11 Best Undervalued Revenue Growth Stocks: Sustainable Growth at Attractive Valuations

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Sweet Spot of Undervalued Growth Investing

Revenue growth stocks with sustainable expansion rates represent the optimal balance between growth potential and valuation discipline. These companies demonstrate proven ability to expand their businesses at attractive rates while avoiding the valuation premiums and execution risks associated with hypergrowth companies.

Companies achieving consistent revenue growth over five years demonstrate:

- 10% CAGR: Revenue increases 61% over 5 years

- 15% CAGR: Revenue increases 101% over 5 years

- 20% CAGR: Revenue increases 149% over 5 years

- 25% CAGR: Revenue increases 207% over 5 years

Undervalued Growth Selection Criteria:

- Intrinsic Value - Undervalued Status: Trading below calculated fair value based on fundamental analysis

- Sustainable Revenue Growth: Demonstrated consistent expansion capability

- Quality Business Fundamentals: Strong competitive positioning and operational metrics

- Balanced Risk-Reward Profile: Growth potential without extreme valuation premiums

Top 11 Undervalued Revenue Growth Stocks - Ranked by Undervaluation Percentage

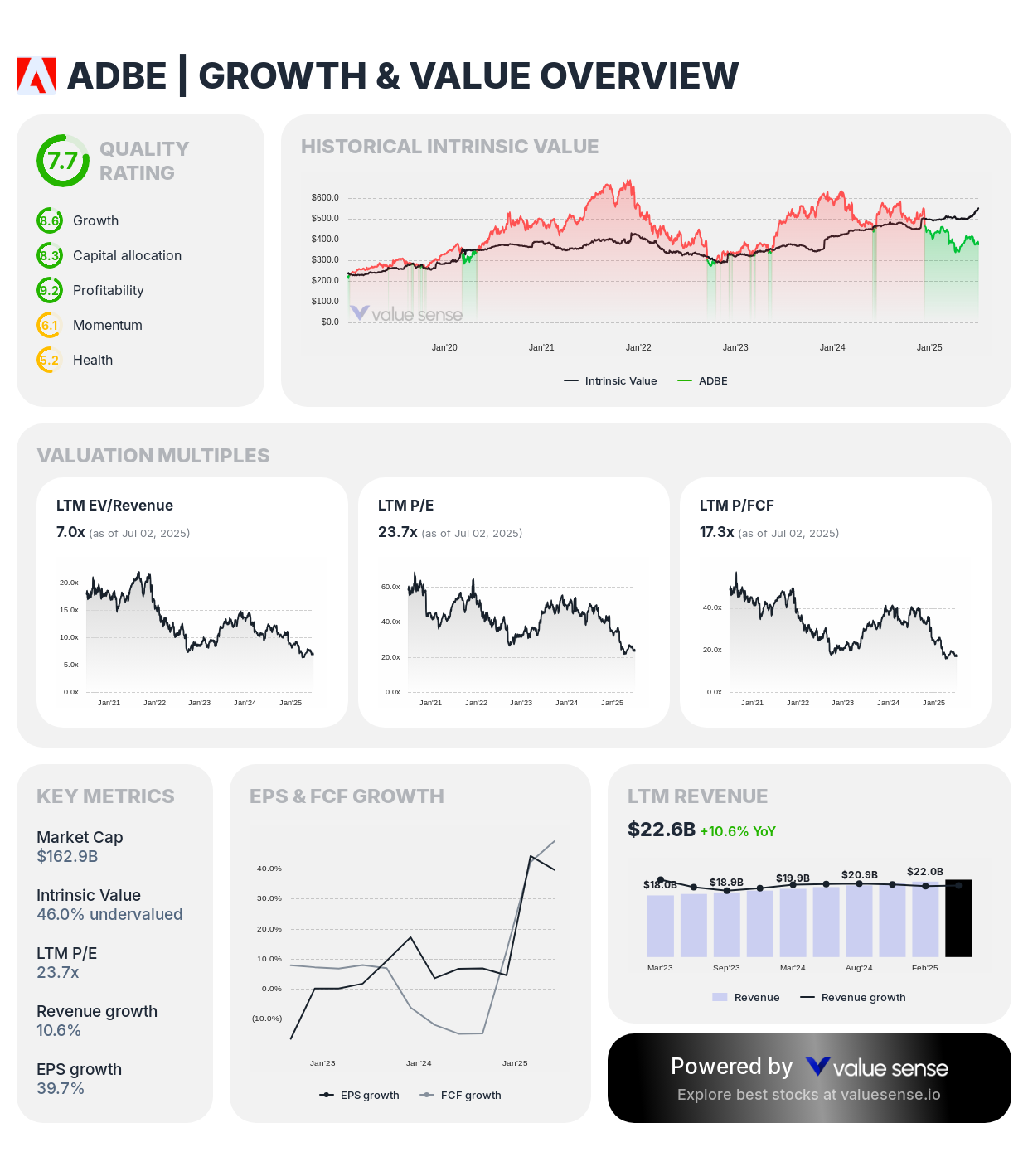

1. Adobe Inc. (ADBE) - 46.0% Undervalued ⭐

Complete Growth Analysis:

- Quality Rating: 7.7 (Exceptional)

- Intrinsic Value: 46.0% undervalued

- 1-Year Return: (33.3%)

- Revenue: $22.6B

- Free Cash Flow: $9,437.0M

- Revenue Growth: 10.6%

- FCF Margin: 41.8%

Investment Thesis: Adobe represents the most compelling undervalued growth opportunity with 46.0% discount to intrinsic value and exceptional quality rating of 7.7. The creative software leader's subscription model transformation, market dominance, and artificial intelligence integration create sustainable competitive advantages that current pricing significantly underestimates.

Growth Sustainability: Adobe's subscription-based Creative Cloud and Document Cloud services provide predictable recurring revenue growth, while AI-powered tools enhance user productivity and competitive positioning. The company's expanding addressable markets through marketing automation and digital document workflows support continued expansion.

