8 Best Undervalued Low-Price Stocks Under $20

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Opportunity of Low-Price Undervalued Stocks

Low-price stocks under $20 per share offer beginning investors and those with limited capital the opportunity to build diversified portfolios while accessing quality companies trading below their intrinsic value. These opportunities often arise from temporary market pessimism, sector rotation, or limited institutional coverage that creates pricing inefficiencies for patient value investors.

Our analysis focuses exclusively on companies trading below their calculated intrinsic value with current stock prices of $20 or below. By limiting undervaluation to 100% or less, we focus on realistic opportunities where market prices could reasonably converge toward fair value within reasonable timeframes, avoiding extreme situations that may indicate fundamental business problems.

Low-Price Undervalued Selection Criteria:

- Current stock price of $20 or below for accessibility to all investors

- Trading below intrinsic value based on our fundamental analysis

- Undervaluation limited to 100% for realistic appreciation potential

- Quality business fundamentals supporting value realization over time

Top 8 Undervalued Low-Price Stocks - Ranked by Undervaluation Percentage

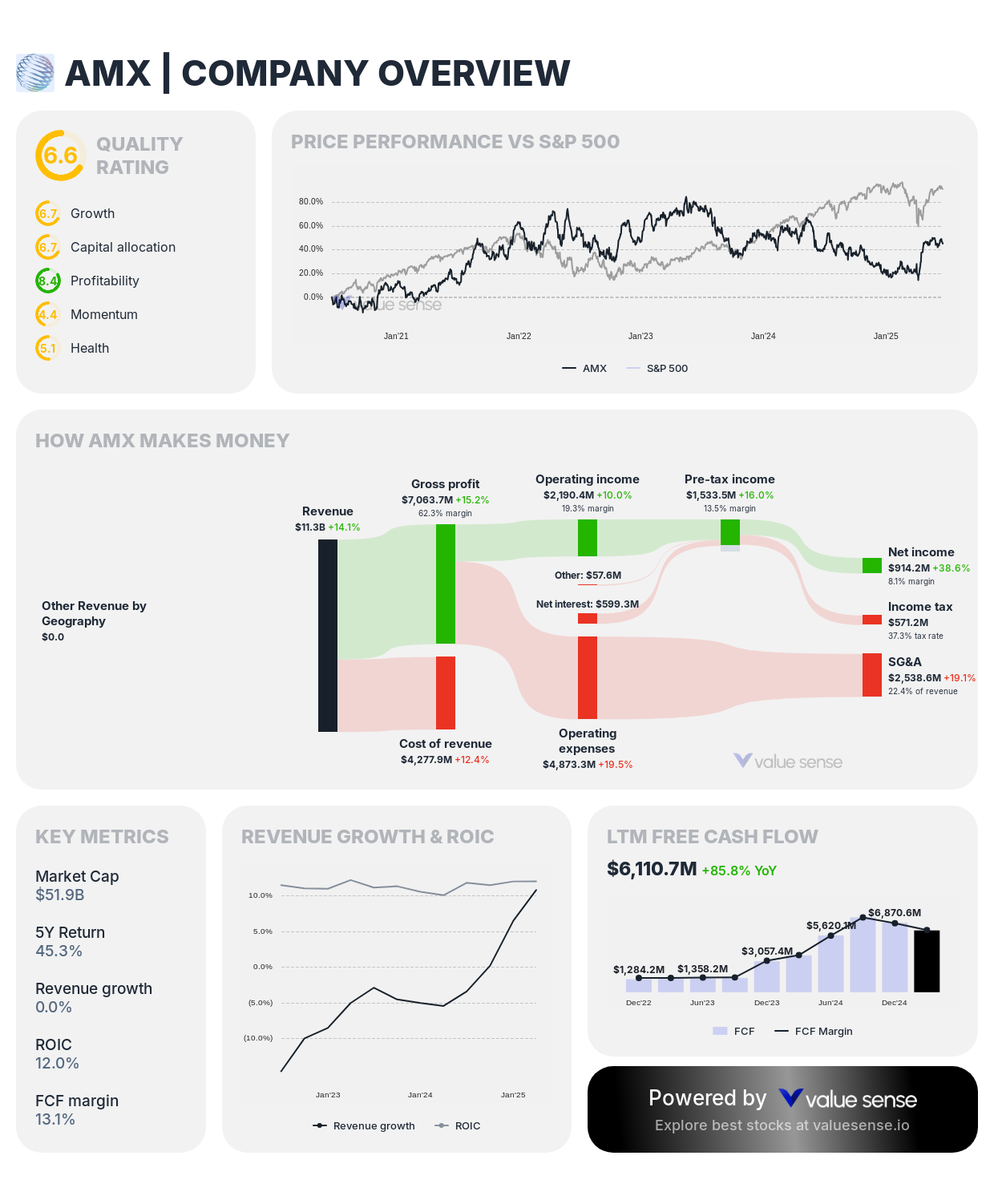

1. América Móvil, S.A.B. de C.V. (AMX) - 307.3% Undervalued

- Current Stock Price: ~$12.75

- Intrinsic Value: $69.4

- Undervaluation: 307.3%

Investment Thesis: América Móvil represents an extraordinary undervaluation opportunity, trading at approximately $12.75 while our analysis indicates an intrinsic value of $69.4. As Latin America's largest telecommunications company, América Móvil operates extensive wireless and fixed-line networks across Mexico and Latin America, serving hundreds of millions of customers with essential communication services.

