Undervalued Fintech Stocks September 2025: 6 Financial Technology Value Plays

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The financial technology sector continues to reshape how we handle money, make payments, and access financial services. While many fintech stocks soared during the pandemic boom, the subsequent market correction has created compelling opportunities for value-oriented investors. As we navigate through September 2025, several high-quality fintech companies are trading below their intrinsic values, presenting attractive entry points for patient investors.

The fintech landscape has matured significantly, with established players demonstrating sustainable business models and emerging companies finding their footing in specialized niches. From traditional financial giants embracing digital transformation to pure-play digital disruptors, the sector offers diverse investment opportunities across various market capitalizations and growth stages.

The Current Fintech Investment Environment

The fintech sector in 2025 presents a tale of two markets. While headline-grabbing artificial intelligence and cryptocurrency stories dominate the news, many solid financial technology companies are quietly trading at attractive valuations. Rising interest rates have compressed growth multiples across the board, creating opportunities for discerning investors to acquire quality assets at reasonable prices.

Several macroeconomic factors are shaping the current investment landscape. Higher interest rates have actually benefited some fintech companies by improving their net interest margins on cash balances and lending products. Simultaneously, the normalization of digital payment adoption post-pandemic has created more predictable revenue streams for established players.

Regulatory clarity has also improved in many jurisdictions, reducing uncertainty around compliance costs and operational frameworks. This stability allows investors to better assess long-term prospects without the overhang of potential regulatory disruption that plagued the sector in previous years.

6 Undervalued Fintech Stocks for September 2025

1. American Express Company (AXP) - $331.28

American Express represents the intersection of traditional financial services and modern fintech innovation. Trading at $331.28, the stock appears modestly undervalued based on multiple valuation metrics. The company's intrinsic value analysis suggests fair value around $353.30, indicating approximately 6.6% upside potential.

The credit card giant has successfully transformed itself into a technology-forward financial services company. Their proprietary payment network, combined with sophisticated data analytics capabilities, creates sustainable competitive advantages. Recent investments in digital wallet integration, merchant services technology, and artificial intelligence-driven fraud detection demonstrate the company's commitment to staying ahead of fintech trends.

American Express benefits from a premium customer base with higher spending power and lower default rates compared to competitors. This quality advantage becomes particularly valuable during economic uncertainty, as evidenced by their resilient performance through various market cycles.

