Best Undervalued S&P 500 Stocks: Top Value Opportunities with Strong Fundamentals

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The S&P 500 continues to offer compelling opportunities for value investors willing to look beyond market sentiment and focus on fundamental analysis. In today's market environment, identifying quality companies trading below their intrinsic value has become increasingly important for building a resilient investment portfolio.

At ValueSense, we analyze thousands of data points to identify the most promising undervalued opportunities within the S&P 500. Our comprehensive screening process evaluates companies based on quality ratings, intrinsic value calculations, free cash flow generation, profitability metrics, and balance sheet strength. The following companies represent our top picks for undervalued S&P 500 stocks that combine strong fundamentals with significant upside potential.

What Makes These Stocks Undervalued?

Our analysis focuses on companies demonstrating a clear disconnect between their current market price and calculated intrinsic value. Each company in our selection maintains strong operational metrics, healthy cash generation, and sustainable competitive advantages while trading at substantial discounts to their estimated fair value. This creates compelling risk-adjusted return opportunities for patient investors.

Top 10 Undervalued S&P 500 Stocks

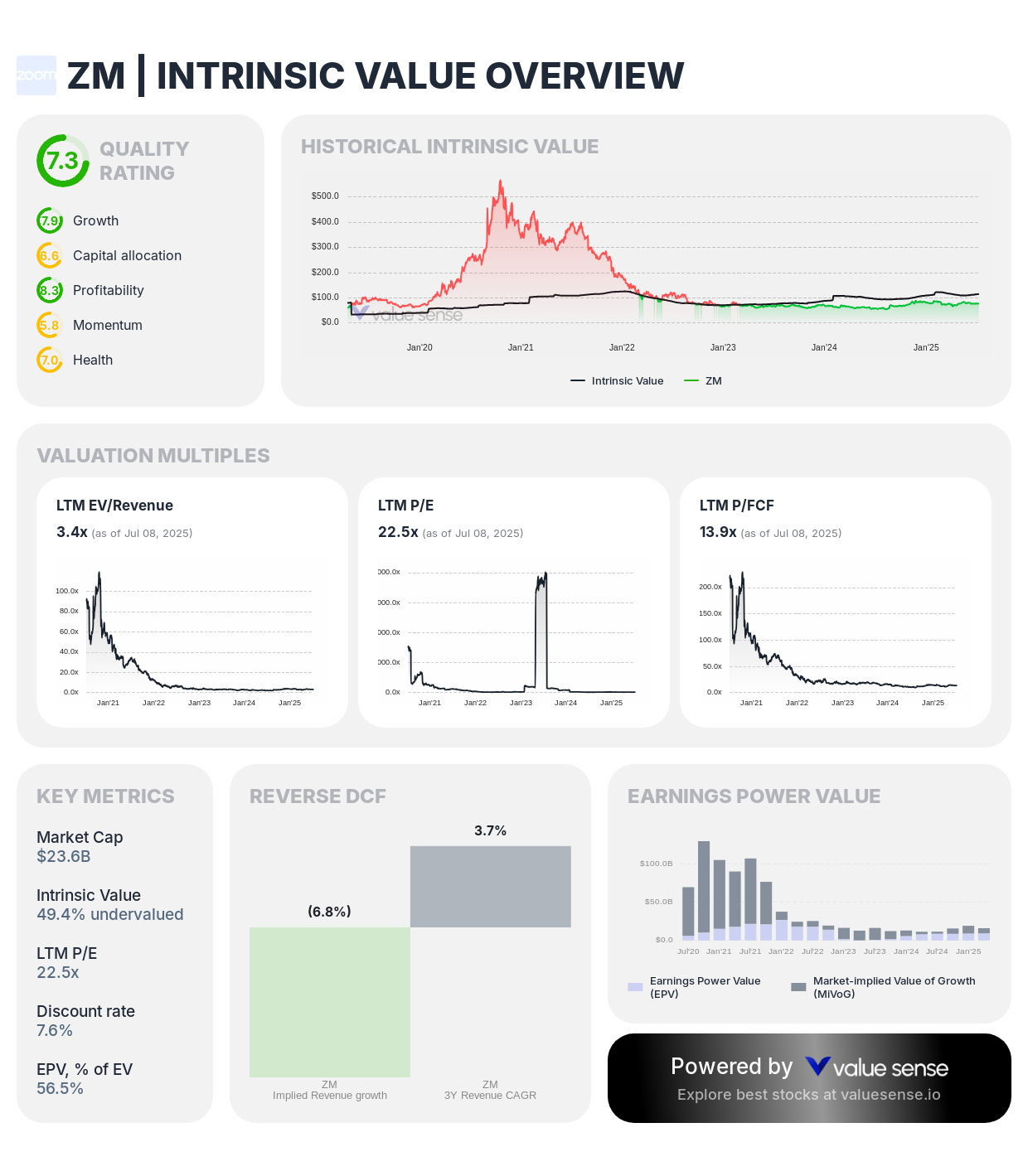

1. Zoom Video Communications (ZM)

Zoom Video Communications represents one of the most significantly undervalued technology stocks in our analysis, trading at nearly half its calculated intrinsic value despite maintaining exceptional profitability metrics.

Key Financial Metrics:

- Quality Rating: 7.3 (Strong) - Demonstrates consistent operational excellence

- Intrinsic Value: 49.4% undervalued - Most significant discount in our analysis

- 1-Year Return: 34.9% - Strong recent performance with continued upside potential

- Revenue: $$4,698.9M - Solid revenue base with recurring subscription model

- Free Cash Flow: $$1,702.4M - Exceptional cash generation capabilities

- Revenue Growth: 3.0% - Stable growth in mature communication market

- FCF Margin: 36.2% - Industry-leading profitability metrics

- Gross Margin: 75.9% - Strong pricing power and operational efficiency

- ROIC: 47.3% - Exceptional return on invested capital

- Total Debt to Equity: 0.7% - Virtually debt-free balance sheet

The company's dominant position in video conferencing technology, combined with its expansion into comprehensive communications platforms, positions it well for sustained growth as hybrid work models become permanent fixtures in the corporate landscape.

