11 Best Undervalued Multibagger Stocks: High-Growth Potential at Value Prices

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Power of Multibagger Value Investing

Multibagger stocks represent the ultimate wealth creation opportunity - companies that multiply initial investments several times over through sustained competitive advantages, exceptional execution, and expanding market opportunities. When these high-potential companies also trade below their intrinsic value, they create extraordinary opportunities for patient investors seeking life-changing returns.

Multibagger Selection Criteria:

- Quality Rating ≥6.0: Strong business fundamentals and competitive positioning

- Intrinsic Value Undervaluation: Trading below calculated fair value for margin of safety

- High Growth Potential: Strong revenue growth and expanding market opportunities

- Exceptional ROIC: Return on invested capital demonstrating efficient capital allocation

- Financial Strength: Strong balance sheets supporting growth investments

Top 11 Undervalued Multibagger Stocks - Ranked by Undervaluation Percentage

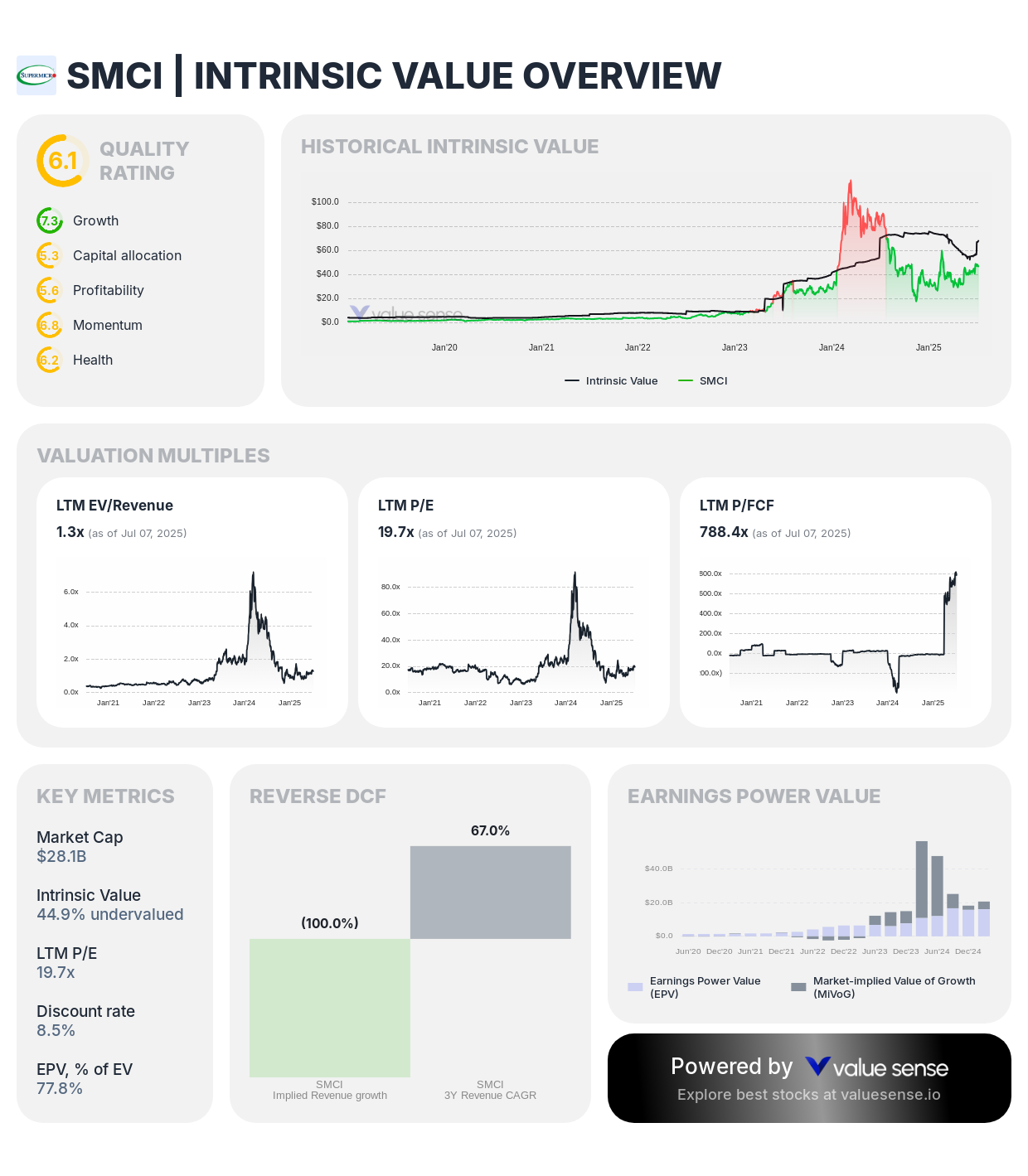

1. Super Micro Computer, Inc. (SMCI) - 44.9% Undervalued ⭐

Complete Multibagger Analysis:

- Quality Rating: 6.1 (Strong)

- Intrinsic Value: 44.9% undervalued

- 1-Year Return: (47.6%)

- Revenue: $21.6B

- Free Cash Flow: $35.6M

- Revenue Growth: 82.5%

- FCF Margin: 0.2%

- Gross Margin: 11.3%

- ROIC: 22.4%

- Total Debt to Equity: 38.4%

Investment Thesis: Super Micro Computer represents the most compelling multibagger opportunity with exceptional 82.5% revenue growth and strategic positioning in AI infrastructure. The company's specialized server and storage solutions for data centers position it perfectly for the artificial intelligence revolution, while current undervaluation provides substantial upside potential.

Multibagger Catalysts:

