11 Best Undervalued Healthcare Stocks: Premium Value Opportunities - Value Sense 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Power of Healthcare Value Investing

Healthcare represents one of the most defensive and recession-resistant sectors in the global economy, offering investors exposure to essential services with predictable demand patterns driven by demographic trends, medical innovation, and aging populations. When quality healthcare companies trade below intrinsic value, they create exceptional opportunities combining defensive characteristics with substantial appreciation potential.

Mathematical Foundation of Healthcare Valuation:

Healthcare companies benefit from predictable demand patterns driven by fundamental demographic equations:

Healthcare Growth = Population Growth + Aging Factor+Medical Innovation

This formula demonstrates why healthcare investing offers both defensive stability and long-term growth potential, as demographic trends create sustained demand regardless of economic conditions.

Undervalued Healthcare Selection Criteria:

- Healthcare Sector Focus: Companies operating across pharmaceuticals, medical devices, biotechnology, and healthcare services

- Undervalued Status: Trading below calculated intrinsic value based on comprehensive fundamental analysis

- Multiple Valuation Confirmation: Undervaluation across various methodologies including DCF, relative value, Ben Graham, and Peter Lynch approaches

- Quality Business Fundamentals: Strong competitive positioning, sustainable business models, and robust cash generation

Top 11 Undervalued Healthcare Stocks - Ranked by Intrinsic Value Undervaluation

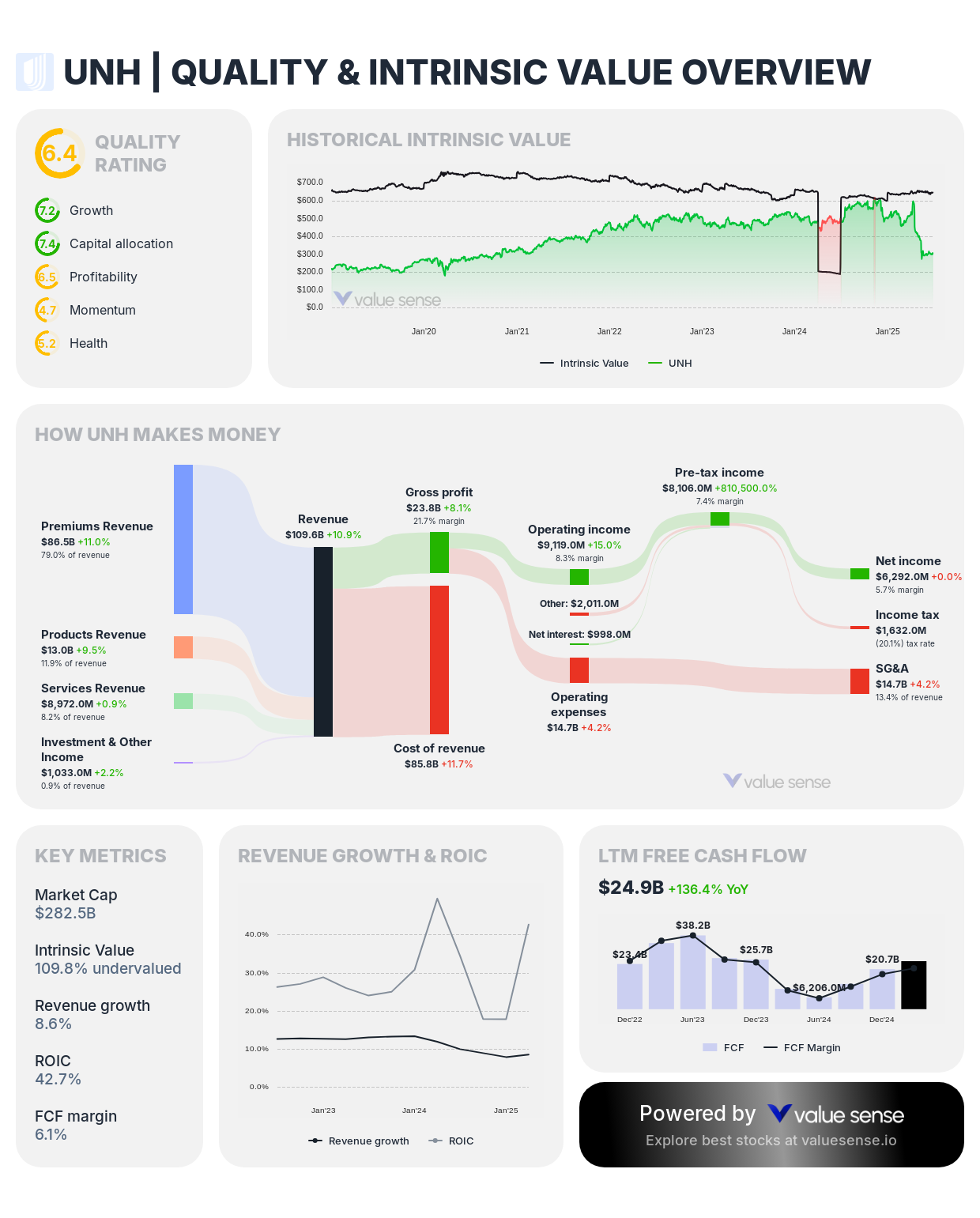

1. UnitedHealth Group Incorporated (UNH) - 109.8% Undervalued ⭐

- Intrinsic Value: 109.8% undervalued

- DCF Value: 237.0% undervalued

- Relative Value: 17.7% overvalued

- Ben Graham Revised Fair Value: 565.4% undervalued

- Peter Lynch Fair Value: 289.0% undervalued

- Earnings Power Value: 93.9% of Enterprise Value

- Market-Implied Growth: 6.1% of Enterprise Value

Investment Thesis: UnitedHealth Group represents the most compelling undervalued healthcare opportunity with extraordinary 109.8% discount to intrinsic value, supported by exceptional undervaluation across DCF (237.0%) and Ben Graham (565.4%) methodologies. As America's largest health insurer with rapidly expanding Optum services, UnitedHealth combines defensive healthcare characteristics with substantial growth potential through demographic trends and integrated care delivery.

Why It's Undervalued: Recent political concerns about healthcare policy and temporary operational challenges have created significant undervaluation of UnitedHealth's exceptional business model. The company's integrated healthcare approach, scale advantages, and demographic tailwinds support substantially higher valuations than current market pricing reflects.

Investment Highlights:

- Dominant position in health insurance with exceptional scale advantages and pricing power

- Optum health services expansion creating higher-margin revenue streams and operational synergies

- Aging population demographics driving sustained healthcare demand growth for decades

- Integrated care delivery model improving patient outcomes while reducing system costs

