Best Undervalued Dividend Stocks Under $50: November 2025 Picks

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

At ValueSense, we've been tracking dividend opportunities for over a decade, and what we're witnessing in November 2025 represents one of the most compelling value environments we've seen since the aftermath of the 2020 market disruption. The difference this time? Instead of broad market panic creating opportunities, we're seeing selective pessimism and temporary business headwinds generating pockets of genuine value that patient investors can exploit.

Our research team has spent hundreds of hours analyzing dividend-paying companies trading under $50, applying our proprietary screening methodology that combines dividend sustainability analysis, multi-factor valuation models, and business quality assessments. What we've uncovered is a collection of ten companies that meet our strict criteria for long-term dividend investing success.

Our Complete Analysis: 10 Undervalued Dividend Stocks Under $50

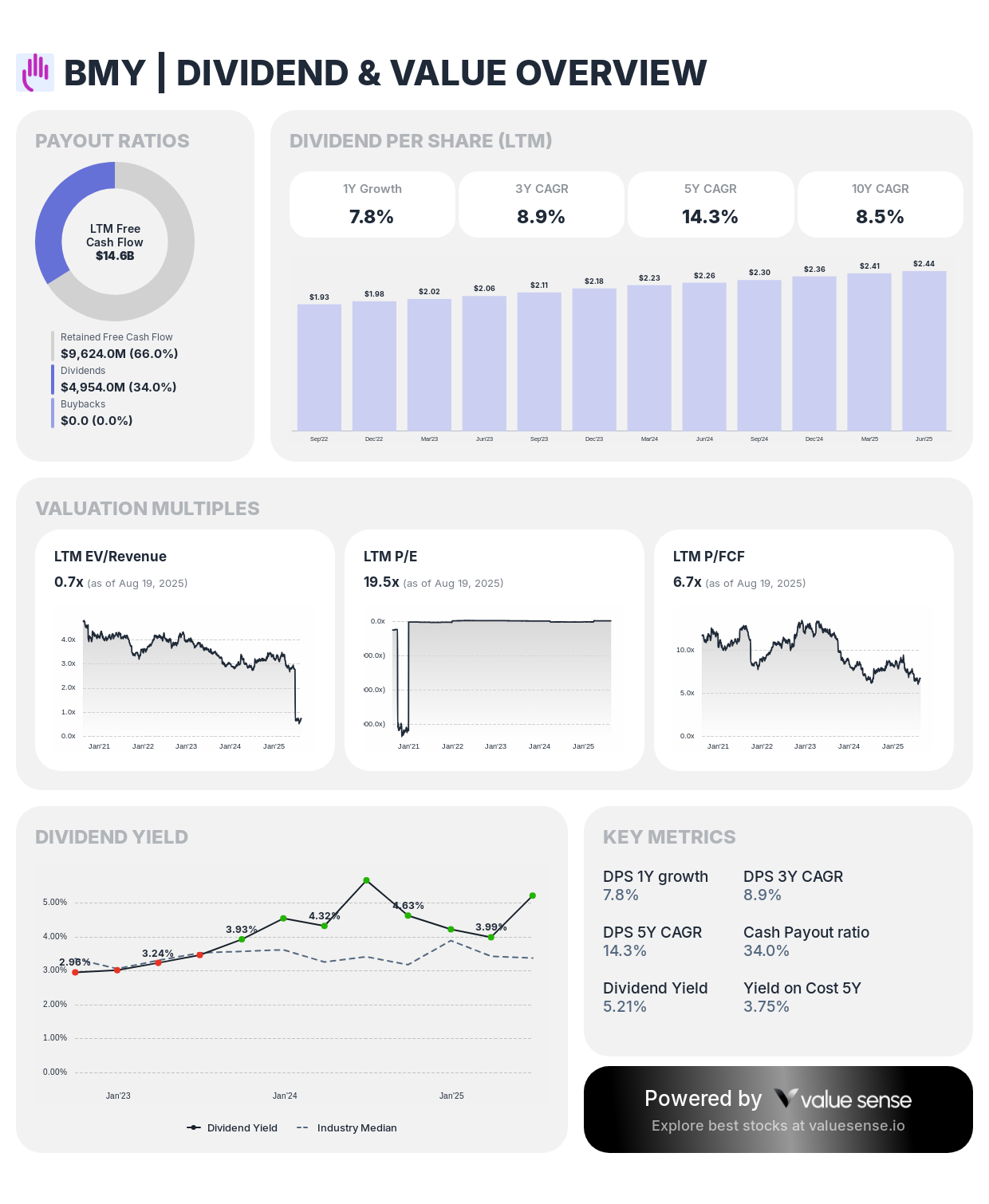

1. Bristol-Myers Squibb Company (BMY) - The Healthcare Giant Trading at a Discount

Our analysis reveals BMY as perhaps the most compelling large-cap dividend opportunity in the healthcare sector. With a 5.0% dividend yield and trading metrics that suggest significant undervaluation, this pharmaceutical giant deserves a spot in any serious dividend portfolio.