The massive undervaluation reflects market concerns about Latin American economic conditions, currency volatility, and regulatory pressures. However, the company's dominant market positions, essential service offerings, and substantial infrastructure assets create significant intrinsic value that current pricing fails to recognize. América Móvil's diversified geographic footprint and integrated telecommunications services provide defensive characteristics and growth opportunities in expanding digital markets.

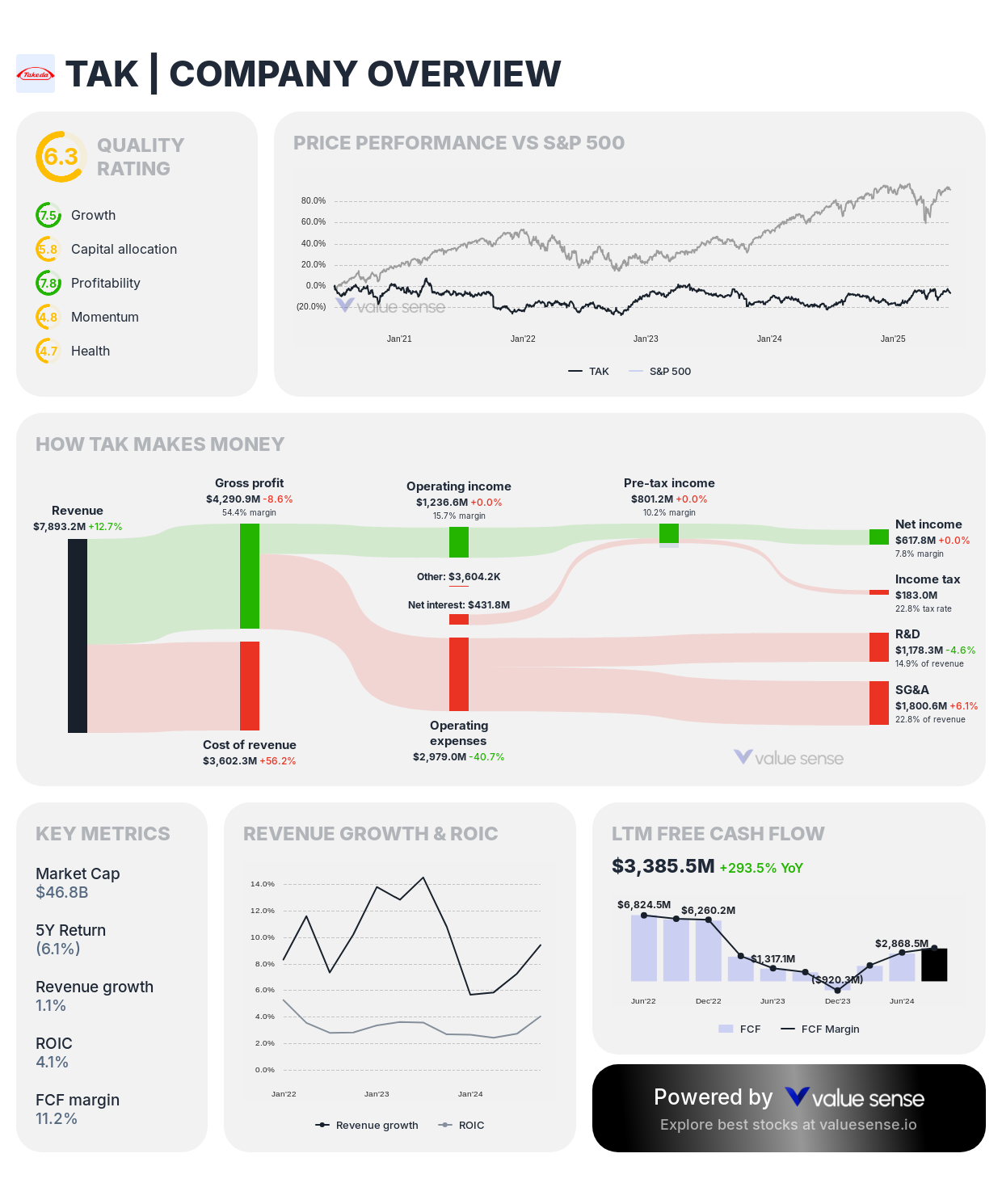

2. Takeda Pharmaceutical Company Limited (TAK) - 241.2% Undervalued

- Current Stock Price: ~$14.75

- Intrinsic Value: $50.4

- Undervaluation: 241.2%

Investment Thesis: Takeda Pharmaceutical demonstrates exceptional undervaluation at 241.2% below intrinsic value, trading around $14.75 against a calculated worth of $50.4. As one of Japan's largest pharmaceutical companies with global operations, Takeda focuses on oncology, gastroenterology, neuroscience, and rare diseases, maintaining a robust pipeline of innovative treatments.

The significant undervaluation stems from concerns about integration costs from major acquisitions, patent cliff challenges, and competitive pressures in key therapeutic areas. However, Takeda's specialized focus on complex diseases, strong R&D capabilities, and growing presence in high-value therapeutic markets support substantially higher valuations. The company's transformation into a focused, innovation-driven pharmaceutical leader creates long-term value that current market pricing underestimates.

