10 Undervalued Quality Stocks with Massive Growth Potential - Value Sense Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

In today's volatile market environment, finding genuinely undervalued stocks with strong fundamentals has become increasingly challenging. At Value Sense, our proprietary valuation model systematically identifies companies trading significantly below their intrinsic value while maintaining robust financial health and growth prospects.

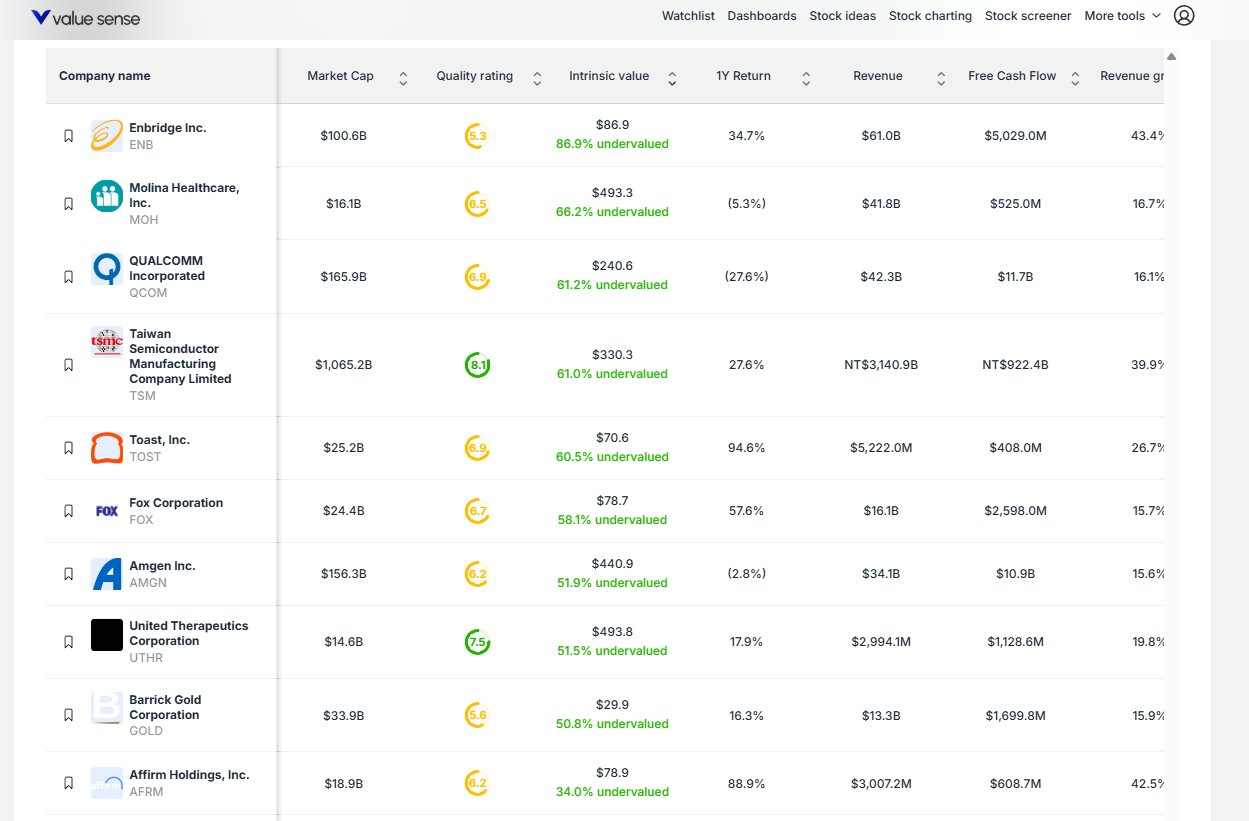

The screenshot from our Value Sense platform reveals a compelling collection of undervalued stocks across diverse sectors, from energy infrastructure and healthcare to technology and semiconductors. What makes these opportunities particularly noteworthy is the combination of quality ratings, significant undervaluation percentages, and strong financial metrics.

Key Market Insights:

- Many quality companies are trading at substantial discounts to their intrinsic values (40-86% undervalued)

- Several sectors show particularly attractive valuation opportunities

- Strong free cash flow generation indicates financial stability despite market volatility

Let's explore these undervalued opportunities in detail, analyzing their fundamentals, growth catalysts, and potential returns.

