9 Undervalued Low Debt Stocks to Buy - 2025

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

In today's market environment, financially resilient companies with strong balance sheets and attractive valuations present compelling investment opportunities. This analysis identifies nine undervalued stocks with low debt profiles that warrant investor attention in 2025.

Selection Methodology

The following companies were selected based on three key criteria:

- Low Debt-to-Equity: below 30%

- Intrinsic Value: Currently trading below calculated intrinsic value

Top Undervalued Low-Debt Opportunities

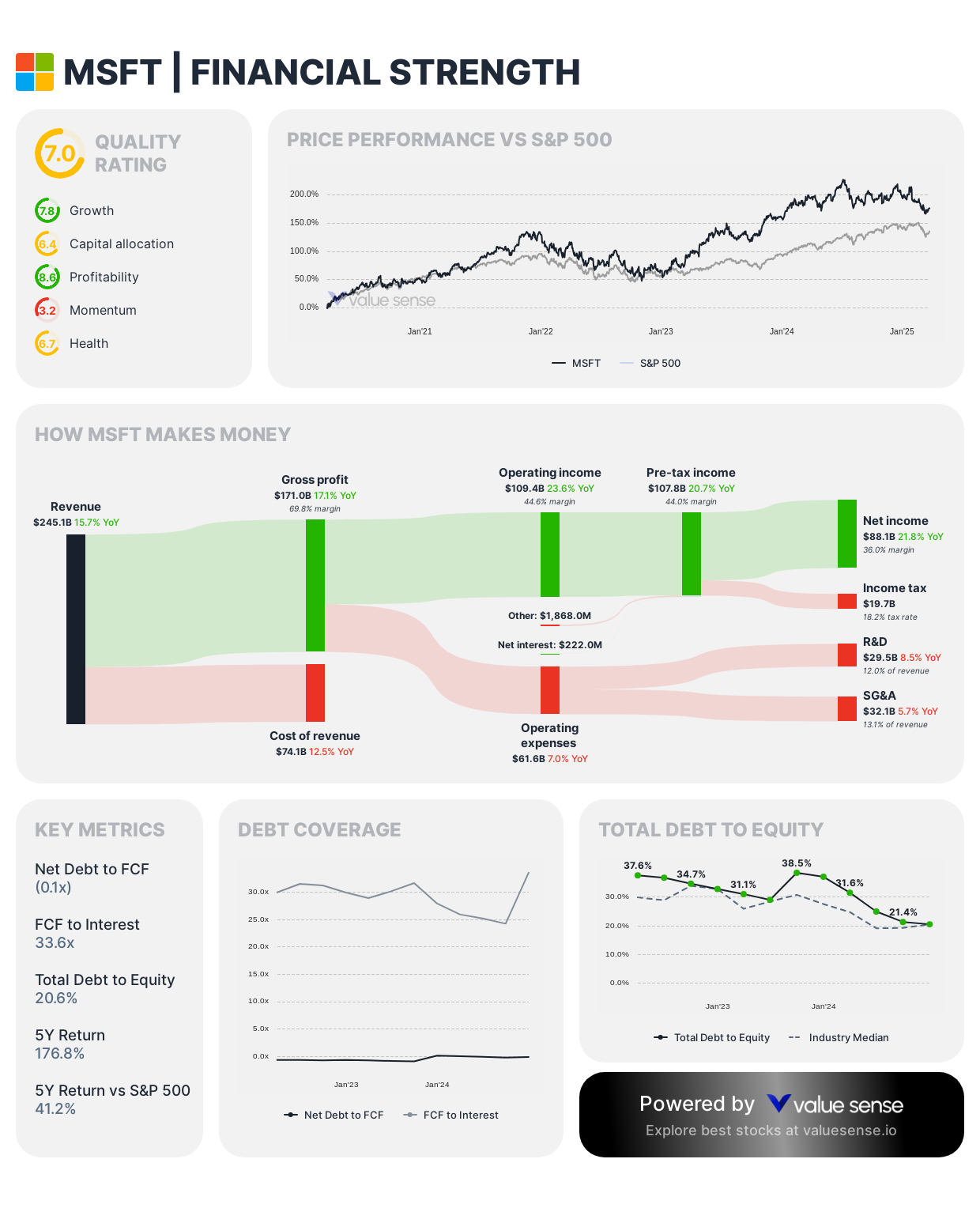

1. Microsoft Corporation (MSFT)

- Debt-to-Equity: 20.6%

- Net Debt: ($9,327.0M) - Cash positive

- Intrinsic Value: $430.1 (9.4% undervalued)

- Highlights: Strong free cash flow ($70.0B), exceptional FCF to Interest coverage (33.6x)

Microsoft continues to dominate the enterprise software landscape while strategically expanding its cloud infrastructure and AI capabilities. The company's diversified revenue streams across software, cloud services, gaming, and hardware create multiple growth vectors. With a fortress-like balance sheet featuring over $9 billion in net cash and generating $70 billion in free cash flow annually, Microsoft demonstrates exceptional financial resilience while continuing to innovate across its product ecosystem. The 9.4% discount to intrinsic value presents an attractive entry point for long-term investors seeking both growth and stability.