Key Metrics That Caught Our Attention:

- LTM EV/Revenue: 0.7x (extremely low for a major pharma company)

- FCF Yield: 14.8% (outstanding free cash flow generation)

- Dividend Payout Ratio: 97.8% (high but sustainable given cash flow strength)

- Market Cap: $98.4B

BMY's patent cliff concerns have created what we believe is an overreaction. The company's pipeline remains robust, and their recent acquisitions have strengthened their position in high-growth therapeutic areas. The 5.0% dividend yield is well-covered by free cash flows, and management has consistently demonstrated commitment to maintaining dividend payments even during challenging periods.

What makes BMY particularly attractive is the combination of defensive healthcare characteristics with a valuation more typical of cyclical industrials. Our DCF analysis suggests the stock is trading at a 33.3% discount to intrinsic value, creating an unusual opportunity to own a dividend-paying healthcare leader at a reasonable price.

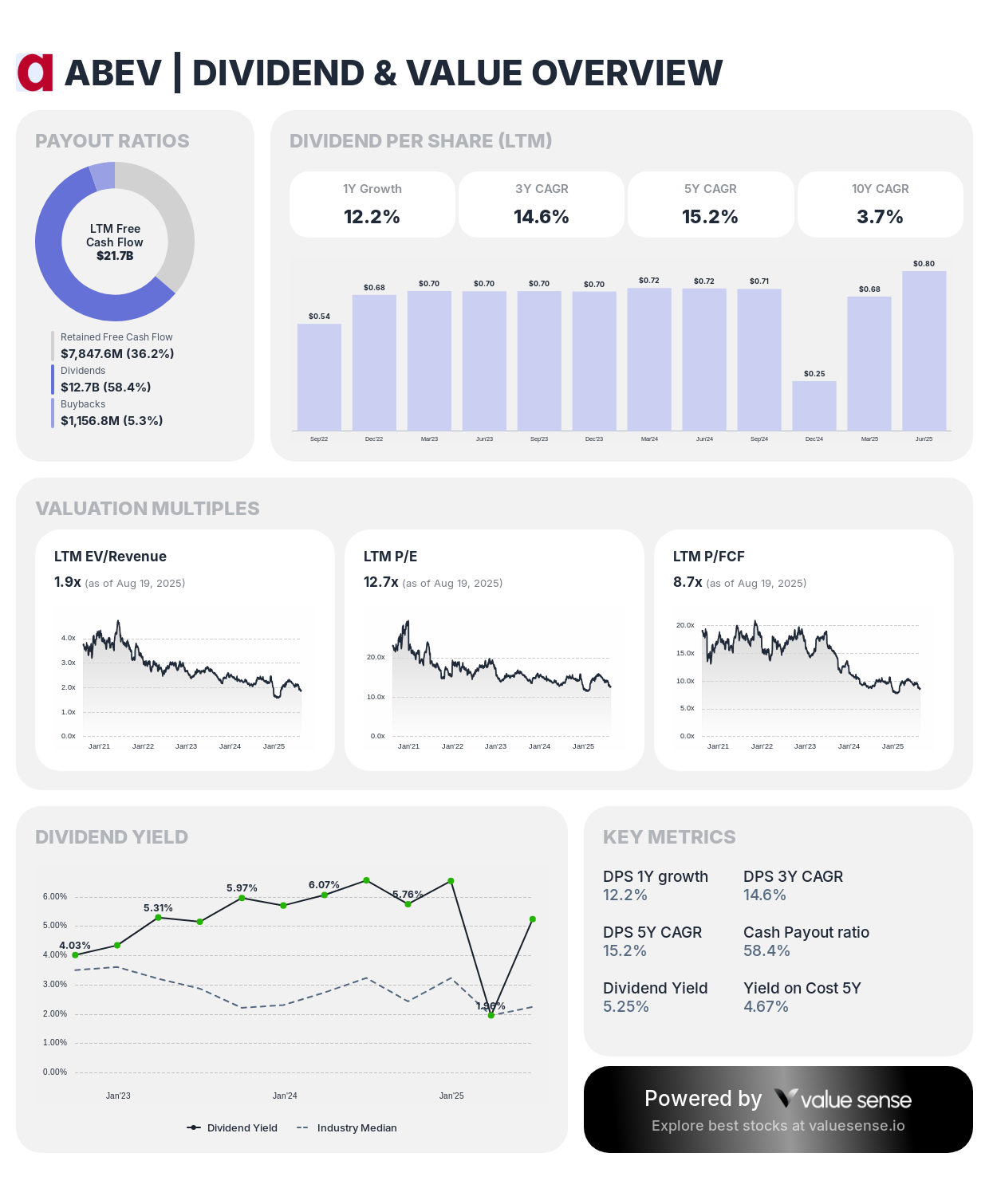

2. Ambev S.A. (ABEV) - International Diversification with Compelling Yields

As one of the world's largest brewing companies, ABEV offers investors exposure to Latin American markets through a business model that has proven remarkably resilient across various economic cycles. Our team has been particularly impressed with the company's recent operational improvements and strategic positioning.