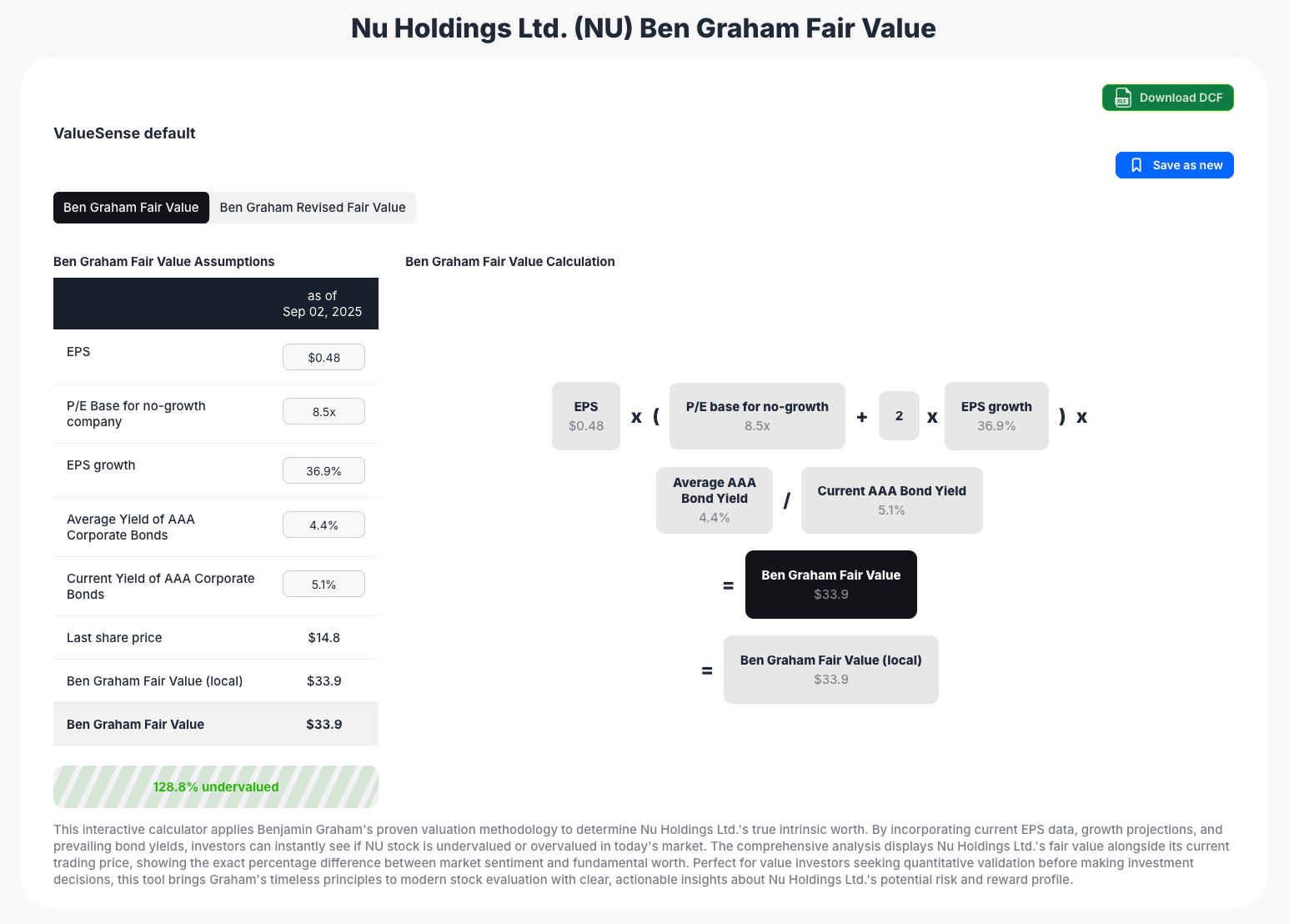

2. Nu Holdings Ltd. (NU) - $14.80

Nu Holdings, the Brazilian digital banking pioneer, trades at $14.80 and represents one of the most compelling value opportunities in the Latin American fintech space. The company's innovative approach to digital-first banking has captured significant market share in Brazil, Mexico, and Colombia.

With an estimated intrinsic value suggesting meaningful undervaluation, Nu Holdings benefits from several secular trends. The ongoing digital transformation in Latin America, combined with the region's historically underbanked population, creates a substantial addressable market for Nu's services.

The company's technology-first approach enables significantly lower operational costs compared to traditional banks. Their machine learning algorithms for credit decisioning and risk management have proven effective at serving previously excluded populations while maintaining healthy unit economics.

3. PayPal Holdings, Inc. (PYPL) - $70.19

PayPal's current price of $70.19 presents an attractive entry point for long-term investors. With intrinsic value estimates around $107.40, the stock appears significantly undervalued by approximately 53%. The market has punished PayPal for slowing user growth and increased competition, but these concerns may be overblown.

The company's two-sided network effects remain intact, with both consumers and merchants benefiting from the platform's reach and reliability. Recent initiatives in cryptocurrency services, buy-now-pay-later offerings, and international expansion demonstrate management's focus on diversifying revenue streams.

PayPal's strong balance sheet and consistent cash flow generation provide flexibility to invest in growth initiatives while returning capital to shareholders. The company's established brand and trust advantage in digital payments create barriers to entry that newer competitors struggle to overcome.

4. Marathon Digital Holdings, Inc. (MARA) - $15.98

Marathon Digital offers exposure to the cryptocurrency ecosystem through its Bitcoin mining operations. Trading at $15.98, the stock presents both significant opportunity and considerable risk. The company's intrinsic value analysis suggests potential upside, though investors must carefully consider the volatile nature of cryptocurrency markets.

Marathon has positioned itself as one of the largest and most efficient Bitcoin miners in North America. Their focus on renewable energy sources and operational efficiency helps differentiate the company from smaller, less sophisticated competitors. The recent investment in next-generation mining hardware should improve hash rate and energy efficiency.

The company benefits from the ongoing institutionalization of Bitcoin and growing acceptance of cryptocurrency as a legitimate asset class. However, investors should recognize the cyclical nature of crypto markets and the regulatory uncertainty that continues to impact the sector.

5. Remitly Global, Inc. (RELY) - $18.53

Remitly specializes in digital money transfers, serving immigrant communities who send money to family members abroad. Trading at $18.53, the company appears significantly undervalued based on its growth prospects and market opportunity.

The global remittance market remains large and underserved by traditional financial institutions. Remitly's digital-first approach offers customers better exchange rates, lower fees, and faster transfer times compared to legacy providers like Western Union. Their technology platform can scale efficiently across new corridors and payment methods.

