8 Best Undervalued Low Debt Stocks: Financial Fortress Companies

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Power of Financial Fortress Investing

Low debt companies represent the financial fortresses of the investment world, offering superior resilience during economic uncertainty while maintaining operational flexibility for growth investments and strategic opportunities. When these financially robust companies also trade below their intrinsic value, they create exceptional opportunities combining safety with substantial appreciation potential.

Enhanced Selection Criteria:

- Intrinsic Value Undervaluation: Trading at least 10% below calculated fair value

- Superior Debt Management: Net debt to FCF ratio below 2.0x, or preferably negative (net cash)

- Strong Health Scores: Quality ratings of 6.0 or higher indicating robust fundamentals

- Excellent Liquidity: Current ratios above 1.0x and strong interest coverage

- Quality Cash Generation: Consistent free cash flow supporting debt service and growth

Top 10 Undervalued Low Debt Stocks - Ranked by Undervaluation Percentage

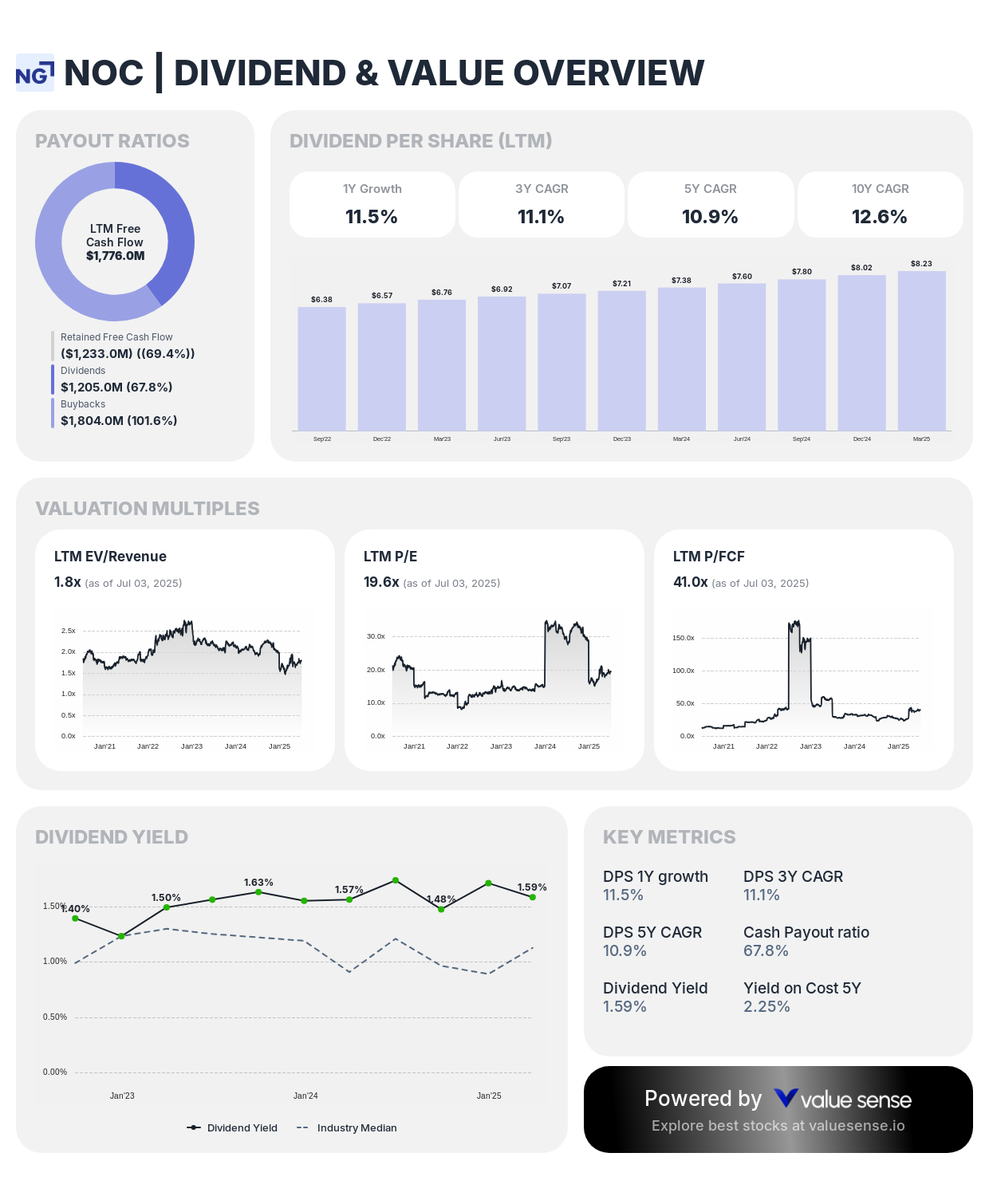

1. Northrop Grumman Corporation (NOC) - 51.7% Undervalued ⭐

Complete Financial Fortress Analysis:

