7 Best Undervalued Tech Stocks with Realistic Upside - 2025 analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Opportunity in Undervalued Technology

The technology sector represents one of the most dynamic segments of the global economy, offering investors exposure to companies driving digital transformation, artificial intelligence, cloud computing, and emerging technologies. When quality technology companies trade below their intrinsic value due to temporary market sentiment, cyclical downturns, or competitive concerns, they create exceptional opportunities for patient investors.

Undervalued Tech Selection Criteria:

- Technology Sector Focus: Companies operating across software, semiconductors, hardware, and technology services

- Realistic Undervaluation: Trading below intrinsic value with reasonable valuation gaps (excluding extreme outliers)

- Quality Business Fundamentals: Strong competitive positioning, sustainable business models, and robust financial metrics

- Multiple Methodology Confirmation: Undervaluation supported by various analytical approaches

Top 8 Undervalued Tech Stocks - Ranked by Intrinsic Value Undervaluation

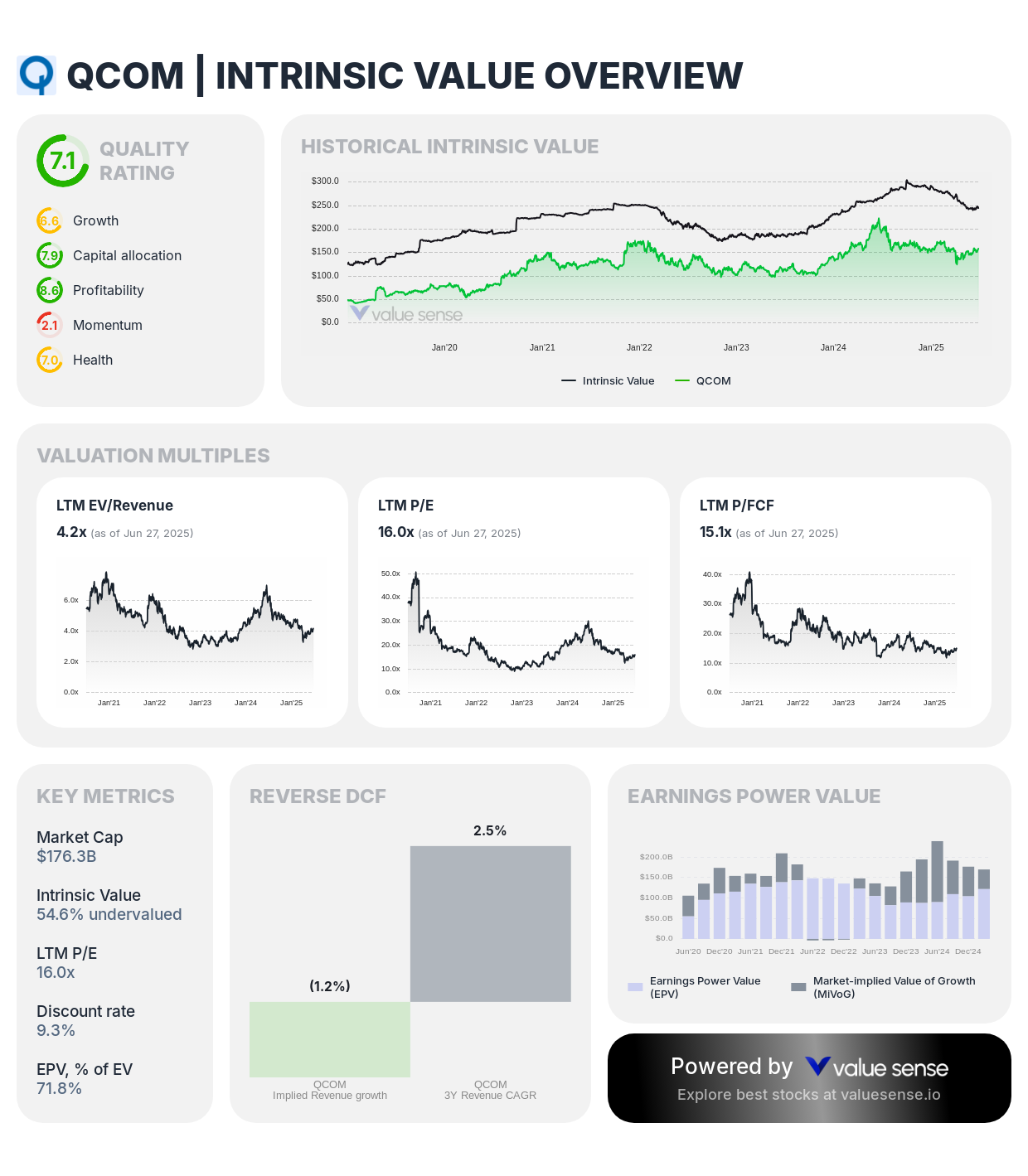

1. QUALCOMM Incorporated (QCOM) - 54.6% Undervalued ⭐

- Enterprise Value: $177.0B

- Intrinsic Value: 54.6% undervalued

- DCF Value: 26.0% undervalued

- Relative Value: 80.7% undervalued

- Ben Graham Revised Fair Value: 94.8% undervalued

- Peter Lynch Fair Value: 14.1% undervalued

- Earnings Power Value: 71.8% of Enterprise Value

Investment Thesis: QUALCOMM represents the most compelling undervalued technology opportunity with 54.6% discount to intrinsic value, supported by strong undervaluation across multiple methodologies. The semiconductor leader's dominance in wireless technology, extensive patent portfolio, and expansion beyond smartphones into automotive, IoT, and 5G infrastructure create substantial value that current pricing fails to recognize.