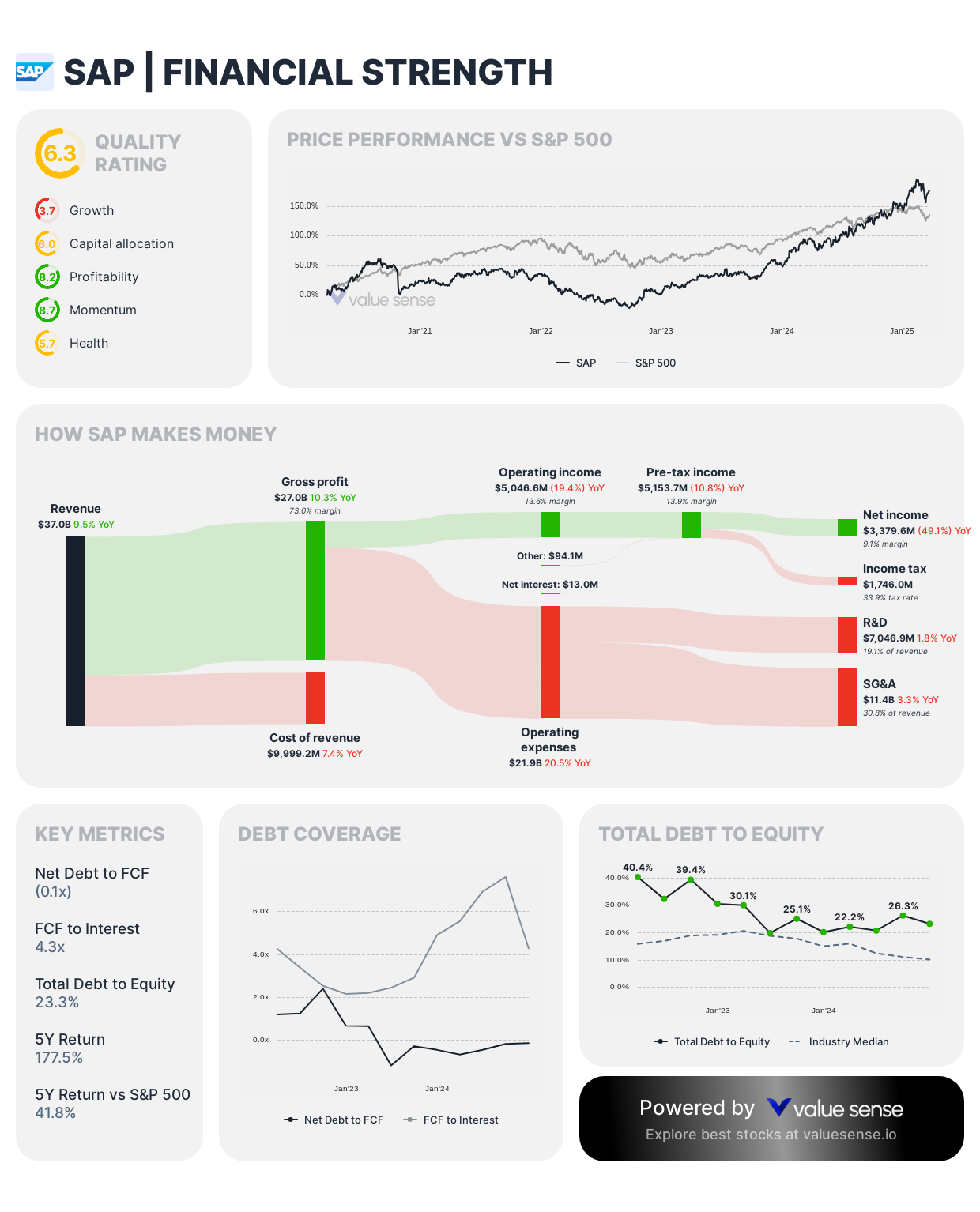

2. SAP SE (SAP)

- Debt-to-Equity: 23.3%

- Net Debt: (€587.0M) - Cash positive

- Intrinsic Value: $279.6 (1.4% undervalued)

- Highlights: Impressive 1Y return (42.5%), solid free cash flow (€4,423.0M)

SAP has successfully executed its strategic pivot to cloud-based enterprise solutions, transforming its business model toward more predictable recurring revenue streams. The German software giant has strengthened its competitive position in enterprise resource planning (ERP) while expanding its footprint in customer relationship management (CRM) and supply chain management. Despite a stellar 42.5% one-year return, SAP remains slightly undervalued with substantial free cash flow generation and a cash-positive balance sheet. The company's entrenched position in mission-critical enterprise systems creates significant switching costs for customers, reinforcing its economic moat.

