Valley Forge Capital Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

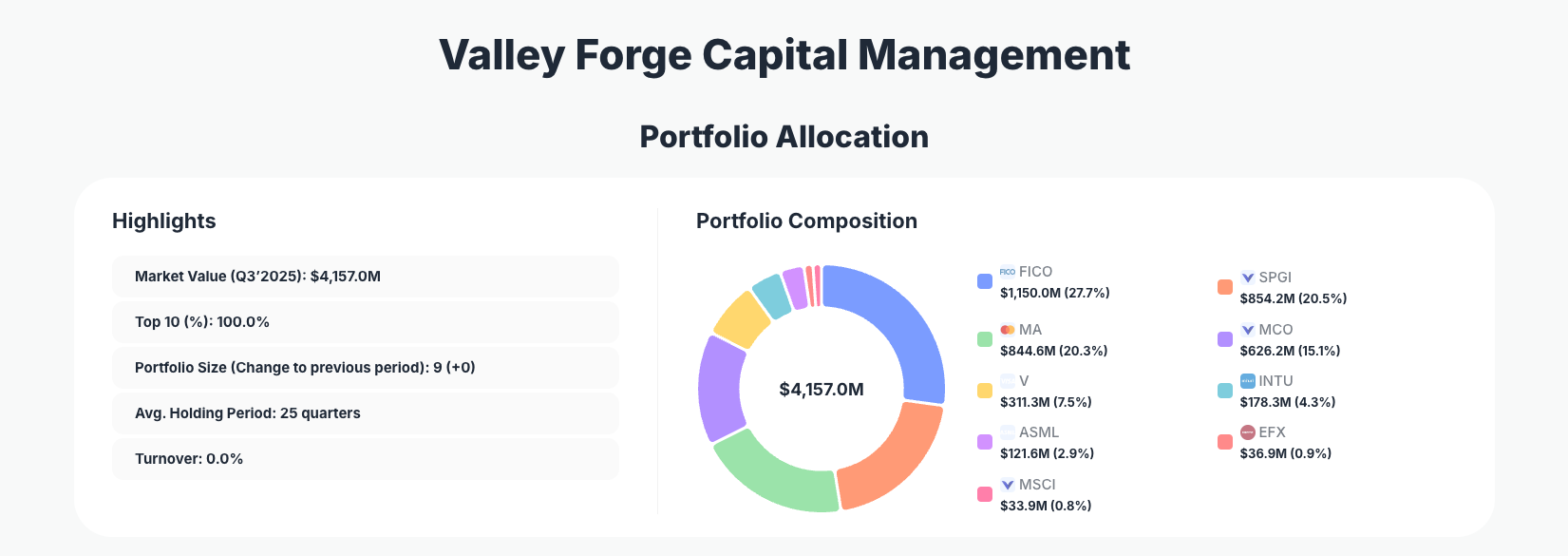

Valley Forge Capital Management continues to exemplify disciplined, long-term investing in high-quality financial infrastructure plays. Their $4.2B portfolio in Q3 2025 shows remarkable stability with just 9 positions and zero turnover, underscoring a conviction-driven strategy that prioritizes enduring competitive advantages over short-term market noise.

Portfolio Overview: Extreme Concentration in Proven Winners

Portfolio Highlights (Q3 2025): - Market Value: $4,157.0M - Top 10 Holdings: 100.0% - Portfolio Size: 9 +0 - Average Holding Period: 25 quarters - Turnover: 0.0%

Valley Forge Capital Management's Q3 2025 portfolio represents the epitome of concentrated investing, with the entire $4.2 billion allocated across just 9 positions—demonstrating unshakeable confidence in their thesis. The 100% concentration in the top 10 holdings (which is the full portfolio) highlights a strategy that avoids diversification for its own sake, instead betting heavily on businesses with wide economic moats in financial data and payments. This approach has delivered through an impressive average holding period of 25 quarters, or over six years, signaling patience in letting quality compound.

The near-zero turnover of 0.0% further reveals a buy-and-hold philosophy rooted in thorough fundamental analysis. Unlike more active managers chasing momentum, Valley Forge maintains positions through market cycles, as evidenced by the stability in their portfolio. This discipline is particularly notable in a volatile 2025 environment, where many funds adjusted aggressively; here, the focus remains on resilient names that generate predictable cash flows.

Top Holdings: Financial Moats and Tech Enablers Dominate

The portfolio's sole notable change in Q3 2025 was a modest reduction in Intuit Inc. (INTU) by 0.84%, now at 4.3% with $178.3 million invested, suggesting fine-tuning rather than a loss of conviction. Anchoring the lineup is Fair Isaac Corporation (FICO) at a commanding 27.7% $1,150.0M, unchanged and reflecting its unchallenged dominance in credit scoring. Close behind, S&P GLOBAL INC holds 20.5% ($854.2M, no change), powering financial markets with indispensable data and analytics.

Mastercard Incorporated (MA) commands 20.3% ($844.6M, no change), paired with Moody's Corporation (MCO) at 15.1% ($626.2M, no change), forming a robust core in payments and credit ratings. Visa Inc. (V) rounds out the payment duopoly exposure at 7.5% ($311.3M, no change), while ASML Holding N.V. (ASML) adds 2.9% ($121.6M, no change) for semiconductor leadership critical to tech infrastructure.

