Undervalued Cloud Computing Stocks November 2025: Pure-Play Opportunities

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The cloud computing revolution continues to transform how businesses operate, creating substantial long-term investment opportunities. Despite the sector's proven growth trajectory, several high-quality cloud computing stocks are trading at attractive valuations in November 2025. Our comprehensive analysis identifies compelling opportunities across both established cloud leaders and emerging pure-play companies.

The cloud computing market has matured significantly, with enterprise adoption accelerating across all sectors. While growth rates have normalized from pandemic highs, the fundamental shift toward cloud-first architectures remains intact. This environment has created a dichotomy where investors can access both stable cloud leaders at reasonable valuations and high-growth pure-plays at compelling discounts.

Cloud Market Dynamics: Sustained Transformation

The global cloud computing market continues expanding at robust rates, driven by digital transformation initiatives, artificial intelligence adoption, and hybrid work requirements. Enterprise spending on cloud infrastructure, software-as-a-service (SaaS), and platform services shows no signs of deceleration despite macroeconomic uncertainties.

Key Market Drivers:

- AI Integration: Cloud platforms becoming essential infrastructure for AI workloads

- Digital Transformation: Enterprises accelerating cloud migration for operational efficiency

- Hybrid Work Models: Remote collaboration driving SaaS adoption across organizations

- Cost Optimization: Cloud services offering better economics than on-premise solutions

The mature market dynamics favor established players with proven execution capabilities while creating opportunities for specialized cloud service providers.