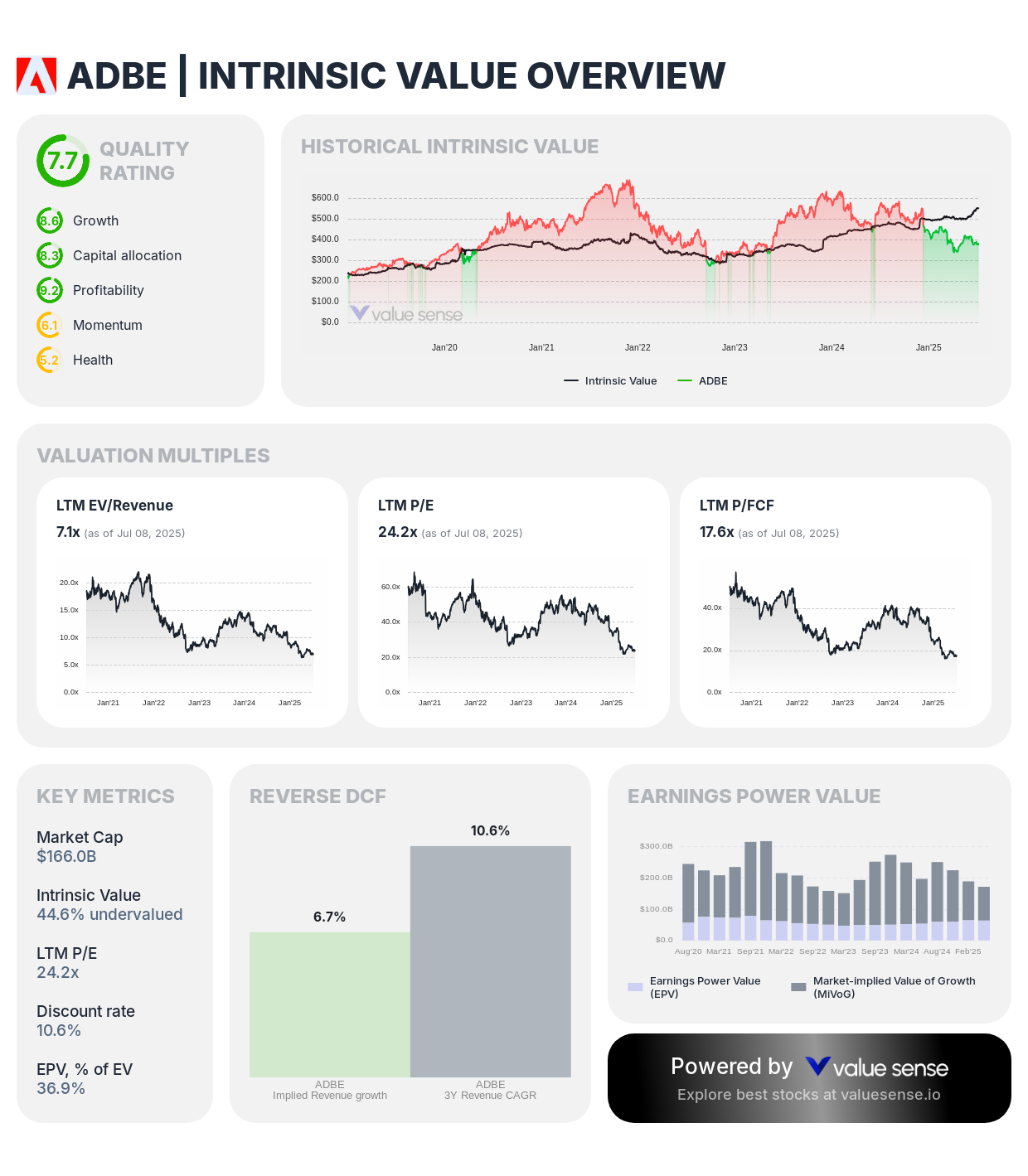

2. Adobe Inc. (ADBE)

Adobe Inc. stands out as a premier software company trading at a significant discount to its intrinsic value, despite maintaining market-leading positions across creative and digital marketing solutions.

Key Financial Metrics:

- Quality Rating: 7.7 (Strong) - Highest quality rating in our analysis

- Intrinsic Value: 44.6% undervalued - Substantial valuation gap presents opportunity

- 1-Year Return: (33.6%) - Recent weakness creates attractive entry point

- Revenue: $$22.6B - Large-scale subscription-based revenue model

- Free Cash Flow: $$9,437.0M - Outstanding cash generation capabilities

- Revenue Growth: 10.6% - Solid double-digit growth trajectory

- FCF Margin: 41.8% - Exceptional profitability metrics

- Gross Margin: 89.2% - Industry-leading margins demonstrate pricing power

- ROIC: 38.8% - Excellent capital efficiency

- Total Debt to Equity: 6.3% - Strong balance sheet with minimal leverage

Adobe's successful transition to a subscription model has created predictable revenue streams, while its artificial intelligence integration initiatives position the company for accelerated growth in the evolving digital content creation landscape.

