Undervalued High Margin Businesses: The Best Stocks for Quality Cash Flow and Growth

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Investors seeking sustainable wealth creation know that high margin businesses with strong free cash flow generation are the bedrock of a resilient, long-term portfolio. When these businesses are trading at a discount to their intrinsic value, they offer a rare combination of safety and upside—a true value investor’s dream. At ValueSense, we screen thousands of global stocks to highlight those rare opportunities where profitability meets undervaluation.

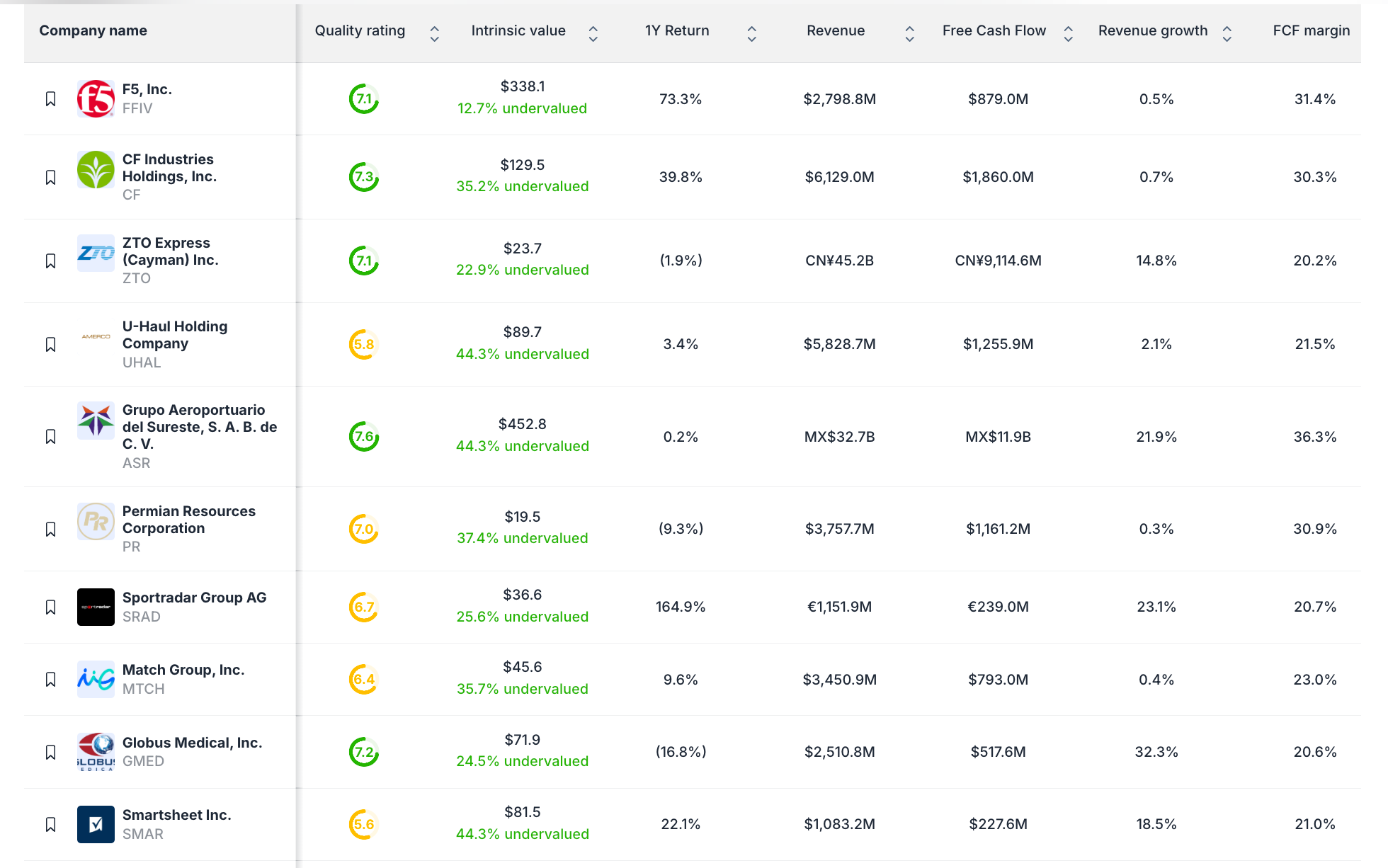

Below, you’ll find our curated list of the best undervalued high margin businesses for 2024. These companies all demonstrate top-tier free cash flow margins, robust revenue growth, and attractive intrinsic value discounts—making them standout picks for any quality-focused investor.

Why Invest in High Margin Businesses?

High margin businesses enjoy several structural advantages:

- Resilience in Downturns: Strong margins mean more earnings retained—even when sales slow.

- Capital Efficiency: High margins often signal a company’s pricing power, competitive moat, and ability to reinvest in growth.