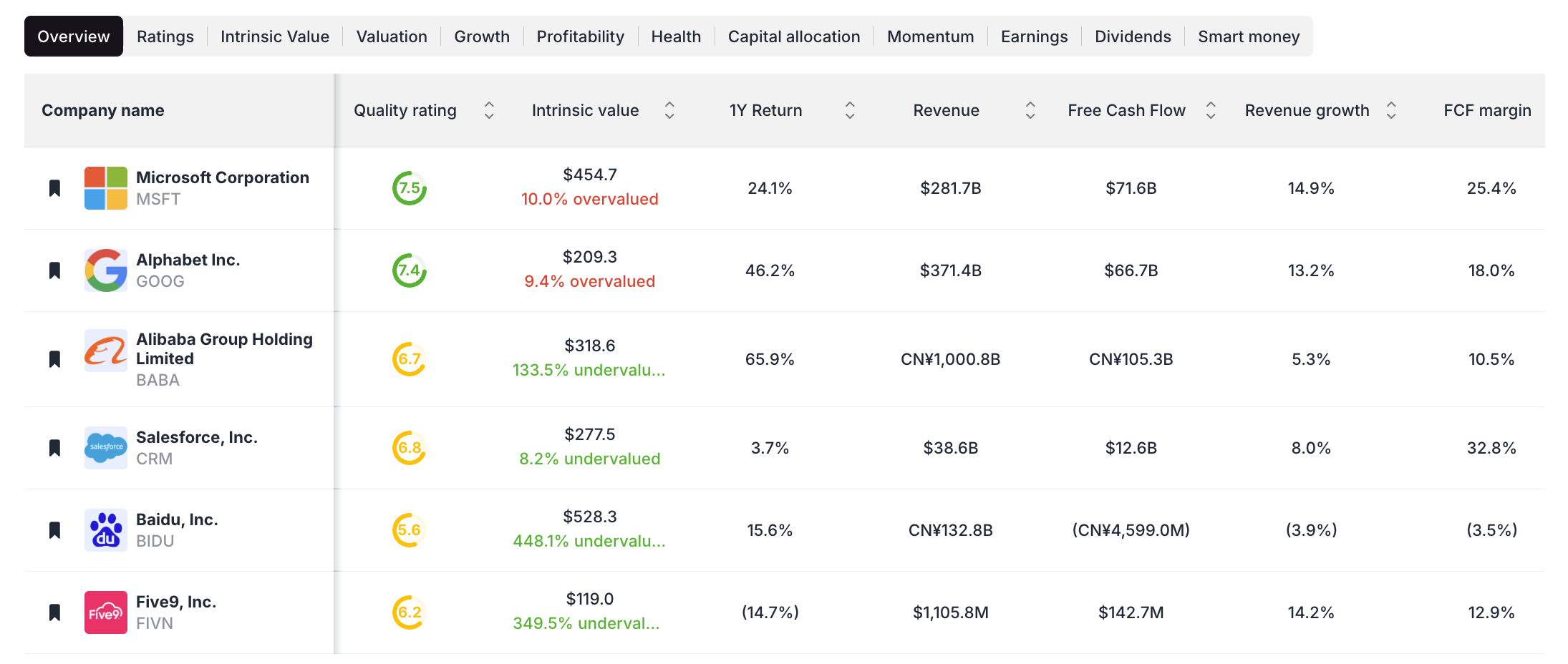

Undervalued Cloud Computing Leaders

Our analysis identifies several cloud computing stocks trading below intrinsic value estimates across different market segments and geographic regions.

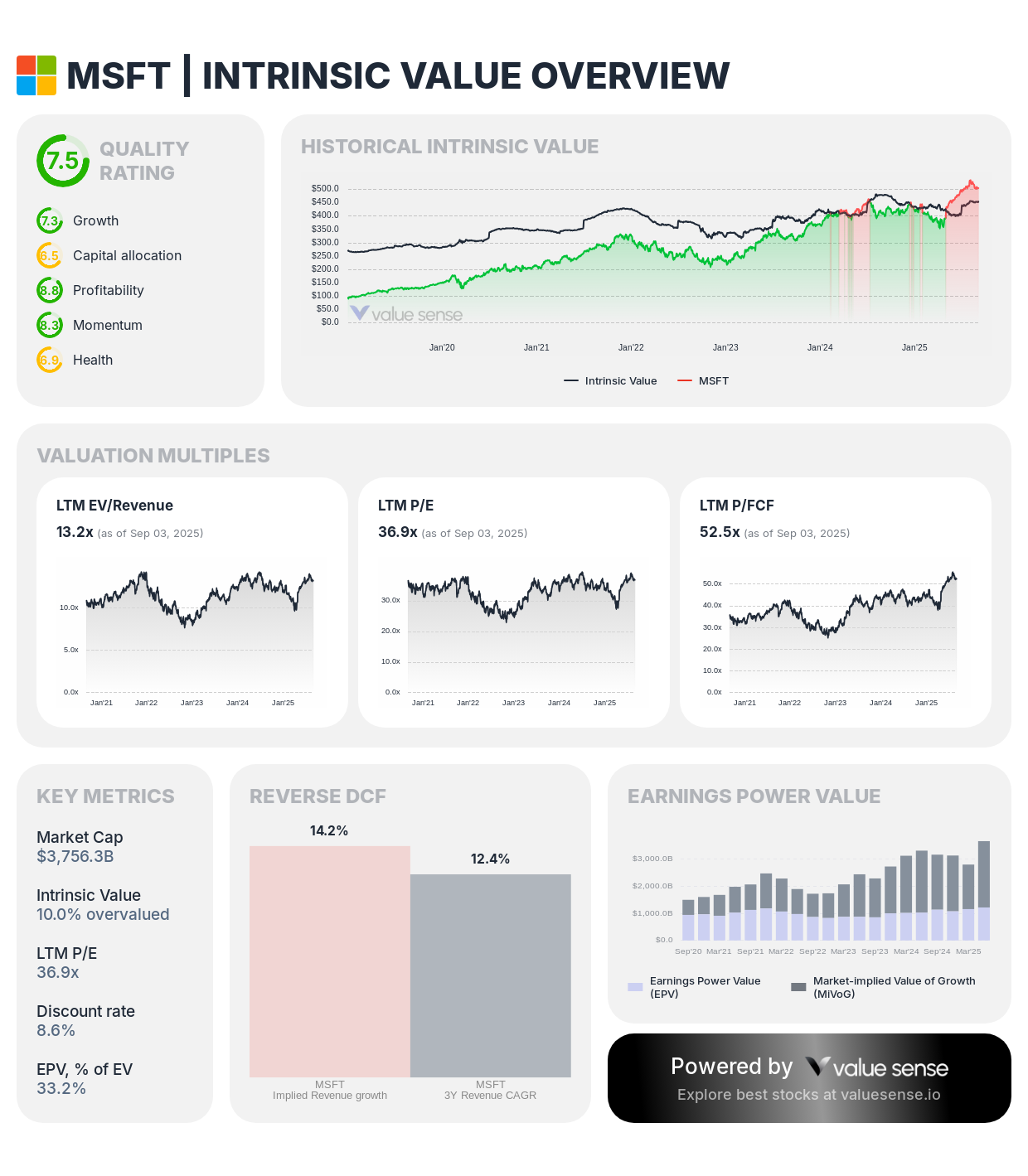

Microsoft Corporation (MSFT) - $454.7 Intrinsic Value

- Current Assessment: Trading near fair value with slight overvaluation across most metrics

