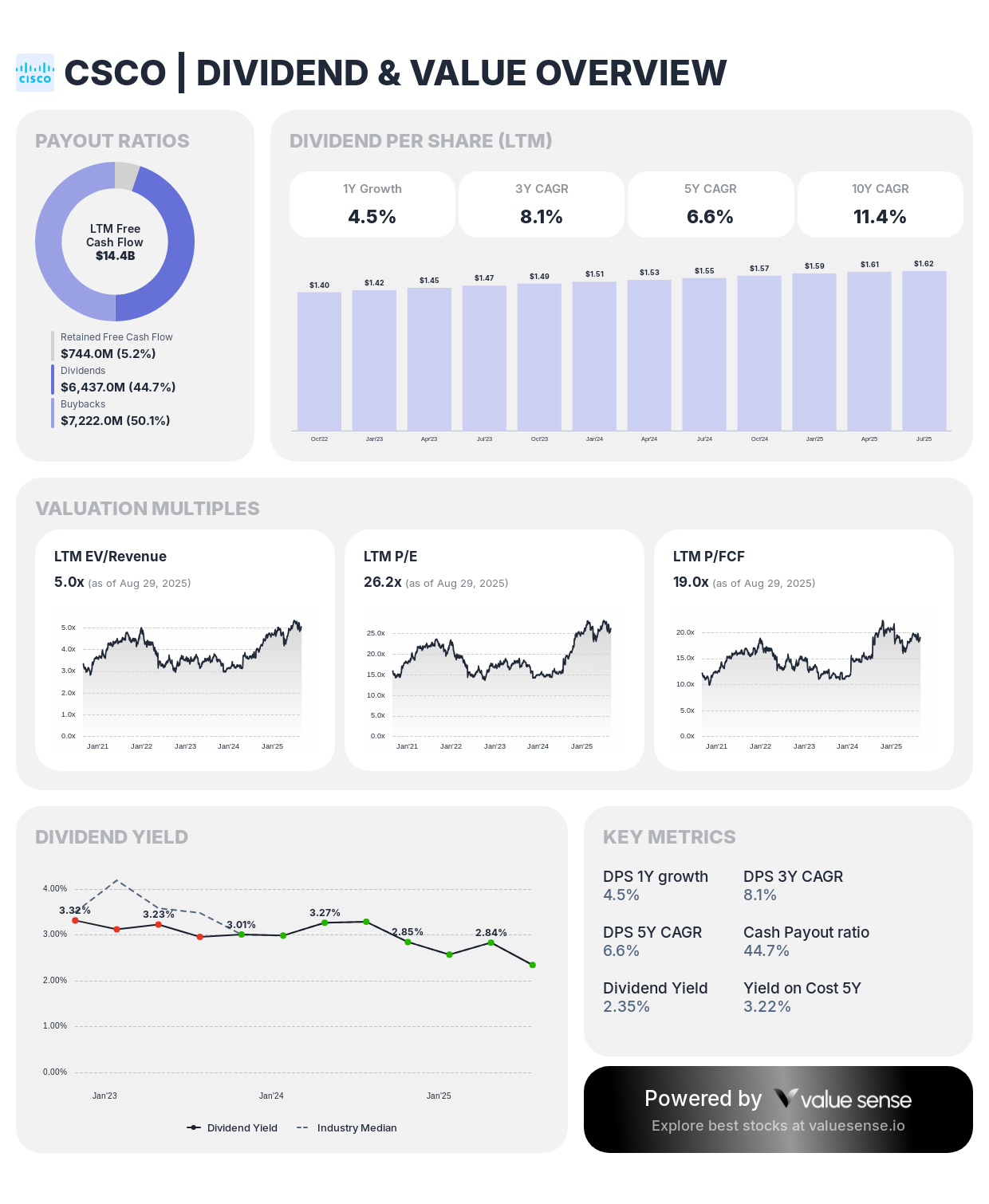

Undervalued Dividend Aristocrats September 2025: Income Value Strategy for Quality Dividends

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Our latest ValueSense analysis has uncovered compelling opportunities in the dividend aristocrat space that we believe deserve immediate attention from income-focused investors. While much of the market remains fixated on AI growth stories, we've identified several blue-chip dividend payers trading at significant discounts to their intrinsic values.