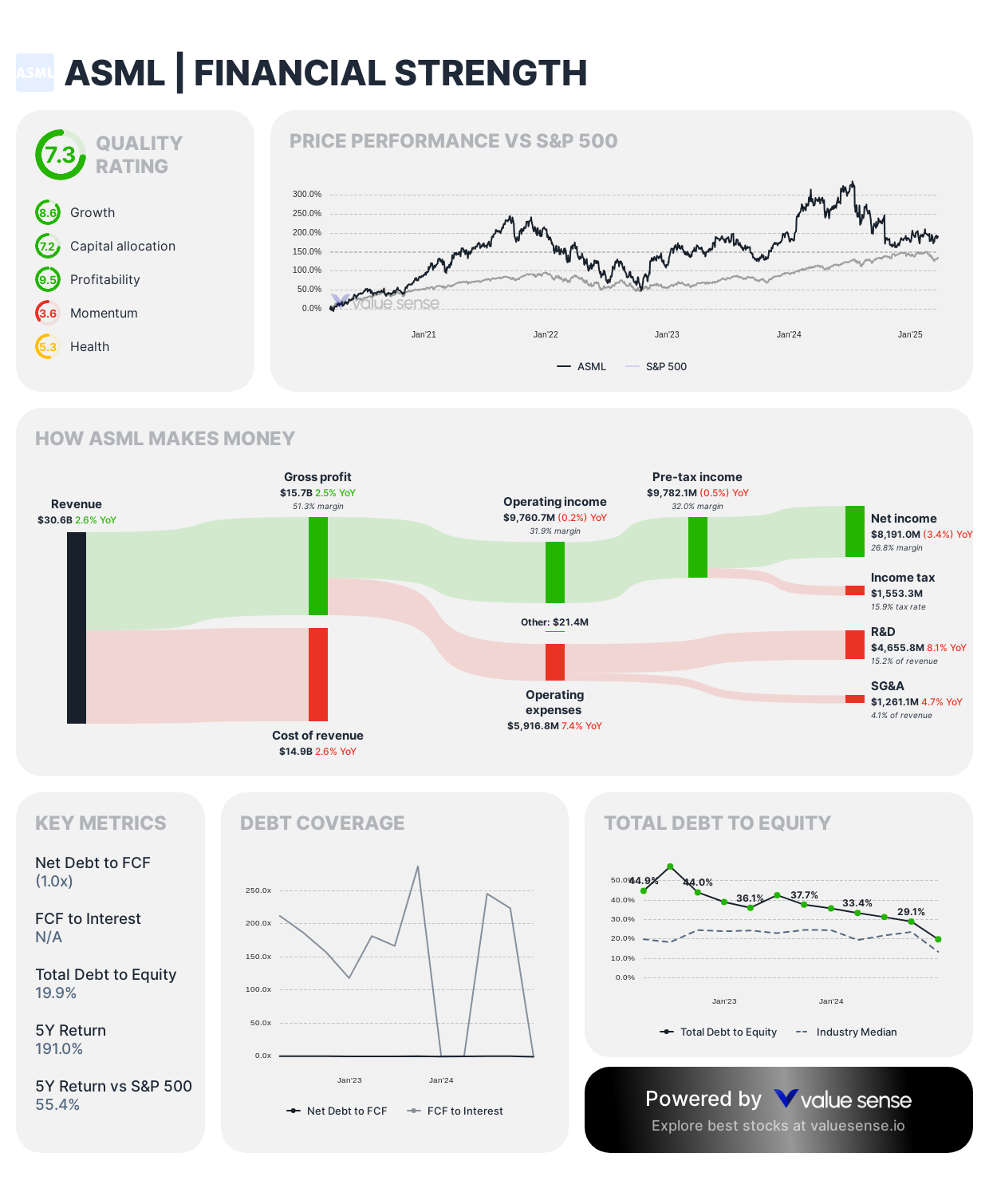

3. ASML Holding N.V. (ASML)

- Debt-to-Equity: 19.9%

- Net Debt: (€9,064.0M) - Cash positive

- Intrinsic Value: $740.5 (1.7% undervalued)

- Highlights: Strong quality rating (7.3), excellent cash position

ASML maintains a near-monopoly position in advanced extreme ultraviolet (EUV) lithography equipment essential for manufacturing cutting-edge semiconductor chips. This strategic position in the semiconductor value chain makes ASML an indispensable enabler of technological advancement across computing, AI, and advanced electronics. With over €9 billion in net cash and a conservative debt-to-equity ratio of 19.9%, ASML combines financial strength with technological leadership. Despite its mission-critical role in global technology infrastructure, ASML trades at a modest 1.7% discount to intrinsic value, offering investors exposure to semiconductor innovation with reduced balance sheet risk.