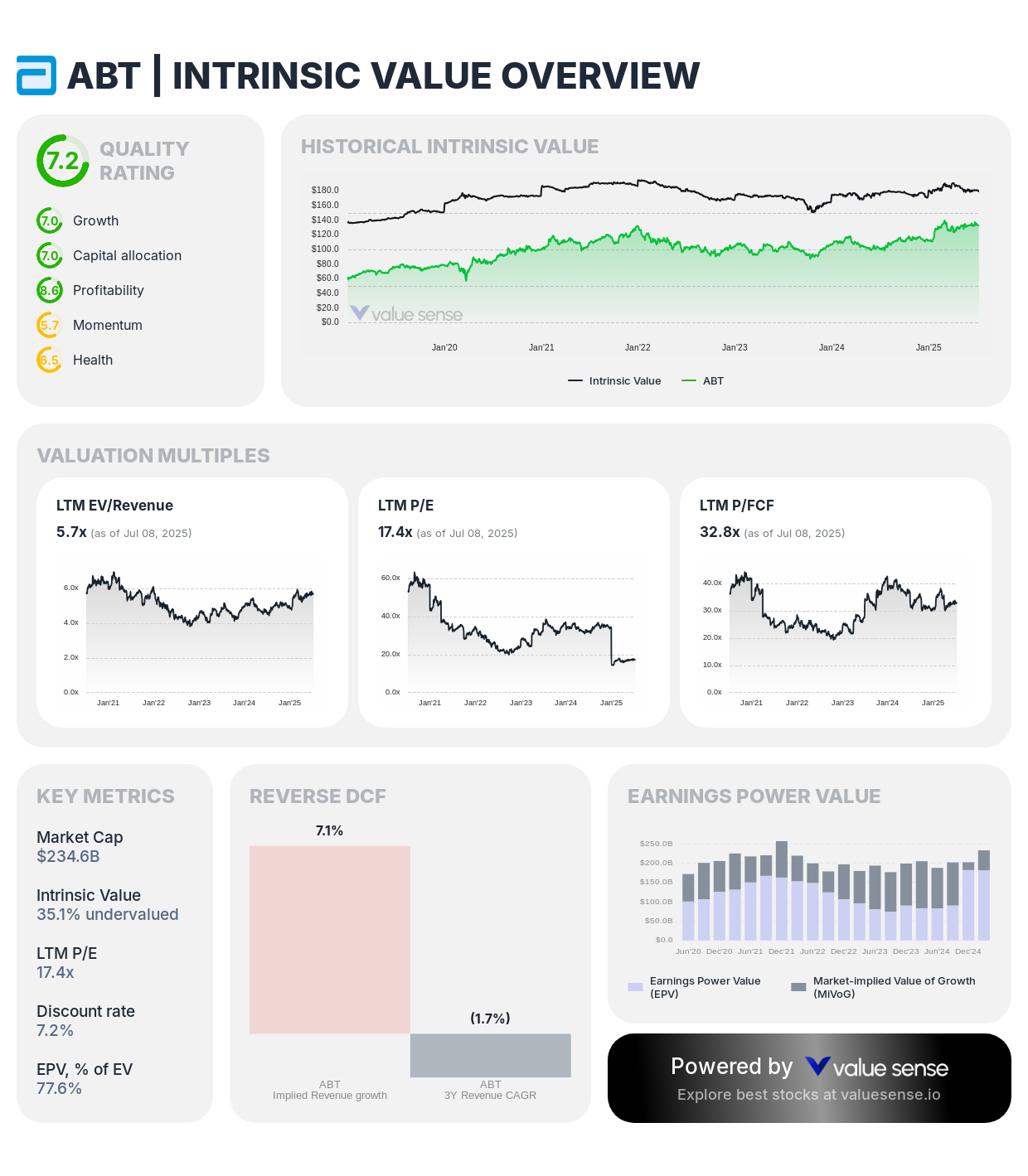

3. Abbott Laboratories (ABT)

Abbott Laboratories offers investors defensive healthcare exposure while trading at an attractive discount to its calculated intrinsic value, supported by diversified revenue streams and consistent cash generation.

Key Financial Metrics:

- Quality Rating: 7.2 (Strong) - Solid quality metrics across healthcare segments

- Intrinsic Value: 35.1% undervalued - Significant valuation opportunity

- 1-Year Return: 32.6% - Strong performance with continued upside potential

- Revenue: $$42.3B - Diversified healthcare revenue base

- Free Cash Flow: $$7,141.0M - Robust cash generation supports dividend growth

- Revenue Growth: 5.0% - Steady growth in defensive healthcare sector

- FCF Margin: 16.9% - Healthy profitability metrics

- Gross Margin: 66.4% - Strong pricing power across product lines

- ROIC: 24.8% - Efficient capital allocation

- Total Debt to Equity: 14.1% - Conservative debt management

The company's diversified portfolio spanning medical devices, diagnostics, nutrition, and pharmaceuticals provides stability and multiple growth avenues across various healthcare markets.

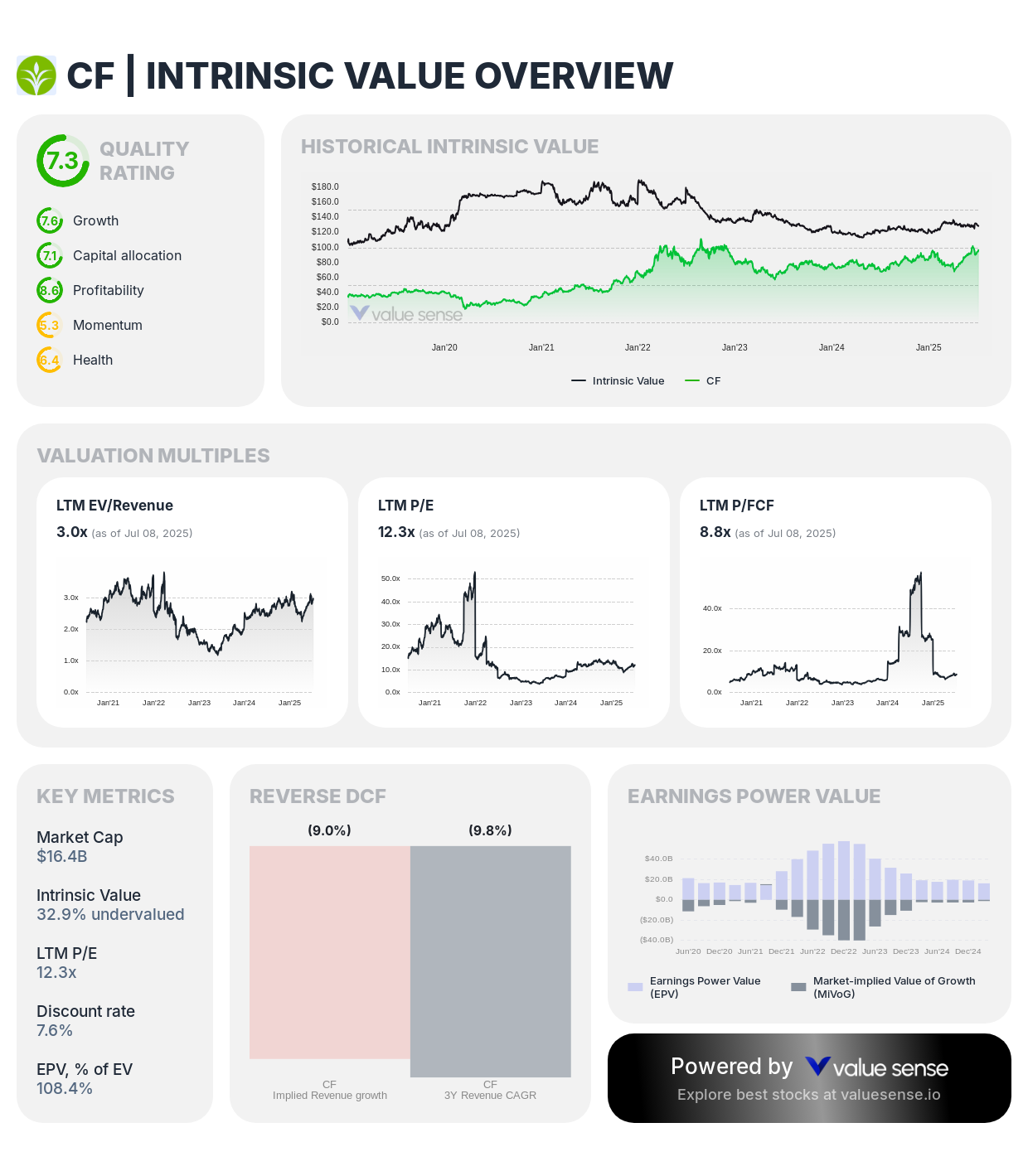

4. CF Industries Holdings (CF)

CF Industries Holdings represents a compelling value opportunity in the agricultural sector, benefiting from strong nitrogen fertilizer demand while trading below its calculated fair value.

Key Financial Metrics:

- Quality Rating: 7.3 (Strong) - Leading market position in nitrogen fertilizers

- Intrinsic Value: 32.9% undervalued - Attractive valuation discount

- 1-Year Return: 42.6% - Strong recent performance with more upside potential

- Revenue: $$6,129.0M - Substantial revenue base in essential agricultural inputs

- Free Cash Flow: $$1,860.0M - Excellent cash generation capabilities

- Revenue Growth: 0.7% - Stable revenue in cyclical commodity business

- FCF Margin: 30.3% - Outstanding profitability metrics

- Gross Margin: 36.2% - Strong operational efficiency

- ROIC: 10.6% - Solid returns on invested capital

- Total Debt to Equity: 45.2% - Manageable debt levels

The company's strategic position in nitrogen fertilizer production, combined with growing global food demand and constrained supply capacity, creates favorable long-term fundamentals for sustained profitability.

