Tudor Investment Corp Et Al Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

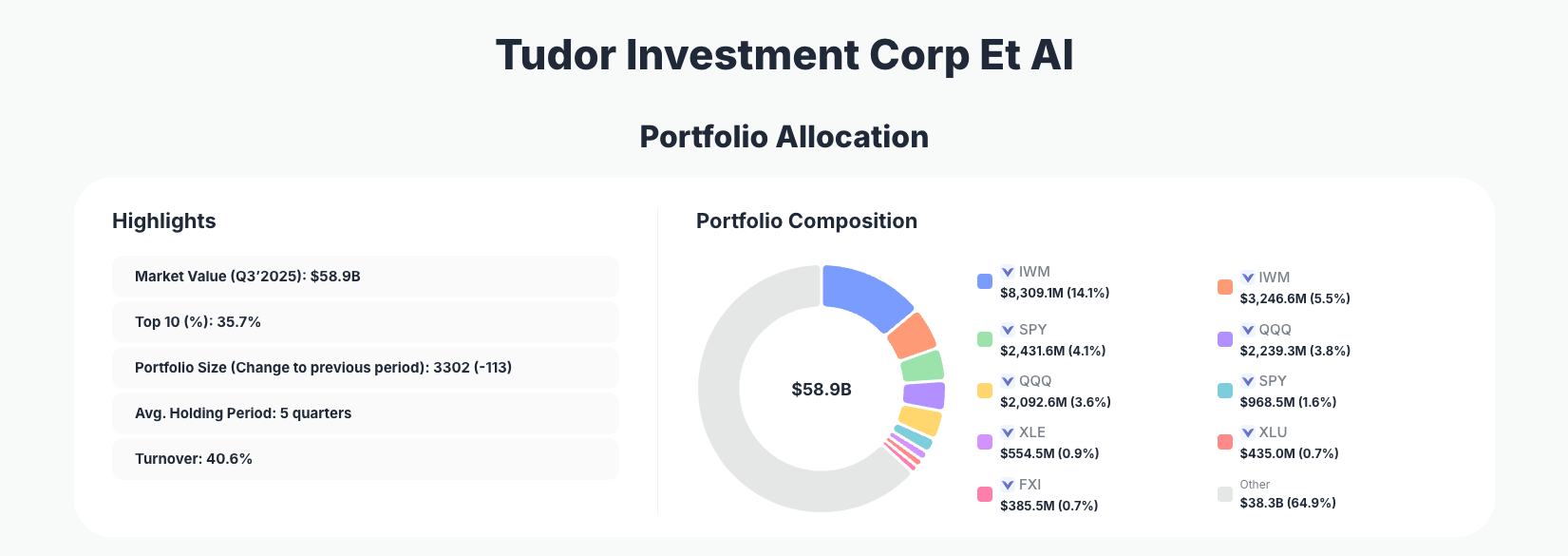

Tudor Investment Corp Et Al, the multi-strategy hedge fund founded by legendary macro trader Paul Tudor Jones, continues to use its 13F book as a highly tactical expression of macro views and risk hedges. Its $58.9B Q3’2025 portfolio is dominated by index and sector ETFs, with meaningful shifts across small caps, the S&P 500, growth-heavy Nasdaq exposure, and targeted sector funds that reveal how the firm is positioning for volatility, rate dynamics, and global growth dispersion.

Analyze Tudor Investment Corp Et Al 13F on ValueSense

Portfolio Overview: Macro Engineered, ETF-Heavy Positioning

Portfolio Highlights (Q3’2025): - Market Value: $58.9B

- Top 10 Holdings: 35.7%

- Portfolio Size: 3302 -113

- Average Holding Period: 5 quarters

- Turnover: 40.6%

The Q3’2025 13F shows that Tudor’s portfolio remains broadly diversified by line items but highly concentrated in exposure terms through a handful of large ETF positions. With 3,302 reported holdings, the fund clearly runs a complex, multi-layered book, yet the top 10 alone account for 35.7% of disclosed long equity value, underscoring the importance of a few key index and sector bets.

A 40.6% turnover combined with a 5-quarter average holding period suggests an actively traded, yet not purely high-frequency, approach in the 13F sleeve. Rather than individual stock picking dominating the top of the book, Tudor Investment’s 13F portfolio is being used as a macro and factor exposure tool: large positions in small-cap, S&P 500, Nasdaq-100, energy, utilities, and China large caps offer flexible levers to express views on growth, inflation, policy, and regional risk.

The reduction in total positions by 113 names versus the prior quarter indicates some pruning of smaller lines while doubling down on liquid ETF structures. For investors tracking Tudor’s holdings, the message is clear: this is a macrocentric, risk-managed book where ETFs sit at the center of the playbook, not an ultra-concentrated stock-picker’s portfolio.

Top Holdings Overview: Indexes, Sectors, and China Exposure

The core of the Q3’2025 13F is built around major ETF exposures, with all of the key disclosed changes occurring in these instruments rather than single-stock bets.