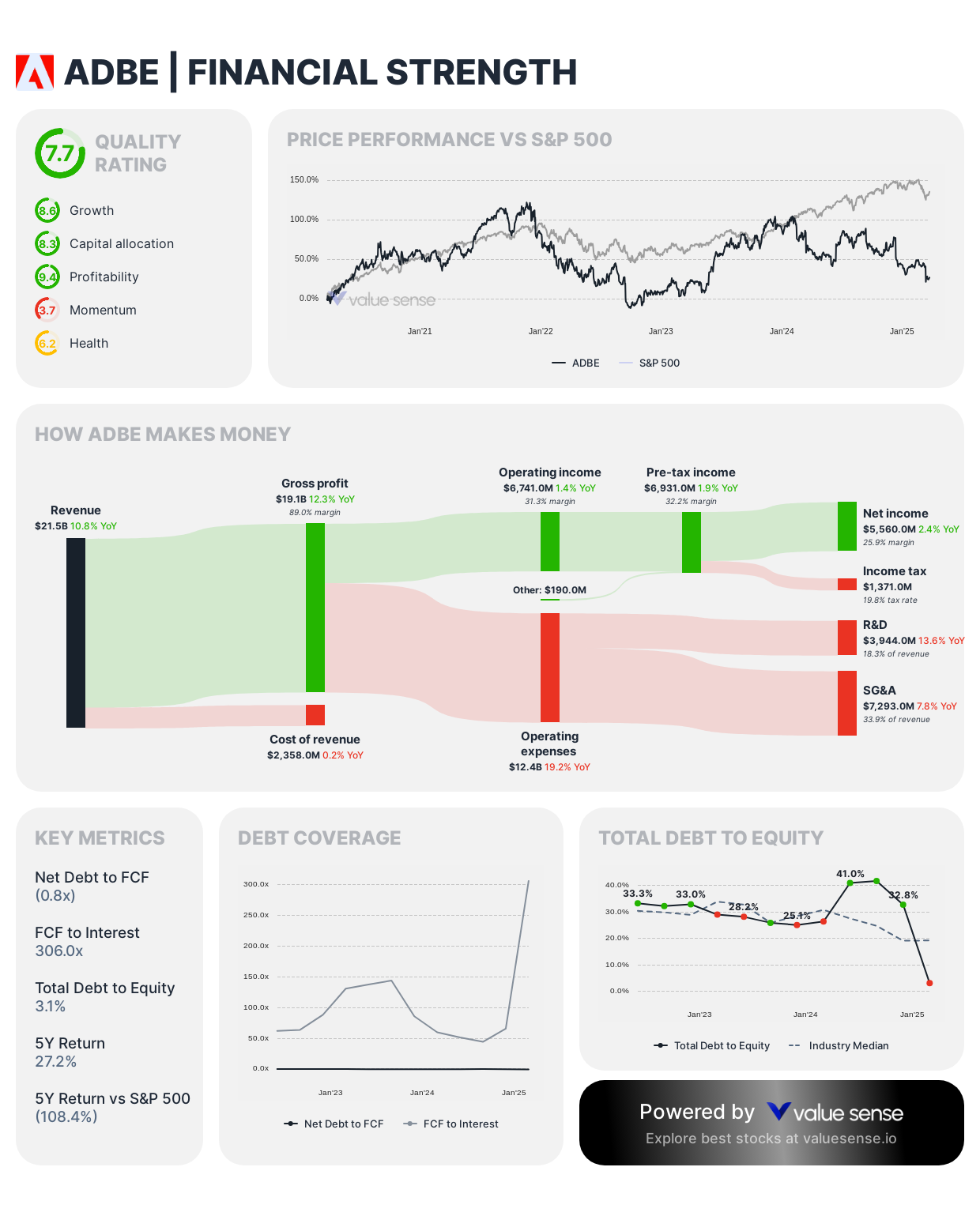

4. Adobe Inc. (ADBE)

- Debt-to-Equity: 3.1%

- Net Debt: ($7,027.0M) - Cash positive

- Intrinsic Value: $510.8 (29.5% undervalued)

- Highlights: Exceptional FCF to Interest ratio (306.0x), quality rating (7.7)

Adobe dominates the digital creative software ecosystem with its Creative Cloud and Document Cloud offerings, while expanding into digital experience and marketing automation solutions. The company's transition to a subscription-based revenue model has successfully created a predictable, high-margin business with substantial customer retention. With a minimal debt-to-equity ratio of just 3.1% and over $7 billion in net cash, Adobe maintains exceptional financial flexibility. The stock's significant 29.5% discount to intrinsic value presents one of the most compelling valuation opportunities among large-cap technology companies. Adobe's stellar FCF to interest coverage ratio of 306x further demonstrates its earnings power relative to debt obligations.