Investment Highlights:

- Dividend Yield: 6.8%

- Revenue Growth: 13.4% (impressive for a mature beverage company)

- Multiple Undervaluation Signals: 14.9% undervalued (intrinsic), 36.8% undervalued (Peter Lynch)

- Market Cap: $34.0B

The beauty of ABEV lies in its defensive characteristics combined with emerging market growth potential. Beer consumption remains remarkably stable across economic cycles, and Ambev's dominant market positions in Brazil and other Latin American countries provide pricing power that many investors underestimate.

Our analysis shows ABEV trading at just 12.7x LTM P/E, which is remarkable for a company with such strong market positions and consistent cash generation. The 84.1% dividend payout ratio might seem high, but it's well-supported by the company's stable cash flows and conservative capital allocation strategy.

3. Brookfield Infrastructure Partners L.P. (BIP) - The Ultimate Infrastructure Play

When we talk about high dividend yield stocks under $50, BIP stands in a category of its own. The 13.8% dividend yield isn't just attractive - it's backed by one of the most diversified infrastructure portfolios in the world.

Why BIP Excels:

- Dividend Yield: 13.8% (highest in our analysis)

- DPS Growth: 72.0% (1Y), 21.5% (3Y), 20.1% (10Y)

- Multiple Undervaluation Indicators: Significant discounts across Graham and Lynch methodologies

- Cash Flow Payout Ratio: Negative 212.3% (indicating strong cash generation beyond distributions)

Infrastructure partnerships like BIP benefit from what Warren Buffett calls "economic moats" - their assets are often irreplaceable and generate predictable cash flows. Roads, bridges, telecommunications networks, and energy infrastructure don't become obsolete overnight.

What sets BIP apart is management's track record of growing distributions while simultaneously growing the asset base. The partnership structure allows for tax-efficient distributions to unitholders, making it particularly attractive for income-focused investors.