- Intrinsic Value: 51.7% undervalued

- 1-Year Return: 16.8%

- Net Debt: $169.0M

- Health Score: 6.6 (Strong)

- Current Ratio: 0.9x

- Quick Ratio: 0.7x

- Net Debt to FCF: 0.1x

- FCF to Interest: 5.6x

- Revenue: $40.4B

- Free Cash Flow: $1,776.0M

- FCF Margin: 4.4%

- Intangibles as % of Assets: 0.5%

Investment Thesis: Northrop Grumman represents the most compelling undervalued low debt opportunity, trading 51.7% below intrinsic value with exceptional debt management (0.1x Net Debt to FCF). As a leading aerospace and defense contractor, Northrop Grumman benefits from long-term government contracts, technological leadership, and essential national security positioning that create predictable cash flows and pricing power.

Financial Fortress Characteristics: The company's minimal debt burden relative to cash flow provides exceptional financial flexibility for strategic investments in advanced technologies while maintaining dividend sustainability. The solid interest coverage (5.6x) and low debt ratio demonstrate conservative financial management ideal for uncertain economic environments.

2. Pfizer Inc. (PFE) - 37.9% Undervalued

Complete Financial Fortress Analysis:

- Intrinsic Value: 37.9% undervalued

- 1-Year Return: (4.1%)

- Net Debt: ($20.5B) - Net Cash Position

- Health Score: 6.3 (Strong)

- Net Debt to FCF: (2.2x) - Net Cash

- FCF to Interest: 4.1x

- Revenue: $62.5B

- Free Cash Flow: $9,449.0M

- FCF Margin: 15.1%

Investment Thesis: Pfizer presents substantial undervaluation at 37.9% below intrinsic worth while maintaining a massive net cash position exceeding $20 billion. Despite post-COVID revenue normalization challenges, Pfizer's pharmaceutical pipeline, oncology leadership, and strategic acquisitions create substantial value that current pricing underestimates.

Financial Fortress Characteristics: Pfizer's substantial net cash position provides exceptional strategic flexibility for acquisitions, R&D investments, and dividend sustainability. The pharmaceutical giant's strong balance sheet enables continued innovation and strategic partnerships without financial constraints.

