10 High-Quality Undervalued Dividend Stocks

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Before examining our top picks, it's important to understand the Value Sense approach to identifying undervalued dividend stocks. Our model evaluates companies based on several key factors:

- Intrinsic Value Analysis: We estimate future free cash flows using a DCF model to determine the intrinsic enterprise value. Then, we adjust this value by subtracting debt and adding cash and investments. Finally, we divide the result by the number of outstanding shares to calculate the per-share DCF value.

- Quality Rating: Our proprietary quality metric examines financial stability, competitive advantages, and management effectiveness.

- Dividend Sustainability: We assess payout ratios, dividend growth history, and free cash flow coverage.

- Market Positioning: Companies with strong competitive moats and industry leadership receive higher ratings.

With this methodology in mind, let's explore the 10 high-quality dividend stocks our model currently flags as undervalued.

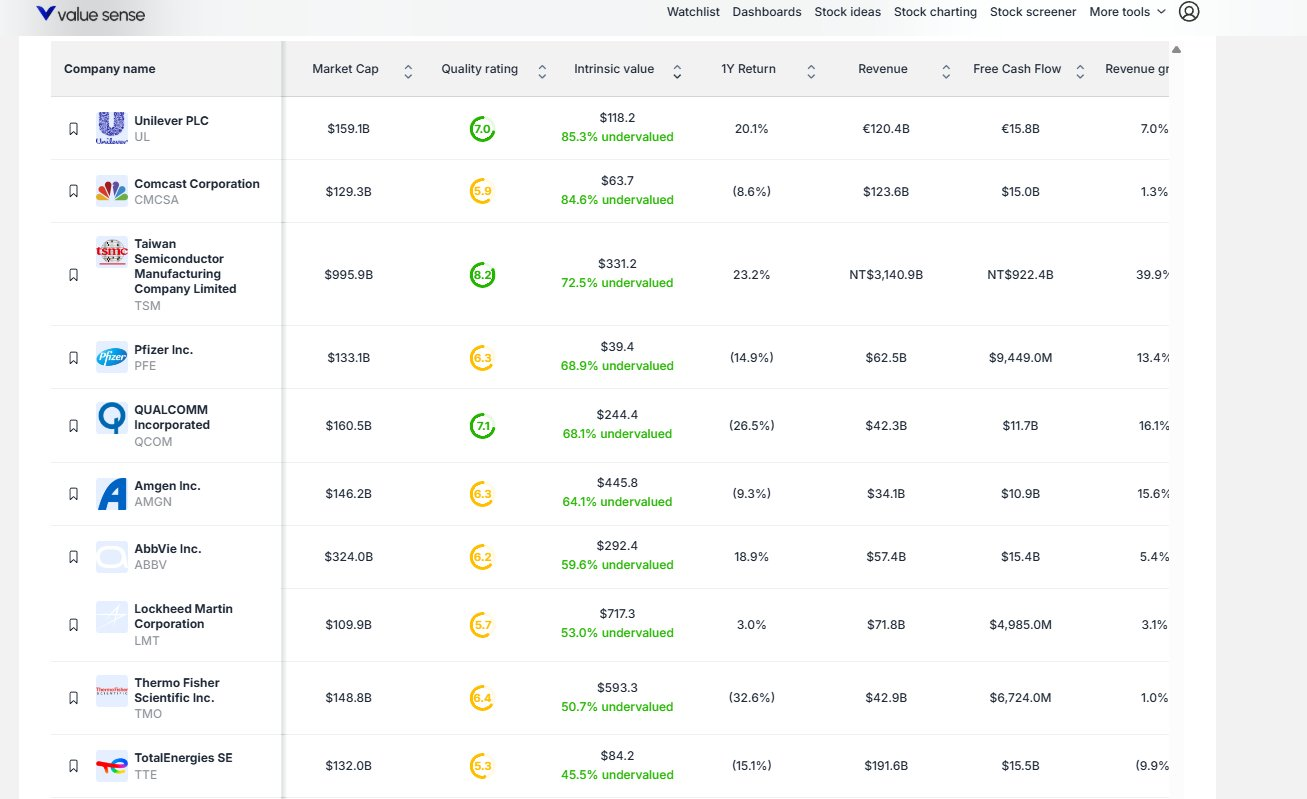

Top 10 Undervalued Dividend Stocks

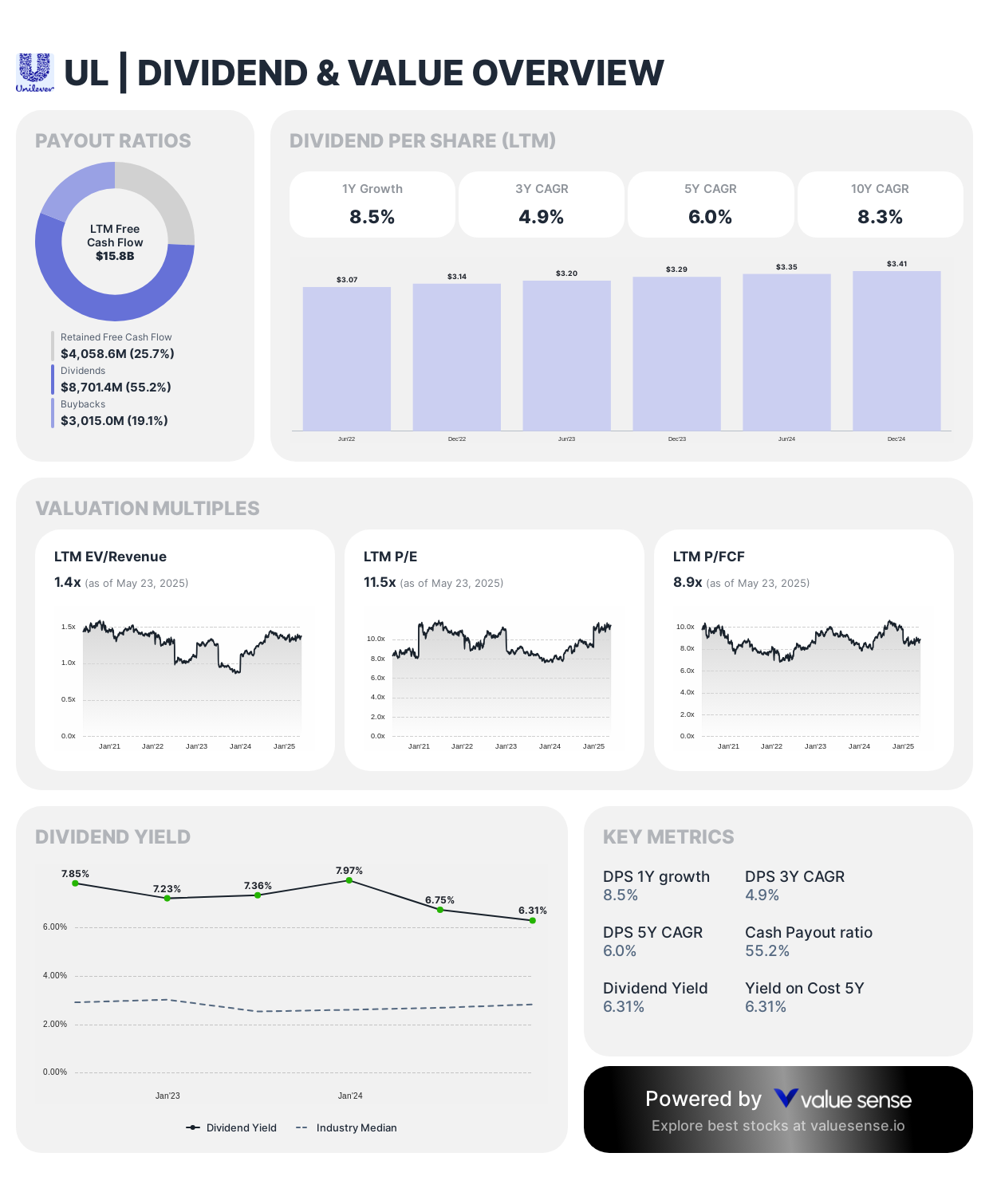

1. Unilever (UL)

Current Price: $63.74

Intrinsic Value: $118.20 (85.3% undervalued)

Market Cap: $159.18 billion

Quality Rating: 7/10

Dividend Yield: 6.31%

Unilever stands out as our most undervalued dividend stock, trading at a significant discount to our calculated intrinsic value. This consumer goods giant boasts an impressive portfolio of over 400 brands spanning food, home care, and personal care products. Our model particularly appreciates Unilever's 20.1% 1-year return and robust free cash flow of €126.48 billion, providing ample coverage for its dividend.

The company's commitment to sustainability and emerging market growth positions it well for future value creation. With revenue of €126.48 billion and a healthy 7.6% operating margin, Unilever offers both stability and growth potential.