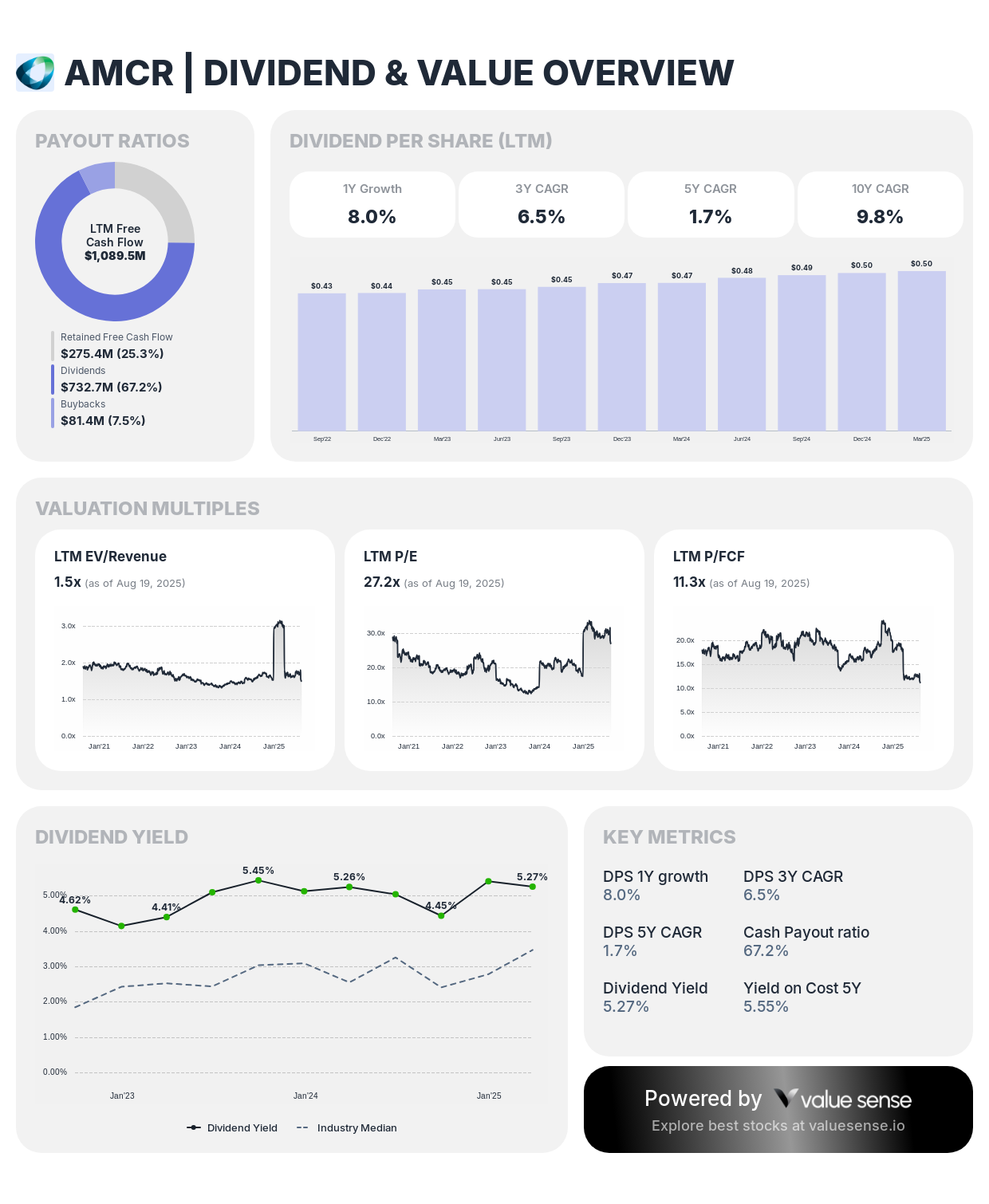

4. Amcor plc (AMCR) - Packaging Powerhouse with Global Reach

AMCR represents what we consider a "hidden gem" in the packaging industry. With operations spanning the globe and exposure to both consumer staples and industrial markets, this Australian-based company offers diversification benefits that many investors overlook.

Key Investment Metrics:

- Dividend Yield: 6.0%

- LTM P/E: 27.2x

- FCF Yield: 8.9%

- Multiple Undervaluation Signals: 25.3% undervalued (intrinsic), 61.4% undervalued (Graham)

The packaging industry benefits from several secular trends: e-commerce growth, emerging market consumption increases, and the ongoing shift toward sustainable packaging solutions. AMCR's global footprint and technical expertise position it well to capitalize on these trends.

Our financial analysis reveals a company with 90.0% dividend payout ratio that's well-supported by consistent cash generation. The business model's defensive characteristics become particularly valuable during economic uncertainty, as packaging demand remains relatively stable regardless of broader economic conditions.

5. Plains All American Pipeline, L.P. (PAA) - Energy Infrastructure at Attractive Valuations

Despite ESG concerns weighing on energy infrastructure stocks, PAA's financial metrics are simply too compelling to ignore. The company operates critical energy transportation infrastructure across North America, generating cash flows that support an attractive distribution yield.

Financial Strength Indicators:

- Distribution Yield: 9.6%

- FCF Yield: 23.9% (exceptional cash generation)

- DPS Growth: 16.8% (1Y), 25.9% (3Y)

- LTM EV/EBIT: 17.3x

Energy transportation infrastructure, particularly pipelines, operates under a different risk profile than energy production. PAA essentially operates toll roads for energy products, generating fee-based revenue that's less sensitive to commodity price fluctuations.

The 91.0% dividend payout ratio reflects management's commitment to returning cash to unitholders while maintaining financial flexibility for growth investments. Our analysis suggests this distribution is well-covered by the partnership's stable cash flows from long-term transportation contracts.

6. PLDT Inc. (PHI) - Asian Telecommunications Opportunity

PHI provides investors with exposure to the Philippines' growing telecommunications market through one of the country's leading service providers. While telecommunications stocks have faced headwinds globally, PHI's dominant market position and improving operational metrics make it an intriguing opportunity.

Investment Case:

- Dividend Yield: 7.5%

- Quality Rating: 6.7/10

- Market Cap: $4.87B

- Multiple Undervaluation Signals: 22.4% undervalued (intrinsic)

The Philippines represents one of Asia's most dynamic economies, with a young, increasingly connected population driving telecommunications demand. PHI's infrastructure investments position it well to benefit from continued digitalization trends.

Our analysis shows a 53.6% dividend payout ratio, indicating significant dividend coverage and potential for future distribution growth as the business continues expanding its subscriber base and improving service offerings.