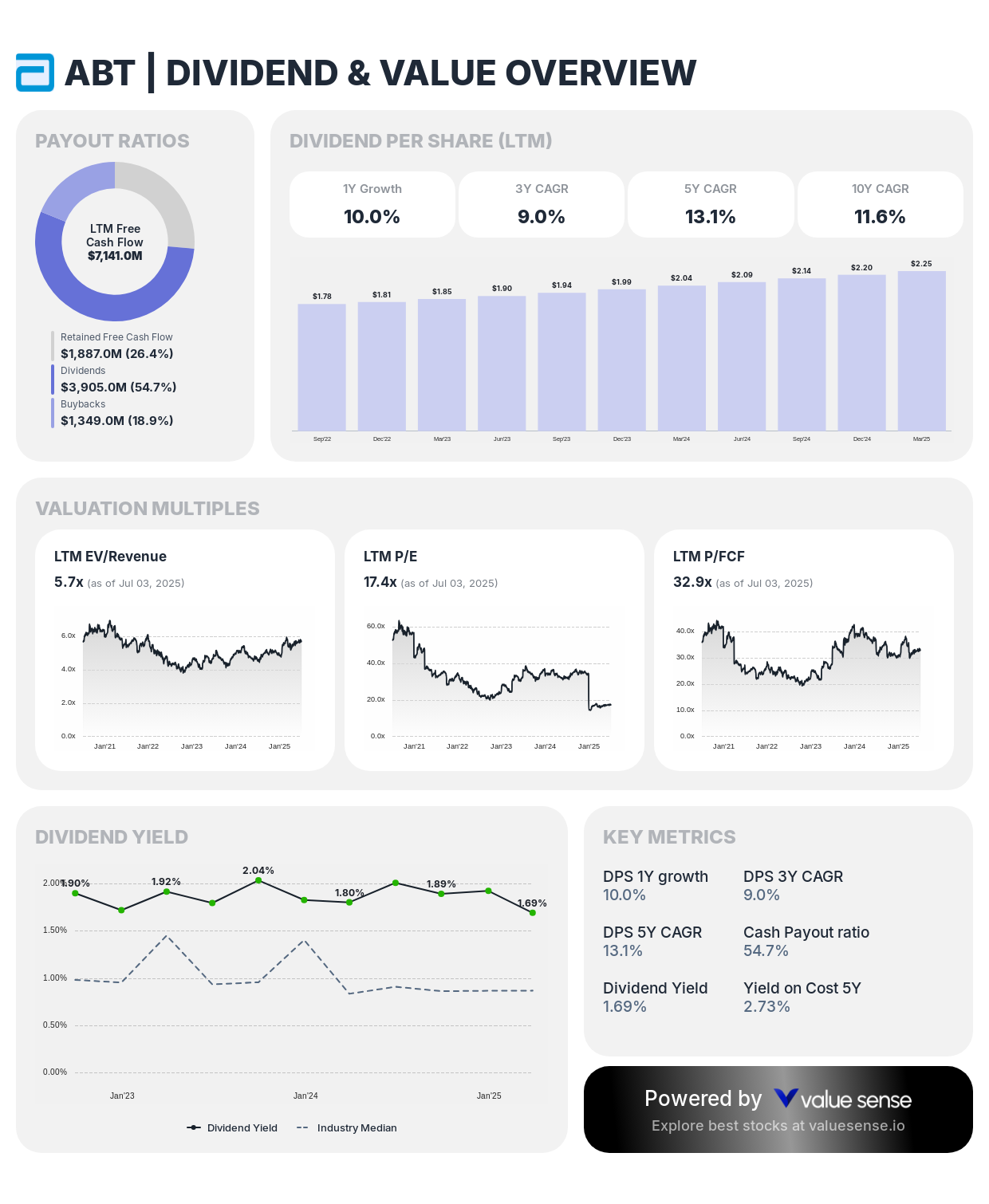

3. Abbott Laboratories (ABT) - 28.1% Undervalued

Complete Financial Fortress Analysis:

- Intrinsic Value: 28.1% undervalued

- 1-Year Return: 33.4%

- Net Debt: $6,398.0M

- Health Score: 6.5 (Strong)

- Current Ratio: 1.8x

- Quick Ratio: 0.5x

- Net Debt to FCF: 0.9x

- FCF to Interest: 18.5x

- Revenue: $42.3B

- Free Cash Flow: $7,141.0M

- FCF Margin: 16.9%

- Intangibles as % of Assets: 6.7%

Investment Thesis: Abbott presents attractive undervaluation at 28.1% below intrinsic value with conservative debt management (0.9x FCF) and exceptional interest coverage (18.5x). The diversified healthcare leader's strength across medical devices, diagnostics, and nutrition creates multiple growth avenues with defensive characteristics ideal for conservative investors.

Financial Fortress Characteristics: Abbott's conservative debt management and strong cash generation provide financial stability and flexibility. The excellent liquidity ratios (1.8x current ratio) and manageable debt-to-cash flow ratio support continued dividend growth and strategic investments.

