11 Best Undervalued Nasdaq Stocks for 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Opportunity in Undervalued Nasdaq Stocks

The Nasdaq represents the epicenter of global innovation, housing technology leaders, biotechnology pioneers, and digital transformation companies that drive economic progress. When quality Nasdaq companies trade below their intrinsic value, they create exceptional opportunities for investors seeking exposure to high-growth sectors at attractive valuations.

Undervalued Nasdaq Selection Criteria:

- Nasdaq Exchange Listing: Companies trading on the premier innovation exchange

- Intrinsic Value Undervaluation: Trading below calculated fair value based on fundamental analysis

- Quality Business Fundamentals: Strong competitive positioning and operational excellence

- Innovation Leadership: Companies positioned at the forefront of technological advancement

Top 11 Undervalued Nasdaq Stocks for 2025 - Ranked by Undervaluation Percentage

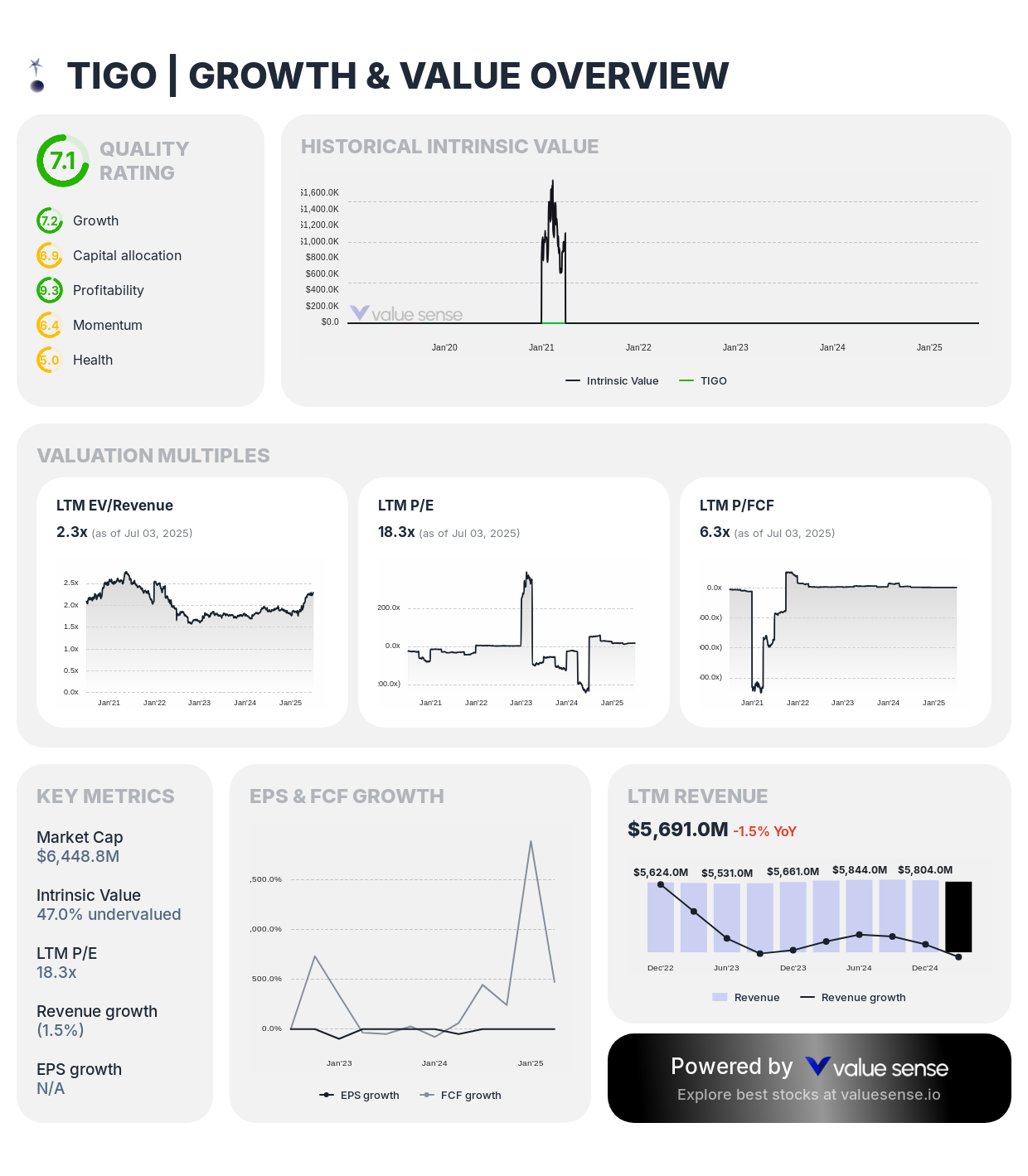

1. Millicom International Cellular S.A. (TIGO) - 47.0% Undervalued ⭐

Complete Analysis:

- Quality Rating: 6.1 (Strong)

- Intrinsic Value: 47.0% undervalued

- 1-Year Return: 58.2%

- Revenue: $5,691.0M

- Free Cash Flow: $1,021.7M

- Revenue Growth: (1.5%)

- FCF Margin: 18.0%

Investment Thesis: Millicom represents the most significantly undervalued Nasdaq opportunity, trading at 47.0% below intrinsic value. As a leading telecommunications provider in Latin America operating under the Tigo brand, Millicom offers exposure to growing emerging markets with increasing digital penetration and essential connectivity services.

Growth Catalysts:

- Expanding mobile and fixed broadband penetration in underserved Latin American markets

- Digital transformation initiatives including fintech and mobile financial services

- Network modernization and 5G deployment opportunities

- Strategic positioning in growing Latin American digital economy

Investment Highlights:

- Leading telecommunications provider in Latin America with strong market positions

- Substantial free cash flow generation supporting dividend payments and growth investments

