The Warren Buffett Way by Robert G. Hagstrom

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

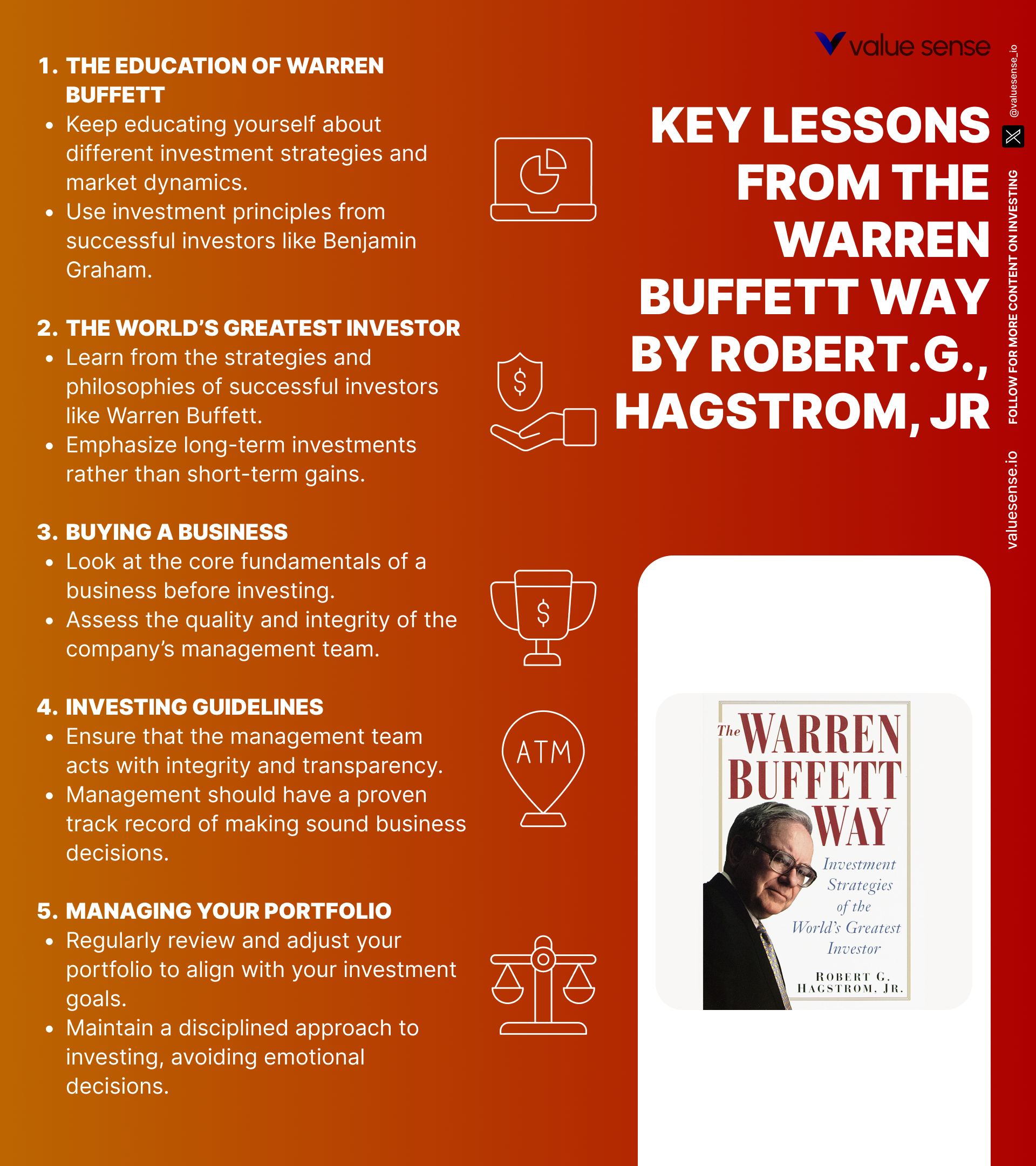

Few names in the world of investing command as much respect as Warren Buffett, and few books have captured his approach as clearly as "The Warren Buffett Way" by Robert G. Hagstrom. First published in 1994 and subsequently updated, this book distills the essence of Buffett’s investment philosophy, offering readers an accessible yet profound guide to value investing. Hagstrom, an experienced investment manager and author, brings both analytical rigor and storytelling skill to the task, making complex ideas approachable for readers at all levels. His deep research, access to historical data, and ability to synthesize Buffett’s public statements and shareholder letters have established him as a leading interpreter of Buffett’s methods.

Hagstrom’s credentials lend significant weight to the book’s content. With a background in portfolio management and a longstanding fascination with Buffett’s strategies, Hagstrom meticulously documents the evolution of Buffett’s thinking, from his early days under the influence of Benjamin Graham to his status as the legendary “Oracle of Omaha.” The book was released at a time when Buffett’s reputation was soaring, following decades of market-beating returns at Berkshire Hathaway. In the years since its publication, "The Warren Buffett Way" has become a cornerstone text for investors seeking to understand not just what Buffett does, but why he does it.

The main theme of the book is the disciplined, rational, and principled approach that underpins Buffett’s investing success. Hagstrom breaks down Buffett’s methodology into clear tenets, focusing on the importance of intrinsic value, the necessity of a margin of safety, the role of high-quality management, and the psychological fortitude required to stay the course. This thematic structure allows readers to see how Buffett’s decisions are rooted in a coherent worldview, rather than a collection of disparate tactics. The book’s purpose is not to provide a step-by-step formula, but to teach the mindset and analytical framework that have guided Buffett’s extraordinary career.

