Tom Bancroft - Makaira Partners Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

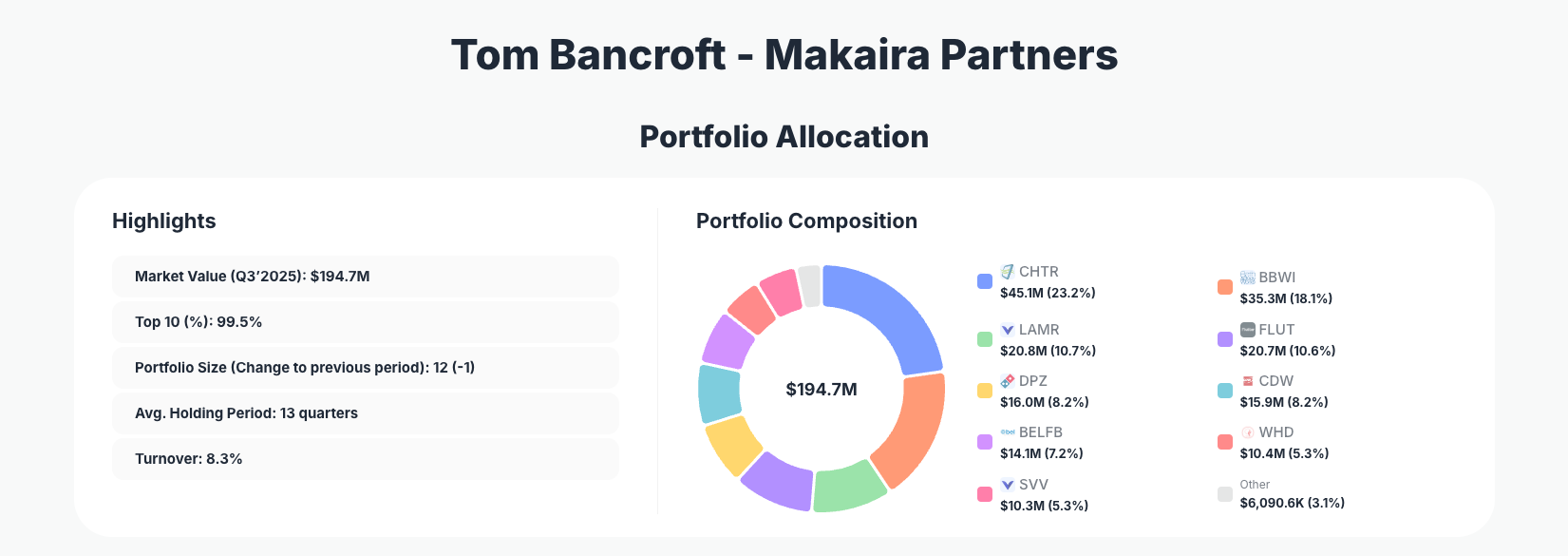

Tom Bancroft - Makaira Partners continues to apply a focused, fundamentals-driven approach to public equities. Their Q3’2025 portfolio shows an almost fully concentrated book, with $194.7M spread across just 12 positions and an extraordinary 99.5% in the top 10. Makaira used the quarter to trim several long‑term winners—most notably Charter Communications, Inc., Bath & Body Works, Inc., and Domino's Pizza, Inc.—while maintaining a low 8.3% turnover and a 13‑quarter average holding period that underlines a true long-term orientation.

See Makaira Partners’ full Q3 2025 portfolio on ValueSense

Portfolio Overview: Concentrated Quality, Selective Trimming

Portfolio Highlights (Q3 2025): - Market Value: $194.7M

- Top 10 Holdings: 99.5%

- Portfolio Size: 12 -1

- Average Holding Period: 13 quarters

- Turnover: 8.3%

Makaira Partners’ Q3’2025 portfolio is a textbook example of high conviction. With 99.5% of assets in the top 10 positions and only 12 holdings in total, every stock must clear a very high bar in terms of business quality and valuation before it earns or keeps a place in the fund. This level of concentration amplifies both upside and downside, signaling deep research and strong confidence in a small set of businesses.