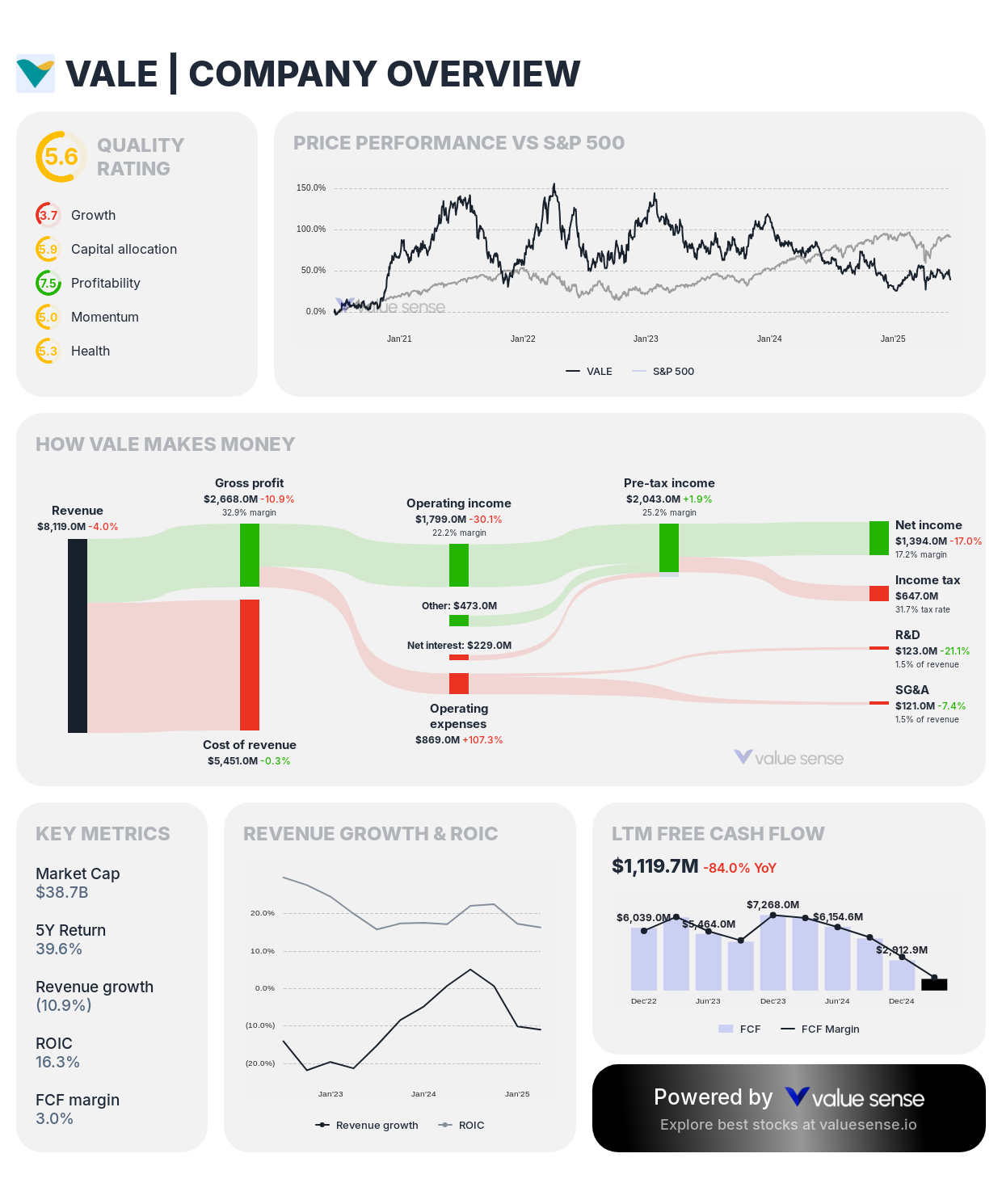

3. Vale S.A. (VALE) - 202.3% Undervalued

- Current Stock Price: ~$9.05

- Intrinsic Value: $27.4

- Undervaluation: 202.3%

Investment Thesis: Vale presents compelling undervaluation at 202.3% below intrinsic value, currently trading around $9.05 while our analysis suggests a fair value of $27.4. As one of the world's largest mining companies, Vale operates extensive iron ore, nickel, and copper operations that supply essential materials for global infrastructure and industrial development.

The substantial undervaluation reflects concerns about commodity price volatility, environmental liabilities, and Brazilian economic conditions. However, Vale's world-class mining assets, strategic positioning in essential commodities, and operational improvements create significant intrinsic value. The company's focus on high-quality, low-cost operations and commitment to environmental sustainability support higher valuations as global infrastructure demand continues growing.