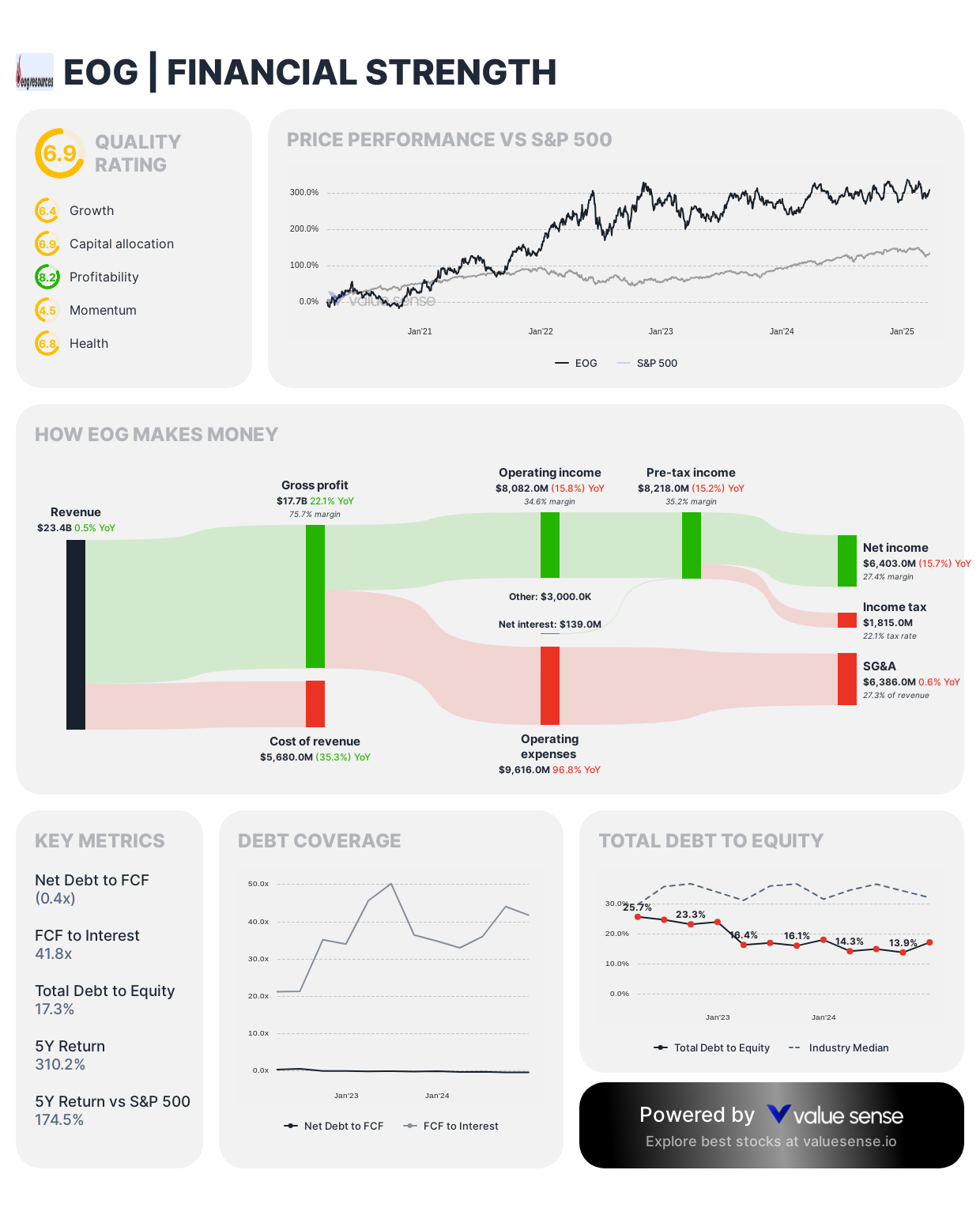

5. EOG Resources, Inc. (EOG)

- Debt-to-Equity: 17.3%

- Net Debt: ($2,025.0M) - Cash positive

- Intrinsic Value: $152.3 (18.7% undervalued)

- Highlights: Strong liquidity (2.1x current ratio, 1.8x quick ratio)

EOG Resources stands out in the energy sector for its disciplined capital allocation, technological innovation in drilling efficiency, and premium drilling inventory. Unlike many competitors, EOG maintains a cash-positive balance sheet with over $2 billion in net cash, providing significant flexibility through commodity price cycles. The company's focus on high-return drilling opportunities and operational excellence has enabled consistent free cash flow generation even during challenging market conditions. Trading at an 18.7% discount to intrinsic value, EOG offers exposure to energy markets with substantially reduced balance sheet risk compared to industry peers. The company's strong liquidity metrics (2.1x current ratio) further reinforce its financial stability.