Investment Highlights:

- Dominant position in creative software with subscription model providing predictable recurring revenue

- Strong competitive moats through ecosystem effects and professional workflow integration

- Artificial intelligence integration enhancing product capabilities and user productivity

- Exceptional free cash flow margin of 41.8% demonstrating operational excellence

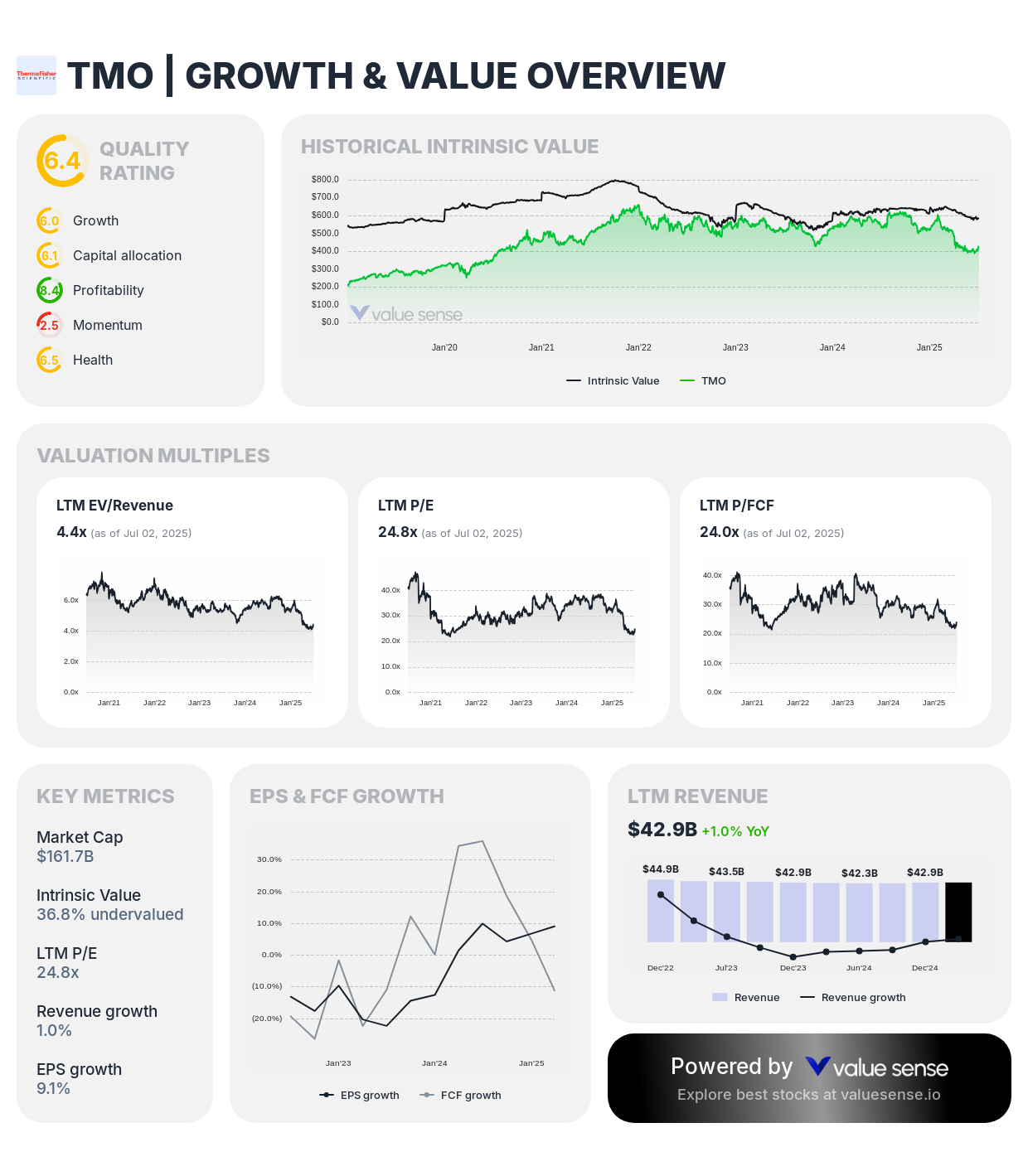

2. Thermo Fisher Scientific Inc. (TMO) - 36.8% Undervalued

Complete Growth Analysis:

- Quality Rating: 6.4 (Strong)

- Intrinsic Value: 36.8% undervalued

- 1-Year Return: (19.8%)

- Revenue: $42.9B

- Free Cash Flow: $6,724.0M

- Revenue Growth: 1.0%

- FCF Margin: 15.7%

Investment Thesis: Thermo Fisher Scientific demonstrates substantial undervaluation at 36.8% below intrinsic worth, reflecting the life sciences tools leader's essential role in pharmaceutical research, diagnostics, and biotechnology. The company's diversified portfolio and strategic positioning support long-term growth potential despite recent revenue moderation.

Investment Highlights:

- Leading position in life sciences tools and services with essential role in pharmaceutical R&D

- Diversified revenue streams across research, diagnostics, and analytical instruments