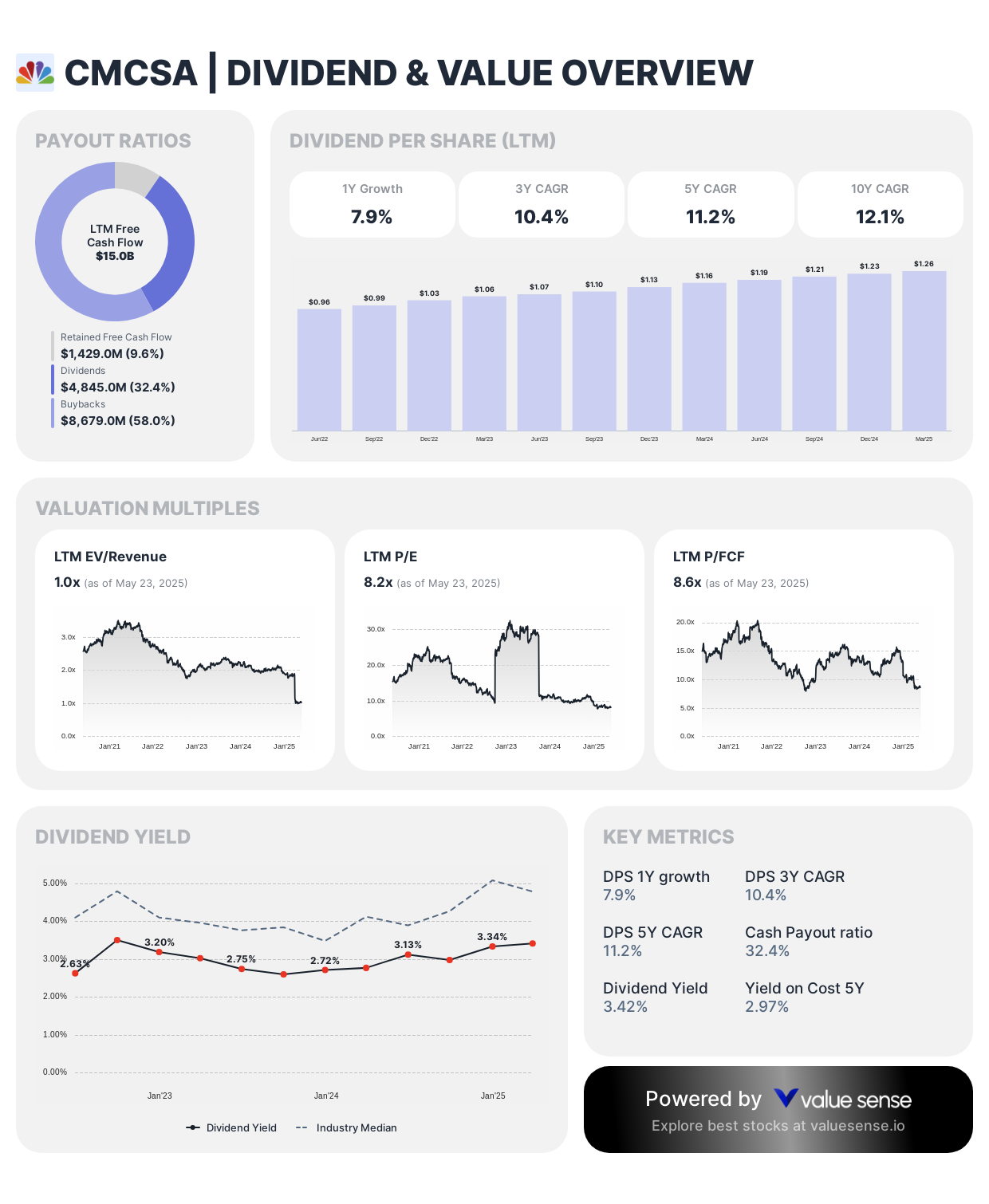

2. Comcast (CMCSA)

Current Price: $34.95

Intrinsic Value: $63.70 (84.6% undervalued)

Market Cap: $126.39 billion

Quality Rating: 5.9/10

Dividend Yield: 3.42%

Our model identifies Comcast as significantly undervalued with an 84.6% discount to fair value. Despite facing challenges in the traditional cable segment, Comcast's diversified revenue streams from broadband internet, NBCUniversal content, and theme parks provide stability and growth opportunities.

With $123.68 billion in annual revenue and $15.48 billion in free cash flow, Comcast maintains a sustainable 3.42% dividend yield backed by 18 consecutive years of dividend increases. The company's strong positioning in broadband infrastructure and content creation should continue to generate robust cash flows for shareholders.

3. Taiwan Semiconductor (TSM)

Current Price: $197.68

Intrinsic Value: $331.2 (72.5% undervalued)

Market Cap: $995.98 billion

Quality Rating: 8.2/10

Dividend Yield: 1.27%

Taiwan Semiconductor Manufacturing Company (TSMC) emerges as a rare combination of growth and value. As the world's largest dedicated semiconductor foundry, TSMC produces chips for technology giants like Apple, NVIDIA, and AMD.

Our model highlights TSMC's exceptional 23.2% ROI and NT$3,140.98 billion in revenue, reflecting the company's critical position in the global technology supply chain. While its 1.27% dividend yield might appear modest, TSMC's 39.9% revenue growth and NT$922.48 billion in free cash flow position it for continued dividend increases and capital appreciation.

4. Pfizer (PFE)

Current Price: $23.61

Intrinsic Value: $39.40 (66.9% undervalued)

Market Cap: $132.39 billion

Quality Rating: 6.3/10

Dividend Yield: 6.66%

Pfizer presents an compelling opportunity for income-focused investors, offering a substantial 6.66% dividend yield that our model views as sustainable despite recent market challenges. The pharmaceutical giant's post-pandemic revenue normalization has created what we believe is a significant undervaluation.

With $62.58 billion in revenue and $9,448.0M in free cash flow, Pfizer maintains strong dividend coverage while investing in its robust drug pipeline. The company's focus on oncology, rare diseases, and immunology positions it for future growth beyond its COVID-related product lines.