The largest position is the iShares Russell 2000 ETF (US ETP), appearing twice in the top rankings. One line of the Russell 2000 shows a massive 14.1% portfolio weight with 34,340,900 shares and an action of “Reduce 1.94%”, indicating a modest trim while keeping it as a dominant expression of small-cap exposure. A second Russell 2000 line at 5.5% of the portfolio (13,418,100 shares) is marked “Reduce 60.93%”, signaling a significant downsize in an additional sleeve of the same small‑cap index exposure.

On the large-cap side, SPDR S&P 500 ETF Trust (US ETP) is a crucial lever. One SPY line at 4.1% of the portfolio (3,650,000 shares) carries a striking “Add 29,335.48%” tag, pointing to a massive ramp-up in this exposure during the quarter. Another SPY line at 1.6% of the book (1,453,780 shares) shows “Reduce 26.87%”, implying active rebalancing across different S&P 500 sleeves or strategies while netting to a strong overall S&P 500 tilt.

Growth and tech-heavy exposure comes through Invesco QQQ Trust Series 1 (US ETP), which appears in two major entries. One QQQ position at 3.8% of the portfolio (3,729,900 shares) registers “Add 7.01%”, while another at 3.6% (3,485,500 shares) is a fresh “Buy”. Together, these two lines show that Tudor is steadily increasing its exposure to Nasdaq-100 growth names, potentially reflecting a constructive view on large-cap tech or a desire to balance cyclical and rate-sensitive bets.

Sector tilts are expressed via Energy Select Sector SPDR Fund (US ETP) and Utilities Select Sector SPDR Fund (US ETP). Energy stands at 0.9% of the reported portfolio (6,206,200 shares) with a clear “Buy” action, while utilities account for 0.7% (4,988,300 shares), also labeled as “Buy”. These moves suggest a deliberate rotation into defensives and real-asset-linked sectors—energy for inflation and commodity dynamics, utilities for yield and defensive cash flows.

International and China risk is introduced through the iShares China Large-Cap ETF (US ETP), which again appears in more than one line. One China Large-Cap ETF position sits at 0.7% of the book (9,370,900 shares) with a small “Add 0.41%”; another nearby entry (rank 11) shows 9,332,200 shares at 0.7% of the portfolio with an aggressive “Add 359.58%”. Together, these data points highlight a notable ramp-up in China large-cap exposure from a previously small base, despite global investors’ cautious stance on the region.

Across these 10–11 key ETF holdings, the pattern is consistent: rather than incremental stock picks, Tudor is using large, liquid index and sector ETFs to rapidly adjust factor exposure—small caps vs large caps, growth vs broad market, US vs China, and cyclical vs defensive sectors.

What the Portfolio Reveals About Current Strategy

Several themes emerge from Tudor Investment Corp Et Al’s Q3’2025 positioning:

- Macro and factor-driven, not stock-specific

The dominance of broad ETFs such as the Russell 2000, SPDR S&P 500, Invesco QQQ, and iShares China Large-Cap indicates that this 13F sleeve is primarily a macro and factor-expression toolkit rather than a bottom‑up stock selection portfolio. - Barbell between growth and cyclicals

Significant allocations to Nasdaq-100 (Invesco QQQ Trust) alongside energy and utilities sector ETFs show a barbell: growth and tech on one side, inflation- and rate-sensitive cyclicals/defensives on the other, giving Tudor flexibility across different macro scenarios. - Active risk management via trims and adds

Actions like “Reduce 60.93%” in one Russell 2000 line while only “Reduce 1.94%” in another, or “Add 29,335.48%” in a SPDR S&P 500 sleeve, highlight very active management of exposure sizing—consistent with a trading-oriented macro fund. - Selective re‑engagement with China

The “Add 359.58%” move in the iShares China Large-Cap ETF suggests a tactical, perhaps contrarian willingness to allocate to Chinese large caps from a previously low base, potentially as valuations compress or policy signals shift.

Overall, the strategy appears to combine liquidity, flexibility, and macro optionality, using ETFs as building blocks to rapidly reposition as macro conditions evolve.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Ishares Russell 2000 Etf - US ETP (Rank 2) | $8,309.1M | 14.1% | Reduce 1.94% |

| Ishares Russell 2000 Etf - US ETP (Rank 3) | $3,246.6M | 5.5% | Reduce 60.93% |

| Spdr S&P 500 Etf Trust - US ETP (Rank 4) | $2,431.6M | 4.1% | Add 29,335.48% |

| InvesCo Qqq Trust Series 1 - US ETP (Rank 5) | $2,239.3M | 3.8% | Add 7.01% |

| InvesCo Qqq Trust Series 1 - US ETP (Rank 6) | $2,092.6M | 3.6% | Buy |

| Spdr S&P 500 Etf Trust - US ETP (Rank 7) | $968.5M | 1.6% | Reduce 26.87% |

| Energy SeleCt SeCtor Spdr Fund - US ETP (Rank 8) | $554.5M | 0.9% | Buy |

| Utilities SeleCt SeCtor Spdr Fund - US ETP (Rank 9) | $435.0M | 0.7% | Buy |

| Ishares China Large-Cap Etf - US ETP (Rank 10) | $385.5M | 0.7% | Add 0.41% |

The concentration table makes clear that a single ETF family—iShares Russell 2000—controls nearly 20% of the entire reported portfolio when combining its two top entries. Adding the prominent SPDR S&P 500 and Invesco QQQ allocations brings the combined weight of broad US index and Nasdaq exposure to well over a quarter of the portfolio, confirming that macro beta and factor tilts drive the risk budget.

