10 Best Undervalued Dividend Stocks for Income and Growth - Value Sense 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Power of Undervalued Dividend Investing

Dividend investing has evolved beyond simply chasing high yields. The most successful dividend strategies focus on companies that combine attractive dividend yields with significant undervaluation relative to intrinsic worth. These opportunities offer the dual benefits of regular income generation and substantial capital appreciation potential as market prices converge toward fair value.

Our comprehensive analysis identifies quality dividend-paying companies trading at discounts to intrinsic value while maintaining dividend yields of at least 1%. This approach ensures investors receive both immediate income and long-term wealth building potential through value realization.

Value Dividend Selection Criteria:

- Trading below intrinsic value based on our proprietary valuation model

- Dividend yield of 1% or higher for immediate income generation

- Quality ratings indicating financial strength and competitive positioning

- Strong free cash flow generation supporting sustainable dividend payments

Top 10 Undervalued Dividend Stocks - Complete Analysis

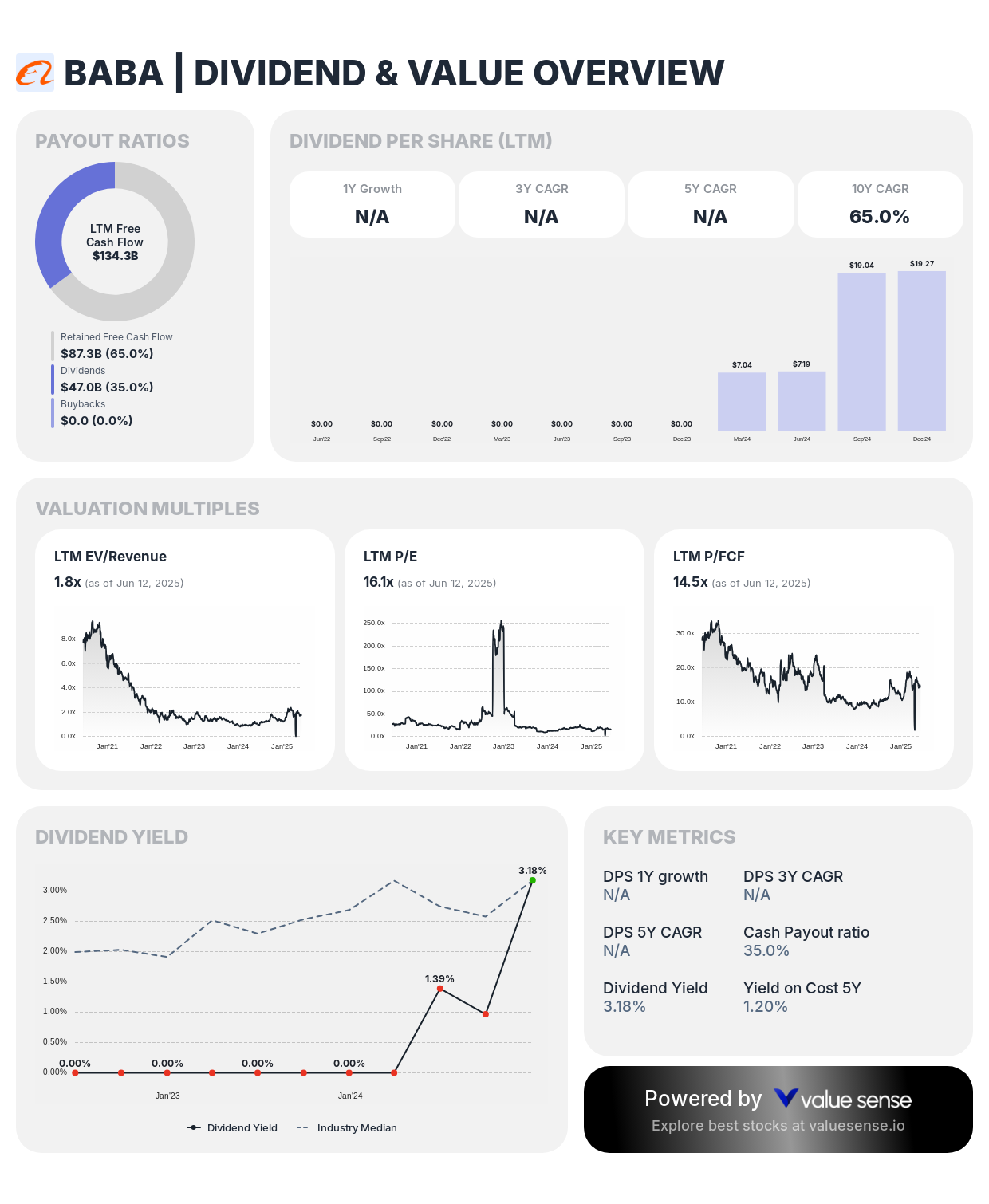

1. Alibaba Group Holding Limited (BABA) - 267.5% Undervalued ⭐

Sector: E-commerce | Quality Rating: 6.2 | 1Y Return: 52.6% | Est. Dividend Yield: 1.8%

Key Financials:

- Revenue: CN¥981.8B

- Free Cash Flow: CN¥134.3B

- Revenue Growth: 5.9%

- FCF Margin: 13.7%

Investment Thesis: Alibaba represents the most compelling undervalued dividend opportunity in our analysis, trading at an extraordinary 267.5% discount to intrinsic value while offering an estimated 1.8% dividend yield. As China's dominant e-commerce platform, Alibaba maintains leadership positions across multiple high-growth markets including cloud computing, digital payments, and international commerce.

Dividend Sustainability: Alibaba's substantial free cash flow of CN¥134.3B provides excellent dividend coverage with significant room for future increases. The company's asset-light business model generates consistent cash flows that support both dividend payments and growth investments.