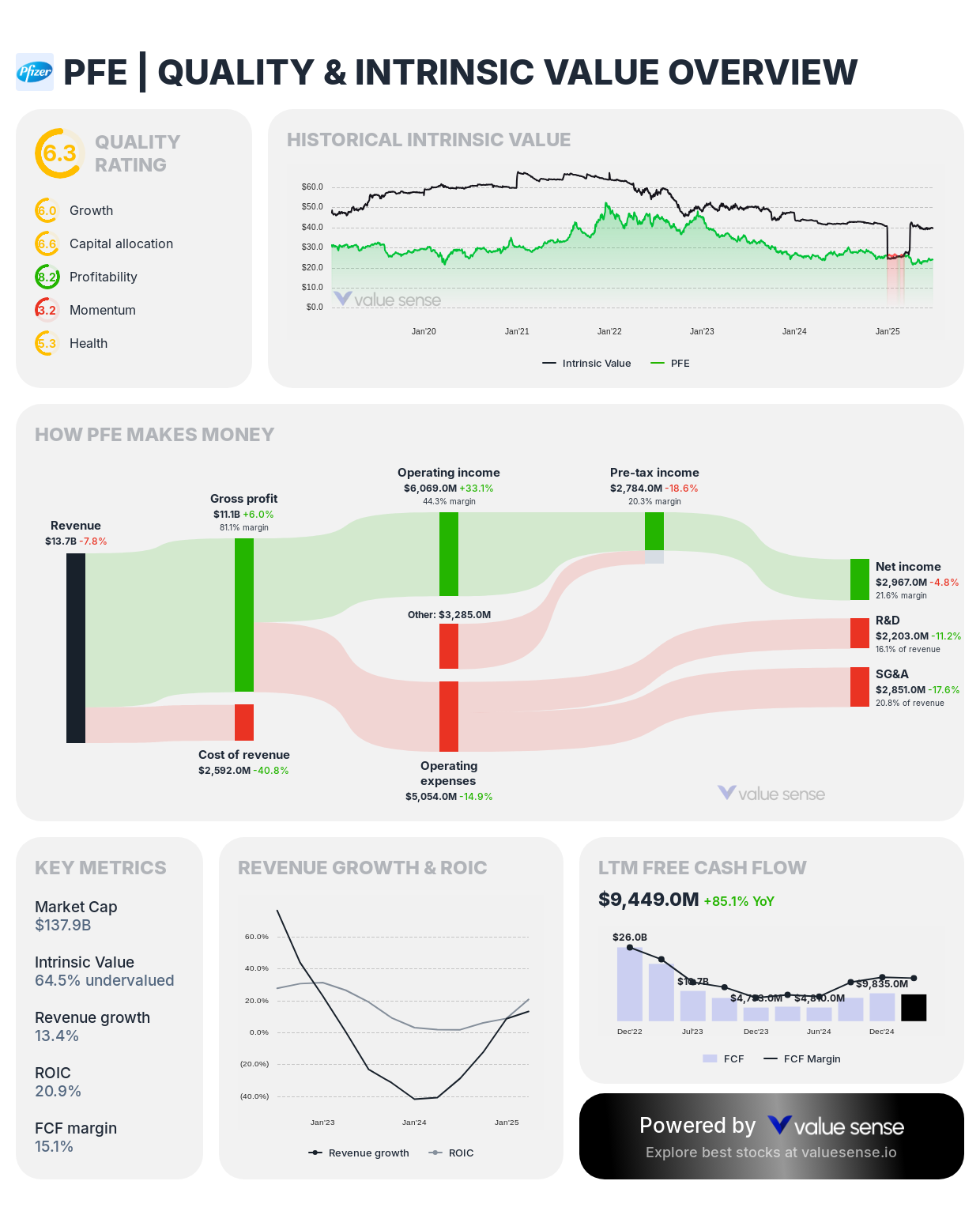

2. Pfizer Inc. (PFE) - 64.5% Undervalued

- Intrinsic Value: 64.5% undervalued

- DCF Value: 32.0% undervalued

- Relative Value: 96.5% undervalued

- Ben Graham Revised Fair Value: 467.2% undervalued

- Peter Lynch Fair Value: 193.8% undervalued

- Earnings Power Value: (99.0%) of Enterprise Value

- Market-Implied Growth: 199.0% of Enterprise Value

Investment Thesis: Pfizer demonstrates substantial undervaluation at 64.5% below intrinsic worth, with exceptional undervaluation across relative value (96.5%) and Ben Graham (467.2%) methodologies. Despite challenges from COVID-19 revenue normalization, Pfizer's robust pharmaceutical pipeline, oncology leadership, and strategic acquisitions create substantial value that current pricing significantly underestimates.

Why It's Undervalued: Market concerns about post-COVID revenue decline and patent cliff challenges have created severe undervaluation of Pfizer's core pharmaceutical capabilities and pipeline potential. The company's oncology portfolio and strategic investments support substantially higher valuations.

Investment Highlights:

- Leading oncology portfolio with multiple blockbuster treatments and expanding pipeline

- Strategic acquisitions enhancing capabilities in high-growth therapeutic areas

- Substantial R&D investment supporting continued innovation and competitive positioning

- Strong balance sheet and cash generation supporting dividend sustainability and growth investments

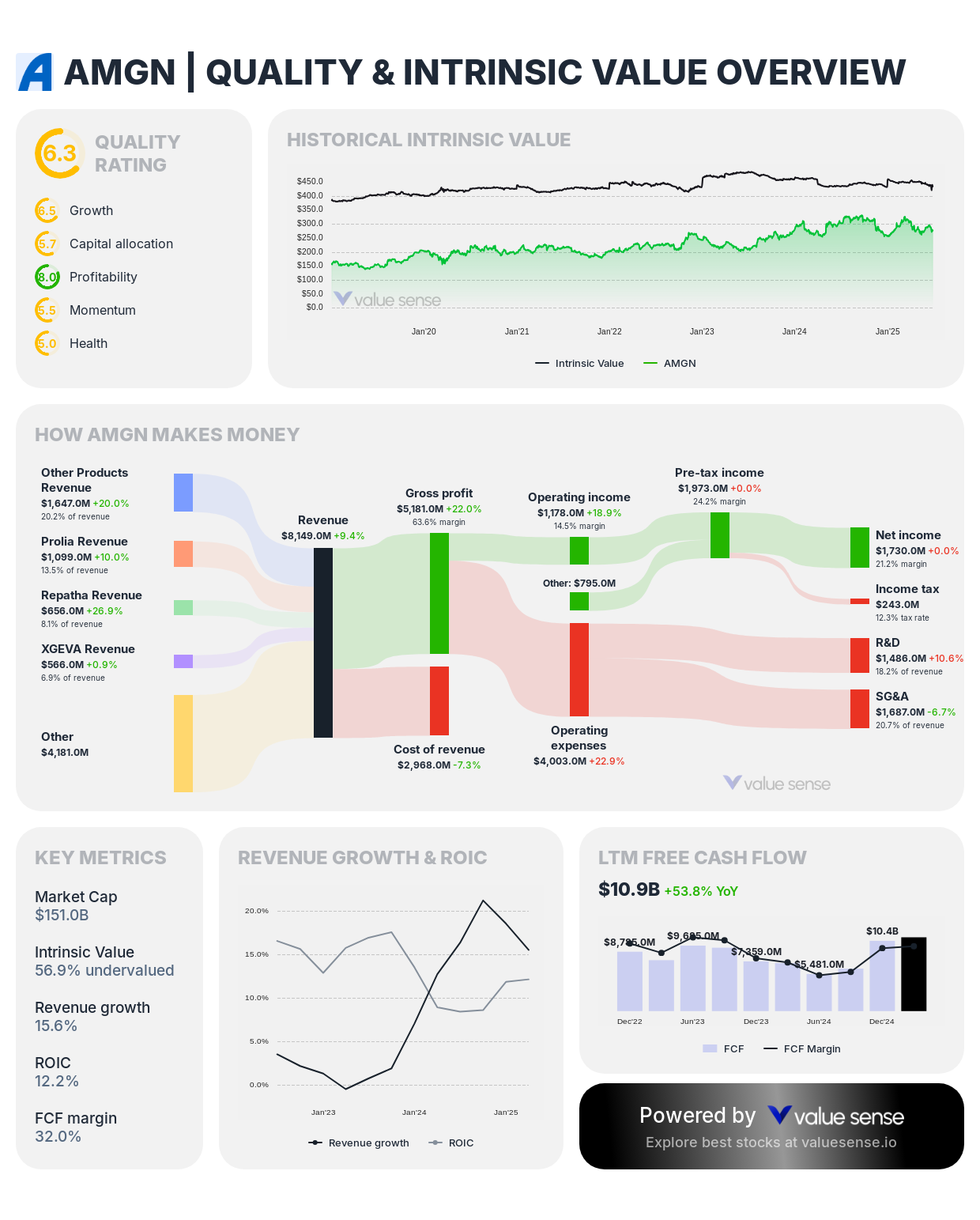

3. Amgen Inc. (AMGN) - 56.9% Undervalued

- Intrinsic Value: 56.9% undervalued

- DCF Value: 113.0% undervalued

- Relative Value: 1.1% undervalued

- Ben Graham Revised Fair Value: 570.2% undervalued

- Peter Lynch Fair Value: 184.6% undervalued

- Earnings Power Value: 53.8% of Enterprise Value

- Market-Implied Growth: 46.2% of Enterprise Value

Investment Thesis: Amgen presents significant undervaluation at 56.9% below intrinsic value, with extraordinary DCF undervaluation (113.0%) and Ben Graham recognition (570.2%). The biotechnology leader's diversified portfolio of treatments for serious illnesses, combined with strategic acquisitions and pipeline development, creates substantial value that current market pricing fails to recognize.

