demonstrates resilience by sticking to his core beliefs while remaining flexible in execution. Schroeder highlights how Buffett learns from failure, adjusts his strategies, and maintains a calm demeanor in the face of volatility. For investors, this theme underscores the importance of emotional discipline, continuous learning, and the ability to pivot without abandoning foundational principles.

- Family and Personal Values: The influence of family and personal values is a recurring motif in Buffett’s life. Schroeder explores how his upbringing in Omaha, the example set by his father Howard Buffett, and the support of his wife Susie shaped his worldview. The book delves into the complexities of his personal relationships, revealing both strengths and flaws. Buffett’s commitment to thrift, honesty, and loyalty is evident in his business dealings and personal life. For readers, this theme highlights the interplay between personal character and professional success, reminding us that enduring achievement is rooted in a strong ethical foundation.

- Philanthropy and Legacy: As Buffett’s wealth grew, so did his commitment to philanthropy and the desire to leave a positive legacy. "The Snowball" examines his decision to pledge the vast majority of his fortune to charitable causes, his involvement with the Gates Foundation, and his philosophy of “giving while living.” Schroeder discusses the motivations behind Buffett’s philanthropy, including his belief in the compounding effect of good deeds and the importance of setting an example for future generations. This theme encourages readers to consider not only how to build wealth, but how to use it for the greater good.

- Market Cycles and Behavior: A deep understanding of market psychology and cycles is central to Buffett’s success. The book details his skepticism of speculative bubbles, such as the dot-com mania, and his ability to remain rational when others are driven by fear or greed. Schroeder provides vivid accounts of Buffett’s speeches and actions during periods of market excess, emphasizing the value of independent thinking and the dangers of herd mentality. For investors, this theme reinforces the importance of contrarianism, patience, and the willingness to act decisively when opportunities arise.

- Leadership and Management: Buffett’s leadership style is characterized by trust, decentralization, and a focus on empowering talented managers. "The Snowball" explores his approach to building Berkshire Hathaway, his relationships with key executives, and his philosophy of “hiring for character, training for skill.” Schroeder highlights how Buffett’s humility, long-term vision, and emphasis on partnership have created a culture of excellence and loyalty. For business leaders, this theme provides a blueprint for building enduring organizations based on trust and shared values.

