Undervalued Stocks vs Bonds: Portfolio Strategy for Rising Rates

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The investment landscape of 2025 presents unique challenges and opportunities for portfolio construction. With interest rates stabilizing at elevated levels and inflation concerns moderating, investors face critical decisions about asset allocation between undervalued stocks and bonds. Our analysis reveals compelling opportunities in both asset classes, but the optimal portfolio strategy depends on risk tolerance, time horizon, and market outlook.

Rising interest rates have fundamentally altered the risk-reward equation for both stocks and bonds. While higher yields make fixed-income investments more attractive than they've been in over a decade, they've also created significant valuation opportunities in equity markets. Quality stocks trading below intrinsic value offer compelling alternatives to traditional bond allocations, particularly for investors seeking long-term wealth building.

Current Market Environment: Interest Rate Impact Analysis

The Federal Reserve's monetary policy normalization has created a new investment paradigm. With the 10-year Treasury yield stabilizing around 4.5-5.0%, bonds offer legitimate competition to dividend-paying stocks for the first time since the 2008 financial crisis. This shift requires fundamental reconsideration of traditional 60/40 portfolio allocations.

Key Market Dynamics:

- Bond Yields: 10-year Treasuries offering 4.8% provide meaningful income generation

- Credit Spreads: Corporate bond spreads remain tight, suggesting strong credit conditions

- Equity Valuations: Many quality stocks trading below historical averages due to rate sensitivity

- Dividend Yields: High-quality dividend stocks yielding 3-6% remain competitive with bonds

The current environment favors active allocation strategies that can capitalize on relative value opportunities between asset classes rather than static allocation models.