Why It's Undervalued: Concerns about biosimilar competition and pipeline execution have created undervaluation of Amgen's innovation capabilities and strategic positioning. The company's acquisition of Horizon Therapeutics and expanding therapeutic focus support higher valuations.

Investment Highlights:

- Leading biotechnology company with diversified portfolio across multiple therapeutic areas

- Strategic acquisition of Horizon Therapeutics expanding rare disease capabilities

- Strong pipeline in inflammation, cardiovascular disease, and oncology applications

- Exceptional cash generation supporting R&D investment and shareholder returns

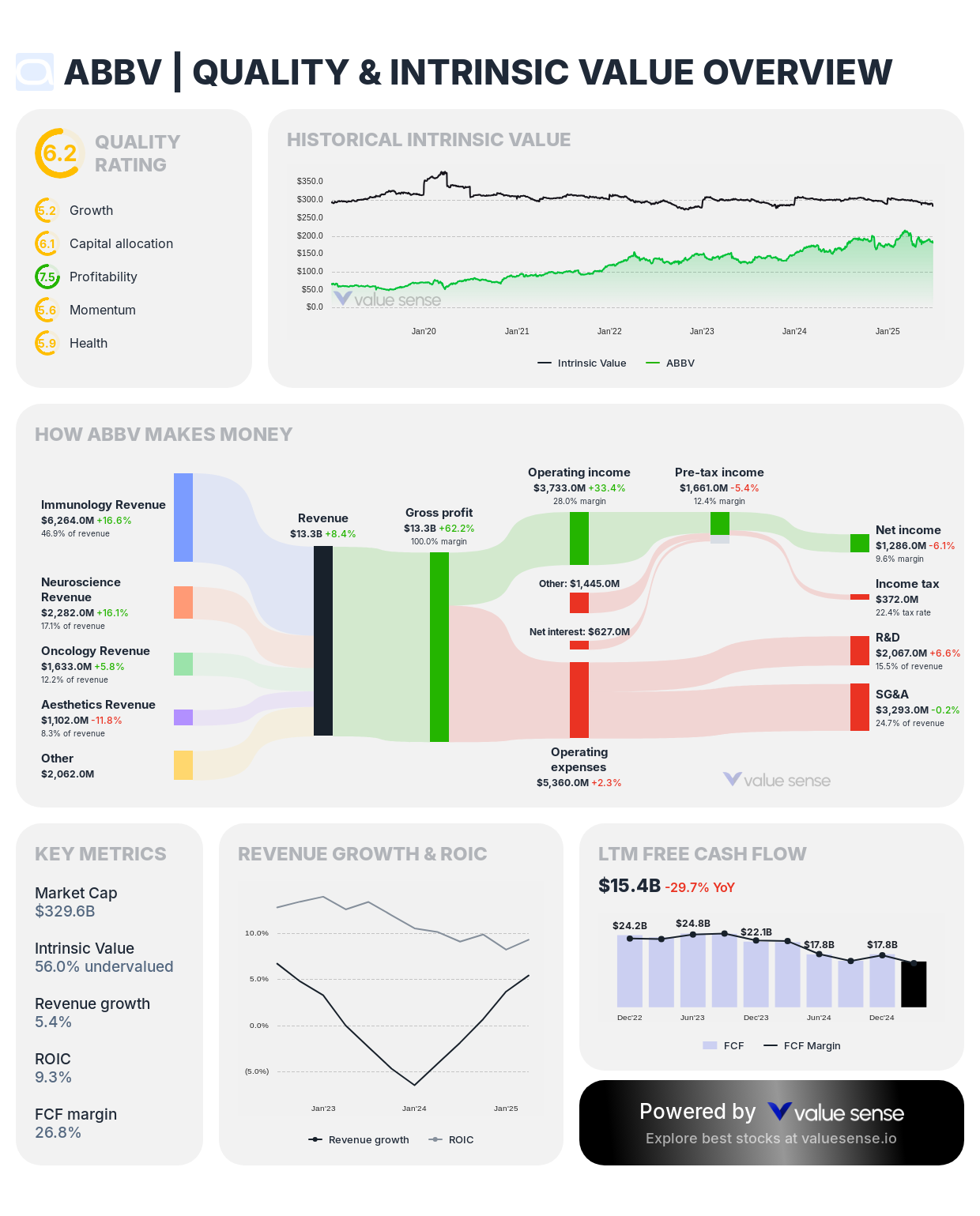

4. AbbVie Inc. (ABBV) - 56.0% Undervalued

- Intrinsic Value: 56.0% undervalued

- DCF Value: 135.0% undervalued

- Relative Value: 23.3% overvalued

- Ben Graham Revised Fair Value: 700.4% undervalued

- Peter Lynch Fair Value: 82.3% undervalued

- Earnings Power Value: 43.6% of Enterprise Value

- Market-Implied Growth: 56.4% of Enterprise Value

Investment Thesis: AbbVie demonstrates substantial undervaluation at 56.0% below intrinsic worth, supported by exceptional DCF undervaluation (135.0%) and extraordinary Ben Graham recognition (700.4%). The pharmaceutical giant's successful diversification beyond Humira and robust pipeline development create significant value that current market pricing substantially underestimates.

Why It's Undervalued: Market concerns about Humira patent cliff and competitive pressures have created undervaluation of AbbVie's diversified portfolio and pipeline potential. The company's strategic acquisitions and breakthrough treatments support substantially higher valuations than current pricing reflects.

Investment Highlights:

- Diversified pharmaceutical portfolio reducing single-product dependency risks

- Breakthrough treatments in immunology, oncology, and neuroscience addressing large markets