- Strategic acquisitions expanding capabilities and market reach

- Strong balance sheet supporting continued investment in innovation

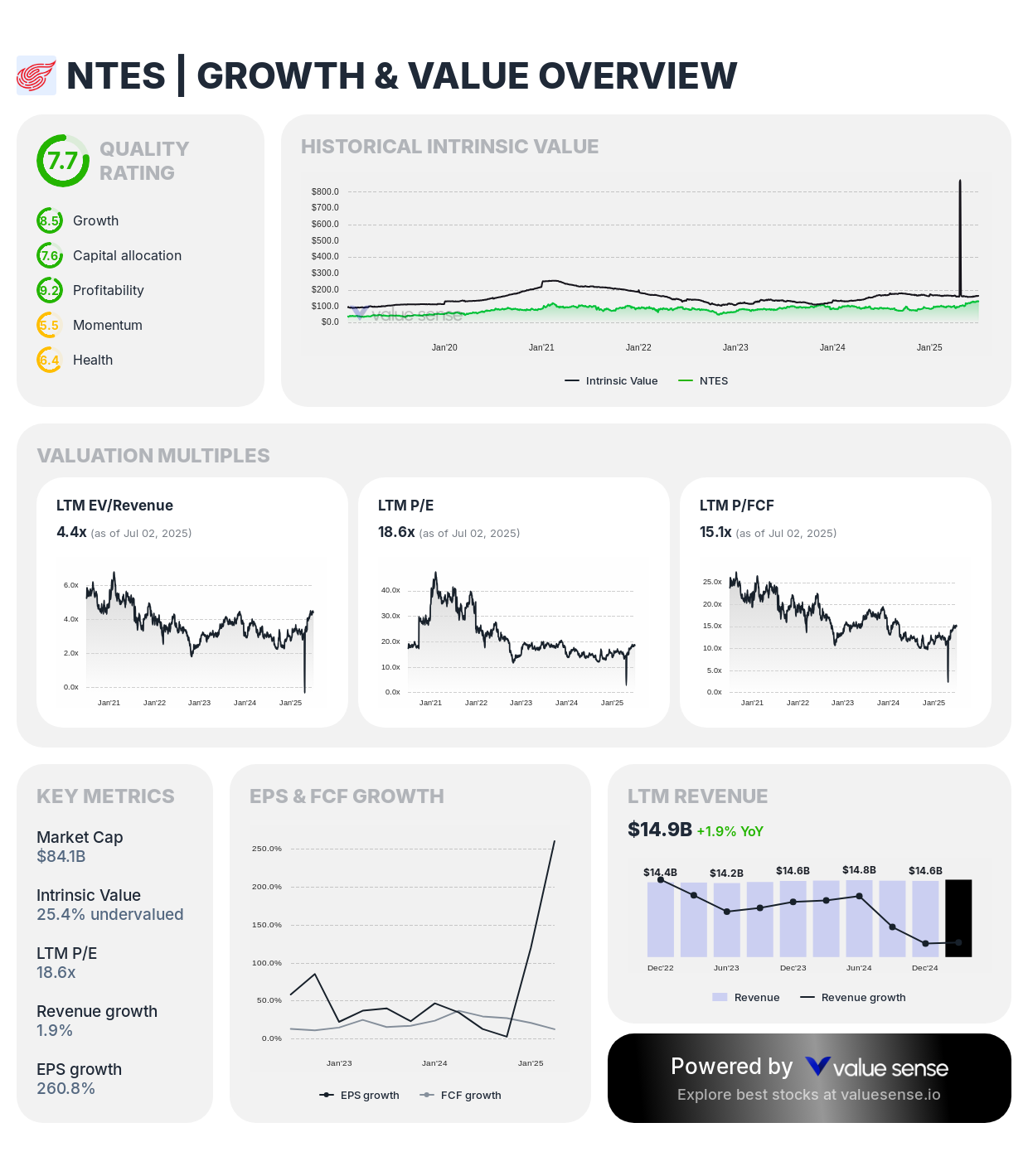

3. NetEase, Inc. (NTES) - 25.4% Undervalued

Complete Growth Analysis:

- Quality Rating: 7.1 (Strong)

- Intrinsic Value: 25.4% undervalued

- 1-Year Return: 44.8%

- Revenue: CN¥107.3B

- Free Cash Flow: CN¥40.0B

- Revenue Growth: 1.9%

- FCF Margin: 37.3%

Investment Thesis: NetEase presents attractive undervaluation at 25.4% below intrinsic value with strong quality rating of 7.1, reflecting the Chinese internet company's leadership in online gaming, music streaming, and educational technology. The company's exceptional free cash flow margin of 37.3% demonstrates operational efficiency.

Investment Highlights:

- Leading Chinese internet company with strong positions in gaming, music, and education

- Exceptional free cash flow generation with 37.3% margin

- International expansion opportunities providing additional growth vectors

- Strong competitive positioning in growing Chinese digital markets

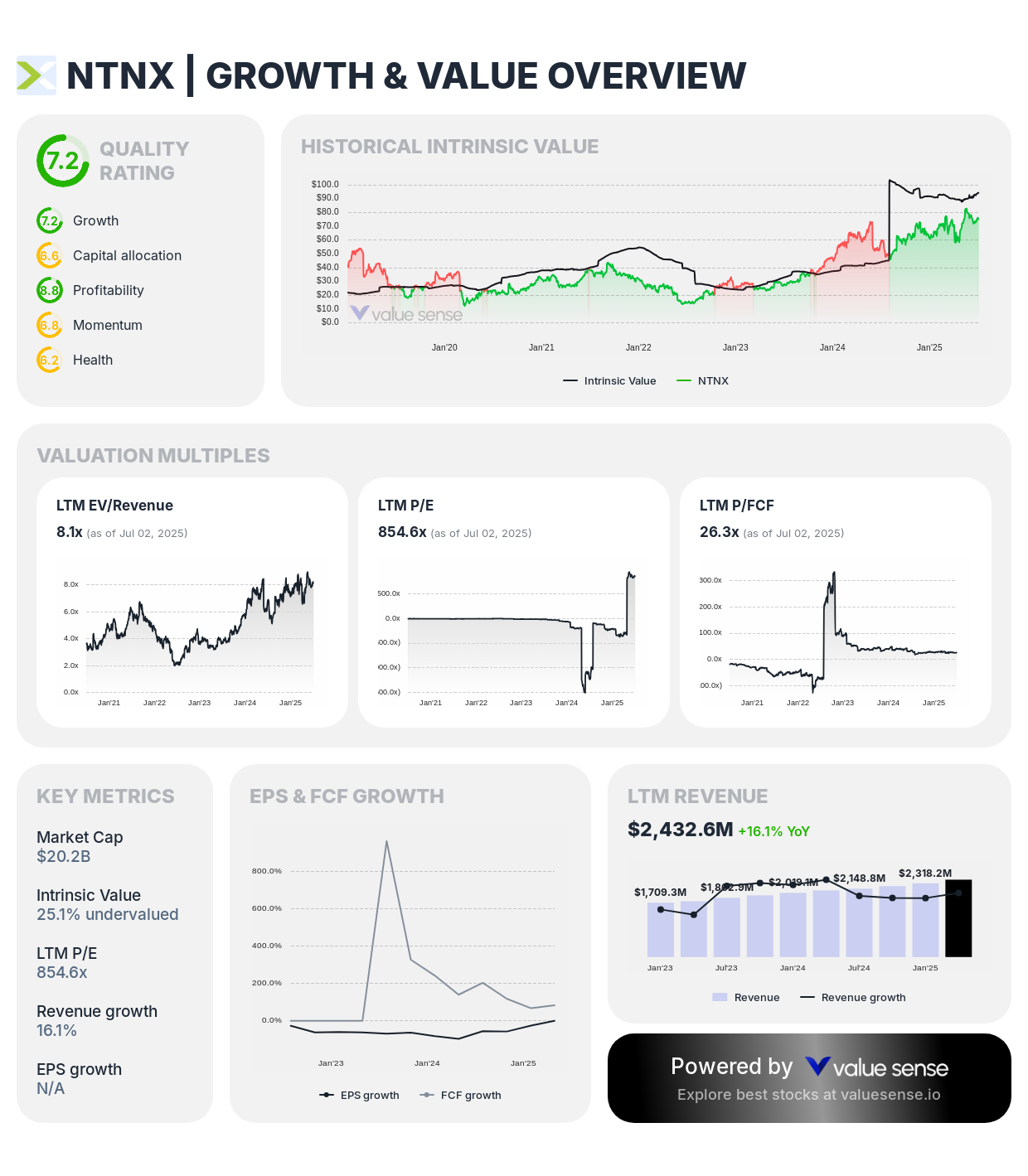

4. Nutanix, Inc. (NTNX) - 25.1% Undervalued

Complete Growth Analysis:

- Quality Rating: 7.2 (Strong)

- Intrinsic Value: 25.1% undervalued

- 1-Year Return: 26.2%

- Revenue: $2,432.6M

- Free Cash Flow: $766.7M

- Revenue Growth: 16.1%

- FCF Margin: 31.5%

Investment Thesis: Nutanix demonstrates solid undervaluation at 25.1% below intrinsic worth with strong quality rating of 7.2, reflecting the cloud infrastructure company's successful transformation to subscription-based services. The company's exceptional free cash flow margin of 31.5% and consistent revenue growth demonstrate operational improvements.