Undervalued Stock Opportunities: Quality at Attractive Prices

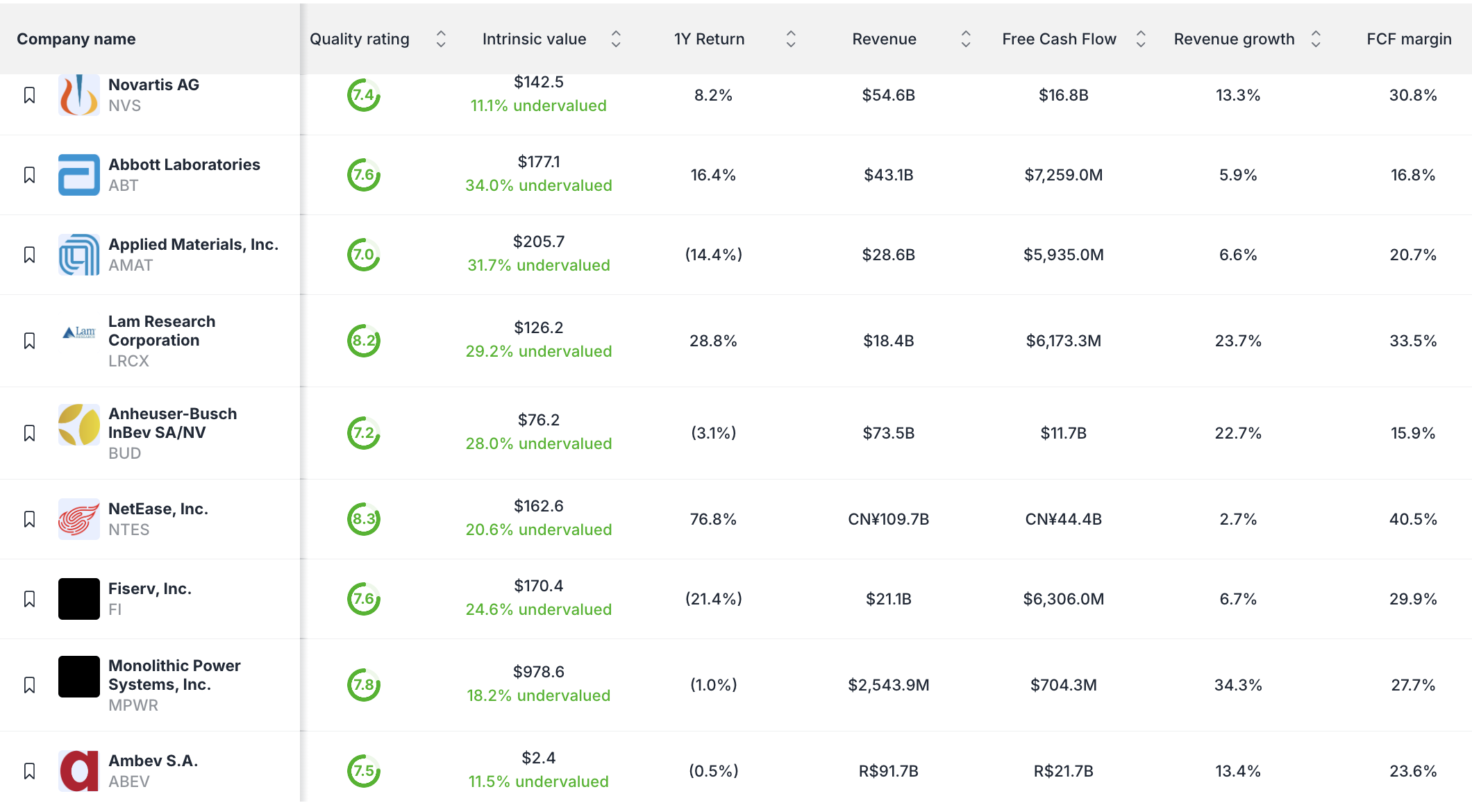

Our screening process has identified numerous high-quality companies trading below intrinsic value estimates. These opportunities span multiple sectors and geographies, providing diversification benefits for portfolio construction.

Top Undervalued Stock Opportunities:

Novartis AG (NVS) - $142.5 Intrinsic Value

- Current undervaluation: 11.1%

- Revenue: $54.6B with strong pharmaceutical pipeline

- Free Cash Flow: $16.8B providing sustainable dividend coverage

- Revenue Growth: 13.3% driven by innovative drug launches

- FCF Margin: 30.8% demonstrating operational efficiency

Abbott Laboratories (ABT) - $177.1 Intrinsic Value

- Current undervaluation: 34.0%

- Revenue: $43.1B across diversified healthcare segments

- Free Cash Flow: $7.3B supporting consistent dividend growth

- Revenue Growth: 5.9% with stable healthcare demand

- FCF Margin: 16.8% reflecting strong business model

Applied Materials (AMAT) - $205.7 Intrinsic Value

- Current undervaluation: 31.7%

- Revenue: $28.6B from semiconductor equipment leadership

- Free Cash Flow: $5.9B despite cyclical industry challenges

- Revenue Growth: 6.6% benefiting from long-term chip demand

- FCF Margin: 20.7% showing operational leverage

Lam Research Corporation (LRCX) - $126.2 Intrinsic Value

- Current undervaluation: 29.3%

- Revenue: $18.4B serving critical semiconductor manufacturing

- Free Cash Flow: $6.2B with strong capital efficiency

- Revenue Growth: 23.7% from advanced node transitions

- FCF Margin: 33.5% indicating premium market position

These companies represent different approaches to value creation, from healthcare innovation to semiconductor technology leadership, providing portfolio diversification across growth drivers.

Bond Market Analysis: Yield and Credit Considerations

The bond market in 2025 offers the most attractive yields in over 15 years, creating legitimate alternatives to equity investments for income-focused portfolios. However, duration risk and credit considerations require careful analysis.

Fixed Income Opportunities:

- Treasury Yields: 2-year at 4.2%, 10-year at 4.8% providing real returns above inflation

- Corporate Bonds: Investment-grade spreads around 100-150 basis points over Treasuries

- High-Yield Bonds: Offering 7-9% yields with moderate default risk expectations

- Municipal Bonds: Tax-equivalent yields attractive for high-income investors

Duration Risk Assessment:

- Short-term Bonds (1-3 years): Limited price sensitivity to rate changes

- Intermediate Bonds (5-10 years): Balanced income and price risk exposure

- Long-term Bonds (20+ years): Higher yields but significant duration risk

The bond market's attractiveness has improved dramatically, but investors must balance higher yields against duration and credit risks.