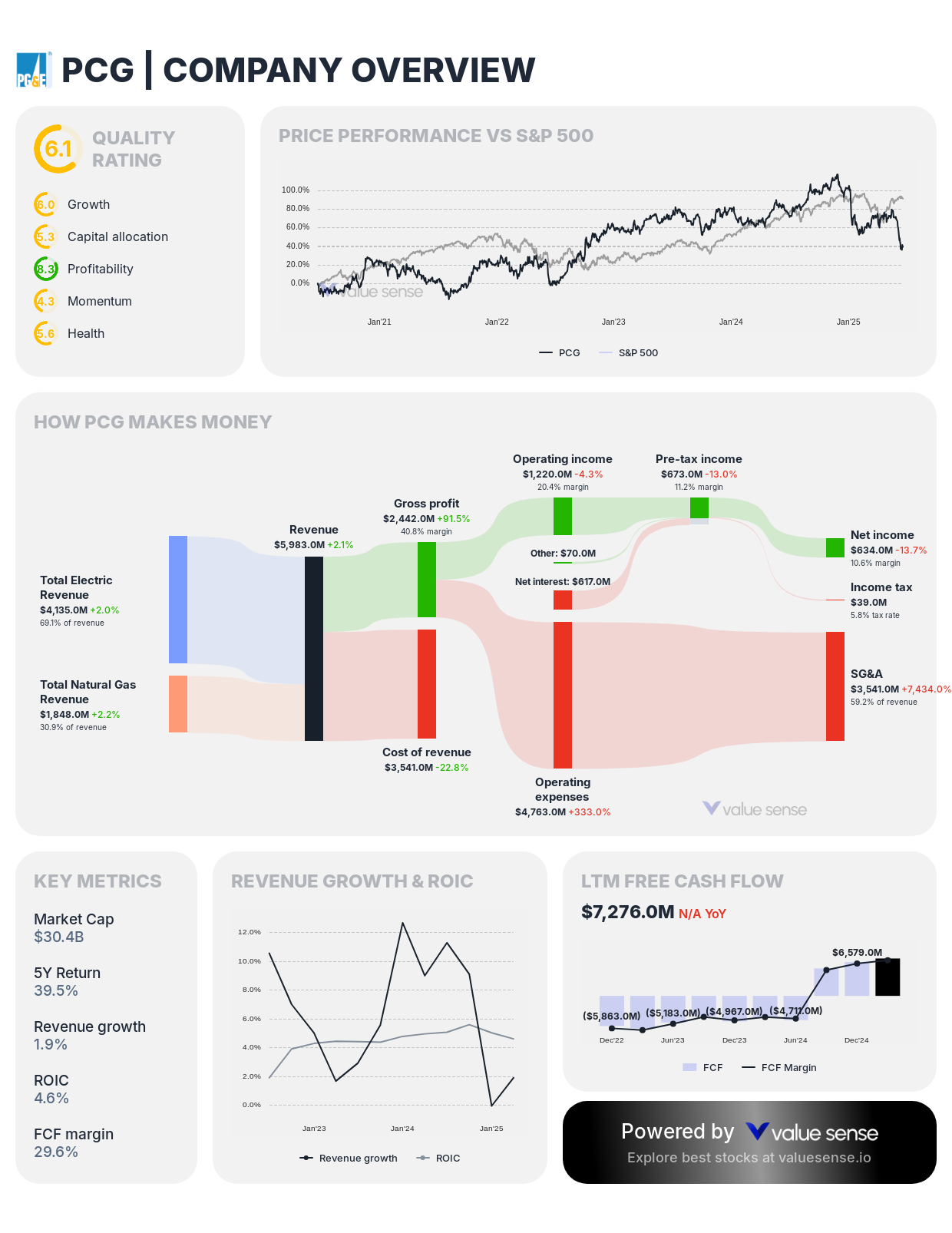

4. PG&E Corporation (PCG) - 195.2% Undervalued

- Current Stock Price: ~$13.85

- Intrinsic Value: $40.9

- Undervaluation: 195.2%

Investment Thesis: PG&E Corporation demonstrates significant undervaluation at 195.2% below intrinsic value, trading around $13.85 against a calculated worth of $40.9. As California's largest utility company, PG&E provides essential electricity and natural gas services to millions of customers across Northern and Central California, operating critical infrastructure supporting the state's economy.

The substantial undervaluation reflects concerns about wildfire liabilities, regulatory challenges, and infrastructure investment requirements. However, PG&E's essential service territory, regulated business model, and strategic investments in grid modernization and renewable energy create substantial intrinsic value. The company's emergence from bankruptcy with improved safety protocols and financial structure positions it for value realization as operational improvements continue.