Recent expansion into additional financial services, including digital wallets and bill payment services, creates opportunities to increase customer lifetime value. The company's focus on compliance and regulatory relationships positions it well for continued international expansion.

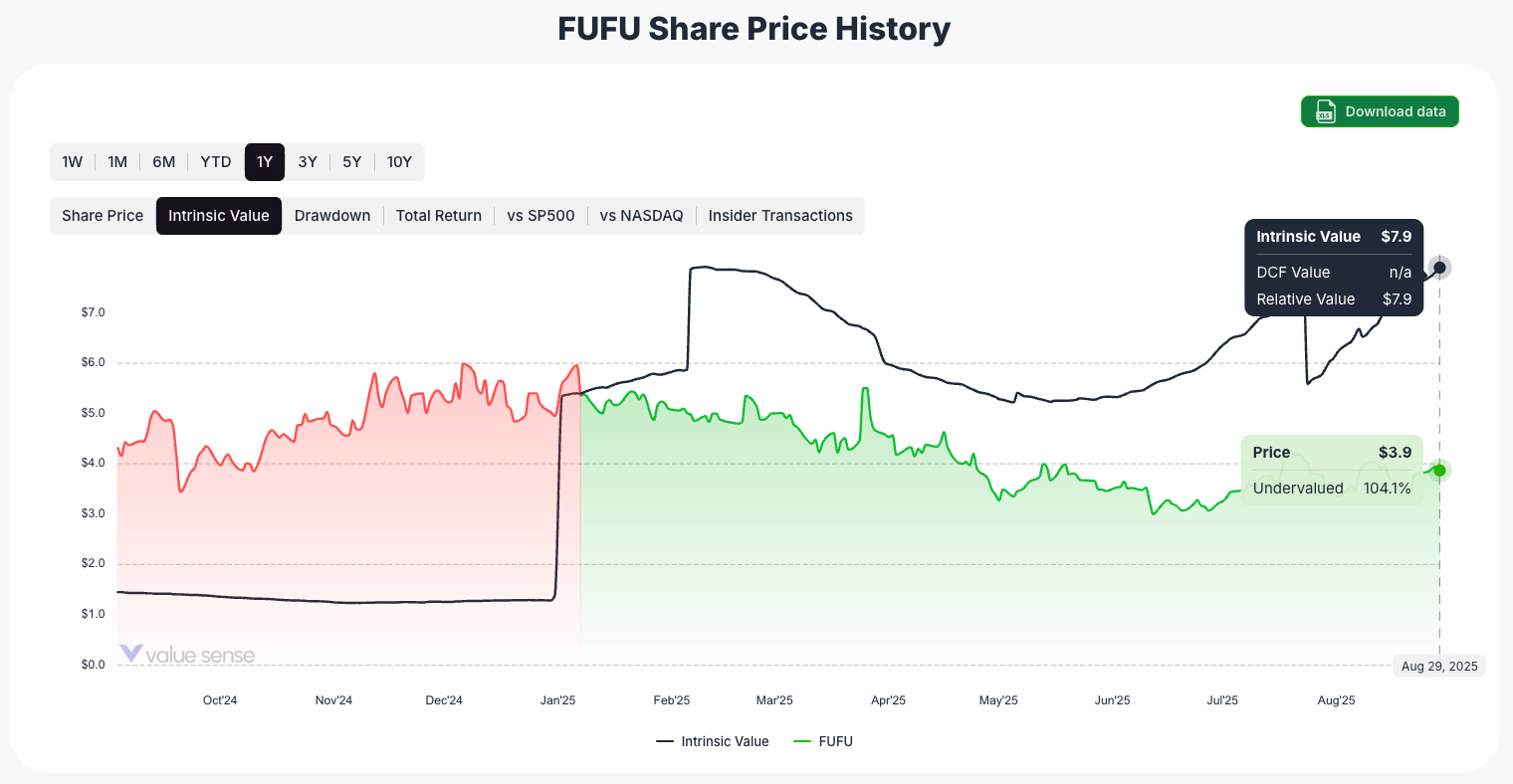

6. BitFuFu Inc. (FUFU) - $3.87

BitFuFu operates in the Bitcoin mining space with a focus on providing mining services and hardware solutions. At $3.87, the stock trades at what appears to be a significant discount to intrinsic value, though investors should approach with caution given the speculative nature of the business.

The company's model of providing mining-as-a-service creates more predictable revenue streams compared to pure-play mining operations. Their relationships with hardware manufacturers and hosting facilities provide competitive advantages in securing mining capacity and managing operational costs.

BitFuFu's exposure to Bitcoin price movements creates both opportunity and risk. While the long-term outlook for Bitcoin adoption remains positive, short-term volatility can significantly impact the company's financial performance and stock price.