"The Warren Buffett Way" is considered a classic because it demystifies one of the most successful investors of all time, translating his principles into actionable guidance. It stands out among investment books for its clarity, depth, and practical focus. Hagstrom doesn’t just recount Buffett’s successes; he explains the reasoning behind each major investment and highlights the psychological discipline required to execute Buffett’s strategies in real-world markets. The book’s enduring relevance is reflected in its continued popularity among both novice and seasoned investors.

This book is essential reading for anyone serious about investing, whether you’re managing your own portfolio or overseeing institutional assets. Beginners will find a clear introduction to value investing, while experienced professionals will benefit from the detailed analysis of Buffett’s decision-making process. What makes "The Warren Buffett Way" unique is its combination of biography, investment analysis, and practical wisdom. Hagstrom’s use of real company case studies, detailed breakdowns of Buffett’s tenets, and exploration of the psychological aspects of investing provide readers with a comprehensive toolkit for long-term success. In a world often obsessed with short-term gains and market noise, this book offers a refreshing reminder of the power of patience, discipline, and rational analysis.

Key Themes and Concepts

At the heart of "The Warren Buffett Way" are several interwoven themes that define Buffett’s approach to investing. Hagstrom presents these not as isolated tactics, but as a cohesive philosophy that has guided Buffett’s decisions for decades. These themes are consistently reinforced throughout the book, using both historical anecdotes and analytical frameworks to illustrate their importance.

The book’s thematic structure is designed to help readers internalize the principles that have made Buffett successful. Each theme is supported by practical examples, real-world case studies, and detailed explanations of how these concepts apply in various market conditions. By understanding these key themes, investors can develop a disciplined, rational approach to the stock market that transcends fads and short-term volatility.

- Value Investing: Value investing is the cornerstone of Buffett’s philosophy. The book explains how Buffett, influenced by Benjamin Graham, seeks to buy stocks at prices below their intrinsic value. This margin of safety protects against downside risk and allows for significant upside when the market eventually recognizes a company’s true worth. Hagstrom details how Buffett uses fundamental analysis to estimate intrinsic value, focusing on companies with strong earnings, robust cash flows, and durable competitive advantages. For investors, this theme is a call to resist market hype and instead focus on objective, data-driven analysis.

- Long-Term Focus: Buffett’s commitment to holding investments for the long term is a recurring theme. The book illustrates how Buffett’s patience allows him to benefit from compounding returns and weather short-term market fluctuations. Hagstrom provides examples of Buffett’s most successful investments, such as Coca-Cola and American Express, which were held for decades. The lesson for investors is clear: true wealth is built not through frequent trading, but through the disciplined ownership of high-quality businesses over many years.

- Quality Management: Another central theme is the importance of investing in companies with exceptional management teams. Buffett looks for leaders who are honest, rational, and shareholder-oriented. Hagstrom explains how Buffett evaluates management by examining their track record, capital allocation decisions, and communication with shareholders. This focus on management quality helps investors avoid companies where poor leadership can erode value, regardless of business fundamentals.

- Intrinsic Value: Determining a company’s intrinsic value is a critical skill in Buffett’s toolkit. Hagstrom breaks down Buffett’s approach to valuing businesses, emphasizing the use of discounted cash flow analysis and other methods to estimate future earnings potential. The book provides step-by-step examples of how to calculate intrinsic value, highlighting the importance of conservative assumptions and a substantial margin of safety. For investors, mastering this theme means learning to look beyond market prices and develop independent valuations.

- Psychology of Investing: The psychological aspects of investing are given significant attention. Hagstrom explores how emotions, cognitive biases, and herd mentality can derail even the most rational investment strategy. Buffett’s success is attributed in part to his emotional discipline and ability to remain calm during market turbulence. The book offers practical advice on cultivating a rational mindset, emphasizing the need for patience, independence, and a willingness to act contrary to popular sentiment when warranted by the data.

- Risk Management: While not always explicitly labeled, risk management is a thread that runs throughout the book. Buffett’s insistence on a margin of safety, focus on strong balance sheets, and avoidance of unnecessary complexity all serve to minimize downside risk. Hagstrom discusses how Buffett assesses both business risk and market risk, using real examples from Berkshire Hathaway’s portfolio. Investors are encouraged to prioritize capital preservation and avoid speculative behavior.

- Concentration vs. Diversification: The debate between concentrated and diversified portfolios is addressed in detail. Buffett’s preference for a focused portfolio of high-conviction investments is contrasted with the conventional wisdom of broad diversification. Hagstrom analyzes the rationale behind Buffett’s approach, showing how concentration can lead to superior returns when applied with rigorous analysis and discipline. The key takeaway for investors is to concentrate only on businesses they deeply understand and have high confidence in.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Book Structure: Major Sections