After running comprehensive valuations across multiple methodologies, we're seeing opportunities that rarely align this favorably. Companies with decades of dividend increases, sustainable payout ratios, and strong competitive positions are available at prices that seemed impossible just months ago.

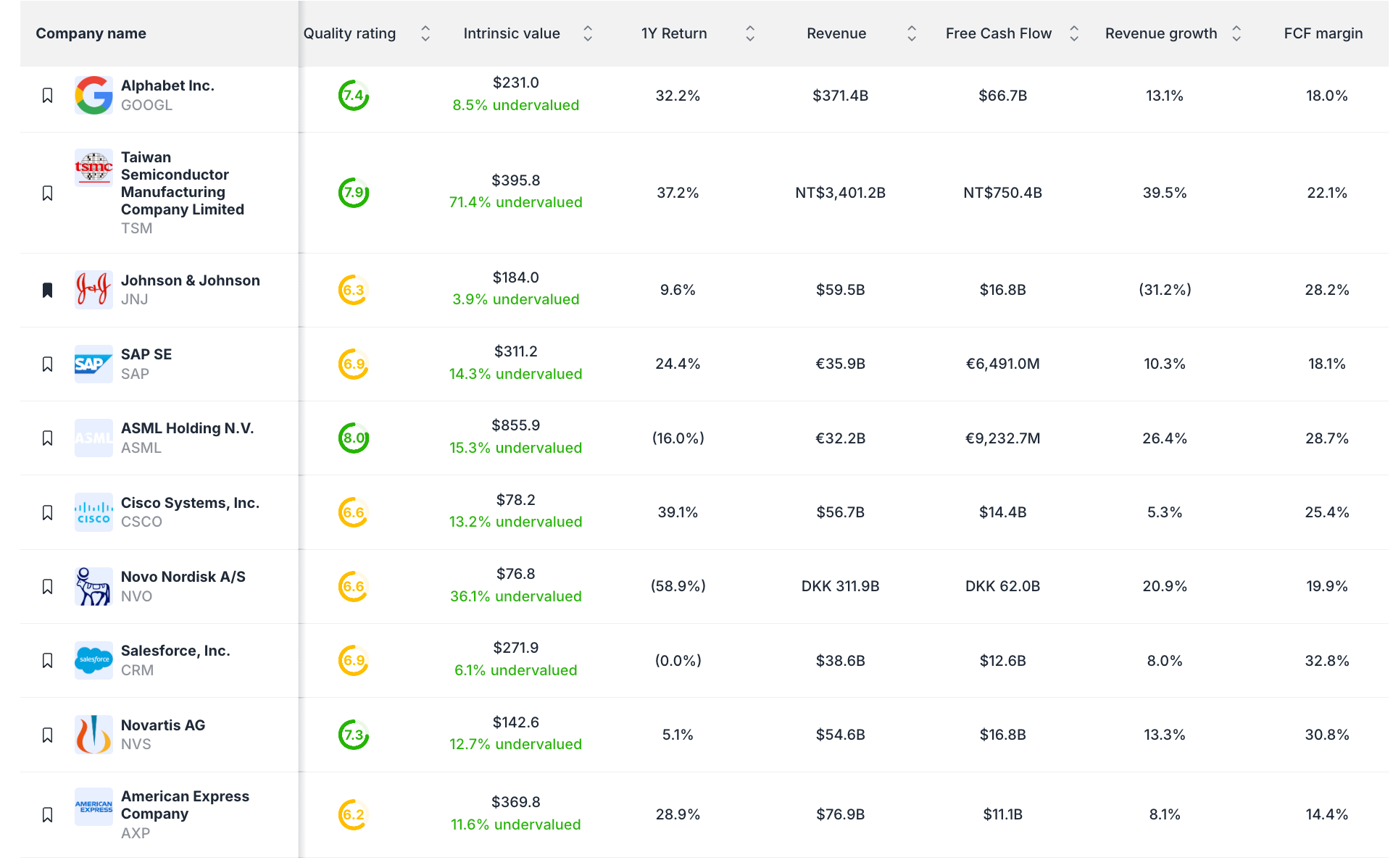

Taiwan Semiconductor: The Unexpected Dividend Value Play

Our most surprising finding comes from Taiwan Semiconductor (TSM), showing a massive 71.4% undervaluation in our intrinsic value calculations. While TSM isn't traditionally considered a dividend-focused investment, the numbers present a compelling case.

The current 0.8% dividend yield appears modest, but the underlying metrics tell a different story. TSM maintains an extremely conservative 28.1% dividend payout ratio and only 39.7% cash flow payout ratio. With NT$750.4B in free cash flow generation and 39.5% revenue growth, this represents significant dividend growth potential.

Our multi-methodology approach confirms the undervaluation thesis: 173% undervalued on relative metrics and over 1,000% using Ben Graham analysis. Even applying conservative haircuts to these numbers, TSM represents exceptional value for a company positioned at the center of global semiconductor demand.

Key Investment Metrics:

- Undervaluation: 71.4% below intrinsic value

- Quality Rating: A+ (Exceptional fundamentals)