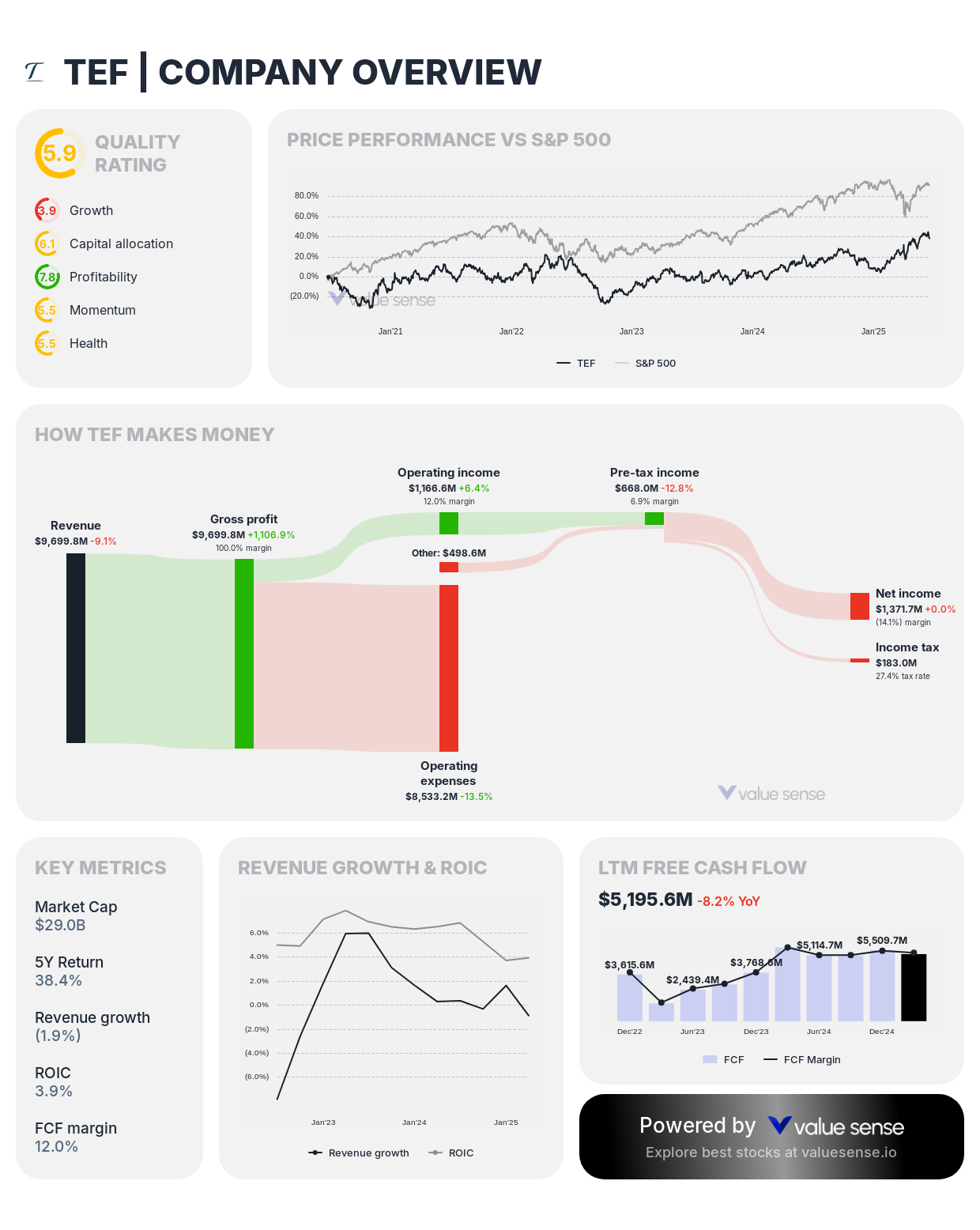

5. Telefónica, S.A. (TEF) - 124.0% Undervalued

- Current Stock Price: ~$5.15

- Intrinsic Value: $11.5

- Undervaluation: 124.0%

Investment Thesis: Telefónica demonstrates strong undervaluation at 124.0% below intrinsic value, currently trading around $5.15 while our analysis indicates a fair value of $11.5. As one of Europe's largest telecommunications companies with significant operations in Spain and Latin America, Telefónica provides essential communication services including mobile, fixed-line, and digital services to hundreds of millions of customers.

The undervaluation reflects concerns about European telecommunications competition, Latin American economic challenges, and legacy infrastructure costs. However, Telefónica's market leadership positions, essential service offerings, and digital transformation initiatives create substantial value. The company's focus on high-growth digital services and operational efficiency improvements support higher valuations as telecommunications demand continues expanding globally.

