9 Fast-Growing Stocks with Strong Momentum and Undervalued Status: A 2025 Investment Opportunity Analysis

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

In today's volatile market environment, identifying stocks that combine strong growth potential with positive momentum and undervalued status presents a compelling investment opportunity. This comprehensive analysis examines 15 standout companies demonstrating exceptional metrics across three critical dimensions: intrinsic value assessment, momentum ratings exceeding 9, and growth ratings above 7.

The current investment landscape demands sophisticated valuation methodologies that transcend conventional approaches. Our analysis identifies companies where market prices significantly diverge from calculated intrinsic values, creating potential asymmetric reward opportunities.

Semiconductor Sector Leadership

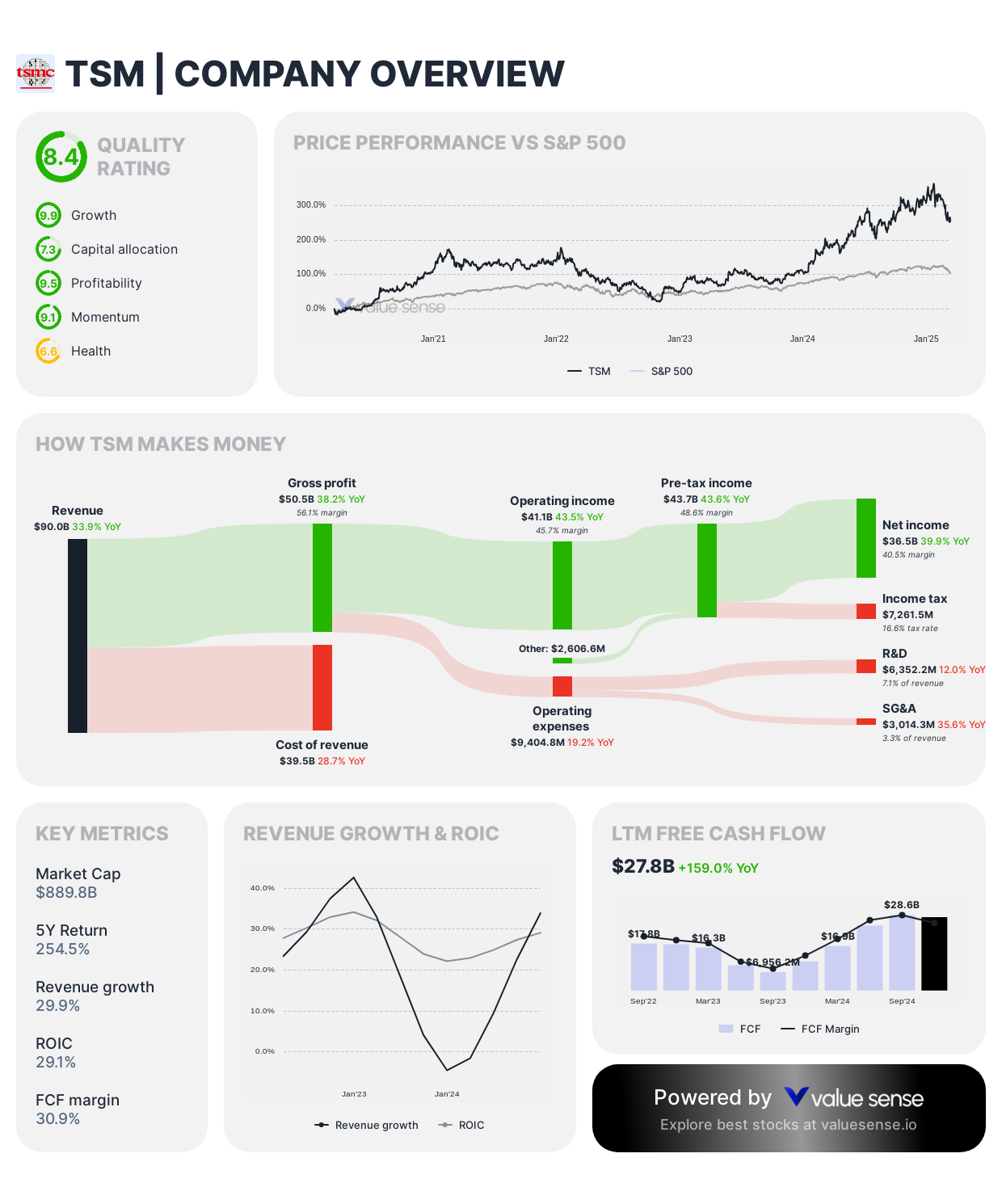

Taiwan Semiconductor Manufacturing Company ($TSM)

- Intrinsic Value Assessment: 177.5% undervalued

- Momentum Rating: 9.2

- Growth Rating: 9.5

TSM continues to dominate semiconductor manufacturing with advanced node production capabilities, positioning it strategically within the AI computing revolution and broader semiconductor demand cycle.