- Payout Safety: 28.1% dividend ratio, 39.7% cash flow coverage

- Growth Profile: 39.5% revenue growth with 22.1% FCF margins

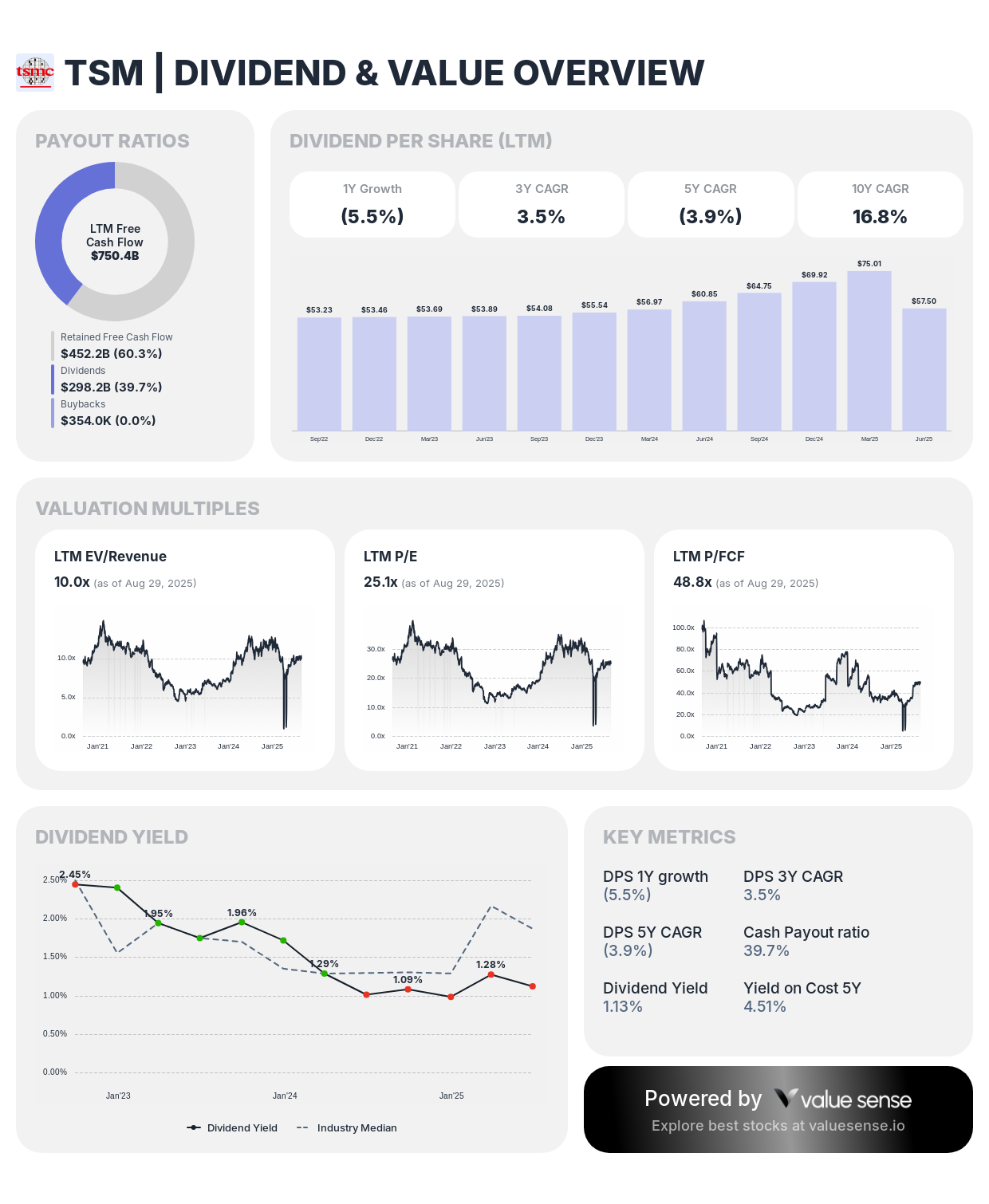

Novo Nordisk: Healthcare Dividend Champion with Growth Runway

Our analysis identifies Novo Nordisk (NVO) as trading 36.1% below intrinsic value while offering a compelling combination of current yield and growth potential. The 3.2% dividend yield supported by 20.7% annual dividend growth creates an attractive total return profile.

The company's dominant position in diabetes care and breakthrough obesity treatments provides defensive healthcare characteristics with significant growth optionality. Our evaluation shows sustainable dividend fundamentals with a 45.6% payout ratio well-covered by strong cash generation.

Financial Strength Indicators:

- Revenue Scale: $311.9B with 20.9% growth

- Cash Generation: $62.0B free cash flow

- Dividend Growth: 20.7% one-year, 30.4% three-year growth

- Margin Profile: 19.9% FCF margin supporting sustainability

The obesity treatment market expansion provides a multi-year growth catalyst that our models suggest the market hasn't fully recognized in current valuations.