Top Undervalued Quality Stocks - Value Sense Analysis

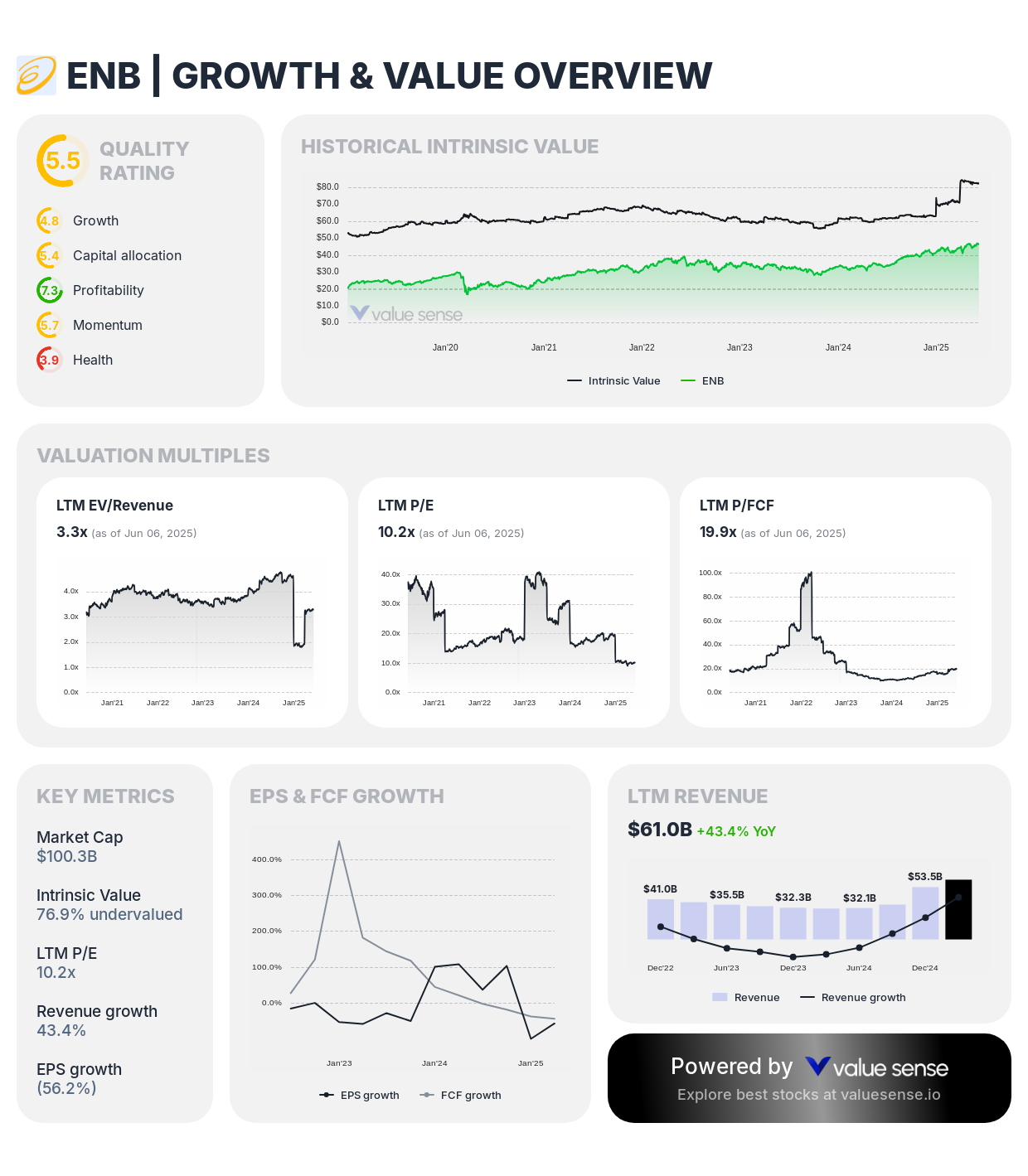

1. Enbridge ($ENB) - 86.9% Undervalued

Sector: Energy Infrastructure | Market Cap: $100.6B | 1Y Return: 34.7%

Investment Thesis: Enbridge represents one of the most significantly undervalued opportunities in our analysis at 86.9% below intrinsic value. As North America's premier energy infrastructure company, Enbridge operates a diversified portfolio of assets including the world's longest crude oil and liquids transportation system, a substantial natural gas pipeline network, and growing renewable energy investments.

Key Financials:

- Revenue: $61.0B

- Free Cash Flow: $5,029.0M

- Revenue Growth: 43.4%

- Quality Rating: 5.5/10

Growth Drivers:

- Strategic positioning in the energy transition with both traditional and renewable assets

- Stable cash flows from long-term contracts and regulated businesses

- Consistent dividend history with growth potential

- Expanding renewable energy portfolio

Why It's Undervalued: Enbridge's market price significantly underestimates its extensive infrastructure network, consistent cash flow generation, and strategic positioning for both traditional energy needs and the energy transition. The 34.7% one-year return suggests the market is beginning to recognize this value gap, but substantial upside remains according to our intrinsic value calculation.

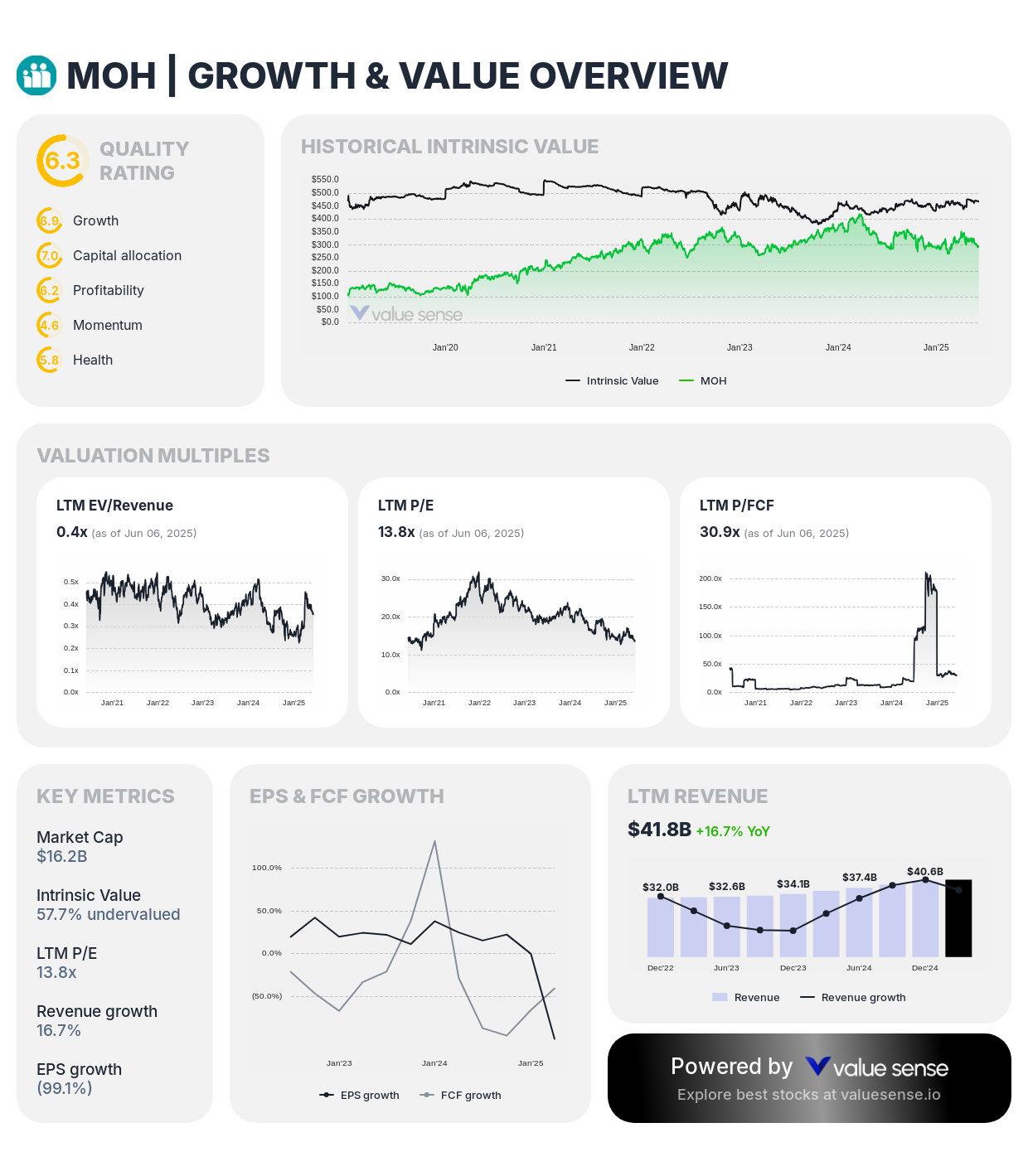

2. Molina Healthcare ($MOH) - 86.2% Undervalued

Sector: Healthcare | Market Cap: $18.1B | 1Y Return: (5.3%)

Investment Thesis: Molina Healthcare presents a compelling value proposition, trading at an 86.2% discount to intrinsic value despite its strong position in the government-sponsored healthcare space. The company's focus on Medicaid, Medicare, and Marketplace health plans provides essential services to vulnerable populations while generating consistent revenue streams.

Key Financials:

- Revenue: $41.6B

- Free Cash Flow: $525.0M

- Revenue Growth: 16.7%

- Quality Rating: 6.3/10

Growth Drivers:

- Expanding Medicaid enrollment and Medicare Advantage opportunities

- Strategic acquisitions to enter new markets

- Technology investments improving operational efficiency

- Aging population demographics supporting long-term growth

Why It's Undervalued: The market appears to be underestimating Molina's growth potential and operational improvements. The negative one-year return of 5.3% has created an attractive entry point for this quality healthcare provider with substantial upside potential according to our valuation model.