E-Commerce Innovation

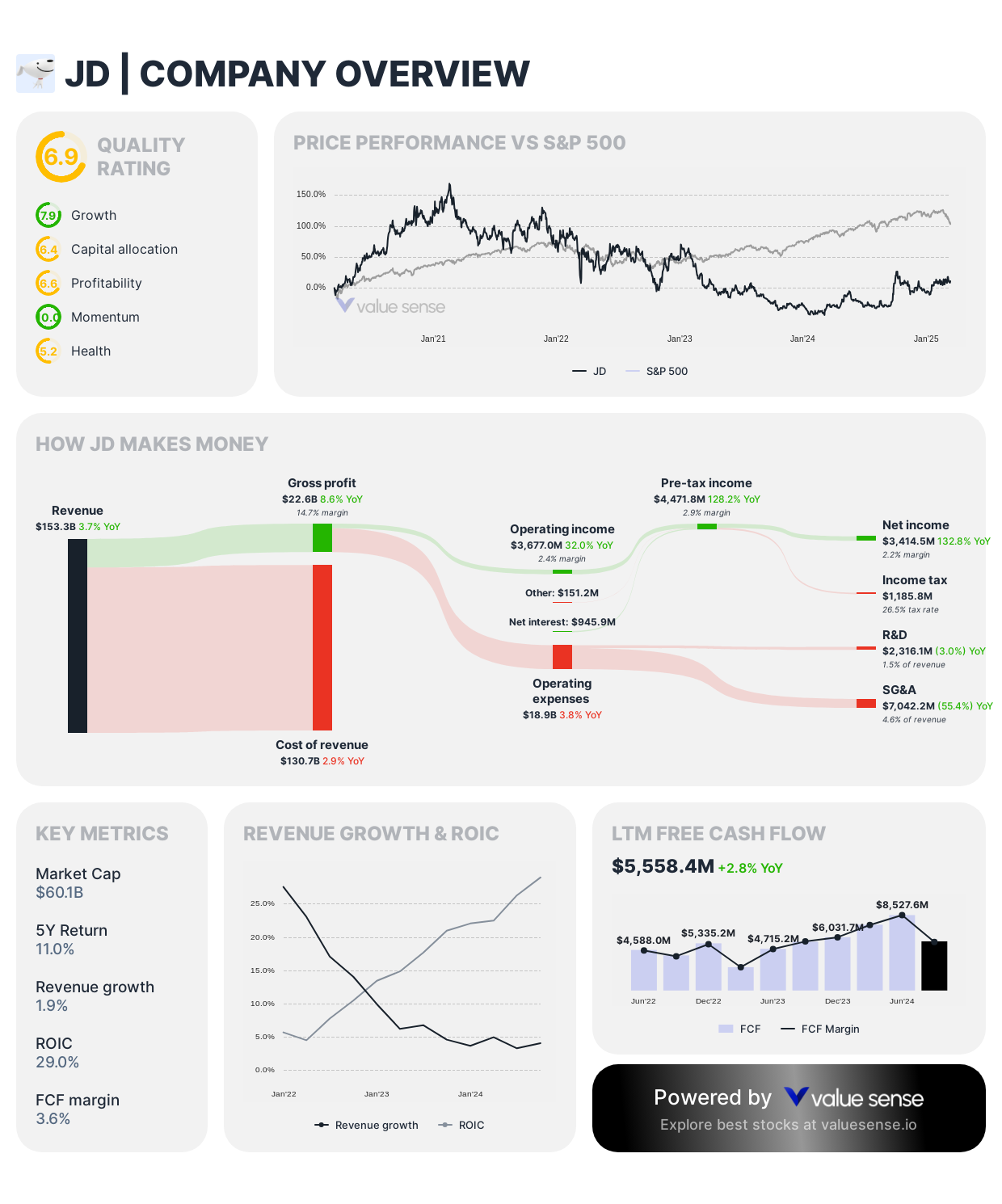

JD.com, Inc. ($JD)

- Intrinsic Value Assessment: 228.0% undervalued

- Momentum Rating: 10.0

- Growth Rating: 7.9

JD's logistics-centric business model provides competitive differentiation in China's e-commerce landscape, with significant valuation disconnect from growth fundamentals.