Investment Highlights:

- Leading provider of hyperconverged infrastructure and hybrid cloud solutions

- Successful transformation to subscription-based revenue model improving predictability

- Strong competitive positioning in growing enterprise cloud infrastructure market

- Exceptional operational leverage with 31.5% free cash flow margin

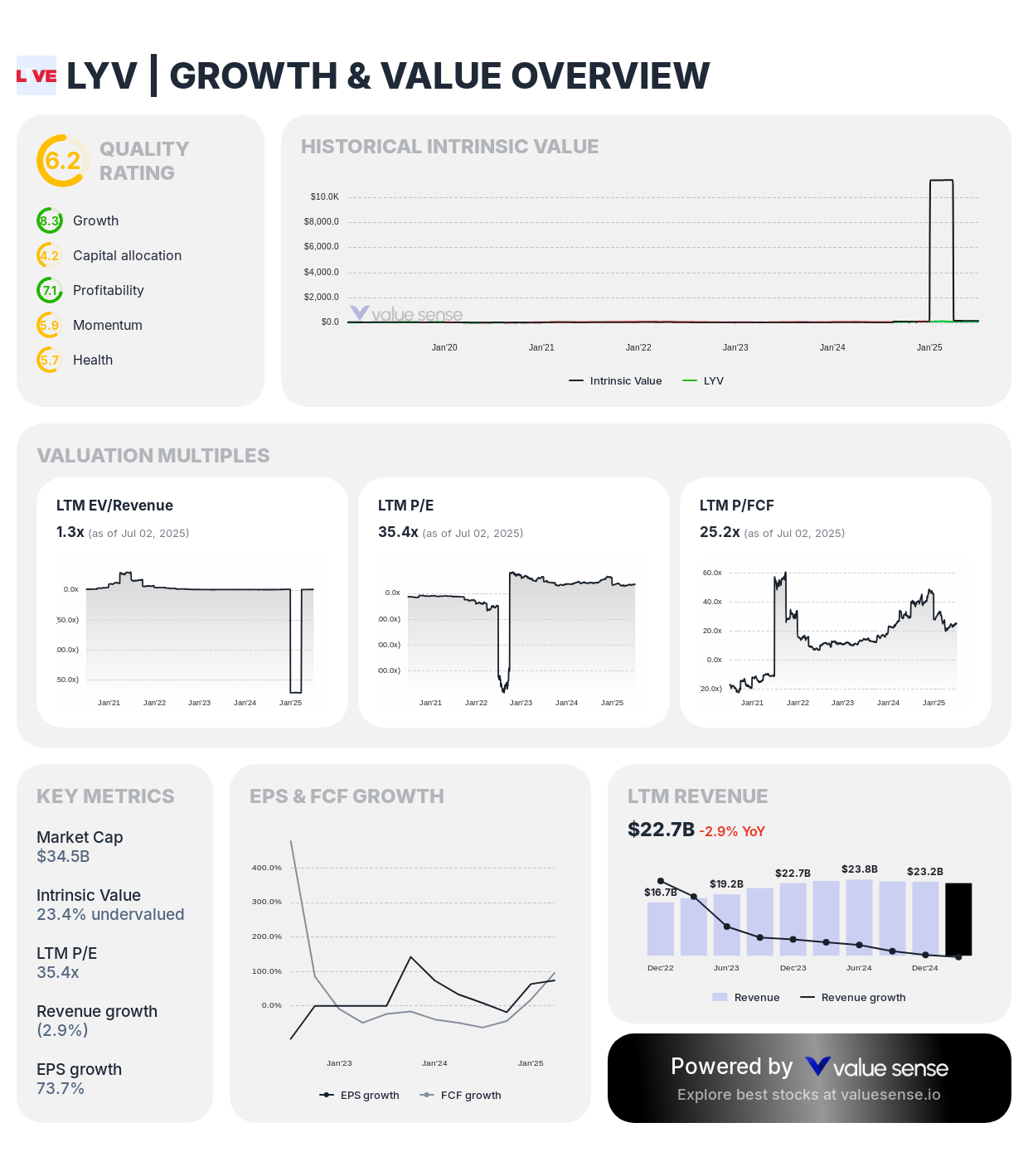

5. Live Nation Entertainment, Inc. (LYV) - 23.4% Undervalued

Complete Growth Analysis:

- Quality Rating: 6.2 (Strong)

- Intrinsic Value: 23.4% undervalued

- 1-Year Return: 54.2%

- Revenue: $22.7B

- Free Cash Flow: $1,365.7M

- Revenue Growth: (2.9%)

- FCF Margin: 6.0%

Investment Thesis: Live Nation presents attractive undervaluation at 23.4% below intrinsic value, reflecting the live entertainment leader's recovery from pandemic impacts and dominant market positioning. The company's integrated platform across ticketing, venues, and artist management creates sustainable competitive advantages.

Investment Highlights:

- Dominant position in live entertainment with integrated platform advantages

- Ticketmaster monopoly providing essential ticketing services with pricing power