Book Structure: Major Sections

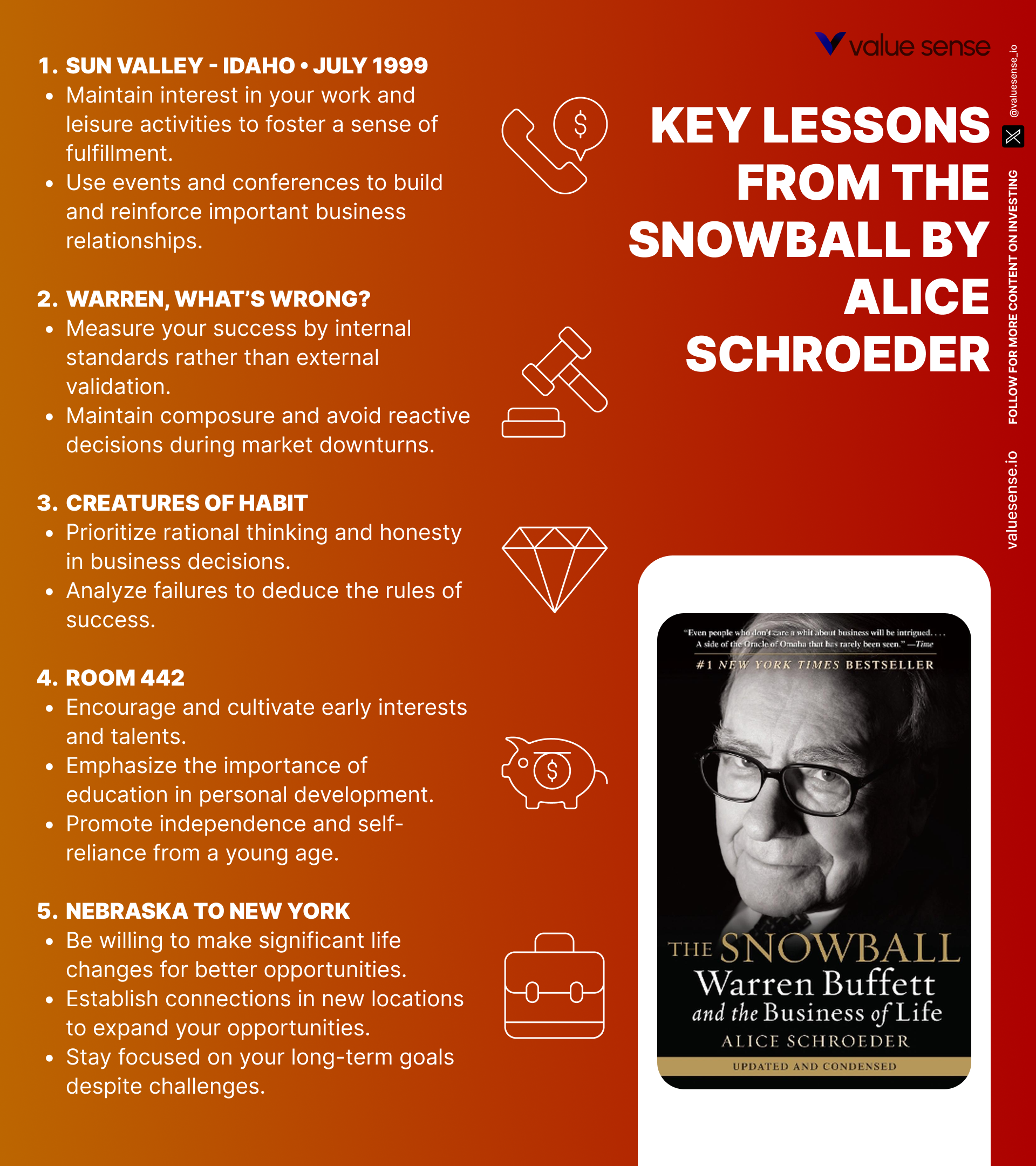

Part 1: Early Life and Influences

This section encompasses the first four chapters of "The Snowball," tracing Warren Buffett’s formative years in Omaha, Nebraska. Schroeder explores Buffett’s family background, the influence of his parents—particularly his father Howard Buffett, a stockbroker and congressman—and the early experiences that shaped his character and ambitions. The narrative delves into his childhood quirks, entrepreneurial experiments, and the values instilled by his family and community.

Key concepts in these chapters include the importance of curiosity, thriftiness, and self-reliance. Schroeder recounts stories such as young Warren’s fascination with numbers, his newspaper delivery routes, and his first ventures in pinball machines and stamp collecting. These anecdotes are not mere nostalgia; they illustrate the compounding effect of small efforts and the seeds of Buffett’s later obsession with investing. The section also examines the impact of the Great Depression on the Buffett family, highlighting how adversity forged resilience and a deep appreciation for financial security.

For investors, this section underscores the value of starting early, developing good habits, and learning from every experience. Parents and mentors will find inspiration in the way Howard Buffett nurtured Warren’s curiosity and independence, while aspiring entrepreneurs will recognize the power of persistence and experimentation. The lessons here are universal: the habits and values developed in youth can become the foundation for lifelong success.

In today’s world, where instant gratification is the norm, Buffett’s early life is a reminder of the power of patience, discipline, and long-term thinking. Modern investors can draw parallels between Buffett’s humble beginnings and the importance of building a strong foundation before taking bigger risks. The enduring relevance of these principles is evident in the continued success of those who embrace them, regardless of market cycles or technological change.

Part 2: Investment Philosophy and Strategies

Chapters five through eight provide a deep dive into the core principles that define Buffett’s approach to investing. Schroeder details the evolution of his investment philosophy, from the influence of Benjamin Graham’s teachings at Columbia Business School to the development of his own unique style. The section covers Buffett’s views on market behavior, intrinsic value, and the discipline required to succeed over the long term.

Central to this section are the concepts of value investing, margin of safety, and the importance of understanding the businesses behind the stocks. Schroeder uses specific examples, such as Buffett’s investments in GEICO and American Express, to illustrate how he applies rigorous analysis and patience to identify undervalued opportunities. The narrative also explores Buffett’s skepticism of market fads and his insistence on independent thinking, even when it means going against the crowd.

Investors can apply these insights by focusing on fundamentals, avoiding emotional decision-making, and maintaining a long-term perspective. The emphasis on intrinsic value and margin of safety provides a framework for evaluating potential investments and mitigating risk. Schroeder’s detailed accounts of Buffett’s thought processes offer a blueprint for developing a disciplined, rational approach to investing.