- Strategic acquisitions including Allergan enhancing competitive positioning

- Strong free cash flow generation supporting dividend growth and R&D investment

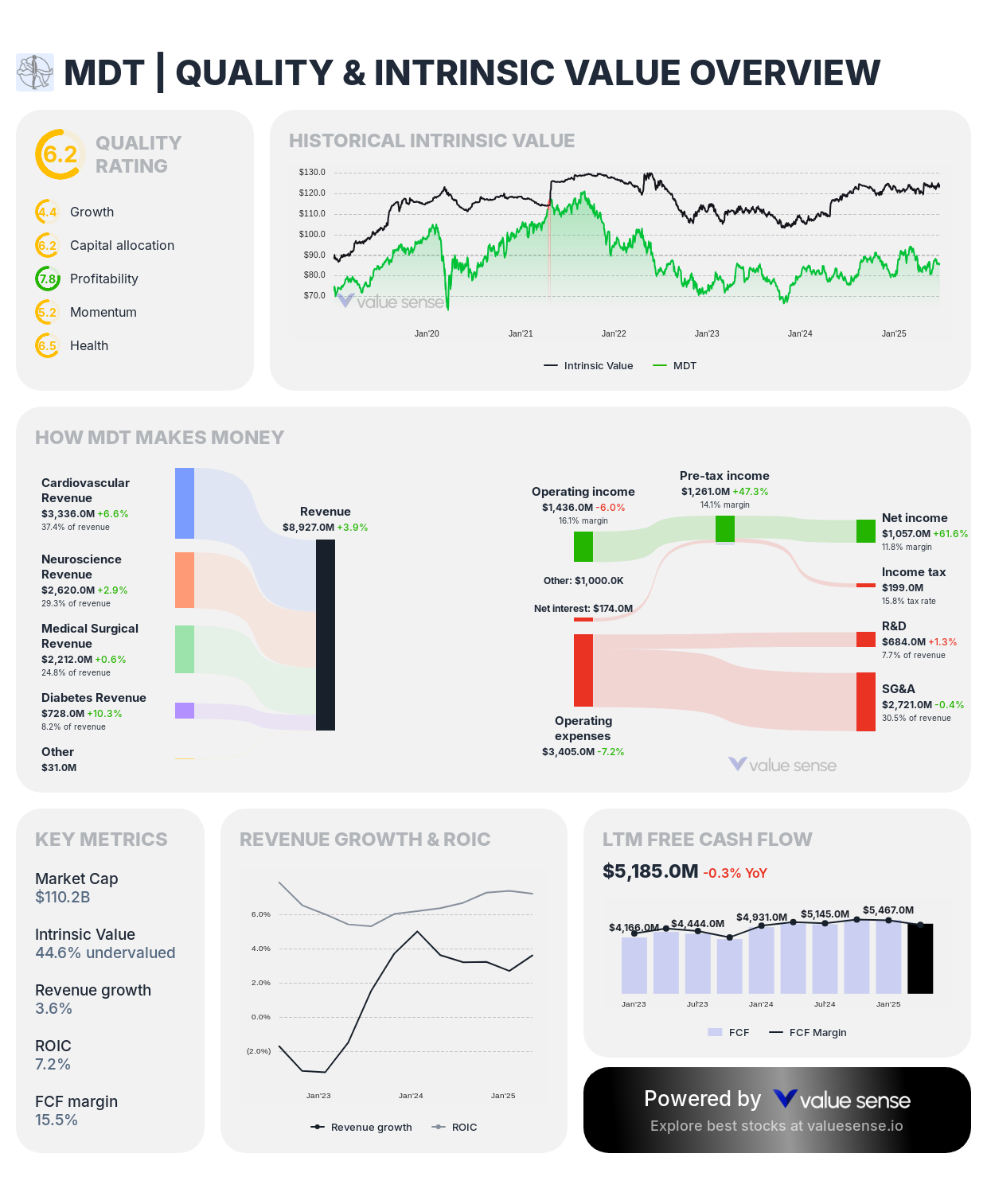

5. Medtronic plc (MDT) - 44.6% Undervalued

- Intrinsic Value: 44.6% undervalued

- DCF Value: 13.0% undervalued

- Relative Value: 76.5% undervalued

- Ben Graham Revised Fair Value: 275.9% undervalued

- Peter Lynch Fair Value: 104.5% undervalued

- Earnings Power Value: 53.5% of Enterprise Value

- Market-Implied Growth: 46.5% of Enterprise Value

Investment Thesis: Medtronic presents significant undervaluation at 44.6% below intrinsic value, with substantial relative value undervaluation (76.5%) and Ben Graham recognition (275.9%). As a global leader in medical technology, Medtronic's diversified portfolio across cardiac, diabetes, surgical, and neurological devices creates substantial value that current pricing underestimates.

Why It's Undervalued: Concerns about medical device market competition and regulatory challenges have created undervaluation of Medtronic's innovation capabilities and market leadership positions. The company's technology investments and global reach support higher valuations.

Investment Highlights:

- Global leadership in medical devices across multiple therapeutic areas

- Continuous innovation pipeline in cardiac, diabetes, surgical, and neurological applications

- Strong international presence providing geographic diversification and growth opportunities

- Defensive healthcare characteristics with predictable demand patterns

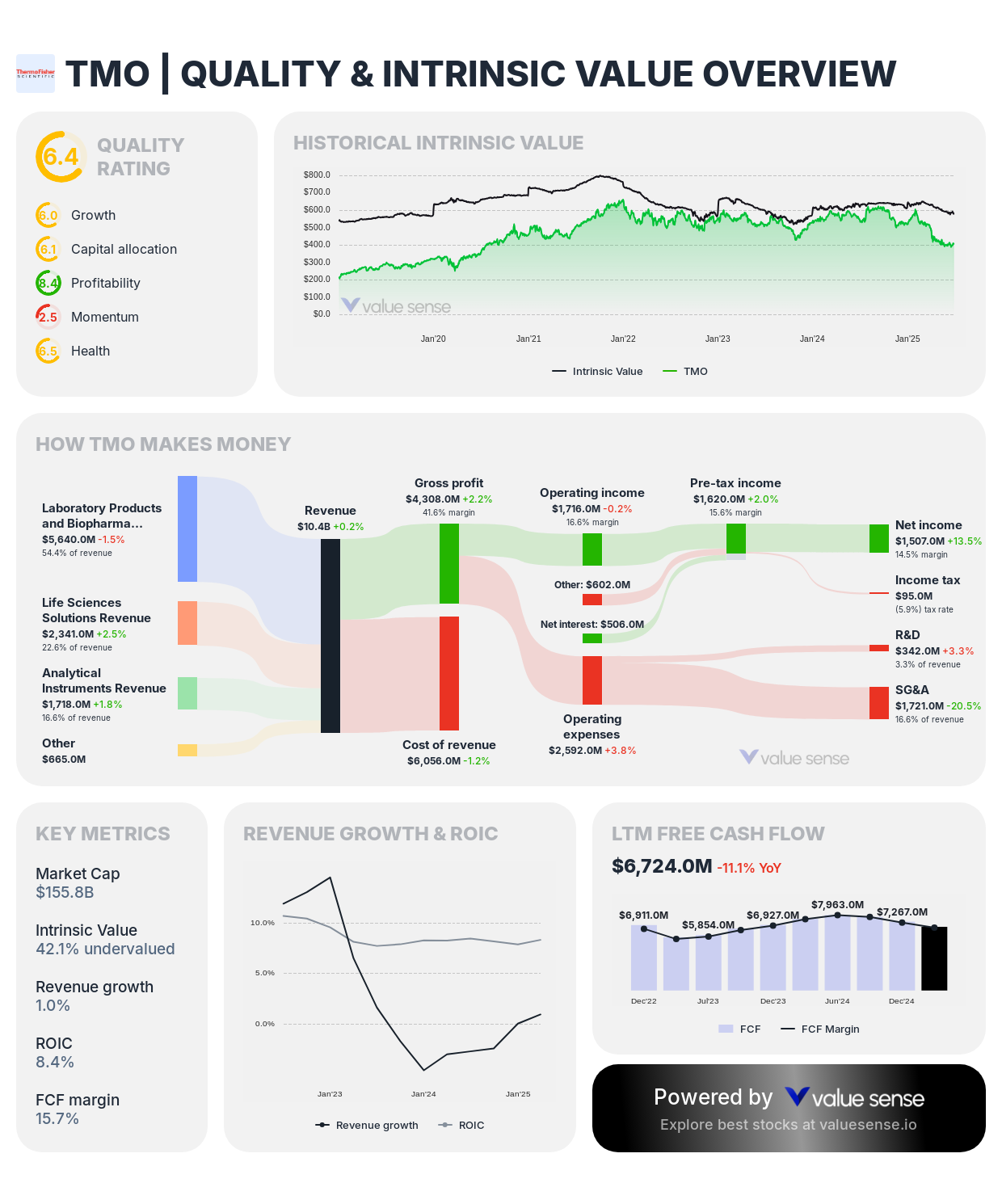

6. Thermo Fisher Scientific Inc. (TMO) - 42.1% Undervalued

- Intrinsic Value: 42.1% undervalued

- DCF Value: 69.0% undervalued

- Relative Value: 15.6% undervalued

- Ben Graham Revised Fair Value: 70.7% undervalued

- Peter Lynch Fair Value: 4.5% undervalued

- Earnings Power Value: 46.9% of Enterprise Value

- Market-Implied Growth: 53.1% of Enterprise Value

Investment Thesis: Thermo Fisher Scientific demonstrates solid undervaluation at 42.1% below intrinsic worth, with substantial DCF undervaluation (69.0%) and Ben Graham recognition (70.7%). The life sciences tools leader's essential role in pharmaceutical research, diagnostics, and biotechnology creates sustainable competitive advantages that current pricing fails to fully recognize.