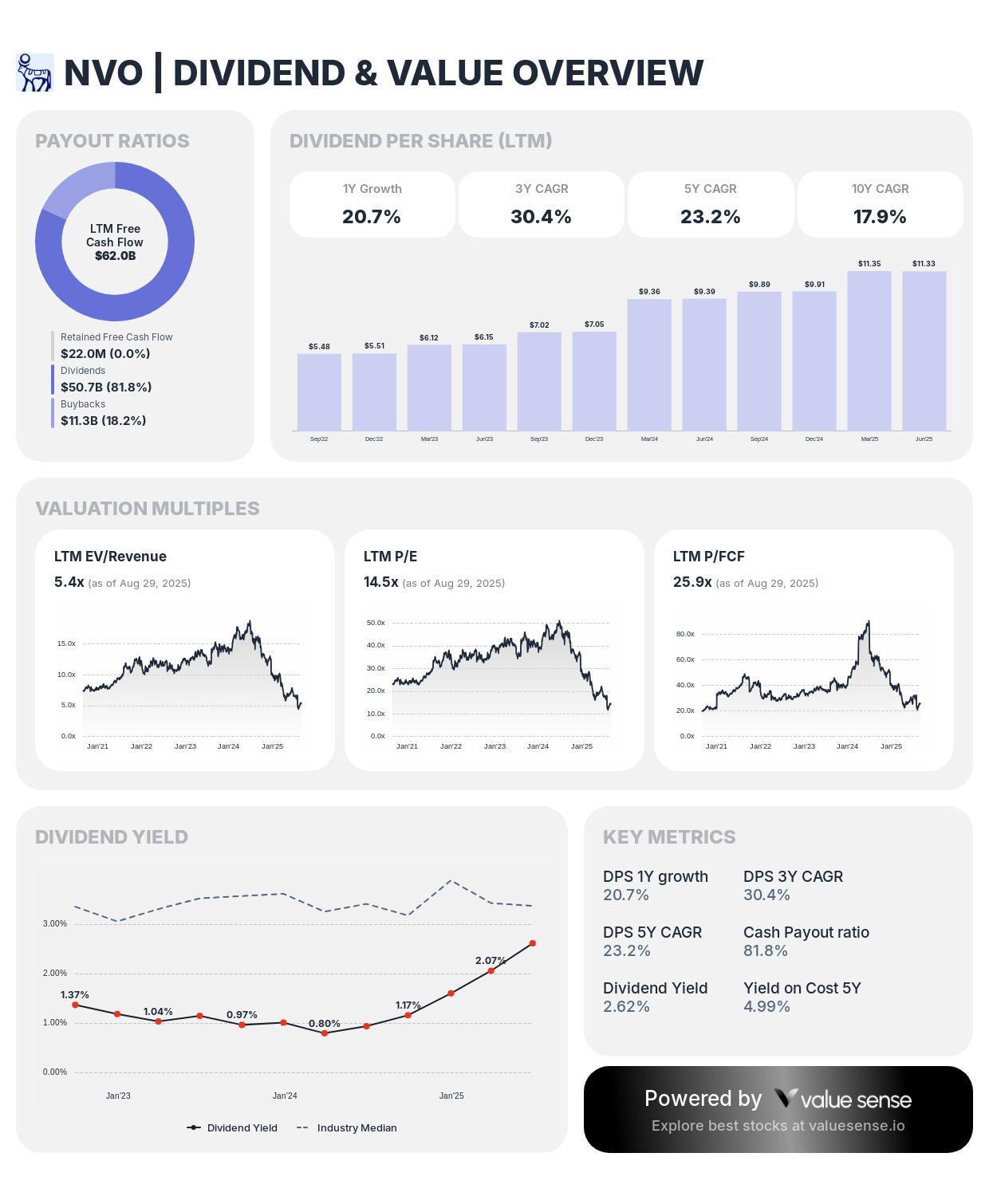

Cisco Systems: Infrastructure Value with Steady Income

Cisco Systems (CSCO) emerges in our analysis as a mature technology infrastructure play offering 2.4% dividend yield with 13.2% undervaluation. While growth rates appear modest, the sustainability metrics and competitive positioning create compelling value.

Our evaluation highlights Cisco's role in essential network infrastructure - every AI data center, cloud expansion, and 5G deployment requires their equipment. The 61.6% dividend payout ratio covered by only 44.7% of cash flow provides significant dividend growth flexibility.

The Ben Graham analysis indicates 92.1% undervaluation potential, while the Peter Lynch methodology shows 16% upside. This convergence across valuation approaches increases our confidence in the opportunity.

Investment Rationale:

- Essential Infrastructure: Mission-critical networking equipment

- Conservative Payout: 44.7% cash flow coverage

- Consistent Growth: 4.5% one-year, 8.1% three-year dividend increases

- Quality Margins: 25.4% FCF margin from market leadership

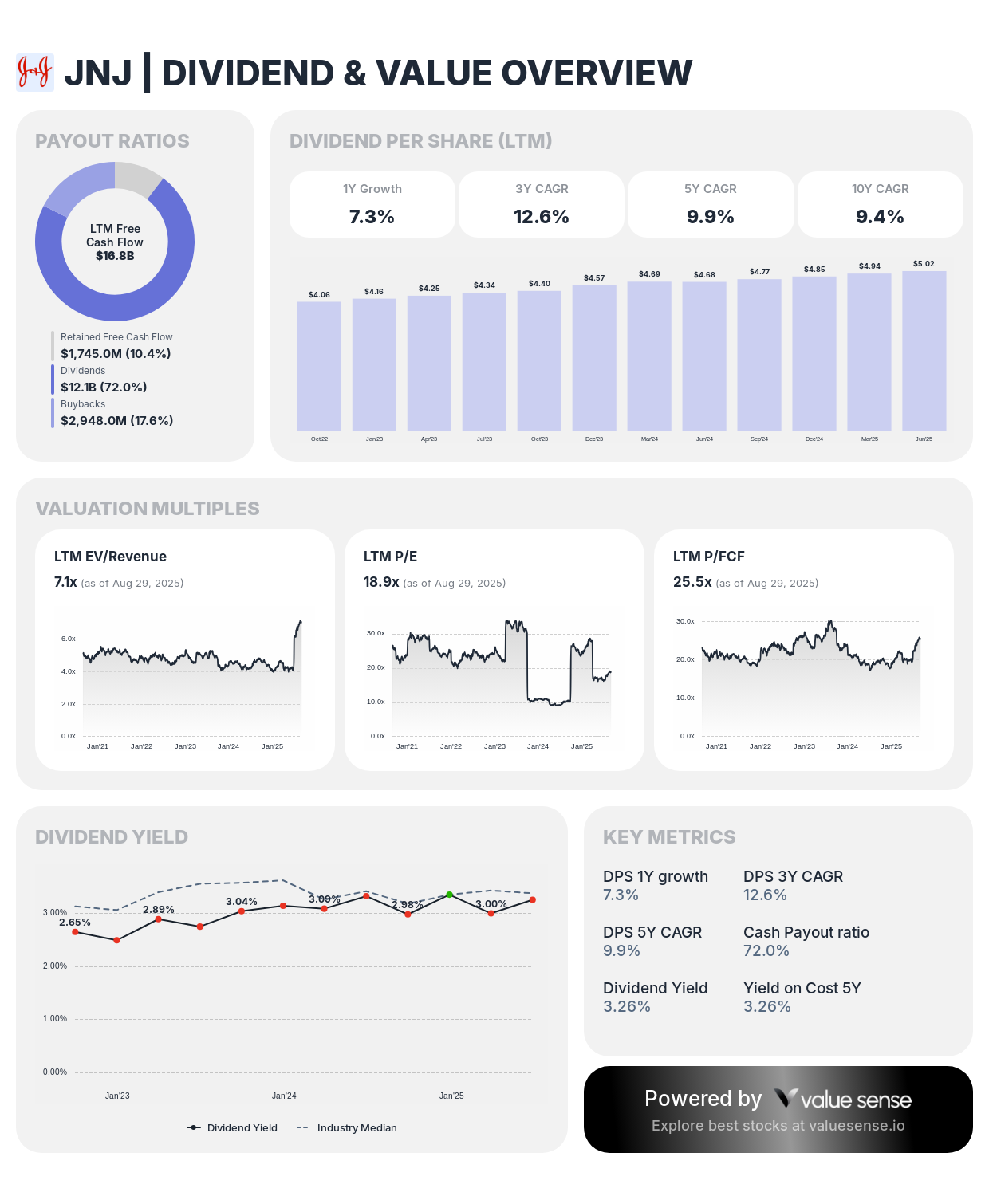

Johnson & Johnson: Defensive Healthcare Reliability

Our analysis shows Johnson & Johnson (JNJ) trading at modest 3.9% undervaluation with traditional dividend aristocrat characteristics. The 2.8% yield backed by decades of consistent increases represents defensive positioning in uncertain markets.

The diversified healthcare model - spanning pharmaceuticals, medical devices, and consumer products - creates multiple cash flow streams that provide stability through various market conditions. Our sustainability analysis shows comfortable 53.3% payout ratio with 72% cash flow coverage.

While the undervaluation appears modest compared to other opportunities, the Ben Graham analysis suggests 127.3% upside potential, indicating significant margin of safety at current prices.