Why It's Undervalued: Market concerns about smartphone market maturity and Chinese competition have created temporary undervaluation of QUALCOMM's technological leadership and diversification strategy. The company's high-margin licensing business and strategic positioning in emerging markets support substantially higher valuations.

Investment Highlights:

- Dominant position in wireless technology with extensive patent portfolio generating recurring licensing revenue

- 5G infrastructure leadership providing long-term growth opportunities across multiple industries

- Expansion beyond smartphones into automotive, IoT, and edge computing applications

- Strong balance sheet and consistent cash generation supporting shareholder returns

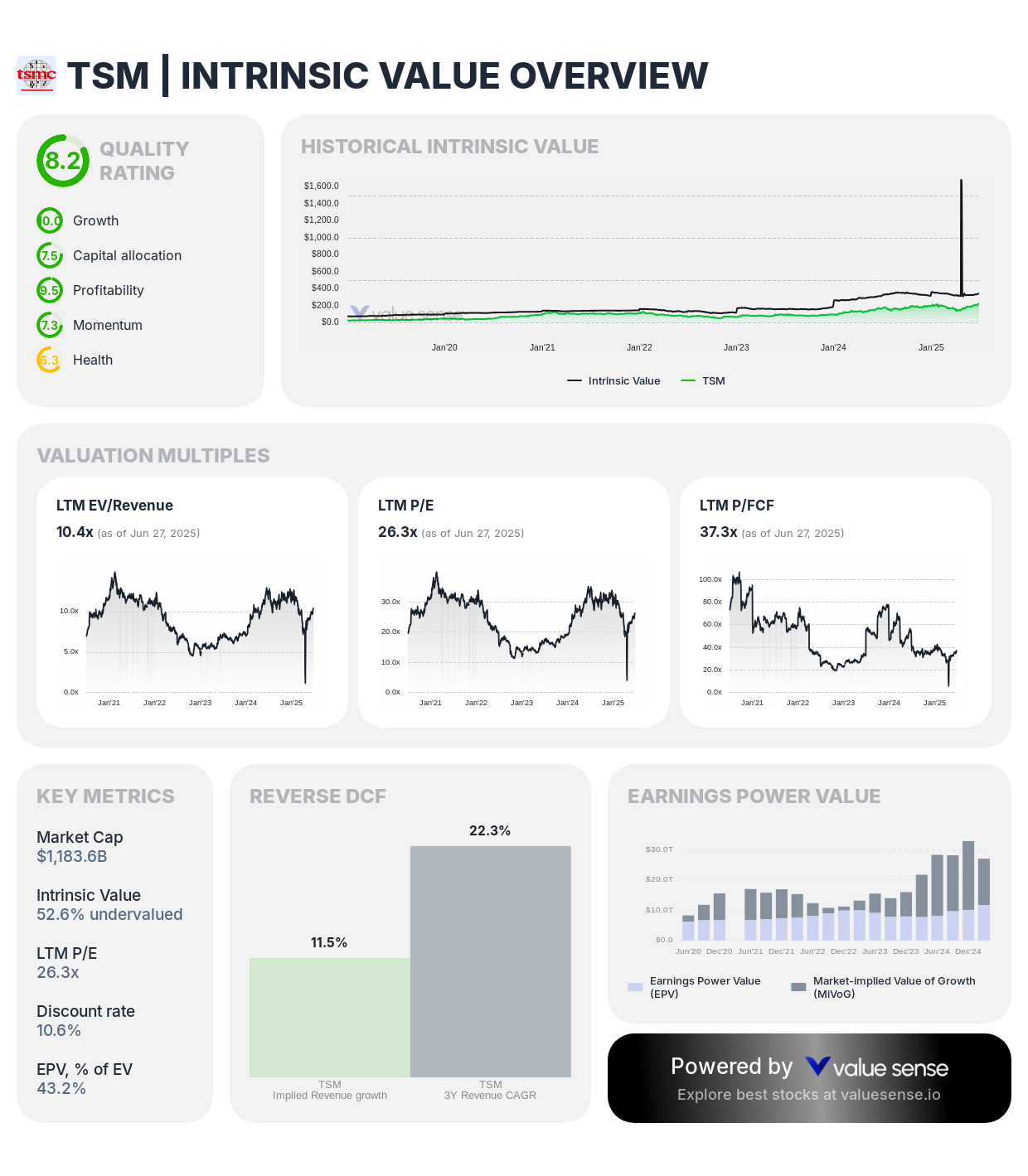

2. Taiwan Semiconductor Manufacturing Company (TSM) - 52.6% Undervalued

- Enterprise Value: $1,124.7B

- Intrinsic Value: 52.6% undervalued

- DCF Value: 22.0% overvalued

- Relative Value: 127.5% undervalued

- Ben Graham Revised Fair Value: 585.6% undervalued

- Peter Lynch Fair Value: 592.3% undervalued

- Earnings Power Value: 43.2% of Enterprise Value

Investment Thesis: TSMC demonstrates substantial undervaluation at 52.6% below intrinsic worth, with exceptional recognition across relative value and traditional methodologies. As the world's leading semiconductor foundry, TSMC occupies an irreplaceable position in global technology supply chains with unmatched technological capabilities in advanced process nodes.