Portfolio Allocation Strategies: Risk-Adjusted Approaches

Optimal portfolio construction in the current environment requires dynamic allocation strategies that can adapt to changing market conditions while maintaining appropriate risk levels.

Conservative Allocation (Risk Score 3-4):

- 40% Undervalued Dividend Stocks: Focus on healthcare, utilities, consumer staples

- 50% Investment-Grade Bonds: Mix of government and corporate bonds

- 10% Cash/Short-term: Flexibility for rebalancing opportunities

This allocation emphasizes capital preservation while providing modest growth potential through carefully selected undervalued equities.

Moderate Allocation (Risk Score 5-6):

- 60% Undervalued Stocks: Diversified across sectors and geographies

- 30% Mixed Bonds: Combination of government, corporate, and high-yield

- 10% Alternative Investments: REITs, commodities, or inflation-protected securities

The moderate approach balances growth potential with income generation, suitable for investors with 5-10 year time horizons.

Growth-Oriented Allocation (Risk Score 7-8):

- 75% Undervalued Growth Stocks: Technology, healthcare, emerging markets

- 15% High-Yield Bonds: Enhanced income generation with credit risk

- 10% Growth Alternatives: International equity, sector-specific ETFs

This allocation maximizes long-term wealth building potential while maintaining some fixed-income stability.

Sector Analysis: Best Opportunities by Industry

Different sectors offer varying value propositions in the current market environment. Our analysis identifies the most attractive sectors for undervalued stock investments.

Healthcare Sector Advantages:

- Defensive Characteristics: Stable demand regardless of economic conditions

- Innovation Pipeline: Strong R&D spending driving future growth

- Dividend Sustainability: Cash flow stability supporting income generation

- Valuation Discounts: Many quality names trading below historical averages

Companies like Novartis and Abbott Laboratories exemplify healthcare value opportunities with sustainable competitive advantages.

Technology Sector Opportunities:

- Secular Growth Trends: AI, cloud computing, and digitization driving demand

- Cyclical Valuations: Semiconductor equipment companies at attractive entry points

- Cash Generation: Strong free cash flow supporting shareholder returns

- Innovation Leadership: R&D investments creating long-term competitive moats

Applied Materials and Lam Research represent technology value plays with exposure to long-term semiconductor growth trends.

Consumer Sector Considerations:

- Brand Value: Strong consumer brands maintaining pricing power

- Global Exposure: International diversification reducing domestic risk

- Operational Efficiency: Margin improvement potential from cost optimization

- Dividend Growth: History of consistent dividend increases

Companies like Anheuser-Busch and Ambev offer consumer staple characteristics with international diversification benefits.

Risk Management: Balancing Stocks and Bonds

Effective risk management requires understanding the correlation between stocks and bonds under different market scenarios. The traditional negative correlation has weakened during periods of inflation concern.

Correlation Analysis:

- Rising Rate Environment: Stocks and bonds may decline together due to valuation pressure

- Economic Slowdown: Traditional negative correlation likely to reassert

- Inflation Surge: Both asset classes vulnerable to real return erosion

- Geopolitical Stress: Flight-to-quality benefiting government bonds over equities

Risk Mitigation Strategies:

- Diversification: Spread risk across sectors, geographies, and asset classes

- Duration Management: Match bond duration to investment time horizon

- Quality Focus: Emphasize companies with strong balance sheets and cash flow

- Rebalancing Discipline: Maintain target allocations through market cycles

Income Generation: Dividends vs Bond Yields

The choice between dividend-paying stocks and bonds for income generation requires careful analysis of sustainability, growth potential, and tax implications.