- Extensive venue portfolio and artist relationships creating competitive moats

- Recovery potential from pandemic impacts with normalized entertainment demand

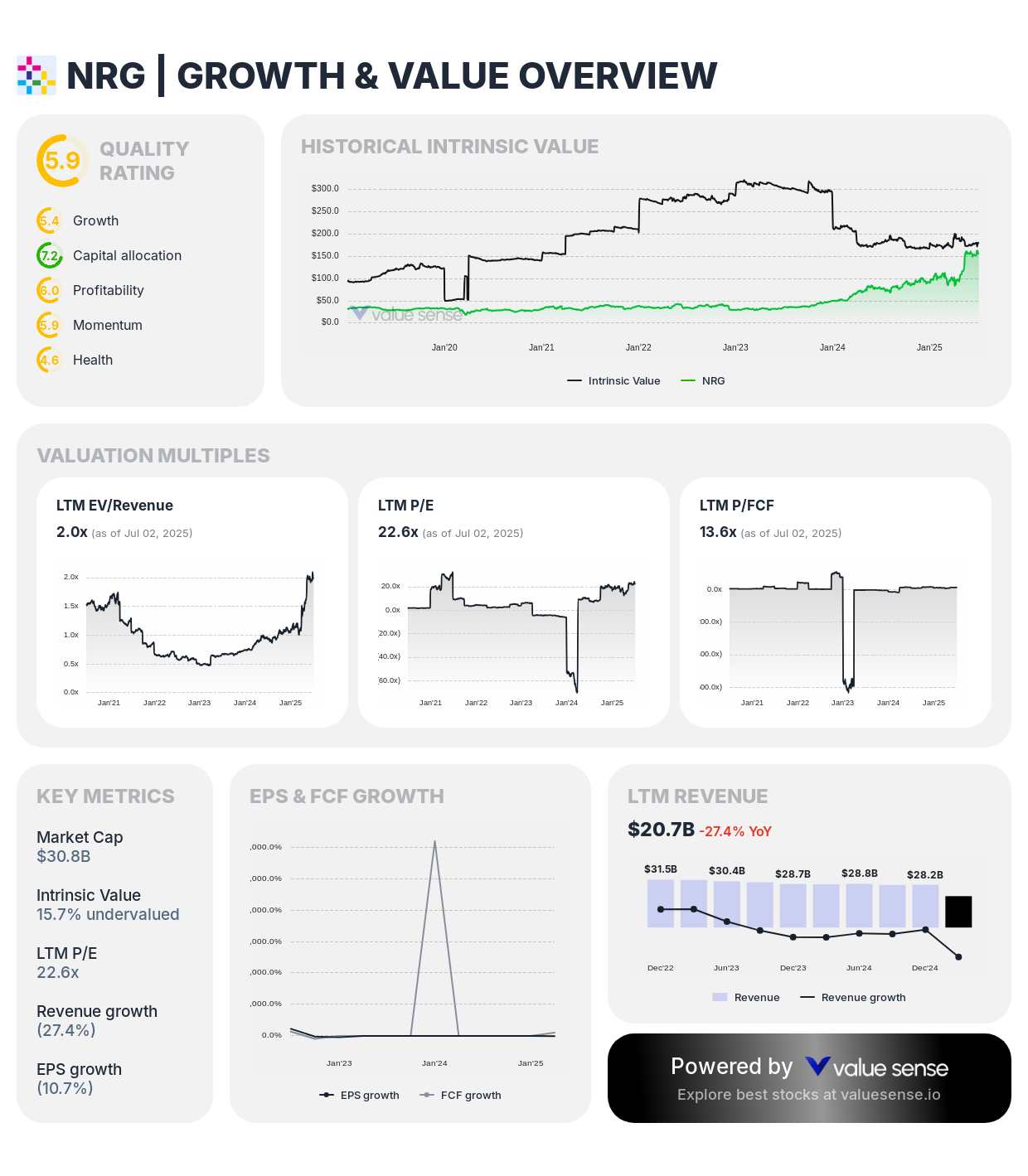

6. NRG Energy, Inc. (NRG) - 15.7% Undervalued

Complete Growth Analysis:

- Quality Rating: 6.0 (Strong)

- Intrinsic Value: 15.7% undervalued

- 1-Year Return: 102.6%

- Revenue: $20.7B

- Free Cash Flow: $2,263.0M

- Revenue Growth: (27.4%)

- FCF Margin: 10.9%

Investment Thesis: NRG Energy demonstrates moderate undervaluation at 15.7% below intrinsic worth despite strong recent performance, reflecting the power generation company's strategic transformation toward renewable energy and customer-focused services.

Investment Highlights:

- Diversified power generation portfolio with renewable energy expansion

- Competitive retail energy business providing customer relationships

- Strategic positioning for energy transition with renewable investments

- Strong cash generation supporting shareholder returns

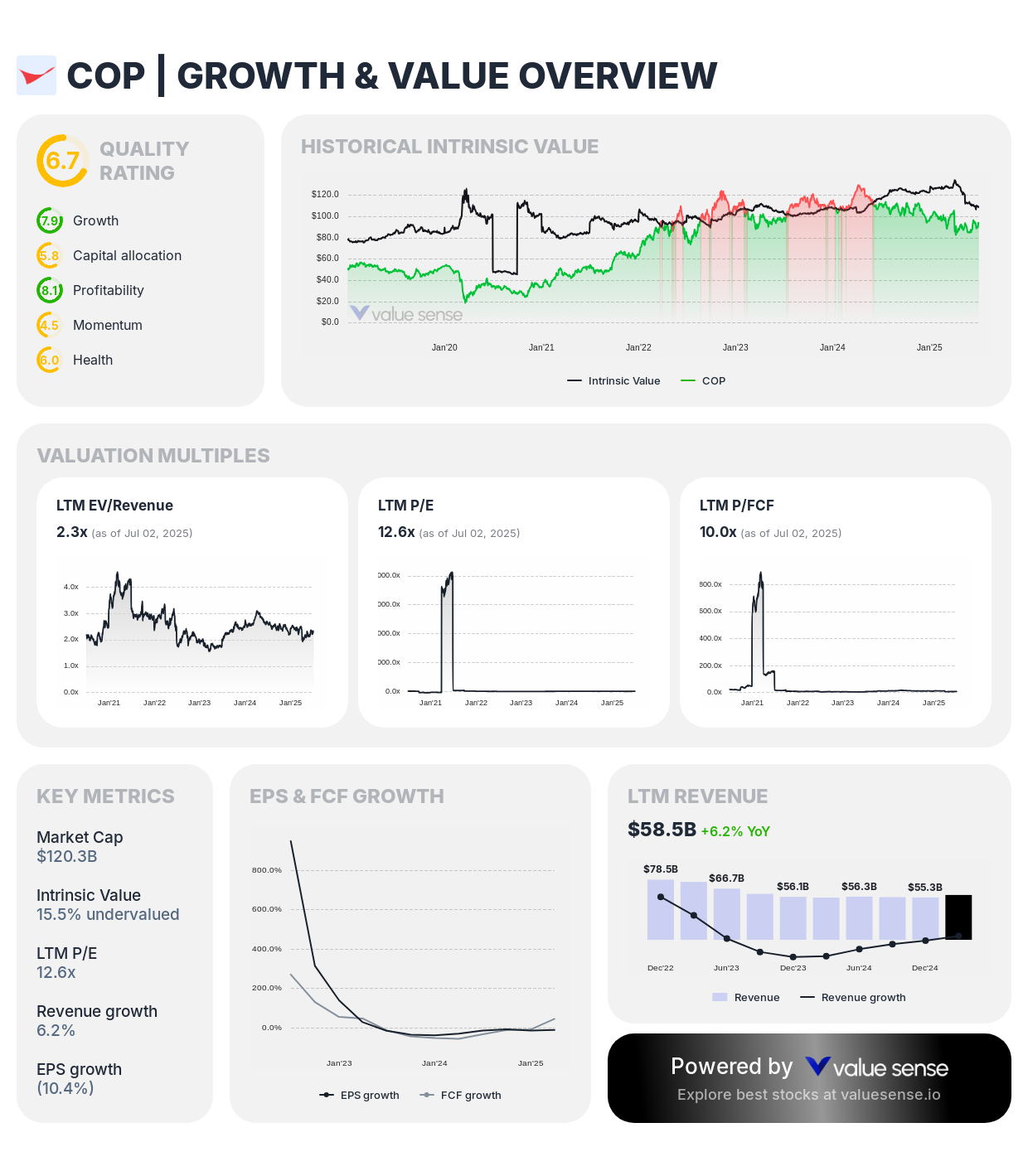

7. ConocoPhillips (COP) - 15.5% Undervalued

Complete Growth Analysis:

- Quality Rating: 6.7 (Strong)

- Intrinsic Value: 15.5% undervalued

- 1-Year Return: (15.4%)

- Revenue: $58.5B

- Free Cash Flow: $12.1B

- Revenue Growth: 6.2%

- FCF Margin: 20.6%

Investment Thesis: ConocoPhillips presents solid undervaluation at 15.5% below intrinsic value with strong quality rating of 6.7, reflecting the independent oil and gas company's disciplined capital allocation and operational efficiency. The company's exceptional free cash flow margin of 20.6% demonstrates superior cash generation capabilities.