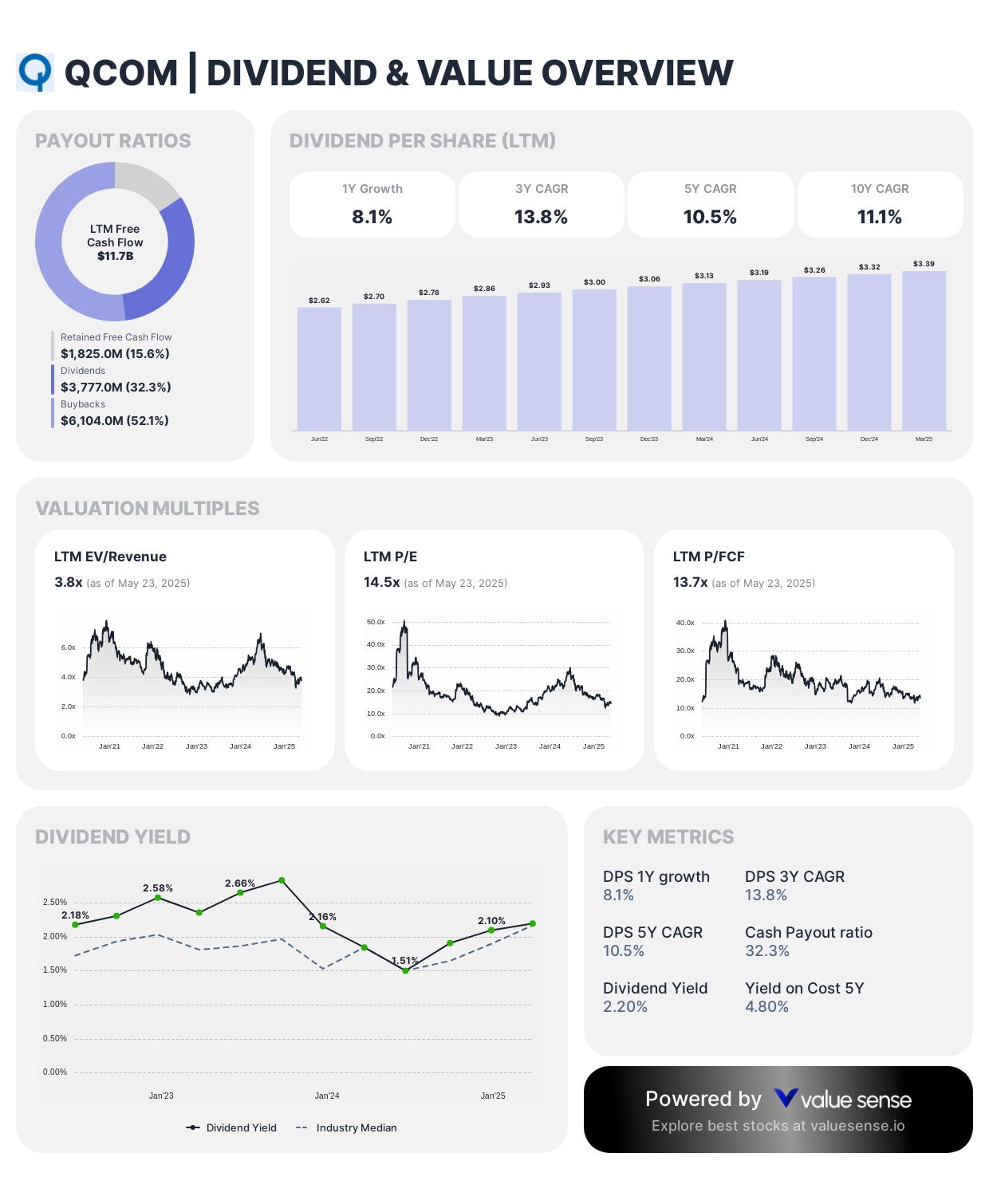

5. Qualcomm (QCOM)

Current Price: $148.63

Intrinsic Value: $234.40 (58.1% undervalued)

Market Cap: $160.58 billion

Quality Rating: 7.1/10

Dividend Yield: 2.2%

Qualcomm stands out in our model as a significantly undervalued technology leader with substantial growth potential. As the dominant supplier of mobile processors and communication chips, Qualcomm is well-positioned to benefit from 5G adoption and expansion into automotive and IoT markets.

The company's $42.38 billion in annual revenue and 28.5% ROI demonstrate its strong market position. With $11.76 billion in free cash flow, Qualcomm offers dividend sustainability while investing heavily in next-generation wireless technologies.