E-Commerce Innovation

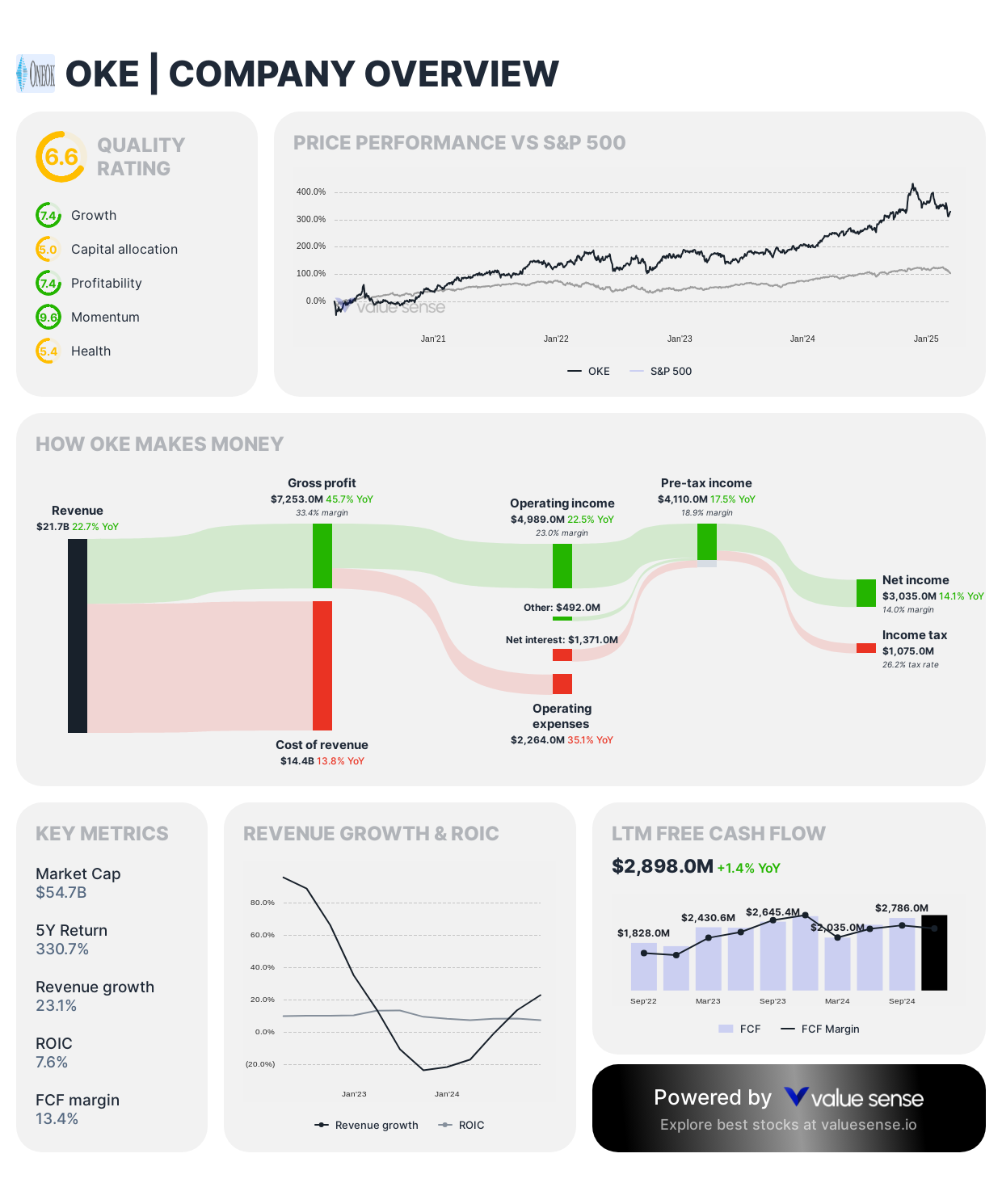

ONEOK, Inc. ($OKE)

- Intrinsic Value Assessment: 135.5% undervalued

- Momentum Rating: 9.0

- Growth Rating: 7.1

ONEOK's midstream energy assets provide essential infrastructure with recurring revenue characteristics, while benefiting from increased natural gas utilization trends.