Investment Highlights:

- Low-cost, diversified production portfolio with operational flexibility

- Disciplined capital allocation prioritizing shareholder returns

- Exceptional free cash flow generation with 20.6% margin

- Variable dividend policy providing additional returns during strong commodity cycles

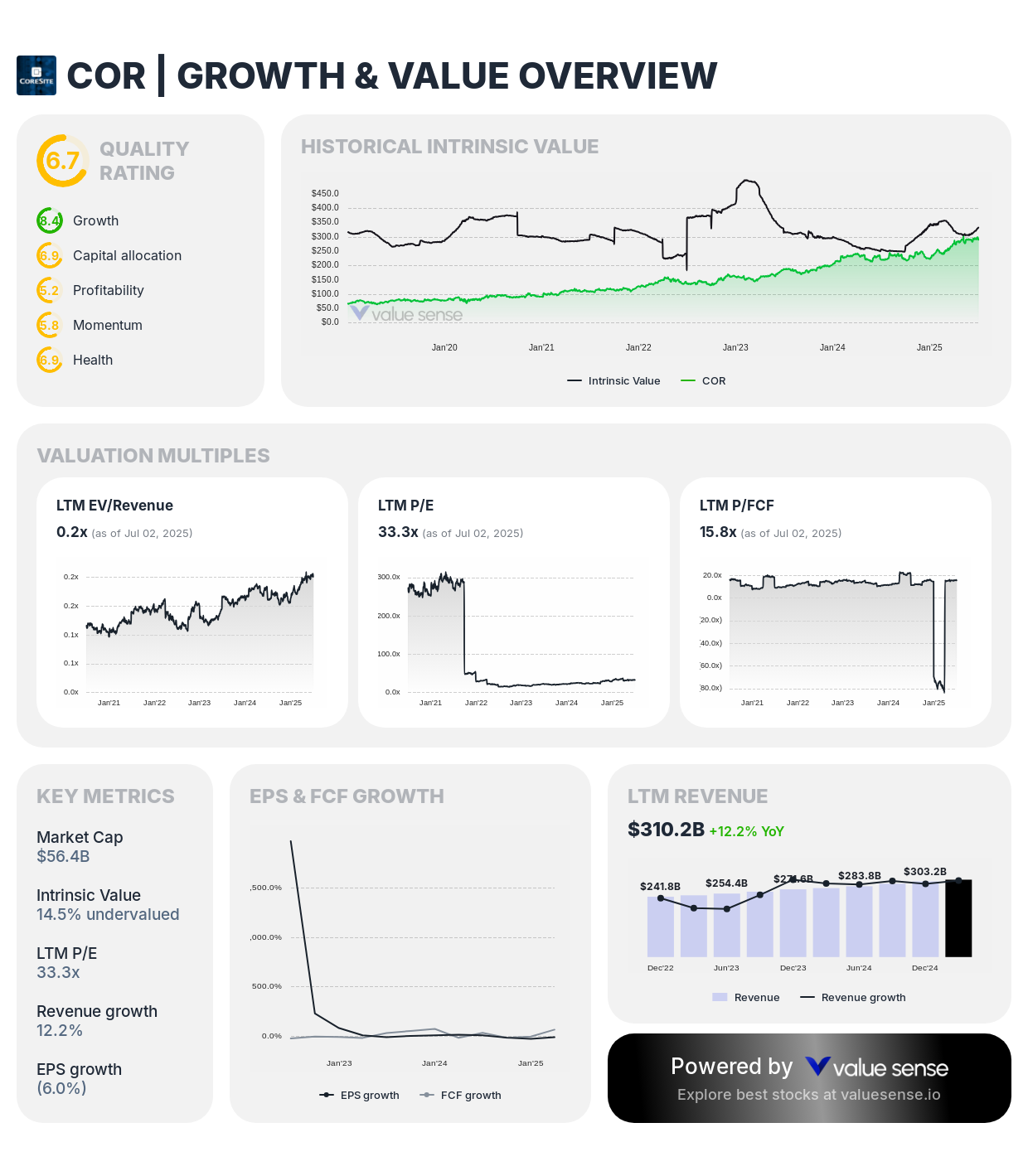

8. Cencora (COR) - 14.5% Undervalued

Complete Growth Analysis:

- Quality Rating: 6.7 (Strong)

- Intrinsic Value: 14.5% undervalued

- 1-Year Return: 31.7%

- Revenue: $310.2B

- Free Cash Flow: $3,575.3M

- Revenue Growth: 12.2%

- FCF Margin: 1.2%

Investment Thesis: Cencora demonstrates moderate undervaluation at 14.5% below intrinsic worth with strong quality rating of 6.7, reflecting the pharmaceutical distribution company's essential role in healthcare supply chains. The company's market leadership and operational scale create sustainable competitive advantages.