- Relative Value: $512.4 suggests modest undervaluation potential

- Competitive Position: Dominant in productivity software and growing Azure market share

- Investment Merit: Quality growth at reasonable valuation despite premium pricing

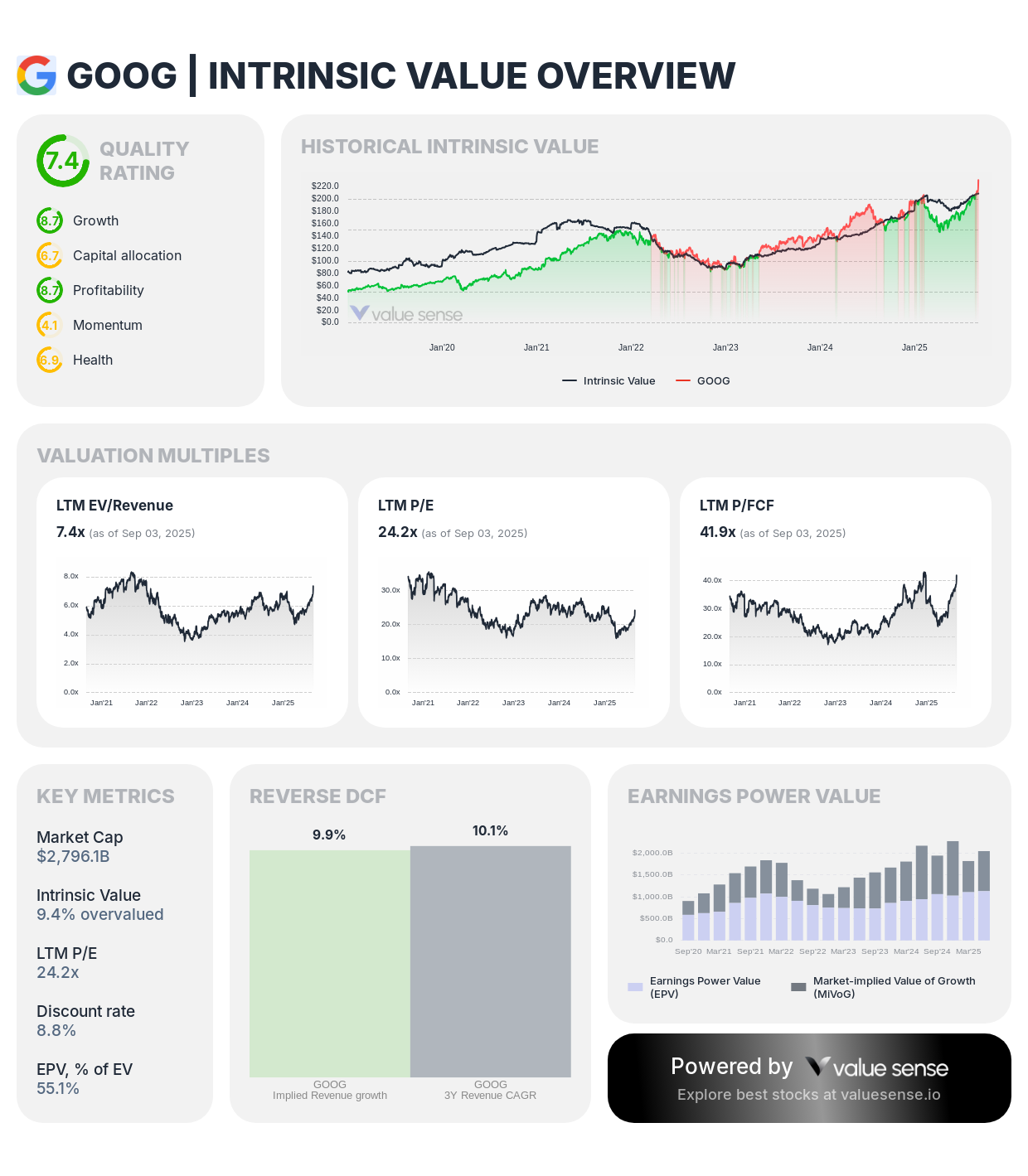

Alphabet Inc. (GOOG) - $209.3 Intrinsic Value

- Current Assessment: Mixed valuation signals with relative value showing upside potential