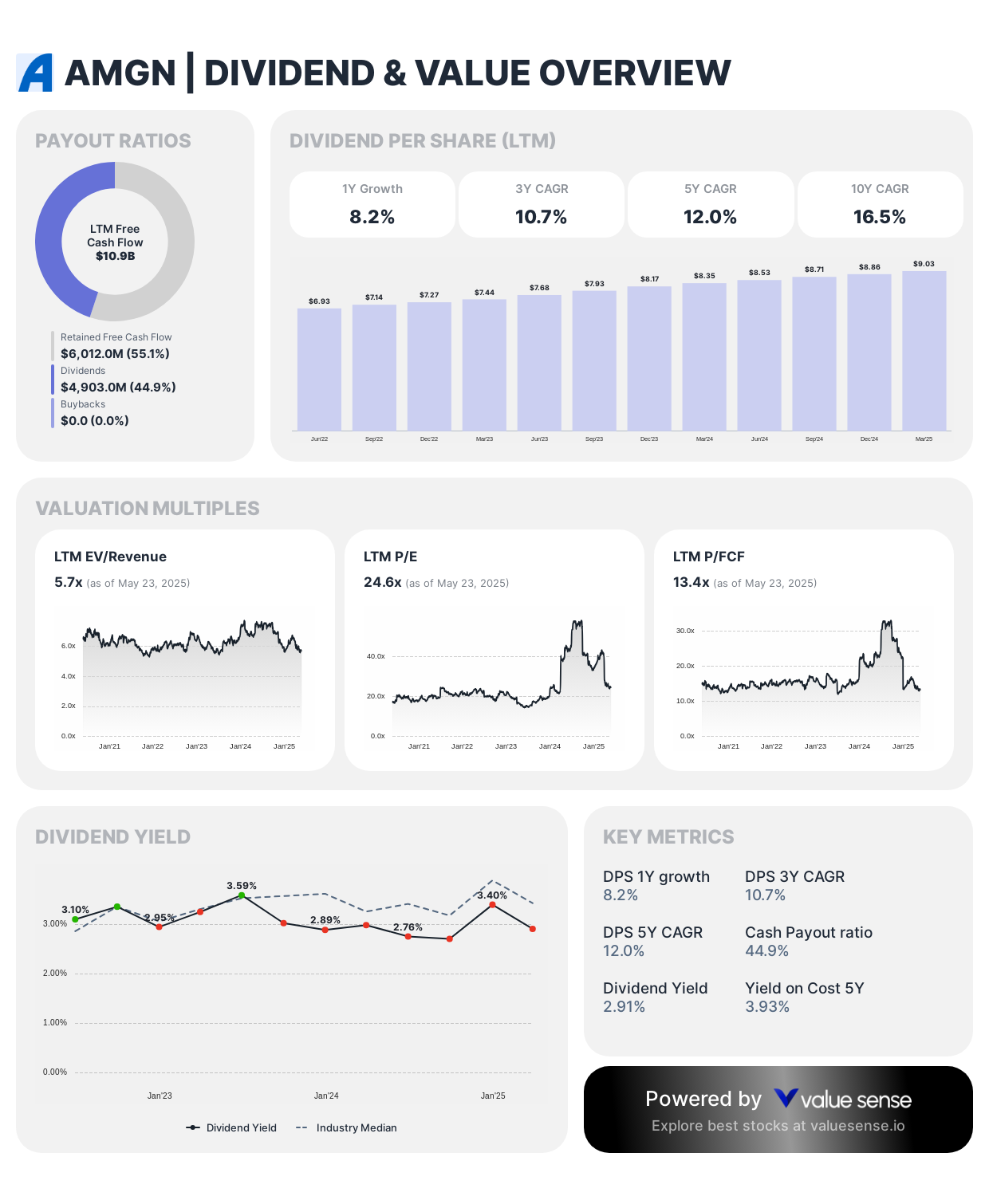

6. Amgen (AMGN)

Current Price: $272.40

Intrinsic Value: $444.80 (64.7% undervalued)

Market Cap: $146.28 billion

Quality Rating: 6.3/10

Dividend Yield: 2.91%

Biotechnology leader Amgen earns a spot in our undervalued dividend stock list with its combination of stability, innovation, and shareholder returns. The company's diverse portfolio of biologic medications generates consistent revenue and free cash flow.

With a strong 2.91% dividend yield backed by 11% dividend growth over the past three years, Amgen delivers meaningful income for investors. The company's $34.18 billion in annual revenue and $10.88 billion in free cash flow provide ample room for continued dividend growth while funding its promising pipeline of new therapies.

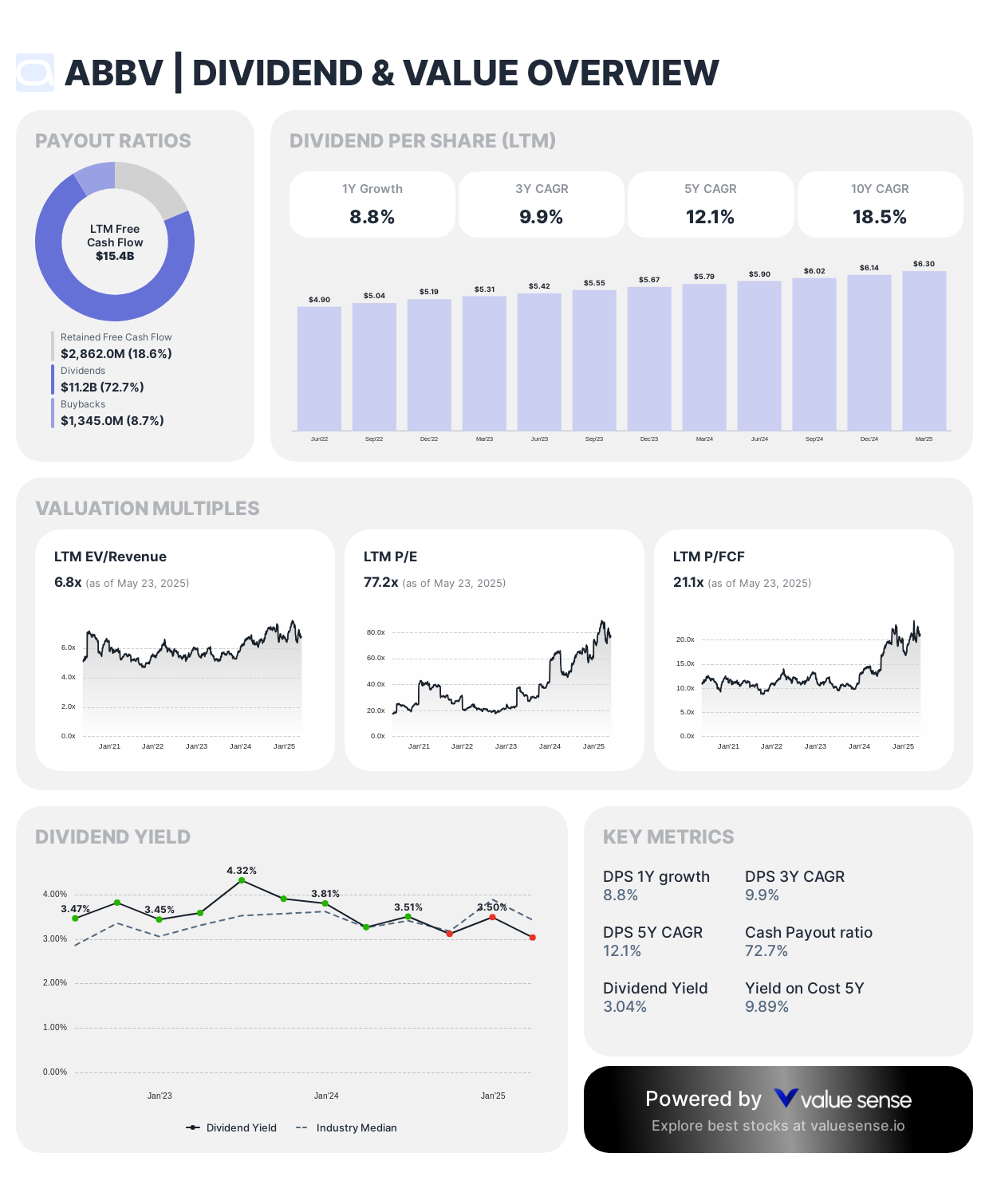

7. AbbVie (ABBV)

Current Price: $184.60

Intrinsic Value: $302.4 (59.6% undervalued)

Market Cap: $324.08 billion

Quality Rating: 6.2/10

Dividend Yield: 3.04%

AbbVie has successfully navigated the patent cliff for its blockbuster drug Humira while building a diversified portfolio that our model views as significantly undervalued. The company's strategic acquisitions and pipeline development have positioned it for sustained growth.