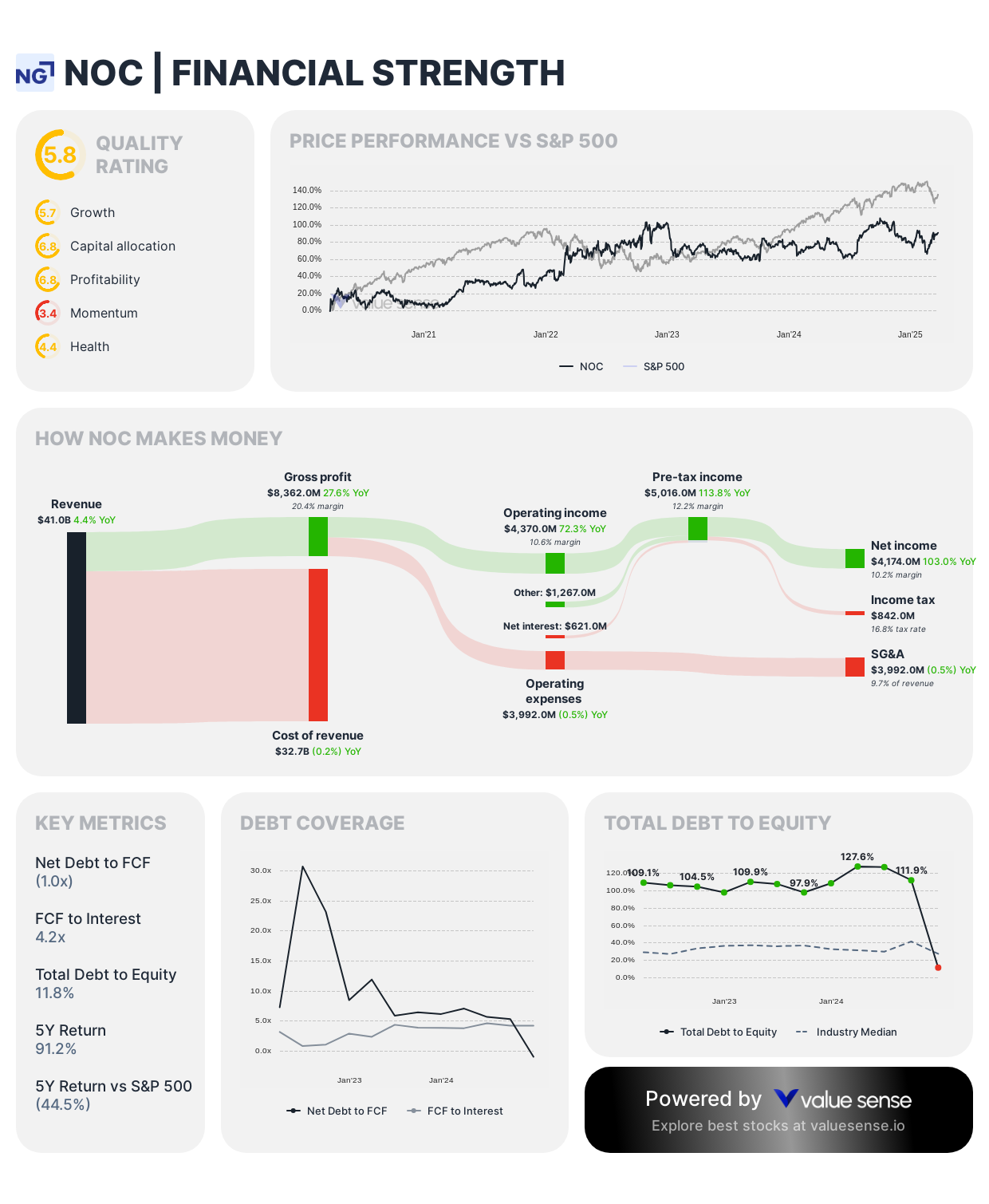

6. Northrop Grumman Corporation (NOC)

- Debt-to-Equity: 11.8%

- Net Debt: ($2,555.0M) - Cash positive

- Intrinsic Value: $701.0 (41.6% undervalued)

- Highlights: Significant undervaluation, stable revenue ($41.0B)

Northrop Grumman has established itself as a crucial defense contractor with leadership positions in space systems, autonomous systems, and cybersecurity. The company benefits from long-term defense contracts providing visibility into future revenue streams, while its technological edge in next-generation defense systems positions it favorably for future procurement decisions. With over $2.5 billion in net cash and a conservative debt-to-equity ratio of 11.8%, Northrop maintains balance sheet strength rare among major defense contractors. The stock's substantial 41.6% discount to intrinsic value represents a compelling opportunity in the aerospace and defense sector. Northrop's $41 billion in annual revenue demonstrates its scale and importance within the national security infrastructure.

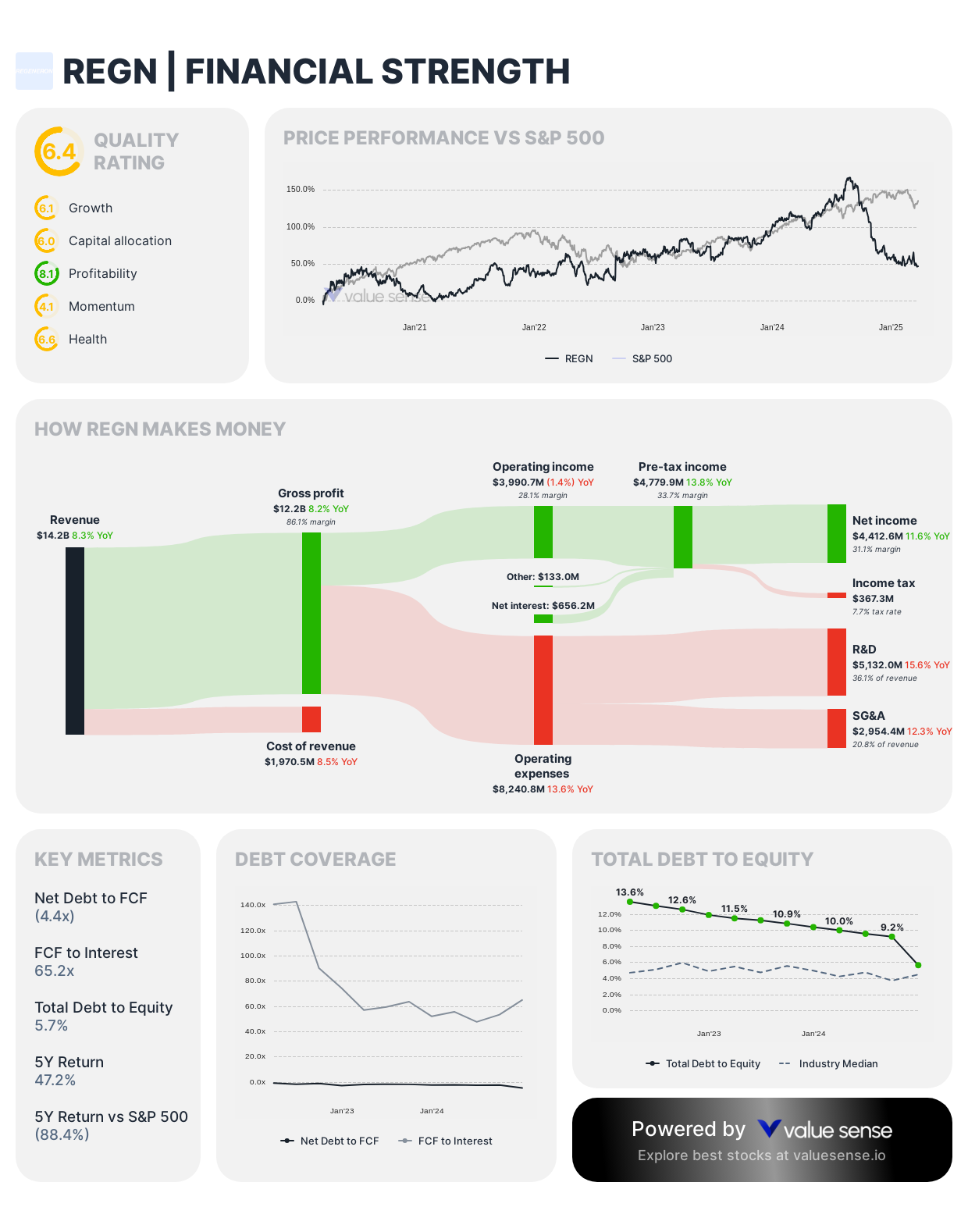

7. Regeneron Pharmaceuticals, Inc. (REGN)

- Debt-to-Equity: 5.7%

- Net Debt: ($15.9B) - Cash positive

- Intrinsic Value: $1,034.1 (56.4% undervalued)