Why It's Undervalued: Geopolitical concerns and cyclical semiconductor worries have created undervaluation of TSMC's technological leadership and essential market position. The company's monopolistic advantages in extreme ultraviolet (EUV) lithography and AI-driven demand provide substantial value realization potential.

Investment Highlights:

- Global semiconductor foundry leadership with advanced process technology and limited viable competition

- Essential supplier relationships with technology leaders including Apple, NVIDIA, and AMD

- Strategic positioning for AI and high-performance computing driving premium demand and pricing

- Continuous technology advancement creating sustainable competitive moats

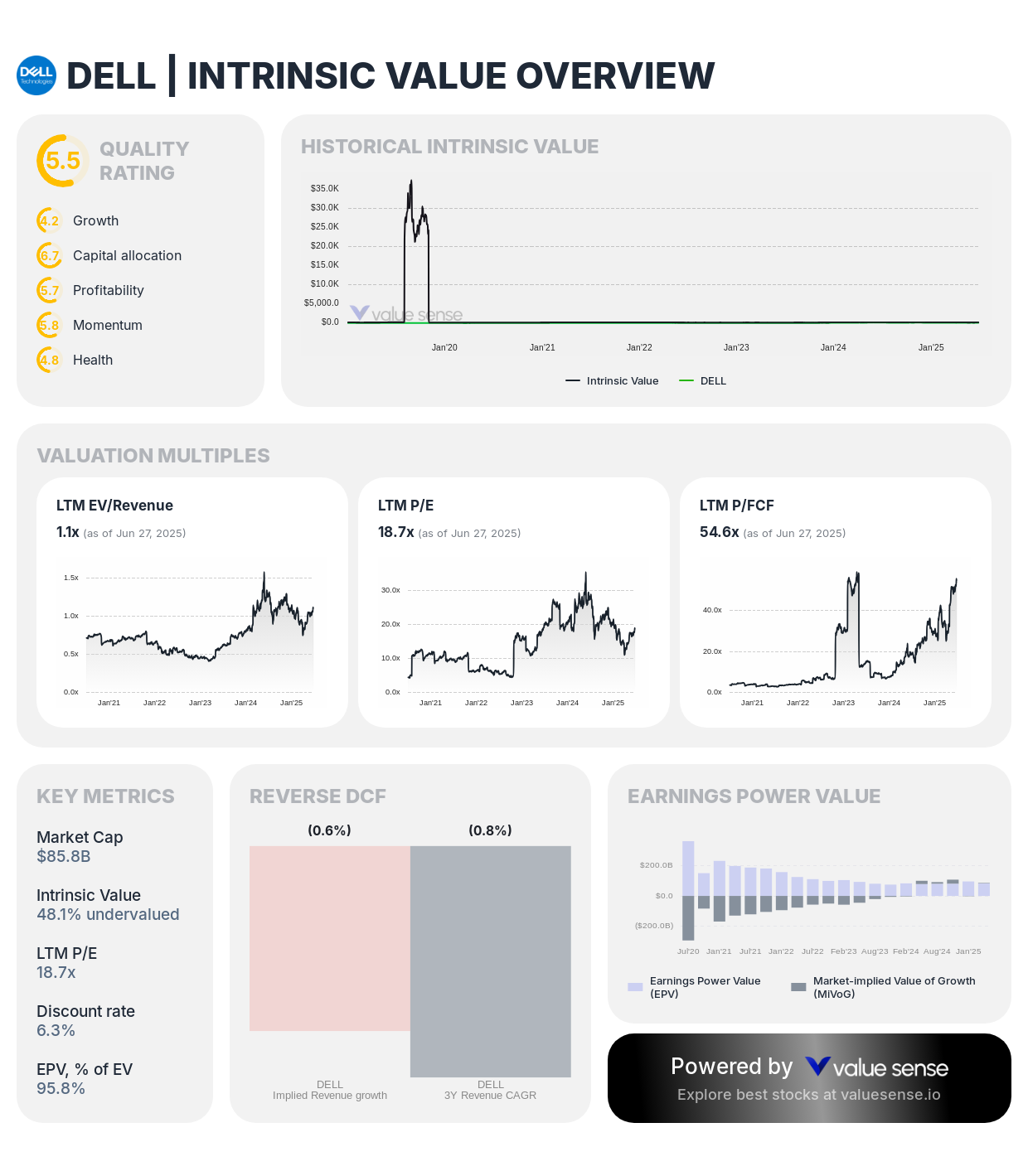

3. Dell Technologies Inc. (DELL) - 48.1% Undervalued

- Enterprise Value: $106.8B

- Intrinsic Value: 48.1% undervalued

- DCF Value: 44.0% undervalued

- Relative Value: 52.1% undervalued

- Ben Graham Revised Fair Value: 83.6% undervalued

- Peter Lynch Fair Value: 54.3% undervalued

- Earnings Power Value: 95.8% of Enterprise Value

Investment Thesis: Dell presents compelling undervaluation at 48.1% below intrinsic value, with consistent undervaluation across all major methodologies and exceptional Earnings Power Value of 95.8%. The enterprise technology leader's positioning in servers, storage, and AI infrastructure creates significant value opportunities despite cyclical industry challenges.