Digital Transformation Enablers

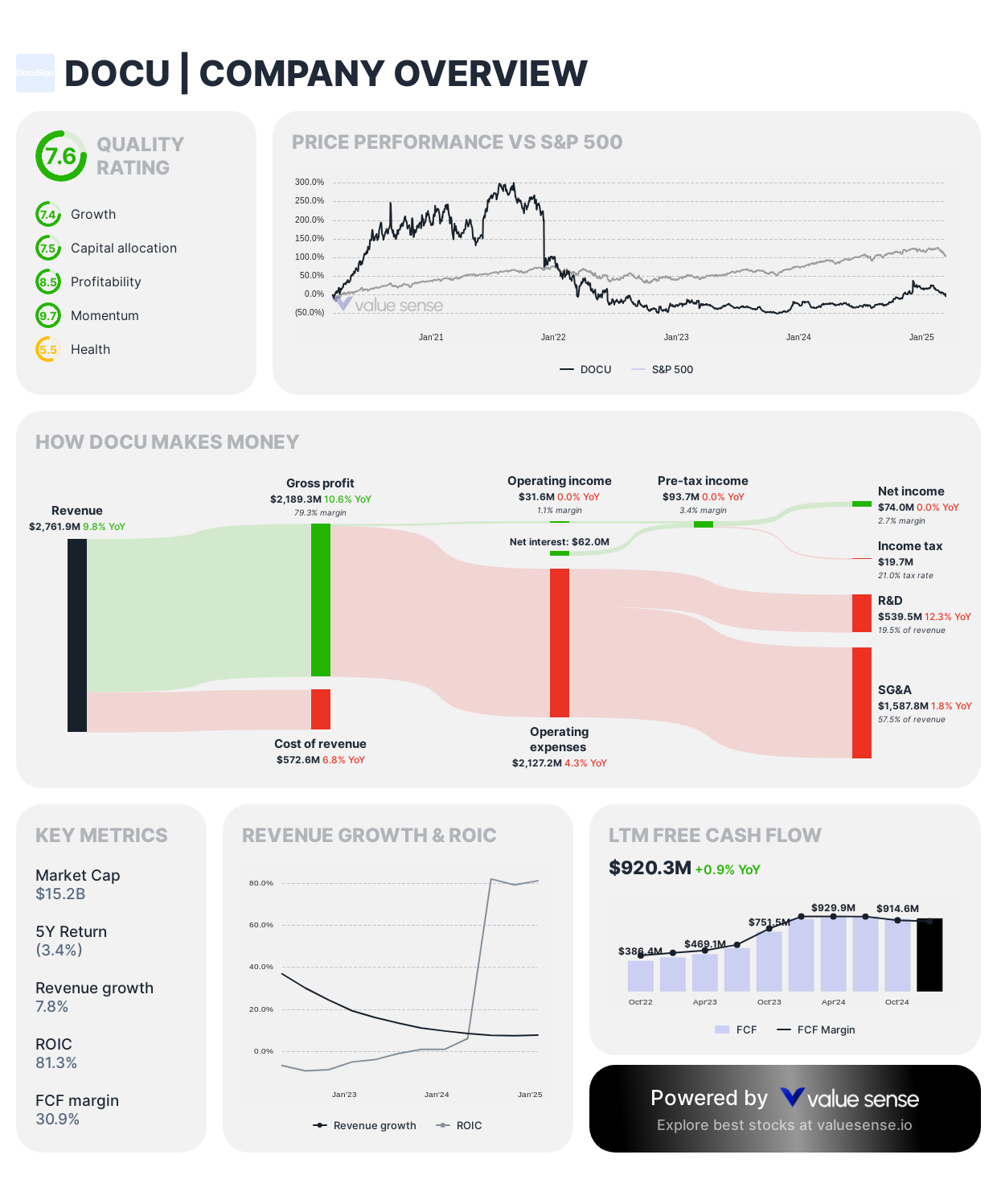

DocuSign, Inc. ($DOCU)

- Intrinsic Value Assessment: 85.7% undervalued

- Momentum Rating: 9.2

- Growth Rating: 7.7

DocuSign's e-signature and contract management solutions continue driving digital transformation across industries, with penetration rates suggesting substantial remaining addressable market opportunity.