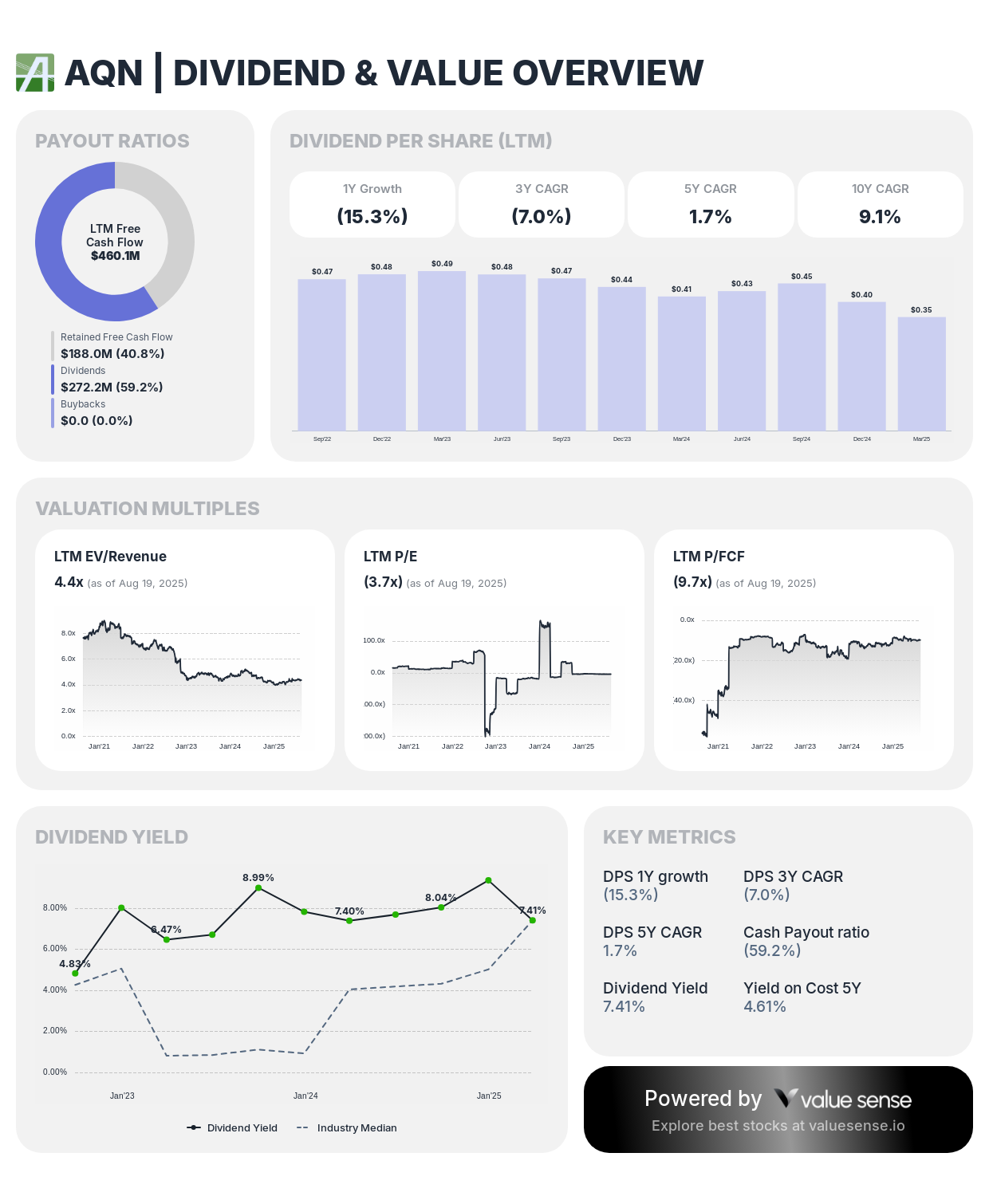

7. Algonquin Power & Utilities Corp. (AQN) - Utility Value at Extreme Discounts

AQN has been one of our most closely watched utilities, and recent market pessimism has created what we believe is an exceptional value opportunity. The combination of utility stability and renewable energy growth exposure makes this a compelling long-term holding.

Valuation Opportunity:

- Dividend Yield: 6.1%

- Extreme Undervaluation: 2,427.0% undervalued (Ben Graham methodology)

- Market Cap: $4.45B

- Quality Rating: 6.8/10

Utility stocks like AQN provide the kind of predictable cash flows that dividend investors crave. The company's focus on renewable energy infrastructure aligns with long-term decarbonization trends while maintaining the regulatory stability inherent in utility operations.

The negative 20.7% dividend payout ratio might seem confusing, but it reflects timing differences in cash flows and demonstrates the underlying strength of the utility's cash generation capabilities.

8. Liberty Global plc (LBTYK) - European Cable Infrastructure

LBTYK offers investors exposure to European cable and broadband infrastructure through one of the continent's largest operators. While the stock has faced headwinds from cord-cutting concerns, the underlying broadband infrastructure remains valuable.

Key Metrics:

- Dividend Yield: 8.0%

- Undervaluation Signal: 17.9% undervalued (intrinsic)

- Market Cap: $4.13B

- Revenue: $2.96B

Cable infrastructure, particularly in European markets, benefits from high barriers to entry and relatively stable subscriber bases. While traditional video services face pressure, broadband demand continues growing as remote work and streaming drive higher bandwidth requirements.

Our analysis reveals a company trading at significant discounts to replacement cost of its infrastructure assets, creating potential value for patient investors willing to look beyond near-term headwinds.

9. Flowers Foods, Inc. (FLO) - Consumer Staples Stability

FLO represents the epitome of defensive dividend investing - a company that makes bread, rolls, and snack cakes for mass market consumption. While not glamorous, the business model's stability and reasonable valuation make it attractive for conservative dividend portfolios.