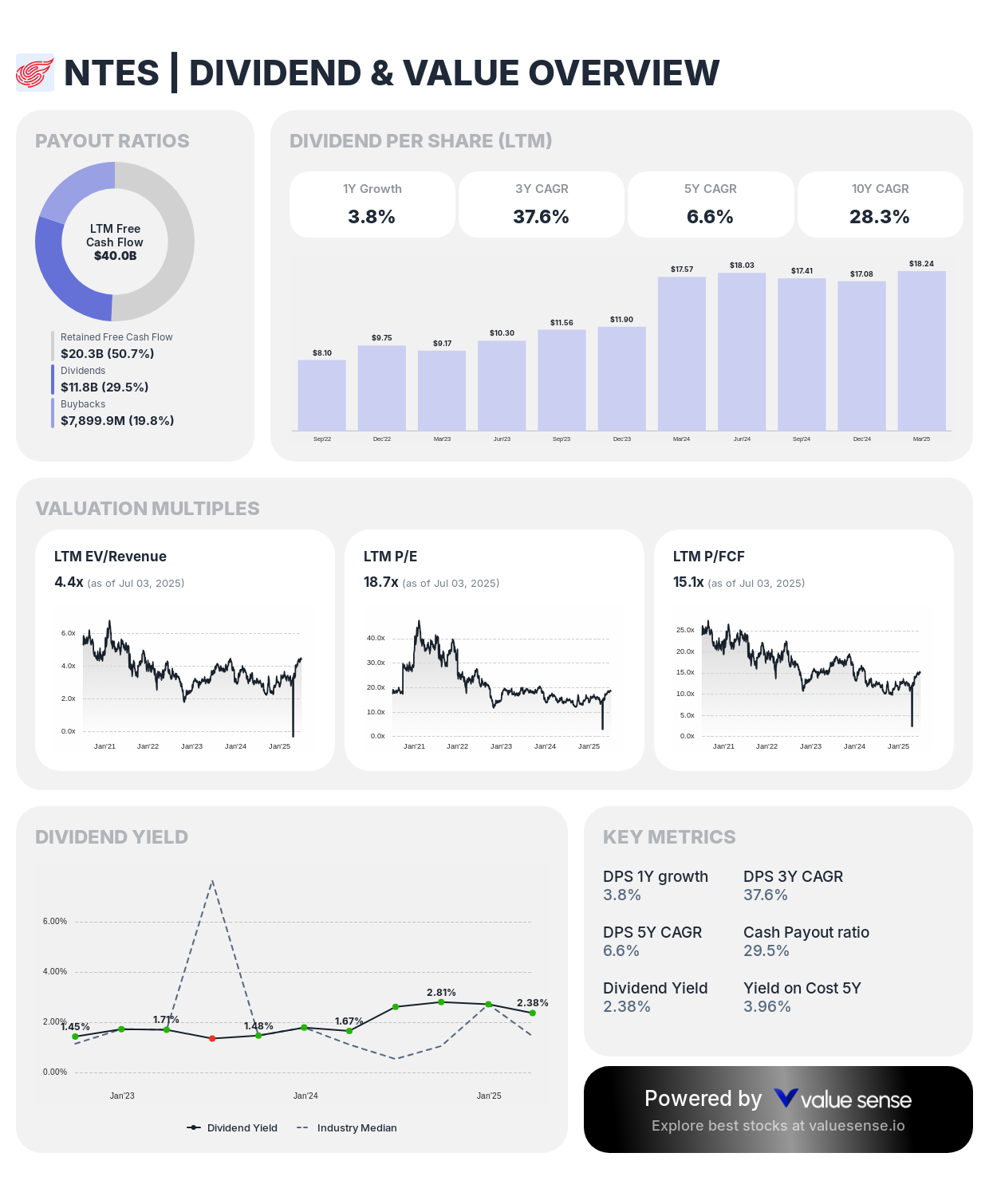

4. NetEase, Inc. (NTES) - 24.8% Undervalued

Complete Financial Fortress Analysis:

- Intrinsic Value: 24.8% undervalued

- 1-Year Return: 41.6%

- Net Debt: (CN¥130.3B) - Net Cash Position

- Health Score: 6.4 (Strong)

- Current Ratio: 3.2x

- Quick Ratio: 3.0x

- Net Debt to FCF: (3.3x) - Net Cash

- FCF to Interest: N/A

- Revenue: CN¥107.3B

- Free Cash Flow: CN¥40.0B

- FCF Margin: 37.3%

- Intangibles as % of Assets: 2.1%

Investment Thesis: NetEase demonstrates solid undervaluation at 24.8% below intrinsic worth with substantial net cash position and exceptional liquidity ratios. The Chinese internet company's leadership in online gaming, music streaming, and educational technology, combined with outstanding 37.3% free cash flow margin, showcases operational excellence.

Financial Fortress Characteristics: NetEase's substantial net cash position and exceptional liquidity ratios (3.2x current, 3.0x quick) demonstrate superior financial strength. The company's asset-light business model generates exceptional cash flows without requiring significant capital investments.

5. Shell plc (SHEL) - 19.2% Undervalued

Complete Financial Fortress Analysis:

- Intrinsic Value: 19.2% undervalued

- 1-Year Return: 1.6%

- Net Debt: ($35.6B) - Net Cash Position

- Health Score: 4.9

- Current Ratio: 1.3x

- Quick Ratio: 0.9x

- Net Debt to FCF: (1.1x) - Net Cash

- FCF to Interest: 6.6x

- Revenue: $281.1B

- Free Cash Flow: $31.3B

- FCF Margin: 11.1%

- Intangibles as % of Assets: 2.9%

Investment Thesis: Shell presents moderate undervaluation at 19.2% below intrinsic worth with strong net cash position and exceptional cash generation. The integrated energy company's balanced approach to traditional and renewable energy investments, combined with disciplined capital allocation, creates value opportunities in the energy transition.

Financial Fortress Characteristics: Shell's net cash position and substantial cash generation provide exceptional financial flexibility for energy transition investments and shareholder returns. The company's conservative balance sheet management supports dividend sustainability and strategic investments.