Part 1: Foundations of Buffett's Philosophy

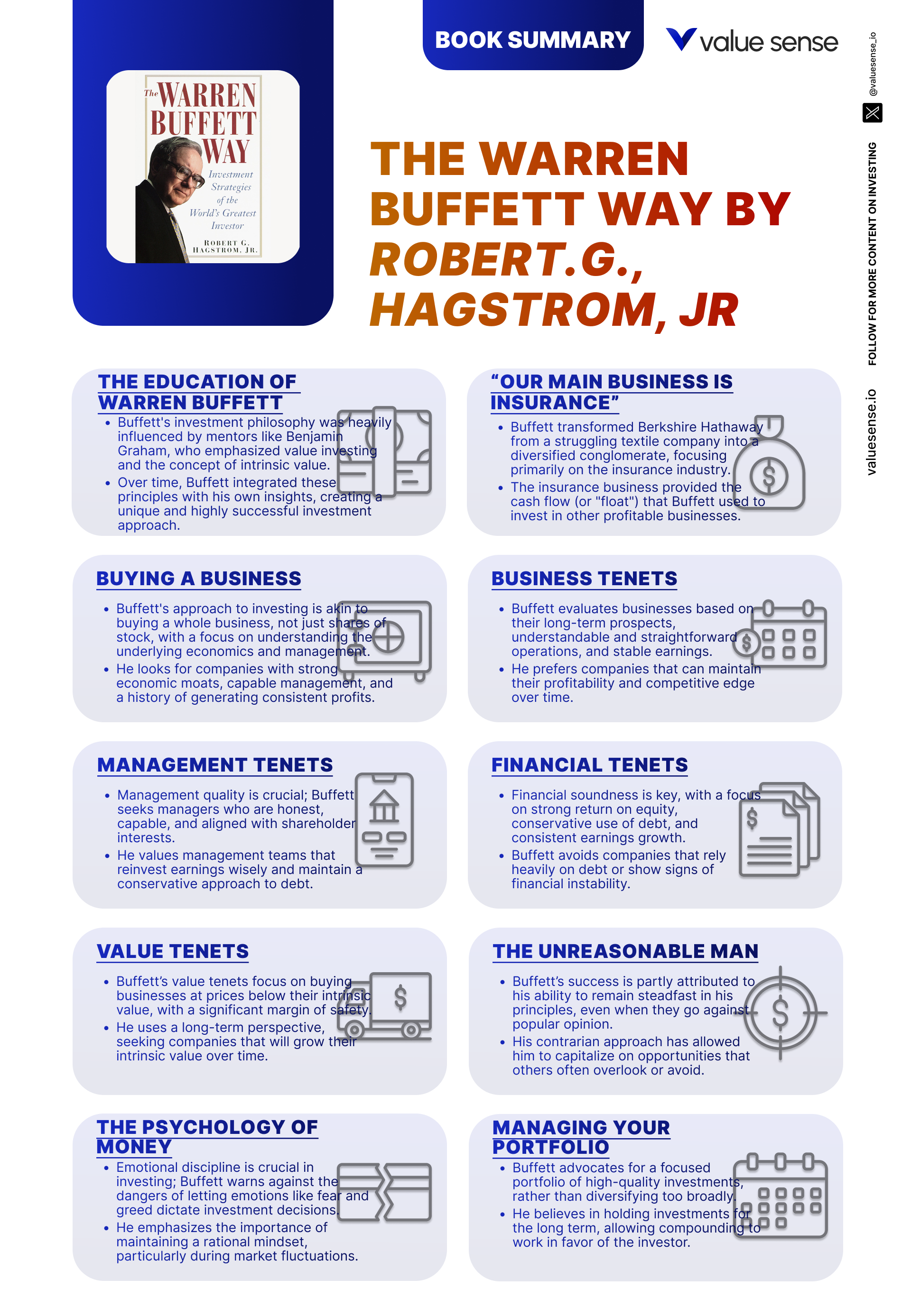

This section, covering the first three chapters, introduces readers to Warren Buffett’s background, the formative influences on his investment thinking, and the early days of Berkshire Hathaway. The unifying theme is the evolution of Buffett’s philosophy, shaped by his mentors and his own experiences in the world of finance. Hagstrom paints a vivid picture of Buffett as both a product of his environment and a unique thinker who synthesized diverse ideas into a singular approach.

Key concepts from this section include Buffett’s formative years in Omaha, his early fascination with numbers and business, and the profound impact of Benjamin Graham’s value investing principles. Hagstrom details how Buffett’s education at Columbia Business School, under Graham, instilled the importance of intrinsic value and a margin of safety. The acquisition of Berkshire Hathaway is presented as a turning point, marking Buffett’s shift from purely quantitative analysis to a more qualitative, business-focused perspective. Case studies of Buffett’s early investments illustrate the application of these foundational ideas.

For investors, the practical takeaway is the importance of grounding one’s strategy in proven principles. By understanding Buffett’s roots in value investing and his relentless pursuit of knowledge, readers are encouraged to develop their own disciplined frameworks. This section also highlights the value of learning from mentors and being open to evolving one’s approach as new information becomes available.

In today’s investing environment, the lessons from Buffett’s early career remain highly relevant. The emphasis on fundamentals, long-term thinking, and continuous learning is as critical now as it was in the 1950s and 1960s. Modern investors can draw inspiration from Buffett’s willingness to adapt while remaining true to core principles, especially in a world flooded with information and short-term noise.

Part 2: Investment Principles and Guidelines

This section spans chapters 4 through 8 and forms the heart of the book, laying out Buffett’s detailed investment criteria and decision-making framework. The unifying theme is the rigorous, systematic approach Buffett uses to evaluate businesses, management teams, financial statements, and intrinsic value. Hagstrom organizes these chapters around the four central tenets: business, management, financial, and value.

Key concepts include the importance of investing in understandable businesses with predictable earnings, the necessity of strong and ethical management, the focus on superior financial metrics such as return on equity and profit margins, and the discipline required to buy only when a company is trading below its intrinsic value. Hagstrom provides specific examples from Berkshire Hathaway’s portfolio to illustrate each tenet, such as the acquisition of See’s Candies for its durable competitive advantage and the analysis of Coca-Cola’s financial statements to demonstrate Buffett’s valuation process. The section is rich with practical checklists and analytical tools.

Investors can apply these insights by developing their own investment checklists, focusing on high-quality businesses with strong leadership and robust financials. The book encourages readers to adopt a patient, disciplined approach, avoiding impulsive decisions and instead waiting for opportunities that meet all of Buffett’s criteria. This section also stresses the importance of independent thinking and the willingness to act decisively when a true bargain presents itself.

In the modern era, these investment guidelines are more valuable than ever. The proliferation of data and the ease of trading have increased the temptation to chase trends and speculate. By adhering to Buffett’s principles, investors can filter out distractions and focus on building portfolios of enduring value. The timelessness of these guidelines is evident in their continued success across decades and market cycles.