Growth Catalysts:

- Recovery in Chinese consumer spending boosting core commerce operations

- Alibaba Cloud expansion in artificial intelligence and international markets

- Strategic partnerships strengthening fintech and logistics capabilities

- International e-commerce growth through Lazada and AliExpress platforms

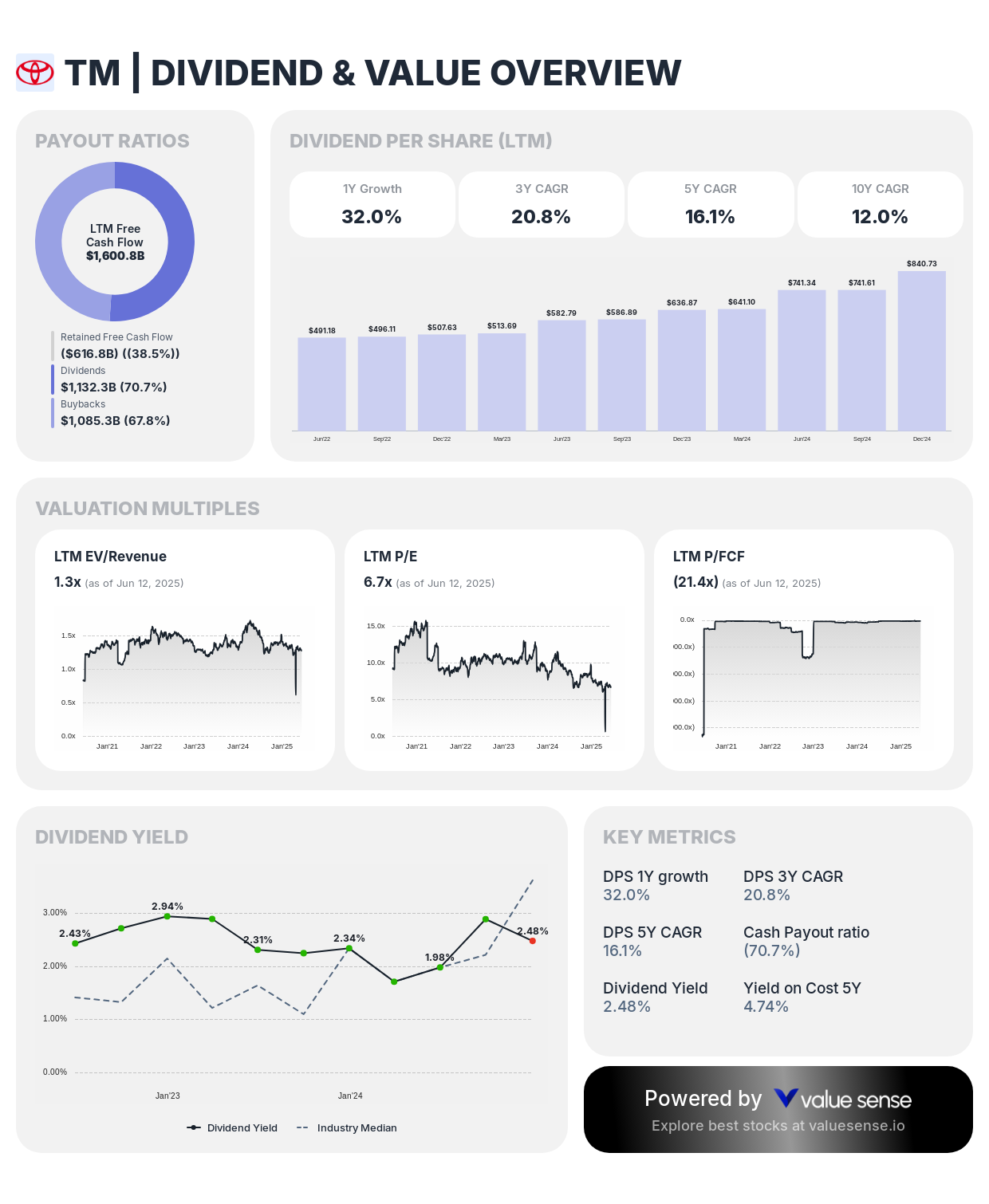

2. Toyota Motor Corporation (TM) - 145.3% Undervalued

Sector: Automotive | Quality Rating: 6.1 | 1Y Return: (10.4%) | Est. Dividend Yield: 2.8%

Key Financials:

- Revenue: ¥46.7T

- Free Cash Flow: (¥1,600.8B)

- Revenue Growth: 6.9%

- FCF Margin: (3.4%)

Investment Thesis: Toyota trades at 145.3% below intrinsic value while offering an attractive estimated 2.8% dividend yield, making it one of the most undervalued dividend opportunities among global automakers. Despite temporary free cash flow challenges from heavy capital investments in electrification, Toyota's leadership in hybrid technology and strong global brand position support long-term value creation.

Dividend Sustainability: Toyota maintains a conservative dividend policy backed by strong operational cash flows and substantial cash reserves. The company's long-term commitment to shareholder returns remains intact despite current investment cycle pressures.

Growth Catalysts:

- Hybrid vehicle technology leadership providing competitive advantages in the transition period