Why It's Undervalued: Post-COVID normalization concerns have created undervaluation of Thermo Fisher's core capabilities and long-term growth potential. The company's essential role in life sciences research and strategic acquisitions support higher valuations.

Investment Highlights:

- Leading position in life sciences tools and services with essential role in pharmaceutical R&D

- Diversified revenue streams across research, diagnostics, and analytical instruments

- Strategic acquisitions expanding capabilities and market reach

- Strong cash generation supporting continued investment in innovation and market expansion

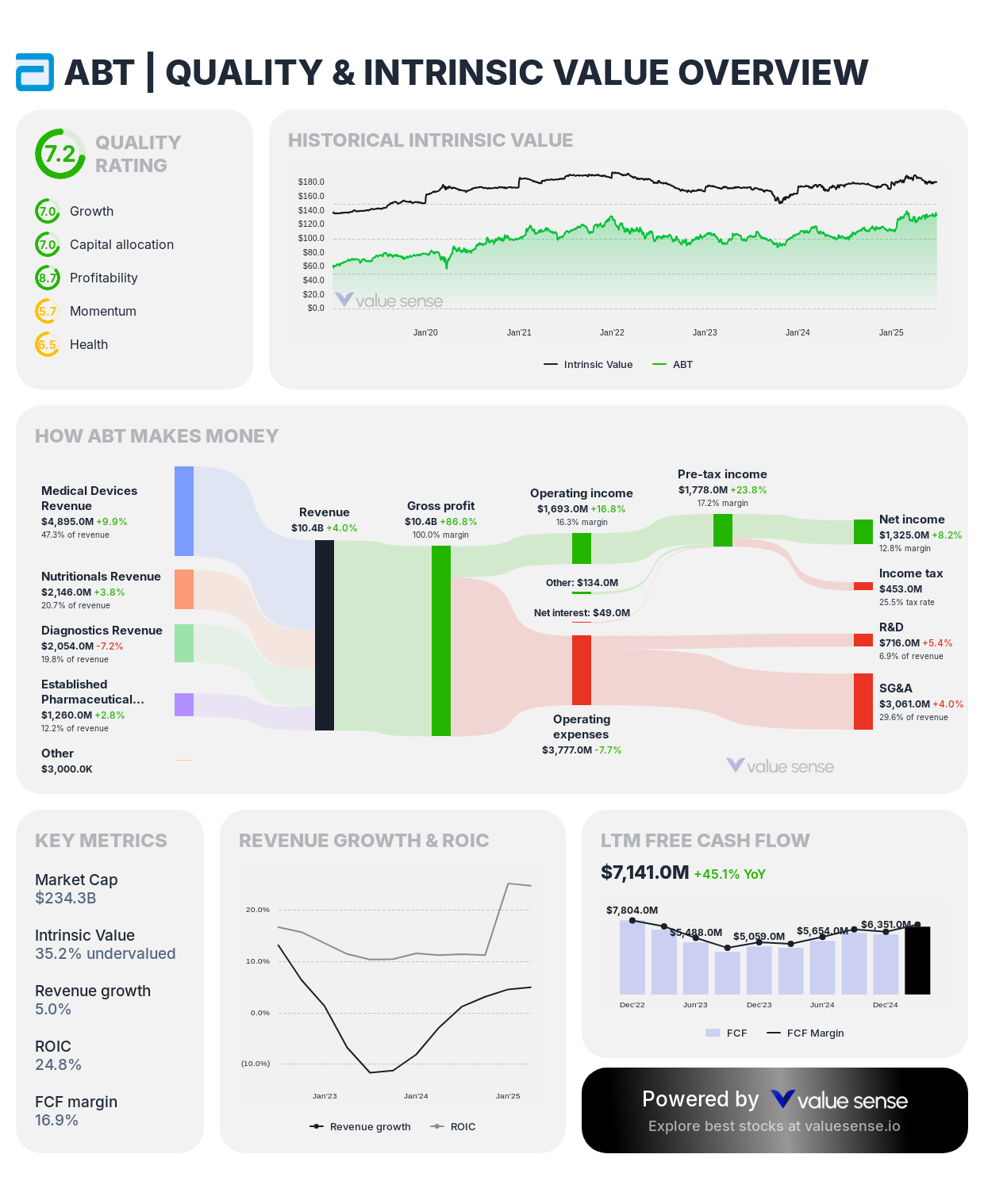

7. Abbott Laboratories (ABT) - 35.2% Undervalued

- Intrinsic Value: 35.2% undervalued

- DCF Value: 58.0% undervalued

- Relative Value: 12.0% undervalued

- Ben Graham Revised Fair Value: 231.4% undervalued

- Peter Lynch Fair Value: 171.8% undervalued

- Earnings Power Value: 77.6% of Enterprise Value

- Market-Implied Growth: 22.4% of Enterprise Value

Investment Thesis: Abbott demonstrates attractive undervaluation at 35.2% below intrinsic value, with substantial DCF undervaluation (58.0%) and exceptional Ben Graham recognition (231.4%). The diversified healthcare leader's strength across medical devices, diagnostics, nutrition, and pharmaceuticals creates multiple growth avenues with defensive characteristics.

Why It's Undervalued: Despite strong fundamentals, Abbott's current valuation fails to fully reflect its innovation pipeline and global expansion opportunities. The company's leadership in continuous glucose monitoring and diversified portfolio support higher valuations.

Investment Highlights:

- Leadership in continuous glucose monitoring with FreeStyle Libre global expansion

