Thomas Russo - Gardner Russo & Quinn Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Thomas Russo - Gardner Russo & Quinn continues to showcase a disciplined, long-term approach centered on dominant global brands and scalable platforms. Their Q3’2025 portfolio reveals a high-conviction, low-turnover strategy, with selective trims to marquee positions like Berkshire Hathaway (BRK‑A), Alphabet (GOOG), and Netflix (NFLX), alongside incremental additions to core holdings such as Berkshire Hathaway (BRK‑B). The result is a concentrated mix of consumer staples, payment networks, and global champions that still reflects Russo’s hallmark “capacity to suffer” philosophy while fine‑tuning position sizes at the margin.

Portfolio Overview: Global Compounders, Patient Capital

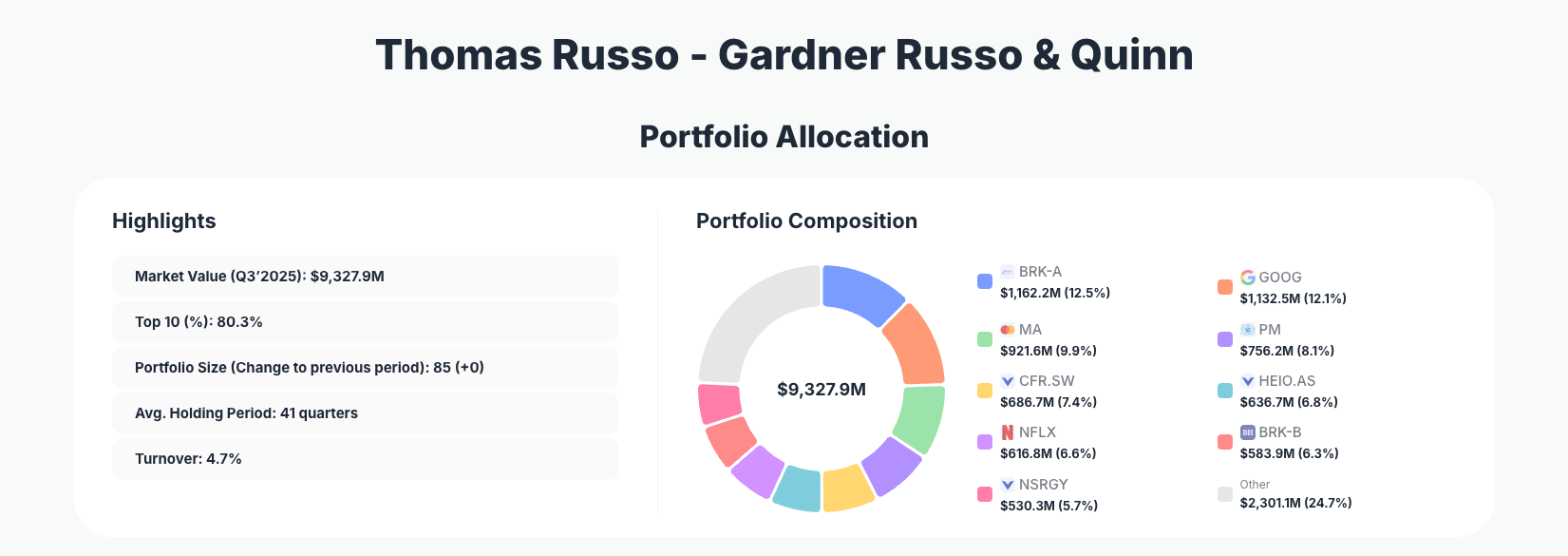

Portfolio Highlights (Q3’2025): - Market Value: $9,327.9M

- Top 10 Holdings: 80.3%

- Portfolio Size: 85 +0

- Average Holding Period: 41 quarters

- Turnover: 4.7%

Thomas Russo - Gardner Russo & Quinn’s Q3’2025 portfolio is intensely focused, with just 10 holdings representing 80.3% of total equity exposure. This level of concentration underscores a philosophy of backing a select group of durable, cash‑generative franchises rather than diversifying broadly across the market. Despite holding 85 positions in total, true economic exposure is driven by a tight core of global leaders in consumer products, financials, and technology‑enabled platforms.

The 41‑quarter average holding period and modest 4.7% turnover further confirm a long-duration mindset. Instead of frequent trading, Russo makes incremental “basis point” adjustments—such as trimming Alphabet and Mastercard, or adding to Berkshire Hathaway (BRK‑B)—to rebalance risk and valuation while maintaining conviction in the underlying business quality across the Gardner Russo & Quinn portfolio.

This construction also highlights a hybrid style: classic consumer staples and luxury brands (Philip Morris, Richemont, Nestlé, Heineken) sit alongside modern compounders in tech and digital media (Alphabet, Netflix) and diversified capital allocators like Berkshire Hathaway. Together, they create an equity basket tilted toward global consumption, brand strength, and recurring cash flows rather than speculative growth.