- Explosive growth in AI and data center infrastructure driving server demand

- Strategic partnerships with NVIDIA and other AI chip leaders

- Expanding addressable market through edge computing and 5G deployment

- Operational leverage potential as margins improve with scale

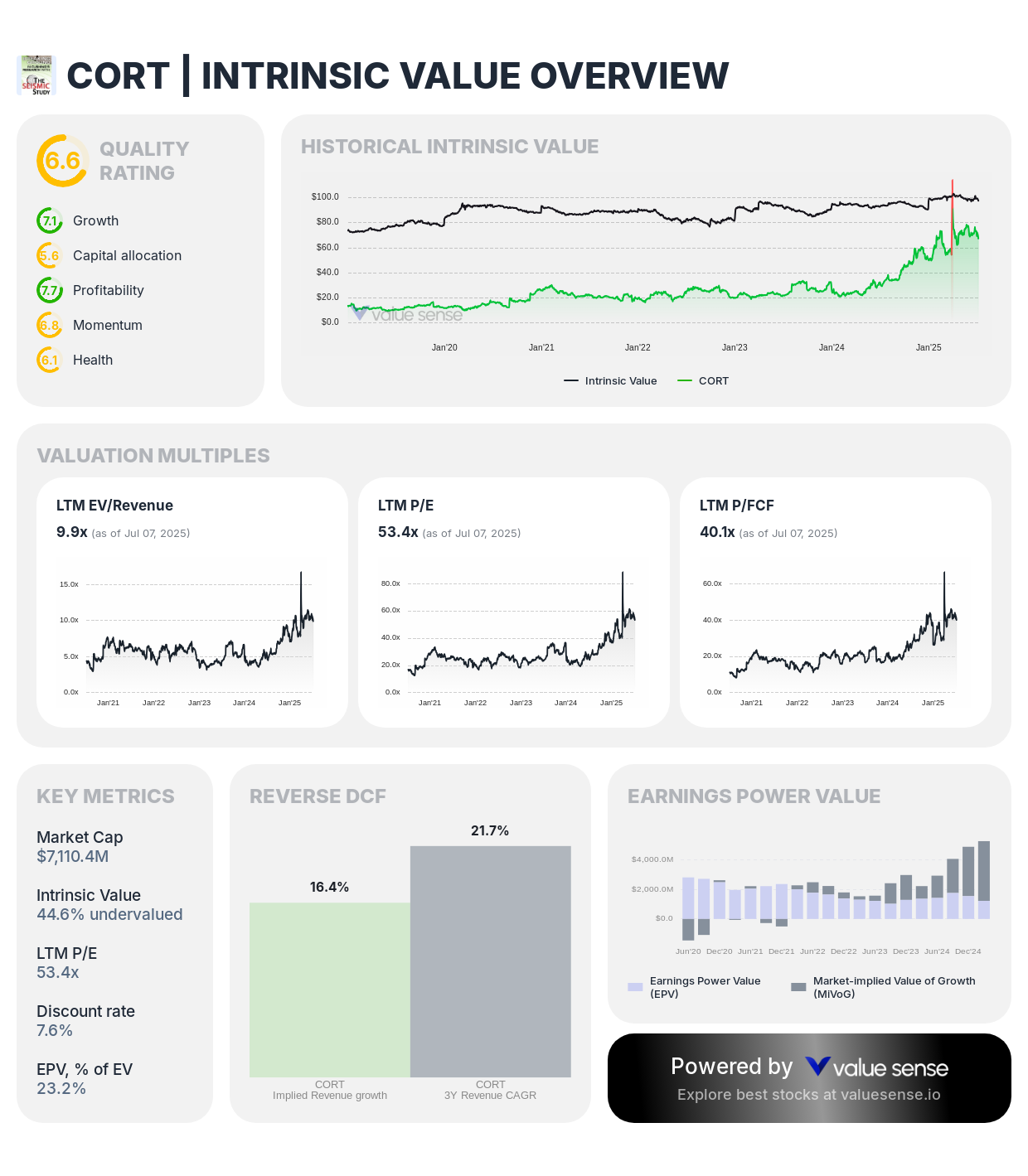

2. Corcept Therapeutics Incorporated (CORT) - 44.6% Undervalued

Complete Multibagger Analysis:

- Quality Rating: 6.4 (Strong)

- Intrinsic Value: 44.6% undervalued

- 1-Year Return: 128.9%

- Revenue: $685.4M

- Free Cash Flow: $177.2M

- Revenue Growth: 30.9%

- FCF Margin: 25.8%

- Gross Margin: 98.4%

- ROIC: 151.2%

- Total Debt to Equity: 1.0%

Investment Thesis: Corcept Therapeutics demonstrates exceptional multibagger potential with extraordinary 151.2% ROIC and outstanding 98.4% gross margins. The biotechnology company's specialized therapeutic focus and exceptional operational metrics create substantial value multiplication opportunities.

Multibagger Catalysts:

- Revolutionary therapeutic approaches addressing large addressable markets

- Exceptional operational efficiency with industry-leading margins

- Strategic partnerships and licensing opportunities

- Pipeline expansion into multiple therapeutic areas

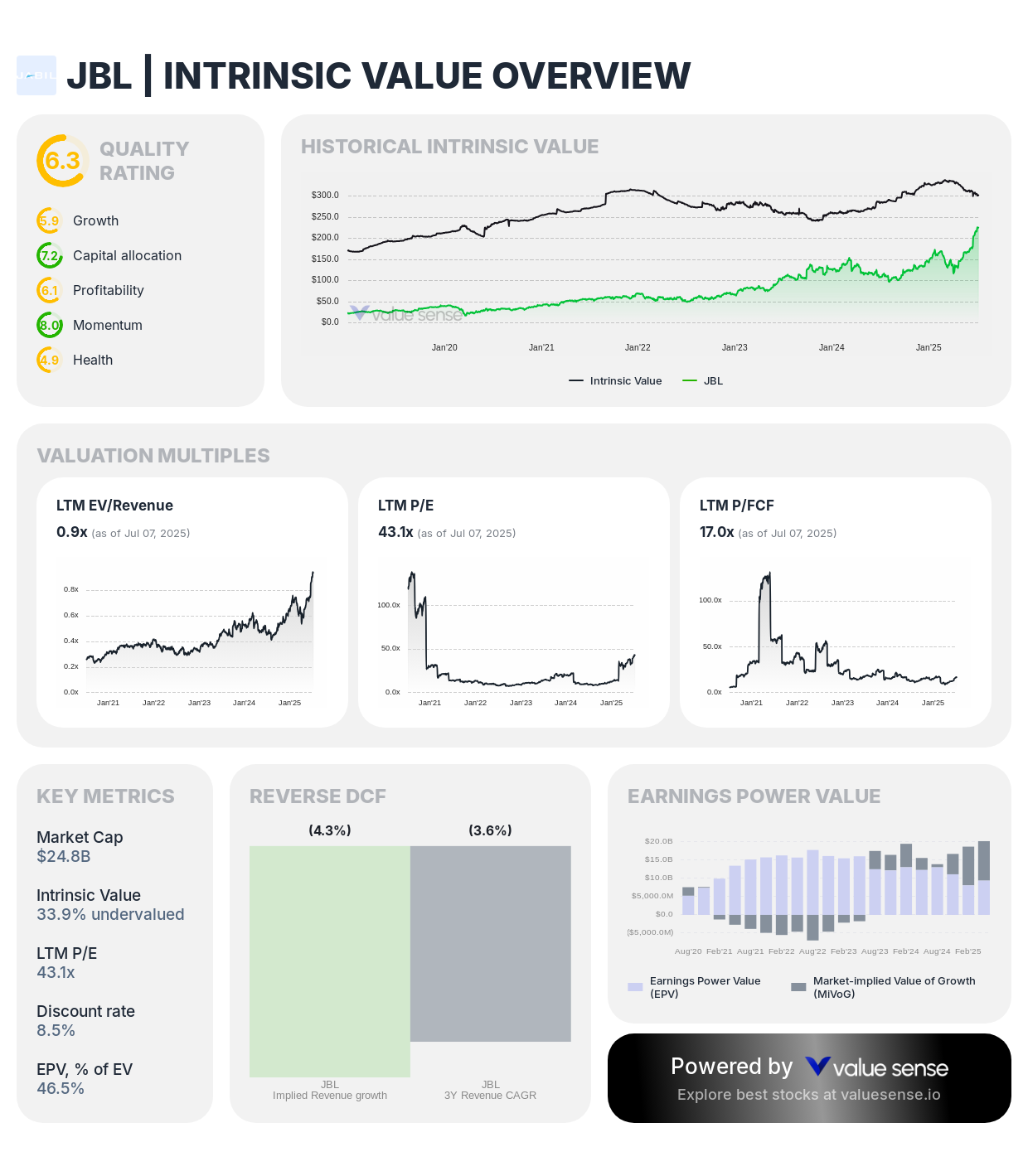

3. Jabil Inc. (JBL) - 33.9% Undervalued

Complete Multibagger Analysis:

- Quality Rating: 6.3 (Strong)

- Intrinsic Value: 33.9% undervalued

- 1-Year Return: 105.3%

- Revenue: $28.5B

- Free Cash Flow: $1,463.0M

- Revenue Growth: (6.1%)

- FCF Margin: 5.1%

- Gross Margin: 8.9%

- ROIC: 18.9%

- Total Debt to Equity: 258.7%

Investment Thesis: Jabil presents strong multibagger potential with exceptional 105.3% one-year return and solid 18.9% ROIC. The electronic manufacturing services company benefits from increasing demand for technology manufacturing and strategic positioning in high-growth sectors.