- Digital services expansion creating higher-margin revenue opportunities

- Defensive business characteristics through essential connectivity services

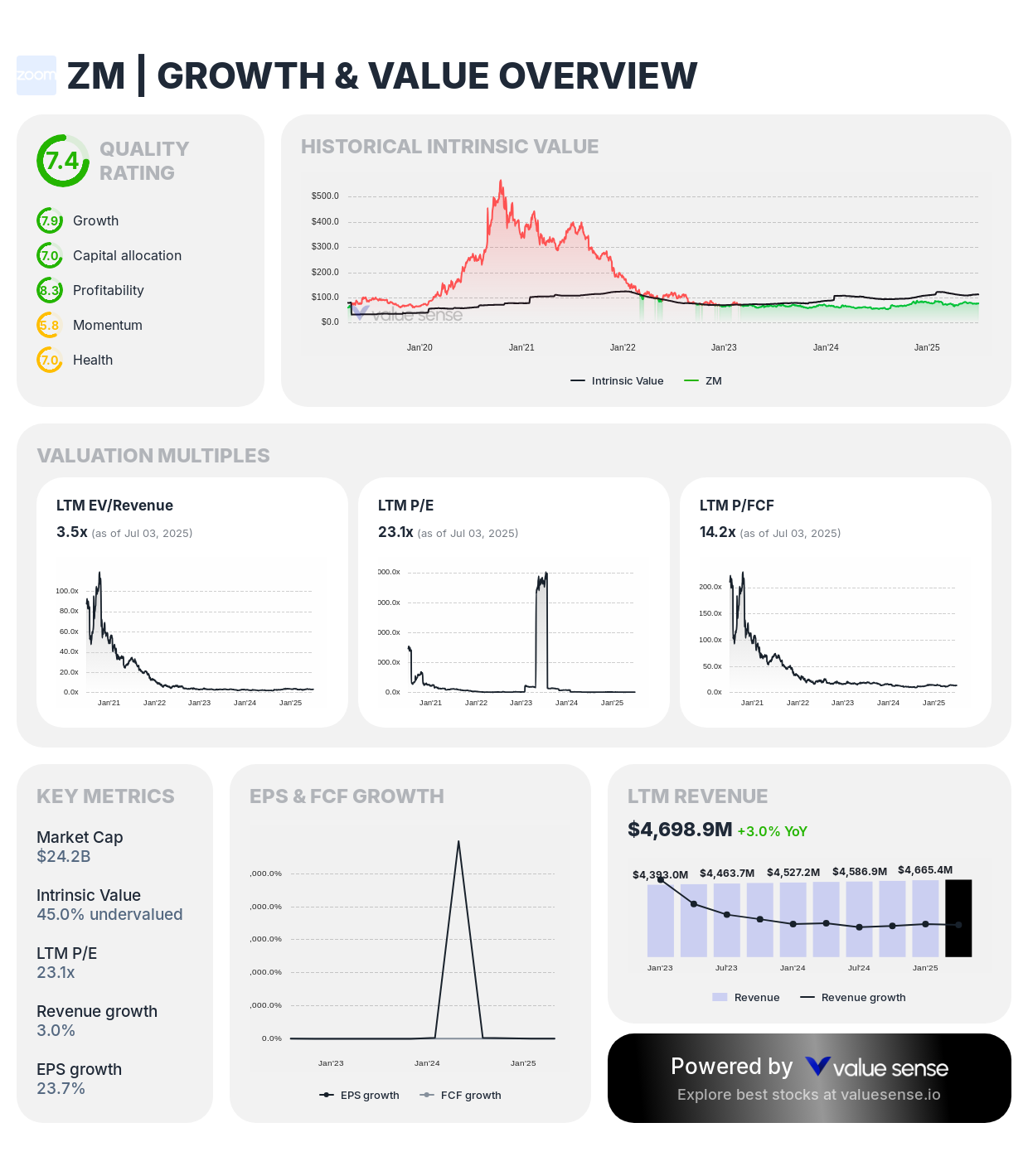

2. Zoom Video Communications, Inc. (ZM) - 45.0% Undervalued

Complete Analysis:

- Quality Rating: 6.3 (Strong)

- Intrinsic Value: 45.0% undervalued

- 1-Year Return: 34.0%

- Revenue: $4,698.9M

- Free Cash Flow: $1,702.4M

- Revenue Growth: 3.0%

- FCF Margin: 36.2%

Investment Thesis: Zoom demonstrates substantial undervaluation at 45.0% below intrinsic worth, reflecting the video communications leader's essential role in remote work and digital collaboration. The company's exceptional 36.2% free cash flow margin showcases operational efficiency and pricing power in enterprise communications.

Growth Catalysts:

- Expansion into enterprise solutions beyond core video conferencing (Zoom Phone, Zoom Rooms)

- Integration of AI features enhancing productivity and user experience

- Growth in hybrid work models driving sustained demand for collaboration tools

- International market expansion and platform ecosystem development

Investment Highlights:

- Dominant position in video communications with strong brand recognition

- Exceptional free cash flow generation demonstrating operational excellence

- Expanding product portfolio creating platform ecosystem advantages

- Strong enterprise market penetration with sticky customer relationships

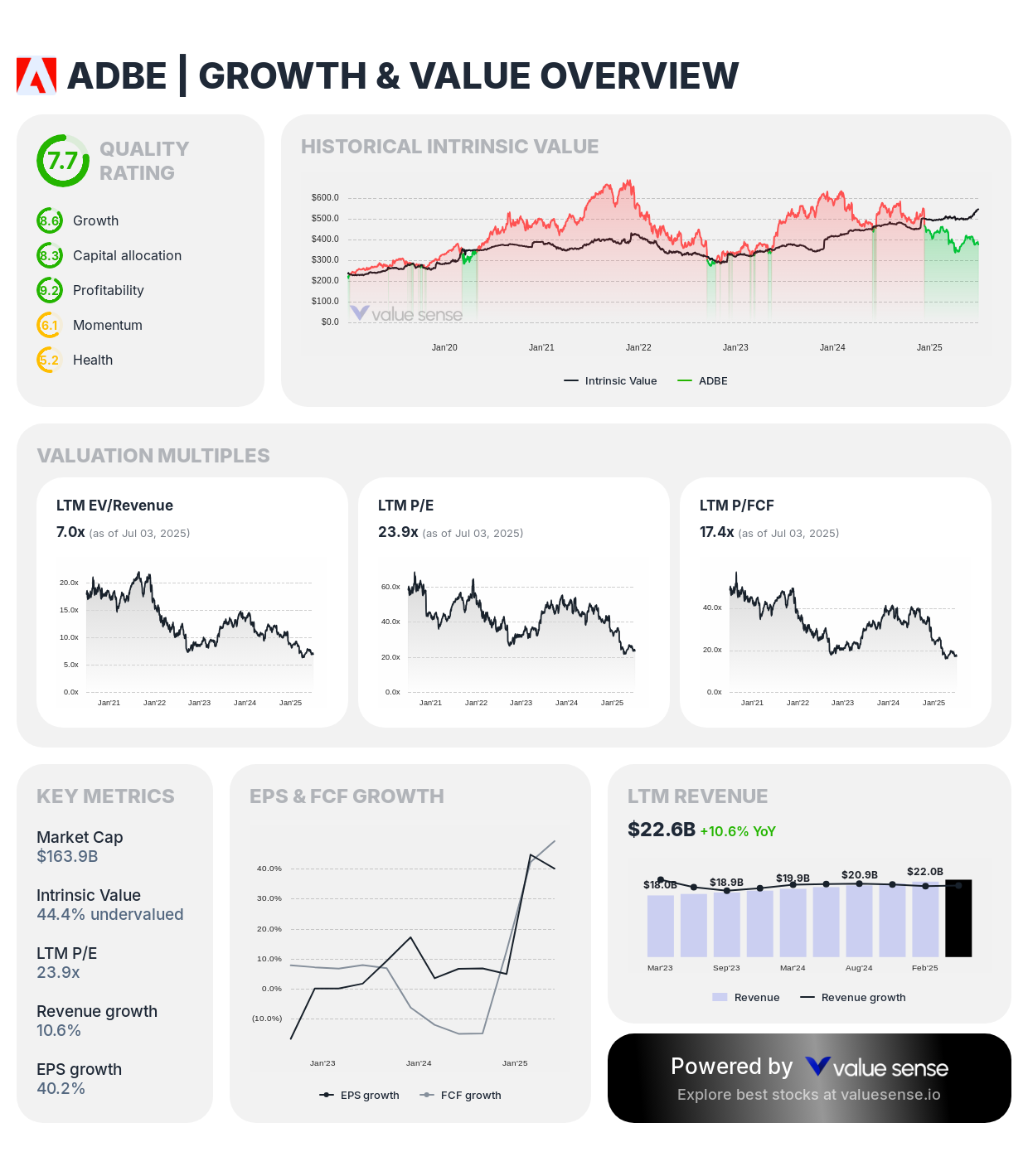

3. Adobe Inc. (ADBE) - 44.4% Undervalued

Complete Analysis:

- Quality Rating: 7.7 (Exceptional)

- Intrinsic Value: 44.4% undervalued

- 1-Year Return: (33.5%)

- Revenue: $22.6B

- Free Cash Flow: $9,437.0M

- Revenue Growth: 10.6%

- FCF Margin: 41.8%

Investment Thesis: Adobe presents compelling undervaluation at 44.4% below intrinsic value with exceptional quality rating of 7.7. The creative software leader's market dominance, subscription model transformation, and AI integration create sustainable competitive advantages that current pricing significantly underestimates.

Growth Catalysts:

- Continued transition to subscription-based services across product portfolio

- Artificial intelligence integration enhancing creative workflows and productivity

- Expansion of digital experience platform leveraging data analytics

- International market growth for creative and business solutions

Investment Highlights:

- Dominant position in creative software with subscription model providing predictable revenue

- Strong competitive moats through ecosystem effects and professional workflow integration

- Exceptional operational efficiency with 41.8% free cash flow margin

- Strategic positioning in growing digital content creation markets

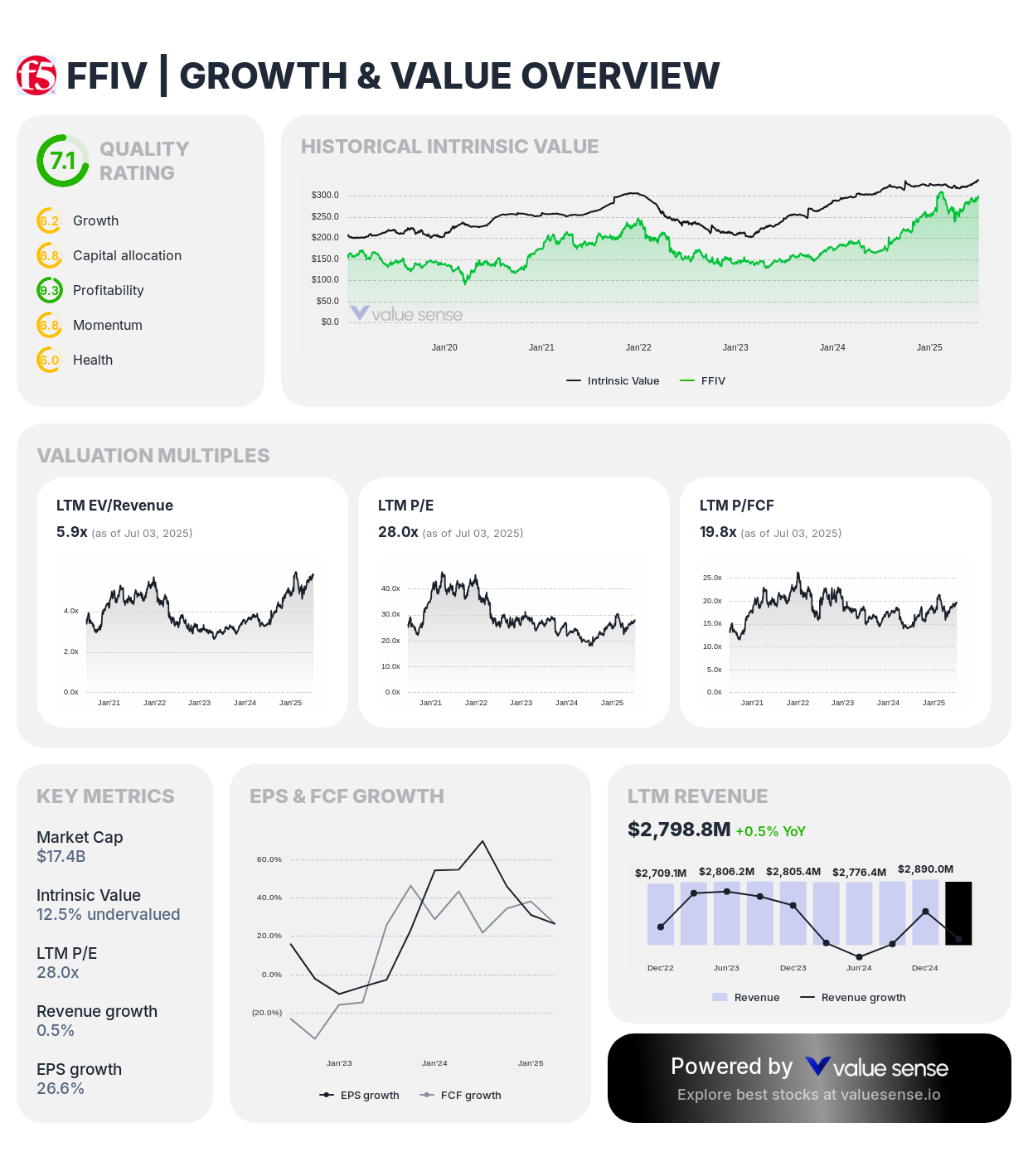

4. F5, Inc. (FFIV) - 42.5% Undervalued

Complete Analysis:

- Quality Rating: 6.1 (Strong)

- Intrinsic Value: 42.5% undervalued

- 1-Year Return: 76.0%

- Revenue: $2,798.8M

- Free Cash Flow: $879.0M

- Revenue Growth: 0.5%

- FCF Margin: 31.4%

Investment Thesis: F5 demonstrates substantial undervaluation at 42.5% below intrinsic worth despite strong recent performance. The application delivery and security company's essential role in enterprise infrastructure and exceptional 31.4% free cash flow margin reflect operational efficiency and market positioning.