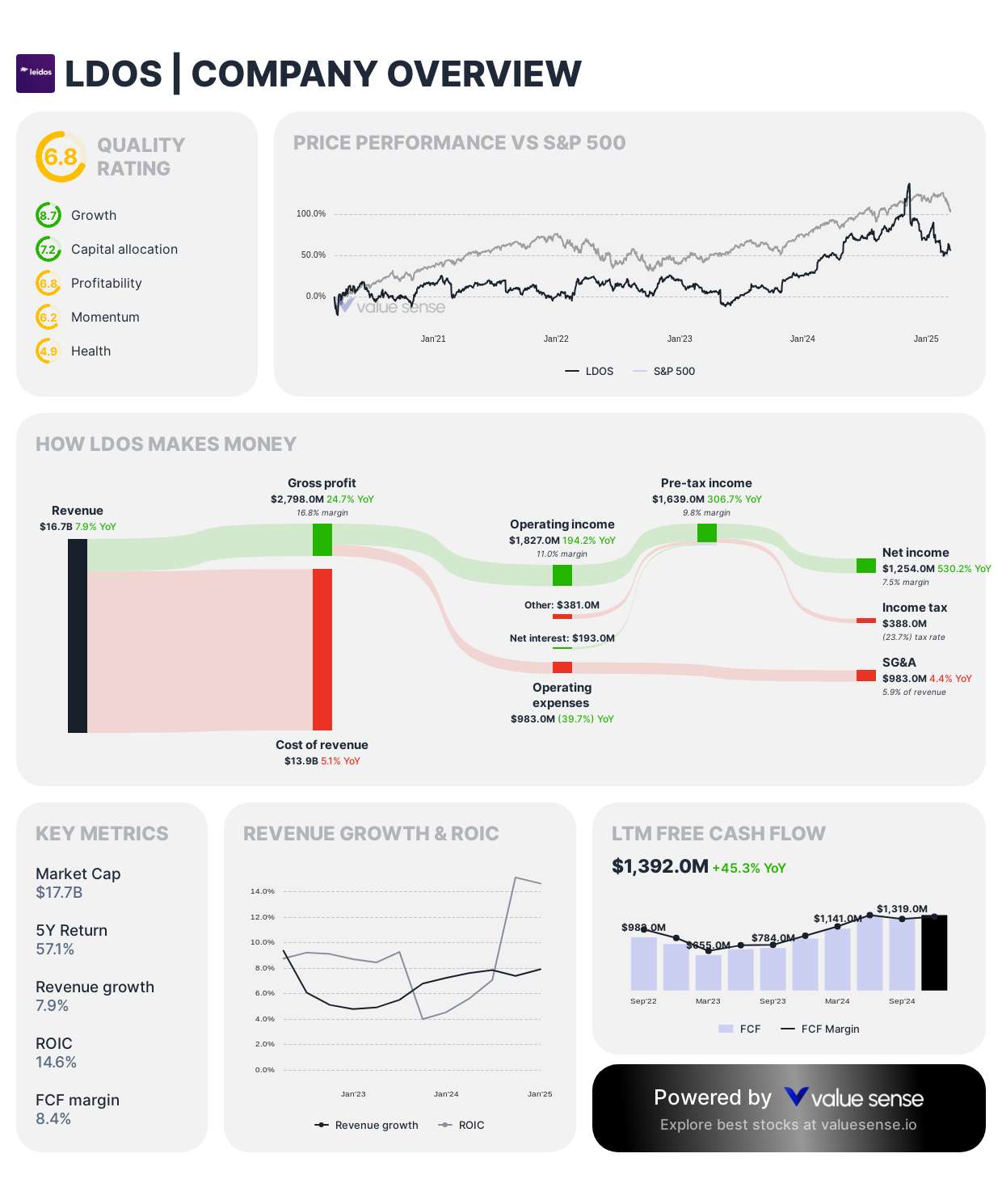

Defense Technology Integration

Leidos Holdings, Inc. ($LDOS)

- Intrinsic Value Assessment: 53.1% undervalued

- Momentum Rating: 9.1

- Growth Rating: 8.6

Leidos maintains critical positioning within defense, intelligence, and civilian government technology modernization initiatives with long-duration contract structures.