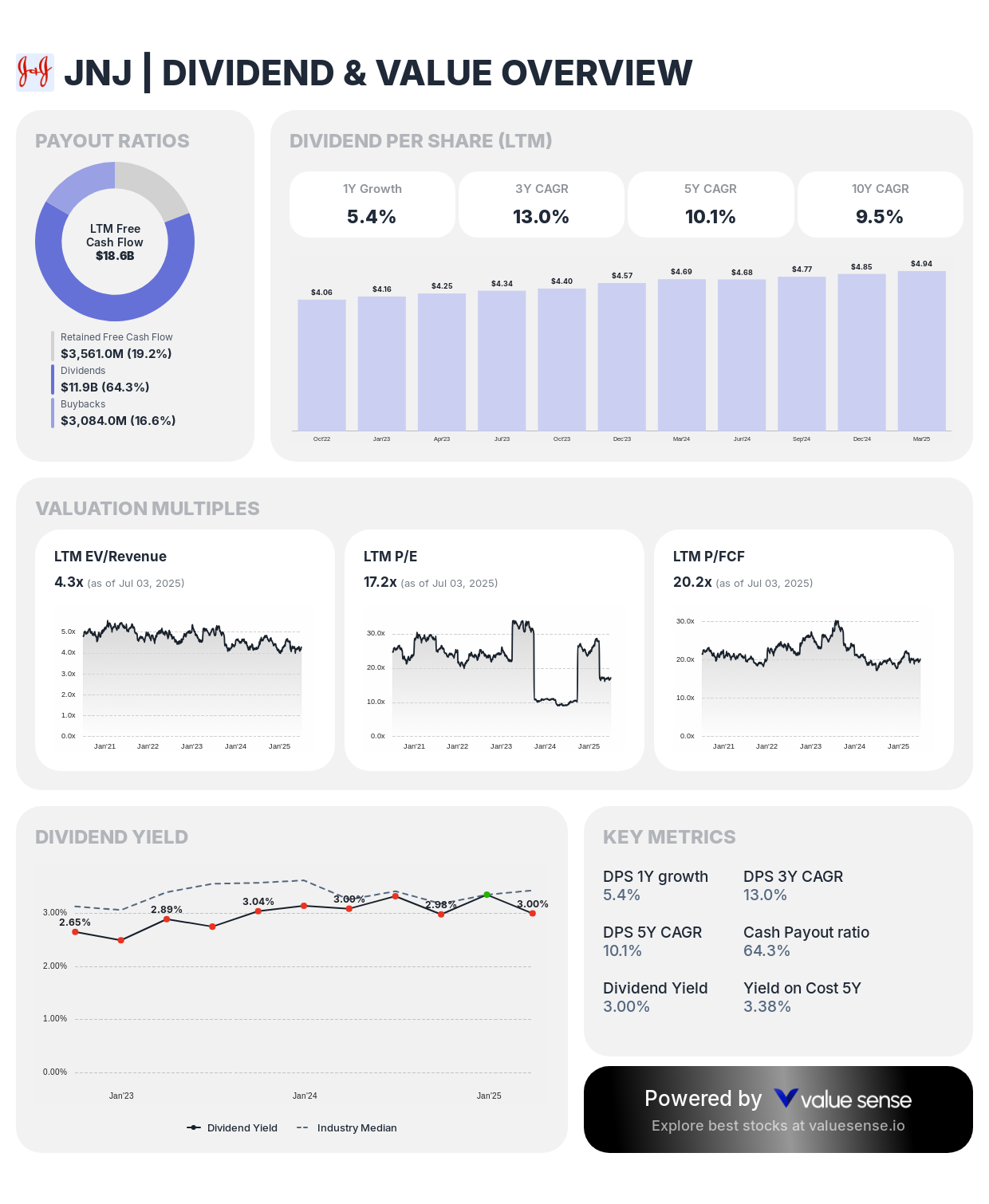

6. Johnson & Johnson (JNJ) - 18.9% Undervalued

Complete Financial Fortress Analysis:

- Intrinsic Value: 18.9% undervalued

- 1-Year Return: 9.6%

- Net Debt: ($24.9B) - Net Cash Position

- Health Score: 6.7 (Strong)

- Current Ratio: 1.3x

- Quick Ratio: 1.0x

- Net Debt to FCF: (1.3x) - Net Cash

- FCF to Interest: 23.1x

- Revenue: $82.0B

- Free Cash Flow: $18.6B

- FCF Margin: 22.7%

- Intangibles as % of Assets: 19.0%

Investment Thesis: Johnson & Johnson demonstrates solid undervaluation at 18.9% below intrinsic value with substantial net cash position and Dividend Aristocrat status. The healthcare giant's diversified operations across pharmaceuticals and medical devices create predictable value despite recent business challenges.

Financial Fortress Characteristics: J&J's substantial net cash position and exceptional interest coverage (23.1x) provide unmatched financial stability. The company's conservative balance sheet supports its 62-year dividend growth streak and strategic pharmaceutical investments.