Below these core index exposures, sector and regional ETFs such as Energy Select Sector, Utilities Select Sector, and iShares China Large-Cap are still meaningful, each just under 1% of the total book but large in nominal dollar terms. These allow Tudor to fine-tune sector and geographic risk without taking concentrated single-stock risk.

Investment Lessons from Tudor Investment’s Macro ETF Playbook

For retail investors studying the Tudor Investment Corp Et Al portfolio Q3’2025, several practical lessons emerge:

- Use broad ETFs to express macro views

Instead of making dozens of small stock bets, Tudor shows how a few large ETF positions can efficiently represent views on small caps, large caps, tech growth, energy, utilities, and China. - Position sizing is a primary risk lever

Changes like “Reduce 60.93%” or “Add 29,335.48%” emphasize that how much you own is often more important than what you own. Risk is managed continuously by resizing exposures. - Diversification can coexist with concentration

While the total book spans 3,302 positions, real economic exposure is concentrated in a tight set of macro ETFs. Investors can similarly hold many smaller lines yet keep true risk centered in a core group of convictions. - Be willing to rotate between factors and regions

Tudor’s increased exposure to QQQ and China large caps, alongside sector bets in energy and utilities, demonstrates flexibility in shifting between growth, defensives, and geographies as conditions evolve. - Think in terms of scenarios, not single outcomes

The barbell between tech growth and defensives suggests preparation for multiple macro regimes (soft landing, re‑acceleration, or renewed volatility), rather than a one‑way bet.

Looking Ahead: What Comes Next for Tudor’s 13F Book?

Based on the current Q3’2025 positioning, several forward-looking implications stand out:

- Room to further adjust US beta

With large exposures to Russell 2000 and SPDR S&P 500 ETFs, Tudor can easily dial US equity beta up or down by adding or trimming these positions as macro data and Fed policy evolve. - Monitoring tech and growth sentiment via QQQ

The increased stakes in Invesco QQQ suggest confidence (or at least optionality) in large‑cap tech. Future quarters will show whether Tudor continues to build this position or locks in gains if volatility resurfaces. - Energy and utilities as macro hedges

Buys in the Energy and Utilities Select Sector SPDR funds provide inflation and rate‑regime diversification. If inflation reaccelerates or rates remain higher for longer, these exposures could act as stabilizers. - China positioning as a key signal

The sharp percentage increase in iShares China Large-Cap ETF from a low base makes this a critical watchpoint. Further adds would signal growing conviction; reversals would suggest that the move was a short‑term tactical trade.

Investors tracking Tudor via ValueSense’s Tudor portfolio page can use future 13F updates to see whether the fund leans more into risk assets, rotates defensively, or further diversifies internationally.

FAQ about Tudor Investment Corp Et Al Portfolio

Q: What were the most significant changes in Tudor’s Q3’2025 13F portfolio?

The biggest changes were large adjustments in ETF exposures: a 29,335.48% add in one SPDR S&P 500 ETF sleeve, a 60.93% reduction in one iShares Russell 2000 ETF line, incremental adds and a Buy in Invesco QQQ Trust positions, and aggressive percentage additions in the iShares China Large-Cap ETF from a previously smaller base.

Q: How concentrated is the Tudor Investment portfolio?

While Tudor reports 3,302 positions, the top 10 holdings represent 35.7% of the total reported $58.9B portfolio, and just a few ETF families (Russell 2000, SPDR S&P 500, Invesco QQQ) account for a large share of overall exposure.

Q: Does this 13F reflect Tudor’s entire strategy?

No. The 13F only discloses long US-listed equity and certain ETF positions above reporting thresholds. It does not show short positions, derivatives, macro futures, or other asset classes that are central to Tudor’s broader multi-strategy and macro trading approach.

Q: How does Tudor manage risk in this portfolio?

Risk is primarily managed through position sizing and ETF selection. Frequent trims and adds in broad index and sector ETFs allow the firm to quickly adjust beta, sector tilts, and geographic exposure without incurring the idiosyncratic risk of concentrated single-stock bets.

Q: How can I track Tudor Investment Corp Et Al’s latest holdings and changes?

You can follow quarterly changes in Tudor’s 13F on the SEC website, but a more convenient way is using the ValueSense superinvestor tracker at Tudor Investment’s portfolio, which aggregates holdings, highlights adds/reductions, and visualizes exposure trends. Remember that 13F filings are reported with a lag of up to 45 days after quarter-end, so positions may have changed since the reported date.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!