Part 3: Portfolio Management

Chapters 9 and 10 are grouped in this section, which explores Buffett’s approach to constructing and managing an investment portfolio. The central theme is the balance between risk and reward, achieved through careful selection of securities and thoughtful allocation of capital. Hagstrom contrasts Buffett’s methods with conventional portfolio theory, emphasizing the benefits of focus and conviction over broad diversification.

Key concepts include Buffett’s selective use of fixed-income securities, his willingness to concentrate capital in a few outstanding businesses, and his long-term holding strategy. Hagstrom discusses how Buffett evaluates risk, not just in terms of volatility, but as the permanent loss of capital. Real-world examples include the decision to hold large positions in companies like American Express and the avoidance of complex derivatives or speculative instruments. The section also covers Buffett’s approach to rebalancing and the rare circumstances under which he sells investments.

Investors can implement these lessons by constructing portfolios around their best ideas, rather than spreading capital thinly across many positions. The book advocates for deep research and high conviction, while also emphasizing the importance of understanding one’s own risk tolerance. Practical steps include regularly reviewing portfolio holdings for changes in business fundamentals and avoiding unnecessary trading.

Buffett’s portfolio management approach is particularly relevant in today’s low-interest-rate, high-volatility environment. The focus on quality, discipline, and simplicity provides a counterpoint to the complexity of many modern investment products. By adopting Buffett’s principles, investors can build resilient portfolios capable of withstanding market shocks and delivering superior long-term returns.

Part 4: Psychology and Philosophy of Investing

The final section, encompassing chapters 11 and 12, delves into the psychological and philosophical dimensions of investing. The unifying theme is the recognition that successful investing is as much about mindset and behavior as it is about analysis and numbers. Hagstrom explores the cognitive biases, emotional pitfalls, and philosophical outlook that distinguish Buffett from the average investor.

Key concepts include the dangers of herd mentality, the importance of emotional discipline, and the value of independent thinking. Hagstrom draws on psychological research to explain why most investors underperform, citing examples of market bubbles and panics. Buffett’s ability to remain calm and rational during periods of market turmoil is presented as a key driver of his success. The section also touches on broader philosophical questions, such as the purpose of investing and the role of money in a fulfilling life.

For investors, the practical application is the cultivation of self-awareness and emotional resilience. The book offers strategies for recognizing and mitigating cognitive biases, maintaining a long-term perspective, and developing the patience required to let investments compound. Readers are encouraged to reflect on their own motivations and to align their investment approach with their personal values and goals.

In the current era of information overload and social media-driven sentiment, the psychological lessons from Buffett’s philosophy are more important than ever. The ability to think independently, remain disciplined, and avoid emotional decision-making is a competitive advantage in today’s fast-paced markets. Hagstrom’s exploration of these themes provides a roadmap for investors seeking to achieve both financial success and personal fulfillment.

Deep Dive: Essential Chapters

Chapter 1: The World’s Greatest Investor

This opening chapter is critically important because it frames the entire narrative of the book, establishing Warren Buffett’s reputation as an unparalleled figure in the investment world. Hagstrom uses this chapter to introduce readers to the scale of Buffett’s accomplishments, comparing his track record to other legendary investors and setting the stage for a detailed exploration of his methods. By highlighting Buffett’s consistent outperformance of the market over decades, the chapter answers the key question: why should we study Buffett’s approach?

Hagstrom presents detailed data on Buffett’s returns at Berkshire Hathaway, noting that the company’s per-share book value compounded at an annual rate far exceeding the S&P 500. The chapter includes charts and tables documenting Buffett’s performance, along with anecdotes about his early business ventures and investment decisions. Quotes from Buffett’s shareholder letters are used to illustrate his humility and focus on process over outcomes. The chapter also references Buffett’s public persona, including his annual meetings and media appearances, to underscore his influence on both Wall Street and Main Street.

Investors can apply the lessons from this chapter by recognizing the value of studying proven track records. The emphasis on long-term performance, rather than short-term gains, encourages readers to adopt a patient, process-oriented mindset. Concrete steps include benchmarking personal performance against relevant indices, focusing on consistency, and prioritizing process over luck or speculation. The chapter also suggests that aspiring investors should seek out mentors and role models with demonstrated success over multiple market cycles.

Historically, Buffett’s rise to prominence coincided with periods of significant market upheaval, including the 1970s bear market and the dot-com bubble. His ability to outperform in both bull and bear markets provides a powerful example for modern investors facing volatility and uncertainty. The chapter’s focus on Buffett’s humility and discipline remains highly relevant in an era where many investors are tempted by quick wins and speculative trends.

Chapter 2: The Education of Warren Buffett

This chapter is essential because it delves into the intellectual development of Buffett, revealing the key influences that shaped his investment philosophy. Hagstrom traces Buffett’s journey from a precocious youth in Omaha to a student under Benjamin Graham at Columbia Business School. The chapter highlights the synthesis of ideas from Graham, Philip Fisher, and other thinkers, showing how Buffett integrated both quantitative and qualitative analysis into his approach.

Hagstrom provides detailed accounts of Buffett’s early exposure to Graham’s "Security Analysis" and "The Intelligent Investor," emphasizing the impact of concepts like intrinsic value and margin of safety. The chapter also explores Buffett’s admiration for Fisher’s focus on qualitative factors, such as management quality and competitive advantage. Quotes from Buffett’s writings and interviews illustrate how he blended these philosophies, moving beyond pure numbers to consider business fundamentals. Case studies of early investments, such as GEICO, demonstrate the practical application of these lessons.