Despite this focus, the fund’s 13‑quarter average holding period and modest 8.3% turnover indicate that Makaira is not trading around short‑term noise. Instead, the portfolio is managed with a long-duration mindset, where trims and adds fine‑tune risk and valuation exposure rather than represent wholesale strategic shifts.

The Q3 activity is dominated by reductions rather than new buys or sector rotations. Across cable, specialty retail, advertising, online gaming, IT distribution, industrial components, energy services, and off‑price retail, Makaira chose to harvest gains and reduce exposure while still keeping these names as significant holdings. That pattern suggests risk management and valuation discipline rather than a loss of conviction in the underlying businesses.

Top Holdings Analysis: Consumer, Media & Services at the Core

The heart of the Makaira Partners book is a cluster of durable, cash‑generative businesses that serve as category leaders in their niches. The largest disclosed position with changes, Charter Communications, Inc. (CHTR), accounts for 23.2% of the portfolio and was trimmed (Reduce 18.07%) to 164,000 shares, valued at $45.1M. Even after this reduction, Charter remains a cornerstone, reflecting Makaira’s belief in the resilience of cable broadband economics despite competitive and regulatory pressures.

Close behind is Bath & Body Works, Inc. (BBWI) at 18.1% of the portfolio. Makaira cut the position by Reduce 25.50% to 1,370,000 shares, worth $35.3M. The sizable trim indicates profit‑taking or a response to valuation expansion, but the remaining weight shows continued conviction in the brand’s pricing power, customer loyalty, and cash‑return potential.

In the mid‑teens, Lamar Advertising Company (LAMR) sits at 10.7% of assets after a Reduce 24.20% move to 170,000 shares and $20.8M in value. Outdoor advertising is cyclical, but Lamar’s scale and local presence can translate into durable free cash flow over cycles—Makaira’s partial reduction keeps it a major bet while moderating macro‑sensitive exposure.

Another sizable position is Flutter Entertainment plc (FLUT), representing 10.6% of the portfolio following a Reduce 23.49% to 81,422 shares $20.7M. Flutter gives Makaira exposure to global online betting and iGaming growth, yet the trim suggests a balanced stance toward regulatory and competitive risks in this fast‑evolving industry.

Consumer and service heavyweights continue with Domino's Pizza, Inc. (DPZ), now 8.2% of assets. Makaira executed one of its largest percentage reductions here—Reduce 43.05%—bringing the stake to 37,000 shares and $16.0M. Even at a smaller size, Domino’s remains a core expression of Makaira’s preference for asset‑light, franchise‑driven models with strong unit economics and recurring demand.

In technology distribution, CDW Corporation (CDW) also holds 8.2% of the book after a Reduce 35.61% adjustment to 100,000 shares valued at $15.9M. CDW’s role as a mission‑critical IT solutions provider to enterprises and public institutions aligns well with Makaira’s bias toward recurring, sticky revenue streams, but the trim again shows careful valuation and risk calibrations.

Industrial and component exposure comes via Bel Fuse Inc. (BELFB), a 7.2% weight after a substantial Reduce 59.35% trade. The position stands at 100,000 shares and $14.1M in value, indicating Makaira aggressively realized gains or reduced cyclical risk while still preserving upside if the business continues to execute.

Energy services exposure is concentrated in Cactus, Inc. (WHD), at 5.3% of the portfolio. Here, Makaira cut by Reduce 26.22% to 263,409 shares worth $10.4M. This maintains a meaningful stake in North American oilfield activity while scaling back exposure in a sector historically prone to volatility.

Rounding out the disclosed changes is Savers Value Village, Inc. (SVV), another 5.3% holding. Makaira reduced this off‑price thrift retailer by Reduce 27.67% to 780,000 shares and $10.3M in value. The remaining allocation suggests Makaira still sees structural growth in value‑oriented retail, but is trimming into strength or managing single‑name risk within the consumer sleeve.

Across these nine disclosed names, the pattern is consistent: large, long‑held positions trimmed but not abandoned, with percentage weights that still signify core conviction. Additional undisclosed top‑10 names (the JSON omits rank 1) likely share similar characteristics—defensible moats, strong free‑cash‑flow generation, and management teams capable of disciplined capital allocation—reinforcing the Makaira investment template.