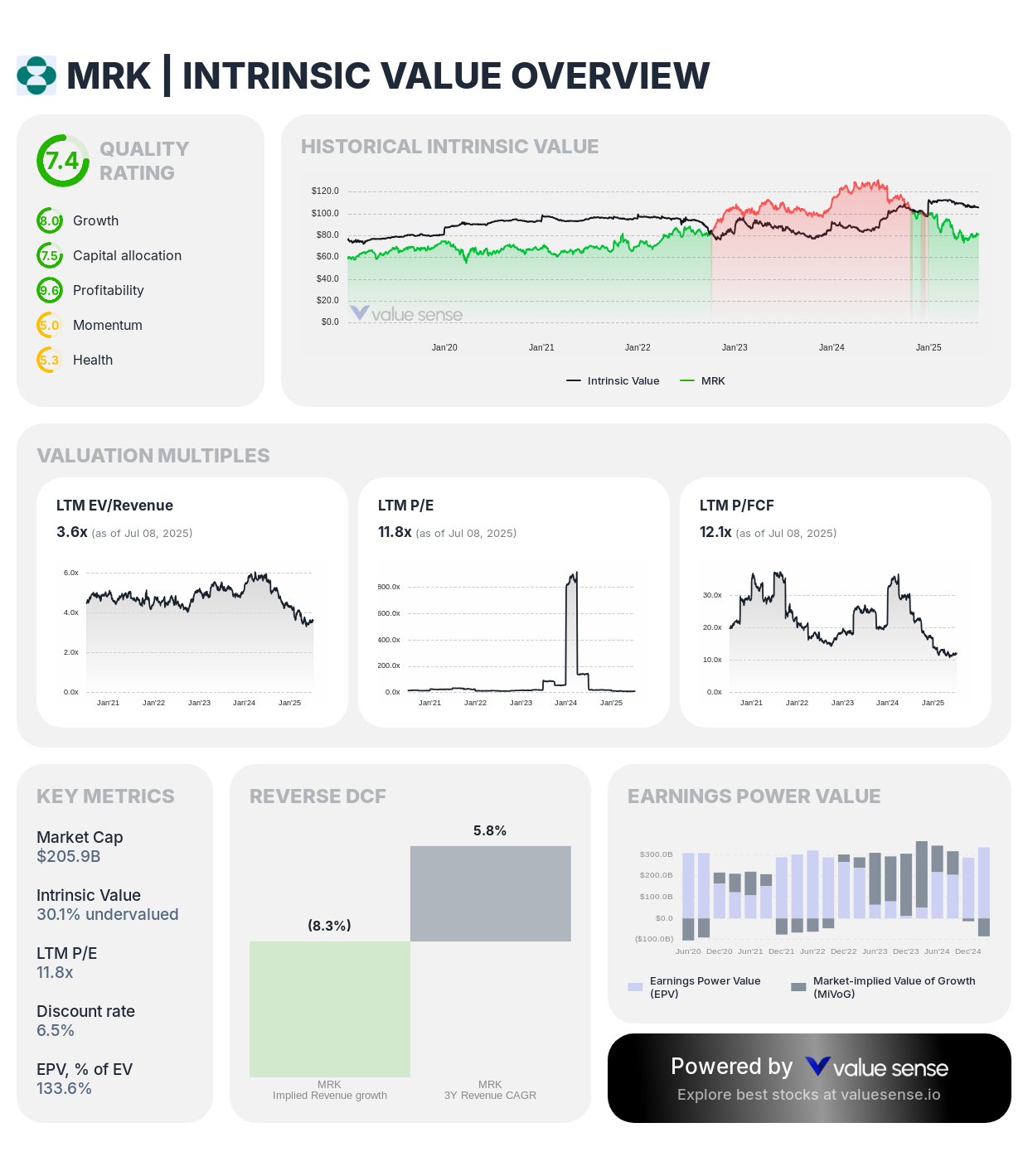

5. Merck & Co. (MRK)

Merck & Co. represents a premier pharmaceutical investment opportunity, combining a strong pipeline with attractive valuation metrics and consistent cash generation capabilities.

Key Financial Metrics:

- Quality Rating: 7.4 (Strong) - High-quality pharmaceutical operations

- Intrinsic Value: 30.1% undervalued - Significant discount to fair value

- 1-Year Return: (34.4%) - Recent weakness creates buying opportunity

- Revenue: $$63.9B - Large-scale pharmaceutical revenue base

- Free Cash Flow: $$17.0B - Exceptional cash generation capabilities

- Revenue Growth: 4.1% - Steady growth in pharmaceutical markets

- FCF Margin: 26.7% - Strong profitability metrics

- Gross Margin: 82.0% - Excellent pricing power

- ROIC: 27.9% - Efficient capital deployment

- Total Debt to Equity: 72.1% - Reasonable leverage for pharmaceutical company

Merck's strong position in oncology and vaccine markets, combined with a robust pipeline of innovative treatments, positions the company for sustained growth in the expanding global healthcare market.

