Triple Frond Partners Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

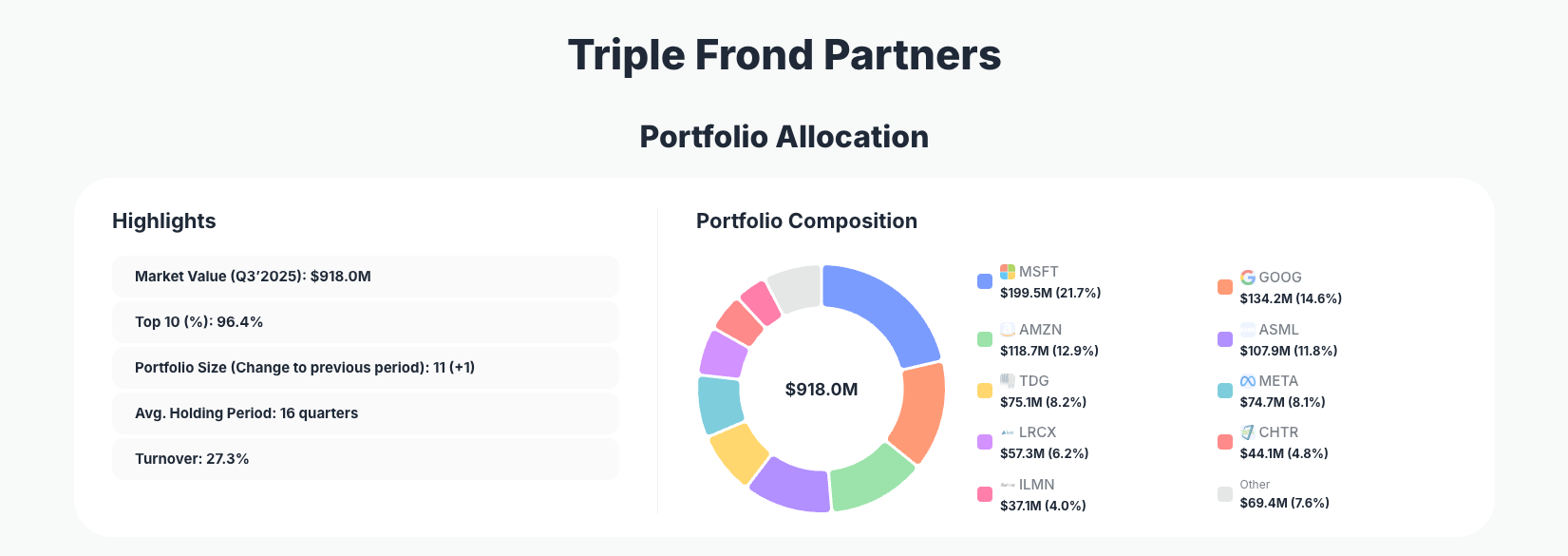

Triple Frond Partners continues to refine a tightly focused, high‑conviction equity strategy. Their Q3’2025 portfolio shows a $918.0M book dominated by mega‑cap tech, semiconductor leaders, and specialized data/analytics businesses, with meaningful trims to winners like Microsoft and Alphabet, sizable adds to cyclical compounders such as ASML and Amazon, and fresh capital deployed into names like Illumina and TransUnion.

Portfolio Overview: A Concentrated Bet on Structural Winners

Portfolio Highlights (Q3’2025): - Market Value: $918.0M

- Top 10 Holdings: 96.4%

- Portfolio Size: 11 +1

- Average Holding Period: 16 quarters

- Turnover: 27.3%

Triple Frond Partners runs an extremely concentrated portfolio, with 96.4% of capital in the top 10 positions despite holding 11 total names. Their Q3’2025 portfolio is effectively a collection of high‑conviction bets where each holding can materially impact overall performance. The average holding period of 16 quarters underscores a multi‑year investment horizon, even as turnover of 27.3% shows they are not afraid to actively rebalance when valuations or fundamentals shift.

The portfolio’s construction reflects a barbell of dominant platform businesses and mission‑critical infrastructure. On one side sit mega‑cap compounders like Microsoft, Alphabet, Amazon, and Meta Platforms. On the other are capital‑intensive, high‑moat operators such as ASML, Lam Research, and aerospace powerhouse TransDigm. This blend leans heavily into long‑duration growth and secular technology trends.

Despite this growth bias, the 27.3% turnover in the Triple Frond portfolio this quarter highlights disciplined risk management. Management trimmed several large winners (Microsoft, Alphabet, Meta, Lam Research, TransDigm) while aggressively adding to ASML and Amazon, and initiating or building positions in data and analytics names such as TransUnion and CCC Intelligent Solutions. The net effect is a portfolio still concentrated, but with risk redistributed toward perceived mispricings and underappreciated upside.

Top Holdings: Tech Platforms, Semis, and Data Monopolies

The Q3’2025 Triple Frond Partners portfolio is dominated by a tight group of 10–12 stocks, with every change this quarter conveying a clear message about conviction and valuation.