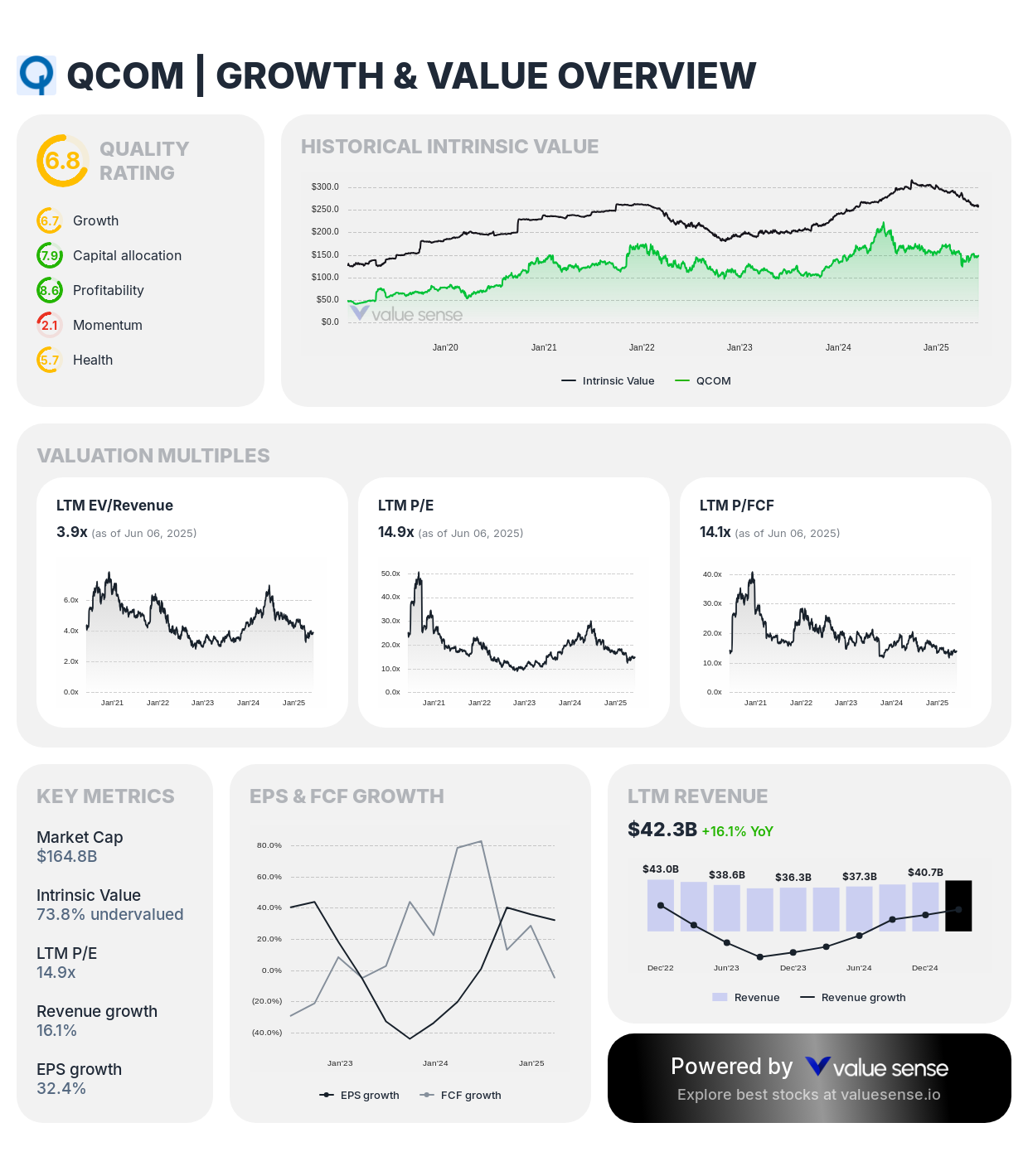

3. Qualcomm ($QCOM) - 81.2% Undervalued

Sector: Semiconductors | Market Cap: $165.9B | 1Y Return: 127.6%

Investment Thesis: QUALCOMM stands out as significantly undervalued at 81.2% below intrinsic value despite its dominant position in mobile technology and chipsets. The company's extensive intellectual property portfolio, leadership in 5G technology, and expansion into automotive and IoT markets position it for substantial growth.

Key Financials:

- Revenue: $42.3B

- Free Cash Flow: $11.7B

- Revenue Growth: 16.1%

- Quality Rating: 6.8/10

Growth Drivers:

- Accelerating 5G adoption globally

- Expansion beyond smartphones into automotive, IoT, and extended reality

- AI integration into mobile platforms

- Strong patent portfolio generating high-margin licensing revenue

Why It's Undervalued: Despite the impressive 127.6% one-year return, our analysis indicates QUALCOMM remains significantly undervalued relative to its intrinsic worth. The market has begun recognizing QUALCOMM's potential, but the substantial gap between current price and intrinsic value suggests continued upside potential.