- Relative Value: $292.7 indicating significant undervaluation opportunity

- Cloud Growth: Google Cloud Platform gaining enterprise market share rapidly

- Investment Merit: Search dominance funding cloud expansion with strong fundamentals

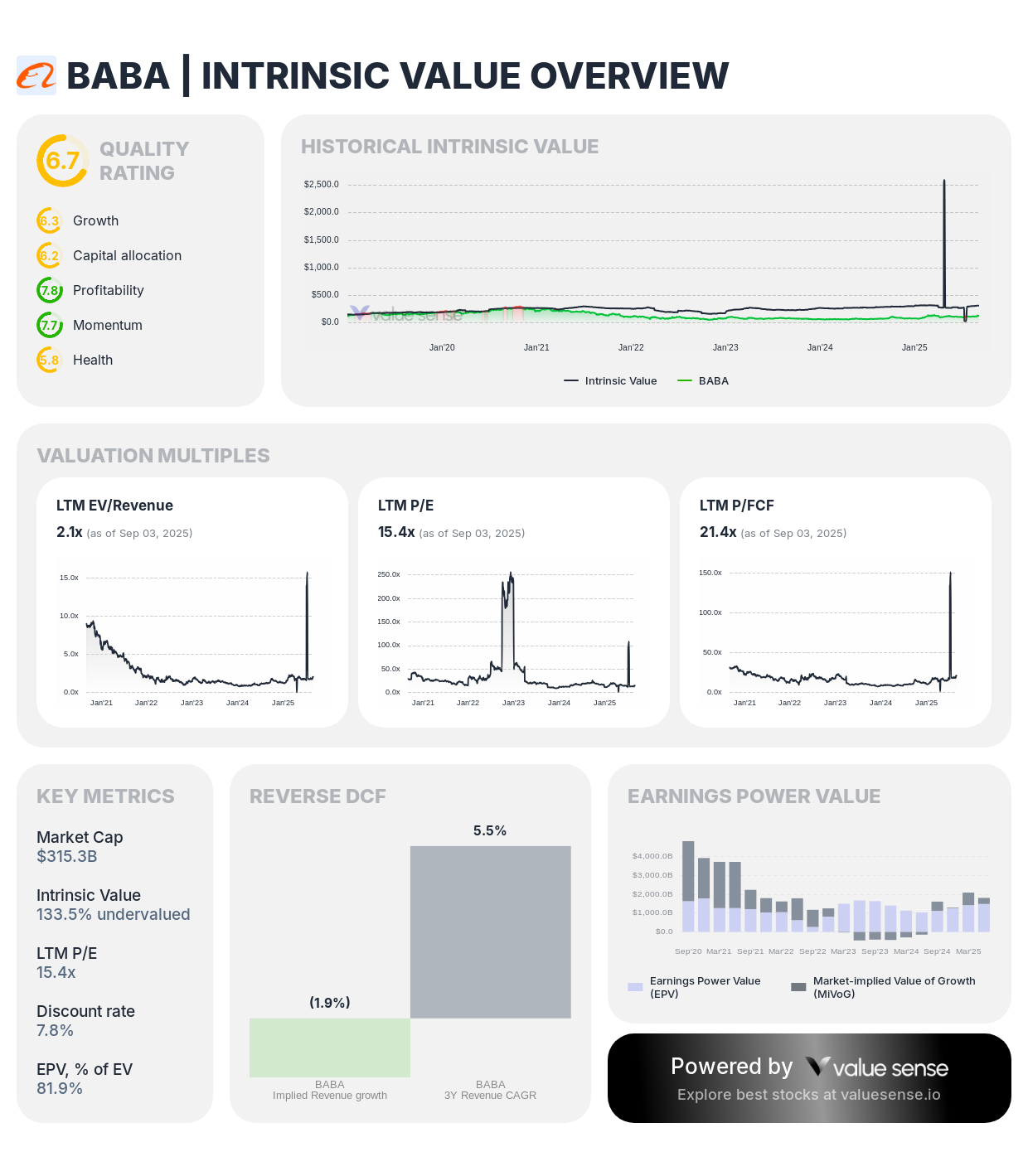

Alibaba Group (BABA) - $318.6 Intrinsic Value

- Current Assessment: Attractive valuation across multiple methodologies

- Relative Value: Substantial undervaluation at current levels

- Cloud Leadership: Dominant position in Asian cloud computing markets

- Investment Merit: Geographic diversification with strong technical capabilities