Multibagger Catalysts:

- Expanding manufacturing services across automotive, healthcare, and technology

- Strategic positioning for electric vehicle and renewable energy manufacturing

- Operational efficiency improvements and margin expansion

- Geographic diversification and supply chain optimization

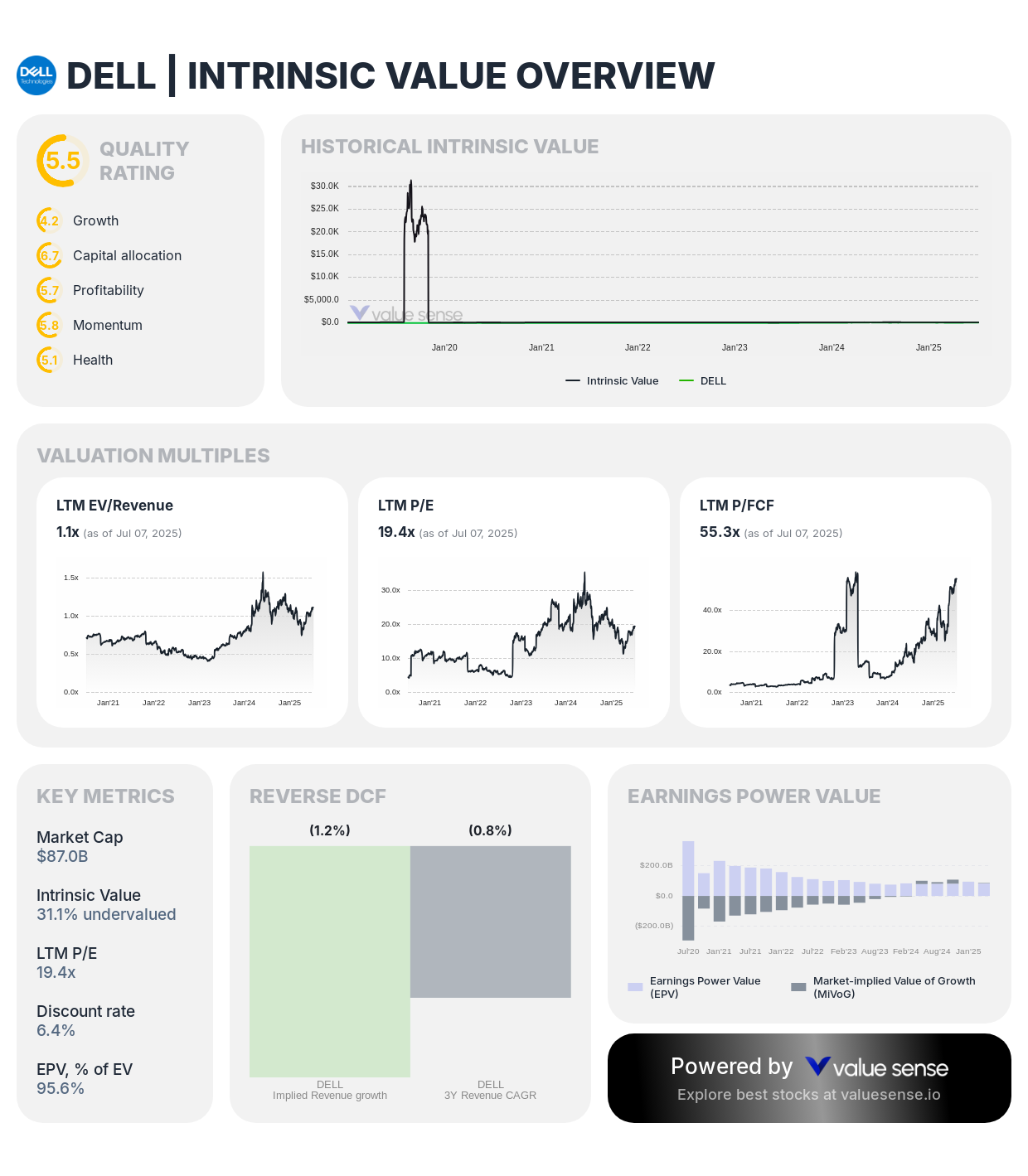

4. Dell Technologies Inc. (DELL) - 31.1% Undervalued

Complete Multibagger Analysis:

- Quality Rating: 6.5 (Strong)

- Intrinsic Value: 31.1% undervalued

- 1-Year Return: (13.6%)

- Revenue: $96.7B

- Free Cash Flow: $1,572.0M

- Revenue Growth: 7.7%

- FCF Margin: 1.6%

- Gross Margin: 22.1%

- ROIC: 21.6%

- Total Debt to Equity: (951.8%)

Investment Thesis: Dell demonstrates multibagger potential through its strategic positioning in enterprise infrastructure and AI computing. The company's transformation toward high-margin solutions and exceptional 21.6% ROIC create value multiplication opportunities despite current challenges.

Multibagger Catalysts:

- Strategic positioning for AI and data center infrastructure growth

- Transformation toward higher-margin enterprise solutions and services

- Operational leverage as enterprise spending recovers

- Share repurchase programs enhancing per-share value

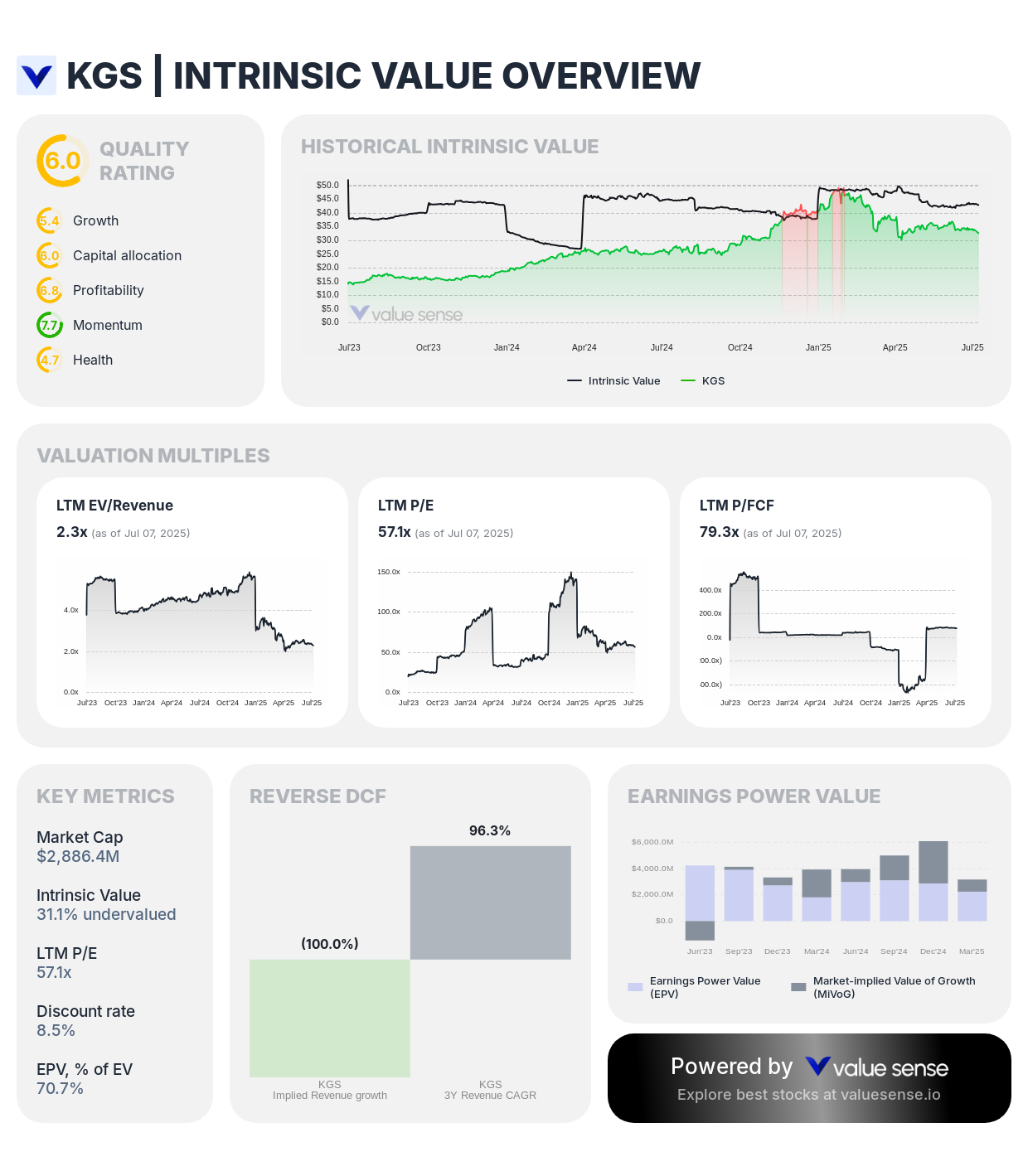

5. Kodiak Gas Services, Inc. (KGS) - 31.1% Undervalued

Complete Multibagger Analysis:

- Quality Rating: 6.0 (Strong)

- Intrinsic Value: 31.1% undervalued

- 1-Year Return: 27.3%

- Revenue: $1,273.5M

- Free Cash Flow: $36.4M

- Revenue Growth: 45.4%

- FCF Margin: 2.9%

- Gross Margin: 42.7%

- ROIC: 6.2%

- Total Debt to Equity: 3.9%

Investment Thesis: Kodiak Gas Services presents multibagger potential with exceptional 45.4% revenue growth and strategic positioning in natural gas compression services. The company benefits from increasing natural gas production and infrastructure development across North America.

Multibagger Catalysts:

- Expanding natural gas production driving compression equipment demand

- Strategic positioning in high-growth unconventional drilling markets

- Operational efficiency improvements and margin expansion

- Market consolidation opportunities through acquisitions

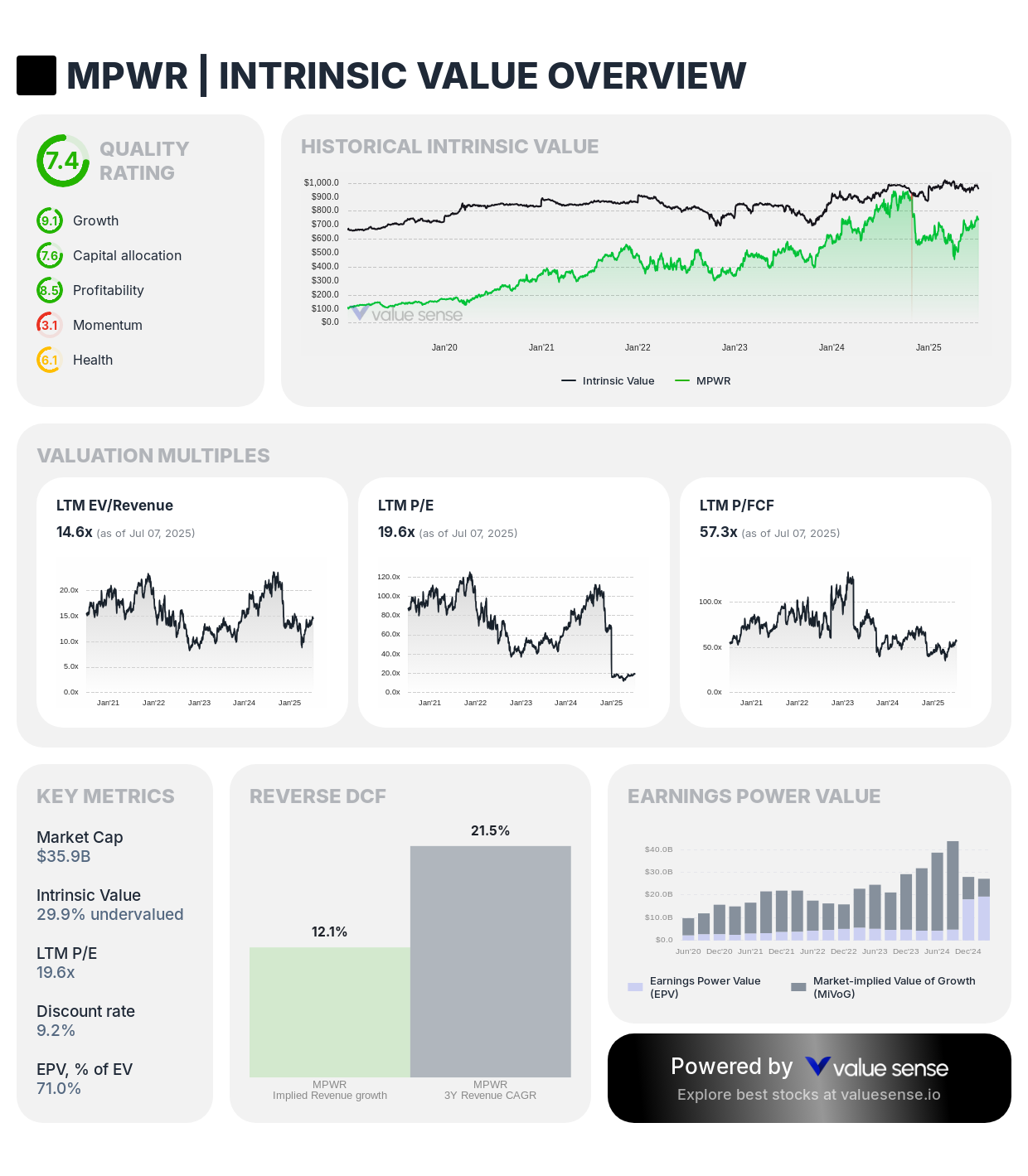

6. Monolithic Power Systems, Inc. (MPWR) - 29.9% Undervalued

Complete Multibagger Analysis:

- Quality Rating: 6.4 (Strong)

- Intrinsic Value: 29.9% undervalued

- 1-Year Return: (12.7%)

- Revenue: $2,386.8M

- Free Cash Flow: $626.3M

- Revenue Growth: 30.6%

- FCF Margin: 26.2%

- Gross Margin: 55.4%

- ROIC: 162.1%

- Total Debt to Equity: 0.0%

Investment Thesis: Monolithic Power Systems demonstrates exceptional multibagger potential with extraordinary 162.1% ROIC and debt-free balance sheet. The analog semiconductor company's specialized expertise and expanding market opportunities create substantial value multiplication potential.