- Diversified healthcare portfolio providing stability across economic cycles

- Strong innovation pipeline in medical devices and diagnostic applications

- International expansion opportunities in emerging healthcare markets

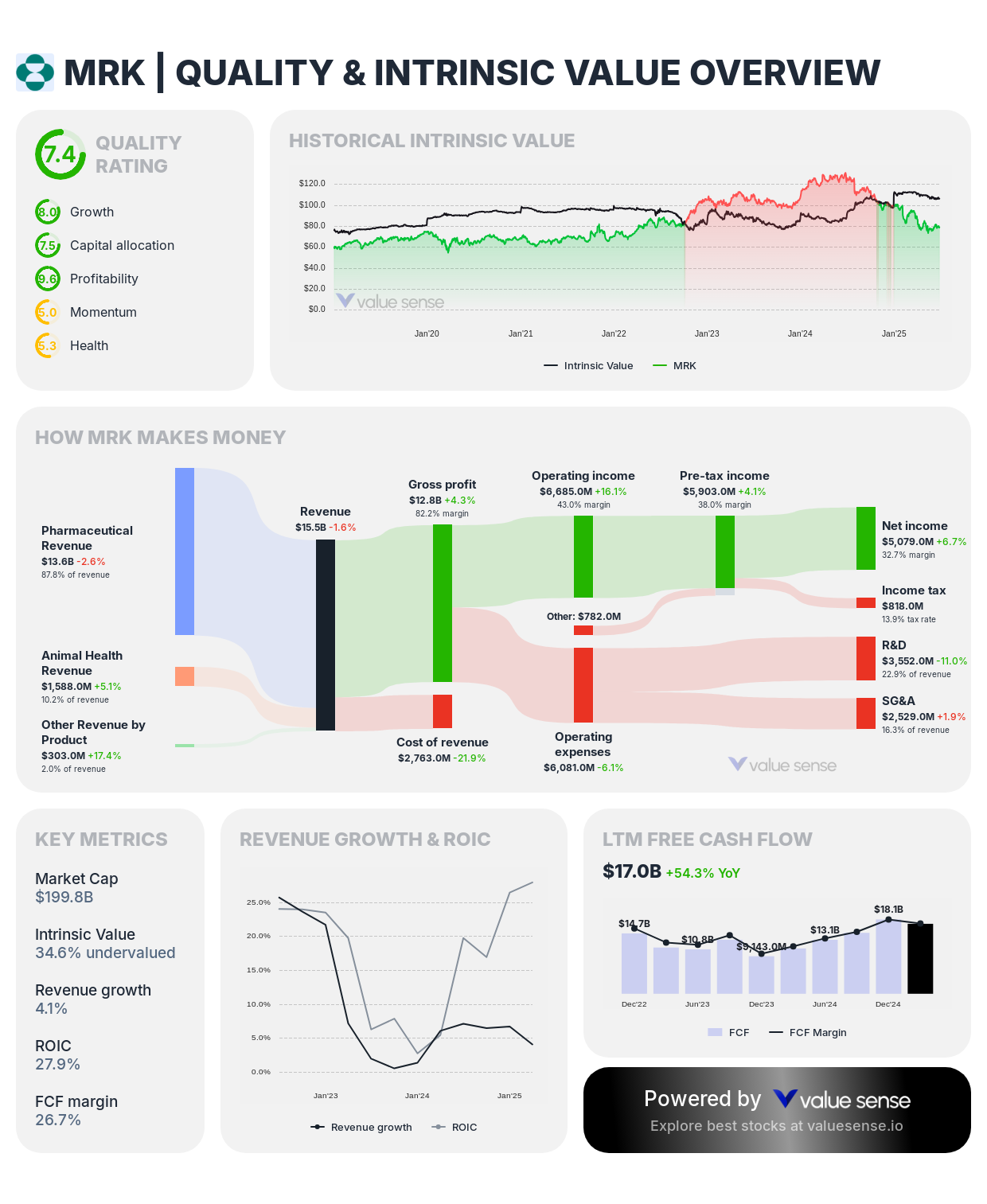

8. Merck & Co., Inc. (MRK) - 34.6% Undervalued

- Intrinsic Value: 34.6% undervalued

- DCF Value: 14.0% undervalued

- Relative Value: 54.9% undervalued

- Ben Graham Revised Fair Value: 111.2% undervalued

- Peter Lynch Fair Value: 117.9% undervalued

- Earnings Power Value: 133.6% of Enterprise Value

- Market-Implied Growth: (33.6%) of Enterprise Value

Investment Thesis: Merck presents solid undervaluation at 34.6% below intrinsic worth, with substantial relative value undervaluation (54.9%) and strong Ben Graham recognition (111.2%). The pharmaceutical leader's strength in oncology, vaccines, and animal health creates sustainable competitive advantages that current pricing underestimates.

Why It's Undervalued: Concerns about Keytruda competition and pipeline execution have created undervaluation of Merck's research capabilities and market positions. The company's innovation track record and therapeutic leadership support value realization over time.

Investment Highlights:

- Leadership position in oncology with Keytruda and expanding immuno-oncology pipeline

- Strong vaccine portfolio providing defensive revenue streams and pandemic preparedness

- Exceptional research and development capabilities with proven innovation track record

- Conservative balance sheet supporting strategic investments and shareholder returns

https://valuesense.io/ticker/mrk

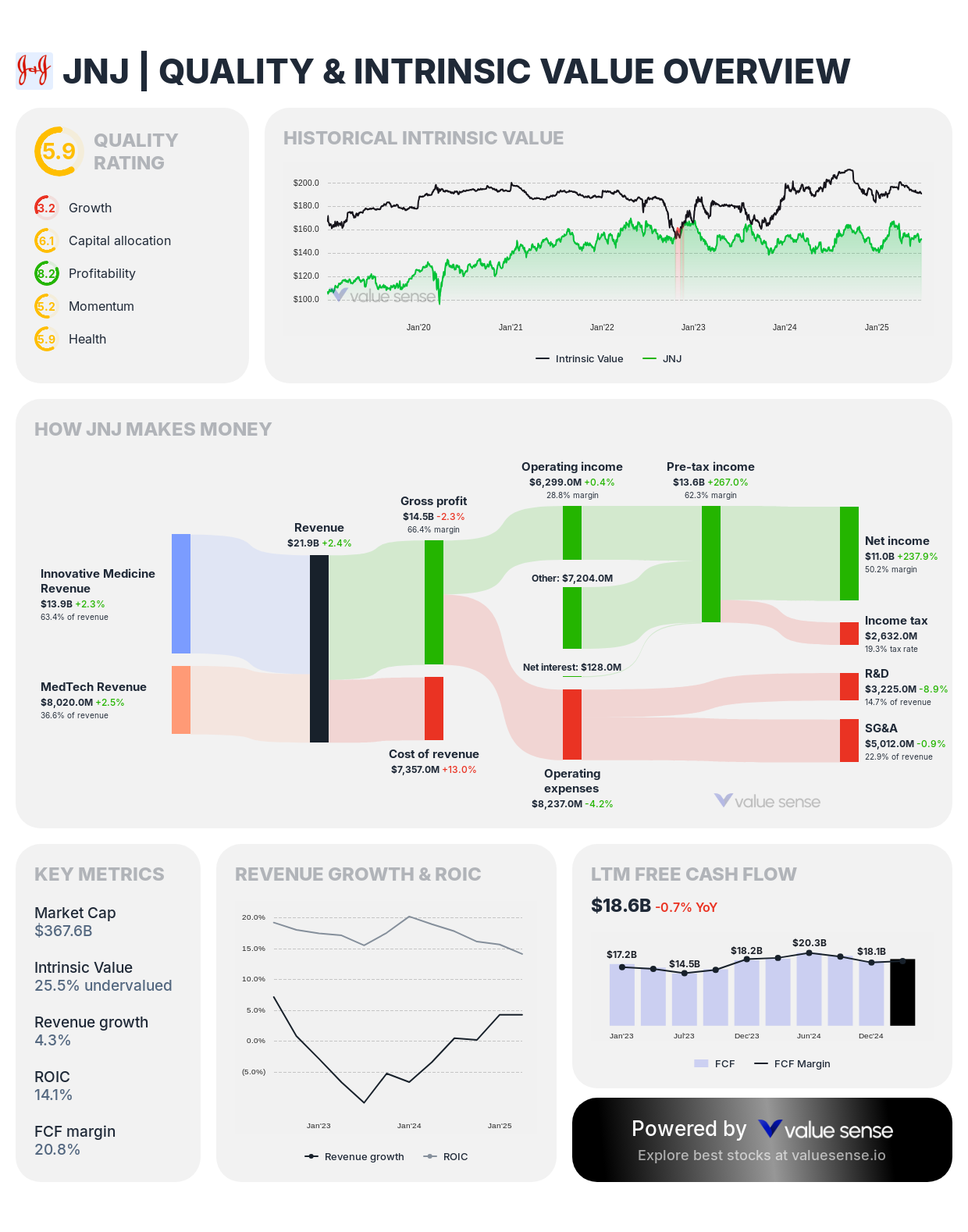

9. Johnson & Johnson (JNJ) - 25.5% Undervalued

- Intrinsic Value: 25.5% undervalued

- DCF Value: 42.0% undervalued

- Relative Value: 8.8% undervalued

- Ben Graham Revised Fair Value: 350.6% undervalued

- Peter Lynch Fair Value: 143.3% undervalued

- Earnings Power Value: 64.8% of Enterprise Value

- Market-Implied Growth: 35.2% of Enterprise Value

Investment Thesis: Johnson & Johnson demonstrates solid undervaluation at 25.5% below intrinsic value, with substantial DCF undervaluation (42.0%) and exceptional Ben Graham recognition (350.6%). The healthcare giant's diversified operations and Dividend Aristocrat status create predictable value that current pricing underestimates.

Why It's Undervalued: Recent divestitures and legal challenges have created temporary undervaluation of J&J's core pharmaceutical and medical device businesses. The company's innovation capabilities and market positions support higher valuations over time.