Valuation Metrics Comparison

| Company | Current Price | Intrinsic Value Est. | Undervaluation % | Market Sector |

|---|---|---|---|---|

| American Express (AXP) | $331.28 | $353.30 | 6.6% | Payment Networks |

| Nu Holdings (NU) | $14.80 | $18.10 | 22.1% | Digital Banking |

| PayPal (PYPL) | $70.19 | $107.40 | 53.0% | Digital Payments |

| Marathon Digital (MARA) | $15.98 | $32.70 | 104.3% | Crypto Mining |

| Remitly Global (RELY) | $18.53 | $62.50 | 237.5% | Money Transfer |

| BitFuFu (FUFU) | $3.87 | $7.90 | 104.1% | Crypto Services |

Note: Valuation estimates based on various methodologies including DCF analysis, comparable company analysis, and asset-based approaches. Past performance does not guarantee future results.

Investment Risks and Considerations

Investing in undervalued fintech stocks requires careful consideration of several risk factors. Regulatory changes can significantly impact business models, particularly for companies operating across multiple jurisdictions. The evolving regulatory landscape around cryptocurrency, data privacy, and financial services creates ongoing uncertainty.

Technology disruption represents another key risk. The rapid pace of innovation in financial technology means that today's competitive advantages may become tomorrow's obsolete business models. Companies must continuously invest in research and development to maintain their market positions.

Market volatility affects fintech stocks disproportionately, as they often trade at higher multiples than traditional financial services companies. Economic downturns can impact customer acquisition, transaction volumes, and credit performance across the sector.

Competition from both established financial institutions and emerging fintech startups creates pressure on market share and pricing power. The low barriers to entry in many fintech subsectors mean that competitive advantages must be continuously reinforced through innovation and execution.

Sector Outlook and Investment Strategy

The fintech sector's long-term prospects remain compelling despite short-term challenges. Digital adoption continues accelerating globally, with emerging markets presenting particularly attractive growth opportunities. The ongoing shift toward cashless payments, digital lending, and automated financial services creates sustainable tailwinds for well-positioned companies.

Investors should approach undervalued fintech stocks with a diversified strategy, recognizing that individual companies may face idiosyncratic risks. A portfolio approach across different fintech subsectors—payments, lending, crypto, and digital banking—can help mitigate concentration risk while capturing upside from sector growth.

Due diligence remains critical when evaluating seemingly undervalued stocks. Understanding each company's competitive position, regulatory environment, and long-term strategic vision helps distinguish between temporary market inefficiencies and fundamental business challenges.

The current market environment creates opportunities for patient investors willing to withstand volatility in exchange for potential long-term returns. However, position sizing should reflect the higher risk profile of fintech investments compared to traditional value plays.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 AMD Undervalued: Chip Wars Value Play Against Intel in 2025

📖 Undervalued Dividend Aristocrats September 2025

📖 Shopify Undervalued: E-commerce Platform's Recovery Story

FAQ: Undervalued Fintech Stocks

What makes a fintech stock undervalued?

A fintech stock becomes undervalued when its market price falls below its intrinsic value based on fundamental analysis. This can occur due to temporary market sentiment, sector rotation, company-specific challenges, or broader economic concerns. Key metrics include price-to-earnings ratios, price-to-book values, and discounted cash flow analyses compared to growth prospects and competitive positioning.

How can investors identify undervaluation in the fintech sector?

Investors should examine multiple valuation metrics including traditional financial ratios and fintech-specific measures like customer acquisition costs, lifetime value, and transaction volumes. Comparing companies to peers, analyzing growth trajectories, and assessing competitive moats helps identify genuine value opportunities versus value traps.

What are the primary risks of investing in fintech stocks?

Fintech investments carry several unique risks including regulatory uncertainty, technology disruption, intense competition, and market volatility. Many fintech companies also operate with negative cash flows while investing in growth, making them vulnerable to changes in market sentiment or funding availability.

When is the best time to buy undervalued fintech stocks?

Market timing is challenging, but undervalued fintech stocks often present the best opportunities during broader market downturns or sector-specific corrections. Investors should focus on companies with strong fundamentals, clear paths to profitability, and sustainable competitive advantages rather than trying to time market bottoms.

How should fintech stocks fit into a diversified investment portfolio?

Fintech stocks should typically represent a small to moderate portion of a diversified portfolio, given their higher risk profile. Most financial advisors recommend limiting exposure to individual sectors to 5-15% of total portfolio value, with position sizes based on individual risk tolerance and investment timeline.