Multibagger Catalysts:

- Increasing demand for energy-efficient power solutions across industries

- Expansion into automotive and data center applications

- Continuous innovation in high-performance analog integrated circuits

- Strategic positioning in electrification and automation trends

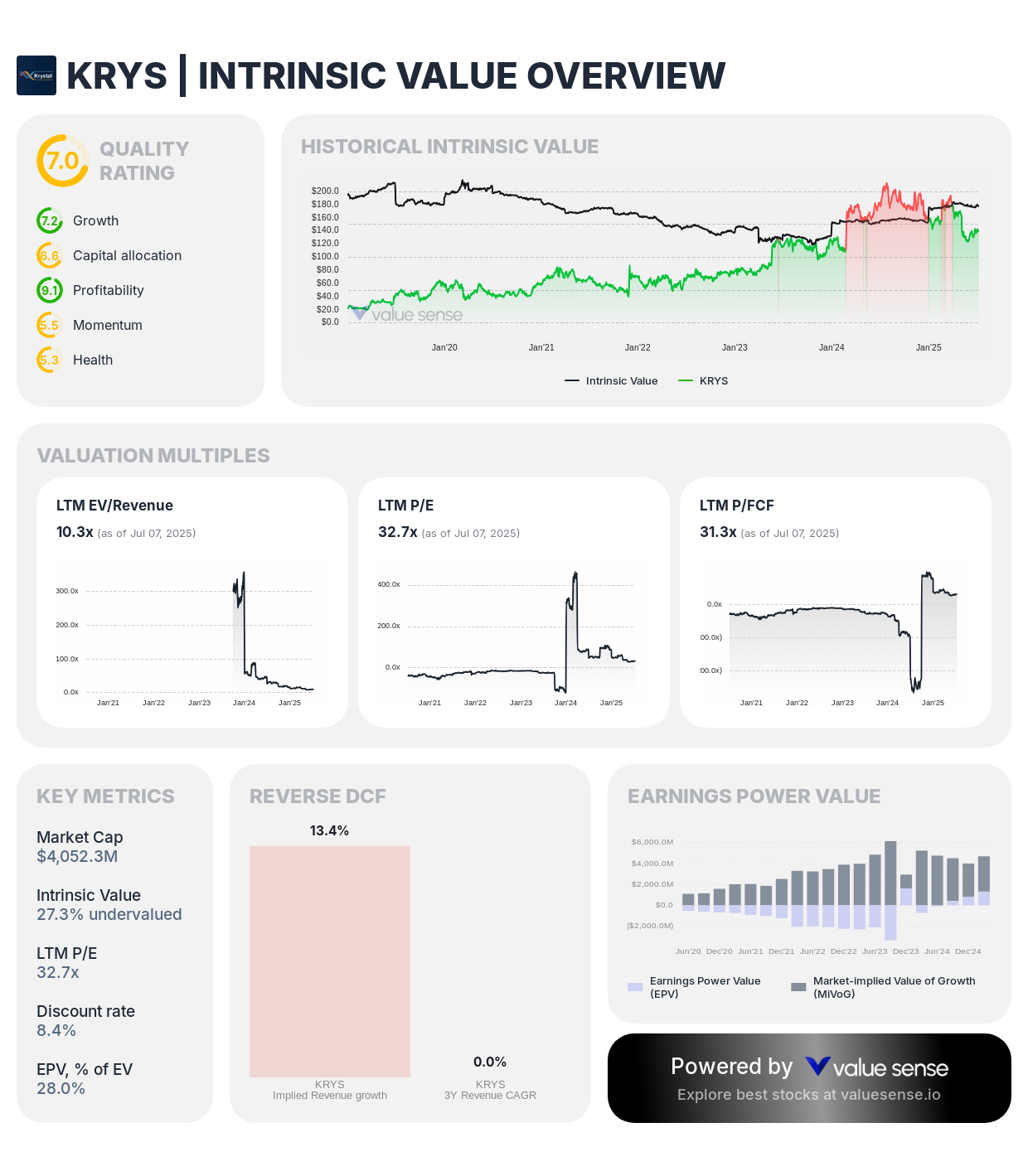

7. Krystal Biotech, Inc. (KRYS) - 27.3% Undervalued

Complete Multibagger Analysis:

- Quality Rating: 7.0 (Strong)

- Intrinsic Value: 27.3% undervalued

- 1-Year Return: (26.9%)

- Revenue: $333.4M

- Free Cash Flow: $129.3M

- Revenue Growth: 247.5%

- FCF Margin: 38.8%

- Gross Margin: 92.6%

- ROIC: 37.1%

- Total Debt to Equity: 1.0%

Investment Thesis: Krystal Biotech presents exceptional multibagger potential with extraordinary 247.5% revenue growth and outstanding 92.6% gross margins. The gene therapy company's breakthrough treatments and exceptional operational metrics create substantial value multiplication opportunities.

Multibagger Catalysts:

- Revolutionary gene therapy platform addressing rare diseases

- Exceptional operational efficiency with industry-leading margins

- Pipeline expansion into multiple therapeutic applications

- Strategic partnerships and licensing opportunities

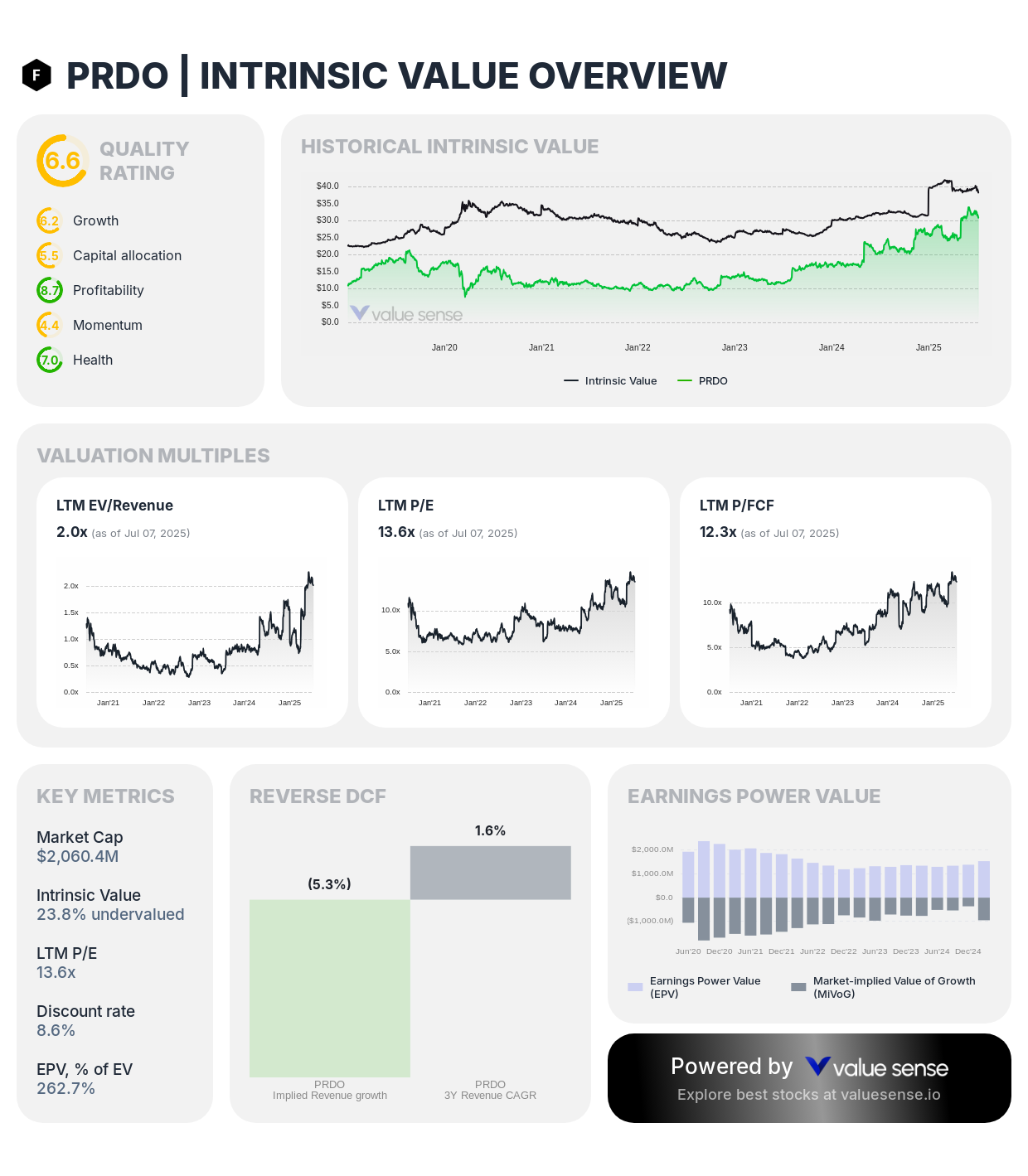

8. Perdoceo Education Corporation (PRDO) - 23.8% Undervalued

Complete Multibagger Analysis:

- Quality Rating: 6.5 (Strong)

- Intrinsic Value: 23.8% undervalued

- 1-Year Return: 46.8%

- Revenue: $726.0M

- Free Cash Flow: $167.1M

- Revenue Growth: 6.3%

- FCF Margin: 23.0%

- Gross Margin: 85.6%

- ROIC: 23.4%

- Total Debt to Equity: 0.0%

Investment Thesis: Perdoceo Education demonstrates strong multibagger potential with exceptional 85.6% gross margins and debt-free balance sheet. The education company's specialized programs and operational efficiency create value multiplication opportunities in growing education markets.

Multibagger Catalysts:

- Expanding demand for specialized professional education and training

- Operational leverage through online education delivery

- Strategic program expansion into high-growth career fields

- Market consolidation opportunities in education sector

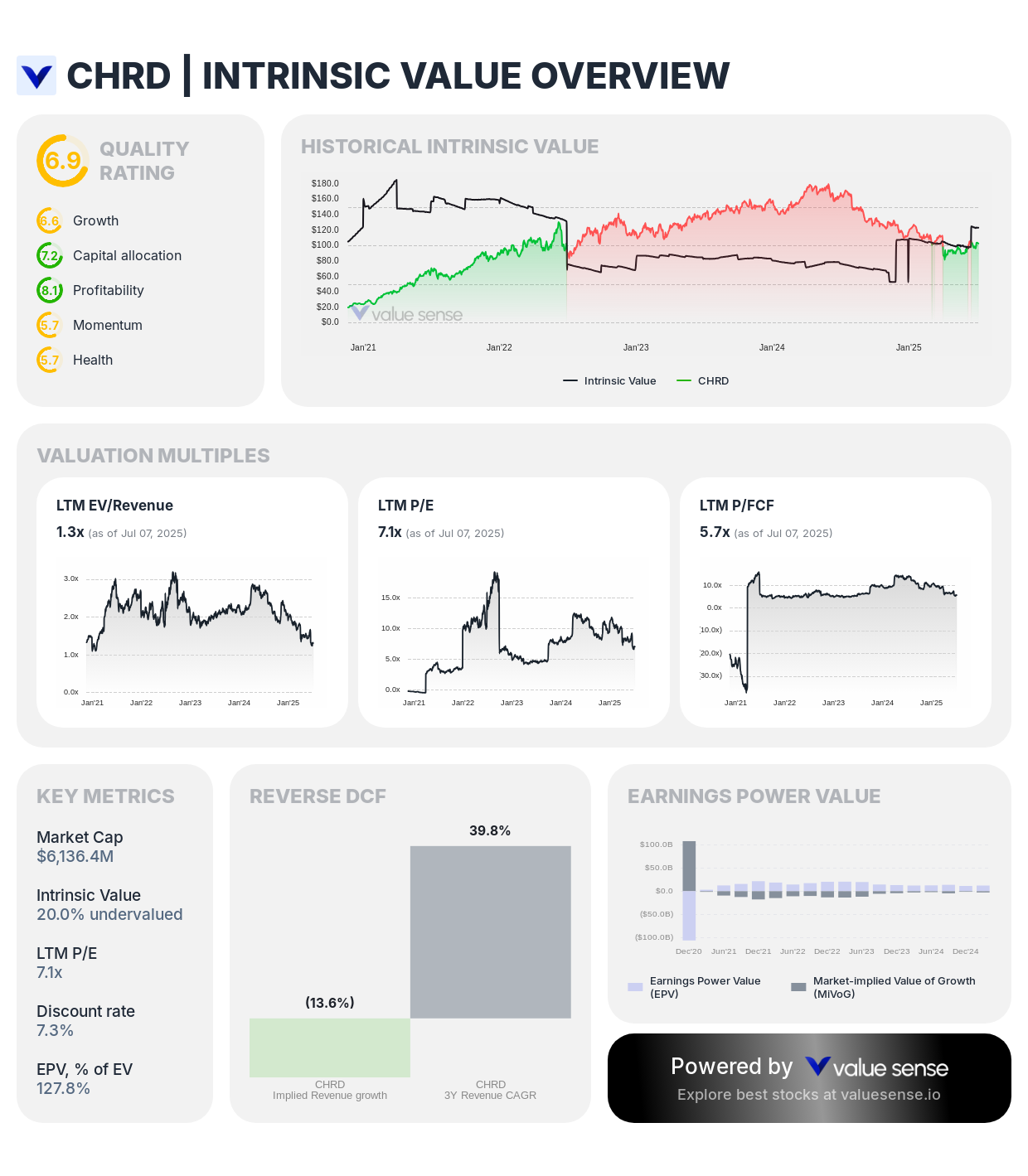

9. Chord Energy Corporation (CHRD) - 20.0% Undervalued

Complete Multibagger Analysis:

- Quality Rating: 6.0 (Strong)

- Intrinsic Value: 20.0% undervalued

- 1-Year Return: (37.5%)

- Revenue: $5,380.9M

- Free Cash Flow: $1,081.6M

- Revenue Growth: 31.7%

- FCF Margin: 20.1%

- Gross Margin: 25.5%

- ROIC: 12.7%

- Total Debt to Equity: 11.2%

Investment Thesis: Chord Energy presents multibagger potential with strong 31.7% revenue growth and exceptional 20.1% free cash flow margin. The independent oil and gas company's focused operations and conservative balance sheet create value multiplication opportunities.