What the Portfolio Reveals About Makaira’s Current Strategy

Makaira Partners’ Q3’2025 moves highlight several strategic themes:

- Quality first, valuation second

The fund is not rotating out of its preferred business models—cable broadband, specialty retail, outdoor advertising, gaming, IT distribution, and industrial components remain central. Instead, Makaira is right‑sizing positions after strong runs or changing risk‑reward, a hallmark of quality‑first but valuation‑sensitive investing. - Consumer & services core, diversified by business model

Many holdings are consumer‑facing—BBWI, DPZ, SVV—but the underlying economics differ: specialty retail, franchised quick‑service restaurants, and off‑price/thrift retail. This creates diversification within the consumer theme while keeping exposure to steady, everyday spending. - Recurring and resilient cash flow as a common thread

Whether it is subscription‑like broadband revenues at CHTR, ad contracts at LAMR, ongoing IT needs served by CDW, or regular pizza orders at DPZ, these businesses share predictable demand profiles. That supports Makaira’s ability to concentrate capital while staying comfortable with downside scenarios. - Risk‑aware capital recycling, not churn

Across the portfolio, every named top position with changes was reduced, and none were increased or newly introduced in the provided data. Coupled with the 8.3% turnover, this points toward measured de‑risking and profit‑taking, not short‑term trading. Makaira is managing position sizes as prices and fundamentals evolve, without abandoning its research pipeline. - Geographic and regulatory nuance

The inclusion of FLUT reflects a willingness to embrace more complex regulatory environments (global online betting) when the upside justifies the risk. Meanwhile, names like WHD and BELFB show Makaira is comfortable owning more cyclical or industrial exposures—as long as the businesses maintain strong balance sheets and structural advantages.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Charter Communications, Inc. | $45.1M | 23.2% | Reduce 18.07% |

| Bath & Body Works, Inc. | $35.3M | 18.1% | Reduce 25.50% |

| Lamar Advertising Company | $20.8M | 10.7% | Reduce 24.20% |

| Flutter Entertainment plc | $20.7M | 10.6% | Reduce 23.49% |

| Domino's Pizza, Inc. | $16.0M | 8.2% | Reduce 43.05% |

| CDW Corporation | $15.9M | 8.2% | Reduce 35.61% |

| Bel Fuse Inc. | $14.1M | 7.2% | Reduce 59.35% |

| Cactus, Inc. | $10.4M | 5.3% | Reduce 26.22% |

| Savers Value Village, Inc. | $10.3M | 5.3% | Reduce 27.67% |

With 99.5% of capital in the top 10, the table illustrates just how top‑heavy the Makaira Partners book is—these nine positions alone account for 97.8% of the portfolio, with at least one additional undisclosed top‑10 name completing the picture. The largest two—CHTR and BBWI—together represent over 41% of assets, embodying the fund’s willingness to bet big where conviction is highest.

At the same time, the across‑the‑board reductions are striking. Every top‑10 disclosed position was trimmed, often by 20–40% and in the case of BELFB by nearly 60%. This consistent pattern reinforces the idea that Makaira is actively managing both single‑name risk and portfolio correlation, locking in gains while retaining substantial exposure to its favorite ideas.

Investment Lessons from Tom Bancroft & Makaira Partners

Makaira’s Q3’2025 13F provides several actionable lessons for individual investors:

- Concentrate when you truly understand the business

A 23.2% allocation to CHTR or an 18.1% stake in BBWI is only sensible if you have deep conviction in competitive advantage, management, and long‑term economics. For most investors, this level of concentration should only apply to a small number of exceptionally well‑researched names. - Long holding periods are a feature, not a bug

A 13‑quarter average holding period shows that Makaira is willing to ride out volatility and focus on multi‑year value creation rather than quarterly earnings noise. This patience lowers frictional costs and can let compounding work more effectively. - Position sizing is dynamic, not static

Makaira’s broad reductions—especially in DPZ, CDW, and BELFB—show that you do not need to “marry” your initial sizing. As prices move and risk‑reward shifts, trimming or adding around core positions can enhance returns and reduce drawdowns. - Seek recurring, resilient cash flows

From infrastructure‑like cable and IT distribution to everyday consumer franchises and thrift retail, Makaira gravitates toward businesses whose revenues are tied to habitual spending or mission‑critical services. These models can better withstand economic shocks and support long‑term compounding. - Respect risk, even when you like the business

The fact that every named top position was partially reduced underscores a disciplined mindset: you can love the business and still decide the stock has run ahead of fundamentals, or that concentration has gotten too high. Risk management and conviction are not opposites—they complement each other.