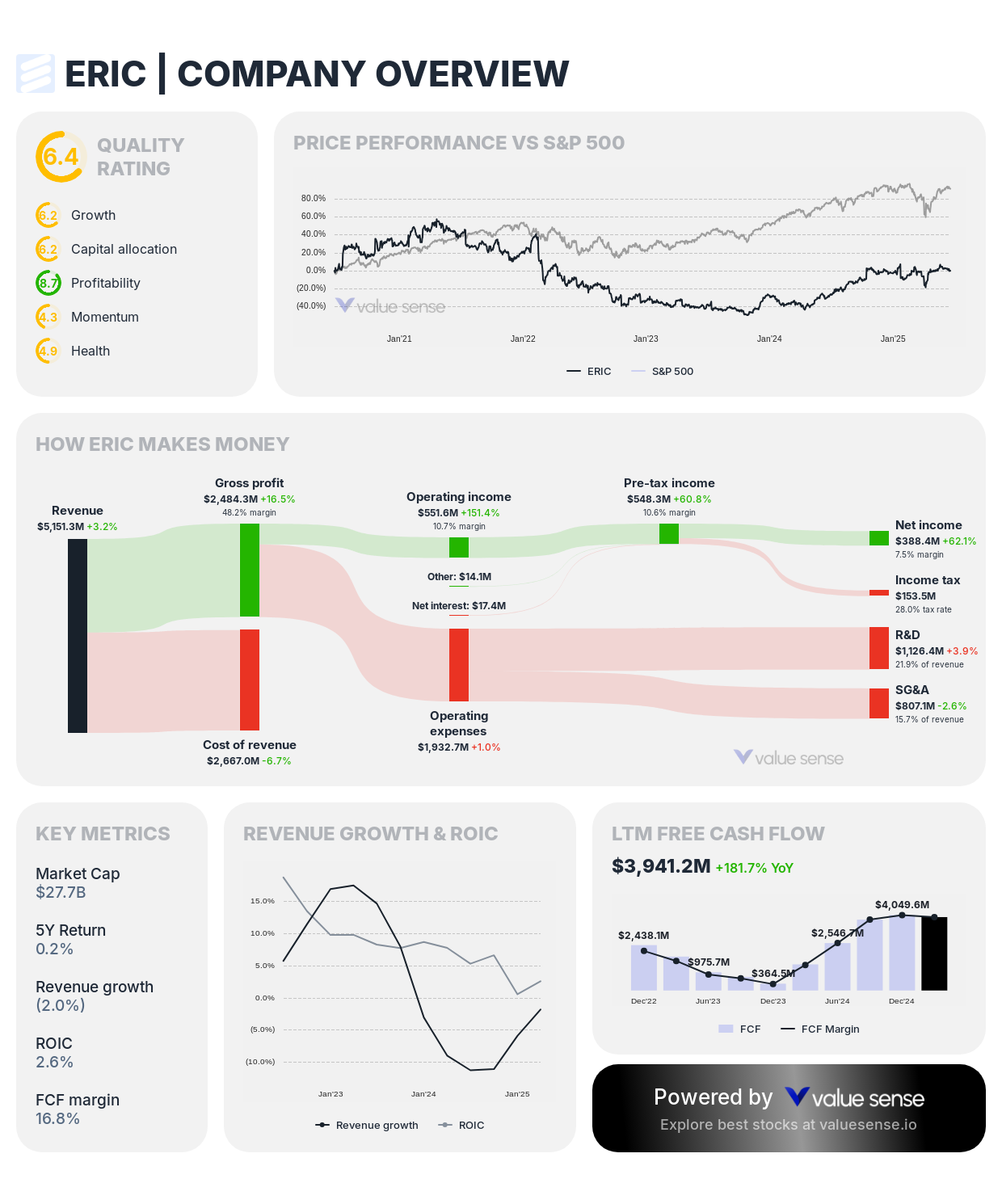

6. Telefonaktiebolaget LM Ericsson (publ) (ERIC) - 87.7% Undervalued

- Current Stock Price: ~$8.30

- Intrinsic Value: $15.6

- Undervaluation: 87.7%

Investment Thesis: Ericsson presents solid undervaluation at 87.7% below intrinsic value, trading around $8.30 against a calculated worth of $15.6. As a global leader in telecommunications equipment and services, Ericsson plays an essential role in 5G network deployments worldwide, providing critical infrastructure, software, and services to mobile operators and enterprise customers.

The undervaluation stems from concerns about Chinese competition, cyclical telecommunications spending, and geopolitical tensions affecting market access. However, Ericsson's technological leadership in 5G, strong intellectual property portfolio, and strategic positioning in Western markets create competitive advantages. The company's essential role in global telecommunications infrastructure and expanding enterprise opportunities support higher valuations as 5G adoption accelerates.

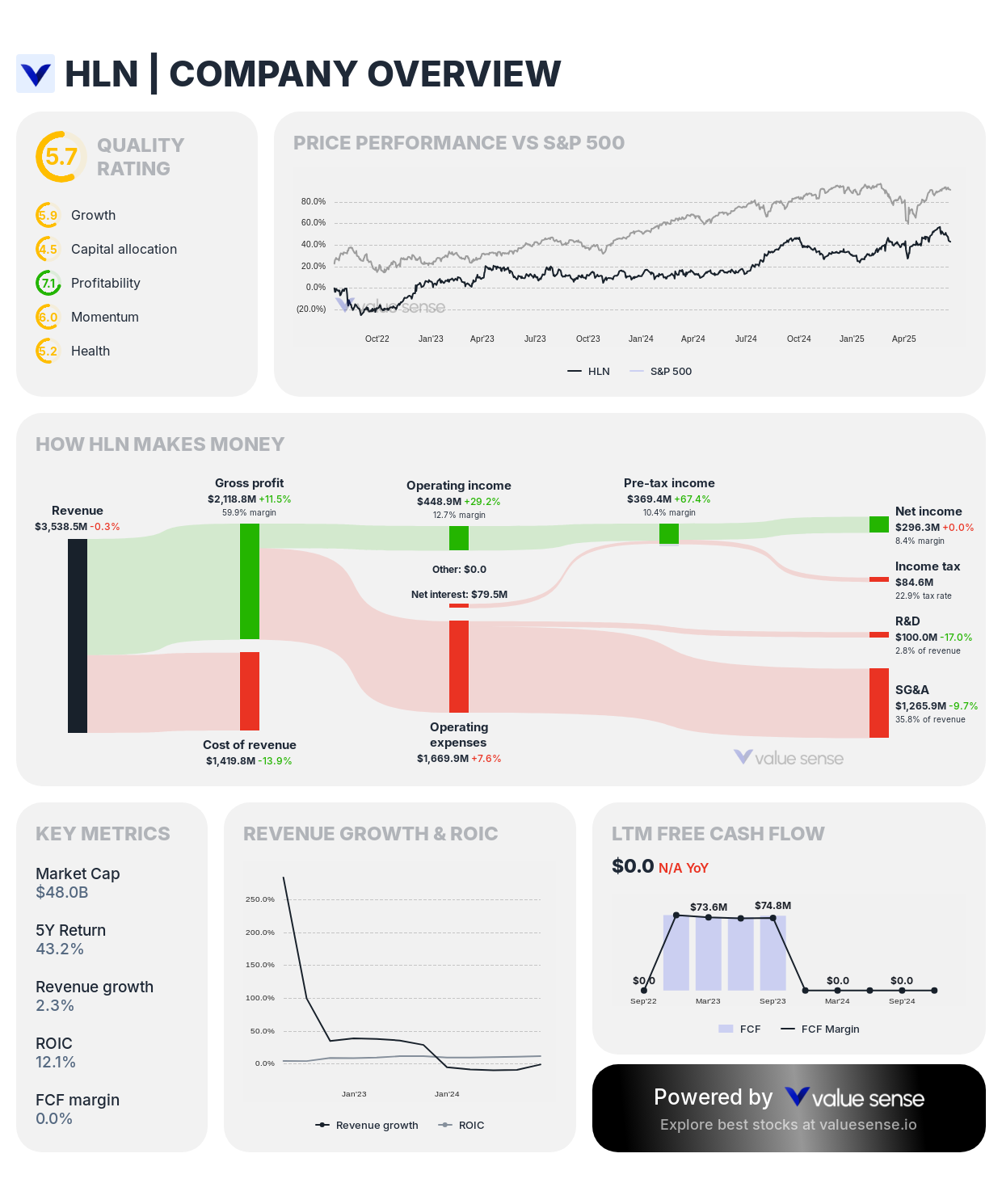

7. Haleon plc (HLN) - 42.5% Undervalued

- Current Stock Price: ~$10.40

- Intrinsic Value: $14.8

- Undervaluation: 42.5%

Investment Thesis: Haleon demonstrates moderate undervaluation at 42.5% below intrinsic value, currently trading around $10.40 while our analysis suggests a fair value of $14.8. As a leading consumer healthcare company spun off from GSK, Haleon operates a portfolio of trusted brands including Sensodyne, Advil, and Centrum that provide essential health and wellness products to consumers worldwide.