With $57.48 billion in annual revenue and $15.48 billion in free cash flow, AbbVie maintains strong dividend coverage. The company's 18.9% ROI and focus on immunology, oncology, and aesthetics support our positive outlook on both dividend sustainability and share price appreciation.

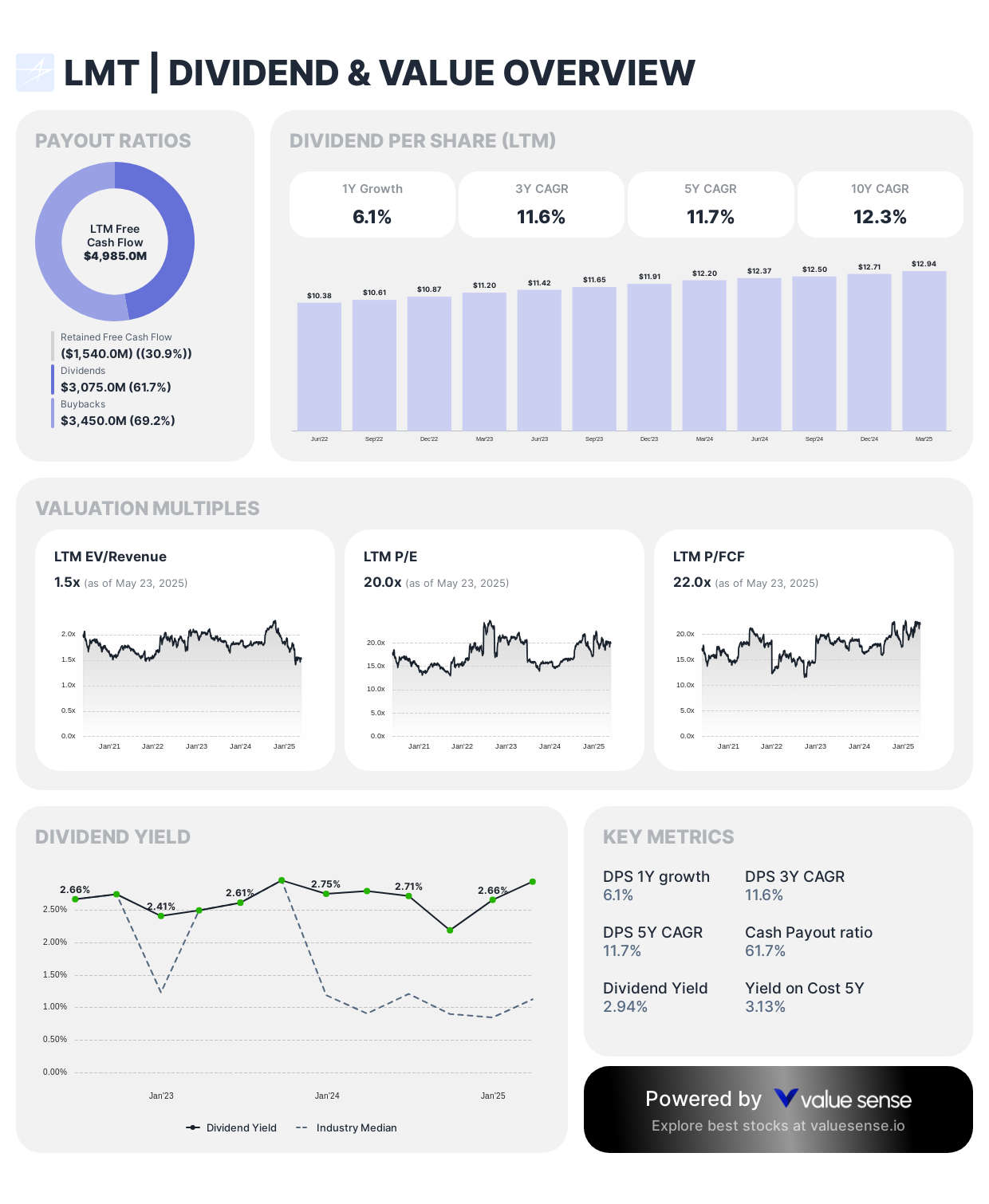

8. Lockheed Martin (LMT)

Current Price: $466.85

Intrinsic Value: $707.3 (53.0% undervalued)

Market Cap: $109.88 billion

Quality Rating: 5.7/10

Dividend Yield: 2.94%

As a premier defense contractor, Lockheed Martin benefits from stable government contracts and growing global defense budgets. Our model identifies LMT as significantly undervalued with a 53% discount to our calculated intrinsic value.

The company's $71.88 billion in annual revenue and $4,985.0M in free cash flow support its attractive 2.94% dividend yield. With a low beta of 0.3 and consistent dividend growth, Lockheed Martin provides defensive characteristics in uncertain market environments while offering meaningful income.