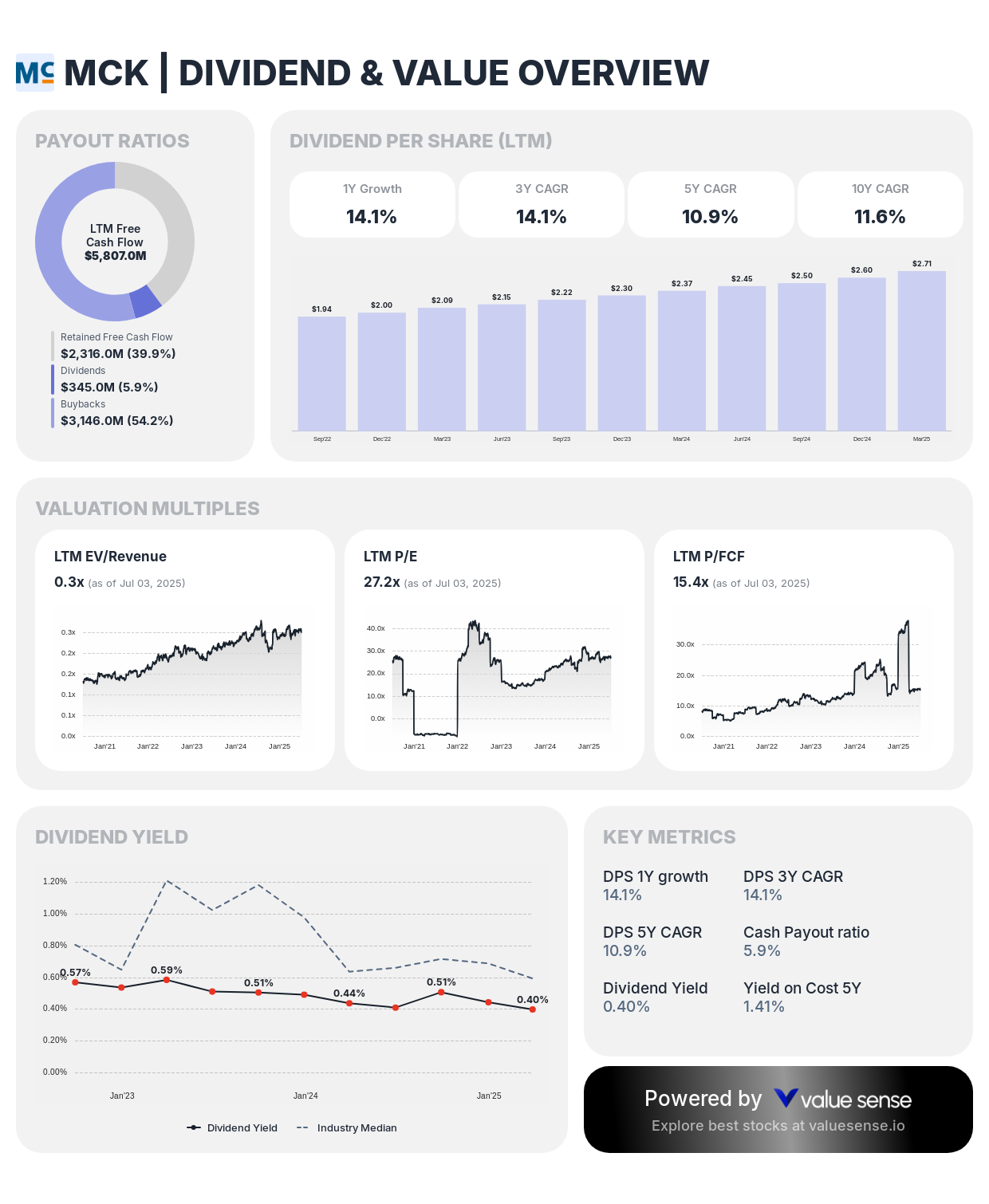

7. McKesson Corporation (MCK) - 4.0% Undervalued

Complete Financial Fortress Analysis:

- Intrinsic Value: 4.0% undervalued

- 1-Year Return: 23.7%

- Net Debt: $1,699.0M

- Health Score: 6.1 (Strong)

- Current Ratio: 0.9x

- Quick Ratio: 0.5x

- Net Debt to FCF: 0.3x

- FCF to Interest: 33.2x

- Revenue: $359.1B

- Free Cash Flow: $5,807.0M

- FCF Margin: 1.6%

- Intangibles as % of Assets: 1.9%

Investment Thesis: McKesson trades near fair value with minimal undervaluation while demonstrating excellent debt management and cash generation. The pharmaceutical distribution leader's essential role in healthcare supply chains and exceptional interest coverage (33.2x) create defensive value characteristics.