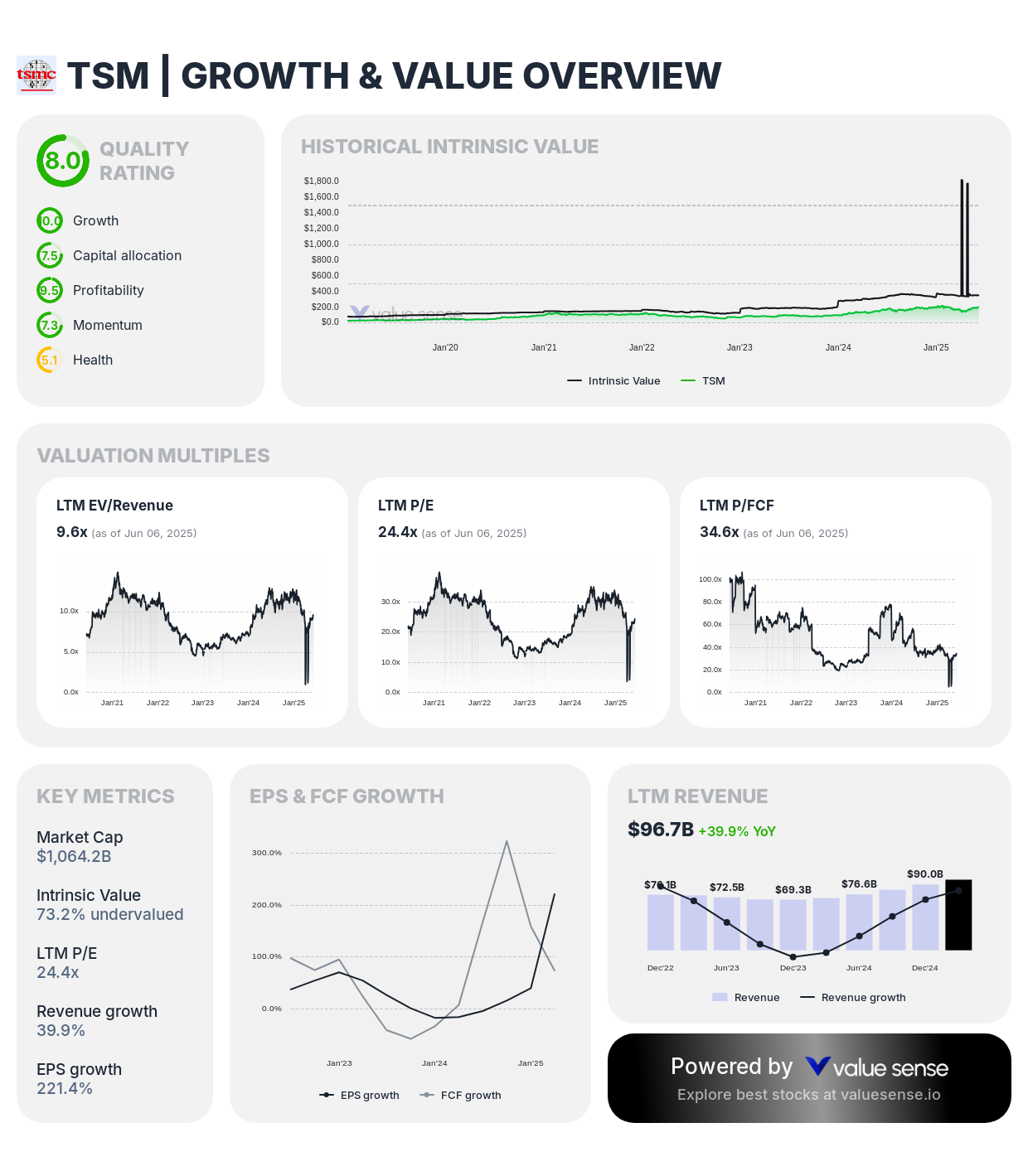

4. Taiwan Semiconductor Manufacturing ($TSM) - 61.0% Undervalued

Sector: Semiconductors | Market Cap: $1,065.2B | 1Y Return: 27.6%

Investment Thesis: As the world's largest dedicated semiconductor foundry, TSMC enjoys unmatched scale, technological leadership, and customer relationships. Trading at 61% below intrinsic value, TSMC represents a compelling opportunity to invest in the backbone of the global technology ecosystem and AI revolution.

Key Financials:

- Revenue: NT$3,140.9B

- Free Cash Flow: NT$922.4B

- Revenue Growth: 39.9%

- Quality Rating: 8/10

Growth Drivers:

- Accelerating demand for advanced chips driven by AI applications

- Leadership in cutting-edge process nodes (3nm, 2nm)

- Strategic partnerships with major technology companies

- Expanding capacity with new facilities globally

Why It's Undervalued: TSMC's market price fails to fully capture its irreplaceable position in the global technology supply chain, technological moat, and growth potential from AI and high-performance computing. The company's 8 quality rating (the highest in this selection) further supports the investment case for this semiconductor leader.

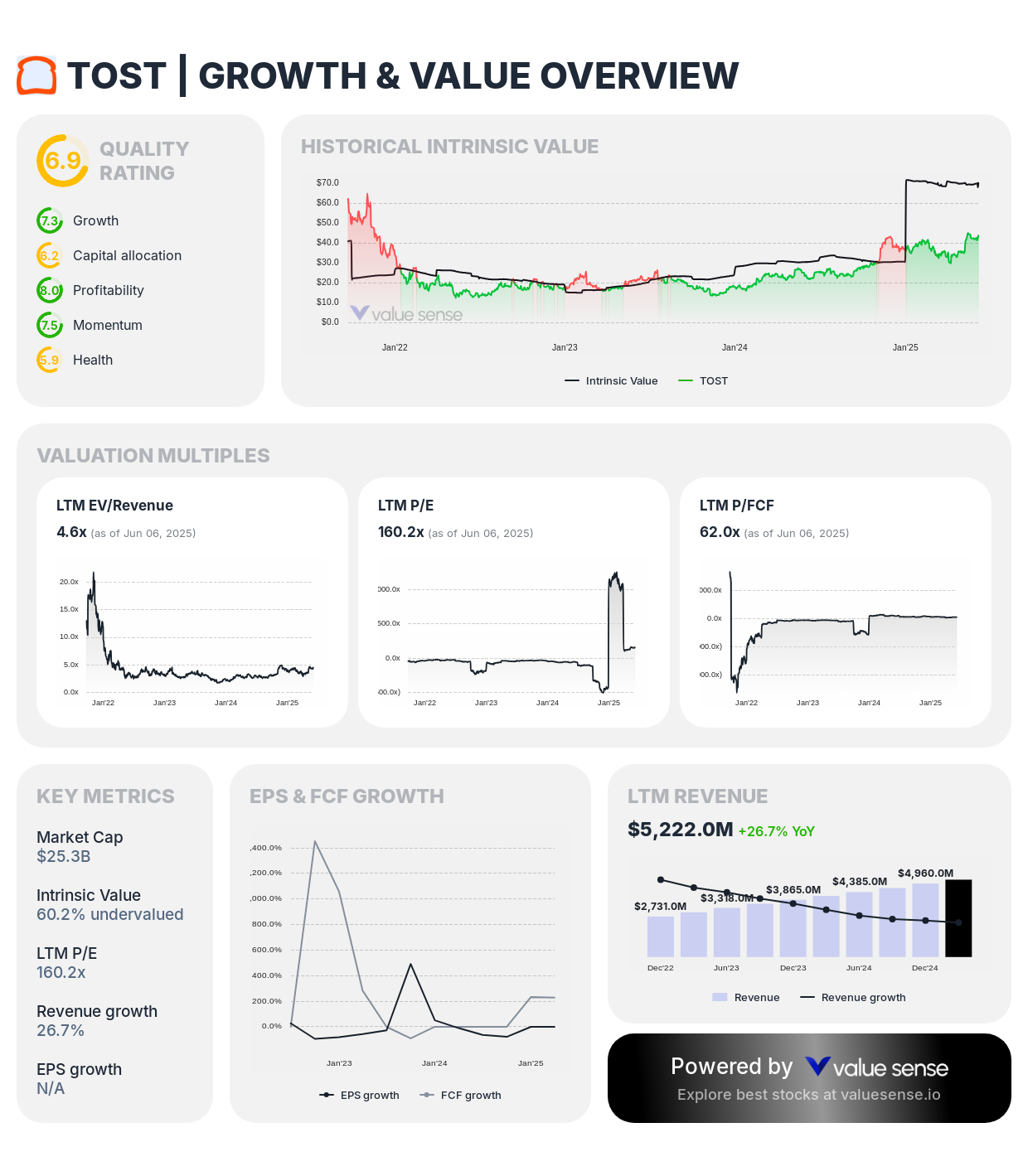

5. Toast ($TOST) - 80.5% Undervalued

Sector: Financial Technology | Market Cap: $25.2B | 1Y Return: 94.8%

Investment Thesis: Toast provides an integrated cloud-based technology platform for the restaurant industry, offering point-of-sale, payment processing, digital ordering, and restaurant management solutions. At 80.5% below intrinsic value, Toast presents a significant opportunity in the restaurant technology space.

Key Financials:

- Revenue: $5,222.0M

- Free Cash Flow: $408.0M

- Revenue Growth: 26.7%

- Quality Rating: 6.9/10

Growth Drivers:

- Expanding market share in the restaurant technology ecosystem

- Growing recurring revenue from subscription services

- Additional monetization through payment processing

- Continuous product expansion addressing restaurant pain points

Why It's Undervalued: Despite nearly doubling in value over the past year (94.8% return), Toast remains significantly undervalued according to our analysis. The market appears to underestimate Toast's growing ecosystem, improving unit economics, and expansion potential within the restaurant technology space.