Investment Highlights:

- Diversified healthcare portfolio across pharmaceuticals, medical devices, and consumer products

- Dividend Aristocrat status with 62 consecutive years of dividend increases

- Strong pharmaceutical pipeline focused on high-growth therapeutic areas including oncology

- Defensive business characteristics providing stability during economic uncertainty

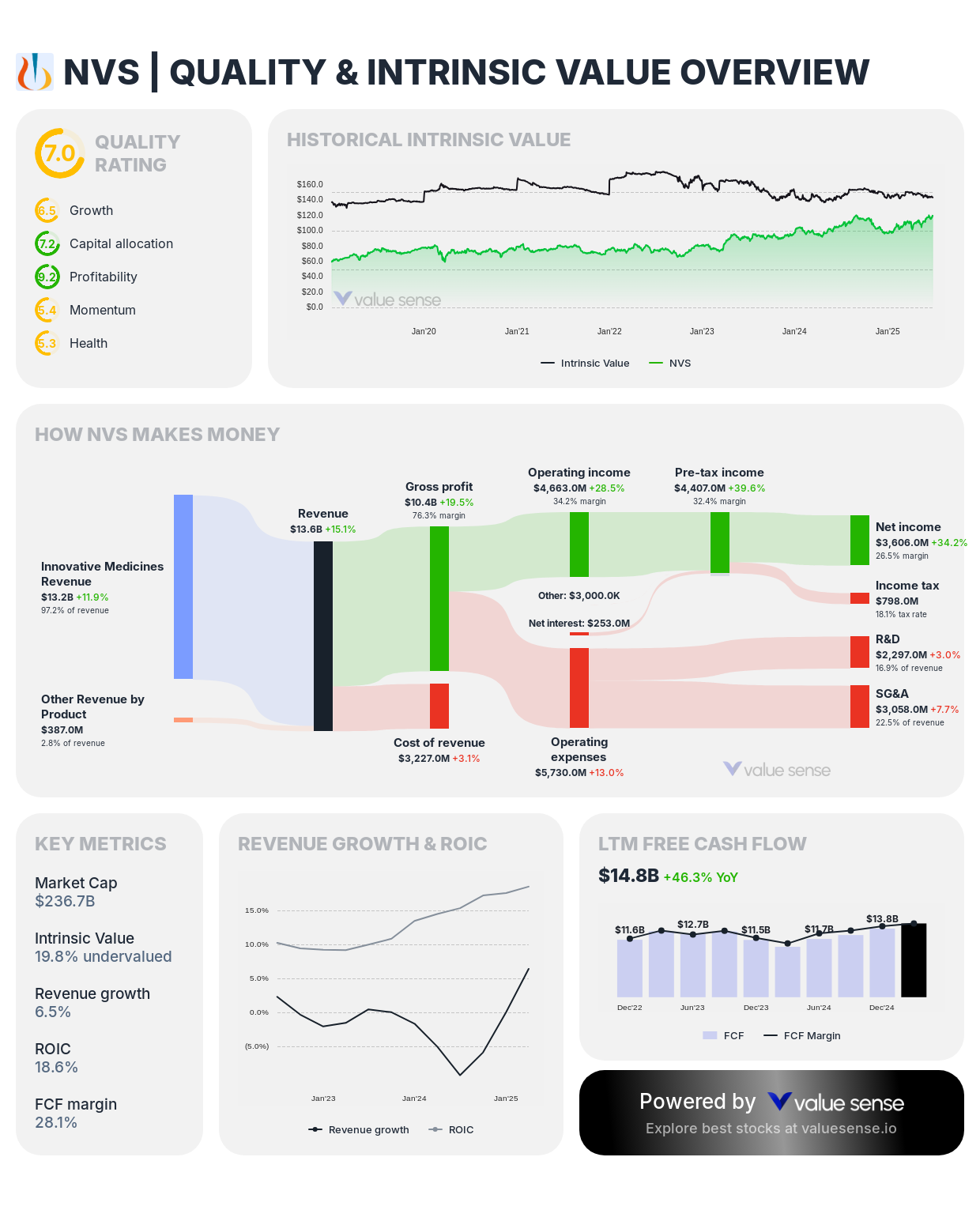

10. Novartis AG (NVS) - 19.8% Undervalued

- Intrinsic Value: 19.8% undervalued

- DCF Value: 35.0% undervalued

- Relative Value: 4.6% undervalued

- Ben Graham Revised Fair Value: 113.5% undervalued

- Peter Lynch Fair Value: 28.7% undervalued

- Earnings Power Value: 84.3% of Enterprise Value

- Market-Implied Growth: 15.7% of Enterprise Value

Investment Thesis: Novartis presents moderate undervaluation at 19.8% below intrinsic worth, with solid DCF undervaluation (35.0%) and strong Ben Graham recognition (113.5%). The Swiss pharmaceutical company's focused portfolio strategy and innovative drug pipeline create predictable value that current pricing underestimates.

Why It's Undervalued: Market concerns about pharmaceutical competition and pipeline execution have created modest undervaluation of Novartis' research capabilities and strategic focus. The company's innovation track record and therapeutic leadership support value realization.

Investment Highlights:

- Focused pharmaceutical portfolio with leadership in key therapeutic areas

- Innovative drug pipeline with multiple potential blockbuster treatments

- Strategic portfolio optimization enhancing focus on high-growth opportunities

- Strong balance sheet and cash generation supporting R&D investment and shareholder returns