Comprehensive Dividend Sustainability Framework

Our dividend sustainability analysis employs both traditional payout ratios and cash flow coverage metrics to assess long-term viability:

Payout Ratio Analysis by Category

Ultra-Conservative (Under 30%):

- Taiwan Semiconductor: 28.1% with massive growth runway

- ASML: 26.6% appropriate for cyclical equipment business

Balanced Approach (30-50%):

- Novo Nordisk: 45.6% enabling growth investment and returns

- American Express: 20.8% conservative for financial services

Mature Payout Models (50%+):

- Johnson & Johnson: 53.3% reflecting established dividend policy

- Cisco Systems: 61.6% appropriate for infrastructure maturity

Cash Flow Coverage: The Ultimate Safety Test

| Company | Dividend Payout | Cash Flow Coverage | Safety Assessment |

|---|---|---|---|

| Taiwan Semiconductor | 28.1% | 39.7% | Extremely Safe |

| ASML | 26.6% | 27.1% | Very Safe |

| Cisco Systems | 61.6% | 44.7% | Safe |

| Johnson & Johnson | 53.3% | 72.0% | Adequate |

| Novo Nordisk | 45.6% | 81.8% | Moderate |

Source: ValueSense Proprietary Analysis

Multiple Valuation Methodology Validation

Our comprehensive valuation approach employs multiple methodologies to identify genuine undervaluation opportunities. We've found that single-metric analysis often provides false signals, while convergence across methods increases investment conviction.

Highest Conviction Opportunities

Taiwan Semiconductor shows remarkable consistency:

- Intrinsic Value: 71.4% undervalued

- Relative Valuation: 173.0% undervalued

- Ben Graham Method: 1,163.9% undervalued

- Peter Lynch Approach: 624.2% undervalued

This convergence across fundamentally different approaches provides exceptional confidence in the opportunity.

Novo Nordisk demonstrates solid cross-methodology support:

- Intrinsic Value: 36.1% undervalued

- Ben Graham Analysis: 77.4% undervalued

- Peter Lynch Method: 82.1% undervalued

The healthcare company's consistent undervaluation across growth and value methodologies suggests broad-based opportunity.

Strategic Portfolio Construction

Based on our analysis, we recommend a diversified approach capturing different aspects of the dividend value opportunity:

Core Holdings (50-60% allocation)

Taiwan Semiconductor (20-25%): Our highest conviction opportunity combining massive undervaluation with conservative dividend policy. Technology exposure balanced by defensive semiconductor positioning and conservative payout ratios enabling future growth.

Novo Nordisk (15-20%): Healthcare defensiveness with obesity treatment growth catalysts. Strong dividend growth history with sustainable fundamentals creating attractive total return profile.

Johnson & Johnson (10-15%): Traditional dividend aristocrat providing portfolio stability. Diversified healthcare cash flows with decades of consistent increases offering defensive characteristics.

Opportunistic Holdings (25-35% allocation)

Cisco Systems (10-15%): Essential infrastructure exposure with mature dividend policy. Network equipment leadership providing recession-resistant cash flows with reasonable valuation entry point.

ASML (5-10%): Semiconductor equipment monopoly with ultra-conservative dividend approach. Significant undervaluation potential across multiple methodologies with limited current payout creating growth runway.

Risk Assessment and Mitigation

Our analysis identifies several risk factors requiring active monitoring:

Sector-Specific Considerations

Technology Concentration Risk: TSM, Cisco, and ASML create technology sector exposure requiring balanced positioning with healthcare and other defensive sectors.

Geopolitical Sensitivity: Taiwan Semiconductor faces unique China-Taiwan tensions that could impact operations and valuations regardless of fundamental performance.

Healthcare Regulation: Novo Nordisk and J&J face ongoing drug pricing pressures and regulatory changes that could affect profitability and dividend sustainability.

Portfolio-Level Risk Management

Geographic Diversification: Balance U.S., European, and Asian exposure to mitigate regional economic risks.

Interest Rate Sensitivity: Monitor dividend stock performance relative to rising rates, particularly for higher-yielding positions.

Payout Ratio Monitoring: Establish triggers for position reduction if payout ratios exceed sustainable levels during economic stress.