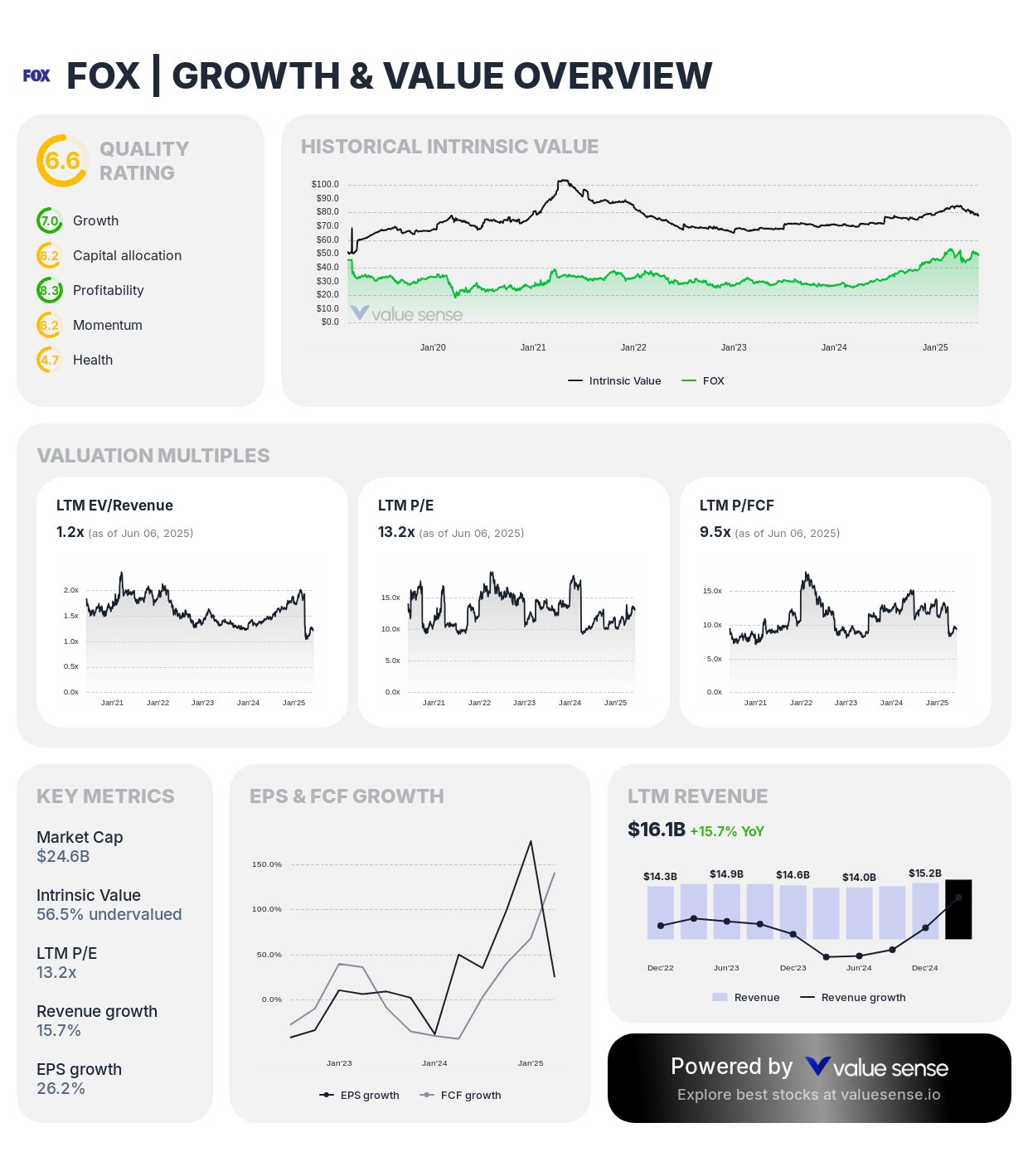

6. Fox Corporation ($FOX) - 58.1% Undervalued

Sector: Media | Market Cap: $24.4B | 1Y Return: 57.8%

Investment Thesis: Fox Corporation maintains strong positions in news, sports broadcasting, and entertainment content. Trading at 58.1% below intrinsic value, Fox offers exposure to valuable live programming assets and sports rights that continue to command premium advertising rates despite broader media industry challenges.

Key Financials:

- Revenue: $16.1B

- Free Cash Flow: $2,598.0M

- Revenue Growth: 15.7%

- Quality Rating: 6.6/10

Growth Drivers:

- Premium sports rights portfolio including NFL, MLB, and FIFA events

- Leading position in news programming

- Tubi streaming platform growth

- Strong free cash flow generation supporting shareholder returns

Why It's Undervalued: Fox's substantial free cash flow generation and valuable content assets are underappreciated by the market. While traditional media faces headwinds, Fox's focus on live sports and news programming provides resilience and advertising premium not fully reflected in its current valuation.