Core Holdings: Franchise Power and Selective Trims

The heart of Thomas Russo’s Q3’2025 positioning lies in a set of 10–11 key names where small but meaningful changes were made.

The largest disclosed position with changes is Berkshire Hathaway (BRK‑A), now 12.5% of the portfolio, where Russo chose to Reduce 5.11% while still keeping it as a cornerstone holding. Close behind, Alphabet (GOOG) stands at 12.1% after an 8.65% reduction, suggesting disciplined profit‑taking in a dominant digital advertising and cloud platform rather than a loss of conviction.

Payment network leader Mastercard (MA) represents 9.9% of the portfolio and was Reduced 3.73%, echoing a theme of modest trims across long‑held compounders. Tobacco giant Philip Morris International (PM) at 8.1% saw a 4.33% reduction, while luxury group Compagnie Financiere Richemont, at 7.4%, was Reduced 3.33%—both changes pointing to valuation discipline in mature, cash‑rich consumer franchises.

On the consumer staples side, Heineken Holding NV accounts for 6.8% of assets and was Add 10.14%, indicating rising conviction in its long‑term global beer footprint and emerging‑markets exposure. Meanwhile, streaming leader Netflix (NFLX) sits at 6.6% after a 5.15% reduction, likely balancing strong performance with position‑size risk controls.

Berkshire’s second share class, Berkshire Hathaway (BRK‑B), makes up 6.3% and was Add 0.59%, a small but notable reallocation from BRK‑A into BRK‑B that maintains overall exposure to Warren Buffett’s capital allocation machine while managing liquidity and price per share. Nestle SA Sponsored ADR, at 5.7%, was Reduced 3.93%, continuing the pattern of trimming large, well‑known consumer staples leaders at the margin.

Rounding out the list of disclosed changes, Uber Technologies (UBER) holds 4.9% of the portfolio and was Reduced 3.80%, reflecting cautious risk management around a more cyclical, execution‑sensitive growth story compared to the entrenched consumer franchises that dominate the rest of the book.

Collectively, these moves show a measured rebalancing rather than a strategic overhaul: core positions remain intact, but Russo is harvesting gains and trimming risk where valuations have expanded, while selectively leaning into enduring consumer names such as Heineken and maintaining robust exposure to Berkshire and Alphabet.

What the Portfolio Reveals About Russo’s Current Strategy

Several clear themes emerge from Thomas Russo - Gardner Russo & Quinn’s Q3’2025 equity lineup:

- Quality and brand power over speculative growth

The largest allocations sit in entrenched franchises—Berkshire Hathaway, Philip Morris, Nestlé, Richemont, Heineken—whose competitive advantages stem from strong brands, global distribution, and pricing power. Even in tech, names like Alphabet and Netflix are dominant platforms with scale advantages, not early‑stage experiments. - Global consumer focus with a tilt to non‑US revenue

Many of the marquee holdings—Philip Morris, Nestlé, Richemont, Heineken—derive a material portion of revenues from outside the United States. This aligns with Russo’s long‑standing preference for global consumer cash‑flow machines that can reinvest in emerging markets and compound in multiple currencies over time. - Low turnover confirms long-term “owner” mindset

With just 4.7% turnover and a 41‑quarter average holding period, the Q3’2025 activity in the Gardner Russo & Quinn portfolio is about refining—not reinventing—the book. Trims in Alphabet, Mastercard, and Netflix appear to be valuation‑ and risk‑driven, not thesis reversals. - Risk management via trims instead of wholesale exits

Across the board, the changes are modest: single‑digit percentage reductions and selective adds. This suggests Russo is managing position‑size risk and valuation creep while preserving exposure to the same set of long‑duration winners. - Balanced exposure to analog and digital compounders

From Philip Morris and Heineken to Alphabet and Uber, the portfolio balances traditional consumer staples with digital platforms and payment infrastructure, aiming to capture both resilient cash flows and secular growth trends.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Berkshire Hathaway Inc. (BRK-A) | $1,162.2M | 12.5% | Reduce 5.11% |

| Alphabet Inc. (GOOG) | $1,132.5M | 12.1% | Reduce 8.65% |

| Mastercard Incorporated (MA) | $921.6M | 9.9% | Reduce 3.73% |

| Philip Morris International Inc. (PM) | $756.2M | 8.1% | Reduce 4.33% |

| Compagnie Financiere Richemont | $686.7M | 7.4% | Reduce 3.33% |

| Heineken Holding NV | $636.7M | 6.8% | Add 10.14% |

| Netflix, Inc. (NFLX) | $616.8M | 6.6% | Reduce 5.15% |

| Berkshire Hathaway Inc. (BRK-B) | $583.9M | 6.3% | Add 0.59% |

| Nestle SA Sponsored ADR | $530.3M | 5.7% | Reduce 3.93% |

| Uber Technologies, Inc. (UBER)* | $461.5M | 4.9% | Reduce 3.80% |

*Uber appears just outside the top‑10 list but is included here due to reported change and significant weight.