The undervaluation reflects uncertainty about standalone operations following the recent spin-off and competitive pressures in consumer healthcare markets. However, Haleon's strong brand portfolio, defensive business characteristics, and global distribution networks create substantial value. The company's focus on everyday health products provides predictable cash flows and growth opportunities that support higher valuations over time.

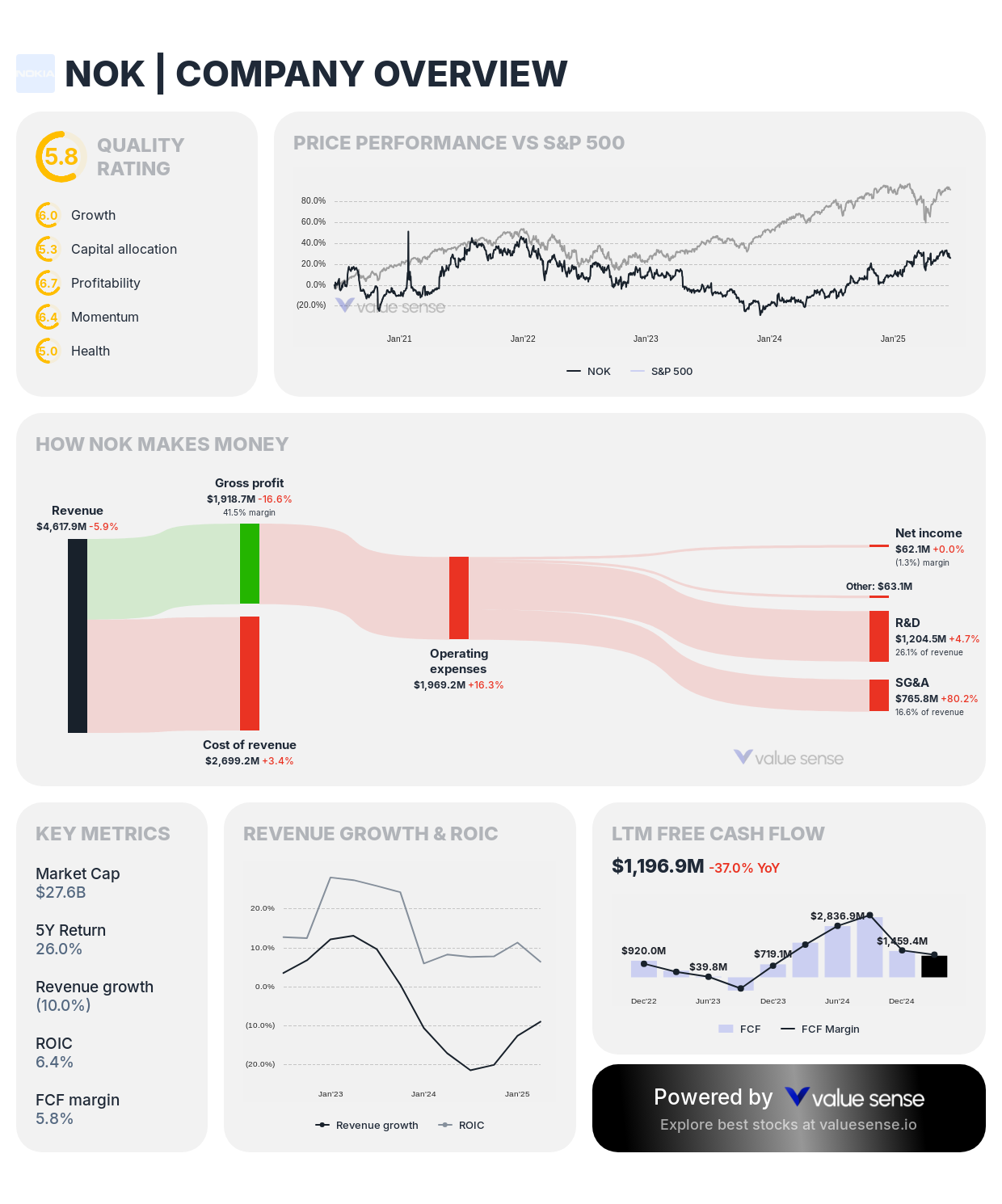

8. Nokia Oyj (NOK) - 33.9% Undervalued

- Current Stock Price: ~$5.15

- Intrinsic Value: $6.9

- Undervaluation: 33.9%

Investment Thesis: Nokia presents modest undervaluation at 33.9% below intrinsic value, trading around $5.15 against a calculated worth of $6.9. As a major telecommunications equipment provider, Nokia supplies essential network infrastructure, software, and services to operators worldwide while expanding into enterprise and industrial markets with private network solutions.

The undervaluation reflects market skepticism about Nokia's competitive positioning against larger rivals and concerns about 5G deployment pace. However, Nokia's strong research and development capabilities, extensive patent portfolio, and strategic focus on network infrastructure create competitive advantages. The company's expansion into enterprise markets and industrial IoT applications provides additional growth opportunities supporting value realization over time.