Multibagger Catalysts:

- Efficient operations in high-quality unconventional resource plays

- Conservative capital allocation approach maximizing shareholder returns

- Operational efficiency improvements and technology adoption

- Strategic positioning for commodity price recovery

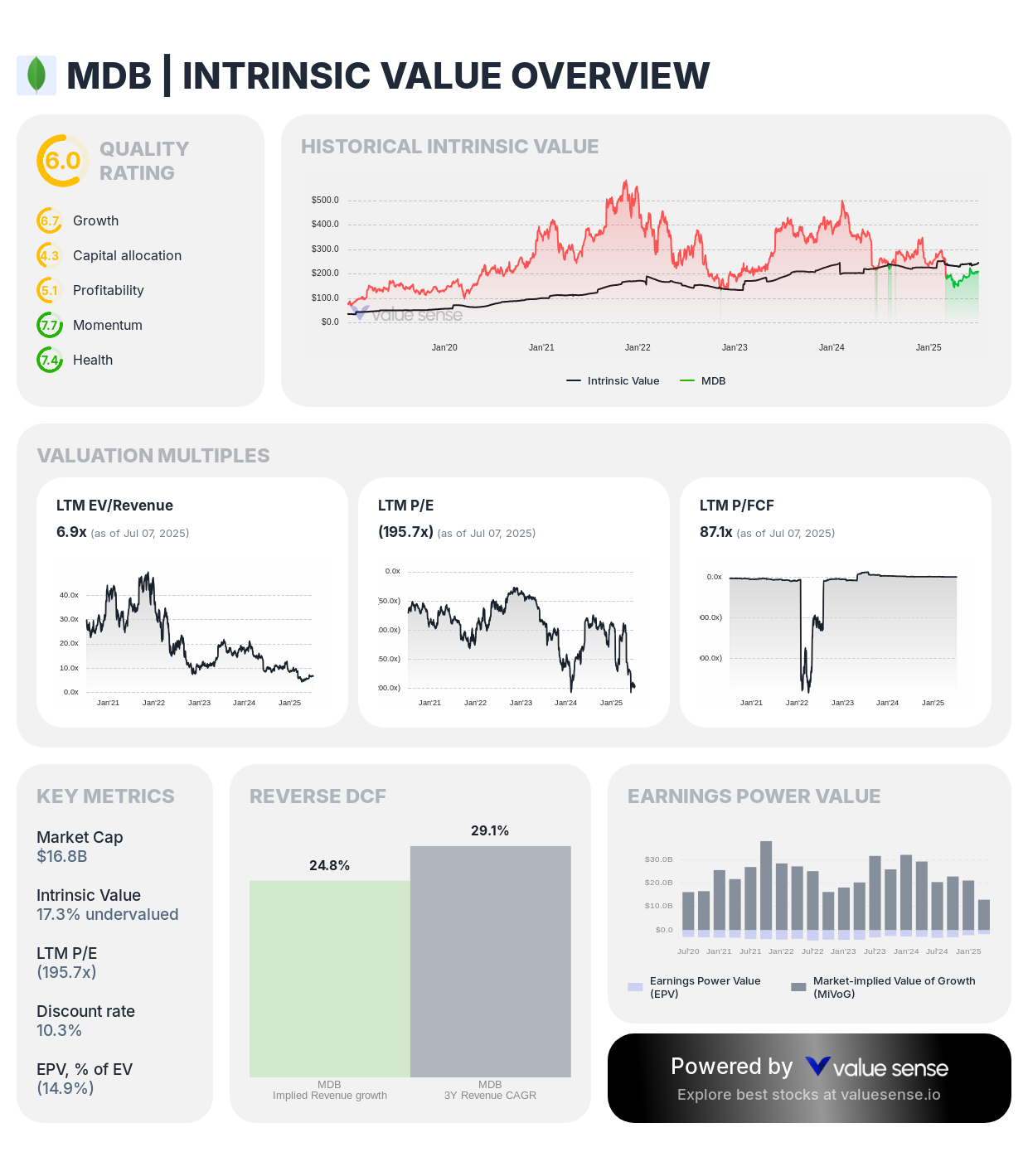

10. MongoDB, Inc. (MDB) - 17.3% Undervalued

Complete Multibagger Analysis:

- Quality Rating: 6.0 (Strong)

- Intrinsic Value: 17.3% undervalued

- 1-Year Return: (19.3%)

- Revenue: $2,104.9M

- Free Cash Flow: $193.5M

- Revenue Growth: 19.2%

- FCF Margin: 9.2%

- Gross Margin: 72.9%

- ROIC: (29.0%)

- Total Debt to Equity: 3.1%

Investment Thesis: MongoDB demonstrates multibagger potential through its leadership in modern database technology and strong 19.2% revenue growth. The company's platform approach and expanding enterprise adoption create substantial value multiplication opportunities.

Multibagger Catalysts:

- Growing adoption of modern database technologies across enterprises

- Expansion into artificial intelligence and machine learning applications

- International market penetration and platform ecosystem development

- Operational leverage as the business scales

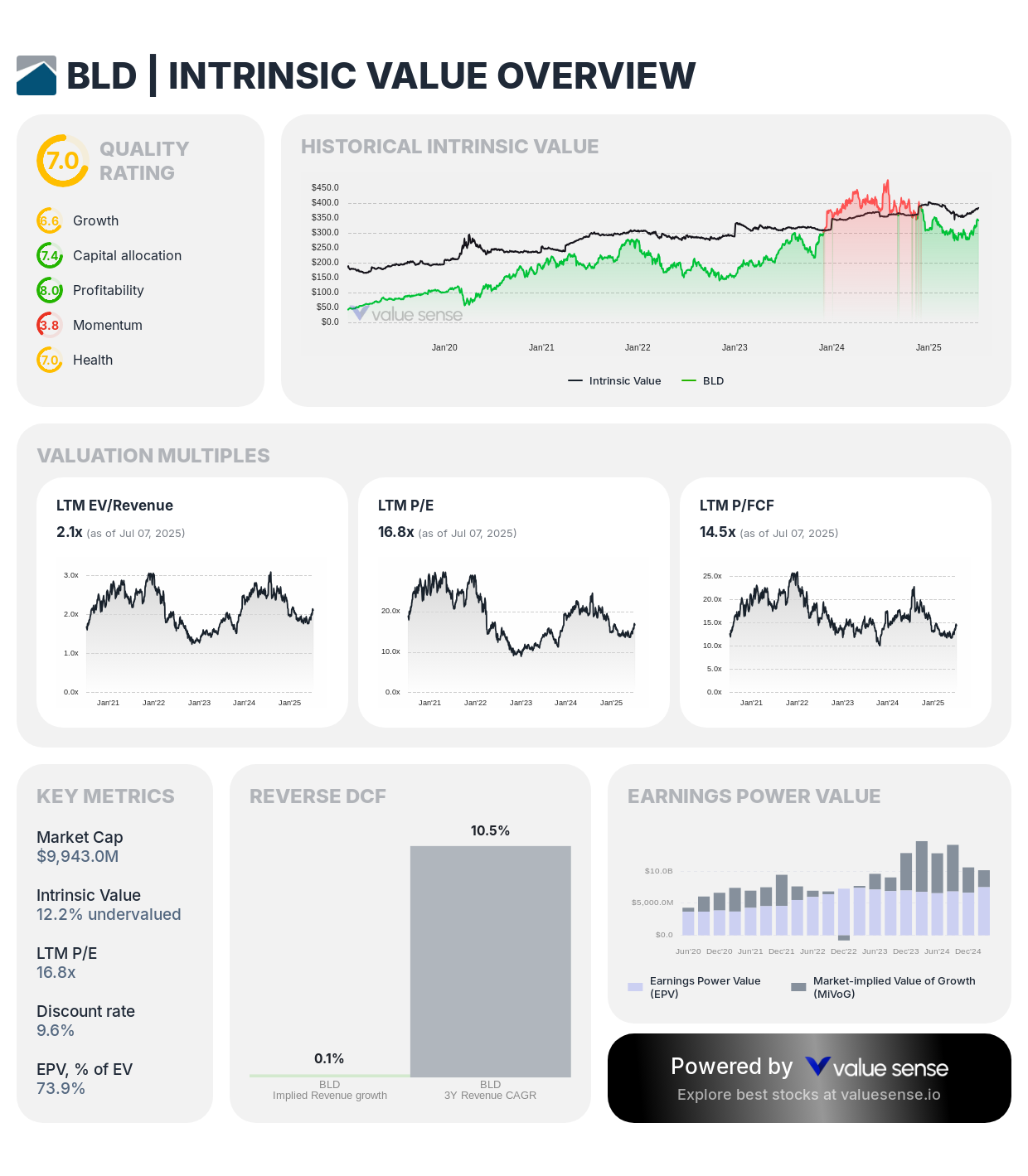

11. TopBuild Corp. (BLD) - 12.2% Undervalued

Complete Multibagger Analysis:

- Quality Rating: 7.0 (Strong)

- Intrinsic Value: 12.2% undervalued

- 1-Year Return: (10.9%)

- Revenue: $5,284.4M

- Free Cash Flow: $687.0M

- Revenue Growth: 1.5%

- FCF Margin: 13.0%

- Gross Margin: 30.1%

- ROIC: 19.0%

- Total Debt to Equity: 74.0%

Investment Thesis: TopBuild presents multibagger potential through its leadership in building insulation and construction services. The company's strategic positioning in energy-efficient construction and solid 19.0% ROIC create value multiplication opportunities.

Multibagger Catalysts:

- Growing demand for energy-efficient building solutions

- Strategic acquisitions expanding market reach and capabilities

- Operational efficiency improvements and margin expansion

- Residential and commercial construction recovery potential

Multibagger Investment Strategy

Focus on Exceptional Growth Metrics: Prioritize companies with extraordinary revenue growth like Krystal Biotech (247.5%), Super Micro Computer (82.5%) that demonstrate exceptional market opportunity capture and execution capability.

Emphasize Operational Excellence: Companies with exceptional ROIC like Monolithic Power Systems (162.1%) and Corcept Therapeutics (151.2%) demonstrate superior capital allocation and business model quality essential for multibagger returns.

Diversify Across Growth Themes: Spread investments across artificial intelligence (Super Micro), biotechnology (Corcept Therapeutics, Krystal Biotech), energy services (Kodiak Gas, Chord Energy), technology (MongoDB, Dell), and specialized services (TopBuild, Perdoceo Education) to capture different growth vectors.

Maintain Long-Term Perspective: Multibagger returns require patience for compound growth to accelerate. Plan for 5-10 year holding periods to capture full value creation potential through business expansion and market recognition.

Key Takeaways for Multibagger Investors

✅ Growth Champions: Super Micro Computer (82.5% revenue growth) and Krystal Biotech (247.5% revenue growth) offer exceptional expansion potential

✅ Operational Excellence: Companies with ROIC above 100% demonstrate exceptional capital efficiency and competitive advantages

✅ Value Entry Points: All selections trade below intrinsic value providing margin of safety for growth investments

✅ Diversified Themes: Opportunities span AI infrastructure, biotechnology, energy services, and specialized technology

✅ Quality Foundation: All companies maintain quality ratings above 6.0 indicating strong business fundamentals

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best Undervalued Nasdaq Stocks for 2025

📖 11 Best Undervalued Revenue Growth Stocks

📖 8 Best Undervalued Low Debt Stocks

FAQ About Multibagger Investing

What distinguishes a true multibagger opportunity from a high-growth stock?

True multibagger opportunities combine exceptional growth potential with sustainable competitive advantages, operational excellence, and undervaluation. Companies like Super Micro Computer with 82.5% revenue growth and strategic AI positioning demonstrate the characteristics necessary for sustained value multiplication over extended periods, rather than just temporary growth spurts.

How important is ROIC for identifying multibagger potential?

ROIC is crucial for multibagger identification because it demonstrates management's ability to generate exceptional returns from invested capital. Companies like Corcept Therapeutics (151.2% ROIC) and Monolithic Power Systems (162.1% ROIC) show the capital efficiency necessary to compound shareholder wealth exponentially over time.

What are the primary risks of multibagger investing?

Multibagger investing carries higher risks including execution risk, market volatility, competitive threats, and potential business model disruption. However, focusing on companies with strong competitive moats, proven management teams, and undervaluation provides downside protection while capturing upside potential.

What timeline should investors expect for multibagger returns?

Multibagger returns typically develop over 5-10 year periods as companies execute growth strategies and markets recognize value. Some opportunities may realize value more quickly through acquisition or rapid market adoption, while others require patience for full business potential to materialize.

How should multibagger stocks fit into a diversified portfolio?

Multibagger stocks should typically represent 10-30% of equity allocations depending on risk tolerance, with higher allocations for growth-oriented investors and lower allocations for conservative investors. Diversification across multiple multibagger opportunities and sectors helps manage individual company risks while capturing upside potential.

Important Note on Multibagger Investing: Multibagger investing involves higher risks and requires patience for value realization. While these companies demonstrate exceptional growth potential and attractive valuations, success depends on continued execution, market adoption, and competitive positioning. Diversification and long-term perspective are essential for managing risks while capturing upside potential.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Multibagger investments carry significant risks including business execution, market volatility, and competitive pressures. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.