Investors can learn from this chapter by seeking a broad education in investment theory and practice. The integration of multiple schools of thought encourages readers to develop a flexible, adaptive approach. Concrete steps include reading foundational texts, attending seminars or lectures, and actively seeking out diverse perspectives. The chapter also emphasizes the importance of continuous learning and intellectual curiosity as keys to long-term success.

In a modern context, Buffett’s educational journey is a reminder that successful investing requires both technical skill and open-mindedness. The ability to evolve one’s approach in response to new information is critical in today’s rapidly changing markets. Hagstrom’s account of Buffett’s intellectual development provides a blueprint for investors looking to build a robust, adaptable investment philosophy.

Chapter 4: Buying a Business

This chapter is a cornerstone of the book, as it details the specific criteria Buffett uses when selecting businesses to invest in. Hagstrom lays out the fundamental question that guides Buffett’s process: “Would I be willing to own this business if the stock market closed for ten years?” The chapter explores the importance of business quality, long-term value, and the avoidance of short-term speculation.

Hagstrom provides examples of Buffett’s acquisitions, such as See’s Candies and Nebraska Furniture Mart, to illustrate the characteristics he seeks: consistent earnings, strong brand, and sustainable competitive advantage. The chapter details Buffett’s preference for simple, understandable businesses and his aversion to companies reliant on unpredictable technology or commodity prices. Quotes from Buffett emphasize the importance of buying businesses, not just stocks, and the need for a long-term perspective. The chapter also includes financial data and case studies showing how these principles have led to superior returns.

Investors can apply these lessons by adopting a business-owner mindset. Concrete steps include conducting in-depth research on potential investments, focusing on companies with durable competitive advantages, and resisting the urge to chase short-term trends. The chapter encourages readers to develop a checklist of criteria, such as earnings consistency and market leadership, to guide investment decisions. By thinking like owners, investors can align their interests with those of management and other long-term stakeholders.

The historical context of this chapter is particularly relevant in today’s market, where many investors are tempted by high-growth, speculative stocks. Buffett’s disciplined approach to buying businesses with predictable cash flows provides a counterbalance to the prevailing focus on momentum and short-term gains. The enduring success of companies like Coca-Cola and American Express in Buffett’s portfolio underscores the value of this approach across market cycles.

Chapter 5: Investing Guidelines: Business Tenets

This chapter is critically important because it outlines the specific business characteristics Buffett looks for when evaluating investment opportunities. Hagstrom organizes these tenets into a structured checklist, emphasizing the need for a sustainable competitive advantage, industry leadership, and the ability to generate consistent profits over time.

Hagstrom provides detailed examples of companies that meet these criteria, such as Gillette and Coca-Cola, highlighting their dominant market positions and strong brand recognition. The chapter discusses the importance of economic moats, pricing power, and growth potential. Quotes from Buffett reinforce the idea that great businesses can withstand competitive pressures and deliver superior returns. Hagstrom also includes financial metrics and case studies to demonstrate how these business tenets translate into real-world success.

Investors can implement these guidelines by developing their own set of business criteria. Concrete steps include analyzing industry structure, assessing barriers to entry, and evaluating the sustainability of a company’s competitive advantage. The chapter encourages readers to focus on businesses with clear, durable moats and to avoid those operating in highly competitive or commoditized industries. By applying these tenets, investors can increase the likelihood of owning businesses that generate long-term value.

Historically, the focus on business quality has been a key driver of Buffett’s outperformance. In an era of rapid technological change and market disruption, the ability to identify companies with enduring advantages is more important than ever. Hagstrom’s analysis of business tenets provides a practical framework for navigating today’s dynamic investment landscape.

Chapter 6: Investing Guidelines: Management Tenets

This chapter is essential because it highlights the often-overlooked role of management quality in investment success. Hagstrom explains that Buffett places a premium on managers who are honest, rational, and aligned with shareholder interests. The chapter explores the traits that distinguish exceptional leaders from average ones and provides a roadmap for assessing management teams.

Hagstrom uses case studies of Berkshire Hathaway’s portfolio companies, such as GEICO and The Washington Post, to illustrate the impact of strong management. The chapter discusses Buffett’s preference for managers who are candid in their communications, disciplined in their capital allocation, and focused on long-term value creation. Quotes from Buffett emphasize the importance of integrity and the dangers of ego-driven leadership. Hagstrom also provides examples of companies that suffered due to poor management, reinforcing the need for careful evaluation.

Investors can apply these lessons by conducting thorough due diligence on company leadership. Concrete steps include reviewing annual reports, listening to earnings calls, and assessing management’s track record of decision-making. The chapter suggests looking for evidence of rational capital allocation, transparent communication, and a history of acting in shareholders’ best interests. By prioritizing management quality, investors can avoid costly mistakes and increase the odds of long-term success.

In today’s market, where management turnover and corporate scandals are common, the ability to assess leadership is a critical skill. Hagstrom’s emphasis on management tenets provides a valuable framework for investors seeking to identify companies with the right people at the helm. The enduring success of Berkshire Hathaway’s investments in companies with strong leadership underscores the importance of this chapter’s lessons.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 7: Investing Guidelines: Financial Tenets

This chapter is critically important because it details the financial metrics and indicators that Buffett uses to evaluate investment opportunities. Hagstrom breaks down the key financial tenets, including return on equity, profit margins, and debt management, providing readers with a quantitative framework for analysis.

Hagstrom provides real-world examples from Berkshire Hathaway’s portfolio, such as the analysis of Coca-Cola’s financial statements, to demonstrate how these metrics are used in practice. The chapter discusses the importance of high returns on equity, strong and stable profit margins, and conservative use of debt. Quotes from Buffett reinforce the idea that financial strength is a prerequisite for long-term success. Hagstrom also includes tables and charts to illustrate how these financial tenets have contributed to superior investment performance.

