Third Avenue Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

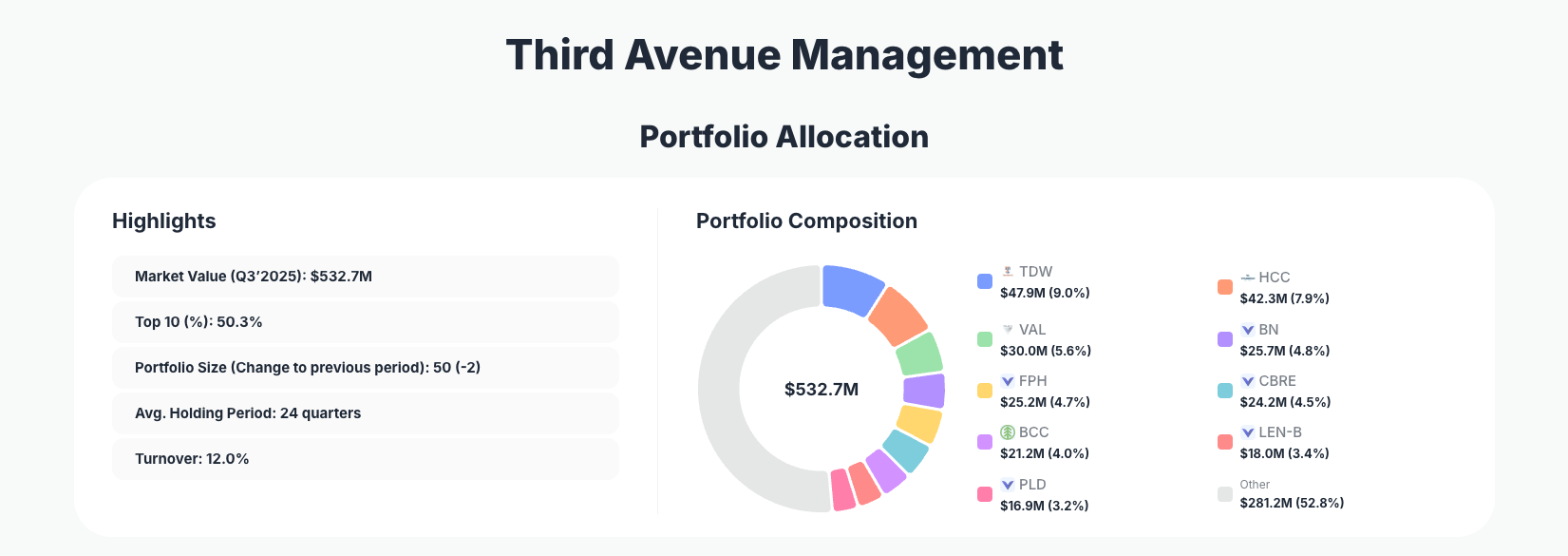

Third Avenue Management, the deep-value firm founded by the legendary distressed and real-asset investor Martin J. Whitman, continues to express a contrarian stance in out-of-favor sectors. Its Q3’2025 portfolio showcases a $532.7M collection of cyclical, asset-rich businesses, with significant exposure to energy services, coal, and real estate—fine‑tuned this quarter through selective buys and small trims across key positions.

The Big Picture: Concentrated Value in Cyclicals and Real Assets

Portfolio Highlights (Q3’2025): - Market Value: $532.7M

- Top 10 Holdings: 50.3%

- Portfolio Size: 50 -2

- Average Holding Period: 24 quarters

- Turnover: 12.0%

Third Avenue’s Q3’2025 portfolio remains moderately concentrated, with just over half of assets in the top 10 positions and 50 total holdings, down from 52. This balance reflects the firm’s classic approach: concentrate where conviction is highest, yet maintain enough breadth to harvest value across multiple special situations and cyclical recoveries.

The long 24‑quarter average holding period and relatively low 12.0% turnover underscore a genuinely long-term orientation. Rather than trading around volatility, Third Avenue tends to underwrite businesses over full cycles—especially in sectors like energy services, building products, and real estate—then incrementally adjusts position sizes as valuations move relative to intrinsic value.

The slight reduction in overall portfolio size (50, -2 positions) suggests ongoing cleanup of smaller or lower‑conviction ideas while reinforcing the core of the strategy. Within this framework, the top of the Third Avenue portfolio is dominated by companies whose value is anchored in tangible assets: offshore service fleets, coal reserves, real estate development rights, and high‑quality logistics and office properties.

Top Holdings Overview: Real Assets, Energy Services, and Select Industrials

The Q3’2025 positioning is defined by a cluster of energy services, coal, real estate, and niche industrials, with nuanced adjustments rather than sweeping shifts.

At the top of the book, Tidewater Inc. (TDW) remains a core holding at 9.0% of the portfolio, even as Third Avenue chose to Reduce 0.06% this quarter, taking a very small amount of risk off the table after strong performance. Tidewater’s fleet of offshore support vessels fits squarely into the firm’s preference for asset-backed, cyclical recovery plays.