Why It's Undervalued: Market concerns about PC market maturity and enterprise spending cycles have created undervaluation of Dell's strategic transformation toward high-margin enterprise solutions. The company's focus on AI infrastructure and operational efficiency improvements support higher valuations.

Investment Highlights:

- Leading provider of enterprise infrastructure including servers, storage, and networking solutions

- Strategic positioning for AI and data center infrastructure growth driving demand

- Strong market positions in both consumer PC and enterprise technology segments

- Substantial free cash flow generation and shareholder-friendly capital allocation

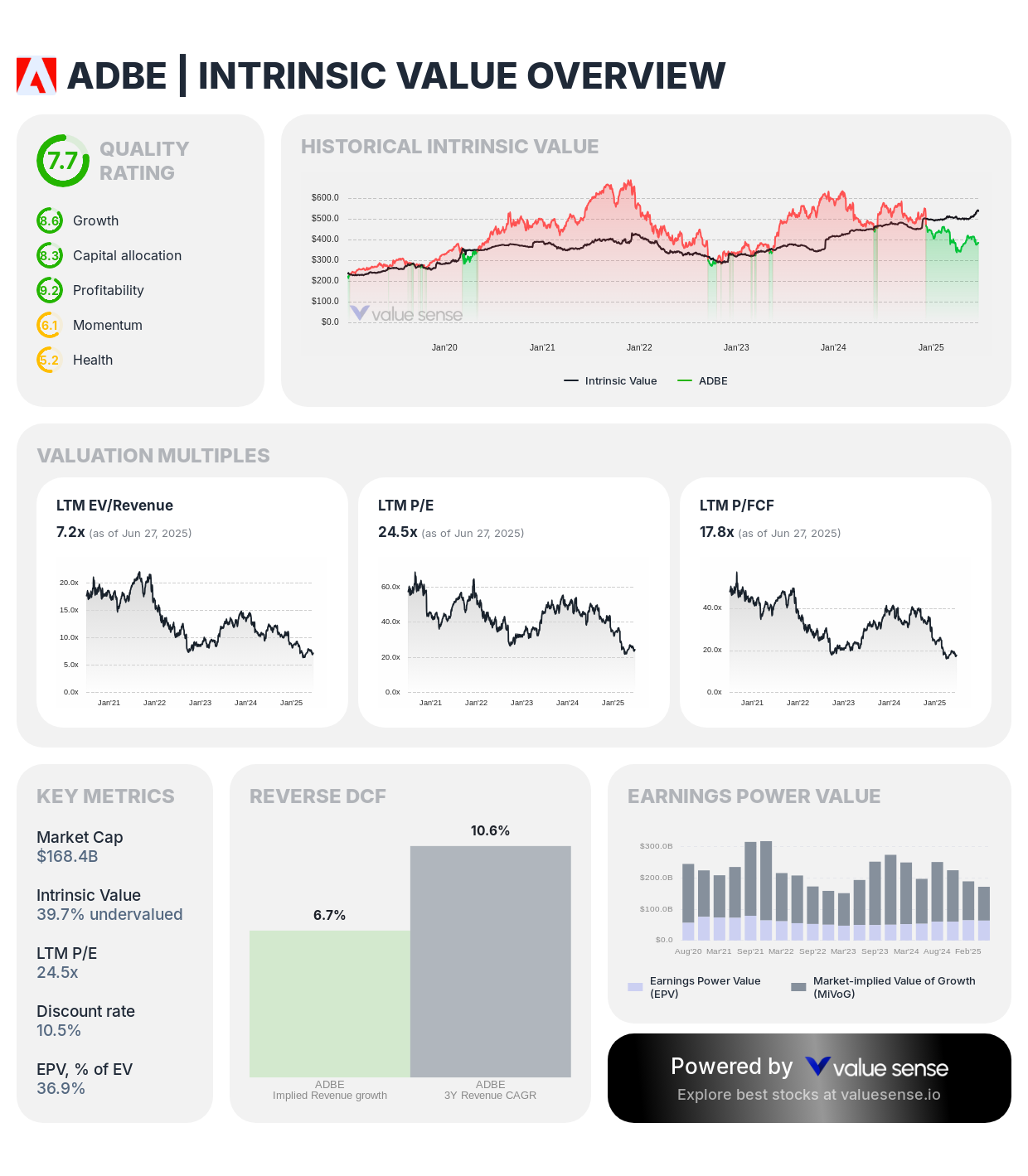

4. Adobe Inc. (ADBE) - 39.7% Undervalued

- Enterprise Value: $163.4B

- Intrinsic Value: 39.7% undervalued

- DCF Value: 18.0% overvalued

- Relative Value: 97.9% undervalued

- Ben Graham Revised Fair Value: 146.7% undervalued

- Peter Lynch Fair Value: 46.8% overvalued

- Earnings Power Value: 36.9% of Enterprise Value

Investment Thesis: Adobe demonstrates attractive undervaluation at 39.7% below intrinsic worth, with substantial relative value undervaluation offsetting modest DCF premium. The creative software leader's subscription model, market dominance, and AI integration create sustainable competitive advantages that current pricing underestimates.