Investment Highlights:

- Leading pharmaceutical distribution company with essential market positioning

- Strong relationships with pharmaceutical manufacturers and healthcare providers

- Growing specialty pharmaceuticals distribution providing higher-margin opportunities

- Defensive business characteristics with predictable demand patterns

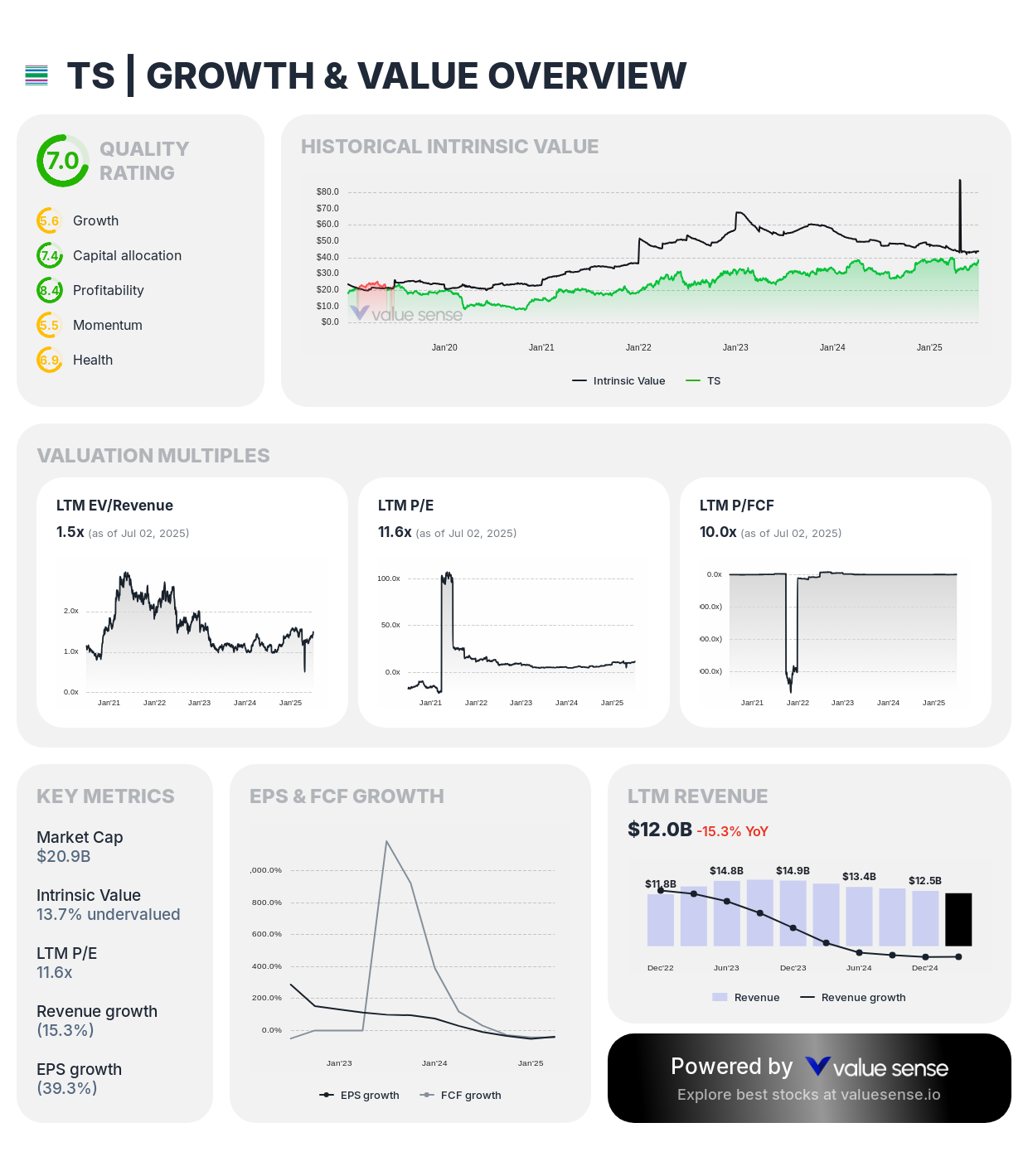

9. Tenaris S.A. (TS) - 13.7% Undervalued

Complete Growth Analysis:

- Quality Rating: 7.0 (Strong)

- Intrinsic Value: 13.7% undervalued

- 1-Year Return: 27.6%

- Revenue: $12.0B

- Free Cash Flow: $2,086.1M

- Revenue Growth: (15.3%)

- FCF Margin: 17.4%

Investment Thesis: Tenaris presents moderate undervaluation at 13.7% below intrinsic worth with strong quality rating of 7.0, reflecting the steel pipe manufacturer's technological leadership and global market position. The company's premium products and operational efficiency create competitive advantages.

Investment Highlights:

- Global leadership in oil country tubular goods with technological advantages

- Premium product portfolio commanding higher margins than commodity steel

- Strategic positioning in key oil and gas production regions

- Strong balance sheet and cash generation supporting operational flexibility

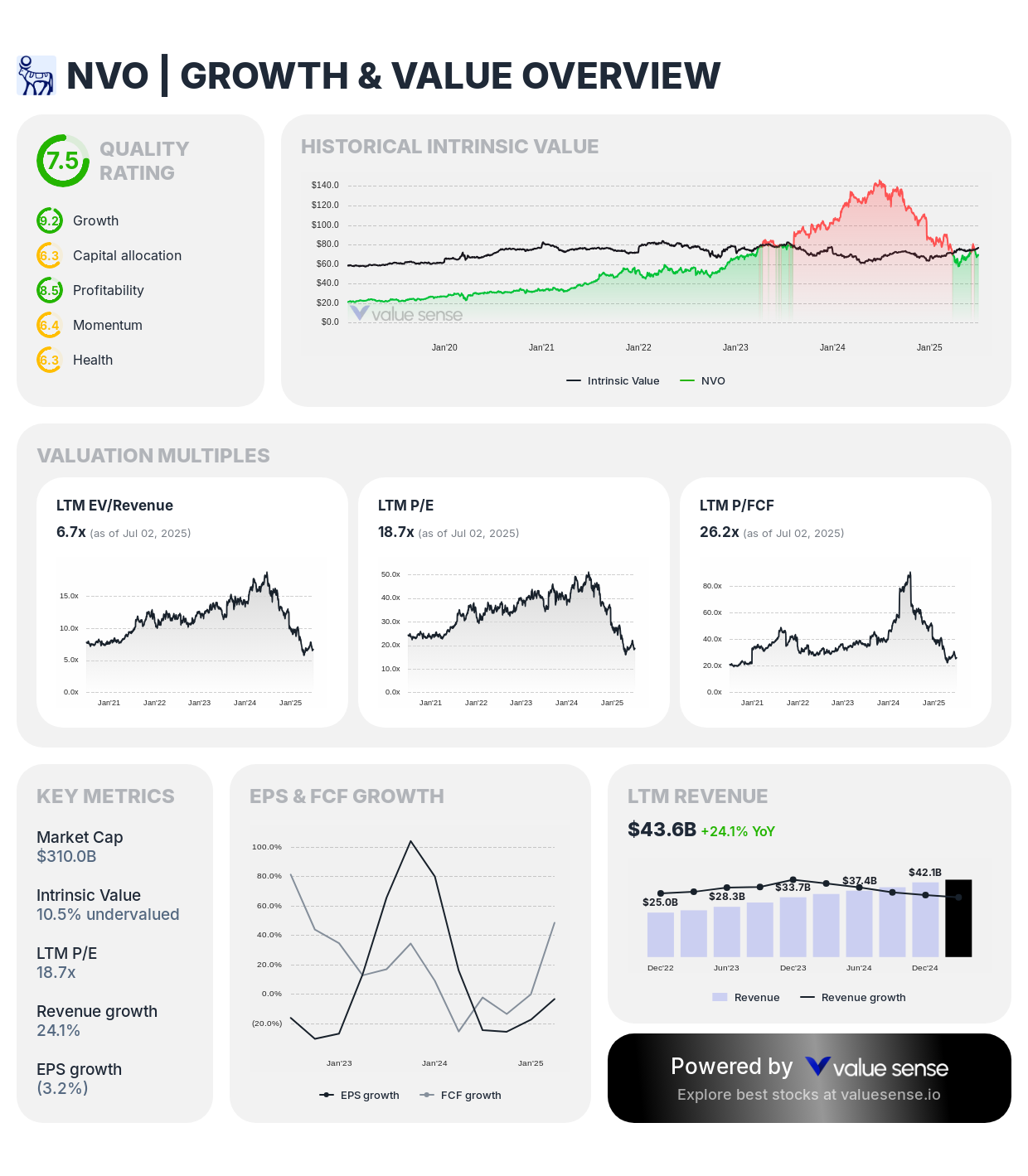

10. Novo Nordisk A/S (NVO) - 10.5% Undervalued

Complete Growth Analysis:

- Quality Rating: 7.5 (Strong)

- Intrinsic Value: 10.5% undervalued

- 1-Year Return: (51.0%)

- Revenue: DKK 303.1B

- Free Cash Flow: DKK 74.7B

- Revenue Growth: 24.1%

- FCF Margin: 24.7%

Investment Thesis: Novo Nordisk demonstrates modest undervaluation at 10.5% below intrinsic worth with exceptional quality rating of 7.5, reflecting the pharmaceutical company's leadership in diabetes care and breakthrough obesity treatments. The company's specialized focus and market expansion create substantial growth potential.

Investment Highlights:

- Global leadership in diabetes care with expanding patient populations worldwide

- Revolutionary obesity treatments addressing massive addressable markets with premium pricing

- Continuous innovation in drug delivery systems and treatment effectiveness

- Strong international expansion opportunities in emerging healthcare markets

11. Workday, Inc. (WDAY) - 10.0% Undervalued

Complete Growth Analysis:

- Quality Rating: 6.5 (Strong)

- Intrinsic Value: 10.0% undervalued

- 1-Year Return: 4.8%

- Revenue: $8,696.0M

- Free Cash Flow: $1,901.0M

- Revenue Growth: 15.3%

- FCF Margin: 21.9%

Investment Thesis: Workday presents modest undervaluation at 10.0% below intrinsic worth with strong quality rating of 6.5, reflecting the enterprise software company's leadership in human capital management and financial management applications. The company's subscription model and market expansion provide growth opportunities.

Investment Highlights:

- Leading provider of cloud-based human capital management and financial applications

- Strong subscription-based revenue model providing predictable recurring revenue

- Expanding product portfolio and international market opportunities

- Excellent free cash flow generation with 21.9% margin demonstrating operational efficiency

Undervalued Growth Investment Strategy

Prioritize Quality with Attractive Valuations: Focus on companies combining substantial undervaluation with strong business fundamentals. Adobe (46.0% undervalued, 7.7 quality) and Thermo Fisher (36.8% undervalued, 6.4 quality) offer exceptional value opportunities with proven growth capabilities.

Diversify Across Growth Themes: Spread investments across software (Adobe, Nutanix, Workday), healthcare (Thermo Fisher, Novo Nordisk, Cencora), energy (ConocoPhillips, NRG, Tenaris), entertainment (Live Nation), and technology (NetEase) to capture different growth drivers while reducing concentration risk.

Balance Growth Rates with Sustainability: Companies demonstrating sustainable expansion avoid the execution risks of hypergrowth companies. This balanced approach provides attractive returns with reduced volatility and valuation risk.

Monitor Free Cash Flow Generation: Strong free cash flow margins like Adobe (41.8%), NetEase (37.3%), and Nutanix (31.5%) indicate companies converting revenue growth into actual cash generation, providing financial flexibility and shareholder return capabilities.

Key Takeaways for Growth Value Investors

✅ Exceptional Value Leaders: Adobe (46.0%) and Thermo Fisher (36.8%) offer substantial undervaluation with quality growth characteristics

✅ Balanced Growth Focus: Companies demonstrate sustainable expansion without hypergrowth execution risks

✅ Quality Emphasis: All companies maintain quality ratings above 6.0 indicating strong business fundamentals

✅ Cash Generation Excellence: Multiple companies demonstrate exceptional free cash flow margins above 20%

✅ Sector Diversification: Opportunities span software, healthcare, energy, entertainment, and technology sectors

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best Long-Term Stocks to Buy

📖 11 Best Undervalued Healthcare Stocks

📖 7 Best Undervalued Tech Stocks with Realistic Upside

FAQ About Undervalued Growth Investing

What makes this the optimal range for sustainable expansion?

Revenue growth rates in the sustainable range represent the sweet spot where companies demonstrate proven expansion capabilities without the execution risks and valuation premiums associated with hypergrowth companies. This range indicates businesses with sustainable competitive advantages, scalable operations, and market opportunities that support continued growth.

How do you evaluate the sustainability of revenue growth in these companies?

Growth sustainability evaluation focuses on competitive positioning, market opportunity size, business model scalability, and operational efficiency improvements. Companies like Adobe with subscription models and Novo Nordisk with demographic tailwinds demonstrate more predictable growth than those dependent on cyclical factors alone.

Why do quality growth companies sometimes trade below intrinsic value?

Quality growth companies may trade below intrinsic value due to temporary market sentiment, sector rotation, competitive concerns, or macroeconomic uncertainty. Adobe's 46.0% undervaluation reflects concerns about AI disruption despite strong competitive positioning, while Thermo Fisher's discount stems from post-COVID normalization concerns.

What role should these stocks play in a growth-oriented portfolio?

Undervalued growth stocks should form the core foundation of growth portfolios, typically representing 60-80% of equity allocations for growth-focused investors. These companies provide both appreciation potential and relative stability through proven business models and sustainable competitive advantages.

How do investors balance growth potential with valuation discipline?

Successful growth investing requires balancing growth prospects with valuation reasonableness to avoid overpaying for future potential. Our focus on companies trading below intrinsic value while demonstrating sustainable growth provides this balance, offering appreciation potential without extreme valuation risk.

Important Note on Growth Investing: Growth investing requires balancing expansion potential with valuation discipline and execution risk assessment. While these companies demonstrate attractive growth characteristics, success depends on continued competitive advantages, market expansion, and operational execution. Diversification across growth themes and quality focus help manage these risks while capturing upside potential.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Growth companies carry risks including competitive pressures, execution challenges, and market volatility. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.