- Free Cash Flow Generation: High FCF margins support dividends, share buybacks, and organic expansion.

When you combine these traits with undervaluation, you’re stacking the odds in your favor for both capital preservation and appreciation.

Top Undervalued High Margin Stocks for 2024

1. F5, Inc. (FFIV)

- Quality Rating: 7.1

- Intrinsic Value: 12.7% undervalued

- 1-Year Return: 73.3%

- Revenue: $2,798.8M

- Free Cash Flow: $879.0M

- FCF Margin: 31.4%

F5 provides mission-critical application delivery and security solutions. The company’s high FCF margin and consistent profitability make it a standout in the software infrastructure segment.

2. CF Industries Holdings, Inc. (CF)

- Quality Rating: 7.3

- Intrinsic Value: 35.2% undervalued

- 1-Year Return: 39.8%

- Revenue: $6,129.0M

- Free Cash Flow: $1,860.0M

- FCF Margin: 30.3%

CF Industries is a global leader in nitrogen fertilizer, benefiting from strong industry fundamentals and a high free cash flow margin—providing both income and growth potential.

3. Grupo Aeroportuario del Sureste (ASR)

- Quality Rating: 7.6

- Intrinsic Value: 44.3% undervalued

- 1-Year Return: 21.9%

- Revenue: MX$32.7B

- Free Cash Flow: MX$11.9B

- FCF Margin: 36.3%

This Mexican airport operator posts remarkable margins, underpinned by strong travel demand and local market dominance. A compelling blend of defensive cash flow and undervaluation.

4. Permian Resources Corporation (PR)

- Quality Rating: 7.0

- Intrinsic Value: 37.4% undervalued

- 1-Year Return: (9.3%)

- Revenue: $3,757.7M

- Free Cash Flow: $1,161.2M

- FCF Margin: 30.9%

A Permian Basin oil and gas leader, PR combines operational discipline with high margins and significant undervaluation, ideal for those seeking energy sector exposure.

5. U-Haul Holding Company (UHAL)

- Quality Rating: 5.8

- Intrinsic Value: 44.3% undervalued

- 1-Year Return: 3.4%

- Revenue: $5,828.7M

- Free Cash Flow: $1,255.9M

- FCF Margin: 21.5%

U-Haul’s brand dominance and asset-light rental model result in robust free cash flow, even as the company undergoes a period of strategic investments.

6. ZTO Express (Cayman) Inc. (ZTO)

- Quality Rating: 7.1

- Intrinsic Value: 22.9% undervalued

- 1-Year Return: (1.9%)

- Revenue: CN¥45.2B

- Free Cash Flow: CN¥9,114.6M

- FCF Margin: 20.2%

China’s logistics powerhouse, ZTO Express, maintains stellar margins thanks to scale and operational efficiency in one of the world’s largest parcel markets.

7. Sprtadr Group AG (SRAD)

- Quality Rating: 6.7

- Intrinsic Value: 25.6% undervalued

- 1-Year Return: 23.1%

- Revenue: €1,151.9M

- Free Cash Flow: €239.0M

- FCF Margin: 20.7%

A leader in sports data and analytics, Sportradar’s recurring revenue and expanding margins make it a stealth high-margin play.

8. Match Group, Inc. (MTCH)

- Quality Rating: 6.4

- Intrinsic Value: 35.7% undervalued

- 1-Year Return: 0.4%

- Revenue: $3,450.9M

- Free Cash Flow: $793.0M

- FCF Margin: 23.0%

Match Group’s digital dating platforms, including Tinder and Hinge, generate impressive margins and consistent free cash flow, making it an attractive tech value pick.

9. Globus Medical, Inc. (GMED)

- Quality Rating: 7.2

- Intrinsic Value: 24.5% undervalued

- 1-Year Return: 16.3%

- Revenue: $2,510.8M

- Free Cash Flow: $517.6M

- FCF Margin: 20.6%

A medtech innovator, Globus Medical’s high margins are driven by a focus on spinal solutions and advanced robotics in healthcare.

10. Smartsheet Inc. (SMAR)

- Quality Rating: 6.5

- Intrinsic Value: 44.3% undervalued

- 1-Year Return: 18.5%

- Revenue: $1,083.2M

- Free Cash Flow: $227.6M

- FCF Margin: 21.0%

Smartsheet, a cloud-based work management platform, combines SaaS scalability with robust free cash flow—a rare feat in the software world.

Key Takeaways

- Diversification: This list includes leaders from tech, industrials, energy, healthcare, and logistics—offering sector and geographic diversification.

- Solid Value: Each company is significantly undervalued on an intrinsic

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Best Undervalued S&P 500 Stocks

📖 11 Best Undervalued Multibagger Stocks

📖 The Magnificent 7 Stocks: Fundamental Quality Rankings & Insights