Defensive Characteristics:

- Dividend Yield: 6.2%

- Undervaluation: 43.0% undervalued (intrinsic)

- Market Cap: $3.32B

- Quality Rating: 6.3/10

Consumer staples companies like FLO benefit from recession-resistant demand patterns. People need bread regardless of economic conditions, and FLO's established distribution networks and brand recognition provide competitive advantages.

The 89.6% dividend payout ratio reflects the mature nature of the business and management's commitment to returning excess cash to shareholders. Our analysis suggests this dividend level is sustainable given the company's stable cash flows and modest capital requirements.

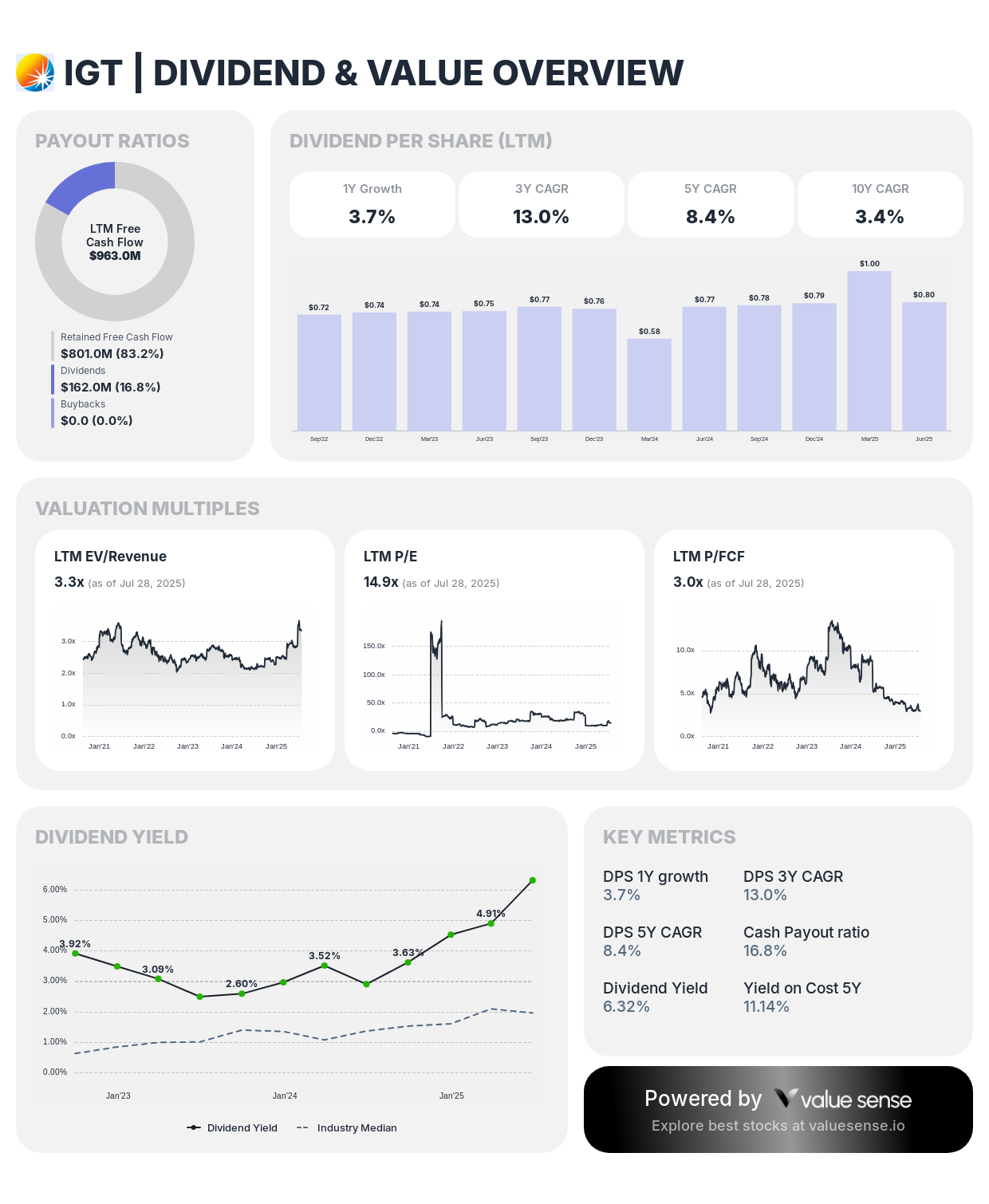

10. International Game Technology PLC (IGT) - Gaming Technology Recovery Play

IGT operates in the global gaming technology sector, providing lottery systems, gaming machines, and related services to operators worldwide. While the stock has faced challenges, recent operational improvements and attractive valuation metrics make it worthy of consideration.