Growth Catalysts:

- Growing demand for application security and multi-cloud management solutions

- Transition to software-based and subscription revenue models

- Expansion into edge computing and 5G network infrastructure

- Strategic acquisitions enhancing platform capabilities

Investment Highlights:

- Leading provider of application delivery networking and security solutions

- Essential role in enterprise infrastructure with high customer switching costs

- Strong transformation toward software and subscription-based revenue

- Exceptional cash generation supporting strategic investments

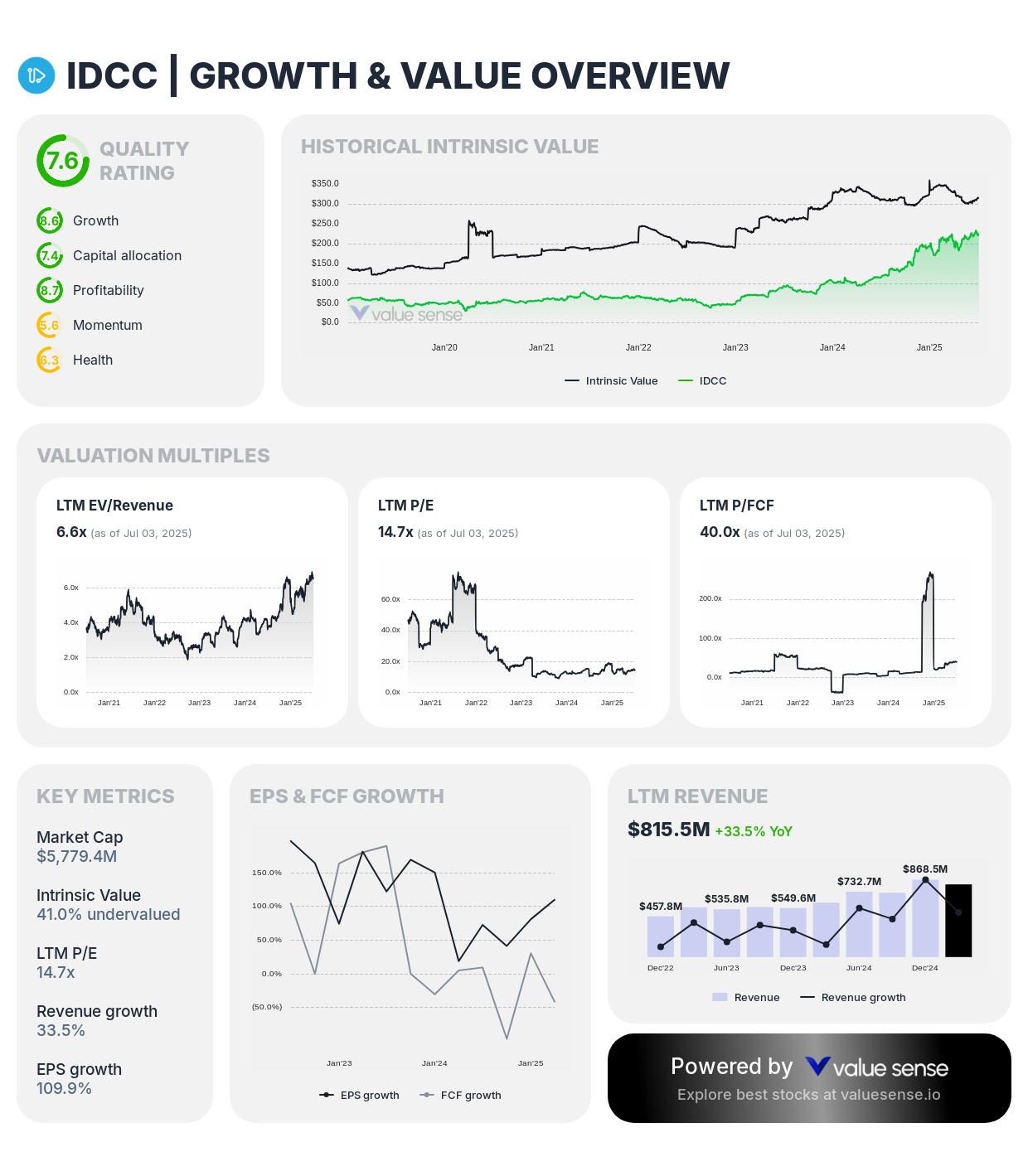

5. InterDigital, Inc. (IDCC) - 41.0% Undervalued

Complete Analysis:

- Quality Rating: 6.5 (Strong)

- Intrinsic Value: 41.0% undervalued

- 1-Year Return: 90.9%

- Revenue: $815.5M

- Free Cash Flow: $144.6M

- Revenue Growth: 33.5%

- FCF Margin: 17.7%

Investment Thesis: InterDigital presents significant undervaluation at 41.0% below intrinsic value with strong quality rating. The wireless technology company's extensive patent portfolio, licensing business model, and 33.5% revenue growth demonstrate expanding market opportunities in 5G and emerging technologies.

Growth Catalysts:

- Expansion of 5G and future wireless communication standards

- Growth in connected devices and IoT requiring licensed technologies

- Strategic patent licensing agreements with major technology companies

- Innovation in artificial intelligence and machine learning applications

Investment Highlights:

- Extensive patent portfolio in wireless communications and emerging technologies

- High-margin licensing business model with recurring revenue characteristics

- Strategic positioning for 5G, IoT, and next-generation wireless technologies

- Strong research and development capabilities supporting continued innovation

6. Coca-Cola Consolidated, Inc. (COKE) - 29.6% Undervalued

Complete Analysis:

- Quality Rating: 7.1 (Strong)

- Intrinsic Value: 29.6% undervalued

- 1-Year Return: (69.2%)

- Revenue: $6,888.1M

- Free Cash Flow: $489.8M

- Revenue Growth: 3.2%

- FCF Margin: 7.1%

Investment Thesis: Coca-Cola Consolidated demonstrates solid undervaluation at 29.6% below intrinsic worth with strong quality rating of 7.1. As the largest independent Coca-Cola bottler in the United States, the company offers defensive characteristics and essential role in beverage distribution.

Growth Catalysts:

- Stable demand for carbonated and non-carbonated beverages

- Operational efficiency improvements in bottling and distribution

- Expansion into new product categories within beverage market

- Strategic positioning in essential consumer staples sector

Investment Highlights:

- Largest independent Coca-Cola bottler with territorial advantages

- Essential role in Coca-Cola distribution system providing defensive characteristics