Warrior Met Coal, Inc. (HCC) represents 7.9% of the portfolio, and Third Avenue opted to Add 0.04%, indicating continued conviction in metallurgical coal as a critical input for steelmaking despite ESG and cyclical overhangs. This incremental add is consistent with a value manager leaning into perceived mispricing in a disliked sector.

Valaris Limited (VAL), another energy‑services‑related name, accounts for 5.6% of assets, with a modest Reduce 0.05% move. After a substantial rebound in offshore drilling day rates, trimming Valaris while maintaining a large position shows discipline in realizing gains while preserving exposure to a multi‑year upcycle.

Real assets and property-related names play a major role. Five Point Holdings, LLC (FPH) stands at 4.7%, with Third Avenue choosing to Reduce 0.29%. Given Five Point’s master‑planned communities and land‑development focus, this trim likely reflects underwriting discipline as housing‑linked valuations improve. In listed real estate services and property, CBRE Group, Inc. (CBRE) holds 4.5%, where the team executed a more noticeable Reduce 6.09%, signaling either valuation sensitivity or a desire to recycle capital within the real estate complex.

On the buy side, Third Avenue introduced or expanded selective cyclical and industrial exposure. Boise Cascade Company (BCC) sits at 4.0% following a clear Buy action—an expression of confidence in building products and housing‑related end markets, even amid macro uncertainty. Similarly, Rogers Corporation (ROG) at 3.1% also received a Buy, adding a specialized materials and components business that often trades at a discount when demand cycles roll over.

Real estate exposure is rounded out by Prologis, Inc. (PLD) at 3.2%, where Third Avenue opted to Reduce 0.09%. As one of the world’s premier logistics REITs, Prologis may have rerated closer to fair value, prompting a slight trim rather than an exit. Meanwhile, homebuilder‑adjacent Lennar Corp – Class B represents 3.4% of the book, with a Reduce 0.13% action that gently scales back exposure to U.S. housing after a strong run.

Finally, real estate and property services diversification continues via Jones Lang LaSalle Incorporated (JLL) at 2.9%, where Third Avenue chose to Reduce 0.14%. Alongside CBRE and Prologis, JLL gives the portfolio multifaceted exposure to commercial real estate cycles, but the incremental trims suggest cautious risk management in the face of higher rates and structural changes in office demand.

Across these 10–12 key names—Tidewater, Warrior Met Coal, Valaris, Five Point, CBRE, Boise Cascade, Lennar, Prologis, Rogers, and JLL—Third Avenue’s Q3’2025 portfolio showcases a coherent tilt toward tangible assets, cyclical upside, and contrarian value, with most position changes measured in basis points rather than percentage points.

What the Portfolio Reveals About Third Avenue’s Current Strategy

Several strategic themes stand out from Third Avenue’s latest 13F:

- Real assets and hard‑asset value at the core

Energy services names like TDW and VAL, coal producer HCC, and asset‑heavy real estate plays such as FPH, CBRE, and PLD highlight a persistent preference for businesses underpinned by tangible, often difficult‑to‑replicate assets. - Cyclical contrarianism, not growth‑at‑any‑price

Modest adds to Warrior Met Coal and Buys in Boise Cascade and Rogers show a willingness to lean into cyclicals when sentiment is cautious but fundamentals and balance sheets remain sound. - Real estate as a long‑term value hunting ground

Between Five Point, CBRE, JLL, and logistics leader Prologis, the portfolio is structurally long real estate in various forms. Trims are incremental, suggesting portfolio rebalancing rather than a strategic exit from the sector. - Risk management via trims, not wholesale exits

Adjustments like Reduce 0.06% in Tidewater, Reduce 0.05% in Valaris, and small reductions in JLL and Lennar Corp – Class B are examples of disciplined profit‑taking, keeping position sizes aligned with evolving risk‑reward without abandoning long-term theses. - Long-term orientation remains intact

With a 24‑quarter average holding period and only 12.0% turnover, the firm’s process continues to emphasize patience. The Q3’2025 13F suggests ongoing refinement rather than a radical shift in strategy.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Tidewater Inc. (TDW) | $47.9M | 9.0% | Reduce 0.06% |

| Warrior Met Coal, Inc. (HCC) | $42.3M | 7.9% | Add 0.04% |

| Valaris Limited (VAL) | $30.0M | 5.6% | Reduce 0.05% |

| Brookfield Corporation (BN) | $25.7M | 4.8% | No change |

| Five Point Holdings, LLC (FPH) | $25.2M | 4.7% | Reduce 0.29% |

| CBRE Group, Inc. (CBRE) | $24.2M | 4.5% | Reduce 6.09% |

| Boise Cascade Company (BCC) | $21.2M | 4.0% | Buy |

| Lennar Corp - Class B | $18.0M | 3.4% | Reduce 0.13% |

| Prologis, Inc. (PLD) | $16.9M | 3.2% | Reduce 0.09% |

| — | — | — | — |

The top 10 positions make up 50.3% of the portfolio, with the largest disclosed stake—Tidewater Inc.—alone representing 9.0%. This reveals a “core‑satellite” structure: a set of sizable, high‑conviction holdings in asset‑heavy cyclicals and real estate, surrounded by a broader collection of smaller, often more idiosyncratic positions.