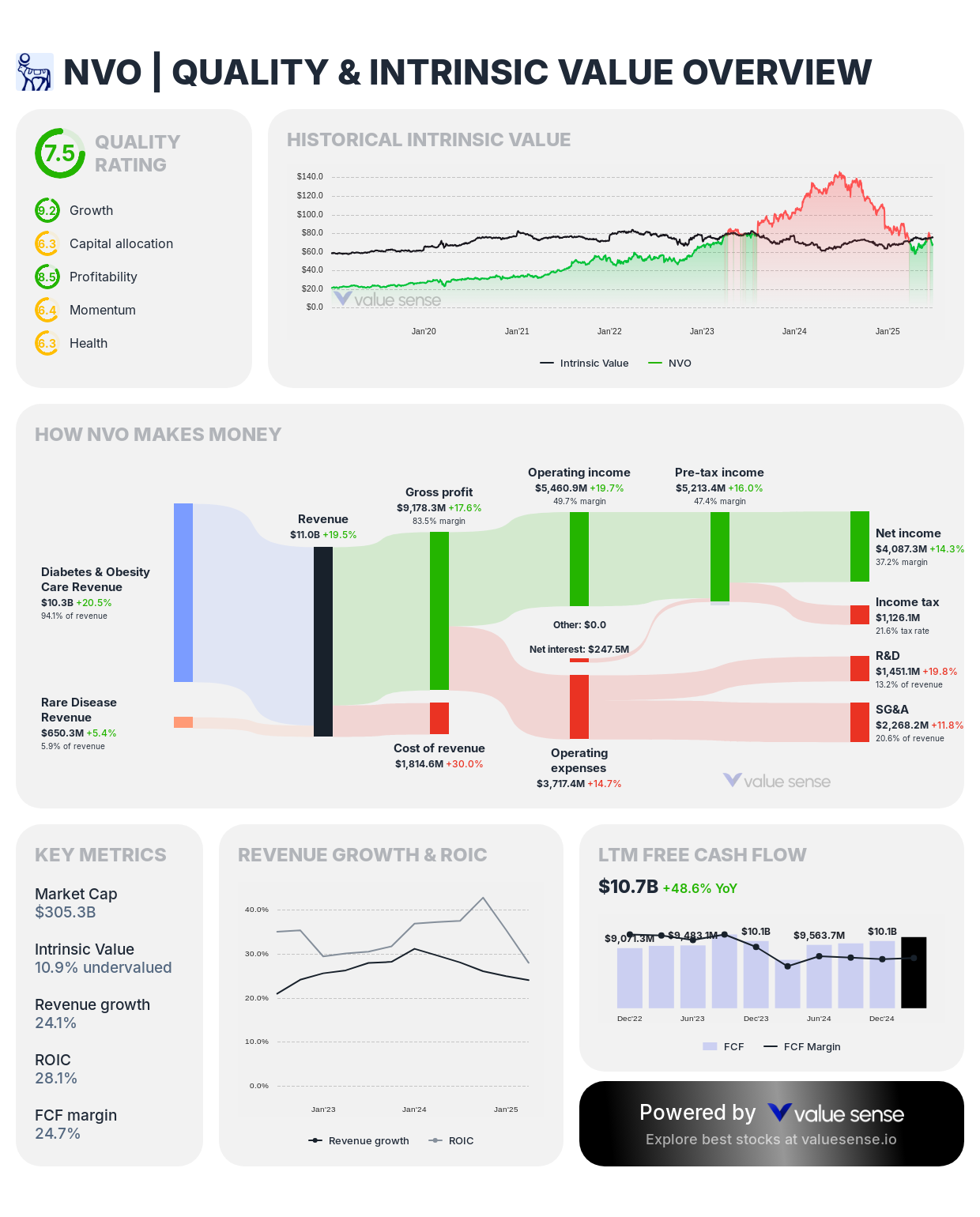

11. Novo Nordisk A/S (NVO) - 10.9% Undervalued

- Intrinsic Value: 10.9% undervalued

- DCF Value: 22.0% undervalued

- Relative Value: 0.1% overvalued

- Ben Graham Revised Fair Value: 30.2% undervalued

- Peter Lynch Fair Value: 41.3% undervalued

- Earnings Power Value: 67.6% of Enterprise Value

- Market-Implied Growth: 32.4% of Enterprise Value

Investment Thesis: Novo Nordisk demonstrates modest undervaluation at 10.9% below intrinsic worth, with solid DCF undervaluation (22.0%) and Ben Graham recognition (30.2%). The Danish pharmaceutical company's leadership in diabetes care and breakthrough obesity treatments create substantial value despite recent market appreciation.

Why It's Undervalued: Despite strong performance, Novo Nordisk's current valuation may not fully capture the long-term potential of its obesity treatment franchise and diabetes care leadership. The company's specialized focus and market expansion support continued value creation.

Investment Highlights:

- Global leadership in diabetes care with expanding patient populations worldwide

- Revolutionary obesity treatments addressing massive addressable markets with premium pricing

- Continuous innovation in drug delivery systems and treatment effectiveness

- Strong international expansion opportunities in emerging healthcare markets

Healthcare Value Investment Strategy

Prioritize Exceptional Undervaluation with Quality: Focus on companies combining substantial undervaluation with strong business fundamentals. UnitedHealth (109.8% undervalued) and Pfizer (64.5% undervalued) offer exceptional value opportunities with defensive healthcare characteristics and quality operations.

Diversify Across Healthcare Subsectors: Spread investments across health insurance (UnitedHealth), pharmaceuticals (Pfizer, AbbVie, Merck, J&J, Novartis, Novo Nordisk), biotechnology (Amgen), medical devices (Medtronic, Abbott), and life sciences tools (Thermo Fisher) to reduce concentration risk while maintaining healthcare sector exposure.

Emphasize Demographic Tailwinds: Healthcare investing benefits from aging population demographics, increasing healthcare spending, and medical innovation trends that create sustained demand growth regardless of economic conditions. These secular trends support long-term value realization.

Focus on Innovation and Pipeline Strength: Prioritize companies with strong R&D capabilities, robust pipelines, and proven innovation track records. Companies like Merck, AbbVie, and Thermo Fisher demonstrate the innovation capabilities necessary for sustained competitive advantages in healthcare markets.

Understanding Our Valuation Methodology

Our comprehensive healthcare valuation approach incorporates multiple analytical frameworks:

Earnings Power Value (EPV) Analysis: EPV estimates a company's value based on current earnings power, assuming no future growth. High EPV ratios like UnitedHealth's 93.9% indicate companies generating substantial current profits relative to their enterprise value, providing a conservative baseline valuation.

Market-Implied Value of Growth (MiVoG): MiVoG represents the portion of enterprise value that markets attribute to future growth beyond current earnings. Lower MiVoG percentages suggest markets have modest growth expectations, potentially creating opportunities when actual growth exceeds these expectations.

Multiple Methodology Confirmation: We require undervaluation across multiple approaches including DCF analysis, relative valuation, Ben Graham revised fair value, and Peter Lynch fair value to ensure robust investment opportunities with margin of safety.

Key Takeaways for Healthcare Value Investors

✅ Exceptional Value Leader: UnitedHealth (109.8% undervalued) offers extraordinary undervaluation with demographic tailwinds

✅ Pharmaceutical Opportunities: Multiple pharmaceutical companies show substantial undervaluation across various methodologies

✅ Defensive Characteristics: Healthcare companies provide recession resistance and predictable demand patterns

✅ Innovation Focus: Companies with strong R&D and pipeline development offer sustainable competitive advantages

✅ Diversified Exposure: Opportunities span health insurance, pharmaceuticals, biotechnology, devices, and services

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best Undervalued Large Cap US Stocks

📖 10 Best Compounding Quality Stocks

📖 11 Best Value Energy Stocks

FAQ About Healthcare Value Investing

What makes healthcare stocks particularly attractive for defensive investors?

Healthcare stocks offer exceptional defensive characteristics because medical care represents essential spending that remains relatively stable during economic downturns. Companies like UnitedHealth and Abbott provide services with predictable demand driven by aging demographics, chronic disease management, and medical innovation. Healthcare spending typically grows faster than GDP regardless of economic conditions, making these companies ideal for investors seeking stability with growth potential.

How should investors evaluate pharmaceutical pipeline risks and opportunities?

Pharmaceutical pipeline evaluation requires analyzing clinical trial progression, regulatory pathways, market opportunity size, and competitive landscapes. Companies like Pfizer and AbbVie with diversified pipelines across multiple therapeutic areas reduce single-drug dependency risks. Focus on companies with strong R&D track records, robust patent portfolios, and strategic partnerships that support continued innovation and market expansion.

Why do quality healthcare companies sometimes trade at significant discounts?

Healthcare companies may trade below intrinsic value due to regulatory concerns, patent cliff challenges, clinical trial setbacks, or broader market rotation away from defensive sectors. UnitedHealth's 109.8% undervaluation reflects temporary political concerns despite strong fundamentals, while pharmaceutical companies face patent expiration cycles that create periodic valuation pressures. These situations often create opportunities for patient investors.

What role do demographic trends play in healthcare investing success?

Demographic trends provide powerful tailwinds for healthcare investing, as aging populations require increased medical care, chronic disease management, and innovative treatments. Companies like Novo Nordisk benefit from growing diabetes and obesity prevalence, while medical device companies like Medtronic gain from increased surgical procedures. These secular trends support sustained demand growth independent of economic cycles.

How should investors balance growth potential with dividend income in healthcare stocks?

Healthcare companies often provide attractive combinations of growth potential and dividend income due to their predictable cash flows and essential service nature. Dividend Aristocrats like Johnson & Johnson offer reliable income with modest growth, while companies like UnitedHealth provide both substantial appreciation potential and growing dividends. Balance depends on individual income needs and growth objectives, with healthcare offering options across the risk-return spectrum.

Important Note on Healthcare Investing: Healthcare stocks offer defensive characteristics but face regulatory risks, patent cliff challenges, and clinical trial uncertainties. While demographic trends provide long-term tailwinds, individual company success depends on innovation capabilities, competitive positioning, and execution. Diversification across healthcare subsectors can help manage company-specific risks while capturing sector growth potential.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Healthcare investments carry risks including regulatory changes, clinical trial failures, and competitive pressures. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.