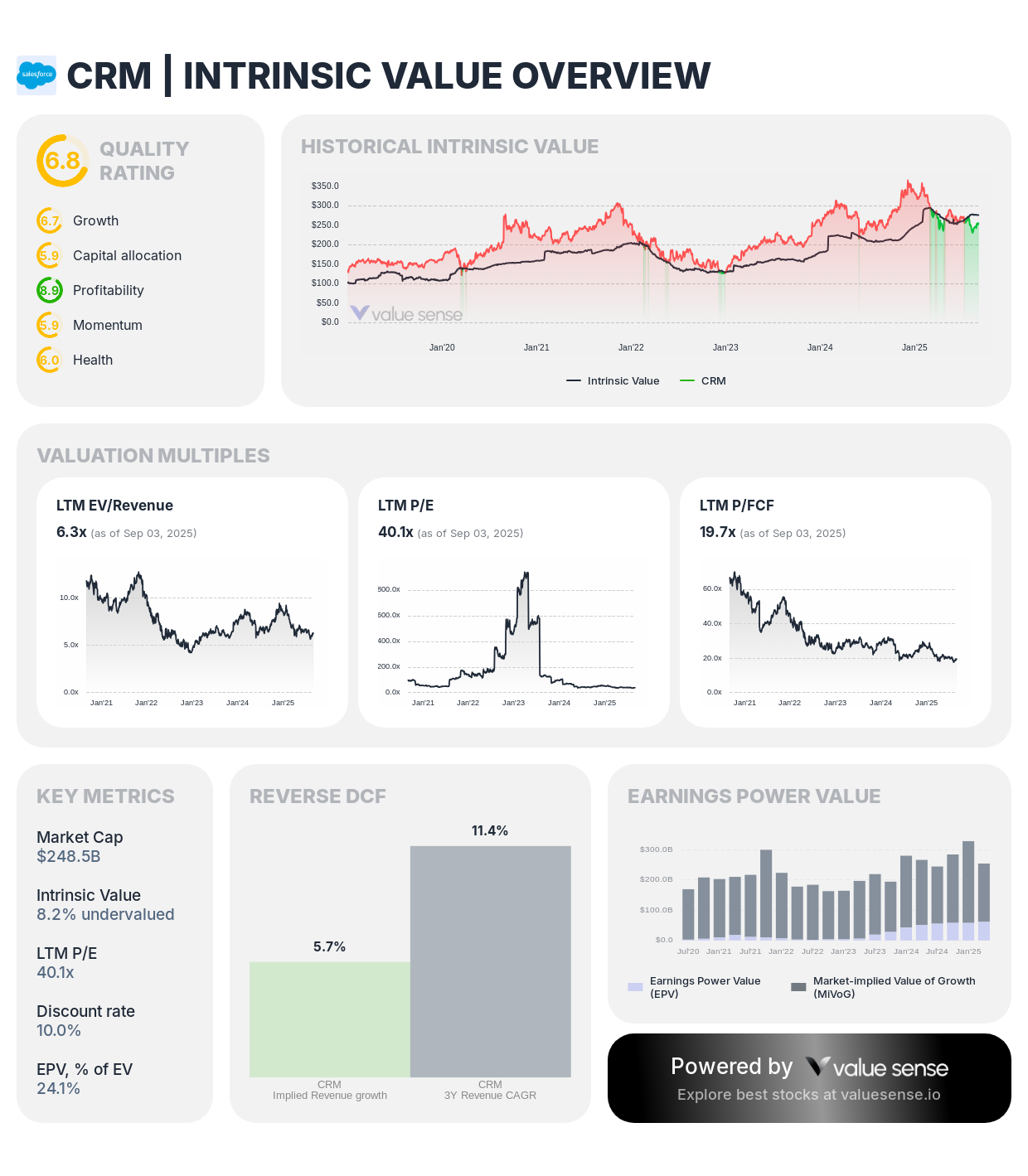

Salesforce, Inc. (CRM) - $277.5 Intrinsic Value

- Current Assessment: Modest undervaluation with strong fundamental metrics

- Market Position: Leading customer relationship management platform globally

- Growth Trajectory: Consistent revenue growth with expanding platform capabilities

