The Ultimate Fundamentals Guide on What You Need to Learn First — From Newbie to Pro Investor

This is going to be the ultimate guide on what you should learn first starting from knowing absolutely nothing about investing to becoming an investor who can beat the market indexes. It doesn’t matter if you invest in penny stocks or blue chips. The principles are all the same.

Prerequisites

- There are no capital requirements to investing. In fact you should start learning as soon as possible because it takes time to become proficient at investing.

- This guide is only for fundamentals as I specialize in fundamentals and not day trading, technical charting, cryptocurrencies or forex trading.

- This guide is tailored towards people who want to individually pick stocks, if you solely do ETF’s or index investing this guide is still useful to you but not aimed at you.

- Investing should be done with disposable income. NOT with income you need such as rent money.

-If you aren’t willing to put in the time and effort that investing requires to beat the market indexes then you should stick to passive investing and just buy an index fund and forget about it for 20 years. This requires 0 effort but you will never beat 8% a year on average and you because you lack experience you may panic and sell at times when you shouldn’t.

1. Getting Started

To start off I would recommend watching this overview video, it quickly goes over the main stuff by legend investor Bill Ackman:

Bill Ackman: Everything You Need to Know About Stocks

Then you should start reading, lots of reading and no big amounts of investing. You have to read books from other fundamental investors to have an idea of how they did it and the decades of accumulated experience of investing they have poured into that book. It’s important to read the right books from authors who have a track record of beating the market, not just anybody. I have ordered this list in terms of ease of reading for newbie investors as well as priority:

- Peter Lynch — One Up On Wall Street

- Peter Lynch — Beating the Street

- Joel Greenblatt — The Little Book That Beats the Market

These 3 are all easy books for a beginner to get their feet wet and start off with some solid fundamentals. The harder books will come later.

2. Reading Financial Statements

Investing is all about reading financial statements and understanding how to read them such as the 10-k, 10-Q etc. Pick any company, it doesn’t matter which one but I recommend that you pick a simple company that you already use and know.

Income Statement

Statement of Cash Flows

The Balance Sheet

Official RNS Reporting Sites

Companies are required to file official reports with their countries regulator, in the U.S this is the SEC (apart from small companies that trade Over The Counter).A list of the most popular official sites, you can search for your company on here:

- SEC — United States Listed Stocks

- OTC — United States OTC (Penny) stocks

- CSE — Canadian Alternative Stocks

- EURONEXT — France, Ireland, Netherlands, Belgium, Portugal, Norway, Alt UK

- BOERSE FRANKFURT — German Stocks

Quarterly reports: https://valuesense.io/

It makes no sense to limit yourself to investing in one country only. A lot of bargains lay in other countries and you should expand your horizons to them and not just U.S stocks on Robinhood. So I added international links above too.

A lot of the above sites also have email signups so you can be notified instantly when a companies publish a new report.

3. Intrinsic Valuations

The most important part of this section in my opinion. If you understand how to intrinsically value a company then you understand when to buy and when to sell a company based on it’s real value.

These differ from relative valuations such as the ratio’s (PEG, PE etc) because here we are trying to find the intrinsic value to a company and NOT the relative value compared to it’s peers. This is an important difference, for example in the 2001 dot com bubble you could have valued an insanely overvalued internet stock with a relative ratio such as Price-Operating-Cash-Flow and you may have found it to be better than it’s peers. Just because it’s better relatively than it’s peers in it’s industry does not mean a company is fair value.

Discounted Cash Flows Models

The reason a lot of people do not like DCF’s is because:

- They do not understand how to do them properly.

- The resources online are absolutely terrible for DCF’s, most use CAPM (in my opinion, a completely flawed way to calculate your WACC).

- The templates are confusing.

I felt the same way until I watched Aswath Damoradan’s course on corporate finance.

Here’s the short course with 15 min long videos each:

Short Course on Valuation (Free)

However I highly recommend you do the entire university course (for free) because it’s invaluable to understanding how to intrinsically value companies:

2019 Full Undergraduate Valuation Course (Free)

2019 Full MBA Valuation Course (Free)

There is a lot of cross-over between the above two playlists so once you do one course you can cherry pick videos from the other course.

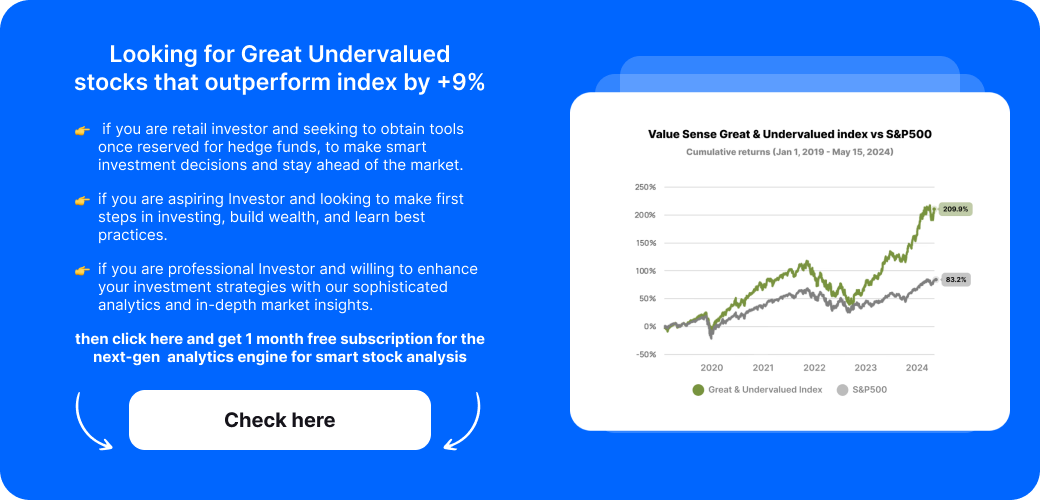

However, you can check the intrinsic value at https://valuesense.io/ (based on DCF and Relative Value)

I now use the above Value Sense link for all my intrinsic value calcs that you see me post here, it’s based on Aswath’s spreadsheets but automates all of the calculations for you so you don’t have to do all of the magic on your side.