Trims and adds within this top group are generally incremental, reflecting risk calibration rather than turnover-driven style. The absence of major wholesale moves implies that Q3’2025 was a quarter of fine‑tuning concentration—harvesting gains where valuations have caught up while adding selectively where the margin of safety remains attractive.

Investment Lessons from Third Avenue’s Deep‑Value Playbook

Third Avenue’s Q3’2025 13F offers several actionable principles for individual investors:

- Anchor on asset value, not headlines

Heavy exposure to names like TDW, HCC, and VAL underscores a focus on replacement cost, asset coverage, and downside protection, even when sectors are unpopular. - Embrace cyclical opportunities with a multi‑year horizon

The 24‑quarter average holding period and ongoing exposure to housing, building products, and commercial real estate demonstrate how value investors can ride full cycles rather than trying to time every macro data point. - Use trims and small adds to manage risk, not headlines

Very small Reduce and Add actions (0.04%–0.29%) show a granular approach to position sizing. You don’t need to swing from 0% to 10%; incremental adjustments can keep exposure aligned with conviction and valuation. - Diversify within a theme, not away from it

Third Avenue spreads its real estate bet across developers (FPH), global logistics (PLD), and service providers (CBRE, JLL), reducing single‑name risk while still expressing a strong sector view. - Align portfolio activity with thesis drift, not price moves alone

The absence of large trades suggests that Third Avenue adjusts when valuation or fundamentals change meaningfully—not just because a stock has become volatile.

Looking Ahead: What Might Come Next for Third Avenue’s Portfolio?

Based on the Q3’2025 positioning, several forward‑looking implications emerge:

- Continued commitment to real assets and cyclicals

Unless there is a major macro or sector‑specific shock, it is reasonable to expect Third Avenue to maintain core exposure to energy services, coal, and real estate, using volatility to scale in and out at the margin. - Selective deployment into dislocated industrials and materials

Recent Buys in Boise Cascade and Rogers suggest that under‑owned industrial and materials businesses may continue to attract capital when valuations disconnect from long‑term fundamentals. - Pruning of smaller or fully valued positions

The reduction in portfolio size from 52 to 50 positions indicates that low‑conviction or fully valued names may keep being trimmed or exited to fund higher‑conviction ideas. - Macro sensitivity but not macro timing

With housing, commercial real estate, and energy all heavily represented, the portfolio is clearly exposed to interest rates, global growth, and commodity cycles—but the long holding periods imply Third Avenue is positioning for normalized conditions, not one quarter’s macro print.

For investors trying to anticipate future moves, monitoring subsequent 13Fs on ValueSense will show whether the firm doubles down on current themes or rotates toward new pockets of distress.

FAQ about Third Avenue Management’s Portfolio

Q: What were the most notable changes in Third Avenue’s Q3’2025 portfolio?

The most notable changes were incremental rather than dramatic: small trims in core holdings like Tidewater (Reduce 0.06%), Valaris (Reduce 0.05%), and multiple real estate–linked names (e.g., Five Point, Reduce 0.29%; CBRE, Reduce 6.09%), alongside new or expanded Buys in Boise Cascade and Rogers. The number of holdings fell from 52 to 50, indicating modest pruning.

Q: How concentrated is Third Avenue’s portfolio, and what does that say about its strategy?

The top 10 positions account for 50.3% of total equity holdings, with the largest disclosed position at 9.0% of the portfolio. This level of concentration suggests a high‑conviction value strategy: Third Avenue is willing to size up its best ideas, particularly in energy services and real estate, while still maintaining diversification across 50 names overall.

Q: Does Third Avenue’s approach depend on a particular manager or succession plan?

While the firm’s roots trace back to Martin J. Whitman’s deep‑value philosophy, the current 13F reveals a consistent application of his core principles—emphasis on asset value, balance sheet strength, and long‑term holding periods—rather than any abrupt stylistic shift. The continuity in portfolio structure, low turnover, and sector focus suggests that the investment team has institutionalized the strategy beyond any single individual.

Q: Which sectors and themes dominate Third Avenue’s Q3’2025 holdings?

Key themes include energy services and commodities (Tidewater, Warrior Met Coal, Valaris), real estate and property services (Five Point, CBRE, JLL, Prologis), and cyclical industrials/building products (Boise Cascade, Rogers). The portfolio reflects a strong tilt toward hard assets and cyclical recovery.

Q: How can I track or follow Third Avenue’s latest moves?

You can follow Third Avenue’s holdings via quarterly 13F filings, which U.S. institutional managers must submit to the SEC—these filings are reported with a 45‑day lag, so positions may have changed since the reporting date. Platforms like ValueSense aggregate these disclosures, visualize changes, and provide history over time. To monitor all updates in one place, use the dedicated Third Avenue page: Third Avenue’s portfolio.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!