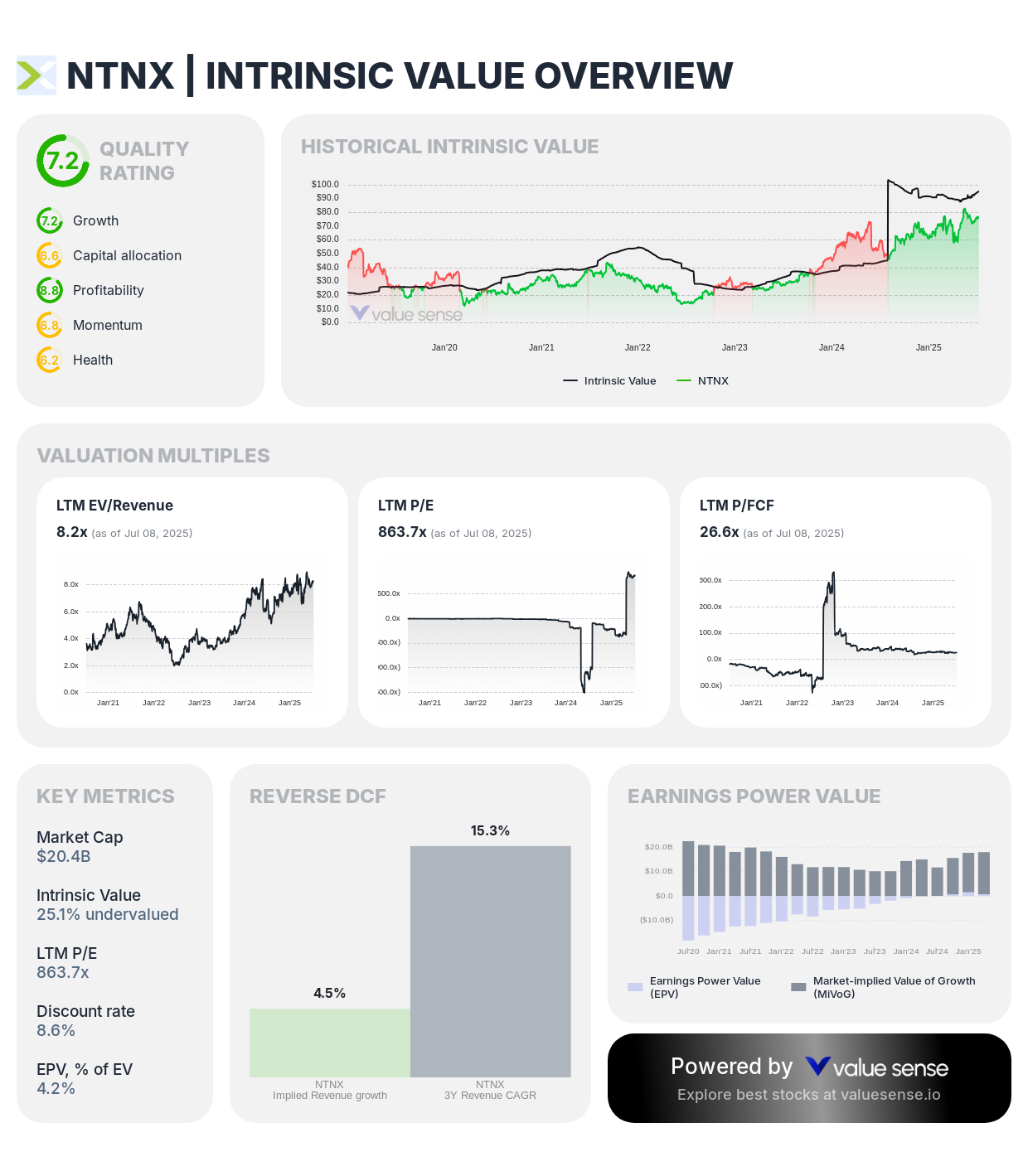

6. Nutanix Inc. (NTNX)

Nutanix Inc. offers investors exposure to the rapidly growing cloud infrastructure market while trading at a meaningful discount to its calculated intrinsic value.

Key Financial Metrics:

- Quality Rating: 7.2 (Strong) - Leading hyperconverged infrastructure solutions

- Intrinsic Value: 25.1% undervalued - Attractive valuation opportunity

- 1-Year Return: 27.7% - Strong momentum with continued upside potential

- Revenue: $$2,432.6M - Growing subscription-based revenue model

- Free Cash Flow: $$766.7M - Improving cash generation profile

- Revenue Growth: 16.1% - Strong double-digit growth trajectory

- FCF Margin: 31.5% - Excellent profitability metrics

- Gross Margin: 86.4% - Software-like margins

- ROIC: 14.8% - Improving capital efficiency

- Total Debt to Equity: (212.6%) - Negative equity from growth investments

The company's successful transition to a subscription model and strong position in hybrid cloud infrastructure solutions position it well for continued growth as enterprises modernize their IT infrastructure.

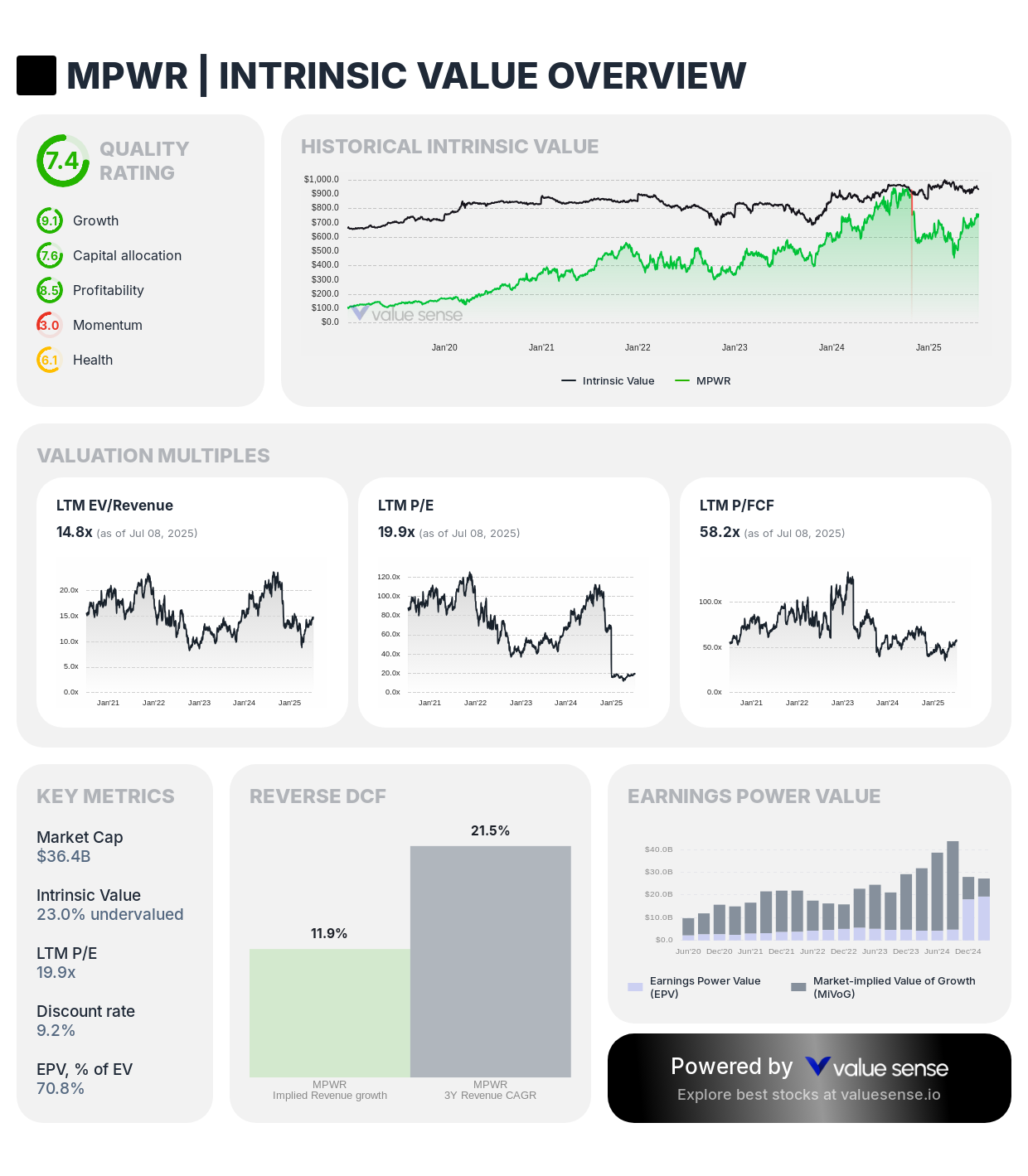

7. Monolithic Power Systems (MPWR)

Monolithic Power Systems stands out in the semiconductor sector with its specialized focus on power management solutions, trading below intrinsic value despite exceptional growth metrics.