- Strategic electric vehicle platform development for future market growth

- Strong positioning in emerging markets with growing automotive demand

- Operational efficiency improvements enhancing profitability margins

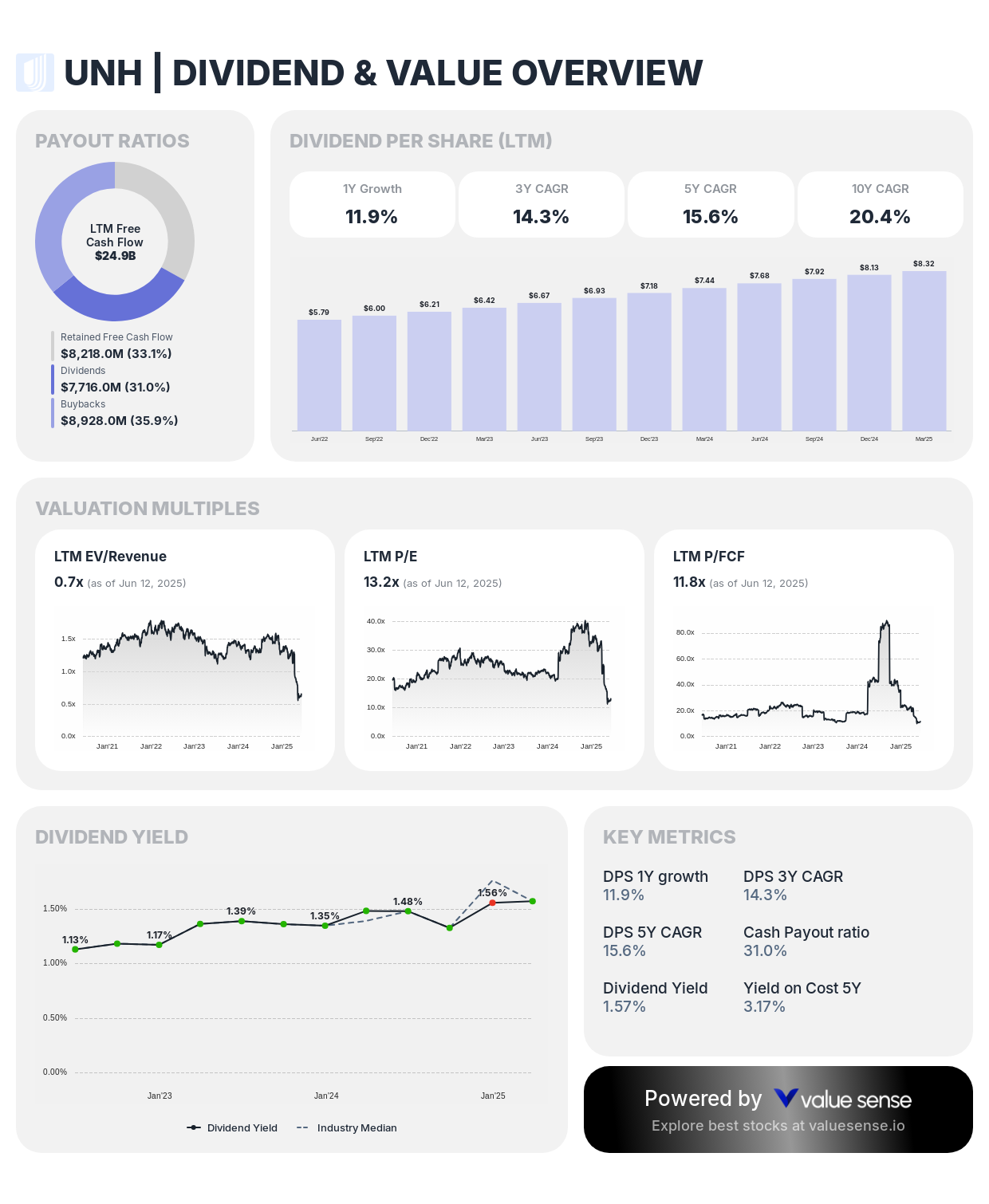

3. UnitedHealth Group Incorporated (UNH) - 104.7% Undervalued

Sector: Healthcare | Quality Rating: 6.4 | 1Y Return: (34.7%) | Est. Dividend Yield: 1.3%

Key Financials:

- Revenue: $407.4B

- Free Cash Flow: $24.9B

- Revenue Growth: 8.6%

- FCF Margin: 6.1%

Investment Thesis: UnitedHealth trades at 104.7% below intrinsic value while maintaining an estimated 1.3% dividend yield, representing exceptional value in the healthcare sector. As America's largest health insurer, UnitedHealth benefits from demographic trends, scale advantages, and integrated care delivery capabilities that create sustainable competitive moats.

Dividend Sustainability: UnitedHealth's substantial free cash flow of $24.9B provides excellent dividend coverage with a long history of consistent increases. The company's diversified healthcare services generate predictable cash flows supporting reliable dividend growth over time.

Growth Catalysts:

- Aging population demographics driving sustained healthcare demand growth

- Optum health services expansion creating additional high-margin revenue streams

- Technology investments improving operational efficiency and patient outcomes

- Medicare Advantage market share growth opportunities in expanding markets

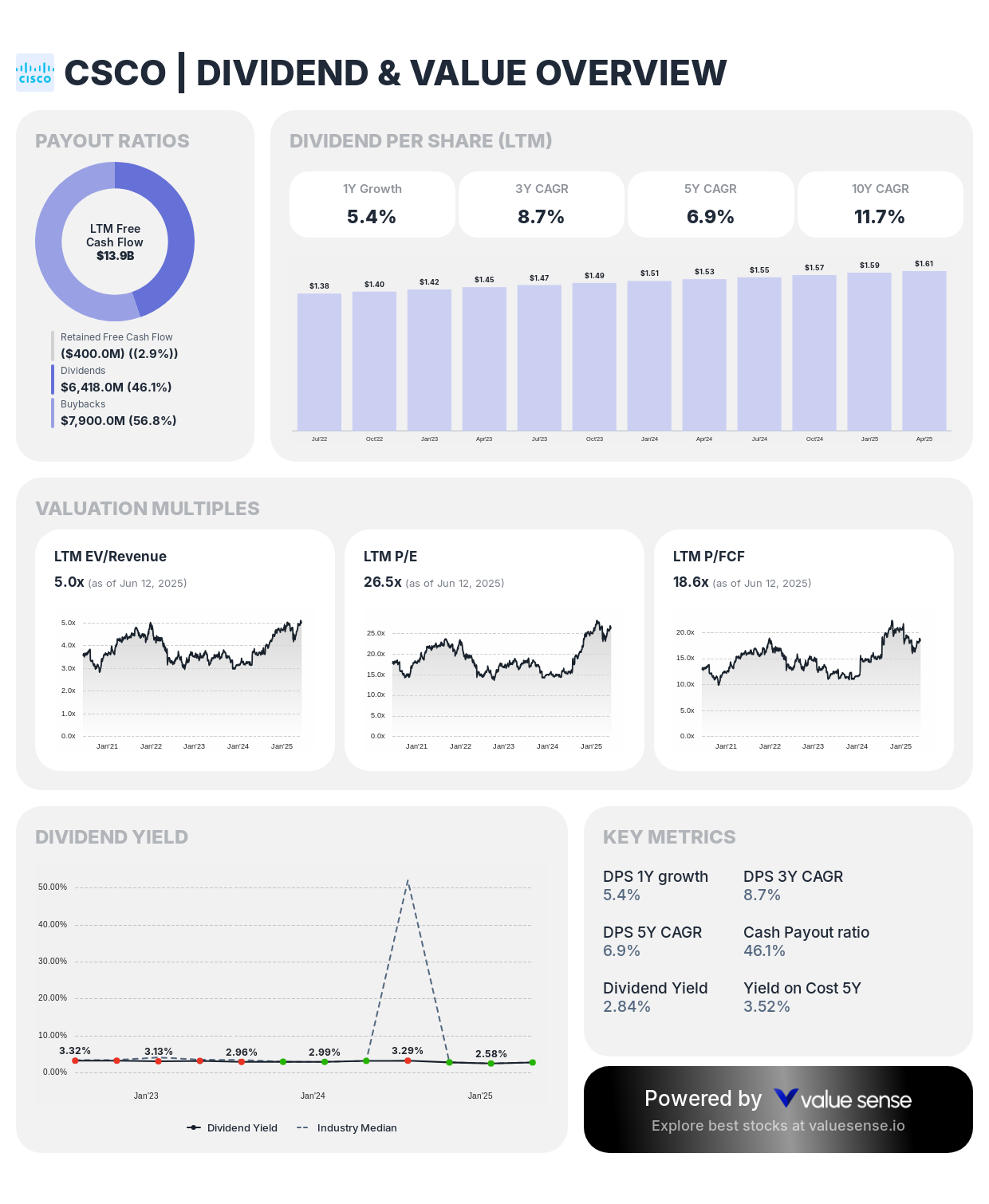

4. Cisco Systems, Inc. (CSCO) - 74% Undervalued

Sector: Networking Technology | Quality Rating: 6.1 | 1Y Return: 46.0% | Est. Dividend Yield: 3.2%