Regeneron has built an impressive biopharmaceutical platform focused on innovative treatments in ophthalmology, immunology, and oncology. The company's proprietary VelociSuite technologies enable efficient antibody discovery and development, creating a sustainable pipeline of potential blockbuster therapies. The stock's dramatic 56.4% discount to intrinsic value suggests significant market underappreciation of both its commercialized treatments and development pipeline. With minimal debt obligations at just 5.7% of equity, Regeneron offers significant downside protection while maintaining substantial upside potential.

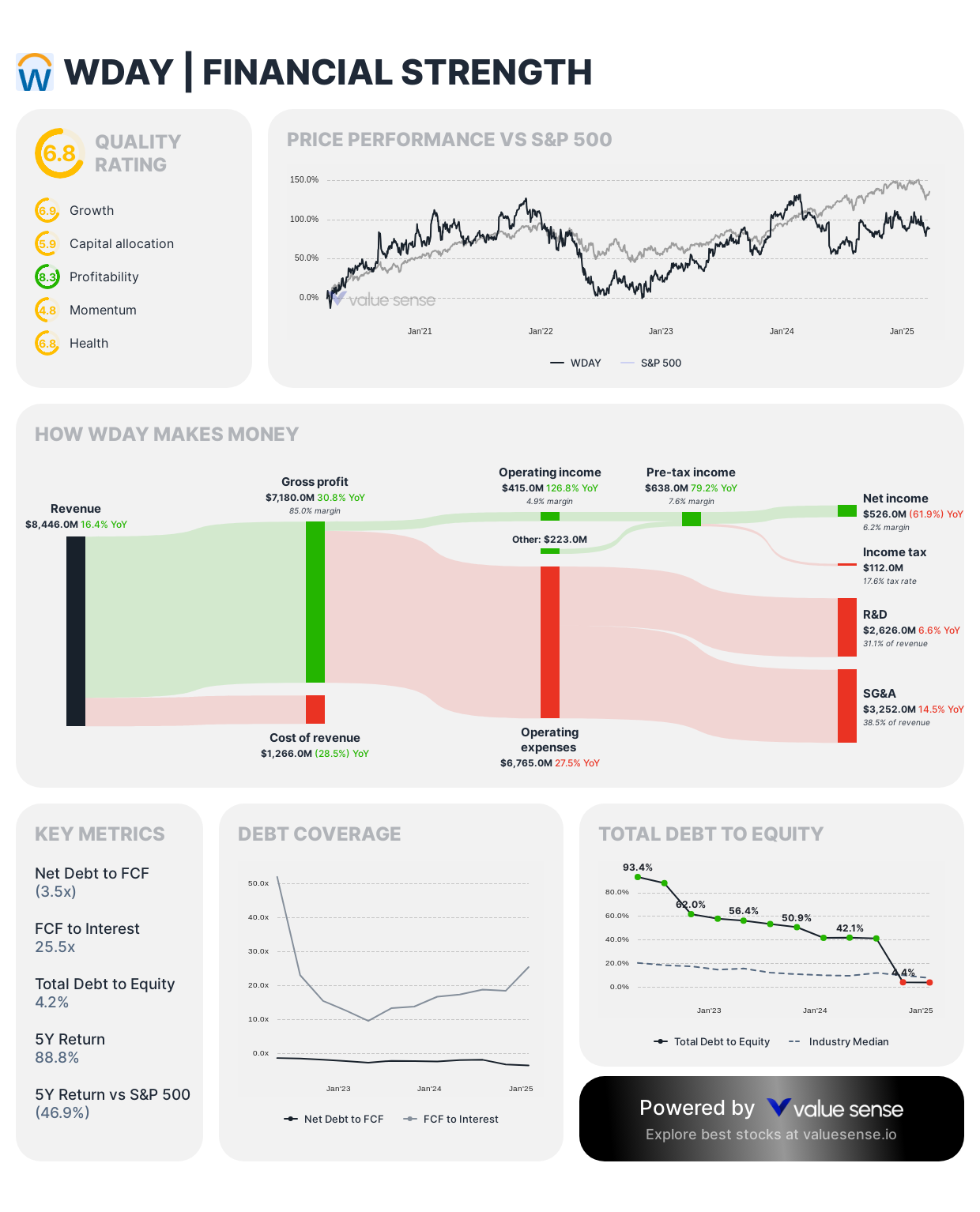

8. Workday, Inc. (WDAY)

- Debt-to-Equity: 4.2%

- Net Debt: ($7,639.0M) - Cash positive

- Intrinsic Value: $310.4 (24.2% undervalued)

- Highlights: Strong revenue growth (16.5%), solid FCF ($2,192.0M)

Workday has disrupted the human capital management and financial management software markets with its cloud-native enterprise solutions. The company's focus on large enterprise customers creates significant recurring revenue streams with high switching costs once implemented. With over $7.6 billion in net cash and minimal debt at just 4.2% of equity, Workday maintains exceptional financial flexibility to pursue growth opportunities. The company continues to demonstrate strong execution with 16.5% revenue growth while generating over $2.1 billion in free cash flow. Trading at a 24.2% discount to intrinsic value, Workday offers investors exposure to enterprise cloud transformation with the safety margin of a fortress balance sheet.