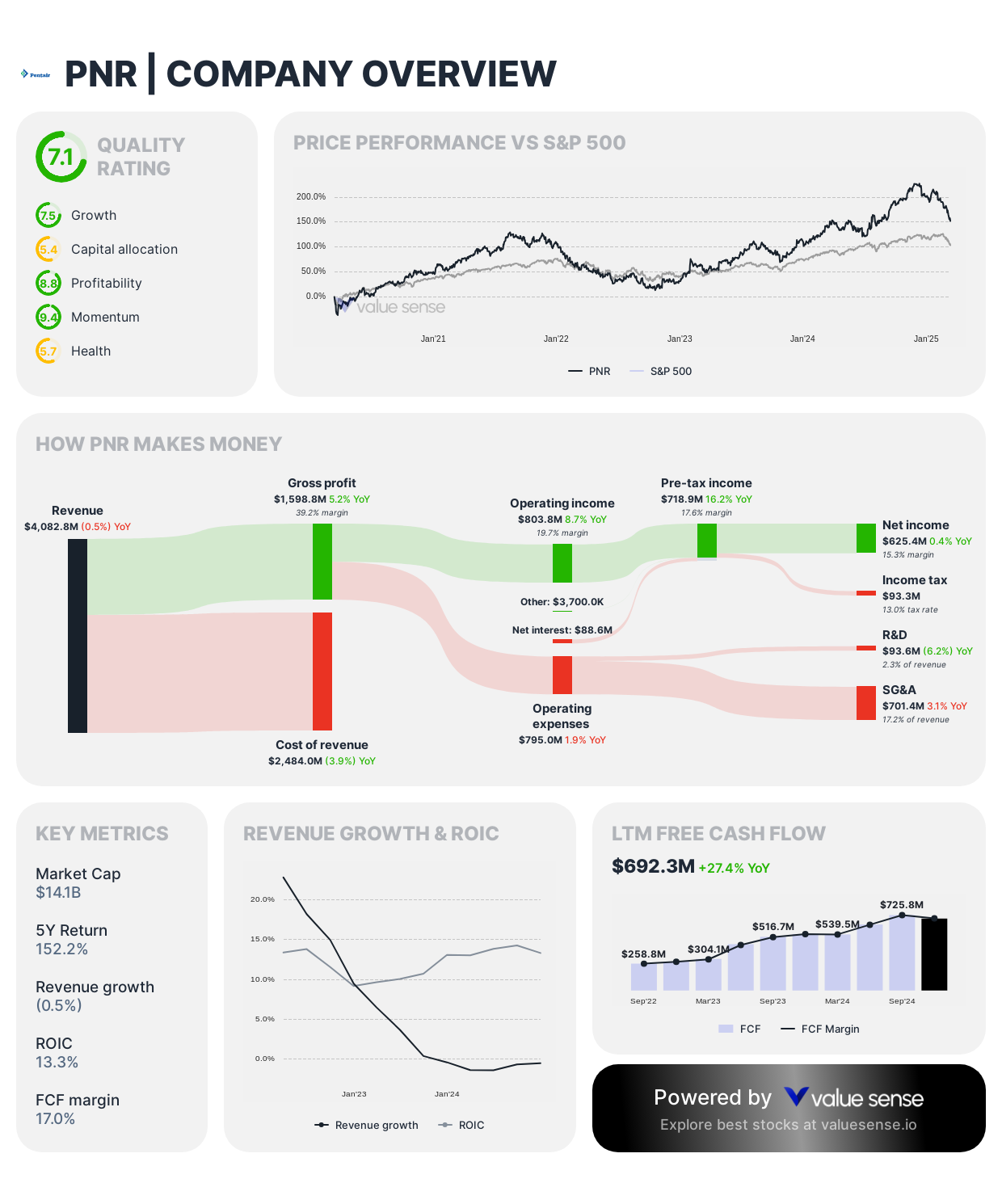

Projects Industrial Innovation

Pentair plc ($PNR)

- Intrinsic Value Assessment: 12.2% undervalued

- Momentum Rating: 9.9

- Growth Rating: 8.1

Pentair's water management solutions address critical resource constraints with sustainable technology applications across residential and commercial markets.