Key Financials:

- Revenue: $55.6B

- Free Cash Flow: $13.9B

- Revenue Growth: 0.5%

- FCF Margin: 25.0%

Investment Thesis: Cisco trades 74% below intrinsic value while offering an attractive estimated 3.2% dividend yield, making it one of the most compelling dividend opportunities in technology. Despite modest revenue growth, Cisco's transformation toward software and services creates more predictable revenue streams and higher profit margins.

Dividend Sustainability: Cisco's exceptional free cash flow margin of 25.0% provides substantial dividend coverage with significant capacity for future increases. The company's capital-light business model generates consistent cash flows supporting reliable dividend payments through various market cycles.

Growth Catalysts:

- Artificial intelligence and machine learning integration across networking products

- Cybersecurity services expansion addressing growing enterprise security needs

- Software subscription model transition improving revenue predictability

- 5G infrastructure deployment driving increased networking equipment demand

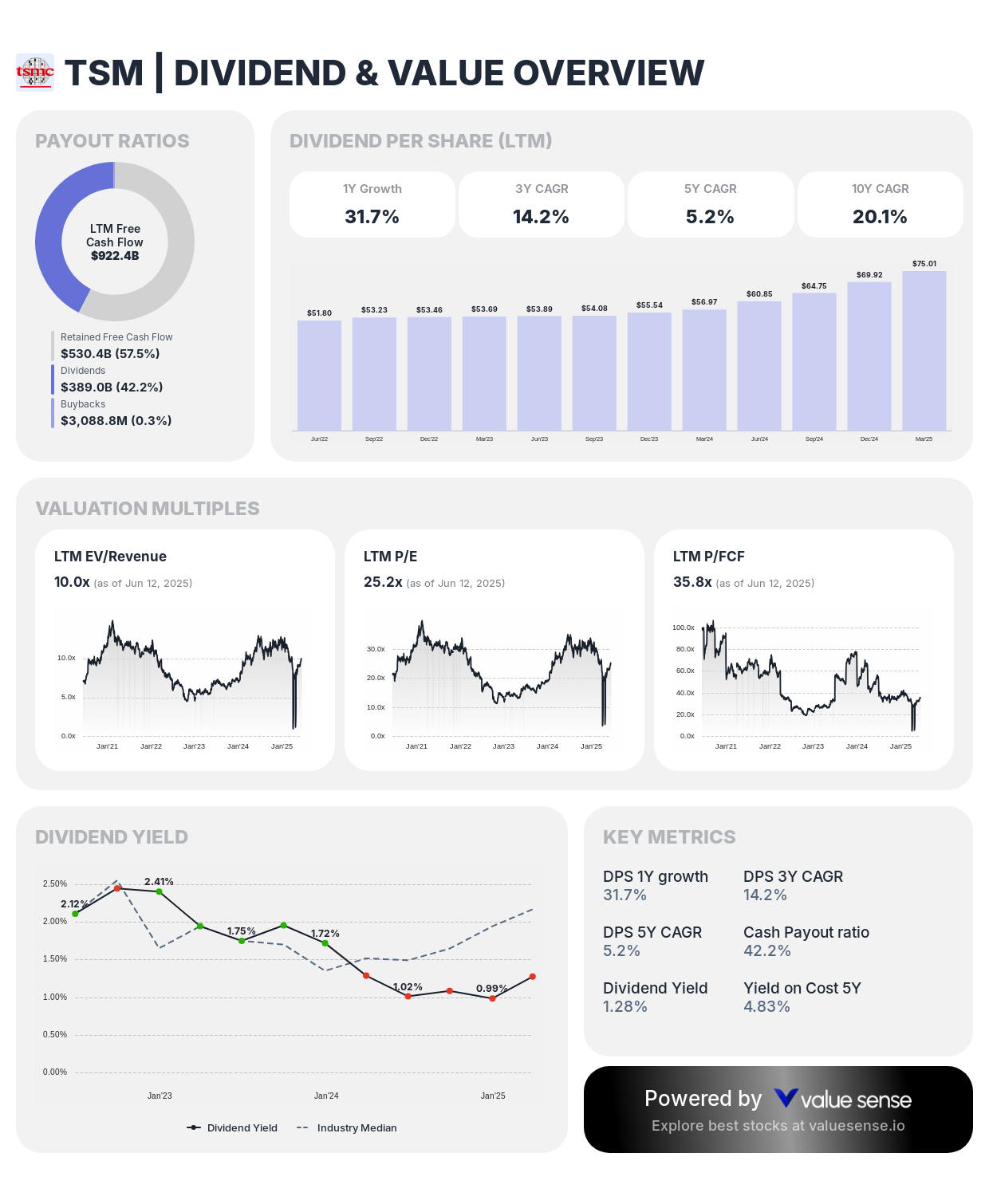

5. Taiwan Semiconductor Manufacturing Company (TSM) - 69.1% Undervalued

Sector: Semiconductors | Quality Rating: 8.2 | 1Y Return: 25.5% | Est. Dividend Yield: 1.5%

Key Financials:

- Revenue: NT$3,140.9B

- Free Cash Flow: NT$922.4B

- Revenue Growth: 39.9%

- FCF Margin: 29.4%

Investment Thesis: TSMC combines the highest quality rating (8.2) in our analysis with 69.1% undervaluation and an estimated 1.5% dividend yield. As the world's leading semiconductor foundry, TSMC occupies an irreplaceable position in the global technology supply chain with exceptional growth prospects driven by AI and advanced computing demands.

Dividend Sustainability: TSMC's massive free cash flow of NT$922.4B and industry-leading margins provide excellent dividend coverage. The company maintains a conservative payout policy while investing heavily in capacity expansion to meet growing demand from technology leaders.