Smaller but strategic positions include Equifax Inc. (EFX) at 0.9% ($36.9M, no change) and MSCI Inc. (MSCI) at 0.8% ($33.9M, no change), both enhancing the financial data theme. This lineup prioritizes oligopolistic businesses with network effects, high barriers, and recurring revenues, with the minor INTU trim as the only adjustment amid broader stability.

What the Portfolio Reveals

Valley Forge's Q3 2025 positioning unveils a clear strategy laser-focused on quality compounders in financial services and data infrastructure. Key themes include:

- Sector dominance in financial data and payments: Over 90% exposure to names like FICO, S&P Global, Moody's, Mastercard, and Visa, betting on secular trends in digital finance, regulatory complexity, and AI-driven analytics.

- Moat-centric selection: Every holding boasts durable competitive advantages—proprietary data (FICO scores, credit ratings), network effects (payment networks), or technological leadership (ASML)—ensuring pricing power and resilience.

- Risk management through concentration: Rather than spreading bets thin, the 100% top-10 allocation minimizes decision-making errors by doubling down on deeply understood businesses.

- Long-term orientation: 25-quarter average hold and 0% turnover signal indifference to short-term volatility, prioritizing intrinsic value growth over market timing.

This approach favors predictable cash flows over high-growth speculation, with minimal geographic risk (primarily U.S.-centric) and no apparent dividend chase, instead emphasizing reinvestment potential.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Fair Isaac Corporation | $1,150.0M | 27.7% | No change |

| S&P GLOBAL INC | $854.2M | 20.5% | No change |

| Mastercard Incorporated | $844.6M | 20.3% | No change |

| Moody's Corporation | $626.2M | 15.1% | No change |

| Visa Inc. | $311.3M | 7.5% | No change |

| Intuit Inc. | $178.3M | 4.3% | Reduce 0.84% |

| ASML Holding N.V. | $121.6M | 2.9% | No change |

| Equifax Inc. | $36.9M | 0.9% | No change |

| MSCI Inc. | $33.9M | 0.8% | No change |

This table underscores Valley Forge's ultra-concentrated philosophy, with the top three holdings—FICO, S&P Global, and Mastercard—alone comprising nearly 69% of the $4.2 billion portfolio. The overwhelming stability (all "No change" except a tiny INTU trim) reflects a high-conviction model where positions are sized by perceived moat strength and held through cycles. Such focus amplifies returns from winners while the small tail (e.g., 0.8% MSCI) allows tactical exposure without diluting the core thesis.

Investment Lessons from Valley Forge Capital Management

Valley Forge's portfolio offers timeless principles for patient investors:

- Embrace extreme concentration in moats you understand: 100% in 9 names shows that diversification often dilutes alpha; bet big on businesses with unbreakable advantages like data monopolies.

- Prioritize holding periods over trading: 25 quarters average proves time in quality trumps timing the market—avoid churn, let compounding work.

- Fine-tune, don't overhaul: The sole 0.84% INTU reduction demonstrates discipline in minor adjustments without abandoning a winning strategy.

- Target recurring revenue machines: Financial data and payments thrive on network effects and regulation, generating cash with low capital needs.

- Ignore short-term noise: Zero turnover amid 2025 volatility highlights conviction rooted in fundamentals, not headlines.

Looking Ahead: What Comes Next?

With a fully invested 9-position portfolio and no reported cash drag, Valley Forge appears poised to maintain its core unless valuations shift dramatically. The minor INTU reduction hints at potential reallocation toward even stronger financial data plays, especially as AI integration boosts demand for FICO, S&P Global, and Moody's analytics. In a market facing rate uncertainty and tech rotations, their payment network staples (MA, V) provide defensive growth, while ASML offers cyclical upside.

Opportunities may emerge in undervalued fintech or data adjacencies if pullbacks occur, but expect continuity given the 0% turnover. Current positioning sets up well for a 2026 environment of steady economic growth, where moated incumbents outperform speculative bets.

FAQ about Valley Forge Capital Management Portfolio

Q: What was the main change in Valley Forge's Q3 2025 13F filing?

A: The only adjustment was a 0.84% reduction in Intuit Inc. (INTU), from its prior stake, amid otherwise complete stability across all 9 holdings.

Q: Why is Valley Forge's portfolio so heavily concentrated?

A: With 100% in the top 10 (full portfolio), the strategy maximizes returns from deeply researched moats in financial data and payments, avoiding dilution from lesser ideas—proven effective over 25-quarter holds.

Q: What sectors dominate Valley Forge's holdings?

A: Financial data providers (FICO, S&P Global, Moody's, MSCI, Equifax) and payment networks (Mastercard, Visa) comprise the bulk, with tech enablers like Intuit and ASML, betting on oligopolies with network effects.

Q: How can I track Valley Forge Capital Management's portfolio?

A: Follow quarterly 13F filings on the SEC site (with a 45-day lag) or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/valley-forge for real-time analysis, visualizations, and historical changes.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!