Low-Price Value Investing Strategy

Focus on Substantial Undervaluation: Prioritize companies with undervaluation exceeding 100%, including América Móvil (307.3%), Takeda (241.2%), and Vale (202.3%). These opportunities provide the greatest potential for price appreciation as market valuations converge toward intrinsic value, though they may require longer investment horizons for full realization.

Diversification Across Sectors and Geographies: Spread investments across telecommunications (América Móvil, Telefónica, Ericsson, Nokia), pharmaceuticals (Takeda), mining (Vale), utilities (PG&E), and consumer healthcare (Haleon) to reduce sector concentration risk. Geographic diversification across Latin America, Europe, Asia, and North America provides additional risk mitigation.

Consider Quality and Business Fundamentals: While focusing on low prices and undervaluation, evaluate underlying business quality, competitive positioning, and financial strength. Companies with stronger market positions and essential service offerings typically demonstrate more reliable value realization over time, even when facing temporary challenges.

Exercise Patience for Value Realization: Low-price undervalued stocks often require extended periods for market recognition of intrinsic value. Maintain long-term perspective and avoid expecting immediate price appreciation, as value realization may take several years depending on company-specific catalysts, market conditions, and economic recovery in relevant regions.

Understanding Our Intrinsic Value Methodology

Our comprehensive intrinsic value calculations incorporate multiple analytical approaches to ensure accurate valuation assessments:

Discounted Cash Flow Analysis: We project future cash flows based on detailed business fundamentals, competitive positioning, and market dynamics, then discount them to present value using appropriate risk-adjusted rates that reflect company-specific and country-specific risks.

Asset-Based Valuation: For companies with substantial physical assets like utilities (PG&E) and mining operations (Vale), we evaluate tangible infrastructure, mineral reserves, and strategic asset values that may not be fully reflected in market pricing.

Relative Valuation: We compare companies to industry peers and historical trading ranges to identify pricing anomalies and market inefficiencies, particularly relevant for telecommunications and pharmaceutical companies with established peer groups.

Sum-of-the-Parts Analysis: For diversified companies operating across multiple segments or geographies, we evaluate individual business units separately to capture full value across different operations and markets.

Key Takeaways for Low-Price Value Investors

✅ Exceptional Opportunities: América Móvil (307.3%) and Takeda (241.2%) offer extraordinary undervaluation with quality assets

✅ Accessible Pricing: All stocks trade under $20, making them accessible to investors with limited capital

✅ Diversified Sectors: Opportunities span telecommunications, pharmaceuticals, mining, utilities, and consumer healthcare

✅ Global Exposure: Companies provide exposure to Latin American, European, Asian, and North American markets

✅ Realistic Appreciation: Substantial undervaluation provides significant upside potential for patient investors

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Margin Businesses

📖 11 Best Earnings Growth Stocks

📖 10 Best Safe Stocks for Beginners

FAQ About Low-Price Value Investing

Are low-price stocks under $20 inherently riskier than higher-priced stocks?

Stock price alone does not determine risk level, as share price reflects the total number of shares outstanding rather than company quality or financial strength. Companies like América Móvil ($12.75) and Takeda ($14.75) represent large, established businesses with substantial global operations despite low share prices. However, some low-price stocks may reflect distressed situations, emerging market risks, or declining businesses, making fundamental analysis crucial for distinguishing quality opportunities from value traps.

How reliable are intrinsic value calculations for companies with such large undervaluations?

Large undervaluations like América Móvil's 307.3% discount often reflect genuine market inefficiencies rather than calculation errors, particularly for companies facing temporary challenges, operating in emerging markets, or experiencing sector-wide pessimism. Our intrinsic value methodology uses conservative assumptions and multiple valuation approaches to ensure reliability. However, extreme undervaluations may require longer time horizons for realization and carry higher execution risk, making diversification and patience essential for investors.

What causes quality companies to trade at such significant discounts to intrinsic value?

Several factors create substantial undervaluation including emerging market concerns (América Móvil, Vale), industry-specific challenges (pharmaceutical patent cliffs for Takeda), regulatory issues (PG&E wildfire liabilities), and macroeconomic uncertainty affecting entire regions or sectors. These situations often create opportunities for patient investors willing to look beyond temporary challenges to underlying business value, asset quality, and long-term competitive positioning.

How should investors approach position sizing with low-price undervalued stocks?

Low-price stocks allow for greater diversification due to lower capital requirements, but investors should maintain appropriate position sizing based on risk tolerance and conviction levels. Consider starting with smaller positions across multiple opportunities rather than concentrating in single names, particularly given potential volatility in undervalued situations. Companies with stronger fundamentals and clearer value catalysts may warrant larger allocations within overall portfolio constraints.

What timeline should investors expect for value realization in these opportunities?

Value realization timelines vary significantly based on company-specific factors, market conditions, and catalyst development. Some opportunities may realize value within 2-3 years through operational improvements or market recognition, while others may require 5+ years for full appreciation. Emerging market companies and those facing regulatory challenges typically require longer investment horizons. Investors should maintain long-term perspectives and avoid expecting immediate results, as the most substantial undervaluations often require extended periods for market recognition of intrinsic worth.

Important Note on Low-Price Investing: Low-price stocks under $20 can offer excellent value opportunities but may experience higher volatility and require longer investment horizons for value realization. Many opportunities involve emerging market exposure, regulatory challenges, or industry-specific headwinds that create both risk and potential reward. Share price alone does not indicate company quality, making fundamental analysis essential for identifying genuine opportunities versus value traps.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Stock prices and intrinsic value calculations are based on recent data and may change with market conditions and new information. Emerging market investments carry additional risks including currency volatility, political instability, and regulatory changes. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.