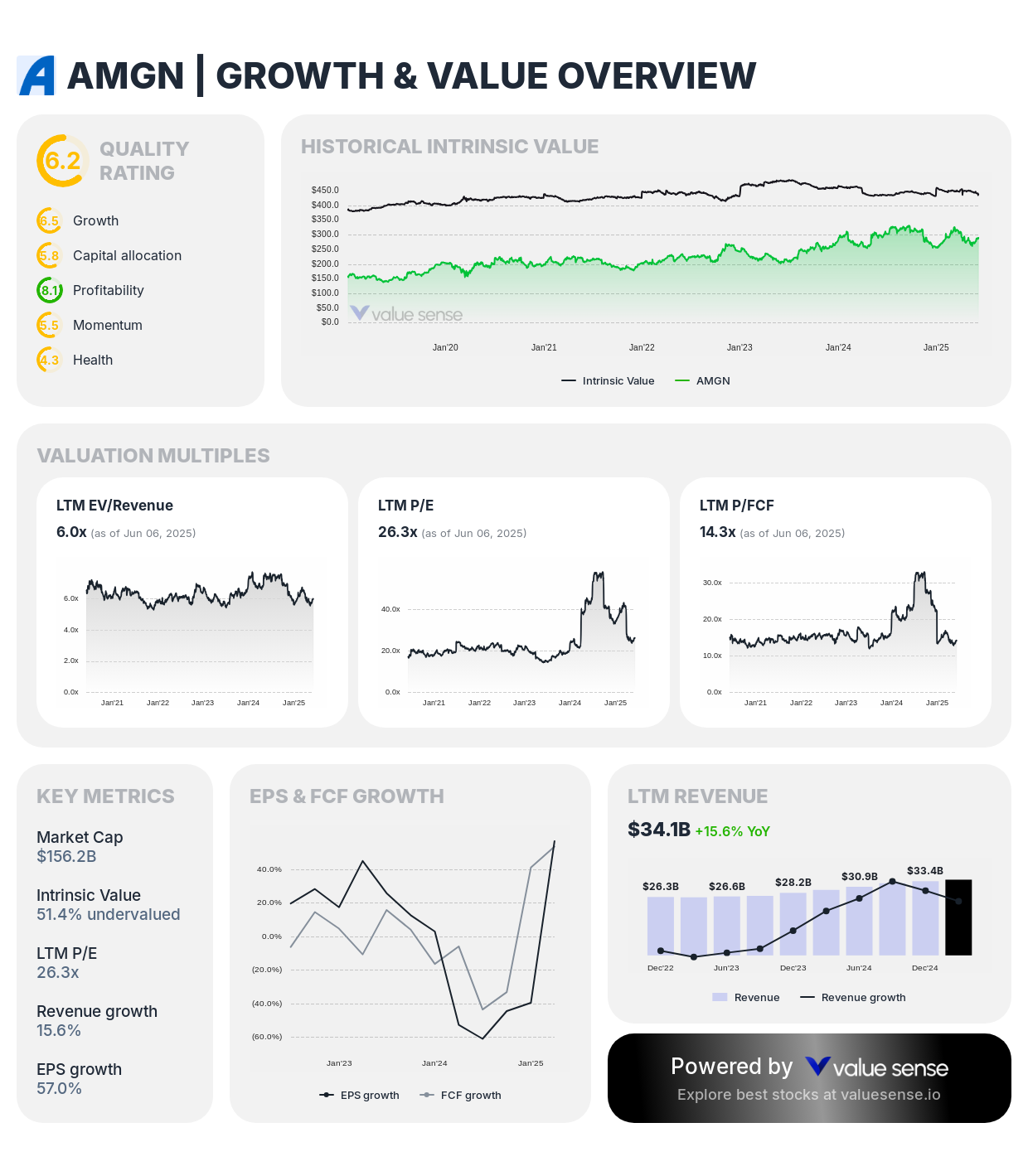

7. Amgen ($AMGN) - 51.9% Undervalued

Sector: Biotechnology | Market Cap: $156.3B | 1Y Return: (2.8%)

Investment Thesis: Amgen is a leading biotechnology company with a diverse portfolio of treatments for serious illnesses. Trading at 51.9% below intrinsic value, Amgen offers a compelling combination of established revenue streams, pipeline potential, and financial strength.

Key Financials:

- Revenue: $34.1B

- Free Cash Flow: $10.9B

- Revenue Growth: 15.6%

- Quality Rating: 6.2/10

Growth Drivers:

- Strategic acquisition of Horizon Therapeutics expanding rare disease portfolio

- Promising pipeline in inflammation, cardiovascular disease, and oncology

- International market expansion opportunities

- Strong cash flow supporting R&D investment and shareholder returns

Why It's Undervalued: Amgen's negative 2.8% one-year return has created an attractive entry point for this quality biopharmaceutical company. The market appears to undervalue Amgen's established product portfolio, acquisition synergies, and pipeline potential, presenting a significant opportunity for long-term investors.

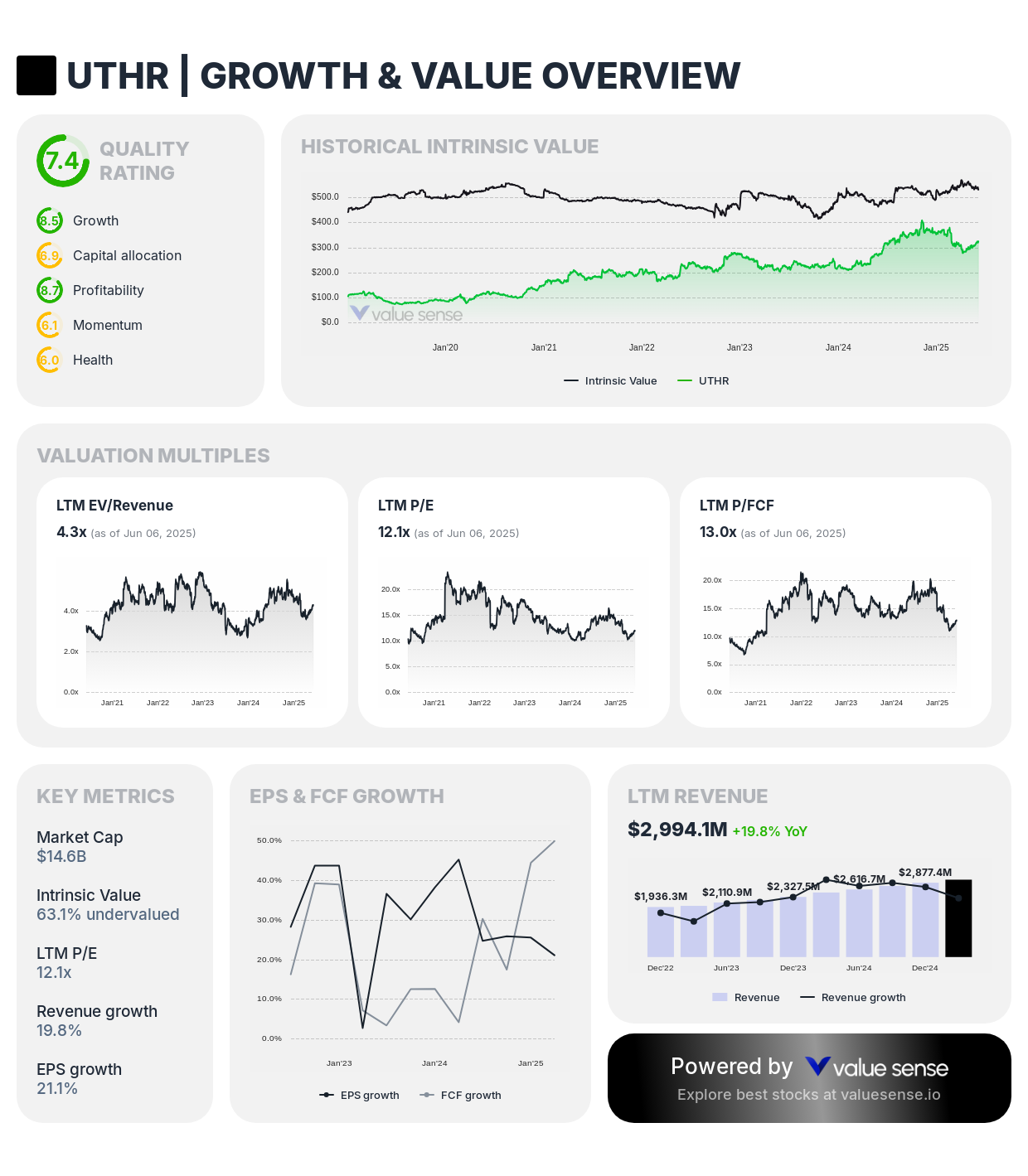

8. United Therapeutics ($UTHR) - 51.5% Undervalued

Sector: Biotechnology | Market Cap: $14.6B | 1Y Return: 17.9%

Investment Thesis: United Therapeutics focuses on developing treatments for pulmonary arterial hypertension and other rare diseases. Trading at 51.5% below intrinsic value, the company offers specialized expertise in an important therapeutic area with high barriers to entry.

Key Financials:

- Revenue: $2,994.1M

- Free Cash Flow: $1,128.6M

- Revenue Growth: 19.8%

- Quality Rating: 7.4/10

Growth Drivers:

- Dominant position in pulmonary arterial hypertension treatments

- Innovative organ manufacturing and transplantation research

- Strong free cash flow supporting R&D initiatives

- Limited competition in specialized therapeutic areas

Why It's Undervalued: United Therapeutics' specialized focus and leadership in pulmonary arterial hypertension provide significant competitive advantages not fully reflected in its current market valuation. The company's 7.4 quality rating and strong free cash flow generation support the investment case for this undervalued biotech company.