- Strong operational efficiency and market leadership

- Consistent cash generation supporting dividend payments

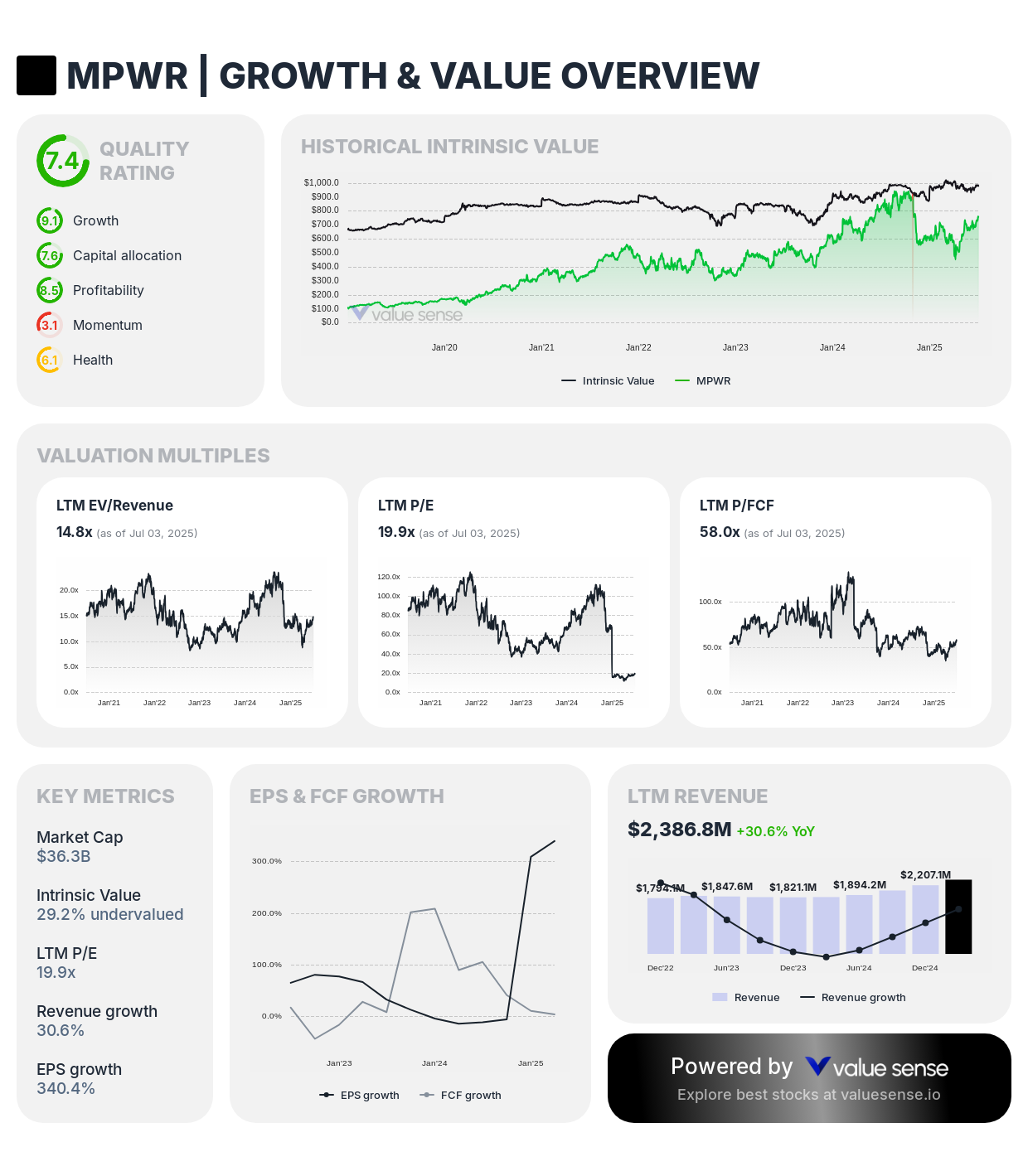

7. Monolithic Power Systems, Inc. (MPWR) - 29.2% Undervalued

Complete Analysis:

- Quality Rating: 6.4 (Strong)

- Intrinsic Value: 29.2% undervalued

- 1-Year Return: (9.3%)

- Revenue: $2,386.8M

- Free Cash Flow: $626.3M

- Revenue Growth: 30.6%

- FCF Margin: 26.2%

Investment Thesis: Monolithic Power Systems presents attractive undervaluation at 29.2% below intrinsic worth with strong fundamentals. The analog semiconductor company's specialized expertise, 30.6% revenue growth, and 26.2% FCF margin demonstrate operational excellence in power management solutions.

Growth Catalysts:

- Increasing demand for energy-efficient power solutions across industries

- Expansion into automotive and data center applications

- Continuous innovation in high-performance analog integrated circuits

- Strategic positioning in electrification and automation trends

Investment Highlights:

- Specialized provider of high-performance analog semiconductor solutions

- Strong competitive positioning in power management and motor control

- Excellent operational metrics with strong revenue growth and margins

- Strategic focus on growing markets including automotive and industrial

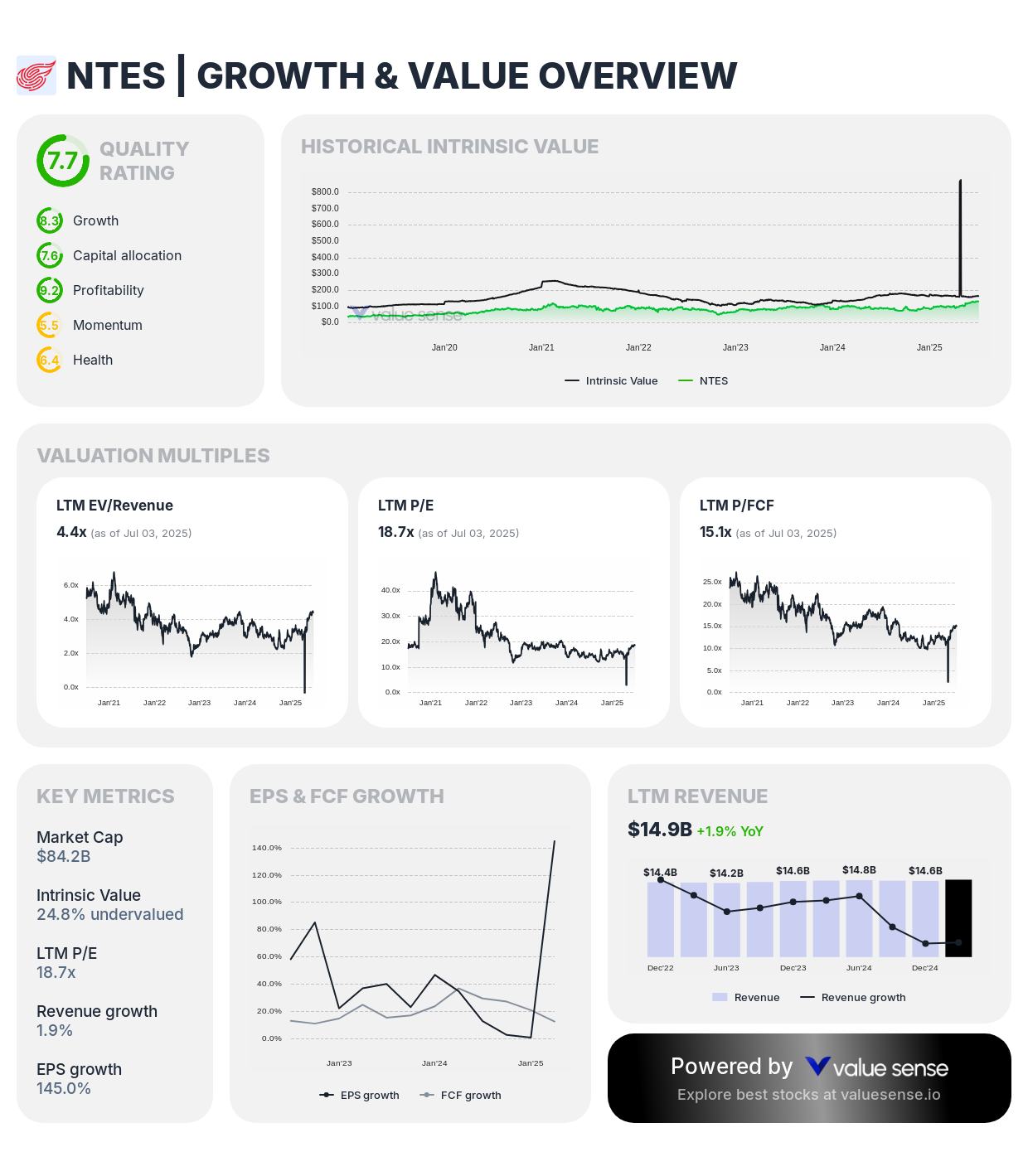

8. NetEase, Inc. (NTES) - 24.8% Undervalued

Complete Analysis:

- Quality Rating: 6.7 (Strong)

- Intrinsic Value: 24.8% undervalued

- 1-Year Return: 41.6%

- Revenue: CN¥107.3B

- Free Cash Flow: CN¥40.0B

- Revenue Growth: 1.9%

- FCF Margin: 37.3%

Investment Thesis: NetEase demonstrates solid undervaluation at 24.8% below intrinsic worth with strong quality rating. The Chinese internet company's leadership in online gaming, music streaming, and educational technology, combined with exceptional 37.3% free cash flow margin, showcases operational efficiency.

Growth Catalysts:

- Continued growth in Chinese online gaming and digital entertainment markets

- International expansion of game portfolio and digital services

- Monetization of music streaming and educational technology platforms

- Strategic investments in emerging technologies and content creation

Investment Highlights:

- Leading Chinese internet company with strong market positions

- Exceptional free cash flow generation demonstrating operational excellence

- Diversified digital ecosystem across gaming, music, and education

- International expansion opportunities providing growth vectors

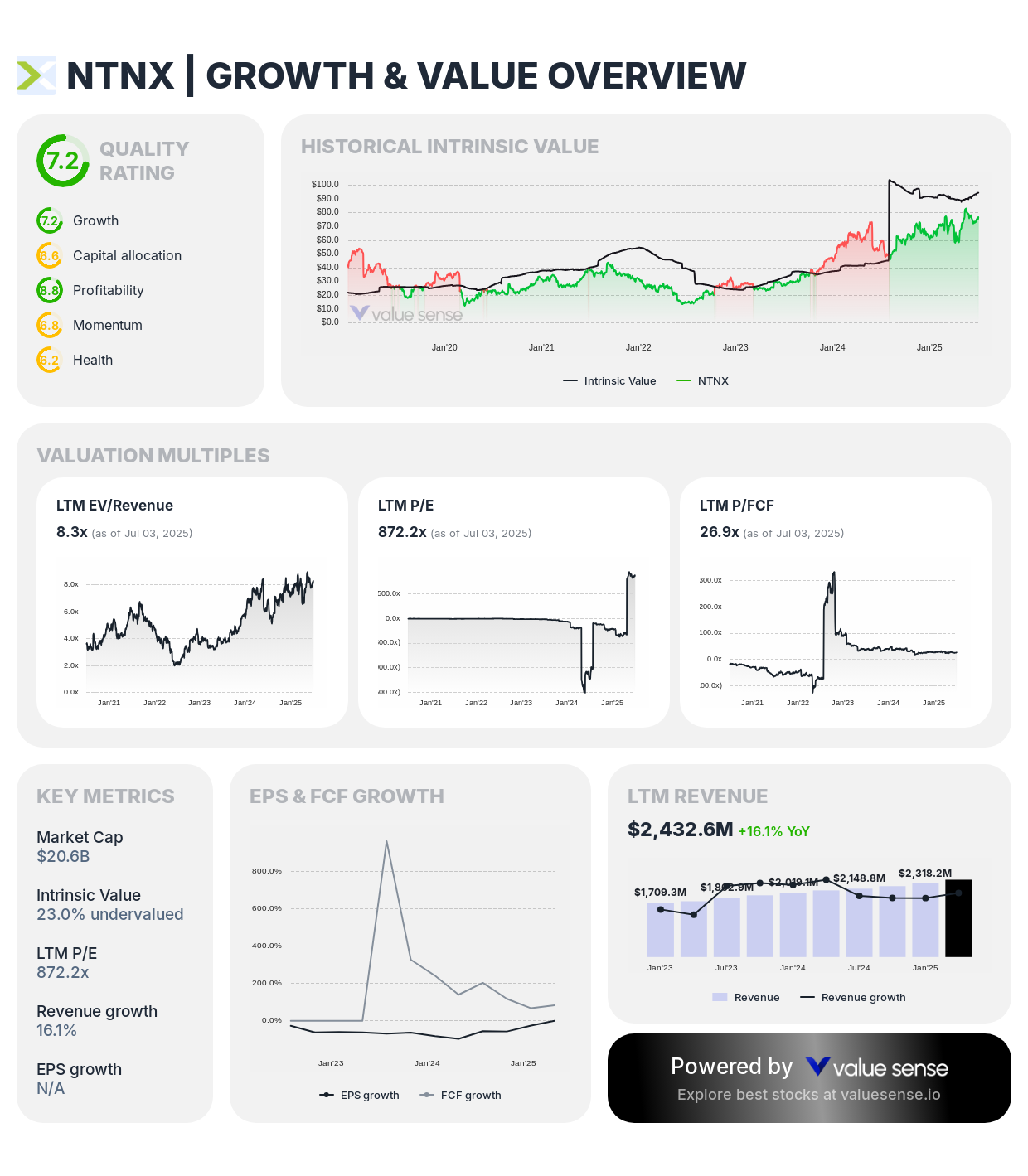

9. Nutanix, Inc. (NTNX) - 23.0% Undervalued

Complete Analysis:

- Quality Rating: 6.2 (Strong)

- Intrinsic Value: 23.0% undervalued

- 1-Year Return: 31.0%

- Revenue: $2,432.6M

- Free Cash Flow: $766.7M

- Revenue Growth: 16.1%

- FCF Margin: 31.5%

Investment Thesis: Nutanix presents attractive undervaluation at 23.0% below intrinsic worth with strong fundamentals. The cloud infrastructure company's successful transformation to subscription-based services and exceptional 31.5% free cash flow margin demonstrate operational improvements and market positioning.