Growth Catalysts:

- Artificial intelligence chip demand driving premium pricing and capacity utilization

- Advanced process node leadership (3nm, 2nm) with limited global competition

- Global capacity expansion reducing geopolitical concentration risks

- Essential supplier relationships with Apple, NVIDIA, and other technology giants

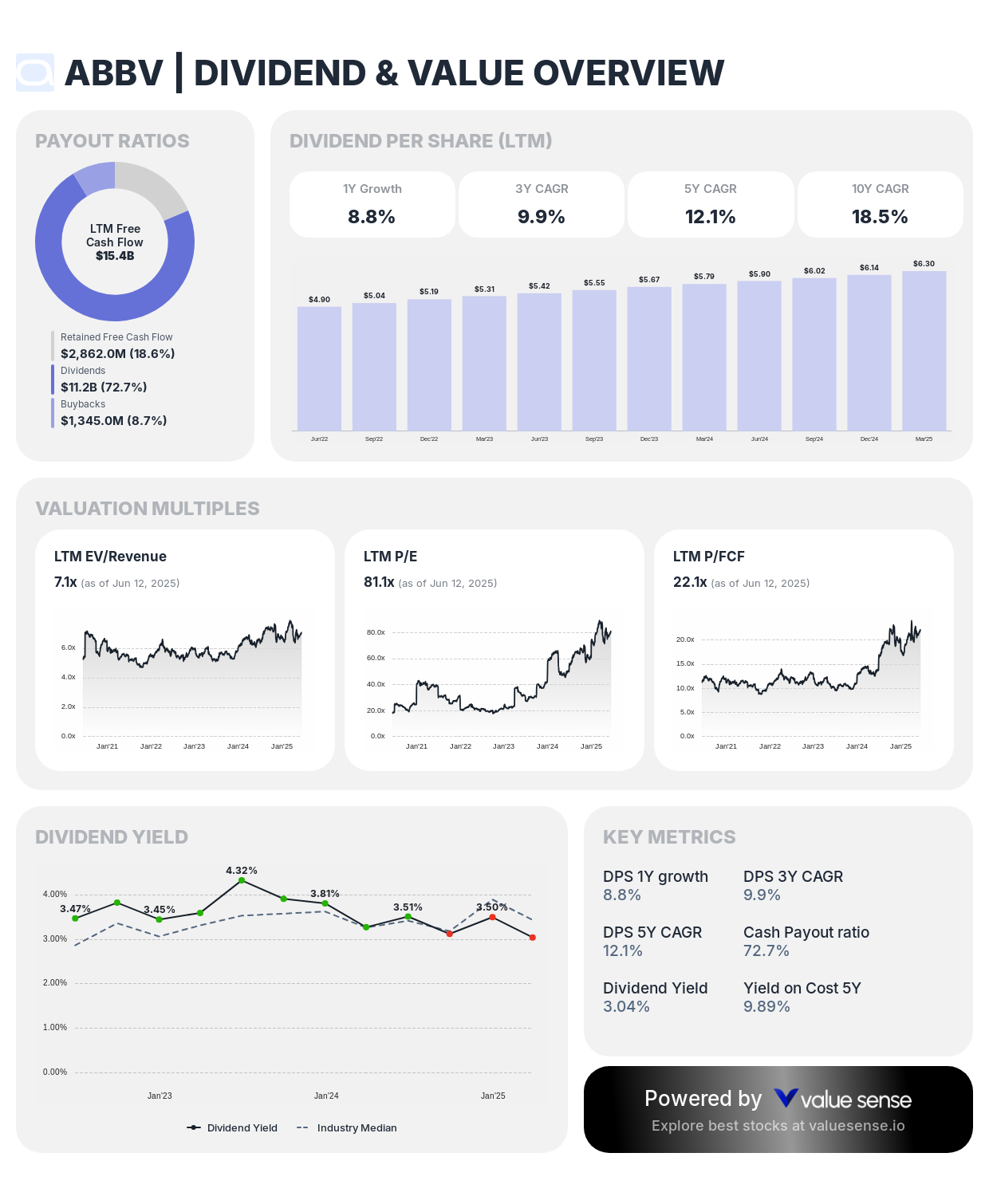

6. AbbVie Inc. (ABBV) - 50.8% Undervalued

Sector: Pharmaceuticals | Quality Rating: 6.5 | 1Y Return: 19.0% | Est. Dividend Yield: 3.4%

Key Financials:

- Revenue: $57.4B

- Free Cash Flow: $15.4B

- Revenue Growth: 5.4%

- FCF Margin: 26.8%

Investment Thesis: AbbVie trades 50.8% below intrinsic value while offering an attractive estimated 3.4% dividend yield, making it a compelling opportunity for income-focused investors. The company's diversified pharmaceutical portfolio and strong pipeline support both dividend sustainability and long-term growth potential beyond patent cliff challenges.

Dividend Sustainability: AbbVie's strong free cash flow generation and conservative payout policy support reliable dividend payments. The company has demonstrated commitment to dividend growth even during patent cliff transitions, reflecting confidence in its pipeline and cash generation capabilities.

Growth Catalysts:

- Immunology portfolio expansion beyond Humira with next-generation treatments

- Oncology pipeline development with promising late-stage candidates

- Neuroscience treatments addressing large addressable markets with high unmet needs