Why It's Undervalued: Market concerns about AI disruption to creative software and growth deceleration have created undervaluation of Adobe's moat strength and adaptation capabilities. The company's integration of AI tools and expanding platform services provide competitive differentiation and growth opportunities.

Investment Highlights:

- Dominant position in creative software with subscription model providing predictable recurring revenue

- Strong competitive moats through ecosystem effects and professional workflow integration

- Artificial intelligence integration enhancing product capabilities and user productivity

- Expanding addressable markets through marketing automation and document services

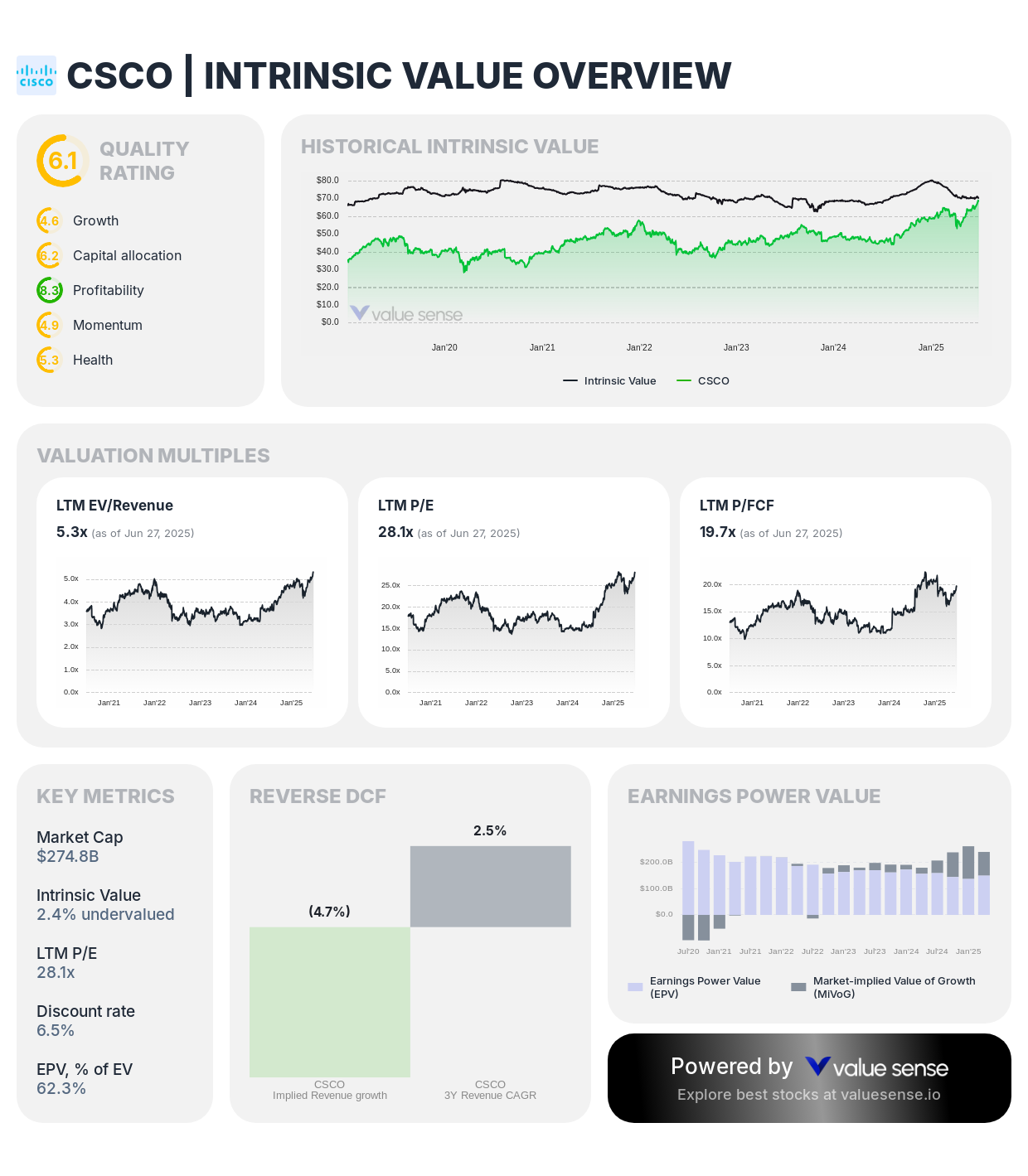

5. Cisco Systems, Inc. (CSCO) - 2.4% Undervalued

- Enterprise Value: $295.9B

- Intrinsic Value: 2.4% undervalued

- DCF Value: 32.0% undervalued

- Relative Value: 27.6% overvalued

- Ben Graham Revised Fair Value: 62.6% undervalued

- Peter Lynch Fair Value: 2.1% overvalued

- Earnings Power Value: 62.3% of Enterprise Value

Investment Thesis: Cisco trades near fair value with modest 2.4% undervaluation, supported by solid DCF undervaluation and Ben Graham recognition. The networking technology leader's transformation toward software and services creates more predictable revenue streams while maintaining essential infrastructure positioning.