Recovery Potential:

- Dividend Yield: 5.6%

- Undervaluation: 30.8% undervalued (intrinsic)

- Market Cap: $2.89B

- Revenue: $2.45B

The gaming technology sector benefits from several positive trends: digital transformation of lottery operations, expansion of legal gaming markets, and increasing demand for sophisticated gaming systems. IGT's established relationships with gaming operators worldwide provide a valuable competitive moat.

Our Strategic Approach to Building a Sub-$50 Dividend Portfolio

At ValueSense, we've developed a systematic approach to constructing dividend portfolios that balance income generation, capital preservation, and growth potential. Here's our recommended framework for investors interested in these undervalued dividend stocks under $50:

Geographic Diversification Strategy

North American Core (50-60%):

- Healthcare: BMY for defensive characteristics

- Energy Infrastructure: PAA for yield and inflation protection

- Consumer Staples: FLO for recession resistance

- Utilities: AQN for stability and renewable energy exposure

International Exposure (25-35%):

- Emerging Markets: ABEV for growth potential

- Developed International: AMCR, LBTYK for diversification

- Asian Growth: PHI for telecommunications exposure

Specialty Holdings (10-15%):

Sector Allocation Philosophy

Our research has consistently shown that sector diversification within dividend portfolios provides better risk-adjusted returns than concentration in any single industry. Even traditionally defensive sectors like utilities can face headwinds from regulatory changes or interest rate movements.

Defensive Core (40-50%): Utilities (AQN), Healthcare (BMY), and Consumer Staples (FLO) form the defensive foundation. These companies operate in industries with relatively predictable demand patterns and regulatory frameworks that support stable cash flows.

Infrastructure Allocation (20-30%): BIP and PAA provide exposure to essential infrastructure assets that generate fee-based revenue streams. These positions offer both attractive current yields and potential inflation protection through their asset-backed cash flows.

International Diversification (20-30%): ABEV, AMCR, LBTYK, and PHI provide geographic diversification that reduces dependence on any single country's economic performance. This is particularly valuable for dividend investors, as different regions often experience economic cycles at different times.

Recovery/Special Situations (5-10%): IGT represents our "recovery play" allocation - a company with turnaround potential trading at attractive valuations. These positions can provide outsized returns but require careful monitoring and position sizing.

Current Market Dynamics and Their Impact

The August 2025 market environment presents several unique factors that influence our dividend stock analysis:

Interest Rate Environment

Current interest rate levels have created relative attractiveness for dividend yields, particularly in the 5-10% range. However, we remain mindful that rising rates can pressure dividend stock valuations, especially for utility and infrastructure companies.

Inflation Considerations

Many of our selected companies benefit from inflation protection through their business models:

- Infrastructure companies (BIP, PAA) often have inflation-adjusted contracts

- Consumer staples (FLO) can pass through cost increases

- International exposure (ABEV, AMCR) provides currency diversification

ESG Impact on Valuations

Environmental, social, and governance considerations have created valuation disparities that informed investors can exploit:

- Energy infrastructure (PAA) trades at discounts despite providing essential services

- Traditional industries (FLO, IGT) face ESG-related selling pressure despite stable fundamentals

Advanced Dividend Analysis: Beyond Yield

At ValueSense, we've learned that successful dividend investing requires looking beyond simple yield calculations. Here are the additional metrics we analyze:

Dividend Coverage Analysis

Free Cash Flow Coverage: We calculate how many times over each company's dividend is covered by free cash flow. Companies like BMY (14.8% FCF yield vs 5.0% dividend yield) provide substantial coverage margins.

Earnings Coverage: Traditional earnings-based coverage ratios, adjusted for one-time items and accounting treatments specific to each industry.

Cash Flow Stability: We analyze the volatility of underlying cash flows to assess dividend sustainability during economic downturns.

Quality Scoring Methodology

Our proprietary quality scoring system evaluates:

- Business Model Defensibility: Competitive moats and barriers to entry

- Financial Strength: Balance sheet metrics and cash flow consistency

- Management Quality: Track record of capital allocation and shareholder-friendly policies

- Industry Dynamics: Secular trends and competitive positioning

Valuation Methodology Integration

We employ multiple valuation approaches to identify genuine opportunities:

Discounted Cash Flow (DCF): Forward-looking analysis based on business-specific assumptions

Ben Graham Net-Net: Asset-based approach for companies with substantial tangible assets

Peter Lynch PEG Analysis: Growth-adjusted valuation metrics for companies with expanding businesses

Relative Valuation: Peer comparison analysis within industries and across dividend-paying sectors

Monitoring Your Dividend Portfolio: Key Metrics to Track

Successful dividend investing requires ongoing monitoring of key performance indicators:

Financial Health Indicators

Debt-to-Equity Ratios: Monitor changes in leverage levels, particularly for utilities and infrastructure companies that typically carry higher debt levels.