In an era of high-frequency trading and speculative bubbles, Buffett’s investment philosophy remains as relevant as ever. The principles outlined in this section have stood the test of time, guiding investors through booms and busts alike. The ongoing success of Berkshire Hathaway and its portfolio companies is a testament to the enduring power of value investing and disciplined decision-making.

Part 3: Building Berkshire Hathaway

This section, covering chapters nine through twelve, chronicles the transformation of Berkshire Hathaway from a struggling textile mill into a global conglomerate. Schroeder examines the strategic decisions, acquisitions, and management practices that have defined Buffett’s stewardship of the company. The narrative highlights key milestones, including the purchases of National Indemnity, See’s Candies, and other iconic businesses.

Key concepts include the importance of capital allocation, the role of decentralized management, and the value of partnering with talented, trustworthy leaders. Schroeder provides detailed accounts of how Buffett evaluates acquisition targets, negotiates deals, and integrates new businesses into the Berkshire ecosystem. The section also explores the challenges and setbacks encountered along the way, emphasizing Buffett’s willingness to learn from mistakes and adapt his strategies.

For investors and business leaders, this section offers practical lessons in strategic vision, risk management, and organizational culture. Buffett’s approach to building Berkshire Hathaway demonstrates the power of compounding—not just in financial terms, but in relationships and reputation. The emphasis on trust, autonomy, and long-term thinking provides a template for sustainable growth and value creation.

In the contemporary business landscape, where mergers and acquisitions are often driven by short-term incentives, Buffett’s patient, principled approach stands out. The success of Berkshire Hathaway serves as a model for companies seeking to balance growth with stability, innovation with tradition, and profit with purpose.

Part 4: Personal Life and Legacy

Chapters thirteen through sixteen shift the focus from business to the personal dimensions of Buffett’s life. Schroeder delves into his relationships with family, friends, and colleagues, exploring the interplay between personal values and professional achievements. The section also examines Buffett’s philanthropic initiatives and his evolving views on wealth and responsibility.

Key themes include the importance of humility, empathy, and self-reflection. Schroeder provides intimate portraits of Buffett’s interactions with his wife Susie, his children, and close friends like Bill Gates. The narrative reveals both strengths and vulnerabilities, highlighting the challenges of balancing ambition with personal fulfillment. The section also explores Buffett’s decision to pledge the majority of his fortune to charity, his involvement with the Giving Pledge, and his commitment to “giving while living.”

Readers can draw valuable lessons about the integration of personal and professional life, the importance of nurturing relationships, and the role of purpose in sustaining long-term success. Buffett’s example encourages investors to consider not only how they accumulate wealth, but how they use it to make a positive impact on the world.

In an age of increasing wealth inequality and social responsibility, Buffett’s approach to legacy and philanthropy is more relevant than ever. His willingness to share his fortune and his wisdom provides a powerful example for current and future generations of leaders, investors, and philanthropists.

Part 5: Challenges and Criticisms

The final thematic section, covering chapters seventeen through twenty, addresses the obstacles and controversies that have punctuated Buffett’s career. Schroeder examines how he has navigated market downturns, public criticism, and personal setbacks, providing a balanced perspective on his strengths and weaknesses.

Key concepts include resilience, adaptability, and the importance of learning from failure. Schroeder details episodes such as the collapse of Salomon Brothers, the fallout from investment missteps, and the scrutiny Buffett faced during periods of underperformance. The narrative highlights his ability to remain calm under pressure, respond constructively to criticism, and use setbacks as opportunities for growth.

Investors can apply these lessons by developing emotional discipline, maintaining perspective during turbulent times, and embracing a growth mindset. The section also underscores the value of transparency, accountability, and humility in leadership.

In today’s volatile and fast-paced markets, the ability to withstand criticism and adapt to changing circumstances is more important than ever. Buffett’s example demonstrates that true success is not defined by the absence of failure, but by the ability to learn, persevere, and continue moving forward.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: The Less Flattering Version

This opening chapter is crucial as it introduces the reader to the real Warren Buffett, not just the financial icon but the human being with quirks, insecurities, and an unconventional approach to life. Schroeder sets the tone for the biography by describing Buffett’s modest office, his unassuming demeanor, and his preference for simplicity over ostentation. The chapter establishes the importance of humility and authenticity, which become recurring themes throughout the book. It also provides insight into Buffett’s interactions with colleagues and friends, revealing a man who values relationships over status and who measures success by personal fulfillment rather than public acclaim.