- Investment Merit: Pure-play SaaS exposure with diversified product portfolio

Valuation Analysis: Multiple Methodologies

The cloud computing sector requires nuanced valuation approaches that consider both current profitability and long-term growth potential. Traditional metrics must be supplemented with cloud-specific indicators.

Key Valuation Insights:

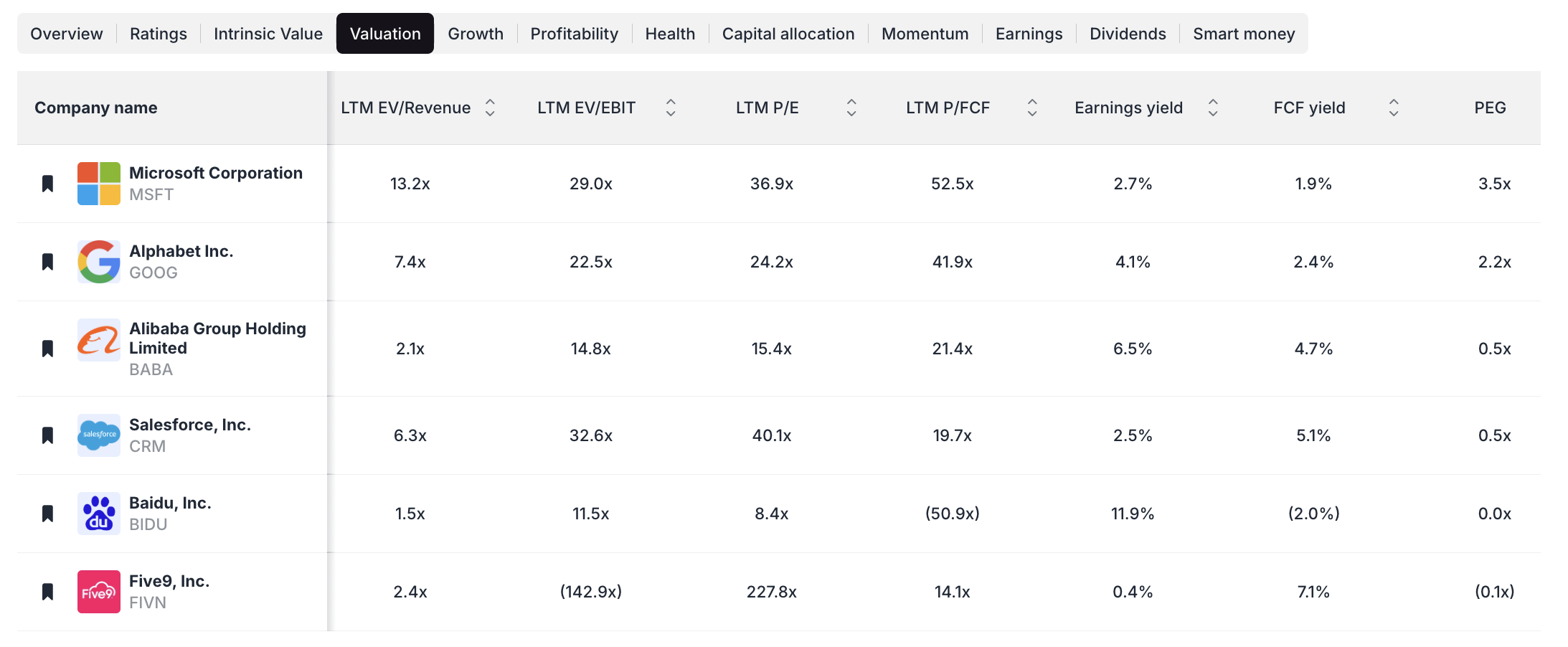

- EV/Revenue: 13.2x reflecting premium positioning and market leadership

- P/E Ratio: 36.9x reasonable for consistent double-digit growth

- FCF Yield: 1.9% supporting dividend and buyback programs

- Growth Quality: Sustainable competitive advantages justifying premium valuation