Why It's Fairly Valued: Current pricing accurately reflects Cisco's successful business model transformation and market leadership position. The company's essential role in networking infrastructure and cybersecurity provides defensive characteristics with modest growth potential.

Investment Highlights:

- Market leadership in networking infrastructure with high switching costs and customer loyalty

- Successful transition to software and subscription-based revenue models improving margins

- Essential role in cybersecurity and 5G infrastructure supporting long-term demand

- Strong balance sheet and consistent dividend payments providing defensive characteristics

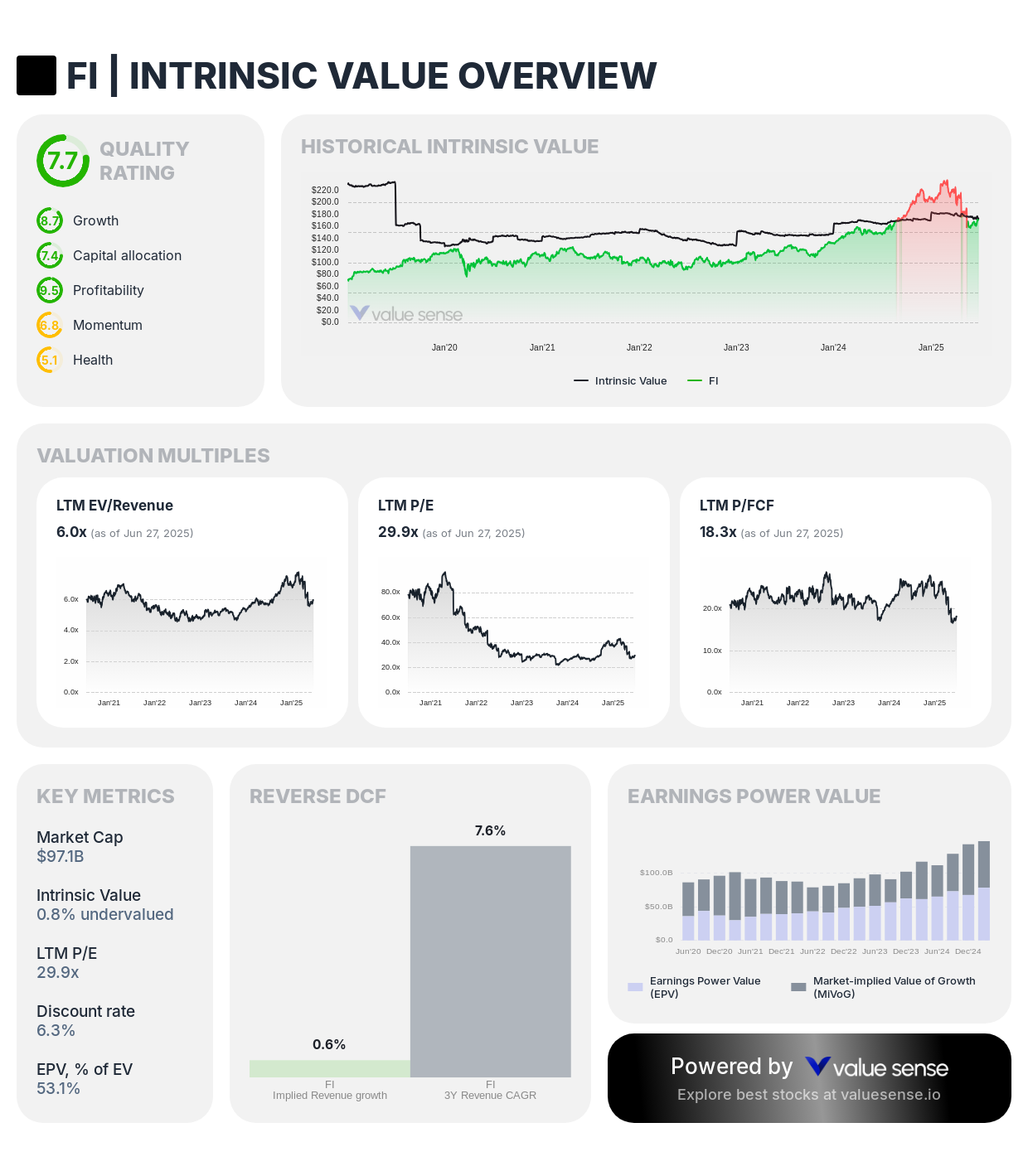

6. Fiserv, Inc. (FI) - 0.8% Undervalued

- Enterprise Value: $124.2B

- Intrinsic Value: 0.8% undervalued

- DCF Value: 11.0% undervalued

- Relative Value: 9.5% overvalued

- Ben Graham Revised Fair Value: 171.9% undervalued

- Peter Lynch Fair Value: 63.8% undervalued

- Earnings Power Value: 53.1% of Enterprise Value

Investment Thesis: Fiserv trades essentially at fair value with minimal undervaluation, representing efficient market pricing for the financial technology leader. The company's essential payment processing and banking services create stable, recurring revenue streams with defensive characteristics ideal for conservative tech exposure.