Schroeder uses vivid anecdotes to illustrate Buffett’s character, such as his habit of eating at McDonald’s, driving himself to work, and maintaining a frugal lifestyle despite his immense wealth. She quotes Buffett’s own reflections on his strengths and weaknesses, highlighting his willingness to acknowledge his flaws and learn from them. The chapter also introduces key figures in Buffett’s life, including his wife Susie and business partner Charlie Munger, setting the stage for the complex relationships that will be explored in later chapters. Data points such as Buffett’s net worth, investment returns, and philanthropic commitments provide context for his achievements and values.

Investors can apply the lessons of this chapter by embracing humility, focusing on substance over appearance, and prioritizing genuine relationships. Buffett’s example demonstrates that success is not defined by material possessions or public recognition, but by the quality of one’s character and the impact one has on others. Practical steps include cultivating self-awareness, seeking honest feedback, and resisting the temptation to compare oneself to others.

Historically, Buffett’s humility has set him apart from many of his peers in the financial world, where ego and bravado often reign supreme. His willingness to admit mistakes, share credit, and maintain a low profile has contributed to his enduring popularity and influence. In an age of social media and celebrity culture, this chapter’s message is more relevant than ever: true greatness is rooted in authenticity and a commitment to continuous self-improvement.

Chapter 2: Sun Valley

This chapter is pivotal because it showcases Buffett’s role as a voice of reason during the height of the dot-com bubble. At the Sun Valley conference, attended by the titans of technology and finance, Buffett delivers a memorable speech warning of the dangers of irrational exuberance and speculative mania. Schroeder captures the tension in the room as Buffett challenges the prevailing narrative, urging his audience to focus on fundamentals and long-term value rather than chasing short-term gains. The chapter highlights Buffett’s willingness to stand alone, his deep understanding of market cycles, and his commitment to independent thinking.

Schroeder provides detailed accounts of Buffett’s speech, including memorable quotes such as “When the tide goes out, you see who’s been swimming naked.” She contrasts Buffett’s caution with the optimism of tech executives, illustrating the psychological dynamics that drive bubbles and crashes. The chapter includes data on market valuations, historical precedents, and the subsequent collapse of the dot-com sector, reinforcing the validity of Buffett’s warnings. Schroeder also explores the impact of Buffett’s message on his reputation, both positive and negative.

For investors, the key takeaway is the importance of skepticism, discipline, and the courage to go against the crowd. Practical steps include conducting independent research, focusing on intrinsic value, and avoiding the temptation to follow fads. Buffett’s example encourages investors to remain patient, maintain a long-term perspective, and be willing to act decisively when opportunities arise.

The Sun Valley episode is a classic example of Buffett’s ability to remain rational in the face of collective euphoria. His warnings were initially dismissed by many, but history vindicated his analysis as the dot-com bubble burst and countless fortunes evaporated. In today’s fast-moving markets, where hype and speculation are rampant, this chapter’s lessons are as relevant as ever: focus on fundamentals, be wary of herd mentality, and remember that true value endures.

Chapter 4: Warren, What's Wrong?

This chapter is significant because it explores a period of intense scrutiny and criticism of Buffett’s investment style during the late 1990s. As technology stocks soared and traditional value investing fell out of favor, Buffett was derided as out of touch, and his performance lagged the broader market. Schroeder delves into the psychological and emotional challenges Buffett faced, highlighting his resilience and steadfastness in the face of doubt. The chapter introduces the concept of the “Inner Scorecard,” which becomes a central theme in Buffett’s philosophy.

Schroeder uses specific examples, such as media headlines questioning Buffett’s relevance and the pressure from investors to change his approach. She quotes Buffett’s own reflections on the importance of staying true to one’s principles, even when it means standing alone. The chapter includes data on Berkshire Hathaway’s performance relative to the S&P 500, illustrating the cyclical nature of investment styles and the dangers of short-term thinking. Schroeder also explores the role of mentors like Benjamin Graham and Charlie Munger in shaping Buffett’s confidence and discipline.

Investors can learn from Buffett’s example by developing their own Inner Scorecard—defining success by personal standards rather than external approval. Practical steps include setting clear investment criteria, maintaining discipline during periods of underperformance, and seeking mentors who reinforce core values. The chapter encourages readers to embrace patience, self-awareness, and the willingness to learn from mistakes.

The historical context of this chapter is particularly relevant in light of recurring cycles of market exuberance and skepticism. Buffett’s ability to withstand criticism and remain focused on fundamentals has been a key factor in his long-term success. In a world where performance is often measured in quarters rather than decades, this chapter’s lessons are invaluable for investors seeking to build enduring wealth and reputation.