Growth Catalysts:

- Accelerating adoption of hybrid and multi-cloud strategies by enterprises

- Expansion of software-defined infrastructure solutions

- Growth in recurring subscription revenue improving predictability

- Strategic partnerships enhancing market reach and capabilities

Investment Highlights:

- Leading provider of hyperconverged infrastructure and hybrid cloud solutions

- Successful transformation to subscription-based revenue model

- Strong competitive positioning in growing enterprise cloud infrastructure market

- Exceptional operational efficiency with strong cash generation

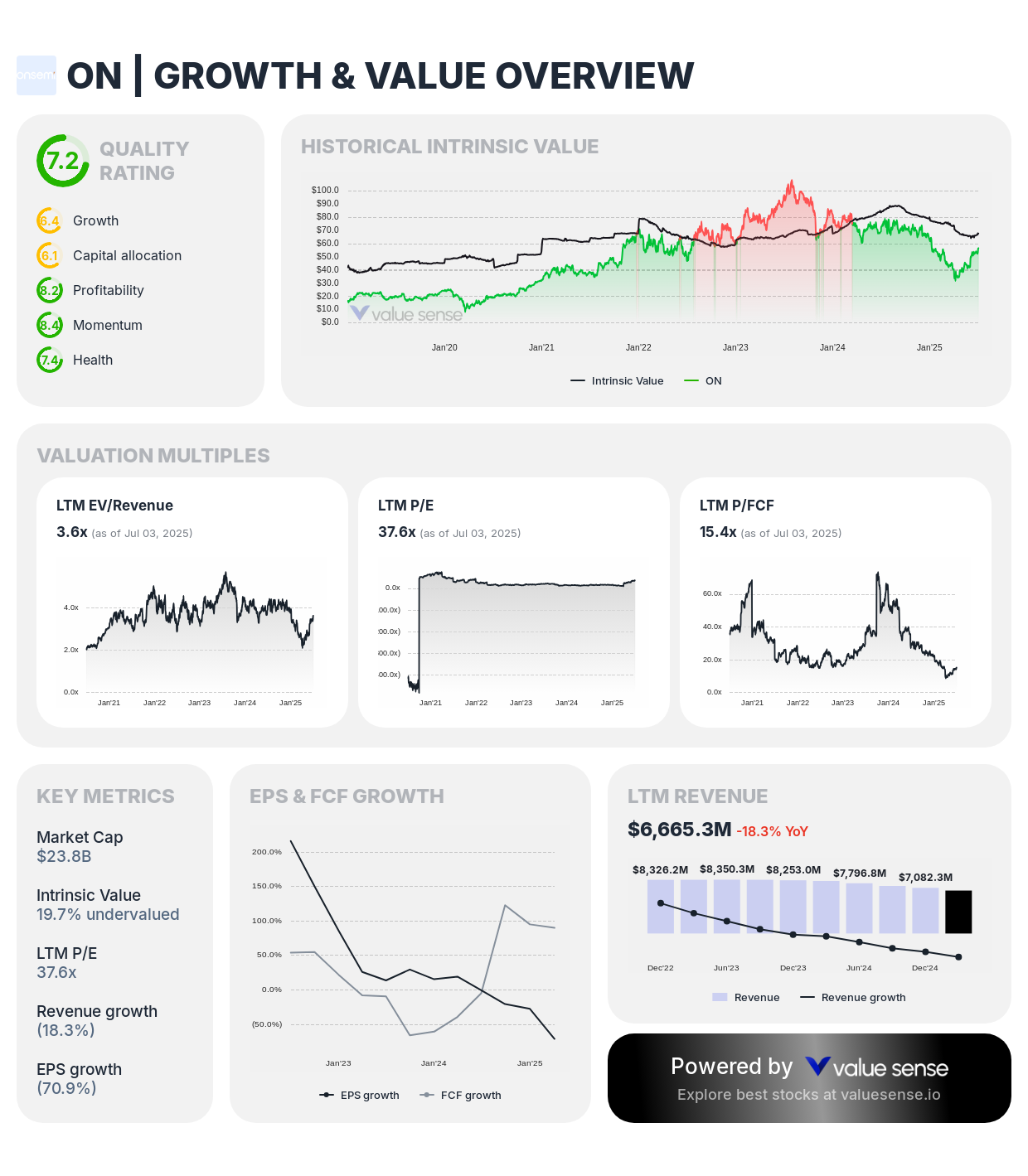

10. ON Semiconductor Corporation (ON) - 19.7% Undervalued

Complete Analysis:

- Quality Rating: 6.2 (Strong)

- Intrinsic Value: 19.7% undervalued

- 1-Year Return: (22.1%)

- Revenue: $6,665.3M

- Free Cash Flow: $1,549.9M

- Revenue Growth: (18.3%)

- FCF Margin: 23.3%

Investment Thesis: ON Semiconductor demonstrates moderate undervaluation at 19.7% below intrinsic worth with strong quality fundamentals. The semiconductor company's strategic positioning in automotive and industrial markets, combined with 23.3% free cash flow margin, showcases operational efficiency despite cyclical challenges.

Growth Catalysts:

- Electrification of vehicles driving demand for power semiconductors

- Industrial automation and renewable energy applications

- Expansion in intelligent sensing solutions across industries

- Strategic focus on high-growth automotive and industrial segments

Investment Highlights:

- Strategic positioning in automotive and industrial semiconductor markets

- Strong competitive advantages in power management and sensing solutions

- Excellent operational efficiency despite cyclical headwinds

- Beneficiary of electric vehicle adoption and automation trends

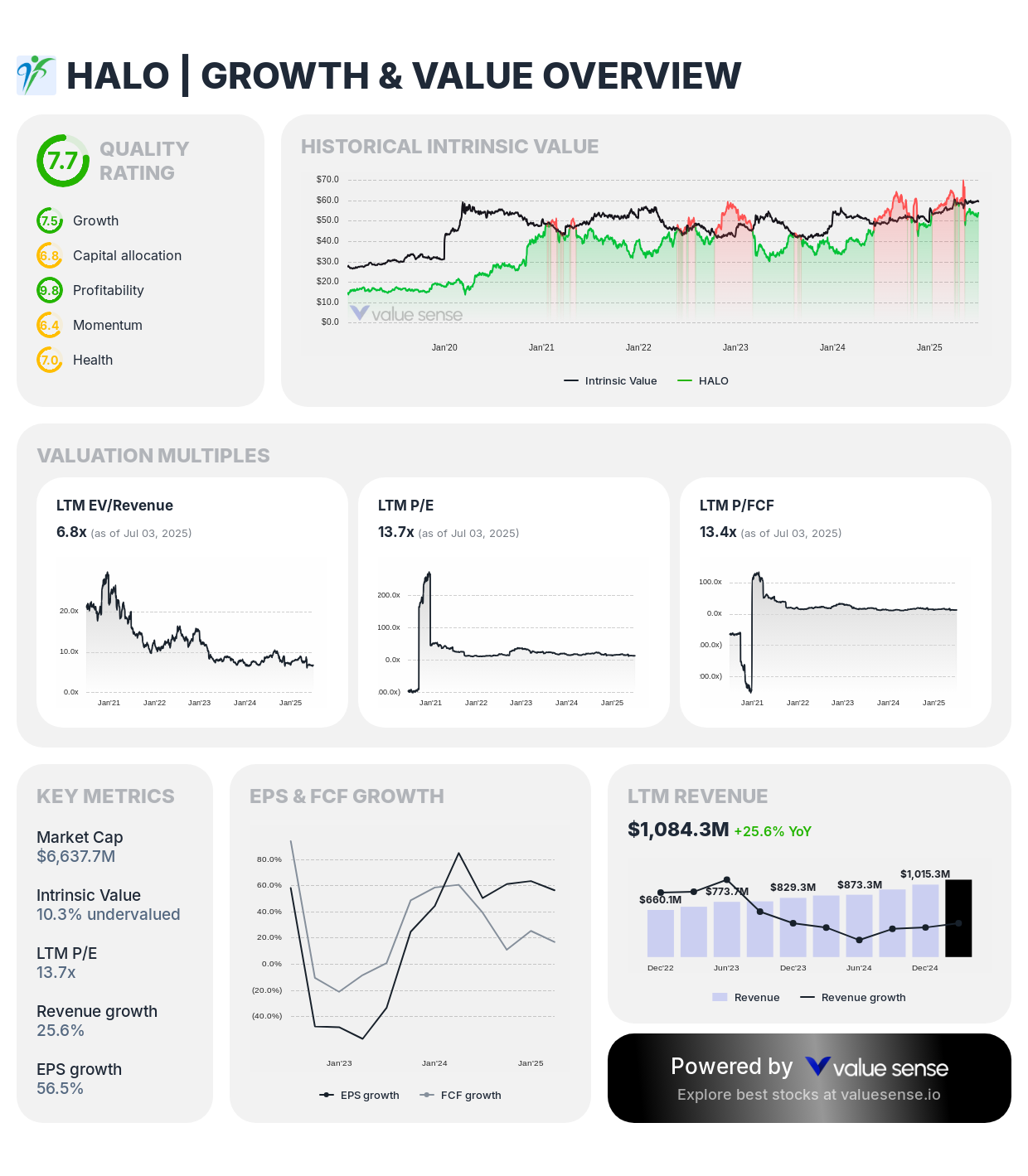

11. Halozyme Therapeutics, Inc. (HALO) - 10.3% Undervalued

Complete Analysis:

- Quality Rating: 6.7 (Strong)

- Intrinsic Value: 10.3% undervalued

- 1-Year Return: 3.8%

- Revenue: $1,084.3M

- Free Cash Flow: $495.8M

- Revenue Growth: 25.6%

- FCF Margin: 45.7%

Investment Thesis: Halozyme presents modest undervaluation at 10.3% below intrinsic worth with strong quality rating. The biotechnology company's specialized drug delivery platform, pharmaceutical partnerships, and exceptional 45.7% free cash flow margin demonstrate operational excellence and market validation.

Growth Catalysts:

- Expansion of ENHANZE drug delivery technology through new partnerships

- Growth in royalty revenues from existing licensed products

- Development of proprietary oncology pipeline

- Strategic licensing agreements with major pharmaceutical companies

Investment Highlights:

- Specialized drug delivery platform technology with industry partnerships

- Exceptional operational efficiency with industry-leading FCF margin

- Strong revenue growth demonstrating market adoption

- Strategic partnerships providing recurring revenue and validation

Nasdaq Value Investment Strategy for 2025

Prioritize Quality Technology Leaders: Focus on companies with quality ratings above 6.0 and strong competitive positioning. Adobe (7.7 quality, 44.4% undervalued) and Coca-Cola Consolidated (7.1 quality, 29.6% undervalued) combine exceptional business quality with attractive valuations.

Diversify Across Technology Themes: Spread investments across software (Adobe, Zoom), semiconductors (Monolithic Power, ON Semiconductor), telecommunications (Millicom), cloud infrastructure (Nutanix), and biotechnology (Halozyme) to capture different growth vectors while reducing concentration risk.

Emphasize Cash Flow Generation: Companies with exceptional free cash flow margins like Halozyme (45.7%), Adobe (41.8%), and NetEase (37.3%) demonstrate operational excellence and financial flexibility that support value realization and shareholder returns.

Consider Market Leadership Positions: Focus on companies with dominant market positions or specialized technologies that create competitive moats and pricing power in their respective markets.

Sector Analysis: Where We See Nasdaq Value

Technology & Software: The software sector offers robust free cash flow generation and high-quality business models. Companies like Adobe, Zoom, and Nutanix demonstrate strong margins and recurring revenue, making them attractive despite sector growth premiums.

Semiconductors: Specialized semiconductor companies like Monolithic Power Systems and ON Semiconductor provide exposure to electrification and automation trends while trading at attractive valuations due to cyclical concerns.

Telecommunications & Internet: Millicom and NetEase provide exposure to growing international markets with increasing digital adoption, offering strong cash flow characteristics with unique geographic diversification.

Biotechnology: Halozyme highlights the potential for innovative biotech companies with proven business models to trade at modest discounts while generating exceptional cash flows.

Market Outlook: Nasdaq in 2025

The Nasdaq continues to be influenced by global economic trends, interest rate policies, and rapid technological innovation, particularly in artificial intelligence. While some high-growth areas command premium valuations, fundamental value remains a critical driver for long-term returns. Companies with strong balance sheets, consistent free cash flow generation, and durable competitive advantages are best positioned to thrive regardless of short-term market fluctuations.

Key Takeaways for Nasdaq Value Investors

✅ Exceptional Value Leaders: Millicom (47.0%) and Zoom (45.0%) offer substantial undervaluation with technology leadership

✅ Quality Focus: All companies maintain quality ratings above 6.0 indicating strong business fundamentals

✅ Cash Flow Excellence: Multiple companies demonstrate exceptional FCF margins above 30%

✅ Technology Diversification: Opportunities span software, semiconductors, telecommunications, and biotechnology

✅ Growth Potential: Companies positioned for continued expansion in technology markets

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best Long-Term Stocks to Buy

📖 11 Best Undervalued Revenue Growth Stocks

📖 7 Best Undervalued Tech Stocks with Realistic Upside

FAQ About Nasdaq Value Investing

What makes Nasdaq stocks particularly attractive for technology investors?

Nasdaq represents the premier exchange for technology companies, housing industry leaders and innovative companies driving digital transformation. The exchange provides access to companies at the forefront of technological advancement, artificial intelligence, biotechnology, and emerging technologies that can create substantial long-term value.

How do you evaluate technology companies that may not have traditional value metrics?

Technology company evaluation requires focusing on business model quality, competitive positioning, market opportunity size, and cash generation capability. Companies like Adobe and Zoom demonstrate strong recurring revenue models and operational efficiency that create sustainable value.

What are the primary risks of investing in undervalued Nasdaq companies?

Nasdaq investing carries risks including technological obsolescence, intense competition, regulatory changes, and market volatility. However, focusing on companies with strong competitive moats, diversified revenue streams, and proven business models helps mitigate these risks.

What timeline should investors expect for value realization in technology stocks?

Technology value realization typically occurs over 2-4 year periods, depending on company-specific catalysts, product cycles, and market adoption. Software companies may realize value through subscription growth, while semiconductor companies depend more on industry cycles.

Important Note on Nasdaq Investing: Nasdaq stocks offer substantial growth potential but carry technology-specific risks including rapid innovation cycles, competitive pressures, and market volatility. Success requires focus on business quality, competitive positioning, and long-term technology trends rather than short-term market movements.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Technology investments carry significant risks including technological obsolescence and competitive pressures. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.