- International market expansion opportunities in emerging healthcare markets

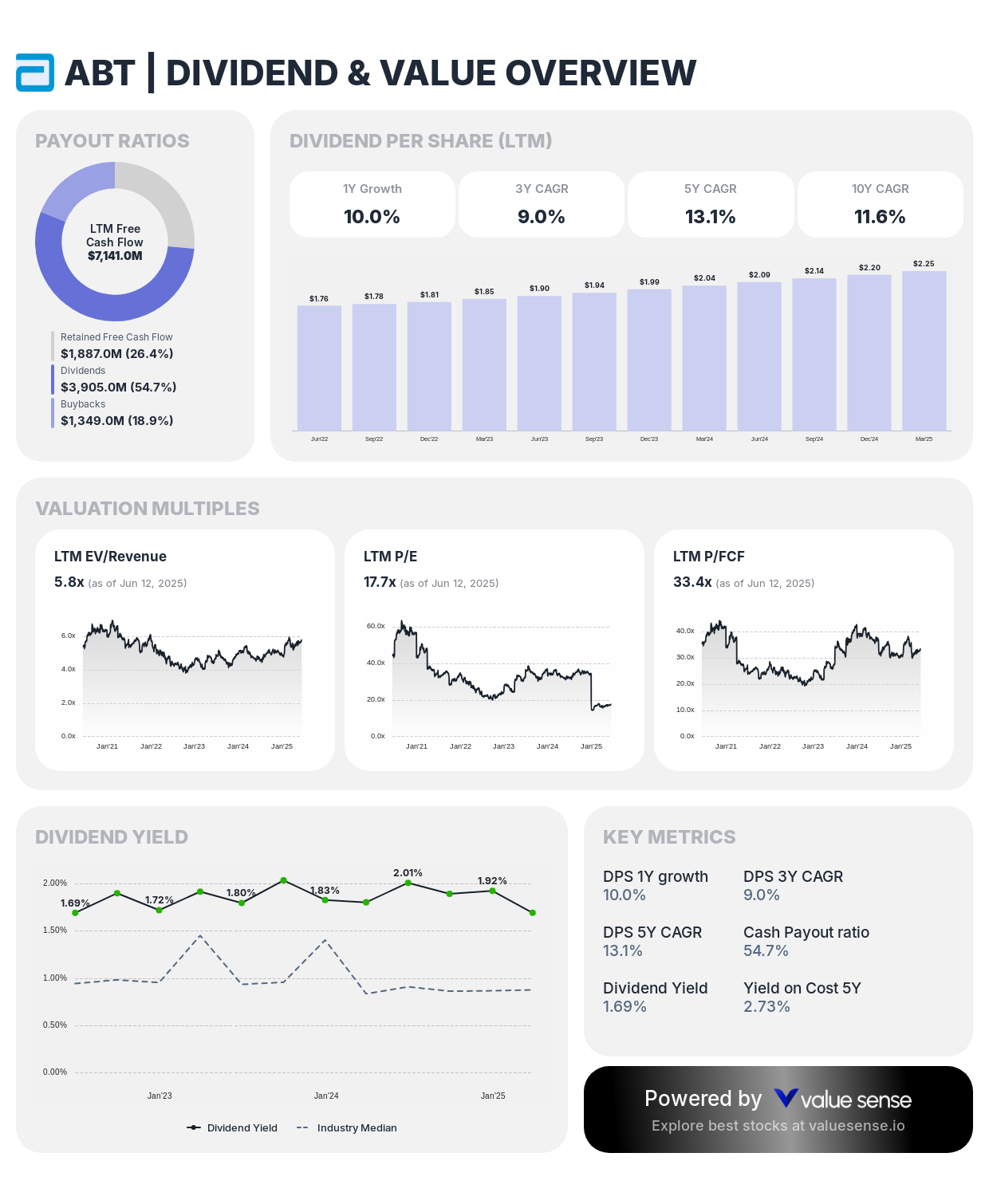

7. Abbott Laboratories (ABT) - 26.9% Undervalued

Sector: Healthcare | Quality Rating: 6.9 | 1Y Return: 32.7% | Est. Dividend Yield: 1.9%

Key Financials:

- Revenue: $42.3B

- Free Cash Flow: $7,141.0M

- Revenue Growth: 5.0%

- FCF Margin: 16.9%

Investment Thesis: Abbott trades 26.9% below intrinsic value while providing an estimated 1.9% dividend yield backed by diversified healthcare operations. The company's leadership in medical devices, diagnostics, and nutrition creates multiple growth avenues with defensive characteristics that appeal to conservative dividend investors.

Dividend Sustainability: Abbott's substantial free cash flow of $7.14B and consistent cash generation across business segments provide excellent dividend coverage. The company maintains a long history of dividend growth spanning multiple decades, demonstrating management's commitment to shareholder returns.

Growth Catalysts:

- FreeStyle Libre continuous glucose monitoring system global expansion

- Structural heart and electrophysiology device growth in aging populations

- Emerging market penetration across medical device and nutrition categories

- Innovation pipeline driving premium product launches and market share gains

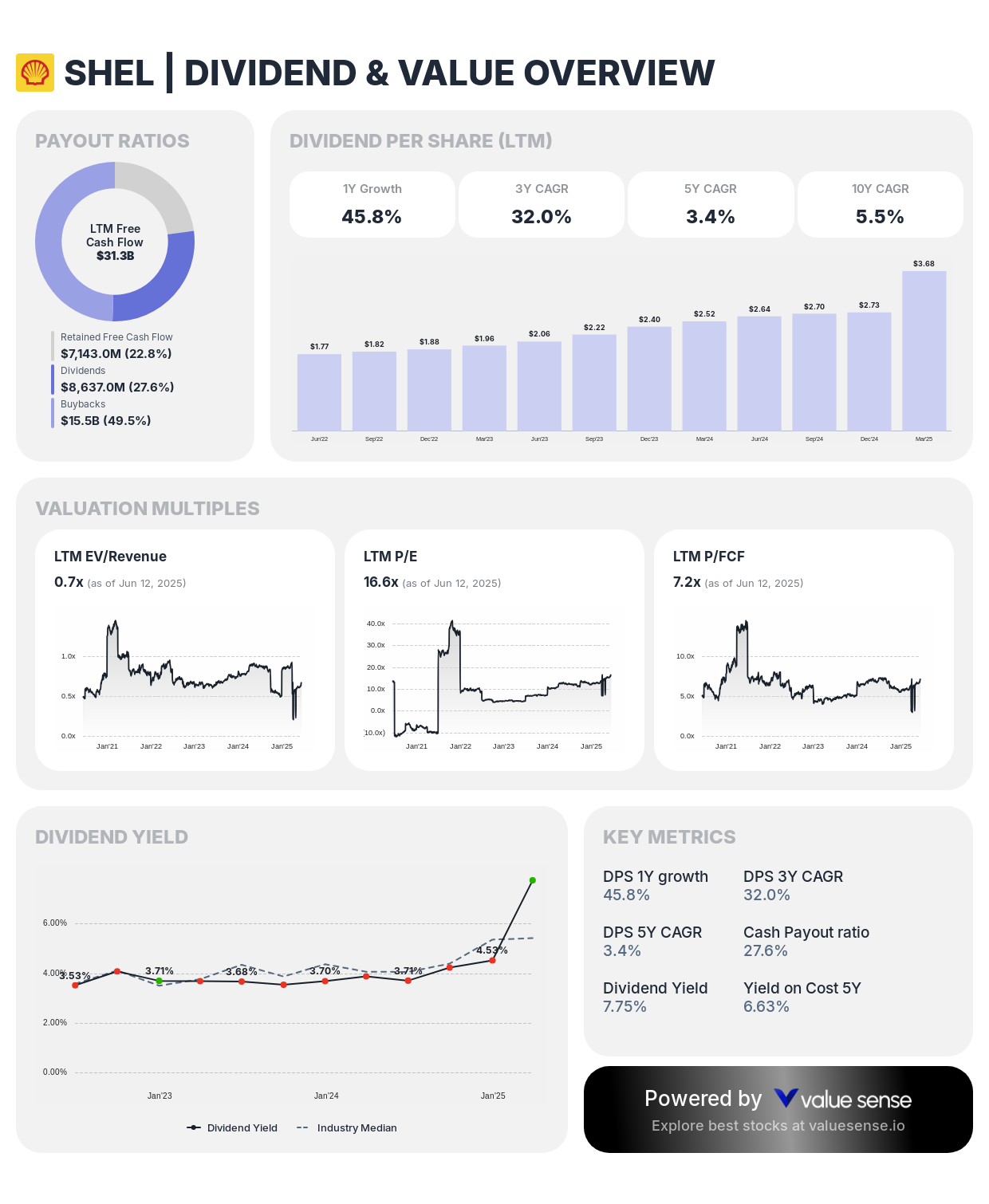

8. Shell plc (SHEL) - 22.0% Undervalued

Sector: Energy | Quality Rating: 6.6 | 1Y Return: 4.6% | Est. Dividend Yield: 3.8%

Key Financials:

- Revenue: $281.1B

- Free Cash Flow: $31.3B

- Revenue Growth: (7.0%)

- FCF Margin: 11.1%

Investment Thesis: Shell trades 22.0% below intrinsic value while offering the highest estimated dividend yield (3.8%) in our selection. The company's integrated energy business model and strategic investments in renewable energy position it for the energy transition while maintaining strong cash generation capabilities.

Dividend Sustainability: Shell's substantial free cash flow of $31.3B provides excellent dividend coverage even during commodity price volatility. The company's disciplined capital allocation approach prioritizes shareholder returns while funding energy transition investments for long-term sustainability.

Growth Catalysts:

- Integrated gas and LNG projects providing stable, long-term cash flows

- Renewable energy investments positioning for global energy transition

- Petrochemicals business benefiting from growing global demand

- Strategic share repurchase programs enhancing per-share returns

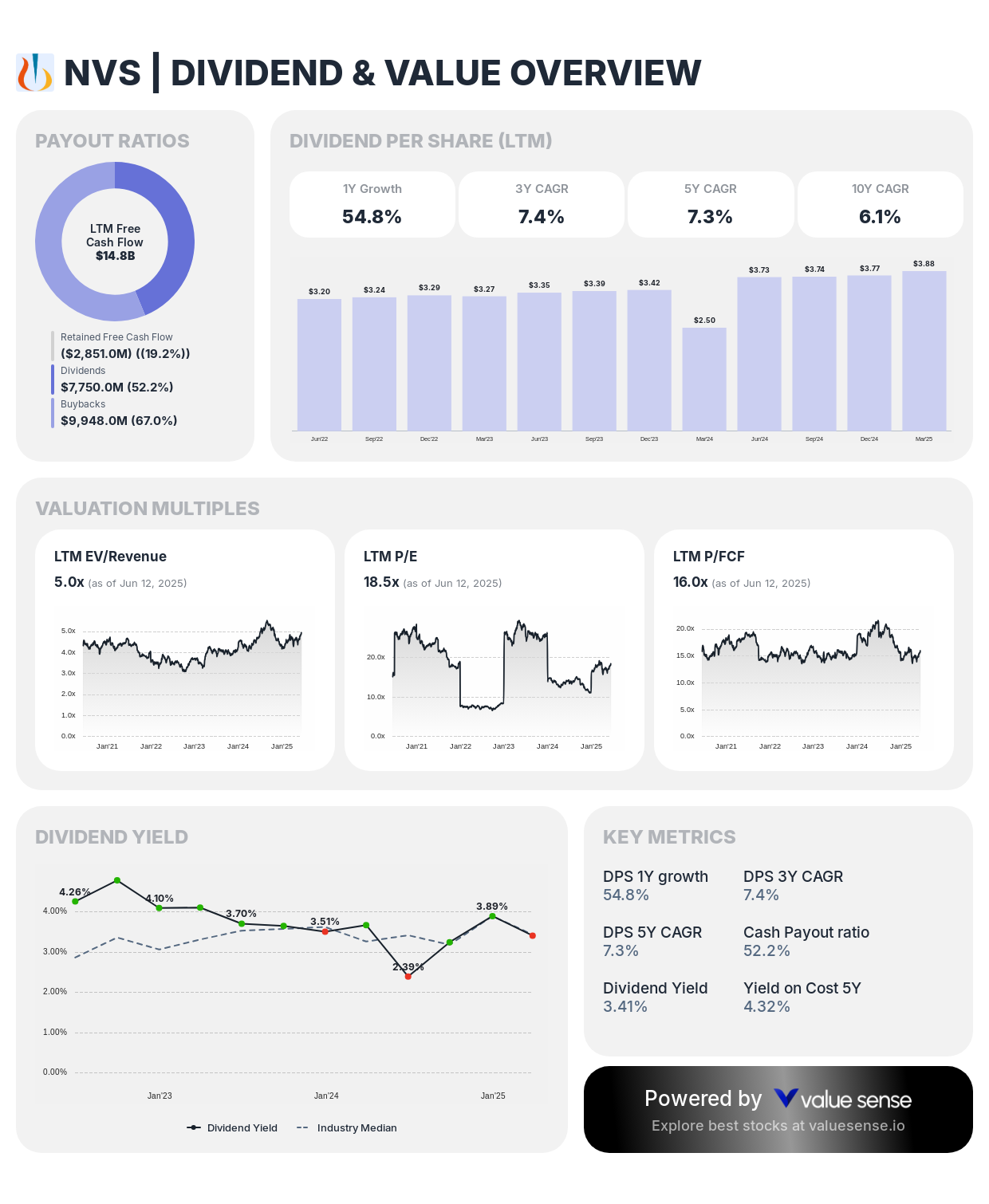

9. Novartis AG (NVS) - 19.4% Undervalued

Sector: Pharmaceuticals | Quality Rating: 7.0 | 1Y Return: 14.4% | Est. Dividend Yield: 3.6%

Key Financials:

- Revenue: $52.9B

- Free Cash Flow: $14.8B

- Revenue Growth: 6.5%

- FCF Margin: 28.1%

Investment Thesis: Novartis trades 19.4% below intrinsic value while offering an estimated 3.6% dividend yield supported by strong pharmaceutical operations. The company's focus on innovative medicines and strategic portfolio optimization creates sustainable competitive advantages in high-growth therapeutic areas.