Chapter 5: The Urge to Preach

This chapter is essential because it traces the family history and values that have shaped Buffett’s character and approach to business. Schroeder explores the influence of Buffett’s parents, particularly his father Howard, whose commitment to integrity, thrift, and service left a lasting impression. The chapter examines the Buffett family’s tradition of “preaching”—sharing wisdom, advocating for causes, and setting an example for others.

Schroeder uses anecdotes from Buffett’s childhood, such as family discussions around the dinner table and Howard’s political campaigns, to illustrate the transmission of values across generations. She quotes Buffett’s reflections on the importance of honesty, hard work, and generosity, and provides examples of how these traits have influenced his decisions as an investor and philanthropist. The chapter also explores the role of storytelling in shaping Buffett’s worldview and communication style.

For investors and business leaders, the key lesson is the importance of grounding decisions in core values and leading by example. Practical steps include articulating a personal mission statement, modeling ethical behavior, and using storytelling to inspire others. The chapter encourages readers to reflect on their own family influences and the legacy they wish to create.

Historically, the transmission of values from one generation to the next has been a powerful force in shaping leaders and organizations. Buffett’s commitment to integrity and service has set him apart in a field often characterized by short-termism and self-interest. In today’s world, where trust and ethical leadership are more important than ever, this chapter’s insights are both timely and timeless.

Chapter 6: The Bathtub Steeplechase

This chapter is critically important as it details the economic challenges faced by the Buffett family during the Great Depression and the early signs of Warren’s entrepreneurial spirit. Schroeder recounts the struggles of maintaining financial stability, the impact of adversity on family dynamics, and the resilience developed through hardship. The chapter provides a vivid portrait of the formative experiences that shaped Buffett’s attitudes toward risk, opportunity, and hard work.

Schroeder uses specific stories, such as young Warren’s ventures in selling gum, Coca-Cola, and magazines, to illustrate his resourcefulness and determination. She quotes family members and friends who observed his early business acumen and relentless curiosity. The chapter includes data on the economic conditions of the era, providing context for the challenges faced by the Buffett family and the broader community.

Investors and entrepreneurs can draw practical lessons from Buffett’s ability to turn adversity into opportunity. Steps include developing resilience, seeking out opportunities in difficult circumstances, and cultivating a mindset of continuous learning. The chapter encourages readers to view setbacks as stepping stones rather than obstacles.

The historical context of the Great Depression is particularly relevant in understanding Buffett’s aversion to debt, focus on cash flow, and preference for conservative financial management. These principles have guided him through multiple market cycles and remain relevant for investors navigating uncertain times. The chapter’s emphasis on resilience and adaptability is a powerful reminder that success is often forged in the crucible of adversity.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 9: The Inner Scorecard

This chapter introduces one of the most important concepts in Buffett’s personal philosophy: the “Inner Scorecard.” Schroeder explores how Buffett measures success by his own standards rather than external validation, a principle that informs both his investment decisions and his approach to life. The chapter delves into the origins of this mindset, its application in business, and its impact on personal fulfillment.

Schroeder uses examples from Buffett’s career, such as his refusal to participate in speculative manias and his commitment to ethical business practices, to illustrate the power of the Inner Scorecard. She quotes Buffett’s reflections on the importance of self-awareness, integrity, and the courage to stand alone. The chapter includes anecdotes about mentors and role models who reinforced these values, as well as data on the long-term performance of investments guided by internal rather than external benchmarks.

For readers, the practical application is clear: define success on your own terms, set personal standards for behavior and performance, and resist the temptation to seek approval from others. Steps include developing a personal mission statement, regularly reviewing goals and values, and seeking feedback from trusted mentors. The chapter encourages readers to cultivate self-confidence and resilience in the face of criticism.

The concept of the Inner Scorecard has broad relevance in today’s world, where external validation is often prioritized over personal fulfillment. Buffett’s example demonstrates that true success is rooted in self-awareness, integrity, and the willingness to live according to one’s own principles. This chapter’s insights are particularly valuable for investors, entrepreneurs, and leaders seeking to build lasting success and satisfaction.

Chapter 13: Creatures of Habit

Chapter 13 is a deep exploration of the routines and habits that have underpinned Buffett’s extraordinary success. Schroeder describes Buffett’s highly structured daily schedule, his obsession with reading and learning, and his deliberate avoidance of distractions. The chapter highlights the power of consistency, discipline, and continuous improvement in achieving long-term goals.