- EV/Revenue: 7.4x attractive for diversified technology platform

- P/E Ratio: 24.2x reasonable given search dominance and cloud growth

- FCF Yield: 2.4% with strong cash generation capabilities

- Investment Case: Undervalued relative to growth prospects and market position

- EV/Revenue: 2.1x significantly undervalued for leading market position

- P/E Ratio: 15.4x attractive for dominant e-commerce and cloud platform

- Earnings Yield: 6.5% providing strong current income potential

- Geographic Value: Asian market exposure at compelling valuation discount

- EV/Revenue: 6.3x reasonable for pure-play SaaS leader

- P/E Ratio: 40.1x reflecting premium growth characteristics

- FCF Yield: 5.1% demonstrating strong cash conversion

- Market Leadership: Dominant CRM position supporting premium valuation

Emerging Cloud Opportunities: High-Growth Potential

Beyond established leaders, several emerging cloud companies offer compelling growth potential at attractive valuations.

Baidu, Inc. (BIDU) - Cloud AI Focus

- Market Position: Leading artificial intelligence cloud services in China

- Valuation Metrics: Trading at reasonable multiples for AI-focused growth

- Growth Catalysts: Autonomous driving and AI platform development

- Investment Consideration: Exposure to Chinese technology innovation

Five9, Inc. (FIVN) - Contact Center Solutions

- Market Niche: Specialized cloud-based contact center solutions

- Growth Trajectory: Benefiting from customer experience automation trends

- Valuation Opportunity: Attractive entry point for specialized SaaS provider

- Market Expansion: Growing addressable market in customer service automation

These emerging opportunities provide exposure to specialized cloud segments with significant growth potential.

Sector-Specific Analysis: Cloud Computing Segments

The cloud computing ecosystem encompasses various segments, each with distinct characteristics and investment merits.

Infrastructure-as-a-Service (IaaS):

- Market Leaders: Amazon Web Services, Microsoft Azure, Google Cloud

- Growth Drivers: Enterprise migration, AI workloads, hybrid cloud adoption

- Investment Appeal: Recurring revenue model with strong customer retention

- Competitive Dynamics: Scale advantages favoring established platforms

Software-as-a-Service (SaaS):

- Market Characteristics: Higher margins, predictable revenue, customer stickiness

- Key Players: Salesforce, Microsoft 365, Adobe Creative Cloud

- Valuation Considerations: Premium multiples justified by business model quality

- Growth Outlook: Continued expansion across business functions and industries

Platform-as-a-Service (PaaS):

- Developer Focus: Tools and platforms for application development

- Market Dynamics: Critical for digital transformation initiatives

- Investment Merit: Sticky customer relationships with high switching costs

- Growth Potential: Accelerating as companies build cloud-native applications

Each segment offers different risk-return profiles suitable for various investment strategies.

Geographic Diversification: Global Cloud Opportunities

Cloud computing adoption varies significantly across global markets, creating diversified investment opportunities.

North American Market:

- Maturity Level: Advanced enterprise adoption with steady growth

- Key Players: Microsoft, Google, Salesforce dominating various segments

- Investment Characteristics: Stable growth with premium valuations

- Market Dynamics: Focus on AI integration and workflow optimization

Asian Markets:

- Growth Potential: Rapid digitization creating substantial opportunities

- Leading Companies: Alibaba Cloud, Baidu AI Cloud capturing market share

- Valuation Advantage: Often trading at discounts to Western peers

- Regulatory Considerations: Government policies supporting domestic cloud providers

European Markets:

- Regulatory Environment: Data sovereignty requirements creating opportunities

- Growth Drivers: GDPR compliance and digital transformation initiatives

- Investment Access: Primarily through global players with European operations

- Market Characteristics: Emphasis on privacy and regulatory compliance

Geographic diversification helps reduce concentration risk while accessing different growth trajectories.

Investment Strategy: Portfolio Construction Approaches

Successful cloud computing investment requires strategic allocation across different market segments and company sizes.