The largest position is Microsoft Corporation (MSFT), at 21.7% of the portfolio and $199.5M in value, even after a Reduce 4.43% move. This modest trim suggests profit‑taking and risk calibration rather than a change in thesis; Microsoft remains the cornerstone technology bet.

Close behind, Alphabet Inc. (GOOG) accounts for 14.6% of capital at $134.2M, but Triple Frond opted to Reduce 15.11% of the position. This larger trim indicates either valuation discipline after strong performance or a desire to reallocate into higher‑conviction opportunities elsewhere in the tech stack.

Amazon.com, Inc. (AMZN) sits at 12.9% of the portfolio, with $118.7M invested following an Add 10.93% decision. Increasing exposure to Amazon signals rising confidence in the company’s ongoing margin expansion, cloud dominance, and durable e‑commerce cash‑flow engine.

Perhaps the most striking move is in ASML Holding N.V. (ASML), now 11.8% of the portfolio at $107.9M after a sizeable Add 40.57%. This aggressive increase underscores a high‑conviction view on the structural demand for advanced lithography equipment, as ASML remains central to leading‑edge semiconductor manufacturing.

In aerospace and defense, TransDigm Group Incorporated (TDG) holds an 8.2% weight and $75.1M position, despite a Reduce 22.81% action. Trimming nearly a quarter of the stake indicates a deliberate move to lock in gains while still maintaining robust exposure to TransDigm’s high‑margin, aftermarket‑driven business model.

Social and advertising exposure comes mainly through Meta Platforms, Inc. (META), representing 8.1% of the portfolio at $74.7M. The Reduce 7.75% activity reflects cautious de‑risking after a strong run, while still keeping Meta as a core digital advertising and social ecosystem pillar.

Semiconductor capital equipment exposure is rounded out by Lam Research Corporation (LRCX), at 6.2% and $57.3M. Here, Triple Frond executed one of the largest trims, with a Reduce 39.45% move. This suggests a more pronounced valuation or cycle‑risk concern, or simply a rotation into ASML where they see a more attractive risk‑reward.

Within communications infrastructure, Charter Communications, Inc. (CHTR) stands at 4.8% of the book $44.1M with No change this quarter. Maintaining the stake untouched highlights Triple Frond’s steady conviction in cable broadband economics and Charter’s capital‑allocation track record.

Healthcare innovation enters through Illumina, Inc. (ILMN), a 4.0% position worth $37.1M, initiated or increased via a Buy action. This step indicates a willingness to look past near‑term noise and regulatory challenges to focus on Illumina’s long‑term role in genomics and sequencing.

In data and analytics, TransUnion (TRU) was added as a 3.9% position $36.1M with a Buy. Combined with Illumina and the platform holdings, this signals a broader theme around owning critical data infrastructure across credit, identity, and health.

Rounding out the list, CCC Intelligent Solutions Holdings Inc. (CCCS) now represents 3.6% of the portfolio at $33.4M after an Add 16.11%. This incremental build shows growing confidence in CCC’s position as a software and data provider to insurance and automotive ecosystems.

Across these 10–12 names, Triple Frond Partners is clearly doubling down on platforms, infrastructure, and proprietary data while selectively trimming over‑extended winners.

What the Portfolio Reveals About Triple Frond’s Strategy

Several core strategic themes emerge from the Q3’2025 positioning:

- Concentration in high‑quality growth

With 96.4% of assets in the top 10 names, Triple Frond is comfortable concentrating capital in businesses with durable moats, recurring revenue, and strong free‑cash‑flow potential. Mega‑cap tech and semis like MSFT, GOOG, AMZN, ASML, and LRCX embody this bias. - Secular technology and data‑infrastructure focus

From cloud and AI leaders (Microsoft, Alphabet, Meta) to semiconductor equipment (ASML, Lam Research) and specialized data providers (TransUnion, CCC Intelligent Solutions), the portfolio leans into secular digitalization and data‑driven decision‑making. - Selective cyclicality via aerospace and communications

Holdings like TransDigm and Charter Communications introduce exposure to aerospace and broadband, sectors with resilient demand profiles but some economic sensitivity. Trims in TransDigm this quarter reflect active cycle‑aware risk management. - Active, valuation‑driven rebalancing

Despite a 16‑quarter average holding period, the 27.3% turnover and multiple Reduce/Add/Buy actions show Triple Frond is not passive. They are willing to trim positions that have rerated (GOOG, META, LRCX, TDG) and reallocate to names where expected return has improved (ASML, AMZN, TRU, CCCS, ILMN). - Long‑term horizon with tactical adjustments