Schroeder provides detailed accounts of Buffett’s daily rituals, such as his early morning reading sessions, his preference for simplicity in diet and dress, and his focus on high-leverage activities. She quotes Buffett’s reflections on the importance of habit formation and the compounding effect of small, positive actions over time. The chapter includes data on Buffett’s reading habits, investment returns, and the impact of routine on decision-making quality.

For investors and professionals, the key takeaway is the importance of developing productive habits and routines. Practical steps include setting aside time for focused learning, eliminating low-value activities, and tracking progress toward long-term goals. The chapter encourages readers to experiment with different routines, identify what works, and make incremental improvements over time.

The historical context of this chapter is particularly relevant in today’s fast-paced, distraction-filled world. Buffett’s ability to maintain focus, prioritize learning, and avoid unnecessary complexity has been a key factor in his enduring success. The lessons of habit formation and consistency are applicable to anyone seeking to achieve excellence, whether in investing, business, or personal life.

Chapter 17: Building Berkshire Hathaway

This chapter is a cornerstone of the book, detailing the transformation of Berkshire Hathaway from a struggling textile mill into a global powerhouse. Schroeder traces the strategic decisions, acquisitions, and management practices that have defined Buffett’s stewardship of the company. The chapter highlights Buffett’s vision, patience, and willingness to take calculated risks in pursuit of long-term growth.

Schroeder provides specific examples of key acquisitions, such as National Indemnity, See’s Candies, and GEICO, illustrating how Buffett evaluates businesses based on their intrinsic value, competitive advantages, and management quality. She quotes Buffett’s reflections on capital allocation, the importance of trust in business relationships, and the role of decentralization in fostering innovation. The chapter includes data on Berkshire Hathaway’s financial performance, shareholder returns, and the compounding effect of reinvested earnings.

For investors and business leaders, the practical lessons are clear: focus on long-term value creation, prioritize quality over quantity, and build relationships based on trust and mutual respect. Steps include developing a disciplined approach to capital allocation, seeking out talented partners, and maintaining a patient, opportunistic mindset. The chapter encourages readers to think beyond short-term results and to invest in people as well as businesses.

The historical significance of Berkshire Hathaway’s transformation cannot be overstated. Buffett’s approach has become a model for value investors and conglomerate builders worldwide. The lessons of strategic vision, disciplined execution, and ethical leadership are as relevant today as they were during the company’s formative years. This chapter provides a blueprint for building enduring organizations that thrive across generations.

Chapter 19: Personal Life and Legacy

This chapter offers a candid look at Buffett’s personal relationships, philanthropic commitments, and the legacy he hopes to leave behind. Schroeder delves into the complexities of Buffett’s family dynamics, his evolving views on wealth and responsibility, and his decision to pledge the majority of his fortune to charity. The chapter highlights the interplay between personal fulfillment and professional achievement, emphasizing the importance of purpose and service.

Schroeder uses intimate anecdotes, such as Buffett’s conversations with his children and his partnership with Bill and Melinda Gates, to illustrate his commitment to making a positive impact. She quotes Buffett’s reflections on the responsibilities of wealth, the joys and challenges of parenting, and the importance of humility in leadership. The chapter includes data on Buffett’s philanthropic giving, the structure of the Giving Pledge, and the impact of his donations on global initiatives.

For readers, the key takeaway is the importance of integrating personal values with professional goals. Practical steps include developing a philanthropic strategy, engaging with family and community, and reflecting on the legacy one wishes to create. The chapter encourages readers to use their resources—financial, intellectual, and emotional—to make a meaningful difference in the world.

Buffett’s approach to legacy and philanthropy has set a new standard for wealthy individuals and business leaders. His willingness to share his fortune and his wisdom has inspired a new generation of philanthropists and change-makers. In an era of rising inequality and social responsibility, this chapter’s insights are both timely and transformative.

Chapter 20: Challenges and Criticisms

This chapter is vital as it addresses the obstacles, controversies, and criticisms that have shaped Buffett’s career. Schroeder examines how Buffett has navigated market downturns, public scrutiny, and personal setbacks, providing a balanced perspective on his strengths and vulnerabilities. The chapter highlights Buffett’s resilience, adaptability, and commitment to learning from failure.

Schroeder provides detailed accounts of episodes such as the Salomon Brothers scandal, investment missteps, and the challenges of managing a large, diverse organization. She quotes Buffett’s reflections on the importance of transparency, accountability, and humility in leadership. The chapter includes data on Berkshire Hathaway’s performance during periods of crisis, as well as the lessons learned from mistakes and setbacks.