Key Financial Metrics:

- Quality Rating: 7.4 (Strong) - Leading analog semiconductor solutions

- Intrinsic Value: 23.0% undervalued - Solid valuation discount

- 1-Year Return: (10.3%) - Recent weakness creates opportunity

- Revenue: $$2,386.8M - Diversified end-market exposure

- Free Cash Flow: $$626.3M - Strong cash generation capabilities

- Revenue Growth: 30.6% - Exceptional growth trajectory

- FCF Margin: 26.2% - Excellent profitability

- Gross Margin: 55.4% - Strong pricing power

- ROIC: 162.1% - Outstanding capital efficiency

- Total Debt to Equity: 0.0% - Debt-free balance sheet

The company's focus on power management solutions across automotive, industrial, and consumer electronics markets positions it well for growth driven by electrification and energy efficiency trends.

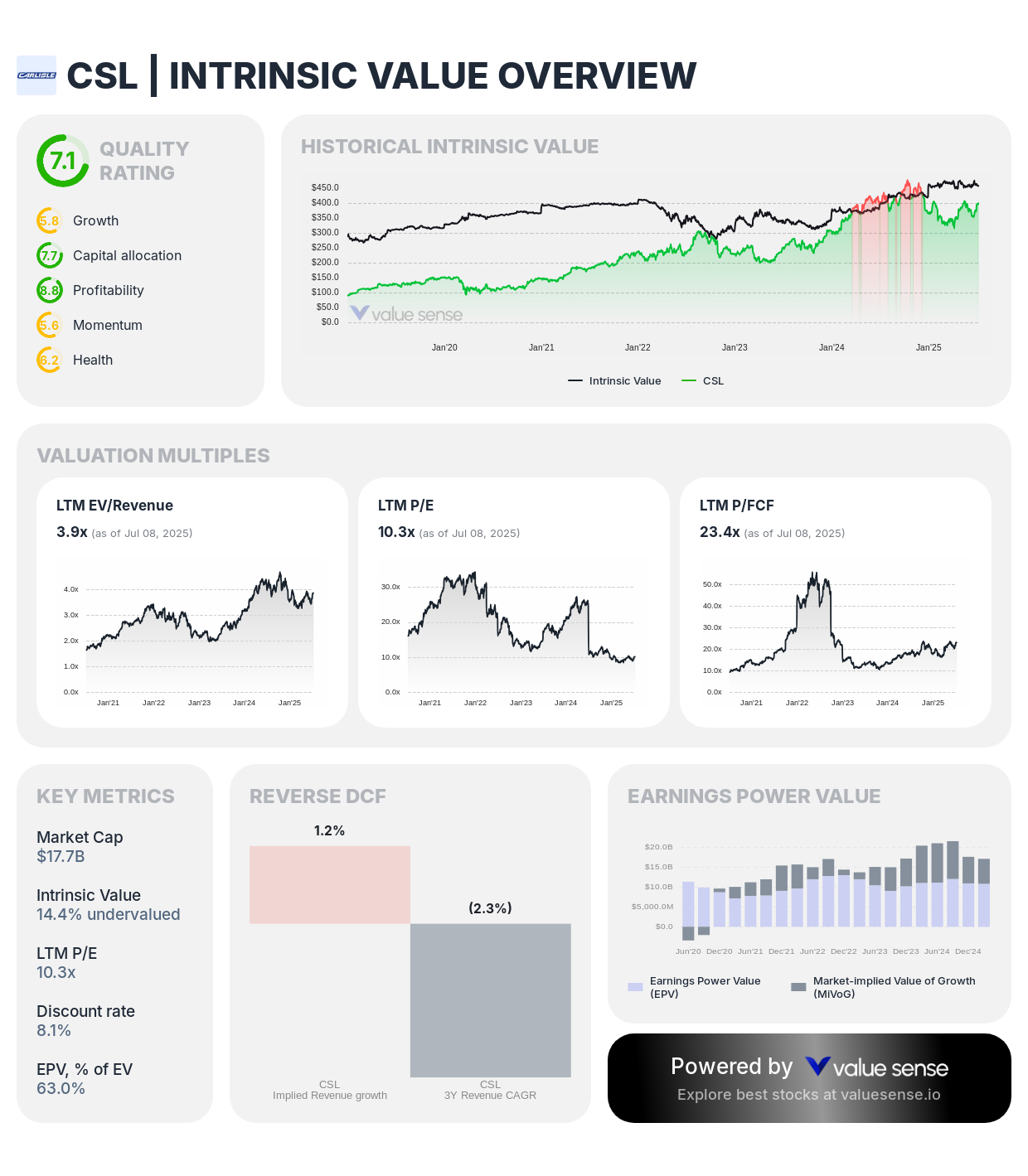

8. Carlisle Companies (CSL)

Carlisle Companies provides diversified industrial exposure while trading below intrinsic value, supported by strong market positions and consistent operational performance.

Key Financial Metrics:

- Quality Rating: 7.1 (Strong) - Diversified industrial solutions provider

- Intrinsic Value: 14.4% undervalued - Solid valuation discount

- 1-Year Return: (1.6%) - Recent weakness creates opportunity

- Revenue: $$5,002.9M - Diversified industrial revenue base

- Free Cash Flow: $$758.8M - Strong cash generation capabilities

- Revenue Growth: (0.1%) - Stable revenue in cyclical markets

- FCF Margin: 15.2% - Solid profitability metrics

- Gross Margin: 51.1% - Strong operational efficiency

- ROIC: 18.8% - Excellent capital allocation

- Total Debt to Equity: 63.7% - Manageable debt levels

The company's diversified portfolio across construction materials, aerospace, and medical technologies provides stability and growth opportunities across multiple industrial end markets.