Investors can implement these lessons by developing a disciplined approach to financial analysis. Concrete steps include calculating key ratios, comparing them to industry benchmarks, and looking for trends over time. The chapter encourages readers to avoid companies with weak balance sheets or inconsistent earnings, focusing instead on those with a track record of financial strength. By applying these financial tenets, investors can reduce risk and improve the quality of their portfolios.

In the current investment landscape, where financial engineering and aggressive accounting are common, the ability to analyze financial statements is more important than ever. Hagstrom’s focus on financial tenets provides a reliable framework for distinguishing between solid businesses and those at risk of financial distress. The continued success of Buffett’s investments in financially robust companies demonstrates the enduring value of this approach.

Chapter 8: Investing Guidelines: Value Tenets

This chapter is a cornerstone of the book because it explains how Buffett determines the intrinsic value of a business and applies the concept of margin of safety. Hagstrom provides a step-by-step guide to calculating intrinsic value, using discounted cash flow analysis and other valuation methods.

Hagstrom presents detailed examples of how Buffett values companies, including case studies from Berkshire Hathaway’s acquisitions. The chapter discusses the importance of conservative assumptions, the need for a substantial margin of safety, and the discipline required to wait for the right price. Quotes from Buffett emphasize the dangers of overpaying and the importance of independent valuation. Hagstrom also includes worksheets and checklists to help readers apply these concepts in their own analysis.

Investors can implement these lessons by learning to conduct their own intrinsic value calculations. Concrete steps include gathering financial data, projecting future cash flows, and discounting them at an appropriate rate. The chapter encourages readers to be conservative in their estimates and to avoid investments where the margin of safety is insufficient. By mastering the art of valuation, investors can make more informed decisions and reduce the risk of permanent capital loss.

In today’s market, where valuations can swing wildly based on sentiment and speculation, the ability to determine intrinsic value is a critical skill. Hagstrom’s detailed explanation of value tenets provides a practical framework for investors seeking to buy businesses at a discount to their true worth. The enduring success of Buffett’s value-oriented approach is a testament to the power of this chapter’s lessons.

Chapter 10: Managing Your Portfolio

This chapter is essential because it provides insights into how Buffett structures and manages his investment portfolio for optimal performance. Hagstrom explores the debate between concentration and diversification, highlighting Buffett’s preference for a focused portfolio of high-conviction investments.

Hagstrom uses examples from Berkshire Hathaway’s holdings to illustrate the benefits and risks of concentration. The chapter discusses Buffett’s willingness to allocate significant capital to a few outstanding businesses, as well as his long-term holding strategy. Quotes from Buffett emphasize the importance of deep research and conviction, while warning against the dangers of overdiversification. Hagstrom also provides data on portfolio performance and risk management techniques.

Investors can apply these lessons by constructing portfolios around their best ideas, rather than spreading capital thinly across many positions. Concrete steps include identifying companies with the highest conviction, allocating capital accordingly, and monitoring positions for changes in fundamentals. The chapter encourages readers to avoid unnecessary trading and to let investments compound over time. By focusing on quality over quantity, investors can improve returns and reduce complexity.

In the modern era, where index investing and broad diversification are the norm, Buffett’s approach offers a compelling alternative. Hagstrom’s analysis of portfolio management provides a practical framework for investors seeking to outperform the market through focused, disciplined investing. The continued success of Berkshire Hathaway’s concentrated portfolio underscores the value of this chapter’s insights.

Chapter 11: The Psychology of Money

This chapter is critically important because it examines the psychological factors that influence investment decisions. Hagstrom explores how emotions, cognitive biases, and herd mentality can derail even the most rational investment strategy. The chapter highlights Buffett’s emotional discipline and ability to remain calm during periods of market turmoil.

Hagstrom draws on psychological research to explain common pitfalls, such as overconfidence, loss aversion, and the tendency to follow the crowd. The chapter includes anecdotes from market bubbles and crashes, illustrating how emotional reactions can lead to poor decisions. Quotes from Buffett emphasize the need for rationality and independence of thought. Hagstrom also provides practical advice for cultivating a disciplined mindset, including techniques for managing stress and avoiding impulsive actions.

Investors can apply these lessons by developing self-awareness and emotional resilience. Concrete steps include keeping an investment journal, setting clear rules for buying and selling, and regularly reviewing decisions for signs of bias. The chapter encourages readers to focus on process rather than outcomes and to seek out environments that support rational thinking. By mastering the psychology of investing, investors can avoid costly mistakes and improve long-term performance.

In today’s fast-paced, information-rich markets, the ability to manage emotions is a critical competitive advantage. Hagstrom’s exploration of the psychology of money provides a valuable toolkit for investors seeking to navigate volatility and uncertainty. The enduring success of Buffett’s emotionally disciplined approach is a testament to the power of this chapter’s lessons.