Core Holdings Strategy (60-70% of cloud allocation):

- Microsoft: Diversified cloud platform with enterprise dominance

- Alphabet: Search funding cloud expansion with AI capabilities

- Salesforce: Pure-play SaaS leader with market-leading position

Growth Opportunities (20-30% of allocation):

- Alibaba: Asian cloud leadership at attractive valuation

- Emerging SaaS: Specialized providers in high-growth niches

- AI-Focused Platforms: Companies leveraging artificial intelligence

Speculative Positions (5-15% of allocation):

- Early-Stage Cloud Companies: Higher risk, higher reward potential

- Regional Players: Geographic diversification beyond major markets

- Niche Solutions: Specialized cloud services with unique value propositions

This approach balances stability with growth potential while managing concentration risk.

Risk Assessment: Cloud Computing Investment Risks

Despite attractive growth prospects, cloud computing investments face several risk factors requiring careful consideration.

Competition Risks:

- Market Saturation: Increasing competition in mature cloud segments

- Price Pressure: Customer demands for lower costs impacting margins

- Technology Disruption: New architectures potentially obsoleting current platforms

- Customer Concentration: Dependence on large enterprise customers

Regulatory Risks:

- Data Privacy: Evolving regulations affecting cloud service delivery

- Antitrust Scrutiny: Large technology companies facing regulatory pressure

- International Relations: Geopolitical tensions impacting global cloud providers

- Compliance Costs: Increasing regulatory requirements raising operational expenses

Market Risks:

- Economic Sensitivity: Enterprise spending cuts during economic downturns

- Interest Rate Impact: Higher rates affecting growth stock valuations

- Currency Fluctuations: International operations exposed to exchange rate risk

- Cybersecurity Threats: Security breaches potentially damaging customer confidence

Growth Catalysts: Future Value Drivers

Several emerging trends support continued growth in cloud computing investments.

Artificial Intelligence Integration:

- AI Workloads: Increasing demand for cloud-based AI processing power

- Machine Learning Platforms: Growing adoption of AI development tools

- Data Analytics: Enhanced analytics capabilities driving cloud migration

- Automation Services: AI-powered workflow optimization creating new revenue streams

Edge Computing Evolution:

- Latency Requirements: Applications requiring processing closer to data sources

- IoT Integration: Internet of Things devices generating edge computing demand

- 5G Networks: Faster connectivity enabling new edge applications

- Hybrid Architectures: Combining cloud and edge computing for optimal performance

Industry-Specific Solutions:

- Healthcare Cloud: Specialized platforms addressing regulatory requirements

- Financial Services: Compliance-focused cloud solutions for banking

- Manufacturing: Industrial IoT and automation driving cloud adoption

- Education: Remote learning accelerating educational technology adoption

These catalysts support long-term growth prospects across the cloud computing ecosystem.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Intel Stock Turnaround: Undervalued Chip Giant

📖 Rule of 40 Stocks September 2025

FAQ - Undervalued SaaS stocks

Which cloud computing stocks offer the best value in 2025?

Based on our analysis, Alphabet (GOOGL) and Alibaba (BABA) offer the most compelling value opportunities, trading significantly below intrinsic value estimates. Salesforce (CRM) also presents attractive value for pure-play SaaS exposure. Microsoft (MSFT) trades closer to fair value but offers quality growth characteristics.

How do I evaluate cloud computing stocks differently from traditional tech stocks?

Cloud stocks require focus on recurring revenue quality, customer retention rates, and scalability metrics beyond traditional valuation measures. Key indicators include annual recurring revenue (ARR) growth, net revenue retention, customer acquisition costs, and lifetime value ratios. These metrics provide better insights into sustainable competitive advantages.

What are the main risks of investing in undervalued cloud stocks?

Primary risks include increasing competition pressuring margins, regulatory changes affecting data handling, economic slowdowns reducing enterprise spending, and technology disruption from new architectures. Additionally, many cloud stocks trade at premium valuations, making them sensitive to interest rate changes and growth expectation shifts.

Should I focus on established cloud leaders or emerging pure-play companies?

A balanced approach typically works best, with 60-70% allocated to established leaders like Microsoft and Google for stability, and 20-30% to pure-play companies like Salesforce for growth potential. This provides exposure to different risk-return profiles while managing concentration risk across the cloud computing ecosystem.

How does geographic diversification impact cloud computing investments?

Geographic diversification provides access to different growth rates and regulatory environments. Asian markets like China offer higher growth potential through companies like Alibaba, while developed markets provide stability. However, consider regulatory risks and currency exposure when investing in international cloud providers.