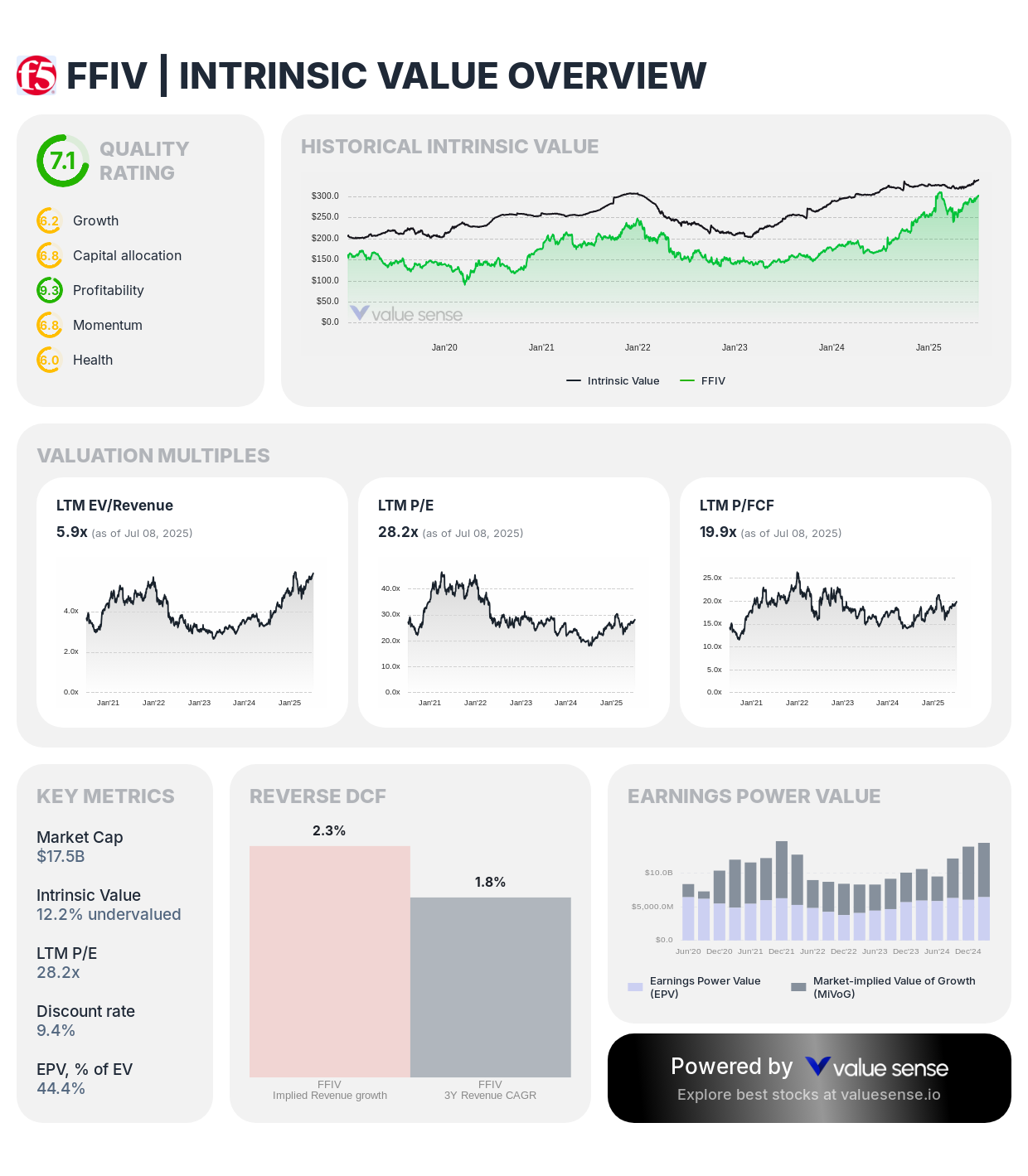

9. F5 Inc. (FFIV)

F5 Inc. offers investors exposure to critical network infrastructure solutions while trading at a discount to intrinsic value, supported by strong cash generation and market position.

Key Financial Metrics:

- Quality Rating: 7.1 (Strong) - Leading application delivery and security solutions

- Intrinsic Value: 12.2% undervalued - Attractive valuation opportunity

- 1-Year Return: 74.7% - Strong momentum with continued potential

- Revenue: $$2,798.8M - Solid revenue base with recurring components

- Free Cash Flow: $$879.0M - Excellent cash generation capabilities

- Revenue Growth: 0.5% - Stable revenue in mature market

- FCF Margin: 31.4% - Outstanding profitability

- Gross Margin: 84.6% - Software-like margins

- ROIC: 17.5% - Strong capital efficiency

- Total Debt to Equity: 4.9% - Minimal leverage

The company's critical role in application delivery and security infrastructure, combined with ongoing digital transformation trends, supports steady demand for its solutions.

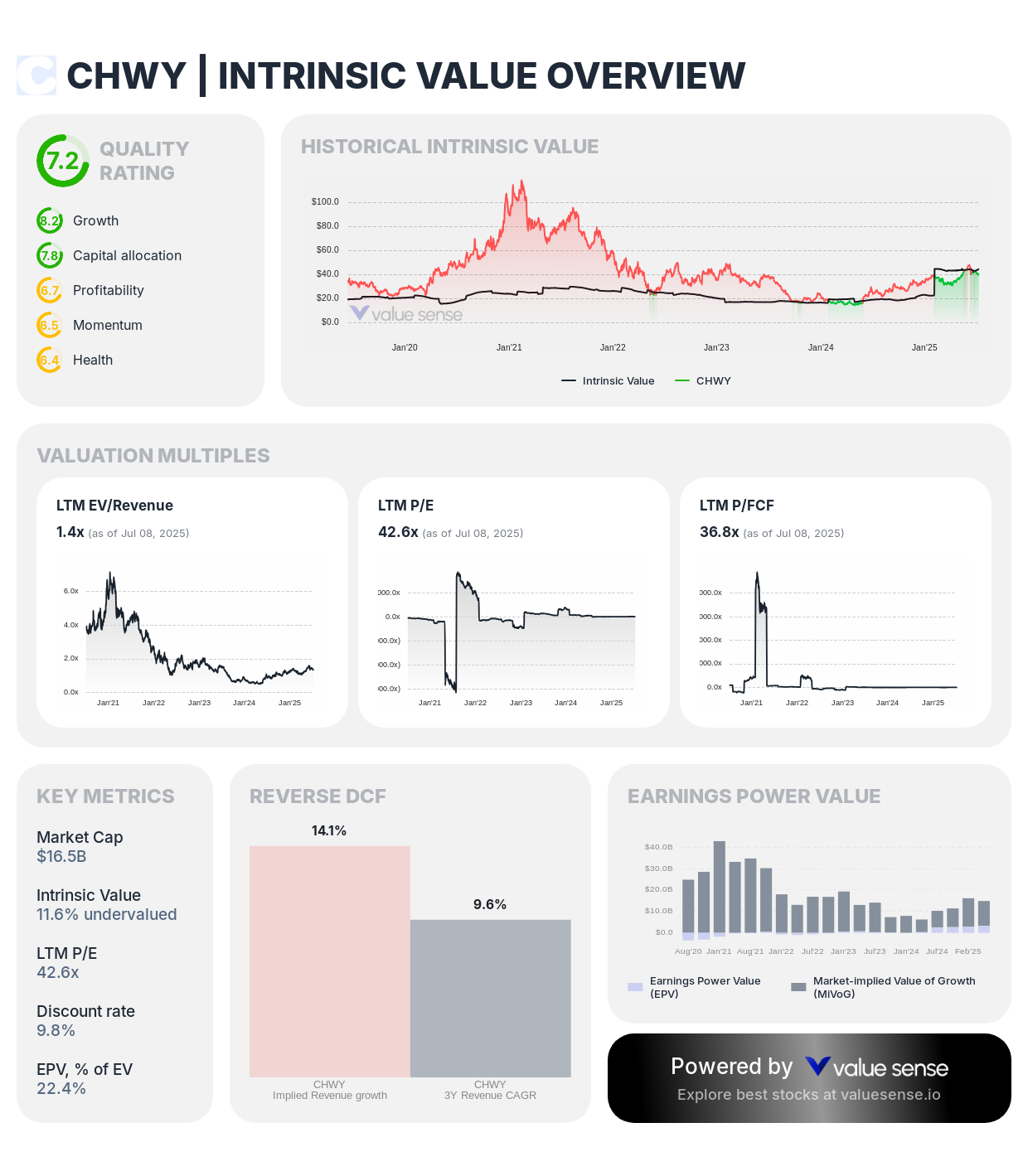

10. Chewy Inc. (CHWY)

Chewy Inc. represents a compelling value opportunity in the e-commerce pet care market, combining defensive characteristics with growth potential while trading below fair value.