Why It's Fairly Valued: The market accurately prices Fiserv's essential role in financial infrastructure and digital payment processing. Current valuation reflects the company's stable growth prospects and defensive business characteristics.

Investment Highlights:

- Leading provider of financial technology services with essential market positioning

- Stable, recurring revenue streams from payment processing and banking services

- Digital transformation trends driving increased electronic payment adoption

- Strong competitive positioning in fragmented financial technology markets

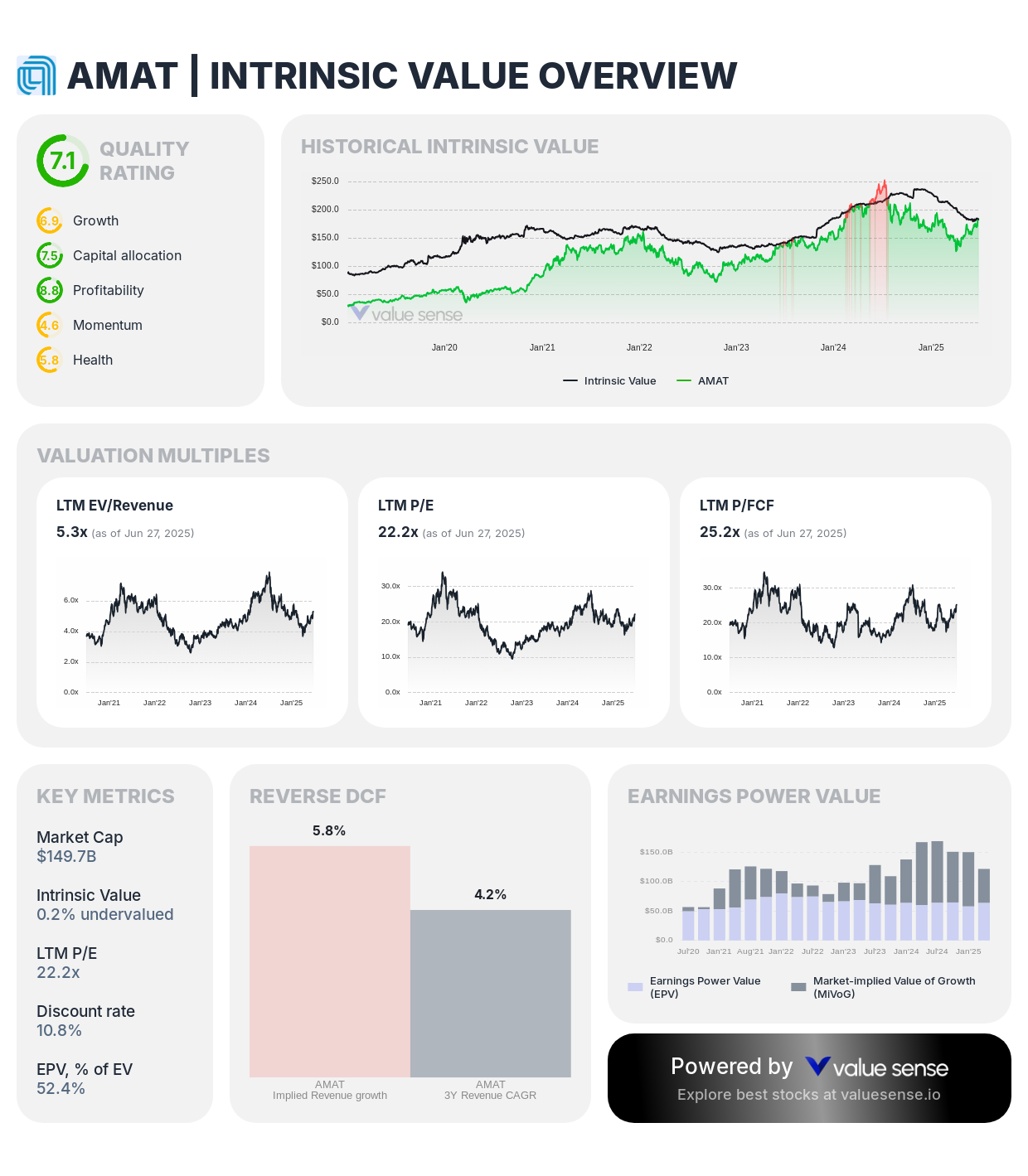

7. Applied Materials, Inc. (AMAT) - 0.2% Undervalued

- Enterprise Value: $149.2B

- Intrinsic Value: 0.2% undervalued

- DCF Value: 30.0% overvalued

- Relative Value: 30.5% undervalued

- Ben Graham Revised Fair Value: 43.2% overvalued

- Peter Lynch Fair Value: 62.1% overvalued

- Earnings Power Value: 52.4% of Enterprise Value

Investment Thesis: Applied Materials trades at fair value with minimal undervaluation, representing balanced pricing for the semiconductor equipment leader. The company's essential role in chip manufacturing and technological innovation creates stable value with cyclical growth opportunities.