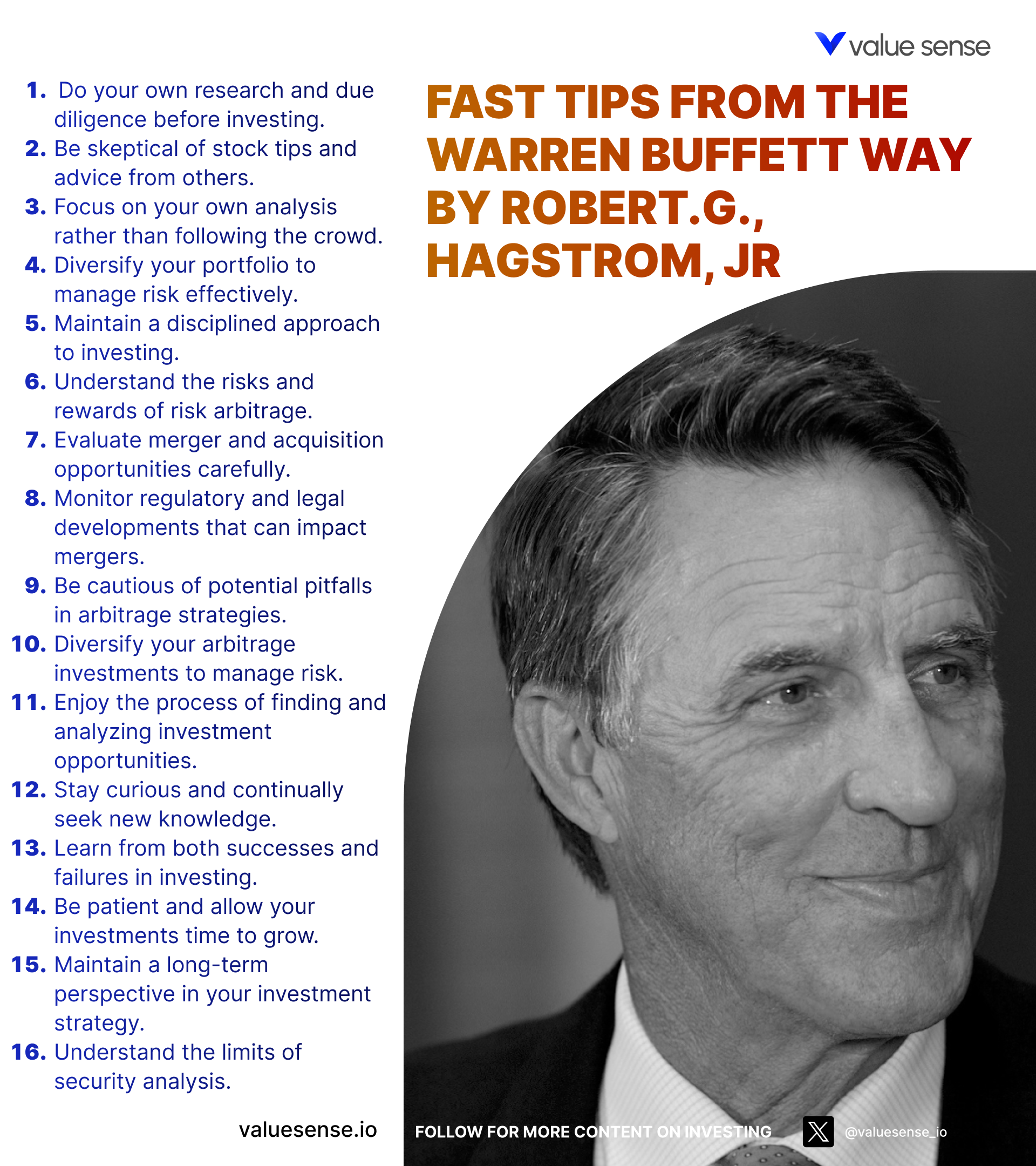

Practical Investment Strategies

- Develop a Business-Owner Mindset: Approach each investment as if you are buying the entire business, not just a stock certificate. Begin by thoroughly researching the company’s products, competitive landscape, and long-term prospects. Ask whether you would be comfortable owning the business if the stock market closed for a decade. This mindset encourages long-term thinking and discourages speculative trading. Action steps: read annual reports, study the company’s history, and assess its ability to withstand industry disruptions.

- Focus on Intrinsic Value and Margin of Safety: Calculate the intrinsic value of a business using discounted cash flow analysis or other valuation methods. Only invest when the stock price is significantly below your estimate of intrinsic value, providing a margin of safety. Gather financial data, make conservative projections, and discount future cash flows at a reasonable rate. This approach reduces the risk of permanent capital loss and increases the likelihood of outsized returns over time.

- Prioritize Quality Management: Evaluate the integrity, rationality, and shareholder orientation of company management. Listen to earnings calls, read shareholder letters, and analyze management’s capital allocation decisions. Look for evidence of transparent communication and a track record of rational decision-making. Avoid companies where management has a history of self-dealing, excessive risk-taking, or poor disclosure. Strong management can create or destroy significant shareholder value over time.

- Concentrate on High-Conviction Ideas: Build a focused portfolio around your best investment ideas, rather than diversifying indiscriminately. Identify companies with durable competitive advantages, strong financials, and high management quality. Allocate more capital to these positions and monitor them closely. This strategy requires deep research and conviction, but it can lead to superior returns when executed with discipline. Rebalance only when fundamentals change, not due to market noise.

- Maintain Emotional Discipline: Recognize and manage the psychological biases that can undermine investment decisions. Develop routines for stress management, such as meditation or regular exercise. Keep an investment journal to document your reasoning and review decisions for signs of bias. Set clear rules for buying and selling, and stick to them even when emotions run high. Emotional discipline is essential for navigating volatile markets and avoiding costly mistakes.

- Use Financial Tenets to Screen Investments: Apply Buffett’s financial criteria—such as high return on equity, strong profit margins, and low debt—to screen potential investments. Use tools like the Value Sense stock screener to automate the process and identify companies that meet your standards. Compare financial metrics to industry benchmarks and look for consistency over time. This approach ensures that only financially robust companies make it into your portfolio.

- Regularly Review and Reflect: Schedule periodic reviews of your portfolio to assess whether each holding still meets your investment criteria. Analyze performance relative to benchmarks and look for changes in business fundamentals, management quality, or industry dynamics. Use these reviews to make informed decisions about adding, trimming, or exiting positions. Continuous reflection and learning are key to long-term success.

- Stay Patient and Avoid Market Noise: Resist the temptation to react to daily market fluctuations or sensational headlines. Focus on the long-term prospects of your businesses and let your investments compound over time. Use volatility as an opportunity to buy high-quality companies at attractive prices, rather than as a reason to panic. Patience and discipline are the hallmarks of successful investors.