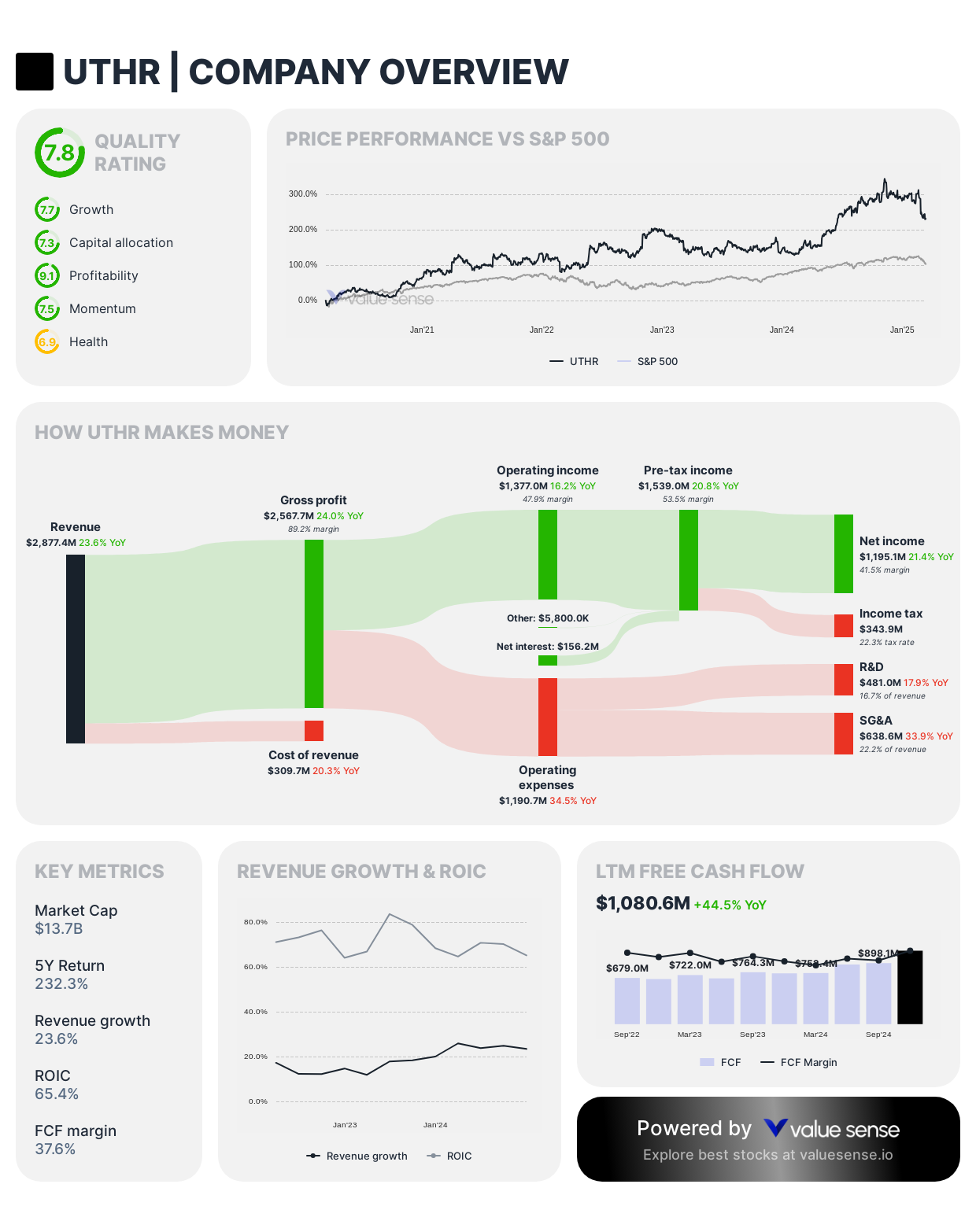

Biotechnology Breakthroughs

United Therapeutics Corporation ($UTHR)

- Intrinsic Value Assessment: 18.3% undervalued

- Momentum Rating: 10.0

- Growth Rating: 7.4

United Therapeutics maintains leadership in pulmonary arterial hypertension treatments with significant pipeline development potential.

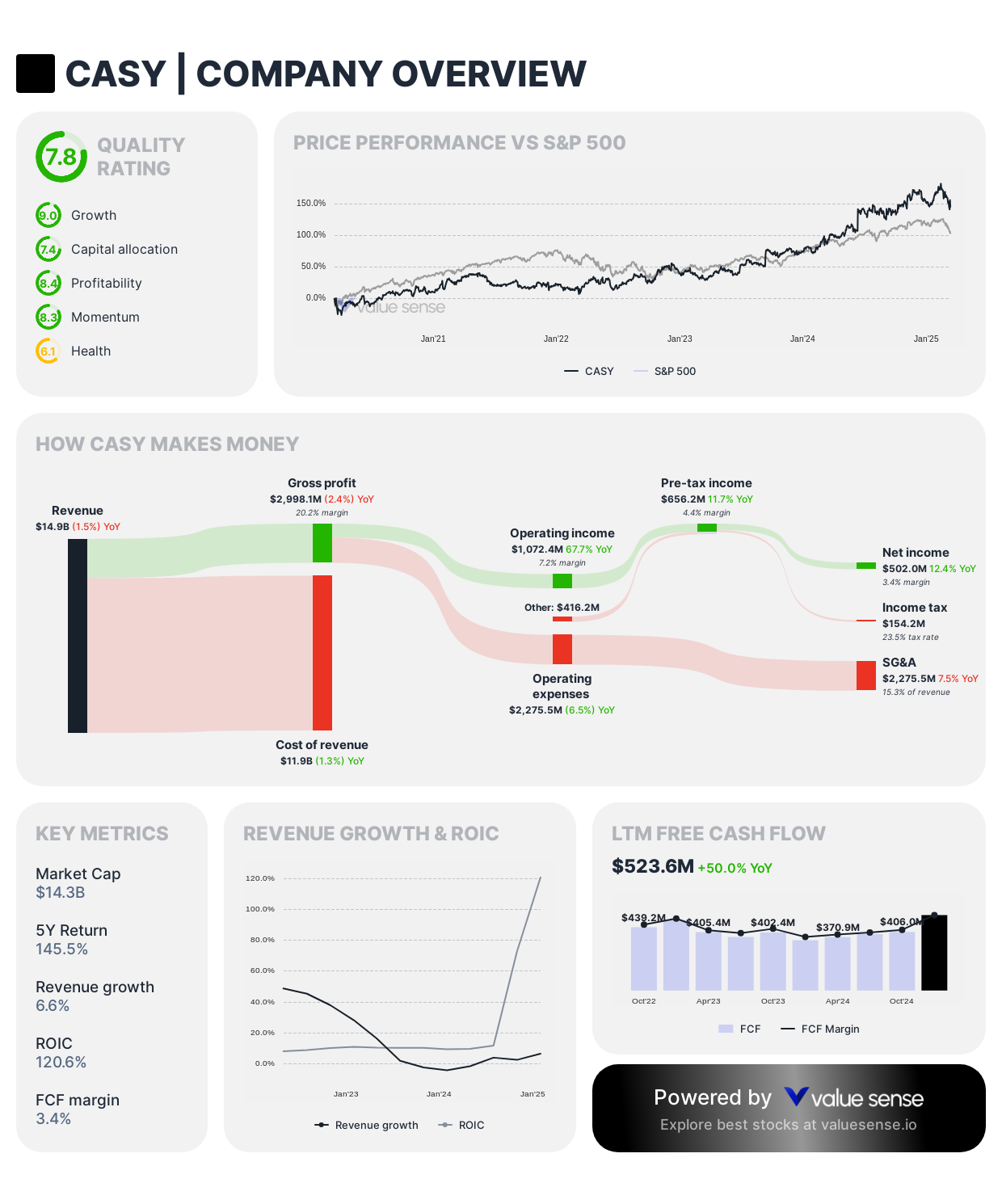

Consumer Services Resilience

Casey's General Stores, Inc. ($CASY)

- Intrinsic Value Assessment: 6.3% undervalued

- Momentum Rating: 9.1

- Growth Rating: 8.3

Casey's unique rural market positioning provides recession-resistant characteristics with expanding prepared food initiatives driving margin expansion.