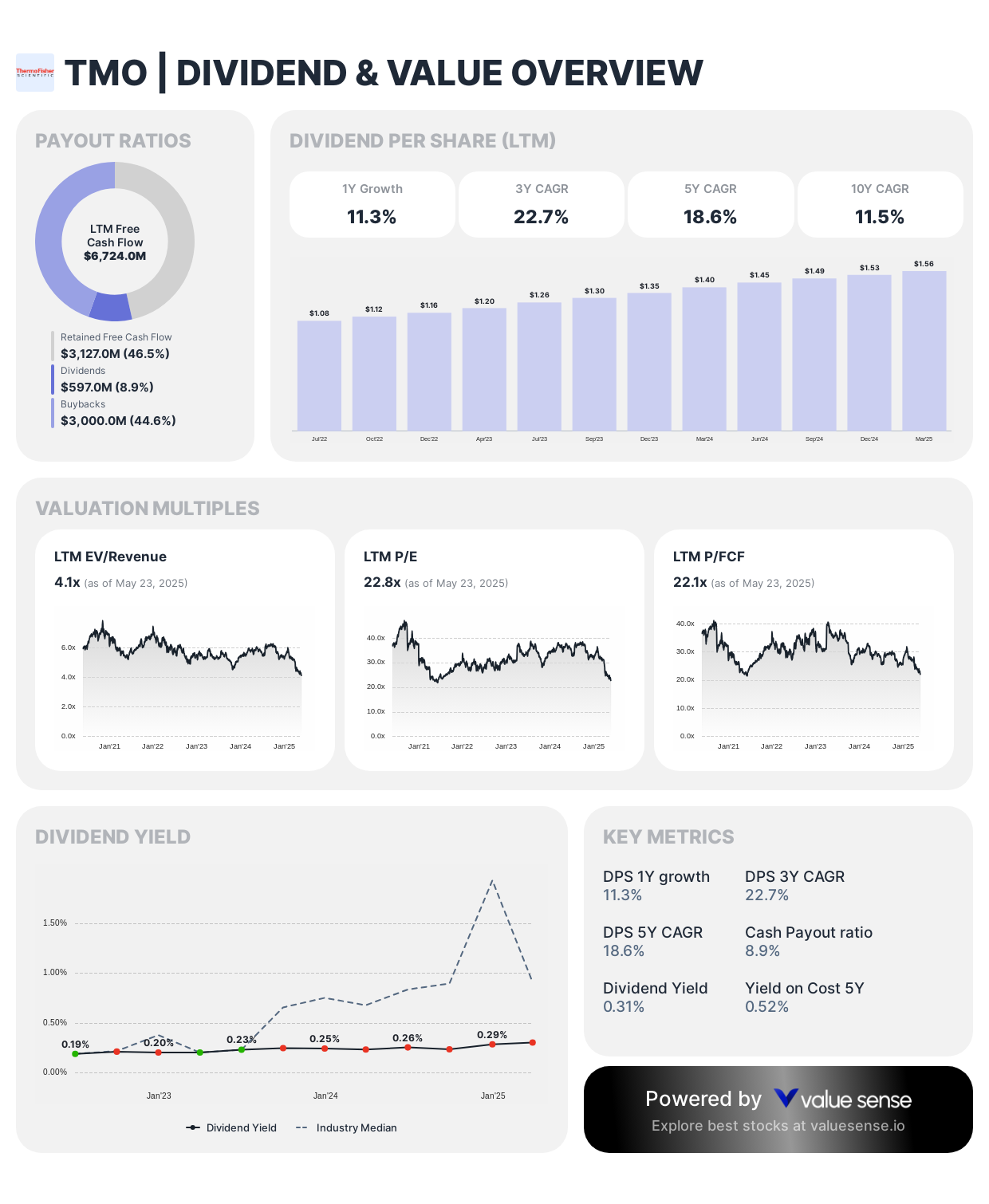

9. Thermo Fisher Scientific (TMO)

Current Price: $405.68

Intrinsic Value: $593.3 (50.7% undervalued)

Market Cap: $148.60 billion

Quality Rating: 6.4/10

Dividend Yield: 0.31%

Thermo Fisher Scientific offers investors exposure to the growing life sciences and diagnostics markets with significant undervaluation according to our model. While its 0.31% dividend yield appears modest, Thermo Fisher's commitment to shareholder returns extends beyond dividends to include substantial share repurchases.

The company's $42.98 billion in annual revenue and $6,724.0M in free cash flow demonstrate its strong market position. With a 32.8% ROI and strategic acquisitions enhancing its capabilities, Thermo Fisher represents an attractive combination of growth potential and value.