Interest Coverage: Ensure companies can comfortably service debt obligations, especially important during rising rate environments.

Cash Conversion: Track how effectively companies convert earnings into cash flow available for dividends.

Business Performance Metrics

Revenue Growth: Sustainable dividend growth typically requires underlying business growth.

Market Share Trends: Monitor competitive positioning within each company's industry.

Capital Allocation: Assess management's decisions regarding reinvestment vs. shareholder returns.

Dividend-Specific Metrics

Payout Ratio Trends: Watch for increasing payout ratios that might signal future dividend pressure.

Dividend Growth Consistency: Companies with consistent dividend growth histories typically continue that pattern.

Coverage Ratio Stability: Fluctuating coverage ratios can indicate underlying business volatility.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Best Undervalued S&P 500 Stocks

📖 11 Best Undervalued Multibagger Stocks

📖 The Magnificent 7 Stocks: Fundamental Quality Rankings & Insights

FAQ about best Undervalued Dividend Stocks Under $50

Q: Are these high dividend yields sustainable, or should I be worried about dividend cuts?

A: At ValueSense, we specifically screen for dividend sustainability using multiple coverage metrics. Companies like BIP (13.8% yield) operate as partnerships that distribute most of their cash flow by design - that's not a red flag, it's the business model. However, always verify that yields aren't high simply because stock prices have fallen due to fundamental problems. Our analysis includes cash flow coverage, payout ratios, and business stability assessments for each recommendation.

Q: How do I handle the tax complexity of partnerships like BIP and PAA?

A: Master Limited Partnerships (MLPs) like BIP and PAA issue K-1 tax forms instead of 1099s, which can complicate tax preparation. However, many investors find the higher after-tax yields worth the additional complexity. The distributions often include return of capital components that defer taxes until you sell. We recommend consulting with a tax professional familiar with MLP taxation, especially if you're holding these in taxable accounts.

Q: Should I be concerned about investing in foreign companies like ABEV and PHI?

A: International diversification is actually beneficial for dividend portfolios, as different countries experience economic cycles at different times. ABEV trades as an ADR on U.S. exchanges, making it as easy to buy as domestic stocks. The main considerations are currency risk and foreign withholding taxes. Both companies operate in defensive industries (beverages and telecommunications) with strong local market positions.

Q: How much of my total portfolio should be allocated to dividend stocks under $50?

A: This depends entirely on your investment objectives and risk tolerance. At ValueSense, we typically recommend dividend allocations of 20-40% for growth-focused investors and 40-70% for income-focused investors. The specific price level ($50 or under) is less important than the overall quality and diversification of your dividend holdings. These sub-$50 stocks simply offer better entry points for building meaningful positions.

Q: What's your view on dividend growth vs. high current yield?

A: We favor a balanced approach. High current yields (like BIP's 13.8%) provide immediate income but may have limited growth potential. Dividend growth stocks (like AMCR with its consistent increases) may start with lower yields but can provide better long-term total returns. Our recommended portfolio includes both types to balance current income with future growth potential.

Q: How often should I rebalance my dividend stock positions?

A: We recommend quarterly monitoring coinciding with earnings releases, but only rebalance when positions drift significantly from targets (typically 20% or more from target weights). Over-rebalancing can create unnecessary transaction costs and tax consequences. Focus on major changes in fundamentals rather than daily price movements - dividend investing rewards patience.

Q: What are the biggest risks I should watch for with these stocks?

A: The primary risks vary by company: interest rate sensitivity for utilities (AQN), commodity exposure for energy infrastructure (PAA), currency risk for international holdings (ABEV, PHI), and regulatory changes for various industries. We mitigate these through diversification and position sizing. The biggest mistake dividend investors make is chasing yield without understanding the underlying business risks.

Q: Are there any red flags that would make you sell these positions?

A: Yes, several red flags would trigger reassessment: sustained decline in cash flow coverage below 1.5x, management changes that alter dividend policy, fundamental shifts in industry dynamics, or dividend cuts (which often signal deeper problems). We also monitor for excessive debt accumulation and deteriorating competitive positions. The key is distinguishing temporary challenges from permanent impairment.

Q: How do you handle dividend reinvestment with these stocks?

A: We generally recommend automatic dividend reinvestment plans (DRIPs) when available, as they eliminate transaction costs and enable dollar-cost averaging. However, for tax-sensitive accounts, you might prefer to receive cash dividends to maintain control over timing and tax consequences. The lower share prices of these sub-$50 stocks make reinvestment more efficient since less cash sits idle between reinvestment opportunities.

Q: What's your outlook for dividend stocks in the current market environment?

A: We remain constructive on dividend stocks, particularly those trading at reasonable valuations like our recommendations. The current environment of moderate economic growth, stabilizing interest rates, and selective market pessimism creates opportunities for patient investors. However, we emphasize that dividend investing is a long-term strategy - short-term market movements shouldn't drive investment decisions.