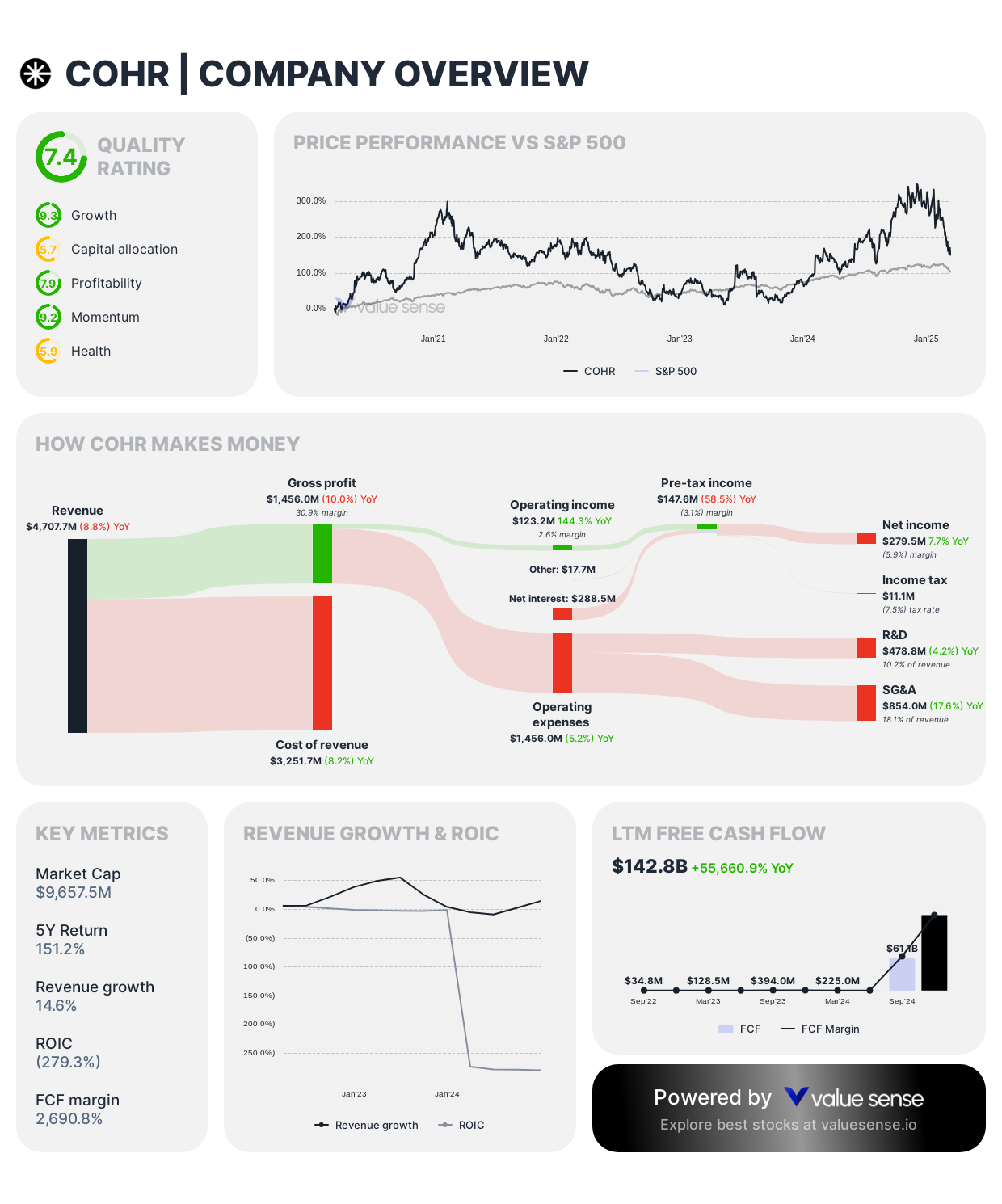

Optical Technology Advancement

Coherent, Inc. ($COHR)

- Intrinsic Value Assessment: 589.6% undervalued

- Momentum Rating: 10.0

- Growth Rating: 8.3

Coherent's photonics and laser solutions enable critical manufacturing processes across semiconductor, telecommunications, and industrial applications.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 6 High-Potential Micro-Cap Stocks for 2025

📖 Warren Buffett's Investment Evolution: From Graham to Munger

📖 Best Value Stocks 2025: Quality Companies at Discount Prices