Dividend Sustainability: Novartis maintains exceptional free cash flow margins of 28.1% providing substantial dividend coverage. The company's commitment to shareholder returns remains strong through consistent dividend payments and strategic share repurchases, supported by a focused pharmaceutical portfolio.

Growth Catalysts:

- Innovative drug pipeline with multiple potential blockbuster treatments

- Biosimilar competition mitigation through next-generation therapeutic innovations

- Emerging market expansion opportunities in underserved healthcare markets

- Strategic divestitures focusing resources on core pharmaceutical strengths

10. Johnson & Johnson (JNJ) - 18.8% Undervalued

Sector: Healthcare | Quality Rating: 6.4 | 1Y Return: 10.3% | Est. Dividend Yield: 2.9%

Key Financials:

- Revenue: $82.0B

- Free Cash Flow: $18.6B

- Revenue Growth: (4.3%)

- FCF Margin: 22.7%

Investment Thesis: Johnson & Johnson trades 18.8% below intrinsic value while offering an estimated 2.9% dividend yield backed by diversified healthcare operations. Despite recent challenges, J&J's pharmaceutical pipeline and medical device innovations support long-term value creation, while its Dividend Aristocrat status provides income reliability.

Dividend Sustainability: J&J's substantial free cash flow of $18.6B and Dividend Aristocrat status (61+ years of increases) demonstrate exceptional dividend reliability. The company's diversified healthcare portfolio provides stable cash flows supporting consistent payments through various market cycles.

Growth Catalysts:

- Pharmaceutical pipeline focused on high-growth therapeutic areas including oncology

- Medical device innovation in surgical and interventional solutions

- Emerging market expansion across healthcare segments

- Strategic acquisitions enhancing competitive positioning in key markets

Value Dividend Investment Strategy

Prioritize Quality and Undervaluation: Focus on companies combining attractive dividend yields with significant undervaluation. Our analysis shows Alibaba (267.5% undervalued, 1.8% yield) and Toyota (145.3% undervalued, 2.8% yield) offer exceptional value opportunities for patient investors.

Diversification Across Sectors: Spread investments across healthcare, technology, energy, and consumer sectors to reduce concentration risk while maintaining exposure to different economic cycles and growth drivers. This approach provides stability during sector-specific challenges.

Free Cash Flow Analysis: Emphasize companies with strong free cash flow generation relative to dividend payments. Companies like Cisco (25.0% FCF margin) and Novartis (28.1% FCF margin) demonstrate exceptional cash generation capabilities supporting sustainable dividend growth.

Long-Term Perspective: Value dividend investing requires patience for market recognition of intrinsic value while collecting dividends during the waiting period. This approach provides both income and capital appreciation potential as valuations normalize over time.

Our Valuation Methodology for Value Dividend Stocks

Financial Health Assessment (40% Weight):

- Balance sheet strength and debt management capabilities

- Consistent free cash flow generation across business cycles

- Sustainable dividend payout ratios with room for growth

- Working capital management and operational efficiency metrics

Growth Prospects Evaluation (30% Weight):

- Revenue growth sustainability and market opportunity size

- Competitive positioning and market share trends

- Innovation pipeline and R&D investment effectiveness

- Ability to grow dividends while funding business expansion

Valuation Discipline (30% Weight):

- Intrinsic value calculation using discounted cash flow methodology

- Comparative analysis against industry peers and historical ranges

- Risk-adjusted return potential assessment

- Margin of safety considerations for downside protection

Key Takeaways for Value Dividend Investors

✅ Top Opportunity: Alibaba offers exceptional undervaluation (267.5%) with growing dividend yield (1.8%)

✅ Sector Diversification: Opportunities span technology, healthcare, energy, and automotive sectors

✅ Quality Focus: Companies with ratings 6.0+ demonstrate financial strength and competitive positioning

✅ Yield Range: Dividend yields from 1.3% to 3.8% provide attractive income potential

✅ Value Upside: All selections trade below intrinsic value with substantial appreciation potential

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Quality Low-Debt Stocks

📖 10 Undervalued Quality Stocks

📖 11 Best Multibagger Stocks with Heavy Moats

Frequently Asked Questions About Value Dividend Stocks

What makes a dividend stock truly undervalued versus just offering a high yield?

A truly undervalued dividend stock trades significantly below its intrinsic value based on fundamental analysis, not just market sentiment or temporary challenges. High yields can sometimes indicate dividend cuts or business deterioration, while undervalued dividend stocks offer both current income and capital appreciation potential. Our analysis focuses on companies like Alibaba (267.5% undervalued with 1.8% yield) where strong fundamentals support both dividend sustainability and substantial price appreciation as valuations normalize over time.

How important is free cash flow coverage for dividend sustainability?

Free cash flow coverage is critical for dividend sustainability because it represents the actual cash available for shareholder returns after covering operational and capital expenditure needs. Companies with strong FCF margins like Cisco (25.0%) and Novartis (28.1%) demonstrate the ability to maintain and grow dividends even during challenging periods. We prioritize companies with FCF coverage ratios above 2.0x to ensure dividend security while maintaining growth investment capacity.

Should investors focus on dividend yield or total return potential?

Successful dividend investing requires balancing current yield with total return potential through dividend growth and capital appreciation. Our analysis emphasizes undervalued companies where intrinsic value exceeds current market price, providing both income and appreciation potential. For example, Taiwan Semiconductor (1.5% yield, 69.1% undervalued) offers modest current income but substantial total return potential, while Shell (3.8% yield, 22.0% undervalued) provides higher immediate income with moderate appreciation upside.

How do quality ratings impact dividend stock selection?

Quality ratings reflect a company's competitive moat strength, financial stability, and ability to sustain dividends through economic cycles. Companies with ratings above 6.0 typically demonstrate stronger business models and more predictable cash flows. Taiwan Semiconductor's 8.2 rating indicates exceptional competitive advantages, while companies with 6.0+ ratings like UnitedHealth and Abbott show solid fundamentals supporting reliable dividend payments and long-term growth potential.

What sectors provide the best opportunities for undervalued dividend stocks?

Our analysis reveals compelling opportunities across multiple sectors, with healthcare companies like UnitedHealth (104.7% undervalued) and Abbott (26.9% undervalued) offering defensive characteristics and demographic growth tailwinds. Technology companies like Cisco provide higher yields with transformation potential, while energy companies like Shell offer attractive yields with commodity exposure. Diversification across sectors reduces risk while capturing different economic cycle benefits and growth drivers.