Key Financial Metrics:

- Quality Rating: 7.2 (Strong) - Leading online pet retailer with loyal customer base

- Intrinsic Value: 11.6% undervalued - Modest but meaningful discount

- 1-Year Return: 61.3% - Strong recent performance with more upside

- Revenue: $$12.1B - Large and growing revenue base

- Free Cash Flow: $$448.6M - Improving cash generation profile

- Revenue Growth: 7.6% - Steady growth in defensive market

- FCF Margin: 3.7% - Improving profitability trajectory

- Gross Margin: 29.2% - Solid operational efficiency

- ROIC: 41.1% - Excellent capital efficiency

- Total Debt to Equity: 133.2% - Higher leverage requires monitoring

The company's dominant position in online pet retail, combined with the defensive nature of pet spending and growing pet ownership trends, creates a stable foundation for long-term growth.

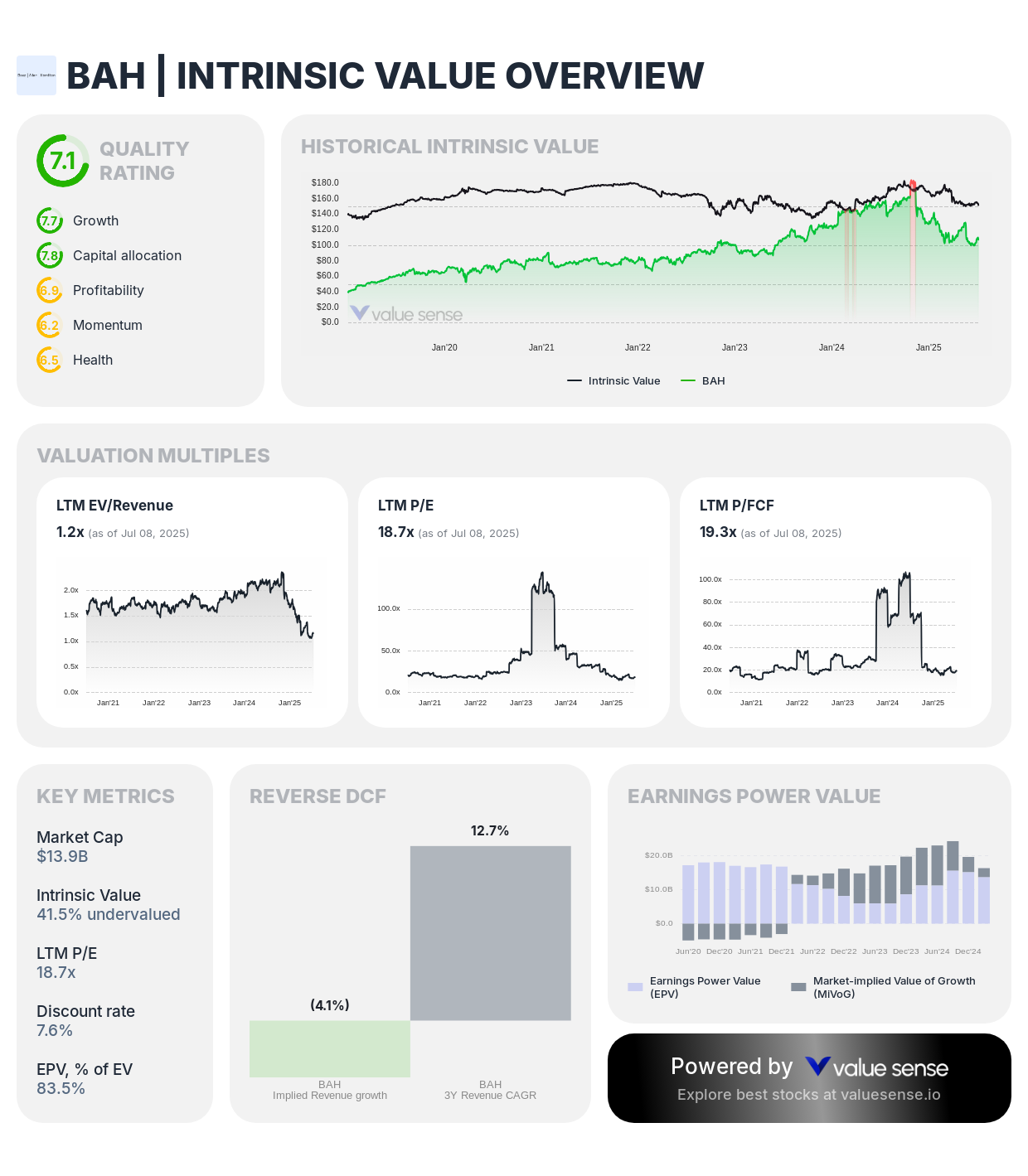

Honorable Mention: Booz Allen Hamilton (BAH)

Booz Allen Hamilton rounds out our analysis with its specialized government consulting services, offering defensive characteristics and steady growth while trading at a substantial discount to calculated fair value.

Key Financial Metrics:

- Quality Rating: 7.1 (Strong) - Leading government consulting and technology services

- Intrinsic Value: 41.5% undervalued - Significant valuation opportunity

- 1-Year Return: (29.2%) - Recent weakness creates attractive entry point

- Revenue: $$12.0B - Large and stable government contract base

- Free Cash Flow: $$716.6M - Consistent cash generation profile

- Revenue Growth: 12.4% - Strong growth in government services

- FCF Margin: 6.0% - Solid profitability in services business

- Gross Margin: 58.1% - Strong service margins

- ROIC: 21.3% - Excellent capital efficiency

- Total Debt to Equity: N/A - Data not available

The company's specialized expertise in government consulting and technology services, combined with growing government spending on digital transformation and cybersecurity, creates a stable foundation for continued growth.

Investment Conclusion

These undervalued S&P 500 stocks represent compelling opportunities for investors seeking quality companies trading below their intrinsic value. Each company demonstrates strong fundamental characteristics including robust cash generation, competitive market positions, and reasonable growth prospects across diverse sectors.

The combination of quality metrics, attractive valuations, and sector diversification makes this selection particularly appealing for investors looking to build a balanced portfolio of undervalued large-cap stocks with significant price appreciation potential as markets recognize their true value.

For deeper analysis and real-time updates on these opportunities, visit ValueSense.io to access our comprehensive database of financial metrics and valuation models.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best Undervalued Nasdaq Stocks for 2025

📖 11 Best Undervalued Multibagger Stocks

📖 8 Best Undervalued Low Debt Stocks