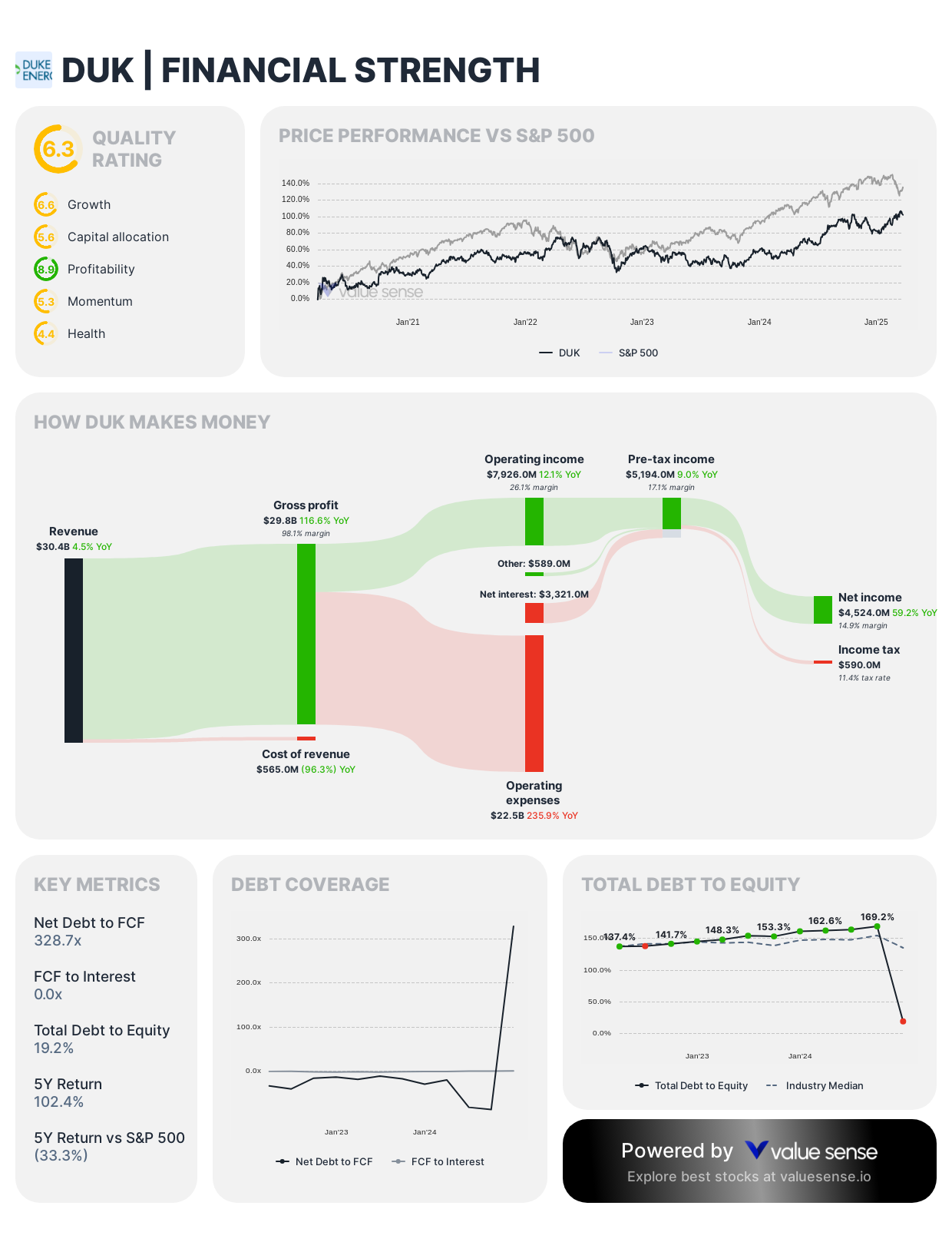

9. Duke Energy Corporation (DUK)

- Debt-to-Equity: 19.2%

- Net Debt: $9,533.0M

- Intrinsic Value: $156.4 (32.3% undervalued)

- Highlights: Stable utility business, high earnings power value (97.3% of EV)

Duke Energy represents the only traditional utility in this selection, offering a different risk-reward profile through its regulated electric and natural gas operations across the Southeast and Midwest. Unlike the other selections, Duke maintains a positive net debt position, though its debt-to-equity ratio remains conservative at 19.2% compared to utility peers. The company's regulated business model provides earnings stability and predictability, while its clean energy transition initiatives create incremental growth opportunities. Duke's substantial 32.3% discount to intrinsic value offers an attractive entry point for income-oriented investors. The company's high earnings power value (97.3% of enterprise value) demonstrates the substantial cash flow generation underpinning its operations and dividend payments.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 9 low P/E & high ROIC stocks for 2025

📖 Top Dividend Stocks for 2025

📖 9 High-Momentum Stocks With Exceptional Quality