Financial Fortress Characteristics: McKesson's minimal debt relative to cash flow (0.3x) and exceptional interest coverage provide outstanding financial stability. The company's essential role in healthcare distribution ensures predictable cash flows and debt service capability.

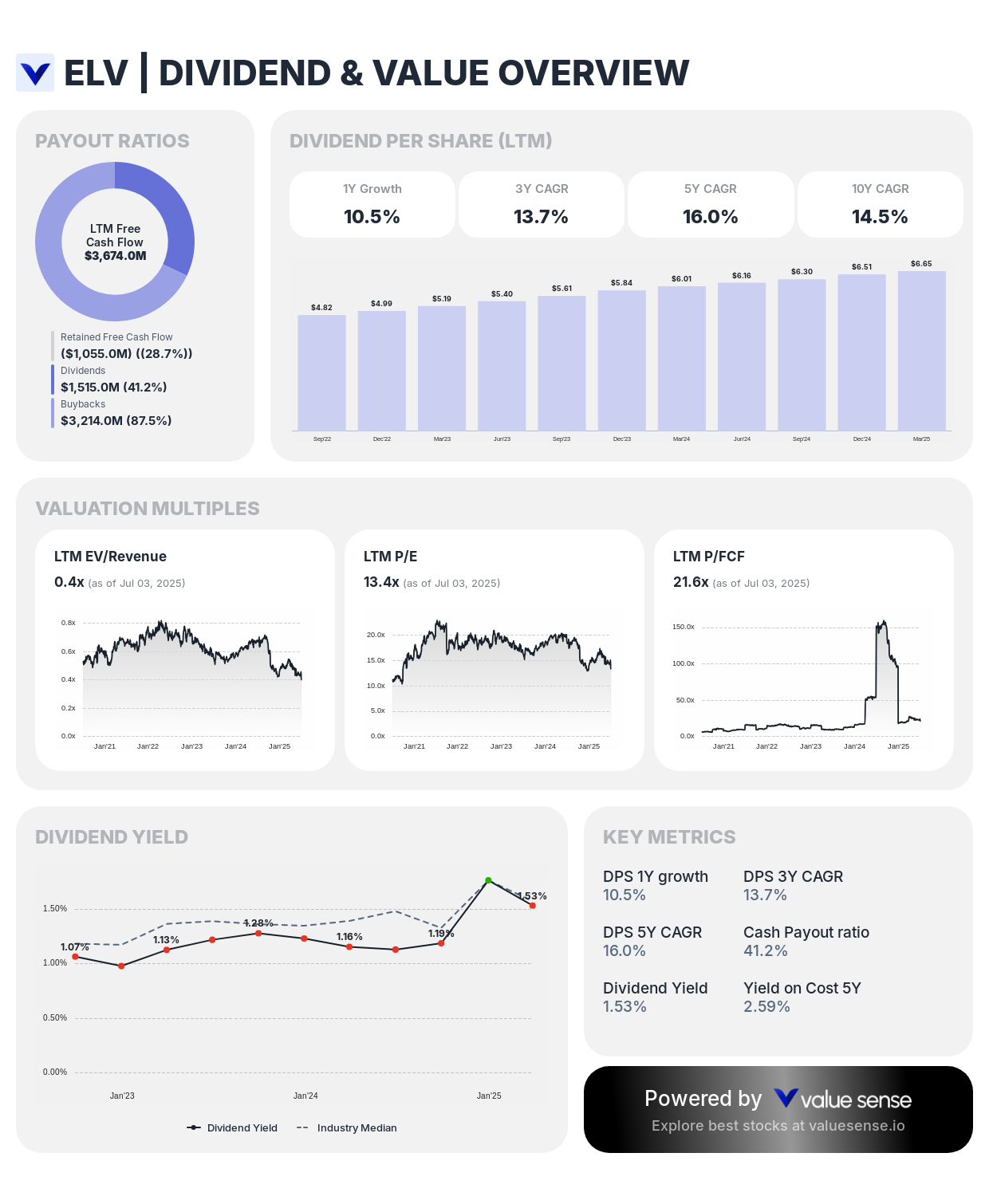

8. Elevance Health Inc. (ELV) - 3.6% Undervalued

Complete Financial Fortress Analysis:

- Intrinsic Value: 3.6% undervalued

- 1-Year Return: (33.7%)

- Net Debt: ($5,607.0M) - Net Cash Position

- Health Score: 6.8 (Strong)

- Current Ratio: 1.4x

- Quick Ratio: 0.5x

- Net Debt to FCF: (1.5x) - Net Cash

- FCF to Interest: 2.9x

- Revenue: $183.1B

- Free Cash Flow: $3,674.0M

- FCF Margin: 2.0%

- Intangibles as % of Assets: 10.0%

Investment Thesis: Elevance Health trades near fair value with modest undervaluation while maintaining strong financial health and net cash position. As a leading health insurer, Elevance benefits from demographic trends and healthcare demand growth while maintaining conservative financial management.