Dividend Stock Advantages:

- Growth Potential: Dividends can increase over time with company growth

- Tax Efficiency: Qualified dividends taxed at favorable capital gains rates

- Inflation Protection: Growing companies can raise dividends with inflation

- Total Return: Combination of income and capital appreciation potential

Bond Advantages:

- Predictable Income: Fixed coupon payments provide certainty

- Capital Preservation: Principal repayment (if held to maturity)

- Lower Volatility: Less price fluctuation than dividend stocks

- Diversification: Low correlation with equity market performance

The optimal choice depends on individual tax situations, risk tolerance, and income needs.

International Diversification: Global Value Opportunities

Global diversification remains important for portfolio construction, with international markets offering different valuation and growth opportunities.

Developed Markets:

- European Stocks: Many quality companies trading at discounts to U.S. peers

- Japanese Equities: Corporate governance improvements supporting valuations

- Government Bonds: Yield differentials creating currency-hedged opportunities

Emerging Markets:

- Valuation Discounts: Many emerging market stocks trading below developed market multiples

- Growth Potential: Higher GDP growth rates supporting long-term returns

- Currency Considerations: Local currency bonds offering yield advantages

International diversification helps reduce portfolio concentration risk while accessing different economic cycles and valuation environments.

Implementation Strategy: Building the Portfolio

Successful implementation requires systematic approach to security selection, allocation sizing, and ongoing monitoring.

Security Selection Process:

- Quantitative Screening: Identify undervalued stocks using multiple metrics

- Fundamental Analysis: Assess business quality and competitive position

- Risk Evaluation: Analyze balance sheet strength and cash flow stability

- Valuation Confirmation: Verify intrinsic value estimates through multiple methodologies

Portfolio Construction:

- Asset Allocation: Determine appropriate stock/bond mix based on risk tolerance

- Sector Allocation: Diversify across industries and economic sensitivities

- Position Sizing: Weight positions based on conviction and risk assessment

- Geographic Distribution: Include international exposure for diversification

Ongoing Management:

- Regular Rebalancing: Maintain target allocations through market movements

- Performance Monitoring: Track individual positions and overall portfolio metrics

- Opportunity Assessment: Identify new undervalued opportunities as they emerge

- Risk Monitoring: Adjust allocations based on changing market conditions

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Walmart Stock Analysis: Retail Giant's Undervalued Digital Transformation

📖 Intel Stock Turnaround: Undervalued Chip Giant

📖 Rule of 40 Stocks September 2025

FAQ - Undervalued stocks vs Bonds

Should I choose undervalued stocks or bonds in a rising rate environment?

The optimal choice depends on your investment timeline and risk tolerance. Bonds offer higher yields than in recent years (4-5%) with lower volatility, while undervalued stocks provide inflation protection and growth potential but with higher short-term risk. A balanced approach typically works best, with younger investors favoring stocks and those nearing retirement emphasizing bonds.

How do I identify truly undervalued stocks versus value traps?

Focus on companies with strong fundamentals including growing free cash flow, reasonable debt levels, competitive advantages, and experienced management. Avoid stocks that appear cheap due to declining business prospects. Companies like Novartis and Abbott in our analysis demonstrate quality characteristics with temporary valuation discounts.

What's the ideal portfolio allocation between stocks and bonds for 2025?

Asset allocation should reflect your risk tolerance and time horizon. Conservative investors might consider 40% stocks/50% bonds/10% cash, while moderate investors could use 60% stocks/30% bonds/10% alternatives. Growth-oriented investors might allocate 75% stocks/15% bonds/10% alternatives. Adjust based on personal circumstances.

How do current bond yields compare to dividend yields on quality stocks?

Ten-year Treasury bonds currently yield around 4.8%, while many quality dividend stocks yield 2-4% with growth potential. High-quality companies like those in our analysis often provide dividend growth that can exceed bond yields over time, plus capital appreciation potential. Consider tax implications, as qualified dividends may be taxed more favorably than bond interest.

What are the main risks of focusing on undervalued stocks in 2025?

Key risks include continued interest rate volatility affecting valuations, potential economic slowdown impacting earnings, and the possibility that apparent undervaluation reflects deteriorating business fundamentals. Mitigate risks through diversification across sectors and geographies, focusing on companies with strong balance sheets and sustainable competitive advantages.