Modern Applications and Relevance

The principles outlined in "The Warren Buffett Way" remain highly relevant in today’s fast-evolving financial markets. While technology, globalization, and regulatory changes have transformed the investment landscape since the book’s original publication, the core tenets of value investing, patience, and disciplined analysis continue to drive long-term success. The proliferation of information and the rise of algorithmic trading have increased market volatility, but they have not diminished the importance of fundamental analysis and intrinsic value assessment.

Since the book’s release, the investment world has witnessed the rise of passive investing, the growth of ETFs, and the emergence of new asset classes such as cryptocurrencies. Despite these changes, Buffett’s emphasis on buying high-quality businesses at reasonable prices remains a timeless strategy. The book’s lessons on emotional discipline and independent thinking are particularly relevant in an era where social media and 24/7 news cycles can amplify herd behavior and market swings.

Modern examples abound of investors applying Buffett’s principles with great success. Notable fund managers, such as Seth Klarman and Monish Pabrai, have built outstanding track records by adhering to value investing disciplines. Companies like Apple and Microsoft, which have become core holdings for Berkshire Hathaway in recent years, demonstrate the adaptability of Buffett’s approach to new industries and technologies. The focus on management quality, financial strength, and competitive advantage has proven effective across sectors and geographies.

To adapt the classic advice of "The Warren Buffett Way" to current conditions, investors should leverage modern tools—such as advanced financial modeling, AI-powered stock screeners, and real-time data platforms—while maintaining a commitment to fundamental research and rational decision-making. The book’s emphasis on continuous learning and evolution is a reminder that successful investors must stay curious and open-minded, integrating new information without abandoning core principles. In a world of rapid change, the ability to combine timeless wisdom with modern techniques is a key differentiator.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Start with a Personal Investment Policy Statement: Clearly define your investment objectives, risk tolerance, and time horizon. Write down your core principles and the criteria you will use to evaluate opportunities. This foundational step provides discipline and consistency, helping you stay focused during periods of market turbulence. Use your policy statement as a reference point before making any major investment decisions.

- Build a Watchlist and Conduct Deep Research: Identify a shortlist of companies that meet your initial criteria for business quality, management, and financial strength. Allocate several weeks to study each company in depth, reading annual reports, analyzing financial statements, and researching industry trends. Set a timeline for completing your research—typically 4-6 weeks per company—before making a buy decision.

- Construct a Focused Portfolio: Select 8-15 high-conviction holdings that meet all of your investment criteria. Allocate capital based on your level of confidence in each company, with larger positions in your best ideas. Maintain a minimum position size to ensure meaningful impact on overall performance, and avoid excessive diversification. Use a spreadsheet or portfolio management tool to track allocations and performance.

- Implement Ongoing Portfolio Monitoring: Establish a regular review schedule—such as quarterly or semi-annual check-ins—to reassess each holding. Evaluate changes in business fundamentals, management quality, and industry dynamics. Document any changes in your investment thesis and consider trimming or exiting positions that no longer meet your standards. Avoid making decisions based on short-term price movements or market sentiment.

- Commit to Continuous Learning and Improvement: Set aside time each month to read investment books, attend webinars, or participate in online forums. Keep an investment journal to record your reasoning, lessons learned, and areas for improvement. Regularly review your process and seek feedback from trusted peers or mentors. Stay informed about new tools, research methods, and market developments, but always filter them through the lens of your core principles.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About The Warren Buffett Way

1. What are the main investment principles described in "The Warren Buffett Way"?

The book outlines Buffett’s core investment principles, including buying businesses with a durable competitive advantage, focusing on intrinsic value and a margin of safety, prioritizing quality management, and maintaining a long-term investment horizon. Hagstrom also emphasizes the importance of financial strength, emotional discipline, and independent thinking. These principles are illustrated with real-world examples from Berkshire Hathaway’s portfolio and are presented as a cohesive framework for value investing.

2. How does "The Warren Buffett Way" differ from other investment books?

Unlike many investment books that focus on technical analysis or short-term trading strategies, "The Warren Buffett Way" centers on fundamental analysis, business quality, and psychological discipline. Hagstrom provides a unique blend of biography, case studies, and practical checklists, making complex ideas accessible to a broad audience. The book’s focus on mindset, process, and real company examples sets it apart as a comprehensive guide to long-term investing.

3. Is "The Warren Buffett Way" suitable for beginner investors?

Yes, the book is highly accessible for beginners while still offering depth for experienced investors. Hagstrom explains key concepts in clear, straightforward language and provides step-by-step guidance on evaluating businesses, management, and financials. The inclusion of practical examples and actionable strategies makes it an excellent starting point for those new to investing, as well as a valuable refresher for seasoned professionals.

4. How can I apply the lessons from "The Warren Buffett Way" to my own portfolio?

Start by adopting a business-owner mindset and focusing on companies with strong fundamentals, quality management, and a clear competitive advantage. Use intrinsic value calculations to determine when to buy, and insist on a margin of safety before investing. Build a focused portfolio of high-conviction ideas, monitor your holdings regularly, and maintain emotional discipline during market volatility. The book’s checklists and frameworks provide a practical roadmap for implementing these strategies.

5. Has Warren Buffett’s approach changed since the book was published?

While the core principles of value investing, patience, and disciplined analysis remain unchanged, Buffett has shown a willingness to adapt his approach over time. In recent years, Berkshire Hathaway has invested in technology companies and expanded its international holdings, reflecting changes in the global economy. However, the fundamental tenets described in "The Warren Buffett Way"—such as focusing on business quality, intrinsic value, and long-term ownership—continue to guide Buffett’s decisions and remain highly relevant for today’s investors.