Why It's Fairly Valued: Current pricing accurately reflects Applied Materials' cyclical semiconductor exposure balanced against its technological leadership and essential manufacturing role. The company's positioning for AI and data center infrastructure provides growth catalysts.

Investment Highlights:

- Leading provider of semiconductor manufacturing equipment with technological advantages

- Essential role in advanced chip production supporting long-term industry growth

- Strategic positioning for AI and data center infrastructure driving equipment demand

- Strong customer relationships with global semiconductor manufacturers

Undervalued Tech Investment Strategy

Focus on Sustainable Competitive Advantages: Prioritize technology companies with strong moats like TSMC's manufacturing leadership, Adobe's creative software ecosystem, or QUALCOMM's patent portfolio. These advantages provide pricing power and market protection supporting value realization over time.

Diversify Across Technology Subsectors: Spread investments across semiconductors (TSMC, QUALCOMM), software (Adobe, Cisco), enterprise technology (Dell, Applied Materials), and financial technology (Fiserv) to capture different growth themes while reducing concentration risk.

Balance Value with Quality: While seeking undervaluation, maintain focus on business quality and competitive positioning. Companies like Adobe and TSMC combine attractive valuations with strong fundamental characteristics.

Consider Investment Timeframes:

- For Growth Seekers: Focus on QUALCOMM, TSMC, and Adobe for secular tailwinds and innovation exposure

- For Stability: Cisco, Fiserv, and Applied Materials offer lower volatility with established market positions

- For Balanced Approach: Dell provides free cash flow generation with digital transformation exposure

Understanding Our Valuation Methodology

Our comprehensive technology valuation approach incorporates multiple analytical frameworks:

Intrinsic Value Calculation: We combine discounted cash flow analysis, competitive positioning assessment, and normalized earnings power to determine fundamental business worth, excluding temporary market sentiment impacts.

Multiple Methodology Confirmation: We require consistent undervaluation signals across various approaches including DCF analysis, relative valuation, Ben Graham revised fair value, and Peter Lynch fair value to ensure robust investment opportunities.

Quality Filters: We exclude companies with extreme valuation discrepancies or negative fundamental metrics that suggest potential value traps or business deterioration rather than genuine opportunities.

Key Takeaways for Tech Value Investors

✅ Quality Value Leaders: QUALCOMM (54.6%) and TSMC (52.6%) offer substantial undervaluation with strong competitive positioning

✅ Balanced Opportunities: Dell (48.1%) and Adobe (39.7%) combine undervaluation with quality business fundamentals

✅ Fair Value Entries: Cisco (2.4%) and Fiserv (0.8%) provide defensive tech exposure at reasonable valuations

✅ Sector Diversification: Opportunities span semiconductors, software, enterprise technology, and financial services

✅ Realistic Expectations: All selections feature achievable value realization potential without extreme assumptions

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best Long-Term Stocks to Buy

📖 11 Best Undervalued Healthcare Stocks

📖 11 Best Value Energy Stocks

FAQ About Undervalued Tech Investing

What makes these tech stocks particularly attractive for value investors?

These technology stocks offer compelling value propositions because they combine strong business fundamentals with temporary market undervaluation. Companies like QUALCOMM and TSMC possess sustainable competitive advantages through patent portfolios and technological leadership, while trading at discounts due to cyclical concerns or geopolitical uncertainties rather than fundamental business deterioration.

How do you ensure valuation estimates are realistic rather than overly optimistic?

Our methodology excludes companies with extreme valuation discrepancies or negative fundamental metrics that often indicate value traps. We focus on companies showing consistent undervaluation across multiple methodologies while maintaining strong earnings power and competitive positioning. This approach helps identify genuine opportunities rather than statistically anomalous situations.

What are the primary risks of investing in undervalued technology stocks?

Technology investing carries inherent risks including rapid technological obsolescence, intense competition, regulatory changes, and cyclical demand patterns. However, our focus on companies with strong competitive moats, diversified revenue streams, and proven business models helps mitigate these risks. Companies like Adobe and Cisco demonstrate the defensive characteristics that can protect value during technology transitions.

What timeline should investors expect for value realization in technology stocks?

Technology value realization typically occurs over 2-5 year periods, depending on company-specific catalysts and market dynamics. Cyclical companies like semiconductor equipment providers may realize value more quickly during industry recovery, while structural opportunities like software platforms may appreciate more gradually through sustained competitive advantages and market expansion.

How should these stocks fit into a diversified technology portfolio?

These undervalued technology stocks should form the foundation of a tech-focused portfolio, representing 60-80% of technology allocations. Complement these value opportunities with small positions in emerging growth companies and international technology exposure. The defensive characteristics of companies like Cisco and Fiserv provide stability, while growth-oriented selections like QUALCOMM and Adobe offer appreciation potential.

Important Note on Technology Investing: Technology stocks offer substantial growth potential but carry risks including rapid innovation cycles, competitive pressures, and market volatility. Our analysis focuses on companies with realistic valuation gaps and strong business fundamentals rather than speculative opportunities. Success requires patience for value realization and focus on long-term competitive positioning.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Technology investments carry significant risks including technological obsolescence and competitive pressures. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.