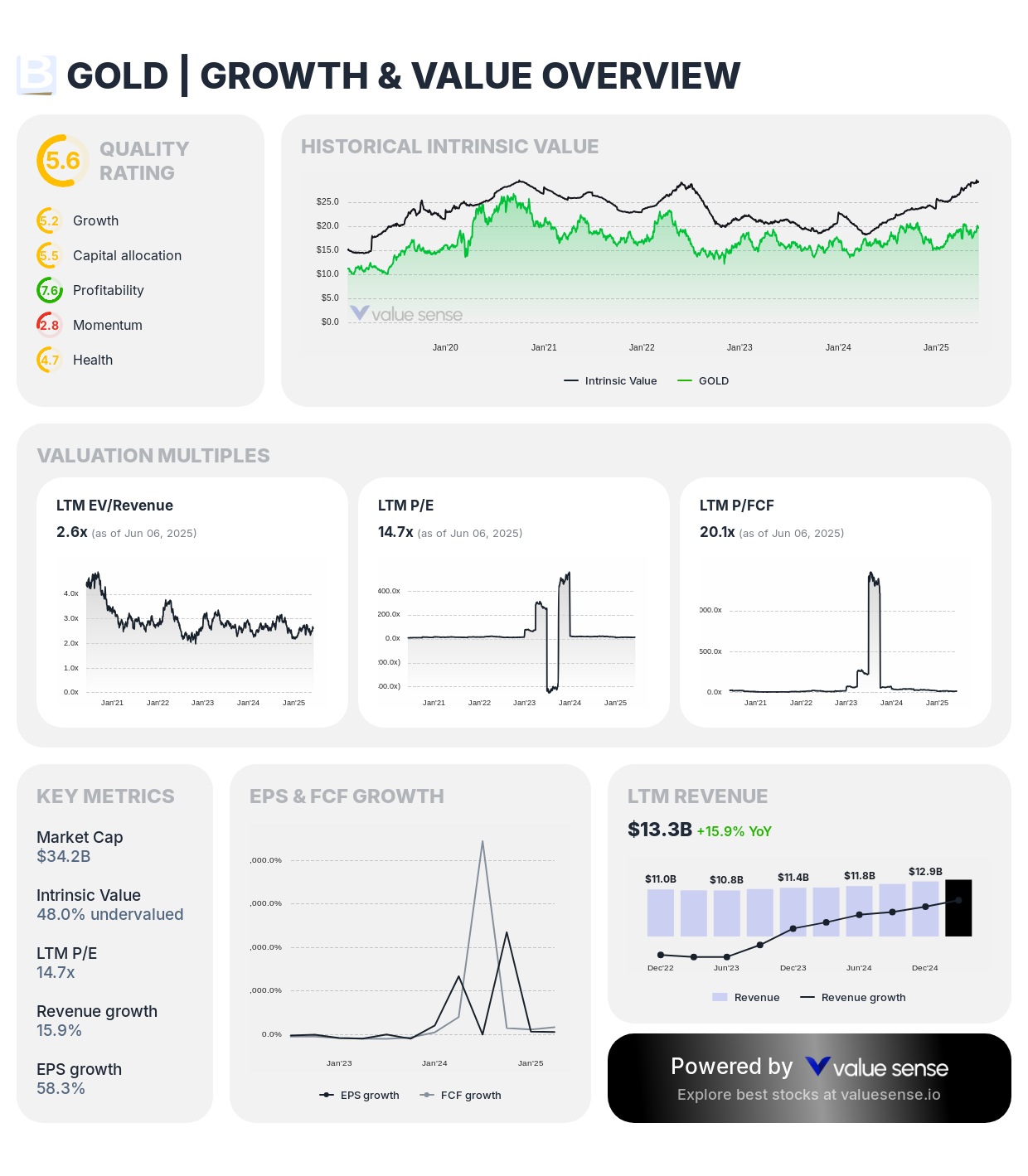

9. Barrick Gold ($GOLD) - 50.8% Undervalued

Sector: Precious Metals | Market Cap: $33.9B | 1Y Return: 16.3%

Investment Thesis: Barrick Gold is one of the world's largest gold producers with operations across the globe. Trading at 50.8% below intrinsic value, Barrick offers exposure to precious metals with the operational discipline and scale advantages of a major producer.

Key Financials:

- Revenue: $13.3B

- Free Cash Flow: $1,699.8M

- Revenue Growth: 15.9%

- Quality Rating: 5.6/10

Growth Drivers:

- Rising gold prices in uncertain economic environments

- Cost reduction initiatives improving margins

- Portfolio optimization focusing on tier-one assets

- Exploration success extending mine life and resources

Why It's Undervalued: Barrick's current valuation fails to fully account for its high-quality mining assets, operational improvements, and potential upside from rising gold prices. As a hedge against economic uncertainty and inflation, Barrick presents an attractive opportunity at its current valuation.