The combination of long holding periods and meaningful quarterly moves suggests a strategy that anchors on multi‑year theses while still acknowledging short‑term dislocations, volatility, and valuation extremes.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Microsoft Corporation (MSFT) | $199.5M | 21.7% | Reduce 4.43% |

| Alphabet Inc. (GOOG) | $134.2M | 14.6% | Reduce 15.11% |

| Amazon.com, Inc. (AMZN) | $118.7M | 12.9% | Add 10.93% |

| ASML Holding N.V. (ASML) | $107.9M | 11.8% | Add 40.57% |

| TransDigm Group Incorporated (TDG) | $75.1M | 8.2% | Reduce 22.81% |

| Meta Platforms, Inc. (META) | $74.7M | 8.1% | Reduce 7.75% |

| Lam Research Corporation (LRCX) | $57.3M | 6.2% | Reduce 39.45% |

| Charter Communications, Inc. (CHTR) | $44.1M | 4.8% | No change |

| Illumina, Inc. (ILMN) | $37.1M | 4.0% | Buy |

These top positions alone account for nearly the entire $918.0M portfolio, illustrating a barbell of mega‑cap platforms and niche leaders. The top four holdings—Microsoft, Alphabet, Amazon, and ASML—collectively represent over 60% of assets, making their performance the primary driver of fund returns.

The pattern of partial trims in Microsoft, Alphabet, Meta, Lam Research, and TransDigm juxtaposed with aggressive adds in ASML and Amazon, plus a Buy in Illumina, highlights Triple Frond’s calibration of both factor and company‑specific risk. They retain outsized exposure to tech and semis but have redistributed capital toward names where they see a superior forward risk‑reward profile, while keeping long‑term compounders at the core.

Investment Lessons from Triple Frond Partners’ Approach

Triple Frond’s Q3’2025 13F offers several actionable investment principles:

- Concentrate when conviction is high

Running 11 positions with 96.4% in the top 10 demonstrates how conviction and deep research can justify concentration, as long as risk is monitored. - Let winners run, but trim when risk builds

Reductions in GOOG, META, LRCX, and TDG show the balance between respecting momentum and taking profits when valuations stretch. - Add aggressively when conviction increases

The Add 40.57% in ASML and Add 10.93% in AMZN exemplify sizing up positions when thesis clarity and upside improve. - Own critical infrastructure in key value chains

From cloud and search (MSFT, GOOG) to lithography and wafer‑fab equipment (ASML, LRCX), aerospace components (TDG), and data/analytics (TRU, CCCS), Triple Frond emphasizes businesses that sit at chokepoints in global economic systems. - Think in years, act quarterly

A 16‑quarter average holding period paired with 27.3% turnover shows that long‑term investors can still use quarterly reviews to refine portfolios, without abandoning core theses.

Looking Ahead: What Comes Next?

Based on current positioning, several forward‑looking implications stand out:

- Continued leverage to AI and cloud

Heavy weights in Microsoft, Alphabet, and Amazon mean Triple Frond will remain highly sensitive to AI adoption, cloud‑spend trends, and digital advertising cycles. - Semiconductor cycle exposure with a tilt toward structural winners

The positioning in ASML and Lam Research keeps the fund exposed to semi capex volatility, but the strong add to ASML suggests a belief that leading‑edge lithography demand will outlast shorter‑term cyclical swings. - Growing bet on data and analytics ecosystems

New and expanded stakes in TransUnion, CCC Intelligent Solutions, and Illumina hint that future additions could continue along the theme of mission‑critical data and workflow software. - Dry powder from trims to redeploy

The meaningful reductions across multiple large holdings imply that, depending on market conditions, Triple Frond may have flexibility to initiate new positions or further increase existing ones if attractive dislocations appear.

For investors following Triple Frond’s style, the current mix suggests a posture prepared for continued volatility but anchored in structural secular growth.

FAQ about Triple Frond Partners’ Portfolio

Q: What were the most significant changes in Triple Frond Partners’ Q3’2025 portfolio?

The standout changes were a 40.57% add to ASML, a 10.93% add to Amazon, and fresh or expanded Buy positions in Illumina and TransUnion, offset by notable reductions in Alphabet (‑15.11%), Lam Research (‑39.45%), and TransDigm (‑22.81%).

Q: How concentrated is the Triple Frond Partners portfolio?

The fund holds 11 positions, with 96.4% of assets in the top 10 names, and the largest holding, Microsoft, alone at 21.7% of the portfolio. This reflects a highly concentrated, high‑conviction approach.

Q: Does Triple Frond Partners trade frequently?

Not excessively. The average holding period is 16 quarters, indicating multi‑year investment horizons, but a 27.3% turnover in Q3’2025 shows they actively rebalance and adjust position sizes when warranted.

Q: Which sectors or themes dominate Triple Frond’s holdings?

The portfolio is heavily tilted toward technology, semiconductors, and data infrastructure, via names like Microsoft, Alphabet, Amazon, ASML, Lam Research, Meta, TransUnion, CCC Intelligent Solutions, and Illumina, with additional exposure to aerospace (TransDigm) and communications (Charter).

Q: How can I track Triple Frond Partners’ holdings and changes over time?

You can follow Triple Frond’s positions through quarterly 13F filings, which U.S. institutional managers file up to 45 days after each quarter‑end. ValueSense aggregates these filings and provides visualizations, history, and change analysis on the dedicated superinvestor page: Triple Frond Partners’ portfolio.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!