For investors and leaders, the practical lessons are clear: embrace transparency, seek feedback, and view failure as an opportunity for growth. Steps include developing crisis management plans, fostering a culture of accountability, and maintaining perspective during turbulent times. The chapter encourages readers to remain calm, focused, and adaptable in the face of adversity.

The historical context of this chapter is particularly relevant in today’s volatile markets and fast-changing business environment. Buffett’s ability to withstand criticism, adapt to new challenges, and continue learning has been a key factor in his enduring success. The lessons of resilience, humility, and continuous improvement are applicable to anyone seeking to build a lasting legacy in business or life.

Practical Investment Strategies

- Long-Term Value Investing: Buffett’s core strategy involves identifying companies trading below their intrinsic value and holding them for extended periods. Investors should begin by screening for businesses with durable competitive advantages, consistent cash flows, and competent management. Use discounted cash flow models and valuation multiples to estimate intrinsic value. Purchase only when a significant margin of safety exists. Hold through market volatility, allowing compounding to work in your favor. Review holdings annually to ensure fundamentals remain intact, but avoid unnecessary trading.

- Margin of Safety Principle: Always invest with a margin of safety to protect against unforeseen risks. This means buying stocks at prices significantly below their calculated intrinsic value. To implement, set strict buy limits based on conservative estimates of earnings and asset values. Use tools like Value Sense’s intrinsic value models to stress-test assumptions. Avoid chasing “hot” stocks or speculative trends; focus on downside protection first. Reassess the margin of safety as market conditions change.

- Contrarian Investing During Market Bubbles: Buffett’s success often comes from going against the grain during periods of market euphoria or panic. When markets are overheated, conduct rigorous analysis to identify overvalued sectors. Build watchlists of high-quality companies that may become undervalued in a downturn. During corrections, deploy capital into these opportunities while others are fearful. Document your rationale for each contrarian bet and set clear performance benchmarks to track results.

- Focus on Business Quality, Not Stock Price: Analyze businesses, not just stock charts. Study annual reports, management commentary, and industry trends. Look for companies with strong brands, pricing power, and ethical leadership. Use qualitative checklists to assess business models and competitive positioning. Avoid companies with excessive leverage, poor governance, or declining market share. Revisit your analysis periodically to ensure the business thesis remains valid.

- Decentralized Management and Trust in Partners: Emulate Buffett’s approach by investing in companies where management is trustworthy and empowered. Assess the track record of executives, their alignment with shareholders, and their capital allocation skills. Diversify across industries and geographies to reduce key-person risk. For business owners, delegate responsibilities to capable leaders and foster a culture of autonomy and accountability.

- Continuous Learning and Intellectual Curiosity: Dedicate time each day to reading and learning. Follow Buffett’s example by consuming a wide range of materials—books, financial reports, industry publications, and economic data. Maintain a journal of investment ideas, lessons learned, and mistakes made. Attend conferences, join investment clubs, and seek out mentors to expand your knowledge base. Update your investment framework as you gain new insights.

- Philanthropic and Ethical Investing: Consider the broader impact of your investments. Integrate environmental, social, and governance (ESG) criteria into your stock selection process. Allocate a portion of profits to charitable causes or impact funds. Engage with company management on issues of sustainability and corporate responsibility. Review your portfolio regularly to ensure alignment with your values and long-term goals.

- Emotional Discipline and the Inner Scorecard: Develop routines and mental models to manage emotions during market swings. Use written checklists and pre-commitment strategies to avoid impulsive decisions. Measure performance against your own goals and process, not short-term market movements or peer comparisons. Seek feedback from trusted advisors and periodically revisit your investment philosophy to reinforce discipline.

Modern Applications and Relevance

The timeless principles outlined in "The Snowball" are as relevant in today’s markets as they were during Buffett’s formative years. While the financial landscape has evolved—characterized by rapid technological change, algorithmic trading, and global interconnectedness—the core tenets of value investing, patience, and integrity remain foundational for long-term success. Buffett’s emphasis on understanding intrinsic value, maintaining a margin of safety, and avoiding speculative manias offers a counterbalance to the short-termism that pervades modern investing.

Since the publication of "The Snowball," the proliferation of data and analytical tools has made it easier than ever for investors to conduct fundamental research. Platforms like Value Sense provide access to automated stock ideas, intrinsic value models, and screeners that embody the principles championed by Buffett. However, the temptation to chase trends, react to news cycles, and compare performance to benchmarks is stronger than ever. In this environment, the discipline to maintain an Inner Scorecard and focus on long-term goals is a distinct competitive advantage.