Financial Fortress Characteristics: Elevance's net cash position and strong health score provide financial flexibility during healthcare policy uncertainty. The company's defensive business model generates predictable cash flows supporting strategic investments.

Low Debt Investment Strategy for Financial Fortress Building

Prioritize Net Cash Positions: Focus on companies with negative net debt like Pfizer ($20.5B net cash), and Shell ($35.6B net cash). These companies provide maximum financial flexibility and zero financial risk from debt obligations.

Emphasize Exceptional Interest Coverage: Companies with interest coverage above 10x like McKesson (33.2x), J&J (23.1x), and Abbott (18.5x) demonstrate exceptional ability to service debt obligations and maintain financial stability through economic cycles.

Balance Safety with Growth Potential: While prioritizing financial strength, seek companies with competitive advantages and growth opportunities. Abbott combine fortress balance sheets with attractive growth prospects in their respective markets.

Diversify Across Defensive Sectors: Low debt opportunities span healthcare (Abbott, J&J, Pfizer, Elevance), technology (NetEase), defense (Northrop Grumman), energy (Shell), and distribution (McKesson), providing balanced exposure to different economic cycles and growth drivers.

Understanding Financial Fortress Metrics

Net Debt to Free Cash Flow Ratio: This critical metric reveals how many years of current cash generation would be required to eliminate net debt. Ratios below 1.0x indicate exceptional financial strength, while negative ratios (net cash positions) provide maximum safety.

Current and Quick Ratios: These liquidity measures indicate a company's ability to meet short-term obligations. Current ratios above 1.3x and quick ratios above 0.8x demonstrate strong liquidity management and operational flexibility.

Free Cash Flow to Interest Coverage: This metric shows how easily companies can service debt from operational cash flows. Coverage above 10x provides exceptional safety, while companies with net cash positions eliminate this risk entirely.

Key Takeaways for Financial Fortress Investors

✅ Net Cash Leaders: Pfizer, Shell, and J&J offer substantial cash positions eliminating financial risk

✅ Conservative Management: All companies demonstrate disciplined capital allocation and debt management

✅ Defensive Characteristics: Low debt companies provide stability and downside protection during uncertainty

✅ Strategic Flexibility: Strong balance sheets enable growth investments, acquisitions, and shareholder returns

✅ Quality Focus: All companies maintain health scores above 6.0 indicating strong business fundamentals

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best Undervalued Nasdaq Stocks for 2025

📖 11 Best Undervalued Revenue Growth Stocks

📖 7 Best Undervalued Tech Stocks with Realistic Upside

FAQ About Low Debt Investing

What makes net cash positions particularly attractive for conservative investors?

Net cash positions eliminate financial risk entirely while providing strategic flexibility for acquisitions, R&D investments, and shareholder returns. Companies like Pfizer ($20.5B net cash) can pursue growth opportunities without financing constraints and actually benefit from higher interest rates on their cash holdings.

How do you evaluate whether a company's debt management is truly conservative?

Conservative debt evaluation requires analyzing net debt to free cash flow ratios (preferably under 1.0x), interest coverage ratios (preferably above 10x), current and quick ratios for liquidity, and debt maturity profiles. Companies like Abbott (0.9x debt/FCF, 18.5x interest coverage) demonstrate truly conservative debt management.

Why do financially strong companies sometimes trade below intrinsic value?

Financially strong companies may trade below intrinsic value due to market rotation toward growth stocks, sector-specific concerns, temporary business challenges, or general market pessimism. These situations create opportunities when underlying business quality and financial strength remain intact, as demonstrated by companies like Northrop Grumman.

What role should low debt stocks play in portfolio construction for different investor types?

For conservative investors, low debt stocks should represent 60-80% of equity allocations, providing stability and dividend income. For balanced investors, 40-60% allocation offers growth potential with downside protection. For aggressive investors, 20-40% allocation provides portfolio stability while allowing higher-risk growth investments.

How do low debt companies perform during rising interest rate environments?

Low debt companies generally outperform during rising rates because they face minimal refinancing risk and may benefit from higher returns on cash holdings. Companies with net cash positions like Shell and J&J can see improved financial performance as rates rise, while heavily indebted companies face increased borrowing costs.

Important Note on Financial Fortress Investing: While low debt companies offer enhanced financial stability and flexibility, investors should also evaluate business quality, competitive positioning, and growth prospects. The strongest opportunities combine fortress balance sheets with sustainable competitive advantages and attractive valuations.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Financial metrics are based on the most recent available data and may change with quarterly reporting. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.