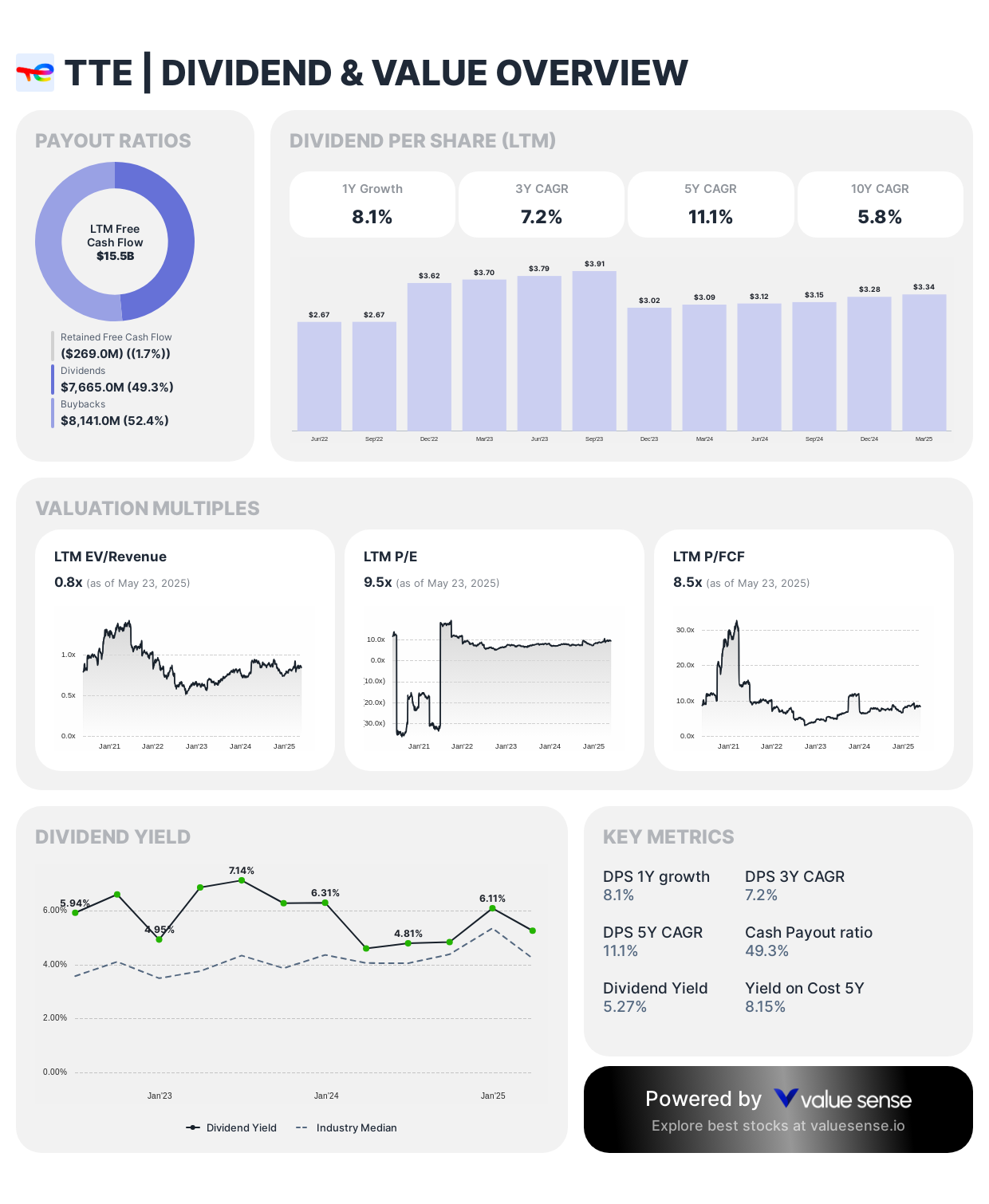

10. TotalEnergies (TTE)

Current Price: $64.20

Intrinsic Value: $94.2 (46.5% undervalued)

Market Cap: $152.08 billion

Quality Rating: 5.3/10

Dividend Yield: 5.27%

Rounding out our top 10 is TotalEnergies, an integrated energy company that's navigating the energy transition more effectively than many peers. Our model appreciates TTE's balanced approach to maintaining traditional energy production while strategically investing in renewables and low-carbon solutions.

With $191.68 billion in annual revenue and $15.58 billion in free cash flow, TotalEnergies offers a generous 5.27% dividend yield that our analysis indicates is well-supported. The company's 19.1% ROI and commitment to maintaining its dividend through energy price cycles make it an attractive option for income-focused investors.

Investment Considerations and Strategy

When evaluating these undervalued dividend stocks, investors should consider several factors beyond our valuation metrics:

1. Portfolio Diversification

The stocks on our list span multiple sectors, providing natural diversification:

- Consumer Staples: Unilever

- Communication Services: Comcast

- Technology: Taiwan Semiconductor, Qualcomm

- Healthcare: Pfizer, Amgen, AbbVie, Thermo Fisher Scientific

- Industrials: Lockheed Martin

- Energy: TotalEnergies

This sector diversity allows investors to build a balanced income portfolio even when selecting from our undervalued recommendations.

2. Income vs. Growth Balance

Our selections offer varying dividend yields and growth profiles:

- High Current Income: Pfizer (7.77%), TotalEnergies (5.57%), Comcast (3.82%)

- Dividend Growth: Taiwan Semiconductor, Thermo Fisher Scientific, Qualcomm

- Balanced Approach: Unilever, AbbVie, Amgen, Lockheed Martin

Investors should balance their income needs with long-term growth objectives when constructing their portfolio.

3. Market Volatility Considerations

While our valuation model identifies these stocks as undervalued, market volatility can create short-term price fluctuations. Investors should consider their risk tolerance and investment timeframe when establishing positions.

Value Sense Outlook

Our analysis suggests that these 10 high-quality dividend stocks offer compelling value in today's market environment. With discounts to intrinsic value ranging from 46.5% to 85.3%, these companies present opportunities for both income and capital appreciation.

As market conditions evolve, we'll continue monitoring these selections and updating our recommendations accordingly. For more detailed analysis on each company, including comprehensive valuation reports and industry comparisons, visit our Value Sense platform.

Remember that successful dividend investing requires patience, discipline, and a long-term perspective. By focusing on undervalued quality companies with sustainable dividends, investors can build wealth through both income streams and share price appreciation over time.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Top 10 undervalued high-quality growth stocks

📖 Analyzing Warren Buffett's Portfolio

📖 The Rule of 40: How Top-Performing Stocks