Market Timing and Entry Strategy

Current market conditions create several favorable factors for dividend value investing:

Market Rotation: AI growth focus has created relative undervaluation in dividend-paying value stocks.

Interest Rate Environment: While elevated rates create competition for dividend stocks, they also stress-test payout sustainability, identifying truly robust dividend policies.

Institutional Positioning: Many institutional investors remain underweight dividend stocks, creating potential catalysts as positioning normalizes.

We recommend dollar-cost averaging into positions over 3-6 months to capture volatility while building full positions in our highest conviction opportunities.

Expected Return Analysis

Based on our valuation work and dividend growth projections:

3-Year Total Return Expectations

- Taiwan Semiconductor: 15-20% annually (capital appreciation + modest dividend growth)

- Novo Nordisk: 12-18% annually (balanced appreciation + strong dividend growth)

- Johnson & Johnson: 8-12% annually (defensive appreciation + steady dividend growth)

- Cisco Systems: 7-11% annually (value recognition + consistent dividend increases)

Long-Term Income Growth Projections (5-10 years)

Conservative estimates suggest 6-10% annual dividend growth as these undervaluations normalize and companies compound their market advantages.

Investment Conclusion

Our September 2025 analysis reveals exceptional opportunities among dividend-paying quality companies trading below intrinsic values. The combination of Taiwan Semiconductor's 71.4% undervaluation with ultra-conservative payout ratios, Novo Nordisk's healthcare growth with 36.1% discount, and established aristocrats like J&J and Cisco available at reasonable prices creates an ideal environment for dividend value investing.

These opportunities don't require perfect market timing or macroeconomic predictions. They represent quality companies with sustainable competitive advantages, conservative dividend policies, and significant valuation gaps that time and compound growth should resolve favorably.

For ValueSense users seeking income generation with capital appreciation potential, September 2025 presents compelling entry points into dividend aristocrat-quality companies at prices that may not persist as markets recognize their operational improvements and valuation disconnects.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Palantir Rule of 40 Analysis

📖 Undervalued Utility Stocks: Best Defensive Value Plays

📖 Shopify Undervalued: E-commerce Platform's Recovery Story

FAQ: Undervalued dividend stocks

Q1: How does ValueSense identify undervalued dividend aristocrats differently from other platforms?

A: ValueSense employs multiple valuation methodologies simultaneously - intrinsic value, DCF, relative value, Ben Graham, and Peter Lynch approaches. Companies like Taiwan Semiconductor showing 71.4% undervaluation across multiple methods provide higher conviction than single-metric analysis offered by other platforms.

Q2: What makes ValueSense confident in these dividend sustainability assessments?

A: Our analysis tracks both dividend payout ratios and cash flow payout ratios, providing dual-layer safety analysis. Companies like Taiwan Semiconductor with 28.1% dividend payout but only 39.7% cash flow usage demonstrate significant safety margins that traditional payout analysis might miss.

Q3: How should investors prioritize these undervalued dividend opportunities?

A: ValueSense recommends prioritizing based on undervaluation magnitude combined with dividend safety. Taiwan Semiconductor's 71.4% undervaluation with ultra-conservative payouts ranks highest, followed by Novo Nordisk's 36.1% discount with strong growth prospects, then established names like Cisco and J&J for stability.

Q4: What specific risks does ValueSense see in these dividend aristocrat picks?

A: Primary risks include technology sector concentration (TSM, Cisco, ASML), geopolitical tensions affecting Taiwan Semiconductor, healthcare regulation impacting Novo Nordisk and J&J, and interest rate sensitivity across all dividend stocks. Geographic and sector diversification helps mitigate these concentrated risks.

Q5: How often does ValueSense update these dividend aristocrat valuations and recommendations?

A: ValueSense updates intrinsic value calculations quarterly with earnings releases, while monitoring dividend sustainability metrics monthly. Significant valuation changes or dividend policy modifications trigger immediate analysis updates, ensuring users have current information for investment decisions.