The table highlights how deeply concentrated the Thomas Russo - Gardner Russo & Quinn portfolio is in its leading positions. Even the smallest name in this group, Uber, still commands 4.9% of the portfolio, while the top two—Berkshire Hathaway (BRK‑A) and Alphabet—each exceed 12%. This structure amplifies both upside and downside: stock‑specific performance in these names will heavily influence overall returns.

At the same time, the spread across industries—insurance/holding company (Berkshire), digital advertising/cloud (Alphabet), payments (Mastercard), tobacco (Philip Morris), luxury (Richemont), beverages (Heineken), streaming (Netflix), consumer staples (Nestlé), and ride‑sharing/logistics (Uber)—provides economic diversification even within a tight top‑10. The modest reductions and the single notable add (Heineken) show Russo prefers fine‑tuning exposure over major sector rotations.

Investment Lessons from Thomas Russo’s Gardner Russo & Quinn Portfolio

Several practical takeaways emerge for investors studying Thomas Russo’s Q3’2025 holdings:

- Concentrate when conviction is high

Allowing 80% of capital to sit in 10 names demonstrates that diversification is not diworsification when you deeply understand the businesses and management teams. - Holding periods matter more than timing the market

An average holding period of 41 quarters reinforces the power of letting compounding work. Small quarterly tweaks can coexist with very long investment horizons. - Quality and competitive advantage justify patience

Many core holdings—Berkshire, Alphabet, Philip Morris, Nestlé, Heineken—are businesses with enduring moats. Russo’s willingness to own them through cycles shows how quality can justify paying and holding at premium valuations. - Position sizing is an active decision

Reducing Berkshire (BRK‑A), Alphabet, Mastercard, and Netflix while adding to Heineken and BRK‑B is a reminder that risk is managed via size as much as via security selection. - Blend resilient cash flows with secular growth

The mix of consumer staples and digital platforms suggests individual investors can benefit from barbell exposure: stable cash‑generators plus select high‑growth compounders, sized appropriately.

Looking Ahead: What Comes Next?

Based on the current Q3’2025 positioning, Thomas Russo - Gardner Russo & Quinn appears well‑placed for a range of macro and market environments:

- With nearly $9.3B deployed and minimal turnover, there is no sign of a defensive retreat; instead, Russo continues to own through volatility, betting on long‑term cash‑flow compounding.

- Incremental trims in richly valued growth and tech names (Alphabet, Netflix, Uber) may signal expectations of more muted forward returns from recent high flyers, or simply disciplined rebalancing after strong performance.

- Adds to Heineken and a slight increase in BRK‑B hint that Russo still sees attractive reinvestment runways in high‑quality consumer and capital‑allocation stories, especially outside the US.

- If markets correct, the low‑turnover, high‑conviction approach suggests Russo is more likely to add to existing winners at better prices than to rotate into new themes.

For investors following the Gardner Russo & Quinn portfolio, the key will be watching whether trims in growth and tech continue in coming quarters, and whether Russo further increases exposure to global consumer staples and beverages as potential defensive compounders.

FAQ about Thomas Russo – Gardner Russo & Quinn Portfolio

Q: What were the most significant portfolio changes in Thomas Russo’s Q3’2025 13F filing?

The biggest moves were reductions in Alphabet (Reduce 8.65%), Berkshire Hathaway BRK‑A (Reduce 5.11%), and Netflix (Reduce 5.15%), alongside an Add 10.14% in Heineken Holding NV and smaller adjustments in Philip Morris, Richemont, Nestlé, BRK‑B, and Uber.

Q: How concentrated is Thomas Russo’s portfolio, and what does that imply?

The top 10 positions account for 80.3% of total equity value, with individual stakes like Berkshire and Alphabet exceeding 12%. This high concentration implies significant conviction in a small group of businesses and suggests that Russo is comfortable with stock‑specific risk when moats and management quality are strong.

Q: Does this 13F show any major strategic shift for Gardner Russo & Quinn?

No. The 4.7% turnover and the scale of changes (mostly single‑digit trims or modest adds) indicate portfolio refinement rather than a strategy overhaul. Core themes—global consumer brands, payment networks, and dominant platforms—remain intact.

Q: Which sectors and business types does Thomas Russo appear to favor right now?

The Q3’2025 filing shows a clear tilt toward consumer staples and discretionary brands (Philip Morris, Nestlé, Heineken, Richemont), financial and payment infrastructure (Berkshire, Mastercard), and digital platforms/media (Alphabet, Netflix, Uber). The common threads are pricing power, brand strength, and scalable economics.

Q: How can I track Thomas Russo’s future portfolio changes?

You can follow Thomas Russo - Gardner Russo & Quinn through quarterly 13F filings, which are typically released up to 45 days after each quarter‑end, meaning there is always a reporting lag between actual trades and public disclosure. Platforms like ValueSense aggregate these filings, so you can monitor the Gardner Russo & Quinn portfolio, visualize historical holdings, and analyze changes over time.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!