Buffett’s approach to leadership and management also holds valuable lessons for today’s business leaders. The rise of remote work, decentralized organizations, and stakeholder capitalism has made trust, empowerment, and ethical governance more important than ever. Companies that prioritize culture, integrity, and long-term value creation are better positioned to navigate uncertainty and build lasting relationships with employees, customers, and investors.

Modern examples abound of investors and organizations applying Buffett’s principles with great success. From the resurgence of value investing in the wake of speculative bubbles to the growing emphasis on ESG factors, the lessons of "The Snowball" continue to shape the strategies of leading asset managers, family offices, and individual investors. By adapting classic advice to current conditions—incorporating new tools, embracing diversity, and staying open to innovation—today’s investors can build resilient, purpose-driven portfolios that stand the test of time.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Define Your Investment Philosophy: Begin by articulating your core beliefs about investing. Write a personal mission statement that outlines your goals, risk tolerance, and ethical standards. Use Buffett’s principles as a starting point but tailor them to your unique circumstances. Set clear criteria for evaluating opportunities and document your decision-making process.

- Develop a Research and Screening Process (1-2 months): Allocate time each week to research potential investments. Use tools like Value Sense’s stock screener and intrinsic value models to identify candidates. Analyze financial statements, management commentary, and industry trends. Create a checklist of key factors—competitive advantage, cash flow, management quality—to ensure consistency in your analysis.

- Construct a Diversified Portfolio (3-6 months): Select a mix of 10-20 high-quality companies across different sectors and geographies. Allocate capital based on conviction, margin of safety, and your risk profile. Limit position sizes to reduce concentration risk. Rebalance annually or as fundamentals change, avoiding unnecessary trading and transaction costs.

- Establish an Ongoing Review Schedule (Quarterly/Annually): Set regular intervals to review portfolio performance, reassess investment theses, and monitor for changes in fundamentals. Track progress against your Inner Scorecard—focusing on process and discipline rather than short-term results. Use written reports and performance dashboards to maintain accountability and identify areas for improvement.

- Commit to Continuous Improvement (Ongoing): Dedicate time each month to learning—reading books, attending seminars, and engaging with mentors. Maintain a journal of lessons learned, mistakes made, and ideas for future research. Stay open to feedback and be willing to adjust your approach as markets and personal circumstances evolve. Leverage platforms like Value Sense for new tools, research, and community insights.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Snowball: Warren Buffett and the Business of Life

1. What makes "The Snowball" different from other books about Warren Buffett?

"The Snowball" is unique because Alice Schroeder was granted unprecedented access to Warren Buffett’s personal archives, family, friends, and Buffett himself. Unlike other books that focus solely on his investment strategies, this biography offers a comprehensive look at both his business achievements and personal life. Schroeder’s financial expertise and candid interviews provide a nuanced, humanizing portrait that reveals Buffett’s character, values, and decision-making process in detail.

2. Is "The Snowball" suitable for beginner investors?

Yes, "The Snowball" is accessible to readers of all backgrounds, including those new to investing. While it covers advanced concepts like intrinsic value and capital allocation, Schroeder explains these ideas clearly and provides real-world examples from Buffett’s life. The book’s focus on habits, values, and decision-making makes it valuable not just for investors, but for anyone interested in personal development and business leadership.

3. Does the book provide actionable investment advice?

While "The Snowball" is primarily a biography, it is filled with actionable lessons and investment principles drawn from Buffett’s experiences. Readers will learn about value investing, the importance of a margin of safety, and the significance of emotional discipline. The book’s anecdotes and case studies offer practical guidance that can be applied to portfolio construction, stock selection, and risk management.

4. How does "The Snowball" address Buffett’s personal life and relationships?

Schroeder devotes significant attention to Buffett’s family dynamics, friendships, and philanthropic activities. The book explores his relationship with his wife Susie, his children, and close associates like Charlie Munger and Bill Gates. These personal stories provide context for Buffett’s professional decisions and highlight the interplay between his values, ambitions, and the legacy he hopes to leave behind.

5. Are the principles in "The Snowball" still relevant in today’s market environment?

Absolutely. The core principles of value investing, patience, integrity, and resilience are timeless, even as markets evolve. Buffett’s emphasis on understanding businesses, maintaining an Inner Scorecard, and focusing on long-term value creation remains highly relevant amid today’s volatility and technological change. Investors and business leaders can adapt these lessons to modern contexts using new tools and data, but the underlying wisdom endures.