Looking Ahead: What Comes Next for Makaira Partners?

Based on the current Q3’2025 positioning and the pattern of trims, several forward‑looking points stand out:

- Dry powder and flexibility

While the 13F does not disclose cash balances, the systematic reductions across major holdings imply Makaira is likely building optionality—either via higher cash levels or capacity to redeploy into new or existing ideas at more attractive prices. - Room to add on volatility

With meaningful but reduced stakes in names like DPZ, CDW, WHD, and SVV, Makaira has left itself room to scale back up if market dislocations or company‑specific pullbacks improve prospective returns. - Potential for new names or sector entries

A portfolio size of 12 (‑1 vs. prior quarter) suggests at least one position was fully exited, even though it does not appear in the top‑10 detail. That creates space for fresh ideas in future filings—possibly adjacent to existing themes (consumer, services, industrials) or in new areas that share Makaira’s preferred cash‑flow and competitive‑advantage characteristics. - Continued focus on durable franchises

Absent evidence of a style shift, future 13F filings are likely to continue emphasizing capital‑light, high‑ROIC businesses with pricing power, while Makaira uses trims and adds to navigate valuation and macro conditions.

Investors watching Makaira should monitor subsequent quarters for signs of new high‑conviction entrants, re‑builds of recently trimmed names, or deeper cuts that could signal a more fundamental thesis change.

FAQ about Tom Bancroft – Makaira Partners Portfolio

Q: What were the biggest changes in Makaira Partners’ Q3 2025 portfolio?

The largest disclosed changes were reductions across multiple core positions. Makaira trimmed Charter Communications (CHTR) by Reduce 18.07%, Bath & Body Works (BBWI) by Reduce 25.50%, Lamar Advertising (LAMR) by Reduce 24.20%, Flutter Entertainment (FLUT) by Reduce 23.49%, Domino’s Pizza (DPZ) by Reduce 43.05%, CDW (CDW) by Reduce 35.61%, Bel Fuse (BELFB) by Reduce 59.35%, Cactus (WHD) by Reduce 26.22%, and Savers Value Village (SVV) by Reduce 27.67%.

Q: How concentrated is the Makaira Partners portfolio?

Extremely concentrated. The Q3’2025 13F shows a market value of $194.7M spread across only 12 positions, with 99.5% in the top 10 holdings. That concentration means each individual stock can materially influence the fund’s performance, which is why Makaira emphasizes high‑quality, resilient businesses and long holding periods.

Q: Does this quarter’s trimming signal a change in Makaira’s strategy?

The data suggests tactical risk and valuation management, not a wholesale strategic shift. All disclosed top positions remain large even after reductions, and the average holding period of 13 quarters plus an 8.3% turnover indicate Makaira is still operating as a long‑term, concentrated investor rather than a trader.

Q: Which sectors or themes does Makaira seem to favor?

Within the disclosed names, Makaira shows a strong preference for: - Consumer and brand‑driven businesses (BBWI, DPZ, SVV)

- Media and advertising (CHTR, LAMR)

- Technology and IT solutions (CDW, BELFB)

- Energy services and cyclical infrastructure (WHD)

- Online gaming and betting (FLUT)

The common denominator is durable competitive positioning and strong cash‑flow generation.

Q: How can I track Makaira Partners’ portfolio going forward?

Makaira Partners’ U.S. equity holdings are disclosed quarterly via 13F filings, which institutional managers must submit to the SEC within 45 days of each quarter‑end. This means there is an inherent reporting lag of up to 45 days, so positions may have changed since the reported date.

You can follow all quarterly changes, historical holdings, and visualizations using ValueSense’s superinvestor tracker at Makaira Partners’ portfolio, which organizes each 13F into an easy‑to‑analyze dashboard.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!