Dividend Discount Models

An alternative way of getting the intrinsic value of a company. I do these very rarely so I’m no expert on them. I hope to up date this section in the future with more details.

4. Relative Valuation Ratio’s & Technical Terms

There are a ton of financial terms and ratios to learn such as PE, PEG, ROIC etc. The way to go about this is to learn these ratios as you go when you encounter them in a book or your valuation and not just all at once. Investopedia usually has good explanations and videos of every term.

The most important ratios and relative valuations in my opinion are:

- Revenue

- ROIC

- WACC (not the CAPM Version)

- Price-to-operating Cash Flow

- PEG

The most useless financial metric by far that way too many people use is the PE ratio, it is easily manipulated by accounting shenanigans, fluctuations in short-term reporting, and reinvesting companies such as Amazon. The PEG ratio also suffers from this but is better as it factors in growth.

In Value Sense you can see the relative value of each company:

5. Psychology of Investing

You should work on your own psychology to investing as soon as possible when you start investing. This will allow you to not panic sell during dips and crashes or FOMO (Fear Of Missing Out) during market rallies.

This is perhaps the most overlooked section, most investors never bother to get their psych in order which is a big mistake usually because of overconfidence of their own abilities.

6. Screeners

You should learn how to use screeners to narrow down stocks within your circle of competence and to the ratios that you learned about in section 2. You want to screen for stocks that have below a certain threshold in x ratio, for example, `PEG < 1` which will screen all stocks for you that have a PEG of less than 1 (A PEG of < 1 is theoretically undervalued…sometimes). It’s best to combine multiple ratios to narrow down to a select few companies to look at. This saves a bunch of time in finding potentially good companies.

The ratios I like to use were all mentioned in section 2.

Screeners I personally like best:

7. Value Investing

The easiest way to make money long term in the stock market is to simple buy undervalued stocks, this ties into value investing. It’s a simple concept where if you buy something undervalued then sooner or later the market will realize it’s undervalued and correct accordingly (most times, sometimes it can stay undervalued forever). A lot of people mistake value investing for price to book ratio or some trash ratio like that, value investing is simply the concept of buying a stock for less than its intrinsic worth (i.e a margin of safety).

You must read the following books:

These are the staples of value investing and what Warren Buffet read multiple times. They are difficult and long books to understand at first which is why I have put them in the 6th section so don’t worry if you don’t understand everything at first.

8. Accounting

To be able to read Financial Statement numbers you really need to know how accounting works, both for GAAP (U.S) and IFRS (Most of Rest of World).

The reason why you should know accounting is not only to spot red flags in financial statements but also to understand the downsides of accounting. For example, only recently in 2018 were companies required to include Capital Leases in their balance sheets liabilities. Before then, companies could hide it in Off-Balance sheet statements that few people looked at, grossly inflating the viability of some businesses with heavy lease requirements.

- David Krug — Accounting 1 Full Course (Free)

- David Krug — Accounting 2 Full Course (Free)

- Aswath Damoradan — Accounting 101 (Free)

- Howard Schilit — Financial Shenanigans, How to Detect Accounting Gimmicks & Fraud in Financial Reports

David Krug’s courses are an in depth full courses on accounting. You may not have the time to learn accounting in full though so if you do not then I would recommend the Accounting 101 course which fast tracks you to learn only what you need for our purposes.

Howard Schilit’s book will give you a good overview into the most common financial accounting tricks that you can try and spot.

9. Monte Carlo Simulations & Data/Statistics

This section is completely optional and not necessary but allows you to fine tune your assumptions.

So monte-carlo simulations are simulations that run thousands of times on your valuation models (such as your DCF model) to simulate multiple cases in your models. So instead of just doing a bear case and a bull case in your DCF model you can run a monte-carlo simulation and give your boundaries for your inputs (e.g 25% with a std. deviation of +/- 5%) and you will get a range of different outputs, in our case estimated prices per share and then you can use the mean price as your estimated price per share.

- Aswath Damoradan — A Monte Carlo Simulation Guide (Free)

- Simular Monte Carlo Simulation Excel Plugin (Free)

- RiskAMP Monte Carlo Simulation Excel

- Comparison of Monte Carlo Excel Plugins

- Khan Academy — Probabilities and Statistics Full Course (Free)

Well… if you’ve made it this far then congratz. It’s a lot to learn, basically a full time job to learn all of it. And that’s the point, if it was easy everyone would be rich.

A final point is that a lot of the above links are from prof. Aswath Damoradan. The reason is that I have found him to be the absolute best source of information in regards to valuation ever and everything he publishes is completely free.

Thanks!