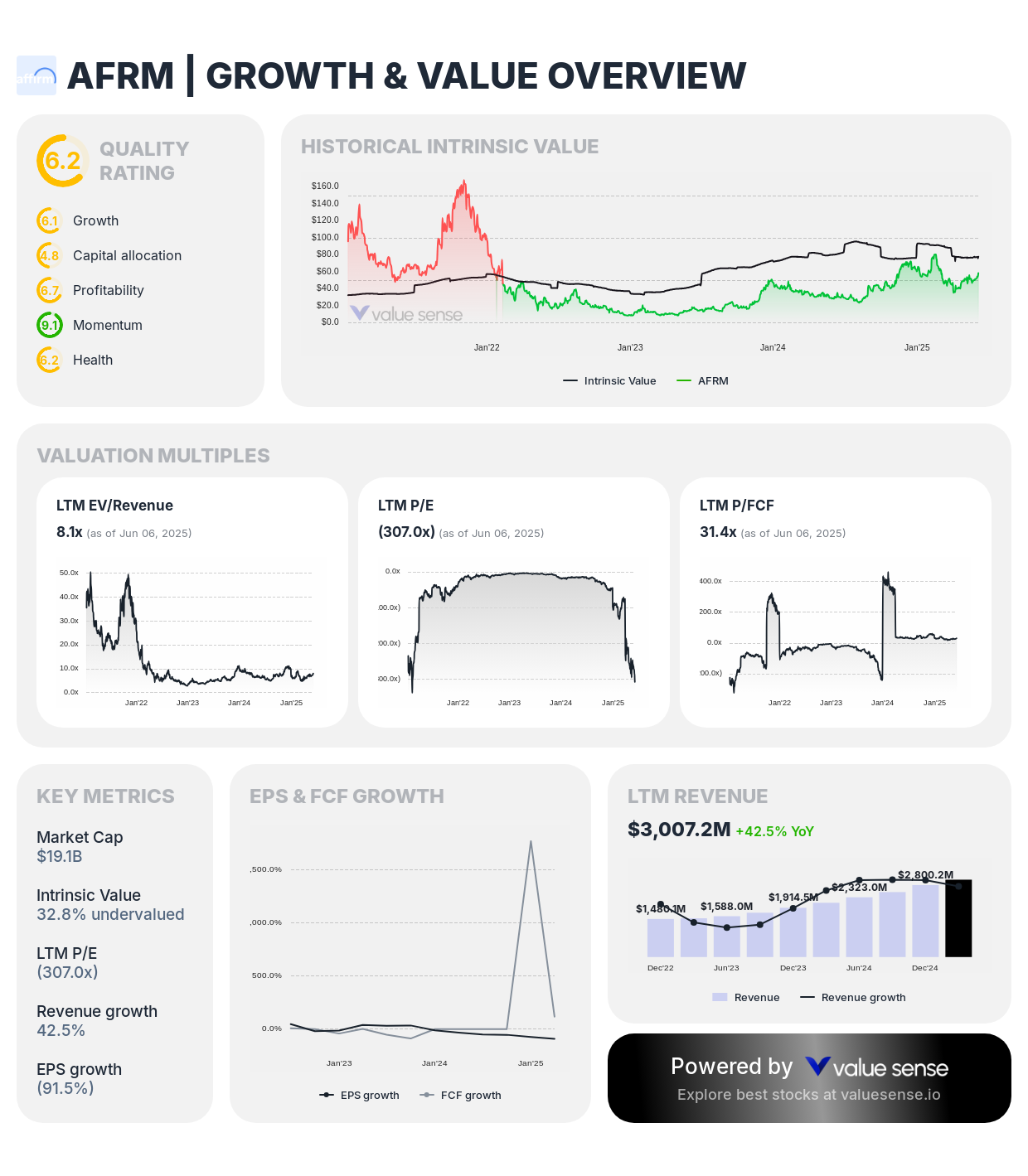

10. Affirm ($AFRM) - 34.0% Undervalued

Sector: Financial Technology | Market Cap: $18.9B | 1Y Return: 88.9%

Investment Thesis: Affirm is a leading buy-now-pay-later platform transforming consumer financing. While the least undervalued stock in our selection at 34.0% below intrinsic value, Affirm's strong partnerships, technological edge, and growing consumer adoption provide significant growth potential.

Key Financials:

- Revenue: $3,007.2M

- Free Cash Flow: $608.7M

- Revenue Growth: 42.5%

- Quality Rating: 6.2/10

Growth Drivers:

- Strategic partnerships with major retailers including Amazon, Walmart, and Shopify

- Expanding product offerings beyond traditional BNPL

- Growing consumer adoption of alternative payment methods

- International expansion opportunities

Why It's Undervalued: Despite strong performance over the past year (88.9% return), Affirm remains undervalued according to our analysis. The market appears to be underestimating Affirm's improving unit economics, strategic partnerships, and potential to capture market share in the evolving consumer finance landscape.

Value Investing Strategy: How to Approach These Opportunities

When considering these undervalued opportunities, investors should adopt a strategic approach that aligns with their investment goals, risk tolerance, and time horizon. Here are key considerations for building positions in these undervalued stocks:

Portfolio Allocation Strategy:

- Diversification Across Sectors: The undervalued opportunities span multiple sectors including energy infrastructure, healthcare, technology, media, and financial services. Consider allocating across these sectors to reduce concentration risk.

- Position Sizing Based on Conviction: While all stocks in our analysis show significant undervaluation, consider larger positions in companies with the highest quality ratings (TSM and UTHR) and strongest financial metrics.

- Entry Strategy: For stocks that have already seen significant appreciation (QCOM, TOST, AFRM), consider phased entry points or waiting for pullbacks while maintaining core positions in deeply undervalued names showing less recent momentum.

- Time Horizon Alignment: These undervalued opportunities may require patience for the market to recognize their intrinsic value. Align your investment timeline with the fundamental catalysts that could drive revaluation.

Key Valuation Metrics Explained

Our Value Sense model evaluates companies across multiple dimensions to determine intrinsic value and identify market inefficiencies. Here's how we approach valuation:

Intrinsic Value Calculation: Our proprietary model incorporates discounted cash flow analysis, comparative valuation metrics, and quality adjustments to determine a company's intrinsic value. The undervaluation percentage represents the discount between current market price and our calculated intrinsic value.

Quality Rating System: Our 5+ ratings for these stocks indicate companies with solid fundamentals, competitive positions, and financial stability. While not the highest possible ratings, these represent quality businesses trading at significant discounts to intrinsic value.

Free Cash Flow Focus: We emphasize free cash flow as a critical metric for evaluating a company's financial health and ability to fund growth, return capital to shareholders, or reduce debt. All companies in our selection demonstrate strong free cash flow generation relative to their market capitalization.

Market Outlook and Timing Considerations

Current market conditions present a unique opportunity for value investors. Despite major indices trading near all-time highs, our analysis reveals significant pockets of undervaluation among quality companies. Several factors support the potential for these valuation gaps to close:

- Sector Rotation: As investors reassess growth stock valuations, capital may rotate toward undervalued quality companies with strong fundamentals.

- Interest Rate Environment: With potential interest rate cuts on the horizon, companies with strong free cash flow and reasonable valuations may benefit from improved investor sentiment.

- Quality Premium: In an uncertain economic environment, companies with proven business models and financial stability tend to command premium valuations over time.

- Catalyst Recognition: Company-specific catalysts including earnings growth, strategic initiatives, and improved market sentiment can accelerate the closing of valuation gaps.

Conclusion: Finding Value in a Complex Market

Our Value Sense analysis reveals compelling opportunities across multiple sectors where market prices significantly understate intrinsic value. From energy infrastructure giant Enbridge (86.9% undervalued) to semiconductor leader TSMC (61.0% undervalued), these companies offer potential for substantial returns as valuations normalize.

The combination of quality ratings, strong financial metrics, and significant undervaluation percentages provides a solid foundation for value-oriented investors seeking opportunities in today's market. While patience may be required for these valuation gaps to close, the underlying business fundamentals support long-term investment cases for these undervalued stocks.

Key Takeaways:

- Multiple quality companies trading 34-87% below intrinsic value

- Strong free cash flow generation across the selection

- Diversified sector exposure from energy to technology

- Combination of momentum names and contrarian opportunities

By focusing on intrinsic value rather than short-term market movements, investors can position themselves to benefit from these market inefficiencies while maintaining a foundation in quality companies with sustainable competitive advantages.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Top 10 undervalued high-quality growth stocks

📖 A Deep Dive into High-Growth Stocks - HIMS, HOOD, and PLTR

📖 10 High-Quality Undervalued Dividend Stocks

FAQ: Most Undervalued Growth Stocks to Buy in 2025

What makes a growth stock undervalued?

An undervalued growth stock is a company whose current market price is below its intrinsic value, as determined by financial models and fundamental analysis. These stocks typically have strong future earnings potential, solid business models, and are overlooked or underappreciated by the market at the time of analysis.

Why are semiconductor stocks like Qualcomm and TSMC considered undervalued growth picks?

Semiconductor stocks such as Qualcomm and Taiwan Semiconductor Manufacturing (TSMC) are flagged as undervalued growth stocks because of their dominant positions in essential tech sectors, strong free cash flow, and significant innovation pipelines. Despite their critical role in global technology, current market prices often do not fully reflect their long-term growth prospects.

How can I identify high-growth stocks with value potential?

To identify high-growth stocks with value potential, look for companies with strong fundamentals—such as robust earnings growth, low debt, and competitive advantages. Use proprietary models or financial tools that compare market price to intrinsic value, and focus on industries with expanding opportunities, like technology, healthcare, and fintech.

What are the benefits of investing in undervalued growth stocks?

Investing in undervalued growth stocks offers the potential for above-average returns as the market corrects its valuation over time. These stocks combine the upside of growth with the safety of buying at a discount, providing a balanced approach to building long-term wealth.

How does Value Sense’s model select the top undervalued growth stocks?

Value Sense’s proprietary algorithm evaluates thousands of stocks based on intrinsic value, quality ratings, growth prospects, and industry leadership. The model identifies those trading at a significant discount to their true worth while demonstrating strong fundamentals and clear paths to future earnings expansion.